#Sole Trader Advantages And Disadvantages

Text

Sole Trader Advantages And Disadvantages

New Post has been published on https://www.fastaccountant.co.uk/sole-trader-advantages-and-disadvantages/

Sole Trader Advantages And Disadvantages

So, you’re considering becoming a sole trader, huh? Well, before you make that leap, let’s check out a few Sole Trader Advantages And Disadvantages. Being a sole trader can offer you the freedom to be your own boss and make all the decisions. On the other hand, it also means taking on all the responsibilities, risks, and financial burdens. In this article, we’ll explore the advantages and disadvantages of being a sole trader, giving you a clearer picture of what awaits you on this entrepreneurial journey. So, grab a cup of tea, sit back, and let’s look at some Sole Trader Advantages And Disadvantages!

youtube

Sole Trader Advantages

Autonomy and Control

No doubt there a sole trader advantages otherwise no one will trade or carry out a business as a sole trader. To start with, as a sole trader, you have complete autonomy and control over your business. You have the freedom to make all the decisions regarding your company without having to consult with anyone else. This independence allows you to steer your business in the direction you desire, making it easier to align with your personal values and goals. You can set your own working hours, choose the clients you work with, and make decisions that best suit your business needs.

Ease of Set Up

Setting up a sole trader business is relatively simple and straightforward. You can register your business name and obtain any necessary licenses or permits without going through a complex process. Compared to other business structures, such as partnerships or Limited Companies, there are fewer legal formalities and administrative requirements involved. This means you can get your business up and running quickly, allowing you to focus on generating income and serving your customers.

Flexibility

As a sole trader, you have the flexibility to adapt and change your business as needed. You can easily change your products or services, modify your marketing strategies, and experiment with different approaches to meet the demands of your customers and the market. Unlike larger businesses that may have multiple layers of decision-making, you can quickly respond to changes and make adjustments on the fly. This agility and adaptability can give you a competitive edge in the marketplace.

Profit Retention

One of the significant advantages of being a sole trader is that you have the sole ownership of all the profits your business generates. Unlike other business structures, where profits are shared among multiple partners or shareholders, as a sole trader, you get to keep all the earnings. This can provide you with a higher level of financial freedom and flexibility. You can reinvest the profits back into your business, use them to expand your operations, or save them for personal use.

Ease of Decision Making

As the sole decision-maker in your business, you can make quick decisions without the need for extensive consultation or approval from others. This streamlined decision-making process allows you to respond to opportunities or challenges promptly. You can evaluate options, weigh the pros and cons, and take decisive action. This agility in decision-making can help you stay ahead of the competition and seize opportunities that may arise in the market.

Direct Customer Interaction

As a sole trader, you have the opportunity to interact directly with your customers. This direct contact allows you to build strong relationships with your clients, gaining a better understanding of their needs, preferences, and feedback. By personally serving your customers, you can provide exceptional customer service and tailor your offerings to meet their specific requirements. This personal touch can foster loyalty and trust, leading to repeat business and positive word-of-mouth referrals.

Tax Advantages

Sole traders also enjoy certain tax advantages compared to other business structures. You have the ability to claim tax deductions for business-related expenses, such as office supplies, equipment, and travel expenses. Additionally, as a sole trader, you can offset any business losses against some of your other taxable income, potentially reducing your overall tax liability. This favorable tax treatment can provide you with more financial flexibility and increase your business’s profitability.

Simple Accounting Requirements

As a sole trader, your accounting requirements are relatively simple and straightforward. You are not obligated to prepare complex financial statements or reports. Instead, you can maintain basic records of your business’s income and expenses, such as receipts and invoices. This simplicity can save you time and effort in managing your finances, allowing you to focus on running and growing your business.

Less Government Regulation and Reporting

Compared to other business structures, sole traders face fewer government regulations and reporting obligations. There are typically fewer legal formalities or compliance requirements for sole traders, which means less time spent on paperwork and administration. This reduced regulatory burden allows you to concentrate on core business activities, such as serving your customers and expanding your operations.

Privacy

As a sole trader, you can maintain a higher level of privacy compared to a Ltd Company. You are not required to disclose sensitive financial or operational information to the public or shareholders. This privacy can be especially important if you value confidentiality or operate in a niche industry. It gives you the freedom to keep your business operations and financial performance private, protecting your competitive advantage and maintaining your personal privacy.

Sole Trader Disadvantages

Unlimited Liability

One significant disadvantage of being a sole trader is that you have unlimited liability. As the sole owner of the business, you are personally responsible for all the business’s debts and obligations. If your business fails or faces financial difficulties, your personal assets, such as your home or savings, can be at risk. This unlimited liability can create a significant personal and financial risk, potentially impacting your personal finances and future prospects.

Limited Resources and Expertise

As a sole trader, you may face limitations in terms of resources and expertise. Since you are the sole owner and operator of your business, you may have limited financial resources compared to larger companies. This can affect your ability to invest in the latest technologies, hire specialized staff, or expand your operations. Additionally, as a sole trader, you may have to handle various aspects of your business, such as marketing, finance, and operations, which requires a broad range of skills. Limited resources and expertise can pose challenges in effectively managing and growing your business.

Difficulty in Raising Capital

Sole traders often face challenges when trying to raise capital to fund their business operations or expansion plans. Since you are solely responsible for the business’s financial obligations, lenders and investors may perceive higher risks in providing funding to sole traders. Traditional sources of financing, such as bank loans or venture capital, may be less accessible to sole traders compared to larger, more established businesses. Limited access to capital can hinder your ability to invest in new opportunities, purchase additional stock, or upgrade your equipment.

Long Working Hours

As a sole trader, you are responsible for overseeing all aspects of your business, which often translates into long working hours. You may find yourself working evenings, weekends, and holidays to meet customer demands, manage administrative tasks, and ensure the smooth operation of your business. The need to juggle multiple responsibilities, including marketing, customer service, bookkeeping, and production, can result in a heavy workload and potential burnout. It is crucial to establish work-life balance strategies to avoid exhaustion and maintain your well-being.

Lack of Continuity

In the case of a sole trader’s illness, incapacity, or retirement, the business’s continuity can be at risk. Unlike larger businesses with multiple owners or shareholders, there is no inherent continuity plan for a sole trader business. If you are unable to operate the business due to unforeseen circumstances, such as a health issue, your business may suffer and potentially fail. Planning for such contingencies, such as having a succession plan or considering business insurance, can help mitigate this risk and ensure the long-term viability of your business.

Limited Growth Potential

Sole traders often face limitations in terms of growth potential compared to larger companies. With limited financial resources and limited expertise, expanding into new markets, launching new products or services, or scaling operations may be challenging. The ability to seize growth opportunities may be dependent on your personal capacity to handle increased workload or generate additional income. It is essential to carefully consider scalability and growth strategies to avoid reaching a point where you cannot further expand or increase revenue significantly.

Personal Liability for Business Debts

As a sole trader, your personal assets are at risk if your business incurs debts. If your business cannot meet its financial obligations, creditors can potentially go after your personal assets, such as your home, car, or savings, to settle the debts. This personal liability can have a significant impact on your financial well-being and future prospects. It is essential to manage your business’s financial health diligently, including monitoring cash flow, minimizing debt, and exploring business insurance options, to protect yourself from personal liability.

