#Samsung vs Oppo foldables

Explore tagged Tumblr posts

Text

Galaxy Z Fold 6 vs OnePlus Open (OPPO Find N3) – Which Should You Buy

Introduction: The foldable mobile market has seen high-quality recommendations in up to date years, and 2024 https://jaidennhyp426.hpage.com/post1.html is no exception. Samsung has just introduced its recent foldable units, the Galaxy Z Flip 6 and Galaxy Z Fold 6, choked with trendy AI positive aspects and progressed hardware. However, Samsung is simply not alone within the foldable enviornment anymore. OnePlus, with its OnePlus Open (also often known as the OPPO Find N3), provides a powerful hassle. In this complete evaluation, we are going to delve into the most important transformations, necessities, and pricing of these two flagship foldables to help you figure out which one is the surest healthy for you.

Design and Build: The Samsung Galaxy Z Fold 6 traits a effective design, safeguarded by means of Gorilla Glass Victus 2 and an aluminum armor body. Weighing 226 grams and measuring simply five.6 mm in thickness whilst spread out, it moves a steadiness between longevity and portability. Additionally, it boasts an IP48 score, making it immune to filth and water to a meaningful extent.

On the alternative hand, the OnePlus Open, with a weight of 239 grams and a thickness of five.8 mm while opened up, is barely heftier. When folded, it measures 11.7 mm in thickness. Although no longer as rugged as the Galaxy Z Fold 6, it still presents an IPX4 rating, which supplies some degree of splash resistance. The OnePlus Open's build best is commendable, but it falls short of the Galaxy Z Fold 6 in terms of durability.

Display: Samsung's Galaxy Z Fold 6 activities a 7.6-inch foldable AMOLED display with a 120Hz refresh fee and a formidable height brightness of two,six hundred nits. The cover display screen, measuring 6.three inches, also facets a 120Hz refresh fee and a peak brightness of one,600 nits. These necessities be sure that vibrant colorings, delicate scrolling, and extremely good visibility even in bright daylight.

The OnePlus Open, alternatively, takes the lead in display screen length and brightness. It boasts a larger 7.eighty two-inch foldable AMOLED screen and a 6.31-inch duvet screen. Both reveals be offering a 120Hz refresh charge, but with an wonderful peak brightness of two,800 nits, making it one of the crucial brightest shows out there. If you prioritize monitor pleasant, the OnePlus Open could be the more advantageous resolution.

Performance: Under the hood, the Samsung Galaxy Z Fold 6 is powered through the Qualcomm Snapdragon 8 Gen three chip, presently the so much mighty chipset accessible for Android instruments. This guarantees precise-notch performance, regardless of whether you might be multitasking, gaming, or by means of demanding applications.

youtube

The OnePlus Open, then again, is supplied with the Qualcomm Snapdragon eight Gen 2 chip. While it changed into the ideally suited chipset on the time of its unencumber, it lags somewhat at the back of the newer Snapdragon 8 Gen three in terms of uncooked overall performance. However, for such a lot clients, the change in actual-world performance won't be considerable.

Storage and RAM: When it involves storage and RAM, the Galaxy Z Fold 6 promises 1TB of garage and 12GB of RAM, supplying considerable space for all of your apps, games, graphics, and videos. This combination guarantees modern multitasking and a unbroken consumer event.

In evaluation, the OnePlus Open comes with 512GB of garage and 16GB of RAM. While the storage is 1/2 of what the Galaxy Z Fold 6 supplies

2 notes

·

View notes

Text

Samsung Galaxy Z Fold 4 Alternatives

Oppo, the world’s fourth-largest smartphone maker, launched its foldable smartphone called the Find N2 Flip. This was priced at more than $1,000. Honor then launched its $1,690 foldable smartphone called the Honor Magic Vs. These together with existing foldable phones give Samsung Galaxy Z Fold 4 a run for its money. Here, we consider all the alternatives currently in the market. (more…) “”

View On WordPress

0 notes

Text

As extra Google Pixel Fold rumors emerge from the depths of liquor-dom, I am beginning to consider it has an opportunity to high our greatest foldable cellphone information. Each new leak or declare makes the Pixel Fold sound like a mixture of different cool foldable telephones that American customers have but to purchase.I and the remainder of Tom's Information nonetheless suppose the Samsung Galaxy Z Fold 4 is a superb system, but it surely has its fair proportion of flaws, which is why it is a disgrace you may't purchase a competing system within the US proper now. The Pixel Fold is claimed to be coming quickly, although – one rumor claims it can arrive in June – and it ought to shake issues up with a extra engaging worth, design and digicam system than something we have seen up to now.For example what I imply, beneath are three foldables that the Google Pixel Fold appears to have taken inspiration from. Neither of those units are bought within the US, so if the Pixel Fold combines all these options, it might be a very highly effective mixture.Kind issue of Oppo Discover N2When you've ever used a Galaxy Z Fold, you may know that the outer cowl show could be very slender in comparison with a standard cellphone, making necessary duties like typing very tough. Nevertheless it seems to be just like the Pixel Fold will not fall into this lure attributable to its supposedly expansive design.This elaborate design is much like what we've already seen on the Oppo Discover N2. Though the exterior show is sort of small, the width is consistent with a typical smartphone, which means navigation and utilizing the keyboard is just not tough in any respect. Oppo Discover N2 (Picture credit score: Tom's Information)Arguably, you may keep away from all of this with a flip-style foldable just like the Galaxy Z Flip 4 or the Oppo Discover N2 Flip, the place the interior show is the one strategy to totally use the cellphone. However the Discover N2's dimension looks as if the optimum dimension for a lot of potential foldable customers, which is why I feel the Pixel Fold can have a definite benefit over the already established Galaxy Z Fold. Digicam high quality of Vivo X FoldAs the most recent Pixel Fold digicam is rumored, it can function most, if not all, the identical digicam because the Pixel 7 Professional. That would assist set the Pixel Fold aside, as one of the best digicam phone-grade hardware is one thing I've lengthy thought foldables ought to function. Since it's a must to pay a lot for the privilege of proudly owning a foldable, why not get a top-class digicam as effectively? That is one thing Chinese language cellphone maker Vivo appears to know. Though it's now nearly a yr outdated, the Vivo X Fold makes use of the very same digicam because the Vivo X80 Professional that was launched earlier.Vivo X Fold (Picture credit score: Vivo)Whereas the Galaxy Z Fold 4 has flagship-grade cameras, they do not provide Samsung's finest tech from the Galaxy S22 Extremely/Galaxy S23 Extremely and do not sound just like the Galaxy Z Fold 5 both. Having the identical digicam as its sibling flagship Pixel might due to this fact drastically improve its attraction to shoppers. Honor Magic Vs its worth Folding telephones are undoubtedly extra helpful than their non-folding counterparts, however by how way more is debatable. Samsung prices a $500 surcharge on high of what you'd pay for a high-end Galaxy S cellphone for the Galaxy Z Fold collection, however that appears a bit excessive.Google fortunately appears to be planning to cost much less for its Pixel Fold, maybe taking a cue from Honor and its Magic Vs. This foldable claims to have a number of benefits over its rivals, however what you may't dispute is its value. At €1,599, it is considerably cheaper than the Galaxy Z Fold 4's €1,799 base worth. (Picture credit score: Tom's Information)The rumor mill at present thinks Google will cost as little as $1,300 for the Pixel Fold. That

