#Raisinghani vs Raisinghani

Explore tagged Tumblr posts

Text

why does indian television continue to fall back on "character falsely accuses guy of sexual assault for some gain" like why does this trope have to come up everywhere I look what are you GETTING from this

3 notes

·

View notes

Text

Karan Wahi opens up on transforming from chocolate boy to multi-layer lawyer in Sony LIV’s Raisinghani vs Raisinghani; calls it “refreshing challenge”

Starring Jennifer Winget, Karan Wahi, Reem Sameer Shaikh, and Sanjay Nath, Raisinghani v/s Raisinghani will stream on Sony LIV.

For years, Karan Wahi has captivated the hearts of millions with his adorable chocolate boy image. Now, with Sony LIV's exclusive series Raisinghani vs Raisinghani, Karan is all set to charm his fans as he takes on the role of Virat, a dynamic lawyer and a charming gentleman who effortlessly captivates attention. Follow Virat's journey as he navigates through professional challenges, immersing you in a world where ambition, rivalry, and charisma intersect.

Talking about his character Karan Wahi says, "After being in the industry for so many years and having the opportunity of portraying so many characters that have resonated with audiences, stepping into Virat Choudhary's shoes was a refreshing challenge. He's not just a character; he's a testament to my personal growth and evolution as an actor. From the carefree chocolate boy who danced through the frames spreading smiles and laughter to the mature, career-driven man who okays on his strength, has been an incredible journey."

He concluded by saying, "Virat knows what he wants, he doesn't just chase dreams – he'll create them. I'm excited to delve into the depths of his determination and multiple-layer personality. Hope the fans will like this version of me as much as they have loved my previous role."

Teaming up with Jennifer Winget, Karan Wahi, Reem Sameer Shaikh, and Sanjay Nath, Raisinghani v/s Raisinghani unfolds a riveting courtroom drama. It deftly weaves the lives of these three professionals, probing the intricacies of moral dilemmas and the challenge of choosing the right path over the easy one.

#Jennifer Winget#Karan Wahi#OTT#OTT Platform#Raisinghani vs Raisinghani#Reem Sameer Shaikh#Sanjay Nath#Sony LIV#bollywood hungama

0 notes

Text

Raisinghani Vs Raisinghani Serial Title Song | Sony Tv

Raisinghani Vs Raisinghani Serial Title Song | Sony Tv, Play, Download & Enjoy all MP3 Songs of Raisinghani Vs Raisinghani (Original Series Soundtrack) for FREE at Trendnut. Enjoy your favourite songs in HD. Free Latest Tv Ad Songs Mobile Ringtone, Tv serial Song, tv serial BG instrumental Ringtone. Mp3 Free “www.trendnut.com” provides absolutely free latest Song. Serial background music, Song…

#Raisinghani Vs Raisinghani Full Theme Song#Raisinghani Vs Raisinghani Serial Ringtone#Raisinghani Vs Raisinghani Serial Song#Raisinghani Vs Raisinghani Title Song

0 notes

Text

Raisinghani vs Raisinghani 10th July 2024 Video Episode 66 - Desi Serial

data-mce-fragment=”1″> Raisinghani vs Raisinghani 10th July 2024 Video Episode 66 – Desi Serial Full Episode 10th July 2024 | Raisinghani vs Raisinghani Full Episode Today Raisinghani vs Raisinghani 10th July 2024 Video Episode 66 – Desi Serial Full Episode Live Raisinghani vs Raisinghani 10th July 2024 Video Episode 66 – Desi Serial Today Episode Full Raisinghani vs Raisinghani 10th July 2024…

0 notes

Text

Who is uncovering Ankita's identity? And what does that imply for Ankita? Is it her job at stake? And what else is left to be uncovered? Watch Raisinghani VS Raisinghani to know what happens next, new episode every Monday to Wednesday at 8 PM, exclusively on Sony LIV

0 notes

Text

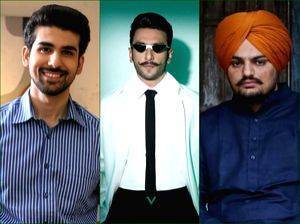

Sidhu Moose Wala's songs, Ranveer's screen energy inspire Eklavya Sood

Sidhu Moose Wala’s songs, Ranveer’s screen energy inspire Eklavya Sood. Image Source: IANS News Mumbai, Feb 24 : Actor Eklavya Sood, who is a part of the web series ‘Raisinghani vs Raisinghani’ shared that for the role of Harsh he found inspiration in rap songs by artists like Sidhu Moose Wala, Krishna, Karan Aujla, and Ranveer Singh’s energetic tracks. To authentically portray his character in…

View On WordPress

0 notes

Text

Raisinghani vs Raisinghani | Streaming Now | Jennifer Winget, Karan Wahi...

