#Radhakishan Damani Share

Explore tagged Tumblr posts

Text

Radhakishan Damani portfolio, corporate shareholdings and investments

Started investing at the age of 32, Damani’s investing preference include long term view, buying quality stocks with strong fundamentals, diversifying the portfolio & rebalancing the portfolio on a prompt basis. Apart from investing, he has also created a successful retail company Avenue Supermarket which runs more than 200 DMart stores in India. These are the shares held by RadhaKishan Damani as…

#Radhakishan Damani#Radhakishan Damani investments#Radhakishan Damani portfolio#Radhakishan Damani stocks

0 notes

Text

Radhakishan Damani portfolio stock Avenue Supermarts surges 15% after Q3 business update

Intensify Research services is a Top SEBI registered Research analyst indore committed to empowering investors with the most reliable stock market insights. Our team of expert analysts uses advanced tools and strategies to provide you with high accuracy stock market tips that enhance your chances of success. To visit- Intensifyresearch.com

0 notes

Text

DMart Q2FY25 Results: Net profit of Radhakishan Damani's company increased by 5.77%, revenue also increased; What about the shares?

Avenue Supermarts Q2FY25 Results: DMart, the company of India's veteran industrialist and well-known investor Radhakishan Damani, has declared the results for the second quarter of FY25 today i.e. on October 12. In the information given to the exchanges, the company said that the net profit of Avenue Supermarts Limited in the September quarter (…)

0 notes

Text

Radhakishan Damani Portfolio, Shareholdings & Investments: An In-Depth Look

Radhakishan Damani, a legendary figure in the Indian stock market, is best known as the founder of Avenue Supermarts, the parent company of the DMart retail chain. His investment strategies, characterized by patience and a keen eye for value, have earned him a reputation as one of India's most successful investors. In this article, we explore the key components of Damani's portfolio, shareholdings, and investments, with detailed insights from Finology Ticker.

Understanding Radhakishan Damani’s Investment Approach

Damani’s investment philosophy is rooted in identifying companies with strong fundamentals, competent management, and significant growth potential. He tends to hold his investments for the long term, allowing the benefits of compounding to enhance his returns. His portfolio is a blend of established, stable companies and promising growth stocks.

Key Holdings in Radhakishan Damani’s Portfolio

1. Avenue Supermarts Ltd. (DMart)

Sector: Retail

Description: DMart is the cornerstone of Damani's portfolio. The company operates a highly efficient chain of hypermarkets and supermarkets across India, known for its customer-centric approach and low-cost operations. DMart’s impressive financial performance and consistent growth make it a flagship investment for Damani.

2. VST Industries Ltd.

Sector: Tobacco

Description: VST Industries is a major player in the tobacco sector, producing a wide range of tobacco products. Damani’s investment in VST Industries highlights his preference for companies with stable revenue streams and regular dividend payouts.

3. India Cements Ltd.

Sector: Cement

Description: India Cements is one of the largest cement manufacturers in India. With its extensive production capacity and distribution network, the company has a significant presence in the market. Damani’s long-term stake in India Cements reflects his confidence in the infrastructure and construction sectors’ growth prospects.

4. Trent Ltd.

Sector: Retail

Description: Trent operates several retail brands, including Westside and Zudio. The company’s diverse product offerings and strategic growth plans make it an attractive investment in Damani’s portfolio.

5. Blue Dart Express Ltd.

Sector: Logistics

Description: Blue Dart is a leading logistics and courier service provider in India. Known for its extensive network and reliable services, Blue Dart is a strategic investment for Damani, leveraging the growing demand for logistics solutions.

6. Sundaram Finance Ltd.

Sector: Financial Services

Description: Sundaram Finance offers a variety of financial products, including loans, insurance, and asset management. The company’s prudent management and consistent performance align with Damani’s investment philosophy.

7. 3M India Ltd.

Sector: Diversified

Description: 3M India operates in multiple sectors, including healthcare, consumer goods, and industrial products. The company’s innovative approach and diversified revenue streams make it a valuable part of Damani’s portfolio.

8. United Breweries Ltd.

Sector: Beverages

Description: Known for its flagship brand Kingfisher, United Breweries is a dominant player in the alcoholic beverages market. Its strong market position and consistent growth have made it a significant holding in Damani’s portfolio.

