#Personal Loan in Rajasthan

Explore tagged Tumblr posts

Text

People also search for Personal Loan in Rajasthan. You can visit our official Rajasthan branch: https://goo.gl/maps/yY7wnKBFK9YSJsT56

0 notes

Text

Simplify Your Home Loan Journey with Mortgage Loan Consultants in Rajasthan

Looking for reliable financial guidance in Udaipur? Mr. Loanwala is your trusted partner for securing the best mortgage deals. As leading Mortgage Loan Consultants in Rajasthan, we specialize in simplifying your loan journey with tailored solutions that suit your needs. Our team ensures a seamless experience, offering expert advice and access to top lenders. Whether it's for a dream home or business expansion, we prioritize transparency and efficiency to help you achieve your goals. Choose Mr. Loanwala for a stress-free mortgage process and unparalleled customer support. Empower your aspirations with Udaipur's finest mortgage consultants today!

0 notes

Text

Exploring Financial Options in Kota: Personal and Business Loans in Rajasthan

Nestled in the southeast of Rajasthan, Kota is a city well-known for its academic institutions and industrial might. This bustling metropolis is a business haven and a great place for professionals and students to pursue possibilities. As a result, there has been a significant increase in Kota, Rajasthan, demand for financial goods including personal and company loans.

Personal Loans in Rajasthan's Kota

Financing a dream trip, paying for emergency medical expenses, or even pursuing further education are just a few of the many personal purposes that personal loan in Kota may be used for. In Kota, there is fierce competition among banks and other financial organizations for personal loans. These loans come with flexible repayment plans and reasonable interest rates.

Key Features of Personal Loans:

Flexible Loan Amounts: Personal loans can have amounts as little as INR 50,000 or as high as INR 20,00,000 or more, depending on the applicant's eligibility.

Fast Disbursal: Many Kota banks and financial institutions provide fast personal loan disbursement, sometimes 24 to 48 hours after an application is approved.

Minimal documents: There is a great reduction in the documents required for personal loans. To execute a loan application, the most basic papers are often those that attest to the applicant's name, residence, and income.

Flexible payback Period: Usually spanning from 12 to 60 months, borrowers can select a payback period that best fits their budget. This flexibility makes it easier to manage monthly installment payments.

Business Loans in Rajasthan's Kota:

A strong financial ecosystem that offers businesses a range of finance choices supports Kota's thriving business climate. Both new and existing companies can benefit from business loan Kota Rajasthan, which can be used to fund equipment purchases, operational expansions, or working capital management.

Types of Business Loans Provided:

Term loans: These are regular loans with a set length and interest rate that are appropriate for large capital expenditures like buying equipment or building new offices.

Working capital loans: Designed to support a company's ongoing operating requirements, these loans guarantee uninterrupted operations even in times of cash flow.

Equipment Financing: This option, which offers advantageous terms and frequently uses the equipment itself as collateral, is available to businesses wishing to replace or improve their equipment.

SME Loans: Designed specifically for small and medium-sized businesses, SME loans offer the funding required to spur innovation and expansion in this vital sector of Kota's economy.

Advantages of Business loans:

Growth & Expansion: Business loans provide you with the money you need to expand your company, take on new markets, or introduce new goods.

Cash Flow Management: Ensuring a consistent flow of funds is essential to ensuring uninterrupted operations.

Benefits from taxes: Borrowers might benefit monetarily from the fact that interest paid on business loans is frequently tax deductible.

Conclusion

In Kota, Rajasthan, personal and commercial loans provide customized financial solutions to fulfill the various demands of people and businesses. These financial goods are essential to Kota's economy, whether they are being used to further personal goals or spur company expansion. Residents and companies in Kota may attain their financial objectives and support the continuous growth and success of the city by selecting the appropriate loan and lender.

0 notes

Text

New Post has been published on RANA Rajasthan Alliance of North America

New Post has been published on https://ranabayarea.org/move-over-apple-microsoft-is-now-the-most-valuable/

Move over Apple: Microsoft is now the most valuable publicly traded company CNN Business

It also holds the distinction of being the first company to hit market caps of $1 trillion, $2 trillion, and $3 trillion. Fractional shares allow you to invest based on a dollar amount how to use shibaswap: what is shibaswap and how to use it instead of being charged per share. Essentially, you get to purchase a fraction of a share instead of paying for the whole thing. This fund gives you exposure to the 500 largest public companies, including Meta. Your $500 goes a lot farther, and you minimize your investing risk by diversifying your portfolio. You also want to consider a company’s assets, earning potential and the overall market condition.

