#Section 39 of the CGST Act

Explore tagged Tumblr posts

Text

Section 39 GST: A Comprehensive Overview

Get a comprehensive overview of Section 39 GST on Gst Gyaan. Discover all you need to know about this important aspect of the Goods and Services Tax in just one place! Get the GST consultancy Contact us Email at:[email protected] Phone No:- 9350171263.

0 notes

Text

52nd GST MEETING MINUTES 07.10.2023

Trade Facilitation measures

Amnesty scheme for appeal filing till 31st January 2024

> Who will it benefit?

Taxable persons

> who could not file an appeal against a demand order passed on or before 31st March 2023

> Whose appeal was rejected since it was not filed within the specified time limit

> How much amount to be pre- deposited?

> 12. 5% of the tax under dispute

> of which 2.5% has to be debited from electronic cash ledger

2.Taxability of Guarantees given to the banks against the credit limits / loans sanctioned by the Company

> Where the guarantee is provided by the directors :The value of the transaction to be treated as zero if there is no consideration paid by the company.

> Where corporate guarantee is provided for related persons including holding company to its subsidiary company :The taxable value of the transaction shall be 1% of such guarantee or the actual consideration whichever is higher (Sub-rule (2) in Rule 28 to be inserted for the purpose).

3.Restoration of provisional attachment of property

Proposed amendment to provide that the order passed in Form GSTR DRC -22 shall not be valid for more than one year from the date of order.

Note :No specific written order required

4. Clarification on issues related to Place of Supply

Circulars to be issued to clarify the place of supply related to i) transportation of goods, including by mail or courier, in cases where the location of supplier or the location of recipient of services is outside India; (ii) advertising services and (iii) co-location services.

5. Clarification related to export of services

> To be treated as export of services , the consideration for supply of services to be received in convertible foreign exchange or in Indian rupees wherever permitted by RBI

> Circular to be issued to clarify the admissibility of export remittances received in Special INR Vostro account, as permitted by RBI

Note : Rupee vostro accounts keeps a foreign entities holding in an Indian Bank in India Rupees and facilitate settlement of transactions in INR.

6. Supplies to Sez unit / sez development on payment of IGST and claiming of refund

Except commodities mentioned in Notification 1/ 2023 dated 31st July 2023, suppliers to Sez units / Sez developers can go for the IGST payment and refund route w.e.f 1st October 2023

Other measures pertaining to law and procedure

> Alignment of provisions of the CGST Act, 2017 with the provisions of the Tribunal Reforms Act, 2021 in respect of Appointment of President and Member of the proposed GST Appellate Tribunals – The eligibility and age criteria has now been specified.

> Amendment to Act and rules to give effect to ISD procedure

> ISD distribution procedure was made mandatory for distribution of Input Services procured by HO.

> In relation to the same amendments has been recommended in Section 2(61) , Section 20 of the CGST Act and Rule 39 of the CGST Rules.

Rate Changes

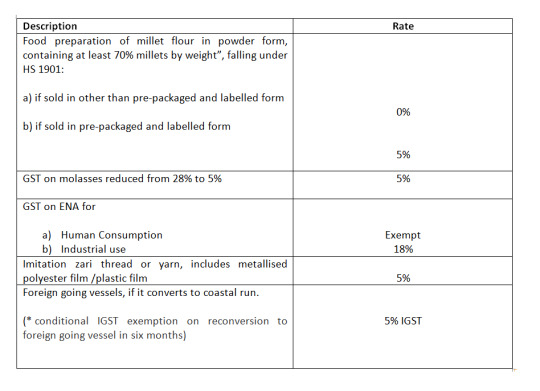

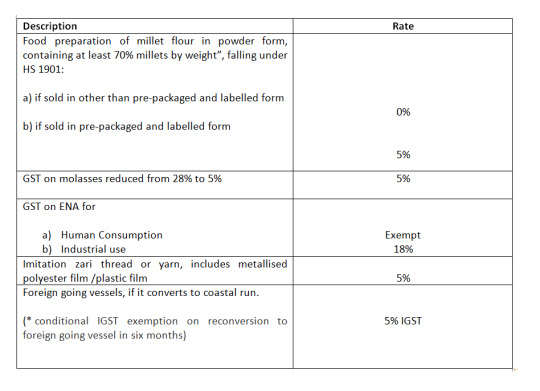

1. Changes in rate of Good

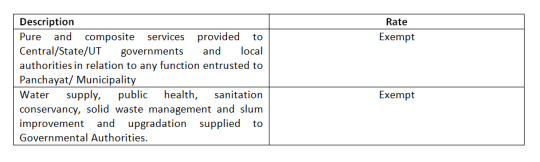

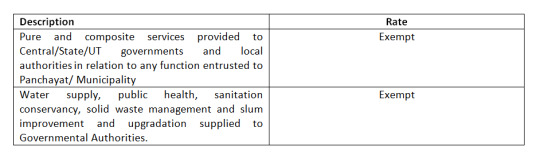

2. Changes in rate of Services

0 notes

Text

52nd GST MEETING MINUTES 07.10.2023

Trade Facilitation measures

Amnesty scheme for appeal filing till 31st January 2024

> Who will it benefit?

Taxable persons

> who could not file an appeal against a demand order passed on or before 31st March 2023

> Whose appeal was rejected since it was not filed within the specified time limit

> How much amount to be pre- deposited?

> 12. 5% of the tax under dispute

> of which 2.5% has to be debited from electronic cash ledger

2.Taxability of Guarantees given to the banks against the credit limits / loans sanctioned by the Company

> Where the guarantee is provided by the directors :The value of the transaction to be treated as zero if there is no consideration paid by the company.

> Where corporate guarantee is provided for related persons including holding company to its subsidiary company :The taxable value of the transaction shall be 1% of such guarantee or the actual consideration whichever is higher (Sub-rule (2) in Rule 28 to be inserted for the purpose).

3.Restoration of provisional attachment of property

Proposed amendment to provide that the order passed in Form GSTR DRC -22 shall not be valid for more than one year from the date of order.

Note :No specific written order required

4. Clarification on issues related to Place of Supply

Circulars to be issued to clarify the place of supply related to i) transportation of goods, including by mail or courier, in cases where the location of supplier or the location of recipient of services is outside India; (ii) advertising services and (iii) co-location services.

5. Clarification related to export of services

> To be treated as export of services , the consideration for supply of services to be received in convertible foreign exchange or in Indian rupees wherever permitted by RBI

> Circular to be issued to clarify the admissibility of export remittances received in Special INR Vostro account, as permitted by RBI

Note : Rupee vostro accounts keeps a foreign entities holding in an Indian Bank in India Rupees and facilitate settlement of transactions in INR.

