#Portfoliomanagement

Explore tagged Tumblr posts

Text

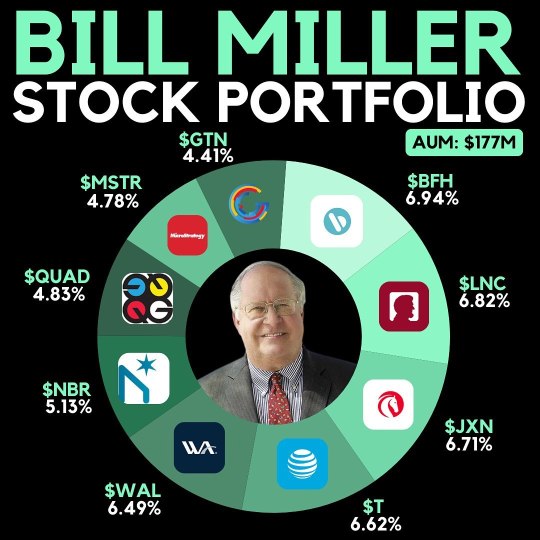

Bill Miller, a renowned hedge fund manager, recently disclosed the top holdings of his fund, which manages $177 million in assets. Here are his key investments: 1. Bread Financial: 6.94% 2. Lincoln National: 6.82% 3. Jackson Financial: 6.71% 4. AT&T: 6.62% 5. Western Alliance: 6.49% 6. Nabors: 5.13% 7. Quad Graphics: 4.83% 8. Microstrategy: 4.78% 9. Gray Television: 4.41% Have you considered any of these stocks in your portfolio? 💼 Investing wisely often requires understanding what successful managers are doing. It's essential to keep an eye on the strategies of experts like Bill Miller, as their insights can guide your own financial decisions. 💡 I believe that diversifying your investments based on proven strategies is key to achieving long-term financial success. Take charge of your financial journey today! 🚀

#BillMiller#HedgeFund#Investing#StockMarket#FinancialAdvice#PortfolioManagement#InvestmentStrategy#WealthManagement#FinancialSuccess#StockPick#Diversification#ValueInvesting#MarketTrends#InvestmentInsights#FinanceTips

2 notes

·

View notes

Text

Fundamental Analysis of Maruti Suzuki

Established in February 1981 as Maruti Udyog Limited, Maruti Suzuki India Limited (MSIL) is now the largest passenger car manufacturer in India. A joint venture between the Government of India and Suzuki Motor Corporation of Japan, the latter currently holds a 58.19% stake in the company. With a diverse portfolio of 16 car models and over 150 variants, Maruti Suzuki caters to various consumer segments, from entry-level small cars like the Alto to the luxury sedan Ciaz.

Sales and Industry Trends

Indian passenger vehicle industry saw record sales of 4.1 million units in 2023, becoming the third largest market globally

Share of utility vehicles in the industry increased to 53% in Q3, with SUVs contributing to about 63%

CNG vehicles saw a share increase to about 16.5% in the industry, with CNG sales reaching an all-time high of ~30%

Company crossed annual sales milestone of 2 million units in 2023 and had highest ever exports of about 270,000 units

Q3 FY23–24 saw total sales of 501,207 vehicles, with net profit rising over 33% year-on-year

Retail sales in Q3 were higher than wholesales, with discounts of INR 23,300 per vehicle

Maruti Suzuki Financials

Revenue and Net Profit: In FY23, Maruti Suzuki witnessed a YoY increase of 33.10% in revenue, reaching Rs. 1,17,571.30 crore, with a net profit of Rs. 8,211 crore, marking a 111.65% YoY increase.

Profit Margins: Operating Profit Margin (OPM) and Net Profit Margin (NPM) improved in FY23, standing at 9% and 6.83%, respectively.

Return Ratios: Return on Equity (RoE) and Return on Capital Employed (RoCE) showed improvements in FY23, reaching 13.28% and 16.02%, respectively.

Debt Analysis: The Debt to Equity ratio slightly increased to 0.02 in FY23, with a healthy Interest Coverage ratio of 70.37.

