#Real estate project funding solutions

Explore tagged Tumblr posts

Text

Unlocking Global Opportunities with Spinac Financial’s International Project Financing

In today’s interconnected world, businesses are seeking to expand their horizons through international project financing. Spinac Financial stands as a trusted partner in making these global ventures a reality, offering tailored solutions for diverse industries and project scales.

Why Choose International Project Financing?

International Project Financing enables businesses to secure the necessary funds to launch or expand operations abroad. Whether it’s infrastructure, renewable energy, or large-scale development, Spinac Financial ensures your projects are financially viable, aligning with international standards and expectations.

What Makes Spinac Financial Different?

At Spinac Financial, we specialize in creating customized financial structures for cross-border projects. Our expertise in international project financing ensures smooth transactions, mitigating risks associated with foreign exchange, political climates, and regulatory frameworks. Our innovative strategies provide clients with the financial stability to execute their plans confidently.

Key Benefits of Partnering with Spinac Financial

Global Expertise: Our team offers unparalleled insights into international markets.

Tailored Solutions: Every project is unique; we design financing solutions to fit specific needs.

Risk Management: Spinac Financial minimizes potential risks, ensuring project sustainability.

A Brighter Future with Spinac Financial

International project financing is a gateway to global growth, and Spinac Financial is committed to empowering businesses in achieving their goals. With a proven track record and a client-focused approach, we ensure that your aspirations are not just dreams but attainable milestones.

Let Spinac Financial turn your international project financing needs into a success story. Reach out to us today and unlock the potential of global opportunities!

#International project financing#real estate project funding solutions#fast business loan approval#global investment platform for entrepreneurs#find investors for large-scale projects

0 notes

Text

By perceiving deserts as frontiers for experimentation, the developers of these real estate projects facilitate the disappearance of fragile ecologies – like that of the saguaro cactus – not only representationally, as in Telosa’s renders, but also materially, causing the very ruin early generations of settlers projected onto such arid landscapes. As our ecological crises solidify, such imaginations of devastated landscapes are becoming globalised, leading humans to perceive the planet itself as a test bed, open to experimentation for those advancing speculative design solutions, technological innovations and business models to mitigate the climate emergency, with little understanding or consideration of their future impacts. Desert cities such as Telosa, Neom and Masdar, and the capital that funds them, are complicit in both the demise of deserts themselves and the planet more broadly. While presenting themselves as inventive solutions to various ecological crises, these supposedly post‑carbon utopias in fact squander the opportunity humanity possesses today to effectively address the climate catastrophe.

59 notes

·

View notes

Text

A Beginner's Guide to Fix and Flip Lending for Real Estate Investors

Investing in real estate has long been a proven methodology for personal wealth development, and one of the hottest vehicles recently has been the fix-and-flip strategy. The essence of this strategy is purchasing properties, improving them to create additional value, and repurchasing at a profit. However, financing is one of the most crucial aspects of this strategy. Thus, this blog will be about everything fix-and-flip lending, especially what it is all about and how it can be maximally utilized in Alabama.

What is fix-and-flip lending?

Fix-and-flip lending usually refers to short-term loans for property investors who wish to buy, renovate, and sell houses. Such loans usually amount to the purchase price of the property as well as some part of the renovation costs. Fix and flip loans differ from conventional mortgages in that they are easier and faster to get, and they are designed to suit the investor who wants to conclude projects in a short period of time.

Key Features of Fix and Flip Loans

Short-Term Duration

Fix and flip loans typically have a term of from 6 to 18 months, so that, fittingly, this is the period to which most investors would require renovating and selling their property.

Flexible Loan Amounts

These often lend the amount required by the investor for the purchase price of property and renovation costs. Such systems suffice to make it easier for the investors in concentrating upon adding value to their projects.

Interest Rates

Similar to any other type of loan, fix-and-flip loans have a higher interest payment compared to traditional mortgages. Such is because of the nature of these loans being short-term and riskier.

Quick Approval Process

These loans can be approved and funded in a hurry so that investors can immediately get to act in very competitive real estate markets.

Benefits of Fix and Flip Lending

It would deliver the following features for fix-and-flip lending as a real estate investor.

Funds Accessibility: Even if an investor lacks cash at hand to buy and renovate the entire real estate property, he/she may get the loan from the lender.

Project-specific Funding: The loan is based on a project, covering purchase costs as well as renovation costs.

Market Flexibility: For instance, the opportunity for dynamic housing markets exists, such as in Alabama.

Fix and Flip Lending in Alabama

Real estate in Alabama offered lucrative opportunities for fix-and-flippers who would invest in their affordable price and real demand for renovated homes. Such projects flourished throughout the state. Birmingham, Huntsville, Mobile, and other cities have emerged as continuously moving places with many prospective buyers looking for homes that resemble what they have recently seen.

It takes a good plan before any investor can venture into the Alabama fix and flip lending business. For consideration include the following:

Trends in the Local Market: Understanding specific neighborhoods' property valuation and buyers' preferences is crucial.

Cost of Renovations: Precise estimations go a long way in preventing excess spending.

Loan offers: Working with a lender who understands real estate in Alabama will ease the financing process.

How to Get Started with Fix and Flip Loans

Monitor and Detect Prospective Properties:

Properties that have got an apparently high potential for value addition and alteration but actually are found under serious disfigurements, neglect, and severe repairs are also great resale or wholesale properties.

Consider the Best Lender:

With reputed lenders like Zeus Commercial Capital, borrowing in a sometimes chaotic world turns very smooth and simple. They get real estate investor needs and things naturally offering them special and tailor-made solutions.

