#Reliance Retail Share Price

Explore tagged Tumblr posts

Text

Reliance Retail: A Price Analysis

Reliance Retail, a subsidiary of Reliance Industries Limited, has become one of India's largest and most influential retail chains. As the retail landscape continues to evolve, investors are keenly watching the performance of Reliance Retail’s share price. In this article, we will delve into a comprehensive price analysis of Reliance Retail, exploring its historical trends, recent performance, and future outlook.

Historical Performance of Reliance Retail Share Price

Reliance Retail share price has experienced significant fluctuations since its initial public offering. Historically, the share price has shown a robust upward trend, reflecting the company’s growth and market expansion. The share price has been influenced by various factors including market conditions, economic trends, and the company's financial performance. Understanding these historical patterns provides valuable insights into the stock's potential future movements.

Recent Trends and Market Impact

In recent months, Reliance Retail share price has been subject to both upward and downward movements. Various market dynamics, including economic policies, consumer spending trends, and competitive pressures, have impacted the stock's performance. Analysts have observed that the share price often reacts to broader market trends and company-specific news. For instance, announcements of new store openings or strategic partnerships can lead to short-term spikes in the share price.

Key Drivers of Share Price Fluctuations

Several factors drive the fluctuations in Reliance Retail share price:

Market Conditions: Economic indicators such as inflation rates, interest rates, and overall market sentiment can influence the share price. A positive economic outlook typically supports higher share prices, while economic uncertainties can lead to declines.

Company Performance: Financial results, revenue growth, and profitability are crucial in determining Reliance Retail share price. Strong earnings reports and positive guidance from the company often lead to an appreciation in share price.

Consumer Trends: Changes in consumer behavior and spending patterns impact Reliance Retail’s sales and, consequently, its share price. A surge in consumer spending or successful marketing campaigns can positively affect the stock.

Competitive Landscape: The presence and performance of competitors in the retail sector also play a role in shaping Reliance Retail share price. Market share shifts and competitive pressures can drive price changes.

Future Outlook

Looking ahead, analysts and investors are closely monitoring factors that could influence Reliance Retail share price. The company’s expansion plans, innovations in retail technology, and strategic initiatives are key areas of focus. Additionally, macroeconomic factors and industry trends will play a significant role in shaping the future trajectory of the share price.

Conclusion

In summary, Reliance Retail share price has demonstrated considerable volatility, influenced by a range of internal and external factors. Historical performance and recent trends offer valuable insights, but the future direction of the share price will depend on a combination of market conditions, company performance, and broader economic factors. Investors should remain informed and consider these aspects when evaluating the potential of Reliance Retail share price in their investment strategies.

By understanding the dynamics of Reliance Retail share price, investors can make more informed decisions and better navigate the complexities of the retail sector.

0 notes

Text

Unraveling the Tapestry of Reliance Retail Share Price: Latest News and Updates

In the bustling arena of financial markets, where every tick of the clock heralds a new opportunity, staying abreast of the latest developments is paramount for investors. Among the myriad of companies that capture the attention of market participants, Reliance Retail Ventures Limited stands out as a formidable player in the retail landscape. In this article, we delve into the latest news and updates surrounding Reliance Retail share price, dissecting the factors shaping its trajectory and providing insights into what the future may hold for investors.

Understanding Reliance Retail Ventures Limited: A Brief Overview

Before delving into the intricacies of Reliance Retail share price, it's essential to grasp the company's background and its significance in the market. Reliance Retail Ventures Limited, a subsidiary of Reliance Industries Limited (RIL), is India's largest organized retail player, with a diverse portfolio spanning multiple sectors including grocery, fashion, electronics, and digital services.

Founded by Mukesh Ambani, the chairman and managing director of RIL, Reliance Retail has redefined the retail landscape in India through its innovative business models, robust supply chain infrastructure, and customer-centric approach. With a widespread presence across urban and rural markets, Reliance Retail caters to the diverse needs of millions of consumers, offering a seamless shopping experience through its offline and online channels.

Factors Influencing Reliance Retail's Share Price

Several factors contribute to the fluctuations in Reliance Retail share price, reflecting the intricate interplay of internal dynamics and external market forces. Understanding these factors is crucial for investors seeking to decipher the rationale behind the stock's movements and make informed decisions.

1. Financial Performance: Reliance Retail's financial performance serves as a key driver of its share price. Investors closely monitor metrics such as revenue growth, profit margins, and same-store sales to gauge the company's operational efficiency and growth prospects. Positive earnings reports often translate into upward momentum in the stock price, while disappointing results may lead to corrections.

2. Expansion and Growth Strategy: Reliance Retail's expansion and growth strategy play a pivotal role in shaping investor sentiment. The company's ambitious plans to scale up its retail footprint, enter new markets, and diversify its product offerings are closely tracked by investors as indicators of future revenue growth and market dominance.

3. Strategic Partnerships and Acquisitions: Reliance Retail's strategic partnerships and acquisitions are closely scrutinized by investors for their potential to create synergies and unlock value. Collaborations with global brands, tie-ups with technology companies, and acquisitions of established players in the retail ecosystem can significantly impact the company's market positioning and Reliance Retail share price performance.

4. Digital Transformation Initiatives: Reliance Retail's foray into digital commerce and technology-driven initiatives is a key focus area for investors. The company's efforts to leverage data analytics, artificial intelligence, and e-commerce platforms to enhance customer engagement and drive online sales growth are viewed as critical factors in shaping its future competitiveness and share price trajectory.

5. Regulatory Environment and Policy Changes: Regulatory developments and policy changes in the retail sector can have a profound impact on Reliance Retail's business operations and growth prospects. Changes in foreign direct investment (FDI) regulations, taxation policies, and e-commerce regulations may create opportunities or challenges for the company, influencing investor sentiment and share price dynamics.

Recent Developments and News Impacting Reliance Retail's Share Price

As of the latest updates, several developments have influenced Reliance Retail share price, reflecting the company's response to evolving market trends and strategic imperatives. Here are some notable news items and events shaping investor sentiment:

1. Expansion into New Verticals: Reliance Retail has been actively expanding its presence in new verticals such as fashion, electronics, and digital services. The launch of exclusive partnerships with leading global brands, expansion of its omni-channel retail ecosystem, and investments in digital platforms have garnered investor attention and contributed to positive sentiment towards the stock.

2. Strategic Investments and Acquisitions: Reliance Retail has made strategic investments and acquisitions to strengthen its market position and enhance its capabilities. Notable acquisitions include the purchase of Future Group's retail assets and investments in emerging digital commerce startups. These moves are seen as strategic steps to consolidate the company's leadership position in the retail sector and drive future growth.

3. Digital Transformation and E-commerce Initiatives: Reliance Retail's focus on digital transformation and e-commerce initiatives has been met with enthusiasm by investors. The integration of JioMart, the company's online grocery platform, with its extensive offline retail network has positioned Reliance Retail as a formidable player in the rapidly growing e-commerce market, fueling optimism about its future growth prospects.

4. Financial Performance and Earnings Outlook: Reliance Retail's financial results for the latest quarter have surpassed market expectations, with strong revenue growth and improved profitability. The company's ability to sustain this momentum and capitalize on emerging opportunities in the retail sector has bolstered investor confidence and contributed to positive sentiment towards the stock.

5. Market Sentiment and Analyst Recommendations: Analyst reports and market sentiment surveys have provided insights into investor sentiment towards Reliance Retail's stock. Positive analyst recommendations, favorable outlooks, and bullish sentiment have contributed to upward pressure on the share price, reflecting confidence in the company's growth trajectory and strategic initiatives.

