#Rental residence structured data

Text

Know Everything About Vacation Rental Structured Data is Introduced by Google

Increase the number of reservations and get noticed in online searches using Google's Vacation Rental Structured Data.

#Vacation home metadata#Structured information for rentals#Holiday property schema#Rental residence structured data#Accommodation data markup#Vacation stay schema#Property details structuring#Lodging information markup#Holiday home metadata#Rental property schema#Structured data#Vacation rental

0 notes

Text

Qatar Bike Sharing Market: Forthcoming Trends and Share Analysis by 2030

The Qatar Bike Sharing is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

Residents and tourists in Qatar are embracing this environmentally friendly and healthful form of transportation as bike sharing grows in popularity. Bike-sharing programs are becoming more popular in Qatar's major centers, such Doha, where more people are riding their bikes. Users of bike-sharing systems are diverse and include families, tourists, young professionals, and students. This is due to the platforms' accessibility and ease.

Bike-sharing is an enjoyable and useful way for the younger people in Qatar to get about the city. As the government makes investments in safety features and infrastructure that makes biking easier, parents are more at ease letting their kids utilize these services for quick excursions to the school, neighboring parks, or leisure destinations.

Local companies have realized there are chances to work together and provide bike-sharing as an extra benefit for their clients and staff as the bike-sharing market in Qatar grows. Hotels, resorts, and recreational centers frequently collaborate with bike-sharing companies to improve the overall experience of its workers and visitors.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Leading players involved in the Qatar Bike Sharing Market include:

Lime (US), Loop Mobility (US), Careem Bike (UAE), Yalla Bike (Qatar), Hello Inc (China), Qatar Bike (Qatar), Saikl Bike Rental (Qatar), Qatar Bicycle Rental (Qatar), My Bike (Qatar), Qatar Ride (Qatar), The Bike Shack (Qatar), MBike (Qatar), Domoded (Qatar), Qatar Bikes (Qatar), Al Nasser Cycle (Qatar), Qatar Cycle (Qatar), Qatar Bikes Online (Qatar), Sports Qatar (Qatar), Velo Qatar (Qatar), Cycle One (Qatar), and Other Major Players

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

If You Have Any Query Qatar Bike Sharing Market Report, Visit:

Segmentation of Qatar Bike Sharing Market:

By Bike Type

Traditional Bike

E-bike

By Sharing System

Docked

Dockless

By User Type

Tourists and Visitors

Regular Commuters

Highlights from the report:

Market Study: It includes key market segments, key manufacturers covered, product range offered in the years considered, Global Qatar Bike Sharing Market, and research objectives. It also covers segmentation study provided in the report based on product type and application.

Market Executive Summary: This section highlights key studies, market growth rates, competitive landscape, market drivers, trends, and issues in addition to macro indicators.

Market Production by Region: The report provides data related to imports and exports, revenue, production and key players of all the studied regional markets are covered in this section.

Qatar Bike Sharing Market Profiles of Top Key Competitors: Analysis of each profiled Roll Hardness Tester market player is detailed in this section. This segment also provides SWOT analysis of individual players, products, production, value, capacity, and other important factors.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]

#Qatar Bike Sharing#Qatar Bike Sharing Market#Qatar Bike Sharing Market Size#Qatar Bike Sharing Market Share#Qatar Bike Sharing Market Growth#Qatar Bike Sharing Market Trend#Qatar Bike Sharing Market segment#Qatar Bike Sharing Market Opportunity#Qatar Bike Sharing Market Analysis 2023

0 notes

Text

Qatar Bike Sharing Market: Forthcoming Trends and Share Analysis by 2030

The Qatar Bike Sharing is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

Residents and tourists in Qatar are embracing this environmentally friendly and healthful form of transportation as bike sharing grows in popularity. Bike-sharing programs are becoming more popular in Qatar's major centers, such Doha, where more people are riding their bikes. Users of bike-sharing systems are diverse and include families, tourists, young professionals, and students. This is due to the platforms' accessibility and ease.

Bike-sharing is an enjoyable and useful way for the younger people in Qatar to get about the city. As the government makes investments in safety features and infrastructure that makes biking easier, parents are more at ease letting their kids utilize these services for quick excursions to the school, neighboring parks, or leisure destinations.

Local companies have realized there are chances to work together and provide bike-sharing as an extra benefit for their clients and staff as the bike-sharing market in Qatar grows. Hotels, resorts, and recreational centers frequently collaborate with bike-sharing companies to improve the overall experience of its workers and visitors.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Leading players involved in the Qatar Bike Sharing Market include:

Lime (US), Loop Mobility (US), Careem Bike (UAE), Yalla Bike (Qatar), Hello Inc (China), Qatar Bike (Qatar), Saikl Bike Rental (Qatar), Qatar Bicycle Rental (Qatar), My Bike (Qatar), Qatar Ride (Qatar), The Bike Shack (Qatar), MBike (Qatar), Domoded (Qatar), Qatar Bikes (Qatar), Al Nasser Cycle (Qatar), Qatar Cycle (Qatar), Qatar Bikes Online (Qatar), Sports Qatar (Qatar), Velo Qatar (Qatar), Cycle One (Qatar), and Other Major Players

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

If You Have Any Query Qatar Bike Sharing Market Report, Visit:

Segmentation of Qatar Bike Sharing Market:

By Bike Type

Traditional Bike

E-bike

By Sharing System

Docked

Dockless

By User Type

Tourists and Visitors

Regular Commuters

Highlights from the report:

Market Study: It includes key market segments, key manufacturers covered, product range offered in the years considered, Global Qatar Bike Sharing Market, and research objectives. It also covers segmentation study provided in the report based on product type and application.

Market Executive Summary: This section highlights key studies, market growth rates, competitive landscape, market drivers, trends, and issues in addition to macro indicators.

Market Production by Region: The report provides data related to imports and exports, revenue, production and key players of all the studied regional markets are covered in this section.

