#Reefer Container Market Trend

Explore tagged Tumblr posts

Text

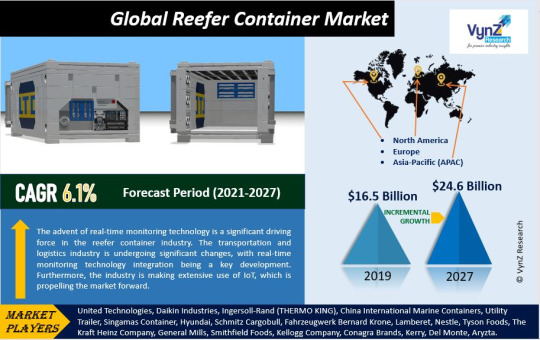

Global Reefer Container Market is Expected to Grow at a CAGR of 6.1% from 2021 to 2027

The global reefer container market is expected to grow at a CAGR of 6.1% from 2021 to 2027. The growth of the market is being driven by the increasing demand for temperature-controlled transportation of perishable goods, the expansion of global trade, and the rising adoption of e-commerce.

Key Drivers of the Market

Increasing demand for temperature-controlled transportation of perishable goods: The global demand for perishable goods, such as fruits, vegetables, meat, and fish, is increasing. These goods require temperature-controlled transportation in order to maintain their freshness and quality. Reefer containers provide a reliable and efficient way to transport perishable goods over long distances.

Expansion of global trade: The global trade of perishable goods is expanding, which is driving the demand for reefer containers. Reefer containers are used to transport perishable goods between countries, and the expansion of global trade is creating new opportunities for the use of reefer containers.

Rising adoption of e-commerce: The rising adoption of e-commerce is also driving the demand for reefer containers. E-commerce retailers need to transport perishable goods to their customers, and reefer containers provide a reliable and efficient way to do this.

Get a free sample copy of the research report: https://www.vynzresearch.com/automotive-transportation/global-reefer-container-market/request-sample

Key Trends in the Market

The increasing adoption of smart reefer containers: Smart reefer containers are equipped with sensors that monitor the temperature and humidity inside the container. This information can be used to track the condition of the goods inside the container and to ensure that they are being transported under the correct conditions.

The growing popularity of 40-foot reefer containers: 40-foot reefer containers are becoming increasingly popular because they offer more space than 20-foot reefer containers. This makes them ideal for transporting large quantities of perishable goods.

The increasing use of reefer containers in the pharmaceutical industry: The pharmaceutical industry is increasingly using reefer containers to transport temperature-sensitive drugs. Reefer containers provide a reliable and secure way to transport these drugs, and they help to ensure that they reach their destination in good condition.

Regional Analysis

The Asia-Pacific region is the largest market for reefer containers, followed by Europe and North America. The growth of the market in the Asia-Pacific region is being driven by the increasing demand for perishable goods in the region, as well as the expansion of global trade.

Competitive Landscape

The global reefer container market is dominated by a few major players, including Maersk Container Industry, Sea-Lead, and Carrier Transicold. These companies offer a wide range of reefer containers to meet the needs of different customers.

Conclusion

The global reefer container market is expected to grow at a CAGR of 8.0% from 2022 to 2030. The growth of the market is being driven by the increasing demand for temperature-controlled transportation of perishable goods, the expansion of global trade, and the rising adoption of e-commerce.

About Us:

VynZ Research is a global market research firm offering research, analytics, and consulting services on business strategies. We have a recognized trajectory record and our research database is used by many renowned companies and institutions in the world to strategize and revolutionize business opportunities.

Source: VynZ Research

#Reefer Container#Reefer Container Market#Reefer Container Market Size#Reefer Container Market Share#Reefer Container Market Analysis#Reefer Container Market Growth#Reefer Container Market Value#Reefer Container Market Trend

0 notes

Text

Developing E-Commerce Sector Boosts Reefer Container Market

In 2023, the reefer container market was 4,004.7 thousand twenty-foot equivalent units (TEU), and it will rise to 7,142.8 thousand twenty-foot units, with an 8.8% compound annual growth rate, by 2030. This is because of the rising need for pharmaceutical drugs globally, the advancing e-commerce sector, the innovation of real-time monitoring technology, and the growing count of trade routes. The…

View On WordPress

#Reefer Container Market#Reefer Container Market Growth#Reefer Container Market Share#Reefer Container Market Size#Reefer Container Market Trends

0 notes

Text

Shipping Container Market Segmented On The Basis Of Product, Type, Size, Flooring, Application, Region And Forecast 2028: Grand View Research Inc.

San Francisco, 15 January 2025: The Report Shipping Container Market Size, Share & Trends Analysis Report By Product (ISO, Non-standard), By Type (Dry, Reefer, Tank), By Size (20′, 40′, High Cube), By Flooring, By Application, By Region, And Segment Forecasts, 2020 – 2028 The global shipping container market size is expected to reach USD 15.83 billion by 2028, according to a new report by Grand…

View On WordPress

0 notes

Text

Next-Gen Shipping: Market Forecast and Trends 2024–2030

Cargo Shipping Market Overview

Request Sample

Report Coverage

The report: “Cargo Shipping Industry Outlook — Forecast (2021–2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Cargo Shipping industry.

By Type: Linear Ships, Tramp Ships.

By Cargo Type: Passenger, Liquid, Container, Dry, General, Bulk, Others.

By Vessel Type: Multi-Purpose Vessels, Dry-Bulk Carriers, Tankers, Container Vessels, Bulk Vessels, Reefer Vessels, Ro-Ro Vessels, Others.

By Vessel Cargo Capacity: <1000 TEU, 1000–4000 TEU, 4000–8000 TEU, 8000–12000 TEU, 12000–16000 TEU, 16000–20000 TEU, >20000 TEU.

By End Use Industry: Food and Beverages, Electrical & Electronics, Manufacturing, Oil & Gas, Metal and Mining, Logistics and E-commerce, Consumer Goods, Chemicals, Medical and Pharmaceutical, Others.

By Geography: North America, South America, Europe, APAC and RoW.

Inquiry Before Buying

Key Takeaways

Improving port infrastructures and incorporation of favourable trade agreements overtime is analyzed to significantly drive the cargo shipping market during the forecast period 2021–2026.

Tankers had accounted for the largest market share in 2020, attributed to the factors including longer sailing, involvement of lesser number of ports and many others, making it highly preferable for conducting marine transportation.

Presence of some key players such as Evergreen Marine, Yang Ming Marine Transport Corporation, Pacific International Lines and so on opting for partnerships, product launches or expansion to improve cargo shipping facilities have helped in boosting its growth within APAC region.