Looking Ahead: Prospects and Challenges

While Reliance Retail enjoys a dominant position in the Indian retail landscape, it faces a set of challenges and opportunities as it charts its course for future growth. Key factors that will influence Reliance Retail share price include:

1. Market Leadership and Competitive Positioning: Reliance Retail's ability to maintain its market leadership position and fend off competition from domestic and international players will be critical for sustaining investor confidence and share price appreciation. Continuous investments in brand building, customer experience, and operational excellence are essential to retaining market share and driving growth.

2. E-commerce Penetration and Digital Innovation: Reliance Retail's success in capturing a larger share of the burgeoning e-commerce market will be instrumental in driving future revenue growth and shareholder value. The company's ability to leverage its digital capabilities, scale up its online platforms, and offer differentiated value propositions to consumers will be key determinants of its competitiveness and share price performance.

3. Regulatory Compliance and Policy Dynamics: Reliance Retail must navigate regulatory challenges and policy uncertainties in the retail sector effectively. Engaging with regulators, advocating for conducive policy frameworks, and ensuring compliance with regulatory requirements are essential to mitigating risks and maintaining investor confidence amidst evolving regulatory dynamics.

4. Consumer Demand and Spending Patterns: Reliance Retail's fortunes are closely tied to consumer demand and spending patterns, which are influenced by factors such as economic growth, income levels, and consumer sentiment. Monitoring shifts in consumer behavior, adapting to changing preferences, and offering relevant product offerings are crucial for driving footfall and sales growth, thereby supporting share price appreciation.

5. Global Economic Trends and Geopolitical Risks: Reliance Retail share price is susceptible to global economic trends and geopolitical risks that may impact commodity prices, currency exchange rates, and market sentiment. Monitoring macro-economic indicators, geopolitical developments, and global market trends is essential for assessing the broader economic context in which Reliance Retail operates and making informed investment decisions. In conclusion, Reliance Retail share price is influenced by a myriad of factors, including financial performance, strategic initiatives, regulatory environment, market sentiment, and global economic trends. By staying abreast of the latest news and developments surrounding the company, investors

0 notes

Text

Is reliance Retail a Listed company?

As of my knowledge arrestment in September 2021, Reliance Retail wasn't a independently listed company. Reliance diligence Limited( RIL) is the parent company that operates Reliance Retail. RIL is listed on the Indian stock exchanges, including the National Stock Exchange( NSE) and the Bombay Stock Exchange( BSE). still, please note that circumstances may have changed since also. For the most over- to- date and accurate information, I recommend checking with a dependable fiscal source or conducting an internet hunt to see if there have been any recent developments regarding Reliance Retail's table status. For further details on upcoming IPOs, share price update, financials etc. visit Planify capital limited.

youtube

#Reliance Retail Pre IPO#Reliance Retail Share Price#Reliance Retail IPO#Reliance Retail Unlisted shares#Reliance Retail Unlisted Share Price#Reliance Retail Upcoming IPO#Reliance Retail Unlisted share

1 note

·

View note

Text

Amazon’s financial shell game let it create an “impossible” monopoly

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me in TUCSON (Mar 9-10), then San Francisco (Mar 13), Anaheim, and more!

For the pro-monopoly crowd that absolutely dominated antitrust law from the Carter administration until 2020, Amazon presents a genuinely puzzling paradox: the company's monopoly power was never supposed to emerge, and if it did, it should have crumbled immediately.

Pro-monopoly economists embody Ely Devons's famous aphorism that "If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’":

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

Rather than using the way the world actually works as their starting point for how to think about it, they build elaborate models out of abstract principles like "rational actors." The resulting mathematical models are so abstractly elegant that it's easy to forget that they're just imaginative exercises, disconnected from reality:

https://pluralistic.net/2023/04/03/all-models-are-wrong/#some-are-useful

These models predicted that it would be impossible for Amazon to attain monopoly power. Even if they became a monopoly – in the sense of dominating sales of various kinds of goods – the company still wouldn't get monopoly power.

For example, if Amazon tried to take over a category by selling goods below cost ("predatory pricing"), then rivals could just wait until the company got tired of losing money and put prices back up, and then those rivals could go back to competing. And if Amazon tried to keep the loss-leader going indefinitely by "cross-subsidizing" the losses with high-margin profits from some other part of its business, rivals could sell those high margin goods at a lower margin, which would lure away Amazon customers and cut the supply lines for the price war it was fighting with its discounted products.

That's what the model predicted, but it's not what happened in the real world. In the real world, Amazon was able use its access to the capital markets to embark on scorched-earth predatory pricing campaigns. When diapers.com refused to sell out to Amazon, the company casually committed $100m to selling diapers below cost. Diapers.com went bust, Amazon bought it for pennies on the dollar and shut it down:

https://www.theverge.com/2019/5/13/18563379/amazon-predatory-pricing-antitrust-law

Investors got the message: don't compete with Amazon. They can remain predatory longer than you can remain solvent.

Now, not everyone shared the antitrust establishment's confidence that Amazon couldn't create a durable monopoly with market power. In 2017, Lina Khan – then a third year law student – published "Amazon's Antitrust Paradox," a landmark paper arguing that Amazon had all the tools it needed to amass monopoly power:

https://www.yalelawjournal.org/note/amazons-antitrust-paradox

Today, Khan is chair of the FTC, and has brought a case against Amazon that builds on some of the theories from that paper. One outcome of that suit is an unprecedented look at Amazon's internal operations. But, as the Institute for Local Self-Reliance's Stacy Mitchell describes in a piece for The Atlantic, key pieces of information have been totally redacted in the court exhibits:

https://www.theatlantic.com/ideas/archive/2024/02/amazon-profits-antitrust-ftc/677580/

The most important missing datum: how much money Amazon makes from each of its lines of business. Amazon's own story is that it basically breaks even on its retail operation, and keeps the whole business afloat with profits from its AWS cloud computing division. This is an important narrative, because if it's true, then Amazon can't be forcing up retail prices, which is the crux of the FTC's case against the company.

Here's what we know for sure about Amazon's retail business. First: merchants can't live without Amazon. The majority of US households have Prime, and 90% of Prime households start their ecommerce searches on Amazon; if they find what they're looking for, they buy it and stop. Thus, merchants who don't sell on Amazon just don't sell. This is called "monopsony power" and it's a lot easier to maintain than monopoly power. For most manufacturers, a 10% overnight drop in sales is a catastrophe, so a retailer that commands even a 10% market-share can extract huge concessions from its suppliers. Amazon's share of most categories of goods is a lot higher than 10%!

What kind of monopsony power does Amazon wield? Well, for one thing, it is able to levy a huge tax on its sellers. Add up all the junk-fees Amazon charges its platform sellers and it comes out to 45-51%:

https://pluralistic.net/2023/04/25/greedflation/#commissar-bezos

Competitive businesses just don't have 45% margins! No one can afford to kick that much back to Amazon. What is a merchant to do? Sell on Amazon and you lose money on every sale. Don't sell on Amazon and you don't get any business.

The only answer: raise prices on Amazon. After all, Prime customers – the majority of Amazon's retail business – don't shop for competitive prices. If Amazon wants a 45% vig, you can raise your Amazon prices by a third and just about break even.

But Amazon is wise to that: they have a "most favored nation" rule that punishes suppliers who sell goods more cheaply in rival stores, or even on their own site. The punishments vary, from banishing your products to page ten million of search-results to simply kicking you off the platform. With publishers, Amazon reserves the right to lower the prices they set when listing their books, to match the lowest price on the web, and paying publishers less for each sale.

That means that suppliers who sell on Amazon (which is anyone who wants to stay in business) have to dramatically hike their prices on Amazon, and when they do, they also have to hike their prices everywhere else (no wonder Prime customers don't bother to search elsewhere for a better deal!).

Now, Amazon says this is all wrong. That 45-51% vig they claim from business customers is barely enough to break even. The company's profits – they insist – come from selling AWS cloud service. The retail operation is just a public service they provide to us with cross-subsidy from those fat AWS margins.

