#Real Estate Appraisers

Explore tagged Tumblr posts

Text

Appraisal Management Companies and what no one is telling you

When it comes to refinancing or purchasing a home, you need to get an appraisal done by your lender. Unlike any other service profession, you the consumer are not entitled to pick your appraiser, rather you will be assigned an appraiser that will perform the inspection and report for you. Seems pretty simple, right? The answer is NO and this blog is going to explain everything that you, the…

View On WordPress

#Agent#AMCS#Consumers#Lenders#Life#Public Trust#Real Estate Agent#Real Estate Appraisal#Real Estate Appraisers#Realtor

5 notes

·

View notes

Text

Best Real Estate Appraisers

Understanding the factors that influence your home’s appraisal value is essential. From local market conditions and neighborhood amenities to home size and recent renovations, each element plays a critical role in determining worth.

* Local market conditions

* Age of the home

* Neighborhood and its amenities

* Comparable homes

* Home features

* Updates and renovations

* Home design

* Size of the home and its location

* Interior and exterior materials

Click Here: https://neevilas.in/exploring-the-best-real-estate-appraisers-near-you/

#plots in delhi#property for sale#plots in delhi ncr#Best Real Estate Appraisers#Real Estate Appraisers

0 notes

Text

What does a commercial real estate appraiser do?

Commercial real estate appraisers are the linchpins of the property market, providing unbiased, professional assessments of property value. Moore Real Estate Group stands out as a leading authority in commercial real estate appraisal. Understand that accurate property valuation is not just about numbers but also about understanding the market dynamics and the specific needs of their clients.

#commercial real estate appraiser#real estate appraisers#best property appraisers#moore commercial real estate

