#Solar Photovoltaic Market Share

Explore tagged Tumblr posts

Text

Solar Photovoltaic Market is expected to grow at a CAGR of 15.33% By 2029

Global Solar Photovoltaic Market is expected to grow owing to ongoing advancements in solar PV technology improving the efficiency, durability, and affordability of solar panels throughout the forecast period.

According to TechSci Research report, “Solar Photovoltaic Market - Global Industry Size, Share, Trends, Opportunity, and Forecast 2019-2029”, the Global Solar Photovoltaic Market is expected to register robust growth during the forecast period. As the world grapples with the consequences of excessive greenhouse gas emissions, there is a growing awareness of the need to mitigate climate change. The burning of fossil fuels for electricity generation is a major contributor to carbon emissions. Solar PV technology, by contrast, generates electricity without direct emissions or air pollutants during operation. This eco-friendly aspect of solar PV makes it an attractive choice for both governments and individuals looking to reduce their carbon footprint.

The decreasing cost of solar PV technology is making it increasingly cost-competitive with conventional energy sources in many regions. Grid parity, where the cost of solar electricity is equal to or lower than that of fossil fuels, is a significant opportunity. As solar energy becomes more affordable, it becomes an attractive choice for both residential and commercial customers, further driving market growth.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on the "Global Solar Photovoltaic Market." https://www.techsciresearch.com/report/solar-photovoltaic-market/22037.html

Based on type, the AR Coated Solar PV Glass segment is expected to dominate the market during the forecast period. AR coatings contribute to a lower levelized cost of electricity (LCOE) for solar power systems. By improving the energy yield of solar panels, AR coated glass helps reduce the cost per unit of electricity generated. This cost reduction is attractive to both solar project developers and end-users, making solar energy more competitive with other forms of energy generation. AR coated solar PV glass aligns with the industry's sustainability goals. By increasing energy production without the need for additional solar panels, it reduces the overall environmental footprint of solar installations. This technology promotes the use of clean energy and contributes to greenhouse gas reduction. The trend of bifacial solar panels, which can capture sunlight from both the front and rear sides, has a synergistic relationship with AR coatings.

Combining bifacial technology with AR coatings enhances the energy yield even further, making this a compelling solution for various solar projects. AR coated solar PV glass is becoming more customizable and adaptable to different panel sizes and shapes. This trend allows for greater flexibility in solar PV system design and promotes the use of solar technology in various applications, from utility-scale projects to building-integrated photovoltaics (BIPV). In conclusion, the AR Coated Solar PV Glass segment is a vital component of the global solar PV market, contributing to increased energy efficiency and environmental sustainability. As technology advances and costs are further optimized, the adoption of AR coatings is expected to continue to grow, improving the performance of solar PV systems worldwide.

Based on end-user, the Crystalline Silicon PV Module segment is projected to dominate the market throughout the forecast period. Crystalline Silicon PV modules have a proven track record of durability and longevity. They are known to have a lifespan of 25 years or more, with minimal degradation in performance over time. This reliability is crucial for both solar project developers and investors, as it ensures a stable return on investment. The cost of manufacturing crystalline silicon modules has been steadily decreasing over the years. Economies of scale, improved production processes, and increased competition in the solar industry have contributed to cost reductions. This trend has made solar energy more accessible and competitive with conventional energy sources.

These innovations in c-Si module design help reduce the impact of shading, minimize electrical losses, and enhance the overall reliability of the modules. Half-cut and shingled cell designs are increasingly being used to improve the performance and robustness of solar panels. Some c-Si module manufacturers are incorporating smart features, such as integrated power optimizers or microinverters, into their modules. These features can enhance the overall efficiency of the system and provide more granular monitoring and control options. In conclusion, Crystalline Silicon PV modules are a cornerstone of the global solar PV market, offering high efficiency, reliability, and cost-competitiveness. As technology and manufacturing processes continue to evolve, these modules are expected to maintain their dominance while addressing sustainability concerns and embracing innovative design trends to further enhance their performance and market presence.

Key market players in the Global Solar Photovoltaic Market are:

Xinyi Solar Holdings Ltd.

IRICO Group New Energy Co., Ltd.

Flat Glass Group Co., Ltd

Qingdao Jinxin Glass Co., Ltd.

Dongguan CSG Solar Glass Co., Ltd.

Nippon Sheet Glass Co., Ltd.

Taiwan Glass Ind. Corp.

Borosil Renewables Ltd.

Nanhai Co., Ltd.

Hecker Glastechnik Gmbh & Co. Kg

Download Free Sample Report https://www.techsciresearch.com/sample-report.aspx?cid=22037

Customers can also request for 10% free customization on this report.

“The Global Solar Photovoltaic Market in Asia Pacific is poised to be the dominant force in the industry. The adoption of rooftop solar panels in residential and commercial buildings is on the rise, driven by favorable policies and the desire for energy independence. Australia, Japan, and South Korea, among others, have seen substantial growth in distributed solar PV. Countries with limited available land, such as Japan and some parts of Southeast Asia, are turning to floating solar PV installations on bodies of water to maximize space usage and energy production.” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based global management consulting firm.

“Solar Photovoltaic Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, 2019-2029 Segmented By Application (Residential, Non-Residential and Utility), By Type (AR Coated Solar PV Glass, Tempered Solar PV Glass, TCO Coated Solar PV Glass and Others), By End-User (Crystalline Silicon PV Module, Thin Film PV Module and Perovskite Module), By Installation (Float Glass Technology and Patterned Glass Technology), By Region, and By Competition,” has evaluated the future growth potential of Global Solar Photovoltaic Marketand provides statistics & information on market size, structure, and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in Global Solar Photovoltaic Market.

