#Pharmaceutical Packaging Market Share

Explore tagged Tumblr posts

Text

The global market for Pharmaceutical Packaging is expected to reach $122.6 billion by 2030 from $109.4 billion in 2022, registering impressive expansion at a compound annual growth rate (CAGR) of 6.7%. Some of the major players are Amcor Ltd., Becton, Dickinson, Aptargroup, Inc., Capsugel Inc., Gerresheimer AG, Schott AG, Terumo Corporation, WEST Pharmaceutical Services, Inc., Berry Plastics Group, Inc., Westrock Company, SGD SA, Comar LLC, International Paper Company, Owens Illinois Inc., Aptar Group Inc.

#Pharmaceutical Packaging Market#Pharmaceutical Packaging#Pharmaceutical Packaging Market Size#Pharmaceutical Packaging Market Share#Pharmaceutical Packaging Market Price#Pharmaceutical Packaging Market Growth#Pharmaceutical Packaging Market Trends

2 notes

·

View notes

Text

Pharmaceutical Packaging Market Trends, Opportunities, and Challenges 2024 - 2030

The global pharmaceutical packaging market was valued at USD 139.37 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.7% from 2024 to 2030. A key driver of this growth is the substantial expansion of the pharmaceutical sector itself. In recent years, the pharmaceutical industry has experienced rapid growth, fueled by continuous advancements in science and technology. This upward trend is expected to persist throughout the forecast period, especially in developing countries such as China, India, Saudi Arabia, and Brazil, where the healthcare infrastructure and pharmaceutical demand are expanding quickly.

The United States is the largest pharmaceutical market in the world. Several factors contribute to this dominance, including the size of the healthcare system, high per capita income, and substantial investments in drug development within the country. These elements collectively drive the growth of the pharmaceutical sector in the U.S. Additionally, the increasing importance of generic drugs and broader access to better healthcare services are expected to create further growth opportunities for pharmaceutical packaging in the coming years.

A significant piece of legislation, the 21st Century Cures Act, was signed into law in the U.S. on December 13, 2016. This act is designed to expedite the development of medical products, including pharmaceutical drugs, by enhancing the approval process and encouraging innovation in the industry. The implementation of the Cures Act is expected to spur new developments in pharmaceutical products, which will, in turn, drive the demand for pharmaceutical packaging in the U.S. market. These factors collectively indicate a continued growth trajectory for the pharmaceutical packaging industry, especially in key markets such as the U.S.

Gather more insights about the market drivers, restrains and growth of the Pharmaceutical Packaging Market

Regional Insights

North America

North America dominated the pharmaceutical packaging market with a revenue share of 35.9% in 2023. The largest end-use segment in the region was pharma manufacturing, which includes in-house production of pharmaceutical products. The presence of a substantial number of pharmaceutical plastic bottle manufacturers in the U.S., such as AptarGroup Inc., Gerresheimer AG, Amcor Ltd., and Berry Plastics Group, Inc., is expected to have a positive impact on the demand for pharmaceutical plastic bottles over the forecast period. These companies play a critical role in supplying the packaging materials required for pharmaceutical products, further driving market growth.

Asia Pacific

The Asia Pacific region is anticipated to register the fastest CAGR of over 12% from 2024 to 2030. This growth is driven by increasing health awareness among consumers, particularly in developing countries such as China and India, and rising disposable income levels. As a result, the demand for pharmaceuticals is expected to grow, which will in turn boost the need for pharmaceutical packaging solutions. In 2020, China led the Asia Pacific market and is expected to maintain this position due to government initiatives like Healthy China 2020, as well as a growing aging population and expanding contract-manufacturing activities. These factors contribute to the increasing demand for pharmaceutical packaging in the region.

Europe

In Europe, the pharmaceutical packaging market is expected to experience significant growth due to rising research and development (R&D) activities and the continuous introduction of new medicines aimed at improving patient health and quality of life. Companies such as BioNTech SE and CureVac in Europe have made notable achievements, particularly with their successful vaccine development in 2020. These successes have attracted further investments into the biotech industry in countries like Germany, Russia, and the U.K., propelling the growth of pharmaceutical packaging in the region.

The Saudi Arabian pharmaceutical packaging market is one of the major players in the Middle East & Africa region. International pharmaceutical companies are recognizing the potential of the Middle Eastern and North African (MENA) market. For example, Sanofi is a leading player in Morocco, and GlaxoSmithKline leads the market in Saudi Arabia. In addition, local pharmaceutical companies such as SPIMACO and Hikma from Jordan and Saudi Arabia are aiming to become regional leaders. These developments are expected to drive the demand for various pharmaceutical packaging materials in the region during the forecast period.

Browse through Grand View Research's Plastics, Polymers & Resins Industry Research Reports.

• The global flexible paper packaging market size was estimated at USD 50.35 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030.

• The global seaweed packaging market size was valued at USD 699.23 million in 2023 and is expected to expand at a CAGR of 6.6% from 2024 to 2030.

