#Property for Sale in Cyprus

Explore tagged Tumblr posts

Text

Cyprus Real Estate: A Rollercoaster Ride of Market Trends and Price Fluctuations

The Cypriot real estate market has experienced significant ups and downs over the years, reflecting the island's economic and political landscape. From boom times to challenging periods, the journey of property for sale in Cyprus has been nothing short of a rollercoaster ride. Let's delve into the fascinating history of this market and explore the factors that have influenced property prices over the decades.

The Early Years: Post-Independence Boom (1960s-1970s)

Following Cyprus's independence in 1960, the real estate market experienced a period of growth. The emerging tourism industry sparked interest in coastal properties for sale Cyprus, particularly in areas like Famagusta. During this time, property prices saw a steady increase as both locals and foreigners invested in holiday homes and hotels.

Turbulent Times: The Impact of the 1974 Invasion

The Turkish invasion in 1974 had a profound effect on the Cyprus property market. The division of the island led to a significant drop in property values, especially in the north. In the government-controlled areas, there was an initial slump followed by a gradual recovery as displaced Cypriots sought new homes.

Recovery and Growth: The 1980s and 1990s

The 1980s marked the beginning of a recovery period for the Cyprus real estate market. As the economy stabilized, property prices began to rise again. The 1990s saw an influx of foreign buyers, particularly from the UK and Russia, attracted by the island's climate and relatively low property prices. This period witnessed a steady appreciation in the value of property for sale Cyprus.

The EU Accession Boom: Early 2000s

Cyprus's entry into the European Union in 2004 triggered a property boom. Prices skyrocketed as foreign investors rushed to buy before the anticipated price hikes. Between 2004 and 2008, some areas saw property values double or even triple. This period marked the peak of the market, with luxury villas and apartments in prime locations commanding premium prices.

Global Financial Crisis: The 2008 Crash

The global financial crisis of 2008 hit the Cyprus property market hard. Property prices plummeted, with some areas experiencing drops of up to 50%. Many foreign investors who had bought at the peak of the market found themselves in negative equity. The market entered a period of stagnation, with little activity in property sales.

The Banking Crisis and Its Aftermath: 2012-2015

The 2012-2013 Cypriot financial crisis, culminating in the controversial bank deposit haircut, further depressed the property market. Prices continued to fall, and many properties for sale in Cyprus struggled to find buyers. This period saw a significant increase in distressed sales and repossessions.

The Road to Recovery: 2016 Onwards

From 2016, the Cyprus property market began showing signs of recovery. The introduction of incentives for foreign buyers, including the "golden visa" scheme, helped stimulate demand. Prices started to stabilize and then gradually increase, particularly in popular coastal areas and Nicosia.

Current Trends and Future Outlook

Today, the Cyprus property market is in a phase of steady growth. While prices have not returned to the peak levels of 2007-2008, they have shown consistent appreciation in recent years. Luxury properties and new developments in prime locations are seeing particularly strong demand.

Looking ahead, factors such as sustainable development, technological integration in homes, and changing buyer preferences post-COVID-19 are likely to shape the market. The ongoing efforts to resolve the Cyprus problem could also have significant implications for property values across the island.

In conclusion, the history of the Cyprus real estate market is a testament to its resilience. Despite facing numerous challenges, the market has consistently bounced back, adapting to changing economic conditions and buyer preferences. For those considering properties for sale in Cyprus, understanding this historical context can provide valuable insights into potential future trends.

0 notes

Text

🏡 La Isla Projesi'nde Çok Özel Fiyatla Satılık 2+1 Loft Daire!