#StockMarket#Investing#TradingTips#FinancialFreedom#InvestmentStrategy#MarketAnalysis#StockPicks#PortfolioManagement#EconomicIndicators#StockResearch#RiskManagement#MarketTrends#DividendInvesting#TechnicalAnalysis#FundamentalAnalysis

3 notes

·

View notes

Text

Always Invest with an Objective!

It's important to remember why you're investing when making one. Investing without a clear goal in mind and for tax reasons or return maximization are frequent practices among individuals. It's not a wise strategy to take!

2 notes

·

View notes

Text

youtube

CFA Level 1 Live Batch Jan 2025 | Portfolio Management & Economics with Sanjay Saraf Sir

Exciting news for CFA aspirants! 🎉 Sanjay Saraf Sir is launching a new CFA Level 1 batch starting on 7th of January 2025, with the first topics being Portfolio Management and Economics. Dive into the world of wealth creation through investments in equity, derivatives, fixed income, and alternatives. Plus, get a strong foundation in macroeconomics, covering the impact of monetary and fiscal policies on business cycles and financial markets.

#CFALevel1#SanjaySaraf#PortfolioManagement#Economics#CFA2025#FinanceCareer#WealthCreation#CFAExam#InvestmentStrategies#FiscalPolicy#MonetaryPolicy#BusinessCycles#FinancialMarkets#SanjaySarafSir#Youtube

1 note

·

View note

Text

Bull market energy: Unstoppable momentum, unmatched growth.📊

#BullMarket#MarketMomentum#StockMarketGrowth#InvestSmart#FinancialFreedom#WealthCreation#InvestmentOpportunities#TradingSuccess#MarketVibes#BullishEnergy#StockMarketTrends#InvestmentGoals#FinancialGrowth#PortfolioManagement#StockMarketTips#InvestingMindset#MarketSuccess#StockMarketNews#EconomicGrowth#UnstoppableVibes#BullRun#GrowthMindset#SuccessMindset#RiseAndInvest#FinancialGoals#MoneyMatters#BusinessGrowth#InvestToGrow#WinningMindset#GreenCharts

0 notes

Text

#ProjectPortfolioManagement#PPM#ProjectManagement#PortfolioManagement#BusinessSolutions#ProjectManagementSoftware#WorkforceOptimization#PMO#ProjectPlanning#EnterpriseSoftware#ProjectExecution#RiskManagement#AgileProjectManagement#ProjectEfficiency#ProjectSuccess#ProjectTracking#DigitalTransformation#ProjectManagementTools#PortfolioOptimization#BusinessGrowth#ResourceManagement

0 notes

Text

Welcome to Crypto Asset Managers: Pioneering the Future of Digital Wealth Management

Introduction

In today’s rapidly evolving financial landscape, digital assets such as cryptocurrencies, NFTs (Non-Fungible Tokens), and decentralized finance (DeFi) are no longer niche investments. They have grown into major pillars of the modern financial system. However, navigating this new world of digital wealth can be overwhelming for both individual and institutional investors. That's where Crypto Asset Managers (CAM) steps in, offering professional, innovative, and secure management services designed to help you maximize returns while minimizing risk.

At Crypto Asset Managers, we specialize in providing tailored investment solutions that cater to the growing demand for digital asset management. Our team of seasoned professionals leverages cutting-edge technology and deep industry knowledge to help clients confidently invest in the world of cryptocurrencies and blockchain-based assets. Whether you're new to digital assets or an experienced investor, CAM is here to guide you on your journey toward financial success in the digital age.

The Rise of Digital Assets

Digital assets, particularly cryptocurrencies, have experienced explosive growth in recent years. Bitcoin, Ethereum, and a host of other altcoins have reshaped how people view wealth, savings, and investment. What once seemed like a niche market is now a multi-trillion-dollar industry with the potential to revolutionize everything from banking to entertainment.

The rise of decentralized finance (DeFi) has added another layer of opportunity, offering new ways to earn passive income, borrow funds, and lend money without the need for traditional intermediaries like banks. In addition, the introduction of NFTs has created new opportunities for creators, investors, and collectors alike. All of these innovations are reshaping the financial landscape, and those who can navigate this complex world stand to benefit immensely.

However, with this growth comes a set of unique challenges. The market can be volatile, regulatory landscapes are still developing, and security concerns are top of mind for many investors. This is where Crypto Asset Managers can provide invaluable assistance.