would slot in with a cheaper-than-average worth in comparison with the flagship Pixel, and can be one other good cause to select the Pixel Fold over the competitors. Pixel Fold Outlook The Might/June launch of the Pixel Fold is now and rumors have extra time to unfold. However as issues stand, this cellphone sounds just like the foldable that American foldable patrons have been wanting for a while, providing a less expensive various to the Galaxy Z Fold collection.(Picture credit score: OnLeaks/Howtoisolve)This might be difficult by different teased incoming foldables, such because the OnePlus V Fold, or the long-rumored iPhone Flip, in addition to extra rumors with the clock ticking on the proposed Pixel Fold launch window. As issues stand now although, I am optimistic concerning the Pixel Fold's potential to be a high foldable cellphone based mostly on how effectively its rumored options have labored on different units. Extra from Tom's InformationAt the moment's finest Google Pixel Buds Professional offers

0 notes

Text

Vivo X Flip to destroy the Galaxy Z Flip4 with better specs

The years when Samsung had a comfortable spot in the foldable segment are over! Since the last year, we saw the Chinese brands coming with full force to compete. Back in the last month, the Korean firm’s hegemony in the global markets started to get disrupted. The Oppo Find N2 Flip reached the global market to compete with the Galaxy Z Flip4, and the Honor Magic Vs came to threaten the Samsung Galaxy Z Fold4. Now, there is a new Vivo X Flip foldable device coming to compete in the hectic “flip foldable segment”. While there are just a few devices like the Galaxy Z Fold4 competing in the global markets, the situation is different with the Flip series. Samsung has to face Motorola and Oppo, and soon Vivo will be joining this trend. The Chinese brand made its entrance in the foldable segment with the Vivo X Fold. A few months later, it brought the Vivo X Fold+ with a better CPU and much better cameras. In fact, the Vivo X Fold+ had one of the most impressive camera setups in a foldable device. Now, the company aims to do the same with its first flip foldable phone, the Vivo X Flip.

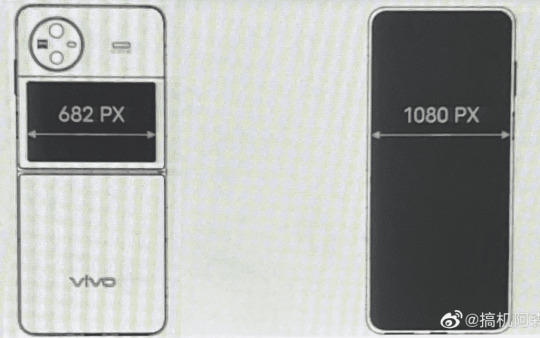

Vivo X Flip leaked specifications and details

A new set of leaks come straight from the tipster Digital Chat Station. He brings interesting details about the new phone set to compete with the Galaxy Z Flip4. According to him, the Vivo X Flip will pack the Qualcomm Snapdragon 8+ Gen 1 SoC. Yes, it will stick with the last year’s flagship CPU. We assume that Vivo will leave the SD8 Gen 2 for a possible Vivo X Fold2. Moving on, the Vivo X Flip will have 12 GB of RAM and 128 GB of Internal Storage. We assume that there will be more storage options, after all, 128GB is few for a flagship nowadays. According to leaked drawings, the phone will bring a large cover display and a dual camera island above it. The Galaxy Z Flip4 has a tiny cover display, and the competitors are trying to impress consumers by offering larger panels. The Vivo X Flip will also bring a good camera setup. It will bring a 50 MP Sony IMX866 main camera and a 12 MP IMX663 ultrawide snapper. There will be an additional camera in the inner display fitted inside a punch-hole cutout. The exact resolution is unclear, but we expect it to be decent. Just like the recently-released Vivo X90 series, the new device will get ZEISS tuning for its cameras.

As per the leaks, the Vivo X Flip will bring a Full HD+ inner display with 6.8 inches and a 120 Hz refresh rate. The device’s display may get similar to Oppo Find N2 Flip which has a 6.8-inch panel. The phone is said to pack a 4,400 mAh battery which is very good for this form factor. Moreover, it will pack 44W fast charging which is way beyond Galaxy Z Flip4. With this capacity, the phone will be flip-foldable with the largest battery. The phone will also have a side-mounted fingerprint scanner. The device is coming soon According to reports, the Vivo X Flip will hit China pretty soon. The teasers may start to appear in the next week. Considering Vivo’s last year’s schedule, we can see a new round of foldable phones in April. Unlike the Vivo X Fold series, the Vivo X Flip will likely hit the global markets. As we’ve said before, the company also plans to launch the Vivo X Fold2. That one will be the new flagship foldable for the year 2023. It will bring significant improvements like the Snapdragon 8 Gen 2. We also expect a powerful camera setup. We are curious to see if there will also be a new Vivo X Note joining the two foldable phones. Read the full article

0 notes

Text

HONOR Announces the Magic5 Pro and Magic Vs at MWC 2023

HONOR finally gave fans something to look forward to following its latest appearance at MWC 2023 - the company finally announced its newest flagship, the HONOR Magic5 Pro, as well as global availability for its foldable handset, the HONOR Magic Vs. Honor Magic5 Pro Hands-on Video: https://youtu.be/X7WCfkZ0TMY HONOR Magic5 Pro The Magic5 Pro has its sights set on competing flagship devices like the Samsung Galaxy S23 and iPhone 14, and features a premium design with some formidable specs to boot. Up front you’ll find a curved 6.81-inch LTPO AMOLED display, complete with a 120Hz refresh rate and 1312 x 2848 pixel resolution, and 1800 nits of maximum brightness. The display houses the front camera, 3D camera for face unlock, and fingerprint scanner. The phone is also IP68-certified, with a textured rear panel (glossy for the black version) and a polished side frame. Inside the phone is a Qualcomm Snapdragon 8 Gen 2 SoC, paired with an Adreno 740 GPU, 12GB of RAM inside the device, and 512GB of internal storage. This set-up should prove ideal for lengthy gaming sessions, heavy app use, as well as more moderate usage. The phone will ship with Android 13 paired with MagicOS 7.1, HONOR’s proprietary custom Android skin. As for camera hardware, there’s a triple-camera set-up on the rear panel with a 50MP main camera with f/1.6 aperture and a 1/1.12 inch sensor. This comes with a 50MP Ultra Wide Camera with f/2.0 aperture, and a 50MP Sony IMX858 Sensor Telephoto lens with f/3.0 aperture, 3.5x Optical Zoom, and 100x Digital Zoom. Meanwhile, the front camera comes with a 12MP lens with f/2.4 aperture alongside the 3D Depth Camera. Honor Magic Vs In addition to the Magic5 Pro, HONOR also revealed that its Magic Vs foldable will be available for consumers worldwide. Designed to compete with other foldables including offerings from Samsung and OPPO, the Magic Vs feature some pretty great hardware. Geared for portable productivity as well as entertainment, the Magic Vs’ foldable design features a 6.45-inch display on the outside, with an inner display that measures 7.9 inches when fully unfolded. There’s also a triple camera setup on the outer rear panel which includes a 54MP main camera, aided by a 50MP ultrawide lens, and an 8MP camera with 3x optical zoom. The foldable is powered by the Qualcomm Snapdragon 8+ Gen 1, and while it’s not the most “recent” flagship chip offering from Qualcomm, it’s still able to hold its own when it comes to resource and graphics-intensive tasks. The chip will be paired alongside up to 12GB of RAM, although buyers can also opt for the 8GB version, while storage goes up to as high as 512GB. In terms of pricing and availability, the HONOR Magic5 Pro will be available in Black and Meadow Green colour variants, and will be available in the UK from early May 2023. As for the HONOR Magic Vs, users will be available to purchase it in the UK from June 2023 in Cyan and Black versions. Read the full article