Seaboard Corporation (SEB)

That’s how much of the S&P 500’s gain for the year could be attributed to Nvidia alone, as of Oct. 31. Nvidia replaced Intel in the Dow Jones Industrial Average earlier this month. That’s how much of the S&P 500’s gain for the year could be attributed to Nvidia alone, as of Oct. 31. Nvidia replaced Intel in the Dow Jones Industrial Average earlier this month. The company’s journey to be one of the most prominent players in AI has produced some eye-popping numbers.

The company owns the online travel sites Booking.com and Priceline.com, as well as the restaurant reservation site OpenTable. Our research is designed to provide you with a comprehensive understanding of personal finance services and products that best suit your needs. To help you in the decision-making process, our expert contributors compare common preferences and potential pain points, such as affordability, accessibility, and credibility. Headquartered in Tennessee, the company also offers ALLDATA, which sells automotive diagnostic and repair software. Autozone has more than 6,100 stores across the U.S., 706 stores in Mexico, and 76 stores in Brazil.

Apple is the third most valuable company in the US with a $3.27 trillion market cap.

The number of Thanksgiving meals one could buy with Nvidia’s market value of $3.579 trillion, using the $65.51 estimated cost of a 15-item meal from retail intelligence provider Datasembly.

Nvidia, Wall Street’s artificial intelligence poster child, is now the most valuable company in the world, taking the crown from Microsoft.

Nvidia has once again turned out quarterly results that exceeded Wall Street’s forecasts.

The company has seen soaring demand for its semiconductors, which are used to power artificial intelligence applications.

On Sept. 15, 1998, Microsoft passed General Electric to become the most valuable stock for the first time.

Understanding Stock Price vs. Market Capitalization

Robert is a senior editor at Newsweek, specializing in a range of personal finance topics, including credit cards, loans and banking. Prior to Newsweek, he worked at Bankrate as the lead editor for small business loans and as a credit cards writer and editor. He has also written and edited for CreditCards.com, The Points Guy and The Motley Fool Ascent. Her work has been featured on several of the top finance and business sites in the country, including Insider, USA Today, Bankrate, Rocket Mortgage, Fox Business, Quicken Loans and The Balance. She covers a variety of personal finance topics including mortgages, loans, credit cards and insurance. Booking Holdings operates leading online travel platforms, primarily in the U.S. and Europe.

Here’s the formula companies like Netflix, Uber, and Spotify will use to capture $2T in growth over the next decade

We use data-driven methodologies to evaluate financial products and companies, so all are measured equally. You can read more about our editorial guidelines and the investing methodology for the ratings below. Expensive shares might even deter investors who feel there’s limited upside for a stock. In addition, smaller investors may not be able to afford a single share of a highly-priced stock.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances.

youtube

It has also branched out into services, including its Apple TV+ streaming service. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. Keep in mind that a stock’s price is largely determined by investors’ current perception of that company. If investors are excited about a certain company and believe it will continue to do well, the stock price will rise and, as a result, its P/E ratio will increase. The price to earnings (P/E) ratio is calculated by dividing a stock’s price by the company’s earnings. A P/E ratio is one of Life of a trader the most common metrics used to determine a stock’s valuation since it helps you determine whether a stock is over or undervalued.

Shop offers free coffee for dancing customers

Seaboard Corporation is a milling and agricultural commodities company with operations in different parts of the world such as Africa, South America, and the Caribbean. The company has segments in products such as pork, sugar, alcohol, turkey, cargo shipping services, and more. Last week, Berkshire Hathaway’s (BRK.A) stock price hit a new milestone, as shares reached a record high of $555,800. Different companies have widely different share structures, even if they have similar market caps. For example, Bank of America and Eli Lilly have similar market caps of around $300 billion—but Bank of America has more than 8.1 billion outstanding shares while Eli Lilly has only 950 million. Our editors are committed to bringing you unbiased ratings and information.

Examples are hypothetical, and we encourage you to seek personalized estimating the positioning of trend followers advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. Large-cap stocks like these are an important part of every investor’s portfolio. They generally provide more safety and stability than smaller stocks since most of them are established companies with strong brands.