6. Supplies to Sez unit / sez development on payment of IGST and claiming of refund

Except commodities mentioned in Notification 1/ 2023 dated 31st July 2023, suppliers to Sez units / Sez developers can go for the IGST payment and refund route w.e.f 1st October 2023

Other measures pertaining to law and procedure

> Alignment of provisions of the CGST Act, 2017 with the provisions of the Tribunal Reforms Act, 2021 in respect of Appointment of President and Member of the proposed GST Appellate Tribunals – The eligibility and age criteria has now been specified.

> Amendment to Act and rules to give effect to ISD procedure

> ISD distribution procedure was made mandatory for distribution of Input Services procured by HO.

> In relation to the same amendments has been recommended in Section 2(61) , Section 20 of the CGST Act and Rule 39 of the CGST Rules.

Rate Changes

1. Changes in rate of Good

2. Changes in rate of Services

0 notes

Text

Failure to File GST Return in Time Can Mean Interest On Entire Gross Tax Liability

Interest u/s 50(1) – The liability to pay interest under Section 50 (1) is self-imposed and also automatic, without any determination by any one

Interest u/s 50(3) – Whenever an undue or excess claim of ITC is made or whenever an undue or excess reduction in out-put tax liability is made, a liability to pay interest arises under Sub-section (3).

Availability of ITC only after valid return filling: Entry in Input tax credit ledger is made and available to taxpayer only after filling of valid return and till such time such Input tax credit is only in air which can not be used for settlement of output tax liability.

This judgment will impact most taxpayers of India who are registered under GST. The judgment was passed in the TELANGANA AND ANDHRA PRADESH HIGH COURT in the case M/S. MEGHA ENGINEERING AND INFRASTRUCTURES LTD. VERSUS THE COMMISSIONER OF CENTRAL TAX, HYDERABAD, THE ASSISTANT COMMISSIONER OF CENTRAL TAX, KUKATPALLY, AND THE SUPERINTENDENT, O/O THE SUPERINTENDENT OF CENTRAL TAX, HYDERABAD; wherein HC dismissed the Writ petition filed by the petitioner on April 18th, 2019.

1. Background of the Case

The petitioner here is the M/S. Megha Engineering and Infrastructures Ltd, the company that makes MS Pipes and executes various infrastructure projects. The company claimed to file their GST returns properly but had delayed in filing the returns in Form GSTR – 3B for the period between October 2017 to May 2018.

They had paid the tax liability along with interest calculated on net tax liability while filing their returns. The petitioner also claimed that the delay in filing returns was not huge. The delay for the months October 2017, November 2017, February 2018 and May 2018 was just by one day.

The revenue had issued a claim letter that the interest is calculated on total tax liability or the gross tax liability. In response to this demand, M/S. Megha Engineering and Infrastructures Ltd. filed a Writ petition in the Telangana High court.

After considering all the various provisions under the GST law, the court dismissed the writ petition and ruled that the company has to pay interest on the gross tax liability.

2. The Legalities Behind The Case

According to section 39 of the CGST Act, 2017, every person registered with the GST law has to file their taxes on or before the 20th of every month. If there are any discrepancies or incorrect particulars, then the registered person needs to rectify it before the returns are furnished.

During the proceedings, the petitioner, M/S. Megha Engineering and Infrastructures Ltd stated that the GST portal is designed in such a way that unless the assessee charges the entire tax liability, the system does not accept the return under GSTR – 3B Form. So even if there is a very small amount is left to be paid, the return could not be filed.

Section 41 of CGST Act 2017 says that every person registered with GST is eligible to take the credit of self-assessed input tax. The amount claimed by the person is credited on his electronic ledger on a provisional basis. But it can be utilised only after the self-assessed output tax is paid.

In layman terms, it means that while paying the tax on output as a manufacturer, agent, supplier, etc., the person can reduce the tax amount by what he has already paid on inputs.

As per section 16, before the person can claim the credit on his input tax paid him during his purchases, he needs to fulfil the below given four conditions:

He should have the tax invoice or the debit note issued by the registered dealer. When goods are received in parts or instalments, the debit note is issued with the delivery of the last lot.

The person should have received the goods or services.

The input tax charged should have been paid for by the supplier.

The supplier should have filed the GST returns under section 39.

Thus, the broad scheme of Section 39 which deals with the filing of returns, Section 41 which deals with the claim of ITC and its provisional acceptance, Section 16 which deals with the conditions and eligibility for taking ITC and Section 49 which deals with payment of tax, make it clear that the moment all the four conditions stipulated in Sub-section (2) of Section 16 are complied with, a person becomes entitle to take credit of ITC. Once a person takes credit of ITC, the amount gets credited on a provisional basis to his electronic credit ledger under Section 41 (1).

Hence when the person does the tax payment as a self-assessed return, it is credited in his electronic ledger which is used while doing the payment of output tax under the Act. But this amount becomes available in his credit ledger only after the return is filed on the self-assessment basis.

Until that is not done, no amount is available in the electronic credit ledger. Once the self-assessed return is filed, the amount in the credit ledger becomes available for payment under output tax.

3. Next is Interest on Delayed Payments

Special emphasis on the Section 50 of the Act deals with specific interest which is levied on the delay in payment of tax. With the failure to pay the tax within the prescribed period, the liability to pay the interest on the same also increases. Interest is levied if tax is not filed by an entity by the 20th of each month and interest starts accruing from the 21st of the month. The interest rate varies overall and is communicated beforehand by the government.

4. Reference to Current Case

Here is this case of M/S. Megha Engineering and Infrastructures Ltd. Versus The Commissioner of Central Tax, Hyderabad, The Assistant Commissioner of Central Tax, Kukatpally and The Superintendent, O/O The Superintendent of Central Tax, Hyderabad; the petitioner did file the return but belatedly. So the payment for the tax liability was made after the prescribed period. As a result, the liability to pay interest arose automatically. Thus, the petitioner cannot escape from this liability. Even though a couple of times, it was just by a day, the interest needs to be paid.

5. Interest on Gross tax liability -The Final Showdown

An amendment to the Act was proposed by the GST council via press release which was mentioned in the HC. The press release reads as follows:

“The GST Council in its 31st meeting held today at New Delhi gave in principle approval to the following amendments in the GST Acts:

Amendment of section 50 of the CGST Act to provide that interest should be charged only on the net tax liability of the taxpayer, after taking into account the admissible input tax credit, i.e., interest would be leviable only on the amount payable through the electronic cash ledger.

The above recommendations of the Council will be made effective only after the necessary amendments in the GST Acts are carried out.”

Unfortunately, these amendments are still on paper only. These cannot be interpreted for the case mentioned above.

Other two decisions of the Gujarat High Court such as the State of Gujarat v. Dashmesh Hydraulic Machinery, dated 19.01.2015, and another in State of Gujarat v. Nishi Communication, dated 29.01.2015 was also referred to. But both these decisions were made based on the Gujarat Value Added Tax Act. VAT and GST are different from each other, and therefore these rulings did not serve its purpose for the petitioner.