Difficulty in Attracting Top Talent

As a sole trader, you may face challenges in attracting and retaining top talent due to limited resources and the perception of job security. Larger companies with more established reputations and resources may be more appealing to highly skilled individuals seeking stability and career advancement opportunities. As a result, you may have to rely on your own skills and expertise or consider alternative recruitment strategies, such as outsourcing or partnering with freelancers, to meet your business’s staffing needs.

Limited Access to Benefits

Sole traders typically do not have access to employee benefits such as health insurance, retirement plans, or paid time off. These benefits are often associated with larger companies that can negotiate favorable terms with providers or offer them as part of their employment packages. As a sole trader, you are responsible for arranging and financing these benefits on your own, which can be cost-prohibitive or less comprehensive. It is essential to consider and plan for your personal benefits requirements to safeguard your well-being and financial stability.

Risk of Business Failure

Like any business, sole traders face the risk of business failure. Without the support or resources of partners or shareholders, the success or failure of your business lies solely in your hands. Economic downturns, changing market conditions, or unforeseen events can impact your business’s revenue and profitability. It is crucial to carefully manage risks, conduct market research, establish contingency plans, and seek expert advice to minimize the risk of business failure and increase your chances of long-term success.

In conclusion, there are several Sole trader advantages, including autonomy and control, ease of set up, flexibility, profit retention, ease of decision making, direct customer interaction, tax advantages, simple accounting requirements, less government regulation and reporting, and privacy. However, there are also sole trader disadvantages to consider, such as unlimited liability, limited resources and expertise, difficulty in raising capital, long working hours, lack of continuity, limited growth potential, personal liability for business debts, difficulty in attracting top talent, limited access to benefits, and the risk of business failure. By carefully weighing these Sole trader advantages and disadvantages and planning accordingly, you can make an informed decision about whether being a sole trader is the right choice for you and your business aspirations.

#advantages of a sole trader#advantages of sole trader#being a sole trader advantages#disadvantages of a sole trader#sole trader advantages#Sole Trader Advantages And Disadvantages

0 notes

Text

Sole Trader Advantages And Disadvantages

So, you’re considering becoming a sole trader, huh? Well, before you make that leap, let’s check out a few Sole Trader Advantages And Disadvantages. Being a sole trader can offer you the freedom to be your own boss and make all the decisions. On the other hand, it also means taking on all the responsibilities, risks, and financial burdens. In this article, we’ll explore the advantages and…

View On WordPress

#advantages of a sole trader#advantages of sole trader#being a sole trader advantages#disadvantages of a sole trader#sole trader advantages#Sole Trader Advantages And Disadvantages

0 notes

Text

Understanding the Pros and Cons of Technical Analysis

In the world of finance, investors and traders often employ various methodologies to analyze and predict market movements. Technical analysis is one such method that relies heavily on historical price data and statistical trends to forecast future price movements. While technical analysis has its proponents who swear by its efficacy, it also has its detractors who argue that it's unreliable and subjective. In this article, we'll delve into the advantages and disadvantages of technical analysis to provide a comprehensive understanding of its utility in the financial markets.

Advantages of Technical Analysis:

Objective Data Analysis: One of the key advantages of technical analysis is its reliance on objective data derived from historical price movements. Unlike fundamental analysis, which involves subjective interpretations of financial statements and economic indicators, technical analysis primarily focuses on price and volume data. This objective approach can be appealing to traders who prefer empirical evidence over qualitative assessments.

Identifying Trends: Technical analysis excels in identifying and capitalizing on market trends. By analyzing charts and patterns, technicians can spot trends such as uptrends, downtrends, and sideways movements. This allows traders to enter positions in line with the prevailing trend, potentially maximizing profits and minimizing losses.

Visualization of Market Psychology: Price charts in technical analysis serve as a visual representation of market psychology. Patterns such as head and shoulders, triangles, and flags reflect shifts in supply and demand dynamics and investor sentiment. Understanding these patterns can provide insights into market participants' behavior, facilitating better decision-making.

Timing Entry and Exit Points: Technical analysis offers tools and indicators that help traders time their entry and exit points with precision. Indicators such as moving averages, relative strength index (RSI), and stochastic oscillators provide signals indicating overbought or oversold conditions, allowing traders to enter or exit positions at opportune moments.

Risk Management: Technical analysis aids in risk management by setting clear stop-loss levels and profit targets based on support and resistance levels. Traders can use technical indicators to assess the risk-reward ratio of a trade before executing it, thereby controlling potential losses and maximizing returns.

Disadvantages of Technical Analysis:

Subjectivity: Despite its claim to objectivity, technical analysis is inherently subjective to some extent. Different technicians may interpret the same chart pattern or indicator differently, leading to conflicting analyses and trading decisions. This subjectivity introduces an element of uncertainty and undermines the reliability of technical analysis.

Limited Scope: Technical analysis solely relies on historical price and volume data, ignoring fundamental factors such as earnings, dividends, and macroeconomic trends. Critics argue that this narrow focus overlooks crucial information that can impact asset valuations and market movements. As a result, technical analysis may fail to provide a comprehensive understanding of market dynamics.

False Signals: One of the criticisms leveled against technical analysis is its susceptibility to false signals. Indicators and chart patterns may generate signals that appear promising but ultimately fail to materialize, resulting in losses for traders. False signals can occur due to market noise, sudden news events, or unexpected changes in market sentiment, undermining the reliability of technical analysis.

Inability to Predict Market Events: Technical analysis is primarily backward-looking, focusing on past price data to predict future movements. While it can identify trends and patterns, it cannot foresee unexpected events or catalysts that may disrupt market dynamics. Economic data releases, geopolitical tensions, and natural disasters are examples of factors that can defy technical analysis predictions, highlighting its limitations in forecasting market events.

Overreliance on Historical Data: Critics of technical analysis argue that its reliance on historical data may lead to backward-looking decision-making, overlooking evolving market conditions and trends. Market dynamics are constantly changing, influenced by factors such as technological advancements, regulatory changes, and shifts in investor sentiment. Relying solely on historical data may result in missed opportunities or misinterpretation of current market conditions.

In conclusion, technical analysis offers several advantages, including objective data analysis, trend identification, and precise timing of entry and exit points. However, it is not without its drawbacks, such as subjectivity, limited scope, and susceptibility to false signals. Traders and investors should weigh these pros and cons carefully and consider integrating technical analysis with other analytical methods to make well-informed decisions in the dynamic world of finance.

0 notes

Text

How To Work from Home As A Bookkeeper (Step-by-step Guide)

If you are ready to kickstart your journey as a freelance bookkeeper, there are several ways you can go about it. First, working as a bookkeeper is a great way to make good money while gaining the flexibility and freedom you desire. Furthermore, getting started with a bookkeeping job is simple.

Aside from a computer, an internet connection, and bookkeeping software, there isn't much setup or equipment required. While learning the ins and outs of bookkeeping takes time, almost anyone with a knack for numbers and data entry can know with practice.

You don't need expensive equipment to start, and you certainly don't have to go through complex processes. All you need is a stable internet connection, bookkeeping software, and a computer – it's that easy!

But if you want to be successful at it, there are certain processes you need to follow. This article highlights the best ways to become a successful work-from-home bookkeeper.

How Lucrative are Work-from-home Bookkeeping Jobs?

