#Short Term Business Loan in Austin

Explore tagged Tumblr posts

Text

Short Term Business Loan in Austin

What Is a Short-Term Business Loan and How Does It Work?

A short-term business loan is a financial product designed to provide businesses with quick access to funds that need to be repaid within a relatively short period, typically ranging from a few months to two years. Unlike long-term loans, which can last for several years or even decades, short-term business loan in Austin are structured to meet immediate financial needs such as managing cash flow, purchasing inventory, or addressing unexpected expenses.

These loans are offered by banks, credit unions, online lenders, and alternative financing companies like Biz2loan. The application process is often faster than traditional loans, with some lenders approving and disbursing funds in as little as 24 hours. Short-term business loans usually come with higher interest rates and smaller loan amounts compared to long-term loans. Repayment terms can involve daily, weekly, or monthly payments, depending on the lender’s policy.

Why Do We Need Short-Term Business Loans?

Short-term business loans serve as a lifeline for businesses facing temporary financial challenges or seeking opportunities that require immediate capital. Here are some scenarios where short-term business loans are essential:

Managing Cash Flow: Seasonal businesses or companies with fluctuating revenues can use short-term loans to bridge gaps in cash flow and meet operational expenses.

Seizing Growth Opportunities: When a sudden growth opportunity arises, like purchasing discounted inventory or investing in equipment—a short-term loan can provide the required funding.

Emergency Expenses: Unexpected costs, such as equipment repairs or unanticipated bills, can disrupt a business’s operations. A short-term loan helps cover these expenses without straining existing resources.

Building Credit: For newer businesses, short-term loans can serve as a steppingstone to building a strong credit history, making it easier to qualify for larger loans in the future.

What Are the Benefits of Taking Short-Term Business Loans?

Short-term business loans offer several advantages, making them a popular choice for small and medium-sized enterprises (SMEs). Here are some key benefits:

Quick Access to Funds: The approval and funding process for short-term loans is often streamlined, ensuring that businesses receive funds quickly when they need them the most.

Flexibility in Usage: Short-term loans can be used for a variety of purposes, from payroll and inventory purchases to marketing campaigns and operational improvements.

Improved Cash Flow Management: Businesses can address temporary cash flow shortages without affecting their day-to-day operations.

Minimal Long-Term Commitment: Since the repayment period is shorter, businesses can clear their debts quickly and avoid prolonged financial obligations.

Easier Qualification: Compared to long-term loans, short-term loans typically have less stringent eligibility criteria, making them accessible to a broader range of businesses.

Credit Building: Timely repayments of short-term loans can improve a business’s credit score, enhancing its ability to secure future financing.

Does a Short-Term Loan Make Sense to a Business?

The decision to take a short-term loan depends on the specific needs and circumstances of the business. Here are some factors to consider:

Purpose of the Loan: If the loan is intended to address an immediate financial need or take advantage of a time-sensitive opportunity, a short-term loan can be an ideal solution.

Repayment Capacity: Businesses should evaluate their cash flow and revenue projections to ensure they can comfortably meet the repayment obligations.

Cost of Borrowing: Short-term loans often come with higher interest rates. Businesses should weigh the cost of borrowing against the potential benefits or returns from using the loan.

Urgency: For situations that require immediate funding, short-term loans are often the quickest and most convenient option.

What Is the Difference Between Short-Term and Long-Term Commercial Loans?

Understanding the distinctions between short-term and long-term commercial loans can help businesses choose the right financing option:

Feature

Short-Term Loans

Long-Term Loans

Repayment Period

A few months to two years

Several years to decades

Loan Amount

Generally smaller amounts

Larger loan amounts

Interest Rates

Higher rates due to shorter terms

Lower rates over extended periods

Purpose

Immediate or short-term needs

Long-term investments

Approval Time

Faster approval and funding

Lengthy application and approval process

Repayment Frequency

Daily, weekly, or monthly

Monthly

Short-term loans are suitable for temporary needs and quick fixes, while long-term loans are better suited for substantial investments such as real estate, major equipment purchases, or business expansions.

How Does a Short-Term Loan Impact a Business’s Credit Score?

Taking a short-term loan can have both positive and negative impacts on a business’s credit score, depending on how it is managed:

Positive Impact:Timely Payments: Regular and on-time repayments can boost the business’s credit score, signaling financial responsibility to future lenders.Diversified Credit History: Successfully managing short-term loans adds variety to the credit profile, which can positively influence the score.

Negative Impact:Missed Payments: Late or missed payments can harm the credit score, making it harder to secure future financing.High Utilization: Taking on too many loans or utilizing a large portion of available credit can negatively affect the score.

To minimize risks, businesses should plan their repayment strategy carefully and avoid over-borrowing.

Conclusion

Short-term business loans are a powerful tool for businesses to address immediate financial needs, seize growth opportunities, and manage cash flow effectively. While these loans come with higher interest rates and shorter repayment terms, their quick accessibility and flexibility make them an indispensable option for many businesses.

At Biz2loan, we understand the unique financial challenges that businesses face and are committed to providing tailored short-term loan solutions. Our streamlined application process, competitive rates, and expert guidance ensure that your business gets the support it needs to thrive.

For more information about short-term business loans or applying, contact Biz2loan at (888) 204-9748 today!

0 notes

Text

Owning Multiple Second Homes: How Many Can You Legally Have?

Acquisition and ownership of second homes are interested today and are no longer limited to high economic profiles but are now becoming an emerging option among many families wanting to build a real estate portfolio, earn rental income, or enjoy multiple vacation trips. But how many second homes can you own? Though there's no fixed limit on the number of second homes owned, zoning laws, tax implications, and short-term rental regulations can affect ownership. Perhaps you plan to use your property for a vacation rental; contacting an Airbnb management company will ease the burden of management, from Austin to other top cities.

Understanding the Legal Aspects of Owning Multiple Second Homes

1. No Legal Cap on Second Home Ownership

In the United States, there isn't a federal law that restricts the number of second homes an individual may own. However, state, county, and municipal laws can affect the usage, maintenance, and even renting out of these properties on platforms like Airbnb.

2. Zoning and Local Regulations

Zoning ordinances applied to a parcel specifically set forth its ability for any specific type of use, whether residential or commercial. If you are using your second home for rental purposes as a short-term vacation rental, then that zoning law must be complied with. Some cities will have heavy restrictions or may even ban outright short-term rentals. For example, with short-term rentals having many rules in Austin, utilizing the services of an Austin Airbnb management company can keep you on the right side of the law.

3. Tax Implications of Owning Multiple Homes

Owning multiple second homes comes with tax obligations that differ depending on how the property is used:

Personal Use: If you do not rent out your second home, you may be eligible for mortgage interest deductions, similar to your primary residence.

Rental Property: If you rent out your property for more than 14 days a year, it is considered a rental business, and you must report the income to the IRS.

Capital Gains Tax: Selling a second home does not qualify for the primary residence capital gains exclusion, meaning you could face a higher tax bill when selling.

A tax professional can help you navigate these complexities, especially if you're earning rental income from your properties.

Maximizing the Value of Your Second Homes

1. Using Properties for Short-Term Rentals

Should you be buying these multiple second homes as an investment, listing them as short-term rentals can prove to be quite a lucrative business. However, managing several rental properties can be quite overwhelming. This is where an Airbnb management company in Austin or in your area of interest comes to play. They take care of everything, including marketing and guest communication, cleaning, and maintenance, allowing you to put all your energy toward expanding your real estate portfolio.

2. Diversifying Locations

When buying a number of secondary homes, make sure they are in different geographical positions. In fact, a beach house, mountain cabin, and urban apartment would attract different types of renters or travelers. Not only does it protect the investment, but it also helps to ensure consistent rental income all year round.

3. Financing Multiple Second Homes

Securing financing for multiple second homes can be challenging. Lenders typically require larger down payments and higher credit scores for additional properties. Some financing options include:

Conventional Loans: These require a higher down payment for second homes.

Portfolio Loans: Useful for investors who own multiple properties.

Home Equity Loans: Allows you to use existing home equity to fund new purchases.

Working with a financial advisor can help determine the best financing strategy for your situation.