0 notes

Text

Oppo Find N2 Flip vs. Galaxy Z Flip 4: it just got interesting

If you want a compact folding smartphone, you’ve now got a legitimate choice, all thanks to the Oppo Find N2 Flip — a clamshell foldable that’s ready to take on the Samsung Galaxy Z Flip 4. I’ve used them both for a while, and this is what makes one better than the other. We’ll start off with a simple specification comparison, and then go into more detail about the differences, focusing on what…

View On WordPress

0 notes

Text

Oppo Find N2 And Find N2 Flip Debut To Rival Samsung’s Foldables In The Market: All Details

Oppo Find N2 And Find N2 Flip Debut To Rival Samsung’s Foldables In The Market: All Details

Oppo has finally unleashed its new foldable devices that will be coming to global markets, at least one of them. The new Find N2 series now has a flip avatar as well, helping the brand take on Samsung’s version of fold and flip smartphones. Oppo hosted an event on Thursday to launch these products, along with other big announcements made at the Oppo Inno Day 2022 this week. The Find N2 and Find…

View On WordPress

#Find N2 Flip vs Galaxy Z Flip 4#Oppo Find N2 Flip India Price#Oppo Find N2 launch#Oppo Foldable phones 2023#Samsung vs Oppo foldables

0 notes

Text

Smartphone Buying Guide - Buy Best Mobile Phones

There are a couple of belongings you got to confine mind while buying the proper smartphone for yourself. You must identify what does one use your smartphone for. This guide takes you thru the entire process of choosing the simplest mobile .

Smartphones have snaked their way into almost every living moment of our technologically-fueled lives. More people are buying smartphones, and therefore the number of options is additionally increasing. Choosing a smartphone from such an awesome list of options might get confusing, so we made a guide that helps you choose the simplest smartphone for your needs.

You can check our extensive best smartphones buying guide for starters, but we recommend you to see out our guide the way to pick the proper smartphone in 2020.

WHAT to think about BEFORE BUYING A SMARTPHONE?

SMARTPHONE PERFORMANCE: PROCESSOR AND RAM

Your smartphone processor, also referred to as the chipset or the SoC, is that the component that's liable for almost everything working on your smartphone. it's essentially the brain of the system, and most of those processors also come equipped with AI capabilities that essentially make your smartphone as ‘smart’ it's today.

A capable processor not only allows your device to function seamlessly but is additionally capable of enhancing other factors. One example is image processing. Samsung phones, as an example, comes in two variants - one hosting the Snapdragon chipset (the latest one being Snapdragon 865+). In contrast, the opposite one employs Samsung’s in house Exynos processor (the latest being Exynos 990). Some reviewers have explicitly stated that there's a tangible difference in not just the processing power of the 2 variants, the Snapdragon being much snappier, but also the image-processing abilities.

So, once you choose your smartphone, it's integral to understand what processor you’re getting along side it since the performance directly correlates with it. Popular ones include Snapdragon, Apple A13 Bionic, Exynos 990, and Kirin 990. Apple processors are known for his or her raw computing power, and Snapdragon processors are the closest equivalent within the Android realm. you furthermore may have lower-powered processors for mid-range and budget devices like the Snapdragon 730 and 730G, Snapdragon 675, MediaTek Helio G90T and G85, and more, that are commonly found in lower-priced 2020 smartphones. If you’re on a budget and don’t mind sacrificing some power to save lots of money, consider buying phones with one among these processors since they drive down costs quite bit. Buying Guide

Coming to RAM, this refers to system memory that smartphones use to carry data that active applications are using. some of your smart- phone’s RAM is usually spent by the OS , to stay it run- ning. We’re not getting to get into the nitty-gritty of RAM usage during a phone since it involves explaining terms like kernel-space which can find yourself taking tons of room during this article. Having sufficient RAM can allow you to possess a bigger number of apps running within the background, which significantly affects your multitasking experience. However, some smartphones are breaking all barriers and installing a whopping 12-16 GB of RAM in their smartphones. That’s definitely overkill for smartphones, especially if you don’t plan on switching between 10-20 apps at an equivalent time. If you’re a light-weight smartphone user, someone who only uses their phone for calls, texts, What- sApp and lightweight browsing, you'll easily escape with 3-4 GB RAM. For power users, something round the ballpark of 6-8 GB is perfectly fine.

CHOICE OF OS

It boils right down to two options - Android or iOS. the selection is really more complicated than you imagine since both operating systems have a large list of pros and cons. If you’re someone who enjoys tinkering around together with your device and customising it to your heart’s content, you’re Team Android. If you wish an easy , powerful OS which gets constant software updates and is supported for a more extended period, you’re Team iOS. Nevertheless, Android is additionally almost as powerful but almost as simple, although the present Android version has become much simpler to use than the times of Gingerbread. Just know that iOS, as an OS, is sort of limiting, in some cases. as an example , you can't sideload apps from the web if they're not available on the App Store, the split-screen mode still isn’t a thing on iPhones (just iPads), you can't customise your home screen (although iOS 14 may include widgets), and you actually cannot use launchers to completely change the design of your phone. However, iOS comes with a plethora of benefits also , like iMessage, FaceTime, regular software updates, and therefore the biggest of all, minimal bloatware, and no adware! We’re watching you, Xiaomi!

PREFERED interface

You also need to confine mind that numerous smartphones accompany their own skin or UI (user interface) smacked on top of Android. OnePlus has OxygenOS, a clean skin that's quite on the brink of stock Android, Samsung comes with One UI 2, which has improved by leaps and bounds from its TouchWiz days, MIUI on Xiaomi phones, which is an ad-fest but is well-optimised, ColorOS on Oppo and Realme smartphones, that's heavily inspired by iOS.

Remember to undertake and knowledge the UI before buying the device to ascertain if it works for you.

