#RoslandCapital

Explore tagged Tumblr posts

Text

Is Rosland Capital a good investment?

Rosland Capital is a precious metals dealer based in Los Angeles, California. They have been in business since 2008 and gained popularity through their TV ads featuring William Devane. The company sells gold and silver products to customers. Also, it helps consumers in setting up Gold IRAs. They have a notable collection of IRA-approved coins which you can add to a gold IRA.

Rosland Capital has partnered with Equity Institutional, one of the most reputed IRA custodians in the market. The correct investment portfolio is essential in a world of growing inflation where six out of ten Americans don't know how much money they need to retire. It's a major no-no to leave your golden years to chance. Rosland Capital not only offer tangible assets to support the stability of a retirement account, but they also give priceless consumer education. In this article, we will find out, Is Rosland Capital is a good investment? and a few other details. For a detailed review, check out: Rosland Capital Reviews

What Is Rosland Capital?

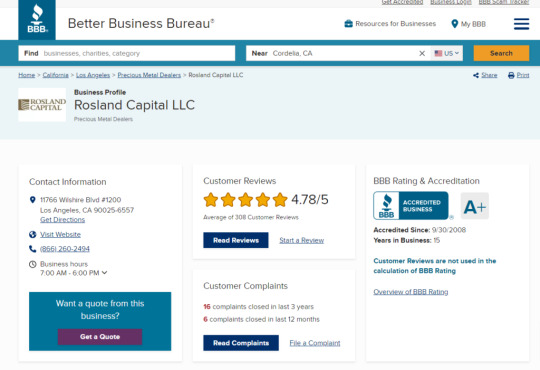

Based in Los Angeles, California, Rosland Capital is a full-service gold IRA and precious metal investing company. They sell gold, silver, and other precious metals in the form of coins, bullion bars, and other items. Their current CEO, Marin Aleksov, founded the company in 2008. Their goal is to assist clients in safeguarding their wealth through investments in material goods like gold and silver. They also offer financial guidance on purchasing actual precious metals in addition to tangible goods. Rosland Capital has earned an exceptional A+ BBB rating and a 4.69 out of 5-star rating, demonstrating its commitment to client satisfaction. The Business Consumer Alliance (BCA), in addition to the Better Business Bureau, has rated them AAA.

The company's physical location and award-winning customer service team enable it to offer personalized help. The customer support staff can address any queries or worries you may have regarding your investments or financial objectives.

Which Products Does Rosland Provide?

Rosland also sells palladium- and platinum-based products in addition to coins and bars of gold and silver. Additionally, they provide storage programs that let clients retain gold and precious metals in a safe vault for safekeeping or utilize them as money overseas if necessary. In addition, they provide IRA accounts for customers seeking tax benefits while investing in precious metals like gold or silver. There are no commission costs or minimum consumer purchase requirements in the process. The business puts a lot of effort into upholding a high standard of customer satisfaction and prides itself on offering investors dependable service and information on investing in precious metals.

The business guarantees quality control, pricing transparency, and security when storing customer capital. Rosland additionally ensures that clients receive the best value for their money by offering competitive pricing on its goods and services. Customers have commented on how helpful email and phone responses have been when they had problems or required assistance with an order, despite the fact that there is no live chat on their website.

Is Rosland Capital a good investment?

Investing in precious metals is a good strategy to diversify a portfolio because they are more reliable than other investments. Rosland Capital is a safe bet for those new to the world of precious metals investing. Rosland offers convenient entry points for investors of all sizes thanks to its wide selection of goods, which includes coins and bars. The business offers inexpensive minimums that begin at just $10,000 and guarantees transparency by avoiding unnecessary fees or hidden charges. A minimum startup charge of $50 and an annual maintenance fee of $100 are required to use Rosland Capital as a precious metals broker.

Notably, all investments in precious metals come with safe storage options that protect assets and offer protection against theft and natural disasters. Depending on the type of storage chosen, storage costs range from $100 to $150.