Challenges of Owning Multiple Second Homes

1. Maintenance and Upkeep

The upkeep of various properties inevitably entails continual maintenance and repairs along with operational costs. Property managers or establishments managing Airbnb rentals in Austin could help relieve these organizations of some responsibilities to keep their homes in good condition.

2. Market Fluctuations

The real estate markets are very dynamic, so the prices of the properties can fluctuate according to the economic conditions. Diversified investments through the use of different locations or rental strategies may protect an investment from recession.

3. Legal and Compliance Issues

Every town and state has its own regulations regarding second homes and how they are rented. You have to keep up with all of those laws so that you will not incur any fines or restrictions later on that might affect your rental income.

Final Thoughts

It is quite possible to have many second homes, but owning them comes with responsibilities as well. While there is no legal limit to the number of homes one can have, it is crucial to know the local regulations, tax implications, and property management strategies. So, if you want to turn your properties into vacation rentals, teaming up with an Airbnb management company in Austin or anywhere else will help you navigate compliance and boost your profitability. Investing smart and keeping tabs on market fluctuations would let you effectively expand your real estate portfolio while enjoying passive income.

Looking for more insights? Our next blog will cover How to Clean a Bathroom Like a Pro: A Step-by-Step Guide. Check back soon!"

0 notes

Link

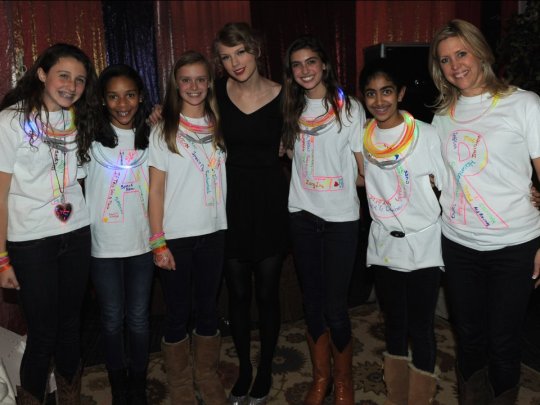

Taylor Swift is worth more than $300 million — see her bicoastal mansions, lavish vacations, and generous gifts to fans and friends

Hillary Hoffower August 19, 2018

Taylor Swift reportedly has a net worth of more than $300 million. Christopher Polk/Getty Images

Taylor Swift's net worth is currently an estimated $320 million, according to Forbes, making her one of the world's highest-paid celebrities.

Once Swift's Reputation Stadium Tour ends this fall, her net worth could climb even higher.

Swift spends her fortune growing her $84 million real estate portfolio and donating to causes and charity.

Taylor Swift never fails to impress.

At 15 years old, she was the youngest songwriter to ever sign with Sony. She now has 10 Grammys on her shelf, several tours under her belt (including one that generated a staggering quarter of a billion dollars), an endless list of chart-topping songs and albums, and a beloved fan base who dub themselves "Swifties."

Such success makes Swift one of the world's highest-paid celebrities and one of the richest female singers. According to Forbes, she has an estimated net worth of $320 million — and that's only expected to rise once her current six-month Reputation Stadium Tour wraps up later this year.

Swift has been strategic and generous with her money, investing in a sprawling $84 million real estate portfolio and often donating it to causes she supports and people in need.

Below, see how Swift earns and spends her fortune.

Taylor Swift currently has an estimated net worth of $320 million, which has grown due to her music, merchandise, and endorsements.

Kevork Djansezian/Getty Images

Source: Forbes

Ever the superstar, Swift's endorsement deals and partnerships are with high-profile brands, including Keds, Diet Coke, CoverGirl, and Apple, which bring in a lot of income.

Charley Gallay/Getty Images

Source:Money

Swift has had a long-term partnership with Diet Coke since 2013, which has involved her chatting about her love for the drink in a "Bon Appetit" interview and holding the drink while on camera.

Anna Webber/Shutterstock

Source:Hollywood Reporter, Variety

Adele and Madonna, who have comparable fan bases to Swift, didn't put as much effort into brand partnerships and touring as Swift did in 2016 — and only made half of her paycheck, at $80.5 million and $76.5 million respectively, according to Quartz.

Sascha Schuermann/Getty Images

Source:Quartz

In fact, aside from brand partnerships and endorsements, touring is Swift's biggest money maker. Her 1989 tour grossed more than $250 million in 2015.

Graham Denholm/Shutterstock

Source: Forbes

She stands to earn even more than that during her current six-month Reputation Stadium Tour that began in May. Five shows in, Swift had already earned $54 million in sales — that's $10.8 million per show.

Kevin Winter/Getty Images

Source: Forbes, Refinery29

But her tours don't just bring in ticket sales. Billboard estimated that Swift sells $17 of merchandise per ticket at her shows.

Andreas Rentz/Getty Images

Source:Billboard

Swift was the world's top-earning musician in June 2016, bringing home a record $170 million from 2015-2016, according to Forbes' 2016 list. The same year, it was estimated that Swift makes $1 million a day.

Evan Agostini/AP Photos

Source:Forbes,Express

Swift had a more "quiet year" in 2017, according to Forbes, bringing in $44 million and ranking ninth on Forbes' list of the world's highest-paid celebrities.

Rich Polk/Getty Images

Source:Forbes

So far in 2018, not including touring revenues, Swift has earned an estimated $5 million in record sales, $2.4 million through streaming, and $2 million in publishing royalties, according to Billboard.

Chris Pizzello/Shutterstock

Source:Billboard

A few years ago, it was estimated Swift could become a billionaire by the time she turns 30. Here's how she spends her fortune...

Carlo Allegri/Reuters

Source:Express

Swift is a real estate mogul, with a sprawling $84 million real estate portfolio that consists of eight properties in four different states, according to property values estimated by Trulia.

Jordan Strauss/AP Photos

Source: Business Insider, Trulia

In Nashville, she owns a 3,240-square-foot condo worth an estimated $3 million and a 5,600-square-foot Greek Revival estate worth an estimated $2.5 million. The latter is the cheapest property she owns.

Google Maps

Source: Business Insider, Trulia

In LA, Swift currently has a Beverly Hills home on the market for $2.85 million. She also owns a 10,982 square-foot Beverly Hills mansion worth nearly $30 million. She plans to turn it into a historic landmark.

From Trulia

Source: Business Insider, Trulia

Across the coast, Swift owns an estate with seaside views in Watch Hill, Rhode Island, valued at $6.65 million. With 12,000 square feet, it has plenty of room for parties with her squad.

Zillow

Source: Business Insider, Trulia

But that's nothing compared to the estimated $40 million worth of property Swift owns in New York City on the same block in Tribeca. That includes a 8,309-square-foot large duplex penthouse and a four-story townhouse.

Taylor Swift bought this townhouse last year located at 153 Franklin St. It's next to a complex where she now owns three units. Google Maps

Source: Business Insider, Trulia

Swift needs a way to travel among all these homes and she's rumored to own two Dassault private jets. There's no word on how much she paid for them, but depending on the model, they can be worth up to $58 million each.

Andrew H. Walker/Getty

Source: Forbes, GOBankingRates

Swift can also use her jet to head out of the country for vacation. She recently spent the Fourth of July in Turks and Caicos with her boyfriend Joe Alwyn and previously took a trip to an undisclosed tropical island with former boyfriend Calvin Harris.

Debbie Ann Powell/Shutterstock

Source:Elle, Travel + Leisure

At the end of her 1989 World Tour, Swift took her 125-person band and crew on a vacation in Australia.

Michael Loccisano/Getty Images

Source: Vanity Fair

But Swift has always been generous with her money, supporting causes and helping those in need. On her 24th birthday, she donated $100,000 to the Nashville Symphony.

Royce DeGrie/Getty Images

Source: People

She's provided supported during natural disasters, donating $1 million to the victims of Louisiana floods and $500,000 to the Nashville flood relief, and raising $750,000 through a Speak Now Help Now benefit concert for victims of tornadoes in the southern US in 2011.

Caroline McCredie/Getty Images

Source: People

Swift is also supportive of education — she pledged $4 million to the Country Music Hall of Fame to fund the Taylor Swift Education Center and donated $50,000 to NYC public schools.