Draw Up an Impressive Framework:

And often the biggest and, of course, most impressive models have multi-million-dollar budgets and timelines put down into one place and include, among other things, purchase price, renovation fees, and contingency allowances.

Marketing the Loan:

Forward your loan application with all supporting documents, like the project plan, estimated costs, and property details.

Perform the Renovation:

Bring that reliable contractor on board and keep the renovations within your budget and time schedule.

Sell the property:

When all the renovations are done, put the property up for sale as best as possible.

Conclusion

It allows you to renovate and sell an asset or part of it. Fix-and-flip financing is great for all types of real estate investors who want to have financial flexibility in transforming potential projects into profits. And Alabama's booming real estate market offers some great opportunities for fixing and flipping.

Whether you are an experienced investor or just getting started, understanding the basics of fix and flip lending would be your first step toward success. Working with a knowledgeable lender such as Zeus Commercial Capital will help you navigate this journey and achieve your investment objectives.

2 notes

·

View notes

Text

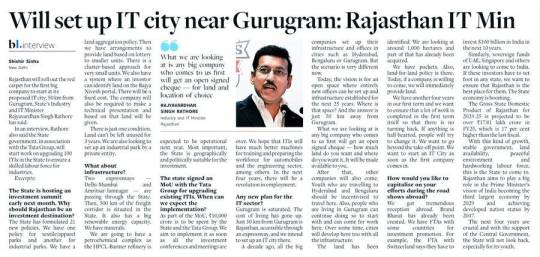

Rajasthan’s Ambitious IT City Plan Near Gurugram: A Vision by Col Rajyavardhan Rathore

A Game-Changer for Rajasthan’s Tech Industry

Rajasthan’s planned IT city near Gurugram is not just a developmental project; it is a bold statement of intent. The initiative underscores the state’s ambition to position itself as a hub for innovation, technology, and entrepreneurship in northern India.

Why 50 km from Gurugram?

Strategic Location: Proximity to Gurugram, a major IT and corporate hub, ensures seamless connectivity and access to talent.

Enhanced Accessibility: With excellent road, rail, and proposed metro connectivity, the IT city will attract investments and workforce from across India.

Proximity to NCR: Being close to the National Capital Region (NCR) boosts the region’s appeal for both domestic and global investors.

Colonel Rajyavardhan Rathore: The Visionary Behind the Push

Colonel Rajyavardhan Rathore, known for his multifaceted leadership as a soldier, Olympic medalist, and parliamentarian, has been a vocal proponent of transforming Rajasthan into a modern economic hub. His unwavering commitment to Rajasthan’s development is reflected in his advocacy for this IT city.

Colonel Rathore’s Vision for the IT City

Creating Jobs: “The IT city will open up countless employment opportunities for the youth of Rajasthan and neighboring states,” he asserts.

Encouraging Startups: Col Rathore envisions the IT city as a launchpad for startups, enabling young entrepreneurs to innovate and thrive.

Building Smart Infrastructure: A focus on sustainable and world-class infrastructure will make the IT city a benchmark for others.

Key Features of the Proposed IT City

The IT city is being planned as a futuristic hub with state-of-the-art facilities to meet the demands of the modern tech world.

Smart Infrastructure

Green energy systems and sustainable architecture.

High-speed internet connectivity across the city.

Dedicated zones for IT parks, startups, and multinational corporations.

Education and Innovation Hubs

Establishment of training institutes and universities specializing in emerging technologies like AI, blockchain, and cybersecurity.

Research and innovation centers to foster collaboration between academia and industry.

Lifestyle and Living

Modern residential areas with smart homes.

Recreational spaces, shopping centers, and healthcare facilities.

Boosting Employment and Entrepreneurship

The IT city is expected to be a massive employment generator. Col Rathore emphasized, “This project will bridge the gap between talent and opportunity, not just for Rajasthan but for the entire NCR region.”

Job Creation

Direct employment in IT and tech industries.

Indirect jobs in construction, retail, and hospitality.

Support for Startups

Incubators and funding programs for young entrepreneurs.

Co-working spaces and mentorship from industry leaders.

The Economic Ripple Effect

The IT city is anticipated to spur growth in multiple sectors, including real estate, transportation, and services. Rajasthan’s economy is set to benefit significantly from this large-scale development.

Increased Investments

Domestic and international IT companies are likely to invest, given the favorable policies and location.

Urban Development

Surrounding areas will see rapid urbanization, improving overall living standards.

Challenges and the Road Ahead

While the project is promising, challenges like land acquisition, environmental sustainability, and seamless integration with Gurugram’s ecosystem need attention. Col Rathore, however, remains confident, stating that the government is committed to addressing these issues with innovative solutions.

Conclusion: A Leap Toward Progress

The establishment of an IT city 50 kilometers from Gurugram is a visionary move that aligns with India’s ambition to become a global tech leader. Under the stewardship of leaders like Colonel Rajyavardhan Rathore, Rajasthan is poised to redefine its identity, not just as a historical and cultural state but as a modern hub for innovation and technology.

This project isn’t just about building an IT city — it’s about laying the foundation for a brighter future for Rajasthan’s youth and economy.

2 notes

·

View notes

Text

Gov. Kathy Hochul is pushing a New York City tax hike to replace the $15 congestion pricing tolls she indefinitely postponed — a last-minute funding Hail Mary that drew fierce opposition Thursday.

Lawmakers and business groups slammed the prospect of a tax increase, especially after Hochul scuttled congestion pricing Wednesday because it would “break the budget” for the working class.