İnşaat süreci hızla ilerliyor! Teslim tarihi: Mart 2025. Döveç Group, hayallerinizdeki yaşam alanını kusursuz mimari ve eşsiz sosyal olanaklarla taçlandırmak için çalışıyor. 🌟 Doğa size aradığınız huzuru verecek, bu daire ise hayalinizdeki evi sunacak. La Isla Villas çok yakında sizlerle buluşacak! 🌿 Yeşil ile Bütünleşeceğiniz, Stresten Uzak Bir Yaşam 🌳 İskele ve Mağusa’ya yakın, prestijli bir konumda yer alan La Isla Villas, ada yaşantısının keyfini ve huzurunu temsil eden bir konseptle tasarlandı. Doğanın ve lüksün buluşma noktasında, çocukların güvenle vakit geçirebileceği, toplam 211 konuttan oluşan bu proje her açıdan harika bir konuma sahip. 🏖️ Long Beach Ormanı’nın yeşiline sadece 400 metre, sahilinin mavisine ise 700 metre mesafede, Mağusa-Karpaz anayolu ile Ötüken giriş yolunun güneyindedir. 🌺 Sokakta Çocukların Güvenli Oynayabileceği Bir Yaşam Alanı 🏀⚽ Her konutun özel bahçesi, özel veya ortak havuzları, restoranı, çalışma alanları, lounge, roof bar, spa, spor merkezi, futbol, basketbol, voleybol sahaları, tenis kortu, çocuk kulübü, korunaklı çocuk parkı, gençlik merkezi, barbekü alanı, evcil hayvan parkı ve botanik bahçesi gibi ortak fonksiyonları ile 211 konutluk bir mahalle sizi bekliyor. 🌟 Bu Çok Özel Fiyatla Satılık 2+1 Daire İçin Hemen Bizimle İletişime Geçin!

#ev#Kıbrıs#2+1#yatırım#amiralgayrimenkul#construction#property#investment#cyprus#holiday#famagusta#rental#sale#home#project#luxury#elegance#best

5 notes

·

View notes

Text

Blaze

1 note

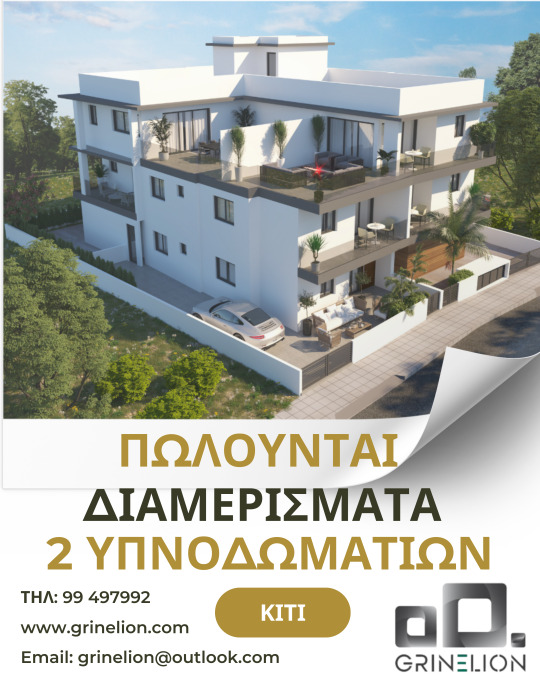

#propertyinkiti#kiti#cyprusproperties#cyprus#real estate#property for sale#property#properties#offplanpropertiesinkiti#apartment buildings#luxury apartments#residential#apartmentforsale#brandnewapartment#newproperty#forsale#2bedroomapartmentforsale#groundfloorapartmentforsale#penthouseapartmentforsale#larnaca#investement#new#newhome#energyefficiency#moderndesign#luxurylifestyle#unique#amazing#2025#project 2025

2 notes

·

View notes

Text

Find Your Ideal Home: Modern Apartments in Limassol, Larnaca, and Cyprus

If you’re looking to invest in property, Larnaca apartments for sale offer great options. Larnaca, a charming coastal city on the southern shores of Cyprus, has become one of the most desirable places to live due to its welcoming environment and excellent amenities. Whether you are a first-time homebuyer or an experienced investor, Larnaca’s range of residential apartments suits various needs and budgets. The city offers both modern, stylish apartments and more traditional homes, allowing you to find the perfect fit for your lifestyle.

Additionally, buy residential properties Cyprus to experience the island's excellent living standards. Cyprus is known for its warm Mediterranean climate, beautiful beaches, and a friendly community, making it an ideal place to live year-round or as a second home. Larnaca provides easy access to the international airport, making travel convenient for residents.

Apart from its natural beauty, Larnaca is a thriving city with plenty to offer. It is home to a variety of local shops, cafes, and restaurants, as well as cultural sites and historical landmarks. Whether you prefer a quiet, relaxed life by the beach or a more active, city-based lifestyle, buy residential properties Cyprus to enjoy everything this stunning island has to offer.

