#Reliable Structural Elements for Aircraft in Investment Castings

Explore tagged Tumblr posts

Text

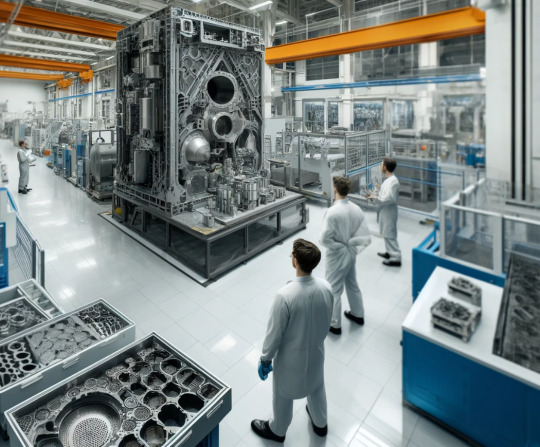

Investment Castings for Aircraft Structural Elements A Focus on Unitritech's Excellence

Investment castings, also known as precision castings, play a crucial role in the aerospace industry, particularly in the manufacturing of structural elements for aircraft. These castings are made using a wax pattern that is coated with a refractory ceramic material. Once the ceramic material hardens, the wax is melted away, leaving a precise mold that can produce high-tolerance, intricate components ideal for aerospace applications.

One of the leading manufacturers in this field is Unitritech, renowned for their superior investment castings for structural elements of aircraft. Unitritech utilizes advanced technologies and stringent quality control processes to ensure that each casting meets the rigorous demands of the aerospace industry. Their investment castings are characterized by exceptional strength, lightweight properties, and the ability to withstand extreme temperatures and pressures, making them perfect for critical structural components of aircraft.

Unitritech's commitment to innovation and excellence has positioned them as a top choice for aerospace manufacturers seeking reliable and high-performance structural elements. Their expertise in producing complex geometries and maintaining tight tolerances ensures that every component contributes to the overall safety, efficiency, and performance of the aircraft.

In summary, investment castings are essential for the aerospace industry, and Unitritech stands out as a premier provider of these critical components, ensuring the highest standards of quality and performance in aircraft structural elements.

#High-Precision Investment Castings for Aerospace Applications#Reliable Structural Elements for Aircraft in Investment Castings#Durable and Lightweight Investment Castings for Aerospace#Quality Investment Castings for Aerospace Structural Elements#Precision Casting for Critical Aircraft Components#Ensuring Flight Safety with Precision Investment Castings

0 notes

Text

Aceforge: Pioneering Excellence in Aluminum Components Manufacturing

Who is Aceforge?

Aceforge is a renowned manufacturer specializing in the production of high-quality aluminum components. With decades of experience in precision manufacturing, Aceforge has carved a niche for itself in providing innovative aluminum parts that serve as critical components in numerous industrial applications. The company’s expertise spans across designing, engineering, and producing components that adhere to the highest standards of quality, performance, and durability.

Aceforge is committed to manufacturing components that offer superior functionality and reliability, whether for OEM (Original Equipment Manufacturer) applications or custom solutions for specific needs. By combining cutting-edge technology with a customer-centric approach, Aceforge ensures that its aluminum components meet the most demanding requirements.

Why Choose Aluminum?

Aluminum is an ideal material for manufacturing components due to its combination of lightweight properties, high strength, and resistance to corrosion. It is also highly malleable, making it suitable for creating intricate designs and shapes. These attributes make aluminum an attractive choice for a wide variety of industries, including automotive, aerospace, electronics, and machinery manufacturing.

Aluminum components can reduce the overall weight of products, improving fuel efficiency in vehicles, enhancing performance in machinery, and extending the lifespan of critical parts due to their corrosion resistance. Additionally, aluminum is highly recyclable, contributing to its appeal in sustainable manufacturing practices.

Aceforge’s Expertise in Aluminum Component Manufacturing

At Aceforge, the focus is on producing aluminum components that exceed customer expectations. The company uses advanced manufacturing technologies such as die-casting, extrusion, forging, and CNC machining to create precision-engineered aluminum parts. These processes allow for the production of components with exceptional strength, precision, and surface finishes.

Aceforge’s skilled engineering team works closely with clients to understand specific requirements and deliver tailored solutions. Whether it’s designing a new aluminum component from scratch or improving an existing design, Aceforge offers comprehensive support from concept to production. The use of sophisticated simulation software during the design phase ensures that the final product meets the desired specifications and performance criteria.