Larry Busacca/Getty Images

Source: People

She's also donated to various GoFundMe campaigns, including $10,000 toward a service dog for an autistic boy and $50,000 to her backup dancer's nephew, who was battling cancer.

Mark Humphrey/Getty Images

Source: People

And then there are the two famous checks she wrote for $1,989 — an ode to her best-selling album — sent to two fans to pay a student loan and to donate to a dance marathon benefit.

Larry Busacca/Getty Images

Source: People

She also helps out her friends, giving pal Kesha $250,000 to help with legal fees during her lawsuit against a music producer.

Kevin Winter/Getty Images

Source:People

But her thoughtfulness doesn't end there. And when she once went out to dinner with pals Ed Sheeran and Austin Mahone in Philadelphia, she reportedly left a generous $500 tip.

Christopher Polk/Getty Images

Source:E News

Swift often spends money dining out with her squad and boyfriends, especially when in New York City, where she's dined at The Fat Radish, The Spotted Pig, Sarabeth's, and L'Asso, where she had a glass of wine and a gluten-free pizza.

KGC-146/STAR MAX/IPx/Getty Images

Source:People

But Swift also saves money dining in. She reportedly loves to cook and bake and has hosted several elaborate dinner parties with her squad.

Jason Merritt/Getty Images

Source:Glamour, InStyle

Swift also has a fur squad. She has two Scottish Fold cats, Meredith Grey and Olivia Benson. The breed costs around $1,000 to $1,500. Her cats even have their own line of merchandise at her store.

Evan Agostini/Shutterstock

Source:Refinery 29, Cat Breeds List

When she's not chilling at home, Swift is usually rocking designer duds during appearances or some serious street style in New York City, often mixing high-end and fast fashion. She's been spotted wearing Saint Laurent sneakers, A Christian Louboutin backpack for $1,237, and an Elie Saab gown.

Michael Loccisano/Getty Images

Source:Who What Wear

But Swift's also sported more affordable pieces, such as $60 Steve Madden sandals and Gen Z-obsession Brandy Melville. She seems to have an affinity for Madewell, whose clothes range around $72 for a pair of shorts or $62 for a denim crop top.

KGC-146/STAR MAX/IPx/AP Photos

Source:Who What Wear, Who What Wear, People

But for all the generous giving and strategic investments Swift has made with her money, she has reportedly used it in one rumored indulgence: $40 million to insure her famous legs.

Andreas Rentz /Getty Images

Source:New York Post

Business Insider

46 notes

·

View notes

Video

tumblr

We are a Nationally Recognized Financial Company Serving all of our Client’s Business Lending Needs. Here at Fund Business Loans, with our expertise as a Small Business Lender, We Syndicate and have Partnerships with National Lenders. We can Provide all of your Business Loan, Finance and Lease Needs. There are a Variety of Business Loans available from Term Loans, SBA loans, to Business Lines of Credit and Business Working Capital. Most Loan types come with Minimum Requirements that Borrowers need to Meet in Order to be Eligible to Apply for the Loan. Plus, They all come with their Own Requirements for Documents you’ll Need to have in order to Apply and Get Approved.

FBL Small Business Loans Austin TX and nearby cities Provide Small Business Loans, SBA Business Loans, Business Startup Loans, Business Acquisition Loans, Accounts Receivable Financing, Short Term Loans, Business Loans, Lines of Credit, Invoice Factoring, Cash Advances, Commercial Equipment Financing, Used Equipment Financing, Commercial Real Estate Loans, Commercial Title Loans

Contact Us: FBL Small Business Loans Austin TX 11105 N Interstate Hwy 35. # D Austin, TX 78753 Phone: 737-295-2209 Email: [email protected] Website: https://fundbusinessloans.com/small-business-financing-austin-tx

#Used Equipment Financing#Commercial Equipment Financing#Cash Advances#Invoice Factoring#Lines of Credit

0 notes

Photo

New Post has been published on https://coinprojects.net/infrastructure-bill-passes-coinbase-posts-1-6-billion-in-q2-profit-600-million-stolen-in-defi-hack-hodlers-digest-aug-8-14/

Infrastructure bill passes, Coinbase posts $1.6 billion in Q2 profit, $600 million stolen in DeFi hack: Hodler’s Digest, Aug.8-14

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

Infrastructure bill passes US Senate — without clarification on crypto

On Tuesday, the controversial infrastructure bill passed in the U.S. senate In a 69-30 vote.

The bipartisan bill proposes roughly $1 trillion of funding into transportation and electricity infrastructure projects. The bill also puts forward more stringent rules for firms handling crypto assets while expanding reporting requirements for brokers, who will be required to report digital asset transactions worth more than $10,000 to the IRS.

Six senators, including Pat Toomey, Cynthia Lummis, Rob Portman, Mark Warner, Kyrsten Sinema and Ron Wyden, proposed an amendment to the buzz-kill bill on Monday that would exempt software developers, transaction validators and node operators as brokers, while proposing that tax reporting requirements “only apply to the intermediaries.”

Their efforts didn’t bear fruit, however, with further clarification on crypto not provided. Senator Toomey flamed the bill in the aftermath, noting that the legislation was “too expensive, too expansive, too unpaid for and too threatening to the innovative cryptocurrency economy.”

Poloniex settles charges with SEC for operating unregistered exchange

The United States Securities and Exchange Commission, or SEC, announced a $10 million settlement with cryptocurrency exchange Poloniex on Aug. 9.

Poloniex was charged with facilitating trades in unregistered securities between July 2017 and November 2019. According to the indictment, the SEC also asserted that Poloniex employees were misbehaving, as they actively sought to circumvent securities regulation in a plot to increase the company’s market share.

On the same day, SEC commissioner Hester Peirce — known colloquially as “Crypto Mom” due to her regular pushback against SEC crypto enforcement — slammed the regulators’ actions in a public statement.

Crypto Mom questioned the regulators’ opaque regulatory framework that crypto firms must navigate in the U.S. while asserting that, even if Poloniex had tried to register with the SEC,

they “likely would have waited…and waited…and waited some more” for a verdict.

Coinbase’s Q2 profits top $1.6B as ETH volume surpasses BTC’s for the first time

Coinbase, the crypto exchange led by media-shy co-founder and CEO Brian Armstrong, posted Q2 profits of $1.6 billion this week.

The firm released its Q2 report on Tuesday, and its net profit of $1.6 billion marked a mammoth increase of 4,900% compared to the $32 million recorded in the same period of 2020. Coinbase’s total revenue for the quarter was $2.23 billion, beating out analysts’ predictions of $1.78 billion in expected revenue.

Interestingly, for the first time since Coinbase was founded nine years ago, Ethereum (ETH) had a higher trading volume than Bitcoin (BTC), with the assets representing 26% and 24% of total volume, respectively.

55% of the world’s top 100 banks reportedly have crypto and blockchain exposure

Despite banks often taking time out of their busy schedules to slam crypto, a new research report found that 55 out of the top 100 banks by assets under management have some form of blockchain or crypto exposure.

According to research by Blockdata, the banks and their subsidiaries have direct and indirect investments in crypto and decentralized ledger technology firms.

Notable banking giants named and shamed included Barclays, Citigroup and Goldman Sachs, who were reported as the most active backers of crypto and blockchain firms, while JPMorgan Chase and BNP Paribas were also identified as serial investors in the sector.

Winners and Losers

At the end of the week, Bitcoin is at $46,262, Ether at $3,189 and XRP at $1.01. The total market cap is at $1.92 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are IoTeX (IOTX) at 314.69%, XinFin Network (XDC) at 71.34%, and Ravencoin (RVN) at 71.23%.

The top three altcoin losers of the week are THORChain (RUNE) at -12.02%, Quant (QNT) at -5.71%, and THETA (THETA) at -2.58%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“If #Bitcoin were to catch up to #Ethereum’s performance this year, the No. 1 crypto’s price would approach $100,000.”

Mike McGlone, senior commodity strategist for Bloomberg Intelligence

“Shutting off this growth engine would be the equivalent of stopping e-commerce in 1995 because people were afraid of credit card fraud. Or regulating the creation of websites because some people initially thought they were complicated and didn’t understand what they would ever amount to.”