The Bottom Line

Is Rosland Capital a good investment? YES. Rosland Capital distinguishes itself from other precious metals IRA providers by providing tangible assets that help maintain retirement funds. Additionally, they offer priceless client education regarding purchasing gold and platinum products. They offer platinum bars and gold bullion coins that are perfect for IRA backup. Additionally, they provide collector's coins that can be displayed with pride and used as conversation pieces. Rosland Capital is certain to have something for everyone who wants precious metals in a safe IRA thanks to its wide range of products and competent customer care personnel. Investing in precious metals can seem difficult. To help you find the best precious metals provider, we have created our top gold IRA companies list. You can check it out to see what the industry’s best has to offer. On the other hand, you can also check out the top provider of your state below: Read the full article

0 notes

Text

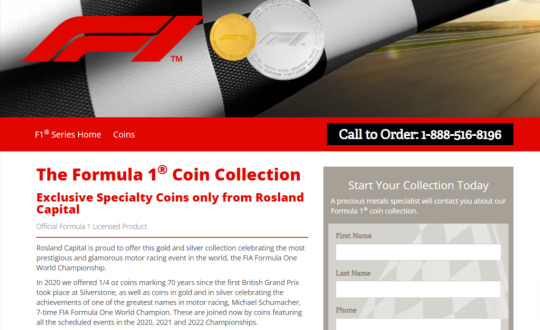

Rosland Capital Formula 1

Rosland Capital Group, a Los Angeles-based precious metals company, has introduced a new line of gold and silver coins that Formula One World Championship Limited has authorized. In partnership with Stunt & Co. Ltd., Collaborating with the world's license holders, Stunt & Co. Ltd., Rosland Capital Group has taken part in creating these limited edition coins, which the renowned coin manufacturer PAMP S.A. in Switzerland is producing.

The Rosland Capital Group will distribute the collection of legal tender-proof coins in the US and the UK. They come in one-quarter and two-and-a-half-ounce sizes. Stunt & Co. Ltd. These Formula 1® collector coins have an exclusive license by Stunt & Co. Ltd., designating Rosland Capital Group as the sole distributor. However, The coins showcase various designs and packaging to commemorate key races and events in the Formula 1® calendar, offering fans a unique way to celebrate the sport's history. For detailed information, check out: Rosland Capital Reviews

Rosland Capital Formula 1: Gold and Silver Coin Collection

Each coin in Rosland Capital Group's recently launched Formula 1® gold and silver coin collection features a stylized representation of a Formula 1® car, the competition's name, and the official Formula 1® emblem. The obverse side of the coin, designed by Ian Rank-Broadley, displays the image of Queen Elizabeth II and the coin's legal tender value. Notably, starting from June 15, the sale of coins commemorating the British Grand PrixTM, scheduled for July 8–10, will commence.

Coins weighing two and a half ounces of gold and silver stand out in particular. Concentric circles around the coin's edge list the 2016 Formula One calendar, with the design's primary focus being the official Formula One emblem. The obverse side of the coin once more displays Ian Rank-Broadley's picture of Queen Elizabeth II and its face value.

Marin Aleksov, CEO of Rosland Capital, expressed his gratitude for working with Stunt & Co. on this project. He emphasized that these coins hold value as prized souvenirs for both coin collectors and Formula One fans, serving as celebratory items for races as well. Therefore, The beautifully sculpted coins in the collection provide a vivid illustration of the lengthy histories of these races.

About Formula 1®

Established in 1950, Formula 1® is the world's top motor racing event. It is known for its prestige and is regarded as the most-watched yearly athletic series globally. The event attracted a staggering audience in 2015 alone, surpassing 400 million unique television viewers from more than 200 different countries.

However, The annual FIA Formula One World Championship for the year 2016 took place between March and November and included 21 events spread out over 21 nations on five continents. Formula One World Championship Limited, a member of the Formula One group and a company founded by CEO Bernie Ecclestone is in charge of this business. The prestigious FIA Formula One World Championship is the sole commercial property of this organization. Anyone interested in learning more about Formula 1® can visit the official website at www.formula1.com for thorough information and updates.

Regarding Stunt & Co.

Insanity & Co. Ltd. is a family-run precious metals company situated in the UK. For its investor clientele, the business buys, refines, and sells the finest bullion and precious metals. Formula One World Championship Limited has granted the worldwide license for precious metal coins to Stunt & Co.

