#Pipelayers

Explore tagged Tumblr posts

Text

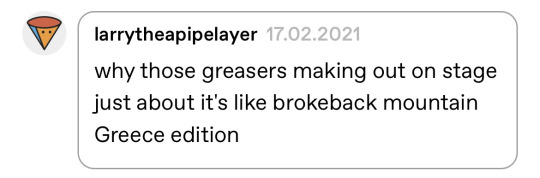

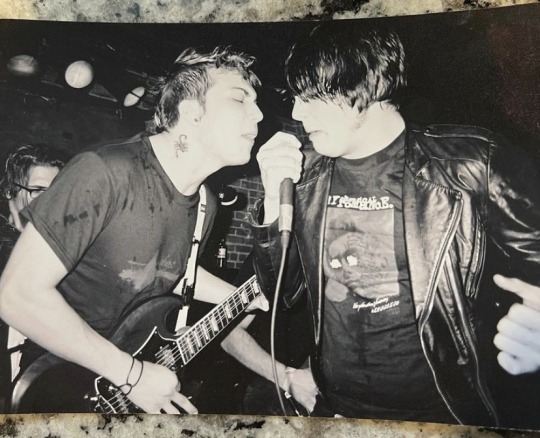

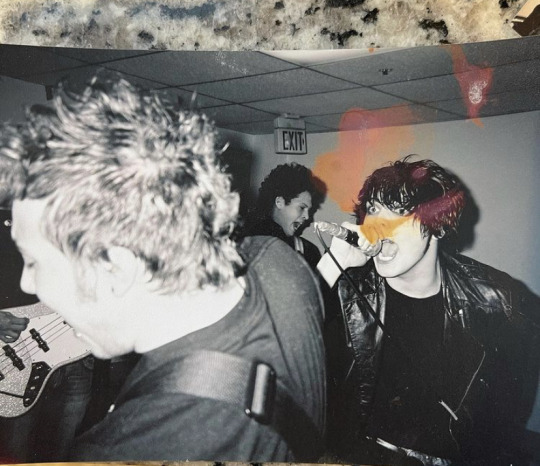

strongandsquishy: Having a little snowy day scroll down memory lane

[Lexington Kentucky, late 2002]

5K notes

·

View notes

Text

Part No:- 1B8742 Description:- Key Application Bulldozer:- D5, D5B, D5E, D6C, D6D, D6E, D6F, D6G . Contact: +91-9999978975 or email - [email protected] https://www.dozerspares.in . Bulldozer Spare Parts | Excavator Spare Parts| Motor Grader Spare Parts | Caterpillar | Komatsu | BEML | Bharat Earth Movers Limited .

#HeavyEquipmentParts#dozerspares#earthmover#bulldozerparts#dozerparts#heavymachineryparts#excavatorparts#1B8742#Key#dayacharansons#DCPL#dayacharan#dcaspl#spareparts#dozer#bulldozer#cat#caterpillar#beml#PipeLayer#komatsu

0 notes

Text

Underwater pipelayer Ivan Artemenko. Andra workers' village in Khanty-Mansia, Russia. Photos by Gennady Koposov as published in Ogonyok magazine (1977).

257 notes

·

View notes

Text

Dutch wasn’t jealous of Bessie. Bessie was like his weird co-wife, she was the sister he never had, they got along better than Dutch & Hosea themselves some days. No, Dutch was jealous of that boy who swept the floors at the quaker church Hosea grew up attending, even though Dutch never met him, even though he didn’t even know Hosea’s name, because it was him who made Hosea realize he wanted men and Dutch can never claim that for himself. So Dutch will always be jealous. And Hosea wasn’t jealous of Annabelle! Because Hosea didn’t meet Annabelle until after Bessie died. He didn’t have the mental space to consider her anything but One Of Dutch’s Girls amidst all that grief, no matter how strong a personality Annabelle was. You know who Hosea was jealous of, around that time? The veteran turned bounty hunter who took Dutch “captive” while he was having a manic episode, who Dutch fucked a couple dozen times before Hosea came to rescue him. Because Dutch formed an intense connection with another man in the middle of the most difficult period of Hosea’s life, and Hosea can’t even say what that connection really looked like, since he only has Dutch’s word to go off of. So yeah. Hosea was a little bitter. Even after he blew off the primo pipelayer’s head.

#hosea matthews#vandermatthews#bessie matthews#Annabelle rdr2#dutch van der linde#rdr2#Dutch copfucker allegations on main#you know he would. he’s that guy.#(quakers had stringent rules about dressing inconspicuously which is why Hosea always dresses so smartly in my mind)#nsft text

11 notes

·

View notes

Text

gonna start telling extended family "i got a job as a pipelayer" oh you mean a pipefitter? "no" ok is it union? "something like dat"

14 notes

·

View notes

Note

Dear Patron Saint of Questionable Taste In Men, Please assist me in my quest to get this pipelayer to lay me some pipe. Amen.

well, okay, amen then!

2 notes

·

View notes

Text

Steel Market — Forecast(2024–2030)

Steel Market — Overview

Steel Market Report Coverage

For More

The report: “Steel Industry — Forecast (2024–2030)”, by IndustryARC covers an in-depth analysis of the following segments of the Steel Market Report.

