#Robinhood IPO

Explore tagged Tumblr posts

Text

Trading platform eToro is said to be eyeing a $5B US IPO in 2025.

Trading platform eToro The company is privately filing for a US IPO, which could value it at more than $5 billion, according to the Financial Times. reported. Thursday. Israel-based eToro, which competes with the likes of Robinhood, told TechCrunch that it is not commenting on IPO rumors. The fintech initially announced plans to go public through a SPAC. It is valued at $10.4 billion. In 2021,…

0 notes

Text

Trading platform eToro is said to be eyeing a $5B US IPO in 2025.

Trading platform eToro The company is privately filing for a US IPO, which could value it at more than $5 billion, according to the Financial Times. reported. Thursday. Israel-based eToro, which competes with the likes of Robinhood, told TechCrunch that it is not commenting on IPO rumors. The fintech initially announced plans to go public through a SPAC. It is valued at $10.4 billion. In 2021,…

0 notes

Text

Trading platform eToro is said to be eyeing a $5B US IPO in 2025.

Trading platform eToro The company is privately filing for a US IPO, which could value it at more than $5 billion, according to the Financial Times. reported. Thursday. Israel-based eToro, which competes with the likes of Robinhood, told TechCrunch that it is not commenting on IPO rumors. The fintech initially announced plans to go public through a SPAC. It is valued at $10.4 billion. In 2021,…

0 notes

Text

Trading platform eToro said to be eyeing $5B US IPO in 2025 | masr356.com

Trading platform eToro It has secretly filed for an initial public offering in the United States that could value the company at more than $5 billion, the Financial Times reports. I mentioned Thursday. Israel-based eToro, which competes with the likes of Robinhood, told TechCrunch that it “does not comment on IPO rumours.” The fintech company initially announced plans to go public via a SPAC in…

0 notes

Quote

2021年は、比較的多くのテクノロジー企業が株式市場に上場したため、株式公開にとって傑出した年でした。 その年にどれだけの IPO があったかを知るために、注目すべきものをいくつか挙げてみましょう。 GitLab (バージョン管理)、Rivian (電気自動車)、Couchbase (NoSQL データベース)、Affirm (後払い)、Bumble (出会い系)、Duolingo (語学学習)、Robinhood (トレーディング)、Expensify (経費精算)、Nubank (フィンテック)、Roblox (ゲーム)、Coinbase (暗号通貨)、Squarespace (ドメイン)、Coupang (e コマース)、DigitalOcean (ホスティング)、Toast (レストラン テクノロジー)、Coursera (教育テクノロジー)、Udemy (教育テクノロジー)、Amplitude (分析)、AppLovin (モバイル分析)、UiPath (自動化)、Monday.com (プロジェクト管理)、Confluent (データ ストリーミング)、Didi Chuxing (ライドシェア)、Outbrain (広告)、Nerdwallet (個人金融) 比較すると、2022年にはテクノロジー分野のIPOはまったくゼロで、2023年には3件(ARM、Instacart、Klaviyo)しかありませんでした。

古いものが再び新しくなる - ゲルゲリー・オロス

0 notes

Text

Cathie Wood’s Ark Invest Trims Holdings in Chipmakers, Coinbase, and Robinhood

Ark Invest, the investment firm led by renowned investor Cathie Wood, has made significant adjustments to its portfolio by trimming holdings in chipmakers, Coinbase, and Robinhood. This strategic move reflects Ark's dynamic approach to portfolio management and its response to evolving market conditions and investment opportunities.

Chipmakers have long been a core component of Ark Invest's investment thesis, given their crucial role in powering technological innovation across various industries. However, recent supply chain disruptions and semiconductor shortages have prompted Ark to reduce its exposure to chipmakers in its portfolio. By trimming holdings in chipmakers, Ark seeks to mitigate risks associated with supply chain constraints while reallocating capital to sectors with more favorable growth prospects.

Additionally, Ark Invest has adjusted its holdings in Coinbase, the leading cryptocurrency exchange, and Robinhood, a popular trading platform. Both Coinbase and Robinhood have experienced significant volatility in their stock prices since their respective initial public offerings (IPOs), prompting Ark to reassess their long-term growth potential. While Ark remains optimistic about the future of cryptocurrency and fintech, it has opted to reduce its exposure to Coinbase and Robinhood in response to market dynamics and competitive pressures.

