#Purging Compound Market size

Explore tagged Tumblr posts

Text

Purging Compound Market: Unlocking Growth Opportunities and Challenges

Introduction

Purging compounds are specially formulated materials that are used to clean plastic processing equipment and eliminate material cross-contamination between different plastic grades or formulations. They essentially "push out" any residual plastic left in the machine after a production run and prepare the equipment for the next material. These compounds are available for most major commercial plastics like polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), nylon, polycarbonate and others.

Composition and Mechanism of Action

Typical purging compounds contain a base resin that matches the type of plastic being purged, along with additives that facilitate better flow and cleaning properties. For example, a polypropylene compound would use PP as the base but contain wax or silicone components. During the purging cycle, the compound is melted and forced through the machine much like the product plastic. Its excellent flow properties help displace any remaining contamination deeply seated in crevices or hard to reach areas. The additives also act as release agents that effectively strip colorants, filler particles or remnants of the previous material from machine surfaces in one pass. Purging for Color Changes One of the most common uses of compounds is when changing between different color batches of the same plastic on an injection molding or blow molding line. Even trace quantities of unintended color carried over can mean rejecting large production runs. Purging removes any discoloration completely to ensure bright, consistent color from the first piece produced after a changeover. It is a more economical solution than completely dismantling and cleaning the machine each time. Compounds are also available in various colors to provide a visual cue of when the purging cycle is complete. Purging for Grade Changes While color changes require fine purging, changing between unrelated plastic formulations or grades demands deeper level of purification. Even minuscule cross-contamination risks incompatibility issues, performance inadequacies or regulatory failures in products. Specialty compounds have been formulated to get into microscopic nooks and remove adhesion of incompatible polymers. Some advanced varieties can even dissolve into prior material rather than simply displace it. Such high performance purging allows confident switching between engineering resins, filled plastics and other dissimilar materials. Meeting Industry Quality Standards Purging is critical in many highly regulated industries like food packaging, medical devices, automotive and barrier films where the tiniest trace of an unintended contaminant could have safety or functionality repercussions. Compounds help manufacturers meet purity levels mandated by ISO 9000, cGMP or customer specifications by leaving machines in pristine condition. They are even applied between production lots of the same material to prevent cross-contact at the molecular level. The assurances of correct purging reassure compliance auditors and quality certifiers. In summary, these compounds have become an indispensable tool that facilitates optimal machine utilization, consistent quality production, regulatory adherence and reduced environmental footprint in plastics processing. Their continually improving performance and formulation diversity are critical enablers powering growth of the global plastics industry. With plastics demand set to rise consistently, purging compounds will play a greater strategic role in the coming years.

0 notes

Text

Caps And Closures Market Business Growth, Opportunities and Forecast 2024-2030

The global caps and closures market size was estimated at USD 74.64 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030.

Growing demand for various food products and alcoholic and non-alcoholic beverages is anticipated to trigger market growth. Caps and closures act as a barrier and prevent packaged contents from getting exposed to ambient air and dust particles and allow easy dispensing. Caps and closures have applications in several other end-use industries, such as healthcare, personal care, home care, and automotive. Rising awareness about the benefits of healthy eating is likely to boost the demand for dietary supplements, which in turn is expected to further drive demand for packaging products.

Gather more insights about the market drivers, restrains and growth of the Caps And Closures Market

Council for Responsible Nutrition (CRN), a leading trade association representing dietary supplement and functional food manufacturers and ingredient suppliers in the U.S. conducted a consumer survey in 2023 on dietary supplements, wherein multivitamins were consumed by 70% of participants, followed by specialty supplements such as omega-3s, melatonin, probiotics, and fiber used by 52 % of participants. In addition, the sports nutrition supplements segment witnessed a 5% increase in consumption compared to previous years. All these factors are anticipated to drive the demand for market growth.

Increasing demand for caps and closures is closely associated with the rise of urbanization in the U.S. Consumers in urban areas prefer packaging solutions that are convenient and suitable for on-the-go consumption of food and beverages. Caps and closures play a vital role in providing this convenience by ensuring easy opening and closing of products, as well as preventing spills. In addition, they create an airtight seal that keeps the products fresh for a longer period by preventing the entry of bacteria. These address the growing concerns about safety and hygiene associated with food and beverage products, as they help prevent spoilage. Hence, expanding food and beverage industries with growing urbanization is expected to boost the demand for caps and closures over the forecast period.

