#South African coal Suppliers in India

Explore tagged Tumblr posts

Link

VRIPL is one of the leading Coal Suppliers in India, Bangladesh and Nepal. We are Indonesian coal suppliers in Bangladesh, Nepal and India. We are also South African Coal Suppliers in India, Bangladesh and Nepal. VR International is one of the pioneer coal suppliers having more than 3 decade of experience.Being one of the leading Indonesian Coal Suppliers in India, Bangladesh and Nepal and South African Coal Suppliers in India, Bangladesh and Nepal, we provide high-grade coal which suitable for various industries.

#indonesian coal suppliers in India#indonesian coal suppliers#indonesian coal suppliers bangladesh#indonesiancoalsuppliers#south african coal suppliers in India#south african coal suppliers in nepal#south african coal suppliers in bangladesh#coal#coalsuppliers#coalsuppliersinindia#southafricancoalsuppliers

0 notes

Text

South African Coal Suppliers in India, Bangladesh & Nepal

South African Coal is generally bituminous thermal grade coal. South African Coal Suppliers in India, Nepal and Bangladesh provides South African coal which has high calorific value and high fusion temperature. VRIPL coal suppliers are connected with reputed coal miners in South Africa which helps South African Coal suppliers to provide coal on all major ports in India, Nepal & Bangladesh

To connect with South African Coal suppliers in India, Nepal, and Bangladesh, visit our website.

#south african coal suppliers in bangladesh#South African Coal Suppliers in India#South African Coal Suppliers in nepal#South African Coal Suppliers#South African Coal#SouthAfricanCoalSuppliersinIndia#SouthAfricanCoalSuppliersinnepal#SouthAfricanCoalSuppliersinbangladesh#coal#coal suppliers#coalsuppliers

0 notes

Text

South African Coal Suppliers in India, Nepal and Bangladesh

Looking for South African coal Suppliers in India, Nepal and Bangladesh? Visit VRIPL.COM, V R International (VRIPL) is leading South African Coal Suppliers in India, Nepal and Bangladesh. We have network of coal miners worldwide which empower us and help us to fulfill each coal requirement on time. There are numbers of South African coal suppliers but only VRIPL has capability to provide all coal varieties under the one roof.

VRIPL coal suppliers also supply USA coal, Australia coal, South African Coal to all major ports in India, Nepal & Bangladesh.

# SouthAfricanCoalSuppliersinIndia # SouthAfricanCoalSuppliersinnepal # SouthAfricanCoalSuppliersinbangladesh # SouthAfricanCoalSuppliers

#South African coal Suppliers in India#South African coal Suppliers in nepal#South African coal Suppliers in bangladesh#South African coal Suppliers#SouthAfricancoalSuppliersinIndia#SouthAfricancoalSuppliersinnepal#SouthAfricancoalSuppliersinbangladesh#SouthAfricancoalSuppliers#SouthAfricancoal#coalSuppliersinIndia#coalSuppliers#coalSuppliersinnepal#coalSuppliersinbangladesh#coal Suppliers

0 notes

Text

South African Coal Suppliers in India, Nepal, and Bangladesh

V R International (VRIPL) is leading coal suppliers in India, Nepal, and Bangladesh. Being pioneer South African Coal Suppliers India, Nepal and Bangladesh, we have the capacity to supply coal to all big as well as a small business. We supply South African coal thermal power plants, textile industry, cement industry, and other coal intensive industries in India, Nepal, and Bangladesh.We supply South African Coal having GCV kcal/kg (ARB) from 5126 – 4243 in India, Nepal & Bangladesh. # southafricanCoalSuppliersinIndia #southafricanCoalSuppliersinnepal #southafricanCoalSuppliersinbangladesh #southafricancoal #coalsuppliers

#southafricanCoalSuppliersinnepal#southafricanCoalSuppliersinindia#southafricanCoalSuppliersinbangladesh#southafricanCoalSuppliers#coalsuppliers#southafricanCoal#south african coal suppliers in India#south african coal suppliers in nepal#south african coal suppliers in bangladesh#south african coal suppliers#south african coal