By Type: Carbon Steel, (Low Carbon Steel, Medium Carbon Steel, High Carbon Steel), Stainless Steel (Austenitic Stainless Steels, Ferritic Stainless Steels, Martensitic Stainless Steels, Precipitation Hardening Grade Stainless Steels, Duplex Stainless Steels), Alloy Steel (Chromium Molybdenum Steel, Nickel-Chromium-Molybdenum Steel, Chromium Vanadium Steel, HSLA -Nickel-Chromium-Molybdenum Steel), Tool Steel (Water-hardening tool steels, Shock-resisting tool steels, Cold-work tool steels, Hot-work steels, High-speed tool steels, Others), Others

By Form: Bar, Rod, Tube, Pipe, Plate, Sheet, Structural, Others

By Application: Transportation (Road, Bridges, Barriers, Rail, Tracks, Rail Cars), Construction (Cool Metal (infrared reflecting) Roofing, Purlins, Beams, Pipe, Recyclable steel framing (studs), Desks/Furniture), Packaging (Canes, Bottles, Others), Water Projects (Levees/Dams/Locks), Energy (Renewable, Nuclear, Bio-fuels, Fossil, Electric Grid), Others

By Industry: Construction (Steel Skeletons, Concrete Walls, Pillars, Nails, Bolts, Screws, Others), Machinery (Bulldozers, Backhoe Leaders, Pipelayers, Others), Automotive and Transportation (Exhaust, Trim/Decorative, Engine, Chassis, Fasteners, Tubing For Fuel Lines), Kitchenware and Domestic Appliances (Small Household Appliances, Black Home Appliances, White Home Appliances), Electrical and Electronics (Motor Mount Brackets, Adapter Plates, Electronic Frames and Chassis, Brackets, Others), Healthcare (Orthopaedic Implants, Artificial Heart Valves, Bone Fixation, Catheters, Others), Energy (Scrubbers, Heat Exchangers, Others)

By Region: North America, South America, Europe, Asia-Pacific and Rest of the World

Inquiry Before Buying

Key Takeaways

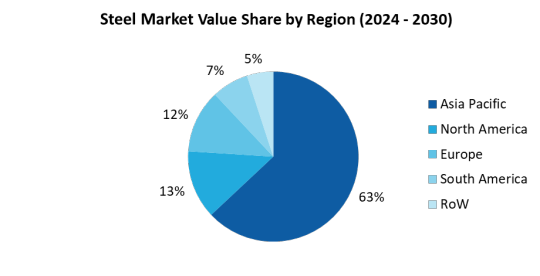

• The Asia-Pacific region, particularly China, has been a dominant force in the global steel market with a share of 63% in 2023, owing to China’s rapid industrialization and urbanization have driven substantial demand for steel in the construction, infrastructure, and manufacturing sectors.

• Government infrastructure spending, particularly in major economies, plays a significant role in driving steel demand. Large-scale infrastructure projects, such as bridges, railways, and urban development initiatives, can create substantial demand for steel products.

For More Details on This Report — Request for Sample

Steel Market Segment Analysis — By Type

In terms of type, the Steel Market is segmented into carbon steel, stainless steel, alloy steel, tool steel and others. In 2023, the Stainless-steel segment generated the greatest revenue of $361.94 billion and is projected to reach a revenue of $482.28 billion by 2030. Owing to the various benefits posed by stainless steel such as corrosion resistance, high and low temperature resistance, the ease of fabrication, strength, aesthetic appeal is one of the key factors for its adoption among various end-use industries, which in turn is boosting its market growth. The stainless-steel segment can be further classified as Austenitic stainless steels, Ferritic stainless steels, Martensitic stainless steels, Precipitation hardening grade stainless steel and Duplex stainless steels.

Steel Market Segment Analysis — By Form

By form, the steel market is segmented into bar, rod, tube, pipe, plate, sheet, structural and others. The bar segment accounted for the major market share in 2023, with a revenue of $554.58 billion, and is forecast to grow at a CAGR of 4.68% by 2030. The increasing demand for steel bar from various end-user industries such as building and construction, bridges, and many others, are driving the growth of the segment during the forecast period of 2024–2030.

Steel Market Segment Analysis — By Application

Steel Market is segmented by its application that includes transportation, construction, packaging, water projects, energy and others. The energy segment held the dominant market share, 31% of the whole market, in 2023, and is expected to maintain its dominance by 2030 with a CAGR of 4.69%. One of the major factors for the segment growth is the increasing awareness and focus towards renewable energy sources. Steel plays a crucial role in producing and distributing energy as well as improving energy efficiency. Renewable energy is further classified as Wind Towers and Foundation, Wind Turbines and Solar Parabolic Mirror Supports & Collectors.

Steel Market Segment Analysis — By Industry

The Steel finds its application across the industries such as construction, machinery, automotive and transportation, kitchenware and domestic appliance, electrical and electronics, healthcare, energy and others. Among them, the construction segment is the largest consumer of steel, as bearable structures can be manufactured easily at a low cost. The property of steel in its various forms and alloys makes it more flexible to cater the exclusive projects integrated with infrastructure. Moreover, the rapid industrialization and urbanization in various developing countries are fueling the segment growth in strengthening its dominant market position during the forecast period.