Caps And Closures Market Segmentation

Grand View Research has segmented the global caps and closures market report based on material, product, application, and region:

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

• Plastic

• Metal

• Others

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

• Dispensing Caps

• Screw Closures

• Crown Closures

• Aerosol Closures

• Others

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

• Beverages

• Food

• Healthcare

• Personal Care

• Home Care

• Industrial

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o Germany

o France

o Italy

o Spain

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

o Southeast Asia

• Central & South America

o Argentina

o Brazil

• Middle East & Africa

o South Africa

o Saudi Arabia

Browse through Grand View Research's Plastics, Polymers & Resins Industry Research Reports.

• The global rigid polyurethane foams market was estimated at a value of USD 20.69 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030.

• The global purging compound market size was valued at USD 748.5 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030.

Key Companies & Market Share Insights

The market is characterized by the presence of multinational as well as regional players and several public-listed companies globally, making the market space highly competitive. Key players mainly cater to the demand from food, beverages, pharmaceutical, and beauty products industries.

Major players operating in the caps and closures industry are undertaking different strategies such as product launches, mergers, joint ventures, acquisitions, and geographical expansion. For instance, in February 2023, Berry Global Inc. introduced a comprehensive packaging solution specifically designed for pharmaceutical and herbal markets, targeting syrup and liquid medicines. This solution includes child-resistant and tamper-evident PET bottles and closures. The product range consists of seven different sizes, ranging from 20ml to one liter, all featuring a 28mm neck. Notably, certain bottles and closures within this range have undergone rigorous testing and certification processes, meeting child-resistant standards set by the EU's ISO8317 and US' 16CFR1700.20 regulations.

Key Caps And Closures Companies:

• Crown

• Amcor plc

• Closure Systems International

• Ball Corporation

• Silgan Holdings Inc.

• Guala Closures S.p.A

• AptarGroup, Inc.

• BERICAP

• Nippon Closures Co., Ltd.

• Sonoco Products Company

• Webpac Ltd

• JELINEK CORK GROUP

• UAB Elmoris

• CL Smith

• PELLICONI & C. SPA

• O. BERK

• UNITED CAPS

Order a free sample PDF of the Caps And Closures Market Intelligence Study, published by Grand View Research.

#Caps And Closures Market#Caps And Closures Industry#Caps And Closures Market size#Caps And Closures Market share#Caps And Closures Market analysis

0 notes

Text

0 notes

Text

Purging Compound Market Size, Share, Report Analysis 2024-32

The global purging compound market size reached US$ 601.3 Million in 2023. Looking forward, IMARC Group expects the market to reach US$ 928.1 Million by 2032, exhibiting a growth rate (CAGR) of 4.94% during 2024-2032.

0 notes

Text

Purging Compound Market Worth $707.9 Million By 2025 | CAGR: 5.9%

The global purging compound market size is expected to reach USD 707.9 million by 2025, expanding at a CAGR of 5.9%, according to a new report by Grand View Research, Inc. The growing plastic processing machinery industry in Asia Pacific is anticipated to be a major driving force triggering the market growth. Injection molding segment has been observing noteworthy growth in the purging compound…

View On WordPress

0 notes

Text

Get Ready for a Wild Ride: The Surprising Surge of the Global Purging Compound Market in 2032: AMR

0 notes

Text

Plastic Compounding Market Trends | Segmentation, Outlook, Industry Report to 2032

The global plastic compounding market is set to witness an impressive growth rate of 7.4% from 2022 to 2032. The plastic compounding market size is anticipated to reach a valuation of around US$ 163.9 Billion by the end of 2032 from the current valuation of US$ 64.8 Billion in 2022.

The plastic compounding process is being utilized to improve electrical properties and UV resistance in polymers rendering it a very critical material in industrial applications. On the other hand, custom polymer compounding is becoming more common in the plastic compounding industry to achieve high-performance qualities in plastic-based goods. The improving economic condition and the rise of plastic end users have promoted plastic compounding market growth.

Due to the comparatively liberal administrative involvement regarding the inclusion of plastics in building materials, rising construction investment is anticipated to present growth possibilities for PVC compounds. The surge in the usage of purging compounds for injection moulding in the building industry is due to their application in flooring, insulation, storage tanks, performance safety windows, doors, pipelines, and cables.