“Proposing another tax is an insulting joke that will only exacerbate the affordability crisis that Gov. Hochul pointed to as her reason for killing congestion pricing,” Assemblyman Matt Slater (R-Putnam) told The Post.

“The combination of corporate income, payroll and other taxes on New York City businesses already has them paying some of the highest effective rates in the nation,” noted Ken Girardin, director of research at the Empire Center for Public Policy.

Bigwigs and politicos who already felt burned by Hochul’s flip-flop on congestion pricing said the tax proposal shows she had no real Plan B to make up for the $1 billion a year Manhattan tolls would have raised for the flailing transit agency — and they’re not likely to throw her a lifeline.

“I think it does not have support,” state Sen. Liz Krueger (D-Manhattan) said about a vote on the tax.

“No new taxes,” added Assemblyman Brian Cunningham (D-Brooklyn).

The governor’s shock announcement also created turmoil at the MTA’s highest levels.

MTA Chair and CEO Janno Lieber, along with Hochul’s board appointees, have threatened to resign, a state Senate source told The Post.

Complicating matters is the fact Albany lawmakers are poised to skip town Friday as the legislative session ends — a deadline that could leave major MTA projects in limbo as officials scramble to replace the $15 billion promised by congestion pricing.

Legislative opponents of congestion pricing hailed Hochul’s move as a victory for everyday New Yorkers, but offered no firm solutions for the last-minute funding problem it created.

State Assemblyman Member David Weprin (D-Queens) said hiking the mobility tax is a possibility, along with other vague “proposals” that he wouldn’t elaborate upon when pressed by The Post.

“You’ll find out within a week,” he said. “We’re committed to find a billion dollars.”

The payroll mobility tax is leveled on businesses and self-employed workers in New York City and the surrounding region to help fund the MTA.

Hochul and lawmakers just last year raised the tax on the city’s largest businesses to raise $1.1 billion annually.

The governor, besides a potential mobility tax hike, has floated tapping into state reserves as a replacement, insiders said.

Staten Island Borough President Vito Fossella, a co-plaintiff in one of the lawsuits to block congestion pricing, said tax hikes can’t always be the answer.

“We have $300 billion combined between the state and city budget,” said Fossella, suggesting efficiencies can be found elsewhere to fund transit.

“Raising taxes will just hurt businesses more. I just don’t understand it,” he said.

Democratic Rep. Jerry Nadler, who supports congestion pricing, also blasted a New York City-focused tax increase.

“Our transit system serves twelve New York counties and two other states,” he tweeted. “It’s completely unacceptable for the burden of yet another payroll tax increase to be raised on NYC small businesses to fund regional transit projects.”

The legislators weren’t alone in their opposition.

Prominent business groups – including some that stuck their necks out in support of congestion pricing, such as The Real Estate Board of New York – have criticized Hochul’s reversal and funding replacement proposals.

“Unquestionably, there is a cost of living and affordability crisis in New York, which is also deeply felt by small business owners,” said Ashley Ranslow, the New York director for the National Federation of Independent Business.

“Increasing the MTA payroll tax will only exacerbate this crisis and worsen New York’s dismal business climate and lagging economic growth post-pandemic.”

Kathryn Wylde, president and CEO of the prominent Partnership for NYC, told NY1 Thursday that she personally expressed her “frustration and disappointment” to Hochul.

Her group later that day issued a statement opposing any increase in the payroll mobility tax to replace the $1 billion.

Business and real estate taxes already account for 44% of MTA revenues, followed by rider fares at 27% and 13% for vehicle tolls – an unfair share that congestion pricing would have corrected, the statement contended.

“Congestion pricing spread the MTA funding burden equitably across all the constituencies that benefit from the mass transit system that supports the tri-state regional economy,” the statement reads.

“The PMT burden is entirely on New York City, which is already the most highly taxed city in the country.”

#nunyas news#this is gonna hurt low income people#if you do anything like this it needs to be on a stepped or sliding scale

3 notes

·

View notes

Text

What Are ESG Funds?

Investors screen companies based on their sustainability compliance scores, and ESG metrics have enabled investment firms to satisfy investor requirements. One result of the increased focus on corporate sustainability is ESG funds. This post will describe different components of ESG funds with examples.

What is an ESG Fund?

ESG funds are financial investment vehicles offered by private equity firms, mutual fund managers, and portfolio management solutions. These funds utilize environmental, social, and governance indicators to prioritize sustainable companies in their stock selection.

However, ESG metrics and performance calculation methods vary across regional sustainability accounting frameworks. So, investors and business owners depend on ESG consulting to evaluate their compliance ratings.

Consider that an investment fund, company stock, bond, or real estate project claims to comply with ESG criteria. Investors will require objective data analytics to cross-examine the validity of such claims. Besides, sustainability benchmarking can reveal other investment opportunities with a better balance between ESG compliance and business growth potential.

Nevertheless, many ESG funds utilize strategies like excluding corporations known for ethically ambiguous practices and offerings. For example, an ESG fund can avoid including an alcohol business in its portfolio due to the social impact concerns.

Types of ESG Funds

1| Ethical Funds

Consulting firms can help you shortlist the funds that use morality, social ethics, faith, and a broader concept of “doing good.” Such mutual funds are ethical funds, and ESG solutions can help investors study more holistic data and their performance.

Each society has unwritten rules, such as keeping children safe or respecting elderly citizens. These values drive investor behavior, resulting in the rise of ethical investing. Imagine high net-worth individuals (HNWI) investing in an ethical fund after a social impact analysis. The “benefit” emphasizes the religious, moral, and political gains rather than returns.

