#Properties in Toronto

Explore tagged Tumblr posts

Text

Scrimbly Jacqueline 50/52: the long bacon store is one of Dite's FAVOURITE places 🤭🤭💙💗

@kscribbs sent me the meme on insta like. two months ago and FIRST OFF, post looking it up, HOW DID I MISS THIS ONE! Secondly, we are now two for two with old memes in these scrimbles, lmao!

The lesbian pride flag is Dite's favourite of the lgbtqia plus flags! She likes pink very very much, you see :)

Her winter jacket is based on this pin. Fun fact! Dite actually has a pinterest board! Not sure if I've ever shared it? I haven't updated it in YEARS lol, now all that shit's mixed into my TO DRAW tag which I will be attempting to tackle ah, next year, lol.

Poor Jacqueline. Can't even keep it together for five minutes when visited by her gf on the job ¯\_(ツ)_/¯

#dani speaks#i briefly thought of doing the scarf as the bi flag or pan flag since those are their orientations#but those two have LESS bacon looking properties than the lesbian pride flag lol#anyway. drawing jacquie half thawed bc of dite is ALWAYS fun but it was ESPECIALLY fun this time around!#colouring* sorry lol#dani doodles#cs posting#crystal springs#diteline#donnieline#scrimbly jacquelines#this one is DEFFS my new fave!!!#it looks EVEN BETTER irl! the bodice and snow is SPARKLING and jacquie's hair looks SO GOOD#dite loves visiting her on the job and when she's in her regular dress#dite's like SCORE bc it means it's just flurries or light frosting#and she can now steal her away for the evening >:)#ALSO i was really proud of jacquie's cleavage hence why you can see it through the scarf lmao#i was so preoccupied having her breast boobily. I forgot about the BACON Y'ALL#anyway. ENJOY! posting late so i will most deffs rereblog it tomorrow while on the train to toronto :)

6 notes

·

View notes

Text

He held an old black boot in the air. "Meyers Toronto," was printed on the leather inside.

"It is worth a mud bath," said he. "It is our friend Sir Henry's missing boot."

"The Illustrated Sherlock Holmes Treasury" - Sir Arthur Conan Doyle

#book quotes#the hound of the baskervilles#sir arthur conan doyle#sidney paget#old boot#blacl boot#lost property#missing clothing#meyers toronto#sherlock holmes#mud bath#worthwhile

5 notes

·

View notes

Text

was going thru my camera roll looking for a very old meme and got caught up looking at some of my favorite pics from my travels

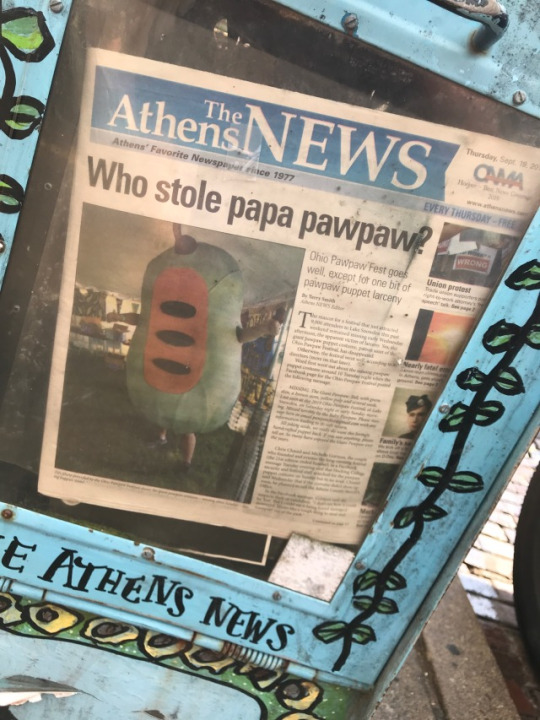

and, courtesy of the great state of Ohio:

#ok2rb#places are: copenhagen - toronto - hudson ny- klamath river in or - salt lake of ut- needles sd- clear lake ia- lake michigan in saugatuck#tuscon az- area southeast of hatch nm - pacific ocean in north ca- somewhere in minnesota - and the lovely athens oh#forgive the shitty instagram filter on some of these. some are very old photos i only have the insta version of anymore#kenposting#ohio natives let me know if papa pawpaw is ok#‘why are there a big pair of glasses on a farm in iowa?’ i hear u ask#well. that’s where buddy holly died. and that was the best memorial they could think of considering it’s private property