Explore the Larnaca apartments for sale and buy residential properties Cyprus to find your dream home. For more information read our blog now. https://lebrusdevelopment.wordpress.com/2025/02/20/find-your-ideal-home-modern-apartments-in-limassol-larnaca-and-cyprus/

0 notes

Text

Property for Sale in Northern Cyprus with Spacewise Real Estate

Northern Cyprus has emerged as a prime destination for property investors seeking beauty, convenience, and a vibrant Mediterranean lifestyle. As one of the most dynamic areas for real estate, Northern Cyprus offers a wealth of opportunities, from luxurious beachfront properties to charming village homes. At Spacewise Real Estate, we are dedicated to helping you find the perfect property for sale in Northern Cyprus that matches your lifestyle and investment goals.

Why Choose Northern Cyprus?

Northern Cyprus combines natural beauty with a warm, welcoming culture. This hidden gem in the Mediterranean boasts pristine beaches, scenic mountain views, and a rich historical heritage. The cost of living is affordable compared to many Western countries, making it attractive to retirees and young professionals alike.

One of the most significant draws of investing in property in Northern Cyprus is the favorable tax environment and relatively low property prices compared to other European and Mediterranean destinations. Whether you’re looking to purchase a summer villa, a family home, or an investment property, Northern Cyprus offers unmatched value.

Types of Properties Available

At Spacewise Real Estate, we provide a diverse selection of properties tailored to suit every taste and budget:

Beachfront Villas: For those who desire direct access to the sea, our selection of luxurious beachfront villas offers stunning views and proximity to some of the most beautiful beaches in Northern Cyprus.

Modern Apartments: Perfect for young professionals and small families, our contemporary apartments feature all the amenities you need for a comfortable lifestyle.

Traditional Village Homes: Experience the charm of traditional Cypriot living with our range of properties in scenic villages. These homes offer unique architecture and a tranquil atmosphere.

Why Choose Spacewise Real Estate?

With a deep understanding of the Northern Cyprus real estate market, Spacewise Real Estate is your trusted partner for all property needs. We offer personalized services and expert guidance, helping you make informed decisions to secure the best property for sale in Northern Cyprus. Our team will walk you through every step, from property selection to finalizing legal documents, ensuring a seamless buying experience.

Ready to Find Your Dream Property?

If you’re considering property for sale in Northern Cyprus, Spacewise Real Estate is here to assist. Our expert team provides unparalleled local knowledge and insight to match you with properties that meet your needs and aspirations. Let us help you make the move to this Mediterranean paradise today.

0 notes

Text

Best Property Selling Company in North Cyprus

The Redland Property Group is the foremost option for property sales in North Cyprus, distinguished by our unwavering commitment to excellence, transparency, and client satisfaction. Our company has solidified its position as the region's top choice. Backed by a dedicated team of experts, we deliver unmatched service, guaranteeing a smooth and gratifying experience for individuals seeking to buy or sell properties in North Cyprus. Contact us today to learn more information!

0 notes

Text

0 notes

Text

Properties for Sale in Limassol: Your Pathway to Homeownership with Licensed Real Estate Agents

When it comes to finding the perfect property in Limassol, the journey is made smoother with licensed real estate agents. Explore the diverse range of properties for sale in this vibrant city and discover how seasoned professionals ensure a secure and rewarding investment.

Unlocking Limassol's Property Potential: Limassol's real estate market offers a myriad of options, from residential retreats to commercial spaces that cater to various needs. Whether you're looking for a cozy apartment, a dynamic office space, or a prime retail location, Properties for Sale in Limassol are abundant and varied.

Guidance by Licensed Real Estate Agents: Navigating the intricate world of real estate demands expertise, and licensed Property Agents in Cyprus provide just that. Their in-depth knowledge of local markets and regulations empowers you to make informed decisions. With their guidance, your property search becomes targeted, efficient, and secure.

Choosing a Licensed Real Estate Agency in Limassol: When it comes to buying property, partnering with Licensed Real Estate agency Limassol is crucial. These agencies combine local insights with global standards, ensuring seamless transactions that align with your goals. With affiliations to recognized associations, they bring integrity and professionalism to every interaction.

In the journey to homeownership, the guidance of licensed real estate agents elevates your experience. Whether you're a first-time buyer or a seasoned investor, their expertise ensures your investment is not only sound but also fulfilling. Embrace the possibilities that Limassol's properties for sale offer, and let licensed professionals pave the way for your real estate success.

1 note

·

View note

Text

Income threshold adjustments for the Cypriot residency program

Are you seeking to migrate to Cyprus? The Cypriot government recently announced an amendment to the income requirement for the residency program, boosting it from €20,000 to €30,000. This revision is meant to make it simpler for individuals to migrate to the nation and establish new lives in a dynamic, Mediterranean setting. In this blog article, we'll explore the changes to the income level and how they will influence the residency program.