Ark's decision to trim holdings in chipmakers, Coinbase, and Robinhood underscores its commitment to active portfolio management and risk mitigation. As a firm known for its disruptive investment strategies and high-conviction bets on innovation, Ark continuously evaluates market trends and adjusts its portfolio accordingly to capitalize on emerging opportunities and manage downside risks.

Moreover, Ark's portfolio adjustments reflect its confidence in its ability to identify and capitalize on secular trends driving long-term growth. While short-term fluctuations in stock prices and market sentiment may influence Ark's investment decisions, its investment philosophy remains grounded in identifying disruptive technologies and visionary companies poised to reshape industries and create long-term value for investors.

Despite trimming holdings in chipmakers, Coinbase, and Robinhood, Ark Invest maintains a diversified portfolio of high-growth stocks across various sectors, including genomics, robotics, artificial intelligence, and fintech. Ark's commitment to innovation and its focus on long-term value creation position it well to navigate market volatility and capitalize on emerging investment opportunities in the ever-changing landscape of technology and finance.

In conclusion, Ark Invest's decision to trim holdings in chipmakers, Coinbase, and Robinhood reflects its proactive approach to portfolio management and its commitment to optimizing risk-adjusted returns for investors. As Ark continues to adapt to evolving market conditions and identify disruptive investment opportunities, its innovative investment strategies and forward-thinking approach are likely to remain key drivers of its success in the years to come.

0 notes

Text

The Top Fintech Companies in the USA: A Comprehensive Overview for 2024

In today's rapidly evolving financial landscape, fintech companies play a pivotal role in reshaping traditional banking and financial services. With the fintech industry continuously growing, it's crucial to stay informed about the key players dominating the market. In this article, we'll delve into the largest fintech companies in the US, shedding light on their innovative solutions, market dominance, and impact on the financial sector.

Stripe

Founded in 2010 by Irish entrepreneurs Patrick and John Collison, Stripe has emerged as one of the leading payment processing platforms globally. Its user-friendly interface and robust infrastructure make it a top choice for businesses of all sizes, from startups to Fortune 500 companies. With a focus on enhancing online payment experiences, Stripe has revolutionized e-commerce and enabled seamless transactions across borders.

Robinhood

Robinhood has disrupted the traditional brokerage industry with its commission-free trading platform, democratizing access to financial markets for millions of users. Launched in 2013, the platform gained immense popularity among millennials and novice investors due to its simplicity and accessibility. Despite facing regulatory challenges and controversies, Robinhood continues to expand its suite of financial products and services, including cryptocurrency trading and cash management accounts.

Square

Square, founded by Twitter CEO Jack Dorsey in 2009, initially gained traction with its point-of-sale systems for small businesses. Over the years, the company diversified its offerings, introducing Square Cash for peer-to-peer payments and Cash App for personal finance management. With its acquisition of Afterpay, Square has ventured into the burgeoning buy-now-pay-later market, positioning itself as a comprehensive fintech ecosystem catering to diverse financial needs.

PayPal

PayPal remains a dominant force in the fintech industry, providing secure online payment solutions to millions of merchants and consumers worldwide. Since its inception in 1998, PayPal has expanded its services beyond peer-to-peer transactions, offering merchant services, digital wallets, and cryptocurrency capabilities. With the recent launch of PayPal's super app, integrating various financial services into a single platform, the company aims to further solidify its position as a fintech powerhouse.

Coinbase

As the largest cryptocurrency exchange in the United States, Coinbase has played a pivotal role in mainstream adoption of digital assets. Founded in 2012, the platform provides a user-friendly interface for buying, selling, and storing cryptocurrencies, catering to both retail and institutional investors. With the growing interest in digital currencies, Coinbase's IPO in 2021 marked a significant milestone for the cryptocurrency industry, highlighting its potential to reshape global finance.

0 notes

Text

How To Make Money On Robinhood [Complete Guide]

In contrast to traditional stockbrokers, who profit by selling their orders to a high-priced market maker, Robinhood earns interest on cash and assets.

Robinhood trading: Robinhood is a free stock trading app that is sweeping the globe. It's already worth more than $5 billion on paper, just closed another massive round of funding at a valuation of $6 billion or more, and its user base is expanding faster than ever.

But how do you make money using Robinhood? In contrast to traditional stockbrokers, who profit by selling your orders to a high-priced market maker, Robinhood earns interest on the cash and assets in your account.

How to Make Money on Robinhood?