This is a hell of a claim. Last year, Amazon raked in $130 billion in seller fees. In other words: they booked more revenue from junk fees than Bank of America made through its whole operation. Amazon's junk fees add up to more than all of Meta's revenues:

https://s2.q4cdn.com/299287126/files/doc_financials/2023/q4/AMZN-Q4-2023-Earnings-Release.pdf

Amazon claims that none of this is profit – it's just covering their operating expenses. According to Amazon, its non-AWS units combined have a one percent profit margin.

Now, this is an eye-popping claim indeed. Amazon is a public company, which means that it has to make thorough quarterly and annual financial disclosures breaking down its profit and loss. You'd think that somewhere in those disclosures, we'd find some details.

You'd think so, but you'd be wrong. Amazon's disclosures do not break out profits and losses by segment. SEC rules actually require the company to make these per-segment disclosures:

https://scholarship.law.stjohns.edu/cgi/viewcontent.cgi?article=3524&context=lawreview#:~:text=If%20a%20company%20has%20more,income%20taxes%20and%20extraordinary%20items.

That rule was enacted in 1966, out of concern that companies could use cross-subsidies to fund predatory pricing and other anticompetitive practices. But over the years, the SEC just…stopped enforcing the rule. Companies have "near total managerial discretion" to lump business units together and group their profits and losses in bloated, undifferentiated balance-sheet items:

https://www.ucl.ac.uk/bartlett/public-purpose/publications/2021/dec/crouching-tiger-hidden-dragons

As Mitchell points you, it's not just Amazon that flouts this rule. We don't know how much money Google makes on Youtube, or how much Apple makes from the App Store (Apple told a federal judge that this number doesn't exist). Warren Buffett – with significant interest in hundreds of companies across dozens of markets – only breaks out seven segments of profit-and-loss for Berkshire Hathaway.

Recall that there is one category of data from the FTC's antitrust case against Amazon that has been completely redacted. One guess which category that is! Yup, the profit-and-loss for its retail operation and other lines of business.

These redactions are the judge's fault, but the real fault lies with the SEC. Amazon is a public company. In exchange for access to the capital markets, it owes the public certain disclosures, which are set out in the SEC's rulebook. The SEC lets Amazon – and other gigantic companies – get away with a degree of secrecy that should disqualify it from offering stock to the public. As Mitchell says, SEC chairman Gary Gensler should adopt "new rules that more concretely define what qualifies as a segment and remove the discretion given to executives."

Amazon is the poster-child for monopoly run amok. As Yanis Varoufakis writes in Technofeudalism, Amazon has actually become a post-capitalist enterprise. Amazon doesn't make profits (money derived from selling goods); it makes rents (money charged to people who are seeking to make a profit):

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

Profits are the defining characteristic of a capitalist economy; rents are the defining characteristic of feudalism. Amazon looks like a bazaar where thousands of merchants offer goods for sale to the public, but look harder and you discover that all those stallholders are totally controlled by Amazon. Amazon decides what goods they can sell, how much they cost, and whether a customer ever sees them. And then Amazon takes $0.45-51 out of every dollar. Amazon's "marketplace" isn't like a flea market, it's more like the interconnected shops on Disneyland's Main Street, USA: the sign over the door might say "20th Century Music Company" or "Emporium," but they're all just one store, run by one company.

And because Amazon has so much control over its sellers, it is able to exercise power over its buyers. Amazon's search results push down the best deals on the platform and promote results from more expensive, lower-quality items whose sellers have paid a fortune for an "ad" (not really an ad, but rather the top spot in search listings):

https://pluralistic.net/2023/11/29/aethelred-the-unready/#not-one-penny-for-tribute

This is "Amazon's pricing paradox." Amazon can claim that it offers low-priced, high-quality goods on the platform, but it makes $38b/year pushing those good deals way, way down in its search results. The top result for your Amazon search averages 29% more expensive than the best deal Amazon offers. Buy something from those first four spots and you'll pay a 25% premium. On average, you need to pick the seventeenth item on the search results page to get the best deal:

https://scholarship.law.bu.edu/faculty_scholarship/3645/

For 40 years, pro-monopoly economists claimed that it would be impossible for Amazon to attain monopoly power over buyers and sellers. Today, Amazon exercises that power so thoroughly that its junk-fee revenues alone exceed the total revenues of Bank of America. Amazon's story – that these fees barely stretch to covering its costs – assumes a nearly inconceivable level of credulity in its audience. Regrettably – for the human race – there is a cohort of senior, highly respected economists who possess this degree of credulity and more.

Of course, there's an easy way to settle the argument: Amazon could just comply with SEC regs and break out its P&L for its e-commerce operation. I assure you, they're not hiding this data because they think you'll be pleasantly surprised when they do and they don't want to spoil the moment.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/03/01/managerial-discretion/#junk-fees

Image: Doc Searls (modified) https://www.flickr.com/photos/docsearls/4863121221/

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

#pluralistic#amazon#ilsr#institute for local self-reliance#amazon's antitrust paradox#antitrust#trustbusting#ftc#lina khan#aws#cross-subsidization#stacy mitchell#junk fees#most favored nation#sec#securities and exchange commission#segmenting#managerial discretion#ecommerce#technofeudalism

606 notes

·

View notes

Text

He’s a f—king madman who has no idea what he’s doing or what kind of harm he’s going to cause. Coffee prices will soar and it won’t’t just be Columbian coffee because it will create a greater demand for coffee from other nations. Then you can expect all the importers and retailers to price gouge on top of that. Pressed flowers will become unaffordable as well. Then gas prices will rise because their cheap crude oil will suddenly cost 25% more and again everyone else in the business will see increased demand and raise their prices and price gouge on top of that. Worse, he’s threatening to Jack the tariffs up to 50% for countries that won’t now to his demands.

Tariffs are meant to be used sparingly to stimulate domestic industry instead of relying on foreign producers. They were never intended to be used across the board on every item from a country. The foreign producers aren’t going to absorb a 25% loss in revenue, that’s never happened and likely never will. Prices for American consumers will rise by 25% plus inconvenience fees and price gouging.

Tariffs aren’t a weapon if you think they are you’re just shooting your own citizens in the foot. This is pretty basic stuff. Most people learned this when studying early American history in elementary school. American leaders in the post-revolutionary years imposed tariffs on European manufactured goods such as tools, guns, furniture, machines, etc to end reliance on imported goods while stimulating American manufacturing and turning us into an exporting nation.

Trump’s sole college degree is a bachelor’s in economics. This dumb ass should know how this works. He the densest mother f—ker alive and is completely incapable of being taught anything. Further he’s suffering cognitive decline due to mental illness and is a raging drug addict on top of that. Coke as an upper and Adderall to come down. His shadow president, Elon Musk, ironically only has a bachelor’s degree as well and surprise it’s also in economics. He should know better but also is suffering from mental illness and the consumption of mass quantities of Ketamine. Two moronic drug addicts.

The Republicants who should be advising Trump aren’t the best and brightest either. Nearly all of them haven’t gone beyond a bachelor’s degree and they certainly didn’t major in anything that would be useful in managing a large country with the largest economy on the planet. They are trying to run a government based on sound bites and talking points they picked up from the uneducated hosts of Fox News and Fox Business.

Once countries get burned by Trump’s tariffs they will seek out trading partners in Russia, Asia, the Middle East, and Africa. Once a trading partner leaves they almost never return. We’ll be forced to seek out more expensive trading partners who will be very cautious dealing with an unreliable USA. Further Columbia will stop cooperating and sharing intelligence in the war against the narco terrorists. Politically all these nations Trump alienates will realign their political goals with BRICS which is growing as an alternative trade and policy for nations not aligned with the Western and first world states. This is an economic and foreign policy disaster that will ripple through the world for decades to come. Trump isn’t just going to crash our economy but likely cause a worldwide depression, or at least recession. When the US catches a cold the rest of the world sneezes.