Shares fell about 1% in after-hours trading following the release of the company’s earnings. There are lots of factors that can contribute to a high stock price. One of the biggest reasons why BRK.A is so expensive is because CEO Warren Buffett has decided against a stock split. A stock split is when a company splits its existing stock to create more shares, often resulting in a lower share price. Not necessarily—the share price alone doesn’t tell you anything about the value of the stock.

youtube

0 notes

Text

JDA Approved Plots on Ajmer Road, Jaipur, Rajasthan — SiddhiAnanta Group

When it comes to real estate investment, JDA-approved plots on Ajmer Road, Jaipur, Rajasthan, offer an excellent opportunity for individuals and businesses seeking a secure and promising investment. Ajmer Road is a rapidly developing area that combines modern infrastructure with the charm of Jaipur’s heritage. Let’s explore why purchasing a JDA-approved plot from the SiddhiAnanta Group could be one of the best decisions you make.

What Does JDA Approval Mean?

JDA, or the Jaipur Development Authority, ensures that a property complies with all legal and regulatory requirements. Owning a JDA-approved plot means:

Legality: The plot is free from legal disputes.

Infrastructure: The area has access to roads, water, electricity, and other essential amenities.

Resale Value: JDA-approved plots have higher resale value due to their authenticity.

Loan Eligibility: Financial institutions readily offer loans for JDA-approved properties.

Investing in such plots is synonymous with peace of mind and future growth prospects.

Ajmer Road: A Hub of Growth and Opportunity

Ajmer Road has emerged as a prime location in Jaipur, offering a perfect blend of connectivity, lifestyle, and development. Here are some reasons why Ajmer Road is a sought-after real estate destination:

1. Strategic Location

Ajmer Road connects Jaipur to Ajmer and is a part of the National Highway 48. This strategic location ensures easy access to:

Jaipur International Airport

Jaipur Railway Station

Major commercial and industrial hubs

Educational institutions like Jaipur National University and Amity University

2. Infrastructural Development

The area is witnessing rapid infrastructural development, including:

Wide roads and flyovers

IT parks and SEZs (Special Economic Zones)

Proposed metro connectivity

Premium residential projects

3. High ROI Potential

The appreciation rate of properties in Ajmer Road has been consistently high due to:

Proximity to Jaipur city

Upcoming infrastructural projects

Increasing demand for residential and commercial spaces

SiddhiAnanta Group: Your Trusted Partner in Real Estate

SiddhiAnanta Group is a renowned name in the real estate industry, known for its commitment to quality, transparency, and customer satisfaction. Here’s why you should choose SiddhiAnanta Group for purchasing JDA-approved plots:

1. Wide Range of Options

SiddhiAnanta Group offers a variety of plot sizes and locations on Ajmer Road, catering to diverse requirements, whether it’s for residential purposes, commercial establishments, or investment.

2. Clear Documentation

The group ensures all legal documentation is in place, making the buying process seamless and stress-free for customers.

3. Affordable Pricing

Competitive pricing makes these plots accessible to a wide range of buyers without compromising on quality or amenities.

4. Customer-Centric Approach

The group prioritizes customer satisfaction by offering personalized assistance, helping buyers choose the best plots based on their needs and budgets.

Key Features of JDA-Approved Plots by SiddhiAnanta Group

Prime Locations: Strategically located plots with excellent connectivity to Jaipur city and nearby areas.

Basic Infrastructure: Ready access to water, electricity, sewage, and well-paved roads.

Green Spaces: Eco-friendly surroundings with parks and gardens.

Security: Safe neighborhoods with proper fencing and street lighting.

Customization: Flexibility to build according to your requirements.

Who Should Invest in These Plots?

1. Home Buyers

Families looking to build their dream homes in a peaceful yet well-connected location will find Ajmer Road ideal.

2. Business Owners

Entrepreneurs seeking commercial spaces in a developing area with high footfall can benefit greatly.

3. Investors

With its high ROI potential, Ajmer Road attracts investors aiming for long-term gains.

4. NRIs

Non-resident Indians looking for safe and high-yield investments in India can trust JDA-approved plots by SiddhiAnanta Group.

Why Now is the Right Time to Invest

Affordable Prices: Property rates are currently competitive but expected to rise as development continues.

Government Initiatives: Jaipur is a part of the Smart Cities Mission, promising enhanced urban infrastructure and growth.