0 notes

Text

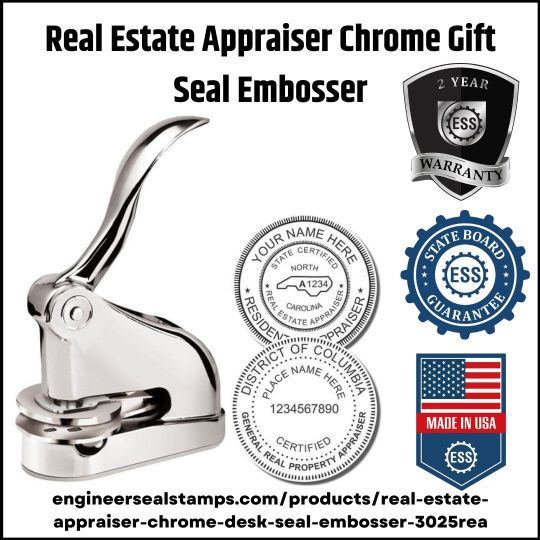

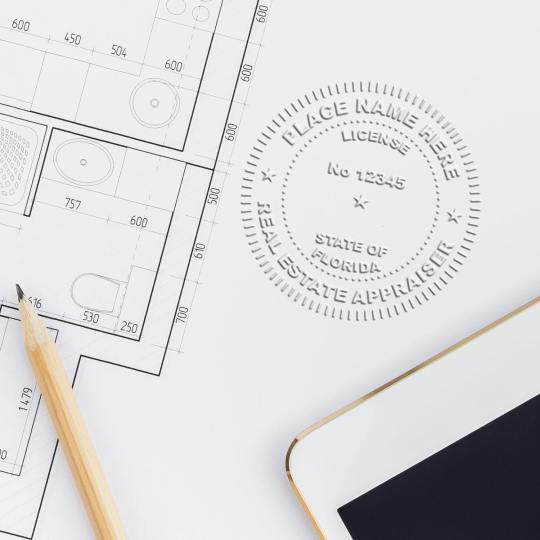

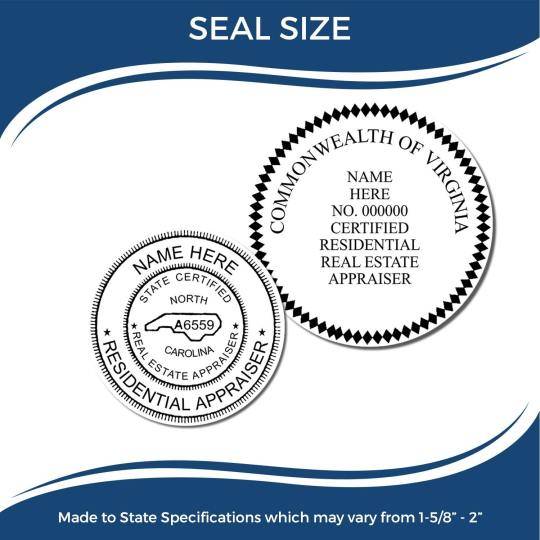

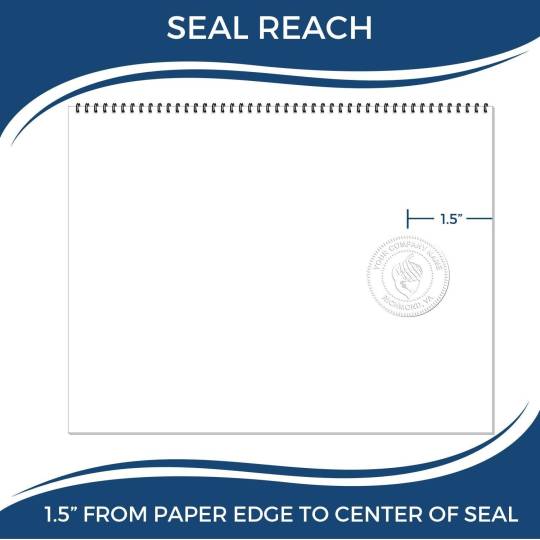

Real Estate Appraiser Chrome Gift Seal Embosser

The Real Estate Appraiser Chrome Gift Seal Embosser is meticulously crafted to deliver high-quality impressions. With its durable frame and precision parts, this desk embosser ensures the finest impressions with every use. It boasts a reach of approximately 1-1/2" into the paper, allowing for clear and professional results. Additionally, the Chrome Gift Desk Seal is designed with a felt base to prevent slipping during operation, adding both functionality and elegance to any office or desk setting.

Highlights:

Seal has a reach of about 1-1/2" into a sheet of paper

Has a felt base that ensures no slipping during use

Adds elegance to your home or office with this Seal

Makes a great gift idea for the newly graduated Real Estate Appraiser

Has a Nice Polished Chrome Finish

Impression Size approximately 1-5/8" to 2" depending on state specifications

Complimentary eSeal emailed as DXF, JPG, PDF & TIF files with Seal Purchase

Guaranteed to meet your State Board specifications

Comes with a Two Year Warranty

#embossers#seal embossers#real estate appraiser#real estate appraisers#appraiser real estate#embossed seal#embosser seal

0 notes

Text

Navigating the Appraisal Process: Your Guide for West Central Florida Home Purchases

Purchasing a home in West Central Florida is an exciting and significant life event. However, amidst the joyous anticipation, navigating the intricacies of the buying process can be overwhelming. One crucial aspect of securing your dream home is the appraisal. This document, prepared by a licensed professional, determines the fair market value of the property, ensuring both buyer and lender are protected.

Understanding the Role of an Appraisal:

An appraisal serves two primary purposes:

Protect the Buyer: By verifying the property's true value, the appraisal ensures you are not overpaying for your home. This minimizes the risk of financial strain and ensures your investment is sound.

Protect the Lender: The appraisal safeguards the lender's financial interests by guaranteeing the property's value is sufficient to secure the loan. This reduces the risk of foreclosure in case of default.

Types of Appraisals:

Different types of appraisals exist, each serving a specific purpose:

Full Appraisal: This comprehensive report analyses the property's interior and exterior, considering location, comparable sales data, and market trends. It is the most common type required by lenders for mortgage approval.

Drive-By Appraisal: This less detailed appraisal involves an exterior inspection and is typically used for refinancing or low-risk loans.

