#Secure Government Contracts: Market Research Opportunities & Benefits

Explore tagged Tumblr posts

Text

youtube

In this video, we delve into the world of securing government contracts through effective market research. Discover valuable insights and strategies to capitalize on market research opportunities, ultimately enhancing your chances of winning government contracts. Learn about the benefits of informed decision-making and gain a competitive edge in the procurement process. Explore the key steps to navigate this dynamic landscape successfully. Unlock the potential of government contracts with expert guidance and stay ahead in the business arena. Subscribe for more updates on government contract strategies and opportunities. Watch video now!

#Secure Government Contracts: Market Research Opportunities & Benefits#GovernmentContracts#MarketResearch#BusinessOpportunities#ProcurementStrategies#GovernmentProcurement#WinningContracts#CompetitiveAdvantage#ContractBidding#MarketInsights#BusinessSuccess#BusinessStrategy#GovernmentOpportunities#ContractWinning#InformedDecisionMaking#MarketAnalysis#Contracting#MarketTrends#BusinessGrowth#ContractManagement#MarketResearchTips#StrategicPlanning#ContractNegotiation#government contracts#Youtube

0 notes

Text

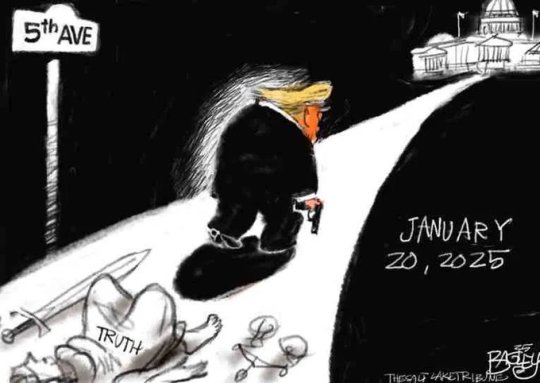

An upwelling of outrage spreads across America

January 29, 2025

Robert B. Hubbell

Trump plunged America into chaos on Tuesday as the implications of his unconstitutional “freeze” on federal grants and loans began to sink in. In a gigantic miscalculation, Trump risked driving the US economy into a tailspin that would take years to overcome.

Or not.

Trump has the opportunity to blink (voluntarily or involuntarily)—but that window is closing rapidly. There are three offramps to this crisis caused by his illegal “freeze” on all federal grants and loans:

Public outrage will force Trump to retreat. A massive upwelling of public outrage is spreading across America. It may take a day or two for MAGA members of Congress to absorb the outrage from their constituents who suddenly realize Trump's thoughtless action has threatened their constituent’s economic security. Millions of Americans have been plunged into uncertainty over government benefits, loans, grants, and payments. They are letting their representatives know how they feel. See Politico, Trump's spending freeze spreads chaos across US. Indivisible has called on congressional Democrats to oppose all nominees until Trump repeals the unconstitutional freeze, saying, “Shut down the Senate.”

The markets may tell Trump to retreat. In a day or two, the money managers on Wall Street will realize that freezing government benefits to seniors, students, veterans, families, government contractors, and people in general will cause a sudden, massive contraction in consumer spending. A shrinking economy will instill fear in the most bullish fund managers. If the markets drop over worries of recession, Trump will hear from the only constituency he fears: Megadonors upset over losses in their portfolios.

Private litigants should be able to obtain an injunction. It is also possible that a judge will pick up a copy of the Constitution and read it. If they do so, they will grant a permanent injunction against Trump's unconstitutional order. On Tuesday, a federal judge granted an “administrative stay,” but that stay was ambiguous and limited. The stay was designed to allow the parties to submit briefing for a hearing next Monday. Moreover, the stay appeared to allow some portions of the “freeze” to remain in effect. See CNN, Judge temporarily blocks part of Trump administration’s plans to freeze federal aid.

Trump attempted to quiet the growing sense of panic by claiming that the freeze would not affect individuals receiving “direct assistance” from the federal government. That assurance is illusory because most federal grants and loans are not paid directly to individuals but rather, are paid through states, federal agencies, and third-party programs that manage federal grants and loans—e.g., Head Start, scientific research grants, federal infrastructure projects, educational subsidies to state schools, programs to support and house veterans.

And despite the assurances from the White House that “direct assistance” to individuals would not be affected, the facts proved otherwise. The Medicaid portal was closed to states (who administer Medicaid funds) for much of the day. See Quartz, Trump Medicaid freeze locks 72 million Americans out of their health insurance. The administration claimed that the shutdown of the Medicaid portal was a “fluke” unrelated to the freeze—a lie so transparent it hurts to repeat it.

Here is the (semi) good news: The Trump administration has already begun to walk-back the reach of the ill-considered freeze, claiming that the following grants and loans are not affected by the freeze: Medicaid, student loans, small business loans, and SNAP food assistance. It is likely that as the media and constituents identify more crucial programs—like food inspection, air traffic control improvements, law enforcement subsidies, veterans’ programs--the administration will make case-by-case exceptions that will swallow the rule.

Although millions of Americans may suffer economic hardship and extreme anxiety in the short term, the financial crisis of withholding hundreds of billions of dollars with no notice may be averted. But the constitutional crisis remains front and center. We cannot allow the constitutional questions to be lost in the understandable focus on the financial implications of Trump's order.

Trump's order is unconstitutional—and it is important that we not lose sight of that fact

Many in the media are downplaying the illegality and unconstitutionality of Trump's “freeze” order. Andrea Mitchell of MSNBC described the illegal order as “controversial.” The New York Times covered the freeze order as a political kerfuffle: “Trump’s ‘Flood the Zone’ Strategy Leaves Opponents Gasping in Outrage.” The NYTimes Editorial Board had nothing to say about Trump's blatant effort to rewrite the Constitution by demoting Congress to an advisory body subject to being overridden on presidential whim.

Congressional Republicans defended the order’s legality. The few Republicans who criticized the order did so only on the ground that it “went too far” in affecting their constituents. Susan Collins said,

I think the administration needs to be more selective and look at it one department at a time, for example. But make sure important direct service programs are not affected.

Here’s the problem with Susan Collins’s analysis: The order is unconstitutional not because it is overbroad but because the president has no authority to freeze funds appropriated by Congress. Period. See ABC News, Trump funding freeze a blatant violation of Constitution, federal law: Legal experts.

As I wrote yesterday, we need to set aside euphemisms and niceties in raising the alarm. Rebecca Solnit (of The Guardian) rose to the challenge with a post on BlueSky:

[T]hat was a coup last night in case no one mentioned that to you. The executive branch seized the power of the purse the Constitution gave to Congress, which is a pretty authoritarian / illegal consolidation of powers move. Time to go yell at your reps, the media, etc.

Senator Angus King of Maine said,

This is a profound constitutional issue. What happened last night is the most direct assault on the authority of Congress, I believe, in the history of the United States.

See Charles P. Pierce, Esquire, Trump’s Federal Grant Freeze Looks Like an Assault on the Authority of Congress.

The grassroots organization Indivisible likewise pulled no punches with a special alert to its members, headlined: Trump’s Dictatorial Power Grab: Chaos, Cruelty, and Constitutional Collapse.

Indivisible wrote:

Congress Controls Federal Spending. The Constitution explicitly gives Congress—not the president—the power to allocate and control federal funds. By freezing funds Congress appropriated, Trump is undermining a foundational principle of democracy. The Impoundment Control Act (ICA). Enacted after Nixon’s abuses, the ICA explicitly prohibits the president from withholding funds appropriated by Congress without following a strict process. Trump has not followed this process, and in many cases, the ICA outright bars the impoundment of these funds.