Schedule a Call

Cargo Shipping Market Segment Analysis- By Vessel Type

By vessel type, the cargo shipping market is segmented into multi-purpose vessels, dry-bulk carriers, tankers, container vessels, bulk vessels, reefer vessels, ro-ro vessels and many others. Tankers had dominated the cargo shipping market with $3234.07 million tons in 2020 and are analyzed to grow at a CAGR of 3.4% during the forecast period 2021–2026. Tankers generally refers to those cargo shipping vessels used in transportation of bulks of liquids and gases, which had emerged as an ideal mode of transportation for chemicals, petrochemicals as well as gas refineries. Oil tankers, chemical tankers, gas carriers are some of the common type of tankers utilized for serving applications based on load carrying capacities for the shipping goods. Compared to other types, these vessels are capable of offering advantages be it longer sailing, involvement of lesser number of ports and so on, thus creating its higher adoption within marine transportation facilities. Factors such as economic slowdown owing to COVID-19, decarbonization measures as well as dropping oil prices are some of the threats encountering the tanker vessels across cargo shipping markets. However, with slow economic recovery post the global pandemic situation, the demand towards crude oil imports or exports are bound to surge in order to begin with various industrial or commercial operations, thereby promoting the market growth of tankers in the long run. In 2021, Shell had signed an agreement to charter crude tankers including very large crude carriers from Advantage Tankers, AET and International Seaways, powered with dual-fuel liquefied natural gas engines. Owing to capability of lowest possible methane slip and highest fuel efficiency with an average 20% less fuel consumption, this is further anticipated to mark an important step towards increasing LNG-fuelled vessels on the water by 2023.

Cargo Shipping Market Segment Analysis- By Vessel Cargo Capacity

By vessel cargo capacity, the cargo shipping market is segmented under <1000 TEU, 1000–4000 TEU, 4000–8000 TEU, 8000–12000 TEU, 12000–16000 TEU, 16000–20000 TEU and >20000 TEU. Vessel cargo capacity of 12000–16000 TEU had held the largest share in the cargo shipping market with of $3269.44 million tons in 2020, thus analyzed to grow further with a CAGR of 4.0% during 2021–2026. Neo panamax vessels with capacity (10000–14500 TEU) and ultra-large container vessels with capacity (14500 and above) have been considered under this segment. Neo panamax refers to those medium to large sized vessels, capable of carrying about 19 rows of containers with a beam of 43 m, with comparable size of Suezmax tankers, while ultra large container vessels are considered as the biggest container ships with capabilities being at least 366 meters long, 49 meters wide, draught of at least 15.2 meters, causing its dominance within the hazardous end-use markets. Due to flexibility perspective, vessels with load carrying capacity ranging from 10000 to 15000 TEU are generally capable of allowing carriers to deploy largest ships which can traverse Panama Canal, gaining popularity in transport of goods including metal ores, coal and so on. In 2020, Evergreen Line had revealed about delivering two 12000 TEU class F-type container ships, featuring an optimized hull design as well as a smart ship system. Since these containers are equipped with a main engine of 58,000 horsepower, along with preventing containers on the deck from affecting the view from the bridge as well as maximizing cargo loadability prior to its configuration, these vessels are further analyzed to create a significant impact towards the market growth of cargo vessels with 12000 TEU capacity in the long run.

Buy Now

Cargo Shipping Market Segment Analysis- Geography

APAC had accounted for the largest share of $6589.12 Million Tons in 2020, analyzed to grow with a CAGR of 4.1% for the Cargo Shipping market during the forecast period 2021–2026. Growth of various end-use industries including food & beverage, consumer goods and so on, initiatives towards improving as well as incorporating new trade agreements, improving sea port infrastructures, rising technological advancements along with many others can be considered as some of the crucial factors which had attributed towards the market growth of cargo shipping across APAC region. Presence of some of the key cargo shipping companies including Evergreen Marine, Mitsui O.S.K Lines Ltd., Yang Ming Marine Transport Corporation, Pacific International Lines and others have also helped in creating a positive impact within the Asia-Pacific ocean freight shipping facilities. Partnerships, expansion, R & D investments and so on were considered as some of the key strategies adopted by the market players to drive cargo shipping services within the region. In 2020, Yang Ming Marine Transport Corporation announced about expanding its Intra-Asia service networking through extending Japan-Taiwan-South China Express (JTS) to Malaysia, Philippines and Singapore. This expansion was meant to optimize the competitiveness between Japan, Taiwan, South China as well as Southeast Asia, while improving the linkage connection of Yang Ming’s main port, Kaohsiung. Such factors are further set to create a positive impact towards adoption of these shipping services in order to facilitate sea transport in the long run.

Cargo Shipping Market Drivers

Growing initiatives towards improving port infrastructure:

Growing initiatives towards improving port infrastructures either by governmental support or shipping company investments can be analyzed as one of the major drivers impacting the growth of cargo shipping during the forecast period 2021–2026. Port infrastructure plays a crucial role in cargo shipping operations be it handling of bulks of goods, which had been creating high need towards upgrading, modernizing or constructing new ports to support growing trade businesses around the world. Increasing demand towards consumer products, crude oil and many other related commodities have been also raising the requirement of infrastructural growth of sea ports in order to help in meeting the consumer demands overtime. Factors such as adaptive secured communication, IT architecture and so on within the ports are getting introduced to benefit strategic traffic while assisting ship infrastructures, thus positively impacting the cargo shipping growth. Sea port infrastructures have been also getting upgraded with advanced handling systems capable of autonomous or semi-autonomous operation to achieve higher throughput levels. In addition, government along with various private infrastructure companies across developed as well as developing countries have started to focus towards establishing new ports, upgrade or expand the existing ones through investments as a move towards supporting growing trade volumes. In 2021, Adani Ports and Special Economic Zone (APSEZ) had revealed about completing its acquisition of Dighi Port Ltd for a value of INR 705 cr (around $97million), alongside an investment of INR 10,000 cr (around $1375 million) to upgrade the existing port into a multi-cargo port. Such measures are further set to boost the market growth of cargo shipping industry in near future.

Increasing number of trade agreements drives the market forward:

Increasing number of favourable trade agreements in a motive towards enhancing the trade business between countries can be considered as one of the major driving factors impacting the growth of cargo shipping market. Trade agreements are essential towards helping the importers or businesses access to low cost goods at reasonable prices, making it one of the crucial factors to drive better and optimum level of sea trades. Regional trade agreements have been increasing over the years towards extending geographic reach within the last five years, including significant increase in pluri lateral agreements with negotiations, as a way behind improving bilateral relations between developed as well as developing economies across the world. In 2020, various Asia-Pacific countries including China, Japan, South Korea, Australia, New Zealand, Indonesia, Malaysia, Laos, Philippines, Thailand, Myanmar, Cambodia, Brunei, Singapore and Vietnam had signed the Regional Comprehensive Economic Partnership (RCEP), making it one of the largest free-trade agreements. This trade agreement was meant to focus at lowering tariffs, increasing investment as well as streamlining customs procedures in order to facilitate free movement of goods. Such initiatives are further set to strengthen the economic integration between these member countries, while creating more growth opportunities in the cargo shipping market in the long run.

Cargo Shipping Market Challenges

Growing incidences of cargo rollover:

Growing incidences of cargo rollover due to ocean freight supply chain issues act as one of the major challenging factors restraining the market growth of cargo shipping. Cargo rollover situations arise mainly due to growing levels of demand at times of usually low volume or traditional seasonal decline in cargo flows, which tends to create shipping delays. Owing to the increase of container demand from U.S as well as Europe terminals and carriers, the Asian port hubs witnessed a rapid surge in cargo rollover in December 2020. Prior to economic shutdowns amidst the COVID-19 pandemic, there was recovering demand from U.S and Europe during the second half of 2020, resulting in creating disruption in the container shipping sector. Moreover, growing rollover incidences result towards clogging in major ports, forcing various carriers to cancel out sailing in order to catch up with the disrupted schedules. Supply chain disruptions are further poised to continue post the pandemic situation, prior to incapability of meeting increasing shipping requirements simultaneously, thus analyzed to hamper the market growth of cargo shipping services. Additionally, shift towards alternatives like air cargo transport can also adversely impact the cargo shipping prior to ocean freight supply chain disruptions as well as port clogging issues in the long run.