Desktop Appraisal: Based solely on data analysis and public records, this type is rare and often used for loan modifications.

Factors Affecting Appraisal Value:

Several factors influence the appraised value of a West Central Florida home:

Property Location: Homes in desirable neighbourhoods with good schools and amenities typically command higher values.

Property Size and Condition: Larger homes in good condition with modern features tend to be appraised higher.

Comparable Sales: Appraisers analyse recent sales of similar properties in the area to determine market trends.

Unique Features: Specific features like pools, waterfront views, or recent renovations can increase value.

Current Market Conditions: The overall health of the real estate market significantly impacts property values.

Prepping Your Home for Appraisal:

To maximize your home's appraised value, take proactive measures:

Complete necessary repairs: Address any structural issues, fix broken appliances, and touch up paint.

Clean and declutter: Ensure your home is clean, organized, and free of clutter to create a positive impression.

Enhance curb appeal: Maintain your lawn, trim landscaping, and add fresh paint to the front door.

Consider minor upgrades: Strategic improvements like new light fixtures or modern hardware can enhance the overall appeal.

Working with an Appraiser:

Choose a licensed and experienced appraiser familiar with West Central Florida real estate. Research their qualifications and compare fees to find someone who aligns with your budget and needs.

Communicate clearly: Inform the appraiser about any unique features of your home or recent improvements made.

Provide necessary documentation: Gather documents like the property deed, survey, and recent utility bills to assist the appraiser.

Be present during the appraisal: While not mandatory, being present allows you to clarify any questions the appraiser may have.

Possible Appraisal Outcomes:

Appraisal Value Meets Contract Price: This is the ideal scenario, ensuring a smooth closing process.

Appraisal Value Below Contract Price: In this case, you have options: negotiate a lower purchase price, pay the difference in cash, or seek alternative financing.

Appraisal Value Above Contract Price: This rarely occurs but results in increased equity in your home.

Additional Considerations:

Contingency Clauses: Include an appraisal contingency clause in your purchase contract. This allows you to withdraw from the deal if the appraisal value falls significantly below the agreed-upon price.

Appealing the Appraisal: If you disagree with the appraisal value, you can appeal to the lender or hire a different appraiser for a second opinion.

Conclusion:

An appraisal is an essential step in the home buying process in West Central Florida. Understanding its purpose, key factors affecting value, and how to prepare your home can ensure a smooth and successful closing. By working closely with a qualified appraiser and staying informed, you can navigate this crucial aspect of your home purchase with confidence and peace of mind.

Source URL: https://bit.ly/3tfSwAK

0 notes

Text

Appraisal and Real Estate Services: A Comprehensive Guide

Real estate appraisal is the process of determining the market value of a property. It is an important step in many real estate transactions, including buying, selling, refinancing, and estate planning. Real estate appraisers are licensed professionals who have the training and experience to assess the value of a property based on a variety of factors, including its location, condition, features, and comparable sales data.

Real estate services are a wide range of professional services that can help buyers and sellers with the real estate transaction process. These services can include finding and qualifying buyers, marketing and selling homes, negotiating contracts, and managing closing transactions.

What is a Real Estate Appraisal?

A real estate appraisal is an unbiased estimate of the market value of a property. Appraisers use a variety of methods to determine market value, including:

The sales comparison approach: This approach compares the property to similar properties that have sold recently in the same area.

The cost approach: This approach estimates the cost to replace the property, minus depreciation.

The income approach: This approach estimates the value of the property based on its income-generating potential.

Appraisers typically use a combination of these approaches to arrive at a final market value estimate.

When is a Real Estate Appraisal Needed?

Real estate appraisals are often required in the following situations:

Buying a home: Lenders typically require an appraisal before approving a mortgage loan. This is to ensure that the loan amount does not exceed the value of the property.

Selling a home: Home sellers often get an appraisal to determine a fair asking price.

Refinancing a mortgage: Lenders may require an appraisal before approving a refinancing application.

Estate planning: Appraisals may be needed to determine the value of a property for estate tax purposes.