Get Related Reports:

Saudi Arabia Smart Energy Market

Saudi Arabia Solar PV Module Market

Saudi Arabia Captive Power Generation Market

Contact Us-

TechSci Research LLC

420 Lexington Avenue, Suite 300,

New York, United States- 10170

M: +13322586602

Email: [email protected]

Website: www.techsciresearch.com

#Solar Photovoltaic Market#Solar Photovoltaic Market Size#Solar Photovoltaic Market Share#Solar Photovoltaic Market Trends#Solar Photovoltaic Market Growth#Solar Photovoltaic Market Forecast

0 notes

Text

Solar Photovoltaic Glass Market Analysis: Key Players, Growth Drivers, and Future Outlook

As the world embraces renewable energy sources, solar power is taking center stage. But what makes solar panels function effectively? It's not just the photovoltaic cells themselves; the transparent shield protecting them plays a critical role. This blog post dives into the Solar Photovoltaic Glass Market Analysis: Key Players, Growth Drivers, and Future Outlook, based on insights from Mordor Intelligence's market research report. Here, we'll explore the key players shaping the industry, the drivers propelling market growth, and the exciting possibilities that lie ahead for solar photovoltaic glass.

The Players Behind the Panels: Key Participants in the Solar Photovoltaic Glass Market

The solar photovoltaic glass market boasts a dynamic landscape with established industry leaders and innovative newcomers:

Leading Manufacturers: Major players like Schott AG (Germany), Asahi Glass Co., Ltd. (Japan), Corning Incorporated (US), Saint-Gobain (France), and Nippon Sheet Glass Co., Ltd. (Japan) dominate the global market.

Emerging Players: Start-ups and companies from developing economies are entering the market, contributing to increased competition and innovation.

Strategic Partnerships: Collaboration between glass manufacturers and solar panel producers fosters technological advancement and product development.

This mix of established and emerging players creates a competitive environment where continuous innovation drives the development of high-performance, cost-effective solar photovoltaic glass solutions.

Shining a Light on Growth: Factors Propelling the Market Forward

Several key trends are fueling the growth of the solar photovoltaic glass market:

Surging Demand for Solar Energy: The increasing focus on clean energy and government initiatives promoting solar installations drive the demand for solar panels, and consequently, PV glass.

Technological Advancements: Manufacturers are constantly developing new technologies for PV glass, focusing on improved light transmittance, anti-reflective coatings, and self-cleaning properties to enhance energy generation.

Cost Reduction Strategies: Efforts to optimize production processes and utilize recycled materials are making PV glass more affordable, further expanding market reach.

Growth of Utility-Scale Solar Projects: Large-scale solar farms require vast amounts of high-quality, durable PV glass, creating a significant market opportunity.

These drivers paint a picture of a market driven by the booming solar energy sector, technological advancements, and a focus on cost reduction. As solar energy becomes increasingly accessible, the demand for solar photovoltaic glass is expected to rise steadily.

A Brighter Future: The Outlook for Solar Photovoltaic Glass

The future of the solar photovoltaic glass market holds exciting possibilities:

Advanced Materials and Coatings: The development of new materials and coatings with superior light transmission and self-cleaning capabilities will further optimize solar energy capture.

Integration with Smart Technologies: PV glass integrated with sensors and data analytics can enable real-time monitoring and optimize energy production in solar farms.

Sustainability Focus: The use of recycled materials, combined with the inherent environmental benefits of solar energy, aligns with the growing focus on sustainable practices.

Expanding Applications: Beyond solar panels, PV glass may find uses in building materials and energy-efficient windows, contributing to eco-friendly architecture.

These advancements highlight the evolving nature of the solar photovoltaic glass market. As technology advances and sustainability remains a priority, we can expect even more innovative and versatile PV glass solutions to emerge. This will undoubtedly play a crucial role in shaping the future of clean energy generation and building a more sustainable tomorrow.

Conclusion

Mordor Intelligence's market research report paints an optimistic picture for the future of the solar photovoltaic glass market. Driven by the growth of the solar energy sector, technological advancements, and a focus on cost reduction and sustainability, the market is positioned for continued expansion. As solar energy continues its ascent, solar photovoltaic glass will remain a critical component, paving the way for a brighter, more sustainable future powered by clean energy.

#Solar Photovoltaic Glass Market#Solar Photovoltaic Glass Market share#Solar Photovoltaic Glass Market size#Solar Photovoltaic Glass Market trends#Solar Photovoltaic Glass Market analysis#Solar Photovoltaic Glass Market research reports#Solar Photovoltaic Glass Market growth drivers#Solar Photovoltaic Glass Market forecasts

0 notes

Text

Residential Solar Photovoltaic System Market Trends, Key Players, DROT, Analysis & Forecast Till 2033

The residential solar photovoltaic (PV) system market has been experiencing rapid growth over the past decade. This surge is largely driven by rising environmental awareness, increased energy costs, and the global push for renewable energy sources. Solar PV systems convert sunlight into electricity, providing a clean, sustainable power solution for households. With advancements in technology,…

#Residential Solar Photovoltaic System Market#Residential Solar Photovoltaic System Market Growth#Residential Solar Photovoltaic System Market Share#Residential Solar Photovoltaic System Market Size

0 notes

Quote

The Global Solar Photovoltaic (PV) Market size was valued at USD 282200 Million in 2023 and is projected to reach USD 1000000 Million by 2030, growing at a CAGR of 17.20% from 2023 to 2030.