A GOOD DISPLAY

Smartphone display sizes seem to be ever-increasing and are continually pushing the boundary of what we’d expect a smartphone display size to be. They’ve reached the ‘phablet’ realm with displays even reaching up to six .9-inches!

However, within the age where content is being consumed increasingly on our pocket devices (hard to call them that now), this might not be a nasty thing. we propose anything above 5.7 inches so you'll really immerse yourself into games and media. As far as display types go, you've got LCD and AMOLED displays. AMOLED displays have variants like OLED or Super AMOLED (in the case of Sam- sung) and have better contrast and darker blacks. They also assist in saving battery since they close up all the black pixels on the phone to display ‘true black’. Buying Guide

Next, you furthermore may have various resolutions like Full HD, Full HD+ Quad HD. While QHD does provide crisper images, the difference between FHD and QHD isn't too jarring, especially to the untrained eye. you ought to also check the screen protection on your device. Gorilla 5 and 6 are usually utilized in current-generation smartphones, and that they provide reasonable protection for your glass sandwiches. However, we still recommend a case strongly.

THE RIGHT AMOUNT OF STORAGE

The current standard is 64GB on lower-end models and 128GB to 512GB on flagships. With swift sharing apps and technologies, most folks import every single GB of knowledge from our previous phones to the new ones. So, adequate storage is important . We recommend that you simply don't go under 128GB since it'll offer you enough breathing space to stay your data also as download apps to your heart’s content. Also, keep an eye fixed out for phones with expandable memory storage. Buying Guide

BATTERY LIFE that matches YOUR DAILY REQUIREMENTS

The golden standard of battery life in flagship smartphones is 6+ hours of screen on time. Anything with higher capacities can mostly allow even heavy-users to power through. Flagship phones, also as some mid-range phones, also can reach 8-10 hours of screen on time, which is brilliant. The goal is to urge a phone which will a minimum of pull through one whole day of intensive usage. So, ensure to see battery tests online before purchasing a tool . Also, attempt to research if the phone you’re planning on buying features a decent power-saving mode. Buying Guide

CAMERA QUALITY THAT JUSTIFIES the worth

In 2020, multi-cameras are the norm and phones with only one rear camera are extremely rare now. you always get a primary lens which sports the very best MP count, a camera lens , and a wide-angle shooter. And then, you furthermore may have a couple of extras that some manufacturers add like the ToF (Time of Flight) sensor, macro lens, and colour filter lens. We, at the Digit Labs, are fans of the fisheye lens due to the magnitude of images you'll now combat phones. Capturing sprawling scenes isn't a drag anymore! The camera lens , when done well, can produce spectacular bokeh shots too. However, if this trend just isn’t for you and therefore the growing camera bumps enrage you, it might be best to shop for older phones with one primary lens or newer ones like the iPhone SE 2020. Also, don’t go MP hunting, higher megapixel-count doesn’t always mean better images since the sensor size is far more integral to producing good photos.

Smartphones have also been employing pixel-binning, which essentially turns four or more pixel into one big pixel, that adds clarity and detail to the image. Also, for now, attempt to stray faraway from the 108MP sensors since they’re pretty rough round the edges at the instant plagued with image fringing and autofocus issues.

MISCELLANEOUS THINGS to think about

Wireless charging

Gaming Mode

Fingerprint sensor vs Face Unlock

Bluetooth version

IP Rating

Dual sim

Reverse wireless charging

Stereo speakers

NFC

Dual-band Wi-Fi

WHAT to not CONSIDER?FOLDABLE DESIGNS

While the planning evolution is innovative and smart, it's just too early to be completely reliable. Our verdict? Hold off on buying foldable phones for a couple of years .Buying Guide

5G SMARTPHONES

In a country just like the US which is slowly but surely seeing widespread 5G integration (low band or mmWave), sure, choose 5G phones to futureproof. However, 5G integration in India remains a ways away, and therefore the proper rollout is years away. So, it makes no sense paying more to get a 5G phone.

#best smartphones buying guide#Buying Guide#Best Buying Guide#best smartphone overall#gsmarena top 10 smartphones 2020#best android phone 2020#flagship phone#compare flagship phones

1 note

·

View note

Text

Oppo Find N vs Samsung Galaxy Z Fold 3: Which is the better Foldable in the market?

Oppo Find N vs Samsung Galaxy Z Fold 3: Which is the better Foldable in the market?

For a long time, Samsung has been the most popular folding phone maker in the world. In 2021, it launched the Galaxy Z Fold 3 5G and Galaxy Z Flip 3 5G. Both of these are purposed to cater to varied use cases and hence come designed, specced, and priced differently too. Simply put, the Fold is more of a book-like format and the Flip resembles the flip-phones of yesteryear. While the Z Flip 3 is…

View On WordPress

0 notes

Text

As extra Google Pixel Fold rumors emerge from the depths of liquor-dom, I am beginning to consider it has an opportunity to high our greatest foldable cellphone information. Each new leak or declare makes the Pixel Fold sound like a mixture of different cool foldable telephones that American customers have but to purchase.I and the remainder of Tom's Information nonetheless suppose the Samsung Galaxy Z Fold 4 is a superb system, but it surely has its fair proportion of flaws, which is why it is a disgrace you may't purchase a competing system within the US proper now. The Pixel Fold is claimed to be coming quickly, although – one rumor claims it can arrive in June – and it ought to shake issues up with a extra engaging worth, design and digicam system than something we have seen up to now.For example what I imply, beneath are three foldables that the Google Pixel Fold appears to have taken inspiration from. Neither of those units are bought within the US, so if the Pixel Fold combines all these options, it might be a very highly effective mixture.Kind issue of Oppo Discover N2When you've ever used a Galaxy Z Fold, you may know that the outer cowl show could be very slender in comparison with a standard cellphone, making necessary duties like typing very tough. Nevertheless it seems to be just like the Pixel Fold will not fall into this lure attributable to its supposedly expansive design.This elaborate design is much like what we've already seen on the Oppo Discover N2. Though the exterior show is sort of small, the width is consistent with a typical smartphone, which means navigation and utilizing the keyboard is just not tough in any respect. Oppo Discover N2 (Picture credit score: Tom's Information)Arguably, you may keep away from all of this with a flip-style foldable just like the Galaxy Z Flip 4 or the Oppo Discover N2 Flip, the place the interior show is the one strategy to totally use the cellphone. However the Discover N2's dimension looks as if the optimum dimension for a lot of potential foldable customers, which is why I feel the Pixel Fold can have a definite benefit over the already established Galaxy Z Fold. Digicam high quality of Vivo X FoldAs the most recent Pixel Fold digicam is rumored, it can function most, if not all, the identical digicam because the Pixel 7 Professional. That would assist set the Pixel Fold aside, as one of the best digicam phone-grade hardware is one thing I've lengthy thought foldables ought to function. Since it's a must to pay a lot for the privilege of proudly owning a foldable, why not get a top-class digicam as effectively? That is one thing Chinese language cellphone maker Vivo appears to know. Though it's now nearly a yr outdated, the Vivo X Fold makes use of the very same digicam because the Vivo X80 Professional that was launched earlier.Vivo X Fold (Picture credit score: Vivo)Whereas the Galaxy Z Fold 4 has flagship-grade cameras, they do not provide Samsung's finest tech from the Galaxy S22 Extremely/Galaxy S23 Extremely and do not sound just like the Galaxy Z Fold 5 both. Having the identical digicam as its sibling flagship Pixel might due to this fact drastically improve its attraction to shoppers. Honor Magic Vs its worth Folding telephones are undoubtedly extra helpful than their non-folding counterparts, however by how way more is debatable. Samsung prices a $500 surcharge on high of what you'd pay for a high-end Galaxy S cellphone for the Galaxy Z Fold collection, however that appears a bit excessive.Google fortunately appears to be planning to cost much less for its Pixel Fold, maybe taking a cue from Honor and its Magic Vs. This foldable claims to have a number of benefits over its rivals, however what you may't dispute is its value. At €1,599, it is considerably cheaper than the Galaxy Z Fold 4's €1,799 base worth. (Picture credit score: Tom's Information)The rumor mill at present thinks Google will cost as little as $1,300 for the Pixel Fold. That