0 notes

Text

Watch Raisinghani VS Raisinghani 1st Episode Screening Only On Mayapuri Cut :-

#RaisinghaniVsRaisinghani#JenniferWinget#LatestNews#Bollywood#actors#bollywoodnewsinhindi#bollywood news#bollywood actress#celebrities#bollywood latest news in hindi mayapuri#mayapurimagazine#bollywoodnews

1 note

·

View note

Text

Raisinghani vs Raisinghani Series: Jennifer Winget, Karan Wahi, Reem Shaikh, and Sanjay Nath

Sony LIV, the popular streaming platform, is all set to launch its exclusive courtroom drama series titled ‘Raisinghani vs Raisinghani,’ featuring powerhouse performances by Jennifer Winget, Karan Wahi, Reem Shaikh, and Sanjay Nath. The series promises to deliver an enthralling narrative, intricately weaving the lives of young law professionals with diverse ideologies and approaches to their…

View On WordPress

0 notes

Text

TD Bank (TSX:TD) vs. RBC (TSX:RY): The Best Bank Stock for 2020

TD Bank (TSX:TD) vs. RBC (TSX:RY): The Best Bank Stock for 2020:

Canadian banks have had an eventful year. Short-sellers from across the world turned their attention to our financial institutions, while the housing market and consumer credit quality deteriorated. Yet, most major bank stocks have delivered respectable gains this year, albeit with plenty of stock price volatility along the way.

Now, investors must turn their attention to the new year and pick fresh candidates for their expanded Tax-Free Savings Account (TFSA) contribution room. Here’s a direct comparison of Canada’s top two bank stocks for your TFSA.

TD

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) had an arguably better year than its rivals. The buyout of its American brokerage subsidiary could add roughly $14.5 billion to the company’s cash hoard. Meanwhile, the bank’s earnings per share expanded modestly this year as well.

The bank started off as the third most shorted stock on the stock exchange earlier this year, but those betting against it have capitulated as the stock surged 9.5% over the course of the year.

It still seems fairly valued, trading at 12 times trailing 12-month earnings and 1.86 times book value per share. The stock offers a reasonable 3.96% dividend yield at the time of writing.

The bank also has more exposure to the United States than the domestic economy. Over the past year, U.S. retail accounted for 31% of the company’s revenue. Along with TD Ameritrade, the U.S. accounted for 40% of the company’s overall sales in 2019.

Now that TD Ameritrade has been sold, it remains to be seen how the company deploys that cash and whether it can bolster its geographical diversification over time.

RBC

Royal Bank of Canada (TSX:RY)(NYSE:RY) is very similar to TD in terms of size and relative valuation. Just like TD, the bank offers a 4% dividend yield and trades at 12 times earnings and 1.93 times book value. The valuation is marginally higher, but not by much.

However, unlike TD, RBC seems to be a lot more domestic in terms of sales. Last year, 65% of the company’s revenue was generated in Canada. U.S. sales accounted for just 23%, while the rest of the world contributed 15% to the company’s top line. In other words, RBC operates offices in 36 countries, but it remains a predominantly Canadian bank.

I believe this marginally higher exposure to the Canadian economy makes RBC slightly more vulnerable than TD. It’s no secret that the Canadian borrower is pushed to the limit. Canada’s household-debt-to-gross domestic product and residential property rent-to-income ratios are the highest in the developed world and much higher than the United States.

A correction in the Canadian credit cycle will impact all banks, but it could have more of an impact on RBC than TD. Coupled with the fact that TD trades at a marginally lower valuation, it seems like the better choice for investors at the moment.

Bottom line

While there is very little difference in the financial strength and valuation of both banks, in terms of geographical diversification, TD stands out as the winner. If you’re bearish on the Canadian economy, TD Bank is probably the better bet for 2020.