Robinhood provides a variety of financial solutions that can be utilized to earn money. Here are a few examples:

Through Dividends

You will likely pay your dividends with stocks and ETFs purchased on Robinhood. Dividends are normally paid quarterly and are automatically deposited to your account's cash balance.

However, the same dividends can be used to purchase further shares. Robinhood allows you to use this dividend reinvestment function if you have your fractional shares activated. You will earn compound interest on this reinvestment. So you can look for and invest in dividend stocks offered by a company that assures dividend payments.

Asset appreciation

All investors profit by following the general investment idea of "buy low and sell high." This means that you buy a stock or an ETF at a low price and then sell it for a profit later. To profit from asset appreciation, you must have the market on your side. As a result, if the overall market is down, all investments will suffer.

Crypto Investing

Users can also make money by trading in cryptocurrency on Robinhood. Cryptos, on the other hand, allow you to profit from asset appreciation.

Given the volatility of the cryptocurrency market, you are likely to profit. However, it is also possible that it will cost you money. As a result, investments should only be undertaken after extensive investigation.

Robinhood IPO Access

Robinhood allows its users, or regular investors, to invest in IPOs and profit from them. Users can look up which IPOs are available and request the number of shares they want to buy. The rest is analogous to asset appreciation.

Interest on Savings

Robinhood's cash management tool allows consumers to earn interest on their idle cash. The platform allows users to earn interest on their account deposits.

Furthermore, it serves as a one-stop shop for consumers to pay bills, send checks, be paid, and earn interest. Robinhood collaborated with FDIC-insured institutions to develop these features.

How Much Can You Make With Robinhood?

If you had purchased $10,000 in Apple stock when Robinhood first launched in February 2015, it would today be worth $14,360. That's a 56 percent return in around 25 months ($340 each month).

To make more money on Robinhood, you must invest more money. There are a couple of simple ways to accomplish this:

Keep the free money in your account and only pay interest on it. How much is it? Apple now offers a dividend yield of 5%, which implies that the $10,000 investment from above would bring in an extra $500 every year.

Put your money in a bank that pays interest. Ally Bank is arguably the best option here, as their savings account now yields 1.35 percent and offers a $150 sign-up bonus. Their checking account earns interest as well, but you must deposit more than $15,000 into it.

Put part of your money in a high-yielding savings account with a trustworthy bank, such as Barclays or Synchrony Bank. They both pay 1% interest and give a sign-up bonus of up to $200. If I recall properly, the initial transfer is free, but the return transfer is not.

You can do this to put more money into Robinhood and spend the interest you'll earn on it, but there's a catch: due to the way Ally works with external banks, you can't buy stocks with an external bank account. After moving cash into Ally, you must withdraw them from the external bank.

0 notes

Text

Yep - the absurd size of companies like Amazon, Alphabet (Google) and Meta (Facebook/Instagram/Whatsapp) has investors hungry for the next "thing that's going to take over the world". They believe the potential payoff is so huge that they're willing to risk a lot of money on companies that promise big but are obviously unlikely to succeed.

The simple take on this is "what a load of dummies, they're so bad at evaluating just how vanishingly small these chances can be". Unfortunately, that's not quite the full story.

See, even when companies fail the investors can often make a lot of money. They don't actually need things to work out - they just need to sell their stake to someone else who believes enough to pay even more. Broadly, this can often be achieved with IPOs that get the money from retail investors (ie people on robinhood/trading212/etc) - but let's be clear, some retail investors know the game as well and are just hoping someone else will pay even more at a later date.

So, overall, these "moonshot" companies are vehicles for a load of finance people to scam each other. And also as a side effect might get chance to kill a load of so-called "traditional" (or "legacy") competitors in whatever the field is.