Indivisible suggests a “no holds barred” response (with which I wholeheartedly agree):

Refuse to Negotiate. Trump is using federal programs as hostages in a power grab. Democrats must refuse to engage in any funding or debt ceiling negotiations while this freeze remains in place. No compromises with dictatorship. Sound the Alarm. Every senator must become a megaphone for what’s at stake. Go on TV, hold town halls, and flood social media with the stories of families who will lose food, homes, and healthcare because of Trump’s chaos. Back Legal Challenges. Support every lawsuit challenging this freeze. File amicus briefs, amplify cases, and make it clear this isn’t just morally wrong—it’s illegal.

All good suggestions. And the point about backing legal challenges may be the best way to fight this power grab. US District Judge Loren L. AliKhan issued a short-term administrative stay to allow further briefing on an application for an injunction. See CNN, Judge temporarily blocks part of Trump administration’s plans to freeze federal aid.

The lawsuit before Judge AliKhan makes an important point: The memo was issued by the Acting Director of the OMB. Per the lawsuit, the OMB has no authority to direct agencies to freeze funds appropriated by Congress. Per the plaintiffs in the lawsuit:

The [OMB] Memo fails to explain the source of (the Office of Management and Budget’s) purported legal authority to gut every program in the federal government.

Good point. While the OMB is integral to the preparation and monitoring of congressional appropriations, OMB has no authority to override a congressional appropriation. See, generally, Congressional Research Service, Office of Management and Budget (OMB): An Overview.

Here are the takeaways:

First, the freeze threatens the separation of powers specified in the Constitution. We must not allow that point to be lost in the chaos and pain that the illegal order will cause.

Second, the upwelling of public outrage spreading across America is already having an impact! This is the path forward! We must do more of it consistently over the long term. We are off to a good start!

[Robert B. Hubbell Newsletter]

#Robert B. Hubbell#Robert B. Hubbell Newsletter#The US Constitution#Constitutional Crisis#illegal orders#OMB#Bagley

15 notes

·

View notes

Text

By: Christopher F. Rufo

Published: Nov 20, 2024

There is an old saw that, in America, every great cause begins as a movement and eventually degenerates into a racket. This is certainly true of the past decade’s most fashionable cause: “diversity, equity, and inclusion.” What might have begun as a social movement has now become a business—and not just in the United States. According to McKinsey & Company, spending on “DEI-related efforts” across the globe totaled $7.5 billion in 2020. If trends continue, that figure will exceed $15 billion by 2026.

And, in another American tradition, government contractors have turned a profit on this fad. While it’s hard to determine the precise amount of money that Washington spends on DEI, a search for contracts, grants, and other outlays that reference “diversity, equity, and inclusion” and similar terms suggests that DEI principles were attached to more than $1 billion in federal contracts last year.

This represents a rapid change. In 2019, according to our search, the federal government awarded only $27 million in contracts with language related to “diversity and inclusion.” But after the death of George Floyd in 2020, the federal government and private contractors went all-in on DEI, seeking to implement the Biden administration’s “whole-of-government” equity agenda.

In a series of executive orders beginning in January 2021, Biden unveiled that agenda. The White House directed each federal agency to “implement or increase the availability of [DEI] training programs,” create “internal policies and procedures to support” employees “transitioning” to another gender, submit annual DEI plans and reports to a White House steering committee, establish “agency equity teams,” and appoint a “chief diversity officer” to oversee compliance. These directives created a sudden demand for DEI consulting and opened the floodgates of federal funding to private contractors who offered “expert” advice on diversity-program management. Consulting firms were delighted; they set about rationalizing and marketing a respectable front for both the ideology and their own cash grab.

The large consulting firms advertised the adoption of DEI as a moral imperative. They boasted of their spending on diversity to demonstrate their credentials. Deloitte, for example, claimed to have spent $1.47 billion on “diverse suppliers.” McKinsey committed to doubling spending on such suppliers, while investing $20 million in DEI research. Deloitte, meantime, published a report titled The Equity Imperative, which encouraged “businesses [to] take the lead in dismantling” systemic racism—preferably with Deloitte’s “premier cross-enterprise DEI analytics tool.”

These firms argued simultaneously that DEI was morally necessary and good for the bottom line. McKinsey published studies that claimed to have found economic benefits from diversity policies. Incredibly, it claimed that narrowing the “gender gap” would add $12 trillion to GDP. Economists have shown that these studies are misleading and potentially fallacious.

The consultant class cashed in. In early 2022, McKinsey partnered with another firm to present “a series of workshops” that would “equip federal leaders working across government with research-based insights” to improve their “DEIA work” (the added “a” is for “accessibility”). Deloitte, seizing the opportunity presented by Biden’s executive orders mandating DEI in the federal workforce, published a paper on the “Government’s equity imperative,” presenting the firm’s “government equity activation model.”

McKinsey and Deloitte were only two of the many consultancies reaping financial rewards from the executive orders, with firms securing millions of taxpayer dollars in DEI-related contracts.

Agencies across the federal government participated in the gold rush. The Treasury Department awarded $2.8 million to Accenture Federal Services for DEI “implementation.” The Department of Health and Human Services gave a $2.9 million DEI contract to Totem. The Department of Defense agreed to pay Tyler Federal $3.3 million for “(DEI) database services.” The Agency for International Development allocated $6.2 million to SSG Advisors for “DEIA buy-in.”

What do these contracts entail in practice? Consider the $4.4 million agreement between the Department of Labor and CALCO Consulting Group to “deliver diversity, equity, inclusion, and accessibility (DEIA) training” for the department’s Job Corps program—an initiative to help young people “complete their high school education, train[] them for meaningful careers, and assist[] them with obtaining employment.”

Rather than focus on helping its clients find meaningful work, the Department of Labor contract funneled millions to outside vendors to conform the program to the DEI creed. For example, a team of CALCO DEI consultants went to Montgomery, Alabama, to lead “a 3-day immersive Student-Centered Design training as part of Job Corps’ plan to adopt DEIA principles at all its centers.” The department, in other words, used the firm to engrain critical race theory principles at every level of the program’s operations.

At NASA, the government awarded $2.4 million to LMI Consulting “to incorporate and deeply engrain diversity, inclusion, equity, and accessibility (DEIA) in” the agency’s “culture and business.” LMI, which has “assisted NASA in transforming its workforce,” happily adapted its product to the new DEI ideology. The agency recognized the firm’s work, giving its “Group Achievement Award” to seven LMI consultants—not for advancing space travel, but for “developing innovative approaches and ways to use lessons learned when implementing [DEI] strategies.”

The Department of Homeland Security is also implementing the White House’s DEI priorities. In September 2023, the department awarded $2.1 million to the Millennium Group International for “(DEIA) professional support services,” a rolling contract that could reach $7.5 million by 2028. That contract is part of the department’s sophisticated diversity apparatus, which includes strategic plans, DEI workshops and seminars, and trainings on “the brain science of inclusion.” Instead of enforcing the law and protecting life and liberty, DHS has focused on “unleashing the power of our shared human spirit” through “inclusive diversity.”

These contracts, and the racialist ideology on which they are predicated, do nothing to serve the national interest. When Donald Trump takes office in January, he should dismantle the diversity apparatus, which threatens his agenda and the principle of equality before the law. DEI is designed to favor ideologues and consultancy grift instead of competent or public-spirited officials. The second Trump administration must put a stop to these contracts immediately, lest they become one more corrupting force in an already deeply compromised federal government.

==

These con artists have perpetrated billions of dollars of fraud on taxpayers. Especially since we now know for certain that, like homeopathy, not only doesn't it work, it makes things worse.

#Christopher F. Rufo#Christopher Rufo#diversity equity and inclusion#diversity#equity#inclusion#DEI bureaucracy#DEI training#diversity training#equality before the law#DEI consultant#fraud

3 notes

·

View notes

Text

Introduction : Brief overview of cryptocurrency investing.