Mark Cuban, billionaire investor

“If you want to store your coins truly outside of the reach of the state, you can just hold those private keys directly. That’s the equivalent of burying a bar of gold in your backyard.”

Nic Carter, co-founder of Coin Metrics

“This legislation imposes a badly flawed, and in some cases unworkable, cryptocurrency tax reporting mandate that threatens future technological innovation.”

Pat Toomey, U.S. Senator

“I think we’re already past the stage of crypto early adoption.”

Stephen Stonberg, Bittrex Global CEO

“We are living in a time where everything is going digital, including traditional assets.”

Austin Woodward, CEO of TaxBit

“Given how slow we have been in determining how regulated entities can interact with crypto, market participants may understandably be surprised to see us come onto the scene now with our enforcement guns blazing and argue that Poloniex was not registered or operating under an exemption as it should have been.”

Hester Peirce, commissioner of the U.S. Securities and Exchange Commission

“Bitcoin’s journey to becoming Gold 2.0 has been beautiful.”

Dan Held, Kraken director of growth marketing

Prediction of the Week

Bitcoin Technicals: Why BTC price breaking $48K resistance is the key to new all-time highs

Bitcoin has recovered a notable amount of ground in recent weeks. The asset hit its all-time high of almost $65,000 back in April but subsequently fell in the days and weeks after, finding its way down to around $30,000. On multiple occasions, the asset briefly fell below $30,000.

Recent weeks, however, have shown bullish price movement for Bitcoin, as the asset has posted chart action seemingly indicative of a reversal, based on analysis from Cointelegraph’s Michaël van de Poppe.

The $48,000 price range on Bitcoin’s chart sits as notable resistance. A move past the price zone of $47,500 to $49,000 could signal a possible further move up to eventual fresh all-time highs, although van de Poppe noted $55,000 as a nearer-term target following a break of the mentioned resistance zone. Alternatively, should Bitcoin’s price break down, a number of levels of price support exist, with $37,500 as an important level to hold.

FUD of the Week

Coinbase removes ‘backed by US dollars’ claim for USDC stablecoin

Earlier this week Coinbase tweaked its description of number-two stablecoin USD Coin (USDC) to paint a picture of a slightly less-than-stable coin.

Coinbase made the change following an audit showing that USDC’s reserves weren’t all held in cash. The previous statement read: “Each USDC is backed by one dollar held in a bank account.”

The new statement reads: “Each USDC is backed by one dollar or asset with equivalent fair value, which is held in accounts with US regulated financial institutions.”

While this might be a blow to USDC owners Circle, the firm’s stablecoin cash reserves are likely larger than Tether’s and its USDT.

Alex Saunders sued for $350K by Nuggets News follower

Alex Saunders, the Aussie behind popular crypto YouTube channel Nuggets News, is being sued by a disgruntled investor for almost 479,270 Australian dollars, worth roughly $353,027.

Plaintiff Ziv Himmelfarb filed a formal written order demanding that the YouTuber pay the amount in losses and damages for unpaid loans and allegedly bogus investments.

Himmelfarb stated that it was a “no-brainer” to trust Saunders when he was asked for loans and offered investment opportunities by the crypto influencer, as he had been following him since 2017 and found him to be a reputable figure in the space.

“When he told me he had temporary liquidity issues in May, I was glad to help with a short-term loan, but couldn’t get any of my money back since then. Hopefully I can get repaid,” Himmelfarb said in regard to his alleged 30 ETH loan to Saunders.

DAO Maker crowdfunding platform loses $7M in latest DeFi exploit

DAO Maker, a crowdfunding platform focused on raising money for crypto projects, was exploited by hackers who stole $7 million worth of USDC out of 5,251 user accounts.

According to DAO Maker CEO Christoph Zaknun, the hackers were able to syphon around $7 million worth of USDC.

“One of the reasons why this did happen is probably that the amount of deposits within the [Strong Holder Offering] contract really exceeded our expectations,” said Zaknun in an AMA on Twitch. “Initially, we never expected more than $2.5 million to be deposited in there, but over time, the SHOs became very popular.”

Cointelegraph didn’t reach out to the hackers to provide comments, as nobody knows who they are.

Best Cointelegraph Features

Large hodlers accumulate Bitcoin below $50K as BTC transactions over $1M soar

The dominance of Bitcoin transaction values above $1 million has doubled year-over-year, hinting at a rising institutional involvement in the cryptocurrency space.

Is the cryptocurrency epicenter moving away from East Asia?

East Asia has experienced a major decline in crypto adoption over the past year when compared with other regions.

Measuring success: Offsetting crypto carbon emissions necessary for adoption?

Crypto companies are doing their best to go green by offsetting Bitcoin carbon emissions, but how accurate are their estimates?

Source link By Cointelegraph By Editorial Staff

#AltcoinNews #Bitcoin #BitcoinNews #BlockchainNews #Coinbase #CoinbaseNews #CryptoNews #WeeklyUpdate

#altcoinNews#Bitcoin#BitcoinNews#BlockchainNews#Coinbase#coinbaseNews#CryptoNews#WeeklyUpdate#CryptoPress#Weekly Overview

0 notes

Text

ABA Therapist / RBT / Behavior Therapist

At our Litchfield Park location near Phoenix, Arizona, Action Behavior Centers – ABA Therapy for Autism is hiring experienced and entry-level Behavior Therapists (BTs) and Registered Behavior Technicians (RBTs) to join our team while offering the sort of compensation and culture that applicants can’t find anywhere else. All our BTs become RBTs within their first 45 days and provide therapy based upon the principles of Applied Behavior Analysis to children with Autism and related developmental disabilities in a clinic-based setting.

You will implement world-class behavior modification programs through one-on-one therapy, collect data electronically, assist with parent training, and coordinate with other team members to offer an incredibly valuable service to our clients and families. About Action Behavior Centers: Action Behavior is a dynamic provider of ABA therapy services founded in Austin, Texas.

Started by experienced, successful entrepreneurs and clinically-rigorous and friendly Board Certified Behavior Analysts, Action Behavior offers a superior career opportunity to behavioral health practitioners.

Each team member at ABC has a commitment to excellence in our work. Requirements: Experience working 1:1 with children and/or in the field of Applied Behavior Analysis – ideally you already are a Registered Behavior Technician and/or have extensive childcare experience Must LOVE working with children 10 and under with ASD Must be able to lift up to 30 pounds Must be able to assume and maintain a variety of postures (kneeling, squatting, crawling, sitting, standing) for extended periods of time.

Must be able to sit on the floor or stand for extended periods of time.

Must be able to receive detailed information through oral and written communication.

Must have reliable transportation, a valid Arizona Driver’s license, and be able to show up on time and ready to go to work every day!

We have great little clients and families that depend on us, and absenteeism isn’t possible!

Education: College degree in any field preferred.

Pursuit of undergraduate degree required. Training: We will provide training to our behavior therapists, even if you are already certified.

We have high standards. Compensation: All Positions Are Full-Time with Guaranteed Hours BTs: Training, coaching, and continued education assistance to new and experienced staff Professional development and extensive growth opportunities Health benefits from day one of employment Paid time off (10 days of PTO + 2 day of flex PTO + 12 days of paid holidays) Annual bonus (up to $2,000) + annual merit-based raises Short Term disability Pet insurance and life insurance options Student loan reimbursement program (up to $600 a year) Tuition assistance program for 4 leading online ABA programs Maternity/Paternity bonus 401K + 2% match 30 hours guaranteed each week minimum After-work voluntary team events Free lunch Fridays and themed Fridays!

Management that is responsive, supportive, and promotes a strong company culture A fun work environment that is based on positive reinforcement and culture formation BT/RBT Hourly Range between $14.42-$20.26/hr depending on the level of experience. To apply: Please share your current RESUME and a COVER LETTER helping us get to know you and why you believe yourself to be a fit within our organization and to help our children.

Please no phone calls at this time as our centers are very busy serving clients and families.

We will reach out directly to any candidates with whom we would like to schedule an interview.