7 notes

·

View notes

Text

Enobariapilled on this fine evening. there is no Baby Book subway au but if there was I just know she’s running D-Beatstro like it’s the navy

#absolutely fucking up a kale salad#in this au she has adult braces#‘Horemheb if you don’t get that tofu scramble out there in 5 seconds I’m not coming to your noise show’#Cashmere keeps trying to get her to go to like Planta and Vegandale but she’s decided she’s above it#‘I’m not letting you gentrify my veganism Cash’ *pulls a whole cucumber out of her tote bag*#she is a personal friend of John Sakars#every media property I get weird about could plausibly have a mid-2010s Toronto au tbh…..

4 notes

·

View notes

Text

[ID: A meme showing a man placing a small domino at the end of a chain of increasingly large dominos. The smallest domino at the end is labeled “Kendrick drops new diss track” while the biggest domino at the other end is labeled “My mutual can afford an apartment”. END ID]

12K notes

·

View notes

Text

Trusted Commercial Property Management Company in Canada

Sider Property Management, a leading commercial property management company in Toronto, offers comprehensive solutions for commercial real estate investments across Canada. We handle everything from tenant relations to property maintenance, maximizing your ROI.

0 notes

Text

Toronto's Skyline Revolt: The HUB at 30 Bay Street - New

Toronto, known for its stunning skyline, is about to undergo a monumental transformation with the revival of a project that has long been dormant – The HUB at 30 Bay Street. This isn’t just another skyscraper; it’s poised to become a landmark that could redefine not only Toronto’s skyline but also its approach to commercial real estate in the post-COVID era. The Genesis of The HUBThe Pause that…

#Commercial Real Estate Toronto#Future of Work Toronto#Oxford Properties Group#Tallest Building in Canada#The HUB#Toronto&039;s Skyline#Urban Development 2030

0 notes

Text

0 notes

Video

youtube

What is the future for Canadian Real Estate

#youtube#realestate#Toronto real estate#toronto housing market#toronto property trends#housing#housing market update#housing market crash#canadian real estate#canada real estate#Canadian housing Market#Toronto real estate investment#toronto property market update#toronto housing market forecast#toronto home prices#Toronto real estate news

0 notes

Text

Available now for $679,900

1102 - 1 Valhalla Inn Road, Toronto

2 + 1 bedrooms

2 full washrooms

850+ Square Feet

Corner unit with views of Lake Ontario and Downtown Toronto.

Easy access to 427, TTC, shops, restaurants, Sherway Gardens, parks, trails, and more.

Message me for more information

0 notes

Text

Harry Naik: Your Trusted Partner Among Top Real Estate Agents in Toronto

Navigating Toronto’s bustling real estate market requires expertise, dedication, and a personalized approach. This is where Harry Naik, one of Toronto’s top real estate agents, excels. With a proven track record of success and a passion for helping clients achieve their real estate goals, Harry is the ideal partner for buying, selling, or renting properties in Toronto.

Understanding Toronto’s Real Estate Landscape

Toronto’s real estate market is one of the most dynamic and competitive in Canada. From luxury condominiums to family homes, the city offers diverse opportunities for buyers and sellers. However, finding the perfect property or securing the best deal requires in-depth market knowledge, negotiation skills, and a thorough understanding of client needs. Harry Naik combines all these qualities to deliver unmatched real estate solutions.

Why Choose Harry Naik?

Expert Knowledge: With years of experience in the Toronto real estate market, Harry provides invaluable insights to clients. Whether it’s understanding market trends, evaluating property values, or navigating legal procedures, Harry’s expertise ensures smooth transactions.

Client-Centered Approach: Every client’s journey is unique, and Harry prioritizes their individual needs. Whether you’re a first-time homebuyer, a seasoned investor, or looking to sell your property, Harry offers tailored solutions designed to meet your goals.

Proven Results: Harry’s impressive portfolio of successful transactions speaks to his dedication and skill. From negotiating favorable deals to closing complex transactions, his commitment to excellence sets him apart.