High Demand: With Jaipur expanding rapidly, demand for quality plots in prime locations like Ajmer Road is skyrocketing.

Steps to Buy a Plot with SiddhiAnanta Group

Purchasing a plot with SiddhiAnanta Group is straightforward:

Initial Consultation: Discuss your requirements with their expert team.

Site Visit: Inspect the available plots and evaluate their suitability.

Documentation Check: Review the JDA approval and other legal documents.

Payment and Registration: Complete the payment and register the plot in your name.

Ownership Handover: Receive all documents and start planning your construction.

Conclusion

JDA-approved plots on Ajmer Road, Jaipur, Rajasthan, with the SiddhiAnanta Group is a decision you won’t regret. Whether you’re looking to build your dream home, start a business, or secure a profitable investment, these plots offer unparalleled advantages. With legal assurance, excellent connectivity, and the trust of SiddhiAnanta Group, your real estate journey is in safe hands.

0 notes

Text

Guide to Proprietorship Firm Registration & PWD Rajasthan Registration.

For entrepreneurs venturing into their own businesses in India, setting up a sole proprietorship is often a preferred choice. With straightforward registration processes, low compliance requirements, and full control for the owner, a proprietorship is a practical option for small businesses. If you're considering starting a Proprietorship Firm Registration, here’s a complete guide on how to register your business, including the process for securing PWD Rajasthan registration for construction and related work.

1. What is Proprietorship Firm Registration?

Proprietorship firm registration is a way to formalize a sole proprietorship business, giving it a legal identity and recognition. This registration facilitates the business's smooth functioning, enables bank transactions, and builds credibility with customers and partners.

Single Ownership: Owned and controlled by one person.

Ease of Setup: Minimal legal formalities, quick setup, and fewer compliances.

Financial Flexibility: No need for a specific minimum capital.

A Proprietorship Firm Registration is an excellent choice for those seeking full control over their business operations without the complexities of company compliance.

2. Benefits of Proprietorship Firm Registration

Registering a proprietorship firm offers various advantages:

Legal Recognition: It provides official recognition, making it easier to work with banks and suppliers.

Complete Control: Since a proprietorship is owned by a single person, they have full control and decision-making authority.

Low Compliance Cost: Compared to other business structures, proprietorships face minimal compliance.

Tax Advantages: Certain tax benefits apply to proprietorship firms that can help reduce financial burdens.

3. Steps for Proprietorship Firm Registration

Here’s a step-by-step guide on how to Proprietorship Firm Registration in India.

Step 1: Choose a Business Name Select a unique name that aligns with your business. Make sure it doesn’t infringe on any trademarks.

Step 2: Apply for GST Registration If your firm has an annual turnover exceeding ₹20 lakh (or ₹10 lakh in some states), GST registration is mandatory. GST compliance also helps build business credibility.

Step 3: PAN and TAN Application A PAN card is essential for all tax purposes. Additionally, if you need to deduct tax at source for employees, you’ll require a TAN.

Step 4: MSME Registration Though not mandatory, registering under MSME (Micro, Small, and Medium Enterprises) can help you access government schemes, loans, and subsidies.

Step 5: Bank Account Setup Open a current bank account in the firm’s name. This account will help streamline your finances and make business transactions smoother.

Step 6: License and Permit Requirements Depending on your business sector, check if there are specific licenses or permits needed (like a shop and establishment license).

4. What is PWD Rajasthan Registration?

For businesses in the construction industry, PWD Rajasthan Registration is essential for bidding on government contracts in Rajasthan. The Public Works Department (PWD) of Rajasthan requires registration for contractors who wish to participate in public projects. This ensures only qualified contractors are allowed to take on public construction and infrastructure projects.

5. Steps for PWD Rajasthan Registration

To become a registered contractor with PWD Rajasthan, follow these steps:

Step 1: Eligibility Check Make sure you meet the necessary eligibility criteria. This includes experience in construction work, availability of required equipment, and qualified personnel.

Step 2: Document Preparation Gather all the necessary documents. These usually include:

Proof of identity and address

Financial statements

Experience certificates

List of equipment and manpower

Step 3: Fill the Application Form The PWD registration form is available online on the official PWD Rajasthan website. Fill it with accurate details about your firm, services, and expertise.

Step 4: Submit Application and Fees Submit your completed form along with the registration fees. You may also need to submit documents in person for verification.