Job Type: Full-time Powered by JazzHR Cw8TR4ySjd

The post ABA Therapist / RBT / Behavior Therapist first appeared on Valley of the Sun Jobs. source https://valleyofthesunjobs.com/healthcare/aba-therapist-rbt-behavior-therapist-7aa0fd/?utm_source=rss&utm_medium=rss&utm_campaign=aba-therapist-rbt-behavior-therapist-7aa0fd

0 notes

Text

Small Business Loan Options in Texas

Did you know that there are 2.8 million small businesses in Texas? Or that these small businesses employ 4.8 million people? Texas is a fantastic place to start or grow a business, whether you are in Austin, Dallas, Houston, or one of the hundreds of other cities in the Lone Star State … but not without a little help. Here is what you need to know about small business loans in Texas.

How A Loan Can Help Your Texas Small Business

When I say “help” I am referring to small business loans, which can be useful in many ways. They can help you buy what your business needs to run on a day-to-day basis and make sure you have enough cash flow to survive slow times in your business.

Taking out a business loan can also help you build and expand your business loan, as long as you pay your monthly installment on time each month.

Find the right financing for you

Don’t waste hours looking for and applying for loans you don’t stand a chance – get matched today based on your business and credit profile.

See my games

Small business credit options in Texas

When it comes to corporate finance, you have several options. Some you may qualify for, especially if you have good credit, while others may offer you finance at higher rates.

COVID-19 pandemic loans

In addition to two federal loan programs, the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL) program, Texas has several COVID-19 grant and small business loan programs, including loans from PeopleFund and various city governments. Check the links for the latest information.

Bank loan

If your credit rating is excellent, you can qualify for a long term loan with loan interest rates from a bank or credit union.

SBA loan

The US Small Business Administration also offers low-interest loans like the 7 (a) loan or SBA 504 loan that can be used for things like business expenses, equipment, and commercial real estate. Learn more at SBA.gov.

Credit lines

When you need access to capital but don’t want to have it all (and don’t have to pay back everything at once), business lines of credit can fill the bill. Borrow from what you are approved for and only pay back that amount.

Equipment financing

If you are using equipment like computers, heavy machinery, or even company cars, there are certain equipment loans that you may want to explore. The devices you buy act as collateral that can bring interest rates down.

Credit cards

Having business credit cards to make purchases for your business can come in handy even when you run out of cash in the bank. Withdraw your balance in full to avoid interest fees and look for a card with rewards to earn on your purchases.

Short-term loan

But what if you don’t qualify for any of the above options, maybe because your business is new or you don’t have good credit? You can still qualify for short-term loans, but know that these tend to have higher interest rates.

How To Choose The Right Loan For Your Texas Business

Start with your fitness. Which financing options do you qualify for? Ideally, apply for the lowest interest rate loan to minimize the additional fees you pay.

Also, think about how you plan to use the funds. Some loans, particularly SBA loans, may have specific loan proceeds use requirements, and there are loans such as equipment finance that are designed for specific purchases.

How To Qualify For A Texas Business Loan

Financial institutions may have slightly different criteria for qualifying for a business loan, but in general you can expect them to look at how long you’ve been in business, your credit history, and your annual sales.

New businesses may struggle to qualify for bank or SBA loans as they typically approve applications from companies that have been in business for two or more years. A better option for a startup might be a business credit card or a short-term loan.

The higher your credit score, both personal and business, the better the deals you will qualify for. More on the subject of creditworthiness in the next section.

What is a Good Credit Score for Getting a Texas Business Loan?

Each lender has their own set of criteria for the credit scores required for small business finance. The SBA doesn’t have a published minimum credit requirement, however, but many lenders require a personal credit score of at least 640.

Some lenders may also check if you have business credit, which not all companies do. If you don’t have them, learn how to set up a business loan to expand your options.

And remember: even with bad credit, there are credit options for you, albeit at a higher cost.

Find out which financing options you qualify for

Get personalized credit and credit card reconciliations and access to your business credit report when you sign up for a free Nav account. The check won’t harm your creditworthiness.

Registration

How To Get A Small Business Loan In Texas

Lenders may differ in their application process but expect to be asked for details about your business, how long it has been in operation, your annual income, etc. And since you may be personally guaranteeing the loan, you may need to provide personal information such as your social security number specify.

After you are approved for a loan, review the loan terms, which details the loan amount, interest rate, and repayment schedule. Sign the agreement and the money should be deposited into your business account in less than a business day.

Ways To Use A Small Business Loan In Texas

The uses of corporate finance are as diverse as the small business owners applying for finance.

If you have slow phases in your business, you may just want to access working capital so your bank account never goes empty. If you want to expand, a loan can be used to purchase commercial real estate and renovate new retail space. You could use the funds to purchase larger inventory so you could save per unit.

An equipment loan could be used to purchase updated equipment that will help serve more customers or speed up your production line. You could use the funds to hire more help to relieve yourself a little.

A small loan for your Texas business can and should help take your business to a new level!

This article was originally written July 8, 2021.

Rate this article

This article has no ratings yet.

class = “blarg”>

source https://www.cassh24sg.com/2021/07/10/small-business-loan-options-in-texas/

0 notes

Text

Hard Money Austin – The Flexible Way To Get A Loan For Investment

Most of the real estate investors find it difficult to get the loan for their real estate investments. Not everyone in the real estate industry gets qualify to get a traditional loan. The bank and other financial institution verify the client’s credit history and background before lending the loan. This makes the loan approval delay and the person with a bad credit history will not be able to get the loan. But this is not the end since there are alternative ways through which you can get the loan. The most effective way of getting the required amount is by using the hard money Austin.

The hard money lenders will not check your creditworthiness and lend the money. They provide the money based on the real estate property used as the collateral. The Corridor funding is an effective way through one can get the hard money loan. The hard money lenders don’t use the traditional loan process since they make the process simpler and easier to get the loan for the real estate investment.

Is it easy to find the hard money Austin lenders?

If you have got a good opportunity which will help in developing your business? Then you approach the best Hard Money Austin lenders so that you can build wealth and improve your business. However, it is important to understand that there are many private money lenders who provide the loan for the investment. Hence you must find the best Corridor funding which is reliable. You can find it with the help of proper research about the lenders near you.

A hard money loan is a form of short-term loan which can be used for any real estate investment. Unlike the bank and financial institutions who look for the credit score, the hard money lenders focus on the one or more real estate property used as the collateral to get the loan. This method is used by the lenders so that they can resell the property to recoup the money. The best thing about the Corridor funding is that you can get any amount as the loan if you have the real estate property which can be used as the collateral.

The lenders provide convenience in getting the loan and repayment so that any real estate investors can use the service. Also, they do not focus on more paperwork. Hence the approval or closing of the loan can be done quickly typically in less than a week or two. Thus, this makes the easiest choice to get the loan for utilizing any good real estate opportunity. Using the hard money lenders services also provide many other benefits like flexibility, customized repayment options and so on.

Hence if you can't get the loan for the real estate investment through the traditional method then you can get the loan from the hard money Austin lenders. You can also close the existing loan and take a new loan easily for your new project.

#hard money austin#hard money lending#hard money lenders near me#hard money construction loans#private money loans

0 notes

Text

KBRA Assigns Preliminary Ratings to Prodigy Finance International Student Loan Securitisation

LONDON–(BUSINESS WIRE) – Kroll Bond Rating Agency UK Limited (KBRA) issues preliminary ratings to Prodigy Finance CM 2021-1 DAC and Prodigy Finance CM2021-1 LLC (together “Prodigy 2021-1” or the “Issuers”) securitization of 303.5 million . USD for unsecured international student loans provided by Prodigy Finance Limited (“Prodigy”, the “Company” or the “Service Provider”). This transaction is Prodigy’s first valued securitization backed by international private student loans. Prodigy 2021-1 will issue Class A, Class B, Class C, Class D and Class R Notes (collectively the “Notes”).

Prodigy is a London-based student loan lender that began lending to graduate students at INSEAD, a private school in France, in 2007. In 2011, Prodigy expanded its offering to students in other European schools, and in 2014 began lending to international students participating in postgraduate programs in the United States.