THIS IS NOT NORMAL AND ITS NOT EVEN RATIONAL.

#trump doesn’t understand tariffs#Trump’s advisers are not intelligent or well educated and certainly are not competent#tariffs are not tools#nobody wins a trade war#an unsuccessful NYC realtor is not qualified to be president#this is self destructive#the US and world economies will suffer#republican assholes#maga morons#traitor trump#crooked donald#traitor#resist#republican values#republican hypocrisy#republican family values

96 notes

·

View notes

Text

What Makes a Reliable Non-Basmati Rice Manufacturer?

Non-basmati rice is a staple food in many countries due to its affordable price, versatility, and varying grain sizes. From long-grain to short-grain varieties, it serves as the backbone of countless meals. But what’s the difference between an ordinary supplier and a reliable manufacturer when it comes to non-basmati rice? For wholesalers, retailers, and even consumers, choosing the right rice manufacturer can make a huge difference in quality, consistency, and long-term relationships. This blog will explore the key factors that ensure you’re sourcing from a trustworthy non-basmati rice manufacturer.

Quality Control Practices and Certifications

The foundation of any reliable rice manufacturer is its commitment to quality. Manufacturers with strict quality control processes ensure that each batch of rice meets specific standards for purity, grain length, moisture content, and taste. Look for manufacturers that adhere to international certifications such as ISO 9001 for quality management and HACCP (Hazard Analysis and Critical Control Points) for food safety. These certifications ensure that the rice is produced under clean conditions and undergoes rigorous testing to remove impurities.

Additionally, quality manufacturers often employ state-of-the-art testing laboratories that analyze rice for contaminants such as pesticides, aflatoxins, and heavy metals. This commitment to food safety ensures that you are getting a premium product that meets global standards.

Consistent Supply and Scalability

A reliable non-basmati rice manufacturer must be able to meet consistent demand, whether you are a small retailer or a large-scale distributor. This means maintaining adequate stock, having capacity for large orders, and increasing production as needed. Manufacturers with extensive farming networks or partnerships with multiple farmers can better guarantee stable supply throughout the year, regardless of seasonal fluctuations.

Scalability is especially important for businesses looking to expand into new markets. A trustworthy manufacturer will have the flexibility to adjust production volumes to align with your growth, ensuring a smooth supply chain even during peak seasons.

Technological advancements in milling and packaging

Modern rice milling and packaging technology plays a key role in maintaining the quality and shelf life of non-basmati rice. Reliable manufacturers invest in advanced milling machinery that reduces broken grains and preserves the natural texture and flavor of rice. Look for manufacturers that use automated sorting technologies to remove discolored or damaged grains, ensuring a more consistent product.

Packaging also matters. Vacuum-sealed or air-tight packaging helps preserve freshness and prevent moisture ingress, which can lead to spoilage or insect infestation. Manufacturers that adopt innovative packaging solutions help ensure that their rice reaches consumers in optimal condition.

Sustainable and ethical sourcing

As consumers and businesses are becoming more aware of sustainability, it is important to work with a manufacturer that values ethical sourcing. Reliable manufacturers prioritize environmentally friendly farming practices, such as minimizing the use of chemical pesticides and adopting water conservation methods. Some manufacturers also support small-scale farmers by offering fair trade agreements, ensuring that local communities benefit from their involvement.

Sustainably sourced rice also tends to be higher in quality, as the plants are grown in healthy soil, without an excessive reliance on synthetic chemicals. Look for manufacturers that openly share their sustainability initiatives or hold certifications such as Fairtrade or Organic to further validate their commitment to ethical practices.

Customer Support and Global Reach

Strong customer support is the hallmark of any reliable non-basmati rice manufacturer. A good manufacturer should provide clear communication channels, timely responses to inquiries, and efficient problem-solving when issues arise. This level of support fosters trust and ensures a seamless business relationship over time.

Additionally, manufacturers with a global reach and experience exporting rice to multiple countries are better equipped to handle the complexities of international shipping, customs regulations, and regional preferences. A manufacturer with a proven export track record can provide invaluable guidance, especially for businesses looking to expand internationally.

Choosing the right non-basmati rice manufacturer isn’t just about considering price. Quality control, supply continuity, technological advancements, consistency and customer support all play a vital role in ensuring you get a great product. By partnering with a reliable manufacturer, you can guarantee that your business will thrive and your customers will be happy.

2 notes

·

View notes

Text

Air Cargo Market: In-depth Research Covering Share Analysis & Industry Overview 2025-2032

The Air Cargo Market plays a vital role in the global supply chain, enabling the rapid transportation of goods across continents. As industries continue to embrace globalization, e-commerce thrives, and supply chain efficiencies improve, the air freight industry is witnessing dynamic shifts. Despite facing challenges such as fluctuating fuel prices, regulatory hurdles, and capacity constraints, the air cargo sector continues to grow, driven by evolving consumer demands and technological advancements.

The Air Cargo Market size was valued at USD 140.94 billion in 2023. The air cargo industry is projected to grow from USD 146.69 billion in 2024 to USD 216.29 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4.97% during the forecast period (2024 - 2032)

Current Trends in the Air Cargo Market

E-commerce Boom Driving Demand The rise of e-commerce giants and direct-to-consumer models has significantly boosted air cargo demand. Online retailers require fast and reliable shipping options to meet consumer expectations, leading to increased reliance on air freight. The demand for express delivery services has surged, particularly in sectors like fashion, electronics, and pharmaceuticals.

Digitalization and Automation The air cargo industry is increasingly adopting digital solutions to improve efficiency. Technologies such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT) are streamlining processes like cargo tracking, inventory management, and customs clearance. Digital freight platforms are also improving transparency and reducing manual paperwork, making the industry more efficient.

Sustainability and Green Initiatives Sustainability is becoming a key focus for air cargo operators. Airlines are investing in fuel-efficient aircraft, sustainable aviation fuels (SAF), and carbon offset programs to reduce their environmental impact. Additionally, regulatory bodies are imposing stricter emissions standards, pushing the industry toward greener operations.

Expansion of Cargo-Dedicated Aircraft Fleets With increasing demand, airlines are expanding their fleets of dedicated freighters. While passenger aircraft belly cargo remains a significant contributor, many companies are investing in purpose-built cargo planes to cater to growing logistics needs.

Regional Growth in Emerging Markets Emerging markets, especially in Asia-Pacific, Latin America, and Africa, are witnessing rapid air cargo market growth. Increasing manufacturing activities, cross-border trade, and infrastructure improvements are driving demand for air freight services in these regions.

Challenges Facing the Air Cargo Industry

Capacity Constraints and High Costs Air cargo is an expensive mode of transportation compared to sea or rail freight. Limited cargo capacity on passenger flights and supply chain disruptions often lead to increased freight rates. The industry faces ongoing pressure to balance costs with profitability.

Regulatory and Security Challenges Stricter regulations on international shipments, security screening, and customs procedures add complexity to air cargo operations. Compliance with changing trade policies and customs requirements can slow down transit times and increase costs for freight operators.

Supply Chain Disruptions Global events such as pandemics, geopolitical tensions, and natural disasters have a direct impact on air cargo operations. Disruptions in supply chains can lead to fluctuations in demand, operational bottlenecks, and increased logistical challenges.

Environmental Concerns and Carbon Emissions Air freight has a higher carbon footprint compared to other transportation modes. Regulatory pressure and consumer awareness are driving the need for sustainable solutions. Airlines must invest in green technologies to remain competitive while meeting emission reduction targets.

Infrastructure Limitations Many airports lack the necessary infrastructure to handle increasing air cargo volumes efficiently. Delays in airport expansion, inadequate cargo-handling facilities, and congestion issues pose challenges for logistics companies.