0 notes

Text

High Cost Of Zimbabwe’s Cheap Solar Gear

Spread This NewsChina Dialogue Agnes Mandishora, 35, was excited about the Chinese solar equipment she’d bought in a Harare shop. She even joked about uprooting her home’s conventional electricity cables and relying entirely on solar-powered lights. But to her dismay she soon found the lamps and batteries to be “defective and impossible to return”. As with many Zimbabweans, Mandishora was persuaded to buy solar gear partly by the terrible drought of 2019. The majority of Zimbabwe’s energy is provided by hydropower, so drought can lead to blackouts. “Electricity would be off for over 12 hours each day,” Mandishora said. “At month-end, our power bills were US$60 for essentially staying in dark.” Households relied on candlelight and factories worked at night when the electricity was switched back on for a few hours. Water levels feeding Zimbabwe’s largest hydropower plant on Lake Kariba were so low that the country could generate just 50% of its peak demand. Ageing coal power plants kept breaking down, adding to the misery. But solar equipment sellers saw opportunity. They launched sales drives on WhatsApp, street shows and radio slots, promising a magical 23 hours of daily power derived from solar photovoltaic panels that could charge batteries in just four hours. Zimbabwe’s power shortages are not only the product of drought. They follow years of inadequate investment in the electricity grid, further aggravated by debts to South African power supplier Eskom, and a growing urban population. In September 2019, the central government approved 39 solar power projects with a total generating capacity of 1,151 MW. Then, in May 2020, Zimbabwe’s state power corporation invited bids for an additional 500 MW. The government also tried to encourage independent power producers to feed their solar power into the national grid. But the country continues to suffer from chronic power undersupply. Figures for 2020 and 2021 are not yet available, but in 2019, the average annual electricity supply was about 1 400MW to meet a peak demand of 1,700MW, according to the Ministry of Energy and Power Development. Access to electricity in rural areas is as low as 21%, with 63.5% of all households in Zimbabwe dependent on wood for cooking. Given the amount of sunshine Zimbabwe receives, it should be able to provide its people with the electricity they need. Sunshine galore Zimbabwe is a sunshine-rich country, enjoying a remarkable 7.5 hours of sunlight a day. Solar radiation varies from an average of about 16 MJ/m2/day in winter to about 22 MJ/m2/day in midsummer. Out of a total area of 390,750 km2, the country has 250,000 km2 that is suitable for concentrating solar power plants. Government policy is already shifting towards solar energy with a ban, announced in November 2019, on electric water heaters in new domestic and commercial buildings, and the mandatory use of solar water heaters. This is likely to stimulate a huge market for “solar geysers”, as they are known locally. Ordinary people have also been seeking alternatives themselves, in the face of long waits to receive electricity in rural and newer townships. By the end of 2019, more than 100,000 homes across the country had solar power systems installed, according to the country’s energy ministry. Many more homes were powered by solar but not recorded as such. Faulty solar gadgets Solar equipment made in China, including batteries, photovoltaic panels, cables and inverters, have become popular in Zimbabwe due to their relatively low price. Such equipment, entering either lawfully or via smugglers, makes up the majority of Zimbabwe’s energy equipment retail market, according to Tawanda Chitiyo, the founder of renewable energy start-up Tawanda Energy. However, the equipment is often substandard and promoted by false claims. And much of it ends up in unregulated urban dumps. Zimbabwe receives so many faulty foreign gadgets because most consumers can’t afford the new stuff, said Gift Mawache, a geographer in the city of Mutare. Wages in Zimbabwe vary widely. The economy is largely informal, so there is no agreed average figure. But, as a guide, in 2020 the government set the minimum wage for the private sector at US$85 a month. Skanyi Jongwe, a disgruntled buyer, said: “I forked US$180 for LED solar lamps, cables and a battery. The lamps’ light was faint, barely shined beyond four hours, or became too hot to the risk of exploding. The warranty said 10 years. The reality – just five months.” “All manufactured electrical solar implements from any country degrade over time. But the rate of failure of Chinese solar panels is now a great concern,” said Tawanda Energy’s Chitiyo. Nigeria, India and Indonesia