Comprehensive Services: Harry provides a full spectrum of real estate services, including buying, selling, renting, and investment consultation. His expertise spans various property types, including condos, single-family homes, and commercial properties.

Buy Your Dream Home in Toronto

For those looking to buy a home in Toronto, Harry Naik is the trusted guide you need. He helps clients navigate every step of the process, from understanding neighborhoods and schools to assessing future investment potential. With Harry’s guidance, you’ll find a property that suits your lifestyle and budget.

Sell Your Property with Confidence

Selling a property in Toronto can be daunting without the right strategy. Harry’s marketing expertise ensures your property gets the visibility it deserves. By using professional staging, photography, and targeted advertising, he maximizes your home’s value and attracts serious buyers.

Investment Opportunities in Toronto

Toronto is a hotspot for real estate investments. Harry assists investors in identifying lucrative opportunities, offering guidance on market trends and high-growth areas. His strategic approach helps clients make informed decisions that yield long-term returns.

What Clients Say About Harry

Harry’s clients consistently praise his professionalism, attention to detail, and ability to deliver results. From first-time buyers to seasoned sellers, his personalized service and unwavering dedication earn him glowing testimonials and referrals.

Contact Harry Naik Today

Ready to embark on your real estate journey? Let Harry Naik, one of the top real estate agents in Toronto, make it seamless and rewarding. Visit HarryNaik.com or call +1 (647) 204 4683 today to schedule a consultation.

Whether buying, selling, or investing, trust Harry to turn your real estate goals into reality.

#property#property dealer#property sales#property investing#propertyinvestment#propertyforsale#Real Estate Agents in Toronto

1 note

·

View note

Text

How to Secure Financing When Purchasing Property in Toronto

Assess Your Financial Health

Before diving into the real estate market in Toronto, it is important to first assess your financial health. Property prices in Toronto can be significantly higher compared to other Canadian cities, so ensuring your finances are in order will give you a clear picture of what you can afford.

Review Your Credit Score

Your credit score plays a major role in determining the type of mortgage you can secure and the interest rate you will be offered. Lenders typically look for a credit score of 650 or higher to approve mortgage applications. A higher credit score can give you access to better interest rates and more favorable loan terms, while a lower score may limit your options.

You can check your credit score with credit bureaus such as Equifax or TransUnion. If your score is lower than you’d like, it’s advisable to work on improving it before applying for a mortgage. Simple actions such as paying off outstanding debts, reducing your credit card balances, and ensuring timely bill payments can significantly improve your score.

Calculate Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio is another important factor that lenders assess when considering your mortgage application. This ratio is calculated by dividing your monthly debt payments by your gross monthly income. Generally, lenders prefer a DTI ratio of 36% or lower, though this can vary depending on the lender and your financial situation.

Determine Your Budget

Once you have a clear picture of your financial situation, the next step is determining your budget for purchasing property in Toronto. The budget should not only account for the cost of the property but also other expenses such as:

Down Payment: In Canada, the minimum down payment for a property is generally 5% of the purchase price for properties under $500,000. For homes priced between $500,000 and $1 million, the minimum down payment is 5% for the first $500,000 and 10% for the portion above that. For properties over $1 million, the down payment must be at least 20%.

Closing Costs: These include legal fees, property inspection fees, title insurance, and land transfer taxes. In Toronto, the municipal land transfer tax (in addition to the provincial tax) can be substantial, so it’s important to factor this into your budget.

Mortgage Insurance: If your down payment is less than 20%, you will need mortgage default insurance, which is provided by the Canada Mortgage and Housing Corporation (CMHC) or other approved insurers.

It’s essential to calculate these costs in advance to avoid any financial surprises and ensure you are prepared for the expenses associated with purchasing a property.

Explore Your Financing Options

Toronto’s real estate market is competitive, and securing financing can be complex. There are various options available for buyers, and choosing the right one depends on your financial situation, goals, and preferences.

Conventional Mortgages

A conventional mortgage is a standard loan that typically requires a down payment of at least 20%. Since you are not required to pay for mortgage default insurance, these mortgages tend to come with lower interest rates. Conventional mortgages are ideal for buyers who have a substantial down payment saved up and can afford a higher initial investment.