Solar Photovoltaic (PV) Market Research Report 2023

0 notes

Text

#Solar Photovoltaic Glass Market#Solar Photovoltaic Glass Market size#Solar Photovoltaic Glass Market share#Solar Photovoltaic Glass Market trends#Solar Photovoltaic Glass Market analysis#Solar Photovoltaic Glass Market forecast

0 notes

Text

#South Africa Solar Photovoltaic (PV) Market#South Africa Solar Photovoltaic (PV) Market Size#South Africa Solar Photovoltaic (PV) Market Share#South Africa Solar Photovoltaic (PV) Market Analysis#South Africa Solar Photovoltaic (PV) Market Trends#South Africa Solar Photovoltaic (PV) Market Report#South Africa Solar Photovoltaic (PV) Market Research#South Africa Solar Photovoltaic (PV) Industry#South Africa Solar Photovoltaic (PV) Industry Report

0 notes

Text

#Global Low Voltage Solar Photovoltaic Power Cable Market Size#Share#Trends#Growth#Industry Analysis#Key Players#Revenue#Future Development & Forecast

0 notes

Text

Global Solar Photovoltaic (PV) Mounting Systems Market was valued at USD 511.21 million in 2021 and is expected to reach USD 727.00 million by 2029, registering a CAGR of 4.50% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes technological advancements, regulatory framework, PESTEL, porter's five forces analysis, industry standards-at a glance, raw material costs/ operational expenditure-overview, supply chain analysis, vendor selection criteria, pricing analysis, production analysis, and climate chain scenario.

#Solar Photovoltaic (PV) Mounting Systems Market Market#Solar Photovoltaic (PV) Mounting Systems Market Market Demand#Solar Photovoltaic (PV) Mounting Systems Market Market Share#Solar Photovoltaic (PV) Mounting Systems Market Market Forecast#Solar Photovoltaic (PV) Mounting Systems Market Market Trend#Solar Photovoltaic (PV) Mounting Systems Market Market Segment#Solar Photovoltaic (PV) Mounting Systems Market Market Overview#Solar Photovoltaic (PV) Mounting Systems Market Market Growth

0 notes

Text

Excerpt from this story from Anthropocene Magazine:

I write about the climate and energy for a living and even I can’t quite wrap my head around how cheap low-carbon power technologies have gotten. The cost of onshore wind energy has dropped by 70% over just the last decade, and that of batteries and solar photovoltaic by a staggering 90%. Our World in Data points out that within a generation, solar power has gone from being one of the most expensive electricity sources to the cheapest in many countries—and it’s showing little signs of slowing down.

So where does this all end?

Back in the 1960s, the nuclear industry promised a future in which electricity was too cheap to meter. Decades later, the same vision seems to be on the horizon again, this time from solar. It seems, well, fantastic. Perhaps (almost) free renewable power leads to climate utopia. Then again, should we be careful what we wish for?

The Road To Decarbonization Is Paved With Cheap Green Power

1. More renewables = less carbon. The math isn’t complicated. The faster we transition to clean energy, the less carbon dioxide we’re adding to the atmosphere and the fewer effects of global warming we will suffer.While humanity is still emitting more greenhouse gases than ever, the carbon intensity of electricity production has been dropping for well over a decade.

2. Cheap, clean power also unlocks humanitarian goals. Modern civilization rests on a foundation of electricity. Beyond its obvious uses in heating, cooling, cooking, lighting and data, electricity can decarbonize transportation, construction, services, water purification, and food production. Increasing the supply and reducing the cost of green electricity doesn’t just help the climate, it improves equity and quality of life for the world’s poorest.

3. Scrubbing the skies will take a lot of juice. Once we get emissions under control, it’s time to tackle the mess we’ve made of the atmosphere. Today’s direct air capture (DAC) systems use about two megawatt hours of electricity for every ton of CO2 plucked from fresh air. Scale that up to the 7 to 9 million tons we need to be removing annually in the US by 2030, according to the World Resources Institute, and you’re looking at about 0.5% of the country’s current energy generation. Scale it again to the nearly 1,000 billion tons the IPCC wants to sequester during the 21st century, and we’ll need every kilowatt of solar power available—the cheaper the better.

Cheap Power Has Hidden Costs

1. Cheap technology doesn’t always mean cheap power. If solar cells are so damn cheap, why do electricity bills keep rising? One problem is that renewables are still just a fraction of the energy mix in most places, about 20% in the US and 30% globally. This recent report from think-tank Energy Innovation identifies volatility in natural gas costs and investments in uneconomic coal plants as big drivers for prices at the meter. Renewables will have to dominate the energy mix before retail prices can fall.

2. The cheaper the power, the more we’ll waste. Two cases in point: cryptocurrency mining and AI chat bots. Unless we make tough social and political decisions to fairly price carbon and promote climate action, the market will find its own uses for all the cheap green power we can generate. And they may not advance our climate goals one inch.

3. Centuries of petro-history to overcome. Cheap power alone can only get us so far. Even with EVs challenging gas cars, and heat pumps now outselling gas furnaces in the US, there is a monumental legacy of fossil fuel systems to dismantle. Getting 1.5 billion gas cars off the world’s roads will take generations, and such changes can have enormous social costs. To help smooth the transition, the Center for American Progress suggests replacing annual revenue-sharing payments from coal, oil, and natural gas production with stable, permanent distributions for mining and oil communities, funded by federal oil and gas revenue payments.