Bookkeeping is one of the highest-paying jobs you can do remotely. It is also an interesting career for anyone interested in finance but does not want to meet the requirements to become an accountant. However, if you are looking for a job that lets you use your knowledge of finance or computer skills, working as a bookkeeper could be a profitable and rewarding option.

Bookkeeping is one of the best stay-at-home mom jobs you should consider since it doesn't require much physical effort. Because the start-up costs are so low, it's an excellent opportunity for many people. Furthermore, there are different ways to work from home as a bookkeeper and you do not need prior experience or a bookkeeping certification/degree.

What Are the Pros vs Cons of Becoming a Work-from-home Bookkeeper?

As with most jobs, there are advantages and disadvantages, and it is ultimately up to you to decide what you are comfortable doing.

Pros

- You can set your own rates.

- You can take on as many clients as you want; it's a flexible career path in which you set your own hours and work schedule.

- You can do this as a side hustle to complement your current job or your children's schedules.

- A high school diploma is required, but no other degrees are needed. Job training is available!

Cons

- You must find your own clients and pitch to them.

- At first, your income may not be consistent from month to month.

- You must be knowledgeable about different accounting software and consistent in your ability to prepare financial reports.

- Certified bookkeepers earn more per hour, so you may want to go the extra mile and pursue certification.

Related: 30 Best Side Hustles To Start With $100

How To Work from Home As A Bookkeeper

Step 1. Register as Self-employed

Registering as self-employed with the HMRC is a simple process that can be completed online. However, starting as a sole trader may be best if you've never registered for VAT.

This will allow you to keep track of your income and expenses for tax purposes, making organizing your business finances easy. If you intend on taking on employees at some point in the future, you will need to register with HMRC as a limited company.

Registering as self-employed allows you to access certain benefits absent when working under an organization.

Step 2. Invest in Your Work Tools

If you want to learn to be a bookkeeper, you need to be willing to invest money in this career. You're basically training to become a virtual bookkeeper, which means you'll work from home, most likely for businesses as a third-party service provider.

It makes sense that you should buy a good computer and a good Internet connection. You'll use these two tools most for work, so they must be good. To reach customers and coworkers, you should also spend money on a landline or mobile phone service.

You can use your personal cell phone and landline while setting up your business, but at some point, you'll need to separate your business communications from your personal ones.

Step 3: Learn How to Use Accounting Software

You need to know the basics of bookkeeping and how to do it, but you also need to understand how to use accounting software. You can learn the basics from online tutorials or working with a professional bookkeeper.

If you know how to use accounting software, you can be even more helpful to your clients. Software tools make it easier to keep track of your books so that you can do your job quickly.

Accounting software for business like QuickBooks also helps keep the costs of starting a business to a minimum. When choosing an online accounting program, you should consider how it will help you and your clients manage their money. Don't forget that you'll also use it to track your money.

Software and programs are usually not free, so it's up to you to choose one worth the money. Here are some things to think about when picking an accounting program or software:

- Cost of software

- Types of bookkeeping tools you'll need

- Collaboration options

- Usability

- Storage

- Mobile options

You don't need the most advanced accounting software when you first start. Instead, you need cheap software with everything you need to manage your money well.

Step 4. Launch Your Bookkeeping Business

After you've learned how to become a bookkeeper and gotten business skills, it's time to start your own bookkeeping business. Or, you can work as a bookkeeper on your own. Whether you decide to open a bookkeeping business or work as a freelance bookkeeper, here are some steps you need to take:

- Acquire a tax identification number

- Licenses and business permits may need to be applied for.

- Select a structure for your business (sole proprietorship, LLC, etc.)

After making your bookkeeping business official, start marketing your business. You can do this in the following ways:

Create a Website: Having your website adds to your credibility. It makes it easier for people to find you and learn about your services. You can host your software in one of these best webhosting platforms to ensure you have a good, responsive and user-friendly website. Eventually, you can also add customer reviews to your website.

Networking: Go to small business groups and events for networking to meet people you might work with or do business with. Look for potential clients on job sites specializing in bookkeeping jobs you can do from home. Websites called "freelance marketplaces" allow you to look for both short-term and long-term jobs.

One thing you can do is focus on a certain niche that you can grow naturally. For example, you can work as a bookkeeper for doctors or new businesses.

Word of Mouth: Tell your family and friends about your business and take advantage of your connections. Ask people to recommend you so you can get clients and build your network.

Create a LinkedIn Profile — Social selling is a good way to market your services, and you can start by connecting with people on LinkedIn. Make sure to keep your profile up to date with useful information, just like you would with your website.

Step 5. Get Clear on Your Pricing and Payment Terms

According to the US Bureau of Labor Statistics, the average annual bookkeeper salary is around $40,000 ($19 per hour). Full-time bookkeepers are paid at this rate.

You can earn more as a service provider or freelancer than the average full-time bookkeeper. The key to commanding a higher rate is providing your clients with the required value.

Make sure you clearly understand how much time and effort it will take to complete your services. After this, place a price tag on your service. Doing this will give you a sense of security and control. It also enables your clients to gain confidence in you.

In addition, you should also be clear on your payment terms—what is expected before the project can begin, what happens after it's completed, and when clients can expect to receive their final product.

How to Set Up Your Bookkeeping Website

Creating a blog for your services may not be necessary, but it is important. A website gives you an online presence and enables you to reach potential clients worldwide. The following are what to do when creating a website:

Create a website that is easy to navigate, responsive to visitors and understandable. Update the blog regularly with content related to bookkeepingInclude a contact form, your pricing, credentials, testimonials, portfolio, and the list of services you offer on the site so potential clients can find it easily.

Start using social media to promote your bookkeeping service. Social media is a great way to promote your bookkeeping service, and with the right social media management tools, you are well on your way to building your brand. It's also an excellent way to connect with your target audience and potential clients.

How do I set up social media accounts for my bookkeeping business

Set up social media accounts for your business

Create engaging content that includes a redirection link to your website. Post regularly so people will keep coming back to the page. Get testimonials and reviews.

What a client wants is to be assured of the services you offer. A testimonial or review from previous clients settles this anxiety they have.

How Do I Get Testimonials from Clients for my bookkeeping business?

Get testimonials from clients and reviews from other bookkeepers. Also, get reviews from the media and the internet (websites like Yelp). Getting positive feedback in as many places as possible is essential, especially if you're a new business with a small client base and need to build your reputation quickly.

Step 6. Create a workflow: Deliverables, Proposals, Processes, and Payments

Losing your sense of direction and stability as a freelance worker is very easy. To avoid this situation, it's best to create a workflow to gain insight into the business pipeline.

Here's how to go about it:

Create a workflow – deliverables, proposals, processes, and payments. Establish your office space. Have clear goals and objectives for your business. Join professional associations or organizations

You can join professional organizations and groups to connect with other bookkeepers, stay up-to-date on industry trends, and find job opportunities.

Professional associations and organizations are also great places to find mentors who can guide you through your career as a bookkeeper.

Some good examples of professional associations include the International Association of Bookkeepers (IAB), the American Institute of Certified Public Accountants (AICPA), the National Association of Accountants (NAA), and the National Society for Certified Public Accountants (CPA).

Step 7. Get a Partner or Network of Bookkeepers.