Cargo Shipping Market Landscape

Product launches, acquisitions, and R&D activities are key strategies adopted by players in the Cargo Shipping market. The key players in the Cargo Shipping market include A.P Moller-Maersk Group, CMA CGM Group, Evergreen Marine, Hapag-Lloyd, Mediterranean Shipping Company S.A (MSC), China Ocean Shipping (Group) Company (COSCO), Hamburg Sud Group, Mitsui O.S.K Lines, Ltd., Pacific International Lines (PIL) and Yang Mang Marine Transport Corporation among others.

Acquisitions/Technology Launches/Partnerships

In February 2020, a container shipping company, Hapag-Lloyd had launched a remote reefer supply chain monitoring tool, named Hapag-Lloyd LIVE. Development of this real time monitoring solution was done in order to increase transparency of cold chain by providing customers with number of data sets related to condition as well as location of their reefer containers.

In March 2019, Yang Ming announced about the launch of two ultra large container vessels, namely YM Warranty and YM Wellspring, under the 14,000 TEU capacity range. These vessels were designed with a nominal capacity of 14,220 TEU, equipped with 1000 reefer plugs, capable of reaching speeds upto 23 knots.

For more Automotive Market reports — Please click here

0 notes

Text

Shipping Container Prices in Ireland: What You Need to Know

The demand for shipping containers in Ireland has been steadily increasing, driven by the growing need for efficient logistics, storage, and even repurposing containers into homes and offices. If you are looking to invest in shipping containers for personal or business use, understanding the factors that influence pricing is essential. Ocean and General Maritime Agencies Ltd, a leader in maritime logistics, provides insights into the current trends, price ranges, and considerations for purchasing shipping containers in Ireland.

1. Types of Shipping Containers Available in Ireland

The price of a Shipping Container Prices Ireland depends largely on the type you require. Each type of container serves different needs, and knowing which one is right for your business can help you make a cost-effective decision. Here are the most common types:

Standard Dry Containers: These are the most commonly used containers for general cargo. Available in 20ft and 40ft sizes, dry containers are suitable for most storage and transportation needs. Prices typically range from €2,500 to €4,500, depending on the condition and size.

Refrigerated Containers (Reefers): If you need to transport perishable goods, a refrigerated container is essential. These containers are equipped with temperature control systems, which make them more expensive. Expect prices starting from €6,000 and up, depending on the cooling capacity and size.

High Cube Containers: Slightly taller than standard containers, high cube containers provide extra space for bulkier cargo. These containers generally cost around €3,000 to €5,000.

Open-Top Containers: Ideal for transporting large machinery or goods that need to be loaded from the top, these containers cost more due to their specialized design, with prices starting from €4,000.

Flat Rack Containers: For heavy or oversized cargo, flat rack containers are essential. They come with collapsible sides to accommodate large equipment. These typically range between €3,500 and €6,000.

2. Factors Affecting Shipping Container Prices in Ireland

Several factors contribute to the price fluctuations in the shipping container market. Understanding these will help you make more informed decisions when buying or leasing a container.

Condition (New vs. Used): The condition of the shipping container significantly impacts its price. New containers are more expensive, with prices ranging from €4,000 to €8,000, depending on the size and type. Used containers, which are often still structurally sound but may have cosmetic wear, can be purchased for much less, sometimes as low as €1,500. However, buyers must ensure the container is in good condition to prevent future repair costs.

Size: As expected, larger containers such as 40ft or high cube variants come with a higher price tag. Depending on the type and condition, larger containers can cost 20% to 30% more than their smaller counterparts.

Location and Transportation Costs: Where you purchase your container matters. In Ireland, shipping containers are often sourced from major ports like Dublin, Cork, and Galway. If the container needs to be transported inland, transportation costs will increase the overall price. It’s always advisable to consider the proximity of the supplier when making your decision.

Market Demand: Like most goods, the prices of shipping containers fluctuate with market demand. Global events, such as the COVID-19 pandemic, caused container shortages, driving prices up. Although the market has stabilized since then, occasional demand spikes can still lead to price increases.

Customization: If you need modifications such as additional doors, windows, insulation, or shelving, these customizations will increase the container’s cost. Basic modifications can add anywhere from €500 to €3,000, depending on the extent of the work.

3. Leasing vs. Buying: Which Is More Cost-Effective?

If you only need a container for a short period, leasing might be the better option. Leasing rates in Ireland typically range from €75 to €150 per month for standard 20ft containers. Leasing refrigerated or specialized containers may cost more, depending on the type and the lease duration.

For long-term use, purchasing is generally more cost-effective, especially if you plan to use the container for storage or transportation over several years. Ocean and General Maritime Agencies Ltd offers flexible leasing options for those who need containers on a temporary basis, ensuring you have the best option for your needs.

4. Repurposing Shipping Containers

Shipping containers are no longer just for transportation. Many companies and individuals in Ireland are opting to repurpose containers into eco-friendly homes, pop-up shops, or mobile offices. The cost of repurposing a container varies depending on the level of customization needed, but this trend has created an additional demand for containers in Ireland, slightly affecting prices.

A basic shipping container home can cost between €15,000 and €30,000 to build, depending on the size and amenities. Companies specializing in container conversions typically offer packages that include insulation, windows, doors, and interior finishing.

5. Where to Buy Shipping Containers in Ireland

If you are looking for high-quality shipping containers in Ireland, Ocean and General Maritime Agencies Ltd offers a wide selection of new and used containers to suit various needs. With decades of experience in the maritime industry, we provide competitive pricing, reliable delivery, and a range of container types, from dry storage to refrigerated and custom solutions.

We are headquartered in Dublin, with access to major ports across the country, ensuring that your container is delivered efficiently, no matter your location. Our team of experts can guide you through the process of selecting the right container for your needs and provide advice on purchasing versus leasing options.

Conclusion

Shipping container prices in Ireland depend on several factors, including the type, condition, and market demand. Whether you're looking to purchase a standard container for transport, a refrigerated unit for perishable goods, or a custom-built container for a new venture, Ocean and General Maritime Agencies Ltd offers tailored solutions to meet your requirements. By understanding these factors, you can make informed decisions that fit your budget and needs.

For more information, visit Ocean and General Maritime Agencies Ltd and explore our comprehensive range of shipping container solutions.

0 notes

Text

Reefer Container Market Overview: Growth Factors and Future Trends (2023-2032)

The Reefer Container Market is projected to grow from USD 6808.1 million in 2024 to USD 9034.5 million by 2032, at a compound annual growth rate (CAGR) of 3.60%.