A Wide Range of Aluminum Components

Aceforge produces a diverse range of aluminum components that serve multiple industries, including:

Automotive Components: Lightweight engine parts, transmission cases, brackets, and chassis components that improve vehicle performance and efficiency.

Aerospace Parts: Aircraft structural components, engine housings, and precision machined parts that meet stringent industry standards.

Industrial Machinery: Aluminum housings, casings, and brackets used in machinery and equipment to reduce weight and enhance durability.

Consumer Electronics: Enclosures, heat sinks, and frames used in the manufacturing of electronic devices, providing strength and effective heat dissipation.

Construction Components: Aluminum profiles, frames, and fittings for doors, windows, and facades that offer strength and resistance to the elements.

Commitment to Quality and Innovation

Aceforge maintains a strong focus on quality control, ensuring that every aluminum component produced meets international standards. The company’s advanced inspection techniques, including non-destructive testing (NDT), microscopic examination, and dimensional verification, ensure that each part is free of defects and performs optimally under real-world conditions.

Aceforge also invests heavily in research and development to stay ahead of industry trends and technological advancements. The company continuously innovates to improve manufacturing processes, enhance product designs, and explore new aluminum alloys that offer enhanced properties for specific applications.

Customer-Centric Approach

Aceforge’s customer-first mindset is one of the key reasons for its success as a leading aluminum components manufacturer. The company prides itself on providing tailored solutions that align with client needs, whether for large-scale manufacturing runs or smaller custom orders. From initial consultations to post-production support, Aceforge works closely with its clients to ensure that every aspect of the project is executed seamlessly.

Additionally, the company’s flexibility and timely delivery ensure that clients receive their orders as per schedule, reducing downtime and enhancing operational efficiency.

Conclusion

As one of the top aluminum components manufacturers, Aceforge combines advanced technology, superior manufacturing processes, and a commitment to quality to produce top-notch aluminum parts for a wide range of industries. Whether it's for automotive, aerospace, industrial machinery, or consumer electronics, Aceforge provides the expertise and reliable products that businesses need to enhance their products’ performance and longevity. With a focus on innovation, sustainability, and customer satisfaction, Aceforge continues to be a trusted partner in the manufacturing of high-quality aluminum components.

0 notes

Text

Aluminium die casting manufacturers in china

Aluminium die casting manufacturers in china is a critical component of many industries, including automotive, aerospace, and electronics. With the increase in demand for high-quality products, it is imperative to choose the right manufacturer. China has become a hub for aluminium die casting manufacturers due to its low cost of production and high-quality standards. However, with so many manufacturers to choose from, it can be difficult to decide which one to trust.

If you are looking for dependable aluminum die casting manufacturer with High pressure die casting service who offers you competitive price, high precision dimension, good service and quality for aluminium (aluminum), zinc, or magnesium die casting, then we are surely a partner you are looking for to fulfill all your die casting needs.With quality service and state of art technology, CNM die casting manufacturer indeed claim in providing high quality pressure die casting including aluminum/zamak/magnesium alloy castings to our customers all over the world.

Why choose aluminium die casting manufacturers in CNM TECH CO.LTD?

Choosing aluminium die casting manufacturers in CNM TECH CO.LTD. can be a smart move for many reasons. Firstly, CNM TECH CO.LTD is known for its vast experience in die casting production. Their manufacturing industry is one of the most established and efficient in the world, which makes them a go-to destination for those in need of high-quality aluminium die cast products. Furthermore, CNM TECH CO.LTD aluminium die casting manufacturers have been heavily investing in advanced technology and machinery to stay at the forefront of the industry.

They utilize the latest technological advancements, which means that they can deliver high-quality, precision parts quickly and efficiently. Additionally, working with aluminium die casting manufacturers in CNM TECH CO.LTD often results in lower production costs. This is because CNM TECH CO.LTD has a vast pool of highly skilled labor, allowing them to produce high-quality products at a more affordable price. They have been exporting their products to various countries worldwide, making them well-experienced in dealing with international clients and meeting their requirements. the combination of high-quality, efficiency, affordability, and reliability makes choosing aluminium die casting manufacturers in CNM TECH CO.LTD an excellent choice for anyone in need of these services.