What We Do at Crypto Asset Managers

At Crypto Asset Managers, our mission is simple: to empower our clients to succeed in the world of digital assets by offering expert guidance, sophisticated technology, and personalized strategies. We offer a range of services that cater to different levels of investors—from individuals looking to diversify their portfolios to institutions seeking to gain exposure to blockchain-based assets.

Here are the key services we provide:

1. Crypto Portfolio Management

At CAM, we understand that every investor has unique goals and risk profiles. Our crypto portfolio management services are designed to help you diversify your investments and achieve long-term financial goals. Our experts analyze market trends, assess your risk tolerance, and create a personalized investment strategy tailored to your needs.

We invest in a broad range of assets, including Bitcoin, Ethereum, DeFi projects, and NFTs, ensuring that your portfolio is well-positioned to benefit from the growth of the digital economy. Whether you’re looking for high-risk, high-reward opportunities or a more conservative approach, we offer a variety of strategies to match your objectives.

2. Risk Management

The digital asset market can be volatile, and risk management is essential to protect your investments. At Crypto Asset Managers, we use advanced risk management tools and strategies to mitigate potential losses. Our team constantly monitors market conditions and makes adjustments to your portfolio to ensure it remains balanced and aligned with your goals.

We employ techniques such as hedging, stop-loss orders, and diversification across multiple assets to minimize exposure to risk. Our risk management approach also takes into account external factors, such as regulatory changes and macroeconomic trends, ensuring that your investments are always in safe hands.

3. DeFi Investment Opportunities

Decentralized finance (DeFi) has emerged as one of the most promising areas in the cryptocurrency space. CAM helps clients navigate the DeFi ecosystem by identifying high-quality projects and opportunities that align with their investment goals. From yield farming and staking to decentralized lending and liquidity pools, we offer a range of DeFi investment opportunities designed to maximize returns while minimizing risk.

Our team conducts thorough research on DeFi projects, evaluating factors such as project legitimacy, security, and potential for growth. We also help clients understand the complexities of DeFi, from smart contract risk to impermanent loss, ensuring they make informed decisions.

4. NFT Advisory and Investment

The NFT market has experienced explosive growth, attracting investors, collectors, and creators alike. At Crypto Asset Managers, we provide expert NFT advisory services, helping clients navigate this dynamic and often unpredictable market. Whether you’re interested in collecting art, investing in virtual real estate, or exploring other NFT use cases, our team is here to provide guidance.

We help clients identify promising NFT projects and assess their potential for long-term growth. Additionally, we offer insights into the underlying technologies, such as blockchain and smart contracts, that power the NFT ecosystem.

5. Institutional Services

For institutional investors, navigating the world of digital assets requires a sophisticated approach. CAM offers a range of institutional services tailored to the needs of hedge funds, family offices, and corporate investors. We help institutions build diversified crypto portfolios, manage risk, and gain exposure to emerging digital asset classes.

Our institutional clients benefit from our deep understanding of the regulatory landscape, market trends, and advanced technology solutions. We also provide consulting services to help institutions integrate blockchain-based assets into their operations and business models.

Why Choose Crypto Asset Managers?

There are many reasons why Crypto Asset Managers is the go-to partner for individuals and institutions seeking to invest in digital assets. Here are a few of the key benefits of working with us:

1. Expertise and Experience

Our team consists of industry professionals with years of experience in both traditional finance and the digital asset space. We understand the nuances of the cryptocurrency market and are well-equipped to help clients make informed decisions. We stay on top of market trends, regulatory changes, and technological advancements, ensuring that our clients receive the most up-to-date advice and guidance.

2. Tailored Solutions

At Crypto Asset Managers, we believe that every investor is unique. That’s why we offer personalized investment strategies that are tailored to your goals, risk tolerance, and financial situation. Whether you’re a seasoned crypto investor or just getting started, we work with you to create a strategy that fits your needs.

3. Security and Transparency

Security is a top priority for us. We employ industry-leading security protocols to safeguard your investments and personal information. Our platform uses advanced encryption and multi-signature wallets to protect your assets from hacking and fraud.

In addition, we value transparency and provide clients with regular reports on portfolio performance, market conditions, and any changes to their investment strategy. You’ll always know exactly where your money is and how it’s performing.