Key Companies & Market Share Insights

The global pharmaceutical packaging market is highly competitive, with numerous players competing for market share. To strengthen their positions, key players are increasingly focusing on acquisitions, which is intensifying the competition within the market. These companies directly compete with each other to secure contracts from large pharmaceutical manufacturers. As a result, the level of competitive rivalry in the market is high.

To differentiate themselves in this competitive landscape, companies are focusing on offering value-added services to attract more clients. Common processes employed by packaging manufacturers to enhance their offerings include spray painting, ultraviolet (UV) coating, and metallization to color packaging containers. Additionally, packaging companies are incorporating various anti-counterfeit measures, such as barcodes, holograms, sealing tapes, and radio frequency identification (RFID) technologies to ensure product authenticity and security.

Notable developments in the market include:

• In November 2023, Amcor Plc, a leading global provider of packaging solutions, announced a Memorandum of Understanding (MOU) with NOVA Chemicals Corporate, a producer of sustainable polyethylene. Under the agreement, Amcor will procure mechanically recycled polyethylene resin (rPE) from NOVA Chemicals for use in the production of flexible packaging films. This partnership supports Amcor’s commitment to sustainable packaging by increasing the use of recycled materials, contributing to the circularity of packaging.

• In July 2023, Constantia Flexibles introduced a new pharmaceutical packaging solution called REGULA CIRC, which uses coldform foil. The packaging replaces conventional PVC with a PE sealing layer, resulting in reduced plastic content and a higher proportion of aluminum. This shift not only enhances the sustainability of the packaging but also improves material recovery during the recycling process.

• In April 2023, Südpack launched its PharmaGuard blister, a new polypropylene-based blister packaging. This product is designed to offer an exceptional water vapor barrier and effective resistance to UV light and oxygen, making it suitable for the packaging of sensitive pharmaceutical products that require enhanced protection.

Key Pharmaceutical Packaging Companies:

• Amcor plc

• Becton, Dickinson, and Company

• AptarGroup, Inc.

• Drug Plastics Group

• Gerresheimer AG

• Schott AG

• Owens Illinois, Inc.

• West Pharmaceutical Services, Inc.

• Berry Global, Inc.

• WestRock Company

• SGD Pharma

• International Paper

• Comar, LLC

• CCL Industries, Inc.

• Vetter Pharma International

Order a free sample PDF of the Pharmaceutical Packaging Market Intelligence Study, published by Grand View Research.

#Pharmaceutical Packaging Market#Pharmaceutical Packaging Market size#Pharmaceutical Packaging Market share#Pharmaceutical Packaging Market analysis#Pharmaceutical Packaging Industry

0 notes

Text

Pharmaceutical Packaging Market Analysis Report - Industry Trends, Growth and Segmentation 2030

In 2023, the global pharmaceutical packaging market reached a valuation of USD 139.37 billion and is projected to grow at a compound annual growth rate (CAGR) of 9.7% from 2024 through 2030. This growth is largely driven by the rapid expansion of the pharmaceutical industry, which has seen significant advancements in science and technology in recent years. These advancements are anticipated to continue driving demand, especially in emerging markets like China, India, Saudi Arabia, and Brazil, where pharmaceutical production and healthcare services are expanding rapidly.

The United States holds the largest pharmaceutical market share worldwide. Key factors behind this include the nation’s extensive healthcare infrastructure, high per capita income, and significant investments in drug research and development. The rise in generic drugs and improved access to healthcare services in the U.S. are also expected to create promising opportunities for pharmaceutical packaging over the coming years. Additionally, the 21st Century Cures Act (Cures Act), signed into law on December 13, 2016, was enacted to accelerate the development and approval of medical products, encouraging innovations that are anticipated to drive demand for pharmaceutical packaging in the U.S.

Gather more insights about the market drivers, restrains and growth of the Pharmaceutical Packaging Market

In Europe, the pharmaceutical industry is a crucial component of the economy and is one of the region's most high-performing and technologically advanced sectors. Recent years have seen a significant shift toward the development of biopharmaceutical drugs, a focus that has grown substantially. Biopharmaceuticals often require specialized packaging, as many biotechnology-derived drug therapies are unstable in liquid form and are instead offered as lyophilized (freeze-dried) or dry powder formulations. These specialized dosage forms demand advanced packaging solutions to maintain the drugs' stability and efficacy, creating new opportunities for packaging manufacturers to innovate.

The pharmaceutical packaging market is diverse and fragmented, featuring large and medium-sized international companies alongside smaller domestic players. Key players in this market include Amcor plc, Becton, Dickinson and Company, AptarGroup, Inc., Drug Plastics Group, Gerresheimer AG, Schott AG, O-I Glass, Inc., SGD Pharma, West Pharmaceutical Services, Inc., Berry Global Group, Inc., WestRock Company, International Paper, Comar, LLC, CCL Industries, and Vetter Pharma International.

Product Segmentation Insights:

Pharmaceutical packaging is categorized into three main types: primary, secondary, and tertiary packaging. In 2023, primary packaging accounted for the largest share of the market. Primary packaging refers to materials such as bottles, tubes, and blister packs that come into direct contact with the drug, protecting it from contamination and aiding in safe storage. Primary packaging often also plays a role in dispensing and dosing, and manufacturers are focusing on user-friendly designs, including easy-open closures and dispensing systems that ensure the correct dose is given at the appropriate time. These advancements are especially beneficial for elderly populations, who may need additional support in handling medication.