If you are looking for high-quality Die casting manufacturers in China, then look no further. CNM TECH CO.LTD of the best and most innovative aluminum die casting manufacturers in the world. They are known for their precision, attention to detail, and the use of the latest technology. Their products are used in a wide range of industries, including automotive, aerospace, and electronics.

By choosing a reliable and reputable aluminum die casting manufacturer in CNM TECH CO.LTD, you can be assured of getting high-quality products that meet your specific needs and requirements. With their dedication to quality control, efficient production processes, and competitive pricing, it is no wonder that so many companie around the world choose to work with CNM TECH CO.LTD die casting manufacturer. So if you need aluminum die casting products for your business, consider working with one of the reputable manufacturer in CNM TECH CO.LTD.

A380 diecast aluminum one of the largest passenger aircraft in the world, is primarily constructed using aluminum alloys, including die-cast aluminum components. Die casting is an important manufacturing method employed in the production of certain A380 parts.

Die-cast aluminum components on the A380 may include various structural elements, such as brackets, fittings, and housings. These parts are typically produced using high-pressure die casting, which involves injecting molten aluminum into a steel mold (die) under high pressure.Die-cast aluminum offers several advantages for aircraft applications, including its lightweight properties, excellent strength-to-weight ratio, and good corrosion resistance. These factors make it suitable for use in the aerospace industry, where weight reduction and structural integrity are crucial.

It's important to note that while die casting is used for specific aluminum components on the A380, other manufacturing processes, such as sheet metal forming and machining, are also employed for various parts of the aircraft's structure.die-cast aluminum parts play a role in the construction of the Airbus A380, contributing to its overall performance, weight efficiency, and structural integrity.

Automotive Components: aluminium die casting products is extensively used in the automotive industry to manufacture engine components, transmission cases, cylinder heads, intake manifolds, brackets, and other structural parts.Electrical and Electronics: Many electrical and electronic devices contain die-cast parts, including connectors, housings for smartphones and tablets, computer hardware components, heat sinks, and motor parts.

Appliance Parts: Die casting is utilized in the production of various appliance parts such as refrigerator components, air conditioner housings, washing machine parts, and oven components. Industrial Machinery: Die-cast parts are found in various industrial machinery applications, including pump housings, valve bodies, hydraulic components, and tooling equipment.Furniture and Lighting: Die casting is also used in the production of furniture hardware, lighting fixtures, and decorative components.

Aerospace and Defense: Certain aerospace and defense applications utilize die casting for producing parts like aircraft components, military equipment, and weapon systems.The versatility of die casting allows for the production of complex shapes, thin walls, and intricate details with high accuracy and surface finish. The process offers advantages such as fast production rates, excellent dimensional accuracy, and the ability to produce large quantities of parts.

Aluminum Die Casting, Zinc Die Casting, and Magnesium Die Casting. We are also invested in machining parts, metal stamping, plastic molds making, shot blasting, ball burnishing, vibratory deburring, and anodizing.

CNM Tech has been around since 1997. And with over 20 years experience you can trust that our die casting products are exemplary. We employ advanced equipment and machinery to produce the highest quality and most cost-effective die casting solutions.

We manufacture a range of products including and not limited to flow meter housing and valves, lighting fixture parts, bicycle parts, automobile parts, motor covers, and decorative hardware. And other than manufacturing, we also export various aluminum casting, zinc casting, and magnesium casting products. machining parts and injection molded parts

Our team of professional engineers and mold designers are always eager and ready to take on new projects. So if you require our services, simply send us a 3D part design in STP or IGS format and your requirements. Our technicians will then get back to you in 24 hours with the pricing details.

Note. We promise quality for affordable prices.

Companies and individuals, both within China and abroad, should look no further than CNM Tech for Aluminum Die Casting and the like. We have high-tech facilities, certified professionals, and 20 plus years of experience.

Moreover, thanks to quality assurance and control, you can be guaranteed of the quality of our products. Our developers and technicians run various inspection methods including CMM, destructive testing, test jigs, shot monitoring et cetera.

Customer engagement with our international customers ensures the dimensional accuracy of our mold and raw casting components. Such precision prevents corrective maintenance in CNC post processing and similar manufacturing processes. Hence, not only saving cost but time as well.

We have an extensive background on die casting, post-processing, and painting & plating processes. plastic mlding process, And we would be honoured to give you our input on your project. That said, feel free to consult us on any technical queries you may have in regards to casting, plastics, wrought material, and machining processes.