Working with a partner or network of bookkeepers can be a great way to expand your business. You can help each other with clients, share resources such as software or cloud storage, and collaborate on marketing strategies.

One partner may specialize in payroll, while another may focus on taxes.

Find Focus – Set Processes, Hours, and Boundaries

The next step is setting working hours, boundaries, and work processes. Again, it's essential to work out what your working day will look like to stay consistent. For example, if you are working from home, you'll need to ensure that your office space has the proper lighting and that there are no distractions.

- Make Provisions for Finances

- You'll need to ensure that you have enough money to cover all of your business expenses, including:

- Rent or mortgage payment(s)

- Utilities (gas, electric, and water)

- Internet service provider fees (if applicable to your business model)

- Office supplies (such as pens, paper clips, and file folders).

Step 8: Invest in Yourself

Investing in work tools is the first step to becoming a bookkeeper from home. Now that we're back where we started, the last step you should always take is to invest in yourself.

This means that you should regularly train to improve your skills. You must also keep up with the latest industry standards to give your clients the best service possible.

Grow your desire to learn new things because there's always something new to find and understand. In addition, the accounting field is always changing, and if you want to stay in business, you must go with the flow.

Step 9. Keep Up With Training and Trends

Professional development is a good idea regardless of industry. The good news is that it is widely accessible! Conferences, events, and professional groups allow you to meet other people in your industry and help you connect with clients, stay on top of changes you need to be aware of, and stay competitive.

Also, keep an eye out for bookkeeping, finance, and accounting-related webinars, online courses, books, and training sessions. There are a lot of online course platforms for learning and teaching to training and developing yourself.

Consider Getting Bookkeeping Certifications

Getting certified can be helpful for both full-time and part-time workers. You can get the Certified Bookkeeper title from the American Institute of Professional Bookkeepers and the National Association of Certified Public Bookkeepers.

To get these certifications, you must have worked as a bookkeeper full-time for at least two years or part-time for the same time. Then you must pass a test and agree to follow a set of rules. You can also get a license as a Certified Public Bookkeeper by taking the Uniform Bookkeeper Certification Exam online.

Certification isn't necessary to be a successful bookkeeper, but it can help you get higher-paying clients. In addition, certified bookkeepers are guaranteed skilled and experienced, so some employers may only hire certified people.

What is Bookkeeping

Bookkeeping is the process of recording, monitoring, and analyzing financial transactions – It is an important part of any business. With bookkeeping, you can have a clear picture of your financial situation. In addition, it helps you to prepare your taxes and keep your finances on track.

Most entrepreneurs and business owners are experts in their fields: carpentry, dentistry, carpet cleaning, and you name it. However, most of them have no idea how to keep track of their finances. Here comes the bookkeeper.

The bookkeeper is the person business owners rely on for accurate financial data. Business owners want to be able to focus on their strengths while delegating their weaknesses. Bookkeeping is an excellent example of a task that savvy business owners delegate to others.

Accountant vs Bookkeeper

You may wonder what responsibilities and experience are required when you hear the term bookkeeping. Unlike an accountant or CPA (certified public accountant), who must have a bachelor's degree and a license, bookkeepers are classified as accountants.

On the other hand, bookkeepers are more concerned with the day-to-day operations of tracking income and expenses and balancing the books. While experience is helpful, you do not need a college degree or a CPA license to work as a bookkeeper.

As a result, while the bookkeeping role requires close attention to detail and a high level of accuracy, the responsibility is lower than that of an accountant. In addition, a college degree or a CPA license is not required. As a result, while bookkeeping requires close attention to detail and a high level of accuracy, the role is less responsible than that of an accountant.

On the other hand, accountants are typically in charge of developing a company's overall budget and financial direction; they oversee tax information and establish the chart of accounts following standard accounting practices. In addition, accountants examine and audit financial data, generate reports, and make strategic recommendations based on data and tax laws.

Why Do Companies Hire Remote Bookkeepers?

You may be wondering why a company would hire an inexperienced remote bookkeeper. Of course, every business requires a bookkeeper at some point — but not every business needs a full-time bookkeeper.

This is particularly true for small businesses such as freelancers and mom-and-pop shops. Many of these businesses have realized that hiring someone online part-time makes more sense than going with a more traditional firm with higher overhead costs that are passed on in the form of higher rates.

In other words, it's a win-win situation: remote bookkeepers frequently earn more than they would work for a traditional firm or agency while still offering their services at a lower rate than clients would find elsewhere.

Furthermore, not every business has the same requirements. For example, traditional bookkeeping firms can be rigid and inflexible.

Read the full article

0 notes

Text

Setting up a Company in the UK

The Legal Structure

When it comes to setting up a company in the UK, the first step is to decide on the legal structure that best suits your business needs. The most common forms of business are sole trader, partnership, and limited company. Each legal structure has its own advantages and disadvantages, and it's important to carefully consider which one aligns with your goals and vision for the company.

Sole Trader: As a sole trader, you have complete control over your business and its profits. However, you are personally liable for any debts incurred by the business, which may not be suitable for high-risk ventures.

Partnership: A partnership involves two or more individuals sharing the profits and losses of the business. It's essential to have a partnership agreement in place to avoid potential conflicts down the line.

Limited Company: Many entrepreneurs opt for a limited company structure due to the protection it offers their personal assets. Setting up a limited company requires registration with Companies House and compliance with various legal and financial regulations.

Registration with Companies House Once you have decided on the legal structure, the next step is to register your company with Companies House, the UK's registrar of companies. The registration process includes providing details such as the company name, registered office address, details of directors and shareholders, and the nature of the business activities.

Companies House will issue a Certificate of Incorporation upon successful registration, giving legal recognition to your business entity.

Taxation and Employment Considerations Setting up a company in the UK also involves understanding the taxation and employment implications. As a business owner, you are responsible for registering for relevant taxes such as Corporation Tax, Value Added Tax (VAT), and Pay As You Earn (PAYE) for staff.

Additionally, you need to adhere to employment laws and regulations, including the creation of employment contracts and compliance with health and safety standards. In conclusion, setting up a company in the UK involves careful consideration of the legal structure, registration with Companies House, and understanding the tax and employment responsibilities.

Seeking professional advice from legal and financial experts can simplify the process and ensure compliance with all legal requirements.

0 notes

Text

Free Forex Signal Service

Introduction:

For traders looking to enter the forex market, the availability of free forex signal services can be enticing. These services provide traders with trading signals and recommendations without any cost. While the idea of accessing free signals may seem appealing, it is essential to understand the pros and cons before relying solely on these services. In this blog, we will explore the advantages and disadvantages of best forex signal services and help you make an informed decision about their suitability for your trading needs

Pros of Free Forex Signal Services:

Cost Savings:

The primary benefit of free forex signal services is, of course, the cost savings. As a beginner or a trader on a limited budget, accessing free signals can help you gain exposure to the forex market without incurring additional expenses. It allows you to test different strategies and signals without financial risk.

Learning Opportunity:

Free best forex signal services can be a valuable learning tool for novice traders. By analysing the signals provided, you can observe and understand various trading strategies, entry and exit points, and risk management techniques. This hands-on experience can help you develop your trading skills and gain insights into market dynamics.