4. Comprehensive Services

At Crypto Asset Managers, we offer a full suite of services that cater to both individual and institutional investors. Whether you’re interested in portfolio management, DeFi, NFTs, or institutional investment, we have the expertise and resources to help you succeed.

The Future of Crypto Asset Management

As the digital asset market continues to evolve, the opportunities for growth are limitless. The integration of blockchain technology into traditional finance, the rise of new cryptocurrencies, and the expansion of decentralized finance are just a few of the trends that will shape the future of investment. At Crypto Asset Managers, we are committed to staying at the forefront of these developments, ensuring that our clients always have access to the latest opportunities in the digital asset space.

Our team will continue to innovate, leveraging new technologies and strategies to help you build and preserve wealth in this exciting new world. Whether you’re looking to take advantage of emerging trends or seeking a more stable, long-term approach, Crypto Asset Managers is here to help you navigate the complex world of digital assets.

Conclusion

The digital asset market is transforming the way we think about investment, wealth management, and financial services. However, the complexity and volatility of this space can be daunting for many investors. That’s where Crypto Asset Managers comes in—we are your trusted partner in navigating the digital asset landscape, offering expert guidance, risk management, and tailored investment solutions to help you achieve your financial goals.

With a focus on security, transparency, and personalized service, Crypto Asset Managers is poised to be a leader in the future of wealth management. Whether you're an individual investor or a large institution, we have the knowledge and experience to help you succeed in the world of digital assets.

Let us help you build a secure and prosperous future in the digital age. Contact Crypto Asset Managers today and discover how we can help you take control of your digital wealth.

#CryptoAssetManagers#CryptocurrencyInvestment#DigitalAssets#DeFi#NFTInvesting#PortfolioManagement#Blockchain#CryptoRiskManagement#FinancialTechnology#CryptoAdvisory#DigitalWealthManagement#CryptoMarket#InstitutionalInvestors#CryptoAssets#BitcoinInvestment#EthereumInvestment#CryptoDiversification#FinancialInnovation#CryptoPortfolio#WealthManagement

1 note

·

View note

Text

🌍 Unlock Global Wealth Potential: Tailored Portfolio Management for NRIs 🌍 As an NRI, you face unique investment opportunities and challenges. Here’s how Wealth Munshi ensures your portfolio is designed for success across borders: Explore Key Investment Avenues: 💼 Equities, Mutual Funds, and ETFs for growth and income 🏘 Real Estate in India and abroad for income and appreciation 📈 Bonds and Fixed Income for secure, low-risk returns Why Wealth Munshi? With our expert guidance, NRI investors benefit from: 🔹 Customized strategies tailored to your financial goals 🔹 Global and Indian market access for diversified growth 🔹 Continuous portfolio monitoring to keep you on track 🔹 Easy-to-use digital tools for real-time tracking anywhere in the world For a Consultation with our NRI Wealth Manager, click the link in the bio! 💬 Ready to optimize your wealth across borders? Discover how we help NRIs maximize growth while managing risk.

#WealthMunshi#PortfolioManagement#NRIs#InvestmentStrategies#GlobalInvesting#TaxEfficiency#FinancialGoals#DigitalTools#6d

1 note

·

View note

Text

Role of Climate Data in Assessing Portfolio Risk

As global climate continues to redefine the state of the world, investors are starting to consider ever more the environmental element in their analysis of risk and performance. However, how do we incorporate climate data into an investment strategy?

Inrate has just released a blog: why using climate data is indispensable to understand both physical and transition risks.

𝐂𝐥𝐢𝐦𝐚𝐭𝐞 𝐫𝐢𝐬𝐤 𝐝𝐚𝐭𝐚 𝐩𝐫𝐨𝐯𝐢𝐝𝐞𝐬 𝐢𝐧𝐯𝐞𝐬𝐭𝐨𝐫𝐬 𝐰𝐢𝐭𝐡:

𝐀𝐧𝐚𝐥𝐲𝐳𝐞 𝐞𝐱𝐩𝐨𝐬𝐮𝐫𝐞: Understand where extreme weather events, or regulatory changes, or shifts in market preferences toward sustainable products are likely to impact event areas, companies, or sectors.

