#S&P New York Stock Exchange Nasdaq

Text

The Dow Jones Industrial Average fell 0.30% or 91 points, the Nasdaq was down 0.61%, and the the S&P 500 fell 0.85%.

The Dow closed lower Thursday, as rising Treasury yields weighed on investor sentiment even as the bulk of quarterly results continued to suggest corporate America is in better shape than feared.

The Dow Jones Industrial Average fell 0.30% or 91 points, the Nasdaq was down 0.61%, and the the S&P 500 fell 0.85%.

The 10-year Treasury yield jumped to fresh 14-year highs as investors weighed up fresh remarks from Federal Reserve officials calling for the central bank to remain the course on rate hikes.

Citing a "disappointing lack of progress on curtailing inflation," Philadelphia Federal Reserve President Patrick Harker said he expects interest rates will be “well above 4% by the end of the year.”

The remarks come as fewer-than-expected weekly jobless claims pointed to strength in the labor market, heightening concerns about ongoing wage growth.

“Demand for labor remains quite strong […] it remains the case that workers who are let go are still having a relatively easy time finding a new job,” Jefferies said in a note.

Tech stocks managed to cut losses but remained under pressure as rising Treasury yields make growth corners of the market including tech less attractive.

International Business Machines (NYSE:IBM), however, bucked the trend to rise more than 4% after the tech giant reported quarterly results that beat estimates on both the top and bottom lines.

Tesla (NASDAQ:TSLA), meanwhile, fell more than 7% after a mixed third-quarter results, though some on Wall Street touted optimism ahead for the EV maker after management said they are considering initiating a stock buyback.

“We are encouraged that management is considering a $5- $10B buyback and believe it is a constructive use of cash,” Oppenheimer said after lifting its price target on the stock to $436 from $432. “[We] believe depth of demand is outstripping most investor expectations, even when considering a looming recession,” it added.

The broader market was also pressured by a fall in travel stocks as investors weighed up quarterly results from airlines and railroad companies.

American Airlines (NASDAQ:AAL) reported quarterly earnings that beat estimates as travel demand continued to recover, but its shares fell more than 3%.

Railroad stocks were hurt by Union Pacific 's (NYSE:UNP) weaker outlook on carload growth and stock repurchases, which offset the quarterly results beat on the top line.

Elsewhere, AT&T Inc (NYSE:T) rallied more than 7% after the telecom reported better-than-expected earnings and revenue and lifted its outlook on full-year earnings to $2.50 from $2.46 a share previously.

The stumble in the broader market has coincided with wild swings in either direction, a pattern that isn't likely to let up anytime soon.

"Most of these volatile moves have inflation uncertainty, and what the Fed is going to do about it, at their core," Wells Fargo said. "We feel this pattern of market behavior is unlikely to change in the near term and is not uncommon during periods of economic uncertainty," it added.

#brainmassfinance#Brainmass#brainmassgroup#brainmasscommunity#brainmasstraders#tradewithraj#nasdaq#s&p 500 index#dowjones#new york stock exchange#treasury#ibm#at&t#brainmassclub

1 note

·

View note

Text

LETTERS FROM AN AMERICAN

May 15, 2024

HEATHER COX RICHARDSON

MAY 16, 2024

All three of the nation’s major stock indexes hit record highs today after the latest data showed inflation cooling. Standard and Poor’s 500, more commonly known as the S&P 500, measures the stock performance of 500 of the largest companies listed on U.S. stock exchanges. Today it was up 61 points, or 1.2%. The Nasdaq Composite is weighted toward companies in the information technology sector. Today it was up 231 points, or 1.4%. The Dow Jones Industrial Average, often just called the Dow, measures 30 prominent companies listed on U.S. stock exchanges. Today it was up 350 points, or 0.9%. The Dow has risen now for eight straight days, ending the day at 39,908, approaching 40,000.

Driving the hike in the stock market, most likely, is the information released today by the Bureau of Labor Statistics in the Labor Department saying that inflation eased in April. Investors are guessing this makes it more likely that the Federal Reserve will cut interest rates this year.

People note—correctly—that the stock market does not reflect the larger economy. This makes a report released yesterday from the nonpartisan Congressional Budget Office, or CBO, an important addition to the news from the stock market. It concludes that the goods and services an American household consumed in 2019 were cheaper in 2023 than they were four years before, because incomes grew faster than prices over that four-year period. That finding was true for all levels of the economy.

That is, “for all income groups…the portion of household income required to purchase the same bundle of goods and services declined.” Those in the bottom 20% found that the share of their income required to purchase the same bundle dropped by 2%. For those in the top 20%, the share of their income required to purchase as they did in 2019 dropped by 6.3%.

These statistics come on top of unemployment below 4% for a record 27 months, and more than 15 million jobs created since Biden took office, including 789,000 in manufacturing. According to Politifact, three quarters of those jobs represented a return to the conditions before the coronavirus pandemic, but the rest are new. Politifact noted that it is so rare for manufacturing jobs to bounce back at all, that the only economic recovery since World War II that beats the current one was in 1949, making the recovery under the Biden-Harris administration the strongest in 72 years.

And yet, a recent Philadelphia Inquirer/New York Times/Siena College poll found that 78% of Pennsylvania voters thought the economy was “fair” or “poor.” Fifty-four percent of them said they trust Trump to handle the economy better than Biden, compared with just 42% who prefer Biden.

The divorce between reality and people’s beliefs illuminates just how important media portrayals of events are.

In the landslide election of 1892, when voters elected Democrat Grover Cleveland to the White House for the third time (he won the popular vote in 1888 but lost in the electoral college) and put Democrats in charge of the House of Representatives and the Senate, Republicans insisted that the economy would collapse. The previous administration, that of Republican Benjamin Harrison, had openly and proudly worked for businessmen, and Republicans maintained that losing that administration would be a calamity. Democrats, the Republicans insisted, were really socialists and anarchists who wanted to destroy America.

As Republican newspapers predicted an impending collapse, fearful investors pulled out of the market. Although economic indicators were actually better in 1892 than they had been for years, as soon as Cleveland was elected, the nation seemed to be in terrible trouble. Money began to flow out of the stock market, and the outgoing Harrison administration refused to reassure investors. By February 1893 the stock market was paralyzed.

In mid-February, financier J. P. Morgan rushed to Washington to urge Harrison to do something, but the calm of the administration men remained undisturbed. Secretary of the Treasury Charles Foster commented publicly that the Republicans were responsible for the economy only until March 4, the day Cleveland would take office. His job was to “avert a catastrophe up to that date.”

He didn’t quite manage it. On Friday, February 17, the stock market began to collapse. By February 23 the slaughter was universal. Investors begged Harrison to relieve the crisis, but with only eight days left in his term, Harrison and his men maintained that nothing important was happening. The secretary of the Treasury spent his last few days in office sitting for his portrait. The New York Times noted that “[i]f the National Treasury Department had been retained especially to manufacture apprehension and create disturbance it could not have done more effective work.”

Secretary Foster had one more parting shot. When he handed the Treasury Department off to his Democratic successor, he told the newspapers that “the Treasury was down to bedrock.”

When Cleveland took office on March 4, 1893, a financial panic was in full swing. As he tried to negotiate that crisis, Republicans sagely told voters the crash was the result of the Democrats’ policies. When Democrats turned to an income tax so they could lower the tariffs that were hurting consumers, Republicans insisted they were socialists. When unemployed workers and struggling farmers marched on Washington to ask for jobs or launched railroad strikes, Republicans insisted that Democrats stood with the mob, while Republicans were the party of law and order.