The Bottom Line

Each coin elegantly features a stylized representation of a Formula 1® car, the event's name, and the official Formula 1® emblem. Therefore, planning to invest in Rosland Capital Formula 1 is a good choice. Investing in precious metals can seem difficult. To help you find the best precious metals provider, we have created our top gold IRA companies list. You can check it out to see what the industry’s best has to offer. On the other hand, you can also check out the top provider of your state below: Read the full article

0 notes

Text

Rosland Capital Customer Review

Rosland Capital, located in Los Angeles, California, is a full-service gold IRA and precious metal investing organisation. The company, founded in 2008 by CEO Marin Aleksov, specialises in selling gold, silver, and other precious metal coins and bullion bars.

They provide secure storage options and individualised portfolio diversification advice to investors who prefer not to keep their actual assets at home. Because of its track record and reputation, Rosland Capital is a popular alternative for many people looking to invest in precious metals. Purchasing precious metals is one common method to diversify investment portfolios. Gold and other precious metals have a reputation for retaining their value longer than other types of investments, making them an appealing option for investors seeking to preserve their wealth and find security. In this article, we will look into Rosland Capital Customer Review, services & more. For detailed information, check out Rosland Capital Reviews

Rosland Capital Products

The procedure can be scary for people who have never invested in precious metals. Rosland Capital steps in as a trustworthy and dependable partner in this situation. As a dealer in precious metals, Rosland Capital provides a wide range of goods, giving investors several choices to fit their preferences and financial objectives.

Rosland Capital caters to investors with a range of investment goals and sizes. Rosland Capital offers coins and bars for buyers of both kinds of investments. With many of their products having low minimums starting at just $10,000, investors may add precious metals to their portfolios without having to spend a fortune.

Transparent Pricing and No Additional Charges

Rosland Capital transparently prices investments in precious metals, ensuring there are no additional fees or extra costs. The only costs incurred by investors are a $50 basic setup fee and a $100 yearly maintenance fee. This clear fee structure ensures that investors have a complete awareness of the costs linked to their investments and enables them to make educated decisions about their investments. Depending on the kind selected, Rosland Capital's storage fees for precious metals range from $100 to $150. These fees pay for the costs of operating safe storage facilities and offering insurance protection, guaranteeing the security of investors' assets. Transparency is Important

Insurance and Safe Storage

One benefit offered by Rosland Capital is the availability of safe storage for all investments in gold and precious metals. Investors can trust that their valuable assets are being safeguarded, alleviating any worries about storage or security. A further layer of security and peace of mind is provided by this storage option's insurance coverage, which guards investments against potential threats like theft and natural disasters.

Rosland Capital Customer Review

There are many Rosland Capital customer review and responses from customers and rating platforms based on different rankings, grievances, and customer reviews from different platforms. - Rosland Capital has an A+ rating from the Better Business Bureau (BBB), which denotes satisfactory levels of customer service and complaint resolution. However, there have been 18 complaints, with most of them revolving around issues with goods and services.

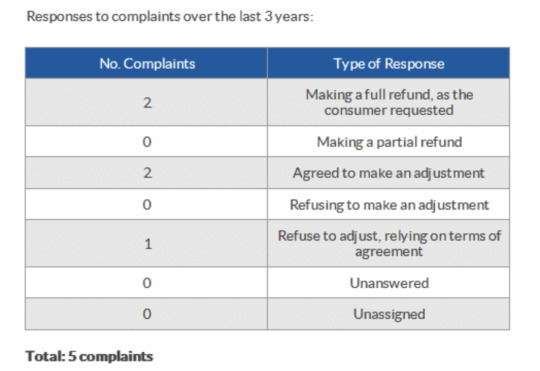

- The Business Consumer Alliance (BCA) regards Rosland Capital's AAA rating as acceptable. However, the company has received 5 complaints, the majority of them related to the undervaluation of client holdings.

- Based on user ratings, Rosland Capital has a 4 out of 5-star rating according to TrustLink. However, numerous complaints have been made concerning the business's sale of expensive coins to its consumers. Resulting in a general consensus among those customers to avoid doing business with them.

Since 2010, Rosland Capital has been the subject of 6 complaints on the Ripoff Report. These accusations emphasize the company's use of dishonest business practices to market overpriced coins at unreasonably high commission rates.

- While Rosland Capital has gotten some favourable customer evaluations. The data shows that there are also a sizable amount of complaints and unfavourable comments alleging overcharging and dishonest business practices. Customers should use caution and do their homework before making any purchases or financial decisions. Just like with any other investment. To have a thorough grasp of the business's reputation and offerings. It is advisable to speak with financial advisors and study evaluations from a variety of sources.

