#Rapid Transaction Processing

Explore tagged Tumblr posts

Text

Cryptocurrency exchange development company

Metaboxfy, India's leading cryptocurrency exchange development company, empowers you to create your own cryptocurrency exchange software. With Metaboxfy, you can establish a platform that functions like any other exchange, but with the added advantage of a finely tuned algorithm that ensures precise and rapid transaction processing. Trust the expertise of Metaboxfy, the premier Cryptocurrency exchange development company in India.

Check It Out!

#Cryptocurrency Exchange Development#Metaboxfy#Cryptocurrency Exchange Software#Rapid Transaction Processing#Cryptocurrency Development Company#Blockchain Technology#Crypto Trading Platform#Financial Technology

1 note

·

View note

Text

https://archiveofourown.org/works/61212229/chapters/163093276

Chapter 14 of Desert of my Heart, Oil on Canvas, Manny Rivera

Sneak Peak Under the Cut!

They moved quickly, Timmy teleporting them to a bustling city in Mexico. Manny wasted no time, expertly navigating the streets to find a liquor store that sold the good stuff.

“This one,” Manny said confidently as they entered a shop. “Best tequila in town.”

Timmy followed, watching in awe as Manny chatted with the shopkeeper in rapid Spanish, charming his way through the transaction. Minutes later, they emerged with several bottles of tequila and a couple cases of Coronas.

“This,” Manny said, holding up a bottle triumphantly, “is how you celebrate properly.”

“You’re insane,” Timmy snickered, “Jimmy’s gonna kill us.”

“Nah,” Manny replied, smirking. “He’s asleep. He’ll be the first to thank me when he wakes up and sees the party.”

With another quick teleport, they returned to the HQ, arms full of their bounty. As they stepped inside, they couldn’t help but laugh, their giggles echoing through the space. Manny set the bottles on the counter, turning to Timmy with a wide grin.

“Let’s get this fiesta started.”

Timmy and Manny teleported directly into the kitchen, arms laden with bottles and clinking cases. As they set everything down on the counter, SB turned from where he was plating his finished dish, eyebrows shooting up as he caught sight of the tequila and beer.

“What— what is this?” SB asked, blinking at the spread. “Manny, you realize we’re too young for that stuff, right?”

Manny didn’t miss a beat, holding up one of the tequila bottles triumphantly. “I got it legally. I’m Mexican, remember? Eighteen’s the drinking age where I’m from.”

SB opened his mouth, looking ready to argue, but Manny cut him off with a grin. “And you don’t have to drink if you don’t want to. But I’m gonna.”

Timmy, still recovering from the trip, snorted. “Yeah, my part wasn’t legal.”

The room erupted in laughter, and Manny clapped Timmy on the shoulder. SB, meanwhile, looked like he was still trying to process it when Jenny strolled in.

“What’s so funny?” Jenny asked, her curiosity piqued. Then her gaze landed on the counter, her expression shifting to one of delight. “Oh, hell yeah! That’s what I’m talking about.”

Timmy turned to SB with a smirk, gesturing toward Jenny. “See? Even she’s on board.”

SB sputtered, clearly outnumbered, when Danny entered, his hair still damp from his shower. He raised an eyebrow at the group. “On board for what?”

Jenny motioned to the counter, and Danny groaned when he saw the spread. “Manny,” he sighed. “Last time we drank together, you fought half the football team.”

Manny gasped, one hand flying to his chest in mock offense. “That is such an exaggeration. You drama king.”

Danny laughed, leaning against the counter. “Yes, my knight in shining armor.”

#nicktoons unite#nicktoons#el tigre#el tigre the adventures of manny rivera#manny rivera#tigerghost#danny phantom#danny fenton#timmy turner#jimmy neutron#jenny wakeman#fop#spongebob squarepants#mlaatr#boy genius#fairy odd parents#fairly oddparents#rambles#ao3#ao3 fanfic#chapter update

10 notes

·

View notes

Text

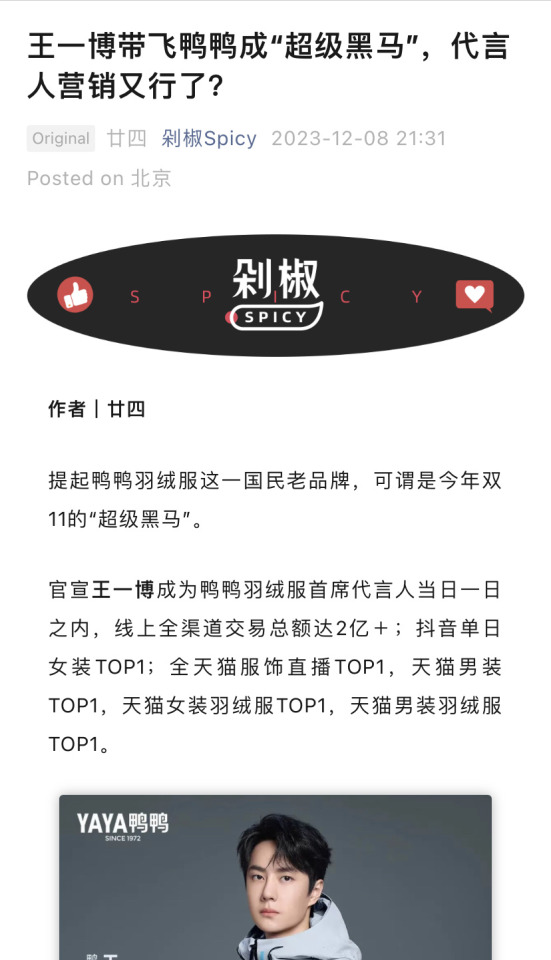

from this article released 12/8 about wyb’s effect on YAYA after being their spokesperson. Their brand director Suki, was interviewed and they gave some insight on WYB being the face of the brand.

“Wang Yibo has led YAYA to become a "super dark horse". Is spokesperson marketing okay again?”

Wang Yibo ’s three-wear goose down jacket with a removable inner lining sold out 120,000 pieces during Double 11 . Suki said, "We have deep stockings of styles for artists' upper body in advance, but the final total sales volume is really surprising. We all joked that the specially opened " Yibo dedicated production line " was so busy that it was smoking. For this reason, we have Hundreds of production lines that have been put into production to meet consumer demand."

On the day it was officially announced that Wang Yibo became the chief spokesperson for YaYa down jackets, the total online transactions in all channels reached 200 million+; Douyin single-day women's clothing top 1; Tmall clothing live broadcast TOP 1, Tmall men's clothing TOP 1, Tmall women's down jackets TOP 1 , Tmall men’s down jacket TOP1.

Q: How did you come up with the idea of asking Wang Yibo to be your spokesperson?

Suki : Yaya has a brand development history of more than 50 years. After the share reorganization in 2020, we vigorously promoted the rejuvenation strategy. The spokesperson is our effective contact point with consumers.

Wang Yibo is a new generation artist born after 1995. He has multiple identities such as actor, singer, race car driver, and dancer. He has both national and commercial influence.

Q: Are there any challenges in this collaboration?

Suki : Yes, the cooperation with Wang Yibo itself is also a process of testing the strength of the brand . We noticed that Wang Yibo has many endorsements, including endorsements for high-end luxury brands and TOP endorsements in various sub-categories. As a brand in the down jacket subcategory, YaYa has experienced relatively rapid growth in market performance after the share reorganization in recent years. Combined with the brand's accumulation and renewal of brand assets over more than 50 years, it finally successfully passed the layer-by-layer review of the artist team and the demands of both parties. And the fit is very high.

Of course, cooperation with top-notch artists does not happen overnight. It ends with a Weibo post on the day of the official announcement. The core test is the brand's ability to undertake, whether it is your products, operations or brand marketing, the ability to undertake will be tens of millions of times. Magnify infinitely with the attention.

Q: How do you feel about working with Wang Yibo’s team overall?

Suki : Professional . They already have a very mature and standardized cooperation process through many cooperations with high-end luxury brands and top brands in various sub-categories, and the docking team has high business literacy. Our overall communication with the artist team is very efficient.