Best Cryptocurrency to Invest in 2023: A Comprehensive Guide

Investing in cryptocurrencies can be both exciting and daunting. With the market constantly evolving, it's crucial to stay informed about the best options for potential investments. In this guide, we'll explore the landscape of cryptocurrency investments, highlighting the top choices and offering insights into the factors that influence their performance.

Introduction

Cryptocurrency has become a buzzword in the financial world, with investors seeking opportunities in the decentralized digital assets. As the market continues to expand, it's essential to navigate through the various options and make informed decisions.

Understanding Cryptocurrency

At its core, cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies, cryptocurrencies operate on decentralized networks based on blockchain technology, ensuring transparency and immutability.

Factors Influencing Cryptocurrency Investments

Market Trends and Analysis

The cryptocurrency market is known for its volatility, influenced by various factors such as market demand, technological advancements, and macroeconomic trends. Analyzing these trends provides valuable insights for investors.

Regulatory Factors Affecting Investments

Government regulations play a significant role in shaping the cryptocurrency landscape. Understanding the regulatory environment is crucial as it can impact the legality and acceptance of specific cryptocurrencies.

Best Cryptocurrencies to Invest In

Bitcoin

As the pioneer of cryptocurrencies, Bitcoin remains a prominent choice for investors. Its historical performance and market dominance make it a relatively stable option, especially for those new to the crypto space.

Ethereum

Beyond being a digital currency, Ethereum is known for its smart contract capabilities, enabling the creation of decentralized applications (DApps). Its potential for future growth is tied to the continued development of the Ethereum ecosystem.

Binance Coin

Operating within the Binance ecosystem, Binance Coin has gained popularity due to its various use cases, including transaction fee discounts and participation in token sales on the Binance Launchpad.

Cardano

Cardano stands out for its focus on sustainability and scalability. With a unique consensus algorithm and a commitment to research-driven development, Cardano offers features that set it apart from other cryptocurrencies.

Solana

Solana boasts impressive speed and scalability, making it a preferred choice for developers. Projects built on Solana benefit from its efficient and low-cost transactions.

Risks and Challenges

While the potential for high returns exists, cryptocurrency investments come with inherent risks. Market volatility, security concerns, and regulatory uncertainties are challenges investors must navigate.

Tips for Successful Cryptocurrency Investing

Diversification of the Portfolio

Diversifying your investment portfolio helps spread risk. Consider allocating funds across different cryptocurrencies to minimize the impact of poor performance in a single asset.

Research and Staying Informed

In the ever-evolving cryptocurrency market, staying informed is crucial. Regularly conduct research, follow market trends, and stay updated on news that may influence your investment decisions.

Risk Management Strategies

Implementing risk management strategies, such as setting stop-loss orders and defining an exit strategy, can help protect your investment from sudden market fluctuations.

Future Trends in Cryptocurrency

As technology advances, new trends emerge in the cryptocurrency space. Keep an eye on developments such as decentralized finance (DeFi), non-fungible tokens (NFTs), and other innovative applications that could shape the future of the market.

Case Studies

Learning from the experiences of successful cryptocurrency investors can provide valuable insights. Additionally, understanding the mistakes made by others can help you avoid common pitfalls.

Frequently Asked Questions (FAQs)

Is cryptocurrency a safe investment?

While the potential for high returns exists, cryptocurrency investments come with risks. It's essential to conduct thorough research and only invest what you can afford to lose.

Which cryptocurrency is the most stable?

Bitcoin is often considered a more stable option due to its long history and market dominance.

How do I diversify my cryptocurrency portfolio?

Diversification involves allocating funds across different cryptocurrencies to minimize risk. Consider a mix of established and promising projects.

What are the security risks associated with cryptocurrency?

Security risks include hacking, fraud, and the potential for technological vulnerabilities. Using secure wallets and practicing good cybersecurity habits is crucial.

How often should I review my cryptocurrency portfolio?

Regularly review your portfolio to stay informed about market trends and adjust your strategy based on changing conditions.

Conclusion

Navigating the world of cryptocurrency investments requires a combination of research, risk management, and a forward-looking perspective. By understanding the factors influencing the market and exploring the best cryptocurrency options available, investors can make informed decisions that align with their financial goals.

4 notes

·

View notes

Text

What is Bullion Coin (BLO)?

Bullion is a cutting-edge DeFi platform that is designed and introduced to help you grow your cryptocurrencies effortlessly. With Bullion, you can earn passive income like never before. Our innovative protocols provide opportunities for yield farming, staking, and liquidity provision, all while ensuring the utmost security and transparency.

Be a Bullioniare!

Introducing you to the all-new Bullion Coin (BLO asset) which is a powerful standard multi-chain cryptocurrency backed by bullion assets such as gold, silver, and platinum for you to boost your earnings up to 100X. This asset is issued by Bullion Defi — a decentralised finance platform for you to lend, borrow, and earn interest in order to stake bullion assets.

BLO coin was developed and introduced to offer a secure, transparent, and scalable platform to imply bullion trading and get better investment options. The asset denotes the value of its decentralized application and serves as a mechanism in terms of utility in the ecosystem. This asset is planned to be released in different standard blockchains including BEP20, ERC20, SOL51, POLYGON, etc.

Some of the functionalities, opportunities, and benefits of Bullion Coin BLO are as follows:

- It is pegged to the value of bullion assets that gets stored in safe vaults and audited on serial regular basis.

- It has low volatility giving a user high liquidity due to the easy exchange of bullion assets or any other cryptocurrencies.

- It provides high returns for staking where you can earn much interest/rewards by locking your owned/held BLO coins in smart contracts.

- It allows you to access the global market and wide opportunities for bullion trading and investment where you can feasibly interact with other participants on the blockchain network.

- It supports the development and exploration of the bullion industry while leveraging the adoption of blockchain technology as well as great innovation in the sector.

Bullion DeFi project is on the verge of building, innovating, and exploring one of the biggest and strongest communities that will believe in the core intention, and potential of the project. The team and project consider the community not to be only the holder of the BLO assets but also to hold the right to share technical/promotional suggestions getting all involved in the decision-making activities and betterment of the project.

This project intends to develop, initiate, and promote the BLO ecosystem to eventually dedicate its resources to research, development, and governance. Bullion Coin is a utility token which is not supposed to hold any value outside the BLO ecosystem.

Total Supply: 20 million (20,000,000 BLO)

· Seed Sale: 6%

· Presale: 4%

· Staking: 36%

· Scheduled minting: 30%

· Marketing: 5%

· Development: 5%

· Team Reserve: 3%

· Initial Developers reserve: 1%

· Contract Royalty: 10%

To buy Bullion Coin BLO, follow the below-mentioned steps:

Step 1: Apply and get a compatible wallet to store BLO coins. You have the option to download the official Bullion Defi wallet from the official website or apply to any other wallet supporting ERC-20 tokens.

Step 2: Hold some cryptocurrency in your wallet, as BLO coins are deployed and support the Ether blockchain protocols. So, you hold some cryptocurrency exchange from Coinbase or Binance.

Step 3: Swap your Ethereum assets for BLO coins on a decentralized exchange that lists BLO coins like Uniswap or say SushiSwap. Check out the contract address and the token symbol of BLO coins from the Bullion Defi official portal.

Step 4: Finally, confirm the transaction and wait for the time period to get processed by the blockchain network. Once approved, you get the amount of BLO coins in your wallet balance.

If you are interested and want to learn more about Bullion Coin (BLO) and the Bullion Defi project, you can visit the official website or read out the whitepaper. You can also follow the team on social media channels like Twitter and Telegram.

website: https://www.bulliondefi.com/

Twitter: https://twitter.com/bulliondefi

Facebook: https://www.facebook.com/BullionDefi

Telegram: https://t.me/bulliondefi

Reddit: https://www.reddit.com/user/bulliondefi

#Bullion Defi#Bullion Coins#Defi#Blo#blockchain#Blo Tokenomics#Bullion#Bullion Defi Swap#Bullion Dex#Defi Earning

2 notes

·

View notes

Text

How to Navigate the Complexities of Hiring Local Talent in the UAE?