are also sources of low-quality solar equipment entering Zimbabwe, but much of the equipment is originally manufactured in China. Redress for disappointed buyers is difficult, explained Chitiyo. “Defects are not immediately apparent to most of the customers. Also, the warranty they offer is very difficult to honour. How can a foreign company in Guangzhou get a return solar shipment from Harare, Zimbabwe?” It is not only Chinese merchants living in Zimbabwe who stand accused of selling defective solar gadgets. Lots of native Zimbabwe merchants also hawk poor products. As Chitiyo said: “ most of the solar cells are sold in shops owned by Zimbabwean traders and not by the Chinese.” Smuggling in the mix Zimbabwe shares porous borders with South Africa, Mozambique, Zambia and Botswana, all avenues for substandard solar devices to enter Zimbabwe, said Dennis Juru, president of the International Cross Border Traders Association in Musina, South Africa, on the border with Zimbabwe. “Prestigious stuff like Rolls batteries exist in a few trendy shops in Zimbabwe, retailing for something like US$1,300… You can buy batteries in China for half what they sell the same battery for in South Africa. At the end of it all, some merchants sometimes smuggle to Zimbabwe to make more,” Juru said. At the height of Zimbabwe’s 2019 blackouts, South Africa immigration police would detain buses headed to Zimbabwe carrying hidden solar panels, inverters or mobile phone tower batteries. An e-waste mountain looms Smuggling substandard equipment ultimately contributes to Zimbabwe’s waste problem. According to Chitiyo: “Defective solar lanterns and panels are not being properly disposed of in these communities. Most solar panels will end up as toys for the kids to play with.” “Solar panels are sealed off with glass, most likely the glass will break or get damaged, exposing children and the environment to harmful substances,” he added. Toxic chemicals released from panels may include copper indium selenide, lead and polyvinyl fluoride. Chitiyo points to Gimboki, a sprawling, informal settlement on the southern outskirts of Mutare. “Very few if any of the solar lanterns in this community are still functional. How will they be disposed of? It’s anyone’s guess where the panels will end up… I think we already have an environmental and health problem that will grow in the future,” he said. Future of solar Zimbabwe is trying to get a grip on solar power generation. In November 2019, the state agency Zimbabwe Energy Regulating Authority (ZERA) announced plans to establish the country’s first solar testing laboratory as a way of checking the solar panels, inverters, batteries or LED lamps coming into the domestic market. ZERA also said it would maintain an online list of genuine solar traders as a guide for consumers. The solar testing lab has so far not started operating, due to funding problems, a public servant in the energy ministry told China Dialogue on condition of anonymity. In June last year, Zimbabwe abolished the unpopular custom duty tax on imports of solar gear, leaving in place only the 15% domestic sales tax. Chitiyo said the tax change was likely to do away with smuggling: “There is now no justifiable need for traders to smuggle equipment into Zimbabwe because it is cheap to import solar energy gadgets into the country.” Importers of solar equipment are very happy about the removal of import taxes. Kuda Moyo, an entrepreneur importing from China, said: “An 8V solar battery and cabling required US$60 upfront. When we used to add tax, the selling price ballooned to $298. We hurt our Zimbabwe customers who are supportive but don’t earn so much.” Some Chinese sellers are doing things by the book. “Our PV panels, batteries and cables get verified before they ship from China. We insist on manufacturers producing certain quality certificates for us to be able to buy their products and bring them to South Africa and Zimbabwe,” said Selma Gaba, manager for Jinbei Electric, a Chinese solar dealer with shops in downtown Johannesburg and in Zimbabwe. “Substandard gear harms consumers’ trust.” Zimbabwe’s own solar manufacturing industry is still nascent. Tawanda Energy is taking steps, collaborating with Infinity PV, a Danish corporation, towards producing cheaper “organic photovoltaics” (OPV) locally. OPV systems use carbon-based materials rather than silicon to absorb different wavelengths of light. They are easier to manufacture than PV systems but have the drawback of a shorter lifespan. Chitiyo plans to send his team to Denmark to be trained to produce these solar cells in Zimbabwe. This may be a suitable model for other developing countries with more sunshine than money or specialist knowledge. Read the full article