The Asia Pacific plastic compounding market is anticipated to experience increased demand as a result of the expanding manufacturing sector. It is the leading manufacturer and user of consumer goods, autos, and packaging materials, which have cleared the path for the rapid adoption of the plastic compounding process.

Request a Sample @ https://www.futuremarketinsights.com/reports/sample/rep-gb-15461

Competitive Landscape

Some of the well-known plastic compounding market players are BASF SE, LyondellBasell Industries Holdings B.V., Dow, Inc., DuPont, SABIC, RTP Company, S&E Specialty Polymers, LLC (Aurora Plastics), Asahi Kasei Corporation, Covestro AG, Washington Penn, Eurostar Engineering Plastics (EEP), KURARAY CO., LTD., TEIJIN LIMITED, Evonik Industries AG, Dyneon GmbH & Co KG among others.

With the rise of independent fully functional plastic compounding market key players, the sector has seen major capacity growth in last few years. Original Equipment Manufacturers or OEMs, which often enter into strategic relationships with plastic compounding market major players, have emerged to be the major market drivers.

Plastic Compounding Market by Segmentation

By Product Outlook:

Polyethylene (PE)

Polypropylene (PP)

Thermoplastic Vulcanizates (TPV)

Thermoplastic Polyolefins (TPO)

Poly Vinyl Chloride (PVC)

Polystyrene (PS)

Polyethylene Terephthalate (PET)

Polybutylene Terephthalate (PBT)

Polyamide

Polycarbonate

Acrylonitrile Butadiene Styrene (ABS)

Others

By Application Outlook:

Automotive

Building & Construction

Electrical & Electronics

Packaging

Consumer Goods

Industrial Machinery

Medical Devices

Optical Media

Others

Recent Developments in the Global Plastic Compounding Market:

Dow, Inc. Company revealed about its investment projects to enhance circular plastics in October 2021 and start supplying it by 2022. These developments will contribute to the reduction of GHG emissions, the prevention of plastic waste, and the availability of recycled polymers with comparable qualities to fresh plastics.

Browse latest Market Reports@ https://www.futuremarketinsights.com/category/chemicals-and-materials

0 notes

Text

Plastic Compounding Market Size To Reach USD 163.9 Billion By 2032

The plastic compounding market size is anticipated to reach a valuation of around US$ 163.9 Billion by the end of 2032 from the current valuation of US$ 64.8 Billion in 2022. The global plastic compounding market is set to witness an impressive growth rate of 7.4% from 2022 to 2032.

The plastic compounding process is being utilized to improve electrical properties and UV resistance in polymers rendering it a very critical material in industrial applications. On the other hand, custom polymer compounding is becoming more common in the plastic compounding industry to achieve high-performance qualities in plastic-based goods. The improving economic condition and the rise of plastic end users have promoted plastic compounding market growth.

Due to the comparatively liberal administrative involvement regarding the inclusion of plastics in building materials, rising construction investment is anticipated to present growth possibilities for PVC compounds. The surge in the usage of purging compounds for injection moulding in the building industry is due to their application in flooring, insulation, storage tanks, performance safety windows, doors, pipelines, and cables.

The current trend of creating PVC from bio-based materials has been a very successful endeavour by plastic compounding market players. For instance, the newly unveiled Equilibrium plasticizer by Dow Chemical Company is expected to have a favourable impact on the growth of plastic compounding market opportunities throughout the projection period.

Request a Sample @ https://www.futuremarketinsights.com/reports/sample/rep-gb-15461

The Asia Pacific plastic compounding market is anticipated to experience increased demand as a result of the expanding manufacturing sector. It is the leading manufacturer and user of consumer goods, autos, and packaging materials, which have cleared the path for the rapid adoption of the plastic compounding process.

Key Takeaways from Market Study

By maintaining the typical CAGR of 7.4%, it is predicted that the entire growth of the worldwide market for plastic compounding would be over US$ 99 Billion within the next 10 years.

Based on various product forms, polypropylene compound is the highest-grossing sector of the target market, with an estimated total share of 25% in 2022.

The most common application of plastic components is used to make automotive components, which is figured out to have a market share of 20% in 2022.

The plastic compounding market analysis report in 2022 indicated that Asia Pacific is the dominant region with a market share of more than 40%.