Secondary pharmaceutical packaging is the next layer of protection, grouping multiple primary packages to safeguard them from external impacts. This packaging is critical for both branding and logistics. It not only helps protect the drug but also serves as a marketing tool by displaying the product in an attractive way. Secondary packaging also makes it easier to handle and transport multiple units, which is important for distribution efficiency.

Tertiary packaging, on the other hand, is used to wrap or bundle large groups of products, facilitating safe handling and transportation of goods across long distances. Examples of tertiary packaging include brown cardboard boxes, shrink wraps, and plastic bags. The growth of e-pharmacy (online pharmaceutical sales) has contributed to the increased need for tertiary packaging, as it ensures the safe and efficient transport of pharmaceutical products directly to consumers. This trend is expected to further drive demand for tertiary packaging over the forecast period.

Order a free sample PDF of the Pharmaceutical Packaging Market Intelligence Study, published by Grand View Research.

#Pharmaceutical Packaging Industry#Pharmaceutical Packaging Market Share#Pharmaceutical Packaging Market Analysis#Pharmaceutical Packaging Market Trends

0 notes

Text

Pharmaceutical Packaging Market Overview, Challenges and Growth Opportunities Analysis till 2030

In 2023, the global pharmaceutical packaging market reached a valuation of USD 139.37 billion and is projected to grow at a compound annual growth rate (CAGR) of 9.7% from 2024 through 2030. This growth is largely driven by the rapid expansion of the pharmaceutical industry, which has seen significant advancements in science and technology in recent years. These advancements are anticipated to continue driving demand, especially in emerging markets like China, India, Saudi Arabia, and Brazil, where pharmaceutical production and healthcare services are expanding rapidly.

The United States holds the largest pharmaceutical market share worldwide. Key factors behind this include the nation’s extensive healthcare infrastructure, high per capita income, and significant investments in drug research and development. The rise in generic drugs and improved access to healthcare services in the U.S. are also expected to create promising opportunities for pharmaceutical packaging over the coming years. Additionally, the 21st Century Cures Act (Cures Act), signed into law on December 13, 2016, was enacted to accelerate the development and approval of medical products, encouraging innovations that are anticipated to drive demand for pharmaceutical packaging in the U.S.

Gather more insights about the market drivers, restrains and growth of the Pharmaceutical Packaging Market

In Europe, the pharmaceutical industry is a crucial component of the economy and is one of the region's most high-performing and technologically advanced sectors. Recent years have seen a significant shift toward the development of biopharmaceutical drugs, a focus that has grown substantially. Biopharmaceuticals often require specialized packaging, as many biotechnology-derived drug therapies are unstable in liquid form and are instead offered as lyophilized (freeze-dried) or dry powder formulations. These specialized dosage forms demand advanced packaging solutions to maintain the drugs' stability and efficacy, creating new opportunities for packaging manufacturers to innovate.

The pharmaceutical packaging market is diverse and fragmented, featuring large and medium-sized international companies alongside smaller domestic players. Key players in this market include Amcor plc, Becton, Dickinson and Company, AptarGroup, Inc., Drug Plastics Group, Gerresheimer AG, Schott AG, O-I Glass, Inc., SGD Pharma, West Pharmaceutical Services, Inc., Berry Global Group, Inc., WestRock Company, International Paper, Comar, LLC, CCL Industries, and Vetter Pharma International.

Product Segmentation Insights:

Pharmaceutical packaging is categorized into three main types: primary, secondary, and tertiary packaging. In 2023, primary packaging accounted for the largest share of the market. Primary packaging refers to materials such as bottles, tubes, and blister packs that come into direct contact with the drug, protecting it from contamination and aiding in safe storage. Primary packaging often also plays a role in dispensing and dosing, and manufacturers are focusing on user-friendly designs, including easy-open closures and dispensing systems that ensure the correct dose is given at the appropriate time. These advancements are especially beneficial for elderly populations, who may need additional support in handling medication.

Secondary pharmaceutical packaging is the next layer of protection, grouping multiple primary packages to safeguard them from external impacts. This packaging is critical for both branding and logistics. It not only helps protect the drug but also serves as a marketing tool by displaying the product in an attractive way. Secondary packaging also makes it easier to handle and transport multiple units, which is important for distribution efficiency.

Tertiary packaging, on the other hand, is used to wrap or bundle large groups of products, facilitating safe handling and transportation of goods across long distances. Examples of tertiary packaging include brown cardboard boxes, shrink wraps, and plastic bags. The growth of e-pharmacy (online pharmaceutical sales) has contributed to the increased need for tertiary packaging, as it ensures the safe and efficient transport of pharmaceutical products directly to consumers. This trend is expected to further drive demand for tertiary packaging over the forecast period.

Order a free sample PDF of the Pharmaceutical Packaging Market Intelligence Study, published by Grand View Research.