Click on this link to continue: click here

0 notes

Link

The CBIC has issued Notification No. 39/2021–Central Tax on 21-12-2021 through which Section 16 of CGST Act, 2017 has been amended. A new clause has been inserted in section 16 of CGST Act, 2017 after sub-section (2), clause (a), which reads as:

0 notes

Text

TDS Return GST - all you need to know by Question Answers (FAQ)

TDS Return GST – all you need to know by Question Answers (FAQ)

TDS Return under GST: Deductor is required to file return electronically to Government. The return is to be filed in prescribed form and manner within ten days after end of each month – section 39(3) of CGST Act. The prescribed form of return is GSTR-7. Offline tool is available to submit GSTR-7 return. Who are liable to file return (GSTR-7)? Post 01.10.2018, DDOs deducting tax will be liable…

View On WordPress

0 notes

Link

Introduction

Section 16 of the Central Goods and Service Tax Act, 2017 deals with eligibility and conditions for taking the input tax credit. Accordingly, every registered person shall be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business.

Section 17 of the CGST deals with apportionment of credit and blocked credit. Sub-section (5) of section 17 enumerates the goods and services in respect of which the input tax credit shall not be available.

Clauses (g) and (h) of sub-section (50 of section 17 envisages the following goods or services, namely; (g) Goods or services or both used for personal consumption (h) Goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples.

The situations mentioned in the above clauses are of such nature where the events of non-eligibility of the input tax credit occur after the availment of credit under section 16. For e.g. a trader of electricity appliances purchases air-conditioners for sale and avails of the input tax credit of the same. At a later point of time, he puts one air-conditioner for his personal use. There may also be cases where the input tax credit is availed of on goods purchased for use in manufacture but the same is found ineligible at a later point of time due to unforeseen future events such as goods being lost or stolen before use in manufacture. In such cases, the assessee having availed the ITC at the time of receipt of such goods would be required to reverse the same in terms of section 17 (5).

In this regard the following issue arises namely; (a)Manner of reversal under section 17(5) (b) Applicability of interest under section 50 and (c) Re-availment of credit reversed under section 17(5) where the events causing a reversal of credit gets nullified, for e.g. if the goods that were lost or stolen is subsequently traced.

The present write-up seeks to examine the above issued in its proper perspective.

Reversal of input tax credit under section 17(5)

Under the GST law, a specific procedure is prescribed for the manner of reversal of credit on account on non-payment of consideration to the vendor within 180 days in terms of the second proviso to section 16(2), or use of input or services in effecting exempt supplies under sub-section (2) of section 17. However, no specified mechanism is prescribed for the manner of reversal of credit for situations mentioned in section 17(5).

In the absence of any specific mechanism for reversal of such credit, debiting the restricted credit in the ineligible ITC Table of GSTR-3B would be sufficient for the purpose of section 17(5).

Applicability Of Interest Under Section 50

Sub-section (1) of section 73 provides that where it appears to the proper officer that any tax has not been paid or short paid or erroneously refunded, or where input tax credit has been wrongly availed or utilised for any reason, other than the reason of fraud or any wilful-misstatement or suppression of facts to evade tax, he may demand the tax so short-paid or not paid or input tax credit wrongly availed or utilised along with interest payable thereon under section 50. Sub-section (1) of section 50 provides for payment of interest where any person who is liable to pay tax fails to pay the tax or any part thereof within the prescribed period.

Sub-section (3) of section 50 provides for a charge of interest on account of under or excess claim of input tax credit under sub-section (10) of section 42 (due to mismatch of credit) or undue or excess reduction in output tax liability under sub-section (10) of section 43.

A careful reading of section 50 suggests that no interest liability is provided where the wrongful availment of credit does not lead to a situation where there is short-payment of tax, due to accumulation of eligible credit.

It is also clear from the clear language of section 50 that even in cases where excess availment of credit is not due to mismatch under section 42 but on account of being an ineligible credit under section 16, no interest can be demanded under section50(3).

Re-Availment Of Credit-Conditions And Limitations

Under the GST law, re-availment of reversed ITC is envisaged under the third proviso to sub-section (2) of section 16 of the Act, where the recipient of goods or services makes payment of the amount towards the value of supply of goods or services or both along with tax payable thereon.

The GST Act or rules made thereunder, however, does not speak about the manner and time limit for re-availment of credit reversed due to the circumstance mentioned under section 17(5).

Though there is no specific provision for re-availment of credit under the above situation on the analogy of the third proviso to sub-section (2) of section 16, if the goods that were lost or stolen are subsequently traced and added back in inventory then the taxpayers become eligible for re-availment of credit as if they were always eligible to avail credit under section 16 of the CGST Act.

Hence, where an assessee is able to establish that the event leading to the reversal of input tax credit under section 17(5) has been nullified, it can be concluded that he would be entitled to re-avail the credit so reversed.

Further, no specific document is prescribed for reclaiming of credit earlier reversed. However, it is advisable to maintain a complete record so as to establish the fact of credit eligibility. It is also prudent to inform the Department about the fact of re-availment of the credit so as to avoid litigation in the future.

Limitation Period For Re-Availment Of The Credit

Sub-section (4) of section 16 envisages the time limit for taking of input tax credit in respect of any invoice or debit, not for the supply of goods or services or both. Accordingly, the input tax credit cannot be taken in respect of any invoice or debit note for the supply of goods or services or both after the date of furnishing of the return under section 39 for the month of September following the end of the financial year to which such invoice or debit note pertains or furnishing of the relevant annual return whichever is earlier.

As per sub-rule (4) of rule 37 of the CGST Rules, the time limit specified in subsection 94, of section16 shall not apply to claim for re-availing of any credit, in accordance with the provisions of the Act or the provisions of Chapter V of the CGST Rules, that has been reversed earlier.

It may be noted that rule 37 prescribes the manner of reversal of input tax credit in the case of non-payment of consideration. But sub-rule (4) of rule 37 speaks about there-availment of input tax credit generally. Hence in the opinion of the author, there is no time limit for re-availment of the credit that was reversed due to applicability of section 17(5). But the credit should be re-availed as soon as the event leading to there-availment occurs.

It is however advisable to keep complete track and documentation of the event leading to reversal as well as re-availment of the credit under section 17(5).

0 notes

Text

Suspension of GST Registration

With an intention to ease up GST for the taxpayer, the government is continuously amending and inserting various provisions under the GST regime. Suspension of GST registration is a new concept the government has come up with the Central Goods and Service Tax (Amendment) Act, 2019 and the Central Goods and Service Tax (Amendment) Rules, 2019. GST Suspension provision was inserted as sub-rule 2A was in Rule 21A of the Central Goods and Services Tax (CGST) Rules.

With the introduction of the suspension of GST registration, taxpayers who have applied for the cancellation of GST registration will not be required to comply with GST return filing provisions during the suspension period. Thus, they would be freed up from the requirement of complying with the GST return filing provision during the suspension period, thereby reducing the compliance cost of the taxpayer. Further, any significant differences or oddities observed between the GSTR-3B and the GSTR-1 or 2B could lead to suspension of GST registration by the tax officer. This could also lead to the cancellation of GSTIN if these differences remain unexplained.