Republicans promised voters that they would restore the health of the economy. The 1894 midterm elections reversed the landslide of 1892, giving Republicans 130 more seats in the House—a two-thirds majority—and a majority in the Senate. The economy had begun to recover before the election, and that uptick continued. The Democrats had plunged the country into a panic, the Chicago Tribune reported, but now “American manufacturers and merchants and business-men generally will draw a long breath of relief.”

How the media covers events matters.

Allison Fisher of Media Matters reported today that with the exception of MSNBC, national television news failed to cover the extraordinary story reported by Josh Dawsey and Maxine Joselow on May 9 in the Washington Post that Trump had told oil executives that if they gave $1 billion to his campaign, he would get rid of all the regulations the Biden administration has enacted to combat climate change.

In the 1920s, President Warren G. Harding’s secretary of the interior, Albert Fall, went to prison for a year for accepting a $385,000 bribe from oilman Edward L. Doheny in exchange for leases to drill for oil on naval reserve land in Elk Hills and Buena Vista, California, and Teapot Dome, Wyoming. Fall was the first former cabinet officer to go to prison, and the scandal was considered so outrageous that “Teapot Dome” has gone down in U.S. history as shorthand for a corrupt presidency.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#History#Heather Cox Richardson#Letters From An American#Media Matters#media#the economy#climate change

2 notes

·

View notes

Text

Investing in Stocks 101: A Beginner's Guide to Building Wealth with Confidence

I. Introduction to Investing in Stock

Investing in stocks can be a powerful tool for building long-term wealth. By acquiring ownership in companies through stock ownership, individuals can participate in the profits and growth of these businesses. This comprehensive guide aims to provide beginners with a solid foundation to navigate the complex world of stock investing, enabling them to make informed decisions with confidence.

Understanding the Basics of Investing in Stocks

Before diving into the intricacies of stock investing, it is crucial to grasp the basic concept of stocks. Stocks, also known as shares or equities, represent a portion of ownership in a company. When individuals purchase stocks, they become shareholders in that company, which entitles them to a share of its profits and assets.

Why Investing in Stocks is Essential for Wealth Building

Investing in stocks offers numerous advantages for wealth building. Unlike traditional savings accounts, stocks have the potential to generate substantial returns over the long term. Additionally, investing in stocks allows individuals to diversify their portfolios and participate in the growth of different industries and sectors. By harnessing the power of compounding returns, investors can exponentially increase their wealth over time.

II. Getting Started in Stock Investing

Embarking on a journey of stock investing requires careful planning and consideration. Before delving into the world of stocks, beginners should lay a strong foundation by following these steps:

Setting Financial Goals and Time Horizon

Determining financial goals is paramount in creating a roadmap for successful investing. Whether the objective is saving for retirement, buying a home, or funding education, setting clear goals helps investors tailor their investment strategies accordingly. Additionally, identifying the time horizon, or the length of time an investor plans to stay invested, plays a crucial role in selecting suitable investment options.

Assessing Risk Tolerance and Investment Options

Understanding personal risk tolerance is vital when considering investment options. Risk tolerance refers to an individual's willingness and ability to withstand fluctuations in investment values. It is essential to strike a balance between risk and potential returns to align investment choices with personal comfort levels. Furthermore, investors should explore different investment vehicles such as stocks, bonds, and mutual funds to diversify their portfolios and manage risk effectively.

Building a Solid Foundation: Budgeting and Emergency Funds

Before entering the world of stock investing, it is imperative to establish a solid financial foundation. Implementing a budgeting system enables individuals to monitor their income, expenses, and savings. By creating a clear picture of their financial health, investors can allocate funds for stock investments without compromising their overall financial stability. Additionally, building emergency funds safeguards against unforeseen circumstances, ensuring the availability of funds for emergencies rather than withdrawing invested capital prematurely.

III. Demystifying the Stock Market

The stock market can be an intimidating concept for beginners. However, gaining a fundamental understanding of its key aspects can help demystify the process of stock investing.

Exploring the Stock Market: Definitions, Exchanges, and Indexes

The stock market refers to the platform where investors can buy and sell stocks. It is an organized marketplace where buyers and sellers meet to trade shares of publicly listed companies. Stock exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ, facilitate these transactions. Indexes, such as the S&P 500 and Dow Jones Industrial Average, track the performance of specific groups of stocks, enabling investors to gauge overall market trends.

How Stock Prices are Determined

Stock prices are determined by supply and demand dynamics in the stock market. When there is high demand for a particular stock, its price tends to rise, while low demand leads to price declines. Various factors, such as company performance, economic conditions, and investor sentiment, contribute to the fluctuations in stock prices.

Key Players in the Stock Market: Brokers, Investors, and Analysts

Several key players participate in the stock market, each with distinct roles and responsibilities. Brokers act as intermediaries between investors and the stock exchange, facilitating the buying and selling of stocks. Investors, who can be individuals or institutions, purchase and own stocks based on their investment objectives. Analysts play a pivotal role by analysing companies, industries, and economic factors to provide insights and recommendations to investors.

IV. Different Types of Stocks

Understanding the different types of stocks available in the market is essential for investors seeking to diversify their portfolios effectively.

Common Stocks vs. Preferred Stocks: Understanding the Differences

Common stocks and preferred stocks are the two primary types of stocks available to investors. Common stocks represent ownership in a company and provide individuals with voting rights in corporate matters. Preferred stocks, on the other hand, typically do not carry voting rights but offer higher priority for dividends and liquidation proceeds.

Growth Stocks, Value Stocks, and Dividend Stocks: Choosing Investments

Within the stock market, investors can select from various categories of stocks based on their investment objectives and strategies. Growth stocks are shares of companies with high growth potential but may not necessarily pay dividends. Value stocks, on the other hand, are stocks that are considered undervalued compared to their intrinsic worth. Dividend stocks are shares of companies that regularly distribute a portion of their profits to shareholders in the form of dividends.

V. Fundamental Analysis: Evaluating Stocks

Fundamental analysis plays a crucial role in evaluating the financial health and performance of companies, enabling investors to make informed decisions about their investments.

Introduction to Fundamental Analysis

Fundamental analysis focuses on assessing the underlying factors that drive a company's financial performance and stock value. By analyzing financial statements, economic factors, and industry trends, investors can gauge the intrinsic value of a stock.

Examining Financial Statements: Balance Sheets, Income Statements, and Cash Flow

Financial statements provide a comprehensive view of a company's financial health. The balance sheet showcases a company's assets, liabilities, and shareholders' equity. The income statement presents the company's revenues, expenses, and profits or losses. The cash flow statement illustrates the movement of cash into and out of the company, providing insights into its liquidity.

Key Financial Ratios for Stock Analysis

Financial ratios offer valuable insights into a company's financial health and performance. Ratios, such as price-to-earnings (P/E), return on equity (ROE), and debt-to-equity (D/E), can help investors assess a company's profitability, efficiency, and financial leverage.

VI. Technical Analysis: Analysing Stock Price Patterns

Technical analysis complements fundamental analysis by examining stock price patterns, trends, and indicators to predict future price movements.

Introduction to Technical Analysis

Technical analysis revolves around the belief that historical price and volume data can provide insights into future price movements. It involves studying stock charts, trend lines, and technical indicators to identify patterns that can guide investment decisions.

Understanding Stock Charts, Trends, and Patterns

Stock charts display the historical price movements of stocks over different time frames. Trend lines help identify the direction and strength of a stock's price movement. Various chart patterns, such as head and shoulders, double bottoms, and triangles, indicate potential reversals or continuations in stock prices.