#Pharmaceutical Packaging Industry#Pharmaceutical Packaging Market Share#Pharmaceutical Packaging Market Analysis#Pharmaceutical Packaging Market Trends

0 notes

Text

#Pharmaceutical Packaging Market#Pharmaceutical Packaging Market size#Pharmaceutical Packaging Market share#Pharmaceutical Packaging Market trends#Pharmaceutical Packaging Market analysis#Pharmaceutical Packaging Market forecast#Pharmaceutical Packaging Market outlook

1 note

·

View note

Text

#Pharmaceutical Packaging Equipment Market#Pharmaceutical Packaging Equipment Market Size#Pharmaceutical Packaging Equipment Market Share

0 notes

Link

0 notes

Text

The Growing Demand for Pharmaceutical Glass Packaging: Market Insights and Future Outlook

Market Overview:

The pharmaceutical glass packaging market is projected to be valued at USD 29.77 billion in 2024 and is expected to grow to USD 38.52 billion by 2029, reflecting a compound annual growth rate (CAGR) of 5.29% during the forecast period from 2024 to 2029.

Key Trends:

Increasing Demand for Biopharmaceuticals: The rise of biologic drugs and vaccines is fueling the demand for high-quality, sterile glass packaging. These drugs require secure and contamination-free packaging, which glass containers can provide due to their superior barrier properties.

Sustainability Initiatives: Glass is considered a sustainable packaging material due to its recyclability. As the pharmaceutical industry focuses more on sustainability, the demand for glass packaging, especially recyclable glass, is increasing.

Technological Innovations in Glass Manufacturing: The industry is witnessing advancements in glass-making technologies, improving the strength, durability, and design of pharmaceutical glass containers. These innovations are aimed at enhancing product protection and safety.

Rising Healthcare Expenditures: With global healthcare spending on the rise, particularly in emerging economies, the demand for pharmaceutical products, and by extension, pharmaceutical packaging, is expected to grow. This provides an opportunity for the glass packaging industry to expand.

Preference for Single-Use Glass Packaging: With a growing focus on hygiene and product safety, there is a shift toward single-use glass packaging solutions in the pharmaceutical sector. This is especially relevant in injectable drugs, where contamination prevention is paramount.

Challenges:

High Cost of Glass Packaging: The production cost of glass packaging is higher compared to other materials like plastic. This can limit its widespread adoption, especially in cost-sensitive markets.

Fragility and Risk of Breakage: Glass, while durable in terms of preserving product integrity, is more fragile than other packaging materials. This increases the risk of breakage during transportation, potentially leading to product loss and increased packaging costs.

Regulatory Compliance: Pharmaceutical glass packaging must comply with stringent regulatory standards, such as FDA requirements. Keeping up with these regulations can be challenging for manufacturers, especially those operating in multiple regions with different compliance standards.

Supply Chain Disruptions: The glass packaging industry is often impacted by raw material shortages and supply chain disruptions. These challenges, such as the availability of high-quality glass and labor shortages, can affect production timelines and costs.

Conclusion:

The pharmaceutical glass packaging market is poised for significant growth driven by the increasing demand for biologics, advancements in packaging technology, and a global push for more sustainable practices. Despite challenges like high production costs and fragility, the industry is innovating to meet the evolving needs of the pharmaceutical sector. As the market grows, manufacturers must focus on overcoming these hurdles while capitalizing on emerging trends to remain competitive in a rapidly evolving environment.

#pharmaceutical glass packaging market#pharmaceutical glass packaging market size#pharmaceutical glass packaging market share#pharmaceutical glass packaging industry#pharmaceutical glass packaging industry analysis

0 notes

Text

#Pharmaceuticals Temperature Controlled Packaging Solutions Market Size#Pharmaceuticals Temperature Controlled Packaging Solutions Market Share#Pharmaceuticals Temperature Controlled Packaging Solutions Market Growth#Pharmaceuticals Temperature Controlled Packaging Solutions Market Trends#Pharmaceuticals Temperature Controlled Packaging Solutions Market Forecast Analysis#Pharmaceuticals Temperature Controlled Packaging Solutions Market Segmentation#Pharmaceuticals Temperature Controlled Packaging Solutions Market 2024#Pharmaceuticals Temperature Controlled Packaging Solutions Market CAGR#Pharmaceuticals Temperature Controlled Packaging Solutions Market Analyzer Industry

0 notes

Text

#Pharmaceutical Contract Packaging Market#Pharmaceutical Contract Packaging Market size#Pharmaceutical Contract Packaging Market share#Pharmaceutical Contract Packaging Market trends#Pharmaceutical Contract Packaging Market analysis

0 notes

Text

The market is primarily driven by growing awareness regarding health and hygiene, coupled with increased spending on pharmaceutical products, mainly in emerging economies. Moreover, many governments are focusing on strengthening pharmaceutical production facilities and population health management is further expanding the demand for pharmaceutical products, which results in boosting the market growth.