Provision related to suspension

A new proviso was inserted to section 29 (1) which read as follows

‘Provided that during the pendency of the proceedings relating to the cancellation of registration filed by the registered person, the registration may be suspended for such period and in such manner as may be prescribed’

Also, Rule 21A(1) provides deeming provision of suspension that says if a registered person applies for the cancellation of registration under Rule 20, the registration shall be deemed to be suspended from the date of submission of the application or the date from which the cancellation is sought, whichever is later, pending the completion of proceedings for cancellation of registration under rule 22. A registered person, whose registration has been suspended under rule 21A(1) of CGST Rules, shall not make any taxable supply during the period of suspension and shall not be required to furnish any return under section 39 of CGST Act.

➤ Suspension of GST registration by the proper officer

Rule 21A (2) provides the proviso for Suspension of GST registration by the proper officer which says that where the proper officer has reasons to believe that the registration of a person is liable to be cancelled u/s 29 or under rule 21, he may after affording the said person a reasonable opportunity of being heard suspend the registration of such person with effect from a date to be determined by him, pending the completion of the proceedings for cancellation of registration under rule 22.

The officer has to issue Form GST REG-31 to intimate the taxpayer of the discrepancies. He also has to mention that the GST registration may be cancelled, if the proper explanation is not given.

The officer can order for suspension under Rule 21A (2A) if he is not satisfied with the furnished information. The suspension can be lifted upon the receiving of a satisfactory reply from the taxpayer.

Things to do after Suspension of GST Registration

In case the taxpayer hasn’t applied for the cancellation of GST registration & who get notice of suspension of GST need to follow these things.

➤ Notice related to Discrepancies

After the issuance of the notice, the taxpayer would be required to furnish a reply to the jurisdictional tax officer within 30 days from the receipt of such notice, explaining the discrepancies or anomalies, if any, and shall furnish the details of compliances made or/and the reasons as to why their registration should not be cancelled.

➤ Notice of cancellation of registration

The respective person would be required to reply to the jurisdictional officer against the notice for cancellation of registration sent to them, in FORM GST REG-18 online through GST Portal within the time limit of 30 days from the receipt of notice or intimation.

➤ Due to the non-filing of returns

In case the notice for suspension or notice for cancellation of registration is issued on the ground of non-filing of returns the said person may file all the due returns and submit the response.

Likewise, in other scenarios as specified under FORM GST REG-31, they may meet the requirements and submit the reply.

Revocation of suspension of GST registration

Once the proceeding of cancellation of GST registration is being completed by the proper officer, the suspension of GST registration shall be revoked.

The revocation of suspension of GST registration shall be effective from the date on which the suspension had come into effect. It may be revoked by the proper officer, anytime during the pendency of the proceedings of the cancellation, if he deems fit.

Final Words

The recent amendments related to the suspension of registration are designed to provide an immediate recourse to the Government against any anomaly or violation of GST laws so that there is no misuse of the online system. As GST is the only indirect tax applicable since 2017, it is necessary to know the intricacies of the concept, its suspension, its grounds, effect and duration. It also talks about the process by which GST Registration can be suspended by the officer.

The rules governing Suspension also provides certain relief to the genuine taxpayer who has applied for cancellation of registration, the same is more inclined towards the department as it provides an ample range of powers to initiate suo-moto cancellation proceedings and to suspend the registration for the time being.

#Cancellation of GST Registration#GST Registration#Online GST Return Filing#Online GST Registration#SuperCA

0 notes

Text

GST Amendment Act, 2018 & Its Impact: 20 Major Changes

THE CENTRAL GOODS AND SERVICE TAX (AMENDMENT) ACT, 2018

With the approval from the GST council in the meeting held on January 10 2019, the changes made by the CGST (Amendment) Act, 2018, IGST (Amendment) Act, 2018, UTGST (Amendment) Act, 2018, and GST Amendment Act (Compensation to States), 2018 along with the corresponding changes in SGST Acts will be applicable from 1sr February 2019.

Keeping in view the implementation of the amendments made in the GST taking place from 1st Feb 2019, it is highly recommended that you must be aware of the changes that have been made in order to understand how they could affect your business.

While some of the amendments provide ease to businessmen, on the other hand, there are some that may be a cause of concern for certain businesses. It is highly recommended to go through some information in order to work accordingly from February 2019 onwards. Here’s an insight into the most important changes that have been made. In order to make it more understandable, we have provided explanations of all the points in a simplified manner.

Changes have been made in relation to various areas including the reverse charge in case of procurement from unregistered persons, eligibility for composition scheme, ITC on motor vehicles, deals involving import and export of goods and services and many more.

From eligibility of registration of e-commerce operators, multiple registrations within the same place, furnishing of returns, recovery of taxes from 2 different persons to the procedure of cancellation of GST registration, a lot has been amended and you must be aware of the new version of the GST that has been rolled out.

Here’s an article that includes the 20 most important amendments in the GST Amendment Act which one must read and will clarify all your queries about the changes that have been made in the respective section. Learn more about Invoices under GST

1. Reverse charge in case of procurement from unregistered persons Sec 9(4) of CGST Act 2018

Initially as per section 9(4) of CGST Act 2018, supply of goods or services, from unregistered person to registered person, were covered under reverse charge basis.

Later on vide notification no. 8/2017-Central Tax (Rate) dated 28th June2017 such reverse charge only applicable in case supply of goods and services received from unregistered person is greater than Rs. 5000 per day which again amended by notification no. 38/2017-Central Tax (Rate) dated 13th October 2017, the intra-state supplies of goods or services or both received by a registered person from unregistered person has been postponed from the central tax completely.

The said provision has been extended till 30th September, 2019, vide notification no. 22/2018 – Central Tax (Rate) dated 6th August, 2018.

However, with effect from 1st Feb 2019, Section 9(4) has been completely amended. Now the registered person is liable to pay tax on reverse charge basis only if following two conditions are satisfied –

Registered person is covered within the notified class; and

Registered person has received specified goods or service from the unregistered person.

With the amendment under GST Amendment Act, the coverage of tax payable under reverse charge basis would be restricted.

It must be noted that the notified class of registered person and the specified categories of goods and services are yet to be notified by the Government and the same would be intimated as and when notified.

2. Composition dealer allowed to supply services

There are two major amendment in GST amendment act 2018 with respect to composition scheme, Earlier the threshold limit of turnover for the taxpayer to be eligible for the composition scheme is INR 1 Crore.

However, after amendment with effect from 01st Feb 2019 registered person having turnover up to INR 1.5 crore can opt for composition scheme.

Before 1st February 2019, Persons engaged in supply of services (other than restaurant service) are not eligible for the composition scheme or in other words person opted for composition scheme was not allowed to make supply of services.