0 notes

Photo

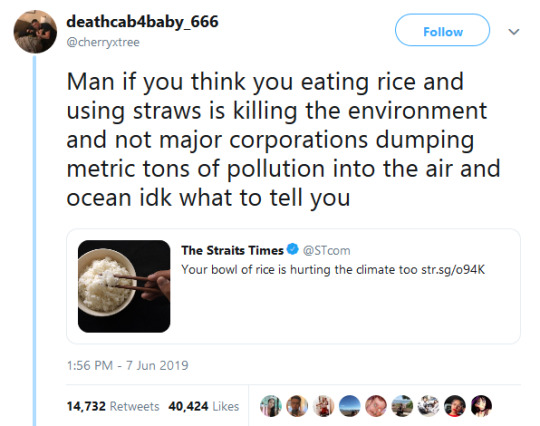

Guys. This is another one of those “y’all gotta actually READ the damned article.” I live in South East Asia, my country is majority Chinese, I eat rice literally every day, and that newspaper is my country’s biggest newspaper. Here’s what it says, in full (I’ve bolded the important parts):

Eco-conscious consumers are giving up meat and driving electric cars to do their part for the environment, but what about that bowl of rice?

Global rice farming, it turns out, could have the same detrimental effect on global warming in the short term as 1,200 average-sized coal power plants, according to the New York-based Environmental Defence Fund (EDF) advocacy group.

That means the grain is just as damaging over the long term as annual carbon dioxide emissions from fossil fuels in Germany, Italy, Spain and Britain combined.

As the sheer size of the staple food's carbon footprint becomes clearer to scientists, companies including Olam International, the world's second-biggest rice supplier, are starting to source more of the grain from farms that aren't flooded, a widespread cultivation technique that releases methane gas into the atmosphere.

"The amount of attention that rice receives for these issues is relatively small compared to the size of the problem," says Mr Paul Nicholson, who heads rice research and sustainability for Olam from Singapore. "People are very informed on their chocolate, coffee, hair care solutions, but rice is an afterthought."

Rice is the staple food of hundreds of millions of Asians and by far the most polluting grain - emitting twice as much of the harmful gases as wheat. Yet it hasn't been in the spotlight as much as, say, beef, which produces far more emissions per calorie and along with other animal products is the culprit behind almost 60 per cent of greenhouse gas emissions coming from food.

That's changing as socially conscious consumers, especially in Europe and North America, increasingly demand evidence that the food they spend their money on is doing the least harm to the environment - and treating farmers and workers in developing countries fairly. With agriculture emitting almost as much greenhouse gas as transportation, those demands will only intensify.

For millennia, rice farmers from Spain to Indonesia have relied on the practice of flooding paddy fields because it stops weeds from growing. But there's a big drawback: Submerging the crop allows tiny underwater microbes to decay organic matter, producing methane, a greenhouse gas that is 25 times more potent than CO2 even though it lingers in the atmosphere for a shorter time.

Growing rice in flooded conditions causes up to 12 per cent of global emissions of methane, a gas blamed for about one quarter of global warming caused by humans.

The Sustainable Rice Platform, or SRP, overseen by the United Nations and International Rice Research Institute, is trying to promote change.

Earlier this year, the Bangkok-based body released updated guidelines on growing rice more sustainably by, for instance, alternately wetting and drying the crop rather than keeping it flooded, not burning what's left of the crop after it has been harvested, using organic fertilisers and promoting fair working conditions.

The SRP is working with thousands of farmers in countries like India, Nigeria, Thailand and Vietnam to give them a score based on these and other factors, with its work funded by corporate members and non-governmental organisations.

Rice that complies with the standard will eventually be eligible to carry an "SRP-verified" logo, a certification that will be rolled out later this year - giving consumers a choice for the first time.

Mars Inc, the producer of the Uncle Ben's brand of rice popular in the United States and Europe, shifted to sourcing 87 per cent of its rice under the standard this year, a ratio it expects to boost to 100 per cent by 2020. Olam, too, said it's pursuing initiatives to get farmers to grow sustainable rice in five Asian and African countries.

"We are working with farmers to develop new methods," said Ms Louke Koopmans, Mars Food's global sustainable sourcing manager. As an example, she said the company's work with 2,500 basmati rice farmers in India and Pakistan has reduced water use by 30 per cent, along with increasing their crop yield and boosting their wages.

But alternative growing methods carry their own risks.

While farmers can drastically curtail overall emissions if they alternate between wetting and drying, this works only if they flood the crops shallowly. Otherwise, as water levels fluctuate, it brings in oxygen which mingles with the nitrogen in the soil and fertilisers to release nitrous oxide, according to Ms K. Kritee, a scientist at the EDF. Nitrous oxide is 300 times more damaging than CO2 and stays around for more than 100 years longer.