0 notes

Text

Metal Forging Market Trend, Industry Restraints, Segmentation, Emerging Economies and Key Players

Market Synopsis: According to the MRFR analysis, Metal Forging Market was valued at more than USD 75.5 Billion in 2018 and is expected to reach over USD 118 Billion by the end of 2025 at a CAGR of 6.6%.

Metal forging is a metalworking process, wherein a metal is deformed in a controlled manner by using compressive forces to form a specific shape product. It is widely used to manufacture complex structured components for the automotive, aerospace & defense, power, and oil & gas industries.

The prominent factors driving the growth of the global market are increasing demand for both passenger and commercial vehicles, growing commercial aircraft production, and increasing demand for metal forged parts in the nuclear power industry.

Global Metal Forging Market Trend was valued at over USD 75.5 Billion in 2018 and is projected to register a CAGR of above 6% during the forecast period, 2019–2025.

By Raw Material

Steel: The steel segment was the dominant raw material segment in 2018 with a market share of over 70%. This is mainly attributed to its strength, availability, a higher degree of reliability and tolerance capabilities, and use of specialized alloy types such as stainless steel and carbon steel. It is widely used for the production of forged components for the automotive, oil & gas, aerospace, agriculture machinery, and other general industries. This is mainly attributed to high strength and durability, dense, non-porous aspect of forged steel parts, close tolerances, increased product efficiency, and low cost offered by steel forgings. Additionally, steel forge parts are free from gas voids, pockets, or cooling defects, thus avoiding load failure.

This segment is further segmented into carbon steel, alloy steel, and stainless steel.

Aluminum: This segment is expected to register healthy growth during the forecast period owing to the increasing demand for light-weight materials in the automotive and aerospace industries, wherein performance and safety are critical as well light-weight metal is desired to increase the energy efficiency. Moreover, aluminum offers a resistance to corrosion, maximum impact strength, superior internal integrity, and elimination of internal voids. Pistons, gears and wheel spindles in high performance automobiles and aircraft are the major applications of forged aluminum. The major developments in the aluminum forging segment have been witnessed in recent years. For instance, in August 2018, Bharat Forge Ltd announced to invest USD 55 million to start an aluminum forging operation in Tennessee, US, which is expected to commence in the second half of 2020.

Magnesium: Magnesium offers excellent mechanical strength and stiffness, high strength-to-weight ratio, damping qualities, and high dent and impact resistance. Owing to these characteristics, magnesium and its alloys are ideal for forging lightweight, durable parts for a wide variety of structural and nonstructural applications varying from aerospace, power tools, and industrial machinery to commercial and military aircraft.

Nickel-Based Alloys: Nickel-based alloys are ideal materials for parts and components used for pumps, piping systems, valves, process equipment, as well as turbines and assemblies in the marine, oil and gas, chemical processing, aerospace and defense industries. This is mainly attributed to the high resistance to heat, corrosion, and acid coupled with excellent wearability offered by these alloys.

Titanium: Titanium metal has the highest strength to density ratio of any metallic elements. It provides excellent durability and resistance to corrosion which is why it is used in applications requiring high operating temperature, high strength, lightweight, and high corrosion resistance.

Others: The other segment includes copper, iron, and brass.

By Type

Closed-die Forging: Closed-die forging, also known as impression-die forging, is the most popular metal forging process, with the segment accounting for a share of over 65% of the market in 2018. This is mainly attributed to the compatibility of all metals with the process; closed-die forged metal components require less machining; allows to produce near net shapes; and supports high production runs.

Open-die Forging: Open-die forging, the other widely used forging process, offers several benefits such as better fatigue resistance, less material waste, reduced chance of voids, valuable cost savings, owing to which is commonly used for steel and steel alloys forging.

Ring Rolling: Ring rolling is widely used for producing forged metal parts for the nuclear, general industrial, and pharmaceutical industries. This process can be used to manufacture metal parts of various heights, diameters, weights, and varied shapes, making it a versatile process. Additionally, it is one of the most cost-effective forging processes.

Others: This segment covers the upset forging and precision forging.

By End-Use Industry

Automotive: The automotive industry has been the major consumer for metal forging and this trend is expected to continue in the near future. The segment held a market share of over 50% in 2018, owing to the widespread use of metal forging in the automotive industry coupled with the surging demand for passenger cars in the emerging economies. The components include engine components, transmission components, steering, front axle, and rear axle. Additionally, the increasing use of forged-aluminum parts in the automobiles to meet the lightweight and high strength requirements is likely to favor the growth of the segment during the assessment period.

