#Segment-wisePerformanceHighlights

Explore tagged Tumblr posts

Text

Calumet's Q3 2023: CEO's Insights Unveiled

A Tale of Two Halves - CEO Todd Borgmann's Overview

Calumet Specialty Products Partners, L.P. (NASDAQ: CLMT) released its third-quarter results, showcasing a mixed performance driven by market dynamics and operational hurdles. CEO Todd Borgmann provided insights into the contrasting facets of the quarter, citing strengths and challenges in different business segments.

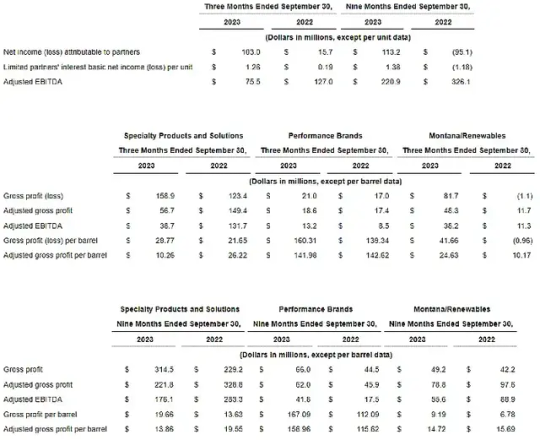

Table of reported results for the third quarter ended September 30, 2023. Photo by Calumet. Strong Start, Transient Hurdles, and Strategic Optimizations Borgmann described the quarter as a tale of two halves, highlighting Montana Renewables' robust earnings and effective commercial execution in the specialties business. Despite the crude costs surge, the company navigated the market successfully. However, transient operational issues surfaced at Shreveport and Montana Renewables, impacting profits. The replacement of a cracked steam drum and catalyst turnaround were opportunistically brought forward, optimizing economic efficiency and minimizing future downtime.

Shreveport Setbacks and Operational Resilience

Operational challenges in Shreveport, notably the plugging of the catalytic dewaxing unit, led to the loss of approximately 300,000 barrels of specialty production during the quarter. The unit has since been fully repaired, and Shreveport's plant is back to normal production levels. Despite these setbacks costing over $50 million in lost profit opportunity, Borgmann expressed confidence that the repairs are either complete or nearing completion, emphasizing their transitory nature. Segment-wise Performance Overview - Specialty Products and Solutions (SPS): Adjusted EBITDA of $38.7 million, reflecting a decline from the previous year due to softened margins and limited production volume, primarily attributed to the Shreveport operational issue. - Performance Brands (PB): The PB segment reported Adjusted EBITDA of $13.2 million, indicating year-over-year margin growth driven by improved industrial volumes and increased unit margins as input costs stabilized. - Montana/Renewables (MR): MR reported $38.2 million of Adjusted EBITDA, impacted by a steam drum replacement. The plant is expected to resume full operations in December, and the new PMA asphalt plant continues to exceed expectations. - Corporate: Total corporate costs represented a loss of $14.6 million of Adjusted EBITDA, demonstrating an improvement from the same quarter in 2022.

Strategic Outlook Amid Challenges

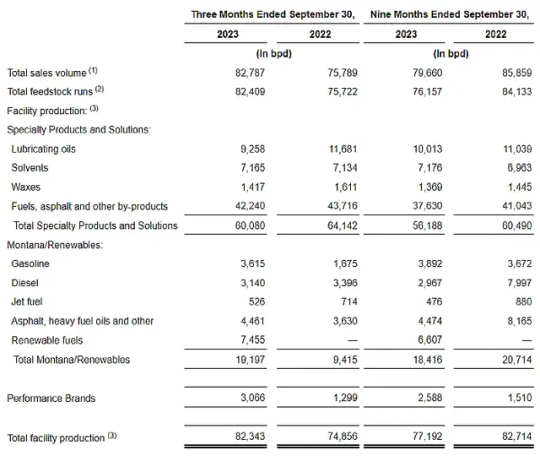

Despite the operational setbacks, Borgmann emphasized that Calumet remains on track to unlock intrinsic value for unitholders in 2024. He acknowledged a potential shift in the strategic timeline due to downtime in Great Falls but underscored confidence in the ongoing DOE loan process, MaxSAF expansion engineering, and potential monetization. Operations Summary and Future Prospects The operations summary highlighted the intricacies of facility production volume, differentiating it from sales volume. As Calumet faces transient challenges, the company's strategic vision and adaptation to market trends position it for a promising future, as outlined in the CEO's strategic overview.