Qatar Bike Sharing Market Profiles of Top Key Competitors: Analysis of each profiled Roll Hardness Tester market player is detailed in this section. This segment also provides SWOT analysis of individual players, products, production, value, capacity, and other important factors.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]

#Qatar Bike Sharing#Qatar Bike Sharing Market#Qatar Bike Sharing Market Size#Qatar Bike Sharing Market Share#Qatar Bike Sharing Market Growth#Qatar Bike Sharing Market Trend#Qatar Bike Sharing Market segment#Qatar Bike Sharing Market Opportunity#Qatar Bike Sharing Market Analysis 2023

0 notes

Text

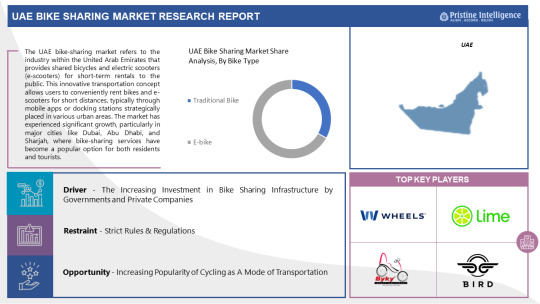

UAE Bike Sharing Market: Forthcoming Trends and Share Analysis by 2030

The UAE Bike Sharing is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

The industry in the United Arab Emirates that offers shared bicycles and electric scooters (also known as e-scooters) for short-term public rentals is known as the "UAE bike-sharing market." Through mobile apps or docking stations positioned thoughtfully around different urban locations, customers may rent bikes and e-scooters for short distances with ease thanks to this creative transportation idea. Bike-sharing programs have been a popular choice for both residents and tourists in major cities like Dubai, Abu Dhabi, and Sharjah, contributing to the market's notable rise.

Numerous service providers are present on the market, providing a variety of choices, such as conventional bicycles and electric scooters, the latter of which are especially well-liked because of how simple it is to ride one around an urban area.

Even while the market is expanding and becoming more popular, there are still issues to be resolved, such as making sure that bikes are safe in traffic, addressing the need for improved infrastructure for cycling, and making sure that shared bikes and e-scooters are maintained properly.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Leading players involved in the UAE Bike Sharing Market include:

Careem Bikes (UAE), Byky Stations (UAE), Arnab (UAE), Lime (US), Bird (US), Circ (Germany), Mobike (China), Jump Bikes (US), Yulu (India), Nextbike (Germany), OBike (Singapore), Aventon Pace (US), VeoRide (US), Wheels (US), Hive (UAE), Beam (UAE), Hawk (UAE), S'COOL Bikes (UAE), ShareaBike (UAE), Yassir (UAE), and Other Major Players.

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

If You Have Any Query UAE Bike Sharing Market Report, Visit:

Segmentation of UAE Bike Sharing Market:

By Bike Type

Traditional Bike

E-bike

By Sharing System

Docked

Dockless

By User Type

Tourists and Visitors

Regular Commuters

Highlights from the report:

Market Study: It includes key market segments, key manufacturers covered, product range offered in the years considered, Global UAE Bike Sharing Market, and research objectives. It also covers segmentation study provided in the report based on product type and application.

Market Executive Summary: This section highlights key studies, market growth rates, competitive landscape, market drivers, trends, and issues in addition to macro indicators.

Market Production by Region: The report provides data related to imports and exports, revenue, production and key players of all the studied regional markets are covered in this section.

UAE Bike Sharing Market Profiles of Top Key Competitors: Analysis of each profiled Roll Hardness Tester market player is detailed in this section. This segment also provides SWOT analysis of individual players, products, production, value, capacity, and other important factors.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]

#UAE Bike Sharing#UAE Bike Sharing Market#UAE Bike Sharing Market Size#UAE Bike Sharing Market Share#UAE Bike Sharing Market Growth#UAE Bike Sharing Market Trend#UAE Bike Sharing Market segment#UAE Bike Sharing Market Opportunity#UAE Bike Sharing Market Analysis 2023

0 notes

Text

[ad_1]

A penthouse on the deliberate Shore Membership challenge in Miami Seaside is reportedly in contract for greater than $120 million, a sale that may set a document worth for condos in Miami-Dade County — if and when it closes.

Witkoff and Monroe Capital are creating the Shore Membership Non-public Assortment, an Auberge Resorts Assortment-branded rental and resort challenge at 1901 Collins Avenue. Douglas Elliman is dealing with gross sales and advertising and marketing of the 49-unit improvement. World Mansion reported that the unit is beneath contract to an unknown purchaser.

The sale would shut as soon as the event is accomplished, which is predicted in 2026. If it sells for not less than $120 million, the ten,500-square-foot penthouse can have traded for greater than $11,000 per sq. foot, additionally a document in Miami-Dade and certain statewide.

The penthouse can have about 7,500 sq. ft of terraces and its personal rooftop pool.

Witkoff and Monroe in 2021 unveiled redevelopment plans for the Shore Membership, a historic Artwork Deco resort. Robert AM Stern Architects is working with the architect of document, Kobi Karp Structure & Inside Design, on the challenge. The redevelopment of the Shore Membership and the Cromwell Lodge, constructed within the Thirties, may also embody a brand new 200-foot-tall tower.

Costs ranged from $6 million to about $40 million when gross sales launched greater than a 12 months in the past.

Witkoff and Elliman declined to remark. Monroe Capital didn't instantly reply to a request for remark.

Monroe took over the property because the lender for the earlier developer, the now-defunct HFZ Capital Group. HFZ deliberate a Fasano-branded rental and resort, however canceled the challenge and returned patrons' deposits in 2017. Elliman additionally led gross sales of that improvement.

The gross sales staff for the most recent challenge consists of Elliman brokers Invoice Hernandez, Bryan Sereny, Norma-Jean Callahan and Fredrik Eklund of the Eklund-Gomes staff. Eklund in contract to purchase a unit for himself on the Shore Membership.

The present worth document for condos is held by a 2015 sale at Faena Home in Miami Seaside. Billionaire hedge fund supervisor Ken Griffin paid $60 million for 2 items, though it was reported on the time that it was one duplex unit. Griffin, who offered the condos at a loss for a whole of $46 million, by no means mixed them. Griffin has since set different data in South Florida, together with his buy in 2022 of Adrienne Arsht's former Coconut Grove property for about $107 million. That sale set a document for single-family residence gross sales in Miami-Dade County.

Learn extra

Apartment pricing for brand new developments has soared throughout South Florida's shoreline, with builders and brokerages boasting of data that might be set as soon as their tasks are accomplished.

A penthouse on the deliberate Raleigh redevelopment close to the Shore Membership is asking $150 million. Michael Shvo is creating the Raleigh challenge along with his companions. Within the fall, Shvo stated patrons at his challenge had been paying $4,000 to $12,000 per sq. foot for items.

—Katherine Kallergis

[ad_2]

Supply hyperlink

0 notes

Text

Understanding the Importance of ESG in Real Estate Development

In real estate development, environmental, social and governance (ESG) factors have taken center stage. These factors tackle issues such as social injustice, climate change, and ethical business practices.

Real estate professionals are now incorporating ESG considerations at every stage of a property’s lifecycle, from due diligence to asset management, in recognition of the wide-ranging impact. By analyzing current trends, innovations & regulatory requirements, this article identifies important ESG factors.