"It requires a careful dance of water levels to manage two populations of microbes," she said.

To reduce emissions risk from both gases, a study by the EDF in India suggested keeping the water level between 5cm above the surface and 5cm below. Over a 20-year horizon, total greenhouse gas emissions from rice could take the same toll on the environment as 1,200 coal plants, with the impact dropping to the equivalent of 600 coal plants over 100 years, EDF research shows.

While a lot of farmers in countries like Vietnam, Cambodia and Laos are already being encouraged to grow rice on non-flooded fields, part of the challenge is that farmers need to be trained, for instance, in how to use field water tubes to measure moisture levels.

Rolling out such methods in India and China, where rice is a daily staple, will be difficult because of the prevalence of small-scale farms where the grain is produced by families for their own consumption.

At the moment, it can take more than 1,400 litres of water to produce 1kg of rice, according to the International Rice Research Institute.

Olam and SRP aim to train 150,000 farmers by 2023 in Asia and Africa. But even that will barely move the needle, accounting for only 0.1 per cent of the households farming rice globally.

One solution for the environment, according to Ms Kritee, would be for consumers to shift to eating more alternative grains - like maize and wheat - that leaves less of a footprint.

But rice consumption is rising in Europe and the US as more people adopt vegetarian and vegan diets. Even so, the the US makes up less than 1 per cent of total consumption, compared with almost 50 per cent in China and India. To meet growing demand in the next 25 years, rice production must increase by 25 per cent, according to the International Rice Research Institute.

"It's a dilemma how to deal with this because rice is a staple and of deep cultural value for all in Asia," Ms Kritee said.

There. Yes, there are other things that contribute more to greenhouse gases, but the point is that commercial rice production is a major contributor to greenhouse gases. Not the biggest one, but a major one, and it behooves us to try and address all contributing factors. It acknowledges that it’s a delicate and difficult issue, does not try to say we should all stop eating rice, and instead offers possible solutions and alternatives. Please, before you start yelling and loudly dismissing things, at least take some time to read. The. Article.

When just 100 companies are responsible for 71% of global emissions of course rice is the damn problem 😒

#rice#climate change#rice sustainability#Asia#read the article#reeeeeead the article#Read. The. Article!

169K notes

·

View notes

Text

Pyridine Market Share, Industry Strategic Analysis, Demand, Suppliers and Forecasts 2023

Pyridine Market Information- By Type {(Alpha Picoline, Beta Picoline, Gamma Picoline, 2-Methyl-5-Ethylpyridine (Mep), And Others)}, End Use (Pharmaceutical, Agrochemical, Food & Beverage, Chemicals, And Others) And By Region- Forecast Till 2023

Key Players:

Jubilant Life Sciences Ltd. (India), KOEI CHEMICAL CO., LTD. (Japan), Lasons (India), Vertellus Holdings LLC (U.S.), The Dow Chemical Company (U.S.), Merck KGaA (Germany), LOBA Feinchemie AG (Austria), RASCHIG GmbH. (Germany), Bayer AG. (Germany), Resonance Specialties Limited (India) among others

Defination

Pyridine is a clear liquid with an unpleasant odor. It is simple heterocyclic aromatic compound with structure related to benzene and possess a CH group in the benzene ring replaced by a nitrogen atom. Moreover, the pyridine ring is generally found in many different compounds such as azines, niacin, vitamins, and pyridoxine.

Initially, pyridine was derived from coal tar and obtained as a byproduct of coal gasification, but the process was very expensive and inefficient. Currently, pyridine and its derivatives are manufactured synthetically. It is miscible with water and other organic solvents which find extensive use in numerous end use industries such as agrochemical, food & beverage, pharmaceuticals, chemicals, and others.

Some of the prominent factors that positively influence the growth of the pyridine market are growing disposable income, rapid urbanization, and improved living standards. Additionally, increasing use of pharmaceuticals has led to an increase in the demand for pyridine globally.

Moreover, continuous growth of electronics industry along with wide utilization of pyridine in development of mobile and other electronic product is expected to fuel the growth of the market over the forecast period. Growing demand for pesticide and insecticide combined with the rising need of high quality crop production is estimated to propel the market growth. However, increasing concern regarding the harmful effect of pyridine is expected to hinder the market growth.