Utilising Technical Indicators for Decision Making

Technical indicators, such as moving averages, relative strength index (RSI), and MACD (moving average convergence divergence), provide additional insights into stock price movements. These indicators help investors identify overbought or oversold conditions, as well as potential trend reversals, aiding in strategic decision-making.

VII. Building a Diversified Stock Portfolio

Diversification is a principle that mitigates risk by spreading investments across various stocks, sectors, and industries.

The Importance of Diversification

Diversifying a stock portfolio protects investors against the risk of holding a concentrated position. By investing in stocks across different industries and sectors, individuals can reduce the impact of negative events affecting a specific company or sector.

Choosing Stocks across Different Industries and Sectors

When building a diversified stock portfolio, it is crucial to allocate investments across various industries and sectors. This strategy ensures exposure to different economic cycles, reducing the potential vulnerability of the portfolio to specific events or industry downturns.

Allocating Portfolio Weightings and Risk Management

Determining the allocation of investments within a portfolio requires careful consideration. By diversifying holdings based on risk tolerance, investment goals, and time horizon, investors can achieve an optimal balance between risk and return.

VIII. Investing Strategies for Long-term Growth

Investing in stocks for long-term growth involves adopting specific strategies that capitalize on compounding returns and market cycles.

Buy and Hold Strategy: Investing for the Long Run

The buy and hold strategy entails purchasing stocks with the intention of holding them for an extended period, often years or even decades. This approach relies on the long-term growth potential of well-established companies and minimises the impacts of short-term market fluctuations.

Dollar-Cost Averaging: Regular Investing Regardless of Market Conditions

Dollar-cost averaging involves investing a fixed amount of money regularly, regardless of market conditions. This strategy allows investors to buy more shares when prices are low and fewer shares when prices are high, potentially reducing the overall average cost of investments.

Understanding Market Cycles and the Role of Patience

Markets experience cycles of expansion, consolidation, and contraction. Recognizing these cycles and maintaining patience are integral to long-term investment success. By avoiding knee-jerk reactions to short-term market movements, investors can harness the power of compounding returns over time.

IX. Performing Due Diligence: Researching and Selecting Stocks

Researching and selecting stocks requires thorough due diligence to make informed investment decisions.

Identifying Sources of Investment Information

Accurate and reliable information is crucial when researching stocks. Investors can access various sources of information, such as financial news websites, company annual reports, SEC filings, and industry reports, to gather insights and make informed decisions.

Evaluating Company Fundamentals and Industry Performance

Analysing a company's fundamentals, including revenue growth, profitability, competitive advantages, and management, helps assess its potential for long-term success. Additionally, understanding industry trends, competition, and market dynamics provides a broader context for evaluating a company's performance.

Selecting Stocks for Your Portfolio

The process of stock selection involves filtering potential investments based on established criteria, such as financial strength, growth prospects, and valuation. By carefully evaluating stocks, investors can assemble a portfolio that aligns with their investment goals and risk tolerance.

X. The Art of Buying and Selling Stocks

Executing buy and sell orders requires understanding various types of stock orders and maintaining a disciplined approach.

Placing Stock Orders: Market Orders, Limit Orders, and Stop Orders

Investors can place different types of orders to buy or sell stocks. Market orders execute immediately at the prevailing market price, while limit orders allow investors to specify the desired price at which to buy or sell. Stop orders are triggered when the stock reaches a specific price, aiming to limit losses or secure gains.

Timing the Market vs. Time in the Market

Timing the market, or attempting to buy stocks at the lowest price and sell at the highest, is extremely challenging and often unsuccessful. Instead, the time spent in the market is a more reliable strategy, allowing investors to benefit from the long-term upward trend of the stock market.

Emotional Pitfalls to Avoid

Emotions can significantly impact investment decisions. Fear and greed often lead to irrational behaviour, such as panic selling during market downturns or chasing speculative investments during market euphoria. Avoiding emotional pitfalls and maintaining a disciplined approach based on the investment plan is key to long-term success.

XI. Managing and Monitoring Your Stock Portfolio

Regularly managing and monitoring a stock portfolio ensures it remains aligned with evolving financial goals and market conditions.

Regular Portfolio Review and Rebalancing

Periodic portfolio reviews are essential to evaluate the performance of individual stocks and the overall portfolio. Rebalancing involves adjusting the portfolio's weightings to maintain the desired allocation and risk level.

Tracking Performance and Monitoring News

Monitoring the performance of individual stocks and the broader market is crucial for making informed decisions. Additionally, staying abreast of relevant news, such as company announcements, industry developments, and economic indicators, allows investors to react to potential opportunities or threats in a timely manner.

Tax Considerations and Investment Record-Keeping

Investors should be mindful of tax implications related to their stock investments. It is important to keep accurate records of transactions and consult with a tax professional to maximize tax efficiency. Maintaining proper documentation also facilitates overall investment record-keeping and simplifies the tax filing process.

XII. Potential Risks and Mitigation Strategies

Investing in stocks involves inherent risks. By understanding them and implementing appropriate mitigation strategies, investors can safeguard their portfolios.

Understanding Volatility and Market Fluctuations

Volatility refers to the degree of variation in stock prices over time. Market fluctuations can be driven by a wide range of factors, including economic events, geopolitical risks, and investor sentiment. Investors should be prepared for the occasional turbulence and remain focused on long-term objectives.

Assessing Systematic and Unsystematic Risks

Systematic risks, also known as market risks, affect the overall stock market and cannot be diversified away. Unsystematic risks, on the other hand, impact specific companies or sectors and can be mitigated through diversification. By diversifying across industries and sectors, investors can mitigate unsystematic risks while accepting the broader market risks.

Hedging and Protective Measures

Hedging involves employing strategies to offset potential losses in a portfolio. Options, futures, and exchange-traded funds (ETFs) are common hedging instruments. Protective measures, such as utilising stop-loss orders or setting trailing stops, enable investors to limit potential downside risks.

XIII. Investing in Stocks for Retirement

Stocks play a crucial role in retirement planning, providing long-term growth potential and income generation.

The Role of Stocks in Retirement Planning

Incorporating stocks in retirement investment portfolios can help counteract the effects of inflation and generate long-term growth. As stocks historically outperform other investment options over extended periods, they play a vital role in ensuring adequate retirement savings.

Considerations for Different Retirement Ages

The appropriate allocation to stocks within a retirement portfolio varies depending on an individual's age and risk tolerance. Younger individuals may have a higher allocation to equities due to their longer time horizon, while older individuals may opt for a more conservative allocation.

Balancing Risk and Income in Retirement Investment Portfolios

Retirees often seek a balance between risk and income in their investment portfolios. This involves diversifying holdings to mitigate potential volatility while considering income-generating assets, such as dividend-paying stocks, to meet ongoing financial needs.

XIV. Investing in Stocks for Specific Goals

Beyond retirement planning, stocks can be utilised to achieve various financial objectives.

Investing for Education: College Funds and 529 Plans

Investors can leverage stocks through college funds, such as 529 plans, to save for their children's education. By starting investments early and adopting a long-term perspective, individuals can potentially accumulate substantial funds for educational expenses.

Investing for a Home Purchase or Down Payment

Stock investments can serve as a means to save for a home purchase or down payment. Aligning investment strategies with the desired time frame and risk tolerance allows individuals to accumulate funds for this significant financial milestone.

Stocks as Passive Income: Dividend Investing

Dividend investing involves selecting stocks that regularly distribute a portion of their profits as dividends. By building a portfolio centred around dividend-paying stocks, investors can generate passive income and

3 notes

·

View notes

Text

The Essentials of Stock Market and Mutual Fund Investing

The stock market and mutual funds are two prominent investment options that can help you grow your wealth over time. However, for many individuals, these concepts can seem complex and overwhelming. In this guide, we’ll break down what you need to know about the stock market and mutual funds, their benefits, and how they can fit into your investment strategy.