The Bottom Line

For investors wishing to diversify their portfolios and protect their money with physical assets. Rosland Capital provides a diversified and secure approach to precious metal investing. Rosland Capital offers a complete solution for people interested in learning more about the world of precious metal investments. With open pricing, a large selection of products, and dependable storage and insurance solutions. Investing in precious metals can seem difficult. To help you find the best precious metals provider, we have created our top gold IRA companies list. You can check it out to see what the industry’s best has to offer. On the other hand, you can also check out the top provider of your state below: Read the full article

0 notes

Text

Rosland Capital Customer Review

Rosland Capital, located in Los Angeles, California, is a full-service gold IRA and precious metal investing organisation. The company, founded in 2008 by CEO Marin Aleksov, specialises in selling gold, silver, and other precious metal coins and bullion bars.

They provide secure storage options and individualised portfolio diversification advice to investors who prefer not to keep their actual assets at home. Because of its track record and reputation, Rosland Capital is a popular alternative for many people looking to invest in precious metals. Purchasing precious metals is one common method to diversify investment portfolios. Gold and other precious metals have a reputation for retaining their value longer than other types of investments, making them an appealing option for investors seeking to preserve their wealth and find security. In this article, we will look into Rosland Capital Customer Review, services & more. For detailed information, check out Rosland Capital Reviews

Rosland Capital Products

The procedure can be scary for people who have never invested in precious metals. Rosland Capital steps in as a trustworthy and dependable partner in this situation. As a dealer in precious metals, Rosland Capital provides a wide range of goods, giving investors several choices to fit their preferences and financial objectives.

Rosland Capital caters to investors with a range of investment goals and sizes. Rosland Capital offers coins and bars for buyers of both kinds of investments. With many of their products having low minimums starting at just $10,000, investors may add precious metals to their portfolios without having to spend a fortune.

Transparent Pricing and No Additional Charges

Rosland Capital transparently prices investments in precious metals, ensuring there are no additional fees or extra costs. The only costs incurred by investors are a $50 basic setup fee and a $100 yearly maintenance fee. This clear fee structure ensures that investors have a complete awareness of the costs linked to their investments and enables them to make educated decisions about their investments. Depending on the kind selected, Rosland Capital's storage fees for precious metals range from $100 to $150. These fees pay for the costs of operating safe storage facilities and offering insurance protection, guaranteeing the security of investors' assets. Transparency is Important

Insurance and Safe Storage

One benefit offered by Rosland Capital is the availability of safe storage for all investments in gold and precious metals. Investors can trust that their valuable assets are being safeguarded, alleviating any worries about storage or security. A further layer of security and peace of mind is provided by this storage option's insurance coverage, which guards investments against potential threats like theft and natural disasters.

Rosland Capital Customer Review

There are many Rosland Capital customer review and responses from customers and rating platforms based on different rankings, grievances, and customer reviews from different platforms. - Rosland Capital has an A+ rating from the Better Business Bureau (BBB), which denotes satisfactory levels of customer service and complaint resolution. However, there have been 18 complaints, with most of them revolving around issues with goods and services.

- The Business Consumer Alliance (BCA) regards Rosland Capital's AAA rating as acceptable. However, the company has received 5 complaints, the majority of them related to the undervaluation of client holdings.

- Based on user ratings, Rosland Capital has a 4 out of 5-star rating according to TrustLink. However, numerous complaints have been made concerning the business's sale of expensive coins to its consumers. Resulting in a general consensus among those customers to avoid doing business with them.

Since 2010, Rosland Capital has been the subject of 6 complaints on the Ripoff Report. These accusations emphasize the company's use of dishonest business practices to market overpriced coins at unreasonably high commission rates.

- While Rosland Capital has gotten some favourable customer evaluations. The data shows that there are also a sizable amount of complaints and unfavourable comments alleging overcharging and dishonest business practices. Customers should use caution and do their homework before making any purchases or financial decisions. Just like with any other investment. To have a thorough grasp of the business's reputation and offerings. It is advisable to speak with financial advisors and study evaluations from a variety of sources.