Consider an ethical fund that utilizes the raised funds to eradicate the malnutrition crisis in the world’s underdeveloped areas. Some investors will use their political views to determine companies that deserve financial assistance.

These concepts often correlate with intangible gains like the religious concepts of virtues and vices. Therefore, some investors request ESG consulting firms to screen ethical funds irrespective of a lower return on investment (ROI).

2| Social Impact Funds

Social impact investing involves corporate stocks related to renewable energy companies or forest and biodiversity conservation. ESG solutions can research the socially positive impact of an enterprise to evaluate whether it qualifies to be in the investment portfolio of social impact funds.

While ethical ESG funds investors leverage religious, moral, or political investor philosophies, social impact funds exclusively emphasize how an investment benefits society. For example, supporting vocational e-learning platforms increases the economic competitiveness of a demographic.

Likewise, some social impact funds garner capital support from non-governmental organizations (NGOs), insurance companies, banks, cooperative societies, and HNWIs. ESG consulting firms consider the social impact funds advantageous due to a more objective outlook driven by tangible gains.

After all, quantifying and modeling statistical data on literacy rates, rehabilitated substance abusers, or renewable energy research outcomes is possible via appropriate ESG solutions.

3| Green Funds

Green funds select portfolio companies by studying the environmentally harmful or beneficial effects of corporate activities. For example, ineffective waste management causes pollution of water bodies. If an animal or human consumes water from these resources, they become ill. Polluted water can also damage trees through soil seepage near the roots.

Investors want to support organizations that realize the ecological cost of industrial development. Such companies always discover recycling and waste reduction technologies. Therefore, ESG consulting firms list green funds as the ones that include only environmentally responsible brands in the portfolio.

Nevertheless, the performance of a green fund will fluctuate due to market trends. You want to balance environmentalist investor activism with holistic risk management. Otherwise, your capital resources will become available to a less reliable enterprise. If an investor experiences a significant loss due to green fund investments, their ability to support other eco-friendly brands diminishes.

Green funds still witness a rise in demand because more investors are utilizing ESG solutions to screen the companies working on renewable energy, forest preservation, pollution analytics, and animal protection projects.

Screening Strategies Employed by the Best ESG Funds

1| Compliance Benchmarking

An ESG score relies on the company’s performance across sustainability accounting metrics. You can estimate it using statistical models. Still, different ESG solutions will develop proprietary performance assessment methods. Therefore, investors must monitor multiple online databases to determine whether a company is committed to sustainable development goals.

Compliance benchmarking uses a single performance management system to determine ESG scores. It reveals the business risks associated with unsustainable operations. So, the manager can selectively address these issues that reduce their ESG score.

A benchmark involves reference values to help with progress monitoring over time. Managers and investors require compliance benchmarking to check how a company has improved its ESG performance. The ESG Funds leverage benchmarking when selecting stocks for their portfolio.

2| Peer Analytics

Two eco-friendly companies can have significant differences across ESG performance metrics. Likewise, businesses working in different industries might exhibit identical ESG compliance ratings. However, comparing them with their business rivals in the same industry gives you a clearer estimate of their sustainability.

Peer analytics investigates multiple organizations to identify the best fit for investors’ preferences and risk profiles. You can quickly learn about which company tops the environmental compliance charts. Later, ESG funds use these insights to distribute their financial resources across the most sustainable companies.

3| Greenwashing Inspections

A brand’s reputation as an ESG-first enterprise must be authentic. Verifying the validity of what a company claims as its sustainability performance can assist the investors in separating the gene the genuinely eco-friendly organizations from the companies that apply greenwashing tactics.

Greenwashing is a result of unethical marketing and ESG report manipulation. It includes creating and falsifying sustainability compliance datasets. So, the company’s compliance ratings seem better than the accurate scores. Professional ESG consulting firms always inspect sustainability disclosure documents to identify greenwashing attempts.

4| Controversy Intelligence

Historical performance records associated with an organization can be instrumental in verifying the legitimacy of its ESG compliance claims. Controversy research and intelligence gathering will allow the fund managers to audit a company’s brand presence across multiple media outlets.

Innovative ESG solutions exist today, featuring scalable social listening capabilities and press coverage analytics. Their essential services include tracking how often publications and social media mention a corporate brand.

Investment strategists can also benefit from more advanced social media listening tools like sentiment analytics and materiality assessment. For example, an organization might have an attractive ESG score greater than 90. Simultaneously, some controversial events could have a particular connection with this organization, and ESG funds will consider it in screening.

Examples of ESG Funds

1| Joint Sustainable Development Goals (SDGs) Fund

The United Nations (UN) created a financial vehicle known as SDG Fund in 2014. This financial mechanism used to have many backers among the UN’s member countries and philanthropists when it was operational. However, the Joint SDG Fund is its latest spiritual successor. It also champions a multi-dimensional cooperative approach to address sustainability integration challenges.

Several agencies help United Nations deliver on-ground support to the marginalized, financially weak, and old individuals in over 23 geopolitical territories through this fund. The Joint SDG Fund concentrates on solving the contemporary social-economic and environmental challenges by promoting the following.

Universal access to authoritative educational resources on climate change,

Social protection systems for the workers in informal sectors,

Scientific breakthroughs vital for sustainable development,

Energy-efficient technologies and research innovations,

Disaster risk management and response strategies,

Availability of clean drinking water.