With effect from 1st February 2019, Person opting for composition scheme is allowed to supply services other than services referred in para 6 (b) of schedule II. i.e. Restaurant services.

Total value of supply of services should not exceed higher of the following –

10% of the turnover in the preceding financial year; or

INR 5 Lakhs

Rate of tax on services by composition dealer- .5% and .5%- SGST and CGST as per notification 8/2017 amended through notification 3/2019

The same can be understood with the help of following table

3. No reversal of common ITC for activities covered under Schedule III

Schedule III contain list of services which will be treated neither as a supply of goods nor a supply of services. Earlier activities covered under this schedule treated as part of exempted supply and reversal of common ITC was to be made.

However, with effect from 1st Feb 2019, new explanation has been inserted mentioning that the term ‘value of exempt supply’ shall not include the value of activities or transactions specified in schedule III, except those specified in paragraph 5 of the said schedule.

Meaning thereby that no reversal of common input tax credit is required on activities or transactions specified in schedule III other than sales of land and sale of building (other than those specified in paragraph 5).

4. Availability of ITC on purchase, leasing, renting or hiring of Motor Vehicles, Air craft and vessels

Earlier ITC on all types of motor vehicles was restricted however in GST Amendment Act with effect from 1st Feb 2019, the Input tax credit shall only be restricted in case of motor vehicles for transportation of persons having approved seating capacity up to 13 persons (including the driver).

However, such motor vehicles when put to use for the following purposes, ITC would be allowed even if their seating capacity is equal to or less than 13 people as per the GST Amendment Act.

Further supply of such motor vehicles

Transportation of passengers

Imparting training on driving, such motor vehicle.

In other words, for all the motor vehicles with approved seating capacity of more than 13 people, ITC would be allowed.

In case of vessels and aircrafts, input tax credit shall be available only when vessels and aircrafts are used for following–

Further supply of such vessels or aircrafts;

Transportation of passengers;

Imparting training on navigating such vessels;

Imparting training on flying such aircrafts;

For transportation of goods.

5. Inputs tax credit on services of general insurance, servicing, repair and maintenance related to motor vehicle, aircraft and vessels

From 1st February, 2019, Services of general insurance, servicing, repair and maintenance in so far as they relate to motor vehicles, vessels or aircraft

If ITC of Such Motor Vehicle , Vessel or Aircraft is allowed

To manufacture of such motor vehicles, vessels or aircraft

To supplier of general insurance services in respect of such motor vehicles, vessels or aircraft insured by him

6. ITC on food and Beverages, Outdoor catering, Beauty treatment etc.

From 1st February 2019, ITC on food and beverages, outdoor catering, beauty treatment etc. would be allowed in following circumstances

Only to those who provide same line of activities

If obligatory in nature to employee under any law

7. Compulsory registration for electronic commerce operator who are required to collect tax at source under section 52

Earlier Every electronic commerce operator was compulsorily required to obtain registration however with effect from 1st Feb 2019 only those electronic commerce operator who is required to collect tax at source under section 52 are compulsorily required to obtain registration as per the GST Amendment Act.

Section 52 of the CGST Act mandates all the e-commerce operator to collect tax at source in respect of all the taxable supplies made through it by other suppliers, wherein, the consideration in respect of all such supplies is collected by it. Which means only those ecommerce operators who works under marketplace model, compulsory registration will be applicable such as amazon, flipkart etc.

8. Multiple registration with in same state for same business.

Earlier person is not allowed to take multiple registration with in same state for same business vertical. Only different verticals will be allowed to take separate registration.

Now registration can be taken based on place of business. multiple registration with in same state allowed for each place of business.

However, where multiple registration will be taken with in same state, each such registration shall be considered as distinct person and taxability will be applicable accordingly.

9. Suspension of GST registration until cancelled

During the ongoing process of cancellation of registration, there would be temporary suspension of registration. This would result into releasing the compliance burden while the cancellation of registration is under process.

10. Issue Consolidate Debit note in place of invoice wise debit note–

Earlier as per the provision of section 34 Debit and Credit Note, single debit note or credit note is issued against each invoices.

With effect from 1st Feb 2019, the registered person is allowed to issue a consolidated debit / credit note in respect of the multiple invoices issued in a financial year. One to one correlation is not required.

11. Procedure for Furnishing Return and availing Input Tax Credit

Section 43A has been newly inserted. This section contain provision with respect to procedure for following –

The registered person can verify, validate, modify or delete the details of supplies furnished by the supplier in the returns furnished under section 39(1).

Procedure for availing input tax credit by the recipient and procedure for furnishing the details of outward supplies by the supplier for the purpose of availing input tax credit by the recipient shall be prescribed.

The amount of tax on details of outward supplies which has been declared by the supplier will be deemed to be payable by the supplier.

The supplier and the recipient are jointly liable for payment of tax or payment of input tax credit availed in relation to the outward supplies for which details have been furnished but the return has not been furnished.

Amendment in return shall be available in new return forms and not for existing returns.

12. Revised settlement system of Input Tax credit

Earlier The credit of SGST / UTGST can be utilized first towards payment of SGST / UTGST and second towards payment of IGST.

NEW SECTION 49A INSERTED – As per the newly inserted section, input tax credit of IGST needs to be first utilized fully towards payment of IGST, CGST, SGST/UTGST.

Once the input tax credit of IGST is utilized, the input tax credit of CGST, SGST / UTGST can be utilized for payment of IGST, CGST, SGST/UTGST.

Before 1st Feb 2019, the ITC tax settlement was as per below table:

With effect from 1st Feb 2019, the ITC tax settlement will be as per below table:

Important conditions for utilization of input tax credit

Credit of IGST should be utilized fully. Once credit of IGST is utilized only then the credit of CGST and SGST can be used.

Credit of SGST can be utilized for payment of IGST only when balance of input tax credit on account of CGST is not available for payment of IGST.

13. Receipt of payment in Indian rupees permitted for refund of ITC under GST

As per the earlier provision in case of export of services, receipt has to be received in foreign convertible exchange only then such export of services will be qualified for refund of IGTS.

However with effect from 1st Feb 2019, In case of services exported out of India, the receipt of payment in Indian rupees which is permitted by the RBI, qualifies as export.

14. Recovery of tax from two distinct person

Explanation has been inserted which says that the word person shall include ‘distinct person’. Meaning thereby that recovery of tax can be made from distinct person present in different states / UTs.

15. Detention, Seizure and Release of goods and conveyances in transit

Earlier In case the person fails to pay the tax amount and penalty as provided under section 129(1) within 7 days of detention or seizure, further proceedings shall be initiated in accordance with the provisions of section 130.

From 1st Feb 2019 onwards, time limit of payment of tax amount and penalty has been increased from 7 days to 14 days. Which means that the proceedings in accordance with section 130 shall be initiated in case of non-payment within a period of 14 days of detention or seizure.