𝐈𝐝𝐞𝐧𝐭𝐢𝐟𝐲 𝐟𝐮𝐭𝐮𝐫𝐞 𝐯𝐮𝐥𝐧𝐞𝐫𝐚𝐛𝐢𝐥𝐢𝐭𝐢𝐞𝐬: This analysis through scenario-based consideration can help investors determine how their portfolios may perform for different climate scenarios, from limitations in global warming to carbon tax imposition. Better risk insights will result in the improvement of investors’ ability to optimize portfolios and channel capital into the more resilient companies in climate change, paving a pathway to a sustainable future.

Including climate data in the risk assessments of investment portfolios means that investors will shift from using traditional risk models to analyze much more significant implications of environmental factors. It’s pretty clear that a sustainable future requires informed decision-making, and climate data plays the role in defining a more resilient investment strategy. Let’s make the best use of these insights towards making this world an even more sustainable and risk-conscious investment world!

Read More: Role of Climate Data in Assessing Portfolio Risk

#ClimateRisk#SustainableInvesting#ESG#GreenFinance#ClimateData#InvestmentStrategy#RiskManagement#SustainableFinance#NetZero#ImpactInvesting#ClimateAction#FinancialResilience#CarbonRisk#FutureOfFinance#PortfolioManagement#EnvironmentalRisk#TransitionRisk#FinanceForGood#InvestInSustainability#ClimateChange#ResponsibleInvesting

0 notes

Text

Traders anticipate a 41% chance that Ethereum will reach a new all-time high by the end of the year, with the current record standing at $4,891 from November 16, 2021. I believe this presents an intriguing opportunity for investors. 📈 In my experience, market predictions can often serve as a complex puzzle — while they provide a glimpse into market sentiment, the underlying fundamentals should also guide your investment decisions. Always conduct thorough research and remain informed about the market dynamics. As we navigate these uncertain waters, let's remember the importance of patience and strategic planning. Investing isn't just about chasing highs; it's about building a stable and resilient portfolio. 💪

#Ethereum#CryptoTrading#InvestmentStrategy#MarketPrediction#AllTimeHigh#CryptoInvesting#Blockchain#TraderSentiment#InvestmentOpportunities#FinancialLiteracy#PortfolioManagement#MarketDynamics#CryptoTrends#StrategicPlanning#InvestSmart#PatienceInTrading

0 notes

Text

Role of Climate Data in Assessing Portfolio Risk

Here are some key ways financial institutions can use their climate data to inform portfolio risk analysis:

1. Geographical and Physical Risk Analysis: The insights provided by climate data allow investors to assess the exposure and vulnerability of their assets. With advanced tools, portfolio managers, investors, or financial institutions can identify the location of their investments and compare these with climate forecasts. For example, the risk of rising sea levels can be understood in terms of the vulnerability of a real estate portfolio. The possibility of assessing these impacts may allow managers to hedge against potential risks, divest from assets at risk, or explore insurance options to curtail their financial exposure.

2. Carbon Footprint and Transition Risk Analysis: As governments and regulatory bodies move toward aligning with a low-carbon economy, there is high transition risk for businesses, and consequently for portfolios that are fossil fuel reliant. In such cases, climate data can help assess the carbon footprint of companies and sectors within a portfolio. An investor can then analyze the extent to which a company will face future regulatory pressures, higher carbon taxes, or stranded assets as fossil fuels become less viable, and evaluate the efficacy of its current transition strategies.

3. Climate Scenario Analysis: Portfolio managers can conduct scenario analysis to validate how different climate pathways may impact the financial performance of companies. For instance, in a 2°C rise scenario, firms that are closer to a low-carbon economy, such as renewable energy-based ventures, may perform better, potentially rewarding those equity exposures. Such analysis can be key to understanding the positioning of a portfolio and developing energy transition pathways.

Read More: Role of Climate Data in Assessing Portfolio Risk

#ClimateRisk#ESGInvesting#PortfolioManagement#SustainableFinance#ClimateData#RiskAssessment#GreenInvestment#ClimateTech#InvestmentStrategy#FinancialRisk#ClimateAction#SustainableInvesting#PortfolioAnalysis#ClimateChange#RiskManagement#FinancialMarkets#ESGMetrics#InvestmentDecisions#EnvironmentalRisk#DataAnalytics

0 notes

Text

How Avanz AI Enhances Portfolio Management Efficiency

In the fast-paced world of asset management, efficiency and accuracy are paramount. Avanz AI addresses these challenges by automating key aspects of portfolio management, enabling managers to focus on strategic decision-making.