Buy Now

Steel Market Segment Analysis — By Geography/Country

The report comprises of the region wise study of the global market including North America, South America, Europe, Asia-Pacific and Rest of the World. Above all, Asia-Pacific region held the biggest share in 2023, up to 63% of the whole steel market owing to the rapidly expanding defense, machinery, automotive, and shipbuilding industries in the countries such as India, China, South Korea, and Japan. Foreign direct investment in energy and infrastructure is likely to provide opportunities for the market vendors. Coupled with favorable government regulations, growing infrastructure and construction activities in developing economies of the Asia-Pacific region are boosting the demand for the market.

Steel Market — Drivers

Growing Demand for Steel Across the Various Regions

Several factors have a significant impact on the overall development of the steel market. The major growth factor driving the Steel Market is the growing demand for steel across a variety of developing regions. For instance, Global crude steel production in January-November 2023 reached 1715.12 million metric tons, marking a marginal 0.5% year-on-year growth, per provisional data from the World Steel Association. November 2023 saw a production of 145.5 million metric tons, up by 3.3% from the previous year. China led the production with 952.14 million metric tons, followed by India and Japan, USA, Russia, South Korea, and Germany.

Construction and Infrastructure Development:

Construction activities, including residential, commercial, and infrastructure projects such as roads, bridges, and railways, are major drivers of steel demand. Urbanization and industrialization also contribute to the growth of the construction sector, thereby increasing the demand for steel products. For instance, as per Green Finance & Development Center, China Belt and Road Initiative (BRI) Investment Report 2023, engagement totalled about USD88.3 billion, with USD44.6 billion from investment and USD43.7 billion from construction contracts. Also, The US Department of Transportation allocates $3.2 billion in extra funding, alongside $4.3 billion from the Bipartisan Infrastructure Law for 2023. The Budget prioritizes $4.5 billion for the Capital Investment Grant program, aiming to bolster transit infrastructure for economic growth. As a result, the steel market is anticipated to thrive, propelled by heightened construction activities and the need for durable materials, reflecting a promising outlook for the industry.

Steel Market -Challenges

Environmental Regulations and Sustainability

The steel industry is facing mounting pressure to tackle environmental issues by cutting carbon emissions and enhancing sustainability efforts. Meeting stringent environmental regulations demands substantial investments in technology and infrastructure, presenting a formidable challenge for many companies. Despite the financial hurdles, embracing these changes can pave the way for a more sustainable and eco-friendly future for the industry.

Steel Market — Competitive Landscape

The companies referred in the study include Baosteel Co., Ltd., Posco Holding Inc, Nippon Steel Corporation, JFE Holdings, Tata Steel Limited, United States Steel Corporation, Anshan Iron and Steel Group Corporation, Hyundai Steel Co., Ltd., ThyssenKrupp AG, ArcelorMittal S.A., among others. Technology launches, acquisitions, and R&D activities are key strategies adopted by the key players in the Steel Market.

Steel Market — Recent Developments

November 2022, Tata Steel launched the fourth edition of MaterialNEXT, focusing on ‘Materials to Wonder.’ This open innovation event aims to gather ideas on emerging materials and their applications. The program spans five months across Idea Selection, Development, and Evaluation stages, fostering collaboration among scientists, researchers, and startups.

May 2022, Kobe Steel introduced “Kobenable Steel,” Japan’s pioneering low CO2 blast furnace steel, aiming to curtail emissions during ironmaking. Utilizing innovative CO2 Reduction Solution technology, it plans to roll out the product this fiscal year, marking a milestone in sustainable steel production.

In June 2023, Nippon Steel introduces ZEXEED™ Checkered Sheet, a new addition to its high corrosion resistant coated steel series

0 notes

Text

Steel Market - Forecast(2024 - 2030)

Steel Market - Overview

The Steel market is analyzed to be $1,746.35 billion in 2023 and is projected to reach $2,105 billion in 2030. The market is estimated to grow with a CAGR of 4.13% during 2024-2030. Steel is an alloy that is made up of iron ore or scrap steel and carbon. In general, steels have various unique properties including being non-corrosive, rust-resistant and heavier than other metals such as aluminum. Therefore, steel is extensively used in various end-use industry verticals, including the manufacturing various transportation and automobile components, medical equipment, metal surgical implants, structural components and more, which in turn is boosting its market growth. In recent years, the steel market has experienced fluctuations driven by several factors. One significant trend in the steel market is the impact of trade policies and tariffs. Trade tensions between major steel-producing nations, such as the United States, China, and the European Union, have led to shifts in supply chains and pricing dynamics. Tariffs imposed on steel imports have affected the competitiveness of domestic producers and influenced global trade patterns. Additionally, sustainability concerns and environmental regulations have influenced market dynamics. Increasing awareness of carbon emissions and the environmental footprint of steel production has led to a growing demand for greener steel products. This has prompted investments in cleaner production technologies such as electric arc furnaces and the development of recycled steel. Moreover, technological advancements and innovations in steel manufacturing processes have enhanced efficiency and product quality. As a result, the steel market is poised for sustained growth as global economic recovery accelerates, with innovations in technology and sustainability shaping future trends.