Types of Real Estate Appraisals

There are two main types of real estate appraisals:

Residential appraisals: These appraisals are used to determine the value of single-family homes, condos, and other residential properties.

Commercial appraisals: These appraisals are used to determine the value of commercial properties, such as office buildings, retail centers, and industrial facilities.

How to Choose a Real Estate Appraiser

When choosing a real estate appraiser, it is important to consider the following factors:

Experience: Choose an appraiser with experience in appraising properties similar to yours.

Qualifications: Make sure the appraiser is licensed and certified by a reputable organization.

Reputation: Ask for references and read online reviews to get an idea of the appraiser's reputation.

Real Estate Services

Real estate services can be a valuable resource for buyers and sellers. Real estate agents can help buyers find homes that meet their needs and budget, and they can help sellers market and sell their homes quickly and for the best possible price.

Here are some of the most common real estate services:

Buyer's agent: A buyer's agent represents the buyer in a real estate transaction. The buyer's agent will help the buyer find homes, negotiate contracts, and manage the closing process.

Seller's agent: A seller's agent represents the seller in a real estate transaction. The seller's agent will help the seller market the home, set a price, negotiate contracts, and manage the closing process.

Dual agent: A dual agent represents both the buyer and the seller in a real estate transaction. This is a less common arrangement, and it is important to note that the dual agent has a fiduciary duty to both parties.

Brokerage: A brokerage is a company that employs real estate agents. Brokerages typically provide a variety of services to buyers and sellers, including marketing, negotiation, and closing assistance.

Conclusion

Real estate appraisals and real estate services can be valuable resources for buyers and sellers. Appraisers can help determine the market value of a property, and real estate agents can help buyers and sellers navigate the real estate transaction process.

Additional Resources

Appraisal Foundation: https://www.appraisalfoundation.org/

National Association of Realtors (NAR): https://www.nar.realtor/

Real Estate Board of New York: https://www.rebny.com/

California Association of Realtors (CAR): https://www.car.org/

Glossary

Appraisal: An unbiased estimate of the market value of a property.

Appraiser: A licensed professional who determines the market value of a property.

Comparable sales: Similar properties that have sold recently in the same area.

Cost approach: An appraisal method that estimates the cost to replace the property

Source URL:

0 notes

Text

The Vital Role of Commercial Real Estate Appraisers in Property Valuation

In the world of real estate, one profession plays a critical role in determining the value of commercial properties - the commercial real estate appraiser. These professionals are the unsung heroes behind the scenes, working diligently to provide accurate and unbiased assessments of property values. In this blog post, we will explore the importance of commercial real estate appraisers in Los Angeles and shed light on the intricacies of their work.

The Role of Commercial Real Estate Appraisers

Commercial real estate appraisers in Los Angeles are highly trained and certified professionals responsible for evaluating the value of commercial properties. Their assessments are instrumental in various aspects of the real estate industry, including property sales, financing, taxation, and insurance. Here's a closer look at their roles and responsibilities:

Property Valuation: A commercial real estate appraiser's primary role is to determine a property's fair market value. This valuation is crucial for buyers, sellers, and lenders to make informed decisions.

Market Analysis: Appraisers conduct in-depth market research to understand the local real estate market dynamics. They consider factors like supply and demand, economic conditions, and recent sales of comparable properties.

Property Inspection: Appraisers physically inspect the property, taking note of its condition, size, layout, and any unique features that may affect its value.

Data Analysis: They collect and analyze comparable property (comps) data to assess how the property stacks up against others in the market.

Report Generation: After completing their analysis, appraisers generate comprehensive reports outlining their findings, methodologies, and the final valuation.

Importance of Accurate Appraisals

Commercial real estate appraisers in Los Angeles provides accurate appraisals are essential for several reasons:

Informed Decisions: Buyers, sellers, and lenders rely on appraisals to make informed decisions about property transactions. An accurate appraisal ensures a property is bought or sold at its true market value.