Get Full Details @ https://www.marketresearchfuture.com/reports/pyridine-market-3198

Pyridine Increasing demand in chemical industry will boost the global market growth

Pyridine Market Segments

The global Pyridine market is segmented on the basis of types, end use industry, and region. Based on types, the market is categorized into alpha picoline, beta picoline, gamma picoline, 2-Methyl-5-Ethylpyridine (MEP), and others. On the basis of end use industry, the market is classified into pharmaceutical, agrochemical, food & beverage, chemicals, and others. Other end use industries comprises of electronics & semiconductor, rubber, paints and coatings, dyes, and building & construction. Among these, agrochemical segment accounted for the largest market share of global pyridine market in 2016 and is predicted to expand with a healthy CAGR over the forecast period.

Pharmaceutical segment holds the second largest segment and is predicted to grow with the moderate CAGR during the assessment period. New product launches in agrochemicals and pharmaceutical segments as well as strong utilization of pyridine derivatives are among the key factors predicted to give new momentum to the growth of the market. The chemical segment provides maximum market potential on account of raise in demand for pyridine and its derivatives for numerous chemical synthesis reactions and as a catalyst.

Pyridine Regions

Asia Pacific is expected to be the largest market for pyridine followed by Europe and North America owing to rising demand from numerous end use industries such as building & construction, agriculture, and chemical among others. Various countries of Asia Pacific such as South Korea, Japan, China, India, Vietnam, Thailand, and Malaysia are the fastest growing market for pyridine, and is predicted to grow with the same pace in the near future.

In Asia Pacific, some of the driving factors for market growth are increasing economic growth rate, competitive manufacturing costs, and ease in availability of raw material. Europe pyridine market is estimated to witness a significant growth on account of the continuous growth of food & beverage industry.

North America is estimated to witness a substantial growth over the forecast period on account of increasing demand for adhesives in the construction sector. The Middle East & African countries is estimated to witness strong market growth due to rising construction activities. In Latin America market growth is majorly due to expansion of chemical and pharmaceutical sector.

#Pyridine Market#Pyridine Market Size#Pyridine Market Share#Pyridine Market Growth#Pyridine Industry#Pyridine 2020

0 notes

Link

We are leading South African & Indonesian Coal suppliers in India, Nepal, and Bangladesh. Being a market leader & South African coal suppliers & Indonesian Coal Suppliers we have long term business relationship with reputed coal miners ensure the timely delivery of the coal. VR International logistic network ensures the delivery of the shipment on all major ports.

#IndonesianCoalsuppliers#IndonesianCoalsuppliersinindia#IndonesianCoalsuppliersinnepal#IndonesianCoalsuppliersinbangladesh#SouthAfricanCoalsuppliers#SouthAfricanCoalsuppliersinnepal#SouthAfricanCoalsuppliersinbangladesh

0 notes

Link

VRIPL is in the industry for more than 30 years, we are the leading coal suppliers to Indian, Nepal, and Bangladesh. We supply Indonesian Coal and South African Coal in India, Nepal & Bangladesh. The coal stocks that we are linked to, ensure that we can provide the mineral as fast as possible. Through our remarkable logistic process, we make sure that we deliver on time.

0 notes

Text

Indonesian Coal Suppliers and South African Coal Suppliers in India, Nepal & Bangladesh

VRIPL is South African coal suppliers in India, Nepal, and Bangladesh. We are also Indonesian coal suppliers in India, Nepal, and Bangladesh. Know more about VRIPL coal suppliers

#south african coal suppliers in India#indonesian coal suppliers in India#coal suppliers in India#indonesian coal suppliers in nepal#coal suppliers in bangladesh#indonesian coal suppliers in bangladesh#south african coal suppliers in nepal#south african coal suppliers in bangladesh#indonesiancoalsuppliersinindia#indonesiancoalsuppliersinnepal#indonesiancoalsuppliersinbangladesh#southafricancoalsuppliersinindia#southafricancoalsuppliersinnepal#southafricancoalsuppliersinbangladesh#southafricancoalsuppliers#coalsuppliers#south african coal suppliers#indonesian coal suppliers

0 notes

Text

Leading South African Coal Suppliers in India, Nepal and Bangladesh

V R International is a pioneer in supplying South African Coal suppliers in India, Nepal, and Bangladesh. VRIPL coal suppliers have a network of coal miners in South Africa which ensure the timely delivery of South African Coal on all major ports of Nepal, India, and Bangladesh. We are South African Coal Suppliers in Bangladesh, India and Nepal provide South African coal to all type of industries. We supply South African Coal with GCV (kcal/kg) (ARB Basis) - 5126 – 4243 with is suitable for various industries.