Environmental:

By addressing embodied carbon emissions during construction, real estate developers are putting more and more emphasis on combating climate change.

The drive to lower carbon footprints highlights the importance of sustainable practices in order to protect asset value. The increasing significance of sustainability in real estate valuation is highlighted by the higher rents associated with green buildings, which are frequently newer and more ecologically friendly.

Because it sequesters a significant amount of carbon during construction, timber is a more environmentally friendly option for green building materials.

Tightening regulations highlights the need for green reporting standards that lower energy use and carbon emissions. Australia’s NABERS building rating system is one example of how this is being done.

Green buildings are becoming premium assets:

Green buildings are highly valued. As a result, rental prices for buildings with superior environmental performance are typically higher than those for non-green properties.

It may take some time to determine the exact sustainability premium for green buildings but the potential for a “brown discount” or reduced value, for assets with superior environmental performance illustrates the importance of sustainability expenditures.

Green building materials:

About 40% of annual carbon emissions worldwide are attributed to the building and construction sectors with the production of steel and concrete making up the remaining 5%.

Timber’s ability to sequester carbon makes it a more environmentally friendly option. In contrast to the 1,000–2,000 metric tons of carbon dioxide emissions from an average steel and concrete building, timber structures can store 2,000–4,000 metric tons of carbon dioxide during construction.

Social:

Communities are significantly impacted by real estate which affects resident wellbeing, property values and state of the local economy.

In Australia, the housing market addresses the urgent need for affordable housing and offers significant opportunities for investing.

The importance of health & wellness in the design of buildings, emphasizing elements that improve indoor air quality and general wellbeing such as adequate ventilation, natural light and low toxicity materials.

Developers are realizing the significance of their projects for society and going above & beyond with their financial gains to produce enduring social advantages.

Governance:

In the real estate industry, governance encompasses matters such as executive remuneration, diversity in management, preventing corruption and upholding moral principles.

As it advances equity, diversity and inclusion, corporate social responsibility or CSR is becoming a crucial component of good governance. Important elements of governance practices include openness, judgment, choosing vendors, and tenant involvement.

To track and assess asset level ESG performance, benchmarking tools such as GRESB are used. These tools offer insights into stakeholder engagement, leadership, risk management and carbon emissions. Technology is essential to reaching ESG objectives as it makes data collection, reporting, and energy performance monitoring easier.

Additionally,

Resilience and Effective Risk Management: Managing disruptive events like pandemics and extreme weather is a key component of resilience in real estate development. A property’s resilience to climate related risks is increased with effective risk management that lowers vulnerability to calamities like floods & wildfires.

Impact Investing in Affordable Housing: The Australian affordable housing market not only fills housing shortages but also offers profitable opportunities for impact investing which provides both financial returns and social benefits.

Health and Wellness in Building Design: The importance of elements like adequate ventilation, access to natural light and fitness centres for resident’s well-being is recognized by developers, who are progressively incorporating health & wellness considerations into their building design.

Technology for ESG Goals: Prop Tech based platforms that improve tenant experiences and data management platforms for ESG data are just two examples of how technology is essential to reaching ESG goals. Enablement technologies support sustainability goals by tracking and optimizing energy performance.

To summarize:

ESG considerations are crucial to real estate development, impacting decisions & actions at every turn of a property’s life. Developers are realizing that a comprehensive approach is necessary, from addressing climate change through sustainable construction to impacting communities with affordable housing.

As ESG becomes more widely recognized, it does not only lower risk and preserves asset value, but it also has positive social effects and synchronizes real estate development with global sustainability objectives.

“In order to gather and report on ESG data and make long lasting impact, benchmarking, technology, and reporting are indispensable to gather, analyze, and present ESG data, and make sustainable advancements.”

0 notes

Text

Why Are Businesses Turning To Scrape New York Apartments From Rent.Com

Why Are Businesses Turning To Scrape New York Apartments From Rent.Com?

Introduction: Property data scraping involves extracting relevant information from real estate websites, empowering users with valuable insights into property markets. Individuals and businesses can gather data on property listings, prices, amenities, and other crucial details by leveraging web scraping techniques. This process streamlines market analysis, aiding in informed decision-making for buyers, sellers, and investors. However, it's important to note that you must conduct property data scraping ethically, respecting website terms of service and legal boundaries. As technology advances, property data scraping services play a pivotal role in transforming the real estate landscape, offering a wealth of information at the fingertips of industry stakeholders.

The demand for scraping New York apartments has surged as individuals and businesses seek efficient ways to gather crucial real estate data. With the dynamic and competitive nature of the New York City housing market, scraping provides a means to collect valuable information on rental prices, property features, and neighborhood trends. Prospective tenants, real estate agents, and investors benefit from this data-driven approach to make informed decisions in a rapidly changing market. However, adhering to ethical scraping practices and respecting website terms and legal regulations are essential to ensure sustainability and integrity in acquiring New York apartment data.

List of Data Fields

Property Type

Property Address

Number of Bedrooms and Bathrooms

Square Footage

Rental Prices

Additional Fees

Amenities

Contact Details

Neighborhood Information

Availability

Images

Reviews

Location coordinate

About Rent.com

Rent.com is a prominent online platform that simplifies the property rental process. Connecting landlords and tenants, Rent.com provides a user-friendly interface to search for apartments and homes. The platform offers comprehensive property listings with details on pricing, amenities, and neighborhood information. Users can explore virtual tours, photos, and reviews to make informed decisions. Rent.com streamlines the rental experience, serving as a go-to resource for individuals seeking residences and property owners looking to showcase their listings efficiently.

Scrape Rent.com data to obtain valuable insights into the New York City rental market, including detailed property information, pricing trends, and neighborhood amenities. This data can empower users, such as prospective tenants, real estate agents, or investors, to make informed decisions, compare rental options, and stay updated on the dynamic landscape of available properties. However, it's crucial to conduct scraping ethically, adhering to Rent.com's terms of service and legal guidelines while respecting user privacy and data protection regulations.

Scrape Rent.com to Understand Property Value

Understanding property values by scraping Rent.com involves collecting relevant information and analyzing key factors influencing real estate pricing. Here's a step-by-step guide:

Scrape Property Listings: Utilize property data scraper or programming scripts to extract data from Rent.com, focusing on details like property type, location, size, amenities, and pricing.

Compile Data: Organize the scraped data into a structured dataset, ensuring that essential information is categorized and easily accessible for analysis.

Location Analysis: Evaluate property values based on location using real estate data scraping services. Factors such as neighborhood safety, proximity to amenities, schools, and public transportation can significantly impact property prices.