5 TSX Stocks for Building Wealth After 50

BRAND NEW! For a limited time, The Motley Fool Canada is giving away an urgent new investment report outlining our 5 favourite stocks for investors over 50.

So if you’re looking to get your finances on track and you’re in or near retirement – we’ve got you covered!

You’re invited. Simply click the link below to discover all 5 shares we’re expressly recommending for INVESTORS 50 and OVER. To scoop up your FREE copy, simply click the link below right now. But you will want to hurry – this free report is available for a brief time only.

Click Here For Your Free Report!

Fool contributor Vishesh Raisinghani has no position in any of the stocks mentioned.

0 notes

Text

punished for being a fangirl I guess

0 notes

Link

Canadian banks have had an eventful year. Short-sellers from across the world turned their attention to our financial institutions, while the housing market and consumer credit quality deteriorated. Yet, most major bank stocks have delivered respectable gains this year, albeit with plenty of stock price volatility along the way.

Now, investors must turn their attention to the new year and pick fresh candidates for their expanded Tax-Free Savings Account (TFSA) contribution room. Here’s a direct comparison of Canada’s top two bank stocks for your TFSA.

TD

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) had an arguably better year than its rivals. The buyout of its American brokerage subsidiary could add roughly $14.5 billion to the company’s cash hoard. Meanwhile, the bank’s earnings per share expanded modestly this year as well.

The bank started off as the third most shorted stock on the stock exchange earlier this year, but those betting against it have capitulated as the stock surged 9.5% over the course of the year.

It still seems fairly valued, trading at 12 times trailing 12-month earnings and 1.86 times book value per share. The stock offers a reasonable 3.96% dividend yield at the time of writing.

The bank also has more exposure to the United States than the domestic economy. Over the past year, U.S. retail accounted for 31% of the company’s revenue. Along with TD Ameritrade, the U.S. accounted for 40% of the company’s overall sales in 2019.

Now that TD Ameritrade has been sold, it remains to be seen how the company deploys that cash and whether it can bolster its geographical diversification over time.

RBC

Royal Bank of Canada (TSX:RY)(NYSE:RY) is very similar to TD in terms of size and relative valuation. Just like TD, the bank offers a 4% dividend yield and trades at 12 times earnings and 1.93 times book value. The valuation is marginally higher, but not by much.

However, unlike TD, RBC seems to be a lot more domestic in terms of sales. Last year, 65% of the company’s revenue was generated in Canada. U.S. sales accounted for just 23%, while the rest of the world contributed 15% to the company’s top line. In other words, RBC operates offices in 36 countries, but it remains a predominantly Canadian bank.

I believe this marginally higher exposure to the Canadian economy makes RBC slightly more vulnerable than TD. It’s no secret that the Canadian borrower is pushed to the limit. Canada’s household-debt-to-gross domestic product and residential property rent-to-income ratios are the highest in the developed world and much higher than the United States.

A correction in the Canadian credit cycle will impact all banks, but it could have more of an impact on RBC than TD. Coupled with the fact that TD trades at a marginally lower valuation, it seems like the better choice for investors at the moment.

Bottom line

While there is very little difference in the financial strength and valuation of both banks, in terms of geographical diversification, TD stands out as the winner. If you’re bearish on the Canadian economy, TD Bank is probably the better bet for 2020.

5 TSX Stocks for Building Wealth After 50

BRAND NEW! For a limited time, The Motley Fool Canada is giving away an urgent new investment report outlining our 5 favourite stocks for investors over 50.

So if you’re looking to get your finances on track and you’re in or near retirement – we’ve got you covered!

You’re invited. Simply click the link below to discover all 5 shares we’re expressly recommending for INVESTORS 50 and OVER. To scoop up your FREE copy, simply click the link below right now. But you will want to hurry – this free report is available for a brief time only.

Click Here For Your Free Report!

Fool contributor Vishesh Raisinghani has no position in any of the stocks mentioned.

0 notes

Text

these guys have zero boundaries

0 notes

Text

smth very weird about everyone and their mom being like omg virat he's such a good lawyer and then hes wrong like. all the gd time.

0 notes

Text

Virat is SUCH an asshole, and it almost looks like the show gets that, but then they kind of start playing romantic music and they start staring at each other. it's like ...what. Why

0 notes