The Bottom Line

For investors wishing to diversify their portfolios and protect their money with physical assets. Rosland Capital provides a diversified and secure approach to precious metal investing. Rosland Capital offers a complete solution for people interested in learning more about the world of precious metal investments. With open pricing, a large selection of products, and dependable storage and insurance solutions. Investing in precious metals can seem difficult. To help you find the best precious metals provider, we have created our top gold IRA companies list. You can check it out to see what the industry’s best has to offer. On the other hand, you can also check out the top provider of your state below: Read the full article

0 notes

Text

Rosland Capital Ltd

Rosland Capital Ltd located in Los Angeles, California, is a full-service gold IRA and precious metal investing organization. The company, founded in 2008 by CEO Marin Aleksov, specializes in selling gold, silver, and other precious metal coins and bullion bars.

The organization centres its core values on providing top-notch goods, services, and information. Along with its headquarters in Los Angeles, California, the company has expanded abroad and now has offices in the UK, Germany, and Hong Kong. For more detailed information, check out, Rosland Capital Reviews

Rosland Capital Ltd: Products

The business sells a variety of precious metals as bullion, bars, and premium coins. The government offers these coins in platinum, palladium, silver, gold, and other precious metals. In order to supply pure fine silver and gold bars, bullion, and premium coins, Rosland has been collaborating with a number of organizations, including the USA Mint, Canadian Mint, PAMP, and many more reputable organizations.

Rosland Capital Ltd also works with numerous organizations to provide special coin lines honoring groups, occasions, and charitable endeavors. In collaboration with Fisher House, they created the $5 Fisher House coin, which became available in 2014. They used a percentage of the profits to support the service personnel receiving medical care and the veterans' families. The business continues to be Formula 1 Coin Collection's sole distributor. The coins honour Formula 1 racers, events, and track layouts. You can purchase the given silver and gold coins for the Grand Prix and the 2017 circuit if you wish to commemorate the important motor vehicle racing events. Rosland Capital Ltd created a coin in collaboration with Senna Institute to honor Ayrton Senna's career for anyone who wishes to do so. The collaboration's earnings go towards the foundation's operations and provide care for Brazilian youngsters. Rosland Capital Ltd worked with the Williams Racing team to create gold and silver coins to commemorate their 40th anniversary. Transparency is Important

Rosland Capital Gold IRA

Rosland Capital offers various IRAs supported by precious metals. The company backs the self-directed retirement account, which takes the form of an IRA, with actual gold, silver, and other metals. Many people are utilizing government-approved precious metal IRAs to set aside money for the future. You may protect your assets during uncertain times by diversifying your retirement portfolio with silver and gold. This way, you can escape currency depreciation and stock market volatility. Similar advantages to standard IRAs are provided by the precious metals-backed IRA, which also shields you from inflation. Due to the increasing demand for gold and silver, experts anticipate that the value will rise over time. The decline in the value of paper assets is believed to have caused many people to lose a significant percentage of their money during the Great Recession. With precious metal-backed IRAs, that is unlikely to happen because the metals maintain their value and paper cannot replace their security if the economy declines. Your retirement money will be secure if you diversify your assets.

Conclusion

People who want to diversify their retirement portfolio should consider Rosland Capital. The business's established reputation, outstanding client reviews, industry accreditation, and friendly staff all attest to its legitimacy. High-quality coins, first-rate services, and round-the-clock customer support are all available. Rosland Capital, which was founded in 2008, offers timely delivery and has a weekly written by an economist to help investors understand current developments. In particular, their administrative costs are rather high, and their advisors might advise numismatic coins instead of more reliable choices like bullion. Some of their advertisements could be interpreted incorrectly or misleadingly. To avoid any misconceptions, anyone thinking about opening a precious metal IRA account with Rosland Capital Ltd should carefully investigate and evaluate the company's policies. Investing in precious metals can seem difficult. To help you find the best precious metals provider, we have created our top gold IRA companies list. You can check it out to see what the industry’s best has to offer. On the other hand, you can also check out the top provider of your state below: Read the full article

0 notes

Text

Rosland Capital Silver

Rosland Capital, located in Los Angeles, California, is a full-service gold IRA and precious metal investing organisation. The company, founded in 2008 by CEO Marin Aleksov, specialises in selling gold, silver, and other precious metal coins and bullion bars.

The organization centres its core values on providing top-notch goods, services, and information. Along with its headquarters in Los Angeles, California, the company has expanded abroad and now has offices in the UK, Germany, and Hong Kong. In this article, we will look into Rosland Capital silver products as well as a few other important details. For more detailed information, check out, Rosland Capital Reviews

Rosland Capital Silver: Why Purchase Silver in Addition to Gold?