Insights from Finology Ticker

Finology Ticker provides a comprehensive overview of Radhakishan Damani's portfolio, shareholdings, and investments. The platform offers detailed information on the performance and financial metrics of the companies in his portfolio, including current share prices, market capitalization, price charts, and balance sheets. This data allows investors to analyze Damani’s investment strategies and the rationale behind his stock selections.

Conclusion

Radhakishan Damani’s portfolio is a reflection of his disciplined investment strategy and deep understanding of market dynamics. His focus on companies with strong fundamentals and growth potential has consistently delivered impressive returns. For investors and market enthusiasts, studying Damani’s portfolio, as detailed on Finology Ticker, provides valuable insights into effective investment strategies and potential market opportunities. By examining his shareholdings and investments, one can gain a better understanding of the principles that drive long-term success in the stock market.

#radhakishan Damani#radhakishan damani portfolio#radhakishan damani stocks#portfolio of radhakishan Damani#radhakishan damani penny stocks

0 notes

Text

Key Factors Behind Radhakishan Damani’s Investment Decisions

Introduction

Damani is a name with a sagacity of the Indian stock market. His investment decisions and strategies are not just successful but serve as a blueprint for aspiring investors.

He founded Dmart, a major retail corporation, and became renowned as a seasoned investor in the Indian equity market. His portfolio has been studied and envied by many. To read more about Radhakishan Daman's portfolio and net worth, read our blog on Altius Investech.

The blog would highlight his strategic moves contributing to the notable success while offering valuable insights to investors.

Long-term investment mindset

With his long-term investment horizon, unlike traders focusing on short-term gains, Damani has invested in various companies for numerous years.

The philosophy and approach of purchasing and holding onto stocks from fundamentally strong companies lets him earn benefits from steady growth, dividend payouts, and appreciation of long-term capital.

Avenue Supermarts, the parent company of DMart, highlights a great example demonstrating the exponential growth attained from long-term holdings.

Damani has also invested in Chennai Super Kings – an IPL franchise backed by India Cements Limited. With an illustrious history, they have participated in a record 10 finals, won a record five IPL titles in 2010, 2011, 2018, 2021, and 2023, and qualified for the playoffs 12 times out of the 14 seasons they have played in, which is more than any other franchise.

To have your hands-on gains that we can vouch for, buy csk unlisted shares from Altius Investech starting from just ₹ 153.

Value in Investments

Damani looks out for companies that are undervalued as per their actual worth. Buying the stocks at prices lower than their real, intrinsic value, makes him position himself for considerable gains once the market corrects the undervaluation. The method needs a deeper understanding of the fundamentals of business, involving debt levels, competitive advantages, and revenue streams.

No to High-debt companies

A significant factor in his investment strategies is an aversion to organizations with high debt levels. Instead, he seeks companies with stronger cash flows and manageable debt. The conservativeness shields his investments from risks linked with high leverage, especially during economic downturns, causing stable returns.

Market Timing

What needs to be acknowledged is the way Damani times his entry or exit from businesses, impeccably. He willingly buys stocks when the market shows pessimistic values and sells as per his interest. For example, his entry into some specific apparel or cement stocks during the time of market lows let him reap considerable gains with the recovery of these sectors.

Market Cycles

Damani’s interpretation and understanding of the market cycles significantly contribute to his success. Through effective studies levied on investor behavior and market patterns, he can anticipate market dynamic shifts. The capability of reading the market makes him adjust his strategies as per the prevailing economic scenario.

Business Fundamentals

The decisions he makes in his processes analyze business procedures to invest only in companies having strong management, sustainable advantages, and clear strategies for growth. Instead of market speculation, he identifies companies offering potential and stability, irrespective of conditions of market volatility.

Diversification

With important holdings in the investments and retail sectors, Damani’s portfolio remains diverse across different industries. Diversification helps in the mitigation of risks as poor performance of one stock or sector is compensated by the gains or stability of the rest. This counts as a classic strategy that served him well over the decades.