With more investors and businesses setting up in the UAE, hiring local talent has become a critical part of company formation services here. However, just like other regulatory frameworks associated with business setup services in the UAE, this aspect also has some requirements to be met.

Recruiting Emirati professionals and integrating them into diverse workplaces requires a deep understanding of the local labor market, cultural nuances, and legal requirements.

This blog post offers a few simple but effective tips that help investors understand the local market and hire local talent in the UAE by offering insights into market research, recruitment approaches, compliance with labor laws, and handling the common challenges.

TIPS TO HIRE LOCAL TALENT IN THE UAE

1. Understand the Local Job Market

Before proceeding with recruitment, first conduct thorough market research to identify key opportunities and challenges in hiring local talent.

The UAE government actively promotes Emiratization, a policy aimed at increasing the participation of Emiratis in the workforce, making it essential for companies to align their hiring strategies with national employment goals. Try to follow the things below.

Identify talent pools. Different Emirates have different economic strengths. For instance, Abu Dhabi has a strong presence in oil, gas, and government sectors, while Dubai thrives in finance, tourism, and technology. Understanding where to find specific skill sets helps streamline recruitment.

Analyze salary benchmarks. Compensation expectations for local talent vary by industry and job role. Reviewing salary benchmarks ensures that your offers remain competitive.

Assess cultural norms. Work-life balance, communication styles, and gender roles play an essential part in attracting and retaining Emirati employees. Employers must be aware of these cultural dynamics to create an appealing work environment.

2. Effective Recruitment Strategies

To successfully attract and hire Emirati professionals, businesses must develop tailored recruitment strategies that align with local expectations and industry trends.

Utilize local job boards and networks. Use digital platforms like LinkedIn to connect with potential candidates. Posting job vacancies on these sites ensures broader visibility.

Partner with recruitment agencies. Agencies specializing in Emirati talent can provide insights into candidate expectations, market trends, and compliance requirements.

Develop targeted job descriptions. Clearly outline the job role, career growth opportunities, and benefits to appeal to local candidates. Emiratis often prioritize job security, professional development, and work-life balance.

Promote your company culture. Highlighting your commitment to diversity, career growth, and employee well-being will make your company stand out among competitors.

3. Assessment and Interviewing

When hiring in the UAE, companies should go beyond evaluating technical skills and consider cultural adaptability and communication styles.

Focus on cultural fit. Many Emirati candidates seek workplaces that align with their professional aspirations. Ensuring that candidates resonate with the company’s mission and values improves long-term retention.

Conduct in-person interviews. While virtual interviews are common, in-person meetings allow employers to gauge candidates' interpersonal skills and workplace adaptability.

Assess language proficiency. While English is widely spoken in business settings, Arabic remains an essential language for government roles and public sector jobs. Ensuring that candidates possess the necessary language skills for their roles is key.

4. Compliance and Legal Considerations

Knowing about the UAE labor laws is a must as it helps avoid legal complications. Employers must comply with Emiratization policies, visa requirements, and employment contract regulations.

The UAE Labor Law, as amended in 2022, outlines employer and employee rights, contract types, and working conditions. Companies must be well-versed in these regulations.

Obtain necessary approvals. Hiring Emiratis and expatriates requires different legal procedures. Employers must follow the correct visa sponsorship and work permit processes.

Comply with gender diversity mandates. The UAE government has introduced initiatives to increase female workforce participation, particularly in leadership roles. Employers should be aware of quotas and incentives related to gender diversity.

5. Building a Local Workforce

Creating long-term career opportunities for Emiratis is essential for fostering a loyal and productive workforce. Businesses that invest in professional development and career progression tend to have higher retention rates.

Develop internship programs. Collaborating with universities such as UAE University and Zayed University allows companies to engage with young talent early and build a pipeline of future employees.

Provide training and development. Emiratis value learning opportunities that align with industry trends. Offering specialized training programs enhances workforce capabilities and strengthens employer branding.

Foster career progression paths. Clearly defined career advancement opportunities encourage Emirati employees to stay with the company and contribute to its long-term success.

Challenges to Consider

Despite the benefits of hiring local talent, companies may encounter several challenges that require proactive solutions.

Language barriers - While many Emiratis are fluent in English, communication gaps may arise, particularly in technical fields or among older generations. Employers should provide language support where necessary.

Skill gaps - Some industries, particularly in technology and specialized engineering fields, may struggle to find local candidates with the required expertise. Training and upskilling programs can help bridge this gap.

Cultural expectations - Emirati employees may have different expectations regarding work-life balance, career stability, and hierarchical workplace structures. Employers must foster an inclusive culture that accommodates diverse perspectives.

Competitive market - The demand for skilled Emirati professionals is high, making it essential for businesses to offer competitive salaries, benefits, and professional growth opportunities to attract and retain top talent.

Build A Productive Team

Hiring local talent in the UAE requires a strategic, culturally aware, and legally compliant approach. Businesses that invest in understanding the job market, developing targeted recruitment strategies, and fostering career growth opportunities will be well-positioned to attract and retain Emirati professionals.

By actively engaging with the local market, adapting recruitment strategies to cultural nuances, and prioritizing compliance with UAE labor laws, companies can effectively navigate the complexities of hiring local talent in the UAE.

0 notes

Text

How to Apply for a Work Visa Successfully

Dreaming of building a career overseas? A work permit is your ticket to exploring working abroad opportunities and achieving your professional goals in a foreign country. Whether you’re looking to understand the work permit meaning, check your work permit status, or explore types of work permits, this guide covers everything you need to know. Plus, we’ll show you how to navigate the process with the help of a trusted work abroad consultancy like Y-Axis.

What is a Work Permit?

A work permit is an official document issued by a country’s government that allows foreign nationals to legally work within its borders. It is often tied to a specific job offer and employer. The work permit meaning varies slightly depending on the country, but its primary purpose is to regulate employment opportunities for non-citizens while protecting local labor markets.

Types of Work Permits

Different countries offer various types of work permits based on the nature of employment, duration, and skills required. Some common categories include:

Temporary Work Permit: For short-term employment, usually valid for a few months to a year.

Permanent Work Permit: For long-term employment, often leading to permanent residency.

Skilled Worker Permit: For professionals with specialized skills or qualifications.

Seasonal Work Permit: For jobs in industries like agriculture or tourism that require temporary labor.

Intra-Company Transfer Permit: For employees transferring to a branch of their company in another country.

How to Check Your Work Permit Status

Once you’ve applied for a work permit visa, it’s essential to track your application. Most countries provide online portals where you can check your work permit status using your application number or passport details. Regularly monitoring your status ensures you’re prepared for any additional steps, such as interviews or document submissions.

How to Work Abroad: A Step-by-Step Guide

If you’re wondering how to work abroad, here’s a simplified process:

Research Opportunities: Identify countries and industries with high demand for your skills.

Secure a Job Offer: Apply for jobs and secure a valid employment contract.

Apply for a Work Visa: Submit your work visa abroad application along with the required documents.

Obtain a Work Permit: Your employer or a work abroad consultancy can assist with this step.

Relocate and Start Working: Once approved, move to your new country and begin your career journey.

Why Choose a Work Abroad Consultancy?

Navigating the complexities of work visa abroad applications can be overwhelming. A reputable abroad work visa consultant like Y-Axis can simplify the process by offering:

Expert guidance on types of work permits and visa requirements.

Assistance with document preparation and application submission.

Updates on your work permit status and interview coaching.

Personalized advice on working abroad opportunities tailored to your profile.

Work Abroad from India: Popular Destinations

Indian professionals have a wide range of options when it comes to work abroad from India. Some of the top destinations include:

Canada: Known for its Express Entry system and high demand for skilled workers.