Q: What is the logic behind choosing these celebrities to sign?

Suki : 1 (top) + N (artists of multiple styles) diversified spokesperson matrix system.

The existence of male spokespersons is to increase the proportion of Yaya men's clothing . YaYa's current market sales situation shows that the proportion of women's clothing is higher than that of men's clothing. In addition to Wang Yibo, we also cooperate with male artists such as Chen Zheyuan, Cheng Lei, and Zhou Yiran . They are all niche actors who have produced hit dramas in recent years and have their own loyal fan groups. In addition, when it comes to the choice of upper body styles, we will also select some unisex styles for female fans to choose from.

65 notes

·

View notes

Note

Hey there! For the dirty headcanon what about e-extra info for angel, coco amd juice? Please and thank you! 💜

omg hello! 💖

little thoughts under the cut for: E - Extra info (any other fetishes? feet? leather? role playing? blood? fantasies that they might want to experience not on this list?)

okay i know it says stuff not mentioned on the list, but one of the initial thoughts that i had for Angel just so happens to be on the list. but fuck it we ball i'm gonna talk about it anyway!! i think that Angel is an absolute menace when it comes to orgasm denial. the amount of enjoyment that man gets out of torturing his girl and watching her squirm like that? unquantifiable. it's a little bit of a test of patience for him too, in a way. but it's worth it because he gets to listen to his girl whimper and beg for a release. when the shoe is on the other foot, though??? when he's the one being told and made to wait?? he almost rethinks ever putting his girl through it again. but then he always does it anyway.

the first time you ask Coco if he has any fantasies, he thinks you're joking. not because you have a habit of doing that, but because he's never been with someone before who has ever actually cared to ask. before you, sex and relationships always had an almost transactional feel to them. everyone knew what they were showing up for and what they were getting out of it. he hadn't been with someone who wanted to know what he was really looking for outside of that. and he doesn't have an answer right away. but that's how the two of you end up trying a bunch of different things together. that's how Coco finds out that he loves the way you look with your wrists bound and tied to the headboard, watching him and fighting the urge to wrap your legs around him and pull him closer when he's making you wait. it's how he discovers just how intoxicating it is to watch the rapid rise and fall of your chest when your eyes are covered and you're waiting to feel where he's going to touch you next. he doesn't think someone has ever trusted him this much before. he doesn't think he's ever trusted someone like this before either.

i think that out of almost anyone in either club, Juice would be the most down to and most into roleplaying. you could tell that man that you want to act out just about any scene and he will give it the ol' college try. if there's one thing he can do it's commit to the bit! there might be some character breaks and laughs in the learning process but he is down for whatever and he will discover things about himself along the way that he wasn't expecting to. i also think that if you were to start off a conversation with Juice by asking, "so do you have any fantasies you want to try?" he'd probably have a minor heart attack at the thought of it. it'd take him a beat or two to actually open up and be honest about it, but once he remembers who it is that he's talking to, he knows that if he can't tell you about it, then what's the point?

here's hoping these boys get the orgasms they deserve 🫡

Dirty Headcanon Game

16 notes

·

View notes

Text

The Future of Cryptocurrency: Trends and Innovations to Watch

Cryptocurrency has evolved from a niche technology into a global financial powerhouse. With major institutions, governments, and retail investors now taking digital assets seriously, the future of crypto is more promising than ever. As we look ahead, here are some key trends and innovations shaping the future of cryptocurrency.

1. Institutional Adoption

One of the most significant changes in the crypto landscape is the growing interest from institutional investors. Companies like Tesla, MicroStrategy, and even traditional banks are now holding Bitcoin and other digital assets on their balance sheets. This growing adoption will likely drive more stability and legitimacy in the market.

2. Central Bank Digital Currencies (CBDCs)

Governments worldwide are exploring Central Bank Digital Currencies (CBDCs) to modernize their financial systems. Countries like China, the U.S., and the European Union are working on their own digital currencies, aiming to offer a secure, government-backed alternative to decentralized cryptocurrencies.

3. Decentralized Finance (DeFi) Expansion

DeFi platforms have revolutionized the financial industry by offering decentralized lending, borrowing, and trading without intermediaries. The rapid growth of DeFi projects suggests that traditional banking could soon face stiff competition from blockchain-based alternatives.

4. Layer 2 Scaling Solutions

One of the biggest challenges facing blockchain networks like Ethereum is scalability. Layer 2 solutions, such as the Lightning Network for Bitcoin and Optimistic Rollups for Ethereum, are designed to reduce transaction fees and improve processing speeds. These advancements will make crypto more accessible and practical for everyday use.

5. NFTs and the Metaverse

Non-Fungible Tokens (NFTs) have transformed digital ownership, impacting art, gaming, and virtual real estate. The integration of NFTs with the metaverse—a digital universe where users interact in virtual spaces—will open new opportunities for creators, businesses, and investors.

6. Regulatory Developments

As crypto adoption grows, governments are working on regulatory frameworks to ensure security and compliance. While some regulations could pose challenges, they could also provide greater legitimacy, attracting more mainstream users and institutions.

7. Sustainable Crypto Mining

The environmental impact of cryptocurrency mining has been a concern, leading to the rise of eco-friendly mining solutions. Innovations such as proof-of-stake (PoS) consensus mechanisms, renewable energy mining, and carbon offset initiatives are helping reduce crypto’s carbon footprint.

Final Thoughts

The cryptocurrency industry is constantly evolving, driven by innovation and adoption. Whether it’s institutional interest, DeFi growth, or the rise of NFTs, the future of crypto looks bright. However, investors should remain informed and cautious as regulatory changes and technological advancements continue to shape the market.

3 notes

·

View notes

Text

The walls are closing in on your financial freedom—but not in the way most Americans believe.

While the debate rages over the future threat of Central Bank Digital Currencies (CBDCs), a far more insidious reality has already taken hold: our existing financial system already functions as a digital control grid, monitoring transactions, restricting choices, and enforcing compliance through programmable money.

For over two years, my wife and I have traveled across 22 states warning about the rapid expansion of financial surveillance. What began as research into cryptocurrency crackdowns revealed something far more alarming: the United States already operates under what amounts to a CBDC.

92% of all US dollars exist only as entries in databases.

Your transactions are monitored by government agencies—without warrants.

Your access to money can be revoked at any time with a keystroke.

The Federal Reserve processes over $4 trillion daily through its Oracle database system, while commercial banks impose programmable restrictions on what you can buy and how you can spend your own money. The IRS, NSA, and Treasury Department collect and analyze financial data without meaningful oversight, weaponizing money as a tool of control. This isn’t speculation—it’s documented reality.

3 notes

·

View notes

Text

B-u-y Verified Cash App Accounts

B-u-y Verified Cash App Accounts

B-u-ying verified Cash App accounts offers the convenience of immediate transactions with added security. Secure, authorized accounts reduce fraud risks and enhance payment efficiency.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

In today's digital era, managing financial transactions smoothly and securely has become imperative for individuals and businesses alike. Verified Cash App accounts provide a reliable solution for making rapid payments and transfers without the hassle of traditional banking processes. These accounts undergo a stringent verification process, ensuring that users' identities are authenticated, thus minimizing the chances of unauthorized activities.

Not only does this bolster confidence in digital transactions, but it also simplifies the user experience. Opting for a verified account on Cash App can significantly improve the way you handle money online, bringing peace of mind and a level of assurance that your financial dealings are safe and recognized by the platform.

The Cash App by Square, Inc has revolutionized money management. A verified Cash App account opens doors to seamless financial transactions. It's a badge of trust in a digital realm filled with uncertainties. Let's dive into why a verified status is the key to upping your Cash App game.

The Perks Of Having A Verified Account

Higher sending limits: Enjoy the freedom to send more money weekly.

Bitcoin trading: B-u-y and sell Bitcoin directly within the app.

Direct Deposit: Get paychecks deposited right into your account.