The characteristics of the joint sustainable development goals fund qualify it as an ESG fund. Therefore, some ESG consulting firms recommend this financial vehicle to environmentally conscious investors.

2| Vanguard FTSE Social Index Fund (VFTAX)

VFTAX tracks US Select Index Series termed FTSE4Good. The Financial Times Stock Exchange (FTSE) index series emphasizes environmental, social, and governance practices. So, VFTAX utilizes this resource to screen portfolio companies and corresponding stocks.

This ESG fund excludes the enterprises creating “vice products” like gambling, adult entertainment, tobacco, and addictive beverages. Investors will observe that VFTAX also avoids corporations relying heavily on non-renewable energy resources.

Besides, any company involved in controversies and discriminatory practices will not make it into the VFTAX portfolio. Moreover, it excludes businesses creating weapons systems for the military and civilians.

VFTAX has a low expense ratio. The minimum investment value is 3000 USD. Institutional investors should also consider VFTNX related to this social index fund, requiring 5 million US dollars. Its portfolio comprises Amazon Inc., Alphabet Inc., Microsoft Corp, and Apple Inc.

Conclusion

ESG funds utilize sustainability accounting frameworks for portfolio management. Investors conscious about how companies affect the world prefer ESG-based investment strategies. Therefore, modern ESG consulting firms develop statistical models to quantify corporate compliance across sustainability metrics.

Mitigating carbon risks, affordable Healthcare, rehabilitating substance abusers, and offering universal access to clean water are the admirable objectives of sustainable businesses. High net-worth individuals (HNWI) and institutional investors also want to make a positive impact.

So, ESG funds allow them to cooperate for ethical, religious, political, social, environmental, and humanitarian development. Still, compliance assessment, monitoring, and reporting remind advanced technological assistance offered by talented domain experts.

A leader in ESG solutions, SG Analytics, empowers organizations and investment managers to conduct holistic analytical operations for sustainability reporting and impact investing. Contact us today for automated multilingual analytics across 1000+ indicators to increase compliance ratings.

2 notes

·

View notes

Text

This is Isaac, my OC with the most lore and worldbuilding around him (but not much art yet). He’s a red panda, he was born in 1804 in Tibet, died in an accident as a young man, and was resurrected by his parents, a pair of powerful necromancers. Isaac is the only known case of full, complete resurrection in history, even Jesus (who historically lived and was resurrected in this universe) was only brought back for several days and in dubious physicality. Isaac was fully resurrected.

Magic in this universe also comes with “riders”, random side effects that correlate roughly in severity to the magic being performed. Usually it’s not a big deal, sometimes you cast fireball and a dove flies out of the flames for some reason. But resurrection is on another level of power, one of the highest levels, and in Isaac’s case, the rider that came attached with his resurrection was immortality. The odds of this are astronomical, which is why he’s the only case of immortality in his universe, ever.

Since his accident and resurrection in the early 1800’s, Isaac has bounced around the world essentially following his passions; fighting in wars he thinks need fought, protesting wars he thinks are pointless, seeking out the hidden magical communities around the world to unravel the secrets of his creation, and prevent the creation of any more beings like himself.

He fought in the First World War, starting in the African Theatre helping local rebellions against Germany, and was praised by his English comrades as a dead shot sniper. He went to the eastern front, where he met bolsheviks, read Marxist theory, and decided to join the brewing Russian Civil War. After the establishment of the Soviet Union, he got a position in the NKVD, and eventually his own special branch, the secret Paranormal Affairs division, which allowed him to seek out and “neutralize” supernatural threats to the Soviet Union, and to study paranormal and magical happenings and artifacts to his heart’s content. Isaac detested Stalin (and had several plans to assassinate him, but never carried them out) but used his paranoia and superstitious nature to get more funding for his research.

When Molotov-Ribbentrop pact was signed, Isaac declared the Soviet project dead in his heart, and began using his position in the NKVD to weaken Stalin’s police state as much as possible, and keep tabs on the Nazis. Isaac learned of the Final Solution in its early stages, but Stalin ignored his letters, so he went and fought on the ground on the eastern front instead.

After WWII, he went back to the Soviet Union, trying to mitigate the damage Stalin could do, tying up loose ends in the NKVD before it would become the KGB. The anti-colonialist and socialist rhetoric of Ho Chi Minh led him to Vietnam, where he fought in the Vietcong (not the Vietminh) primarily as a sniper. But when the firebombing campaign began, the compounding traumas of war drove him slightly insane.

He left Vietnam, took a job on a cargo ship from the Philippines to South America, and began working his way north toward the US, unsure of what he was going to do, but mired in nightmares and hallucinations of the firebombings. He’s stopped in Mexico by an empath, an indigenous healer who senses his rage and trauma, and guides him on several mushroom and peyote trips, which reveal to him the true nature of his existence, the permanence of his being, the power that grants him, and the fragility of his mind.

So for a while he spends his time having fun, through the late 60’s to the late 80’s, and his idea of fun is fast boats and cars, lots of drugs, and getting shot at. He begins hoarding wealth for his perpetual retirement, mostly by designing and selling submachine guns to the drug cartels (and socialist revolutionaries! He didn’t forget!) and smuggling high value items between Colombia, the US, and Cuba.

In the 90’s he begins buying up real estate around the world, and on 7 carefully selected plots of land, he builds his Compounds: places where he can safely store magical artifacts, which he’s been accumulating over the years; places where he can relax, disconnect himself from the world (all 7 are in remote locations); places where he can meditate, do drugs, work on his projects.

And that’s his history up to now, basically.