A reefer container, short for refrigerated container, is a specialized shipping container equipped with a refrigeration unit to transport temperature-sensitive cargo. These containers are essential for the global supply chain, particularly for perishable goods such as fruits, vegetables, dairy products, meat, seafood, and pharmaceuticals. Reefer containers are capable of maintaining a controlled environment, which can include refrigeration, deep freeze, and temperature control within a specific range, ensuring the quality and safety of the products throughout the transportation process. They are available in various sizes, most commonly 20-foot and 40-foot, and can be used in both ocean and intermodal transportation. The ability to maintain consistent temperatures, regardless of external weather conditions, makes reefer containers indispensable for industries that require strict temperature control. This technology has significantly expanded global trade opportunities by enabling the safe and efficient long-distance transport of perishable goods.

The reefer container market presents several growth opportunities driven by various factors and trends:

Increasing Global Trade of Perishable Goods: The rising demand for fresh and perishable goods such as fruits, vegetables, dairy products, seafood, and pharmaceuticals across the globe is a significant driver for the reefer container market. The ability to transport these goods safely over long distances opens up new markets and expands international trade opportunities.

Advancements in Refrigeration Technology: Technological advancements in refrigeration systems are enhancing the efficiency, reliability, and environmental sustainability of reefer containers. Innovations such as improved insulation, energy-efficient refrigeration units, and remote monitoring systems provide better temperature control, reduce energy consumption, and lower operational costs.

Growing Pharmaceutical and Healthcare Sectors: The pharmaceutical industry requires stringent temperature control during the transportation of medicines, vaccines, and other healthcare products. The growing demand for biopharmaceuticals and vaccines, particularly highlighted by the COVID-19 pandemic, has boosted the need for specialized reefer containers capable of maintaining specific temperature ranges and ensuring product integrity.

Expansion of Cold Chain Infrastructure: The development and expansion of cold chain logistics infrastructure, particularly in emerging markets, are creating significant growth opportunities for the reefer container market. Investments in ports, storage facilities, and transportation networks are facilitating more efficient and reliable cold chain operations.

Rising Consumer Demand for Fresh and Organic Products: Increasing consumer preference for fresh, organic, and minimally processed foods is driving demand for efficient cold chain solutions, including reefer containers. This trend is particularly strong in regions with growing urban populations and rising disposable incomes.

Regulatory Compliance and Safety Standards: Stringent regulations regarding food safety and quality, as well as pharmaceutical product integrity, are boosting the demand for reefer containers that can meet these standards. Compliance with international guidelines and certifications is essential for companies involved in the global trade of temperature-sensitive goods.

Environmental Sustainability Initiatives: There is a growing emphasis on reducing the environmental impact of transportation and logistics. Reefer containers with eco-friendly features, such as reduced carbon emissions and energy-efficient refrigeration systems, are becoming increasingly popular as companies seek to align with sustainability goals.

Digitalization and Smart Technologies: The integration of digital technologies and IoT solutions in reefer containers allows for real-time monitoring of temperature, humidity, and other critical parameters. This capability enhances supply chain visibility, improves risk management, and ensures the integrity of perishable goods throughout the transportation process.

Growth in E-commerce and Online Grocery Shopping: The rise of e-commerce and online grocery shopping has increased the demand for efficient cold chain logistics, including the use of reefer containers for the last-mile delivery of perishable goods. This trend is particularly relevant in urban areas with high demand for convenient and fast delivery options.

Strategic Partnerships and Collaborations: Companies are increasingly forming partnerships and collaborations to enhance their cold chain capabilities and expand their market presence. These partnerships can involve logistics providers, technology companies, and other stakeholders in the supply chain.

Key Player Analysis

Maersk Container Industry

Daikin Reefer

Carrier Transicold

Thermo King

Singamas Container Holdings

CIMC Group

China International Marine Containers (CIMC)

Hyundai Translead

Klinge Corporation

MCI (Mitsubishi Chemical Corporation)

Texmaco Rail & Engineering Ltd.

MSC Mediterranean Shipping Company

Triton Container International Limited

Seaco Global Limited

Blue Sky Intermodal

Evergreen Marine Corporation

CMA CGM Group

ZIM Integrated Shipping Services

Hapag-Lloyd

COSCO Shipping Lines

More About Report- https://www.credenceresearch.com/report/reefer-container-market

The reefer container market exhibits distinct regional characteristics influenced by factors such as trade volumes, infrastructure development, and regional demand for perishable goods. Here are some regional insights:

North America: The North American reefer container market is well-developed, driven by strong demand for perishable goods, including agricultural products, pharmaceuticals, and seafood. The United States, in particular, is a significant market due to its extensive trade networks and advanced cold chain infrastructure. The region also benefits from technological advancements in refrigeration and logistics, enhancing the efficiency of reefer container operations.

Europe: Europe has a mature reefer container market, supported by a robust cold chain network and stringent food safety regulations. The region's demand is driven by a high consumption of perishable goods, including dairy products, meat, and fruits. Key markets include Germany, the Netherlands, and the United Kingdom, which serve as major hubs for food imports and exports. The European market also emphasizes sustainability, driving demand for energy-efficient and eco-friendly reefer containers.

Asia-Pacific: The Asia-Pacific region is experiencing rapid growth in the reefer container market, driven by increasing urbanization, rising disposable incomes, and expanding middle-class populations. China, Japan, South Korea, and India are significant markets, with growing demand for fresh and frozen foods, pharmaceuticals, and other perishable goods. The region is also seeing substantial investments in cold chain infrastructure to support its burgeoning e-commerce and retail sectors.

Latin America: Latin America's reefer container market is growing, supported by the region's strong agricultural sector and exports of fresh produce, seafood, and meat. Brazil, Mexico, and Chile are key markets, benefiting from increasing international trade and improvements in cold chain logistics. However, the market faces challenges related to infrastructure development and regulatory compliance.

Middle East and Africa: The Middle East and Africa region is an emerging market for reefer containers, driven by rising demand for imported food products and pharmaceuticals. The UAE, Saudi Arabia, and South Africa are notable markets, with ongoing investments in logistics and cold storage facilities. The region's hot climate and reliance on food imports underscore the importance of efficient cold chain solutions.

Regional Trends and Challenges: Across all regions, the reefer container market is influenced by trends such as the growth of e-commerce, increased focus on food safety and quality, and the demand for energy-efficient solutions. However, challenges such as infrastructure limitations, regulatory hurdles, and varying levels of technological adoption can impact market growth differently in each region.

Segments:

Based on Container Size:

Less than 20 feet

20 to 40 feet

More than 40 feet

Based on End Use:

Food and Beverage

Chemical

Pharmaceutical

Based on Mode of Transportation:

Roadways

Railways

Seaways

Browse the full report – https://www.credenceresearch.com/report/reefer-container-market

Contact Us:

Phone: +91 6232 49 3207

Email: [email protected]

Website: https://www.credenceresearch.com

0 notes

Text

Container Transport: Streamlining Global Trade

In the dynamic landscape of global commerce, container transport plays a pivotal role in ensuring the efficient movement of goods across vast distances. This method of freight transportation has revolutionised logistics, offering reliability, scalability, and cost-effectiveness to businesses worldwide.

Let's delve into what Container Transport Melbourne entails, its benefits, challenges, and its crucial role in shaping modern supply chains.