Competitive Landscape

Some of the well-known plastic compounding market players are BASF SE, LyondellBasell Industries Holdings B.V., Dow, Inc., DuPont, SABIC, RTP Company, S&E Specialty Polymers, LLC (Aurora Plastics), Asahi Kasei Corporation, Covestro AG, Washington Penn, Eurostar Engineering Plastics (EEP), KURARAY CO., LTD., TEIJIN LIMITED, Evonik Industries AG, Dyneon GmbH & Co KG among others.

With the rise of independent fully functional plastic compounding market key players, the sector has seen major capacity growth in last few years. Original Equipment Manufacturers or OEMs, which often enter into strategic relationships with plastic compounding market major players, have emerged to be the major market drivers.

Recent Developments in the Global Plastic Compounding Market:

Dow, Inc. Company revealed about its investment projects to enhance circular plastics in October 2021 and start supplying it by 2022. These developments will contribute to the reduction of GHG emissions, the prevention of plastic waste, and the availability of recycled polymers with comparable qualities to fresh plastics.

Plastic Compounding Market by Segmentation

By Product Outlook:

Polyethylene (PE)

Polypropylene (PP)

Thermoplastic Vulcanizates (TPV)

Thermoplastic Polyolefins (TPO)

Poly Vinyl Chloride (PVC)

Polystyrene (PS)

Polyethylene Terephthalate (PET)

Polybutylene Terephthalate (PBT)

Polyamide

Polycarbonate

Acrylonitrile Butadiene Styrene (ABS)

Others

By Application Outlook:

Automotive

Building & Construction

Electrical & Electronics

Packaging

Consumer Goods

Industrial Machinery

Medical Devices

Optical Media

Others

By Region:

North America

Latin America

Europe

East Asia

South Asia

Oceania

Middle East and Africa

Read Full Report @ https://www.futuremarketinsights.com/reports/plastic-compounding-market

0 notes

Link

#Purging Compound Market#Purging Compound#Purging Compound Market Size#Purging Compound Market Share

0 notes

Link

“Purging Compound Market” report focuses on the market status, future forecast, growth opportunities, market trends and leading players.

0 notes

Link

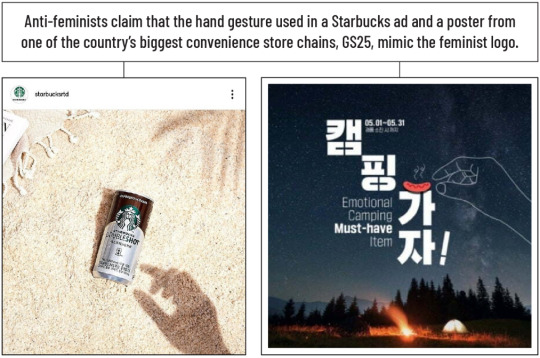

Why a hand gesture has South Korean companies on edge 👌

It took three years for players to notice the "offensive" hand gesture lurking in one of South Korea's most popular multiplayer games.

When players made their avatars laugh, talk or give the "OK" sign in "Lost Ark," they clicked an icon featuring a gesture that might have appeared benign to many: an index finger nearly touching a thumb.

But some of "Lost Ark's" users began claiming in August that the gesture was a sexist insult against men, and they demanded its removal.

What happened next underscores a trend in South Korea among anti-feminists, who have been increasingly pushing companies to repent for what they see as a conspiracy within the government and private companies to promote a feminist agenda.

Smilegate — the creator of "Lost Ark" and one of South Korea's biggest video game developers — quickly complied with the requests for removal. The company removed the icon from the game, and vowed to be more vigilant about policing "game-unrelated controversies" in their products.

A gender war has been unfolding in South Korea for years, pitting feminists against angry young men who feel they're being left behind as the country seeks to address gender inequality.

Now, though, the latest development in this war is reaching a fever pitch. Since May, more than 20 brands and government organizations have removed what some see as feminist symbols from their products, after mounting pressure. At least 12 of those brands or organizations have issued an apology to placate male customers.

Anti-feminism has a years-long history in South Korea, and research suggests that such sentiments are taking hold among the country's young men. In May, the Korean marketing and research firm Hankook Research said it found that more than 77% of men in their twenties and more than 73% of men in their 30s were "repulsed by feminists or feminism," according to a survey. (The firm surveyed 3,000 adults, half of whom were men.)