#worldbuilding#furry#red panda#magic system#alternate history#omg I can write so much more than I could on twitter where have you been all my life

12 notes

·

View notes

Text

Real Estate Equity Capital Solutions - Enterstate Capital

Real estate equity capital solutions refer to financial strategies and resources utilized to fund real estate projects or ventures. Equity capital is a form of financing where investors provide funds in exchange for ownership stakes or shares in the project. These solutions are designed to help real estate developers, investors, and businesses raise the necessary capital to acquire, develop, or improve properties. By accessing equity capital, stakeholders can leverage their assets to achieve growth and profitability.

This capital can be used for various purposes, including property acquisitions, construction projects, renovations, and expansions. Real estate equity capital solutions play a vital role in the industry by providing a means for investors to participate in real estate ventures and enabling developers to turn their visions into reality. These solutions often involve partnerships, joint ventures, or private equity arrangements, allowing investors to share in the risks and rewards associated with the property's performance. Overall, real estate equity capital solutions serve as a catalyst for driving growth, innovation, and value creation in the dynamic world of real estate.

For More Information: https://www.enterstatecapital.com/

2 notes

·

View notes

Text

Experion is a 100% FDI funded real estate developer backed by Experion Holdings Pte. Ltd., Singapore, the real estate investing arm of the $2.5 billion AT Holdings group of companies. Other businesses of AT Holdings include Construction, Oil & Gas, Renewable Energy, and Asset Management.

onkar real estate solutions

onkar

sobha city gurgaon

sobha city gurgaon sector 108

url:-http://onkar.co/sobha-city.html

2 notes

·

View notes

Text

Commercial Real Estate Loans in Salem, OR

AmeriCapital Solutions LLC offers Commercial Real Estate Loans. We facilitate multiple real estate-based funding needs for our clients such as fix & flips, buy & holds, commercial construction, bridge loans, hard money loans, project financing, cash-out refinance of investment properties and commercial real estate properties, etc. For a free consultation, call us at (541) 236-2930 and visit our website here: https://www.americapitalsolutions.com/property-based-loans

#Loans#Real Estate#Real Estate Loans#Loans For Real Estate#Commercial Real Estate Loans#Commercial Real Estate Loans in Salem#Commercial Real Estate Loans in Salem OR

4 notes

·

View notes

Text

Global investment platform for entrepreneurs - Spinac Financial

Spinac Financial Services investment platform for entrepreneurs. Connect with international investors to fund your projects and drive global business success.

#fast business loan approval#global investment platform for entrepreneurs#international project financing#real estate project funding solutions#best financial services for entrepreneurs

0 notes

Text

Fix and Flip Financing 101: Turning Real Estate Projects into Profits

This is where the best private money lenders for real estate investors and strategic financing solutions play a pivotal role. They offer investors access to fast, flexible funding options tailored specifically for short-term real estate projects. In this guide, we’ll dive deep into the importance of financing, explore various funding options, and share actionable tips for maximizing profits in your fix-and-flip ventures.

0 notes

Text

Parsvnath Developers Ltd: Navigating Legal Challenges & Driving Growth

Parsvnath Developers Ltd. is a prominent name in the Indian real estate sector, known for its commitment to innovation, quality, and customer satisfaction. While the company recently faced a legal challenge involving its Managing Director & CEO, Mr. Sanjeev Jain, it remains steadfast in its growth trajectory and dedication to excellence.

Addressing Legal Challenges Responsibly

The legal issue originated from a consumer complaint filed in 2017 regarding a delay in property possession. The Hon’ble National Consumer Disputes Redressal Commission (NCDRC) in New Delhi ruled in favor of the complainant and directed Parsvnath to provide compensation. While the company complied with the ruling, a delay in the final refund stage resulted in a non-bailable warrant being issued against Mr. Jain.

Parsvnath acted swiftly to address the matter by depositing the required funds with the court, ensuring full legal compliance. This prompt resolution underscores the company’s commitment to integrity, transparency, and responsible business conduct.

Commitment to Sustainable Growth

Despite legal challenges, Parsvnath Developers Ltd. remains focused on long-term growth and market leadership. As the real estate sector evolves, the company continues to adapt to changing consumer preferences and technological advancements.

Key Strategies Driving Parsvnath’s Growth:

Expanding Project Portfolio: Parsvnath is consistently broadening its portfolio, encompassing residential complexes, commercial office spaces, and integrated townships. By entering new markets, the company strengthens its national presence.

Leveraging Technology: Investing in smart building solutions and digital tools enhances operational efficiency, streamlines project execution, and improves customer experiences.

Sustainability & Green Building Practices: With increasing environmental concerns, Parsvnath prioritizes eco-friendly construction. The company integrates sustainable designs to minimize environmental impact while ensuring modern, high-quality living and working spaces.

Customer-Centric Approach: Understanding and fulfilling customer needs is at the core of Parsvnath’s strategy. The company remains committed to delivering high-quality developments that enhance the lifestyles of its customers.

Resilience Amid Challenges

Challenges are an inevitable part of business, but Parsvnath Developers Ltd. continues to demonstrate resilience. Despite legal hurdles, the company remains focused on its core values of growth, innovation, and customer satisfaction. Its proactive approach in resolving issues and maintaining strong leadership sets it apart in the industry.

Conclusion

Parsvnath Developers Ltd. exemplifies strength and adaptability in the real estate industry. While legal challenges emerged, the company swiftly resolved them, reinforcing its commitment to customers and stakeholders. Looking ahead, Parsvnath is poised for sustainable growth, driven by innovation, transparency, and a customer-first approach. With a strong foundation, the company is well-positioned to maintain its leadership in the dynamic real estate market.