Adding silver to your investing portfolio brings specific benefits, especially when including gold. Silver has a unique dual purpose as a commodity used in industry and as a collectible. With industrial uses sustaining their worth even if collectible interest declines, this duality provides a wider base of demand. Transparency is Important The high conductivity of silver is essential for producing electronics, where it finds use in a variety of products such as circuit boards, solar panels, batteries, and more. This industrial need gives silver's value a consistent foundation.

In addition to coins, silver is also available as bars, rounds, bullion, and other forms. Due to their portability and liquidity, coins are a common choice. These government-minted coins possess the status of negotiable currency and gain acceptance as legal tender worldwide. In addition, silver is reasonably priced, making a wider spectrum of investors able to purchase it. Owning silver in addition to gold helps you diversify your assets by utilizing its dual appeal and industrial relevance and by providing a liquid asset in times of need.

Rosland Capital Silver: The historical market value of Silver

The most recent spot price record for silver was $35.12 in 2011, and like all precious metals, its value has varied widely over the past century. For instance, the spot price of silver was only $4.95 per ounce in the year 2000, but by 2008 it had risen to $14.99. Silver's price has dropped since peaking above the $35 mark in 2011, but it has stayed quite stable since then in the range of $22-28.

Like all precious metals, silver's spot price changes in response to supply and demand. Unquestionably, the fact that the globe had recently experienced a serious financial crisis and that many individuals wanted to buy silver as a hedge against probable loss was one factor that contributed to the sharp increase in silver prices between 2009 and 2011. Coincidentally, around 2011, there was a significant increase in industrial demand for silver, which contributed to the spot price rising to previously unheard-of levels. The spot price for silver fell once the global economy stabilized and the rise in industrial demand for silver subsided, and it has been hovering around this level for a while.

Conclusion

A potentially wise strategy to protect assets against probable local or global economic downturns is by investing in silver. That makes it a practice that is worth thinking about for just about anyone, even if you don't have a lot of money to spend on silver. You should be aware of a number of factors before actually purchasing silver, starting with why it could be worthwhile to do so. The ideal location to acquire silver should also be determined after you have decided what kind of silver to buy and how to go about doing it. After reading the information below, you should have a better understanding of these factors and be slightly more equipped to make wise silver purchases that will diversify your holdings. Investing in precious metals can seem difficult. To help you find the best precious metals provider, we have created our top gold IRA companies list. You can check it out to see what the industry’s best has to offer. On the other hand, you can also check out the top provider of your state below: Read the full article

0 notes

Text

Rosland Capital Gold

Rosland Capital, located in Los Angeles, California, is a full-service gold IRA and precious metal investing organization. The company, founded in 2008 by CEO Marin Aleksov, specializes in selling gold, silver, and other precious metal coins and bullion bars.

The organization's main tenets revolve around offering high-quality products, services, and information. In addition to its headquarters in Los Angeles, California, the firm has expanded globally, with offices in the United Kingdom, Germany, and Hong Kong. In this article, we will look into Rosland Capital gold products and other details. For more detailed information, check out: Rosland Capital Reviews

Rosland Capital Gold Products

Rosland Capital provides a wide variety of precious metal goods in different forms, including: - Bars and Bullions: From reputable firms like the Canadian Mint, USA Mint, and PAMP, they offer genuine quality bars of silver, gold, palladium, and platinum.

- High-end coins: In order to provide special coin lines, including commemorative coins for organizations, events, and charities, Rosland works with reputable organizations. A couple of notable examples include the $5 Fisher House coin, which benefits military families, and the Formula 1 Coin Collection, which honors Formula 1 drivers, races, and circuits. - Special Partnerships: To create coins that assist foundations and philanthropic causes, they collaborate with organizations like the Senna Institute and the Williams Racing team. Transparency is Important

The Historically Rising Price of Gold

Since President Nixon decided to end the gold standard in 1971, the cost of gold has increased at a historically unprecedented rate. By December 2021, gold's price had risen from its initial $35 per ounce valuation to approximately $1800 per Troy ounce. Few assets have had outstanding growth over the previous 50 years.