Financing: Lenders use appraisals to determine the maximum amount they will lend on a property. Overvalued properties can lead to financial instability if accurate appraisals do not back loans.

Taxation: Local governments use property appraisals to calculate property taxes. An accurate assessment ensures that property owners pay their fair share of taxes.

Insurance: Property insurance premiums are often based on appraised values. An inaccurate appraisal can result in underinsured or overinsured properties.

Challenges in Commercial Real Estate Appraisals

Commercial real estate appraisers in Los Angeles face several challenges in their line of work:

Property Diversity: Commercial properties vary significantly in size, type, and purpose. Appraisers must be well-versed in assessing various property types, from office buildings to retail centers and industrial facilities.

Market Volatility: Real estate markets can be volatile, making it challenging to determine property values accurately, especially during economic downturns or rapid market fluctuations.

Data Availability: Appraisers heavily rely on data, and the availability and accuracy of this data can vary. Access to reliable information is crucial for producing credible appraisals.

Regulatory Changes: Appraisers must stay up-to-date with changing regulations and standards in their field, ensuring that their appraisals meet the latest industry requirements.

Conclusion

Commercial real estate appraisers are the backbone of the real estate industry, providing essential valuation services that facilitate transactions, financing, taxation, and insurance. Their work requires a deep understanding of the real estate market, meticulous research, and adapting to changing conditions. With accurate appraisals, stakeholders in the commercial real estate sector can make informed decisions, promoting transparency and stability in the industry. Commercial real estate appraisers in Los Angeles play a pivotal role in maintaining trust and stability in the real estate market by providing accurate valuations, benefiting buyers, sellers, lenders, and communities alike. In a world where property values can shape the fortunes of individuals and businesses alike, the role of commercial real estate appraisers remains indispensable.

#commercial real estate appraisers in Los Angeles#commercial real estate appraisers#Los Angeles#real estate appraisers#commercial real estate#real estate

0 notes

Text

Professional Real Estate Appraisers in St Louis, MO

Welcome to Authority Appraisals for Professional Real Estate Appraisers in St Louis, MO. Our team of certified appraisers uses the latest technology and market data to provide thorough and comprehensive evaluations of your property. Trust us to provide you with the precise valuation you need for your residential property in St. Louis. Visit our website today for more information.

0 notes

Text

I wish I could show you guys gifs of Trent Crimm in my dream last night

#he looked amazing first of all. great hair. pretty sure he was wearing earrings??#but also he did this iconic bitchy coat flip spin move lmao#anyway he was working as like a historic art appraiser or something#and was also using those skills to become a real estate agent?

2 notes

·

View notes

Text

Selling Your Home in Huntington Beach: How to Avoid Mistakes and Get the Best Results

If you're planning to sell your home in Huntington Beach, California, you may be feeling overwhelmed by the process. The purchase agreements on their own are 16 pages long that includes arbitration and mediation if Buyer or Seller does not perform execution of the contract. However you can streamline the process and maximize your profits by avoiding some common mistakes to selling your home. Here are some key tips for selling your home in Huntington Beach.

1. Price Your Home Competitively

Huntington Beach is a popular and competitive real estate market, so it's crucial to price your home competitively to attract potential buyers. You have to understand that the location of your home gives the best value. Huntington Beach homes near the 405 will not be the same value as in Huntington Harbor. Having an agent who knows how appraisers work will give your the best approximate range of value. However in the end, the Buyer purchasing your home is the Final price not what it is listed on the market.

2. Make Repairs and Maintenance a Priority

Before listing your home, make sure everything is in good working order. Address any necessary repairs that are major repairs. Having a roof and termite inspection to know exactly what the costs are so there are no surprises while in escrow. Not only will this make your home more appealing to potential buyers, but it can also help you get the best possible price for your home. Buyers are nervous when they do not know the condition of the property and many are not experienced. Escrow moves easier when the condition of the home is excellent.

3. Stage Your Home

Staging your home can make a big difference in how quickly and easily it sells. Work with a professional stager or take the time to declutter and organize your space. Sometimes it's as easy as removing a couple chairs in the dinning room or making your home ready for many people to walk through your home at a time. This can make your home feel more inviting and help potential buyers envision themselves living there.