782 notes

·

View notes

Text

[ad_1] To get a roundup of TechCrunch’s largest and maximum vital tales delivered on your inbox on a daily basis at 3 p.m. PDT, subscribe right here. Hi and welcome to Day-to-day Crunch for July 19, 2021. Within the outdated days, enterprise capital had seasons. VCs didn’t paintings in December, and the July-August duration can be a bit hazy. Such diversifications have declined. Deal-making, it seems, is now just about the theme for all seasons. Proof? Simply learn what’s beneath! — Alex The TechCrunch Best 3 Rappi raises $500M: The on-demand financial system remains to be scorching world wide, one thing we will know evidently because of Rappi’s newest half-billion-dollar lift. The Colombian transport corporate is now price $5.25 billion. That’s some huge cash. Consistent with Crunchbase information, the unicorn has now raised greater than $2 billion since inception. Rappi operates in 9 international locations and 250 towns throughout Latin The united states. Zoom buys Five9: Smartly, the deal were given introduced a minimum of. It gained’t shut till subsequent yr. However the $14.7 billion transaction has people speaking. It’s a big amount of cash, and it’s the combo of 2 public corporations. Each corporations, after all, are previously venture-backed corporations, and the deal may assist set some pricing notes for different device M&A. TechCrunch has a have a look at the cost of the deal right here. Robinhood and Duolingo set costs for his or her IPOs: If you're into observing the largest tech corporations pass public, you might be in success. We were given recent infusions of information from each Robinhood, the U.S. shopper fintech massive, and Duolingo, the U.S. edtech massive. Experience! Startups/VC Sweetch raises $20M that will help you get off your bottom: When you put on a smartwatch, you’ve gotten notifications from it on the fallacious time. A nudge to stand up and transfer, say, when you find yourself seated at a cafe. Sweetch needs to supply smarter inducements for people to take higher care of themselves, framing it in an effort to “outsmart persistent stipulations.” Given how a lot shall we all do higher at well being, I'm all for how this startup plays. Dover raises $20M to make recruiting extra arranged: Recruiting isn't a really perfect procedure. Most commonly it’s achieved by way of hand, and controlled in spreadsheets, or possibly a device like Lever. However startups suppose that there's more space for growth. Dover is one such corporate, hoping that its device that is helping recruiters “juggle and combination a couple of candidate swimming pools to supply appropriate task applicants robotically, after which organize the method of outreach” is solely the price ticket. And now it has raised from Tiger. Breakr needs to attach musicians and influencers: The times when radio play was once the best way to wreck into the mainstream are firmly at the back of us. Startups like Breakr need to assist musical artists navigate the brand new international by way of connecting them to parents with their very own audiences. Alongside the way in which, Breakr will take a ten% minimize of charges generated from linking the 2 events. Recapped raises $6.3M for higher gross sales device: Corresponding to how Dover needs to assist in making recruiting a smoother procedure, Recapped needs to give a boost to the gross sales procedure, particularly by way of construction device that gives higher visibility into gross sales pipelines and by way of offering consumers with a an identical virtual interface that it supplies to gross sales people. Anything else to make purchasing stuff much less terrible, please! Jones needs to make hiring business actual property distributors more practical: When you personal a construction, hiring people to do paintings in or on mentioned construction is fraught with legal responsibility. Jones simply raised $12.5 million to assist CME people “to find and rent the folks they want in a compliant method.”

TechCrunch broke the scoop that non-public fairness workforce Carlyle is taking a look to spend greater than $400 million on LiveU, a livestreaming provider. Founders: How neatly do you actually perceive seed-stage financing? A well-known poem advises us to not evaluate ourselves with others, “for all the time there will likely be higher and lesser individuals than your self.” The similar holds true for startup fundraising; the scale of your seed spherical will likely be made up our minds only by way of your corporate’s instant wishes and the traders you’re running with. “Remember the fact that fundraising isn't the function,” says three-time YC alum Yin Wu. “Construction a a success trade is.” If you're an early-stage founder who’s in search of readability about apportioning fairness — or for those who’re biting your nails over how a lot to boost — learn this primer. It’s additionally an invaluable assessment for early workers and co-founders who is also new to startup financing. How financing works: SAFEs as opposed to fairness rounds. How a lot to boost. The best way to arrive at your valuation. (Additional Crunch is our club program, which is helping founders and startup groups get forward. You'll be able to join right here.) Large Tech Inc. Chaos in lidar-world: The CEO is out at Velodyne, a lidar corporate that went public by way of a SPAC. The inside track follows a lot different post-SPAC drama, our personal Kirsten Korosec reviews. In brief, going public does now not be sure that an organization’s geese will stay in a row after its stocks begin to business. Velodyne is now price simply $8.69 in keeping with percentage, down from a top of $32.50. CNN goes +: Yep, every other streaming provider with a “+” in its title is popping out. This time from cable information pioneer and hoster-of-many-useless-panels CNN. The corporate is it seems that hiring closely for the trouble. CNN, I hereby be offering to host a standard TechCrunch display on CNN+. Name me. Uber needs to ship extra carrots: That’s our takeaway from information that the ride-hailing massive is increasing its grocery-delivery provider to a couple 400 new towns. Uber additionally has income arising, so the timing of this information merchandise isn’t an twist of fate; the corporate may have one thing sure to speak about in case its income don't satisfaction traders’ expectancies relating to its trailing efficiency. As of late in cybersecurity, america is pointing a finger at China for “the mass-hacking of Microsoft Alternate servers previous this yr, which brought on the FBI to intrude as issues rose that the hacks may result in well-liked destruction,” TechCrunch reviews. The local weather relating to cyber fuckery is converting, with realms increasingly more content material to indicate a finger at China and Russia for unhealthy conduct. TechCrunch Professionals: Enlargement Advertising and marketing Symbol Credit: SEAN GLADWELL (opens in a brand new window) / Getty Pictures Sign up for us day after today, July 20, at 5 p.m. ET on Twitter Areas to listen to Danny Crichton and MKT1, who we’ve prior to now interviewed for TechCrunch Professionals, communicate in regards to the developments they’re seeing in expansion advertising and marketing. Saying the time table for the Disrupt Degree in September We’re excited to come up with a more in-depth have a look at the Disrupt Degree, the place the largest names in tech speak about their corporations, their plans and what’s subsequent for the higher tech ecosystem. [ad_2] Supply hyperlink