Aerospace & Defense: Aerospace & defense is expected to register the highest CAGR during the review period. This is mainly attributed to the rising demand for commercial aircraft, thus speeding up the production rates. According to the Airbus data, the commercial aircraft order backlog is at its peak and is expected to produce over 20,000 aircraft globally over the next decade. Metal forged parts offer high strength-to-weight ratio and structural reliability, thus favoring the performance, range, and payload capabilities in the aerospace industry. Metal forgings are widely used in jets and piston-engine planes, engine mounts, helicopters, military aircraft, and spacecraft. Furthermore, with the geopolitical tensions continuing to increase, the demand for military equipment is expected to be on the uptick, thus boosting demand for metal forgings during the forecast period.

Power: The power segment is also expected to register significant growth during the review period on account of the increasing dependence on nuclear power reactors to generate electricity. In 2018, nuclear power plants supplied 2,563 TWh of electricity, up from 2,503 TWh in 2017. Metal forgings are widely used in the manufacturing of pressure vessels, generator rotors, valve bodies, turbine blades and rotors, and fittings for power generation equipment. The clear need for increasing the energy capacity around the world to meet the growing demand for electricity is further expected to propel the market growth in the years to follow.

Oil & Gas: Metal forged products are used in a wide range of applications ranging from onshore to offshore, midstream, subsea, and downstream.

Others: The other segment includes medical, sports, and mining.

By Region

North America: Market growth is driven by the well-established automotive industry

Europe: Germany is the largest contributor to the regional market growth owing to the growing nuclear power industry.

Asia-Pacific: The largest and fastest-growing regional market for metal forging.

Latin America: A small but growing automotive industry is likely to fuel the demand for metal forging in the coming years.

Middle East & Africa: High growth potential of the automotive manufacturing hub in Egypt, UAE, and Saudi Arabia, may propel the regional market growth during the forecast period.

Regional Analysis

North America: The regional market has a well-established automotive industry and is the leading region in the aerospace & defense market. The widespread presence of manufacturing hub and increasing demand for aluminum and nickel-based forgings in the automotive and defense industry is likely to propel the growth of the regional market in the coming years.

Europe: The automotive industry in Europe is projected to witness healthy growth during the forecast period. Additionally, the dependence of the region on electricity generation from power plants is expected to boost demand for metal forging in the manufacturing of power generation equipment.

Asia-Pacific: The market in Asia-Pacific for metal forging held the largest market share, of more than 50% in 2018 and is projected to retain its dominance during the forecast period. This is primarily due to the high demand for the product in the automotive and aerospace industries. The contributors to the robust growth of the regional market are China, India, and South Korea.

Latin America: The automotive industry in the regional market is relatively small, yet rapidly expanding, which is expected to boost the demand for metal forging during the review period.

Middle East & Africa: In 2018, the market for metal forging in the region accounted for a relatively smaller market share. However, the high potential of the automotive manufacturing sector in the region and the ease of availability of raw materials (metals) for forging, is projected to propel the market growth in the coming years.

KEY PLAYERS

Arconic (US)

China First Heavy Industries (China)

ATI (US)

Bharat Forge (India)

JAPAN CASTING & FORGING CORP. (Japan)

LARSEN & TOUBRO LIMITED (India)

Brück GmbH (Germany)

Forgiatura Marcora (Italy)

NIPPON STEEL CORPORATION (Japan)

North American Forgemasters (US)

OMZ-Special Steels LLC (Russia)

PILSEN STEEL s.r.o. (Czech Republic)

JIANGYIN HENGRUN HEAVY INDUSTRIES CO., LTD (China)

Bharat Heavy Electricals Limited (India)

Access Full Report Details and Order this Premium Report @

https://www.marketresearchfuture.com/reports/metal-forging-market-8495

NOTE: Our Team of Researchers are Studying Covid19 and its Impact on Various Industry Verticals and wherever required we will be considering Covid19 Footprints for Better Analysis of Market and Industries. Cordially get in Touch for More Details.

0 notes

Text

Aceforge: Leading the Way as Forging Aerospace Parts Suppliers

In the highly demanding aerospace industry, precision, durability, and reliability are paramount. Whether it's aircraft components, engine parts, or structural elements, the quality of materials and manufacturing processes directly impacts safety, performance, and efficiency. This is where Aceforge stands out as a trusted name among forging aerospace parts suppliers.