0 notes

Text

Best Mortgage Loan Services of Rangpo, Sikkim

Best Mortgage Loan Services of Sikkim: A Comprehensive Guide

When it comes to securing financial support for purchasing a home or making significant investments, mortgage loans are often the go-to solution for many individuals. In Sikkim, a beautiful state nestled in the northeastern part of India, residents are increasingly seeking mortgage loan services to meet their housing and financial needs. With a growing real estate market and a surge in housing demand, understanding what makes the best mortgage loan services in Sikkim is crucial for making informed decisions.

Understanding Mortgage Loans

A mortgage loan is essentially a type of loan used to purchase or refinance real estate. The borrower pledges the property as collateral to the lender, who, in return, offers the loan. If the borrower fails to repay, the lender has the right to take possession of the property. Mortgages are one of the most commonly used financial products, enabling individuals and families to purchase homes, build properties, or take on real estate projects with manageable repayment terms.

Key Factors for the Best Mortgage Loan Services in Sikkim

The best mortgage loan services in Sikkim combine a range of essential features that ensure the satisfaction of borrowers while offering transparency and flexibility. Let’s explore these factors in more detail:

1. Competitive Interest Rates

Interest rates play a major role in determining the affordability of a mortgage loan. A lower interest rate translates to lower monthly payments and a reduced financial burden over time. Borrowers in Sikkim should always seek services that offer competitive interest rates that are in line with current market trends. The best mortgage loan services often provide flexible rates based on individual financial profiles, ensuring that customers can access affordable home loans tailored to their needs.

2. Flexible Loan Terms

Each borrower’s financial situation is unique, and therefore, mortgage loan services that offer flexible loan terms can help borrowers manage their payments more effectively. The best mortgage loan providers in Sikkim understand that some borrowers may prefer shorter loan tenures, while others may opt for longer repayment periods to keep monthly payments more manageable. Flexible loan terms can offer options ranging from 5 years to 30 years, depending on the borrower's capacity to repay the loan.

3. Minimal Documentation and Hassle-Free Process

The application process for mortgage loans should be streamlined and efficient. Many people in Sikkim are looking for mortgage loan services that require minimal paperwork and have easy eligibility criteria. The best mortgage loan services often provide quick approval processes, ensuring that applicants can obtain funds swiftly without unnecessary delays or complications. Services that simplify the documentation process, such as requiring basic identification, income proof, and property details, make the loan experience more accessible.

4. Transparency and Clear Terms

A reliable mortgage loan service should be transparent in all aspects, from loan disbursement to repayment terms. Customers in Sikkim need to understand all the terms and conditions associated with their loan, including interest rates, fees, penalties, and prepayment options. The best mortgage loan services will outline all charges and explain any fine print clearly, allowing borrowers to make informed decisions without worrying about hidden costs.

5. Customer Support and Guidance

Navigating the world of mortgage loans can be overwhelming, especially for first-time homebuyers. The best mortgage loan services in Sikkim often offer excellent customer support to assist borrowers throughout the process. This may include one-on-one consultations, loan officers who guide borrowers through every step, and support teams that are available to answer any queries. Personalized advice and guidance help borrowers choose the loan that best suits their needs and financial capacity.

#home loan#mortgage loan#loan against property#agriculture loan#new startup business loan#new startup project loan#new start up company loan#business loan#unsecured loan#secured loan

0 notes

Text

Understanding Plot Construction Composite Loan: How Does It Work

In the realm of real estate and construction, financing plays a pivotal role in turning dreams into reality. One such financing option that has gained popularity is the composite loan. If you’re considering purchasing a plot of land and building your dream home on it, understanding the nuances of a composite loan is crucial. In this blog, we will delve into what a composite loan is, how it works, and why it could be the perfect choice for your dream home. Additionally, we will explore why collaborating with the best builders in Bangalore can make all the difference in your journey.

What is a Plot Construction Composite Loan?

A composite loan is a type of financing that combines two phases of lending: purchasing the plot and constructing a home on it. Unlike traditional loans, which are usually for either land purchase or construction, a composite loan is structured to cater to both needs.

This dual-purpose loan offers several advantages, including reduced paperwork, better financial planning, and seamless execution of the project. The loan amount is typically disbursed in stages, aligning with the progress of the construction.

How Does a Composite Loan Work?

The working mechanism of a composite loan can be broken down into several stages:

1. Loan Application and Approval

The process begins with selecting a lender and applying for the loan. You will need to submit the necessary documents, including proof of income, land purchase details, and your construction plan. Once approved, the lender provides funds for the plot purchase and the subsequent construction.

2. Disbursement in Stages

One of the defining features of a composite loan is stage-wise disbursement. Initially, the lender releases funds for the purchase of the plot. As construction progresses, additional funds are disbursed in phases such as foundation work, roof installation, and finishing.

3. Repayment Structure

During the construction phase, borrowers usually pay only the interest on the amount disbursed, known as pre-EMI. Once the entire loan amount is disbursed, the repayment transitions into regular EMIs covering both principal and interest.

4. Tax Benefits

Composite loans offer tax benefits under sections 80C and 24(b) of the Income Tax Act. These benefits are applicable after the construction is complete and can significantly reduce the financial burden.

Advantages of a Composite Loan

1. Convenience

With a single loan for both plot purchase and construction, borrowers save time and effort compared to managing separate loans.

2. Cost Efficiency

Composite loans often come with competitive interest rates, making them a cost-effective solution.