Steel Market Report Coverage

The report: “Steel Industry – Forecast (2024-2030)”, by IndustryARC covers an in-depth analysis of the following segments of the Steel Market Report.

By Type: Carbon Steel, (Low Carbon Steel, Medium Carbon Steel, High Carbon Steel), Stainless Steel (Austenitic Stainless Steels, Ferritic Stainless Steels, Martensitic Stainless Steels, Precipitation Hardening Grade Stainless Steels, Duplex Stainless Steels), Alloy Steel (Chromium Molybdenum Steel, Nickel-Chromium-Molybdenum Steel, Chromium Vanadium Steel, HSLA -Nickel-Chromium-Molybdenum Steel), Tool Steel (Water-hardening tool steels, Shock-resisting tool steels, Cold-work tool steels, Hot-work steels, High-speed tool steels, Others), Others

By Form: Bar, Rod, Tube, Pipe, Plate, Sheet, Structural, Others

By Application: Transportation (Road, Bridges, Barriers, Rail, Tracks, Rail Cars), Construction (Cool Metal (infrared reflecting) Roofing, Purlins, Beams, Pipe, Recyclable steel framing (studs), Desks/Furniture), Packaging (Canes, Bottles, Others), Water Projects (Levees/Dams/Locks), Energy (Renewable, Nuclear, Bio-fuels, Fossil, Electric Grid), Others

By Industry: Construction (Steel Skeletons, Concrete Walls, Pillars, Nails, Bolts, Screws, Others), Machinery (Bulldozers, Backhoe Leaders, Pipelayers, Others), Automotive and Transportation (Exhaust, Trim/Decorative, Engine, Chassis, Fasteners, Tubing For Fuel Lines), Kitchenware and Domestic Appliances (Small Household Appliances, Black Home Appliances, White Home Appliances), Electrical and Electronics (Motor Mount Brackets, Adapter Plates, Electronic Frames and Chassis, Brackets, Others), Healthcare (Orthopaedic Implants, Artificial Heart Valves, Bone Fixation, Catheters, Others), Energy (Scrubbers, Heat Exchangers, Others)

By Region: North America, South America, Europe, Asia-Pacific and Rest of the World

Request Sample

Key Takeaways

• The Asia-Pacific region, particularly China, has been a dominant force in the global steel market with a share of 63% in 2023, owing to China's rapid industrialization and urbanization have driven substantial demand for steel in the construction, infrastructure, and manufacturing sectors.

• Government infrastructure spending, particularly in major economies, plays a significant role in driving steel demand. Large-scale infrastructure projects, such as bridges, railways, and urban development initiatives, can create substantial demand for steel products.

• The automotive sector is a significant consumer of steel, particularly in the production of vehicles. Changes in consumer demand for automobiles, as well as shifts towards electric vehicles which may use different materials, can impact steel demand in this sector.

Steel Market Segment Analysis – By Type

In terms of type, the Steel Market is segmented into carbon steel, stainless steel, alloy steel, tool steel and others. In 2023, the Stainless-steel segment generated the greatest revenue of $361.94 billion and is projected to reach a revenue of $482.28 billion by 2030. Owing to the various benefits posed by stainless steel such as corrosion resistance, high and low temperature resistance, the ease of fabrication, strength, aesthetic appeal is one of the key factors for its adoption among various end-use industries, which in turn is boosting its market growth. The stainless-steel segment can be further classified as Austenitic stainless steels, Ferritic stainless steels, Martensitic stainless steels, Precipitation hardening grade stainless steel and Duplex stainless steels.

Inquiry Before Buying

Steel Market Segment Analysis – By Form

By form, the steel market is segmented into bar, rod, tube, pipe, plate, sheet, structural and others. The bar segment accounted for the major market share in 2023, with a revenue of $554.58 billion, and is forecast to grow at a CAGR of 4.68% by 2030. The increasing demand for steel bar from various end-user industries such as building and construction, bridges, and many others, are driving the growth of the segment during the forecast period of 2024-2030.

Steel Market Segment Analysis – By Application

Steel Market is segmented by its application that includes transportation, construction, packaging, water projects, energy and others. The energy segment held the dominant market share, 31% of the whole market, in 2023, and is expected to maintain its dominance by 2030 with a CAGR of 4.69%. One of the major factors for the segment growth is the increasing awareness and focus towards renewable energy sources. Steel plays a crucial role in producing and distributing energy as well as improving energy efficiency. Renewable energy is further classified as Wind Towers and Foundation, Wind Turbines and Solar Parabolic Mirror Supports & Collectors.

Steel Market Segment Analysis – By Industry

The Steel finds its application across the industries such as construction, machinery, automotive and transportation, kitchenware and domestic appliance, electrical and electronics, healthcare, energy and others. Among them, the construction segment is the largest consumer of steel, as bearable structures can be manufactured easily at a low cost. The property of steel in its various forms and alloys makes it more flexible to cater the exclusive projects integrated with infrastructure. Moreover, the rapid industrialization and urbanization in various developing countries are fueling the segment growth in strengthening its dominant market position during the forecast period.