The Importance of Forged Aerospace Parts

Forged parts play a critical role in the aerospace sector, offering superior strength, resistance to wear, and reliability compared to cast or machined components. Through a process of shaping metal using compressive forces, forging ensures that parts have superior mechanical properties, essential for the extreme conditions aerospace parts endure.

From jet engines to landing gears, forging aerospace parts involves creating components that can withstand high temperatures, stress, and fatigue while maintaining structural integrity. As aerospace designs become more complex and materials advance, the need for precision forging has never been greater.

Aceforge: A Leader in Aerospace Forging

Aceforge has positioned itself at the forefront of the aerospace forging industry, catering to manufacturers, OEMs (Original Equipment Manufacturers), and Tier-1 suppliers across the globe. With years of expertise, advanced technology, and a commitment to quality, Aceforge offers an array of forged components that meet or exceed industry standards.

Key Features of Aceforge’s Aerospace Forging Capabilities:

Precision and Customization: Aceforge understands the unique demands of the aerospace industry. Our forging capabilities ensure that every part is created with exceptional accuracy. Whether you need high-tolerance parts or customized components for specific aircraft models, Aceforge can deliver precision-forged aerospace parts tailored to your needs.

Material Expertise: The aerospace industry requires materials that can endure extreme conditions. Aceforge uses advanced forging techniques with high-quality metals such as titanium, aluminum, steel, and Inconel. These materials are known for their strength-to-weight ratios and resistance to heat and corrosion, ensuring that each part meets the demanding requirements of aerospace applications.

Advanced Technology and Innovation: At Aceforge, we invest in the latest forging technology, including state-of-the-art CNC machinery, die design systems, and heat treatment processes. This commitment to innovation enables us to offer solutions that optimize performance, reduce weight, and enhance the lifespan of aerospace components.

Rigorous Quality Control: Quality assurance is the cornerstone of Aceforge’s operations. Every aerospace component undergoes stringent testing to ensure it meets international aerospace standards, including AS9100 certification. From visual inspections to non-destructive testing (NDT), we ensure that every part performs at its best.

Efficient Lead Times: We understand that the aerospace industry operates on tight schedules and high production volumes. Aceforge has refined its processes to offer quick turnarounds without compromising on quality. Our streamlined production capabilities allow us to deliver high-volume orders with fast lead times, ensuring that you meet your project deadlines.

Sustainability and Safety: Aceforge not only focuses on performance but also sustainability. We adopt eco-friendly practices throughout the manufacturing process, from material sourcing to waste management, ensuring that our forging practices are environmentally responsible. Additionally, we prioritize safety in all aspects of our operations, adhering to the highest industry safety standards.

Applications of Forged Aerospace Parts

The aerospace sector covers a broad range of applications, and forged parts from Aceforge can be found in various critical systems, including:

Jet Engines: Components such as turbine blades, shafts, and casings need to withstand extreme temperatures and mechanical stresses. Aceforge produces forged parts that enhance engine efficiency and safety.

Landing Gear: Forged parts like struts, wheels, and support frames are essential for the safe takeoff and landing of aircraft. These parts must be strong and reliable, even in harsh environments.

Aircraft Structural Components: Parts like wing spars, fuselage beams, and engine mounts require forged precision to ensure the structural integrity of the aircraft during flight.

Why Choose Aceforge as Your Forging Aerospace Parts Supplier?

Aceforge’s reputation as a trusted forging aerospace parts supplier stems from our dedication to quality, innovation, and customer satisfaction. Here’s why aerospace companies choose Aceforge:

Expertise in Aerospace Forging: With a dedicated focus on the aerospace industry, Aceforge brings specialized knowledge and experience to every project.

End-to-End Solutions: From design and prototyping to large-scale production, Aceforge offers complete solutions for aerospace forging needs.

Global Reach: Serving clients around the world, Aceforge has the infrastructure and logistics to meet the needs of both large-scale manufacturers and niche aerospace applications.

Proven Track Record: Over the years, we have forged strong partnerships with aerospace giants, providing them with high-quality, high-performance components that keep aircraft flying safely and efficiently.

Conclusion

In an industry where precision, safety, and performance are non-negotiable, Aceforge stands as a trusted partner for forging aerospace parts suppliers. With our advanced forging technology, expert team, and commitment to quality, we continue to play a key role in ensuring that aerospace components meet the highest standards of excellence. Whether you are looking for custom parts or high-volume production, Aceforge is ready to support your aerospace manufacturing needs with unparalleled expertise and reliability.