3. Streamlined Process

Since the loan is disbursed in phases, it aligns with the pace of construction, ensuring optimal fund utilization.

4. Long-Term Savings

By combining the purchase and construction into one loan, borrowers avoid the hassle of refinancing or taking multiple loans, ultimately saving on processing fees and other charges.

Why Choose Teamhome for Your Construction Needs?

When embarking on a project as significant as building your dream home, choosing the right builder is paramount. Teamhome, recognized as one of the best builders in Bangalore, stands out for its expertise, customer-centric approach, and commitment to quality.

1. Expertise in Composite Loan Projects

Teamhome understands the intricacies of composite loans and works closely with clients to ensure smooth execution of their projects.

2. Tailored Solutions

Every client has unique needs, and Teamhome offers customized solutions to meet those requirements, ensuring satisfaction at every step.

3. Sustainable Construction Practices

As advocates of sustainable development, Teamhome emphasizes the use of eco-friendly materials and practices, aligning with global standards.

4. On-Time Delivery

Timely project completion is a hallmark of Teamhome. Their streamlined processes and experienced team ensure your dream home becomes a reality without delays.

Eligibility Criteria for Composite Loans

To avail of a composite loan, you must meet the following criteria:

Credit Score: A good credit score, usually above 750, is essential.

Income Stability: Proof of a steady income is required to assure lenders of your repayment capability.

Land Documentation: The plot must have clear titles and be legally compliant.

Construction Plan: A well-documented construction plan approved by local authorities is mandatory.

Documents Required for Composite Loan Application

Identity proof (Aadhaar, PAN, etc.)

Address proof

Income proof (salary slips, IT returns, etc.)

Land documents (sale deed, encumbrance certificate)

Construction plan and cost estimate

Common Challenges and How to Overcome Them

1. Delays in Construction

Delays can impact loan disbursement schedules. To avoid this, work with reliable partners like Teamhome, one of the best builders in Bangalore.

2. Documentation Issues

Incomplete or incorrect documentation can delay loan approval. Ensure all papers are in order before applying.

3. Interest Rate Variations

Monitor interest rates and negotiate with lenders for the best terms.

How to Choose the Best Composite Loan?

Selecting the right composite loan involves comparing various lenders on:

Interest rates

Processing fees

Repayment terms

Customer service

Additionally, choose a lender with experience in composite loans to ensure a hassle-free process.

Tips for Managing a Composite Loan

Plan Your Finances: Budget for the entire project, including unforeseen expenses.

Track Construction Progress: Regularly monitor construction to ensure it aligns with the loan disbursement schedule.

Choose the Right Builder: Partnering with a trusted builder like Teamhome can eliminate many challenges.

Utilize Tax Benefits: Maximize the tax benefits offered under composite loans.

Why Bangalore is Ideal for Composite Loan Projects

Bangalore, known as the Silicon Valley of India, offers a blend of urban amenities and serene residential areas. Its robust real estate market, coupled with the presence of best builders in Bangalore like Teamhome, makes it an excellent choice for composite loan projects.

Key Factors

Availability of premium plots

Skilled labor force

Modern infrastructure

Conclusion

With expertise in composite loan projects, sustainable practices, and a customer-first approach, Teamhome is your ideal partner in building your dream home. Ready to turn your vision into reality? Reach out to Teamhome today!

A composite loan is an efficient and cost-effective way to finance your plot purchase and home construction. By understanding how it works and collaborating with the best builders in Bangalore, such as Teamhome, you can ensure a smooth journey from planning to completion

0 notes

Text

Why is RERA Important? Insights from Sankalp Organisers

Introduction The Real Estate (Regulation and Development) Act (RERA) has redefined the landscape of the Indian real estate sector since its introduction in 2016. Designed to bring transparency, accountability, and fairness, RERA has become a cornerstone for ensuring trust between buyers and developers. At Sankalp Organisers, we prioritize RERA compliance to provide secure, transparent real estate solutions in Ahmedabad.

Why is RERA Important?

Transparency in Real Estate RERA mandates developers to disclose critical project details like approvals, timelines, and progress. This transparency helps buyers make informed decisions, ensuring they know exactly what they’re investing in.

Accountability for Developers With RERA, developers are held accountable for timely project completion. Failure to deliver on promises results in penalties, ensuring greater reliability for buyers.

Protection of Buyer Interests RERA’s buyer-centric approach provides legal safeguards, ensuring customers get value for their money. It includes mechanisms for dispute resolution, making it easier for buyers to address grievances.

Regulation of Finances Developers are required to deposit 70% of project funds in an escrow account. This regulation ensures that funds are used solely for project development, preventing misuse and delays.

Encouraging Trust By standardizing real estate practices, RERA builds trust between developers and buyers, fostering long-term relationships.

Insights from Sankalp Organisers

At Sankalp Organisers, RERA compliance is more than a requirement—it’s a commitment to excellence. Each project we undertake in Ahmedabad is RERA-registered, ensuring transparency, quality, and timely delivery. By aligning with RERA’s principles, Sankalp Organisers aims to make every property transaction a secure and satisfying experience.

Conclusion

RERA plays a vital role in creating a more organized and trustworthy real estate market. With developers like Sankalp Organisers leading the way, Ahmedabad’s real estate sector is setting new benchmarks for transparency and customer satisfaction. When you choose Sankalp, you choose a partner that values your trust and delivers on its promises.

Discover Your Dream Space—Visit Our Website Now! https://www.sankalporganisers.in/

0 notes