Investment features: Grow your wealth by investing in stocks with as little as $1.

Increased security: Verified accounts come with an extra layer of security checks.

The Risks Associated With Unverified Accounts

Limited functionality: Send and receive money within smaller limits.

Withdrawal woes: Face restrictions on accessing your money from ATMs.

No Bitcoin fun: Miss out on cryptocurrency transactions.

Investment restrictions: You can't tap into stock market investments.

Potential delays: Encounter slower transaction processing times.

Unverified accounts may face scrutiny and hold-ups. Verification breathes trust into your digital wallet, lifting many restrictions and granting peace of mind.

Essential Steps To Verify Your Cash App Account

Verifying your Cash App account unlocks a plethora of features and benefits. Essential steps ensure a smooth and secure verification process. Let's dive into how to achieve this.

Providing Personal Information

To begin the verification, you must provide specific personal details. This includes your full name, date of birth, and the last four digits of your Social Security number. A government-issued ID might be required.

Understanding The Verification Process

Enter personal details accurately within the app.

Submit any requested documentation through the app interface.

Allow processing time, which may take several days.

Watch for confirmation of verification status.

Why B-u-y A Verified Cash App Account?

B-u-ying a Verified Cash App account opens up a world of quick and secure financial transactions. With a verified account, you can send and receive money with peace of mind. Experience instant online payments and money management without the usual hassle.

Convenience For Online Transactions

Imagine paying for your online shopping cart with just a few taps. Or splitting dinner bills without exchanging cash. A verified Cash App account makes these transactions effortless. You can quickly transfer funds to friends, family, or merchants.

Access To Higher Transaction Limits

A major benefit of verified accounts is the increased transaction limits. With verification, your weekly sending limit boosts significantly. This means you can:

Transfer larger sums of money effortlessly.

Handle big transactions like rent or loan repayment without restrictions.

Maintain fluid cash flow for your personal or business needs.

You can forget about being held back by low limits. A verified account supports your larger financial ambitions.

The Legality Of B-u-ying And Selling Cash App Accounts

When discussing financial services, we often touch upon Cash App. It's a popular platform for instant transactions. Cash App requires account verification, which involves confirming identity. This process ensures safety for both the user and the platform. Now, some users might consider B-u-ying a verified account. Why? To save time or bypass personal verification. The critical question arises: Is it legal to B-u-y or sell Cash App accounts?

Navigating Legal Considerations

Understanding the legality of B-u-ying and selling Cash App accounts is essential. The Cash App terms of service forbid sharing, B-u-ying, or selling accounts. This policy ensures user protection against fraud. Users agree to this policy upon account creation. It is important to read and understand these terms.

Account sales can lead to banned services.

False information in account setup violates terms.

Legal repercussions may include fines or prosecution.

Potential Consequences Of Illicit Account Trading

Trading verified Cash App accounts can have serious repercussions. Users often overlook risks for convenience. Yet, consequences are far-reaching and damaging.

Immediate account suspension or permanent ban

Possible loss of funds within the account

Legal action for breach of contract

Always respect the legal framework of financial services. Ensuring compliance prevents risks for all users.

How To Spot A Genuine Verified Cash App Account

Navigating the digital finances world requires vigilance, especially with apps like Cash App. Users often seek the security of verified accounts. Understanding how to recognize a real verified Cash App account is essential for safe transactions. Here are key indicators to help spot a genuine verified account.

Identifying Verification Badges

The most direct way to identify a verified Cash App account is through the verification badge. A badge is a check mark that appears next to the account's name. This symbol signifies that Cash App recognizes the account as both authentic and reputable. Follow this checklist to confirm the badge’s legitimacy:

Position: The badge should always be right next to the user's name.

Color: It must be white within a green background.

Shape: Look for the typical check mark shape.

Tapping: Click on the badge. A genuine badge will have a pop-up confirming verification.

Checking Account History

Another reliable method to confirm if a Cash App account is truly verified is by examining its account history. Conduct a thorough review with these steps:

Access past transactions to assess regular activity patterns.

Check for a history of successful payments and receipts.

Ensure transparency in transaction details.

Review feedback or comments from other users.

Real verified Cash App accounts will often have an established transaction history. This history reflects consistent and transparent financial dealings.

Avoiding Scams In The Verified Account Marketplace

When shopping for a verified Cash App account, it's vital to stay alert. Scammers are everywhere, waiting to pounce. They create realistic traps, aiming to snatch your money. To stay safe, knowing their tactics and how to dodge them is crucial.

Common Scam Tactics

Scammers are crafty and use various methods to deceive B-u-yers seeking verified Cash App accounts. Here are some tricks they often use:

Phishing Emails: Emails mimicking official Cash App communication to steal info.

Too Good to Be True Offers: Unrealistic bargains that tempt and trap.

Impersonation: Posing as Cash App support to gain trust and swindle money.

Advance Payment Frauds: Asking for money up front with no intent to provide the account.

Tips For Safe Transactions

To ensure a safe purchase of a verified Cash App account, follow these tips:

Tip

Why It Helps

Verification

Confirm the seller's identity and account legitimacy.

Secure Payment

Use a method that protects your funds until the account is securely transferred.

Check Reviews

Past B-u-yer experiences can indicate reliability.

Direct Support

Contact Cash App directly for any doubts or clarifications.

By staying informed and careful, you can ensure your purchase is fraud-free. Stick to these practices to keep your transaction secure.

The Cost Factor: Pricing For Verified Cash App Accounts

Finding and purchasing verified Cash App accounts involves a key element: understanding the cost. Price can be a deciding factor for many when choosing where to B-u-y these accounts. Let’s delve into what makes up the pricing and discover how to appraise the value of a verified Cash App account.

Estimating The Fair Price

Finding a fair price for verified Cash App accounts requires research. Here are some facets affecting cost:

Account features: The more the features, the higher the cost.

Verification level: Details in the verification process can increase price.

Account history: Clean history might command a premium.

Market demand: Popular times may push prices up.

Costs can range widely. So, what should you pay? Aim for a balance between feature richness and budget. Use a simple equation:

Value = (Features + Verification + History) / Price

An account is a good B-u-y if the value score is high.

Comparing Prices Across Sellers

Comparing various sellers is crucial. Finding the best deal means checking multiple aspects:

Seller

Quality

Price

Reviews

Support

Seller A

High

$320

Positive

24/7

Seller B

Medium

$250

Mixed

Business hours

Seller C

Low

$190

Negative

Limited

Put sellers side by side to see who offers the best deal. Consider quality, price, seller feedback, and customer support before you B-u-y.

Transferable: Selling Your Own Verified Cash App Account

Imagine unlocking the value of your verified Cash App account in a marketplace. Yes, it's possible! You can transfer ownership to someone else. Let's navigate the process of preparing and setting terms for such a transfer.

Preparing Your Account For Sale

Before the sale, your Cash App account needs a tidy up. Purge personal information and ensure no links exist between you and the account.

Remove personal transactions.

Update settings to default.

Ensure the account maintains a zero balance.

A clean, impersonal account is more appealing to B-u-yers. This turns your account into a secure asset, ready for transfer.

Setting Terms For The Transfer

Agreeing to terms ensures a smooth transfer. Have clear conditions on how and when the transfer will occur.

Term

Description

Price

Set a fair market price for the account.

Payment Method

Choose how you want to receive funds.

Transfer Date

Decide on a specific date for the account handover.

With these steps, your verified Cash App account is prepared for sale. B-u-yers get a valuable asset, and you enjoy the benefits of a smooth transaction.

Pros And Cons Of A Verified Cash App Account

When pondering a Verified Cash App Account, weighing the pros and cons is key. Such an account can offer enhanced features. Yet, it's not without its downsides. Let's delve into both to see if verification fits your financial needs.

Exploring The Advantages

Verified Cash App accounts tout a range of benefits:

Higher Sending Limits: Users enjoy increased transaction limits.

Inclusive Features: Direct deposit and Bitcoin trading become available.