5 notes

·

View notes

Text

Guiding the design of silicon devices with improved efficiency

Silicon is one of the most pervasive functional materials of the modern age, underpinning semiconductor technologies ranging from microelectronics to solar cells. Indeed, silicon transistors enable computing applications from cell phones to supercomputers, while silicon photovoltaics are the most widely deployed solar-cell technology to date. The U.S. Department of Energy (DOE) reports that nearly 50% of new electric generation capacity in 2022 came from solar cells, and according to the International Energy Agency (IEA), silicon has a 95% market share. Yet despite silicon's undisputed importance to our modern way of life, many open questions remain about its fundamental physical properties. In semiconductor devices, the functionality of the material comes from the motion and interactions of subatomic particles such as electrons (which have negative charge) and holes (the absence of an electron from an otherwise occupied state that itself behaves like a positively charged particle), which are called carriers as they "carry" electrical charge through the material.

Read more.

#Materials Science#Science#Silicon#Semiconductors#Electronics#Computational materials science#University of Michigan

7 notes

·

View notes

Text

BIPV Market: Trends Supplement Large-Scale Solar Systems Adoption

As per the International Energy Outlook, the global power demand is expected to rise by 80%, requiring an investment of around $19.7 trillion by 2040. Also, the Paris Agreement set a target of limiting global warming temperature below 2° Celsius, preferably 1.5° Celsius. This has influenced governments to seek innovative ways to reduce emissions while meeting energy demand, which has paved the way for photovoltaic materials in buildings. Triton’s analysis estimates that the global building integrated photovoltaics market will propel at a CAGR of 17.31% during the forecast period 2023-2030.

Building integrated photovoltaics serves the dual purpose of being the outer layer of a building and a power generator. This, in turn, has opened a new frontier in green infrastructure, influencing architects to develop energy-efficient and aesthetically appealing buildings. For instance, Ubiquitous Energy’s transparent solar window panels, UE Power, have emerged as an aesthetically appealing power-generating alternative to conventional windows.

BIPV Revolution: Trends Reshape Energy Landscape

According to the International Renewable Energy Agency (IRENA) , around 90% of the world’s power can be generated with renewable energy by 2050. Since buildings consume high amounts of energy, BIPV integration will facilitate their transition from energy users to producers. On that note, the notable trends reshaping the market are:

Governments perceive investing in green energy solutions as an opportunity to attain GHG reduction targets. Hence, over the past few years, authorities worldwide have employed various measures to stimulate the adoption of sustainable technologies, including BIPV modules, across residential, commercial, and industrial sectors. For example:

As per the Indian Ministry of New & Renewable Energy (MNRE) , the government has implemented the production-linked incentive (PLI) scheme for high-efficiency solar PV modules with an outlay of INR 24,000 crore, to achieve domestic manufacturing capacity of solar PV cells and modules.

In 2021, the German government amended the Renewable Energy Act by establishing grid priority to drive the onshore wind, solar PV, and biogas growth. The government proposed to increase its solar capacity installations to 100 GW by 2030.

The Chinese government also formulated a policy that requires all new buildings to conform to energy guidelines modeled after LEED specifications. This policy combines a recent initiative to reconstruct 50% of residential high-rise buildings. The country is anticipated to add more than 600 GW of solar power by 2030.

Reaping the benefits from such incentives, the industrial sector leads the BIPV market at 39.54%. However, over the forecast period 2023-2030, the commercial sector is expected to witness the fastest growth at 17.38%.

As per IEA, the global solar PV generation reached around 821 TWh in 2020, a whopping 23% increase from 2019. The energy association also stated that next to utility-scale deployment, distributed applications on buildings contribute to around 40% of PV use globally. In this regard, rooftop-based applications are alleviating the burden on the distribution grids, enabling companies and households to pay lesser energy bills while reducing emissions. Moreover, the cost of installing rooftop PV systems reached around $1 per watt. Hence, roofing captures the majority of the market share at 55.69% in terms of application.

China drives the global market, followed by the US, European nations, and Japan playing a major role. The rise in installations from around 19.4 GW in 2017 to 27.3 GW in 2021 was the key aspect that made China a leader in rooftop installations. For instance, Shanghai and Dezhou have acquired the title of ‘Solar City’, which features a large fleet of rooftop solar water heaters. Besides, the Net Zero Energy Building mandate across China is expected to accelerate the PV roofing segment, with solar tiles gaining major traction. Hence, these developments are expected to widen the scope of the Asia-Pacific BIPV market over the forecast period 2023-2030.

IEA projects that photovoltaic systems are estimated to account for approximately 14% of the total power generation by 2050, owing to the rising detrimental impact of fossil fuels. In fact, the organization stated that PV systems saved more than 860 million tons of C02 in 2020. The construction industry is highly innovative in the commercial sector owing to the development of cost-effective zero-emission green facilities.

As per IRENA, Germany ranks fourth in solar energy production globally. In 2021, the nation installed solar capacities of almost 60 GW, an increase of 5.3 GW from 2020. These actions are based on the country’s aim to obtain a 65% share of the renewable energy sector by 2030. Moreover, the Energy Efficiency Strategy for Building suggested advanced technology development to achieve the goal of a virtually climate-neutral building stock by 2050. Hence, the growing focus on sustainable energy sources fuels the overall Europe BIPV market, spearheaded mainly by Germany.