The long-term worth of gold is a major draw, even though future increases may not approach this quick pace. Gold has shown consistency and dependability amidst economic ups and downs, making it a wise choice for investment portfolios. Gold has established itself as a dependable asset deserving of consideration for investors due to its ability to hold value even in challenging economic circumstances. https://youtu.be/7WxgqK3-5Dw

Why Buy Gold?

One thing has stayed true regardless of the state of the economy: gold will always have some value. Since the first Egyptian dynasty, people have regarded gold as precious for its beauty and intrinsic value. Even today, more than 5,000 years later, many people still trust gold. One of the most valuable commodities in the world, gold, has endured the test of time. Tons of gold have been bought by developing nations including Brazil, China, Russia, South Korea, India, and Mexico. Why? A country's wealth has long been safeguarded and preserved by gold; this is also true for individuals with assets, who include gold for the same reasons.

By controlling the risk associated with your asset holdings and using gold to help balance out intrinsically unstable paper assets and currencies, diversification can help you plan for the future of your family. Security could help you safeguard your investments and be ready for when the economy changes and the market becomes unstable.

The Bottom Line

If someone wants to add precious metals to their retirement portfolios as a way to diversify them, Rosland Capital can be a reliable investment partner. They provide a variety of precious metal products and services and have a history of providing high-quality service and happy customers. Potential investors should carefully study the recommendations made by representatives and be aware of the administration costs. Ensuring a successful investing experience with Rosland Capital involves conducting in-depth due diligence and comprehending its policies. Investing in precious metals can seem difficult. To help you find the best precious metals provider, we have created our top gold IRA companies list. You can check it out to see what the industry’s best has to offer. On the other hand, you can also check out the top provider of your state below: Read the full article

0 notes

Text

Rosland Capital Gold Price

Rosland Capital is a precious metals dealer based in Los Angeles, California. They have been in business since 2008 and gained popularity through their TV ads featuring William Devane.

As a trustworthy repository of wealth, particularly in unsteady times, gold has endured the test of time. The "gold standard" actually rested on a foundation of material worth, which is arguably the same reliable value that gold, silver, platinum, and palladium continue to have today. Rosland Capital has the knowledge to guide you in selecting precious metals products and accumulating a wide portfolio of assets. We will assist you in becoming more informed about the possibility of increasing your holdings, purchasing coins, and acquiring other precious metal items. For detailed information, check out: Rosland Capital Reviews

Rosland Capital Gold Price: Rising Price of Gold

When President Nixon officially pulled the United States from the gold standard and implemented the fiat financial system in 1971, one ounce of pure gold cost only $35. In the 50 years since then, the price of gold has risen to more than $1800 a Troy ounce as of December 2021. What other asset classes come to mind that have expanded so dramatically in the last 50 years?

By December 2021, the price of gold will have increased significantly over the previous 50 years, reaching over $1800 per Troy ounce. This remarkable increase prompts the consideration of other asset types that have experienced such significant gains over a 50-year period. While many assets, such as real estate, particular equities, and cryptocurrencies, have experienced tremendous rises, the distinctiveness of gold's price trend stands out. Contrary to some investments that can be influenced by specific industries, technology, or market trends, a number of variables, including economic conditions, geopolitical events, inflation fears, and generalized uncertainty, influence the value of gold. This robust basis helps explain gold's ongoing appeal and potential for value appreciation. When the economy is unstable or uncertain, people frequently seek gold due to its long history of serving as a store of value. Its apparent dependability and stability are what make it attractive. Gold's price growth during the past 50 years may not have been as quick, but given its previous performance, it is possible that its worth will endure despite uncertain economic conditions, market swings, and geopolitical uncertainties. Because of its exceptional resilience to economic shocks. However, people view gold as a reliable asset that can add security and stability to a portfolio of investments. Gold has frequently shown resiliency in situations where traditional currencies may devalue. As economies may endure downturns, geopolitical conflicts may emerge. It can serve as a safeguard against currency swings and a haven during emergencies. Due to its exceptional resilience to economic shocks, investors consider gold a reliable asset. As it can enhance the security and stability of an investment portfolio.