Size and Features: Analyze how property size and features using Real Estate Scraper, such as the number of bedrooms, bathrooms, and additional amenities, correlate with pricing. More extensive or more feature-rich properties often command higher values.

Pricing Trends: Track pricing trends over time. By scraping real estate data regularly, you can identify fluctuations in rental prices, helping you understand market dynamics and seasonal variations.

Comparative Analysis: Compare the scraped data with similar properties in the area. This comparative analysis provides insights into whether a property's pricing is competitive or if adjustments are needed.

Tenant Reviews: Consider tenant reviews and ratings. Positive reviews indicate a property's perceived value and desirability, while negative feedback may highlight issues affecting its value.

Historical Data: Collect historical data on a property's rental history. Understanding its past rental rates and occupancy trends can provide context for its current value.

External Factors: Factor in external elements like economic trends, job market stability, and overall city growth. These broader influences can impact property values in a given area.

Data Visualization: Utilize data visualization tools to create charts and graphs illustrating correlations between different factors and property values. This visual representation enhances your understanding of the data.

Machine Learning Models (Optional): Consider employing machine learning models to predict property values based on historical data and identified features. These models can provide more sophisticated insights and predictions.

Types of Businesses Benefiting from Property Data Scraping

Real Estate Brokerages: Property data scraping enables real estate agencies to stay competitive by providing accurate and timely information on property listings, market trends, and pricing. It assists agents in offering clients up-to-date insights for informed decision-making.

Investment Firms: Investors benefit from property data scraping services to analyze market trends, identify lucrative opportunities, and make data-driven investment decisions. Scraped data aids in assessing property values, potential returns, and overall market conditions.

Property Management Companies: Property managers leverage scraping to optimize rental property performance. Access to data on market demand, tenant demographics, and pricing trends helps in effective property management, ensuring competitive rental rates and tenant satisfaction.

Financial Institutions: Banks and financial institutions use Rent.com data scraping to assess property values for mortgage lending and risk management. Accurate and current property information aids in making informed decisions related to property-backed financial transactions.

Proptech Startups: Emerging proptech companies utilize property data scraping to develop innovative solutions. From creating advanced property valuation algorithms to developing user-friendly real estate apps, scraping contributes to developing cutting-edge technologies in the real estate sector.

Marketing and Advertising Agencies: Businesses benefit by tailoring their campaigns based on scraped property data. Understanding regional preferences, demographic trends, and market demand allows agencies to create targeted advertising strategies for reaching specific audiences interested in real estate services and products.

Conclusion: Scraping New York apartments from Rent.com offers a wealth of insights for various stakeholders in the real estate industry. From real estate agencies and property management firms optimizing their services to investors making informed decisions, the scraped data provides a comprehensive view of the dynamic New York City rental market. However, it is crucial to conduct scraping ethically, respecting legal and privacy considerations. By leveraging this data responsibly, businesses can stay competitive, make informed decisions, and contribute to the overall efficiency and innovation within the real estate sector.

Know More:

https://www.iwebdatascraping.com/scrape-new-york-apartments-from-rent-com.php

#ScrapeNewYorkApartmentsFromRentCom#HowtoScrapeApartmentsfromRentcom#RentComScraper#NewYorkApartmentsFromRentComdatascraping#Propertydatascraping#RentComdatacollectionservice#ScrapeRentcomdata#ApartmentscomScraper#ApartmentscomscraperAPI#Rentcomdatascraping

0 notes

Text

Understanding Your Personal Financial Statement as a Business Owner

As a business owner, you understand the importance of financial tracking and maintaining records. One of the most important documents that you need to be familiar with is your personal financial statement. This document can provide you with insight into your current financial situation and help you plan for future success. Let’s take a closer look at what a personal financial statement is and how it can be used to benefit your business.

What Is a Personal Financial Statement?

A personal financial statement is an overview of your current assets and liabilities, including net worth. It is used to assess your creditworthiness when applying for loans or other forms of financing. It also helps provide lenders with information about your ability to manage debt and repay loans on time. When preparing your personal financial statement, it’s important to be accurate in order to get an accurate picture of your overall financial position.

Items Included in Your Personal Financial Statement

Your personal financial statement should include all of the following items:

• Cash on hand (bank accounts)

• Investment accounts (retirement accounts, stocks, funds, etc.)

• Real estate (primary residence, rental property)

• Personal property (vehicles, jewelry, art)

• Liabilities (credit cards, mortgage payments, student loan debt)

• Business assets (inventory, equipment)

• Net worth (assets minus liabilities)

Access a Personal Financial Statement Calculator

It is important that these items are accurately reported on your personal financial statement so that potential lenders can get an accurate picture of your finances and make informed decisions about whether or not to extend credit to you.

How Can My Personal Financial Statement Help My Business?

Your personal financial statement provides valuable insight into both current and future opportunities for growth and success within your business. By understanding where you currently stand financially, you can better plan for the future by setting realistic goals for saving money or taking out loans. Additionally, lenders will use this information to determine if they feel confident extending credit or taking on additional risk with new investments or projects within the company. Knowing where you stand financially gives you more control over decision-making when it comes to borrowing money and taking risks within the business environment.

A personal financial statement provides invaluable insight into both present-day and long-term planning for businesses owners looking to grow their operations. Being aware of how much money you have in assets versus how much money is owed in liabilities gives greater control over decision making when it comes time to borrow money or take risks within the company structure. Understanding your total net worth also helps potential lenders assess whether or not they want to extend credit lines or work with additional investments within the organization.

Make sure that all data included on this form is accurately reported in order to get an accurate representation of where you stand financially as a business owner today!

1 note

·

View note

Text

Investment Insights: Finding Gems in Real Estate

Real estate can be a highly rewarding investment if you know where to look. While hot markets get a lot of attention, hidden gems offering sizable returns can be uncovered through smart research and analysis. Here are key insights for finding undervalued properties before they become real estate gold.

Look Beyond Obvious Investment Hot Spots

Major metro areas like New York City and San Francisco are frequently cited as top real estate markets. But competition is high, and many properties are already overvalued. Instead, look just outside major hubs in smaller cities and suburbs poised for growth. Areas with expanding industries, improving infrastructure, and increasing demand are smart bets.

Consider Undervalued Neighborhoods

Within a city, certain neighborhoods can be undiscovered gems. Look just beyond currently trendy areas to find undervalued districts on the rise. Analyze factors like new development, shifting demographics, and planned community improvements to identify appreciating neighborhoods. Get to know these areas early before values spike.

Seek Outdated and Distressed Properties

Properties with dated finishes or in need of renovation can be diamonds in the rough, purchased below market value. Consider cosmetic fixes like kitchen updates or new flooring to boost value. Keep in mind major structural issues can turn a deal sour. Inspect carefully and estimate renovation costs.