PV Cost Reduction: A Driving Force for Market Players

Since photovoltaic systems generate energy with around 42% efficiency using multi-junction cells, they have emerged as an ideal alternative over complex installations, such as wind turbines. As per the UN, between 2010 to 2020, the cost of power from solar systems plummeted by around 85%. This highlights the question:

What induced PV cost reduction?

The significant cost decline is mainly because of overproduction and higher investment in PV modules. Another factor is the efforts by Chinese suppliers and wholesalers to reduce the stock held in European warehouses to prevent anti-dumping and anti-subsidy tariffs. This oversupply, from China to Europe thus shrunk the cost of silicon. Such developments led energy solutions supplier Sungrow to supply products to the world’s largest BIPV plant (120 MW) in Central China’s Jiangxi Province. Therefore, the increasing efficiency, ease of installation, and decreasing cost of PV modules over conventional sources like coal and natural gas are expected to open new avenues for players in the building integrated photovoltaics market.

#building integrated photovoltaics market#bipv market#bipv#energy industry#power industry#market research report#market research reports#triton market research

2 notes

·

View notes

Text

Unveiling the Growth of the Europe Solar Photovoltaic (PV) Market

Introduction

The installed base of the Europe Solar Photovoltaic Market is projected to grow from 294.70 gigawatts in 2024 to 526.15 gigawatts by 2029, with a compound annual growth rate (CAGR) of 12.30% during the forecast period (2024-2029).

As Europe marches toward a greener, more sustainable future, the solar photovoltaic (PV) industry is playing a vital role in transforming the region’s energy landscape. With ambitious climate goals, favorable policies, and advances in solar technology, the solar PV market in Europe is growing at an impressive rate. In this blog, we explore the dynamics driving the Europe Solar PV market, the key challenges, and the opportunities that lie ahead based on recent market research insights.

Market Overview

The Europe Solar Photovoltaic (PV) market has experienced remarkable growth over the past decade, solidifying its position as one of the leading renewable energy sectors in the region. As countries within the European Union (EU) aim to meet stringent carbon reduction targets, solar power has become a cornerstone of the continent’s renewable energy strategy.

The market is not only driven by the need to combat climate change but also by increasing energy demand and a desire for energy independence. With a growing emphasis on decarbonization, Europe’s solar PV market is projected to see significant expansion, supported by both government initiatives and private sector investments

Key Market Trends Driving Growth

EU’s Green Deal and Renewable Energy TargetsOne of the most significant drivers of growth in Europe’s solar PV market is the European Union’s Green Deal. The ambitious plan sets forth goals for Europe to become climate-neutral by 2050, with intermediate targets to cut greenhouse gas emissions by at least 55% by 2030. Solar energy is seen as a key contributor to achieving these targets, and EU countries are rolling out favorable policies, subsidies, and incentives to boost solar adoption.In 2022, the European Commission also announced its REPowerEU initiative, aimed at reducing reliance on Russian energy imports by increasing the deployment of renewable energy sources, with solar PV being a major focus.

Technological Advancements in Solar PVThe rapid advancement of solar PV technology has been another key factor in driving market growth. Innovations in PV panel efficiency, bifacial modules, and thin-film solar cells are making solar energy more cost-effective and accessible. As the cost of solar technology continues to fall, more households, businesses, and utility-scale projects are being developed across Europe.Additionally, the integration of solar PV with energy storage systems has made solar energy a more reliable option, ensuring energy can be stored and used during non-sunny periods, further enhancing grid stability and energy independence.

Rise of Rooftop Solar InstallationsEurope has witnessed a surge in rooftop solar installations, particularly in residential and commercial buildings. With rising energy prices and growing environmental consciousness, consumers and businesses are increasingly opting for rooftop solar PV systems to reduce electricity costs and carbon footprints. Countries like Germany, Spain, and the Netherlands have seen substantial growth in this segment, aided by supportive government policies and incentives for decentralized solar energy generation.

Utility-Scale Solar FarmsAlongside rooftop solar, utility-scale solar farms are contributing significantly to Europe’s renewable energy mix. Several large-scale solar projects have been developed across Southern European countries like Spain, Italy, and Greece, where abundant sunlight offers ideal conditions for large solar farms. Utility companies and governments are investing heavily in expanding solar power capacity, further boosting the market.

Challenges Facing the Europe Solar PV Market

Supply Chain Disruptions and Raw Material ShortagesWhile demand for solar PV systems has surged, supply chain disruptions, particularly during the COVID-19 pandemic, have posed challenges for the market. Shortages of key raw materials like polysilicon, which is crucial for the production of solar panels, have led to price fluctuations and project delays. These supply chain issues are being gradually resolved, but they remain a challenge for large-scale solar deployment in the near term.

Grid Integration and Infrastructure ConstraintsAs solar PV capacity expands, there are growing concerns over the ability of existing electricity grids to integrate increasing amounts of intermittent renewable energy. Grid modernization and energy storage solutions are essential to ensuring the stability and reliability of power supply, especially as solar power generation increases across Europe.

Regulatory Hurdles and Policy VariabilityWhile the EU has set overarching renewable energy goals, the regulatory framework for solar PV can vary significantly from country to country. Navigating local policies, permitting processes, and grid connection requirements can be cumbersome for developers. Ensuring consistency in regulations and reducing bureaucratic barriers are crucial for fostering faster solar PV adoption across all member states.