High-Ratio Mortgages

If you are unable to make a down payment of 20% or more, you may opt for a high-ratio mortgage. These mortgages are insured by CMHC, Genworth Canada, or Canada Guaranty and allow you to purchase a home with a down payment as low as 5%. However, keep in mind that the cost of mortgage insurance can add to your monthly payments.

Fixed-Rate Mortgages

A fixed-rate mortgage locks in your interest rate for the duration of the loan term, which can range from 1 to 10 years. Fixed-rate mortgages provide stability and predictability in monthly payments, making them a popular option for buyers who prefer consistency in their financing.

Variable-Rate Mortgages

A variable-rate mortgage offers an interest rate that fluctuates based on the prime lending rate set by the Bank of Canada. While variable-rate mortgages may offer lower initial rates, they come with a higher level of risk as your interest payments could increase if rates rise. However, they can be a good option if you anticipate a drop in interest rates or if you plan to sell the property within a few years.

Bank vs. Mortgage Broker

When securing financing, you can choose to approach a bank directly or work with a mortgage broker.

Banks: Working directly with a bank can be a good option if you already have an established relationship with the institution. However, banks may offer limited options and may not provide as personalized advice.

Mortgage Brokers: A mortgage broker acts as an intermediary between you and various lenders, helping you shop around for the best mortgage rates and terms. Brokers typically have access to a broader range of products and can often help you secure better deals, particularly if you have a complex financial situation.

Prepare Documentation

When applying for a mortgage in Toronto, you will need to provide a variety of documentation to prove your financial stability. Lenders will assess your ability to repay the mortgage, and they will require detailed information to make an informed decision.

Common documents required for a mortgage application include:

Proof of Identity: Government-issued ID such as a driver’s license or passport.

Proof of Income: Recent pay stubs, tax returns, or proof of business income (if self-employed).

Employment Verification: A letter from your employer verifying your job position and salary.

Credit Report: A recent credit report to assess your creditworthiness.

Down Payment: Proof of the source of your down payment, whether from savings, a gift, or another source.

It’s important to gather these documents early to streamline the approval process.

Get Pre-Approved for a Mortgage

One of the most important steps in securing financing is obtaining pre-approval for a mortgage. A pre-approval gives you an estimate of how much you can borrow based on your financial situation and provides a rough idea of your potential monthly payments. It also helps you understand what price range of properties you should be looking at, making it easier to focus on homes within your budget.

During the pre-approval process, the lender will review your credit score, income, employment history, and down payment. They may also lock in an interest rate for a period of time, which can be particularly beneficial if interest rates are expected to rise.

While a pre-approval is not a guarantee that you will receive a mortgage, it gives you a competitive edge when you start making offers on properties. Sellers are more likely to take you seriously if you have already been pre-approved for financing.

Consider Additional Financing Programs

In addition to traditional mortgage options, there are several government programs and incentives that can help with financing, particularly for first-time homebuyers.

First-Time Home Buyer Incentive (FTHBI): This program offers a shared equity loan from the federal government to help reduce monthly mortgage payments. Eligible first-time buyers can receive 5% or 10% of the home’s purchase price in the form of a shared loan.

Home Buyers’ Plan (HBP): This allows first-time homebuyers to withdraw up to $35,000 from their Registered Retirement Savings Plan (RRSP) to use as a down payment. The funds must be repaid over a 15-year period.

Understand Toronto-Specific Financing Considerations

Toronto’s real estate market is unique, and there are specific factors to consider when securing financing for a property in the city.

High Property Prices: Toronto’s housing market is known for its high property prices, particularly in desirable neighborhoods like downtown and Yorkville. This means you may need to look for larger down payments or consider alternative financing options, such as joint mortgages or securing additional funding from family members.

Foreign Buyer Tax: If you are a foreign national purchasing property in Toronto, you may be subject to additional taxes, such as the Non-Resident Speculation Tax (NRST), which can add to your overall costs.

Work with Professionals

Securing financing for your property purchase can be complex, but you don’t have to navigate it alone. Working with a real estate agent, mortgage broker, or financial advisor can help guide you through the process, provide expert advice, and ensure you get the best financing options available.