Step 5: Await Verification and Approval Once your application is submitted, PWD authorities will verify your credentials. Upon successful verification, you’ll receive your registration certificate, allowing you to participate in government tenders and contracts.

6. Why is PWD Rajasthan Registration Important?

Securing PWD Rajasthan registration allows proprietorship firms in the construction and infrastructure sectors to access opportunities with government projects, which offer steady work, credibility, and growth potential. Benefits of this registration include:

Access to Government Contracts: Eligibility to bid on state and local government projects.

Enhanced Credibility: Government-registered contractors enjoy a reputation of reliability and trustworthiness.

Financial Opportunities: Government projects provide a secure payment structure and often involve larger project scopes.

Conclusion

Registering a proprietorship firm in India is the first step toward formalizing your business. If your business involves construction or infrastructure, securing PWD Rajasthan registration opens doors to lucrative government contracts. This combination of registrations offers both independence and opportunities for growth in the public sector.

Legalman can assist with the entire registration process, ensuring you meet all the necessary legal requirements and that your journey into entrepreneurship is seamless. Whether it’s proprietorship firm registration or PWD registration, reach out to Legalman for expert assistance and start building your business on the right foundation.

#private limited company registration#TDS/TCS return filing services#tds return filing services#gst return filing services#income tax filing services

0 notes

Text

Building Your Dream Home: Home Construction Loans by SRG Housing Finance Ltd.

Turning Your Dream Home into Reality with SRG Housing Finance

Building a home is a dream many cherish, and with SRG Housing Finance Ltd., that dream can become a reality. Whether in Madhya Pradesh, Gujarat, Rajasthan, or Maharashtra, SRG Housing Finance is here to make financing your house construction easier. Our construction loans are tailored to meet each state's unique requirements, ensuring you get the support and flexibility needed to bring your dream home to life.

This guide explains how SRG’s home construction loan, offered by the best housing finance company in India, can help residents of these states build their homes on their land. It provides answers to common questions and outlines our eligibility criteria.

Why Choose SRG Housing Finance for Home Construction Loans?

SRG Housing Finance Ltd. is one of India’s fastest-growing housing finance companies, committed to helping customers in Madhya Pradesh, Gujarat, Rajasthan, and Maharashtra achieve their home-building dreams. Unlike traditional home loans, which are typically for ready-built properties, SRG’s Home Construction Loans are designed for individuals who wish to construct homes on their land. Our loans are disbursed in phases to align with construction progress, offering customers maximum flexibility.

Benefits of SRG Housing Finance’s Construction Loans

SRG’s construction loans are packed with features that make financing home construction in these states easier:

Flexible Disbursement: Funds are disbursed in stages, allowing you to use the funds as needed at each phase of construction.

Competitive Interest Rates: We offer attractive rates tailored to suit the local economic landscape in Madhya Pradesh, Gujarat, Rajasthan, and Maharashtra.

Personalized Service: With our deep understanding of the real estate sector, we offer a customer-centric approach to address your unique needs in each state.

Construction Home Loans Across Different States

1. Madhya Pradesh

Madhya Pradesh has diverse landscapes and a unique architectural style. SRG Housing Finance offers construction loans designed to meet the specific needs of residents here. Our flexible loan options make it easier for individuals to build homes that align with local regulations and real estate conditions.

2. Gujarat

Gujarat is known for its rapid development and modern infrastructure. SRG Housing Finance provides construction loans that support both traditional and contemporary home designs, with competitive rates and flexible loan disbursement options that cater to the state’s evolving housing market.

3. Rajasthan

Rajasthan combines traditional architecture with modern amenities. SRG Housing Finance offers construction loans tailored to the unique building styles of this state. Our loans are designed to help residents build affordable and flexible homes that blend tradition with modern comforts, especially in areas like Udaipur.

4. Maharashtra

Maharashtra’s real estate market is varied, from busy urban centers like Mumbai to quieter residential areas. SRG Housing Finance’s construction loans are structured to meet the needs of home builders in this state, whether they are constructing in the city or the countryside. Our loans are adaptable to the state’s diverse building requirements.

Frequently Asked Questions

1. Can I get a home loan for house construction in Madhya Pradesh, Gujarat, Rajasthan, or Maharashtra?

Yes, SRG Housing Finance Ltd. offers home construction loans for residents of these states. Our loans are designed to cover the costs associated with building a house, including materials, labor, and other related expenses. We understand the local needs and regulatory requirements of each state, ensuring a seamless financing experience.