Market Awareness:

Utilizing free best signal services can help you stay informed about market conditions, price movements, and potential trading opportunities. The signals serve as a source of market analysis and can enhance your understanding of the forex market. This awareness can be valuable when combined with your own analysis and trading decisions.

Cons of Free Forex Signal Services:

Limited Quality Control:

Free forex signal services are often plagued by a lack of quality control. Providers may not have sufficient resources or expertise to consistently deliver accurate and reliable signals. There is a risk of receiving signals that are outdated, poorly researched, or based on unreliable indicators. It is crucial to thoroughly evaluate the credibility and track record of the signal provider before relying on their signals.

Delayed or Real-time Alerts:

Free signal services may not provide real-time alerts. This delay can significantly impact your trading decisions, as the forex market is dynamic and moves quickly. By the time you receive the signal and act on it, the market conditions may have changed, resulting in missed opportunities or potential losses.

Limited Support and Analysis:

Free signal services often lack comprehensive support and analysis. Providers may not offer detailed explanations or insights into their trading signals. Without a clear understanding of the rationale behind the signals, it becomes challenging to make informed trading decisions or learn from the signals provided.

Potential Bias and Conflicts of Interest:

Free signal services may have a hidden agenda or conflicts of interest. Some providers may be affiliated with brokers or have vested interests in promoting certain trades or products. This bias can lead to skewed signals and recommendations, which may not align with your trading goals or strategies.

Conclusion:

While free forex signal services may seem appealing, it is crucial to approach them with caution. They can serve as a valuable starting point for novice traders or those on a limited budget, providing learning opportunities and market awareness. However, the lack of quality control, potential delays, limited support, and the presence of bias must be considered. It is advisable to conduct thorough research, seek out reputable providers, and consider free signals as just one component of your overall trading strategy. Balancing free signals with your own analysis and research can lead to better trading decisions and long-term success in the forex market.

1 note

·

View note

Text

Your Guide to Starting a Business in Australia

Are you ready to start your exciting journey of turning your business dreams into reality? Australia, with its thriving economy and dynamic market, presents a plethora of opportunities for aspiring entrepreneurs. Whether you are a local ready to explore the business landscape or an international enthusiast seeking new horizons, starting a business in Australia can be a game-changer.

To help you start your business, here is your guide with key steps, regulations, and insider tips to navigate the intricate path of starting a business in Australia successfully.

1. Market Research: Lay the Foundation for Success

Before diving headfirst into your business venture, it’s crucial to conduct thorough market research. Australia’s diverse market requires a nuanced approach, so use tools like surveys, interviews, and industry reports to gather valuable insights. Identify your target audience, analyze competitors, and understand the demand for your product or service. A well-researched foundation is key to sustained success.

2. Choose the Right Business Structure

Australia offers various business structures, each with its advantages and disadvantages. The most common structures include sole trader, partnership, company, and trust. Your choice will impact taxation, liability, and compliance requirements. Seek professional advice to determine the structure that aligns with your business goals and provides the best legal and financial framework.

3. Register Your Business

Registering your business is a legal requirement in Australia. Visit the Australian Business Register (ABR) and complete the necessary forms. Choose a business name that reflects your brand and ensures it’s available for registration. Registering for an Australian Business Number (ABN) is also essential, as it simplifies dealings with other businesses and government agencies.

4. Understand Taxation Obligations

Australia has a well-established taxation system that includes Goods and Services Tax (GST), income tax, and other levies. Familiarize yourself with your taxation obligations, keep accurate records, and consider consulting a tax professional to optimize your financial strategy. The Australian Taxation Office (ATO) website provides comprehensive resources to guide you through the taxation maze.

5. Secure Funding

Whether you’re self-funding or seeking external investment, having a solid financial plan is crucial. Explore various funding options, such as bank loans, government grants, or venture capital. Australia’s government provides support for small businesses through grants and incentives, so investigate these opportunities to give your startup a financial boost.

6. Navigate Employment Regulations

If your business requires hiring employees, familiarize yourself with Australia’s employment regulations. Understand the Fair Work Act, which outlines the rights and obligations of employers and employees. Create clear employment contracts, adhere to minimum wage requirements, and implement fair workplace practices to build a positive and productive work environment.

7. Embrace Digital Marketing

In the digital age, establishing an online presence is non-negotiable when starting a business in Australia. Leverage social media, search engine optimization (SEO), and content marketing to reach your target audience. Create a user-friendly website, optimize it for search engines, and engage with your audience through various online channels. A robust digital marketing strategy will enhance your visibility and drive customer acquisition.

8. Network and Collaborate

If you’re starting a business in Australia, building a network is essential for business success. Attend industry events, join local business chambers, and connect with fellow entrepreneurs. Networking not only opens doors to potential partnerships and collaborations but also provides valuable insights and mentorship opportunities. Australia’s business community is supportive, so don’t hesitate to reach out and forge meaningful connections.

9. Prioritize Customer Service

Exceptional customer service is the key to building a loyal customer base. Prioritize customer satisfaction, actively seek feedback, and address any issues promptly. Satisfied customers become brand ambassadors, contributing to positive word-of-mouth marketing and long-term success.

10. Stay Informed About Regulatory Changes

Australia’s regulatory landscape is dynamic, with laws and regulations evolving to meet the changing business environment. Stay informed about any legislative changes that may impact your business. Regularly check government websites and subscribe to updates to ensure compliance and mitigate any potential risks.

11. Embrace Cultural Sensitivity

Australia’s diverse population is a rich tapestry of cultures and backgrounds. Embracing cultural sensitivity in your business practices can lead to better relationships with customers and partners. Understanding the local nuances and respecting cultural diversity can significantly impact how your brand is perceived. Tailor your marketing strategies to resonate with the cultural values of your target audience, creating a more inclusive and welcoming brand image.

12. Leverage Government Support Services

For someone starting a business in Australia, the Australian government provides an array of support services for businesses, both startups and established enterprises. Take advantage of resources such as business advisory services, mentoring programs, and industry-specific assistance. These services can provide valuable guidance, connect you with experts, and offer insights into navigating regulatory frameworks, giving your business a competitive edge.

13. Establish a Robust Online Presence

In the digital age, an online presence is pivotal for business success. Beyond just a website, consider e-commerce capabilities if applicable to your business model. Optimize your website for mobile devices and ensure a seamless user experience. Utilize social media platforms to engage with your audience, share updates, and build a community around your brand. A strong online presence not only enhances visibility but also allows for direct interaction with your customer base.

14. Implement Sustainable Practices

Australia places a growing emphasis on sustainability. Consider integrating environmentally friendly practices into your business model. From sourcing products ethically to reducing waste and implementing energy-efficient measures, showcasing a commitment to sustainability can attract environmentally-conscious consumers and enhance your brand’s reputation.

15. Monitor and Adapt

The business landscape is ever-evolving, and adaptability is key to long-term success. Regularly monitor market trends, consumer behavior, and industry developments. Be open to refining your strategies and pivoting your business model if needed. Staying agile and responsive to changes will position your business to thrive in dynamic market conditions.

Summing Up

Starting a business in Australia is not just about meeting legal requirements; it’s about embracing the culture, leveraging available resources, and adapting to the ever-changing business landscape. By incorporating these additional aspects into your business plan, you can create a solid foundation for success in the Australian market. Remember, resilience, creativity, and a commitment to excellence will set your business apart on the path to success in the vibrant Australian business ecosystem. Good luck on your entrepreneurial journey Down Under!