The fact that corporations are responding to pressure to modify their products suggests that these anti-feminists are gaining influence in a country that is already struggling with gender issues. The Organization for Economic Cooperation and Development says that South Korea has by far the largest gender wage gap among OECD countries. And roughly 5% of board members at publicly listed companies in the country are women compared to the OECD average of nearly 27%.

A suspicious sausage

The online firestorm that has spread across South Korea's corporate landscape kicked off in May with a simple camping advertisement.

GS25, one of the country's biggest convenience store chains, released an ad that month enticing customers to order camping food on their app, promising free items as a reward. The ad showed an index finger and a thumb appearing to pinch a sausage. The finger-pinching motif is frequently used in advertising as a way to hold an item without obscuring the product.

Critics, though, saw something different in that hand signal. They accused it of being a code for feminist sympathies, tracing the use of the finger-pinching motif to 2015, when the symbol was co-opted by Megalia, a now-defunct feminist online community, to ridicule the size of Korean men's genitals.

Megalia has since shut down, but its logo has outlived the group. Now anti-feminists are trying to purge South Korea of its existence.

Source: Megalia, @starbucksrtd/Instagram, @gs25_official/Instagram

GS25 removed the hand symbol from the poster. But critics still weren't satisfied, and began trawling the advertisement for other feminist clues. One person pointed out that the last letter of each word featured on the poster — "Emotional Camping Must-have Item" — spelled "Megal," a shorthand for "Megalia," when read backward.

GS25 removed the text from the poster, but that still wasn't enough. People theorized that even the moon in the background of the poster was a feminist symbol, because a moon is used as the logo of a feminist scholar organization in South Korea.

After revising the poster multiple times, GS eventually pulled it entirely, just a day after the campaign launched. The company apologized and promised a better editorial process. It also said it reprimanded the staff responsible for the ad, and removed the marketing team leader.

The online mob had tasted success, and it wanted more.

Other companies and government organizations soon became targets. The online fashion retailer Musinsa was criticized for offering women-only discounts, as well as using the finger-pinching motif in an ad for a credit card. The company defended the use of that motif as a neutral element regularly used in advertising, and said its discount program was meant to help expand its small female customer base. Still, founder and CEO Cho Man-ho stepped down after the backlash.

South Korean demonstrators hold banners during a rally to mark International Women's Day as part of the country's #MeToo movement in Seoul on March 8, 2018. Dongsuh, the Korean company that licenses a Starbucks ready-to-drink line in the country, was attacked in July after one of its Korean Instagram accounts published an image of fingers pinching a can of coffee. The company pulled the ad and apologized, saying that it "considers these matters seriously." The firm also said the image had no hidden intent.

Even local governments have been caught up in the pressure campaign. The Pyeongtaek city government was criticized in August after uploading an image to its Instagram account that warned residents of a heatwave. It used an illustration of a farmer wiping his forehead — and critics noticed that the farmer's hand was shaped similarly to the finger pinch.

"How deeply did [feminists] infiltrate?" one person wrote on MLB Park, an internet forum used primarily by men. Another person shared contact information for the city government, encouraging people to flood their channels with complaints. The image was later removed from the Instagram account.

Gender wars

At the core of the anti-feminist campaign is a widespread fear among young men that they are falling behind their female peers, according to Professor Park Ju-yeon, professor of sociology at Yonsei University.

The sentiment has grown because of a��hyper competitive job market and skyrocketing housing prices. The government has also rolled out programs in recent years to bring more women into the workforce. Proponents of those programs have said they're necessary for closing gender gaps, but some men have worried they give women an unfair advantage.

Another compounding factor: Unlike women, men in South Korea have to complete up to 21 months of military service before they're 28 years old — a sore point for some men who feel unfairly burdened.

Anti-feminists have also taken umbrage with President Moon Jae-in, who, when elected in 2017, promised to be a "feminist president." Moon pledged to fix the systemic and cultural barriers that prevented women from participating more in the workforce. He also vowed to address sexual crimes in the wake of the global #MeToo movement.

This year's corporate pressure campaign adds another complication, as brands weigh the possible fallout.

Young men are "big spenders," said Professor Choi Jae-seob, a marketing professor at Namseoul University in Seoul. He added that many young people today are driven by personal political values when they buy things.

Ha, a 23-year-old university student, said he pays attention to what companies say about gender issues before making a purchase.

"Between two stores, I would use the one that doesn't support [feminism]," said Ha, who declined to give his full name because he said that gender is a thorny topic among his peers.