would slot in with a cheaper-than-average worth in comparison with the flagship Pixel, and can be one other good cause to select the Pixel Fold over the competitors. Pixel Fold Outlook The Might/June launch of the Pixel Fold is now and rumors have extra time to unfold. However as issues stand, this cellphone sounds just like the foldable that American foldable patrons have been wanting for a while, providing a less expensive various to the Galaxy Z Fold collection.(Picture credit score: OnLeaks/Howtoisolve)This might be difficult by different teased incoming foldables, such because the OnePlus V Fold, or the long-rumored iPhone Flip, in addition to extra rumors with the clock ticking on the proposed Pixel Fold launch window. As issues stand now although, I am optimistic concerning the Pixel Fold's potential to be a high foldable cellphone based mostly on how effectively its rumored options have labored on different units. Extra from Tom's InformationAt the moment's finest Google Pixel Buds Professional offers

0 notes

Text

Global smartphone growth stalled in Q4, up just 1.2% for the full year: Gartner

Gartner’s smartphone marketshare data for the just gone holiday quarter highlights the challenge for device makers going into the world’s biggest mobile trade show which kicks off in Barcelona next week: The analyst’s data shows global smartphone sales stalled in Q4 2018, with growth of just 0.1 per cent over 2017’s holiday quarter, and 408.4 million units shipped.

tl;dr: high end handset buyers decided not to bother upgrading their shiny slabs of touch-sensitive glass.

Gartner says Apple recorded its worst quarterly decline (11.8 per cent) since Q1 2016, though the iPhone maker retained its second place position with 15.8 per cent marketshare behind market leader Samsung (17.3 per cent). Last month the company warned investors to expect reduced revenue for its fiscal Q1 — and went on to report iPhone sales down 15 per cent year over year.

The South Korean mobile maker also lost share year over year (declining around 5 per cent), with Gartner noting that high end devices such as the Galaxy S9, S9+ and Note9 struggled to drive growth, even as Chinese rivals ate into its mid-tier share.

Huawei was one of the Android rivals causing a headache for Samsung. It bucked the declining share trend of major vendors to close the gap on Apple from its third placed slot — selling more than 60 million smartphones in the holiday quarter and expanding its share from 10.8 per cent in Q4 2017 to 14.8 per cent.

Gartner has dubbed 2018 “the year of Huawei”, saying it achieved the top growth of the top five global smartphone vendors and grew throughout the year.

This growth was not just in Huawei “strongholds” of China and Europe but also in Asia/Pacific, Latin America and the Middle East, via continued investment in those regions, the analyst noted. While its expanded mid-tier Honor series helped the company exploit growth opportunities in the second half of the year “especially in emerging markets”.

Huawei Honor’s smartphone with a hole-punch display is real

By contrast Apple’s double-digit decline made it the worst performer of the holiday quarter among the top five global smartphone vendors, with Gartner saying iPhone demand weakened in most regions, except North America and mature Asia/Pacific.

It said iPhone sales declined most in Greater China, where it found Apple’s market share dropped to 8.8 percent in Q4 (down from 14.6 percent in the corresponding quarter of 2017). For 2018 as a whole iPhone sales were down 2.7 percent, to just over 209 million units, it added.

“Apple has to deal not only with buyers delaying upgrades as they wait for more innovative smartphones. It also continues to face compelling high-price and midprice smartphone alternatives from Chinese vendors. Both these challenges limit Apple’s unit sales growth prospects,” said Gartner’s Anshul Gupta, senior research director, in a statement.

“Demand for entry-level and midprice smartphones remained strong across markets, but demand for high-end smartphones continued to slow in the fourth quarter of 2018. Slowing incremental innovation at the high end, coupled with price increases, deterred replacement decisions for high-end smartphones,” he added.

Further down the smartphone leaderboard, Chinese OEM, Oppo, grew its global smartphone market share in Q4 to bump Chinese upstart, Xiaomi, and bag fourth place — taking 7.7 per cent vs Xiaomi’s 6.8 per cent for the holiday quarter.

The latter had a generally flat Q4, with just a slight decline in units shipped, according to Gartner’s data — underlining Xiaomi’s motivations for teasing a dual folding smartphone.

Because, well, with eye-catching innovation stalled among the usual suspects (who’re nontheless raising high end handset prices), there’s at least an opportunity for buccaneering underdogs to smash through, grab attention and poach bored consumers.

Or that’s the theory. Consumer interest in ‘foldables’ very much remains to be tested.

In 2018 as a whole, the analyst says global sales of smartphones to end users grew by 1.2 percent year over year, with 1.6 billion units shipped.

The worst declines of the year were in North America, mature Asia/Pacific and Greater China (6.8 percent, 3.4 percent and 3.0 percent, respectively), it added.

“In mature markets, demand for smartphones largely relies on the appeal of flagship smartphones from the top three brands — Samsung, Apple and Huawei — and two of them recorded declines in 2018,” noted Gupta.