Boosted Security: Verification adds a layer of protection to your finances.

These perks make a verified account enticing for avid users.

Acknowledging The Drawbacks

With advantages come inevitable drawbacks:

Privacy Concerns: Personal data is necessary for verification.

Verification Process: Some users find the process cumbersome.

Account Scrutiny: Verified accounts may face closer monitoring.

Consider these factors carefully before making your decision.

Security Measures To Keep Your Purchased Account Safe

For those who B-u-y verified Cash App accounts, security is a top priority. Your financial information needs to be kept under a secure umbrella. Implementing robust security measures ensures your account stays protected.

Implementing Two-factor Authentication

Two-factor authentication (2FA) adds an extra layer of security. When logging in, you'll need a second piece of information. This could be a code sent to your phone or email. Here's how you set up 2FA:

Open Cash App settings.

Go to the 'Security' section.

Click ‘Two-Factor Authentication’.

Follow the on-screen instructions to complete setup.

Regularly Updating Security Settings

Stay ahead of threats by updating your security regularly. This includes your password and security questions.

Change your passwords every few months.

Review security questions for strong, unguessable answers.

Check for any unfamiliar devices or login activity.

Alert Cash App support immediately if something seems off.

Action

Benefit

Enable 2FA

Extra security step

Update regularly

Latest security features

Understanding Cash App's Policies On Account Verification

Cash App requires users to verify their accounts to access additional features. These include higher transaction limits and direct deposits. Verification involves providing personal information, such as your Social Security Number. This ensures a secure and compliant platform.

Reading The Fine Print

It's crucial to read Cash App's terms of service carefully. The fine print details the verification process. Users must agree to these terms to complete account verification. The fine print contains important information like the documents needed and the verification timeframe.

Types of identification accepted

Limitations on unverified accounts

Steps to verify your Cash App account

The Role Of User Conduct

User conduct influences account status on Cash App. Verified accounts must adhere to Cash App's acceptable use policy. Failure to comply can lead to suspension or termination of verification status. Engaging in fraud, unauthorized transactions, or other illict activities can affect account functionality.

Follow platform policies strictly

Avoid violating terms to maintain verification

Report suspicious activities immediately

The Role Of Customer Support In B-u-ying Verified Accounts

When B-u-ying verified Cash App accounts, customer support is your guide. From setup issues to verification hiccups, a strong customer support team ensures a smooth transaction and post-purchase experience. Trustworthy support can make all the difference in getting your account up and ready.

Seeking Assistance For Account Issues

Got a problem with your new Cash App account? Quick help is crucial. The right support team will:

Resolve login troubles fast.

Answer your security questions with care.

Fix verification glitches without delay.

Navigating Post-purchase Support

Once you own a verified account, you need ongoing support. A responsive customer service offers:

Swift guidance on features.

Help with transaction concerns.

Assistance in account recovery cases.

Consistent support means hassle-free account management.

Maximizing The Benefits Of Your Verified Cash App Account

A Verified Cash App account unlocks new financial territories. Enjoy higher transaction limits. Discover exclusive features. Learn to maximize these advantages.

Making The Most Of Increased Limits

With verification, your Cash App world expands. Send and receive more money everyday.

Send up to $7,500 per week

Receive an unlimited amount

Here's how to use those limits:

Plan big purchases

Pay bills ahead

Split large expenses with friends

Exploring Additional Features

Verification comes with extra perks. Direct Deposits. Bitcoin B-u-ying. ATM withdrawals.

Feature

Description

Benefit

Direct Deposit

Get paychecks early

Access funds faster

Bitcoin

B-u-y and sell Bitcoin

Dive into cryptocurrency

ATM Withdrawals

Use your Cash Card to get cash

Easier access to your money

Unlock these features. Level up your financial game.

A Step-by-step Guide To Purchasing A Verified Account

Welcome to the ultimate guide on securing your own verified Cash App account. Today's digital landscape demands not only convenience but also security and legitimacy. By the end of this guide, you will learn how to confidently navigate the world of digital payments with a verified Cash App account.

Choosing The Right Marketplace

Start by finding a trustworthy platform. Look for indicators of authenticity such as user reviews and security measures. Ensure the site has clear terms of service and a privacy policy.

Check for encryption: A secure connection is vital. Look for "https://" in the URL.

Read user feedback: What are other B-u-yers saying? High ratings and positive reviews are good signs.

Assess support options: A reliable marketplace offers customer support. Does the site have contact details?

Completing A Secure Transaction

Once you've chosen a marketplace, it's time to focus on transaction security.

Verify the seller: Confirm the seller's credibility. Look at their transaction history.

Use secure payment options: Always opt for payment methods with fraud protection.

Keep records: Save all transaction details. These can be useful in case of a dispute.

Following these steps will lead to a safer purchase of a verified Cash App account. Look for secure check-out procedures before finalizing the transaction. Ensure the account you receive matches the seller's descriptions.

Long-term Considerations After B-u-ying A Verified Account

Once you've bought a verified Cash App account, the journey doesn't end. Keeping your account in good standing is vital. Let's dive into the long-term strategies to maintain your investment.

Maintaining Account Verification Status

Stay active and ensure regular transactions. Cash App reviews account activities. Inactivity may trigger re-verification processes.

Regularly review transaction history.

Keep banking info up-to-date.

Avoid suspicious activity to prevent flags.

Compliance with Cash App's terms is crucial. Read updates to these terms to stay compliant.

Updating Personal Information

If your personal info changes, update your Cash App immediately. This includes:

Legal Name

Address

Contact Details

Accurate information keeps your account secure. It also eases the resolution process if issues arise with your account.

The Ethics Of Account Verification And Purchase

The digital landscape is constantly evolving, including how people use financial services. One controversial practice is the purchase of verified Cash App accounts. This raises questions about the ethics involved in account verification and purchase.

Debating The Morality Of B-u-ying Accounts

B-u-ying verified Cash App accounts walks a fine line ethically. People argue over its morality. On one hand, some see it as a quick step to accessing features without hassle. On the other, critics argue that it bypasses necessary security measures and undermines trust.

Convenience vs. Compliance: Does the need for easy access outweigh compliance with set rules?

Fairness: Are purchased accounts fair to users who go through the proper channels?

Security Risks: Do these accounts compromise the safety of the digital financial space?

Assessing The Impact On The Digital Economy

The sale and purchase of verified accounts hold implications for the digital economy. We must assess this impact critically.

Aspect

Positive Impact

Negative Impact

User Growth

Spike in user numbers

Inaccurate representation of active, legitimate users

Service Integrity

Potentially quick expansion of service usage

Loss of integrity and trust in the service

Market Dynamics

Creation of ancillary marketplaces

Distortion of market and unfair advantages

Scrutiny reveals both sides of the coin: stimulating growth yet possibly undermining trust. B-u-yers and platforms alike bear responsibility for maintaining a secure digital ecosystem.

Real-life Stories: Experiences With Verified Cash App Accounts

Every day, people just like you navigate the world of digital payments. The surge in online transaction platforms brings countless narratives of triumph and lessons learned. Here we share compelling tales from users who have embraced verified Cash App accounts.

Success Stories

Meet Sarah. She's an online tutor. After getting her Cash App account verified, her payment process simplified. Let's delve into her story:

Instant Payments: Sarah started receiving fees immediately after class.

Satisfied Clients: Her students appreciated the ease of payment.

Financial Tracking: Sarah tracked her income with Cash App's history feature.

John also shared his experience. With his verified account, his online store saw a sales peak:

Pre-Verification

Post-Verification

Sales dipped due to payment hurdles

Customer trust increased, boosting sales

Lengthy checkout times

Streamlined, quick transactions

Lessons From Failed Transactions

Not all stories sparkle. Emma faced a roadblock. She ignored the verification step and faced consequences:

Transaction Limits Hit: Sales were lost after hitting her unverified limits.

Customer Complaints: B-u-yers were frustrated with declined payments.

Then, there's Mike, who got scammed. He learned:

Verify Recipients: Always ensure the recipient's account is legitimate.