0 notes

Text

Robinhood is already a 'comeback' stock. There are more aggressive plans for 2025.

Robinhood CEO Vlad Tenev has a lot to celebrate this holiday season. A few years after Robinhood's 2021 IPO — during which the commission-free trading app's shares have fallen. Over 90% The 12-year-old company announced — after suddenly restricting trading in some meme stocks Yahoo Finance's “Comeback Stock” of the Year. When asked about that medal by Zoom in recent days, Tenev shrugged. Tenev,…

0 notes

Text

Robinhood is already a 'comeback' stock. There are more aggressive plans for 2025.

Robinhood CEO Vlad Tenev has a lot to celebrate this holiday season. A few years after Robinhood's 2021 IPO — during which the commission-free trading app's shares have fallen. Over 90% The 12-year-old company announced — after suddenly restricting trading in some meme stocks Yahoo Finance's “Comeback Stock” of the Year. When asked about that medal by Zoom in recent days, Tenev shrugged. Tenev,…

0 notes

Text

Robinhood is already a 'comeback' stock. There are more aggressive plans for 2025.

Robinhood CEO Vlad Tenev has a lot to celebrate this holiday season. A few years after Robinhood's 2021 IPO — during which the commission-free trading app's shares have fallen. Over 90% The 12-year-old company announced — after suddenly restricting trading in some meme stocks Yahoo Finance's “Comeback Stock” of the Year. When asked about that medal by Zoom in recent days, Tenev shrugged. Tenev,…

0 notes

Text

Robinhood, already a ‘comeback’ stock, has even more aggressive plans for 2025 | masr356.com

Robinhood CEO Vlad Tenev has a lot to celebrate this holiday season. After a bumpy few years following Robinhood's 2021 IPO — a period during which shares of the commission-free trading app fell by more than 90% After trading in some meme stocks was suddenly restricted – the 12-year-old company has just gone public Yahoo Finance Stocks Return This Year. Asked about the honor in recent days via…

0 notes

Text

IPO Stocks To Observe In 2023

With the securities exchange exchanging at all-time highs through quite a bit of 2021, the Initial public offering market has areas of strength for stayed, the energy from the final part of 2020 when a solid bounce back in tech stocks empowered new contributions. Despite the fact that financial backer feeling might be moving with loan fees expected to ascend, there are as yet various hot Initial public offerings entering the market, and others are expected. If you wish to uncover extra more about IPO, Stocks, Mutual Funds, Insurance related updates, you may visit us at Money helpr.

Among the new Initial public offerings to watch are the accompanying:

1) Robinhood Markets

Robinhood (HOOD 0.5%) was one of the most expected Initial public offerings of 2021. The problematic web-based financier is quite possibly the most discussed organization in the money management world nowadays. Robinhood’s no-bonus stock exchanges and simple to-utilize portable connection point have brought a surge of new millennial financial backers into the market and assisted fuel the image with loading rallies in GameStop (GME — 1.9%) and AMC Diversion (NASDAQ: AMC), as well as the swell in digital currency costs.