Look Where Others Aren't

Opportunities exist where fewer investors are looking. Secondary cities with universities or industries drawing younger residents can offer strong rental demand. Affordable Midwest and Southern markets tend to be overlooked but can deliver high returns. Do in-depth research to find the right emerging areas.

Follow Economic Growth

Growing industries bring new residents and development. Scan local economic data and news to find areas adding major employers. A new tech hub or satellite office for a major company can spark a real estate boom. Be ready to buy ahead of the surge.

Talk to Local Experts

Real estate agents, lenders, and contractors have insider knowledge of hidden gem neighborhoods and properties before they hit the radar. Build relationships with experts familiar with the area's history, changes, and opportunities. Tap into their expertise.

With the right homework and local connections, hidden gem investment opportunities can be uncovered. Patience and persistence are key - not every property will pan out. But securing the right undervalued asset at the right time pays off when value is unleashed. Happy hunting!

0 notes

Text

How to open a bank account in dubai islamic bank

Opening a bank account in Dubai Islamic Bank (DIB) is a straightforward process that caters to individuals seeking Sharia-compliant banking services in the vibrant city of Dubai. DIB, one of the leading Islamic banks in the UAE, offers a range of financial products and services designed to align with Islamic principles. If you're interested in opening an account with Dubai Islamic Bank, here is a step-by-step guide to help you through the process.

Eligibility and Documentation: Before you proceed with opening an account, ensure that you meet the eligibility criteria. DIB typically requires the following documents from individual account applicants:

A valid passport with a UAE residence visa for expatriates or a valid Emirates ID for UAE nationals.

Proof of your residential address, such as a utility bill or a rental agreement.

Proof of your income or employment, like a salary certificate or bank statements.

Choosing the Account Type: Dubai Islamic Bank offers a variety of accounts, each tailored to meet different financial needs. Consider your requirements and choose the type of account that best suits you. Options may include savings accounts, current accounts, or fixed-term deposit accounts.

Visit the Branch: To initiate the account opening process, visit your nearest Dubai Islamic Bank branch. The bank has a wide network of branches across the UAE, making it easily accessible for potential customers.

Account Application Form: You will be provided with an account application form at the branch. Fill out this form carefully, ensuring that all the required information is accurate and complete. If you have any questions, the bank staff will be happy to assist you.

Minimum Balance Requirement: Dubai Islamic Bank may require you to maintain a minimum balance in your account. Be sure to inquire about this and ensure that you can meet this requirement.

Sharia Compliance: Dubai Islamic Bank operates under Islamic finance principles, ensuring that its services are Sharia-compliant. This means they do not engage in interest-based transactions. Be prepared for your account to be subject to these principles, which prohibit earning or paying interest.

Signature Verification and Biometrics: Your signature and biometric data, such as fingerprints, may be collected for account security and verification purposes. This is a standard procedure.

Initial Deposit: Depending on the type of account you're opening, you may need to make an initial deposit. Ensure you have the required funds available.

Wait for Approval: After submitting your application, the bank will review your documents and information. This may take a few days, and the bank will contact you once your account is approved.

Receiving Your Account Details: Once your account is approved, you will receive your account details, including your account number and any associated documents or cards.

Online and Mobile Banking: Dubai Islamic Bank provides convenient online and mobile banking services, allowing you to access your account and perform transactions from anywhere.

Visa Debit Card: Depending on your account type, you may also receive a Visa Debit Card, which you can use for shopping and ATM withdrawals.

In conclusion, opening a bank account with Dubai Islamic Bank is a well-structured process, and the bank's staff is typically helpful in guiding you through the necessary steps. By ensuring that you meet the eligibility criteria, providing the required documents, and understanding the Sharia-compliant nature of the bank, you can start enjoying the benefits of Islamic banking services in Dubai. Whether you are a resident or an expatriate, DIB provides a variety of options to meet your financial needs while adhering to Islamic principles.

1 note

·

View note

Text

how to start a car rental business setup in Dubai

Dubai, with its thriving tourism sector and thriving economy, gives a wonderful chance for entrepreneurs to launch a vehicle rental business. Offering a fleet of well-maintained automobiles to locals and tourists alike may be a profitable investment in this booming metropolis. In this detailed tutorial, we will lead you through the stages of starting a successful vehicle rental business in Dubai.

Conduct Extensive Market Research

It is critical to understand the Dubai market before venturing into the automobile rental sector. Analyse the rental automobile market, determine your target clients, and evaluate the competitors. Determine which vehicle kinds are in great demand, whether they are luxury automobiles, economical vehicles, or specialised services such as SUVs for desert excursions.

Create a Sound Business Plan

A well-structured company strategy is your success map. It should include your company's objectives, financial estimates, pricing strategy, marketing strategy, and operational data. Define your market, decide whether you'll cater to visitors or residents, and develop a distinctive selling proposition that distinguishes your vehicle rental company.

Legal Prerequisites and Licencing

Setting up a business in Dubai necessitates compliance with local legislation. To begin a car rental business, you must first:

Register Your Company

Select an appropriate legal structure, such as an LLC or a sole proprietorship. For registration requirements, contact the Dubai Department of Economic Development (DED).

Obtain the Required Permits and Licences

You will require a trade licence for your automobile rental firm, which usually entails paperwork and payments. You may also require permission from the Roads and Transport Authority (RTA) and the Department of Tourism and Commerce Marketing (DTCM).

Insurance

Make sure your vehicle fleet has comprehensive insurance coverage, including liability and damage insurance.

Create Your Own Fleet

Purchase a fleet of automobiles that cater to your desired demographic. When choosing a car, consider criteria such as brand, model, and upkeep. Check that they are well-maintained and include current conveniences like as GPS and entertainment systems.

Facilities and Location

Choose a good location for your vehicle rental business. Areas with high foot traffic, such as those near airports, hotels, and tourist attractions, are suitable. Make sure your rental office has the tools it needs for customer support, vehicle maintenance, and administrative activities.

Hire and Train Employees

Employ qualified personnel for customer service, vehicle maintenance, and administrative duties. Provide extensive training to ensure that they understand your company's policies, vehicle characteristics, and customer service expectations.

Advertising and Promotion

Promote your automobile rental company through numerous marketing methods, such as:

Create an online presence by developing a user-friendly website with an online booking system. Use search engine optimisation (SEO) to increase the visibility of your website on search engines.

Social media channels like as Instagram, Facebook, and Twitter may be used to communicate with new customers and disseminate fleet and promotion information.

Customer Service and Assistance

To establish a loyal client base, provide great customer service. Provide emergency help 24 hours a day, seven days a week, and make sure your clients have a smooth rental experience from booking to car return.