16. Transitional Arrangement of Input Tax Credit

The amendment is in the form of clarification and the same is having a retrospective effect from 1st July, 2017. The clarification is as follows –

Transitional credit of only the eligible duties can be carried forward in the returns.

The term ‘eligible duty’ and the term ‘eligible duties and taxes’, provided at explanation 1 and explanation 2, does not include the additional duty of excise leviable under section 3 of the Additional Duties of Excise (Textile and Textile Articles) Act, 1978.

The term ‘eligible duties and taxes’ does not include any cess which has not been specified in explanation 1 and explanation 2 and any cess which is collected as additional duty of customs under section 3 (1) of the Customs Tariff Act, 1975. Which means transitional credit of any type of cess is not available under GST.

It is re-mentioned here that all the above points are in the form of clarification and the same are effective retrospectively from 1st July, 2017.

17. Extension in JOB WORK period

EARLIER POSITION – A registered person can send inputs / capital goods to a job worker for job work purpose without payment of tax. It is mandatory that the inputs need to be brought back within a period of one year and capital goods needs to be brought back within a period of three years.

AMENDMENT IN THE PROVISION – The commissioner can extend the above referred period of one year (in case of inputs) and three years (in case of capital goods) for further period not exceeding one year (in case of inputs) and two years (in case of capital goods). However, it is mandatory to provide sufficient cause for the extension.

OUTCOME OF THE AMENDMENT –

18. Place of supply will be outside India when goods transported outside India from a place in India

New proviso has been inserted which states that the place of supply in case of transportation of goods to a place outside India shall be the place of destination of such goods i.e. place outside India.

Earlier CGST and SGST was getting charged by courier companies in such cases, however after this amendment IGST would be charged by courier company even if service recipient and service provider both are in same state.

19. No GST on job work services of any treatment or processes on goods imported for job work in India.

As per the earlier provision, tax exemption was available in case of job work services supplied in respect of goods which are temporarily imported into India only for the purpose of repairs and the said goods are exported back after such repairs.

However, amendment with effect from 1st Feb 2019 has been made to extent the tax exemption benefit in case of job work services supplied in respect of goods which are temporarily imported into India for repairs or for any other treatment or process and the said goods are exported back after such repairs or treatment or process.

Now the scope of exemption has been extended and covered all the process and treatment done good imported temporarily.

20. Ceiling on limit of amount to be deposited before filling Appeal to Appellate Authority and Appellate Tribunal

Amendment has been made and ceiling on limit of amount to be deposited before filling appeal to appellate authority and appellate tribunal has been provided.

The same can be understood with the help following table.

Conclusion Having listed the most important points from the amendments made, we hope we could help you understand them and their applicability in the future.

Know more about SEIS Incentives

Read for more - https://vjmglobal.com/gst/gstupdate/page/2/

0 notes

Text

GST Return Filing: Business Looking At Big Loss Of Tax Credit, State Professionals

Reconciliation of what a buyer bought and a seller sold was expected to be the bedrock of availing input tax credit under the Product and Solutions Tax. The lack of a mechanism that would've made it possible for taxpayers to reconcile invoices might now cause the loss of significant quantity of tax credit, professionals told BloombergQuint.Input tax credit indicates that a provider can decrease the tax paid on inputs from tax payable on outside supplies.According to the Central GST Act, a taxpayer can get

input tax credit in a financial as much as the due date of filing returns for September or the annual return, whichever is previously. For the year ended March 2018, the last date for availing input tax credit was Oct. 20-- the date of filing returns for September.But that's one interpretation.When one refers to filing of returns for a month, section

39 of the CGST Act contemplates GST

return form 1, 2 and 3, but GSTR 2 and 3 haven't been notified, Ritesh Kanodia, an indirect tax partner at Dhruva Advisors, pointed out. In the absence of GSTR 2 and 3, Type 3B-- for summary returns-- was informed pursuant to a guideline and not based on area 39. It can be argued the last date isn't sacrosanct for availing input tax credit and it's instead the annual return, he explained.GSTR-1 is a reflection of all sales, GSTR-2 is a record of purchases and GSTR-3 is the regular monthly summary of all sales, purchases and tax liability.A great deal of business had actually taken a conservative approach to state that let's deal with Oct. 20 as the last date for availing input tax credit. This( was )regardless of the challenges they dealt with in reconciling their information with that of their vendors because the deals encountered lakhs, there were a lot of mistakes and even missing out on invoices.Ritesh Kanodia, Partner, Dhruva Advisors The conservative method hasn't been rewarded, though, Jigar Doshi, an indirect tax partner at consulting firm SKP Group, stated. This was because on Oct. 21, the federal government extended the due date for filing returns for September by five days, which implied the last date for

availing input tax credit was Oct. 25. Taxpayers who made sure filing of returns and input tax credit by Oct. 20 won't be able to amend the data although timelines have actually been extended. Taxpayers who were non-compliant got more time instead.Jigar Doshi, Partner, SKP Group Last month, the government extended the due date for filing GSTR 1 for July 2017-Sept

. 2018 to Oct. 31. The data in GSTR 1 can be seen by the purchaser on the GST portal in GSTR 2A-- an auto-populated return form. This assists purchasers reconcile their purchase information with what their suppliers or sellers have disclosed.The extension of GSTR 1 due date indicated that taxpayers had to avail input tax credit by Oct. 20 without having

the advantage of reconciling their purchases with the data uploaded by their vendors.Doshi said this could result in 5 scenarios: Whatever credit a purchaser has declared matches with GSTR 2A-- that's a safe zone.Credit being in a buyer's books however isn't showing in GSTR 2A-- in such scenarios, taxpayers have declared credit based on purchases taped in

their own books although it's not tape-recorded in GSTR 2A as the information potentially may not have actually been divulged by the seller properly in its GSTR 1. Taxpayers are now asking vendors to either disclose such invoices by Oct. 31, which

is the due date of September GSTR 1 or refund

the GST amount with interest.Credit which is in GSTR 2A but not in the purchaser's books-- in this circumstance, most taxpayers have actually claimed credit based on their own data regardless of GSTR 2A showing a higher credit that they can get. This is since taxpayers ensure their own data and GSTR 2A isn't constantly taping the proper information.Mismatch due to incorrect details, such as invoice date or tax value not matching. Here the buyer must go to the vendor to get the details rectified.Finally, where the vendor has actually transferred tax with the federal government which isn't showing in GSTR 2A. Such situations would lead to disputes.The problem will occur in the yearly return-- the due date for which is Dec. 31. The yearly return type will choose up data from GSTR 2A. If a taxpayer has credit worth Rs 100 in his books however GSTR 2A is showing just Rs 80, Rs 20 worth of credit will lapse, Doshi said. Since this amount will be available as a gross number, the taxpayer won't even understand which supplier to chase after for this lapsed credit unless the taxpayer has completed its reconciliation, line product or invoice-wise, Doshi said.For some business, the inequality in credits totals up to Rs 16-20 crore since the suppliers aren't tailored up and their filings are very bad-- both quantity and quality-wise, Kanodia stated."If a taxpayer has actually taken excess credit, they are liable to reverse it with interest,"he stated."And if you have actually not reserved this credit by Oct. 20 or Oct. 25, it will lapse. "

0 notes

Text

How to Calculate Interest on GST Liability – Know the Instructions

Due to ever changing due dates of GSTR 3B return fillings and relaxations given by the government from payments of GST liability and interest there upon, there is always a confusion on how to calculate the interest on GST Liability.