Scam Awareness: He now knows the common signs of fraudulent accounts.

These stories teach valuable lessons. Verify your Cash App account. Secure your transactions. Embrace a hassle-free financial journey today.

Alternatives To B-u-ying Verified Cash App Accounts

Thinking about verified Cash App accounts, there are safe paths to explore. Trust is crucial in digital payments. This section explores grounded alternatives to B-u-ying verified Cash App accounts.

Building Trust Organically

Creating a verified account doesn't have to be a shortcut purchase. Begin by setting up your account with fact-based details. Promptly provide necessary verification when requested. This builds a strong foundation. It's a way to earn legitimacy without cutting corners. Display consistent behavior. Engage in transactions that reflect reliability and honesty. This attracts positive feedback. Over time, an organic reputation for trustworthiness will develop.

Exploring Other Payment Platforms

Alternative trusted payment services exist. Consider platforms like PayPal, Zelle, or Venmo. Each offers its unique verification process to ensure security. Below is a list of widely-used platforms:

PayPal: Global reach with robust security measures.

Venmo: Popular for its social element and ease of use.

Zelle: Integrates with many banking apps for quick transfers.

Legal Repercussions For Misuse Of Verified Accounts

Exploring the purchase of verified Cash App accounts opens a world of ease and financial fluidity. Proper use is paramount. Ignoring rules can lead to severe outcomes. Let's discuss the risks tied with the misuse of these accounts and how to stay within legal boundaries.

Understanding Potential Penalties

Unlawful behavior with a verified Cash App account invites trouble. You face heavy fines and restrictions. Below are penalties you might encounter:

Legal fines: Paying hefty amounts to settle violations.

Account suspension: Losing access to your account immediately.

Criminal charges: Facing court and potential jail time.

Preventative Measures To Avoid Legal Trouble

To use verified Cash App accounts safely, follow these steps:

Read terms and conditions: Know the rules well.

Maintain one account per user: Multi-accounting is a no-go.

Report suspicious activity: Stay alert and report.

Take these preventative steps to keep your account in good standing.

The Future Of Cash App And Digital Wallet Verification

The digital payment landscape is rapidly evolving. As Cash App and other digital wallets gain popularity, so does the need for robust verification methods. These advanced systems ensure secure transactions and build user trust. The future revolves around enhancing security while maintaining user convenience.

Predicting Trends In Financial Technology

The world of financial technology is always on the move. Here are a few trends we expect to see:

Biometric security will become more common.

Blockchain technology will play a bigger role in transaction validation.

Artificial intelligence will enhance fraud detection processes.

Users will expect more control over their data.

Evolving Verification Methods

Verification processes are becoming more advanced. Here's what's on the horizon:

Multi-factor authentication will be a must for all users.

Real-time ID checks will make transactions safer.

Machine learning will help verify users faster.

Privacy concerns will result in anonymity-enhanced verification.

B-u-y Verified Cash App Accounts represent the forefront of these innovations. Verified accounts integrate these technologies, offering users peace of mind and a seamless experience.

Frequently Asked Questions Of B-u-y Verified Cash App Accounts

Is B-u-ying Cash App Accounts Safe?

B-u-ying Cash App accounts poses significant risks including fraud and account suspension. It's crucial to ensure transactions comply with Cash App's terms of service and prioritize security to avoid potential legal and financial repercussions.

How To Verify A Cash App Account?

To verify a Cash App account, submit your full name, birth date, and the last four digits of your SSN in the app. Verification typically takes 48 hours. Upon approval, benefits like increased transaction limits become available.

What Are Benefits Of Verified Cash App Accounts?

Verified Cash App accounts offer higher sending and receiving limits. They also allow users to B-u-y, sell, and withdraw Bitcoin and invest in stocks. Full verification adds a layer of security and credibility to transactions.

Can I B-u-y A Cash App Account Legally?

Purchasing Cash App accounts is against Cash App’s terms of service. Engaging in this practice can result in legal issues and permanent bans from the platform. It's best to create and verify your own account legitimately.

Conclusion

Navigating the digital finance landscape requires reliable tools. Verified Cash App accounts offer that dependability, ensuring smooth transactions. Embrace the confidence in transferring funds with verified security. Don't let uncertainty hold you back. Secure your verified account and step into streamlined financial management today.

7 notes

·

View notes

Text

**From PCI DSS to HIPAA: Ensuring Compliance with Robust IT Support in New York City**

Introduction

In contemporary digital world, organisations are a growing number of reliant on science for their operations. This dependence has caused a heightened focus on cybersecurity and compliance specifications, specifically in regulated industries like healthcare and finance. For services working in New York City, wisdom the nuances of compliance frameworks—specifically the Payment Card Industry Data Security Standard (PCI DSS) and the Health Insurance Portability and Accountability Act (HIPAA)—is quintessential. Navigating those policies requires potent IT give a boost to, which encompasses everything from community infrastructure to documents management.

With the rapid advancement of technological know-how, organizations ought to additionally remain abreast of high-quality practices in details technologies (IT) give a boost to. This article delves into how organizations can ensure that compliance with PCI DSS and HIPAA thru triumphant IT processes whilst leveraging materials from accurate providers like Microsoft, Google, Amazon, and others.

Understanding PCI DSS What is PCI DSS?

The https://brooksxaoj631.over.blog/2025/04/navigating-cybersecurity-in-the-big-apple-essential-it-support-solutions-for-new-york-businesses.html Payment Card Industry Data Security Standard (PCI DSS) is a group of safety principles designed to look after card tips all the way through and after a economic transaction. It was once proven by using significant credit card enterprises to fight growing times of fee fraud.

Why is PCI DSS Important?

Compliance with PCI DSS enables groups defend touchy economic recordsdata, thereby modifying visitor trust and slicing the possibility of info breaches. Non-compliance can bring about intense consequences, such as hefty fines or maybe being banned from processing credit score card transactions.

youtube

Key Requirements of PCI DSS Build and Maintain a Secure Network: This carries fitting a firewall to preserve cardholder knowledge. Protect Cardholder Data: Encrypt kept files and transmit it securely. Maintain a Vulnerability Management Program: Use antivirus utility and develop protect structures. Implement Strong Access Control Measures: Restrict entry to in basic terms people that want it. Regularly Monitor and Test Networks: Keep observe of all get admission to to networks and aas a rule look at various protection tactics. Maintain an Information Security Policy: Create insurance policies that cope with defense necessities. Exploring HIPAA Compliance What is HIPAA?

The Health Insurance Portability and Accountability Act (HIPAA) sets the ordinary for conserving sensitive sufferer know-how in the healthcare trade. Any entity that offers with blanketed well being know-how (PHI) have got to adjust to HIPAA regulations.

Importance of HIPAA Compliance

HIPAA compliance no longer handiest protects affected person privateness however also guarantees more suitable healthcare outcome with the aid of permitting maintain sharing of affected person data between permitted entities. Violations can cause titanic fines, prison results, and wreck to popularity.

" style="max-width:500px;height:auto;">

Core Components of HIPAA Compliance Privacy Rule: Establishes countr

2 notes

·

View notes

Text

Best Payment Gateway – Quick Pay

In the fast-paced digital age of today, online payments have become an essential aspect of conducting business. You could be an entrepreneur, a small business proprietor, or running a large corporation; selecting the best payment gateway is necessary to give your customers a seamless, secure, and hassle-free payment experience. That's where Quick Pay comes in—ultimately the best payment gateway solution for streamlining online transactions and giving businesses a trustworthy, hassle-free platform.

What is Quick Pay?

Quick Pay is a modern and trustworthy best payment gateway that allows companies to accept payments from clients around the world. Whether you have an online store, subscription-based business, or sell services online, Quick Pay provides a straightforward and safe means of accepting payments. Its powerful infrastructure and adjustable features make it the best fit for businesses of all shapes and sizes.