4. Market Your Home Effectively

In Huntington Beach's competitive real estate market, effective marketing is key. Work with a real estate agent who has a strong online presence and utilizes social media to showcase your home. This can help you reach a larger audience and generate more interest in your home. The listing agent's job is to get as many eyes inside your home. The more people seeing your home physically than online is a great sign of good marketing.

5. Be Prepared for Showings

When selling your home in Huntington Beach, it's important to always be prepared for showings. What's important is knowing when buyers are available to capture the most eyes of your home possible. Keep your home clean and tidy, and be ready to vacate the premises at a moment's notice. This can help ensure that potential buyers have a positive impression of your home. This can be very tiresome if your home is not priced accordingly or marketed effectively because you'll be doing this chore more often.

6. Work with a Local Real Estate Agent

Working with a local real estate agent who knows the Huntington Beach market can make a big difference in the success of your sale. They can provide valuable insights into the market, handle negotiations, and help you navigate the selling process with ease. It's also important to have the ability to market your home to attract the most buyers possible. Chances that someone buying your home in Huntington Beach will be out of area. That's why it is important to have a program that casts the widest net possible.

It is also important to understand the purchase contract. Many transactions that I represented the Buyer, I've had Listing Agents counter with 'as-is'. That might be small, but in the state of California all real estate residential transactions are conducted "as-is in the current condition". So it is not necessary for a seller to counter that to a buyer in a purchase contract.

By avoiding these common mistakes you can be confident that your home will sell in Huntington Beach and maximize your equity.

Mr. Huntington Beach Real Estate

315 7th St D Huntington Beach, CA 92648

949-310-4110

#Mr. Huntington Beach#Mr. Huntington Beach Real Estate#Real Estate Agent Huntington Beach California#Realtors in Huntington Beach California#Huntington Beach California Realtors#Real estate agents in Huntington Beach California#Huntington Beach Real Estate Agents#Appraiser#Appraisal#Appraiser near me#Home Value Huntington Beach#Huntington Beach Realtor near me#Huntington Beach real estate agents near me#Huntington Beach Realtor#Huntington Beach Real Estate Agent#Huntington Beach Brokers#Huntington Beach Real Estate Agency#Real Estate Agency Huntington Beach#Realtor in Huntington Beach#Real Estate Agent in Huntington Beach#Cash Offer#Appraisal Huntington Beach#Best Realtor in Huntington Beach#Best Real Estate Agent in Huntington Beach#Huntington Beach realestate#Realestate Huntington Beach California#California Real Estate#Huntington Beach#Conrad#Conrad Mazeika

2 notes

·

View notes

Text

Look In The Mirror (Part 1)

The phrase “take a look in the mirror” is a common idiom used to encourage self-reflection and introspection. It is a powerful statement that can evoke a range of emotions and reactions from individuals, from contemplation to defensiveness. At its core, the phrase is a call to examine oneself honestly and objectively. It asks us to step back from our assumptions, biases, and preconceptions and…

View On WordPress

0 notes

Text

Fix and Flip Loans Lenders California - How To Find The Right One?

One of the very popular strategies is fix and flip, which promises an enormous return when done perfectly. However, such investments usually demand significant upfront capital. That's where fix and flip loans providers in California come in, making dreams come true.

California's active real estate market requires lenders who know the lay of the land. Good fixand flip loans lenders in California, therefore, not only fund but guide investors through some of the challenges of property flipping.

Some of the benefits associated with working with California-based lenders include the following:

Fast Approvals: Real estate needs speed. Reliable lenders ensure swift approvals, which help investors move fast.

Flexible Terms: Loan terms are often tailored to match the investor's project timeline and budget.

Competitive Rates: Established providers offer competitive interest rates, ensuring better ROI for your projects.

Local Expertise: Knowledgeable lenders understand California's zoning laws, property trends, and market dynamics.