Understanding Container Transport

Container transport refers to the shipment of goods in standardised containers, typically steel boxes of varying sizes (most commonly 20 feet or 40 feet in length), designed to withstand the rigours of long-distance transportation. These containers are loaded onto specialised trucks, trains, or ships, facilitating seamless transfer between different modes of transport without the need to unpack and repack goods.

Key Components of Container Transport

Intermodal Compatibility: Containers are designed to be compatible across different modes of transport—trucks, trains, and ships—allowing for efficient transhipment at ports or intermodal terminals.

Container Types: Standard containers are the norm, but specialised containers exist for specific cargo types, such as refrigerated (reefer) containers for perishable goods or flat racks for oversized items.

Logistics Infrastructure: Ports, terminals, and distribution centres are critical nodes in the container transport network, ensuring smooth transitions between transportation modes and facilitating efficient cargo handling.

Benefits of Container Transport

Efficiency and Speed

Containerisation reduces cargo handling time significantly. Once loaded, 3pl services Melbourne remain sealed until reaching their destination, minimising delays and streamlining logistics operations. This efficiency translates into faster delivery times and improved supply chain reliability.

Cost-Effectiveness

By optimising space and reducing labour costs associated with handling individual pieces of cargo, container transport offers substantial cost savings for businesses. Standardised containers also enable better utilisation of transportation capacity, lowering overall shipping costs per unit.

Security and Protection

Containers provide a secure environment for goods during transit, protecting them from weather conditions, theft, and damage. Advanced tracking container transport Melbourne technologies further enhance security by allowing real-time monitoring of cargo, reducing the risk of loss or tampering.

Global Reach

Container transport facilitates global trade by connecting manufacturing centres with consumer markets across continents. Ports act as vital hubs for international trade, handling millions of containers annually and supporting economic growth through enhanced trade flows.

Challenges in Container Transport

While containerisation offers numerous advantages, it also presents challenges that require strategic management and investment:

Infrastructure Constraints: Port congestion and inadequate intermodal infrastructure can lead to delays and increased costs.

Environmental Impact: Despite efficiency gains, container transport contributes to carbon emissions and environmental concerns, prompting efforts to adopt greener practices and technologies.

Security Risks: Container theft and smuggling remain persistent challenges, necessitating robust security protocols and cargo tracking systems.

Future Trends and Innovations

The future of container transport is marked by technological advancements and sustainability initiatives:

Digitalisation: Adoption of blockchain 3pl Services Melbourne technology for supply chain transparency and efficiency improvements in cargo tracking and logistics management.

Automation: Increased use of automated terminals and robotic systems to enhance operational efficiency and reduce labour costs.

Green Logistics: Implementation of eco-friendly practices such as electric-powered ships, alternative fuels, and carbon offset programs to mitigate environmental impact.

Final Words

Container transport stands as a cornerstone of modern logistics, driving economic growth and facilitating global trade through its efficiency, scalability, and reliability. While facing challenges like infrastructure limitations and environmental impact, ongoing innovations promise to further enhance the sustainability and efficiency of container transport.

As businesses continue to expand their global footprint, understanding and leveraging container transport Melbourne remains essential for optimising supply chain operations and meeting the demands of a connected world.

Source - https://logistic-company-melbourne.blogspot.com/2024/06/container-transport-streamlining-global.html

0 notes

Text

0 notes

Text

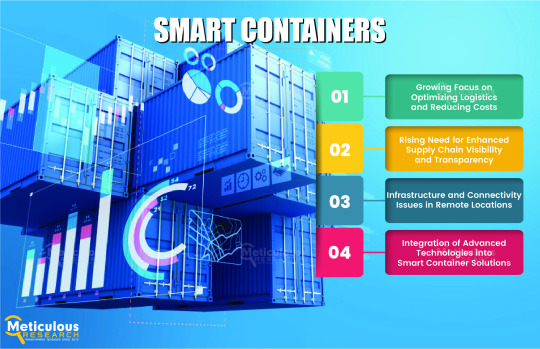

Smart Containers Market Projected to Reach $16.9 Billion by 2030

Meticulous Research®—a leading global market research company, published a research report titled, ‘Smart Containers Market by Offering (Hardware, Software, Services), Type (Reefer, Dry), Size (20, 40), Technology (AI, Blockchain, IoT), Application (Asset Tracking & Management, Supply Chain Optimization), Sector, and Geography - Global Forecast to 2030.’

Meticulous Research® has released a new publication projecting the global smart containers market to reach $16.9 billion by 2030, growing at a CAGR of 20.1% from 2023 to 2030. This market growth is driven by increasing efforts to optimize logistics and reduce costs, the rising demand for improved supply chain visibility and transparency, and growing concerns over cargo security and counterfeiting. The adoption of cloud-based platforms for smart container management and the expanding applications of smart container technologies in the healthcare and agriculture sectors are expected to create significant growth opportunities. However, the high implementation costs of smart container technologies and infrastructure and connectivity challenges in remote locations are major obstacles for market players.

A notable market trend is the integration of advanced technologies such as blockchain and AI into smart container solutions.

The global smart containers market is segmented by offering, type, size, technology, application, and sector, with the study evaluating industry competitors and analyzing the market at regional and country levels.

Market Segmentation:

By Offering:

Hardware

Software: Expected to account for the largest share in 2023, driven by the demand for data analytics and insights, cloud-based platforms for data storage and processing, and the need to manage extensive data from IoT devices. This segment is projected to register the highest CAGR.

Services

By Type:

Reefer Containers: Projected to have the highest CAGR, driven by the need to maintain product quality and freshness, increased demand for transporting temperature-sensitive goods, investments in cold chain infrastructure, and advancements in refrigeration and temperature monitoring.

Dry Containers: Expected to account for the largest share in 2023 due to e-commerce growth, demand for general cargo transportation, and the need for easy integration with existing logistics networks.

Tank Containers

Other Smart Container Types

By Size:

20-foot Containers

40-foot Containers: Expected to dominate in 2023, driven by the need to ship goods from manufacturers to distribution centers and retail stores, and the transport of a wide range of cargo. This segment is also projected to have the highest CAGR.

By Technology:

Artificial Intelligence

Blockchain: Expected to register the highest CAGR, driven by the need for enhanced traceability, smart contracts, and ensuring document integrity.

Cloud Computing

Internet of Things (IoT): Expected to account for the largest share in 2023, driven by real-time monitoring needs, cargo security, and remote tracking.

Geolocation Technology

Connectivity Technology

By Application:

Asset Tracking & Management: Expected to dominate in 2023, driven by the demand for real-time visibility, cost reduction, and streamlined operations.

Supply Chain Optimization: Projected to have the highest CAGR, driven by the need to identify bottlenecks, optimize inventory and routes, and improve efficiency.

Safety & Security

Other Applications

By Sector:

Pharmaceutical & Healthcare

Food & Beverage: Projected to register the highest CAGR, driven by the need for better inventory management, accurate tracking of shelf life, and maintaining the quality of perishable goods.

Chemicals & Hazardous Materials

Retail & E-commerce: Expected to dominate in 2023, driven by the need for real-time tracking, shipment transparency, and minimizing delivery delays and order inaccuracies.