Quick Pay is specifically made to enable a wide range of transactions such as credit and debit card transactions, bank transfers, UPI, digital wallets, and many more. Quick Pay, with its rapid processing of transactions and easy-to-use interface, has become one of the top best payment gateways in the present times.

Key Features of Quick Pay

1. Security You Can Trust

One of the most important elements of any internet payment system is security. Quick Pay is serious about security and uses industry-standard encryption to secure customer data. It is PCI DSS (Payment Card Industry Data Security Standard) compliant, indicating that it follows the highest security standards for the protection of cardholder information.

Quick Pay employs SSL encryption to protect all transactions, ensuring your customers' sensitive payment data is safe from fraudsters. It also incorporates two-factor authentication (2FA) and sophisticated fraud detection tools, adding a level of protection to minimize unauthorized transactions. You can be certain that each transaction is secure when you have Quick Pay as your best payment gateway.

2. Seamless Integration

Quick Pay's seamless integration process enables companies to link their online platforms effortlessly, be it an e-commerce site, mobile application, or online reservation platform. With powerful APIs and plugins, integrating Quick Pay into your system is quick and easy.

3. Global Payment Acceptance

For companies interested in going international, Quick Pay has a total solution for taking payment from foreign customers. It's multi-currency enabled, and businesses can sell to customers all over the globe and process payment in the local currency preferred by their customers.

This worldwide coverage positions Quick Pay as a great option for companies that are involved in a global market. You can receive payments from consumers located in other nations, opening your company to more customers, and minimize the trouble of having to deal with several different payment processors. As a world solution, Quick Pay is genuinely the best payment gateway to use for international transactions.

4. Immediate Payment Processing

Quick Pay is built for velocity. Whatever you're charging for a product, service, or subscription, Quick Pay facilitates fast and effective payments. Its real-time payment processing means that businesses get paid in an instant, enabling faster order fulfillment and improved customer experience.

The rapid payment processing also assists in minimizing cart abandonment rates, as the customers will readily complete a transaction when they're assured that it would be processed rapidly and not delayed. Quick Pay facilitates companies to reap the benefits of the finest payment gateway for efficient and rapid payment processing.

5. Customizable Payment Solutions

Each business is different, and Quick Pay knows that one size won't fit all. Whether you require recurring billing for subscriptions, single payments for product sales, or payment solutions specific to your business model, Quick Pay provides a flexible solution.

With adjustable features, companies can tailor payment pages and processes to suit their individual requirements. Quick Pay has both fixed and dynamic pricing support, allowing companies to provide customized pricing plans based on customer preferences or market dynamics. In terms of flexibility, Quick Pay is indeed the most suitable payment gateway for your business requirements.

6. Comprehensive Analytics and Reporting

With Quick Pay, you have access to a rich suite of reporting and analytics tools that give you worthwhile insights into your payment transactions. The dashboard presents you with an uncluttered picture of your transaction history, sales volume, refund history, and much more, helping you keep the financial performance of your business easily in check.

These analytics platforms also assist companies in recognizing trends, tracking customer actions, and handling cash flow in an effective manner, all within a single integrated platform. Your company will always have the information it requires to remain at the top of the game through Quick Pay's reporting and analytics features, which makes it the optimal payment gateway for financial management and business expansion.

7. 24/7 Customer Support

A payment gateway should always offer prompt and reliable customer support, and Quick Pay excels in this area. The platform offers 24/7 customer support via multiple channels, including phone, email, and live chat, ensuring that businesses and customers can resolve any payment-related issues quickly and efficiently. This round-the-clock support ensures that you never have to worry about payment disruptions, giving you peace of mind while running your business. As the best payment gateway, Quick Pay is always available to assist you and your customers.

8. Mobile-Friendly Payment Gateway

With mobile commerce on the rise, a mobile-optimized payment gateway is a must. Quick Pay's mobile-responsive interface makes it possible for customers to make payments effortlessly from any device, be it their desktop, tablet, or smartphone.

The responsive design makes the payment process smooth and easy, irrespective of the device used, which is very important in delivering a great user experience. As a top payment gateway, Quick Pay makes sure that your customers enjoy the best payment experience on any device.

Why Use Quick Pay?

1. Reliability and Uptime

Quick Pay’s robust infrastructure ensures that your business can process payments round the clock, with minimal downtime. The platform guarantees high uptime, which is crucial for businesses that rely on consistent payment processing. When it comes to reliability, Quick Pay is undoubtedly the best payment gateway to keep your business running smoothly.

2. Affordable Pricing Plans

Quick Pay provides affordable and transparent price plans, optimized to suit companies of all sizes. There are no hidden costs, and you pay only for what you utilize, giving you the best returns on your investment. Whether a small business startup or a big enterprise, Quick Pay has pricing plans that can fit your needs, making it an affordable top payment gateway for every business.

3. Customer Trust

With thousands of companies already using Quick Pay for their payment processing requirements, it has established itself as a company that is dependable, secure, and efficient. Quick Pay is used by companies in all sectors, ranging from e-commerce and retail to hospitality and services. This trust is what makes Quick Pay the most suitable payment gateway for your business.

Conclusion

In the current digital economy, an enterprise needs to have a fast, reliable, and secure payment gateway in order to prosper online. Quick Pay is one of the most prominent payment gateways that provides an easy, secure, and convenient platform for making online payments.

With its seamless integration, rapid transaction processing, international presence, and best-in-class security, Quick Pay is the perfect solution for companies looking for a powerful and easy-to-use payment gateway. Whether you're operating a small business or a large corporation, Quick Pay gives you the tools and assistance you require to thrive in the fast-paced arena of online payments.

To learn more and sign up for Quick Pay today, go to Quick Pay.

2 notes

·

View notes

Text

Cryptocurrency exchange development company

Metaboxfy is a cryptocurrency exchange development company you may hire to help you create a trading app for cryptocurrencies. Since the algorithm that controls its trading is customized by Metabofy, a cryptocurrency exchange development company, for precision and speed, the exchange functions normally.

Check It Out!

#Cryptocurrency Exchange Development#Metaboxfy#Cryptocurrency Exchange Software#Rapid Transaction Processing#Cryptocurrency Development Company#Algorithmic Trading#Crypto Trading Platform

0 notes

Text

What Are the Benefits of Adopting Latest Fintech Technologies?

The financial industry is witnessing a rapid transformation driven by the adoption of the latest fintech technologies. These technologies are revolutionizing how financial services are delivered, enhancing efficiency, improving security, and fostering innovation across banks, insurance companies, investment firms, and payment platforms. By integrating advanced fintech software into their operations, businesses are unlocking numerous benefits that enable them to stay competitive in an increasingly digital world. In this article, we will explore the key advantages of adopting the latest fintech technologies and how they are reshaping the financial landscape.

1. Enhanced Efficiency and Automation

One of the primary benefits of adopting the latest fintech technologies is the significant boost in efficiency. Traditional financial systems often rely on manual processes, which can be time-consuming, prone to errors, and costly. With the integration of fintech software solutions, businesses can automate a wide range of processes, from payment processing to data analysis.

For example, AI-powered algorithms can automate tasks like credit scoring, fraud detection, and risk assessment, enabling financial institutions to make faster and more accurate decisions. Additionally, blockchain technology enables automated, transparent transactions, reducing the need for intermediaries and speeding up processes like cross-border payments. The efficiency gained through automation allows businesses to handle a larger volume of transactions and deliver services more swiftly, benefiting both the institutions and their customers.

2. Improved Customer Experience

The latest fintech technologies also play a crucial role in enhancing customer experiences. Consumers today demand convenience, speed, and personalized services. Fintech software solutions enable businesses to meet these demands by offering innovative and user-friendly platforms for managing finances.

Digital wallets, mobile banking apps, and AI-powered chatbots are just a few examples of how fintech technologies are transforming customer interactions. Mobile payment systems like Apple Pay and Google Pay allow users to make secure transactions with just a tap of their phone, while robo-advisors provide tailored financial advice based on individual needs. AI-driven chatbots can respond to customer inquiries instantly, providing 24/7 support and delivering personalized responses. These innovations make financial services more accessible, faster, and tailored to the unique needs of each customer.