Vehicle Maintenance and Safety

Maintain and service your cars on a regular basis to keep them in peak shape. Implement safety precautions such as pre- and post-rental vehicle checks.

Regulations and Compliance

Keep up to date on the newest rules in the Dubai vehicle rental sector. Follow any changes in licensing, insurance, or safety regulations.

Starting a vehicle rental business in Dubai may be a successful endeavour, considering the city's flourishing tourism sector and economic prosperity. However, success needs careful planning, adherence to regulatory regulations, a well-maintained fleet, and great customer service. By following this detailed guidance, you may establish a vehicle rental business that flourishes in Dubai's dynamic market. by consulting with a expert advice with business setup consultant in Dubai can setup a vechile rental business setup in Dubai

#business setup services in dubai#business setup company in dubai#business setup consultancy#low cost business setup in dubai#company formation in dubai#business setup in dubai#business setup consultants in dubai#business news#company formation consultant

0 notes

Text

The Importance of NRI Investment in the Indian Real Estate Market

The Indian real estate investment sector has grown significantly over the past ten years, and Non-Resident Indians (NRIs) have contributed considerably to this boom. Due to hybrid work arrangements, a desire to return to their own country, and a desire for a higher standard of living, NRIs are more likely to buy a home in India.

Reasons For NRIs Investment In India

When NRIs purchase homes in India, they can make domestic investments that help the nation's economy. Foreign investors are a significant additional source of capital for the Indian economy. NRIs can now easily participate in the rapidly growing Indian real estate market through a professional and gain from it.

Expanding Economy

India's economy has experienced some of the world's quickest growth. The real estate sector has dramatically facilitated this increase. By making NRI property investments, NRIs can participate in India's economic progress and profit from long-term expansion.

A Home to Reside

Second homes are also becoming popular among NRIs as they are increasingly viewed as assets that might produce a steady income. Purchasing a weekend home was once considered an upscale and ambitious act. Yet now, weekend homes are becoming recognized as being more prudent and safe.

Priced affordably

Compared to many other affluent countries, Indian real estate is more cheap and offers relatively lower property costs. NRIs who invest in real estate can take advantage of this accessibility and the underlying prospect for diversification and increased returns on their capital.

Policy for Liberalized Investment

To encourage NRI investment in real estate businesses, the Indian government has implemented several policies. These policies, which include light rules, repatriation advantages, and streamlined procedures for purchasing and selling real estate, are open to NRIs.

Potential Returns

NRIs consider investing in Indian real estate as a lucrative opportunity to boost their earnings and help them diversify their holdings. With the structural transformation and demographic dividend, the nation is anticipated to experience within the next few years, NRI investment in Indian real estate is predicted to continue to increase, and we believe that real estate will continue to be a substantial and dynamic investment for all.

Procedure of Purchasing Simplified

Government investment in infrastructure has also boosted tier-two city growth and increased linkages. The linkages in tier-one cities are frequently stronger than those in tier-two and tier-three cities.

The Indian real estate industry is a desirable investment location for NRIs to be exposed to due to strong economic growth, government efforts, competitive returns, and regulatory improvements. Furthermore, the emergence of REITs has created new options for foreign investors looking for liquidity and diversity.

Availability of Multiple Types of Properties

There are several Residential properties for sale in Hyderabad, in Tier 2 cities, NRI's interest in acquiring substantial properties in their hometowns has also surged.

The habit of working from home (WFH), which began during the epidemic, is also driving demand for more significant places. Professionals often seek additional space in their homes to put up workstations.

Together with the physical infrastructure, the digital infrastructure has also changed. In these new locations, broadband speeds have increased, mobile data costs have reduced, and data availability has increased. Regarding the commercial plots for sale in Hyderabad, connectivity has improved due to the tremendous infrastructural growth in these locations, and there are more businesses in tier-two cities.

Possibility for Rental Income

NRIs can gain from regular rental income by investing in residential or commercial properties because India has a healthy rental market. In addition, the stability and potential profitability of the rental market are influenced by expanding metropolitan areas and the need for high-quality housing.

Diversification of holdings

NRIs can geographically diversify their financial portfolio by investing in real estate. NRIs can lower their chance of experiencing economic volatility and take advantage of various real estate market cycles by diversifying across several nations.

Exceptional Resell Value

According to their public statements, real estate is preferred by NRI investors over other asset classes like shares and gold. Real estate is considered the most stable asset class in the world's current political and economic upheaval.

The cost of gold, a product with a global market, has soared compared to underperforming debt securities. The stock market has undergone several irrationally huge swings as the world struggles with war and a global recession.

Real estate is a secure investment that generates vast returns in the long run.

Transparency

NRIs now have more faith in the government due to reforms like the RERA Act (Real Estate Regulatory Authority). RERA has made it feasible for real estate transactions to be more transparent. As a result, both local and NRI home purchasers now have more confidence. It is common knowledge that the Indian real estate industry has many challenges. One of the key problems is the lack of transactional exposure.

The lack of confidence between buyers and sellers was the result. In order to solve this problem, RERA was created. The introduction of RERA has made it easy for people to buy or sell properties without a dispute or concern for being fooled or duped because all information about a property can be accessed on this site.

Due to enhanced transparency, there are no hidden fees associated with any transaction, which gives buyers and sellers more confidence. This leads to higher property prices and more transactions.

Takeaway

In the Indian real estate market, a transparent market has replaced an opaque and inefficient one. Thanks to technology, NRIs can now more easily purchase and transfer real estate even if they are not physically present in India. India's real estate boom, higher transparency standards, a declining rupee, and stronger real estate regulations contribute to the rise in NRI house demand. The real estate market's strength suggests that this trend will continue.

NRIS should do extensive research, consult a specialist, and fully comprehend India's legal and regulatory environment before investing in NRI real estate. Aside from general risks related to investing in Indian real estate, such as market volatility, currency changes, and potential difficulties with property management, they should also evaluate advice for NRIs. These actions will aid NRIs in making wise investing choices and effectively reducing risks.

Frequently Asked Questions

Why is NRI investment significant in the Indian real estate market?

NRI investment is crucial in boosting the Indian real estate sector as it enhances market liquidity and promotes economic growth.

2. What are the advantages of NRI investment for the Indian real estate market?

NRI investments offer several benefits, such as increased funding for residential and commercial projects, reduced dependency on domestic investors, and a more stable real estate market.

3. What are the regulations and guidelines for NRIs investing in Indian real estate?

NRIs must adhere to specific rules and regulations when investing in Indian real estate. These include property acquisition guidelines, repatriation of funds, taxation policies, and compliance with the Foreign Exchange Management Act (FEMA).