If you’re seeking a supplier that understands the complexities of aerospace forging and can deliver superior parts for your critical applications, look no further than Aceforge.

0 notes

Text

Metal Forging Market , Industry Restraints, Segmentation, Emerging Economies and Key Players

Market Synopsis: According to the MRFR analysis, Metal Forging Market was valued at more than USD 75.5 Billion in 2018 and is expected to reach over USD 118 Billion by the end of 2025 at a CAGR of 6.6%.

Metal forging is a metalworking process, wherein a metal is deformed in a controlled manner by using compressive forces to form a specific shape product. It is widely used to manufacture complex structured components for the automotive, aerospace & defense, power, and oil & gas industries.

The prominent factors driving the growth of the global market are increasing demand for both passenger and commercial vehicles, growing commercial aircraft production, and increasing demand for metal forged parts in the nuclear power industry.

Global Metal Forging Market was valued at over USD 75.5 Billion in 2018 and is projected to register a CAGR of above 6% during the forecast period, 2019–2025.

By Raw Material

Steel: The steel segment was the dominant raw material segment in 2018 with a market share of over 70%. This is mainly attributed to its strength, availability, a higher degree of reliability and tolerance capabilities, and use of specialized alloy types such as stainless steel and carbon steel. It is widely used for the production of forged components for the automotive, oil & gas, aerospace, agriculture machinery, and other general industries. This is mainly attributed to high strength and durability, dense, non-porous aspect of forged steel parts, close tolerances, increased product efficiency, and low cost offered by steel forgings. Additionally, steel forge parts are free from gas voids, pockets, or cooling defects, thus avoiding load failure.

This segment is further segmented into carbon steel, alloy steel, and stainless steel.

Aluminum: This segment is expected to register healthy growth during the forecast period owing to the increasing demand for light-weight materials in the automotive and aerospace industries, wherein performance and safety are critical as well light-weight metal is desired to increase the energy efficiency. Moreover, aluminum offers a resistance to corrosion, maximum impact strength, superior internal integrity, and elimination of internal voids. Pistons, gears and wheel spindles in high performance automobiles and aircraft are the major applications of forged aluminum. The major developments in the aluminum forging segment have been witnessed in recent years. For instance, in August 2018, Bharat Forge Ltd announced to invest USD 55 million to start an aluminum forging operation in Tennessee, US, which is expected to commence in the second half of 2020.

Magnesium: Magnesium offers excellent mechanical strength and stiffness, high strength-to-weight ratio, damping qualities, and high dent and impact resistance. Owing to these characteristics, magnesium and its alloys are ideal for forging lightweight, durable parts for a wide variety of structural and nonstructural applications varying from aerospace, power tools, and industrial machinery to commercial and military aircraft.

Nickel-Based Alloys: Nickel-based alloys are ideal materials for parts and components used for pumps, piping systems, valves, process equipment, as well as turbines and assemblies in the marine, oil and gas, chemical processing, aerospace and defense industries. This is mainly attributed to the high resistance to heat, corrosion, and acid coupled with excellent wearability offered by these alloys.

Titanium: Titanium metal has the highest strength to density ratio of any metallic elements. It provides excellent durability and resistance to corrosion which is why it is used in applications requiring high operating temperature, high strength, lightweight, and high corrosion resistance.

Others: The other segment includes copper, iron, and brass.

By Type

Closed-die Forging: Closed-die forging, also known as impression-die forging, is the most popular metal forging process, with the segment accounting for a share of over 65% of the market in 2018. This is mainly attributed to the compatibility of all metals with the process; closed-die forged metal components require less machining; allows to produce near net shapes; and supports high production runs.

Open-die Forging: Open-die forging, the other widely used forging process, offers several benefits such as better fatigue resistance, less material waste, reduced chance of voids, valuable cost savings, owing to which is commonly used for steel and steel alloys forging.

Ring Rolling: Ring rolling is widely used for producing forged metal parts for the nuclear, general industrial, and pharmaceutical industries. This process can be used to manufacture metal parts of various heights, diameters, weights, and varied shapes, making it a versatile process. Additionally, it is one of the most cost-effective forging processes.

Others: This segment covers the upset forging and precision forging.