Germany: Offers opportunities in engineering, IT, and healthcare.

Australia: Ideal for professionals in healthcare, construction, and education.

USA: A hub for tech professionals and those in specialized fields.

UAE: A growing market for construction, finance, and hospitality roles.

Benefits of Working Abroad

Higher Salaries: Many countries offer competitive pay scales compared to India.

Career Growth: Gain international exposure and enhance your professional skills.

Quality of Life: Enjoy better infrastructure, healthcare, and education for your family.

Cultural Experience: Immerse yourself in a new culture and broaden your horizons.

How Y-Axis Can Help You Work Abroad

At Y-Axis, we specialize in helping Indian professionals achieve their dreams of working abroad. Our services include:

Work Visa Assistance: From application to approval, we handle it all.

Job Search Support: Access to global job portals and employer networks.

Documentation Help: Ensure your paperwork is error-free and complete.

Post-Landing Services: Assistance with accommodation, banking, and more.

Visit our dedicated page for work visa services here to get started on your journey.

Conclusion

A work permit is more than just a document—it’s your gateway to a world of opportunities. Whether you’re exploring types of work permits, checking your work permit status, or seeking guidance on how to work abroad, Y-Axis is here to help. With the right support and preparation, you can turn your dream of working abroad from India into reality.

Ready to take the first step? Visit Y-Axis Work Visa Services today and let us guide you toward a brighter future!

0 notes

Text

The Growth of Decentralized Finance and Its Implications for Entrepreneurs

Decentralized finance (DeFi) is transforming the financial landscape, offering entrepreneurs new opportunities to access capital, manage transactions, and scale their businesses. By eliminating intermediaries, DeFi platforms provide faster, more efficient financial services, reshaping how businesses interact with the global economy. Understanding this shift is essential for entrepreneurs looking to stay competitive and harness the benefits of this evolving technology.

What Is Decentralized Finance?

DeFi refers to financial systems built on blockchain technology that operate without traditional banks or financial institutions. Through smart contracts — self-executing agreements encoded on a blockchain — DeFi platforms enable direct peer-to-peer transactions. This model offers greater transparency, reduced costs, and faster processing times, making financial services more accessible to businesses worldwide.

Eric Hannelius, CEO of Pepper Pay, emphasizes the transformative potential of DeFi. “Decentralized finance is breaking down barriers that once limited entrepreneurial growth. By providing access to capital and financial tools without the constraints of traditional institutions, DeFi is opening new avenues for innovation and expansion.”

Opportunities for Entrepreneurs.

One of the most significant advantages of DeFi is its ability to democratize access to funding. Entrepreneurs can secure loans and investments through decentralized lending platforms, often with fewer requirements and faster approval times. This accessibility is especially valuable for startups and small businesses that may struggle to obtain financing through conventional channels.

DeFi also streamlines cross-border transactions, reducing costs and eliminating delays associated with currency conversions and intermediary banks. This efficiency allows businesses to expand into international markets more easily, enhancing their growth potential. Additionally, decentralized platforms offer tools for managing assets, processing payments, and automating financial operations, helping businesses operate more efficiently.

Challenges to Consider.

While DeFi presents significant opportunities, it also comes with challenges. Regulatory uncertainty remains a primary concern, as governments worldwide are still developing frameworks to address the unique aspects of decentralized finance. Entrepreneurs must stay informed about evolving regulations to ensure compliance and avoid potential legal issues.

Security is another critical consideration. Although blockchain technology is inherently secure, DeFi platforms can be vulnerable to hacking and smart contract bugs. Businesses must prioritize cybersecurity measures and choose reputable platforms to safeguard their assets.

Eric Hannelius highlights the importance of balancing innovation with risk management: “Entrepreneurs should approach DeFi with both enthusiasm and caution. The opportunities are vast, but success requires a thorough understanding of the technology and a proactive approach to managing potential risks.”

Best Practices for Leveraging DeFi.

To maximize the benefits of DeFi, entrepreneurs should begin by educating themselves about blockchain technology and decentralized platforms. Understanding the fundamentals of smart contracts, digital wallets, and cryptocurrency transactions is essential for making informed decisions.

Partnering with experienced professionals can also help businesses navigate the complexities of DeFi. Financial advisors with expertise in blockchain technology can provide valuable insights, while legal counsel can ensure compliance with relevant regulations.

When selecting DeFi platforms, entrepreneurs should prioritize transparency, security, and reputation. Conducting thorough research and choosing platforms with a proven track record can reduce the risk of fraud and technical issues. Additionally, diversifying investments and financial tools can help mitigate potential risks and enhance long-term stability.

The Future of DeFi for Entrepreneurs.

As DeFi continues to evolve, its impact on entrepreneurship will only grow stronger. Emerging innovations, such as decentralized autonomous organizations (DAOs) and tokenized assets, will create new opportunities for funding, collaboration, and business operations. Entrepreneurs who embrace these advancements and adapt to the changing financial landscape will be well-positioned for long-term success.

Eric Hannelius concludes by emphasizing the importance of adaptability: “The rise of decentralized finance is reshaping the business world. Entrepreneurs who stay ahead of these trends, leverage the available tools, and manage risks effectively will be well-equipped to thrive in this new era of financial innovation.”

Incorporating DeFi into business strategies offers a path to greater financial flexibility, global reach, and operational efficiency. By staying informed, embracing innovation, and approaching challenges with strategic foresight, entrepreneurs can unlock the full potential of decentralized finance and drive sustainable growth in an increasingly interconnected world.

0 notes

Text

How to Apply for Service Tenders 2025, Solar Power Tenders 2025, and Agriculture Tenders?

The year 2025 brings fresh opportunities for businesses looking to secure government contracts. With the rise of digital procurement, bidding for Service Tenders 2025, Solar Power Tenders 2025, and Agriculture Tenders has become more accessible than ever. Whether you are in the service sector, renewable energy, or agriculture, keeping up with new tenders can help grow your business.

The Growing Demand for Service Tenders 2025

The service sector plays a crucial role in government projects, covering areas like facility management, IT solutions, security, healthcare, and more. Service Tenders 2025 offers various opportunities for companies to provide essential services to public institutions. Governments are focusing on outsourcing critical functions to ensure efficiency and cost-effectiveness. By participating in these tenders, businesses can secure long-term contracts and expand their reach in the public sector.

Opportunities in Solar Power Tenders 2025

With the global push towards clean energy, Solar Power Tenders 2025 present a significant opportunity for companies in the renewable energy sector. Governments are actively investing in solar infrastructure, including solar farms, rooftop installations, and solar-powered street lighting. These tenders attract businesses specializing in solar panel manufacturing, installation, and maintenance. If your company operates in the solar industry, participating in these tenders can help you contribute to the green energy movement while securing profitable projects.

Agriculture Tenders: A Boost for Farmers and Agri-Businesses

The agriculture industry continues to receive strong support through government tenders. Agriculture Tenders cover a range of services, including the supply of farming equipment, irrigation projects, organic farming initiatives, and agricultural research. With increasing demand for sustainable farming solutions, governments are issuing tenders to encourage innovation in agriculture. Businesses dealing with seeds, fertilizers, and farming technology can benefit significantly from these tenders by expanding their market reach.

How to Apply for Service Tenders 2025, Solar Power Tenders 2025, and Agriculture Tenders

If you are interested in bidding for Service Tenders 2025, Solar Power Tenders 2025, or Agriculture Tenders, following the proper steps can increase your chances of success:

Register on Government e-Procurement Portals – Ensure your business is registered on the relevant government websites to access tender opportunities.

Monitor New Tender Announcements – Regularly check for the latest tenders in your industry to stay ahead of the competition.

Prepare Strong Bids – A well-documented proposal highlighting your experience, quality standards, and competitive pricing can improve your chances of winning.

Follow Compliance Guidelines – Each tender has specific requirements, so ensuring full compliance will help avoid disqualification.