Opportunities for Growth in the Solar PV Market

Emerging Markets in Eastern EuropeWhile Western European countries like Germany, Spain, and Italy have historically led solar PV adoption, Eastern European nations are now emerging as promising markets for solar energy. Countries like Poland, Romania, and Hungary are ramping up their solar investments to diversify their energy portfolios and reduce dependence on fossil fuels. These emerging markets offer significant growth potential for solar developers and investors.

Floating Solar PV ProjectsFloating solar PV, which involves installing solar panels on bodies of water, is an emerging trend gaining traction in Europe. Countries with limited land space, such as the Netherlands, are exploring the potential of floating solar farms on lakes, reservoirs, and coastal areas. This innovative approach not only saves land but also enhances the efficiency of solar panels due to the cooling effect of water.

Corporate Power Purchase Agreements (PPAs)With an increasing number of corporations committing to renewable energy targets, corporate power purchase agreements (PPAs) are emerging as a powerful driver for solar PV development. Under these agreements, companies directly purchase electricity from solar projects, helping to secure long-term revenue for solar developers while enabling businesses to meet their sustainability goals.

Energy Storage IntegrationAs the integration of solar PV with energy storage solutions becomes more widespread, the ability to store excess solar energy and use it during periods of low sunlight will unlock new opportunities for growth. Europe’s energy storage market is rapidly evolving, with advancements in battery technology, particularly in lithium-ion batteries, expected to drive further adoption of solar-plus-storage systems.

Conclusion

The Europe Solar Photovoltaic market is set for robust growth as the continent accelerates its transition to a sustainable, low-carbon future. Driven by ambitious climate policies, technological advancements, and increased investment in solar infrastructure, the solar PV industry is poised to expand rapidly over the coming years.

While challenges such as supply chain disruptions and grid integration issues persist, the opportunities for growth are vast. Emerging markets in Eastern Europe, floating solar projects, and corporate PPAs represent promising avenues for future expansion.

As the demand for clean, renewable energy continues to rise, the solar PV market in Europe will remain at the heart of the region’s energy transformation, offering enormous potential for innovation, investment, and long-term sustainability.

#Europe Solar Photovoltaic Market trends#Europe Solar Photovoltaic Market size#Europe Solar Photovoltaic Market share#Europe Solar Photovoltaic Market analysis#Europe Solar Photovoltaic Market forecast#Europe Solar Photovoltaic Market demand

0 notes

Text

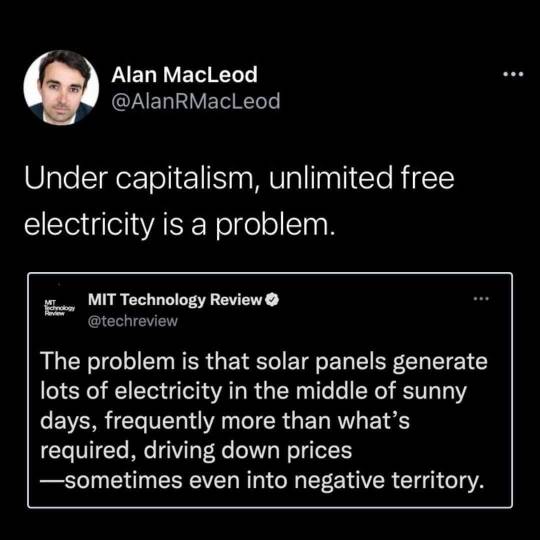

So I think I found the right article.

The thumbnail quote in the original tweet is the second paragraph:

And like, unless I'm missing something, the article ... isn't talking about grids getting damaged because of overload. I do think that what @crazy-pages said is correct, because I've heard parts of it often enough before, but the article is pretty much just talking about market economics. Do I have the wrong article?

MIT Tech Review has limited free articles, so I've copied and pasted the full text below the cut. It isn't a super long read.

A few lonely academics have been warning for years that solar power faces a fundamental challenge that could halt the industry’s breakneck growth. Simply put: the more solar you add to the grid, the less valuable it becomes.

The problem is that solar panels generate lots of electricity in the middle of sunny days, frequently more than what’s required, driving down prices—sometimes even into negative territory.

Unlike a natural gas plant, solar plant operators can’t easily throttle electricity up and down as needed, or space generation out through the day, night and dark winter. It’s available when it’s available, which is when the sun is shining. And that’s when all the other solar plants are cranking out electricity at maximum levels as well.

A new report finds that California, which produces one of the largest shares of solar power in the world, is already acutely experiencing this phenomenon, known as solar value deflation.

The state’s average solar wholesale prices have fallen 37% relative to the average electricity prices for other sources since 2014, according to the Breakthrough Institute analysis, which will be published on July 14. In other words, utilities are increasingly paying solar plants less than other sources overall, due to their fluctuating generation patterns.

Wholesale prices are basically the amount that utilities pay power plants for the electricity they deliver to households and businesses. They shift throughout the day and year, edging back up for solar operators during the mornings, afternoons and other times when there isn’t excess supply. But as more solar plants come online, the periods of excess supply that drive down those costs will become more frequent and more pronounced.

Lower prices may sound great for consumers. But it presents troubling implications for the world’s hopes of rapidly expanding solar capacity and meeting climate goals.It could become difficult to convince developers and investors to continue building ever more solar plants if they stand to make less money or even lose it. In fact, California construction has already been flat since 2018, the study notes. But the state will need the industry to significantly ramp up development if it hopes to pull off its ambitious clean energy targets.