Background on the Cypriot Residency Program

The Cypriot residency program, also known as the Cyprus Investment Program, was launched in 2013 to promote international investment in the country. It gives non-European Union persons the possibility to earn Cypriot citizenship or residence via several investment alternatives. To be eligible for the residence program, candidates must meet specific conditions, including making a large investment in Cyprus. This may be done by acquiring real estate, founding a company, or investing in government bonds or financial assets. Once accepted, successful candidates and their families may enjoy the advantages of residing in Cyprus, such as access to great healthcare and education, a high level of living, and visa-free travel to many countries. The initiative has been effective in recruiting international investors and improving the Cypriot economy. It has become especially popular among people from nations like China, Russia, and the Middle East.

Over the years, the program has undergone several modifications and improvements to make it more appealing and accessible to prospective investors. This includes the current increase to the income threshold, which has been raised from €20,000 to €30,000. In the following sections, we will analyze why income levels matter in the residency program, review the recent revisions in greater depth, and assess the effect they will have on candidates. We will also compare the Cypriot scheme with other residence programs in the European Union.

What are income thresholds and why do they matter?

Income thresholds are a significant part of every residency program, including the Cypriot residency program. An income threshold refers to the minimal yearly income that an applicant must earn in order to be eligible for the program. In the case of the Cypriot program, the current modification has increased the income level from €20,000 to €30,000. But why do income thresholds matter? Well, they serve as a tool for the government to guarantee that applicants have a secure financial basis to sustain themselves and their families while residing in Cyprus. By imposing minimum income criteria, the government hopes to recruit persons who are financially capable of contributing to the local economy and integrating into Cypriot society. Income limitations also assist in safeguarding the integrity of the program by prohibiting persons with inadequate financial means from acquiring the residence. This guarantees that only those who are really interested in investing in the nation and contributing to its progress are given residence. So, let's find some residential apartments for sale in north Cyprus. I think Cyprus is the best location to invest your money.

Furthermore, income requirements play a key part in establishing the level of life for successful candidates. Meeting the minimal income criteria guarantees that people may afford the cost of living in Cyprus, which includes costs such as housing, education, healthcare, and leisure activities. In summary, income requirements are an important component of the residency program as they help to attract financially competent persons who can contribute to the local economy, protect the program's integrity, and assure a decent quality of living for successful candidates and their families.

Recent modifications to income thresholds

The latest modifications to the income limits in the Cypriot residency program have generated a lot of attention and enthusiasm among prospective candidates. With the threshold being increased from €20,000 to €30,000, more persons will now be able to apply and take advantage of the perks that come with residing in Cyprus.

This modification is a deliberate effort by the Cypriot government to attract a broader spectrum of persons who can contribute to the local economy and bring new ideas and investments to the nation. By raising the salary criteria, the government is guaranteeing that applicants have the financial stability to sustain themselves and their families while residing in Cyprus. For many, the change to the income level offers new opportunities. Individuals who previously may not have satisfied the prior income threshold now have the option to follow their ambitions of living in a lovely Mediterranean setting. Whether it's launching a company, investing in real estate, or just enjoying a high quality of life, the choices are unlimited. It's crucial to note that although the income criterion has been changed, all other qualifications for the residency program remain the same. Applicants will still need to satisfy the investment requirements and complete other qualifying conditions.

Impact of the increased income limitations on applicants

With the recent increase in the income requirements in the Cypriot residency program, prospective candidates are already feeling a substantial effect. The rise from €20,000 to €30,000 has opened up new prospects for those who may not have previously fulfilled the income criterion. For many, this tweak is a game-changer. It means that more individuals may now follow their ambitions of residing in the lovely Mediterranean setting of Cyprus. Whether it's launching a company, investing in real estate, or just enjoying a high quality of life, the choices are unlimited. The new income requirements provide people and their families the possibility to enjoy the advantages of living in Cyprus, such as access to great healthcare and education, a safe and dynamic society, and the option to travel visa-free to many countries. Furthermore, the modification to the income requirements indicates the Cypriot government's aim to recruit a wide variety of persons who can contribute to the local economy and provide new ideas to the nation. By enhancing the financial stability of applicants, the government is guaranteeing that individuals who are granted residence are capable of integrating into Cypriot society and having a constructive influence.