2. Which bank is best for a home construction loan?

While many banks offer home construction loans, SRG Housing Finance Ltd. specializes in this area with a deep understanding of local markets in Madhya Pradesh, Gujarat, Rajasthan, and Maharashtra. Our competitive interest rates, flexible disbursement options, and customer-centric approach make us a preferred choice for construction loans in these regions.

3. What type of loan is best for building a house in India?

A home construction loan is the best option for building a house, as it allows funds to be disbursed in stages based on construction progress. SRG Housing Finance Ltd. offers well-optimized construction loans that are specifically designed to meet the challenges of building a home in the dynamic Indian real estate market.

How to Apply for an SRG Home Construction Loan

Applying for a construction loan with SRG Housing Finance Ltd. is a straightforward process. Our customer service team will guide you through each step, from application to loan disbursement. We understand the unique needs of each state, making it easier for residents of Madhya Pradesh, Gujarat, Rajasthan, and Maharashtra to access the funds they need.

Steps to Apply:

Submit Your Application: Fill out the application form on our website or visit a nearby SRG Housing Finance branch.

Provide Documentation: Submit necessary documents such as proof of identity, income statements, and property documents.

Eligibility Assessment: Our team will assess your eligibility based on the provided information.

Loan Disbursement: Once approved, the loan amount will be disbursed in stages to fund each phase of your home construction.

Conclusion

Building a home is an enriching journey that SRG Housing Finance Ltd. is proud to support. Our construction loans are tailored to meet the unique needs of residents in Madhya Pradesh, Gujarat, Rajasthan, and Maharashtra, providing financial solutions that empower you to bring your dream home to life. With our expertise and commitment to customer satisfaction, SRG Housing Finance Ltd. makes financing your home-building journey as fulfilling as the journey itself. For personalized consultation and expert guidance throughout the loan application process, our dedicated team is here to assist you every step of the way. Contact us today to learn more about how we can help you realize your vision for your new home.

#finance#srghousingfinance#loan#homeloan#housing finance#homeloanpreapproval#Home Construction#Construction Home Loans

0 notes

Text

Bajaj Finserv, one of India’s leading financial services companies, is currently hiring Sales Apprentice Trainees for multiple locations across the country. If you are a recent graduate with 0-1 year of experience and are looking to build your career in sales, this is a great opportunity to work with a top-tier organization in the financial sector. With positions available in various departments such as Debt Management Services, Rural Two-Wheeler Loans, and Salaried Personal Loans, Bajaj Finserv is looking for enthusiastic and driven individuals who are ready to kickstart their careers in sales. Vacancy Information Role: Sales Apprentice Trainee (Debt Management Services, Two-Wheeler Loans, Lifestyle Finance, Salaried Personal Loans) Experience Required: 0-1 Year Job Type: Full-time, Apprentice Program Department: Sales, Collection, Rural Loans Location: PAN India (Delhi, Mumbai, Bangalore, Pune, Chennai, Hyderabad, and more) Departments and Locations Bajaj Finserv is hiring Sales Apprentice Trainees across various departments. Here’s a breakdown of the job roles and the locations: Debt Management Services (Call Centre) Locations: Madhya Pradesh, Gujarat, Maharashtra, Rajasthan Rural Two-Wheeler Loans Locations: Karnataka, Andhra Pradesh, Odisha, Bihar, Jharkhand RCD Two-Wheeler Loans Locations: Rajasthan, Uttar Pradesh, Punjab, Kerala, Madhya Pradesh Lifestyle Finance (Two-Wheeler Loans) Locations: Rajasthan, Uttar Pradesh, Punjab, Kerala, Madhya Pradesh Salaried Personal Loans (SALPL) Locations: Delhi, Bangalore, Mumbai, Pune, Hyderabad, Chennai, Kolkata, Ahmedabad [caption id="attachment_101618" align="aligncenter" width="930"] Bajaj Finserv Hiring Sales Apprentice Trainees Across India[/caption] Key Responsibilities As a Sales Apprentice Trainee, you will: Support Sales Operations: Assist in generating leads, explaining products, and converting potential customers into clients. Customer Interaction: Engage with customers to understand their financial needs and recommend suitable loan products. On-the-job Training: Receive training on various loan products including Two-Wheeler Loans and Personal Loans. Target Achievement: Work with senior sales professionals to meet and exceed set targets for loan disbursement and sales growth. Required Qualifications Education: Graduate in any discipline. Experience: 0-1 year of sales experience, particularly in the financial services sector, is preferred but freshers are welcome to apply. Skills: Strong communication, interpersonal skills, and a passion for sales. Locations: Willingness to work in any of the listed locations. How to Apply Interested candidates can apply online by visiting the following link: Apprentice Registration – Bajaj Finserv.