Ha said he's far from alone. When his friends were discussing the GS25 camping poster, for example, he was surprised to find that many of them felt the way he did: "I realized that many men were silently seething."

"I realized that many men were silently seething."Ha, a 23-year-old university student

The gender war leaves companies in a tough spot, according to Noh Yeong-woo, a consultant at the public relations agency PR One.

By not responding to allegations that they are taking a stance on gender issues, that could lead to what Noh called a "constant barrage of accusation" and the creation of a stigma. It also means that companies are actively monitoring online groups and studying what their users have designated as hidden codes or associations, to avoid being called out.

"They are continuously checking for the next problematic symbols," Noh said of brands in South Korea.

Stigmas and fighting back

Some women, though, say that the corporate apologies are also creating a climate where some people are afraid to identify as feminist.

"It's the new Red Scare. Like McCarthyism," said Yonsei University's Park, referring to the mass hysteria to root out communists in the United States in the 1950s.

Lee Ye-rin, a college student, said she has been a feminist since middle school. But in recent years she has found it impossible to be open about her stance.

"It's the new Red Scare. Like McCarthyism."Professor Park Ju-yeon, professor of sociology at Yonsei University

She recalled an incident in high school, when some boys openly heckled a feminist friend of hers while that friend was giving a class presentation on the depiction of women in the media. Lee and her classmates were too scared to defend the friend.

"We all knew that a person who would step up and say that feminism is not some weird thing would be stigmatized, too," Lee said.

In response to this year's anti-feminist pressure campaigns, though, some feminists have been fighting back. The apology over the camping poster from GS25, for example, prompted feminists to call for boycotts against the company. Some people shared images online of themselves shopping at rival stores, using hashtags that called on people to avoid shopping at GS25.

Balancing act

As there doesn't seem to be much hope of finding middle ground for those waging South Korea's gender war, experts say companies have to figure out ways to avoid being dragged into a brand-damaging fight.

Noh, from PR One, encouraged companies and organizations to educate their employees on gender sensitivity — and even reconsider the use of symbols that have become heavily politicized.

Finger-pinching motifs "are images with complex metaphors and symbols and they already carry a social stigma," he said. "So, once you get involved in it, it's hard to explain them away ... the issue keeps spreading until they are removed as demanded."

Park, the Yonsei University professor, said that part of the problem is that many South Korean companies are led by older men who don't have a firm grasp of present-day gender issues. The average age of an executive-level employee at the country's top 30 publicly traded companies is 53, according to a 2020 analysis by JobKorea, a Korean version of LinkedIn.

That suggests a level of irony. Maybe it's not that some of these companies have a specific agenda, as online critics are accusing them. Perhaps for some of them, high levels of leadership are just not in tune with the debate.

To Park, the vitriol directed at companies has also buried some of the underlying, systemic issues that contribute to gender inequality, along with debates about how best to crack the glass ceiling or address the division of labor at home, among other concerns.

"Some very important debates are being buried," Park said, adding that today's gender war is being fought on the tip of the "iceberg." "It's not a fight about the fingers."

60 notes

·

View notes

Note

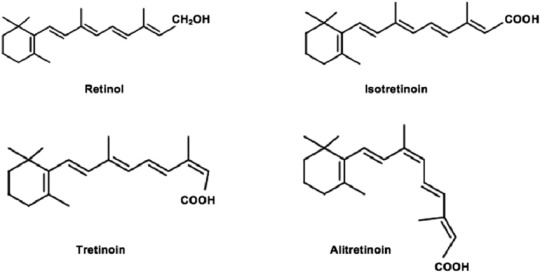

Hey Lori, I was wondering if you could help me with a skincare question. I took isotretinoin for a hear and a half two years ago for severe acne, and it gave me flawless skin for a year, but now I have acne again. It's not as severe as it was back then but it's still enough to bother me. However I would not like to take Accutane again as the side effects really bothered me. So I was wondering if applying tretinoin cream has the same/similar effects? After all, it is the same active (right?)

the answer to your question is yes but no lol. isotretinoin and tretinoin, while technically the same thing, are not actually the same thing. “wait what” u might ask. that is because they are isomers! which means they have the same formula, aka the same atoms make up both molecules, but the configuration of those molecules in the space they occupy is different.