#Pharmaceutical Packaging Equipment Market#Pharmaceutical Packaging Equipment Industry#Pharmaceutical Packaging Equipment Market 2023#Pharmaceutical Packaging Equipment Market Size#Pharmaceutical Packaging Equipment Market Share#Pharmaceutical Packaging Equipment Market Revenue#Pharmaceutical Packaging Equipment Market 2030

0 notes

Text

India Pharmaceutical Glass Packaging Market

#India Pharmaceutical Glass Packaging Market#India Pharmaceutical Glass Packaging Market Share#India Pharmaceutical Glass Packaging Market Size#India Pharmaceutical Glass Packaging Market Growth#India Pharmaceutical Glass Packaging Market Trends.

0 notes

Text

Pharmaceutical Packaging Market Challenges, Strategies And Forecast Report 2024 - 2030

The global pharmaceutical packaging market size was valued at USD 139.37 billion in 2023 and is expected to grow a compound annual growth rate (CAGR) of 9.7% from 2024 to 2030.

The enormous growth of the pharmaceutical sector is one of the primary growth factors for the pharmaceutical packaging sector. The pharmaceutical business has been expanding quickly in recent years due to scientific and technological advancements, and this trend is predicted to continue over the projection period, particularly in developing nations like China, India, Saudi Arabia, and Brazil.

The U.S. accounted for the largest pharmaceutical market worldwide. Large healthcare system, high per capita income, and large investments in drug development in the country are some of the key factors driving the U.S. market. Furthermore, growing importance of generic drugs and access to better healthcare services are anticipated to provide lucrative opportunities for pharmaceutical packaging in the coming years. The 21st Century Cures Act (Cures Act) was signed on December 13, 2016, in the U.S. and is designed to accelerate medical product development. The law is expected to drive new innovations in product developments in pharmaceutical industry. This is expected to drive the demand for pharmaceutical packaging in U.S.

Gather more insights about the market drivers, restrains and growth of the Pharmaceutical Packaging Market

Pharmaceutical Packaging Market Report Highlights

• Asia Pacific is expected to register the fastest CAGR of more than 12% from 2024 to 2030. This growth is due to the rapidly expanding pharmaceutical market, particularly in China & India, and rising cases of various diseases, such as cancer and heart problems

• In terms of material, the glass segment is projected to ascend at the highest CAGR of 10.3% over the forecast period. Strong chemical resistance to various medicinal products and the ability to withstand heating treatment during the sterilization process is expected to expand the penetration of glass packaging

• Pharma manufacturing is the key end-use segment that accounted for the highest share of 49.9% in 2023 and is expected to witness strong growth from 2024 to 2030. This is owing to the increasing demand for medicines.

• In April 2022, Amcor has launched new and more sustainable High Shield laminates to its pharmaceutical packaging portfolio. This is low carbon, recycle-ready, and moisture resistant packaging solution, thus end use companies’ recyclability agendas

Browse through Grand View Research's Plastics, Polymers & Resins Industry Research Reports.

• The global flexible paper packaging market size was estimated at USD 50.35 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030.

• The global seaweed packaging market size was valued at USD 699.23 million in 2023 and is expected to expand at a CAGR of 6.6% from 2024 to 2030.

Pharmaceutical Packaging Market Segmentation

Grand View Research has segmented the pharmaceutical packaging market on the basis of on material, product, drug delivery mode, end-use, and region:

Pharmaceutical Packaging Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

• Plastics & Polymers

o Polyvinyl Chloride (PVC)

o Polypropylene (PP)

o Homo

o Random

o Polyethylene Terephthalate (PET)

o Polyethylene (PE)

o HDPE

o LDPE

o LLDPE

o Polystyrene (PS)

o Others

• Paper & Paperboard

• Glass

• Aluminium Foil

• Others

Pharmaceutical Packaging Product Outlook (Revenue, USD Million, 2018 - 2030)

• Primary

o Plastic Bottles

o Caps & Closures

o Parenteral Containers

o Syringes

o Vials & Ampoules

o Others

o Blister Packs

o Prefillable Inhalers

o Pouches

o Medication Tubes

o Others

• Secondary

o Prescription Containers

o Pharmaceutical Packaging Accessories

• Tertiary

Pharmaceutical Packaging Drug Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

• Oral Drugs

• Injectables

• Topical

• Ocular/ Ophthalmic

• Nasal

• Pulmonary

• Transdermal

• IV Drugs

• Others

Pharmaceutical Packaging End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Pharma Manufacturing

• Contract Packaging

• Retail Pharmacy

• Institutional Pharmacy

Pharmaceutical Packaging Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

o Italy

o Spain

o Russia

o Turkey

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

o Southeast Asia

• Central & South America

o Brazil

o Argentina

• Middle East & Africa

o Saudi Arabia

o UAE

o South Africa

o Egypt

Order a free sample PDF of the Pharmaceutical Packaging Market Intelligence Study, published by Grand View Research.

#Pharmaceutical Packaging Market#Pharmaceutical Packaging Market size#Pharmaceutical Packaging Market share#Pharmaceutical Packaging Market analysis#Pharmaceutical Packaging Industry

0 notes

Text

Anti-counterfeit Pharmaceutical Packaging Market: Key Strategies for Drug Authentication

The pharmaceutical industry plays a critical role in public health by providing life-saving medications and treatments. However, this industry faces an ongoing challenge: counterfeit drugs. Counterfeit pharmaceuticals pose a significant threat to patients' health, as they may contain ineffective or harmful ingredients. To combat this issue, the pharmaceutical sector has embraced anti-counterfeit pharmaceutical packaging solutions. In this article, we will delve into the "Anti-counterfeit Pharmaceutical Packaging Market," exploring its growth drivers, current trends, key players, and future prospects.