Conclusion

Securing financing when purchasing property in Toronto requires careful planning, research, and a solid understanding of your financial situation. By assessing your credit score, exploring various mortgage options, gathering necessary documentation, and considering government programs, you can significantly increase your chances of securing the financing you need. Toronto’s real estate market can be challenging, but with the right preparation, you can confidently navigate the financing process and make a smart investment in your future.

By staying informed, working with professionals, and making prudent financial decisions, you can successfully secure financing and become a property owner in one of Canada's most vibrant cities.

0 notes

Link

Sarao Law: Your Economical Real Estate lawyer

We provide expert legal advice for buying, selling, leasing, and property disputes.

0 notes

Text

Earn Extra Income with Your Travel Ads on BorrowBe.com

Traveling is more than just a pastime; it’s an enriching adventure that expands our horizons and creates unforgettable memories. From the vibrant streets of New York City to the serene beaches of California and the stunning landscapes of the Rockies, every journey has its unique allure. But what if you could share these experiences while earning a little extra income? Enter BorrowBe.com.

The Joys of Traveling

Traveling offers countless benefits, both physically and mentally. It allows us to escape our daily routines, reduces stress, and boosts creativity. Exploring new cultures, meeting new people, and trying different cuisines can be incredibly rewarding. Each journey teaches us valuable lessons and helps us grow.

Renting Out Your Travel Essentials

If you have travel gear or accommodations, renting them out can be a fantastic way to generate additional income while assisting fellow travelers. Popular items like camping gear, bicycles, and kayaks are always in demand. Additionally, consider renting out your primary residence in Canada or vacation homes for a steady rental income opportunity.

Why Choose BorrowBe.com?

BorrowBe.com is a unique marketplace that connects owners with individuals seeking to rent various items and services. Here’s why you should post your travel-related ads on BorrowBe.com:

Wide Audience Reach: Attract a diverse crowd looking for rentals, increasing the chances of your ad being seen by potential customers.

User-Friendly Interface: The platform simplifies the ad-posting process, allowing you to create and manage your listings effortlessly.

Dedicated Categories: With specific sections for travel equipment and accommodations, your ads will reach the right audience, including those interested in commercial real estate in Canada for rent.

Community Support: By posting your ads, you contribute to a network of like-minded individuals, supporting local businesses and communities.

How to Post Your Travel Ads on BorrowBe.com

Register an Account: Sign up on BorrowBe.com using your email or social media accounts.

Create a Listing: Click the “Post Ad” button and provide details about your travel item or accommodation. Include high-quality images and thorough descriptions to attract interest.

Set Your Price: Determine a fair rental price. BorrowBe.com allows free listings or offers affordable promotional packages for increased visibility.

Publish Your Ad: Once satisfied with your listing, hit the publish button to go live and start attracting potential renters.

Conclusion

Traveling is a shared passion, and BorrowBe.com offers the perfect platform to connect with others. By posting your travel ads, you can earn extra income, support the travel community, and rent your residence in Canada, whether it’s your primary home or a vacation property. Explore home rental listings in Canada and find tenants for your rental property with ease.

Unlock the endless rental income opportunities in Canada today with www.borrowbe.com Start posting your ads and let your travel items and accommodations find new purpose! Happy travels! 🌍✈️🏖️

#Find tenants for your rental property in Canada#Home rental listings in Canada#Property leasing services in Canada#Rental income opportunities in Canada#Investment properties for rent in Canada#Houses for rent in Toronto#where to post rental ads canada#perfect home on the best site for rentals Canada#1 bedroom House for rent in Canada#Cheap apartments for rent in Canada#cheap rent Apartments in Canada#Rental properties in Canada#Cheap apartments for rent in Canada for students#British Columbia apartments for rent#best app for renting apartments canada#1 bedroom apartment price in canada

0 notes

Text

Coming soon. Torontoville.com The City of Neighbourhoods

0 notes

Text

Why Toronto Landlords Are Choosing Sider Property for Property Management Services in 2025

Find out why Toronto landlords rely on Sider Property for trusted property management services in 2025. Boost your rental income now!

#best property management company in Toronto#property management services in Toronto#property management services#Toronto landlords#property management company

0 notes