4. How can NRIs make informed decisions while investing in Indian real estate?

NRIs should conduct thorough research, consult with local experts, and consider factors like location, property type, and developer reputation.

1 note

·

View note

Text

UAE Bike Sharing Market: Forthcoming Trends and Share Analysis by 2030

The UAE Bike Sharing is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

The industry in the United Arab Emirates that offers shared bicycles and electric scooters (also known as e-scooters) for short-term public rentals is known as the "UAE bike-sharing market." Through mobile apps or docking stations positioned thoughtfully around different urban locations, customers may rent bikes and e-scooters for short distances with ease thanks to this creative transportation idea. Bike-sharing programs have been a popular choice for both residents and tourists in major cities like Dubai, Abu Dhabi, and Sharjah, contributing to the market's notable rise.

Numerous service providers are present on the market, providing a variety of choices, such as conventional bicycles and electric scooters, the latter of which are especially well-liked because of how simple it is to ride one around an urban area.

Even while the market is expanding and becoming more popular, there are still issues to be resolved, such as making sure that bikes are safe in traffic, addressing the need for improved infrastructure for cycling, and making sure that shared bikes and e-scooters are maintained properly.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Leading players involved in the UAE Bike Sharing Market include:

Careem Bikes (UAE), Byky Stations (UAE), Arnab (UAE), Lime (US), Bird (US), Circ (Germany), Mobike (China), Jump Bikes (US), Yulu (India), Nextbike (Germany), OBike (Singapore), Aventon Pace (US), VeoRide (US), Wheels (US), Hive (UAE), Beam (UAE), Hawk (UAE), S'COOL Bikes (UAE), ShareaBike (UAE), Yassir (UAE), and Other Major Players.

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

If You Have Any Query UAE Bike Sharing Market Report, Visit:

Segmentation of UAE Bike Sharing Market:

By Bike Type

Traditional Bike

E-bike

By Sharing System

Docked

Dockless

By User Type

Tourists and Visitors

Regular Commuters

Highlights from the report:

Market Study: It includes key market segments, key manufacturers covered, product range offered in the years considered, Global UAE Bike Sharing Market, and research objectives. It also covers segmentation study provided in the report based on product type and application.

Market Executive Summary: This section highlights key studies, market growth rates, competitive landscape, market drivers, trends, and issues in addition to macro indicators.

Market Production by Region: The report provides data related to imports and exports, revenue, production and key players of all the studied regional markets are covered in this section.

UAE Bike Sharing Market Profiles of Top Key Competitors: Analysis of each profiled Roll Hardness Tester market player is detailed in this section. This segment also provides SWOT analysis of individual players, products, production, value, capacity, and other important factors.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]

#UAE Bike Sharing#UAE Bike Sharing Market#UAE Bike Sharing Market Size#UAE Bike Sharing Market Share#UAE Bike Sharing Market Growth#UAE Bike Sharing Market Trend#UAE Bike Sharing Market segment#UAE Bike Sharing Market Opportunity#UAE Bike Sharing Market Analysis 2023

0 notes

Text

UAE Bike Sharing Market: Forthcoming Trends and Share Analysis by 2030

The UAE Bike Sharing is Expected to Grow at a Significant Growth Rate, and the Forecast Period is 2023-2030, Considering the Base Year as 2022.

The industry in the United Arab Emirates that offers shared bicycles and electric scooters (also known as e-scooters) for short-term public rentals is known as the "UAE bike-sharing market." Through mobile apps or docking stations positioned thoughtfully around different urban locations, customers may rent bikes and e-scooters for short distances with ease thanks to this creative transportation idea. Bike-sharing programs have been a popular choice for both residents and tourists in major cities like Dubai, Abu Dhabi, and Sharjah, contributing to the market's notable rise.

Numerous service providers are present on the market, providing a variety of choices, such as conventional bicycles and electric scooters, the latter of which are especially well-liked because of how simple it is to ride one around an urban area.

Even while the market is expanding and becoming more popular, there are still issues to be resolved, such as making sure that bikes are safe in traffic, addressing the need for improved infrastructure for cycling, and making sure that shared bikes and e-scooters are maintained properly.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Leading players involved in the UAE Bike Sharing Market include:

Careem Bikes (UAE), Byky Stations (UAE), Arnab (UAE), Lime (US), Bird (US), Circ (Germany), Mobike (China), Jump Bikes (US), Yulu (India), Nextbike (Germany), OBike (Singapore), Aventon Pace (US), VeoRide (US), Wheels (US), Hive (UAE), Beam (UAE), Hawk (UAE), S'COOL Bikes (UAE), ShareaBike (UAE), Yassir (UAE), and Other Major Players.

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

If You Have Any Query UAE Bike Sharing Market Report, Visit:

Segmentation of UAE Bike Sharing Market:

By Bike Type

Traditional Bike

E-bike

By Sharing System

Docked

Dockless

By User Type

Tourists and Visitors

Regular Commuters

Highlights from the report:

Market Study: It includes key market segments, key manufacturers covered, product range offered in the years considered, Global UAE Bike Sharing Market, and research objectives. It also covers segmentation study provided in the report based on product type and application.

Market Executive Summary: This section highlights key studies, market growth rates, competitive landscape, market drivers, trends, and issues in addition to macro indicators.

Market Production by Region: The report provides data related to imports and exports, revenue, production and key players of all the studied regional markets are covered in this section.

UAE Bike Sharing Market Profiles of Top Key Competitors: Analysis of each profiled Roll Hardness Tester market player is detailed in this section. This segment also provides SWOT analysis of individual players, products, production, value, capacity, and other important factors.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

About Us:

We are technocratic market research and consulting company that provides comprehensive and data-driven market insights. We hold the expertise in demand analysis and estimation of multidomain industries with encyclopedic competitive and landscape analysis. Also, our in-depth macro-economic analysis gives a bird's eye view of a market to our esteemed client. Our team at Pristine Intelligence focuses on result-oriented methodologies which are based on historic and present data to produce authentic foretelling about the industry. Pristine Intelligence's extensive studies help our clients to make righteous decisions that make a positive impact on their business. Our customer-oriented business model firmly follows satisfactory service through which our brand name is recognized in the market.