Also Read: Base Website Design for your Sales Process

#BusinessInAustralia#AustralianEntrepreneur#StartupGuide#AustralianBusiness#TaxationObligations#MarketResearch#BusinessStructure

0 notes

Text

Advantages of Being a Sole Trader

New Post has been published on https://www.fastaccountant.co.uk/advantages-of-being-a-sole-trader/

Advantages of Being a Sole Trader

Being a sole trader presents numerous advantages that make it an appealing option for entrepreneurs. By assuming full control and responsibility for your business, you have the freedom to make autonomous decisions and navigate the direction of your enterprise. As a sole trader, you have sole ownership of profits, allowing you to retain and reinvest all earnings. Additionally, the simplified legal and financial requirements, coupled with the ease of set up, provide a seamless platform for individuals starting their business journey. In this article, we will explore the various advantages of being a sole trader, shedding light on the potential benefits that lie ahead for those who choose this path.

youtube

Tax Advantages

Simplified tax reporting

Being a sole trader can bring significant tax advantages. One of the key benefits is the simplified tax reporting process. Unlike larger businesses with complex structures, as a sole trader, you have the convenience of reporting your business income and expenses directly on your personal tax return. This simplification not only saves you time but also makes it easier to keep track of your financials and ensure compliance with tax obligations.

Income tax deductions

As a sole trader, you are entitled to claim income tax deductions on various business-related expenses. This means that you can offset the costs incurred in running your business against your taxable income, potentially reducing your overall tax liability. Common deductions include office rent, utilities, business-related travel, and marketing expenses. By taking advantage of these deductions, you can effectively lower your taxable income and save on your tax bill.

Access to small business concessions

Operating as a sole trader makes you eligible for various small business concessions, which can provide significant financial benefits. For example, certain tax concessions may be available, such as the simplified depreciation rules, which allow you to immediately deduct the cost of assets up to a certain threshold. Additionally, you may have access to capital gains tax concessions, which can reduce the tax payable when you sell certain business assets. These concessions not only support your business growth but also help improve your overall financial position.

Autonomy and Control

Decision-making freedom

As a sole trader, you have complete autonomy and control over your business decisions. Unlike in a partnership or company where decision-making involves multiple individuals, as a sole trader, you can make important choices independently. This freedom allows you to respond quickly to market changes, implement innovative strategies, and drive your business towards success without the delays and complications that can arise from consensus decision-making.

Flexibility in operations

Being a sole trader grants you the flexibility to mold your business operations according to your preferences and the needs of your customers. You have the freedom to set your own working hours, determine pricing strategies, and develop unique products or services. This flexibility enables you to adapt to changing market conditions swiftly and efficiently, staying ahead of your competitors and meeting the evolving demands of your customers.

Direct interaction with customers and suppliers

Operating as a sole trader provides you with the distinct advantage of having direct interaction with both your customers and suppliers. This direct line of communication allows you to establish personal connections and build stronger relationships with your stakeholders. By understanding your customers’ needs and preferences firsthand, you can tailor your offerings to suit their requirements, thereby enhancing customer satisfaction and loyalty. Similarly, direct interaction with suppliers enables you to negotiate better terms, forge mutually beneficial partnerships, and ensure a smooth supply chain.

Ease of Formation

Simplified registration process

Forming a sole trader business is relatively simple and straightforward. Compared to the formation of complex business structures, such as partnerships or companies, the registration process for a sole trader involves fewer legal formalities. In most cases, you only need to register with HM Revenue and Customs (HMRC) by 5th of October following the tax year in which you started the business. This ease of formation means that you can start your business quickly, avoiding the complexities and delays associated with more elaborate business structures.

Lower startup costs

Starting a business as a sole trader typically incurs lower startup costs compared to other business structures. Since there are no requirements for shareholders or directors, you can begin operating with minimal financial investment. This allows you to allocate your resources efficiently, reducing the financial burden during the early stages of your business. By keeping your startup costs manageable, you can navigate the initial challenges with ease and focus on growing your business sustainably.

No requirement for shareholders or directors

One of the key advantages of operating as a sole trader is the absence of any requirement for shareholders or directors. This means that you can establish and run your business entirely on your own. Unlike companies that often necessitate multiple stakeholders and directors, a sole trader business allows you to maintain complete control and independence. This simplicity enables you to make decisions swiftly and avoid the complexities associated with managing diverse perspectives and conflicting interests.

Profit Retention

Full control over profits

As a sole trader, you have full control over your business profits. Unlike in partnerships or companies where profits are often shared among multiple owners, all the profits generated by your sole trader business belong to you. This control allows you to decide how to allocate and reinvest your earnings according to your business priorities and growth objectives. By retaining full control over profits, you have the flexibility to reinvest in your business, expand your operations, or save for future endeavors.

Ability to reinvest

Since you retain full control over your business profits, you have the freedom to reinvest your earnings back into your business. This reinvestment can take various forms, such as upgrading equipment, expanding your product range, or improving marketing efforts. By reinvesting, you can enhance the competitiveness and productivity of your business, paving the way for long-term growth and success. This ability to reinvest your profits without external constraints is a distinct advantage of being a sole trader.

No obligation for profit distribution

Unlike in partnerships or companies, there is no legal obligation to distribute profits to other stakeholders as a sole trader. This means that you are not compelled to share your hard-earned profits with anyone else. Instead, you can choose to reinvest the profits, save for future needs, or enjoy the financial rewards personally. This flexibility in profit distribution allows you to prioritize your financial goals and choose how best to utilize the earnings of your business to support your personal and business aspirations.

Privacy

No public disclosure of financial information

One of the main advantages of a sole trader is the level of privacy and confidentiality that it offers which may not be available to businesses with larger structures. Unlike companies, which are required to publicly disclose their financial statements, as a sole trader, you can keep your financial information private. This confidentiality ensures that sensitive business details, including revenue, expenses, and profits, remain confidential, shielded from competitors and the general public. Privacy regarding financial information can provide a sense of security and protect your business interests.

Confidentiality in business affairs

Being a sole trader allows you to maintain a high level of confidentiality in your business affairs. Unlike companies, where information is often shared among shareholders and directors, as a sole trader, you have the luxury of confidentiality. You can keep your business strategies, trade secrets, and competitive advantages confidential, reducing the risk of unauthorized use or dissemination of critical business information. This confidentiality can give you a competitive edge and protect your business interests.

Direct Relationships

Cultivating personal connections

One of the key advantages of being a sole trader is the opportunity to cultivate personal connections with your customers, suppliers, and other stakeholders. As the sole face of your business, you have the chance to build strong relationships based on trust and personal rapport. By engaging directly with your stakeholders, you can better understand their needs, preferences, and concerns. This personalized approach establishes a solid foundation for long-term relationships and customer loyalty, allowing your business to thrive.

Building trust and loyalty

Direct interaction with stakeholders enables you to build trust and loyalty, critical components for the success of any business. As a sole trader, your customers and suppliers have direct access to you, allowing for open lines of communication and prompt resolution of any issues or concerns. By consistently delivering exceptional customer service, maintaining transparency, and meeting commitments, you can earn the trust and loyalty of your stakeholders, leading to repeat business and positive word-of-mouth recommendations.