Network and Mentorship

A close-knit group consisting of seasoned investors as friends and mentors, including the famous Rakesh Jhunjhunwala, gives him a network providing him with robust exchanges of strategies and ideas, and refining his investment tactics and decisions.

Conclusion

Several disciplined approaches happen to focus on value investing, fundamental analyses, and cautious approaches for debt as well as market timing, making a huge figure to emulate in the world of investment.

Investors who intend to mirror his success must understand and implement these principles as a step forward in earning significant returns in the volatile world of trading stocks. To further diversify and grow your investment, consider investing in unlisted shares on Altius Investech, a platform known for its promising opportunities.

0 notes

Text

Avenue Supermarts: DMart stock surge boosts Radhakishan Damani's wealth by ₹2,695 crore

Avenue Supermarts, which operates the retail chain of DMart, saw its shares zoom 5.8% to hit a new one-year high of ₹4,715 apiece in today’s trading before finishing the trade at ₹4,645 apiece, up 4.13%. Investor sentiment was buoyed by the company’s impressive business update for the fourth quarter of FY24, which garnered positive attention from market participants. The upbeat performance of…

View On WordPress

0 notes

Text

DAY 399 - *Radhakishan Damani - A silent billionaire!!!* - A must read

Early Life:

RKD was born on 12 January 1954 in a Marvari family in Bikaner, Rajasthan.

His father, Shivkishan Damani was a stock broker. RKD completed his early schooling in Bikaner.

Later he went to Mumbai for completing his Bachelor of Commerce degree from Mumbai university.

He was a business mind person from his early days. In middle he left his commerce education and started a Ball Bearing business.

Joined broking business:

After the death of his father he left his business and joined broking business with his elder brother Gopikishan.

After spending some time in broking he realized that, to make big he has to take active part in stock market.

At the age of 32 he entered in stock market. Manu manik was his mentor in initial days. Rkd learned short selling from him.

Harshad Mehta entered in 90s. Who was the the super bull in those days. He used to manipulate the stocks.

In 90s RKD made handsome money by short selling.

Once RKD was short on the market & Harshad was long. RKD panicked coz the stocks were going up. Harshad was manipulating the scripts.

But fortunately Sucheta Dalal mam exposed the scam of Harshad and due to that entire market collapsed. RKD made huge money. It happened in 1992.

Once RKD told, he would have gone bankrupt if harshad had held the position for 7 more days. But luck favoured him.

Super investor:

He understood that, short selling is very risky & to create wealth he has to invest for long term.

Then RKD came across a great value investor Chandrakant Sampat. Sampat sir used to invest in undervalued, high quality and lesser known companies.

He inspired a lot by Sampat sir. Gave up on trading and shifted his focus on long term value investing.

He made handsome money in VST, Gillette, Colgate, Jubiliant foodwork, Nestle, HUL, 3M, Sundaram Finance, Hdfc Bank.

In 1995 he was the largest individual investor in a bank. He made killing there.

He bought VST industries at the price of 85, today its trading at 3400rs/share. He still holds this.

Super businessman:

After successful career in stock market he started his third inning as a businessman in 1999.

He was interested in a retail business. He bought a franchise of Apna Bazaar in 1999. He didn't like the model and closed it immediately.

Then he went to America to study the business model of worlds largest retail chain Walmart.

He really liked the model and decided to apply it into India more effectively.

So, in 2000 he founded Avenues super mart, the parent company of Dmart.

He launched first store in 2001 in Mumbai. Daily discounts, daily savings was their tagline.

Low interior cost. No store in a mall. Purchase in bulk increased their bargaining power.

Everyday low price. They were selling at much cheaper price than competitor.

Dmart became massive hit!!!

Low margin but high inventory turnover helped them to make superb return on capital.

Everybody wanted to sell their products in Dmart, so they started charging slotting fees.

They followed slow and steady store growth strategy. RKD focused on the profitability over growth.

Till 2011 they just has 25 stores. As they keep generating robust cash flows, they slowly expanded across the nation. Today thay have 325+ stores.

Mr. White and white:

Today he is the 8th riches person in India.

He rarely appears on media. He love staying low profile.

He always wear white shirt and white. Live simple.

Thats why street use to Call him Mr White and White.