Oil & Gas

Automotive

Agriculture

Other Sectors

By Geography:

North America

Europe

Asia-Pacific: Expected to account for the largest share in 2023 and register the highest CAGR, driven by the strong presence of key industries, commitment to eco-friendly logistics, real-time tracking, and stringent regulatory requirements.

Download Free Sample PDF Copy Here: https://www.meticulousresearch.com/download-sample-report/cp_id=5517

Key Players:

Key players in the smart containers market include Panasonic Industry Co., Ltd. (Japan), CMA CGM Group (France), ORBCOMM (U.S.), TRAXENS (France), Globe Tracker, ApS (Denmark), Emerson Electric Co. (U.S.), ZIM Integrated Shipping Services Ltd. (Israel), MSC Mediterranean Shipping Company S.A (Switzerland), Sealand - A Maersk Company (U.S.), China International Marine Containers (Group) Co., Ltd. (China), Berlinger & Co. AG (Switzerland), Hapag-Lloyd AG (Germany), Ocean Network Express Pte. Ltd. (Singapore), Nexxiot AG (Switzerland), Thinxtra Ltd (Australia), SAVVY Telematic Systems AG (Switzerland), Sensolus (Belgium), ZillionSource Technologies (U.S.), and SkyCell AG (Switzerland).

Key Report Insights:

High-growth market segments based on various categories.

Historical market data and forecasts for 2023–2030.

Major market drivers, restraints, opportunities, and challenges.

Competitive landscape and market share analysis.

Recent developments and strategies of key players.

Geographic trends and high-growth countries.

Competition among local emerging players.

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#Smart Containers#Smart Special Containers#Smart Dry Containers#Smart Tank Containers#Maersk Smart Containers

0 notes

Text

Cool Cargo: Analyzing the Market Share Dynamics in the Reefer Container Industry

The global reefer container market is experiencing a chill of innovation and a sizzle of demand as the need for temperature-controlled transportation escalates across various industries. This press release provides an insight into the market size, trends, applications, and a snapshot of the competitive landscape within the reefer container industry.

Free Sample Copy of This Report at: https://www.econmarketresearch.com/request-sample/EMR0014/&Mode=econA

Market Size and Trends:

The reefer container market is on an upward trajectory, witnessing substantial growth attributed to the expanding global trade of perishable goods. According to recent market analysis, the market size is forecasted to reach [insert market size] by [insert year], reflecting a noteworthy compound annual growth rate (CAGR).

Key trends driving this growth include the rising demand for fresh and frozen food products, increasing pharmaceutical shipments requiring temperature control, and a growing emphasis on reducing food wastage through efficient cold chain logistics. Technological advancements, such as real-time monitoring and remote controlling capabilities, are also influencing the market dynamics.

Applications and Product Insights:

Reefer containers, also known as refrigerated containers, find diverse applications across various industries. Key applications include:

Food and Beverage Industry: Reefer containers are indispensable for the transportation of perishable goods, including fruits, vegetables, meat, and dairy products. They ensure the preservation of quality and freshness throughout the supply chain.

Pharmaceutical Industry: The pharmaceutical sector relies on reefer containers for the transportation of temperature-sensitive drugs and vaccines. Maintaining a consistent and controlled temperature during transit is critical to preserving the efficacy of these products.

Chemical and Biotechnology Industries: Reefer containers are increasingly used for the transportation of chemicals and biotechnological products that require specific temperature conditions. This ensures the integrity of the cargo and compliance with safety regulations.

Ask For Discount: https://www.econmarketresearch.com/request-discount/EMR0014/?Mode=econA

Competitive Landscape and Regional Analysis:

The reefer container market is marked by intense competition among key players striving to provide innovative solutions that cater to the evolving needs of the industry. Notable companies in the market include [insert major companies], which are investing in research and development to enhance container efficiency and sustainability.

Regionally, Asia-Pacific is a prominent market for reefer containers, driven by the rapid growth in the food and pharmaceutical industries. Europe and North America also play significant roles, with a mature cold chain infrastructure and stringent quality standards. The market in Latin America and Africa is witnessing growth, propelled by increasing international trade and rising consumer demand for fresh produce.

In conclusion, the reefer container market is experiencing a cool wave of innovation and a hot surge in demand as industries recognize the critical role of temperature-controlled logistics in preserving the quality and safety of perishable goods.

Full Report: https://www.econmarketresearch.com/industry-report/reefer-container-market/

Competitive Landscape:

Some of the main manufacturers of Reefer Container Market are:

A.P. Moller - Maersk A/S

Singamas Container Holdings Ltd.

China International Marine Containers (Group) Co. Ltd.

Seaco Srl

Triton International Ltd.

MSC Mediterranean Shipping Company S.A.

Hapag-Lloyd AG

Ocean Network Express (ONE) Pte. Ltd.

ZIM Integrated Shipping Services Ltd.

SeaCube Container Leasing Ltd.

Segmentations:

Based on Size

20 Feet

40 Feet

More than 40 Feet

Based on Transportation Mode

Seaways

Roadways

Railways

Based on Industry

Food

Fruits

Meat/poultry

Fish/seafood

Vegetables

Dairy products

Pharmaceutical

Liquid medicines

Pills

Vaccines

Biologicals

Chemical

Geographical Analysis

North America

U.S.

Canada

Europe

Germany

U.K.

Netherlands

France

Italy

Spain

About Us:

Econ Market Research is an all-inclusive resource for providing useful insight gleaned through industry research. Through our syndicated and consulting research services, we assist our clients in finding solutions to their research needs. Industries including semiconductor and electronics, aerospace and defence, automobiles and transportation, healthcare, manufacturing and construction, media and technology, chemicals, and materials are among our areas of expertise.

Contact Us:

Econ Market Research Private Limited.

E-mail: [email protected]

Phone: +1 812 506 4440

Website: — Https://Www.Econmarketresearch.Com

Connect with us at LinkedIn | Facebook | Twitter | YouTube

0 notes

Text

Container Fleet Market Trends, Business Strategies and Opportunities With Key Players Analysis 2028

IMARC Group has recently released a new research study titled “Container Fleet Market by Type (Dry Container, Reefer Container, Tank Container, Special Container), End User (Automotive, Oil and Gas, Food, Mining and Minerals, Agriculture, and Others), and Region 2023-2028”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to…

View On WordPress

0 notes

Text

Container shipping

Introduction:

Container shipping is the backbone of global trade, facilitating the movement of goods on a massive scale. Whether you're a business owner looking to expand your market or an individual planning an international move, understanding the intricacies of container shipping is essential. In this blog, we'll explore the key aspects of container shipping, offering insights into how you can maximize efficiency and reliability in your shipping endeavors.

1. The Significance of Container Shipping:

- Understand the vital role container shipping plays in the global economy and its impact on international trade and commerce.

2. What Is Container Shipping?

- Define container shipping and its core components, including standard container sizes, types, and the containerization process.

3. Benefits of Container Shipping:

- Explore the numerous advantages of container shipping, such as security, efficiency, and cost-effectiveness compared to other shipping methods.

4. Container Loading and Securing:

- Learn about the proper techniques for loading and securing cargo in containers, ensuring it remains intact and safe during transit.

5. Different Types of Cargo Containers:

- Explore the various types of cargo containers, from standard dry containers to refrigerated (reefer) containers and open-top containers. Discover which container type best suits your cargo.