Additionally, by leveraging the latest fintech technologies, businesses can offer cross-channel experiences, where customers can seamlessly transition between online platforms, mobile apps, and physical locations without interruption. This level of convenience significantly improves customer satisfaction and loyalty.

3. Cost Savings and Reduced Operational Expenses

Adopting fintech technologies can result in significant cost savings for businesses. Traditional banking systems often involve high overhead costs related to maintaining physical branches, processing manual transactions, and managing large teams. By embracing fintech software, financial institutions can streamline their operations, reducing the need for human intervention in routine tasks.

For example, cloud computing solutions allow businesses to store and process large amounts of data without the need for expensive in-house infrastructure. This can lead to significant savings in terms of hardware and maintenance costs. Additionally, automated systems for customer service, fraud detection, and compliance reduce the reliance on human resources, leading to further cost reductions.

For small businesses and startups, fintech solutions offer an affordable way to access sophisticated financial tools that were previously out of reach. Cloud-based accounting, invoicing, and payment solutions enable these companies to operate more efficiently without the need for large investments in infrastructure or personnel.

4. Improved Security and Fraud Prevention

As the financial industry becomes more digital, security has become a top priority. The latest fintech technologies offer advanced security features that help protect businesses and their customers from cyber threats and fraud. Blockchain technology, for example, provides a decentralized and immutable ledger, ensuring the integrity and transparency of transactions. This makes it nearly impossible for malicious actors to alter or tamper with transaction records, reducing the risk of fraud.

Additionally, fintech software solutions integrate cutting-edge encryption methods and biometric authentication, such as facial recognition and fingerprint scanning, to safeguard sensitive data. AI-powered fraud detection systems can monitor transactions in real-time, flagging suspicious activities and preventing fraudulent transactions before they occur. These security measures help businesses build trust with their customers and ensure that sensitive financial information is protected.

By adopting the latest fintech technologies, financial institutions can also ensure compliance with stringent data protection regulations, such as the GDPR (General Data Protection Regulation), further reducing the risk of penalties and reputational damage.

5. Greater Accessibility and Financial Inclusion

Fintech technologies are making financial services more accessible to underserved and unbanked populations around the world. In developing regions, where access to traditional banking services may be limited, mobile phones and fintech apps are enabling individuals to manage their finances, make payments, and even access credit.

Digital wallets and mobile banking apps allow users to store, send, and receive money without the need for a physical bank account. Peer-to-peer (P2P) lending platforms are helping individuals and small businesses access credit that they might otherwise not be able to obtain from traditional banks. Additionally, fintech software solutions are allowing micro-lending institutions to assess creditworthiness more accurately using alternative data, such as mobile usage and payment history, making it easier for individuals without formal credit histories to secure loans.

By adopting fintech technologies, businesses can contribute to financial inclusion, helping to bridge the gap between the banked and unbanked populations and enabling more people to participate in the global economy.

6. Better Decision-Making and Data Analytics

Data is at the heart of fintech innovation. The latest fintech technologies, such as AI and big data analytics, enable businesses to gather, process, and analyze vast amounts of information in real-time. This allows financial institutions to make data-driven decisions, improve risk management, and offer more personalized services to their customers.

For example, AI algorithms can analyze a customer's spending habits, credit history, and financial goals to offer personalized financial advice and recommend investment opportunities. Similarly, advanced analytics tools can identify emerging trends in the market, allowing businesses to adjust their strategies accordingly. The ability to harness the power of data leads to more informed decision-making and better outcomes for both businesses and their customers.

7. Scalability and Flexibility

Fintech software solutions offer unmatched scalability, allowing businesses to grow without the constraints of traditional systems. Whether it’s increasing transaction volumes, expanding to new markets, or offering additional services, fintech technologies can easily adapt to changing business needs. Cloud-based platforms, for instance, allow businesses to scale up or down quickly without incurring significant costs or requiring significant infrastructure investments.

Xettle Technologies, for example, provides scalable fintech solutions that help businesses manage their growth seamlessly, offering flexibility and adaptability in a fast-evolving digital landscape.

Conclusion

The adoption of the latest fintech technologies offers a wide range of benefits for businesses in the financial sector. From enhanced efficiency and automation to improved customer experiences, cost savings, and better security, fintech solutions are revolutionizing the way financial services are delivered. By embracing these innovations, businesses can stay competitive, drive growth, and provide more personalized and accessible services to their customers. The future of finance is digital, and those who adopt the latest fintech technologies today will be better equipped to succeed in tomorrow’s rapidly evolving market.

3 notes

·

View notes

Text

High-Risk Payment Processing: Strategies for a Thriving Credit Repair Business

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the ever-shifting landscape of financial services, the voyage of credit repair businesses encounters unique challenges, particularly in the realm of payment processing. As e-commerce ascends and the demand for credit repair services burgeons, the quest for effective high-risk payment processing solutions takes center stage. Whether at the helm of credit repair or navigating the intricate waters of CBD products, the acceptance of credit card payments emerges as a compass pointing to success. This article plunges into the intricacies of high-risk payment processing, unraveling strategies that not only foster flourishing enterprises but also position them as pioneers in their industry.

DOWNLOAD THE HIGH-RISK PAYMENT PROCESSING INFOGRAPHIC HERE

The Magnetic Pull of Credit Card Acceptance

Beyond mere convenience, the magnetic pull of credit card acceptance resonates profoundly in today's business milieu. It is not merely about transactional ease; it's about broadening horizons and amplifying revenue streams. By embracing credit card payments, be it in the arena of credit repair or CBD enterprises, businesses swing open gates to a more extensive clientele. Customers, valuing the versatility and security offered by credit and debit cards, find it simpler to engage with services providing this option, translating into heightened conversion rates and the organic growth of businesses.

High-Risk Merchant Processing: A Strategic Alliance

In sectors like credit repair and CBD trade, where the "high-risk" tag is commonplace, perceiving it as an opportunity rather than an obstacle becomes paramount. It's not merely a label but a gateway to markets teeming with potential. To navigate this successfully, forging alliances with reliable high-risk merchant processing providers emerges as a strategic imperative. These specialized processors comprehend the unique challenges faced and deliver tailored solutions to suit the specific needs of credit repair businesses and CBD merchants.

E-commerce Payment Processing: Transformative Paradigms

The realm of e-commerce payment processing emerges as a transformative force for credit repair businesses. It not only facilitates secure online payments but also equips businesses with tools to efficiently manage transactions. The article underscores the significance of e-commerce payment processing, shedding light on its pivotal role and emphasizing the need for specialized payment gateways attuned to the intricacies of the credit repair industry.

The Strategic Leverage of Credit Repair Payment Gateways

A credit repair payment gateway stands as the linchpin for online business operations, ensuring seamless connections between customers and services while safeguarding their financial data. The article advocates for the careful selection of payment gateways aligned with business goals, ensuring a frictionless checkout process, reduced cart abandonment rates, and an augmented revenue stream. Features like one-click payments and compatibility with various credit and debit cards take center stage in enhancing the user experience.

The Tactical Significance of CBD Merchant Accounts

For CBD merchants, the possession of a dedicated CBD merchant account emerges as a strategic imperative. The association of the CBD industry with cannabis places it within the high-risk category. However, with the burgeoning acceptance of CBD products, the market presents rapid expansion. The article delves into the significance of a dedicated CBD merchant account, emphasizing its role in enabling businesses to offer customers the convenience of credit card payments and contributing to overall business growth.

The Ever-Present Ally: Online Payment Gateways

In a digital age where business operations transcend time zones, an online payment gateway becomes the perpetual ally, processing payments even when physical stores shutter for the day. The perpetual availability not only broadens revenue potential but also elevates customer satisfaction. The global reach facilitated by online payment gateways extends business access to customers worldwide, free from geographical constraints.