One quote of Buffet precisely applicable for him,

*”I am a better investor because I am a businessman, and a better businessman because I am an investor."*

0 notes

Text

DMart Jobs 2023 DMart New Jobs For Fresher

DMart New Recruitment 2023

Introduction

DMart, one of India's leading retail chains, is set to embark on a new recruitment drive in 2023. Known for its commitment to quality, affordability, and customer satisfaction, DMart has become a household name since its establishment. With the expansion of its operations, DMart aims to hire talented individuals who share its passion for excellence and customer service.

Apply Link - https://freemejob.com/private-jobs/

Overview of DMart

DMart, a venture of Avenue Supermarts Ltd., was founded by Mr. Radhakishan Damani in 2002. The retail chain operates stores across various cities in India, offering a wide range of products from groceries to household items and apparel. DMart's business model focuses on providing high-quality products at reasonable prices, making it a preferred shopping destination for millions of customers.

DMart's Expansion Plans

In line with its commitment to growth and customer-centric approach, DMart is planning to open new stores and expand its presence in both existing and new locations. This expansion initiative has led to the need for additional staff, resulting in the announcement of new recruitment in 2023.

Job Opportunities at DMart

Available Positions

DMart will be offering diverse job opportunities across different departments. From store operations to marketing, finance, and human resources, the recruitment drive will cater to various skill sets and qualifications.

Qualifications and Requirements

To be eligible for the available positions, candidates must possess the required educational qualifications and relevant experience in their respective fields. Additionally, candidates with excellent communication and problem-solving skills will be preferred.

DMart's Work Culture and Benefits

At DMart, employees are considered the cornerstone of its success. The company prides itself on fostering a positive work culture that promotes employee growth and job satisfaction.

Employee Training and Development

DMart invests significantly in training and developing its workforce. New employees will undergo comprehensive training programs to ensure they are well-equipped to excel in their roles. Ongoing learning opportunities are also provided to encourage continuous improvement and skill development.

Employee Benefits and Perks

Apart from competitive salaries, DMart offers a range of benefits and perks to its employees. These may include health insurance, performance-based incentives, employee discounts, and more, making it an attractive employer for job seekers.

Application Process

How to Apply

Interested candidates can apply for positions at DMart through the company's official website or by visiting their nearest DMart store. The website features a dedicated career section where candidates can explore available job openings and submit their applications online.

Interview Process

Shortlisted candidates will be invited for interviews. The interview process at DMart focuses on assessing candidates' skills, knowledge, and alignment with the company's values.

Career Growth at DMart

DMart is committed to providing ample opportunities for career growth to its employees. With a strong emphasis on recognizing talent and promoting from within, many employees have experienced remarkable career progression at DMart.

Advancement Opportunities

Employees who demonstrate exceptional performance and dedication have the chance to climb the organizational ladder and take on more significant responsibilities within the company.

Success Stories of Current Employees

DMart boasts inspiring success stories of employees who started at entry-level positions and, over time, advanced to managerial roles. Such stories are a testament to DMart's dedication to nurturing talent and fostering career development.

DMart's Commitment to Diversity and Inclusion

DMart is an equal-opportunity employer and strongly believes in promoting diversity and inclusion in the workplace. The company values the unique perspectives and contributions of individuals from diverse backgrounds and strives to create an inclusive environment for all.

Conclusion

As DMart gears up for its expansion in 2023, the new recruitment drive presents an excellent opportunity for job seekers to be part of a dynamic and customer-oriented organization. With its focus on employee growth, work culture, and commitment to diversity, DMart continues to be a preferred employer in the retail sector.

Apply Link - https://freemejob.com/private-jobs/

0 notes

Text

RK Damani is a renowned value investor in India. Investors seek his guidance for portfolio building and long-term wealth creation. His market reputation is solid, as everything he buys tends to be successful. He excels in selecting stocks with the potential for significant growth. Investors trust his investment expertise and buy shares based on his choices. To assist long-term investors, we will provide a list of Radhakishan Damani's portfolio holdings.