Direct communication with stakeholders

Operating as a sole trader grants you the advantage of direct communication with your stakeholders. Unlike larger businesses where layers of bureaucracy can hinder effective communication, as a sole trader, you have the ability to interact directly and promptly respond to inquiries, feedback, and concerns. This direct line of communication fosters clarity and understanding, minimizing misunderstandings and facilitating collaborative solutions. By maintaining open and direct communication channels, you establish stronger relationships and increase overall stakeholder satisfaction.

Flexibility in Decision Making

Quick decision-making process

Operating as a sole trader allows for a quick and efficient decision-making process. Without the need to consult or seek approval from others, you can make important business decisions rapidly. This agility enables you to respond promptly to market changes, capitalize on emerging opportunities, and address any challenges without delays. By leveraging this flexibility in decision-making, you can adapt to evolving business landscapes and maintain a competitive advantage in a fast-paced economy.

Ability to adapt to market changes

Flexibility in decision-making as a sole trader allows you to adapt swiftly to market changes. You have the freedom to adjust your business strategies, products, or services to meet the evolving needs and preferences of your target market. Unlike larger organizations that may face internal resistance or numerous approval processes, as a sole trader, you can embrace change more readily. This adaptability ensures that your business remains relevant and competitive, giving you a better chance of capturing new opportunities and thriving in dynamic market conditions.

Ability to change business direction easily

Operating as a sole trader provides you with the ability to change your business direction easily. Without the complexities associated with larger business structures, you have the freedom to pivot your business focus or explore new opportunities swiftly. This flexibility allows you to capitalize on emerging trends, respond to competitive pressures, or even shift industries if needed. The ease with which you can change your business direction empowers you to fully harness your entrepreneurial creativity and take advantage of evolving market dynamics.

Lower Compliance Burden

Less paperwork and legal formalities

One of the notable advantages of being a sole trader is the lower compliance burden compared to larger business structures. As a sole trader, you are generally subject to fewer paperwork requirements and legal formalities. This simplification reduces the time and effort spent on administrative tasks, freeing up more time for you to focus on business growth and customer satisfaction. By streamlining compliance processes, you can operate efficiently and avoid unnecessary administrative complexities.

Reduced regulatory requirements

Operating as a sole trader often entails reduced regulatory requirements compared to larger business structures. For instance, as a sole trader, you are generally exempt from holding annual general meetings, releasing annual reports, or maintaining intricate governance structures. This exemption allows you to minimize bureaucratic obligations and focus on core business operations. By adhering to simplified regulations, you can operate more smoothly and dedicate more resources to value-adding activities that drive your business forward.

Simplified financial reporting

The financial reporting obligations for sole traders are generally simpler and more straightforward than those for larger business structures. While companies often must comply with strict reporting standards, as a sole trader, you have the flexibility to adopt a simplified approach to financial reporting. With fewer formal requirements, you can save time, effort, and resources in preparing financial statements, allowing you to focus on other key aspects of your business. This simplified financial reporting process ensures that you maintain compliance without unnecessary burdens.

Faster Response to Customer Needs

Direct handling of customer inquiries

Being a sole trader allows you to directly handle customer inquiries, providing a faster response to their needs. Without layers of customer service departments or complex communication channels, you can promptly address customer queries, concerns, or requests. This direct interaction builds trust and confidence, as customers appreciate the personalized attention they receive. By ensuring speedy resolution to customer inquiries, you can foster customer satisfaction, enhance your reputation, and ultimately drive customer loyalty and repeat business.

Immediate problem-solving

As a sole trader, you have the advantage of immediate problem-solving. Since you are the sole decision-maker, you can quickly identify and resolve any issues that arise within your business. Whether it’s a supply chain disruption, a customer complaint, or a logistical challenge, you can take immediate action to rectify the situation without bureaucratic delays. This agility in problem-solving demonstrates your commitment to customer satisfaction and allows you to maintain a high level of responsiveness to meet their needs efficiently.

Ability to offer personalized solutions

Direct interaction with customers as a sole trader enables you to offer personalized solutions tailored to their specific requirements. Unlike larger businesses that may struggle to provide individual attention, you have the advantage of understanding each customer’s unique needs and preferences. This deeper understanding allows you to offer customized products, services, or solutions that truly meet their expectations. By delivering personalized solutions, you can build stronger customer relationships, foster loyalty, and differentiate yourself from your competitors.

Retain Intellectual Property

Retain ownership of ideas and creations

Operating as a sole trader ensures that you retain ownership of the ideas and creations that are generated within your business. Unlike larger business structures where intellectual property ownership can be complex and subject to legal agreements, as a sole trader, you automatically own the intellectual property you create. This protection allows you to leverage your unique ideas, innovations, or creative works for commercial gain without concerns about ownership disputes. Retaining ownership of intellectual property empowers you to fully capitalize on your creations and drive your business forward.

Control over the use and licensing of IP

Being a sole trader grants you full control over the use and licensing of your intellectual property (IP). Unlike in partnerships or companies where IP decisions often require consensus or involve multiple stakeholders, being a sole trader, you have the exclusive authority to determine how your IP is used and licensed. This control enables you to negotiate favorable arrangements, license your IP to generate additional revenue streams, or protect your creations from unauthorized use. This autonomy over IP decisions allows you to maximize the value of your intellectual capital to benefit your business.

Ability to fully capitalize on innovations

By operating as a sole trader, you have the ability to fully capitalize on your innovations. Any unique products, services, or processes that you develop within your business are owned entirely by you, providing the opportunity for exclusive commercialization. Unlike larger businesses where innovations may be subject to complex approval processes or shared ownership, being a sole trader, you can quickly bring your innovations to market and enjoy the full benefits of their success. This ability to fully capitalize on your innovations gives you a competitive edge and supports long-term business growth.

In conclusion, the advantages of a sole trader are numerous and cuts across various aspects of business. From sole trader tax advantages and autonomy to ease of formation and profit retention, being a sole trader empowers you with control and flexibility. The privacy, direct relationships, flexibility in decision-making, lower compliance burden, faster response to customer needs, and the ability to retain intellectual property further enhance the appeal of this business structure. By carefully considering these advantages, you can make an informed decision about whether operating as a sole trader is the right choice for you and your entrepreneurial aspirations.

#advantages of a sole trader#Advantages of Being a Sole Trader#advantages of sole trader#benefits of being a sole trader#disadvantages of sole trader#Sole Trader benefits

0 notes

Text

Advantages of Being a Sole Trader

Being a sole trader presents numerous advantages that make it an appealing option for entrepreneurs. By assuming full control and responsibility for your business, you have the freedom to make autonomous decisions and navigate the direction of your enterprise. As a sole trader, you have sole ownership of profits, allowing you to retain and reinvest all earnings. Additionally, the simplified legal…

View On WordPress

#advantages of a sole trader#Advantages of Being a Sole Trader#advantages of sole trader#benefits of being a sole trader#disadvantages of sole trader#Sole Trader benefits

0 notes

Text

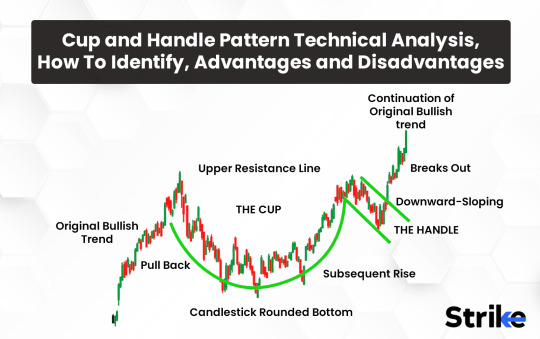

Understanding the Cup and Handle Pattern in Technical Analysis

Introduction:

In the vast world of technical analysis, traders and investors employ various tools and strategies to predict price movements in financial markets. One such tool is the Cup and Handle pattern, which is widely recognized for its potential to identify trend reversals and continuation patterns. In this article, we'll delve into what the Cup and Handle pattern is, how to identify it, and its advantages and disadvantages in trading.