Future Outlook for the Air Cargo Market

Advancements in Air Cargo Technology The future of air cargo will be shaped by continued technological innovation. Autonomous drones, AI-driven logistics, and blockchain-based tracking systems will enhance efficiency, security, and transparency in cargo movement.

Increased Use of Sustainable Aviation Fuels (SAF) Sustainable aviation fuels are expected to play a crucial role in reducing the carbon footprint of air freight operations. Governments and industry players are investing in SAF production and infrastructure to drive adoption.

Growth in Pharmaceutical and Perishable Goods Transport The demand for time-sensitive cargo, including pharmaceuticals, vaccines, and perishable food items, is expected to grow. Airlines are expanding their capabilities in temperature-controlled logistics to cater to this demand.

Resilience in Supply Chains Companies are focusing on building more resilient and agile supply chains to mitigate disruptions. This includes diversifying transportation options, increasing warehousing capacity, and leveraging predictive analytics for demand forecasting.

Integration of Multimodal Transportation The future of air cargo will involve greater integration with other transportation modes. Seamless coordination between air, sea, rail, and road logistics will optimize delivery routes and reduce costs for global supply chains.

MRFR recognizes the following Air Cargo Companies - Qatar Airways (Qatar),Etihad Airways (UAE),International Consolidated Airlines Group, SA (UK),All Nippon Airways Co., Ltd (Japan),Deutsche Lufthansa AG (Germany),Japan Airlines (Japan),The Emirates Group (UAE),Singapore Airlines (Singapore),Cargolux (Luxembourg),Korean Air (South Korea),China Eastern Airlines Corporation Limited (China),Cathay Pacific Airways Limited (Hong Kong),DHL International GmbH (Germany),United Parcel Service of America, Inc. (US),FedEx (US)

The air cargo market is evolving rapidly, driven by digital transformation, e-commerce growth, and sustainability efforts. While challenges such as regulatory constraints, high costs, and environmental concerns persist, technological advancements and strategic investments are shaping a promising future for the industry. As global trade and logistics continue to expand, the air cargo market will remain a crucial component of the worldwide supply chain, adapting to meet changing consumer and business demands.

Related Reports

Blister Packaging Market - https://www.marketresearchfuture.com/reports/blister-packaging-market-1181 PET Packaging Market - https://www.marketresearchfuture.com/reports/pet-packaging-market-1779 Aerosol Can Market - https://www.marketresearchfuture.com/reports/aerosol-can-market-2097 Antimicrobial Packaging Market - https://www.marketresearchfuture.com/reports/antimicrobial-packaging-market-2167 Ampoules Packaging Market - https://www.marketresearchfuture.com/reports/ampoules-packaging-market-2420 Edible Packaging Market - https://www.marketresearchfuture.com/reports/edible-packaging-market-5435 Snack food Packaging Market - https://www.marketresearchfuture.com/reports/snack-food-packaging-market-8702 PCR Plastic Packaging Market - https://www.marketresearchfuture.com/reports/pcr-plastic-packaging-market-11051

0 notes

Text

The Energy Intelligence Solution Market is projected to grow from USD 4625 million in 2024 to an estimated USD 14749.4 million by 2032, with a compound annual growth rate (CAGR) of 15.6% from 2024 to 2032.The global push toward sustainability and energy efficiency has created an expanding market for energy intelligence solutions. These systems integrate advanced technologies such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), and big data analytics to monitor, analyze, and optimize energy consumption. As businesses and governments increasingly focus on reducing carbon footprints and operational costs, the demand for energy intelligence solutions is accelerating.

Browse the full report at https://www.credenceresearch.com/report/energy-intelligence-solution-market

Market Overview

The energy intelligence solutions market is projected to witness significant growth in the coming years. According to industry estimates, the market size is expected to grow at a compound annual growth rate (CAGR) exceeding 10% from 2023 to 2030. This growth is driven by the rising adoption of smart grid systems, stricter environmental regulations, and the growing awareness of sustainable practices across industries.

Energy intelligence solutions provide a comprehensive approach to managing energy consumption. They enable businesses to track energy usage patterns, predict future demand, and implement cost-saving measures without compromising operational efficiency. These solutions find applications across various sectors, including manufacturing, healthcare, retail, and residential buildings, further expanding their market potential.

Key Drivers of Market Growth

1. Rising Energy Costs

The volatile nature of energy prices is a major concern for businesses worldwide. Energy intelligence solutions help organizations optimize their energy use, leading to substantial cost savings. By identifying inefficiencies and automating energy management processes, these solutions ensure more predictable and manageable energy expenditures.

2. Sustainability Goals and Regulations

Governments worldwide are imposing stringent regulations to curb greenhouse gas emissions. Initiatives like the Paris Agreement and carbon neutrality commitments have put pressure on organizations to adopt cleaner, greener practices. Energy intelligence solutions provide actionable insights to meet these regulatory requirements while promoting long-term sustainability.

3. Technological Advancements

The integration of AI, IoT, and cloud computing in energy intelligence systems has revolutionized energy management. These technologies allow real-time data collection, predictive analytics, and remote monitoring, enabling businesses to make data-driven decisions. Additionally, advancements in sensor technologies and smart meters have improved the accuracy and efficiency of energy monitoring systems.

4. Smart Cities and Infrastructure Development

The global push toward smart cities and modern infrastructure has fueled the demand for energy intelligence solutions. Smart cities rely on efficient energy management to power advanced systems like intelligent transportation, public lighting, and connected buildings. Energy intelligence systems play a pivotal role in achieving these goals.

Challenges in the Market

Despite its promising growth, the energy intelligence solutions market faces certain challenges:

High Initial Costs: Implementing energy intelligence systems can be expensive, deterring smaller businesses from adoption. However, the long-term cost savings often outweigh the initial investment.

Data Security Concerns: The reliance on IoT and cloud-based solutions raises concerns about data breaches and cybersecurity. Addressing these challenges is critical for market expansion.

Lack of Awareness: Many organizations remain unaware of the benefits of energy intelligence solutions, especially in developing regions. Increasing education and outreach will be crucial for market penetration.

Future Outlook

The energy intelligence solutions market is set to play a vital role in the global transition toward sustainable energy practices. Emerging technologies like blockchain and edge computing are expected to further enhance the capabilities of these systems, making them more efficient and secure. Additionally, partnerships between technology providers, energy companies, and governments will drive innovation and adoption.

As the world moves toward a greener future, energy intelligence solutions will be at the forefront of enabling businesses and cities to achieve their energy efficiency and sustainability goals. With continuous advancements in technology and growing awareness of environmental concerns, the market is primed for robust growth.

Key Player Analysis:

ABB Ltd.

Alteryx

Amazon Web Services, Inc.

Atos SE

Cisco Systems, Inc.

Copyright Microstrategy Incorporated

Eaton Corporation

General Electric (GE)

Google LLC

Honeywell International Inc.

IBM Corporation

Intel Corporation

Johnson Controls International

Microsoft

Open Text Corporation

Oracle

Rockwell Automation, Inc.

com, Inc.

SAP

SAS Institute, Inc.

Schneider Electric

Siemens AG

Teradata

TIBCO Software Inc.