What is the Stock Market?

The stock market is a collection of markets where stocks (shares of ownership in companies) are bought and sold. It provides a platform for companies to raise capital and for investors to participate in the company's growth and profit. The stock market operates through various exchanges, where buyers and sellers conduct transactions.

Key Aspects of the Stock Market:

Stock Exchanges: These are platforms where stocks are traded, such as the New York Stock Exchange or the NASDAQ. Each exchange has its own listing requirements and trading rules.

Stock Prices: The price of a stock fluctuates based on supply and demand, company performance, and broader economic factors.

Types of Stocks: Stocks are generally classified into common and preferred shares. Common stocks provide voting rights and potential dividends, while preferred stocks offer a fixed dividend but usually no voting rights.

Market Indices: These are benchmarks that track the performance of a specific group of stocks. Examples include the S&P 500 and the Dow Jones Industrial Average.

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who allocate the fund’s assets based on the fund’s investment objectives.

Key Aspects of Mutual Funds:

Diversification: By investing in a mutual fund, you gain exposure to a wide range of securities, which helps spread out risk. This diversification can be particularly beneficial for individual investors who may not have the resources to build a diversified portfolio on their own.

Professional Management: Mutual funds are managed by experienced professionals who conduct research, select investments, and manage the fund’s portfolio. This allows investors to benefit from expert decision-making without having to manage their investments directly.

Types of Mutual Funds: There are various types of mutual funds, including equity funds, bond funds, and money market funds. Each type has different risk and return profiles and is suitable for different investment goals.

Fees and Expenses: Mutual funds typically charge management fees and other expenses. It's important to understand these fees, as they can impact your overall returns.

Comparing the Stock Market and Mutual Funds

Both the stock market and mutual funds offer unique advantages, but they cater to different investment needs and preferences. Here’s a comparison to help you decide which might be better for you:

Risk and Return: Individual stocks can offer high returns, but they also come with higher volatility and risk. Mutual funds, with their diversified portfolios, generally offer more stability but may not achieve the same high returns as a well-performing stock.

Control and Management: Investing directly in the stock market gives you control over individual stock choices but requires significant time and knowledge. Mutual funds offer professional management and convenience but with less direct control over specific investments.

Accessibility: The stock market allows for direct investment in individual stocks and can be accessed through brokerage accounts. Mutual funds can be purchased through investment companies, financial advisors, or retirement accounts.

How to Get Started

Assess Your Goals: Determine your investment objectives, risk tolerance, and time horizon. This will guide your choice between investing in individual stocks or mutual funds.

Research Options: For stocks, research different companies and industries. For mutual funds, examine the fund’s performance history, management team, fees, and investment strategy.

Start Small: If you’re new to investing, consider starting with smaller investments in both stocks and mutual funds to build your experience and confidence.

Monitor and Adjust: Regularly review your investments to ensure they align with your goals and make adjustments as needed.

Conclusion

Understanding the stock market and mutual funds can empower you to make informed investment decisions. Whether you choose to invest in individual stocks for their potential high returns or opt for mutual funds for their diversification and professional management, each option has its place in a balanced investment strategy. By aligning your investments with your financial goals and risk tolerance, you can work towards building a secure financial future.

0 notes

Text

Understanding Stock Market Basics: What New Investors Need to Know

For those new to investing, navigating the stock market can seem daunting. The world of finance is full of jargon and complexity that can overwhelm even the most enthusiastic beginner. To facilitate this exciting journey, it is important that you understand the basics of the stock market and understand how to seek reliable investment advice. In this guide, we’ll break down the basic concepts and explore how to identify the best stocks to invest in right now.

What is the Stock Market?

Stock market is a platform where shares of publicly traded companies are bought and sold. When you invest in a stock market, you buy a small ownership stake in these companies. Companies issue securities to raise capital for growth and development, while investors buy securities in the hope of reaping a return on their investments through inflation or delay.

Fundamentals of the Stock Market

Stock Exchanges: These are places where stocks are traded. Major exchanges include the New York Stock Exchange (NYSE) and Nasdaq. Each exchange has its own listing rules and requirements, but all act as a marketplace for buying and selling stocks.

Stocks: Stocks represent the ownership of a company. They come in two main types:

Common stock: Provides voting rights and dividends but is last in line if the company faces liquidation.

Preferred stock: Generally, does not give voting rights but it gives fixed dividends and has a greater claim to the assets in case of liquidation.

Indices: Stock indexes such as the S&P 500 and the Dow Jones Industrial Average (DJIA) track the performance of the stock group. They provide insight into all aspects of the market and can help investors gauge the performance of their investments.

Brokers: You will need a broker to buy or sell stocks. Brokers act as intermediaries between you and the stock exchange. Today, many online marketers offer forums with tools and resources to help you make informed decisions.

How to choose the Best Stock to Invest Right Now:

Currently, it takes research and strategic decisions to choose the best stocks to invest. Here’s an easy way to find your promising stocks:

Research and Analysis: Start by researching companies that interest you. Assess their financial health, industry status and growth potential. Key factors to consider are earnings per share (EPS), price to earnings (P/E) ratio and return on equity (ROE). Utilizing stock market consulting services can provide valuable insights and recommendations.

Industry Trends: Analyze current industry trends and economic conditions. Some businesses may be performing better because of economic changes, technological advances, or changes in consumer behavior. For example, the industrial and renewable energy industries were booming.

Fundamental vs. Technical Analysis: Use fundamental analysis to assess the financial health and viability of the company. But technical analysis involves analyzing stock price patterns and policies to predict future trends. Combining both methods can improve your decision-making process.

Diversification: Avoid investing all your money in one stock. Diversifying your portfolio across different industries and assets can help manage risk and improve return potential.

Get Professional Advice: If you are unsure about choosing the best stocks to invest in right now, consider consulting a stock market consulting firm. Advisors will provide expert analysis, personalized recommendations and strategic insights tailored to your financial goals.

Important Considerations for New Investors

Diversification: Investment diversification involves spreading your investments across different assets and sectors to reduce risk. By not putting all your eggs in one basket, you reduce the impact of one inefficient investment on your overall portfolio.

Risk Tolerance: Understanding risk tolerance is important. It reflects how much risk you have to invest. Factors that affect risk tolerance include your financial situation, investment goals, and your response to market fluctuations.

Investment: Your investment is the length of time you plan to invest before you need the money. Long-term investors generally have a higher tolerance for risk and are better able to withstand market fluctuations than short-term investors.

Stock Market Advisory: Expert opinion and strategic guidance can be obtained by using stock market advisory services. Advisors analyze market trends, recommend investments, and help you make tough investment decisions, which can be especially useful for beginners.

Understanding Orders: When trading stocks, you use different orders

The market system takes effect immediately at the current market price.

The limit order only works at or better than the specified price, allowing you to control the price you pay or receive for the stock.

Conclusion:

Understanding the basics of the stock market is important for someone who asks, “How do I invest in the stock market?”. By identifying important concepts, conducting comprehensive research, and considering the advice of stock market professionals, you can make informed investment decisions and identify the best investments now Remember that there are risks involved in investing, including the possibility of losing principal It is important, therefore, to stay informed, diversify investments, and make your choices with your finances aligning objectives and risk tolerance With the right strategy and resources, you will be well on your way to building a successful investment portfolio.