This could soon become a broader problem as well.

“California is a little sneak peek of what is in store for the rest of the world as we dramatically scale up solar,” says Zeke Hausfather, director of climate and energy at the Breakthrough Institute, and author of the report.

That’s because while solar accounts for about 19% of the electricity California generates, other regions are rapidly installing photovoltaic panels as well. In Nevada and Hawaii, for instance, the share of solar generation stood at around 13% in 2019, the study found. The levels in Italy, Greece and Germany were at 8.6%, 7.9% and 7.8%, respectively.

The race

So far, heavy solar subsidies and the rapidly declining cost of solar power has offset the falling value of solar in California. So long as it gets ever cheaper to build and operate solar power plants, value deflation is less of a problem.

But it’s likely to get harder and harder to pull off that trick, as the state’s share of solar generation continues to climb. If the cost declines for building and installing solar panels tapers off, California’s solar deflation could pull ahead in the race against falling costs as soon as 2022 and climb upward from there, the report finds. At that point, wholesale pricing would be below the subsidized costs of solar in California, undermining the pure economic rationale for building more plants, Hausfather notes.The state’s SB 100 law, passed in 2018, requires all of California’s electricity to come from “renewable and zero-carbon resources” by 2045. By that point, some 60% of the state’s electricity could come from solar, based on a California Energy Commission model.

The Breakthrough study estimates that the value of solar–or the wholesale average price relative to other sources–will fall by 85% at that point, decimating the economics of solar farms, at least as California’s grid exists today.

How do we fix it?

There are a variety of ways to ease this effect, though no single one is likely a panacea.The solar sector can continue trying to find ways to push down solar costs, but some researchers have argued it may require shifting to new materials and technologies to get to the dirt-cheap levels required to outpace value deflation.

Grid operators and solar plant developers can add more energy storage—and increasingly they are.Researchers at Lawrence Berkeley National Laboratory highlighted similarly declining solar values in California in a broader study published in Joule last month. But they also noted that numerous modeling studies showed that the addition of low cost storage options, including so called hybrid plants coupled with lithium-ion batteries, eases value deflation and enables larger shares of renewables to operate economically on the grid.

There are likely limits to this, however, as study after study finds that storage and system costs rise sharply once renewables provide the vast majority of electricity on the grid.

States or nations could also boost subsidies for solar power; add more long-distance transmission lines to allow regions to swap clean electricity as needed; or incentivize customers to move energy use to times of day that better match with periods of high generation.

The good news is that each of these will help to ease the transition to clean electricity sources in other ways as well, but they’ll also all take considerable time and money to get underway.

The California solar market offers a reminder that the climate clock is ticking.

This story was updated to add details from the Joule study.

#I don't intend this as any kind of callout#I just want to make sure we're actually reading and citing our sources#environmentalism#sustainability#solar panels#renewable energy#economics#uwo convo

71K notes

·

View notes

Text

[ad_1] Think about your investments rising whereas powering a sustainable future on the facet! Inexperienced shares supply simply that—corporations producing clear energy from renewable sources like photo voltaic and wind. With the renewable vitality market projected to surpass $1.5 trillion by 2025 the sector’s progress is plain. The Indian authorities’s dedication to “Inexperienced Progress” within the 2024-25 funds additional boosts the sector’s prospects. This makes now the best time so as to add inexperienced vitality firm shares to your portfolio and make it future-ready. Right here’s a listing of the highest 5 inexperienced shares to look at for 2025 to develop your portfolio. High 5 Inexperienced Power Shares for 2025 Listed here are the highest inexperienced vitality shares to look at. Adani Inexperienced Power Restricted (AGEL) is a number one participant within the renewable vitality house. It operates the Kamuthi Photo voltaic Energy Venture, one of many largest photo voltaic photovoltaic crops globally. As of Nov 2024, AGEL has a market capitalization of ₹2,55,180 crore, with a share worth closing at ₹1,600+. The corporate lately reported a 39% enhance in consolidated web revenue for the September 2024 quarter. For buyers, AGEL is a stable alternative, given its spectacular monetary progress and vital contribution to India’s renewable vitality panorama. 2. KPI Inexperienced Power Ltd KPI Inexperienced Power Restricted, based in 2008 is dedicated to sustainability by way of solar energy technology. Working underneath the model Solarism, the corporate at the moment has a market capitalization of ₹10,903 crores and a share worth of ₹800+. Notably, KPI Inexperienced Power has additionally achieved zero web debt standing as of August 2024. The corporate has even skilled outstanding income progress of 101.85% over the previous three years, indicating robust monetary well being. 3. SJVN Ltd SJVN Ltd, previously generally known as Satluj Jal Vidyut Nigam, is a serious participant in India’s hydropower sector. Presently, the share worth stands at ₹110+ with a market cap of 43,817 crores. With plans to extend its whole put in capability to 25 GW by 2030 and 50 GW by 2040, SJVN is actively increasing its portfolio to incorporate photo voltaic and hydroelectric initiatives. The corporate enjoys a wholesome liquidity place, robust money stream administration, and substantial promoter holdings. Authorities assist, particularly from Maharashtra by way of two MoUs, additional boosts SJVN’s prospects, making it a stable alternative for buyers trying to capitalize on renewable vitality progress. 4. WAA Photo voltaic Ltd WAA Photo voltaic Ltd, established in 2009 in Gujarat, is a photo voltaic vitality firm identified for creating and managing photo voltaic initiatives throughout India, together with the ten MW Photo voltaic Photovoltaic Grid in Patan. With a formidable common working margin of 79.83% over the previous 5 years and a stable money stream place, the corporate demonstrates monetary resilience. Its present market cap is at ₹178 crore, with share worth buying and selling at 100+. WAA Photo voltaic’s current Letter of Intent to fee 47.50 MW photo voltaic initiatives in Gujarat, strengthens its outlook, making it a pretty choice for buyers excited about renewable vitality. 5. KKV Agro Powers Restricted KKV Agro Powers Restricted combines renewable vitality with agriculture, creating photo voltaic and wind farms that instantly assist inexperienced vitality within the agricultural sector. The corporate has proven spectacular progress, with a 69.4% income enhance during the last three years, reflecting robust market efficiency. With a present market capitalization of ₹45 crore and a share worth of ₹800+, KKV Agro Powers stands out for its distinctive mix of renewable vitality with agro initiatives. Conclusion Investing in inexperienced vitality shares presents an opportunity to assist sustainable progress whereas positioning your portfolio for the longer term.