6. Container Shipping Routes:

- Dive into the world of container shipping routes, understanding the major trade lanes and the significance of key ports and hubs in global trade.

7. Container Shipping Companies:

- Evaluate different container shipping companies, considering factors like reputation, reliability, and service quality when selecting a carrier for your cargo.

8. Container Shipping Documentation:

- Navigate the paperwork involved in container shipping, including bills of lading, shipping invoices, customs documentation, and container inspection reports.

9. Tracking and Monitoring:

- Discover how technology has revolutionized container shipping with real-time tracking and monitoring solutions. Learn how to leverage these tools to keep tabs on your cargo throughout its journey.

10. Container Shipping Challenges:

- Explore the common challenges faced in container shipping, such as delays, customs regulations, and security concerns, and gain insights into effective solutions.

11. Sustainability in Container Shipping:

- The container shipping industry is increasingly focusing on sustainability. Explore eco-friendly practices and innovations, such as environmentally friendly container designs and cleaner fuel alternatives.

Conclusion:

Container shipping is a linchpin of global commerce, offering secure and efficient transport for goods worldwide. By understanding the nuances of container types, loading and securing techniques, documentation requirements, and the latest industry trends, you can ensure the success of your container shipping endeavors.

0 notes

Text

Cargo Handling Equipment Market Outlook, Trends, Report 2022-2029

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the global cargo handling equipment market size at USD 24.63 billion in 2022. During the forecast period between 2023 and 2029, BlueWeave expects the global cargo handling equipment market size to grow at a steady CAGR of 3.5% reaching a value of USD 30.28 billion by 2029. Major growth drivers for the global cargo handling equipment market include globalization, rapid industrialization, and increasing cargo activities. Cargo handling equipment has garnered significant attention due to its multifaceted benefits, which encompass the mitigation of revenue losses stemming from protracted cargo loading and unloading procedures. Moreover, this equipment augments the efficiency of cargo handling operations, reinforces safety protocols, and diminishes the probability of accidents. Significantly, it expedites cargo processing by streamlining cargo movement within docks and warehouses, thereby enhancing precision and reducing handling durations. Also, the equipment curtails the risk of worker injuries and the occurrence of accidents, thereby elevating safety benchmarks within the industry. However, high initial cost is anticipated to restrain the growth of the overall market during the period in analysis.

Global Cargo Handling Equipment Market – Overview

Cargo handling equipment encompasses specialized off-road, self-propelled vehicles and machinery used in intermodal rail yards and ports to handle containers, bulk goods, and liquid cargo transported by sea, air, or rail routes, with additional functions including scheduled maintenance and repairs. This equipment includes a range of machines such as mobile cranes, yard trucks, rubber-tired gantry cranes, side handlers, reach stackers, top handlers, loaders, forklifts, sweepers, dozers, excavators, and aerial lifts. The choice of equipment depends on the specific cargo type. Tankers are equipped with pumping systems, hose-handling cranes, and tank cleaning machinery. Dry-bulk carriers often rely on shoreside facilities, but some feature self-unloading mechanisms like conveyors or deck-mounted cranes. Reefer vessels are designed with refrigerated cargo holds and extensive refrigeration systems. Given the global dominance of containerized cargo transportation across land, air, and sea, precise handling of containers is vital, particularly at sea, where challenging weather conditions and strong winds prevail.

Sample Request @ https://www.blueweaveconsulting.com/report/cargo-handling-equipment-market/report-sample

Impact of COVID-19 on Global Cargo Handling Equipment Market

COVID-19 pandemic adversely affected the global cargo handling equipment market. Lockdown restrictions during the outbreak led to the closure of manufacturing units in this market. Despite the initial challenges caused by a lack of skilled professionals, there is a projected resurgence in the supply sector post-lockdown, as restrictions are gradually lifted. Also, the heightened demand for cargo handling and transportation services has created growth opportunities for the market in the aftermath of the pandemic, underscoring the profound impact of COVID-19 on the global cargo handling equipment market.

Global Cargo Handling Equipment Market – By Equipment

Based on equipment, the global cargo handling equipment market is divided into Industrial Trucks Tow Tractors, Conveying Equipment, Stackers, and Port Cranes segments. The industrial trucks tow tractors segment holds the highest share in the global cargo handling equipment market by equipment. The segment's prominence is attributed to the vital role tow tractors play in the efficient movement of materials and cargo within industrial settings, such as warehouses, factories, and distribution centers. Tow tractors are prized for their versatility and ability to tow heavy loads, making them indispensable for various logistics and materials handling operations. Their reliability, ease of use, and adaptability to diverse applications have contributed to their widespread adoption, solidifying their position as a key driver of the cargo handling equipment market.

Competitive Landscape

Major players operating in the global cargo handling equipment market include Hangcha Forklift, Siemens Logistics GmbH, TOYOTA INDUSTRIES CORPORATION, Terex Corporation, Anhui Heli, Textron Ground Support Equipment Inc., Liebherr-International Deutschland GmbH, TLD, KION GROUP AG, ABB, Hoist Material Handling, Inc., Hyster-Yale Group, Inc., and Konecranes. To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product launches.

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

Global Reefer Container Market — Growth, Trends, COVID-19 Impact, and Forecasts (2021–2027)

The global reefer container market is expected to grow at a CAGR of 6.1% from 2021 to 2027. The growth of the market is being driven by a number of factors, including the increasing demand for temperature-sensitive goods, the expansion of global trade, and the rising adoption of e-commerce.

Key Drivers of the Market

Increasing demand for temperature-sensitive goods: The global demand for temperature-sensitive goods is growing due to the increasing population, rising affluence, and changing dietary habits. This is leading to an increased need for reefer containers to transport these goods in a safe and efficient manner.

Expansion of global trade: The global trade of temperature-sensitive goods is expanding due to the growing economic integration of countries. This is leading to an increased demand for reefer containers to transport these goods across long distances.

Rising adoption of e-commerce: The rising adoption of e-commerce is also driving the growth of the reefer container market. E-commerce retailers are increasingly using reefer containers to transport fresh food and other temperature-sensitive goods to their customers.

Get a free sample copy of the research report: https://www.vynzresearch.com/automotive-transportation/global-reefer-container-market/request-sample

Regional Analysis

The Asia-Pacific region is expected to be the largest market for reefer containers during the forecast period. This is due to the growing demand for temperature-sensitive goods in the region, coupled with the expansion of the global trade of these goods. Other major markets for reefer containers include North America, Europe, and Latin America.

Segmentation

The global reefer container market is segmented by container size, transportation mode, application, and region.

By container size: The market is segmented into 20 feet, 40 feet, and more than 40 feet. The 20 feet segment is expected to be the largest market during the forecast period. This is due to the increasing demand for smaller reefer containers for the transportation of fresh food and other temperature-sensitive goods.

By transportation mode: The market is segmented into sea, road, and rail. The sea mode is expected to be the largest market during the forecast period. This is due to the increasing volume of global trade of temperature-sensitive goods.

By application: The market is segmented into food, pharmaceuticals, chemicals, and others. The food segment is expected to be the largest market during the forecast period. This is due to the increasing demand for fresh food products in the global market.