Interest on GST on Net Tax liability

The key question to answer is “whether the interest should be charged on the Gross Liability or the Net Tax Liability if the GSTR 3B is not filed on time”.

The provision of interest on late payment of GST liability is enumerated in section 50(1) of CGST Act, 2017. The provision is reproduced hereunder for convenient reading.

As per Section 50(1) of the Act:

“Every person who is liable to pay tax in accordance with the provisions of this Act or the rules made thereunder, but fails to pay the tax or any part thereof to the Government within the period prescribed, shall, for the period for which the tax or any part thereof remains unpaid, pay, on his own, interest at such rate, not exceeding eighteen per cent, as may be notified by the Government, on the recommendation of the Council.”

The above provision of the Act was not clear to tax authorities whether the Interest shall be levied on Gross Liability or net liability. Based on this, there was unrest among business communities as tax authorities started demanding interest on Gross GST Liability.

Considering the pain points of the taxpayers on Interest on Gross Liability or Net Liability, the Finance (No. 2) Act, (23 of 2019) vide clause 100 proposed to amend section 50 by inserting following proviso to section 50(1) of CGST Act, 2017.

“Provided that the interest on tax payable in respect of supplies made during a tax period and declared in the return for the said period furnished after the due date in accordance with the provisions of section 39, except where such return is furnished after commencement of any proceedings under section 73 or section 74 in respect of the said period, shall be levied on that portion of the tax that is paid by debiting the electronic cash ledger.”

The above proviso was in the best interest of the taxpayers as it made it clear that the interest shall be calculated only on Net GST Liability i.e. only that portion which was paid through cash ledger. However, it was released late and in the notification No. 63/2020 dated August 25th 2020, it was made applicable only prospectively effective August 25th 2020.

Which again made the taxpayers worried on the past months implications as there were lot of demand notices from department for charging interest base don gross liability.

Fortunately, the CBIC provided further clarification to the above notification No. 63/2020 via Press release dated 26.08.2020 that this notification issued with prospective effect due to certain technical limitation and given an assurance that no recovery of interest shall be made on gross output tax liability for the period prior to 01-09-2020 by the State and Central Tax administration.

The above press release clears all doubts in the Act and now it is a settled rule that taxpayer shall not pay the interest on gross liability of GST but only on Net Liability of GST after setting of the Input credit.

0 notes

Text

Series-29

Question Answer ITC on IGST Paid at the time of import. Is it also subject to time limit of availing credit till Sept.? As per Section 16(4) of the CGST Act, 2017, A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the due date of furnishing of the return under section 39 for the month of…

View On WordPress

0 notes

Text

Failure to File GST Return in Time Can Mean Interest On Entire Gross Tax Liability

Recently a major judgment was passed in the High Court regarding the payment of interest under section 50 of CGST Act, 2017. The highlights of the judgement were:

Interest on Gross liability in case of late return filling: In case of late GST returns filling, liability to pay interest accrues on Gross tax liability

Interest u/s 50(1) – The liability to pay interest under Section 50 (1) is self-imposed and also automatic, without any determination by any one

Interest u/s 50(3) – Whenever an undue or excess claim of ITC is made or whenever an undue or excess reduction in out-put tax liability is made, a liability to pay interest arises under Sub-section (3).

Availability of ITC only after valid return filling: Entry in Input tax credit ledger is made and available to taxpayer only after filling of valid return and till such time such Input tax credit is only in air which can not be used for settlement of output tax liability.

This judgment will impact most taxpayers of India who are registered under GST. The judgment was passed in the TELANGANA AND ANDHRA PRADESH HIGH COURT in the case M/S. MEGHA ENGINEERING AND INFRASTRUCTURES LTD. VERSUS THE COMMISSIONER OF CENTRAL TAX, HYDERABAD, THE ASSISTANT COMMISSIONER OF CENTRAL TAX, KUKATPALLY, AND THE SUPERINTENDENT, O/O THE SUPERINTENDENT OF CENTRAL TAX, HYDERABAD; wherein HC dismissed the Writ petition filed by the petitioner on April 18th, 2019.

1. Background of the Case

The petitioner here is the M/S. Megha Engineering and Infrastructures Ltd, the company that makes MS Pipes and executes various infrastructure projects. The company claimed to file their GST returns properly but had delayed in filing the returns in Form GSTR – 3B for the period between October 2017 to May 2018.

They had paid the tax liability along with interest calculated on net tax liability while filing their returns. The petitioner also claimed that the delay in filing returns was not huge. The delay for the months October 2017, November 2017, February 2018 and May 2018 was just by one day.

The revenue had issued a claim letter that the interest is calculated on total tax liability or the gross tax liability. In response to this demand, M/S. Megha Engineering and Infrastructures Ltd. filed a Writ petition in the Telangana High court.

After considering all the various provisions under the GST law, the court dismissed the writ petition and ruled that the company has to pay interest on the gross tax liability.

2. The Legalities Behind The Case

According to section 39 of the CGST Act, 2017, every person registered with the GST law has to file their taxes on or before the 20th of every month. If there are any discrepancies or incorrect particulars, then the registered person needs to rectify it before the returns are furnished.

During the proceedings, the petitioner, M/S. Megha Engineering and Infrastructures Ltd stated that the GST portal is designed in such a way that unless the assessee charges the entire tax liability, the system does not accept the return under GSTR – 3B Form. So even if there is a very small amount is left to be paid, the return could not be filed.

Section 41 of CGST Act 2017 says that every person registered with GST is eligible to take the credit of self-assessed input tax. The amount claimed by the person is credited on his electronic ledger on a provisional basis. But it can be utilised only after the self-assessed output tax is paid.

In layman terms, it means that while paying the tax on output as a manufacturer, agent, supplier, etc., the person can reduce the tax amount by what he has already paid on inputs.

As per section 16, before the person can claim the credit on his input tax paid him during his purchases, he needs to fulfil the below given four conditions:

He should have the tax invoice or the debit note issued by the registered dealer. When goods are received in parts or instalments, the debit note is issued with the delivery of the last lot.

The person should have received the goods or services.

The input tax charged should have been paid for by the supplier.

The supplier should have filed the GST returns under section 39.