Robinhood likewise has the numbers to back up the promotion. Through the initial 3/4 of 2021, income hopped 126% to $1.45 billion, and subsidized accounts really depended on 22.4 million by the second from the last quarter of 2021, multiplying on a year-over-year premise.

After a solid presentation, notwithstanding, the stock has drooped in the midst of inquiries regarding its capacity to be a key part of digital currency and as a few key measurements declined after the Dogecoin (CRYPTO: DOGE) blast in the second quarter of 2021. The organization presented crypto wallets toward the finish of 2021, showing that it isn’t overlooking the most current boondocks in effective money management.

While Robinhood’s future is dubious given the danger of guidelines and the discussion encompassing it, it’s decent wagered that this problematic organization will keep on impacting the manner in which we contribute.

2) Coinbase

The digital money blast formally went standard in April 2021 with the fruitful presentation of Coinbase (COIN — 3.35%), the biggest cryptographic money trader in the U.S. also, the principal major crypto business to list on the public business sectors.

Coinbase decided to open up to the world through an immediate posting, which is like an Initial public offering yet permits an organization to skirt the most common way of selling new offers and try not to need to pay guarantors. The stock just starts exchanging on a trade at a foreordained cost, permitting current value holders to sell their portions.

Coinbase’s stock cost at first flooded in its presentation, hopping from the $250 “reference cost” to nearly $430 in its most memorable exchanging days. Before long, in any case, the stock’s cost tumbled, and the stock has been moderately peaceful from that point forward.

Anticipate that Coinbase’s worth should be firmly connected for years to come to that of the most famous digital currencies like Bitcoin (BTC 0.65%) and Ethereum (ETH — 0.05%), as well as exchanging action crypto.

3) Roblox

Like Coinbase, the web-based gaming stage Roblox (NASDAQ: RBLX) opened up to the world in Walk 2021 through an immediate posting, and the stock acquired esteem in the resulting weeks. Roblox is definitely not a game creator however the administrator of a stage that permits anybody to make a computer game.

As of September 2021, Roblox had in excess of 8 million designers on its site and 47.3 million day-to-day dynamic clients. Like other computer game organizations, Roblox’s development advanced during the Coronavirus pandemic as appointments hopped 171% during 2020 contrasted with a 39% development rate in 2019.

The executives have cautioned that development will decelerate as the pandemic blurs, however, the stage plan of action has functioned admirably for different organizations and ought to keep on doing as such for Roblox. The organization has various upper hands, including network impacts and primary boundaries to section, which ought to fuel its drawn-out development. Here’s a brief summary of the Features & Factors of Credit Risk Mutual Funds that you don’t want to miss out.

4) Rivian

Electric vehicles have brought high as-can-be valuations since Tesla (TSLA — 3.35%) stock detonated in 2020. Rivian (RIVN — 3.73%) turned into the most recent perfect example of financial backer enthusiasm for the area when it opened up to the world in November 2021.

The EV creator’s market cap took off past $150 billion momentarily prior to blurring. Rivian had scarcely any income prior to opening up to the world, however, the organization’s innovation has been intensely advertised. It likewise has consented to offer 100,000 conveyance vans to Amazon and counts both Amazon and Portage (F — 1.55%) as significant financial backers.

Rivian is sloping up the creation of its R1T pickup truck, with plans for 40,000 vehicles this year and an objective of 1 million in 10 years. The electric truck has gotten rave surveys and could put the stock in a Tesla-like direction on the off chance that Rivian can fabricate a comparable committed fan base.

Forthcoming Initial public offerings: Organizations opening up to the world in 2023

Here are some other huge-name organizations with plans to open up to the world in 2023. Note, nonetheless, that given economic situations in mid-2022, organizations might defer arranged Initial public offerings and anticipate a better economy prior to opening up to the world.

1 ) Instacart

The forerunner in the web-based staple conveyance is additionally nearly opening up to the world in 2022. A public stock contribution has been not too far off since President Apoorva Mehta proclaimed the organization’s expectations in September 2019, albeit the organization said in November it was stopping intends to open up to the world to differentiate its business. In any case, an Initial public offering is probably going to come sooner or later, perhaps this year, since the organization documented with the SEC on May 11, 2022.

Instacart was a major champ during the pandemic with its staple conveyance administration profiting from flood popularity. The organization raised $265 million at a $39 billion valuation in Walk 2021, making it likely that an Instacart Initial public offering would be one of the greatest presentations of the year.