0 notes

Text

D Mart Share Price

D-Mart is a retail chain that operates stores in India under the brand name “DMart”. The company is owned by Avenue Supermarts Ltd. The company was founded in 2002 by Radhakishan Damani. D-Mart offers a wide range of products including groceries, household items, apparel, footwear, and more. D-Mart has become a popular retail chain in India due to its affordable prices and wide selection of…

View On WordPress

0 notes

Text

Know India’s Top Investors In Share Market

Rakesh Jhunjhunwala, also known as The Big Bull, was regarded as India’s very own Warren Buffet. Before investing, Radhakishan Damani believes the company’s ethical principles should be thoroughly examined. We frequently follow eminent Indian stock market investors who have achieved phenomenal success and attempt to engage in the same kinds of ventures that they have. Incredible investing…

View On WordPress

0 notes

Text

Raquel Leviss Net Worth: When Did Raquel Leviss Join ‘Vanderpump Rules’?

In this article, we will discuss the life and career of Raquel Leviss. Raquel Leviss, star of Vanderpump Rules on Bravo, has a huge fortune thanks to a variety of sources of income. Continue reading to learn about her income and net worth.

Net Worth Raquel Leviss

As of the year 2023, Raquel Leviss is expected to have earned $30 million in wealth.

Raquel Leviss Early Life And Career

Raquel Leviss is a reality television personality, model, and beauty pageant queen. She was born on April 30, 1994, in Sonoma County, California, and grew up in a close-knit family. Leviss developed a passion for beauty and fashion at a young age and pursued her interests by participating in local beauty pageants. Leviss rose to fame after appearing on the reality television show "Vanderpump Rules," which follows the lives of employees at Lisa Vanderpump's restaurant, SUR Restaurant, in West Hollywood, California. On the show, Leviss is known for her bubbly personality and her relationship with James Kennedy, a DJ and fellow cast member. Aside from her reality television career, Leviss is also a trained medical aesthetician and has worked in the beauty industry for several years. She has used her platform to promote skincare and beauty products and has become a social media influencer with a large following on Instagram. In addition to her beauty and fashion pursuits, Leviss is also a well-rounded individual with a passion for fitness and wellness. She is an avid runner and fitness enthusiast and often shares workout tips and healthy eating habits with her followers.

Raquel Leviss Overall, Raquel Leviss is a versatile and multifaceted individual who has made a name for herself in the beauty, fashion, and entertainment industries. With her infectious personality, dedication to her craft, and growing platform, she is sure to make a lasting impact in the years to come. You may also like the following: - Sad News: Shanti Bhushan, Former Law Minister, Dies at 97 - Are Lindy and Miguel Still Together After Married at First Sight?

What is Raquel Leviss's Source Of Income?

Raquel competed in multiple pageants after winning Miss Sonoma County in 2016, including Miss California and Miss Malibu USA, as reported by Us Weekly. Raquel began using Instagram to promote various brands through professional photographs and videos of herself modeling after she became a regular on Pump Rules. Did Raquel Leviss Earn a College Degree? The SUR-ver went to school at California's Sonoma State University, where they majored in kinesiology and prepared for a career in occupational therapy. According to Bravo, Raquel plans to return to school in 2020 to pursue a master's degree in occupational therapy. During the seventh season reunion of VPR, Raquel declared, "I think I'm going to start applying very, very soon." I haven't forgotten about the GRE! There is no getting around the fact that I need to prepare for that test. Then I'll submit my applications to universities. I hope to remain a California resident. This is something I want to get going on right away. When Did Raquel Leviss Join ‘Vanderpump Rules’? The employee at SUR first appeared on the popular reality show during its fifth season, and he or she has since returned for the sixth. Their relationship with ex-boyfriend/costar James Kennedy helped boost her profile. After five years together, the couple got engaged in May of 2021, only to call off the wedding seven months later. Raquel and James announced their breakup in a joint Instagram post in December 2021, writing, "After these 5 wonderful years we had together, we decided we have two different goals and made the decision to call off the engagement." We still care deeply for one another, but our romantic feelings have faded. https://www.instagram.com/p/CXG6T4iJ-iS/?utm_source=ig_web_copy_link Also, Check: - Radhakishan Damani Net Worth: How Did Damani Become Rich? - Mukesh Ambani Net Worth: What is His Daily Income? During the season 9 reunion special that aired in January 2022, Raquel explained why she and her former boyfriend had to split up. "He really has shown me how dedicated he is to me and the things that he is willing to do to better himself," so she didn't want to give up on him. But I can't help but think it's rooted in my very being. The fact that I keep having nightmares about the day of our wedding should be a red flag to you. However, after a steamy hookup session with Tom Schwartz during season 10, shortly after his split from ex-wife Katie Maloney, Raquel has set her sights on him. Follow us on Twitter to check out our latest updates on our social media pages. Read the full article