Overall, smartphone market leader Samsung took 19.0 percent marketshare in 2018, down from 20.9 per cent in 2017; second placed Apple took 13.4 per cent (down from 14.0 per cent in 2017); third placed Huawei took 13.0 per cent (up from 9.8 per cent the year before); while Xiaomi, in fourth, took a 7.9 per cent share (up from 5.8 per cent); and Oppo came in fifth with 7.6 per cent (up from 7.3 per cent).

from RSSMix.com Mix ID 8176395 https://techcrunch.com/2019/02/21/global-smartphone-growth-stalled-in-q4-up-just-1-2-for-the-full-year-gartner/ via http://www.kindlecompared.com/kindle-comparison/

0 notes

Text

HONOR Announces the Magic5 Pro and Magic Vs at MWC 2023

HONOR finally gave fans something to look forward to following its latest appearance at MWC 2023 - the company finally announced its newest flagship, the HONOR Magic5 Pro, as well as global availability for its foldable handset, the HONOR Magic Vs. HONOR Magic5 Pro The Magic5 Pro has its sights set on competing flagship devices like the Samsung Galaxy S23 and iPhone 14, and features a premium design with some formidable specs to boot. Up front you’ll find a curved 6.81-inch LTPO AMOLED display, complete with a 120Hz refresh rate and 1312 x 2848 pixel resolution, and 1800 nits of maximum brightness. The display houses the front camera, 3D camera for face unlock, and fingerprint scanner. The phone is also IP68-certified, with a textured rear panel (glossy for the black version) and a polished side frame. Inside the phone is a Qualcomm Snapdragon 8 Gen 2 SoC, paired with an Adreno 740 GPU, 12GB of RAM inside the device, and 512GB of internal storage. This set-up should prove ideal for lengthy gaming sessions, heavy app use, as well as more moderate usage. The phone will ship with Android 13 paired with MagicOS 7.1, HONOR’s proprietary custom Android skin. As for camera hardware, there’s a triple-camera set-up on the rear panel with a 50MP main camera with f/1.6 aperture and a 1/1.12 inch sensor. This comes with a 50MP Ultra Wide Camera with f/2.0 aperture, and a 50MP Sony IMX858 Sensor Telephoto lens with f/3.0 aperture, 3.5x Optical Zoom, and 100x Digital Zoom. Meanwhile, the front camera comes with a 12MP lens with f/2.4 aperture alongside the 3D Depth Camera. Honor Magic Vs In addition to the Magic5 Pro, HONOR also revealed that its Magic Vs foldable will be available for consumers worldwide. Designed to compete with other foldables including offerings from Samsung and OPPO, the Magic Vs feature some pretty great hardware. Geared for portable productivity as well as entertainment, the Magic Vs’ foldable design features a 6.45-inch display on the outside, with an inner display that measures 7.9 inches when fully unfolded. There’s also a triple camera setup on the outer rear panel which includes a 54MP main camera, aided by a 50MP ultrawide lens, and an 8MP camera with 3x optical zoom. The foldable is powered by the Qualcomm Snapdragon 8+ Gen 1, and while it’s not the most “recent” flagship chip offering from Qualcomm, it’s still able to hold its own when it comes to resource and graphics-intensive tasks. The chip will be paired alongside up to 12GB of RAM, although buyers can also opt for the 8GB version, while storage goes up to as high as 512GB. In terms of pricing and availability, the HONOR Magic5 Pro will be available in Black and Meadow Green colour variants, and will be available in the UK from early May 2023. As for the HONOR Magic Vs, users will be available to purchase it in the UK from June 2023 in Cyan and Black versions. Read the full article

0 notes

Text

Global smartphone growth stalled in Q4, up just 1.2% for the full year: Gartner

Gartner’s smartphone marketshare data for the just gone holiday quarter highlights the challenge for device makers going into the world’s biggest mobile trade show which kicks off in Barcelona next week: The analyst’s data shows global smartphone sales stalled in Q4 2018, with growth of just 0.1 per cent over 2017’s holiday quarter, and 408.4 million units shipped.

tl;dr: high end handset buyers decided not to bother upgrading their shiny slabs of touch-sensitive glass.

Gartner says Apple recorded its worst quarterly decline (11.8 per cent) since Q1 2016, though the iPhone maker retained its second place position with 15.8 per cent marketshare behind market leader Samsung (17.3 per cent). Last month the company warned investors to expect reduced revenue for its fiscal Q1 — and went on to report iPhone sales down 15 per cent year over year.

The South Korean mobile maker also lost share year over year (declining around 5 per cent), with Gartner noting that high end devices such as the Galaxy S9, S9+ and Note9 struggled to drive growth, even as Chinese rivals ate into its mid-tier share.

Huawei was one of the Android rivals causing a headache for Samsung. It bucked the declining share trend of major vendors to close the gap on Apple from its third placed slot — selling more than 60 million smartphones in the holiday quarter and expanding its share from 10.8 per cent in Q4 2017 to 14.8 per cent.

Gartner has dubbed 2018 “the year of Huawei”, saying it achieved the top growth of the top five global smartphone vendors and grew throughout the year.

This growth was not just in Huawei “strongholds” of China and Europe but also in Asia/Pacific, Latin America and the Middle East, via continued investment in those regions, the analyst noted. While its expanded mid-tier Honor series helped the company exploit growth opportunities in the second half of the year “especially in emerging markets”.

Huawei Honor’s smartphone with a hole-punch display is real

By contrast Apple’s double-digit decline made it the worst performer of the holiday quarter among the top five global smartphone vendors, with Gartner saying iPhone demand weakened in most regions, except North America and mature Asia/Pacific.

It said iPhone sales declined most in Greater China, where it found Apple’s market share dropped to 8.8 percent in Q4 (down from 14.6 percent in the corresponding quarter of 2017). For 2018 as a whole iPhone sales were down 2.7 percent, to just over 209 million units, it added.

“Apple has to deal not only with buyers delaying upgrades as they wait for more innovative smartphones. It also continues to face compelling high-price and midprice smartphone alternatives from Chinese vendors. Both these challenges limit Apple’s unit sales growth prospects,” said Gartner’s Anshul Gupta, senior research director, in a statement.

“Demand for entry-level and midprice smartphones remained strong across markets, but demand for high-end smartphones continued to slow in the fourth quarter of 2018. Slowing incremental innovation at the high end, coupled with price increases, deterred replacement decisions for high-end smartphones,” he added.

Further down the smartphone leaderboard, Chinese OEM, Oppo, grew its global smartphone market share in Q4 to bump Chinese upstart, Xiaomi, and bag fourth place — taking 7.7 per cent vs Xiaomi’s 6.8 per cent for the holiday quarter.

The latter had a generally flat Q4, with just a slight decline in units shipped, according to Gartner’s data — underlining Xiaomi’s motivations for teasing a dual folding smartphone.

Because, well, with eye-catching innovation stalled among the usual suspects (who’re nontheless raising high end handset prices), there’s at least an opportunity for buccaneering underdogs to smash through, grab attention and poach bored consumers.

Or that’s the theory. Consumer interest in ‘foldables’ very much remains to be tested.

In 2018 as a whole, the analyst says global sales of smartphones to end users grew by 1.2 percent year over year, with 1.6 billion units shipped.

The worst declines of the year were in North America, mature Asia/Pacific and Greater China (6.8 percent, 3.4 percent and 3.0 percent, respectively), it added.

“In mature markets, demand for smartphones largely relies on the appeal of flagship smartphones from the top three brands — Samsung, Apple and Huawei — and two of them recorded declines in 2018,” noted Gupta.