As of June 7, 2021, the Prodigy 2021-1 collateral pool includes $ 8,048-based loans to 6,037 borrowers with an average loan size of $ 37,705, an average exposure per borrower of $ 50,265, weighted average margin of 6, 6% above the variable base rate, which results in a weighted average current interest rate of 6.7% and a weighted average remaining term of 12.9 years. Indian citizenship borrowers make up 44.4% of the pool, and the next largest concentrations are Brazil with 9.7% and China with 5.3%. Prodigy estimates that 62.2% of borrowers who are in the repayment phase currently reside in the United States. 84.8% of the pool are loans to finance graduate courses in the United States.

Click here to view the report. To access reviews and relevant documents, click here.

Related publications

Disclosure Learn more about key credit considerations, sensitivity studies that take into account what factors may affect these credit ratings and how they could lead to an upgrade or downgrade, and ESG factors (if they are a significant factor in changing the credit rating or the rating outlook) can be found in the full rating report listed above.

A description of all material material sources used in establishing the credit rating and information on the methodology (s) (including any material models and sensitivity analyzes of the relevant material rating assumptions, if any) that were used in determining the credit rating is available in the information disclosure forms here.

Information on the meaning of the individual assessment categories can be found here.

This credit rating is confirmed by Kroll Bond Rating Agency Europe Limited for use in the European Union. Information on the confirmation status of a credit rating is available on its rating page at KBRA.com.

Further information on this rating measure can be found in the information disclosure forms mentioned above. Further information on KBRA policies, methods, rating scales and information is available at www.kbra.com.

About KBRA UK Kroll Bond Rating Agency, LLC (KBRA) is a full-service credit rating agency registered as an NRSRO with the Securities and Exchange Commission. Kroll Bond Rating Agency Europe Limited is registered as a CRA with the European Securities and Markets Authority. Kroll Bond Rating Agency UK Limited is registered with the UK Financial Conduct Authority as a CRA under the temporary registration system. In addition, KBRA has been named by the Ontario Securities Commission as the designated rating organization for issuers of asset-backed securities for the submission of a short prospectus or shelf prospectus. KBRA is also recognized as a credit rating provider by the National Association of Insurance Commissioners. Kroll Bond Rating Agency UK is based in Augustine House, Austin Friars, London, EC2N 2HA, United Kingdom.

source https://www.cassh24sg.com/2021/07/07/kbra-assigns-preliminary-ratings-to-prodigy-finance-international-student-loan-securitisation/

1 note

·

View note

Text

Small businesses have received uneven relief from COVID-19 federal aid

Register at https://mignation.com The Only Social Network for Migrants. #Immigration, #Migration, #Mignation ---

New Post has been published on http://khalilhumam.com/small-businesses-have-received-uneven-relief-from-covid-19-federal-aid/

Small businesses have received uneven relief from COVID-19 federal aid

By Sifan Liu, Joseph Parilla On May 28, the U.S. House of Representatives passed the Paycheck Protection Program Flexibility Act, which aims to modify the $660 billion Paycheck Protection Program (PPP) to make loans more accessible and flexible for the nation’s struggling small business sector. After a surge in demand for PPP loans in the program’s first several weeks, both the number and volume of loans has flatlined since May 8, with over 40% of the program’s second funding tranche still available. The PPP Flexibility Act would extend the loan forgiveness period from eight weeks to 24 weeks, extend the June 30 hiring deadline to receive forgiveness, and allow for greater flexibility to include nonpayroll expenses in forgiveness. These reforms reflect how many small businesses are not applying due to lack of guidance or concerns that they will not be able to get their loan forgiven. Even for those who did apply, many are still waiting. Using data from the U.S. Census Bureau’s Small Business Pulse Survey, this post examines trends across the nation’s 50 largest metropolitan areas on two of the key dimensions for making the PPP successful for any local community: (1) maximizing applications through effective outreach and guidance, and (2) delivering the relief to businesses as fast as possible.

Business closure rates and PPP application rates vary across major metro areas

The intensity of the small business crisis differs across geography due to the varying severity of the pandemic, levels of lockdown orders, and industry exposure. To get a sense of the regional demand for small business liquidity relief, we use the share of surveyed small businesses that reported revenue loss from COVID-19. Nationwide, 66% of surveyed small businesses experienced a revenue loss from April 26 to May 23, but that varied among the 50 largest metro areas—from 74% of small businesses in Buffalo, N.Y. to 58% of small businesses in Jacksonville, Fla. and Salt Lake City (Chart 1).

In general, a metro area with more revenue loss will have a higher PPP application rate—but there are some notable exceptions. Fewer than 70% of small businesses in New Orleans, Miami, and Providence, R.I. have applied for PPP assistance, even though small businesses there experienced above-average revenue loss. In the upper left portion of Chart 1, Midwestern and Southern metro areas had below-average revenue loss but some of the nation’s highest shares of PPP applications, led by Memphis, Tenn., Columbus, Ohio, Austin, Texas, and Virginia Beach, Va.

The race to deliver liquidity relief

If applying to the PPP is the first step in stabilizing the sector, processing loans to local small businesses is the second. In general, PPP processing rates in most large metro areas had stabilized at around 90% by May 23 (Chart 2), meaning that for every 10 businesses that said they applied to the program, around nine had received their loan. As these rates approach 100%, it underscores the importance of increasing accessibility to broaden the base of applying businesses now that application backlogs are cleared. But the uneven progress in earlier weeks is still concerning. By May 2, one month after the PPP’s launch, only 50% of small businesses that applied had received their loan. Again, this varied by metro area: In Minneapolis, Oklahoma City, Okla., Kansas City, Mo., and Birmingham, Ala., about 70% of small businesses that applied had received PPP loans. At the same time, small businesses in the bottom five metro areas—all located in California—only saw 30% of their PPP applications processed by May 2.

This lag matters because it may indicate where small businesses have already gone under. By early May, small businesses had been forced to withstand about six weeks of stay-at-home orders, which means that the PPP processing rate in early May is critical because that was the point when many small businesses were about to run out of cash. Nationwide, 54% of small businesses indicated that they had less than four weeks of cash flow on hand in early May, ranging from 68% in Buffalo to 38% in Columbus (Chart 3). Small businesses in New York, Riverside, Calif., and Hartford, Conn. were particularly short on cash, and the low PPP processing rates in those metro areas in early May mean those small businesses might not have received the essential assistance in time.

Three actions to support local small business stabilization efforts

These findings underscore that the small business crisis is widespread but locally differentiated in its severity and response, and point to three main takeaways for policymakers. First, banks, credit unions, community development financial institutions (CDFIs), economic development groups, local government leaders, and small business owners understand how the nation’s relief strategy is playing out on the ground, and can be a powerful and practical advocate for needed changes. While the PPP is far from perfect, modifying it to be more accessible and flexible is likely the most politically palatable near-term solution. The Paycheck Protection Program Flexibility Act was approved by a vote of 417-1, a rare show of bipartisan support that was likely bolstered by a push from a wide set of constituencies. Institutions that are closest to the problem should maintain this local-federal feedback loop. Second, there is still a need for continued outreach and guidance to small businesses that would benefit from the PPP but have not yet received their loan or even applied. The program’s recent plateau is not a sign that the job is done, as conversations with local leaders indicate that many small businesses (such as microbusinesses with fewer than 10 employees and businesses in communities of color) are still not being served by the PPP. Bolstering CDFI capacity is a universal recommendation we have heard over the last several weeks to help increase accessibility to federal relief. Third, there needs to be additional support from the federal government for local outreach and technical assistance related to loan forgiveness. According to a recent survey conducted by National Federation of Independent Business, 75% of surveyed small business owners find the terms and conditions of the PPP loan difficult to understand. Indeed, the process for loan forgiveness is likely to be more complicated than the process for loan applications, which means that there needs to be a commensurate investment in local capacity to help small business owners with technical assistance. This analysis has shown that, after wide local variation in PPP applications and receipts, lenders across the nation’s 50 largest metro areas have been able to process most of the loans in their backlogs. But there are still small businesses—particularly those that had been underbanked or unbanked—that likely could benefit from access to the PPP, but require additional outreach and guidance through community-based business networks supported by federal legislation. Supporting these local technical assistance networks will also be critical in helping more vulnerable small businesses obtain loan forgiveness. Without it, the paperwork burden and somewhat confusing rules and regulations could leave small businesses with debts that they cannot sustain.