Steel Market Segment Analysis - By Geography/Country

The report comprises of the region wise study of the global market including North America, South America, Europe, Asia-Pacific and Rest of the World. Above all, Asia-Pacific region held the biggest share in 2023, up to 63% of the whole steel market owing to the rapidly expanding defense, machinery, automotive, and shipbuilding industries in the countries such as India, China, South Korea, and Japan. Foreign direct investment in energy and infrastructure is likely to provide opportunities for the market vendors. Coupled with favorable government regulations, growing infrastructure and construction activities in developing economies of the Asia-Pacific region are boosting the demand for the market.

Schedule a Call

Steel Market - Drivers

Growing Demand for Steel Across the Various Regions

Several factors have a significant impact on the overall development of the steel market. The major growth factor driving the Steel Market is the growing demand for steel across a variety of developing regions. For instance, Global crude steel production in January-November 2023 reached 1715.12 million metric tons, marking a marginal 0.5% year-on-year growth, per provisional data from the World Steel Association. November 2023 saw a production of 145.5 million metric tons, up by 3.3% from the previous year. China led the production with 952.14 million metric tons, followed by India and Japan, USA, Russia, South Korea, and Germany.

Construction and Infrastructure Development:

Construction activities, including residential, commercial, and infrastructure projects such as roads, bridges, and railways, are major drivers of steel demand. Urbanization and industrialization also contribute to the growth of the construction sector, thereby increasing the demand for steel products. For instance, as per Green Finance & Development Center, China Belt and Road Initiative (BRI) Investment Report 2023, engagement totalled about USD88.3 billion, with USD44.6 billion from investment and USD43.7 billion from construction contracts. Also, The US Department of Transportation allocates $3.2 billion in extra funding, alongside $4.3 billion from the Bipartisan Infrastructure Law for 2023. The Budget prioritizes $4.5 billion for the Capital Investment Grant program, aiming to bolster transit infrastructure for economic growth. As a result, the steel market is anticipated to thrive, propelled by heightened construction activities and the need for durable materials, reflecting a promising outlook for the industry.

Steel Market -Challenges

Environmental Regulations and Sustainability

The steel industry is facing mounting pressure to tackle environmental issues by cutting carbon emissions and enhancing sustainability efforts. Meeting stringent environmental regulations demands substantial investments in technology and infrastructure, presenting a formidable challenge for many companies. Despite the financial hurdles, embracing these changes can pave the way for a more sustainable and eco-friendly future for the industry.

Buy Now

Steel Market - Competitive Landscape

The companies referred in the study include Baosteel Co., Ltd., Posco Holding Inc, Nippon Steel Corporation, JFE Holdings, Tata Steel Limited, United States Steel Corporation, Anshan Iron and Steel Group Corporation, Hyundai Steel Co., Ltd., ThyssenKrupp AG, ArcelorMittal S.A., among others. Technology launches, acquisitions, and R&D activities are key strategies adopted by the key players in the Steel Market.

Steel Market - Recent Developments

November 2022, Tata Steel launched the fourth edition of MaterialNEXT, focusing on 'Materials to Wonder.' This open innovation event aims to gather ideas on emerging materials and their applications. The program spans five months across Idea Selection, Development, and Evaluation stages, fostering collaboration among scientists, researchers, and startups.

May 2022, Kobe Steel introduced "Kobenable Steel," Japan's pioneering low CO2 blast furnace steel, aiming to curtail emissions during ironmaking. Utilizing innovative CO2 Reduction Solution technology, it plans to roll out the product this fiscal year, marking a milestone in sustainable steel production.

In June 2023, Nippon Steel introduces ZEXEED™ Checkered Sheet, a new addition to its high corrosion resistant coated steel series

#steel market#steel market size#steel market shape#steel market forecast#steel market analysis#steel market report#steel market growth

0 notes

Text

Erik Eberhardson Net Worth

Erik Eberhardson biography

Erik Eberhardson has been Vice Chairman of the Board of Ferronordic Machines AB since August 26, 2016. He has previously served as Executive Vice Chairman of the Board and Head of Business Development at the Company. He has been Member of the Board of Directors of the Company since 2010. He has also been employed at the Company since 2010. He is Founder of Ferronordic Machines. His previous positions include Board Member of Lindab International AB (2009-2016), Chairman of OJSC GAZ (2008-2009), Chief Executive Officer and President of OJSC GAZ (2006-2007), Vice President of OJSC GAZ (2005-2006), President of Volvo Construction Equipment, CIS and Russia (2002-2005) and President of Volvo Ukraine LLC (1996-2000). He has a Bachelor of Science degree in Business Administration as well as studies in Applied Physics.

What is the salary of Erik Eberhardson?

As the Vice Chairman of the Board of Ferronordic AB, the total compensation of Erik Eberhardson at Ferronordic AB is kr808,000. There are 2 executives at Ferronordic AB getting paid more, with Lars Corneliusson having the highest compensation of $8,565,000.

How old is Erik Eberhardson?

Erik Eberhardson is 47, he's been the Vice Chairman of the Board of Ferronordic AB since 2016. There are 7 older and 9 younger executives at Ferronordic AB. The oldest executive at Ferronordic AB is Staffan Jufors, 67, who is the Chairman of the Board.

What does Ferronordic AB do?