#best stock market advisor#best trading advisory services#small cap stocks#stock market advisory services#best stock to invest in right now

0 notes

Text

It's Likely Going to Be a Rough Day on Wall Street Today

Wall Street is likely to be a bloodbath today. The first warning signs were on Friday, culminating on Sunday night when all hell broke loose in Asia. The Nikkei had its worst day since 1987, sinking nearly 4,000 points. It suspended trading after sinking nearly eight percent. South Korea’s stock exchange halted all sell orders as a looming wave of brutality is expected to hit Wall Street this morning. We’ll update this post accordingly, but a drubbing on the New York Stock Exchange shouldn’t surprise anyone. Also, don’t look at your 401ks (via CNBC):

U.S. stock futures fell Sunday night following a volatile week for Wall Street, in which the Nasdaq Composite dropped into correction territory.

Wall Street is coming off a brutal week for the major averages. On Friday, the Nasdaq capped a third straight week of losses, bringing the tech-heavy index down more than 10% from a record set last month.

The S&P 500 also posted a third straight losing week, down 2% for the week. Even the Dow Jones Industrial Average, which had been outperforming, snapped a four-week win streak, falling 2%.

Treasury yields tumbled as well. The benchmark 10-year note on Friday yielded 3.79%, down from where it was one week previously at 4.20%.

The recent pullback in stocks was exacerbated Friday when a disappointing jobs report spurred investor fears the Federal Reserve made a mistake last week when it kept interest rates unchanged, and that the economy is headed toward a recession.

BREAKING: Japan's Nikkei stock index down over 4,000 points, largest drop in its history— BNO News (@BNONews) August 5, 2024

JUST IN: 🇯🇵 Japan's stock market suffers worst losses since 1987.— Watcher.Guru (@WatcherGuru) August 5, 2024

BREAKING: The Nikkei 225 futures trade is suspended due to a circuit breaker, Japanese market down 8%, headed to one of worst three days in Japan market history— unusual_whales (@unusual_whales) August 5, 2024

— Mario Nawfal (@MarioNawfal) August 5, 2024

Well, it’s almost a year later, Chuck. https://t.co/mRZvJm99Ch— John Ekdahl (@JohnEkdahl) August 5, 2024

JUST IN: $366 million liquidated from the cryptocurrency market in the past 60 minutes.— Watcher.Guru (@WatcherGuru) August 5, 2024

The Japanese stock market looks like it's experiencing Black Monday right now, holy shit. pic.twitter.com/vylm14uXYe— TEN (@TenLetters100) August 5, 2024

— RealBenGeller (@RealBenGeller) August 5, 2024

— Jacob King (@JacobKinge) August 4, 2024

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) August 5, 2024

On a scale of one to fucked we're the nanny— Jarvis (@jarvis_best) August 5, 2024

Tomorrow a senile POTUS will enter the Oval Office facing a global collapse in equity markets and an imminent war in the Middle East. Fun times.— Gordo Stevens (@GordoCDA) August 5, 2024

More on the Japanese stock market plunge (via AP):

Japan’s benchmark Nikkei 225 stock index plunged as much as 8.1% early Monday, extending sell-offs that shook world markets last week as worries flared over the state of the U.S. economy.

At one point, the Nikkei shed more than 2,900 points, to 32,991.88. The market’s broader TOPIX index also fell 8% as selling picked up in the afternoon.

A report showing hiring by U.S. employers slowed last month by much more than expected has convulsed financial markets, vanquishing the euphoria that had taken the Nikkei to all-times highs of over 42,000 in recent weeks.

The Nikkei 225 dropped 5.8% on Friday and it is headed for its worst two-day decline ever. Its worst single-day rout was a plunge of 3,836 points, or 14.9%, on a day dubbed “Black Monday” in October 1987. Share prices have fallen in Tokyo since the Bank of Japan raised its benchmark interest rate on Wednesday. The Nikkei is now at about the level it was a year ago.

It will be fun watching Kamala Harris trying to explain all of this if she’s asked. She’s been hiding from the media since she was given the nomination despite no Democratic voter ever voting for her in a primary.

— #𝕎𝕒𝕣 ℍ𝕠𝕣𝕚𝕫𝕠𝕟 (@WarHorizon) August 5, 2024

How Trump responded to the economic news:

— Donald J. Trump Posts From His Truth Social (@TrumpDailyPosts) August 5, 2024

UPDATE: Yikes.

Japan's Nikkei index now down over 12% pic.twitter.com/O6JRRuLpKy— Steve Lookner (@lookner) August 5, 2024

— Investing.com (@Investingcom) August 5, 2024

Trending on Townhall Videos

0 notes

Text

The Hong Kong stock market was in a tailspin and was struggling at the 17,000 level in the afternoon. After opening 74 points higher, the Hang Seng Index rose as much as 224 points to an all-day high of 17,229 points. However, the upward trend was weak. It once fell 80 points and fell below 17,000 points. It closed at 17,021 points, up 16 points or 0.1%; the Technology Index It rose 22 points or 0.66% to 3,443 points. Market turnover reached HK$104.7 billion.

For the whole week, the Hang Seng Index fell 396 points or 2.28%, and the Technology Index fell 92 points or 2.62%.

Last week, the Hang Seng Index temporarily stood at 17,000. Once it is broken, it will not find greater support until the 16,000 to 16,100 area. In the short term, the daily chart shows a "pregnant Liujia" favorable rebound, but the 250-DMA (17,439) is expected to provide resistance. The external market is in shock, and the mainland economy has not shown improvement. Hong Kong stocks are expected to remain at 17,000 to 18,000 points, and the direction will be revealed when the performance peaks next month.

European stock markets performed well, with British, French and German stock markets rising by 1.21%, 1.22% and 0.65% respectively.

The U.S. Personal Consumption Expenditure Deflator (PCE) data was generally in line with expectations, reflecting that inflation is under control. The market is more optimistic that the Federal Reserve will start cutting interest rates as soon as September. U.S. stocks rose significantly in the early hours of Friday (26th), with the Dow Jones Industrial Average After opening 205 points higher, it quickly soared 818 points, reaching a high of 40,753 points; the S&P 500 rose 1.63%, and the Nasdaq, dominated by technology stocks, rebounded 1.59%.

At the close of U.S. stocks, the Dow rose 654 points to 40,589 points; the S&P 500 rose 59 points, or 1.11%, to 5,459 points; and the Nasdaq rose 176 points, or 1.03%, to 17,357 points.

The U.S. exchange rate index fell another 0.14% to 104.207; the Japanese yen rose repeatedly, reaching a high of 153.15 per dollar, up 0.51%; the Euro rose by up to 0.2%, hitting $1.0868.

New York gold futures closed up 1.2% at $2,381 an ounce. Spot gold rose 0.8% to $2,382.98 an ounce. This major correction in gold may be over: from the highest point of US$2,483 to the lowest of US$2,353, a fluctuation of about US$130. The support of $2,350 is the market’s psychologically recognized line of defense. The next step will be a volatile rise, this time it can break the $2,500 mark, which will be around the beginning of September when the U.S. dollar interest rate cut begins!

0 notes

Text

Understanding How the Stock Market Works

Understanding how stock market works is essential for making informed investment decisions. Knowledge of market operations, key players, and trading strategies can help mitigate risks and maximize returns. Explore the intricacies of the stock market, where companies issue shares that investors buy and sell through exchanges. Discover how factors such as company performance, market sentiment, and economic trends influence stock prices, providing opportunities for both long-term investors and active traders to participate in this dynamic financial ecosystem.

1. Stock Exchanges

Primary Exchanges: The most prominent stock exchanges are the New York Stock Exchange (NYSE) and the NASDAQ.