2) Stripe

As the most significant secretly held tech fire-up in the U.S., computerized installment organization Stripe might be the most expected Initial public offering out there. While the organization has not declared plans to open up to the world, Reuters detailed that Stripe had ventured out toward a market debut, tapping a law office to direct it through the cycle. The wire administration likewise said the organization was anticipating an immediate posting rather than a conventional Initial public offering since it doesn’t have to raise new assets. Do visit us, If you want to get information about the IPO Stocks to Observe in 2023.

Stripe, which gives cloud programming that permits organizations to consistently deal with installments, was esteemed at $95 billion in its most recent subsidizing round in Walk 2021. Considering that rich valuation, it’s not shocking that a posting would be inescapable since early financial backers and insiders need the organization to open up to the world to cash out their possessions.

3) Reddit

Online entertainment organization Reddit pulled in a great deal of consideration during the pandemic as the subreddit bunch WallStreetBets helped drive a flood in image stocks like GameStop and AMC Diversion. Social removing conventions likewise assisted fuel with fascinating conversation board-based sites.

Presently, Reddit is hoping to parlay that tailwind into a public contribution. The organization recorded privately to open up to the world in December 2021 and is profiting from solid client development. In October 2020, day-to-day dynamic clients were up 44% from the earlier year to 52 million, and the level of individuals in the U.S. who use Reddit rose from 11% in 2019 to 18% in 2021.

Reddit’s Initial public offering without a doubt will not be the greatest of the year; the organization was esteemed at $10 billion in its most recent financing round. All things considered, it is one of the more interesting organizations set to open up to the world this year. Given the progress of other web-based entertainment stocks, the organization is probably going to draw extensive consideration.

0 notes

Text

In Focus: The Robinhood IPO Pt II

In 2012 a company the entire world was waiting on to go public finally did. It priced its IPO at $38 a share and went public on May 18 of that year, and out of the gate it was a dud.

The stock would trade downwards over the next 16 weeks falling below $20 a share. Again, this was a company a large portion of the investment community was waiting on to go public. Many expected the stock to go to the moon right out of the gate, but it didn't. 22 weeks after the IPO, the stock started to catch its footing and would go on a massive run upwards. That company was Facebook (FB), and the stock price now is $365.30 per share.

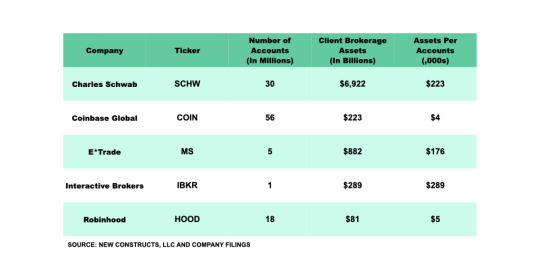

This week Robinhood (HOOD) went public at $38 per share and it wasn't a great outing. The stock currently trades at $35.15 as of this writing and there has been a lot said about Robinhood and its IPO. At its IPO price Robinhood was valued at $35 billion, and that may have turned some investors off. At $35 billions Robinhood would be more valuable than American Airlines (AAL) ($13 billion) and United Airlines (UAL) ($15.6 billion) combined, and more valuable thanAmerica's number one pure play grocer Kroger (KR) ($30 billion). Robinhood has value, but investors weren't convinced that $32 billion was it, and for good reason.

In Robinhood's S1 filing it noted 18 million accounts with $81 billion of assets under custody. In 2020 Morgan Stanley (MS) paid $13 billion for E-Trade, which had only 5 million accounts but $360 billion in assets. Looking at it that way, the numbers don't add up for Robinhood.

Then there's the payment for order flow issue. It's the reason why Robinhood can offer commission free trading and the reason the company became public enemy number one earlier in the year. Never forget, Ted Cruz and Alexandria Ocasio-Cortez were concerned and on the same side on the same issue, and the issue revolved around Robinhood.

There's a belief that there are major changes in the works around payment for order flow, and that the practice could be banned in the U.S. as it is in the U.K. In Q1 2021, more than 80% of Robinhood's revenue came from order flow. If the practice were to be banned, that would be a massive hit to Robinhood, and the company would be a shell of its former self, and may not be able to survive without being acquired.

$35 Billion?