Problem Statement: Asset managers often face challenges in managing complex portfolios due to the time-consuming nature of manual processes and the risk of human error.

Application: By integrating Avanz AI, asset managers can automate tasks such as report generation, risk assessment, and scenario analysis. For example, an investment firm can use Avanz AI to automatically generate daily performance reports and receive real-time risk alerts, allowing for prompt adjustments to investment strategies.

Outcome: Users experience increased operational efficiency, reduced errors, and enhanced ability to respond swiftly to market changes, leading to improved portfolio performance.

Industry Examples:

Hedge Funds: Utilize Avanz AI to automate risk management processes.

Private Equity Firms: Leverage the platform for efficient portfolio monitoring.

Wealth Management Advisors: Employ Avanz AI to provide clients with timely insights and recommendations.

Enhance your portfolio management with Avanz AI's advanced automation tools. Visit aiwikiweb.com/product/avanzai

0 notes

Text

A Project Management Office (PMO) serves as the backbone of project governance and delivery within an organization, ensuring that projects align with strategic objectives. One of the most powerful tools at a PMO's disposal is its Service Catalog. This essential document outlines the services provided by the PMO, enabling project teams to navigate resources efficiently. In this blog, we will explore the components and benefits of an effective PMO Service Catalog.

#PMO#ProjectManagement#ServiceCatalog#Governance#StakeholderEngagement#ResourceManagement#ContinuousImprovement#ProjectSuccess#BusinessExcellence#PortfolioManagement#ProjectDelivery#ProjectSupport#TrainingAndDevelopment#Efficiency#TeamCollaboration

0 notes

Text

🌟 CFA Level 1 – New Batch Starting January 2025! 🌟| SSEI

Join Sanjay Saraf Sir for an exciting start to your CFA Level 1 journey! 🚀 Dive deep into Portfolio Management & Economics and master the strategies of wealth creation and investment planning.

#CFA2025#PortfolioManagement#Economics#SanjaySaraf#InvestmentGoals#FinanceSuccess#cfa#finance#studysmart#SSEI

0 notes

Photo

Rolling over your old 401(k)/403(b)/Pension into an IRA is an underrated financial move that can greatly accelerate your path to financial independence. Schedule a time today to talk about your specific situation. https://www.afitonline.com/appointments

#401k#403b#PensionToIRA#FinancialIndependence#RetirementSavings#InvestSmart#WealthBuilding#IRAInvesting#RetirementPlanning#FinanceTips#MoneyMatters#FinancialFreedom#InvestmentStrategy#FuturePlanning#WealthManagement#SavingsPlan#FinancialAdvisor#SmartInvesting#RetireWell#LongTermWealth#PlanForRetirement#FinancialGoals#MoneyGrowth#RetirementAccount#SecureYourFuture#FinancialLiteracy#PortfolioManagement#InvestInYourself#TaxBenefits#RetirementSuccess

0 notes

Text

🚀 Samant Kumar's Legacy of Leadership and Innovation 🌟

From engineer to agile leader, Samant Kumar's journey is a masterclass in commitment and excellence in project management. As an award-winning Portfolio Manager and Agile Program Manager at Capgemini, Samant brings over 20 years of experience driving success across industries, transforming businesses with agile methodologies. His certifications—SAFe SPC, PMI-ACP, A-CSM, and more—underscore his deep expertise and leadership in the agile space 🏅.

Join us in exploring Samant’s incredible career, from his technical beginnings to becoming a key player in aligning business goals with agile practices, fostering cross-functional collaboration, and leading complex programs to success 🌐.

For more information:- https://www.globaltimesnow.com/samant-kumar-leadership-innovation/

#AgileLeadership#ProjectManagement#Innovation#BusinessTransformation#AgileCoach#PortfolioManagement#TechInnovation#ScrumMaster#LeadershipExcellence#JiraAlign#AzureDevOps#AIInBusiness#Mentorship#ContinuousLearning

0 notes