Global Exchanges: Other major global exchanges include the London Stock Exchange (LSE), Tokyo Stock Exchange (TSE), and more.

2. Shares and Stocks

Shares: Represent ownership in a company. When you buy a company's stock, you are buying a small part of that company.

Stocks: The general term for shares of ownership in a company. Stocks can be common or preferred, with common stocks often carrying voting rights and preferred stocks generally offering fixed dividends.

3. Buying and Selling

Investors and Traders: Individuals or institutions that buy and sell stocks.

Brokerages: Firms that act as intermediaries between buyers and sellers. Investors use brokerage accounts to execute trades.

Orders: Investors place orders to buy or sell stocks. Types of orders include market orders, limit orders, stop orders, etc.

4. Price Determination

Supply and Demand: Stock prices are determined by the supply and demand in the market. If more people want to buy a stock (demand) than sell it (supply), the price goes up. If more people want to sell a stock than buy it, the price goes down.

Market Influences: News, earnings reports, economic indicators, and other factors can influence investor sentiment and stock prices.

5. Types of Stock Markets

Primary Market: Where new shares are issued and sold to investors via Initial Public Offerings (IPOs).

Secondary Market: Where previously issued shares are traded among investors. Most stock market activities occur in the secondary market.

6. Indices

Stock Market Indices: Benchmarks used to measure and report value changes in a selected group of stocks. Examples include the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ Composite.

Purpose: Indices help investors gauge the performance of the market or a segment of the market.

7. Regulation

Regulatory Bodies: Stock markets are regulated by governmental and independent organizations to ensure fair practices. In the U.S., the Securities and Exchange Commission (SEC) is a key regulator.

Laws and Regulations: Designed to protect investors and maintain market integrity.

8. Risks and Rewards

Potential for Profit: Stocks can offer significant returns over time through price appreciation and dividends.

Risk of Loss: Stocks can also lose value, sometimes significantly, leading to potential losses.

9. Investment Strategies

Long-Term Investing: Buying and holding stocks for an extended period, typically years, to benefit from the company’s growth.

Short-Term Trading: Buying and selling stocks within a short period, ranging from minutes to months, to capitalize on market fluctuations.

Diversification: Spreading investments across various sectors and asset classes to mitigate risk.

10. Tools and Resources

Research and Analysis: Investors use various tools, such as financial news, analyst reports, and market data, to make informed decisions.

Technology: Online trading platforms and mobile apps provide easy access to market information and trading capabilities.

Understanding how stock market works is essential for making informed investment decisions and effectively managing your portfolio.

#stock market#stock market course in delhi#option trading course#best share trading institute#stock market institute#stock market training#stock market trading

0 notes

Text

Stock market news for June 21, 2024

New Post has been published on https://petn.ws/mVmaz

Stock market news for June 21, 2024

Traders work the floor of the New York Stock Exchange. NYSE The S&P 500 ticked lower Friday as shares of market bellwether Nvidia pulled back for a second day. The broad market index fell 0.16% to finish at 5,464.62, while the Nasdaq Composite dipped 0.18% to settle at 17,689.36. The Dow Jones Industrial Average edged […]

See full article at https://petn.ws/mVmaz

#OtherNews

0 notes

Text

What is the Stock Market?

The stock market is a place where people buy and sell shares of companies. Companies sell shares to raise money, and investors buy them to own a piece of the company. Prices go up and down based on supply and demand. Major stock exchanges like the New York Stock Exchange and Nasdaq facilitate trading. Stock market indices like the S&P 500 track how the market is doing overall. Investing in stocks can be risky, but it also offers the potential for long-term growth.

0 notes

Text

Dow Jones

The Dow Jones Industrial Average, commonly abbreviated as simply the Dow Jones or Dow, is an indicator used in the stock market that follows the performance of thirty major publicly traded businesses that trade on the NASDAQ and the New York Stock Exchange (NYSE). This is a synopsis:

Origin and History: In 1896, statistician Edward Jones and Wall Street Journal editor Charles Dow founded the Dow Jones Industrial Average. The index, which at first only included 12 companies, was designed to give investors a quick overview of the state of the American stock market as a whole. The Dow has grown and changed over time, now comprising 30 of the biggest and most significant businesses from a range of industries.

The 30 blue-chip businesses that make up the Dow Jones Industrial Average are representative of a wide range of industries, including consumer products, healthcare, technology, and finance. The Wall Street Journal editors have chosen these firms based on a variety of criteria, including overall economic significance, liquidity, and market value.

The Dow Jones Industrial Average is a price-weighted index, which means that each component stock's price affects the index in proportion to its share price. This is how the index is calculated. In contrast, some indexes—like the S&P 500—are weighted according to market capitalization. The total value of the index may fluctuate in response to changes in the stock prices of the 30 Dow businesses.

Significance: The Dow Jones Industrial Average, one of the world's oldest and most watched stock market indices, is a reliable indicator of the general state and trajectory of the American economy. Investors, financial experts, and politicians regularly use it as a barometer of investor mood and market performance.

In summary, the Dow Jones Industrial Average is an important indicator of the performance of large-cap U.S. equities for investors, and it plays a vital role in the worldwide financial markets. The Dow is still a well-known and significant benchmark for investors all over the world, despite being just one of many indicators used to evaluate market trends.

To make wise investing decisions and be aware of the larger trends influencing the economy, keep up with the most recent changes and advancements in the Dow Jones Industrial Average.

ALSO READ-

Experience the Enchantment of Delhi at Night with a Private Tour Guide India Company Night Tour

Overview of the Night Tour

The Private Tour Guide India Company's Night Tour offers an unforgettable opportunity to witness Delhi's captivating charm and lively energy after dark. With this interactive tour, visitors may discover the city's well-known sites, vibrant marketplaces, and cultural hubs while taking in the captivating nighttime light show.

Why Select India's Private Tour Guide Company?

Expert Guides: We guarantee that guests have an enriching and unforgettable experience by providing them with individualized help and perceptive commentary from our expert guides.

Personalized plan: Create a customized plan based on your interests and let yourself see the sites that most interest you at your own speed.

Comfortable Transportation: Enjoy a smooth and pleasurable ride during the night tour by traveling in comfort and style with private transportation.

Excellent Service: We are dedicated to giving our clients outstanding service and life-changing experiences. We are committed to excellence and customer satisfaction.

The Night Tour's highlights

Discover Delhi's Famous Landmarks

India Gate: Observe the magnificent India Gate illuminated against the backdrop of the night, honoring the troops who gave their lives in defense of the country.

Qutub Minar: Marvel at the magnificent Qutub Minar's elaborate architecture and historical significance as a UNESCO World Heritage Site as you take in its majestic illumination.

Vibrant Night Markets

Connaught Place: Come and feel the dynamic spirit of Connaught Place, one of Delhi's most well-liked dining and shopping places, as it comes to life with lit-up stores and street vendors.

Highlights of Culture

Explore the ancient Jama Masjid, one of the biggest mosques in India, and take in the beautiful Mughal architecture while relaxing in the courtyard's tranquil environment.

Visit the well-renowned Sikh center of worship, Gurudwara Bangla Sahib, and take part in the captivating evening prayer ritual, known as the "Sukhmani Sahib Path."

Street Food Delights: Treat your palate to a variety of mouthwatering street food treats, such as crunchy samosas and spicy chaat, as well as sweet jalebis and creamy kulfi.

In summary

The Night Tour, offered by Private Tour Guide India Company, gives visitors an amazing experience that highlights the beauty and charm of the city after dark while offering a riveting peek into Delhi's lively nightlife and cultural diversity.