here, take a peep:

as u can see, isotretinoin and tretinoin are cis-trans isomers. what does that mean? it may mean nothing, it may mean everything. to explain it simply, the spacial configuration of a double bond influences on how a compound interacts with other things. two isomers may have similar effects but they also may have completely different (and sometimes opposite!) effects. there are medications that had to be pulled from the market because one isomer would be, like, a headache medication, and the other would cause malformation on babies. yikes. I’d love to bore you more with chemistry talk but this is really all you need to know: they are “technically” the same thing, but actually, they are not. so operating under the impression tret cream will give you the exact same result as accutane is wrong! however! all is not lost!

isotretinoin works by actually shrinking the size of your pores because it reduces your oil production. (that’s why your skin looks so dang PERFECT. oh, how I miss my accutane skin) as far as I understand (be aware that I’m but a lil chemistry dropout and an enthusiast - I do my best but I’m no specialist), it does so by blocking the production of sebum on a molecular level. your pores shrink because there is simply not enough stuff happening there to justify them being more stretched out (not more open, because pores don’t open and close. they are pores, not doors). tretinoin, as other retinoid creams like adapalene and actual retinol, actually does kind of the the opposite! it stimulates cellular renewal, basically making ur skin go brrrrrrr really fast. in other words, it accelerates your natural skin cycle. that is why, a couple weeks into using a retinoid, you will get what is called a “purge” - the retinoid accelerated the surfacing of the closed comedones that would later become acne under your skin. however, if you brace through the purge, your skin benefits from being constantly stimulated. there is less of a chance for a closed comedone to form because there isn’t “idle” skin on ur face, and as a bonus, this also stimulates collagen production. other good news? your pores shrink when they are more clean, so since a chemical exfoliator like tretinoin helps with maintaining ur pores pristine, they do actually shrink with time (obviously as soon as you upkeep your care).

so! in the end both of them target acne in different ways. so the reply to ur q is yes but no - yes, they end up targeting similar things and having the similar result of helping with acne, but no, they are not the same thing. accutane will take a couple weeks (!) to take action, while a retinoid purge can last MONTHS. that is something to consider. I’m not a derm so I can’t really tell you what to do (as both of them require a doctor’s prescription) but since your acne isn’t bothering you so much rn I wouldn’t take accutane again if I were you just because of the side effects. it depends on what ur doc says when they see ur skin. but if you ask for a tretinoin cream prescription you will be asking for a very good alternative!!! I’ve seen incredible results with tret, there is a subreddit called r/tretinoin if you want to go there take a peep at the before and afters. some of them are simply unbelievable and u might bump into me in the comments hehe ;)

I hope I didn’t ramble too much! sorry if I did! I fuckin love talking about retinoids! they’re so fuckin interesting! chemistry fuckin rules! if you have any further questions pls shoot them my way I love a good excuse to go read up on retinoids on the journal of dermatology instead of studying hehe

21 notes

·

View notes

Link

Purging compounds are plastic resins that are used to clean and remove contagions from plastic processing machines such as injection molding, blow molding and extrusion processes. Purging compound removes un-melted resins, true gels, degraded residues, foreign contaminants, moisture and air bubbles from screws and barrels.Global Purging Compound Market based on type has been segmented into mechanical purging, chemical/foaming purging and liquid purging. The chemical/foaming and liquid purging is largely used in industry.The market based process has been segmented into injection molding, extrusion and blow molding. The extrusion segment is expected to hold one of the largest shares of the market during the forecast period. This is due to wide use of purging compound in the plastic processing equipment industry.

0 notes

Text

Purging Compound Market Size, Share, Growth and Report 2024-2032

The global purging compound market size reached US$ 601.3 Million in 2023. Looking forward, IMARC Group expects the market to reach US$ 928.1 Million by 2032, exhibiting a growth rate (CAGR) of 4.94% during 2024-2032. The growing focus on minimizing waste production and maintaining quality control, increasing popularity of thermoplastic processing, and rising utilization of polyester polymers in the textile industry to produce clothes are some of the major factors propelling the market.

0 notes

Text

Purging Compound Market Worth $707.9 Million By 2025 | CAGR: 5.9%

The global purging compound market size is expected to reach USD 707.9 million by 2025, expanding at a CAGR of 5.9%, according to a new report by Grand View Research, Inc. The growing plastic processing machinery industry in Asia Pacific is anticipated to be a major driving force triggering the market growth. Injection molding segment has been observing noteworthy growth in the purging compound…

View On WordPress

0 notes