Seek Professional Assistance – If you are new to tendering, consulting experts like TendersOnTime can simplify the process and improve your success rate.

Conclusion

TendersOnTime is here to assist you. We provide end-to-end GeM registration services, tender consultation, and bidding support to help your business successfully win government tenders.TendersOnTime is a trusted GeM consultant, providing expert guidance in major cities like Mumbai, Pune, Maharashtra, Kolkata, Chennai, Delhi, and Bengaluru.

The year 2025 is set to bring vast opportunities in Service Tenders 2025, Solar Power Tenders 2025, and Agriculture Tenders. By staying informed and preparing well, businesses can secure profitable government contracts. Whether you are in the service industry, renewable energy, or agriculture, now is the time to explore these tenders and grow your business.For expert guidance on government tenders, contact TendersOnTime today.

0 notes

Text

youtube

In this video, we delve into the world of securing government contracts through effective market research. Discover valuable insights and strategies to capitalize on market research opportunities, ultimately enhancing your chances of winning government contracts. Learn about the benefits of informed decision-making and gain a competitive edge in the procurement process. Explore the key steps to navigate this dynamic landscape successfully. Unlock the potential of government contracts with expert guidance and stay ahead in the business arena. Subscribe for more updates on government contract strategies and opportunities. Watch video now!

#Secure Government Contracts: Market Research Opportunities & Benefits#GovernmentContracts#MarketResearch#BusinessOpportunities#ProcurementStrategies#GovernmentProcurement#WinningContracts#CompetitiveAdvantage#ContractBidding#MarketInsights#BusinessSuccess#BusinessStrategy#GovernmentOpportunities#ContractWinning#InformedDecisionMaking#MarketAnalysis#Contracting#MarketTrends#BusinessGrowth#ContractManagement#MarketResearchTips#StrategicPlanning#ContractNegotiation#government contracts#Youtube

1 note

·

View note

Text

Buy a Tech Startup in Albuquerque: Innovative Business Listings

Albuquerque, New Mexico, is rapidly emerging as a hub for technology and innovation. With a growing ecosystem of entrepreneurs, research institutions, and tech-focused investors, the city is gaining a reputation for supporting high-tech startups. For business owners or investors looking to capitalize on this momentum, exploring tech-related businesses for sale in Albuquerque offers a unique opportunity to enter the booming tech sector. Whether you’re interested in software development, cybersecurity, or e-commerce, Albuquerque has several tech businesses ripe for acquisition.

In this guide, we’ll explore the benefits of investing in Albuquerque’s tech scene, key opportunities available, and factors to consider before purchasing a tech business.

Why Invest in Albuquerque’s Tech Industry?

Albuquerque has seen significant growth in its tech industry, driven by institutions like Sandia National Laboratories, the University of New Mexico, and numerous startup incubators. The city provides a supportive environment for innovation, with access to grants, mentorship programs, and affordable operational costs compared to major tech hubs like Silicon Valley.

The rising demand for tech solutions across various industries—healthcare, education, energy, and finance—positions Albuquerque-based startups for long-term growth. Additionally, Albuquerque’s strategic location and high quality of life make it an attractive place for tech talent to live and work.

Types of Tech Businesses for Sale in Albuquerque

If you’re looking for a tech business for sale in Albuquerque, it’s important to choose a sector that aligns with your expertise and goals. Here are some of the most promising categories:

1. Software Development Companies

Albuquerque has a growing demand for custom software solutions in industries such as healthcare, education, and logistics. Startups specializing in enterprise software, app development, or software-as-a-service (SaaS) platforms are well-positioned to thrive in this environment.

When exploring a software company business for sale in Albuquerque, evaluate the strength of its existing product offerings, customer base, and intellectual property. Companies with proprietary technology and recurring revenue models can offer strong returns on investment.

2. IT and Cybersecurity Firms

As cyber threats continue to evolve, businesses across all sectors are prioritizing cybersecurity. IT service providers and cybersecurity startups that offer network security, data protection, and compliance solutions are in high demand. Albuquerque’s proximity to research institutions focused on national security makes it an ideal location for businesses in this sector.

When evaluating an IT or cybersecurity business for sale in Albuquerque, check for existing contracts with government agencies or large enterprises, as these can provide a stable revenue stream.

3. E-Commerce and Online Retail Platforms

E-commerce businesses have seen explosive growth in recent years, and Albuquerque’s diverse market supports a range of niche online stores. Tech startups specializing in digital marketplaces, subscription services, or online product sales can benefit from Albuquerque’s access to both regional and national customers.

If you’re interested in acquiring an e-commerce business for sale in Albuquerque, focus on companies with strong branding, efficient supply chains, and scalable platforms.

4. Renewable Energy Tech Companies

With New Mexico’s abundant natural resources and commitment to sustainability, there is growing interest in renewable energy technologies. Startups working on solar energy systems, energy storage solutions, and smart grid technology have significant growth potential.

When considering a renewable energy tech business for sale in Albuquerque, evaluate the company’s partnerships, patents, and access to state and federal incentives for clean energy development.

5. Healthcare Technology Startups

Healthcare technology is a fast-growing sector, particularly in cities with strong research institutions like Albuquerque. Startups developing telemedicine platforms, medical devices, or healthcare data analytics tools can benefit from the city’s partnerships with hospitals and universities.

Look for healthcare tech businesses for sale in Albuquerque that have established pilot programs or contracts with local healthcare providers. These early partnerships can accelerate growth and provide valuable case studies for future expansion.

Factors to Consider When Buying a Tech Business

Purchasing a tech business involves more than just acquiring assets and customers—it requires a deep understanding of the business’s technology, competitive positioning, and scalability. Here are key factors to consider during the buying process:

Technology and Intellectual Property: Assess the quality and uniqueness of the company’s technology. Does it have patents or proprietary software that provide a competitive edge?

Customer Base: Understand the company’s existing clients and revenue streams. Are there long-term contracts or recurring revenue models in place?

Growth Potential: Evaluate the market opportunity for the company’s products or services. How scalable is the business, and what are the barriers to expansion?

Team and Talent: In tech businesses, the expertise and innovation of the team are critical. Determine whether the key team members will remain with the company post-sale, and assess their skills and experience.

Financial Performance: Review financial statements, including revenue, profit margins, and operating expenses. Look for consistent growth trends and opportunities to improve efficiency.

Market Trends: Research industry trends and potential competitors. Understanding the market landscape will help you position the business for continued success.

How to Find Tech Businesses for Sale in Albuquerque

There are several resources to help you find the right tech business for sale in Albuquerque. Business brokers and online marketplaces specializing in tech startups can provide listings and valuable insights. Additionally, networking within Albuquerque’s tech and startup community can uncover off-market opportunities.

Incubators, accelerators, and local investment groups may also have information on tech companies seeking acquisition or partnerships. Engaging with these organizations can provide a deeper understanding of Albuquerque’s startup ecosystem and help you identify high-potential businesses.

Support for Entrepreneurs in Albuquerque

Albuquerque offers numerous programs and resources to support entrepreneurs and business owners. Organizations such as the New Mexico Technology Council and the Albuquerque Economic Development agency provide access to networking events, funding opportunities, and mentorship programs. Additionally, state and local incentives, including tax credits and grants for technology businesses, can help reduce startup and operational costs.

Final Thoughts

Albuquerque’s growing tech industry presents a wealth of opportunities for entrepreneurs and investors. From software development firms to renewable energy startups, the city offers a diverse range of tech businesses for sale in Albuquerque that can deliver both financial returns and long-term growth. By carefully researching each opportunity and leveraging local resources, you can find the perfect business to help you achieve your entrepreneurial goals in this dynamic and innovative market.