With professional supervision and individualized service, reserve your night tour today and set off on a spectacular adventure through Delhi's lighted streets and iconic sites.

0 notes

Text

Stocks are holding steady as the Dow Jones Industrial Average teeters on the brink of reaching the 40,000 milestone. Investors are cautiously optimistic as they navigate Market volatility and economic uncertainty. Stay tuned for the latest updates on the stock Market as it continues to tread water in today's trading session.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

US stocks saw a mixed day on Friday as the Dow Jones Industrial Average (^DJI) held steady after touching the key 40,000 level for the first time. The S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) also made slight gains, signaling a positive end to the week for all three indexes.

Investor sentiment was tempered by comments from Fed officials cautioning that interest rates are likely to remain high for the foreseeable future. This led to uncertainty over the possibility of a rate cut in September, despite encouraging inflation data.

With a light economic and corporate calendar on Friday, the focus turned to appearances by the Fed's Mary Daly and Christopher Waller. Investors will be closely watching for any divergence from the Fed's current stance of data-driven decision-making regarding inflation and interest rates.

In individual stock movements, Reddit (RDDT) shares surged 15% following a partnership announcement with OpenAI. Meanwhile, GameStop (GME) saw its shares tumble over 20% as the company projected a drop in first-quarter sales due to a shift in consumer behavior towards online shopping.

Overall, the Market remains cautious as it navigates through the recent economic and geopolitical uncertainties. Stay tuned for more updates on the latest Market trends and developments.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. What does it mean when stocks "tread water"?

- Treading water in the stock Market means that prices are staying relatively stable without significant increases or decreases.

2. What is the Dow Jones Industrial Average?

- The Dow Jones Industrial Average is a stock Market index that measures the performance of 30 large, publicly-owned companies trading on the New York Stock Exchange and the Nasdaq.

3. Why is the Dow Jones poised for another bid for 40,000?

- The Dow Jones is poised for another bid for 40,000 because investor confidence and optimism in the Market are driving stock prices higher.

4. How should I interpret the stock Market treading water?

- When the stock Market treads water, it may be a sign of uncertainty or consolidation. Investors may be cautious or waiting for more information before making big moves.

5. Should I be concerned about the stock Market reaching 40,000?

- Reaching 40,000 in the Dow Jones is a significant milestone, but it does not necessarily indicate a bubble or impending crash. It's important to monitor Market trends and consult with a financial advisor for personalized advice.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Text

Title: Demystifying the Stock Market: A Beginner’s Guide to Investing

The stock market often evokes images of bustling trading floors, flashing tickers, and the potential for enormous wealth. For beginners, however, it can seem like an impenetrable world filled with jargon and risks. This guide aims to demystify the stock market, explaining what it is, how it works, and how you can start investing wisely.

What is the Stock Market?

The stock market is a network of exchanges where investors can buy and sell shares of publicly traded companies. It provides a platform for companies to raise capital by selling stock and for investors to purchase ownership in those companies. The most well-known stock exchanges include the New York Stock Exchange (NYSE) and the Nasdaq.

Key Components of the Stock Market

Stocks: Also known as shares or equities, stocks represent a fraction of ownership in a company. When you buy a stock, you become a shareholder and own a part of that company.

Stock Exchanges: These are the marketplaces where stocks are traded. Examples include the NYSE and Nasdaq. They provide the infrastructure and regulations for trading activities.

Indices: Stock indices, such as the S&P 500 and Dow Jones Industrial Average (DJIA), track the performance of a group of stocks. They provide a snapshot of market trends and overall economic health.

How the Stock Market Works

The stock market operates on the principles of supply and demand. Here's a simplified explanation:

Issuance of Stocks: Companies issue stocks to raise money for expansion, paying off debt, or other corporate activities. This is often done through an Initial Public Offering (IPO).

Buying and Selling: Investors buy and sell stocks on stock exchanges. They place orders through brokers, who execute these transactions.

Price Determination: Stock prices are determined by supply and demand. When more people want to buy a stock (demand) than sell it (supply), the price goes up. Conversely, if more people are selling a stock than buying it, the price goes down.

Participants in the Stock Market

Several key players make up the stock market ecosystem:

Retail Investors: Individual investors who buy and sell stocks for their personal portfolios.

Institutional Investors: Organizations such as mutual funds, pension funds, and insurance companies that trade large volumes of stocks.

Brokers: Intermediaries who facilitate buy and sell orders on behalf of investors.

Market Makers: Firms or individuals who provide liquidity by being ready to buy and sell stocks at any time.

Why Invest in the Stock Market?

Investing in the stock market offers several benefits:

Potential for High Returns: Historically, stocks have provided higher returns compared to other asset classes such as bonds and savings accounts.

Ownership and Voting Rights: As a shareholder, you have ownership in the company and can vote on important corporate matters.

Dividend Income: Some companies pay dividends, which are portions of their earnings distributed to shareholders.

Risks of Stock Market Investing

While the stock market can be lucrative, it also comes with risks:

Market Risk: The overall market can decline, leading to a decrease in stock prices.

Company-Specific Risk: Individual stocks can be affected by company performance, management decisions, and industry conditions.

Liquidity Risk: Some stocks may not be easily sold without impacting their price.

Getting Started with Stock Market Investing

For beginners, here are some steps to start investing in the stock market:

Educate Yourself: Learn about basic investment principles, market terminology, and financial statements.

Set Financial Goals: Determine your investment objectives, risk tolerance, and time horizon.

Choose a Broker: Select a reputable brokerage firm that offers user-friendly platforms and educational resources.

Start Small: Begin with a small investment that you can afford to lose. This helps you learn without significant financial risk.

Diversify: Spread your investments across different sectors and asset classes to reduce risk.

Stay Informed: Keep up with market news, economic indicators, and company performance to make informed decisions.

Practical Tips for Beginners

Patience is Key: Investing is a long-term endeavor. Avoid the temptation to react to short-term market fluctuations.

Regular Contributions: Consistently invest a portion of your income. This approach, known as dollar-cost averaging, can reduce the impact of market volatility. Want to know more

0 notes

Text

Stock Market: Definition and How It Works

The stock market, also known as the equity market, is a financial marketplace where individuals and institutions can buy, sell, and trade shares of publicly listed companies. Shares, also referred to as stocks or equities, represent ownership in a company. The stock market serves as a platform for companies to raise capital and for investors to participate in the growth of businesses.

How the Stock Market Works

The stock market operates through exchanges, where buyers and sellers come together to trade shares. Here's how the stock market works in detail:

Stock Exchanges:

Stock exchanges are organized markets where shares of publicly traded companies are bought and sold. Examples of stock exchanges include the New York Stock Exchange (NYSE), the Nasdaq, and the London Stock Exchange (LSE).

Companies list their shares on an exchange through an initial public offering (IPO) to raise capital and allow their shares to be traded.

Trading Process:

Trading in the stock market is facilitated by brokers who execute buy and sell orders on behalf of investors.

Orders can be placed in various ways, including market orders (buying or selling at the current market price) and limit orders (buying or selling at a specified price).

Stock Prices:

Stock prices fluctuate based on supply and demand. When demand for a stock exceeds supply, the price rises; when supply exceeds demand, the price falls.

Prices are influenced by various factors such as a company's financial performance, economic conditions, market sentiment, interest rates, and geopolitical events.

Market Indices:

Market indices are benchmarks that track the performance of a group of stocks. Popular indices include the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite in the United States.

Indices provide a snapshot of the overall market's performance and are often used as indicators of economic health.