0 notes

Text

Top 10 Richest People In India 2023

India’s top 2 billionaires position them successfully in the list of the Top 10 richest billionaires in the world. And it’s been more than a year, hence indicating that the country has a record high number of billionaires and industrialists.

Mukesh Ambani and Gautam Adani have become the top industrialists while Cyrus Poonawalla’s Serum Institute of India became the country’s biggest producer of Covid-19 vaccines and earned huge revenue.

It is also important to know the contribution of Savitri Jindal, the only woman on the list of the top 10 richest people in India.

Let’s quickly take a look at the top 10 richest people in India in 2023:

youtube

10. UDAY KOTAK

Net Worth: $13.6 Billion (as of January 2023)

Age: 63 Years

Source of Wealth: Kotak Mahindra Bank

The Indian billionaire, the Founder and Managing Director of Kotak Mahindra Group, Uday Kotak is a renowned personality and is idealised by many around the nation. He was born in 1959 in an upper-middle-class Gujarati Lohana joint family in Mumbai.

Although he built his career as a cricketer, an immediate surgery marked the end of his cricket dreams. Recollecting the hope, he began his entrepreneurial journey by establishing his finance and bill discounting business with a seed capital borrowed from his friends and near & dear ones. As the major part of the investment that he borrowed came from Anand Mahindra, he named his agency ‘Kotak Mahindra’.

9. KUMAR BIRLA

Net Worth: $15.5 Billion (as of January 2023)

Age: 55 Years

Source of Wealth: Hindalco Industries

Another richest billionaire on the list is Kumar Birla, the Chairman of the third largest Indian business conglomerate, Aditya Birla Group. He is also the Chairman of the Indian Institute of Management Ahmedabad and the Chancellor of the Birla Institute of Technology & Science.

He took over the Aditya Birla Group at the age of 28 due to the sudden demise of his father. He faced a lot of scepticism because of his lack of experience but with his sharp business sense, he took the company to the heights.

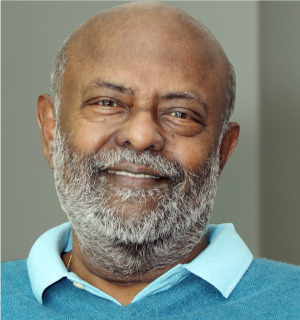

8. RADHAKISHAN DAMANI

Net Worth: $16.1 Billion (as of January 2023)

Age: 68 Years

Source of Wealth: Avenue Supermarts Limited

A renowned Mumbai-based investor and entrepreneur, Radhakishan Damani is the owner of India’s third-largest mega-retail stores’ chain, ‘DMart.’ Rakesh Jhunjhunwala considers him as his mentor in the Indian share market.

He was born in 1954 to an Indian Marwari family, born and brought up in Bikaner, Rajasthan. He started his career as a stockbroker but soon started stock trading in the Indian stock market. He gained a foothold in the business community only after he overpowered the Indian stockbroker Harshad Mehta.

7. DILIP SHANGHVI

Net Worth: $16.6 Billion (as of January 2023)

Age: 67 Years

Source of Wealth: Sun Pharmaceuticals

Dilip Shantilal Shanghvi is a popular Indian billionaire who is also the Founder of Sun Pharmaceuticals. After Dilip made the company public in 1994, three years later Sun Pharma made its first international acquisition when it bought Detroit-based Caraco Pharmaceutical Laboratories. Among many other acquisitions, the notable one was the purchase of Ranbaxy Laboratories in 2014.

Sun Pharma experienced multifaceted growth under the leadership of sharp-witted Dilip Shanghvi. In 2018, he became a member of the Reserve Bank of India’s central board.