How To Find The Right Fix and Flip Loan Provider

It's always good to identify the reputation, loan term, and support offered to clients by your lender of choice. Among the Fix and Flip Loans Providers California, most often specialize in offering customized financing solutions such that you'll get what you need for success.

California is alive with a thriving real estate market where your creativity and ambition come into play. Experienced Fix and Flip Loans Lenders California will help you unlock distressed property potential while maximizing the return. Whether an investor or first-time flipper, the right lender gives you your ticket to success.

Transform properties, realize profits, and grow your real estate portfolio with the perfect fix and flip loan provider by your side.

With experienced bridging loan finance lenders, navigate through your financial challenges and have an easy time dealing with them. Explore possibilities today and unlock the potential of bridging loans for personal or business needs!

Tailor-made solutions and expert advice are available at Bull Venture Capital.

#Fix and Flip Loans Lenders California#flexible loan terms#no appraisal loans#fix and flip loan#hard money loans for real estate

0 notes

Text

Real Estate Property Appraisals WY for Accurate Valuations

When it comes to real estate property appraisals in WY, accurate and reliable assessments are key. Their team specializes in providing precise valuations for residential and commercial properties. Whether buying, selling, or refinancing, trust us to deliver professional appraisal services that meet your needs. For all your real estate appraisal requirements, contact Altitude Appraisal today and experience top-notch service.

0 notes

Text

Are Weston Property Appraisals Reflecting the True Market Trends?

When discussing property appraisal in Weston, a common question arises: Do appraisals reflect current market trends? Weston’s thriving real estate market, known for its family-friendly neighborhoods, excellent schools, and lush green spaces, continues to evolve. Understanding how appraisals align with real-time values becomes crucial for buyers, sellers, and homeowners as the market changes.

1. Appraisal Process

Property appraisals are a key part of any real estate transaction. They help lenders, buyers, and sellers determine the fair market value of a home. But how accurate are these assessments in Weston’s competitive market?

Appraisers evaluate properties based on comparable sales, known as “comps.”

They consider the property’s size, location, condition, and unique features.

Local market conditions, such as demand and inventory, heavily influence appraisals.

However, market trends can shift rapidly, sometimes leaving appraisals slightly behind.

2. Rising Home Prices in Weston

Weston has seen a steady increase in home values over the past few years, driven by demand and limited inventory. But are these price hikes fully captured in property appraisals?

Homes in Weston often sell quickly, with multiple offers driving up prices.

Appraisals sometimes lag behind actual sale prices due to outdated comp data.

In hot markets, appraisers may struggle to keep up with rapid value shifts.

This gap between appraisals and market realities can challenge buyers and sellers.

3. The Role of Comparable Sales

Comparable sales play a significant role in determining property values. Appraisers rely on recent sales data, but finding true “comparables” can be difficult in Weston’s diverse neighborhoods.

Unique homes or custom-built properties may lack similar comps.

Neighborhood-specific trends, such as proximity to top schools or parks, can skew values.

Older comps may not reflect the current competitive climate in Weston.

Ensuring that appraisers use the most relevant and recent data is critical for accurate assessments.

4. Impact of Upgrades and Renovations

Home upgrades and renovations can significantly increase property value, but not all appraisals fully account for these improvements.

Kitchen remodels or bathroom upgrades add significant appeal and value.

Energy-efficient systems, like solar panels or updated HVAC units, attract modern buyers.

Outdoor amenities, such as pools or landscaped yards, are highly desirable in Weston.

If appraisers overlook these features, the property’s true market value might not be reflected.

5. Market Trends Influencing Appraisals

Various factors shape Weston's market trends, including buyer preferences, interest rates, and economic conditions. Appraisers must consider these trends to provide accurate valuations.

Increasing demand for move-in-ready homes often drives higher values.

Low inventory levels create competition, pushing sale prices above appraised values.

Changes in interest rates affect affordability and market activity.

Keeping appraisals aligned with these trends ensures they reflect true market dynamics.