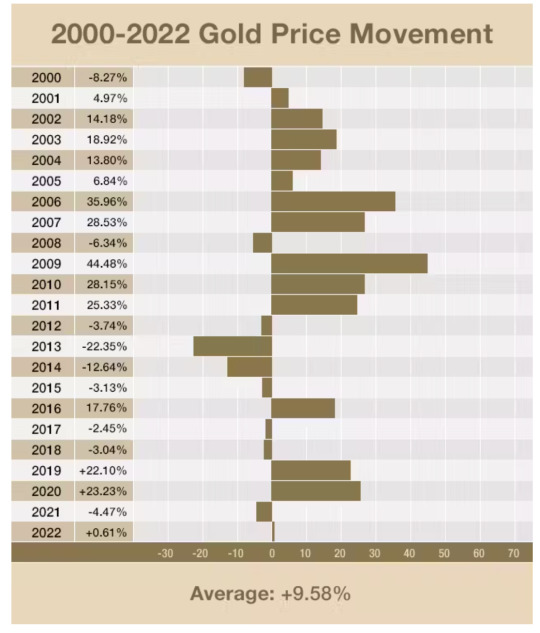

Rosland Capital Gold Price: Changes in Gold Prices from 2000 to 2022

The chart below displays the annual growth or drop in the price of gold. As well as the average rate of growth. (Source: Industry Data as of December 25, 22)

Rosland Capital Gold Price: Conclusion

Rosland Capital Gold Price has a long history of protecting wealth. Therefore, it is making it a good option for investors looking for security, diversity, and possible long-term growth. Investing in precious metals can seem difficult. To help you find the best precious metals provider, we have created our top gold IRA companies list. You can check it out to see what the industry’s best has to offer. On the other hand, you can also check out the top provider of your state below: Read the full article

0 notes

Text

Rosland Capital UK

Rosland Capital UK provides physical forms of gold, silver, platinum, and palladium for direct delivery and inclusion in IRAs backed by precious metals. The company aims to educate the public about the possible benefits of owning and employing precious metals in order to diversify a person's assets. Rosland Capital is rated AAA by the Business Consumer Alliance and A+ by the Better Business Bureau.

Marin Aleksov founded the company in Los Angeles in 2008 after working in the precious metals market for 20 years. Aleksov has been the company's CEO for the past 15 years and continues to be so. Aleksov worked for Rosland and wrote "The Rosland Capital UK Guide to Gold," disseminated free numismatic kits and guides to the general public, and negotiated exclusive coin series with well-known household brands such as the PGA TOUR® and F1®. For detailed information, check out: Rosland Capital Reviews

Rosland Capital UK: Products And Investments

The written and visual content on the Rosland Capital UK website is of the highest calibre. Because many of Rosland UK's products are unique, their catalogue pages include stunning, high-resolution photographs and in-depth descriptions to provide potential customers with the most possible insight into investments before making a purchase.

Aside from the news and blog pieces, other site areas like the investing guidelines, general precious metals guidance, and FAQs are thorough without being overbearing. For people who prefer reading tangible books for their knowledge, "The Rosland Book of Gold" is well recognized for its practical, understandable information and is free to obtain by phoning 0800 902 0000. Transparency is Important

How Functional Is The Rosland Capital UK Website?

The Rosland Capital UK website is exceedingly simple to use with very obvious navigational and informational signage. Due to the site's full responsiveness, placement and menu design scale down. When the screen size decreases, making it equally easy to use on a computer as it is on a phone. Large, sharp images with searchable information and illustrative text are provided.

Text is large and easy to see, with links typically in dark gold. There is an excellent contrast between dark grey text and white or light grey backgrounds. When text covers a picture, the image usually experiences noticeable darkening, with white writing overlaying it. The site adeptly handles scaling even when in-browser size controls are enabled. Legal information, disclaimers, and FAQs are all readily available and presented in simple, understandable language. The extensive site footer contains all contact and business information.

Reviews by outside parties of Rosland Capital UK

Due to the magnitude of Rosland's US presence and how search engines operate. The majority of reviews are for the US company. Nevertheless, those found on UK-specific websites are typically quite favorable, praising the company's strong customer service standards and ease of dealing.

The Bottom Line

Rosland Capital UK offers accessible platforms, knowledgeable leadership, and a dedication to excellence, making it a reliable partner in the precious metals industry. Rosland Capital allows people to learn about and engage with the potential benefits of precious metal investing through their products and educational tools. Investing in precious metals can seem difficult. To help you find the best precious metals provider, we have created our top gold IRA companies list. You can check it out to see what the industry’s best has to offer. On the other hand, you can also check out the top provider of your state below: Read the full article

0 notes