By End-Use Industry

Automotive: The automotive industry has been the major consumer for metal forging and this trend is expected to continue in the near future. The segment held a market share of over 50% in 2018, owing to the widespread use of metal forging in the automotive industry coupled with the surging demand for passenger cars in the emerging economies. The components include engine components, transmission components, steering, front axle, and rear axle. Additionally, the increasing use of forged-aluminum parts in the automobiles to meet the lightweight and high strength requirements is likely to favor the growth of the segment during the assessment period.

Aerospace & Defense: Aerospace & defense is expected to register the highest CAGR during the review period. This is mainly attributed to the rising demand for commercial aircraft, thus speeding up the production rates. According to the Airbus data, the commercial aircraft order backlog is at its peak and is expected to produce over 20,000 aircraft globally over the next decade. Metal forged parts offer high strength-to-weight ratio and structural reliability, thus favoring the performance, range, and payload capabilities in the aerospace industry. Metal forgings are widely used in jets and piston-engine planes, engine mounts, helicopters, military aircraft, and spacecraft. Furthermore, with the geopolitical tensions continuing to increase, the demand for military equipment is expected to be on the uptick, thus boosting demand for metal forgings during the forecast period.

Power: The power segment is also expected to register significant growth during the review period on account of the increasing dependence on nuclear power reactors to generate electricity. In 2018, nuclear power plants supplied 2,563 TWh of electricity, up from 2,503 TWh in 2017. Metal forgings are widely used in the manufacturing of pressure vessels, generator rotors, valve bodies, turbine blades and rotors, and fittings for power generation equipment. The clear need for increasing the energy capacity around the world to meet the growing demand for electricity is further expected to propel the market growth in the years to follow.

Oil & Gas: Metal forged products are used in a wide range of applications ranging from onshore to offshore, midstream, subsea, and downstream.

Others: The other segment includes medical, sports, and mining.

By Region

North America: Market growth is driven by the well-established automotive industry

Europe: Germany is the largest contributor to the regional market growth owing to the growing nuclear power industry.

Asia-Pacific: The largest and fastest-growing regional market for metal forging.

Latin America: A small but growing automotive industry is likely to fuel the demand for metal forging in the coming years.

Middle East & Africa: High growth potential of the automotive manufacturing hub in Egypt, UAE, and Saudi Arabia, may propel the regional market growth during the forecast period.

Regional Analysis

North America: The regional market has a well-established automotive industry and is the leading region in the aerospace & defense market. The widespread presence of manufacturing hub and increasing demand for aluminum and nickel-based forgings in the automotive and defense industry is likely to propel the growth of the regional market in the coming years.

Europe: The automotive industry in Europe is projected to witness healthy growth during the forecast period. Additionally, the dependence of the region on electricity generation from power plants is expected to boost demand for metal forging in the manufacturing of power generation equipment.

Asia-Pacific: The market in Asia-Pacific for metal forging held the largest market share, of more than 50% in 2018 and is projected to retain its dominance during the forecast period. This is primarily due to the high demand for the product in the automotive and aerospace industries. The contributors to the robust growth of the regional market are China, India, and South Korea.

Latin America: The automotive industry in the regional market is relatively small, yet rapidly expanding, which is expected to boost the demand for metal forging during the review period.

Middle East & Africa: In 2018, the market for metal forging in the region accounted for a relatively smaller market share. However, the high potential of the automotive manufacturing sector in the region and the ease of availability of raw materials (metals) for forging, is projected to propel the market growth in the coming years.

KEY PLAYERS

Arconic (US)

China First Heavy Industries (China)

ATI (US)

Bharat Forge (India)

JAPAN CASTING & FORGING CORP. (Japan)

LARSEN & TOUBRO LIMITED (India)

Brück GmbH (Germany)

Forgiatura Marcora (Italy)

NIPPON STEEL CORPORATION (Japan)

North American Forgemasters (US)

OMZ-Special Steels LLC (Russia)

PILSEN STEEL s.r.o. (Czech Republic)

JIANGYIN HENGRUN HEAVY INDUSTRIES CO., LTD (China)

Bharat Heavy Electricals Limited (India)

Access Full Report Details and Order this Premium Report @

https://www.marketresearchfuture.com/reports/metal-forging-market-8495

NOTE: Our Team of Researchers are Studying Covid19 and its Impact on Various Industry Verticals and wherever required we will be considering Covid19 Footprints for Better Analysis of Market and Industries. Cordially get in Touch for More Details.

0 notes