Overall, the effect of the increased income limitations on applicants is considerable. It offers a world of possibilities for persons who are willing to enjoy the beauty and opportunity that Cyprus has to offer.

Comparison with other EU residence schemes

When contemplating migrating to Cyprus, it's vital to compare the Cypriot residency scheme with other comparable programs in the European Union. While Cyprus provides various perks, it's always useful to grasp the possibilities accessible elsewhere. One popular option is the Portuguese Golden Visa scheme. This program offers residence to those who invest in Portugal, such as acquiring real estate or generating employment.

Portugal's scheme has gained appeal because of its lower investment requirement compared to Cyprus and the potential of getting citizenship after a specific term of stay. Another intriguing possibility is the Malta Individual Investor Program. This program gives citizenship to persons who make a large financial commitment to the nation, such as investing in government bonds or buying land. Malta is recognized for its advantageous tax structure and appealing lifestyle, making it a popular option for individuals seeking EU residence.

Additionally, the Greek Golden Visa program gives residence to people who invest in Greece. The program provides possibilities such as acquiring real estate or making a financial investment. Greece's rich history, gorgeous scenery, and affordable cost of living make it an alluring destination for many. It's vital to examine and evaluate various programs, taking into account elements such as investment requirements, processing timelines, and the perks that come with each program. Ultimately, the ideal residency program for you will rely on your personal objectives, interests, and financial resources.

#apartments for sale in north cyprus#properties for sale#real estate in northern cyprus#flats for sale#north cyprus property investment

1 note

·

View note

Text

Cyprus Real Estate Outlook 2025: Steady Growth and Strategic Investments

The Cypriot real estate market is set to sustain its growth momentum into 2025, building on a solid foundation established in previous years. With a projected compound annual growth rate (CAGR) of 3.51% from 2025 to 2029, the market is anticipated to reach a volume of approximately US$141.20 billion by 2029. This steady expansion is underpinned by rising property prices, robust foreign investment, and ongoing development projects across key regions.

Market Growth and Property Prices

Since 2019, property prices in Cyprus have surged by 50%, and forecasts indicate an additional 30% increase in the coming years. This upward trend is driven by sustained demand from both local residents and international buyers seeking attractive investment opportunities. The overall market growth is expected to continue, albeit at a more moderated pace compared to the rapid post-pandemic recovery. This balanced growth reflects a mature market adapting to economic conditions and investor expectations.

Regional Highlights

Nicosia, the capital, is poised for significant appreciation with average property prices expected to rise by 15% by the end of 2025. This increase is fueled by high demand and limited housing supply, making Nicosia a prime location for property investment. Limassol remains a focal point for luxury real estate, particularly within the limassol property market. The luxury apartment segment in Limassol is projected to see a 25% increase in value over the next two years, attracting high-net-worth individuals seeking premium living spaces.

Rental Market Dynamics

The rental sector is also experiencing dynamic changes, with short-term rentals expected to grow by 20% by 2025. This growth is supported by a thriving tourism industry and the popularity of platforms like Airbnb. Investors can look forward to average rental yields between 4% to 6% annually, with Limassol offering yields as high as 7%. Such returns make the market particularly attractive for those interested in flats for sale Limassol and other rental properties.

Construction and Development Trends

The construction sector is responding to the rising demand with a 10% annual increase in new residential projects until 2025. These developments are focused on providing modern living spaces that meet the needs of a diverse population. Additionally, there is a noticeable shift towards sustainable developments, with an emphasis on energy-efficient and environmentally friendly housing. This trend is driven by stricter environmental regulations and a growing preference for sustainable living among buyers and investors.

Market Sentiment and Economic Factors

Investor confidence in the Cypriot real estate market remains strong, supported by declining interest rates and the completion of numerous construction projects. The favorable tax regime, combined with Cyprus's high-quality lifestyle and strategic location, continues to attract international buyers, particularly from the UK. This influx of foreign investment plays a crucial role in maintaining the market's dynamism and resilience.

The Cyprus real estate market in 2025 is expected to maintain its upward trajectory, characterized by steady growth and strategic investments. Property prices are set to continue rising, supported by robust demand and limited supply in key regions like Nicosia and Limassol. The rental market offers lucrative opportunities, especially in high-demand areas, while construction trends point towards sustainable and modern developments. For those interested in houses for sale in Limassol Cyprus or exploring other property options, Cyprus presents a promising and stable environment for real estate investment. As the market evolves, stakeholders should stay informed about emerging trends and economic factors to make well-informed decisions in this vibrant sector.