Ferronordic AB (publ) sells, rents, and services construction equipment, trucks, and other machines in Russia, Kazakhstan, and Germany. It offers wheel-loaders, excavators, articulated and rigid haulers, backhoe loaders, pavers, compactors, bulldozers, pipelayers, forwarders and harvesters, and diesel generators, as well as other compact equipment. The company also sells, repairs, and maintains machines, trucks, engines, spare parts, and attachments; and offers aftermarket sales services, as well as technical support, contracting, and other services. In addition, it provides consultancy services, such as machine operator training. The company's brand portfolio includes Volvo Construction Equipment, Terex Trucks, Dressta, Rottne, Mecalac, Ferronordic, Volvo, and Renault Trucks. It serves the mining, road construction, general construction, forestry, quarries and aggregates, and oil and gas industries. The company was founded in 2010 and is headquartered in Stockholm, Sweden.

What does Ferronordic AB's logo look like?

Ferronordic AB executives and stock owners

Ferronordic AB executives and other stock owners filed with the SEC include:

Lars Corneliusson, Pres, CEO, MD & Director

Lars Corneliusson, President, Chief Executive Officer, Director

Erik Eberhardson, Vice Chairman of the Board

Magnus Brannstrom, Independent Director

Erik Danemar, Chief Financial Officer and Investor Relations Director and Member of Group Management

Hakan Eriksson, Director

Annette Brodin Rampe, Director

Anton Zhelyapov, Head of Trucks Business

Alexander Shmakov, Mining Director

Henrik Carlborg, Managing Director, Group's subsidiaries in Germany, Business Development Director

Nadezhda Arzumanova, Human Resources Director

Onur Gucum, Commercial Director

Dan Eliasson, General Counsel

Staffan Jufors, Chairman of the Board

Martin Bauknecht, Managing Director for German Bus.

Nadezhda Semiletova, HR Director

Ceren Wende, Director of Marketing & Communication

Dan Eliasson, Gen. Counsel

Erik Danemar, Group CFO & Head of Investor Relations

1 note

·

View note

Text

Part No:- 3J0375 Description:- Seal Lip Type Application Bulldozer:- D4D, D4E, D4E SR . Contact: +91-9999978975 or email - [email protected] https://www.dozerspares.in . Bulldozer Spare Parts | Excavator Spare Parts| Motor Grader Spare Parts | Caterpillar | Komatsu | BEML | Bharat Earth Movers Limited

#HeavyEquipmentParts#dozerspares#earthmover#bulldozerparts#dozerparts#heavymachineryparts#excavatorparts#3J0375#SealLipType#SealLip#Seal#dayacharansons#DCPL#dayacharan#dcaspl#spareparts#dozer#bulldozer#cat#caterpillar#beml#PipeLayer#komatsu

0 notes

Text

Mastering Construction: A Comprehensive Guide to Tools and Equipment

Undertaking a construction project demands not just ambition but also a profound understanding of the tools and equipment that drive progress. Ranging from basic hand tools to state-of-the-art machinery, each element plays a pivotal role in shaping the built environment. In an era marked by technological advancements, staying abreast of the latest innovations is imperative for both seasoned professionals and eager enthusiasts. Join us as we delve into the indispensable tools and equipment vital for every construction venture, spanning from groundwork to the finishing touches that transform blueprints into tangible structures.

Excavators: Unleashing Earthmoving Power

Excavators emerge as behemoths within the construction realm, capable of displacing vast quantities of earth and materials with unparalleled efficiency. Whether maneuvering through tight spaces or delving deep into the ground, their adaptability and power revolutionize construction methodologies.

Backhoe Loaders: Versatility Redefined

Backhoe loaders stand as veritable workhorses, seamlessly transitioning between excavation and loading tasks with finesse. Their robust engines and hydraulic systems, complemented by an array of attachments, make them indispensable assets across a spectrum of construction endeavors.

Bulldozers: Shaping the Terrain

Bulldozers wield unmatched prowess in reshaping landscapes, from clearing land to grading roads with precision. With their formidable blades and robust construction, they embody efficiency and versatility on construction sites worldwide.

Draglines: Engineering Marvels in Motion

Draglines epitomize engineering excellence, efficiently excavating earth and transporting materials in large-scale projects. Through intricate cable and pulley systems, they embody precision and effectiveness in construction operations.

Electric Rope Shovels: Pioneers of Eco-Friendly Excavation

Electric rope shovels lead the charge in eco-conscious excavation practices, powered by electricity for reduced environmental impact. Supported by advanced safety measures and auxiliary equipment, they epitomize efficiency and sustainability in construction endeavors.

Hydraulic Mining Shovels: Precision in Action

Hydraulic mining shovels excel in material transport with hydraulic precision, laying the groundwork for new structures with unparalleled efficiency. Their seamless integration with other machinery underscores their indispensability in construction projects.

Motor Graders: Crafting Foundations with Precision

Motor graders emerge as artisans in land preparation, meticulously shaping terrains to establish the foundation for construction projects. With elongated blades and sophisticated systems, they ensure meticulous accuracy in groundwork.

Pipelayers: Streamlining Pipeline Installation

Pipelayers streamline pipeline construction by facilitating the movement of heavy pipes and trench excavation with precision. Their integration into construction processes enhances efficiency and safety across projects.