The Need for Anti-counterfeit Pharmaceutical Packaging

Counterfeit pharmaceuticals are a global concern, with potentially devastating consequences. Patients relying on counterfeit drugs may experience worsened health conditions, adverse side effects, or even fatalities. The World Health Organization (WHO) estimates that around 10% of drugs available worldwide are counterfeit, with the percentage rising in some regions. To address this alarming issue, the pharmaceutical industry has adopted anti-counterfeit measures, and packaging is at the forefront of these efforts.

Market Growth Drivers

Stringent Regulatory Requirements: Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have implemented strict guidelines regarding pharmaceutical packaging and labeling to ensure product integrity and patient safety. Compliance with these regulations drives the adoption of anti-counterfeit packaging solutions market.

Increasing Counterfeit Drug Incidents: As counterfeit drug incidents continue to rise, pharmaceutical companies are compelled to invest in advanced packaging technologies to protect their brand reputation and, more importantly, patient well-being.

Advancements in Technology: Innovations in printing, tracking, and authentication technologies have made it easier for pharmaceutical companies to implement anti-counterfeit measures in their packaging. QR codes, holograms, tamper-evident seals, and unique serial numbers are just a few examples of such advancements.

Growing Pharmaceutical Industry: The pharmaceutical industry is expanding, driven by an aging population, increased healthcare spending, and the demand for new treatments. This growth, in turn, fuels the demand for effective anti-counterfeit packaging solutions.

Current Trends in the Market

Track-and-Trace Technologies: Pharmaceutical companies are increasingly adopting track-and-trace technologies to monitor the movement of their products throughout the supply chain. This ensures that medications reach their intended destination without tampering.

Smart Packaging: Smart packaging solutions, such as RFID (Radio-Frequency Identification) tags and NFC (Near-Field Communication) labels, enable real-time monitoring of products and enhance supply chain security.

Authentication Features: Innovative authentication features, like digital watermarks and 3D holograms, are being integrated into pharmaceutical packaging to make it more difficult for counterfeiters to replicate.

Blockchain in Pharmaceuticals: Blockchain technology is gaining traction in the pharmaceutical industry to create transparent and immutable records of a drug's journey from manufacturer to consumer. This helps in verifying the authenticity of pharmaceutical products.

Key Players in the Market

Several companies specialize in providing anti-counterfeit pharmaceutical packaging solutions. Some of the key players in this market include:

Avery Dennison Corporation: Known for its expertise in labeling and packaging materials, Avery Dennison offers a range of anti-counterfeit solutions, including tamper-evident labels and RFID tags.

CCL Industries Inc.: CCL Industries is a global leader in specialty packaging solutions, offering technologies such as brand protection labels and tamper-evident closures.

SICPA: SICPA specializes in secure traceability and authentication solutions, providing pharmaceutical companies with tools to combat counterfeit drugs effectively.

Essentra: Essentra focuses on providing packaging, authentication, and security solutions tailored to the pharmaceutical industry's needs.

Future Prospects

The anti-counterfeit pharmaceutical packaging market is poised for significant growth in the coming years. As the pharmaceutical industry expands and regulations become even more stringent, the demand for innovative packaging solutions will continue to rise. Furthermore, advancements in technology, including the integration of blockchain and artificial intelligence, will further enhance the effectiveness of anti-counterfeit measures.

In conclusion, the "Anti-counterfeit Pharmaceutical Packaging Market Growth" is essential for safeguarding public health and maintaining the integrity of the pharmaceutical industry. As counterfeit drug incidents persist, pharmaceutical companies will increasingly invest in advanced packaging solutions to protect their products and, most importantly, their patients. With evolving technology and a commitment to regulatory compliance, this market is set to play a pivotal role in ensuring the safety and efficacy of pharmaceutical products in the years to come.

#Anti-counterfeit Pharmaceutical Packaging Market Share#Anti-counterfeit Pharmaceutical Packaging Market Growth#Anti-counterfeit Pharmaceutical Packaging Market Demand

0 notes

Text

India Pharmaceutical Packaging Market Is Estimated To Witness High Growth Owing To Increasing Demand for Safe Drug Packaging