0 notes

Text

Get Personal Loan In Easy Application Process At Dadhich Finserv

Apply now for personal loan with easy steps and get loan approval in 24 hours at Dadhich Finserv Alwar, Rajasthan. Yes, you heard it right here you will get loan approval in 24 hours only with 0% foreclosure charges. Apply Now!

Visit Now:- https://www.dadhichfin.com/personal-loan-in-alwar Call Us:- +91-9119241400

#instant personal loan in alwar#personal loan proivder alwar#personal loan#loan service provider in alwar

0 notes

Text

Unveiling the Potential of RTF Finance: Your Pathway to Mortgage Loan in Dungarpur

In the realm of financial services, the landscape is ever-evolving, presenting individuals with a plethora of options to fulfill their monetary needs. Among these, RTF Finance stands out as a beacon of hope, offering tailored solutions to address the diverse financial requirements of individuals and businesses alike. Today, we delve into the world of RTF Finance, exploring its significance and efficacy, particularly in the context of acquiring a Mortgage Loan in Dungarpur.

Understanding RTF Finance

RTF Finance, short for "Real-Time Finance," epitomizes innovation and flexibility in the financial domain. It leverages technology and data-driven insights to streamline the lending process, making it more accessible and efficient for borrowers. Unlike traditional financial institutions, RTF Finance institutions often prioritize speed, convenience, and personalized service, ensuring that borrowers receive the funds they need in a timely manner.

The Importance of Mortgage Loans in Dungarpur

Dungarpur, a picturesque city in Rajasthan, India, boasts a rich cultural heritage and a burgeoning real estate market. As more individuals aspire to own homes in this vibrant city, the demand for mortgage loans continues to surge. Whether it's purchasing a cozy apartment in the heart of the city or investing in a sprawling villa on the outskirts, mortgage loans play a pivotal role in fulfilling these aspirations.

Why Choose RTF Finance for Mortgage Loans in Dungarpur?

Speed and Efficiency: RTF Finance institutions understand the urgency associated with property transactions. By harnessing cutting-edge technology and streamlined processes, they expedite the loan approval and disbursal process, allowing borrowers to seize lucrative real estate opportunities without delay.

Personalized Solutions: Mortgage requirements vary from one individual to another. RTF Finance providers recognize this diversity and offer customized loan solutions tailored to meet the specific needs and financial circumstances of borrowers in Dungarpur.

Accessibility: In a digitally-driven era, accessibility is paramount. RTF Finance institutions prioritize accessibility by offering online platforms and mobile applications, enabling borrowers to initiate loan applications, track progress, and access support services conveniently from anywhere, at any time.

Transparency and Trust: Transparency breeds trust. RTF Finance institutions uphold transparency in their operations, ensuring that borrowers are fully informed about the terms, conditions, and associated costs of their mortgage loans. This commitment to transparency fosters trust and strengthens the borrower-lender relationship.

Navigating the Mortgage Loan Process with RTF Finance

Acquiring a mortgage loan in Dungarpur through RTF Finance is a straightforward process:

Pre-Approval: Begin by seeking pre-approval from an RTF Finance institution. This involves assessing your financial eligibility and determining the loan amount you qualify for based on factors such as income, credit history, and property value.

Property Valuation: Once pre-approved, the next step involves conducting a thorough valuation of the property you intend to purchase. This appraisal helps determine the property's market value and ensures that it meets the lender's criteria for mortgage financing.

Documentation and Application: Prepare the necessary documentation, including proof of identity, income documents, property documents, and any other relevant paperwork. Submit your loan application along with these documents to the RTF Finance institution for review.

Approval and Disbursal: Upon successful review and approval of your application, the RTF Finance institution will issue a formal loan offer outlining the terms and conditions. Upon acceptance, the loan amount will be disbursed to facilitate the purchase of your desired property in Dungarpur.