Operational Summary. Photo by Calumet.

Webcast Information

Mark your calendars for November 9, 2023, at 9:00 a.m. ET – the stage is set for a deep dive into Calumet Specialty Products Partners' financial and operational results for Q3. Investors, analysts, and media aficionados are invited to join the live webcast at www.calumetspecialty.investorroom.com/events. Dive into the nitty-gritty of the call and enjoy the presentation slides. Dial-in warriors can join the conversation at (844) 695-5524. And, in case you miss the action, a replay awaits on the investor relations section of Calumet's website for a generous 90 days. About the Partnership Headquartered in the heart of Indianapolis, Indiana, Calumet Specialty Products Partners, L.P. (NASDAQ: CLMT) is a powerhouse, manufacturing, formulating, and marketing a diverse range of specialty branded products and renewable fuels. With operations spanning twelve facilities across North America, Calumet caters to customers in consumer-facing and industrial markets.

Navigating Forward: Cautionary Tale

Eye on the Horizon: Forward-Looking Statements In the tumultuous sea of market dynamics, Calumet casts its gaze forward. Certain statements and info in this press release may take the form of "forward-looking statements." The crystal ball words – "will," "may," "intend," "believe," and their kin – signal the anticipation of future developments. Not just run-of-the-mill historical data, these statements dive into the implications of supply chain disruptions, global energy shortages, and the ever-looming shadow of the COVID-19 pandemic. From the demand for finished products to the delicate dance of balance sheet de-leveraging, Calumet lays its cards on the table. Strategic Prowess: Unveiling the Game Plan In the intricate dance of market forces, Calumet waltzes through a strategic outlook and operational resilience. From the Montana Renewables business to capital expenditures and strategic initiatives, the stage is set. Will the business outlook shine? How does Calumet plan to navigate the twists and turns? Stay tuned for an in-depth analysis. Risks and Realities: Navigating Choppy Waters While the crystal ball predicts, the sea is not always smooth. Calumet acknowledges the risks and uncertainties that pepper its forward-looking statements. From environmental liabilities to the impact of laws and governmental regulations, the journey ahead is not without its storms. As conflicts in Ukraine and the Middle East cast shadows, Calumet steers its ship through the economic, market, and political currents.

Reading the Signs: Forward-Looking Wisdom

Dear reader, as we navigate the seas of forward-looking statements, it's essential to read the signs. Calumet's predictions are not guarantees; they're an exploration of what might be. It's a dance with uncertainties and risks, a balancing act on the tightrope of assumptions. The management urges caution and reminds us that the future might unfold differently than anticipated.

Navigating Murky Waters: Non-GAAP Insights

In the financial seas, Calumet deploys non-GAAP performance measures as guiding lights. EBITDA, Adjusted EBITDA, Distributable Cash Flow – these are the stars by which the ship sails. Beyond the realm of GAAP, these measures illuminate the financial performance, guiding analysts, investors, and market sailors. As we explore these metrics, we must remember: that these are supplementary insights, not alternatives, giving us a deeper understanding of the voyage ahead. In Summary: A Journey Unfolds Calumet's Q3 2023 journey is not just about numbers; it's about strategies, resilience, and a nuanced understanding of the market's ebbs and flows. As the ship sails through uncertainties, the crew invites all to join the journey, peek into the crystal ball, and navigate the sea of forward-looking possibilities. Sources: THX News & Calumet Specialty Products Partners, L.P. Read the full article

#CalumetMarketDynamicsAnalysis#CalumetOperationalResilienceStrategies#CalumetQ32023Results#CEOToddBorgmannInsights#MontanaRenewablesPerformanceAnalysis#Segment-wisePerformanceHighlights#ShreveportOperationalSetbacksOverview#StrategicOptimizationsandObjectives#ToddBorgmannStrategicOutlook#TransientChallengesinQ3

0 notes