The India Pharmaceutical Packaging Market is estimated to be valued at USD 1,573.40 million in 2021 and is expected to exhibit a CAGR of 7.50% over the forecast period 2022 to 2030, as highlighted in a new report published by Coherent Market Insights. A) Market Overview: The India Pharmaceutical Packaging Market refers to the packaging solutions specifically designed for pharmaceutical products. These packaging solutions ensure the safety, integrity, and efficacy of the drugs during storage, transportation, and distribution. The need for pharmaceutical packaging arises from the requirement to protect the drugs from moisture, light, oxygen, and other external factors that can potentially degrade their quality. Additionally, pharmaceutical packaging also plays a crucial role in providing important information such as dosage instructions, expiry dates, and batch numbers to the end-users. B) Market Key Trends: One key trend driving the growth of the India Pharmaceutical Packaging Market is the increasing demand for safe drug packaging. With the rising prevalence of counterfeit drugs in the market, there is a growing concern among consumers regarding the safety and authenticity of the drugs they purchase. As a result, pharmaceutical companies are focusing on implementing advanced packaging solutions that incorporate tamper-evidence features and anti-counterfeiting technologies. For example, blister packs with holographic seals and track-and-trace systems are being widely adopted to ensure the integrity of drugs and prevent counterfeiting. C) PEST Analysis: Political: The Indian government has implemented strict regulations and guidelines for pharmaceutical packaging to ensure the safety of drugs and protect consumer interests. Economic: The pharmaceutical industry in India is witnessing substantial growth due to factors such as increasing healthcare expenditure, a large patient population, and favorable government initiatives. Social: There is a growing awareness among consumers regarding the importance of safe drug packaging and its impact on health outcomes. Technological: The pharmaceutical packaging industry in India is witnessing advancements in technologies such as smart packaging, RFID tagging, and serialization, which help improve the efficiency and traceability of drugs. D) Key Takeaways: - The India Pharmaceutical Packaging Market Size is expected to witness high growth, exhibiting a CAGR of 7.50% over the forecast period, due to increasing demand for safe drug packaging. - The fastest growing and dominating region in the India Pharmaceutical Packaging Market is North India, which is home to several pharmaceutical manufacturing hubs and healthcare facilities. - Key players operating in the India Pharmaceutical Packaging Market are Amcor Plc, Aptar Group Inc., Huhtamaki Plc, and Uflex Limited. These companies are focusing on product innovation, strategic partnerships, and acquisitions to expand their market share. In conclusion, the India Pharmaceutical Packaging Market is experiencing significant growth due to the increasing demand for safe drug packaging. The market is driven by the need to protect drugs from external factors and prevent counterfeiting. With advancements in technology and stringent government regulations, the market is expected to flourish in the coming years. The key players in the market are actively investing in research and development to stay competitive in this evolving landscape.

#India Pharmaceutical Packaging Market#Pharmaceutical Packaging Market Demand#Pharmaceutical Packaging Market Insights#Pharmaceutical Packaging Market Value#Pharmaceutical Packaging Market Shares#Pharmaceutical Packaging Market Size#Pharmaceutical Packaging#pharmaceutical industry#packaging materials#Coherent Market Insights

0 notes

Text

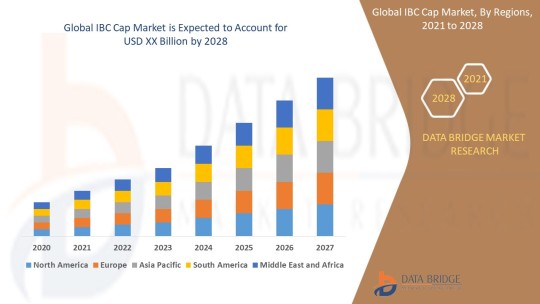

IBC Cap Market Size, Share, Trends, Growth and Competitive Analysis

"IBC Cap Market – Industry Trends and Forecast to 2028

Global IBC Cap Market, By Product Type (Flange, Plugs, Vent-in Plug, Vent-out Plug and Screw closure), Type (Plastic IBC, Metal IBC and Composite IBCs), Material Type (Plastics, Metal, Aluminium and Steel), End Use (Chemicals & Fertilizers, Petroleum & Lubricants, Paints, Inks & Dyes, Food & Beverage, Agriculture, Building & Construction, Healthcare & Pharmaceuticals and Mining), Application (Food And Drinks, Chemical Industry, Oil and Agriculture), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028

Access Full 350 Pages PDF Report @

The global IBC cap market is expected to witness significant growth over the forecast period due to the increasing demand for intermediate bulk containers (IBCs) in various industries such as chemicals, food and beverages, pharmaceuticals, and others. The IBC caps play a crucial role in ensuring the safe storage and transportation of liquid products. The market growth is also being driven by technological advancements in IBC cap designs, such as tamper-evident seals and spouts for easy dispensing. Additionally, the growing focus on sustainability and recyclability of packaging materials is further boosting the adoption of IBC caps made from eco-friendly materials.

**Segments**

- Based on material type, the IBC cap market can be segmented into plastic, metal, and others. Plastic caps are widely used due to their lightweight nature and cost-effectiveness. - By cap type, the market can be categorized into screw caps, snap-on caps, and flip-top caps. Screw caps are preferred for their secure sealing properties. - On the basis of end-user industry, the market can be divided into chemicals, food and beverages, pharmaceuticals, and others. The chemicals segment is anticipated to hold a significant market share due to the widespread use of IBCs for storing chemical products.