Segmentation:

By Service Type:

Support and Maintenance Service

Consulting Services

System Integration Service

By Application

Energy Management

Demand Response Management

Predictive Maintenance

Data Analytics

Grid Management

By Deployment Model:

Cloud-based

On Premise

By Industry Vertical:

Manufacturing Units

Offices and Commercial Areas

Residential Buildings

By Region:

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report at https://www.credenceresearch.com/report/energy-intelligence-solution-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

0 notes

Text

The Oldest Consumer Retail Chain of India 🇮🇳 Did you know that India’s first and largest consumer retail chain was neither Reliance, Star Bazaar, More, nor Spencer’s? The country’s pioneering consumer retail network was in fact, the government’s very own multi-state cooperative society—Kendriya Bhandar. Established in 1963, Kendriya Bhandar was founded with the mission of providing essential consumer goods to central government employees and their families. Over the decades, it has grown into India’s largest chain of consumer retail stores, offering essential goods at cost-effective, discounted prices. Even after six decades of operations, Kendriya Bhandar continues to stand strong in Retail space amidst competition from both Indian and multinational retail giants. With a staggering turnover of over ₹4,300 crores, a diversified product portfolio, and a nationwide presence, Kendriya Bhandar remains a trusted name in retail. 🚢 Meet the Captain of the Ship at News 365Times Insight Hour At the helm of this prestigious organization is Dr. Mukesh Kumar, Managing Director of Kendriya Bhandar. Leading the organization through a rapidly evolving and highly competitive business environment, Dr. Kumar has been instrumental in expanding operations, ensuring product quality, and maintaining the trust of millions of Indian consumers. Dr Kumar shares with News 365Times an insider’s perspective on his journey, his vision for Kendriya Bhandar, and how the organization continues to make essential goods accessible and affordable for every Indian . Exclusive Interview: Namaskar Dr. Mukesh Kumar Ji, welcome! Kindly brief us about your journey with Kendriya Bhandar? Namaskar, thank you! My journey has been truly challenging and inspiring. I studied in a simple government school with limited facilities, but with dedication and hard work, I secured a place in the Indian Air Force. After serving there for 25 years, I decided to join Kendriya Bhandar to contribute further to society. How is Kendriya Bhandar serving India? Kendriya Bhandar not only provides groceries and consumer goods but is now also making affordable medicines available. Our goal is to offer high-quality and cost-effective products to the general public. We understand from our sources that Kendriya Bhandar plans to launch a new range of low-cost medicines. Can you tell us more about this initiative? Yes, we are soon introducing a wide range of affordable medicines. This initiative will be a major step towards making healthcare services more accessible and economical to masses. How does Kendriya Bhandar ensure the quality of its products? We follow a three-level quality check system, where every product undergoes rigorous testing. This ensures that our customers always receive high-quality and reliable products. You have also praised the leadership of Prime Minister Shri Narendra Modi and support of Union Minsiter of Cooperation and Home ,Shri Amit Shah. Absolutely! Modi Ji's dynamic leadership is truly inspiring. His visionary approach has taken India to new heights. At the same time, Amit Shah Ji has played a crucial role in strengthening Kendriya Bhandar. His strategies and guidance have been key to our success. Being a Multi state cooperative ,Kendriya Bhandar under the aegis of Minstry of DoPT (Department of Personal & Training ) and regulatory umbrella of Ministry of Cooperation have been able to devise a sustainable ,profitable business model along with being cost effective to masses. What is the future of Kendriya Bhandar? We aim to expand our retail and online presence so that more people can easily access our products. Utilizing digital technology, we plan to provide even better services to our customers. As already stated our objective is to serve masses with quality consumer products and hence Kendriya Bhandar under the aegis of Minstry of DoPT (Department of Personal & Training ) and regulatory umbrella of Ministry of Cooperation have been able to devise a sustainable ,profitable business model despite being cost effective.

Your journey has been very inspiring. Best wishes for your future plans! Thank you to you and yours news channel in taking this initiative to highlight Kendriya Bhandar to media though we don’t advertise too much , As a Govt. servant my constant effort will always be to serve my department , my country and its people and I feel immensely proud in this . Jai Hind ,Namaskar Stay tuned for this power-packed discussion—only on News 365Times! 🚀

0 notes

Text

The Oldest Consumer Retail Chain of India 🇮🇳 Did you know that India’s first and largest consumer retail chain was neither Reliance, Star Bazaar, More, nor Spencer’s? The country’s pioneering consumer retail network was in fact, the government’s very own multi-state cooperative society—Kendriya Bhandar. Established in 1963, Kendriya Bhandar was founded with the mission of providing essential consumer goods to central government employees and their families. Over the decades, it has grown into India’s largest chain of consumer retail stores, offering essential goods at cost-effective, discounted prices. Even after six decades of operations, Kendriya Bhandar continues to stand strong in Retail space amidst competition from both Indian and multinational retail giants. With a staggering turnover of over ₹4,300 crores, a diversified product portfolio, and a nationwide presence, Kendriya Bhandar remains a trusted name in retail. 🚢 Meet the Captain of the Ship at News 365Times Insight Hour At the helm of this prestigious organization is Dr. Mukesh Kumar, Managing Director of Kendriya Bhandar. Leading the organization through a rapidly evolving and highly competitive business environment, Dr. Kumar has been instrumental in expanding operations, ensuring product quality, and maintaining the trust of millions of Indian consumers. Dr Kumar shares with News 365Times an insider’s perspective on his journey, his vision for Kendriya Bhandar, and how the organization continues to make essential goods accessible and affordable for every Indian . Exclusive Interview: Namaskar Dr. Mukesh Kumar Ji, welcome! Kindly brief us about your journey with Kendriya Bhandar? Namaskar, thank you! My journey has been truly challenging and inspiring. I studied in a simple government school with limited facilities, but with dedication and hard work, I secured a place in the Indian Air Force. After serving there for 25 years, I decided to join Kendriya Bhandar to contribute further to society. How is Kendriya Bhandar serving India? Kendriya Bhandar not only provides groceries and consumer goods but is now also making affordable medicines available. Our goal is to offer high-quality and cost-effective products to the general public. We understand from our sources that Kendriya Bhandar plans to launch a new range of low-cost medicines. Can you tell us more about this initiative? Yes, we are soon introducing a wide range of affordable medicines. This initiative will be a major step towards making healthcare services more accessible and economical to masses. How does Kendriya Bhandar ensure the quality of its products? We follow a three-level quality check system, where every product undergoes rigorous testing. This ensures that our customers always receive high-quality and reliable products. You have also praised the leadership of Prime Minister Shri Narendra Modi and support of Union Minsiter of Cooperation and Home ,Shri Amit Shah. Absolutely! Modi Ji's dynamic leadership is truly inspiring. His visionary approach has taken India to new heights. At the same time, Amit Shah Ji has played a crucial role in strengthening Kendriya Bhandar. His strategies and guidance have been key to our success. Being a Multi state cooperative ,Kendriya Bhandar under the aegis of Minstry of DoPT (Department of Personal & Training ) and regulatory umbrella of Ministry of Cooperation have been able to devise a sustainable ,profitable business model along with being cost effective to masses. What is the future of Kendriya Bhandar? We aim to expand our retail and online presence so that more people can easily access our products. Utilizing digital technology, we plan to provide even better services to our customers. As already stated our objective is to serve masses with quality consumer products and hence Kendriya Bhandar under the aegis of Minstry of DoPT (Department of Personal & Training ) and regulatory umbrella of Ministry of Cooperation have been able to devise a sustainable ,profitable business model despite being cost effective.

Your journey has been very inspiring. Best wishes for your future plans! Thank you to you and yours news channel in taking this initiative to highlight Kendriya Bhandar to media though we don’t advertise too much , As a Govt. servant my constant effort will always be to serve my department , my country and its people and I feel immensely proud in this . Jai Hind ,Namaskar Stay tuned for this power-packed discussion—only on News 365Times! 🚀

0 notes

Text

Reliance Retail Unlisted Shares: A Guide to Investing

Investing in unlisted shares can be a strategic move for savvy investors looking to gain exposure to high-growth companies before they go public. One prominent player in this space is Reliance Retail, a subsidiary of Reliance Industries and one of India's largest retail chains. This guide will help you understand the potential of investing in Reliance Retail unlisted shares, including how to track the Reliance Retail unlisted share price and make informed investment decisions.

Understanding Reliance Retail Unlisted Shares

Reliance Retail is a major player in India's retail sector, with a vast network of stores across various formats, including grocery, fashion, and electronics. As an unlisted entity, its shares are not available on public stock exchanges. Instead, they are traded privately, often through over-the-counter (OTC) platforms or direct transactions between buyers and sellers.