Overall, smartphone market leader Samsung took 19.0 percent marketshare in 2018, down from 20.9 per cent in 2017; second placed Apple took 13.4 per cent (down from 14.0 per cent in 2017); third placed Huawei took 13.0 per cent (up from 9.8 per cent the year before); while Xiaomi, in fourth, took a 7.9 per cent share (up from 5.8 per cent); and Oppo came in fifth with 7.6 per cent (up from 7.3 per cent).

0 notes

Text

Global smartphone growth stalled in Q4, up just 1.2% for the full year: Gartner

Gartner’s smartphone marketshare data for the just gone holiday quarter highlights the challenge for device makers going into the world’s biggest mobile trade show which kicks off in Barcelona next week: The analyst’s data shows global smartphone sales stalled in Q4 2018, with growth of just 0.1 per cent over 2017’s holiday quarter, and 408.4 million units shipped.

tl;dr: high end handset buyers decided not to bother upgrading their shiny slabs of touch-sensitive glass.

Gartner says Apple recorded its worst quarterly decline (11.8 per cent) since Q1 2016, though the iPhone maker retained its second place position with 15.8 per cent marketshare behind market leader Samsung (17.3 per cent). Last month the company warned investors to expect reduced revenue for its fiscal Q1 — and went on to report iPhone sales down 15 per cent year over year.

The South Korean mobile maker also lost share year over year (declining around 5 per cent), with Gartner noting that high end devices such as the Galaxy S9, S9+ and Note9 struggled to drive growth, even as Chinese rivals ate into its mid-tier share.

Huawei was one of the Android rivals causing a headache for Samsung. It bucked the declining share trend of major vendors to close the gap on Apple from its third placed slot — selling more than 60 million smartphones in the holiday quarter and expanding its share from 10.8 per cent in Q4 2017 to 14.8 per cent.

Gartner has dubbed 2018 “the year of Huawei”, saying it achieved the top growth of the top five global smartphone vendors and grew throughout the year.

This growth was not just in Huawei “strongholds” of China and Europe but also in Asia/Pacific, Latin America and the Middle East, via continued investment in those regions, the analyst noted. While its expanded mid-tier Honor series helped the company exploit growth opportunities in the second half of the year “especially in emerging markets”.

Huawei Honor’s smartphone with a hole-punch display is real

By contrast Apple’s double-digit decline made it the worst performer of the holiday quarter among the top five global smartphone vendors, with Gartner saying iPhone demand weakened in most regions, except North America and mature Asia/Pacific.

It said iPhone sales declined most in Greater China, where it found Apple’s market share dropped to 8.8 percent in Q4 (down from 14.6 percent in the corresponding quarter of 2017). For 2018 as a whole iPhone sales were down 2.7 percent, to just over 209 million units, it added.

“Apple has to deal not only with buyers delaying upgrades as they wait for more innovative smartphones. It also continues to face compelling high-price and midprice smartphone alternatives from Chinese vendors. Both these challenges limit Apple’s unit sales growth prospects,” said Gartner’s Anshul Gupta, senior research director, in a statement.

“Demand for entry-level and midprice smartphones remained strong across markets, but demand for high-end smartphones continued to slow in the fourth quarter of 2018. Slowing incremental innovation at the high end, coupled with price increases, deterred replacement decisions for high-end smartphones,” he added.

Further down the smartphone leaderboard, Chinese OEM, Oppo, grew its global smartphone market share in Q4 to bump Chinese upstart, Xiaomi, and bag fourth place — taking 7.7 per cent vs Xiaomi’s 6.8 per cent for the holiday quarter.

The latter had a generally flat Q4, with just a slight decline in units shipped, according to Gartner’s data — underlining Xiaomi’s motivations for teasing a dual folding smartphone.

Because, well, with eye-catching innovation stalled among the usual suspects (who’re nontheless raising high end handset prices), there’s at least an opportunity for buccaneering underdogs to smash through, grab attention and poach bored consumers.

Or that’s the theory. Consumer interest in ‘foldables’ very much remains to be tested.

In 2018 as a whole, the analyst says global sales of smartphones to end users grew by 1.2 percent year over year, with 1.6 billion units shipped.

The worst declines of the year were in North America, mature Asia/Pacific and Greater China (6.8 percent, 3.4 percent and 3.0 percent, respectively), it added.

“In mature markets, demand for smartphones largely relies on the appeal of flagship smartphones from the top three brands — Samsung, Apple and Huawei — and two of them recorded declines in 2018,” noted Gupta.

Overall, smartphone market leader Samsung took 19.0 percent marketshare in 2018, down from 20.9 per cent in 2017; second placed Apple took 13.4 per cent (down from 14.0 per cent in 2017); third placed Huawei took 13.0 per cent (up from 9.8 per cent the year before); while Xiaomi, in fourth, took a 7.9 per cent share (up from 5.8 per cent); and Oppo came in fifth with 7.6 per cent (up from 7.3 per cent).

from iraidajzsmmwtv https://ift.tt/2GARVzt via IFTTT

0 notes

Link

Gartner’s smartphone marketshare data for the just gone holiday quarter highlights the challenge for device makers going into the world’s biggest mobile trade show which kicks off in Barcelona next week: The analyst’s data shows global smartphone sales stalled in Q4 2018, with growth of just 0.1 per cent over 2017’s holiday quarter, and 408.4 million units shipped.

tl;dr: high end handset buyers decided not to bother upgrading their shiny slabs of touch-sensitive glass.

Gartner says Apple recorded its worst quarterly decline (11.8 per cent) since Q1 2016, though the iPhone maker retained its second place position with 15.8 per cent marketshare behind market leader Samsung (17.3 per cent). Last month the company warned investors to expect reduced revenue for its fiscal Q1 — and went on to report iPhone sales down 15 per cent year over year.

The South Korean mobile maker also lost share year over year (declining around 5 per cent), with Gartner noting that high end devices such as the Galaxy S9, S9+ and Note9 struggled to drive growth, even as Chinese rivals ate into its mid-tier share.

Huawei was one of the Android rivals causing a headache for Samsung. It bucked the declining share trend of major vendors to close the gap on Apple from its third placed slot — selling more than 60 million smartphones in the holiday quarter and expanding its share from 10.8 per cent in Q4 2017 to 14.8 per cent.

Gartner has dubbed 2018 “the year of Huawei”, saying it achieved the top growth of the top five global smartphone vendors and grew throughout the year.

This growth was not just in Huawei “strongholds” of China and Europe but also in Asia/Pacific, Latin America and the Middle East, via continued investment in those regions, the analyst noted. While its expanded mid-tier Honor series helped the company exploit growth opportunities in the second half of the year “especially in emerging markets”.

Huawei Honor’s smartphone with a hole-punch display is real

By contrast Apple’s double-digit decline made it the worst performer of the holiday quarter among the top five global smartphone vendors, with Gartner saying iPhone demand weakened in most regions, except North America and mature Asia/Pacific.

It said iPhone sales declined most in Greater China, where it found Apple’s market share dropped to 8.8 percent in Q4 (down from 14.6 percent in the corresponding quarter of 2017). For 2018 as a whole iPhone sales were down 2.7 percent, to just over 209 million units, it added.