0 notes

Text

Annotated edition, Week in Ethereum News, April 19 issue

Here’s the most clicked for the week:

As I always say, the most clicked is determined by what people hadn’t already seen during the week.

My thought is that the annotated edition tries to give people a more high-level overview. If I were only reading a few things this week, I would read

Quarterly update from each EF team

Prysmatic launches the Topaz testnet, ready for multi-client testnet

Compound’s decentralized governance launches

Why so many South Americans are into DeFi: “when you believe and know in your heart that nothing is riskier than your government or a bank, any alternative becomes much more enticing”

7 reasons Eth2 will change the blockchain game

The quarterly update from each EF team is pretty down in the weeds, but some of those teams don’t do much communicating. They don’t have the same need to communicate as EF pays salaries, plus some of teams are low-level stuff where the audience is already quite small. It’s at least worth skimming to get a general idea of what the EF teams are doing though.

Prysmatic launched their new testnet, which isn’t the multi-client testnet™ but is very close. We should see that in the next few weeks. The “7 reasons Eth2 changes the game” is certainly an Eth bullish post, but I suspect that the “eth2 skepticism trade” is going to start unwinding and it could have a big impact on the price of ETH. In fact, I think the price of ETH would likely be higher right now if Eth2 didn’t exist, because crypto fund managers have all turned eth2 into “just a meme” and sold on skepticism. Meanwhile literally zero Eth wannabes have yet to deliver anything scalable without trading off decentralization - and if you trade off decentralization, then you may as well just use SQL.

I suspect Compound’s governance will prove to be something that many projects copy. Of course they didn’t come up with it all on their own, they certainly incorporated many elements from others (eg, Maker) but it’s a solid model for web3 apps to follow.

Finally Mariano Conti’s essay on why DeFi. Contrary to Bitcoin’s “tHe DoLlAr iS aBoUt tO coLaPsE,” DeFi provides an alternative financial system to the folks whose fiat is actually on the verge of collapsing and who don’t want to hold volatile assets like ETH (or an unsustainable memecoin like BTC). Of course it’s not perfect, and it’s risky but any Argentine has a pretty good sense that DeFi is less risky than their banking system or Argentina’s Peronist Peso Printer.

That thing goes brrrrrrrrrrrrrr like no other.

Eth1

Geth v1.9.13, with dynamic state snapshots if you use the flag

Nethermind v.1.8.1 – receipts, bodies and state can be synced in parallel. WebSockets and HTTP run on same port

Latest core devs call. Beiko’s notes. Progress and discussion on EIPs for Berlin.

Quilt doc on account abstraction implementation plan

Most of this speaks for itself. The clients continue to improve while things are being worked on for the next hard fork. Meanwhile the longer-term stateless Ethereum continues to be worked on.

Eth2

Prysmatic launches the Topaz testnet, ready for multi-client testnet

Chainsafe’s Lodestar client in TypeScript releases initial audit report from Least Authority

Latest what’s new in Eth2

Latest eth2 call, lots of talk of API standardizations. Ben’s notes

Proto’s eth2fastspec, an optimization for transition speed to the spec

An update to add atomicity to cross-shard transfers at EE level

The Lodestar tooling has already proven to be really useful to devs and the code quality is quite high by all accounts.

Ben’s what’s new in eth2 is also a good high-level read, I just assume you already know that.

Layer2

When DeFi meets rollup, how rollup chains will work together

Arguably this could be in the “things you should read this week” above, as it’s a relatively high-level look at how rollups will work together, using Eth as the settlement layer.

Stuff for developers

Writing your first zk proof with circom and snarkjs from Iden3

Brownie v1.7 – (python-based dev/testing framework). easy CLI github/EthPM package install. And a quick walkthrough of using OpenZeppelin contracts with Brownie

Remix online and desktop IDE v0.10 – more e2e tests, dev node in browser, plugin improvements, publish to IPFS, async/await for script execution

OpenZeppelin test environment v0.1.4

dshackle – Eth API load balancer

Flash mintable asset backed tokens

Upload to IPFS directly from ENS manager with Temporal

How MeTokens personalizes with 3Box Profiles

Loopring launches an API for their dex rollup

Patterns for access control in Solidity

money-legos: tool to build DeFi apps

I’ve been trying to provide more context in the links of the devs section, which means I have less to say here.

That money-legos quickstarter for DeFi apps seems like it’s built for hackthons.

Security and ERC777 attacks

Sebastian Bürgel finds a bug cancelling the transaction in the Multis UI

Certora on a Synthetix reentrancy bug they found

Slither v0.6.11 – support for Solidity v0.6, auto-generate properties for unit tests and fuzzer

Curve found a vulnerability in the Curve sUSD code. Funds are safe.

Two ERC777 re-entrancy attacks this weekend. ERC777 is widely known to be vulnerable to reentrancy attacks, something ConsenSys Diligence highlighted in the Uniswap audit and on which OpenZepplin published an exploit on last summer

Thus a Uniswap market for imBTC (ERC777) got drained for ~1300 ETH with reentrancy and then lendFme also got drained for $25m USD by the attacker tricking the code into believing more had been deposited than actually had. Peckshield has a solid writeup. The losers are the liquidity providers, and dForce which had the entirety of its liquidity drained.

The dforce/lendfme attacker ended up giving back the money, apparently because he (i’ll use masculine probabalistically) used some front ends without covering his tracks, so he decided it was better to quit while still ahead.

ERC20 has some problems as a token standard, but auditors are generally quite skeptical of ERC777. Could we see a better standard someday? We certainly could, but it seems unlikely to be 777.

Ecosystem

Quarterly update from each EF team

What is still lacking to replace WeChat with web3?

Transaction fees > uncle rewards for miners in March 2020. Obviously Black Thursday’s transaction fee spike contributed to this

Replacing all the different components to make a web3 WeChat is hard. Even stuff like pictures is quite complicated.

Enterprise

EY releases OpsChain, v4, new SaaS model for public/private chains

Study of key management systems for enterprise

How the Baseline Protocol synchronizes between different systems of record

Using Baseline Protocol for medical tests

John Wolpert’s “mainnet as middleware” for a way of synchronizing different databases. It’s not quite “global settlement layer” but it basically is settlement but without the finance aspect.

Governance, DAOs, and standards

Compound’s decentralized governance launches

EIP2585: Minimal Native Meta Transaction Forwarder

Austin Williams mentions this 2002 Microsoft Research paper on Sybil resistance

Sybil resistance is quite hard, as we’ve found out with some Gitocin grants issues. I don’t think anyone is surprised by the issues, it’s obviously not a 100% onchain trustless system yet.

Application layer

A guide to the shutdown of Maker’s SAI

Play short-deck hold’em with Phil Ivey is the new VirtuePoker promo

Ox opens the waitlist for Matcha, a “better way to swap tokens”

First RocketDAO loan using an ENS name as collateral

DeFi Saver’s vault protection product Automation v2 with flash loans and Maker’s next price

How MetaCoin is thinking about Nikolai’s Reflex Bonds idea for a stablecoin without pegs

dYdX crosses 1billion USD in originated loans

AtStake, an Eth-based competitor to OpenBazaar. Also: help test OpenBazaar with Eth

A writeup of PieDAO’s managed Balancer pools

AtomicLoans lets you lock up BTC for a Dai/USDC loan. (Get ~9% by lending your Dai/USDC)

Gnosis launches a dex protocol with ring trades in batch auctions every 5 mins. First app on the protocol is dxDAO’s Mesa, available through mesa.eth

Do dexes count as DeFi? I’ll count them as a yes for my weekly metric, which - now that I’ve counted - is at 9/11.

I didn’t count VirtuePoker as DeFi but I’ve seen some persuasive arguments that gambling has often historically served as a (rather inefficient) method of capital formation.

It’s also interesting to see dexes evolve. Exchange is so fundamental to web3 that I think it’s quite possible that we see a segmented market in the long-term, despite the fact that liquidity is a great barrier to entry. There are simply niches that can be best served by certain tradeoffs, and Gnosis’s batched auction ring trades is an interesting look.