What is the Cup and Handle Pattern?

The Cup and Handle pattern is a bullish continuation pattern that typically forms during an uptrend, signaling a potential resumption of the upward momentum after a brief consolidation phase. It consists of two main components: the cup and the handle.

The Cup: The cup is the first part of the pattern and resembles a rounded bottom, often resembling the shape of a "U" or a "V" on the price chart. This phase represents a period of consolidation or correction following an uptrend, where sellers gradually lose control, and buyers start to regain dominance. The depth and symmetry of the cup are important factors in determining the strength of the pattern.

The Handle: Following the formation of the cup, there is usually a small downward price movement, forming what is known as the handle. The handle is characterized by lower trading volumes and typically takes the shape of a small downward sloping channel or a sideways consolidation. It represents a final consolidation before the breakout and serves as a bullish continuation signal.

How to Identify the Cup and Handle Pattern:

Identifying the Cup and Handle pattern requires a keen eye for chart patterns and an understanding of price action dynamics. Here are the key steps to identify this pattern:

Uptrend Confirmation: The pattern is most reliable when it occurs within the context of a well-defined uptrend. Look for a sustained upward movement in prices before the formation of the cup.

Cup Formation: Identify the formation of the cup, which should resemble a rounded bottom with relatively smooth price action. The depth and duration of the cup can vary, but a deeper and more symmetrical cup is considered more reliable.

Handle Formation: After the cup is formed, observe the formation of the handle, which typically appears as a small downward price movement with lower trading volumes. The handle should be relatively shallow compared to the cup and can take the shape of a sideways consolidation or a minor downward sloping channel.

Breakout Confirmation: The pattern is confirmed when the price breaks out above the resistance level formed by the high point of the cup. This breakout should ideally be accompanied by an increase in trading volume, indicating renewed buying interest.

Advantages of the Cup and Handle Pattern:

The Cup and Handle pattern offers several advantages for traders and investors:

Clear Entry and Exit Points: The pattern provides clear entry points near the breakout level, allowing traders to enter positions with defined stop-loss levels to manage risk effectively.

Strong Bullish Bias: The pattern's bullish nature makes it attractive for traders seeking opportunities to capitalize on upward price movements in the market.

Relatively Low Risk: Since the pattern occurs within the context of an uptrend, there is a lower risk of false signals compared to other reversal patterns.

Target Price Projection: Traders can use the height of the cup as a basis for projecting the potential price target after the breakout, providing a useful tool for setting profit targets.

Disadvantages of the Cup and Handle Pattern:

Despite its benefits, the Cup and Handle pattern also has some limitations:

False Signals: Like any technical pattern, the Cup and Handle pattern is not foolproof and can sometimes result in false signals, leading to losses for traders who rely solely on this pattern for decision-making.

Subjectivity in Identification: Identifying the pattern requires subjective judgment, and different traders may interpret the formation differently, leading to inconsistency in trading decisions.

Time-consuming Formation: The pattern's formation can be time-consuming, requiring patience from traders who may need to wait for weeks or even months for the pattern to fully develop.

Market Volatility: High levels of market volatility can invalidate the pattern, leading to erratic price movements that deviate from the expected bullish continuation.

Conclusion:

The Cup and Handle pattern is a valuable tool in the arsenal of technical analysts, offering a reliable method for identifying bullish continuation patterns in uptrending markets. By understanding the structure of the pattern and its key characteristics, traders can effectively incorporate it into their trading strategies to capitalize on potential price movements. However, it is essential to recognize the pattern's limitations and exercise caution when trading based solely on its signals. As with any trading strategy, risk management and proper analysis are crucial for success in the markets.

0 notes

Text

Effective Tax Planning Strategies in Brisbane: Maximizing Returns and Minimizing Liabilities

Tax planning is an essential aspect of financial management for individuals and businesses alike. It allows you to legally optimize your tax obligations, maximize returns, and minimize liabilities. If you're a resident or business owner in Brisbane, understanding the specific tax regulations and implementing effective tax planning strategies can have a significant impact on your financial well-being. In this blog post, we'll explore some key strategies for tax planning brisbane to help you make informed decisions and achieve your financial goals.

Stay Informed about Tax Regulations

The first step in effective tax planning is to stay updated with the latest tax regulations specific to Brisbane. Tax laws are subject to changes, and being aware of the updates ensures compliance and helps you take advantage of any available tax benefits. Regularly visit the official websites of the Australian Taxation Office (ATO) and the Queensland Government to access accurate and up-to-date information.

Engage a Tax Professional

Navigating the complex world of tax planning can be challenging, especially if you have limited knowledge or experience in the field. Engaging a qualified tax professional in Brisbane can provide you with expert advice tailored to your specific circumstances. A tax professional can help you identify potential deductions, credits, and exemptions, ensuring that you optimize your tax position while staying within the legal framework.

Plan for Deductions and Credits

Brisbane residents and businesses can take advantage of various deductions and tax credits to reduce their overall tax liability. Common deductions include expenses related to self-education, work-related travel, charitable donations, and investment costs. It's crucial to maintain proper documentation and receipts to substantiate your claims and ensure compliance with ATO regulations.

Superannuation Strategies

Superannuation, or retirement savings, plays a significant role in tax planning. Brisbane residents can consider maximizing their concessional (pre-tax) contributions to superannuation, which may result in reduced taxable income. Additionally, exploring non-concessional (after-tax) contributions and implementing effective superannuation investment strategies can help you build wealth for retirement while minimizing tax implications.

Capital Gains Tax (CGT) Planning

If you own investments such as shares, property, or assets that are subject to Capital Gains Tax, careful planning can minimize your tax obligations. Brisbane residents can consider strategies such as deferring the sale of assets to a later financial year or utilizing concessions available for small business owners. Seeking professional advice can help you navigate CGT regulations and optimize your tax outcomes.

Structure Business Operations Efficiently

For business owners in Brisbane, structuring your business operations efficiently can result in significant tax savings. Options such as operating as a sole trader, partnership, company, or trust can have different tax implications. Understanding the advantages and disadvantages of each structure and seeking professional advice can help you choose the most tax-efficient option for your business.

Effective tax planning is a valuable tool for individuals and businesses in Brisbane to minimize tax liabilities and maximize returns. Staying informed about tax regulations, engaging a tax professional, planning for deductions and credits, utilizing superannuation strategies, considering CGT planning, and structuring business operations efficiently are essential steps to optimize your tax position. By implementing these strategies and seeking expert advice when needed, you can proactively manage your tax obligations and achieve your financial goals in Brisbane.