“Apple has to deal not only with buyers delaying upgrades as they wait for more innovative smartphones. It also continues to face compelling high-price and midprice smartphone alternatives from Chinese vendors. Both these challenges limit Apple’s unit sales growth prospects,” said Gartner’s Anshul Gupta, senior research director, in a statement.

“Demand for entry-level and midprice smartphones remained strong across markets, but demand for high-end smartphones continued to slow in the fourth quarter of 2018. Slowing incremental innovation at the high end, coupled with price increases, deterred replacement decisions for high-end smartphones,” he added.

Further down the smartphone leaderboard, Chinese OEM, Oppo, grew its global smartphone market share in Q4 to bump Chinese upstart, Xiaomi, and bag fourth place — taking 7.7 per cent vs Xiaomi’s 6.8 per cent for the holiday quarter.

The latter had a generally flat Q4, with just a slight decline in units shipped, according to Gartner’s data — underlining Xiaomi’s motivations for teasing a dual folding smartphone.

Because, well, with eye-catching innovation stalled among the usual suspects (who’re nontheless raising high end handset prices), there’s at least an opportunity for buccaneering underdogs to smash through, grab attention and poach bored consumers.

Or that’s the theory. Consumer interest in ‘foldables’ very much remains to be tested.

In 2018 as a whole, the analyst says global sales of smartphones to end users grew by 1.2 percent year over year, with 1.6 billion units shipped.

The worst declines of the year were in North America, mature Asia/Pacific and Greater China (6.8 percent, 3.4 percent and 3.0 percent, respectively), it added.

“In mature markets, demand for smartphones largely relies on the appeal of flagship smartphones from the top three brands — Samsung, Apple and Huawei — and two of them recorded declines in 2018,” noted Gupta.

Overall, smartphone market leader Samsung took 19.0 percent marketshare in 2018, down from 20.9 per cent in 2017; second placed Apple took 13.4 per cent (down from 14.0 per cent in 2017); third placed Huawei took 13.0 per cent (up from 9.8 per cent the year before); while Xiaomi, in fourth, took a 7.9 per cent share (up from 5.8 per cent); and Oppo came in fifth with 7.6 per cent (up from 7.3 per cent).

from Mobile – TechCrunch https://ift.tt/2GARVzt ORIGINAL CONTENT FROM: https://techcrunch.com/

0 notes

Text

Global smartphone growth stalled in Q4, up just 1.2% for the full year: Gartner

Gartner’s smartphone marketshare data for the just gone holiday quarter highlights the challenge for device makers going into the world’s biggest mobile trade show which kicks off in Barcelona next week: The analyst’s data shows global smartphone sales stalled in Q4 2018, with growth of just 0.1 per cent over 2017’s holiday quarter, and 408.4 million units shipped.

tl;dr: high end handset buyers decided not to bother upgrading their shiny slabs of touch-sensitive glass.

Gartner says Apple recorded its worst quarterly decline (11.8 per cent) since Q1 2016, though the iPhone maker retained its second place position with 15.8 per cent marketshare behind market leader Samsung (17.3 per cent). Last month the company warned investors to expect reduced revenue for its fiscal Q1 — and went on to report iPhone sales down 15 per cent year over year.

The South Korean mobile maker also lost share year over year (declining around 5 per cent), with Gartner noting that high end devices such as the Galaxy S9, S9+ and Note9 struggled to drive growth, even as Chinese rivals ate into its mid-tier share.

Huawei was one of the Android rivals causing a headache for Samsung. It bucked the declining share trend of major vendors to close the gap on Apple from its third placed slot — selling more than 60 million smartphones in the holiday quarter and expanding its share from 10.8 per cent in Q4 2017 to 14.8 per cent.

Gartner has dubbed 2018 “the year of Huawei”, saying it achieved the top growth of the top five global smartphone vendors and grew throughout the year.

This growth was not just in Huawei “strongholds” of China and Europe but also in Asia/Pacific, Latin America and the Middle East, via continued investment in those regions, the analyst noted. While its expanded mid-tier Honor series helped the company exploit growth opportunities in the second half of the year “especially in emerging markets”.

Huawei Honor’s smartphone with a hole-punch display is real

By contrast Apple’s double-digit decline made it the worst performer of the holiday quarter among the top five global smartphone vendors, with Gartner saying iPhone demand weakened in most regions, except North America and mature Asia/Pacific.

It said iPhone sales declined most in Greater China, where it found Apple’s market share dropped to 8.8 percent in Q4 (down from 14.6 percent in the corresponding quarter of 2017). For 2018 as a whole iPhone sales were down 2.7 percent, to just over 209 million units, it added.

“Apple has to deal not only with buyers delaying upgrades as they wait for more innovative smartphones. It also continues to face compelling high-price and midprice smartphone alternatives from Chinese vendors. Both these challenges limit Apple’s unit sales growth prospects,” said Gartner’s Anshul Gupta, senior research director, in a statement.

“Demand for entry-level and midprice smartphones remained strong across markets, but demand for high-end smartphones continued to slow in the fourth quarter of 2018. Slowing incremental innovation at the high end, coupled with price increases, deterred replacement decisions for high-end smartphones,” he added.

Further down the smartphone leaderboard, Chinese OEM, Oppo, grew its global smartphone market share in Q4 to bump Chinese upstart, Xiaomi, and bag fourth place — taking 7.7 per cent vs Xiaomi’s 6.8 per cent for the holiday quarter.

The latter had a generally flat Q4, with just a slight decline in units shipped, according to Gartner’s data — underlining Xiaomi’s motivations for teasing a dual folding smartphone.

Because, well, with eye-catching innovation stalled among the usual suspects (who’re nontheless raising high end handset prices), there’s at least an opportunity for buccaneering underdogs to smash through, grab attention and poach bored consumers.

Or that’s the theory. Consumer interest in ‘foldables’ very much remains to be tested.

In 2018 as a whole, the analyst says global sales of smartphones to end users grew by 1.2 percent year over year, with 1.6 billion units shipped.

The worst declines of the year were in North America, mature Asia/Pacific and Greater China (6.8 percent, 3.4 percent and 3.0 percent, respectively), it added.

“In mature markets, demand for smartphones largely relies on the appeal of flagship smartphones from the top three brands — Samsung, Apple and Huawei — and two of them recorded declines in 2018,” noted Gupta.

Overall, smartphone market leader Samsung took 19.0 percent marketshare in 2018, down from 20.9 per cent in 2017; second placed Apple took 13.4 per cent (down from 14.0 per cent in 2017); third placed Huawei took 13.0 per cent (up from 9.8 per cent the year before); while Xiaomi, in fourth, took a 7.9 per cent share (up from 5.8 per cent); and Oppo came in fifth with 7.6 per cent (up from 7.3 per cent).

source https://techcrunch.com/2019/02/21/global-smartphone-growth-stalled-in-q4-up-just-1-2-for-the-full-year-gartner/

0 notes