**Market Players**

- TPS Industrial Srl - Schuetz GmbH & Co. KGaA - Mauser Packaging Solutions - Time Technoplast Ltd - Berry Global Inc. - THIELMANN UCON AG - Precision IBC, Inc. - Peninsula Packaging LLC

These market players are actively involved in strategic initiatives such as product launches, partnerships, and acquisitions to strengthen their market presence and expand their product offerings. The competitive landscape of the IBC cap market is characterized by intense competition, prompting companies to focus on innovation and quality to gain a competitive edge.

The Asia-Pacific region is expected to witness substantial growth in the IBC cap market, driven by the rapid industrialization and the increasing adoption of IBCsThe Asia-Pacific region represents a significant growth opportunity for the global IBC cap market due to several key factors. With rapid industrialization and the expanding manufacturing sector in countries like China, India, and Southeast Asia, there is a growing demand for efficient storage and transportation solutions, including IBCs and their associated caps. The increased focus on chemical production, food processing, and pharmaceutical manufacturing in the region further fuels the need for reliable packaging solutions like IBC caps. As these industries continue to grow, the adoption of IBC caps is expected to rise, driving market expansion in the Asia-Pacific region.

Moreover, the emphasis on enhancing safety standards and ensuring product integrity is a crucial factor contributing to the growth of the IBC cap market in Asia-Pacific. Regulations regarding the safe handling and transportation of hazardous chemicals and pharmaceuticals necessitate the use of high-quality caps that can effectively seal and protect the contents of IBCs. As companies in the region strive to comply with stringent regulatory requirements, the demand for advanced and secure IBC caps is projected to increase significantly.

Additionally, the shift towards sustainability and eco-friendly practices is another trend shaping the IBC cap market in Asia-Pacific. With growing environmental concerns and increasing awareness about plastic pollution, there is a rising preference for IBC caps made from recyclable and biodegradable materials. Market players in the region are focusing on developing sustainable packaging solutions to meet the evolving consumer demands and align with global sustainability goals. This shift towards eco-friendly IBC caps not only addresses environmental concerns but also presents market players with opportunities to differentiate their offerings and attract environmentally conscious customers.

Furthermore, the competitive landscape of the IBC cap market in Asia-Pacific is characterized by the presence of both local manufacturers and international players. Local companies often have a strong understanding of regional market dynamics and customer preferences, giving them a competitive advantage in catering to specific industry needs. On the other hand, multinational companies bring technological expertise and a wide product portfolio, which can appeal to a broader customer base seeking innovative and**Global IBC Cap Market, By Product Type**

- Flange - Plugs - Vent-in Plug - Vent-out Plug - Screw closure

**Type**

- Plastic IBC - Metal IBC - Composite IBCs

**Material Type**

- Plastics - Metal - Aluminium - Steel

**End Use**

- Chemicals & Fertilizers - Petroleum & Lubricants - Paints, Inks & Dyes - Food & Beverage - Agriculture - Building & Construction - Healthcare & Pharmaceuticals - Mining

**Application**

- Food And Drinks - Chemical Industry - Oil and Agriculture

The Global IBC Cap market is experiencing significant growth due to the rising demand for intermediate bulk containers across various industries. Plastic caps are increasingly preferred for their lightweight and cost-effective nature, driving market growth within the material type segment. Screw caps, known for their secure sealing properties, dominate the cap type category. The chemicals segment is anticipated to hold a substantial market share among end-user industries, attributed to the widespread use of IBCs for chemical storage. The market players in the industry are focusing on strategic initiatives like product launches and partnerships to enhance their market presence and offerings. The competitive landscape is intense, spurring companies to innovate and prioritize quality for a competitive advantage.

In Asia-Pacific, the IBC cap market is poised for robust growth fueled by rapid industrialization and the expanding manufacturing sector, particularly in countries like China,

Countries Studied:

North America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of Americas)

Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of Europe)

Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA)

Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Key Coverage in the IBC Cap Market Report:

Detailed analysis of IBC Cap Market by a thorough assessment of the technology, product type, application, and other key segments of the report

Qualitative and quantitative analysis of the market along with CAGR calculation for the forecast period

Investigative study of the market dynamics including drivers, opportunities, restraints, and limitations that can influence the market growth

Comprehensive analysis of the regions of the IBC Cap industry and their futuristic growth outlook

Competitive landscape benchmarking with key coverage of company profiles, product portfolio, and business expansion strategies

TABLE OF CONTENTS

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Research Methodology

Part 04: Market Landscape

Part 05: Pipeline Analysis

Part 06: Market Sizing

Part 07: Five Forces Analysis

Part 08: Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers and Challenges

Part 13: Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse Trending Reports:

Calcium Glycinate Market Retinal Biologics Market Facial Fat Transfer Market Angio Suites Diagnostic Imaging Market Adoption Of Benelux Power Tools Market De Quervains Tenosynovitis Treatment Market Biodetectors And Accessories Market Colposcope Market Sports Medicine Market Automotive Adhesives Market Infrared Imaging Market Vapour Deposition Market Professional Diagnostics Market Ct Scanner Market Programmable Application Specific Integrated Circuit Asic Market Hospital Operating Room Or Products And Solutions Market Castor Oil Market Zika Virus Infection Drug Market Toluene Diisocynate Market Antibiotic Resistance Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

2 notes

·

View notes