The author specialises in real estate insights, providing up-to-date market trends and investment strategies. Explore top property listings, including houses and apartments for sale or rent in Limassol, Cyprus, by visiting https://chris-michael.com.cy/

0 notes

Text

Find Your Perfect Space ✅

Nestled within a vibrant neighborhood, your future home awaits. Crafted with care, this inviting space offers the perfect blend of comfort and community. Make it yours and enjoy a lifestyle designed around you.

Detaylar veya alternatifler için bize ulaşın. 👈

🌐www.amiralgayrimenkultr.com

☎ +1(862)413-7325 / (862)413-7326

☎ +90(549)485-7060 / (530)485-7060

☎ +90(216)370-0123

#Emlak#Yatırım#Fırsat#Yatırımcı#EmlakDanışmanlığı#amiralgayrimenkul#construction#property#investment#cyprus#holiday#famagusta#rental#sale#home#project#luxury#elegance#best#beach

0 notes

Text

Find Your Ideal Home: Modern Apartments in Limassol, Larnaca, and Cyprus

If you’re looking to invest in property, Larnaca apartments for sale offer great options. Larnaca, a charming coastal city on the southern shores of Cyprus, has become one of the most desirable places to live due to its welcoming environment and excellent amenities. Whether you are a first-time homebuyer or an experienced investor, Larnaca’s range of residential apartments suits various needs and budgets. The city offers both modern, stylish apartments and more traditional homes, allowing you to find the perfect fit for your lifestyle.

Additionally, buy residential properties Cyprus to experience the island's excellent living standards. Cyprus is known for its warm Mediterranean climate, beautiful beaches, and a friendly community, making it an ideal place to live year-round or as a second home. Larnaca provides easy access to the international airport, making travel convenient for residents.

Apart from its natural beauty, Larnaca is a thriving city with plenty to offer. It is home to a variety of local shops, cafes, and restaurants, as well as cultural sites and historical landmarks. Whether you prefer a quiet, relaxed life by the beach or a more active, city-based lifestyle, buy residential properties Cyprus to enjoy everything this stunning island has to offer.

Explore the Larnaca apartments for sale and buy residential properties Cyprus to find your dream home. For more information read our blog now. https://lebrusdevelopment.wordpress.com/2025/02/20/find-your-ideal-home-modern-apartments-in-limassol-larnaca-and-cyprus/

0 notes

Text

Property for Sale Northern Cyprus: Discover Your Dream Home

Northern Cyprus has become an increasingly popular destination for real estate investment, offering a unique blend of natural beauty, affordability, and cultural richness. Whether you're looking for a holiday home, a retirement haven, or a lucrative investment opportunity, property for sale Northern Cyprus is something worth exploring.

Property for sale Northern Cyprus offers a diverse range of options, from luxurious villas overlooking the Mediterranean Sea to modern apartments located in bustling city centers. One of the key benefits of investing in Northern Cyprus is the lower property prices compared to other Mediterranean destinations, without compromising on quality or lifestyle.

Why Invest in Northern Cyprus?

Strategic Location: Northern Cyprus is located at the crossroads of Europe, Asia, and the Middle East, making it a prime location for both personal use and rental opportunities.

Growing Tourism: The region attracts millions of tourists each year, driving up demand for holiday homes and short-term rentals.

Tax Benefits: Investors enjoy favorable tax conditions, with no capital gains tax after holding a property for five years.

Stunning Landscapes: With its beautiful beaches, mountains, and historical sites, Northern Cyprus offers a serene and picturesque environment for property owners.

Types of Property Available

There is something for everyone when it comes to property for sale Northern Cyprus. The types of properties available include:

Villas: Ideal for those looking for privacy and space, many villas come with private pools and breathtaking views.

Apartments: Modern apartments are perfect for singles, couples, or small families, often located near the coast or city centers.

Townhouses: A middle-ground option offering both community living and the luxury of more personal space.

Whether you are searching for a permanent residence or a second home, Northern Cyprus has a lot to offer. Start your journey by exploring the latest projects Spacewise and property for sale Northern Cyprus here.

Conclusion

Investing in property for sale Northern Cyprus is a smart move for anyone looking to enjoy a Mediterranean lifestyle without the high costs typically associated with similar regions. With its strategic location, tax incentives, and stunning surroundings, Northern Cyprus is the ideal place to find your dream property. Explore the latest real estate opportunities and make your investment today!

0 notes