Track Loaders: Versatility Unleashed

Track loaders navigate rugged terrains effortlessly, executing earthmoving tasks with precision. Equipped with a diverse range of attachments, they serve as indispensable allies in construction projects of all scales.

Pavers: Crafting Pathways to Excellence

Pavers meticulously craft pathways with precision, culminating in seamless, high-quality outcomes. Augmented by stringent safety protocols and an arsenal of equipment, paver construction ensures excellence at every step.

In the dynamic domain of construction, success hinges on adept utilization of the right tools and equipment. Each component, from humble hand tools to imposing machinery, contributes indispensably to project realization. By embracing innovation and fostering expertise among construction crews, projects can achieve excellence, timeliness, and fiscal prudence. Thus, choose your tools judiciously and let them pave the path to a brighter future. Readmore...

0 notes

Text

Steel Market — Forecast (2024–2030)

Steel market is analyzed to be $1,746.35 billion in 2023 and is projected to reach $2,105 billion in 2030. The market is estimated to grow with a CAGR of 4.13% during 2024-2030. Steel is an alloy that is made up of iron ore or scrap steel and carbon. In general, steels have various unique properties including being non-corrosive, rust-resistant and heavier than other metals such as aluminum. Therefore, steel is extensively used in various end-use industry verticals, including the manufacturing various transportation and automobile components, medical equipment, metal surgical implants, structural components and more, which in turn is boosting its market growth. In recent years, the steel market has experienced fluctuations driven by several factors. One significant trend in the steel market is the impact of trade policies and tariffs. Trade tensions between major steel-producing nations, such as the United States, China, and the European Union, have led to shifts in supply chains and pricing dynamics. Tariffs imposed on steel imports have affected the competitiveness of domestic producers and influenced global trade patterns. Additionally, sustainability concerns and environmental regulations have influenced market dynamics. Increasing awareness of carbon emissions and the environmental footprint of steel production has led to a growing demand for greener steel products. This has prompted investments in cleaner production technologies such as electric arc furnaces and the development of recycled steel. Moreover, technological advancements and innovations in steel manufacturing processes have enhanced efficiency and product quality. As a result, the steel market is poised for sustained growth as global economic recovery accelerates, with innovations in technology and sustainability shaping future trends.

Steel Market Report Coverage

The report: “Steel Industry – Forecast (2024-2030)”, by IndustryARC covers an in-depth analysis of the following segments of the Steel Market Report. By Type: Carbon Steel, (Low Carbon Steel, Medium Carbon Steel, High Carbon Steel), Stainless Steel (Austenitic Stainless Steels, Ferritic Stainless Steels, Martensitic Stainless Steels, Precipitation Hardening Grade Stainless Steels, Duplex Stainless Steels), Alloy Steel (Chromium Molybdenum Steel, Nickel-Chromium-Molybdenum Steel, Chromium Vanadium Steel, HSLA -Nickel-Chromium-Molybdenum Steel), Tool Steel (Water-hardening tool steels, Shock-resisting tool steels, Cold-work tool steels, Hot-work steels, High-speed tool steels, Others), Others By Form: Bar, Rod, Tube, Pipe, Plate, Sheet, Structural, Others By Application: Transportation (Road, Bridges, Barriers, Rail, Tracks, Rail Cars), Construction (Cool Metal (infrared reflecting) Roofing, Purlins, Beams, Pipe, Recyclable steel framing (studs), Desks/Furniture), Packaging (Canes, Bottles, Others), Water Projects (Levees/Dams/Locks), Energy (Renewable, Nuclear, Bio-fuels, Fossil, Electric Grid), Others By Industry: Construction (Steel Skeletons, Concrete Walls, Pillars, Nails, Bolts, Screws, Others), Machinery (Bulldozers, Backhoe Leaders, Pipelayers, Others), Automotive and Transportation (Exhaust, Trim/Decorative, Engine, Chassis, Fasteners, Tubing For Fuel Lines), Kitchenware and Domestic Appliances (Small Household Appliances, Black Home Appliances, White Home Appliances), Electrical and Electronics (Motor Mount Brackets, Adapter Plates, Electronic Frames and Chassis, Brackets, Others), Healthcare (Orthopaedic Implants, Artificial Heart Valves, Bone Fixation, Catheters, Others), Energy (Scrubbers, Heat Exchangers, Others) By Region: North America, South America, Europe, Asia-Pacific and Rest of the World

Request Sample

Key Takeaways

Steel Market Segment Analysis – By Type In terms of type, the Steel Market is segmented into carbon steel, stainless steel, alloy steel, tool steel and others. In 2023, the Stainless-steel segment generated the greatest revenue of $361.94 billion and is projected to reach a revenue of $482.28 billion by 2030. Owing to the various benefits posed by stainless steel such as corrosion resistance, high and low temperature resistance, the ease of fabrication, strength, aesthetic appeal is one of the key factors for its adoption among various end-use industries, which in turn is boosting its market growth. The stainless-steel segment can be further classified as Austenitic stainless steels, Ferritic stainless steels, Martensitic stainless steels, Precipitation hardening grade stainless steel and Duplex stainless steels.