As renewable vitality demand rises and governments proceed backing clear vitality initiatives, corporations like Adani Inexperienced Power, KPI Inexperienced Power, SJVN, WAA Photo voltaic, and KKV Agro Powers stand out with robust market efficiency and innovation. Diversifying with inexperienced vitality shares may deliver each potential returns and environmental affect. Able to discover? Get began with an investing app to trace these shares and energy up your portfolio for 2025. [ad_2] Supply hyperlink

0 notes

Text

PV Solar Panel Market Trends and Insights: A Comprehensive Overview of Competitive Dynamics

The PV solar panel market has witnessed remarkable growth over the past decade, driven by increasing awareness of environmental sustainability, technological advancements, and favorable government policies. As nations strive to reduce carbon emissions and transition towards renewable energy sources, solar power has emerged as a frontrunner. This article explores key trends and insights within the PV solar panel market, focusing on competitive dynamics, market drivers, and emerging opportunities.

Market Growth and Drivers

The global PV solar panel market is projected to continue its upward trajectory, with a compound annual growth rate (CAGR) of over 20% expected in the coming years. Key drivers fueling this growth include

Government Initiatives and Incentives: Many governments worldwide are implementing policies to promote renewable energy adoption. Incentives such as tax credits, rebates, and feed-in tariffs encourage residential and commercial users to invest in solar energy systems.

Technological Advancements: Continuous innovation in solar technologies, including the development of more efficient photovoltaic cells and energy storage solutions, is enhancing the performance and affordability of solar panels. Technologies like bifacial solar panels and thin-film solar cells are gaining traction, offering improved efficiency and versatility.

Rising Energy Demand: As global energy consumption continues to rise, there is an urgent need for sustainable energy solutions. Solar power, being abundant and renewable, is positioned as a viable option to meet increasing energy needs while minimizing environmental impact.

Competitive Dynamics

The competitive landscape of the PV solar panel market is characterized by several key players and emerging companies vying for market share. Major manufacturers like First Solar, JinkoSolar, Trina Solar, and Canadian Solar dominate the market. These companies focus on enhancing production capacities, expanding product portfolios, and investing in research and development to stay ahead in the competitive race.

Moreover, the rise of local manufacturers in emerging markets is reshaping competitive dynamics. Countries like India and China are investing heavily in domestic solar panel production, leading to increased competition and reduced prices in the global market. This trend is further accelerated by supply chain shifts, as companies seek to minimize reliance on traditional manufacturing hubs.

Sustainability and Environmental Considerations

Sustainability is at the forefront of market trends in the PV solar panel sector. Consumers are increasingly conscious of the environmental impact of their energy choices, leading to a surge in demand for eco-friendly solar products. Manufacturers are responding by adopting sustainable practices in production, such as using recycled materials and implementing efficient manufacturing processes.

Furthermore, the lifecycle assessment of solar panels is becoming crucial in evaluating their overall environmental impact. Companies are focusing on end-of-life solutions, including recycling programs, to ensure that solar panels contribute to a circular economy.

Emerging Opportunities

The future of the PV solar panel market is rife with opportunities. The integration of solar energy with smart technologies, such as smart grids and energy management systems, is poised to revolutionize energy consumption patterns. Additionally, the growth of electric vehicles (EVs) presents a unique opportunity for solar panel manufacturers to collaborate with EV companies, enabling consumers to charge their vehicles sustainably.

Moreover, the increasing interest in community solar projects and decentralized energy solutions is creating avenues for innovative business models, enabling households and businesses to benefit from solar energy without the need for extensive upfront investments.

Conclusion

The PV solar panel market is undergoing a significant transformation driven by technological advancements, government support, and rising environmental awareness. As competitive dynamics evolve and new opportunities arise, stakeholders must adapt to the changing landscape to leverage the benefits of solar energy. With a strong emphasis on sustainability and innovation, the future of the PV solar panel market looks promising, paving the way for a cleaner, more sustainable energy landscape.

Get Free Sample and ToC : https://www.pristinemarketinsights.com/get-free-sample-and-toc?rprtdtid=NDUz&RD=PV-Solar-Panel-Market-Report

#PVsolarPanelMarketIndustryForecast#PVsolarPanelMarketDemand#PVsolarPanelMarketResearch#PVsolarPanelMarketCompetitiveIntelligence#PVsolarPanelMarketTrends

0 notes