When Robinhood's IPO price started to make the news, I asked myself why does Robinhood's founders and its underwriters believe it's a $30 billion company? Then I remembered, it's because it's tech, and in this day and age investors are overpaying for "tech." Don't believe me, compare GM (GM), Ford (F), and Tesla (TSLA), an $82 billion company, a $56 billion company, and a $680 billion company respectively. In 2019 GM delivered 2.8 million vehicles, Ford sold 2.4 million vehicles, and Tesla delivered 376,000 vehicles. GM and Ford have long been considered automobile manufacturers, but Tesla, Tesla is a tech company that makes cars, like Apple (AAPL) is a tech company that makes phones and Netflix (NFLX) is a tech company that leases, produces, and displays content. In the old days, Netflix would be a broadcast company or a movie studio, but today it's a tech firm, so we'll pay 53x earnings to own it over the 9x earnings to own ViacomCBS (VIAC), a simple broadcast company.

Since around the time of 2012, it didn't matter what a company did, what mattered was what box we put the company in, and this is why Robinhood's stock will be a winner in the end.

Remember E-Trade was acquired for $13 billion dollars, and while it offered everything Robinhood does and more, it was considered a discount brokerage firm, not a tech firm and not a FinTech, just a plain old boring brokerage. Same for TD Ameritrade, another company with more assets ($1.3 trillion) but less accounts (12 million) than Robinhood. TD was acquired by Charles Schwab (SCHW) for $26 billion, and like E-Trade, TD offered everything Robinhood offers and more, but it wasn't considered tech. That simple four letter word, "tech" makes all the difference in how Wall Street values a company.

For Robinhood, unfortunately, their tech isn't as free to grow as "tech" in some other industries. Robinhood has major regulations to abide by that prevent it from spreading its wings as far as it wants to. Remember how long it took the company to get its cryptocurrency purchasing arm online and how long it took the company to offer debit cards to its account holders. Being a steward of the public's money comes with serious restrictions, and Robinhood has to balance that with the tech attitude of go fast and break things.

There are issues, but I'm still a believer in Robinhood and it's primarily because of its social status. The company is everywhere, good news or bad news, Robinhood always seems to find its way into an important timeline or news feed.

While many of us, myself included, tend to harp on the GameStop debacle that Robinhood created, there was a lot of good happening on the app before they halted trading on GameStop and other meme stocks that week. Before the halt, regular people were making big money, and enticing others who had never thought about investing before to join in. Those new investors signed up to Robinhood, because that's the user interface they saw on their timelines. When people see +$10,000 of total returns on a green and white background, they're not going to go and open a WeBull or Public account, they're going to open a Robinhood account.

As bad as the GameStop debacle was at the time, and as much as people say they're still upset about it, people are still using Robinhood and finding their way to Robinhood. When the next meme stock takes off, it will only attract more people to sign up to the platform.

Assuming that the government does nothing about payment for order flow (which I don't think they will), Robinhood's best days are ahead of it. For many young companies, investors who buy in at the growth stages have little to no idea what the destination is for the company. When Netflix was delivering DVDs, we didn't know it would transition into a streaming giant. We didn't know the iPod would turn into the iPhone or that Google search would turn into Google Maps, Google Docs, G-Mail, and Android, or that Musical.ly would turn into Tik Tok, but we know exactly where Robinhood can go.

Robinhood has to grow into the "tech" version of E-Trade and TD Ameritrade. It also has to convince its 18 million users to not leave for better platforms when those customers build up their accounts. There is still this idea that having $5,000 in a Robinhood account is okay, but $50,000 needs a better place to rest, and Robinhood has to tackle that kind of thinking. That's the goal for Robinhood, that's what you're hoping for if you're a Robinhood investor now, that the company will continue to expand its offerings, grow its customer base, keep more of its users than it loses from quarter-to-quarter, and hopefully be properly funded so that it can be on the right of history when the next GameStop comes around, and it will come around.

Since the Facebook IPO, I've been attracted to big names with slow starts out of the gate and Robinhood fits the bill. Overthe past few years I've done well grabbing Corsair (CRSR), Palantir (PLTR), and Slack (CRM) after their not so spectacular debuts, and all have performed great. What I learned watching Facebook is that professional money managers are like kids, they like it if someone else likes it, but no one wants to say they like it first. Robinhood definitely has its issues, but hey, it's tech.

#Stocks#Investing#Investments#Investment Education#Financial Education#Money#MoneyEducation#Robinhood#Robinhood IPO#Reddit#GameStop#StocksToWatch#Corsair#Tesla#Slack#Tech#TechInvesting

2 notes

·

View notes