The Pulsating Core: Credit Card Processing Systems

In the intricate dance of credit repair or CBD ventures, the pulsating core lies in a reliable credit card processing system. This system serves as the nucleus, ensuring secure and swift transactional processes. The article advocates for investments in robust credit card processing systems, emphasizing the need for real-time transaction monitoring and fraud prevention features. The assurance of secure transactions emerges as priceless for both businesses and customers.

The Guardian Shield: High-Risk Merchant Accounts

In the arena of high-risk businesses, a high-risk merchant account stands as the guardian shield, offering protection against potential challenges. This shield provides access to payment processing solutions tailored to the industry's needs. With the right high-risk merchant account, businesses can navigate the labyrinth of high-risk payment processing with unwavering confidence.

Embracing High-Risk Payment Processing for Triumph

Embracing high-risk payment processing is not merely a choice but a necessity for credit repair businesses and CBD merchants. The article underscores the empowerment derived from accepting credit cards, enabling businesses to thrive and grow. The advocacy for partnerships with reliable merchant processing providers and the utilization of secure payment gateways crystallizes into a seamless and secure transaction experience for customers.

youtube

In a dynamic business landscape, adaptability emerges as the keystone. The high-risk label should not be viewed as a deterrent but as an opportunity to shine in the industry. The article encourages investments in robust credit card processing systems and dedicated high-risk merchant accounts to safeguard businesses and propel them toward success.

In the contemporary digital epoch, where convenience and security reign supreme, accepting credit cards for credit repair and CBD products paves the path to prosperity. The article urges businesses to embrace the power of high-risk payment processing, positioning themselves for success and a brighter future. It's an invitation to say yes to new heights.

#high risk merchant account#payment processing#credit card processing#high risk payment gateway#high risk payment processing#accept credit cards#credit card payment#merchant processing#credit repair#Youtube

18 notes

·

View notes

Text

TAPS Token Goes Live on STON.fi: A New Era for GameFi and DeFi on TON

The TON blockchain is evolving rapidly, and STON.fi is right at the center of it. As the leading decentralized exchange (DEX) on TON, STON.fi has been setting the pace with record-breaking growth, deep liquidity, and seamless trading experiences.

Now, there's a new addition that’s turning heads: TAPS token is officially live on STON.fi, opening up fresh opportunities for traders, liquidity providers, and GameFi enthusiasts.

STON.fi: The Powerhouse of TON’s DeFi Ecosystem

Before diving into TAPS, it's important to understand why STON.fi dominates the TON DeFi landscape. This isn’t just another DEX—it’s the DEX on TON, consistently delivering high trading volume, deep liquidity, and rapid user adoption.

The latest stats paint a clear picture:

✅ $5+ billion in total trading volume—the highest among all DEXs on TON.

✅ 4+ million unique wallets, covering 81% of all DEX users on TON.

✅ 25,800 daily active users, with 16,000 making multiple transactions daily.

✅ 700+ trading pairs processed daily, ensuring diverse market activity.

✅ 8,000+ new users joining every day, making STON.fi the fastest-growing DEX on TON.

This level of activity shows how STON.fi isn’t just leading the charge—it’s defining the future of decentralized trading on TON.

TAPS Token Arrives on STON.fi

Now, TAPS token is officially trading on STON.fi, adding a whole new dimension to the platform.

TAPS is the native token of TapSwap, a GameFi platform with over 72 million players worldwide. The project focuses on skill-based gaming, allowing users to participate in competitive tournaments and earn real rewards.

This integration is not just another token listing—it’s a major step toward merging GameFi with DeFi. By bringing TAPS onto STON.fi, TapSwap is bridging two powerful sectors within the TON ecosystem, unlocking new use cases for traders, gamers, and liquidity providers alike.

Why TAPS on STON.fi Is a Big Deal

The listing of TAPS on STON.fi isn’t just exciting—it’s strategically significant for multiple reasons:

🔹 Increased Liquidity – With TAPS entering the market, STON.fi sees higher trading volume and deeper liquidity pools.

🔹 Stronger TON Adoption – More GameFi users are now interacting with DeFi, expanding TON’s overall reach.

🔹 Enhanced Earning Potential – Liquidity providers stand to gain significantly from this listing.

And speaking of liquidity providers…

Liquidity Providers Are Getting DOUBLE the Rewards

STON.fi is doubling the trading fees for the TAPS/TON liquidity pool from 0.2% to 0.4%. This means liquidity providers can earn twice as much in rewards, making it one of the most lucrative pairs on the platform.

For those already providing liquidity on STON.fi, this is a golden opportunity to increase earnings while supporting a high-growth token. And for those still on the sidelines, there has never been a better time to get involved.

Final Thoughts

The integration of TAPS on STON.fi is a game-changer for both the DeFi and GameFi sectors on TON. It represents a powerful intersection of trading, liquidity, and gaming rewards, opening up new ways for users to earn, trade, and participate in the growing TON ecosystem.

With STON.fi’s explosive growth and TAPS’ massive user base, this collaboration is set to push adoption and utility even further. Whether you’re a trader, liquidity provider, or GameFi enthusiast, there’s an opportunity here that shouldn’t be overlooked.

The market is moving fast—now is the time to take action.

3 notes

·

View notes

Text

STON.fi: Redefining DeFi on TON with Unmatched Growth and Innovation

Decentralized finance (DeFi) is rapidly evolving, and the demand for efficient, scalable, and high-performing decentralized exchanges (DEXs) has never been higher. While many platforms struggle to gain traction, STON.fi has emerged as the backbone of DeFi on The Open Network (TON), consistently delivering exceptional trading experiences, deep liquidity, and seamless transactions.

From breaking records in trading volume to integrating with major cross-chain solutions, STON.fi is not just leading the charge on TON—it’s reshaping how decentralized trading works.

STON.fi’s Explosive Growth: The Numbers That Matter

Success in DeFi isn’t just about technology; it’s about adoption, liquidity, and real usage. The growth trajectory of STON.fi is unmatched, setting a new standard for what a DEX can achieve.

📌 Total Trading Volume: Over $5.2 billion, the highest among TON-based DEXs.

📌 Unique Wallets: 4 million+, accounting for 81% of all TON DEX users.

📌 Daily Active Users: 25,800+, with 16,000 users making multiple trades daily.

📌 New Users Per Day: More than 8,000, reflecting the platform’s rapid adoption.

📌 Trading Pairs: 700+ transactions happening every day, ensuring deep liquidity.

These figures are not just milestones; they are a testament to STON.fi’s dominance in the TON ecosystem. The platform’s growth over the past year is nothing short of exceptional, with total trading volume and total value locked (TVL) increasing by 50-80 times.

This kind of expansion isn’t accidental—it’s the result of a well-designed, user-focused DEX that prioritizes efficiency, accessibility, and cross-chain interoperability.

STON.fi’s Unmatched Trading Experience

For any DEX to succeed, speed, cost-efficiency, and liquidity must be at the core of its operations. STON.fi has optimized every aspect of decentralized trading, ensuring that users experience a smooth and rewarding process.

🔹 Instant Transactions

STON.fi eliminates delays. Transactions are processed without congestion, network slowdowns, or unnecessary costs. This allows traders to execute strategies without worrying about failed transactions or high gas fees.

🔹 Low Fees, High Efficiency

High transaction fees are one of the biggest barriers in DeFi adoption. STON.fi keeps costs at a minimum, allowing users to trade seamlessly without hidden charges.

🔹 Deep Liquidity Across Hundreds of Pairs

Access to 700+ trading pairs means users can trade a wide range of assets with minimal slippage. Whether you're executing a small trade or handling a large-volume transaction, STON.fi ensures market stability and competitive pricing.

🔹 Consistent Growth in User Adoption

A DEX’s success is measured by its ability to attract and retain users. STON.fi doesn’t just onboard new traders—it keeps them engaged with a seamless experience, diverse trading options, and expanding integrations.

With new users joining at a record pace of 8,000+ per day, STON.fi is on track to further solidify its dominance in the TON DeFi landscape.

STON.fi Expands Beyond TON: A Major Cross-Chain Breakthrough