Investor Participation:

Investors participate in the stock market by buying shares of companies. They can hold these shares for the long term, hoping for capital appreciation and dividends, or trade them for short-term gains.

Institutional investors such as mutual funds, pension funds, and hedge funds also play a significant role in the market.

Market Regulation:

Stock markets are regulated by government agencies to ensure fair and transparent trading. In the United States, the Securities and Exchange Commission (SEC) oversees the market.

Regulations aim to protect investors and maintain market integrity.

Impact on Economy:

The stock market plays a crucial role in the economy by enabling companies to raise capital and investors to earn returns on their investments.

The market's performance is often seen as an indicator of economic health and can influence consumer and business confidence.

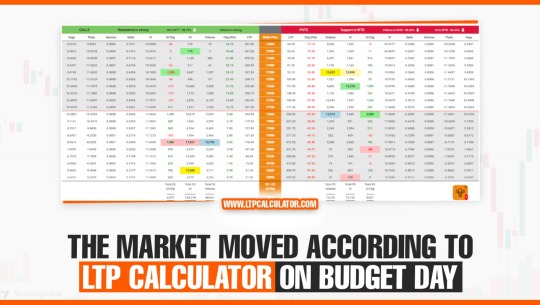

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

Conclusion

The stock market is a dynamic and complex marketplace where companies and investors interact. It provides opportunities for wealth creation and economic growth but also carries risks due to market volatility and unpredictability. Investors should approach the stock market with a clear understanding of its workings and their investment goals.

0 notes

Text

Making Smart Investments: Guide to Earning Money in Shares

Navigating the labyrinth of the stock market, with its ever-changing share prices and jargon, may seem akin to deciphering an ancient codex to the uninitiated.

Yet, the truth remains that amidst this complexity lies a golden opportunity for wealth creation, a chance to grow one’s savings account beyond the modesty of fixed income avenues.

It begins with understanding the melody of the market, recognizing the harmony in volatility, and learning to dance to its rhythms.

Stepping into the arena armed with knowledge transforms the daunting into the achievable.

In this guide, we embark on a journey to demystify the art and science of making money through shares, shedding light on strategies that range from the fundamental to the advanced.

Keep reading to explore how you can harness the power of the stock market to fuel your financial growth.

Understanding the Basics of the Stock Market

Embarking on a journey through the labyrinthine world of the stock market, where prices ebb and flow like the tide, can initially feel akin to navigating an unfamiliar city without a map.

This section is your compass, designed to guide you through the foundational concepts needed to make informed investment decisions.

At its core, the stock market is a grand marketplace for shares - the very essence of ownership in a company.

Understanding its mechanisms is akin to learning the rules of a complex yet rewarding game.

Equally crucial is grasitating the significance of market indices, those beacons that illuminate the market's overall health and direction, providing investors with a bird's-eye view of the financial landscape.

Additionally, the market's diverse sectors and industries, offering a kaleidoscope of investment opportunities, beckon with potential profits.

Each sector behaves almost like a character in a novel, with its own motivations, challenges, and responses to the economy's fluctuations.

Together, these elements comprise the vibrant ecosystem known as the stock market, a realm where wisdom and strategy can chart the path to prosperity.

What Is the Stock Market and How Does It Work?

Imagine the stock market as a colossal network, buzzing and vibrant, where pieces of companies, known as stocks, change hands every moment. It is a public square where anyone, from the titan of industry to the individual with a modest savings account, can claim a segment of a company's future fortunes—or bear the brunt of its failures.

The market operates through a sophisticated yet fascinating ecosystem: stock exchanges like the New York Stock Exchange or the NASDAQ serve as the arenas where these transactions occur. Each trade, a decision weighed and executed, influences a stock's price, mirroring the collective judgement of the market's participants on the value of the company:

ComponentDescriptionStockA share of ownership in a company.Stock ExchangeThe venue for buying and selling stocks.PriceThe amount at which a stock is traded.InvestorAn individual or entity engaging in the trade of stocks.

The Importance of Market Indices for Investors

Like a captain relying on a constellation to navigate the vast oceans, investors use market indices as guiding stars through the turbulent waves of the stock market. These indices serve as snapshots, encapsulating the market's overall health and trends, enabling investors to make informed decisions without being swamped by the details of individual stocks.

My strategy often involves leaning on these indices, for they distill the essence of market movements into digestible figures. Whether it's the buoyant rise of NASDAQ reflecting tech sector vigor, or the steady hum of the S&P 500 revealing broader economic shifts, these numbers are not just cold data; they are the pulse of markets, vital for anticipating changes and sculpting a resilient portfolio.

Different Sectors and Industries Within the Market

Peering into the vast cosmos of the stock market, one discovers a mosaic of sectors and industries, each with its unique characteristics and potential for profit. These sectors, like distinct ecosystems within a larger biosphere, range from technology and healthcare to finance and consumer goods, each responding differently to economic climates and market trends:

SectorCharacteristicsPotential for ProfitTechnologyHighly volatile but with significant growth potential.HighHealthcareDefensive with steady demand, but subject to regulatory risks.Medium to HighFinanceSensitive to interest rates and economic cycles.MediumConsumer GoodsTypically stable with consistent demand, yet with lower growth.Low to Medium

This vibrant palette of sectors offers investors a pathway to diversify their portfolios, mitigating risk while capturing opportunities for growth across the economic spectrum. Understanding these differences is akin to an artist selecting the right colors to create a masterpiece: It involves both intuition and a deep knowledge of each sector's nuances.

Now that we've demystified the stock market's enigmatic dance, let's embark on an adventure into the world of investing. Grab your financial compass; it's time to chart a course through the thrilling landscape of stocks, a journey tailored for beginners.

How to Start Investing in Stocks: A Beginners Guide

Embarking on the mission to make money in shares begins with choosing the right brokerage account, a decision that stands as the foundation of your investment journey.

Just as a sculptor selects the perfect chisel to bring their vision to life, this step requires meticulous consideration, ensuring the tools at your disposal align with your financial objectives and risk appetite.

My journey through the meticulous selection of stocks, illuminated by the beacon of research and analysis, has taught me the art of weaving together a portfolio that not only mirrors my ambitions but also stands resilient against the stormy seas of market volatility.

With the architecture of my investment blueprint in mind, the moment to set up my first stock purchase was a rite of passage, marking my initiation into the world of investing.

Each of these steps, crucial in their own right, are interwoven into the tapestry of investment success, guiding beginners like me toward the path of achieving our financial aspirations.

Choosing the Right Brokerage Account

Navigating the sea of brokerage options is the first crucial step on my investing voyage, much like selecting the suitable sail for a ship setting off into the unknown. The right brokerage account acts as a gateway to the stock market, enabling me to buy and sell shares with ease. It's essential I choose one that aligns with my financial goals, offers a user-friendly interface, and educates me with comprehensive market research.

My decision on a brokerage was influenced heavily by the consideration of fees and the range of services provided. I sought a partner in my financial journey that wouldn't erode my earnings with high transaction costs, yet would offer advanced tools for analyzing stock performance. This delicate balance of cost efficiency and resource richness was my North Star, guiding me towards a brokerage that matched my investment temperament and aspirations.

How to Analyze and Select Stocks for Your Portfolio

Analyzing and selecting stocks for my portfolio begins with distilling a sea of data into actionable insight. This involves scrutinizing a company's fundamentals: its financial health, profitability, competitive advantage, and growth potential are akin to the cardinal points guiding my investment decisions.

- Diligently examining the company's financial statements reveals the robustness of its foundation.

- Exploring market trends and industry analyses sharpens my understanding of the competitive landscape.