First Choice Business Brokers Albuquerque

6300 Riverside Plaza NW Suite 100 Albuquerque, NM 8712015059991260https://albuquerque.fcbb.com/

0 notes

Text

Opening Earnings: A Comprehensive Guide to Certified Medical Billing and Coding Salaries in 2023

Unlocking Earnings: A Thorough Guide to Certified Medical Billing and Coding Salaries in 2023

As the healthcare industry continues to expand, the demand for qualified medical billing and coding professionals remains at an all-time high. For those considering a career in this field, understanding the salary landscape in 2023 is crucial. In this comprehensive guide, we will explore certified medical billing and coding salaries, factors influencing pay, benefits of this profession, and practical tips for maximizing earnings.

The Salary Overview of Certified Medical Billing and Coding Professionals

In 2023, salaries for certified medical billing and coding professionals vary widely based on several factors including location, experience, and specialization. According to the U.S. Bureau of Labor Statistics (BLS), the median salary for medical records and health information technicians, which includes medical billing and coding, is estimated around $45,240 per year.

Average Salary by Region

Region

Average Salary

Northeast

$51,830

Southeast

$44,290

Midwest

$46,840

Southwest

$48,610

West

$55,620

Factors Influencing Salaries

As with many professions, salaries in medical billing and coding can be influenced by a variety of factors:

Experience: Entry-level positions generally start at lower salaries, but with experience, professionals can command higher rates.

Certification: Obtaining certifications such as Certified Professional Coder (CPC) or Certified Billing and Coding Specialist (CBCS) can enhance earning potential.

Specialization: Specialized areas such as outpatient care and surgical coding can lead to higher salaries.

Location: Urban areas and states with a high cost of living typically offer higher salaries.

Employer Type: working in hospitals, private practices, or insurance companies can influence pay scales.

Benefits of a career in medical Billing and Coding

Beyond salary, there are numerous benefits to pursuing a career in medical billing and coding, including:

Job Security: The healthcare industry’s growth ensures a consistent demand for skilled professionals.

flexible Working Conditions: many positions offer options for remote work,providing work-life balance.

Career advancement: Opportunities for specialization and advancement can lead to senior positions with higher pay.

Contributing to Healthcare: Play a vital role in the functioning of healthcare systems by ensuring accurate billing and coding.

Practical Tips to Maximize Your earnings

To enhance your earning potential in the medical billing and coding field, consider the following tips:

continuous Education: Stay updated with changes in codes and regulations through courses and workshops.

network: Join professional organizations and networking groups to connect with peers and explore job openings.

Consider Contract work: Freelancing or contract work can offer more lucrative pay for specific projects.

Negotiate Your Salary: Don’t be afraid to negotiate your salary based on your skills and market research.

Explore Diverse Job Opportunities: Look into various sectors—hospitals,clinics,insurance companies,and government agencies.

Case Studies: Real�� Earnings from the Field

To provide a clearer picture of what one can expect in terms of earnings, here are case studies from three professionals in the billing and coding field:

case Study 1: Sarah, a CPC certified coder in New York City, earns approximately $65,000 annually due to her 7 years of experience and specialization in cardiology coding.

Case Study 2: John, who started as a billing specialist two years ago in a small clinic in Texas, currently makes around $45,000. He plans to pursue further certifications for better opportunities.

Case Study 3: Anjali, a remote coder with 5 years of experience, works for a major healthcare facility and earns about $55,000. She credits her networking and continuous education for her success.

First-Hand Experiences

Many professionals in the medical billing and coding field share their experiences regarding salary and job satisfaction. Here are some highlights:

Adaptability is Key: Many coders appreciate the ability to work from home and retain a balanced lifestyle.

Job Satisfaction: Many take pride in their work, ensuring that healthcare providers are reimbursed accurately and promptly.

Conclusion

As we move further into 2023, the job outlook for certified medical billing and coding professionals looks shining.With competitive salaries and considerable opportunities for growth, this career path not only offers financial rewards but also a chance to contribute to improving healthcare systems. By understanding market trends, enhancing skills, and leveraging opportunities, you can unlock your earning potential in this promising field.

youtube

https://medicalcodingandbillingclasses.net/opening-earnings-a-comprehensive-guide-to-certified-medical-billing-and-coding-salaries-in-2023/

0 notes

Text

Public Cloud Market Opportunity, Driving Factors And Highlights of The Market

The global public cloud market size is anticipated to reach USD 1,987.79 billion by 2030, according to a new report by Grand View Research, Inc. The market is projected to grow at a CAGR of 17.0% from 2024 to 2030. Owing to the high scalability and reduced operational costs offered by cloud services in the wake of digital transformation of industries, the market is witnessing rapid growth. Moreover, enterprises across the globe are gradually adopting public cloud technology to rapidly build, test, and release quality software products.

The public cloud is a multi-tenant environment, which offers rapid elasticity and high scalability with capability to consume resources on a pay-per-use basis. Governments and institutions are planning gradually to completely integrate its conventional systems with these computing technologies. As a part of the IT Modernization effort, U.S Federal Government had initiated Cloud Smart Strategy in October 2018 to improve citizen-centric services, accessibility, and maintain cybersecurity. Moreover, adoption of the technology is rapidly gaining importance among Small and Medium Enterprise (SMEs) sector due to the cost competitiveness offered in the market.

Currently, most of the enterprises of varying sizes, are revamping from traditional to digital mode of business. The transformation is likely to create potential market for public cloud owing to its benefits such as reduced Total Cost of Ownership (TCO), agility, and flexibility. IBM Corporation states that around 89% of IT professionals expect to move business-critical workloads to cloud, which are driven by the growth in digitization.

Government organizations are also this technology services for storage, disaster recovery, risk compliance management, and identity access management applications. In October 2019, amidst corporate hostility, Microsoft Corporation was awarded the U.S Department of Defense contract, Joint Enterprise Defense Infrastructure (JEDI) worth USD 10 billion.

Gather more insights about the market drivers, restrains and growth of the Public Cloud Market

Public Cloud Market Report Highlights

• Infrastructure as a Service segment is predicted to expand at the highest CAGR over the forecast period owing to elimination of capital expense, increased scalability and reliability, better security, and fast data accessibility

• Amazon.com Inc.; Microsoft Corporation; Alibaba Group Holding Ltd.; Google LLP.; and IBM Corporation are some of the key IaaS vendors in the market, however there are around 160 startups that are also competing in the IaaS domain

• Small and medium enterprise is anticipated to be the fastest growing segment owing to reduced costs for IT hardware and software, improved processing capacity and elasticity of storage, and greater mobility of access to data and service. The growth in adoption of technology among SMEs in emerging economies such as India, Brazil, Vietnam, and the Philippines is likely to boost the market growth over the forecast period

• The manufacturing end use segment is expected to expand at the fastest CAGR over the forecast period. The industry report asserts that executive management in manufacturing, high-tech, and telecommunications are likely to adopt cloud based services completely. Moreover, the industries report that digital services such as public cloud provides around 25% of the total inputs to manufacture a finished product

• Asia Pacific is expected to emerge as the fastest-growing region owing to the increasing focus of SMEs and large enterprise to enhance their digital initiatives. The presence of large companies such as IBM with their establishment of cloud computing centers in China, India, South Korea, and Vietnam is likely to boost the growth

Public Cloud Market Segmentation

Grand View Research has segmented the global public cloud market report on the basis of service, enterprise size, end-use, and region:

Public Cloud Service Outlook (Revenue, USD Billion, 2018 - 2030)

• Infrastructure as a Service (IaaS)

• Platform as a Service (PaaS)

• Software as a Service (SaaS)

Public Cloud Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

• SMEs

• Large Enterprises

Public Cloud End-use Outlook (Revenue, USD Billion, 2018 - 2030)

• BFSI

• IT & Telecom

• Retail & Consumer Goods

• Manufacturing

• Energy & Utilities

• Healthcare

• Media & Entertainment

• Government & Public Sector

• Others

Public Cloud Regional Outlook (Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

• Asia Pacific

o Japan

o China

o India

o Australia

o South Korea

• Latin America

o Brazil

• Middle East & Africa

o South Africa

o Saudi Arabia

o UAE

Order a free sample PDF of the Public Cloud Market Intelligence Study, published by Grand View Research.