6. LAKSHMI MITTAL

Net Worth: $17.9 Billion (as of January 2023)

Age: 72 Years

Source of Wealth: ArcelorMittal

Successfully securing his position among the top 10 richest persons in India, Lakshmi Narayan Mittal is an Indian billionaire who is the Executive Chairman of the world’s leading steel and mining company ArcelorMittal. He served as the CEO of the company till February 2021.

He was born in Sadulpur in Rajasthan in 1950. He began his career in his family’s steelmaking business in India before he moved to Indonesia in 1976 to set up a small steel company that over time grew to become today’s widely popular ArcelorMittal. He was awarded the Padma Vibhushan, India’s second highest civilian honour, by the President of India in 2008.

5. SAVITRI JINDAL AND FAMILY

Net Worth: $18.1 Billion (as of January 2023)

Age: 72 Years

Source of Wealth: O.P. Jindal Group

Savitri Jindal is a wonderful example of being the only richest woman in a self-proclaimed man’s world. She is the Chairperson Emeritus of Jindal Steel & Power Limited. She is also the President of Maharaja Agrasen Medical College (MAMC), Agroha established in 1998.

After the sudden death of her husband, Om Prakash Jindal in 2005, India’s richest woman Savitri Jindal took over her husband’s steel and power conglomerate. Committed to following the values of OP Jindal, she is running the business with full vigour.

4. CYRUS POONAWALLA

Net Worth: $21 Billion (as of January 2023)

Age: 81 Years

Source of Wealth: Serum Institute of India

Cyrus Poonawalla is the Founder and Managing Director of Cyrus Poonawalla Group, which includes the Serum Institute of India (SII), an Indian biotechnology company manufacturing highly specialised life-saving biologicals.

In 1966, Cyrus incepted the Serum Institute of India to derive therapeutic serum from horse blood. Within two years, the institute launched its first therapeutic tetanus serum and started producing anti-tetanus vaccines. Although he faced a couple of challenges with financing and recognition of the company, Cyrus also stood to fight against all of them.

3. SHIV NADAR

Net Worth: $25.6 Billion (as of January 2023)

Age: 77 Years

Source of Wealth: HCL Enterprise

Another prominent name in the list of top 10 richest billionaires in India is famous billionaire industrialist and philanthropist, Shiv Nadar who is also the Founder of Hindustan Computers Limited (HCL).

Shiv Nadar was born on 14th July 1945, to his father, Sivasubramaniya and mother, Vamasundari Devi in Tiruchendur, Tamil Nadu India. He started his career in 1967 as an engineer at Walchand Group’s Cooper Engineering (COEP) in Pune. After a few years, he quit his job to take up a business-oriented career in partnership with Ajai Chowdhry and other colleagues to establish an enterprise which came to be known as Microcomp under the brand name ‘Televista’. Later, all of them together founded HCL Tech in 1976 to manufacture microprocessors and calculators.

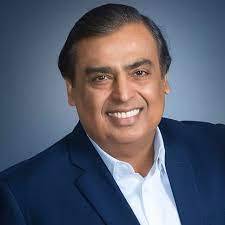

2. MUKESH AMBANI

Net Worth: $88.3 Billion (as of January 2023)

Age: 65 Years

Source of Wealth: Reliance Industries Ltd

Mukesh Ambani is a widely recognized Indian billionaire industrialist who is the Chairman and Managing Director of Reliance Industries Ltd. (RIL), an MNC with diverse businesses including energy, natural gas, mass media, retail, petrochemicals, telecommunications, and textiles.

After the death of his father Dhirubhai Ambani, the brothers Mukesh Ambani and Anil Ambani assumed joint leadership of the Reliance companies but due to feuds between the brothers, Kokilaben Ambani, their mother, split the assets under which Mukesh assumed control of the gas, oil, and petrochemicals units. He grew the business multifariously and became one of the richest persons in India.

1. GAUTAM ADANI

Net Worth: $125.6 Billion (as of January 2023)

Age: 60 Years

Source of Wealth: Adani Group

The first name on the list of richest Indians is none other than Gautam Adani. Born on 24 June 1962, Gautam Adani is the Founder and Chairman of Adani Group. The self-made billionaire operates a world-class integrated infrastructure company that includes coal trading, coal mining, ports, oil and gas exploration, multimodal transportation, transmission, power production, and gas distribution.