#south african coal suppliers in India#south african coal suppliers in nepal#south african coal suppliers in bangladesh#south african coal suppliers#coal suppliers#coalsupplier#southafricancoalsuppliersinIndia#southafricancoalsuppliersinnepal#southafricancoalsuppliersinbangladesh#southafricancoalsuppliers#southafricancoal

0 notes

Link

V R International (VRIPL) is leading Coal suppliers in Nepal. We are Indonesian coal suppliers in Nepal as well as South African coal suppliers in Nepal.

Being Indonesian coal suppliers in Nepal, we always provide Indonesian coal with high thermal efficiency which makes it suitable for wide range of industries.

VRIPL, South African coal suppliers in Nepal has a network with coal miners across the globe which help us to fulfill the coal requirement for all industries in the committed timeline.

#IndonesiancoalsuppliersinNepal #SouthAfricancoalsuppliersinnepal #SouthAfricancoalsuppliers #SouthAfricancoal #SouthAfricancoalsuppliersnepal #SouthAfricancoalsuppliersinbangladesh #Indonesiancoalsuppliersinnepal #Indonesiancoalsuppliersinbangladesh #Indonesiancoalsuppliers #Indonesiancoal

#South African Coal Suppliers in Nepal#South African Coal Suppliers in india#South African Coal Suppliers in bangladesh#coal suppliers#coalsuppliers#south african coal suppliers#South African Coal#SouthAfricanCoalSuppliersinNepal#SouthAfricanCoalSuppliersinindia#SouthAfricanCoalSuppliersinbangladesh#SouthAfricanCoalSuppliers#SouthAfricanCoal#IndonesianCoalSuppliersinNepal#IndonesianCoalSuppliersinindia#IndonesianCoalSuppliersinbangladesh#IndonesianCoalSuppliers#IndonesianCoal#Indonesian coal suppliers in Nepal#Indonesian coal suppliers in india#Indonesian coal suppliers in bangladesh#Indonesian coal suppliers#Indonesian coal

0 notes

Link

0 notes

Link

We are South African Coal suppliers, Indonesian Coal suppliers, US Coal suppliers, Australian Coal suppliers, Anthracite Coal suppliers and bituminous Coal Suppliers in India, Nepal and Bangladesh.

0 notes

Link

Indonesian Coal Suppliers, Australian coal suppliers, US & Bituminous Coal Suppliers, South African Coal Suppliers

0 notes

Text

Resin Additives Market- Overview by Business, Suppliers and Manufacturers Forecast to 2022

Resin Additives Market is expected to grow at a significant CAGR in the upcoming years as the scope and its applications are increasing across the globe. A natural or synthetic organic compound comprising a non-crystalline or viscous liquid substance is known as resin. Usually, resin additives are used in order to enhance physical properties of plastics or upgrade their processing ability.

Browse Full TOC of This Report @ https://www.millioninsights.com/industry-reports/resin-additives-market

The factors that propel the growth of the Resin additives Market include increasing demand, rapid urbanization & industrialization, wide range of applications and product development & technological innovations. This market is classified on the basis of product type, applications, distribution channel and geography. The industry is segmented by product type as coal, coconut shell charcoal, wood charcoal, and others.

Resin additives Market is classified on applications as chemical purification, environmental applications, fuel storage, food and beverage industry, gas purification, metal finishing field, mercury scrubbing, sound absorption, and others. Resin additives Industry is segmented by distribution channel as online stores, specialty stores and others. Resin additives Market is classified on the basis of geography as North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Japan and Middle East and Africa.

The North American region consists of the U.S., and Canada. Latin America region consists of Mexico and Brazil. The Western European region consists of Germany, Italy, France, England and Spain. The Eastern European region consists of Poland and Russia. Asia Pacific region consists of China, India, ASEAN, Australia & New Zealand. The Middle East and African region consists of GCC, South Africa and North Africa.

Request a Sample Copy of This Report @ https://www.millioninsights.com/industry-reports/resin-additives-market/request-sample

0 notes