Why Invest in Reliance Retail Unlisted Shares?

Growth Potential: Reliance Retail has shown impressive growth over the years. Investing in its unlisted shares allows you to tap into the company's future growth potential before it becomes publicly traded.

Diversification: Adding Reliance Retail unlisted shares to your portfolio can diversify your investments, especially if you're looking to gain exposure to the retail sector.

Early Access: Buying Reliance Retail unlisted shares provides an opportunity to invest in a leading company at a potentially lower price before it lists on the stock exchange.

Tracking the Reliance Retail Unlisted Share Price

Since Reliance Retail shares are unlisted, their prices can be less transparent than those of listed stocks. To track the Reliance Retail unlisted share price, consider the following methods:

Private Marketplaces: Unlisted shares are often traded on private marketplaces or OTC platforms. These platforms may provide current pricing and recent transaction data.

Brokerage Firms: Some brokerage firms specialize in unlisted shares and can provide up-to-date information on the Reliance Retail unlisted share price.

Financial News and Reports: Keep an eye on financial news and reports that may offer insights into the company's performance and any potential changes in its share price.

How to Invest in Reliance Retail Unlisted Shares

Research: Thoroughly research Reliance Retail’s financial health, business model, and growth prospects. Understanding the company's fundamentals is crucial before making any investment.

Find a Seller: Since these shares are unlisted, you’ll need to find a seller, which could be through private transactions or specialized brokers dealing in unlisted shares.

Valuation: Determine the fair value of the shares based on current market conditions and the Reliance Retail unlisted share price. Ensure you are paying a reasonable price.

Legal and Regulatory Aspects: Ensure that all transactions comply with legal and regulatory requirements. Consult with legal experts if necessary.

Risks and Considerations

Investing in unlisted shares carries its own set of risks:

Liquidity: Unlisted shares may be harder to sell quickly compared to listed stocks.

Transparency: Information about unlisted companies may not be as readily available as it is for publicly traded companies.

Valuation: Valuing unlisted shares can be challenging, and prices may vary significantly based on supply and demand.

Conclusion

Investing in Reliance Retail unlisted shares offers the potential for significant returns, especially given the company's strong market position and growth prospects. However, it's essential to stay informed about the Reliance Retail unlisted share price and conduct thorough research before making any investment decisions. By understanding the dynamics of unlisted shares and following a strategic approach, you can position yourself to benefit from one of India’s leading retail giants.

For the latest updates and information, regularly check private marketplaces, consult with financial advisors, and keep abreast of industry news.

0 notes

Text

Analyzing Reliance Retail Share Price and the Impact of its IPO

Introduction to Reliance Retail Share Price

In the bustling landscape of Indian retail, Reliance Retail Ventures Limited (RRVL) has emerged as a juggernaut, redefining the dynamics of the industry with its innovative strategies and expansive reach. As a subsidiary of Reliance Industries Limited (RIL), India's largest conglomerate, Reliance Retail has witnessed remarkable growth, captivating investor interest and reshaping market dynamics. This article delves into the captivating narrative of Reliance Retail share price trajectory, with a keen focus on its Initial Public Offering (IPO) and the factors influencing its market performance.

Understanding Reliance Retail: A Brief Overview

Reliance Retail, the retail arm of Reliance Industries Limited, has etched its presence across diverse segments, including grocery, fashion, electronics, and digital services. With a pan-India footprint comprising thousands of stores and a robust e-commerce platform, Reliance Retail has become synonymous with convenience, affordability, and innovation. Leveraging its synergies with RIL's other businesses, Reliance Retail has created a formidable ecosystem, offering consumers a seamless shopping experience.

Reliance Retail Share Price: A Historical Perspective

To comprehend the dynamics of Reliance Retail share price, it's essential to delve into its historical performance. Over the years, the company's stock has been a reflection of its strategic maneuvers, financial prowess, and market sentiments. The trajectory of Reliance Retail's share price has been marked by periods of exponential growth, interspersed with occasional corrections and consolidation phases.

Despite encountering market volatilities, Reliance Retail has demonstrated resilience, with its share price exhibiting an upward trajectory fueled by robust business fundamentals, strategic acquisitions, and market expansion initiatives. The company's ability to adapt to changing consumer trends, innovate across business verticals, and capitalize on emerging opportunities has been instrumental in driving its stock performance.

The Impact of Reliance Retail IPO

One of the watershed moments in Reliance Retail's corporate journey was its Initial Public Offering (IPO), which captured widespread attention and investor enthusiasm. The IPO represented a strategic move aimed at unlocking value, enabling broader participation in the company's growth story, and providing Reliance Retail with the necessary capital infusion for expansion and strategic initiatives. Backed by RIL's reputation and track record, the IPO garnered significant investor interest, reflecting confidence in Reliance Retail's prospects.

The IPO not only catapulted Reliance Retail into the limelight but also reinforced its position as a dominant player in India's retail landscape. It provided a platform for the company to showcase its robust business model, diverse revenue streams, and growth potential to potential investors. Moreover, the IPO facilitated liquidity for existing stakeholders, enabling them to monetize their investments and unlock value.

Factors Influencing Reliance Retail Share Price

Several factors influence the share price dynamics of Reliance Retail, encompassing both internal and external elements. Let's explore some key determinants shaping the company's stock performance:

1. Financial Performance: Reliance Retail's financial performance, including revenue growth, profitability margins, and cash flow generation, serves as a key determinant of its share price. Strong quarterly earnings, coupled with prudent financial management, often translate into positive market reactions and upward momentum in the stock price.

2. Expansion and Diversification: Reliance Retail's expansion initiatives, both organically and through strategic acquisitions, play a crucial role in shaping investor perceptions and driving share price appreciation. The company's foray into new markets, introduction of innovative retail formats, and diversification into high-growth segments contribute to its long-term growth trajectory, thereby positively impacting Reliance Retail share price.

3. Economic and Market Trends: Macroeconomic indicators, consumer sentiment, and broader market trends exert significant influence on Reliance Retail's share price. Favorable economic conditions, coupled with rising disposable incomes and consumption patterns, bode well for the company's retail operations, driving investor confidence and share price appreciation.

4. Technological Disruptions: The advent of digital technologies and e-commerce platforms has revolutionized the retail landscape, presenting both opportunities and challenges for Reliance Retail. The company's ability to embrace digital transformation, innovate across its omnichannel offerings, and leverage data analytics to enhance customer experiences can influence its competitiveness and, consequently, Reliance Retail Stock Price.

5. Regulatory Environment: Regulatory changes and policy interventions, particularly those related to foreign direct investment (FDI) norms, taxation policies, and retail regulations, can impact Reliance Retail's operations and profitability, thereby influencing its share price.

6. Investor Sentiment and Market Perception: Investor sentiment, analyst recommendations, and institutional investor interest play a crucial role in shaping market perceptions about Reliance Retail. Positive analyst coverage, favorable investor sentiment, and strategic endorsements can bolster investor confidence and drive share price appreciation.

Conclusion The journey of Reliance Retail share price is a captivating saga, reflecting the company's resilience, strategic foresight, and commitment to value creation. From its historical performance to the transformative impact of its IPO, Reliance Retail's trajectory in the stock market underscores its emergence as a formidable force in India's retail landscape. As the company continues to innovate, expand its footprint, and capitalize on emerging opportunities, investors remain poised to reap the benefits of its sustained growth and value creation. With a steadfast focus on consumer-centricity, technological innovation, and strategic partnerships, Reliance Retail is poised to chart new heights, driving shareholder value and shaping the future of retail in India and beyond.