6. Challenges in Hot Markets

In fast-moving markets like Weston, appraisals sometimes fail to keep pace with transaction speeds, leading to discrepancies between appraised values and sale prices.

Buyers may offer above-appraisal prices to secure homes in competitive situations.

Sellers may face difficulties if appraisals don’t meet the agreed sale price.

Appraisers often need to balance lender requirements with market realities.

These challenges highlight the need for appraisers to stay updated on local trends.

7. Appraisals and Mortgage Approval

A property appraisal is a critical step for buyers in securing a mortgage. Lenders rely on appraisals to ensure they’re not over-lending on a property.

If an appraisal comes in low, buyers may need to pay the difference out of pocket.

Low appraisals can stall or derail transactions, leading to renegotiations.

Accurate appraisals provide confidence for both lenders and buyers.

Navigating this process is smoother when appraisals reflect true market values.

8. Tips for Ensuring Accurate Appraisals

Homeowners and sellers can take proactive steps to ensure their properties are accurately appraised.

Provide a detailed list of upgrades and renovations, including receipts and permits.

Highlight unique features that may set your home apart from comps.

Ensure your property is in its best condition before the appraiser’s visit.

These steps can help bridge the gap between appraised value and market expectations.

9. The Role of Local Experts

Working with local real estate professionals can make a significant difference in navigating Weston’s appraisal process.

Real estate agents provide insight into recent market trends and comps.

Appraisers familiar with Weston understand the nuances of the area.

Local experts can guide you in presenting a strong case for your property’s value.

Collaboration with knowledgeable professionals ensures a fair and accurate appraisal.

10. When to Challenge a Low Appraisal

Sometimes, appraisals come in lower than expected. You have options if you believe the value doesn’t reflect your property’s worth.

Review the appraisal report for errors or outdated data.

Gather additional comparable sales or evidence of upgrades.

Request a reconsideration of value (ROV) from your lender.

Disputing a low appraisal can lead to a more accurate valuation and a smoother transaction.

11. Future Market Outlook for Weston

Weston’s real estate market continues to evolve, with promising trends on the horizon.

Ongoing infrastructure improvements may boost property values.

Growing demand for family-friendly neighborhoods sustains market activity.

The increasing popularity of energy-efficient and sustainable homes shapes buyer preferences.

Staying informed about these trends helps homeowners and buyers make better decisions.

12. The Importance of Accurate Appraisals

Accurate property appraisals are essential for maintaining fairness and transparency in the real estate market. In Weston, where homes often have unique features and are in high demand, appraisals must align with local realities.

Buyers benefit from knowing they’re paying a fair price.

Sellers avoid delays and disputes caused by undervaluation.

Lenders reduce risks by financing properties at true market values.

A fair appraisal process supports the health and stability of Weston’s real estate market.

Final Thoughts

In Weston’s competitive market, it is crucial to ensure that property appraisals reflect true market trends. By understanding the appraisal process, staying informed about local trends, and working with experienced professionals, you can ensure your property is accurately valued. A fair appraisal benefits everyone involved, whether buying, selling, or refinancing.

0 notes

Text

Meet Andrew

Andrew has a track record of achieving outstanding outcomes for his clients, consistently selling properties above expectations and building lasting relationships through exceptional service and dedication.

“Real estate is about more than transactions. Its about helping people achieve their dreams. My mission is to make the process seamless, enjoyable, and rewarding. Your positive experience makes the difference."

If you’re ready to sell your property in Berwick , find your perfect home, or simply need an update on the market Andrew is here to guide you. Contact him today to start your real estate journey.

0 notes

Text

Are you looking for the Best service for House Valuation in Dora Creek? Then contact Mark Johnson - McGrath Estate Agents. Whether you're buying or selling, Mark offers personalized, no-pressure guidance to help you navigate the property market with ease. Visit the site for more information: https://maps.app.goo.gl/6ZyHvmRr6TBqspps6

#Real Estate Agent Dora Creek#Real Estate Agency Dora Creek#Property Appraisal Dora Creek#Property Valuation Dora Creek#House Valuation Dora Creek

0 notes