Steel Market Segment Analysis – By Form By form, the steel market is segmented into bar, rod, tube, pipe, plate, sheet, structural and others. The bar segment accounted for the major market share in 2023, with a revenue of $554.58 billion, and is forecast to grow at a CAGR of 4.68% by 2030. The increasing demand for steel bar from various end-user industries such as building and construction, bridges, and many others, are driving the growth of the segment during the forecast period of 2024-2030.

Steel Market Segment Analysis – By Application Steel Market is segmented by its application that includes transportation, construction, packaging, water projects, energy and others. The energy segment held the dominant market share, 31% of the whole market, in 2023, and is expected to maintain its dominance by 2030 with a CAGR of 4.69%. One of the major factors for the segment growth is the increasing awareness and focus towards renewable energy sources. Steel plays a crucial role in producing and distributing energy as well as improving energy efficiency. Renewable energy is further classified as Wind Towers and Foundation, Wind Turbines and Solar Parabolic Mirror Supports & Collectors.

Steel Market Segment Analysis – By Industry The Steel finds its application across the industries such as construction, machinery, automotive and transportation, kitchenware and domestic appliance, electrical and electronics, healthcare, energy and others. Among them, the construction segment is the largest consumer of steel, as bearable structures can be manufactured easily at a low cost. The property of steel in its various forms and alloys makes it more flexible to cater the exclusive projects integrated with infrastructure. Moreover, the rapid industrialization and urbanization in various developing countries are fueling the segment growth in strengthening its dominant market position during the forecast period.

Buy Now

Steel Market Segment Analysis - By Geography/Country The report comprises of the region wise study of the global market including North America, South America, Europe, Asia-Pacific and Rest of the World. Above all, Asia-Pacific region held the biggest share in 2023, up to 63% of the whole steel market owing to the rapidly expanding defense, machinery, automotive, and shipbuilding industries in the countries such as India, China, South Korea, and Japan. Foreign direct investment in energy and infrastructure is likely to provide opportunities for the market vendors. Coupled with favorable government regulations, growing infrastructure and construction activities in developing economies of the Asia-Pacific region are boosting the demand for the market.

Steel Market - Drivers

Growing Demand for Steel Across the Various Regions Several factors have a significant impact on the overall development of the steel market. The major growth factor driving the Steel Market is the growing demand for steel across a variety of developing regions. For instance, Global crude steel production in January-November 2023 reached 1715.12 million metric tons, marking a marginal 0.5% year-on-year growth, per provisional data from the World Steel Association. November 2023 saw a production of 145.5 million metric tons, up by 3.3% from the previous year. China led the production with 952.14 million metric tons, followed by India and Japan, USA, Russia, South Korea, and Germany.

Construction and Infrastructure Development: Construction activities, including residential, commercial, and infrastructure projects such as roads, bridges, and railways, are major drivers of steel demand. Urbanization and industrialization also contribute to the growth of the construction sector, thereby increasing the demand for steel products. For instance, as per Green Finance & Development Center, China Belt and Road Initiative (BRI) Investment Report 2023, engagement totalled about USD88.3 billion, with USD44.6 billion from investment and USD43.7 billion from construction contracts. Also, The US Department of Transportation allocates $3.2 billion in extra funding, alongside $4.3 billion from the Bipartisan Infrastructure Law for 2023. The Budget prioritizes $4.5 billion for the Capital Investment Grant program, aiming to bolster transit infrastructure for economic growth. As a result, the steel market is anticipated to thrive, propelled by heightened construction activities and the need for durable materials, reflecting a promising outlook for the industry.

Steel Market -Challenges

Environmental Regulations and Sustainability The steel industry is facing mounting pressure to tackle environmental issues by cutting carbon emissions and enhancing sustainability efforts. Meeting stringent environmental regulations demands substantial investments in technology and infrastructure, presenting a formidable challenge for many companies. Despite the financial hurdles, embracing these changes can pave the way for a more sustainable and eco-friendly future for the industry.

Steel Market - Competitive Landscape The companies referred in the study include Baosteel Co., Ltd., Posco Holding Inc, Nippon Steel Corporation, JFE Holdings, Tata Steel Limited, United States Steel Corporation, Anshan Iron and Steel Group Corporation, Hyundai Steel Co., Ltd., ThyssenKrupp AG, ArcelorMittal S.A., among others. Technology launches, acquisitions, and R&D activities are key strategies adopted by the key players in the Steel Market.

0 notes

Text

Saw this up on a light post and thought it was fake but nope, pipelayers 69 is the actual name/number combo for a real union local.

It was organized in 2020 though so maybe someone did it intentionally? Either way it's hilarious.

1 note

·

View note

Text

"i cant wait to get out of retail and have an office job" or you could be a hairstylist or a fisherman or a teacher or a pipelayer or a bartender or a phlebotomist or a truck driver or an exterminator or a massage therapist or a cook or a stripper

whys everyone in my notes acting like office work is the only alternative to retail. "well its boring but its better than retail" you realize youre not saying anything at all because getting beaten with a stick for 40 hours a week would also be better than retail right. that is not a high bar. there are a lot of other jobs in the world for people to do.

99 notes

·

View notes