0 notes

Text

Online Store Development: Build Your E-commerce Website Today

The rapid expansion of the digital marketplace has made online store development an essential step for businesses looking to thrive in the modern economy. Whether you are a small business owner, a startup, or an established retailer, an e-commerce website provides a global reach, enhances customer convenience, and boosts revenue potential. In this guide, we will explore the fundamentals of online store development and help you build a functional and profitable e-commerce platform today.

Why Invest in Online Store Development?

With the increasing reliance on digital shopping, businesses that lack an online presence risk losing a significant share of potential customers. Here are some key reasons why online store development is crucial:

Global Reach – An e-commerce website allows businesses to sell products beyond local markets, reaching customers worldwide.

24/7 Availability – Unlike brick-and-mortar stores, an online store operates around the clock, ensuring customers can shop at their convenience.

Cost Efficiency – Running an online store eliminates many overhead costs associated with physical stores, such as rent and utilities.

Customer Insights – E-commerce platforms provide analytics tools that help track customer behavior, preferences, and trends.

Scalability – Businesses can scale their operations easily by adding new products, services, and features to their online store.

Steps to Build Your E-commerce Website

1. Choose the Right E-commerce Platform

Selecting the right platform is the foundation of online store development. There are several options available, including:

Shopify – A user-friendly, hosted platform ideal for beginners.

WooCommerce – A WordPress plugin that provides flexibility and customization options.

Magento – Suitable for large-scale businesses requiring advanced features.

BigCommerce – A scalable solution for growing businesses.

2. Register a Domain and Choose Hosting

A unique domain name establishes your brand identity, while reliable hosting ensures smooth website performance. If you opt for a hosted platform like Shopify, hosting is included. However, for self-hosted platforms like WooCommerce or Magento, choosing a reputable hosting provider is essential.

3. Design Your Online Store

The design of your e-commerce website should be visually appealing and user-friendly. Key elements include:

Responsive Design – Ensuring the site works seamlessly on all devices.

Easy Navigation – A well-structured menu helps customers find products quickly.

Fast Load Speed – Optimize images and minimize code to reduce loading times.

High-Quality Images – Use professional photos to enhance product appeal.

4. Add Essential Features

Your online store should include:

Product Pages – Detailed descriptions, images, and pricing information.

Shopping Cart – A seamless checkout experience for customers.

Payment Gateway Integration – Secure payment options such as PayPal, Stripe, or credit/debit card payments.

Security Measures – Implement SSL certificates and data encryption to protect customer information.

5. Implement SEO Strategies

Search engine optimization (SEO) is vital to driving organic traffic. Optimize your site with:

Keyword-Rich Content – Use target keywords like "Online Store Development" in product descriptions, blogs, and meta tags.

Mobile Optimization – Ensure your website is mobile-friendly for better search rankings.

Fast Loading Speed – Improve page speed with optimized images and caching.

Internal Linking – Connect related pages to enhance navigation and SEO value.

6. Integrate Marketing Tools

Effective marketing is key to driving sales. Implement:

Email Marketing – Build an email list and send promotions, newsletters, and updates.

Social Media Integration – Connect with customers via platforms like Instagram, Facebook, and Twitter.

Paid Advertising – Use Google Ads and social media ads to increase visibility.

Content Marketing – Maintain a blog with valuable insights related to your industry.

7. Test and Launch Your Website

Before launching, conduct thorough testing to identify and fix any issues. Key tests include:

User Experience Testing – Ensure smooth navigation and functionality.

Checkout Process Testing – Verify that payment gateways and cart functions work properly.

Mobile Compatibility Testing – Test responsiveness on different devices.

Once everything is in place, launch your online store and start promoting it to attract customers.

Conclusion

Online store development is an invaluable step for businesses aiming to thrive in the digital marketplace. By choosing the right platform, optimizing SEO, and implementing effective marketing strategies, you can build a successful e-commerce website today. Start your journey now and tap into the limitless opportunities of online commerce.

0 notes

Text

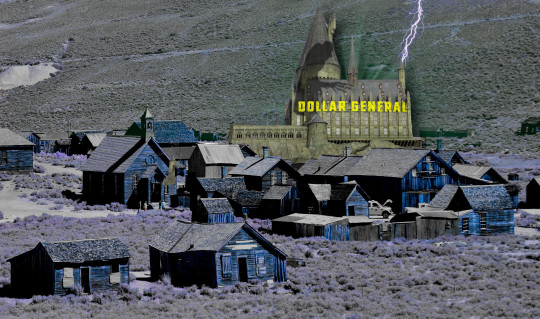

Rural towns and poor urban neighborhoods are being devoured by dollar stores

Across America, rural communities and big cities alike are passing ordinances limiting the expansion of dollar stores, which use a mix of illegal predatory tactics, labor abuse, and monopoly consolidation to destroy the few community grocery stores that survived the Walmart plague and turn poor places into food deserts.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/27/walmarts-jackals/#cheater-sizes

"The Dollar Store Invasion," is a new Institute For Local Self Reliance (ILSR) report by Stacy Mitchell, Kennedy Smith and Susan Holmberg. It paints a detailed, infuriating portrait of the dollar store playback, and sets out a roadmap of tactics that work and have been proven in dozens of places, rural and urban:

https://cdn.ilsr.org/wp-content/uploads/2023/01/ILSR-Report-The-Dollar-Store-Invasion-2023.pdf

The impact of dollar stores is plainly stated in the introduction: "dollar stores drive grocery stores and other retailers out of business, leave more people without access to fresh food, extract wealth from local economies, sow crime and violence, and further erode the prospects of the communities they target."

This new report builds on ILSR's longstanding and excellent case-studies, augmenting them with the work of academic geographers who are just starting to literally map out the dollar store playbook, identifying the way that a dollar stores will target, say, the last grocery store in a Black neighborhood and literally surround it, like hyenas cornering weakened prey. This tactic is repeated whenever a new grocer opens in the neighborhood: dollar stores "carpet bomb" the surrounding blocks, ensuring that the new store closes as quickly as it opens.

One important observation is the relationship between these precarious neighborhood grocers and Walmart and its other big-box competitors. Deregulation allowed Walmart to ring cities with giant stores that relied on "predatory buying" (wholesale terms that allowed Walmart to sell goods more cheaply than its competitors bought them, and also rendered its suppliers brittle and sickly, and forced down the wages of those suppliers' workers). This was the high cost of low prices: neighborhoods lost their local grocers, and community dollars ceased to circulate in the community, flowing to Walmart and its billionaire owners, who spent it on union busting and political campaigns for far-right causes, including the defunding of public schools.

This is the landscape where the dollar stores took root: a nation already sickened by an apex predator, which left a productive niche for jackals to pick off the weakened survivors. Wall Street loved the look of this: the Private equity giant KKR took over Dollar General in 2007 and went on a acquisition and expansion bonanza. Even after KKR formally divested itself of Dollar General, the company's hit-man Michael M Calbert stayed on the board, rising to chairman.

The dollar store market is a duopoly. Dollar General's rival is Dollar Tree, another gelatinous cube of a company that grew by absorbing many of its competitors, using Wall Street's money. These acquisitions are now notorious for the weaknesses they exposed in antitrust practice. For example, when Dollar Tree bought Family Dollar, growing to 14,000 stores, the FTC waved the merger through on condition that the new business sell off 330 of them. These ineffectual and pointless merger conditions are emblematic of the inadequacy of antitrust as it was practiced from the Reagan administration until the sea-change under Biden, and Dollar Tree/Family Dollar is the poster child for more muscular enforcement.

The duopoly has only grown since then. Today, Dollar General and Dollar Tree have more than 34,000 US outlets - more than Starbucks, #Walmart, McDonalds and Target - combined.

Destroying a community's grocery store rips out its heart. Neighborhoods without decent access to groceries impose a tax on their already-struggling residents, forcing them to spend hours traveling to more affluent places, or living off the highly processed, deceptively priced (more on this later) goods for sale on the dollar store shelves.