Tokens/Business/Regulation

Another flippening: value transfer on Ethereum exceeds Bitcoin

7 reasons Eth2 will change the blockchain game

Swiss Financial Stability Board recommends heavy stablecoin regulation in response to G20 call for stablecoin comments

Coindesk reports that China’s Blockchain Service Network will incorporate Ethereum

Canada’s regulatory guidance for crypto exchanges

Bullionix: mint gold coin NFTs using DGX

HashCash v2 – personal token spam protection with auto-decreasing bond

me tokens, synthetic labor personal tokens on a bonding curve integrated with Moloch/Aragon from Chris Robison. Unfortunately I can’t read the blog post because Medium censored it.

DeFi Market Cap, neat way to compare what pools are popular inside of DeFi

Virtual gold coins is a pretty interesting bundle.

Also cool to see some folks experimenting with personal tokens. Until 2017 got out of control, the hope was to see more experiments (and no scams, ahem!) at small scale, rather than “here’s $100m in ETH, now it’s 1 billion in ETH....now you’re panic selling the bottom.” Capital allocation in decentralized ecosystems has not been great.

General

MyCrypto and PhishFort get 49 malicious Chrome extensions removed

Etherscan’s ETHProtect, taint inference analysis

Shapeshift buys Portis, and will rebrand it as Shapeshift

Binance is planning a centralized (DPoS) EVM chain

SheFi, a DeFi education program aimed at women

Why so many South Americans are into DeFi: “when you believe and know in your heart that nothing is riskier than your government or a bank, any alternative becomes much more enticing”

The Eth logo made of Venezuelan bolivars

The Eth logo was made up of 3.71 million bolivars, so 0.16 ETH, or under $30 USD. A sad commentary for a country that briefly had the same standard of living as the United States just a couple decades before I was born.

Ultimately it is hard to retain the fruits of your labor if poor public policy choices are made by voters, and none was worse than electing an authoritarian dictator.

Finally, you might notice that below I added the sponsor and calendar section to the annotated edition for the first time.

This newsletter is made possible by ConsenSys

I own 100% Week In Ethereum News. Editorial control has always been me.

If you’re wondering “why didn’t my post make it into Week in Ethereum News,” then here’s a hint: don’t email me. Do put it on Reddit.

Dates of Note

Upcoming dates of note (new/changes in bold):

Apr 21-23 – EY Global Blockchain Virtual Summit

Apr 24 – EthGlobal’s HackMoney virtual hackathon starts

Apr 24-26 – EthTurin

Apr 29-30 – SoliditySummit (Berlin)

May 8-9 – Ethereal Summit (NYC)

May 22-31 – Ethereum Madrid public health virtual hackathon

June 17 – EthBarcelona R&D workshop

Did you get forwarded this newsletter? Sign up to receive it weekly

0 notes

Text

COLLEGE LOANS A PROSTITUTION MOTIVATOR

College loans are an issue in the 2020 Presidential election. Borrowing easy. Repayment a back breaker.

The system will be recorded as one of history’s major rip offs. It is geared so everyone benefits except the student. Everyone consisting of the government, private lenders, and universities.

One example of the system’s abuse is the way universities handle a facet of the student borrowing experience. The more a student borrows, the more that person’s cost for an education increases.

Cato Institute economist Neal McCluskey spells it out thusly: “The basic problem is simple: Give everyone $100 to pay for higher education and colleges will raise their prices by $100, negating the value of the aid.”

Students are plagued by pay back of the loans. Some loans in excess of $200,000. Whether $50,000 or $200,000, impossible for most.

Access to huge sums of money is required. Most post college graduation jobs pay insufficient amounts to handle repayment at any level.

Some female college students and graduates believe they have found a better way. Prostitution. By their way of thinking, a more reasonable and sophisticated approach.

On July 14, 2016, I published an article covering the “new” female repayment program. Titled: The New Prostitution. Following it is set forth in its entirety. Draw your own conclusions as to the righteousness of what is occurring.

THE NEW PROSTITUTION

Bernie Sanders argued for a free college education in the recent primaries. College is expensive. Tuition a back breaker. Rent a killer. Borrowing resulting in long term debt.

There is a new phenomenon in the country. It has become increasingly popular in recent years. Considered trendy.

It is referred to as the girlfriend experience. Ladies selling their bodies for a fee. The ladies generally college girls or in their 20s. The men rich.

No pimps or street corners involved. The ladies use the internet to make contact.

The ladies sell their bodies in order to pay tuition, student loans, rent and some to afford designer labels.

The girlfriend experience is the new prostitution economy.

The experience is not a meet, quick bang and thank you m’am. More is involved. The men want the perfect short term girl friend. Well groomed, cultured, classy, able to converse about anything. A lady that never brings her personal problems to the relationship.

The time involved may be an evening, a day, a weekend, a trip.

The men are older. Decidedly so. Generally 40 to 60 years. Affluent. Money no object to them.

The wages of sin are pretty good. All over the place. The price generally set forth in the site ad. Anywhere from $400 an hour to $2,000-$5,000 an evening. Some higher.

One young lady in South Africa offers herself for $42,000 an evening. She will travel anywhere. I cannot conceive what she can do for that kind of money.

The lady friend of today is the sugar baby of yesterday. The men, the sugar daddies of yesterday. Interestingly, both labels still apply.

Most arrangements last 1-3 years. A weekly meeting. A set figure in advance. Many contract for $5,000 a month. That is $60,000 a year. One hundred eighty thousand dollars over three years.

The ladies generally have 2-3 sugar daddies they provide service for during the course of a week.

The money earned astronomical. Described as an allowance.

The men seek a cultured sexual relationship with a much younger lady. The ladies view the relationship as a job. They do it for the money. No emotional entanglement involved.

The men view the women as sex objects. Whores. Beneath them. Though the ladies are treated with respect at all times.

Most of the men involved are married. They receive from the younger ladies that which their wives fail to provide.

In addition to the agreed remuneration, there are perks/incidental gifts. Extra cash, shopping sprees, jewelry, travel. Benefits of a high end easy life.

The ladies kiss. A no no in the prostitution trade. Men do not kiss the ladies and the ladies not the men. The relationship of sugar daddy/sugar baby is closer and different. The relationship more than that found in other prostitution situations. Kissing is expected and welcomed.

The parties meet via the internet. The leading site is SeekingArrangement.com. More female subscribers than men by a 10-1 ratio. The ladies in their ads set forth their asking price. Men, their net worth.

The ladies are listed free. The men pay $44.95 per month. For an additional $1,200 paid by the man, Seeking Arrangement offers a Diamond Club. The Diamond Club verifies incomes and net worth for the ladies.

Other oft mentioned internet sites are SeekingMillionaire.com and SeekingBillionaire.com.

The feminist movement has mixed feelings. To some, it is empowering. The ladies are entering the work force. The sex industry. Others consider it slutty.

Some maintain the ladies involved are oppressed. Many of the sugar babies have a contrary opinion. They believe those working for $7 an hour are the oppressed ones.

The business world has found a new way of not paying new or entry level employees. They call them interns and make them work for nothing. A sugar baby does not have to tolerate such an experience.

2014 found a large spike as regards the ladies. Especially in southern states. The University of Austin had the greatest growth. Two hundred twenty seven percent.

The top four universities in every area reported were Georgia State University, Kent State University, Arizona State University, and New York University. Number one was New York University.

A top ten listing of cities with the highest density of daddies showed Atlanta #1 and Austin #10.

The ladies are sometimes referred to as hidden hos. Websites such as Seeking Arrangement as convenience stores for adulterers. More dignified, a virtual brothel.

I wish to venture a personal opinion.

Prostitution is illegal in the United States, except for Nevada. Whether sexual activity constitutes a crime is dependent on the services provided. If something more than sex is provided, the acts are not viewed as prostitution. The something more such things as house cleaning or companionship. All difficult of proof.

More than 15 nations world wide have legalized prostitution. Included are New Zealand, Austria, Belgium, Columbia, Denmark, Ecuador, Germany, France and the Netherlands.