In May 2022, Gautami Adani’s firm picked up two well-known companies—Ambuja Cement and ACC—that Holcim owned. He is not only India’s richest person but is also the wealthiest person in the world.

Frequently Asked Questions:

Q. Who is the richest man in Asia? Gautam Adani

Q. Why Ratan Tata is not in the list of richest people in India? Ratan Tata is involved in a lot of philanthropy work through Tata Trusts. He is at the 433 position on the IIFL Wealth Hurun India Rich List 2021. 66% of the profits earned by Tata Companies is donated for philanthropic activities.

Q. Who will become the first trillionaire on Earth? Founder of SpaceX and Tesla, Elon Musk will become the first trillionaire in the future.

Must Read:

TOP 10 RICHEST BILLIONAIRES IN THE WORLD 2023

Top 10 Indian Origin CEOs Leading International Companies

TOP 10 IN-DEMAND SKILLS FOR 2023

SUCCESS STORY OF TIM COOK: A MAN WITH A VISION

HIGHEST-PAID CEOs IN THE WORLD

Success Story Of Mukesh Ambani

TOP 10 NEWSPAPERS IN THE WORLD 2023

Elon Musk: Biography Of A Self-Made Entrepreneur And Billionaire

10 GADGETS TO KEEP YOU COOL THIS SUMMER

7 R’s Of Waste Management – Steps To Sustainability

What Are The 5 Must Watch Netflix Thrillers

0 notes

Text

राधाकिशन दमानी को 3 महीने में लगा 26000 करोड़ रुपये का बड़ा झटका

राधाकिशन दमानी को 3 महीने में लगा 26000 करोड़ रुपये का बड़ा झटका

शेयर बाजार की गिरावट ने आम निवेशकों की हालत खस्ता कर दी है। दिग्गज निवेशक भी अपने पोर्टफोलियो को इस गिरावट से बचा नहीं पाए हैं। रिटेल चेन डी-मार्ट (D-Mart) के मालिक और दिग्गज इनवेस्टर राधाकिशन दमानी को भी शेयर बाजार की इस गिरावट में बड़ा झटका लगा है। राधाकिशन दमानी को वित्त वर्ष 2023 की पहली तिमाही में करीब 26,000 करोड़ रुपये का नुकसान हुआ है। इकनॉमिक टाइम्स की एक रिपोर्ट में यह बात ट्रेंडलाइन और…

View On WordPress

#D-mart Owner Radhakishan Damani#Hindi News#Hindustan#News in Hindi#Radhakishan Damani#Radhakishan Damani Business#Radhakishan Damani Company#Radhakishan Damani news#Radhakishan Damani Portfolio#Radhakishan Damani Share#Radhakishan Damani Share list#Radhakishan Damani Stock list#डीमार्ट#डीमार्ट ओनर राधाकिशन दमानी#डीमार्ट के ओनर#राधाकिशन दमानी#राधाकिशन दमानी पोर्टफोलियो#राधाकिशन दमानी बिजनेस#राधाकिशन दमानी शेयर#राधाकिशन दमानी शेयर लिस्ट#राधाकिशन दमानी स्टॉक#राधाकिशन दमानी स्टॉक लिस्ट#हिन्दुस्तान

0 notes

Photo

Radhakishan Damani picks up 0.5% stake in Cochin Shipyard Shares of Cochin Shipyard ended up 9.85% at Rs 359.05 on Thursday. Source link

0 notes

Text

DMart’s Noronha wealthiest CEO in India - ET Retail

DMart’s Noronha wealthiest CEO in India – ET Retail

[ad_1]

Who is India’s richest non-promoter professional? He is neither a tech whizkid, nor a new-age banker. And neither is he an alumnus of the mighty IIT+IIM combo. Instead, he is in a line of business that’s as traditional as it gets – groceries, largely.

With more than Rs 3,100 crore of net worth, Ignatius Navil Noronha, CEOof Avenue Supermarts that runs D-Mart stores, has emerged as the…

View On WordPress

0 notes