Thus, the broad scheme of Section 39 which deals with the filing of returns, Section 41 which deals with the claim of ITC and its provisional acceptance, Section 16 which deals with the conditions and eligibility for taking ITC and Section 49 which deals with payment of tax, make it clear that the moment all the four conditions stipulated in Sub-section (2) of Section 16 are complied with, a person becomes entitle to take credit of ITC. Once a person takes credit of ITC, the amount gets credited on a provisional basis to his electronic credit ledger under Section 41 (1).

Hence when the person does the tax payment as a self-assessed return, it is credited in his electronic ledger which is used while doing the payment of output tax under the Act. But this amount becomes available in his credit ledger only after the return is filed on the self-assessment basis.

Until that is not done, no amount is available in the electronic credit ledger. Once the self-assessed return is filed, the amount in the credit ledger becomes available for payment under output tax.

3. Next is Interest on Delayed Payments

Special emphasis on the Section 50 of the Act deals with specific interest which is levied on the delay in payment of tax. With the failure to pay the tax within the prescribed period, the liability to pay the interest on the same also increases. Interest is levied if tax is not filed by an entity by the 20th of each month and interest starts accruing from the 21st of the month. The interest rate varies overall and is communicated beforehand by the government.

4. Reference to Current Case

Here is this case of M/S. Megha Engineering and Infrastructures Ltd. Versus The Commissioner of Central Tax, Hyderabad, The Assistant Commissioner of Central Tax, Kukatpally and The Superintendent, O/O The Superintendent of Central Tax, Hyderabad; the petitioner did file the return but belatedly. So the payment for the tax liability was made after the prescribed period. As a result, the liability to pay interest arose automatically. Thus, the petitioner cannot escape from this liability. Even though a couple of times, it was just by a day, the interest needs to be paid.

5. Interest on Gross tax liability -The Final Showdown

An amendment to the Act was proposed by the GST council via press release which was mentioned in the HC. The press release reads as follows:

“The GST Council in its 31st meeting held today at New Delhi gave in principle approval to the following amendments in the GST Acts:

Amendment of section 50 of the CGST Act to provide that interest should be charged only on the net tax liability of the taxpayer, after taking into account the admissible input tax credit, i.e., interest would be leviable only on the amount payable through the electronic cash ledger.

The above recommendations of the Council will be made effective only after the necessary amendments in the GST Acts are carried out.”

Unfortunately, these amendments are still on paper only. These cannot be interpreted for the case mentioned above.

Click on this link to continue:click here

0 notes

Text

Central Goods and Services Tax (Amendment) Rules, 2019 notified to amend CGST Rules, 2017

G.S.R. 63(E).— In exercise of the powers conferred by Section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government hereby makes the following rules further to amend the Central Goods and Services Tax Rules, 2017, namely:-

1. (1) These rules may be called the Central Goods and Services Tax (Amendment) Rules, 2019. (2) Save as otherwise provided in these rules, they shall come into force on the first day of February, 2019.

2. In the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as the said rules), in Chapter-II, in the heading, for the words “Composition Rules”, the words, “Composition Levy” shall be substituted.

3. In the said rules, in Rule 7, in the Table, against serial number (3), in column (3), for the word “goods”, the words, “goods and services” shall be substituted.

4. In the said rules, in Rule 8, in sub-rule (1),–

(a) the first proviso shall be omitted; (b) in the second proviso, for the words “Provided further”, the word “Provided” shall be substituted.

5. In the said rules, for Rule 11, the following rule shall be substituted, namely:-

“11 Separate registration for multiple places of business within a State or a Union territory- (1) Any person having multiple places of business within a State or a Union territory, requiring a separate registration for any such place of business under sub-section (2) of section 25 shall be granted separate registration in respect of each such place of business subject to the following conditions, namely:-

(a) such person has more than one place of business as defined in clause (85) of Section 2; (b) such person shall not pay tax under Section 10 for any of his places of business if he is paying tax under Section 9 for any other place of business; (c) all separately registered places of business of such person shall pay tax under the Act on supply of goods or services or both made to another registered place of business of such person and issue a tax invoice or a bill of supply, as the case may be, for such supply.

Explanation – For the purposes of clause (b), it is hereby clarified that where any place of business of a registered person that has been granted a separate registration becomes ineligible to pay tax under Section 10, all other registered places of business of the said person shall become ineligible to pay tax under the said section.

(2) A registered person opting to obtain separate registration for a place of business shall submit a separate application in FORM GST REG-01 in respect of such place of business.

(3) The provisions of Rule 9 and Rule 10 relating to the verification and the grant of registration shall, mutatis mutandis, apply to an application submitted under this rule”.

6. In the said rules, after Rule 21, the following rule shall be inserted, namely:-

“Rule 21 A. Suspension of registration– (1) Where a registered person has applied for cancellation of registration under Rule 20, the registration shall be deemed to be suspended from the date of submission of the application or the date from which the cancellation is sought, whichever is later, pending the completion of proceedings for cancellation of registration under rule 22.

(2) Where the proper officer has reasons to believe that the registration of a person is liable to be cancelled under Section 29 or under Rule 21, he may, after affording the said person a reasonable opportunity of being heard, suspend the registration of such person with effect from a date to be determined by him, pending the completion of the proceedings for cancellation of registration under Rule 22.

(3) A registered person, whose registration has been suspended under sub-rule (1) or sub-rule (2), shall not make any taxable supply during the period of suspension and shall not be required to furnish any return under Section 39.

(4) The suspension of registration under sub-rule (1) or sub-rule (2) shall be deemed to be revoked upon completion of the proceedings by the proper officer under Rule 22 and such revocation shall be effective from the date on which the suspension had come into effect.”

Follow the link for the detailed notification: Notification

[F. No. 20/06/16/2018-GST (Pt. II)]

Tweet

The post Central Goods and Services Tax (Amendment) Rules, 2019 notified to amend CGST Rules, 2017 appeared first on SCC Blog.

Central Goods and Services Tax (Amendment) Rules, 2019 notified to amend CGST Rules, 2017 published first on https://sanantoniolegal.tumblr.com/

0 notes

Text

Section 39 of GST - Furnishing of returns, CGST Section 39

Section 39 of GST – Furnishing of returns, CGST Section 39

Section 39 of GST – Furnishing of returns. Complete Details for GST Section 39, In this section you may find all details for Furnishing of returns as per GST Act 2017. Must Read – List of all sections of GST Section 39 of GST – Furnishing of returns 1.[Every registered person, other than an Input Service Distributor or a non-resident taxable person or a person paying tax under the provisions of…

View On WordPress

0 notes

Text

Guidelines for Deductions and Deposits of TDS by the DDO under GST

Guidelines for Deductions and Deposits of TDS by the DDO under GST

[tags GST, circular, GST TDS, GST Press release]

Circular No. 65/39/2018-DOR : New Delhi, Dated the 14th September, 2018

Section 51 of the CGST Act 2017 provides for deduction of tax by the Government Agencies (Deductor) or any other person to be notified in this regard, from the payment made or credited to the supplier (Deductee) of taxable goods or services or both, where the total value of…

View On WordPress

0 notes