Contact Us:

Office No 101, Saudamini Commercial Complex,

Right Bhusari Colony,

Kothrud, Pune,

Maharashtra, India - 411038 (+1) 773 382 1049 +91 - 81800 - 96367

Email: [email protected]

#UAE Bike Sharing#UAE Bike Sharing Market#UAE Bike Sharing Market Size#UAE Bike Sharing Market Share#UAE Bike Sharing Market Growth#UAE Bike Sharing Market Trend#UAE Bike Sharing Market segment#UAE Bike Sharing Market Opportunity#UAE Bike Sharing Market Analysis 2023

0 notes

Text

Important Information on Recovery and Assistance Programs in the Wake of Hurricane Idalia

In the wake of the impacts caused by Hurricane Idalia, the Citrus County Chamber of Commerce has been in direct communication with Citrus County Administrator Steve Howard and Crystal River City Manager, Doug Baber.

Damage assessments are currently underway, marking the first step towards community recovery. Additionally, businesses and residents in affected areas are authorized to make necessary repairs needed to protect their structures within the next 72 hours, beginning today, with no initial City or County permits issued.

FloridaCommerce and the State Emergency Response Team (SERT) activated the Business Damage Assessment Survey in response to Hurricane Idalia. Survey responses will allow the state to expedite Hurricane Idalia recovery efforts by gathering data and assessing the needs of affected businesses. Businesses can complete the survey online by visiting http://www.FloridaDisaster.biz and selecting “Hurricane Idalia” from the dropdown menu.

Information on Recovery and Assistance Programs in the Wake of Hurricane Idalia

SBA Opens Disaster Relief:

President Biden has granted a major disaster declaration, which includes Citrus County. Small businesses, nonprofits, homeowners, and renters in declared disaster areas can apply for assistance through the Small Business Administration (SBA) to help recover and rebuild.**To apply for SBA assistance:**1. Visit: (https://disasterloanassistance.sba.gov)2. New applicants will need to create a Login.gov account and use an authenticator app.3. For assistance with the application, call 1-800-659-2955 or email [email protected].

Individual Assistance Programs:

1. **Mass Care and Emergency Assistance (MC/EA)**2. **Crisis Counseling Assistance and Training Program (CCP)**3. **Disaster Unemployment Assistance (DUA)**4. **Disaster Legal Services (DLS)**5. **Disaster Case Management (DCM)**

Details of these programs are available on FEMA's website and in the attached fact sheet.

**To apply for FEMA Individual Assistance or check the status of your application, visit (https://www.disasterassistance.gov/).**

Individual and Households Assistance Programs:

- Housing Assistance Provision:1. **Rental Assistance**2. **Expense Reimbursement**3. **Home Repair Assistance**4. **Replacement Assistance**- Other Needs Assistance (ONA) Provision:1. **SBA-Dependent Types of ONA**2. **Non-SBA Dependent Types of ONA**

Eligibility:

Applicants must meet general conditions including citizenship status, identity verification, and have needs directly caused by a declared disaster.Full details about these provisions and their limitations are available in the attached fact sheet.**For more information on appealing FEMA decisions, contact the FEMA Disaster Helpline at 800-621-3362.**The Citrus County Chamber of Commerce is actively processing incoming information regarding recovery efforts, assistance, and funding opportunities for businesses and individuals in affected areas. Attached are the fact sheets for the Individual Assistance Programs and Individuals and Households Assistance Programs. We are making efforts to contact all our members in the affected areas to assess your status and needs.For immediate questions or concerns, please reach out to your Member Relations Manager, Corrine, at [email protected], or our President/CEO, Josh Wooten, at [email protected] understand that the journey to recovery may be long and complex. Know that we are here to support you every step of the way. Together, we will rebuild stronger than before.

Click for attachments on the links below:

Individual Assistance Programs Fact Sheet

Individuals and Households Assistance Programs Fact Sheet

Read the full article

0 notes

Text

Know More About REITs | Good Time Builders

REIT, short for Real Estate Investment Trust, refers to a company that owns, operates, or finances income-generating real estate assets. These organizations oversee portfolios consisting of valuable real estate properties, assets, and mortgages. Their primary operation involves leasing out these properties and collecting rent payments, which are then distributed among shareholders as income and dividends. By investing in REITs, individuals, both large and small investors, have the opportunity to invest in valuable real estate and earn dividend income, allowing their capital to grow over time. This investment avenue offers the dual benefit of capital appreciation and income generation. Small investors can even pool their resources with others to invest in large commercial real estate projects.

REITs typically include a wide range of properties such as data centers, infrastructure, healthcare facilities, apartment complexes, and more. Structurally, REITs are similar to mutual funds, pooling funds from multiple investors. This arrangement allows individual investors to earn dividends from real estate investments without the need to personally purchase, manage, or finance any properties. REITs invest in various types of real estate properties, including apartment buildings, medical facilities, offices, data centers, hotels, cell towers, retail centers, and warehouses.

Here are some key points regarding REITs:

1. The origin of Real Estate Investment Trusts (REITs):

REITs have a long history, dating back over 50 years to their establishment in the United States through the Cigar Excise Tax Extension Act in 1960. The first REIT was listed on the New York Stock Exchange in 1965, and similar instruments later appeared on stock exchanges in Europe, Japan, and Australia. In India, REITs were introduced by the Securities and Exchange Board of India (SEBI) in 2007. Updated regulations for REITs were introduced by SEBI in September 2013, officially approved on September 26, 2014. Today, REIT companies listed on Indian stock exchanges are overseen by SEBI and subject to regular monitoring.

2. Types of Real Estate Investment Trusts (REITs):

a. Equity REITs: These REITs own and manage income-generating real estate properties, primarily generating income from rental revenue received from tenants. Equity REITs invest in properties such as office buildings, residential apartments, shopping centers, industrial estates, and hotels. Investors can gain exposure to a diversified portfolio of income-generating real estate assets by investing in equity REITs.

b. Mortgage REITs: These REITs invest in real estate-related assets, particularly mortgage-backed securities. Instead of owning physical properties, mortgage REITs generate income by investing in and financing real estate through debt instruments like mortgage loans and mortgage-backed securities. Investors in mortgage REITs receive dividends primarily from the interest on these mortgage loans or securities.

c. Retail REITs: Also known as shopping center REITs, these entities primarily invest in retail properties such as shopping centers, malls, grocery stores, hypermarkets, and supermarkets. Retail REITs own, manage, and develop these properties to generate income from rental revenue received from tenants like department stores, specialty shops, restaurants, and entertainment venues.

d. Residential REITs: These REITs specialize in investing in residential properties, including apartments, single-family homes, gated communities, and similar housing establishments. Residential REITs own, manage, and develop these properties to generate income from rental revenue received from tenants residing in the properties.

e. Healthcare REITs: Healthcare REITs focus on investing in properties related to the healthcare industry, such as hospitals, medical office buildings, senior living facilities, and skilled nursing facilities. These REITs own, manage, and develop these properties to generate income from rental revenue received from healthcare

Learn more — https://www.gtgroupindia.com/blog/

0 notes