#Public Cloud Market#Public Cloud Market Size#Public Cloud Market Share#Public Cloud Market Analysis#Public Cloud Market Growth#public cloud market share 2024#public cloud market trends

0 notes

Text

Things to Know About Foreign Investment Reforms and Strategies in Saudi Arabia

Saudi Arabia is undergoing a profound economic transformation as part of its Vision 2030 program, which aims to reduce its dependency on oil. For this, the government has introduced several reforms and strategies over the past few years for encouraging foreign investment.

These measures reflect Saudi Arabia's openness to foster international collaborations. If you’re an investor interested in setting up business in the Kingdom of Saudi Arabia (KSA), here’s what you need to know about the kingdom’s foreign investment reforms and strategies.

Role of Foreign Investors in KSA

Foreign investors play a pivotal role in Saudi Arabia’s economic transformation. By bringing capital, expertise, and innovation, they contribute significantly to the Kingdom’s growth.

Key Contributions of Foreign Investors:

Economic Diversification: Investments in non-oil sectors help reduce reliance on oil revenues.

Job Creation: Foreign businesses create employment opportunities for Saudi nationals, supporting Saudization efforts.

Infrastructure Development: Investments in sectors like real estate, transportation, and utilities improve the Kingdom’s infrastructure.

Key Legal Reforms Driving Foreign Investment

To attract foreign investors, Saudi Arabia has introduced significant legal reforms that are directed towards business transparency, simplifying processes, and aligning the kingdom’s regulatory framework with international standards. Let’s take a look at the major reforms.

1. New Investment Law

One of the most significant reforms is the updated investment law, which places Saudi and non-Saudi investors on equal footing. The law also offers more protection for investors, including safeguards against expropriation, stronger intellectual property rights, and better dispute resolution mechanisms.

These measures ensure that both local and foreign investors feel secure about the kingdom’s legal framework.

2. Amendments to Labour Law

Saudi Arabia’s updated labour law is designed to align with international standards and attract global talent. Key amendments include:

Increasing maternity leave from 10 to 12 weeks with full pay.

Introducing three days of paternity leave and bereavement leave for the death of a sibling.

Extending the probationary period to180 days, reducing administrative burdens and providing clarity for employers and employees.

These changes create a more supportive and attractive environment for both foreign investors and professionals, reinforcing the kingdom’s reputation as a competitive global market.

3. Companies Law

Unveiled in 2023, the modernized companies law simplifies the process of establishing and managing different types of businesses in Saudi Arabia. The law provides clear guidelines on corporate governance, dividend distribution, accounting records, and financial statements.

By merging international standards with Sharia principles, the law offers a flexible regulatory framework that meets the needs of the global business community.

4. Civil Transactions Law

The civil transactions law codifies principles that govern contracts, obligations, and dispute resolution, bringing greater clarity to commercial transactions. By integrating Sharia law with international best practices, the law ensures predictability and transparency for investors in various sectors, including infrastructure, construction, and energy.

5. Special Economic Zones Law

Saudi Arabia has introduced special economic zones (SEZs) to provide tailored incentives and benefits for investors. These zones offer tax exemptions, better licensing procedures, and infrastructure support, making them ideal for companies in technology, logistics, and manufacturing sectors.

Investment Strategies in Saudi Arabia

For a successful business setup, strategic planning is vital. Here are four key investment strategies to consider.

1. Market Research and Analysis

Saudi Arabia’s economy is an evolving one. Before investing, its necessary to get an in-depth market insight including sector-specific research, thorough analysis including competitors and audience, and cultural insights as well.

2. Networking

Collaboration is key to navigating the Saudi market effectively. Try to forge local partnerships and be a part of business councils and forums. In short, build a strong network.

3. Legal and Regulatory Compliance

Saudi Arabia has a well-defined legal and regulatory framework to facilitate foreign investment. Adherence to these regulations is required to ensure a fully compliant business setup in Saudi Arabia.

4. Technology

Saudi Arabia is embracing digital transformation across all sectors. Businesses that leverage technology are more likely to thrive. So, invest in digital solutions and explore and embrace emerging tech.

Take Advantage of Saudi Arabia’s Latest Reforms

Saudi Arabia’s foreign investment reforms and strategies are paving the way for a new era of economic growth and diversification. By introducing investor-friendly laws, simplifying processes, and enhancing protections, the kingdom is emerging as a shining example of prosperity.

With Vision 2030 at its center, the kingdom is not only open for business but is actively shaping a future where international collaboration and innovation drive its success.

#company formation uae#uae free zone company formation#company setup services in uae#best business consultants in dubai#mainland company setup

0 notes

Text

How to Buy a House in Jervis Bay Real Estate: A Complete Guide

Why Jervis Bay?

Jervis Bay real estate, located on the South Coast of New South Wales, is officially recognised by the Guinness World Records for having some of the whitest sands on the planet. It’s a haven for families, retirees, and holidaymakers, with growing appeal for property investors. According to CoreLogic, property prices in Jervis Bay have experienced a steady annual increase of 6% over the past five years, reflecting its desirability as both a lifestyle and investment destination.

Step 1: Understand Your Budget

The first step to buying a house in Jervis Bay is determining a realistic budget. Due to increasing demand following the pandemic, the median home price in Jervis Bay real estate as of 2024 is roughly $880,000

Key Considerations:

Upfront Costs:

Deposit (usually 20% of the property price).

Stamp duty (check the NSW government’s concessions for first-time buyers).

Legal fees and conveyancing costs.

Ongoing Costs:

Council rates, utilities, and property maintenance.

Potential mortgage insurance if your deposit is less than 20%.

Loan Pre-Approval:

Securing pre-approval from a lender will give you a clear understanding of your borrowing capacity and strengthen your negotiation position.

Step 2: Research the Market

In Jervis Bay real estate competitive real estate market, thorough research is crucial. This involves staying updated on local listings, market trends, and auction results.

2024 Market Insights:

High Demand for Coastal Properties: Suburbs like Hyams Beach, Vincentia, and Huskisson are particularly sought after for their proximity to the beach and amenities.

Rental Yields: Rental returns: Due to Jervis Bay's popularity as a travel destination, investors find it appealing because vacation rental returns typically range between two and five percent.

Practical Steps:

Use property platforms and local agency websites to track market activity.

Attend open houses to understand pricing and availability trends.

Consult resources like CoreLogic reports for detailed market data.

Step 3: Engage a Local Real Estate Agent

Partnering with a local real estate agent is a smart move when navigating Jervis Bay real estate. Their expertise can help you uncover off-market opportunities and negotiate the best deal.

Benefits of Working with Local Agents:

Access to exclusive listings and market insights.

In-depth knowledge of zoning regulations and potential restrictions.

Guidance through the negotiation process.

Look for agents with a proven track record in the Jervis Bay area, such as Wright Way Realty, to ensure you’re getting reliable support.

Step 4: Visit Open Houses and Inspections

Once you’ve shortlisted properties, attending open houses and inspections is essential. You can assess the property's layout, condition, and suitability directly in this phase.

Checklist for Inspections:

Structural Integrity: Check for cracks, dampness, and signs of wear.

Natural Lighting & Ventilation: Assess whether the property feels open and airy.

Neighborhood Assessment: Consider noise levels, safety, and proximity to schools or shopping.

Step 5: Conduct Due Diligence

Conducting due diligence is critical to avoid costly surprises down the line. According to NSW Fair Trading, one in four homes in coastal regions like Jervis Bay show signs of termite activity, underscoring the importance of professional pest and property inspections.