By region: The market is segmented into Asia-Pacific, North America, Europe, Latin America, and Middle East & Africa. The Asia-Pacific region is expected to be the largest market during the forecast period.

Competitive Landscape

The global reefer container market is highly competitive. The major players in the market include Carrier, Maersk Container Industry, Sea Box, and Thermo King. These players are focusing on expanding their product portfolio and geographic reach in order to gain a competitive advantage.

Future Outlook

The global reefer container market is expected to grow at a healthy pace during the forecast period. The growth of the market will be driven by the increasing demand for temperature-sensitive goods, the expansion of global trade, and the rising adoption of e-commerce.

Conclusion

The global reefer container market is a promising market with a lot of growth potential. The market is expected to grow at a healthy pace during the forecast period, driven by a number of factors. The key players in the market are focusing on expanding their product portfolio and geographic reach in order to gain a competitive advantage.

About Us:

VynZ Research is a global market research firm offering research, analytics, and consulting services on business strategies. We have a recognized trajectory record and our research database is used by many renowned companies and institutions in the world to strategize and revolutionize business opportunities.

Source: VynZ Research

0 notes

Text

Shipping Container Market Landscape: Trends, Drivers, and Forecast (2023-2032)

The Shipping Container market is projected to grow from USD 10,408.79 million in 2024 to USD 13,780.72 million by 2032, at a compound annual growth rate (CAGR) of 3.57%.

Shipping containers are large, standardized steel boxes designed for intermodal freight transport, meaning they can be used across different modes of transport – from ship to rail to truck – without unloading and reloading their cargo. Developed in the mid-20th century, these containers revolutionized global trade by significantly reducing the cost and time of cargo transport, enhancing efficiency, and improving the security of goods. Typically, shipping containers are 20 or 40 feet long, though variations exist to accommodate different types of cargo. Their standardized design allows them to be easily stacked and handled by various types of equipment, such as cranes and forklifts, facilitating the seamless transfer of goods across the world. The durability and robustness of shipping containers, made from weathering steel, protect their contents from the harsh conditions at sea and in transit.

Additionally, they come in various types, such as dry containers, refrigerated containers (reefers) for perishable goods, open-top containers for oversized cargo, and tank containers for liquids. Beyond their primary use in transportation, shipping containers have found secondary applications in architecture and construction, being repurposed into homes, offices, and storage units due to their modular and sturdy nature. This adaptability, combined with their role in the global supply chain, underscores the shipping container's significance in modern logistics and trade.

Shipping Container Market Trends:

The shipping container market is experiencing several significant trends driven by various global economic, technological, and environmental factors. Firstly, the rising demand for efficient and cost-effective transportation solutions is propelling the growth of the shipping container market. The increasing globalization of trade and the expansion of e-commerce have heightened the need for reliable and scalable freight transport options, making shipping containers an essential component of the logistics infrastructure.

Another notable trend is the shift towards more sustainable and eco-friendly container solutions. With growing environmental concerns and stringent regulations aimed at reducing carbon emissions, there is a surge in the adoption of green containers. These include containers made from recycled materials and those designed for energy efficiency, such as refrigerated containers with advanced insulation and energy-saving refrigeration units.

Technological advancements are also playing a pivotal role in shaping the shipping container market. The integration of Internet of Things (IoT) technology and smart sensors in containers is enhancing the tracking, monitoring, and management of cargo. These innovations provide real-time data on container location, condition, and security, thus improving supply chain transparency and efficiency.

The trend towards containerization in non-traditional sectors is another factor driving market growth. Industries such as agriculture, pharmaceuticals, and retail are increasingly utilizing containers for their supply chain needs due to the advantages of standardized transport and enhanced protection of goods. For instance, the use of refrigerated containers is expanding in the food and pharmaceutical industries to maintain the quality and safety of perishable and temperature-sensitive products during transit.

Moreover, the market is witnessing a growing interest in container modification and repurposing. The versatility of shipping containers makes them suitable for various secondary applications, including portable storage units, pop-up retail shops, and even residential and commercial buildings. This trend is particularly prominent in urban areas where space constraints and sustainability goals drive the adoption of innovative container-based solutions.

Geopolitical factors and trade dynamics are also influencing the shipping container market. Trade tensions, tariff regulations, and shifts in manufacturing hubs are impacting container flows and demand patterns. For example, the relocation of manufacturing activities from China to other regions, such as Southeast Asia and India, is altering traditional shipping routes and container usage.

Key Player Analysis

P. Moller–Maersk Group

CARU containers

COSCO SHIPPING Development Co. Ltd

China International Marine Containers

CXIC Group

Singamas Container Holdings Limited

OEG Offshore limited

TLS Offshore Containers International

W&K Containers Inc.

YMC Container Solutions

More About Report- https://www.credenceresearch.com/report/shipping-containers-market

Here are the key challenges facing the shipping container market:

Supply Chain Disruptions: Unpredictable events such as natural disasters, pandemics, and geopolitical conflicts can cause significant disruptions in the global supply chain, leading to container shortages or surpluses and affecting the overall market dynamics.

Port Congestion: Increasing trade volumes and inadequate port infrastructure can result in severe congestion at major ports, causing delays in container handling and movement, which impacts the efficiency of global shipping operations.

Environmental Regulations: Stricter environmental regulations aimed at reducing carbon emissions and improving sustainability require significant investments in eco-friendly containers and alternative fuels, posing a financial challenge for industry players.

Fluctuating Freight Rates: Volatility in freight rates, influenced by factors such as fuel prices, demand-supply imbalances, and economic conditions, can create financial uncertainty and impact the profitability of shipping companies.

Technological Integration: While technological advancements offer benefits, integrating new technologies like IoT and smart sensors into existing container fleets can be costly and complex, requiring substantial investment and expertise.

Trade Policies and Tariffs: Changing trade policies, tariffs, and international trade agreements can impact container flows and demand, creating uncertainty and potential disruptions in the market.

Container Maintenance and Management: Ensuring the timely maintenance and repair of containers to meet safety and operational standards is a significant logistical and financial challenge for shipping companies.

Security Concerns: The risk of cargo theft, piracy, and smuggling presents ongoing security challenges that require robust measures and technologies to protect containers and their contents.

Capacity Constraints: Limited container manufacturing capacity and the time required to build new containers can lead to supply constraints, especially during periods of high demand, affecting market availability and pricing.

Adaptation to New Standards: The introduction of new industry standards and practices, such as those related to container tracking and data sharing, necessitates ongoing adaptation and compliance efforts from market participants.

Segments:

Based on Container Size

Large Containers (40 Feet)

Small Containers (20 Feet)

High Cube Containers (40 Feet)

Based on Product Type

Dry Storage Containers

Flat Rack Containers

Refrigerated Containers

Special-purpose Containers

Others

Based on End-User

Food and Beverages

Consumer Goods

Healthcare

Industrial Products

Vehicle Transport

Browse the full report – https://www.credenceresearch.com/report/shipping-containers-market

Browse Our Blog: https://www.linkedin.com/pulse/shipping-container-market-landscape-chulf

Contact Us:

Phone: +91 6232 49 3207

Email: [email protected]

Website: https://www.credenceresearch.com

0 notes