In Conclusion

RTF Finance heralds a new era of financial empowerment, offering swift and flexible solutions to address the diverse needs of borrowers, including mortgage loans in Dungarpur. By embracing innovation, transparency, and customer-centricity, RTF Finance institutions pave the way for individuals to achieve their homeownership dreams and embark on a journey of financial prosperity. Whether you're a first-time homebuyer or a seasoned investor, consider the unparalleled benefits of RTF Finance as you navigate the realm of mortgage financing in Dungarpur.

0 notes

Text

Your Complete Guide to Obtaining a Rajasthan Personal Loan

Their in-depth knowledge of the regional financial scene is one of the main advantages of working with a personal loan consultancy in Rajasthan. They are knowledgeable about the different banks and non-banking financial companies that are present in the area, as well as their loan offerings and qualifying requirements. Whether you're looking for a loan with low interest rates, a longer repayment period, or a quick approval process, their local knowledge allows them to suggest the best financial institution for your needs. Additionally, personal loan consultants can assist you in getting everything ready to prevent any delays or rejections during the approval process because they are knowledgeable about the necessary paperwork.

Managing financial needs in the fast-paced world of today can be difficult, particularly when it comes to getting a personal loan. Many people find themselves in a position where they require extra money to cover a range of personal or professional costs, including weddings, medical bills, home improvements, and education. But applying for a loan can be a daunting and perplexing process. This is where Rajasthani personal loan consultants come in very handy. Securing a personal loan becomes a simple and hassle-free process with the correct advice and knowledge, enabling people to make wise decisions and successfully manage their money.

Personal loans are unsecured loans that don't require collateral and can be used for nearly anything. Depending on the lender, loan amount, tenure, and interest rate, these loans can have a wide range of terms and conditions. There are many financial institutions in Rajasthan, a state renowned for its diverse communities and rich cultural legacy, that provide personal loans, but many people find the application process to be challenging. At this point, a personal loan consultant's role becomes extremely valuable. A consultant guarantees that you are selecting the best course of action for your financial circumstances in addition to assisting you with the paperwork.

Important assistance in determining your financial eligibility is also offered by a personal loan consultancy in Rajasthan. To decide whether you qualify for a loan and how much you can borrow, lenders usually look at things like your income, credit score, employment status, and current debts. In addition to offering advice on how to increase your chances of getting your loan approved, a consultancy can help you comprehend how these factors are evaluated. By providing individualised guidance based on your unique financial circumstances, they can assist you in avoiding typical mistakes that many first-time borrowers make, like applying for loans that exceed their ability to repay.

The time-saving aspect of obtaining help from a personal loan consultancy is another important benefit. A consultancy handles all the legwork for you, saving you hours of time spent looking into different loan options, visiting several banks, and completing countless forms. After comparing various loan products, they will show you the options that best fit your financial objectives. They can also expedite the application process by making sure that all necessary paperwork is in order. They can also bargain for better loan terms on your behalf, like lower interest rates or no processing fees.

It is impossible to overestimate the significance of a trustworthy consultant for Rajasthani individuals seeking to obtain a personal loan. With their guidance, you can avoid common mistakes like choosing loans with high-interest rates, missing out on discounts, or submitting incomplete paperwork. To make sure you are ready for the financial commitment, they can also assist you in understanding the loan terms and repayment schedule.

In conclusion, people wishing to obtain personal loans can benefit greatly from the knowledge and support provided by a personal loan consultancy in Rajasthan. A consultant can greatly increase your chances of obtaining a loan that satisfies your financial needs by utilising their comprehension of lender requirements, local market knowledge, and ability to expedite the loan application process. Look no further than Mr. Loanwala, a reputable name in personal loan consulting, if you're in Rajasthan and need professional advice. Their committed staff will make sure your borrowing experience is easy and stress-free while also helping you identify the best loan options.

0 notes

Text

New Post has been published on RANA Rajasthan Alliance of North America

New Post has been published on https://ranabayarea.org/interest-tax-shield-what-is-it-formula-example/

Interest Tax Shield What Is It, Formula, Example, Benefits

If the firm puts a tax shield into consideration when making the mortgage decision, then it will be easier to make a decision. For example, a business is deciding whether to lease a building or buy the building. Taking on a mortgage for the purchase of a building would create a tax shield because mortgage interest is deductible to a business. If the business puts the tax shield benefit from the mortgage into the decision, the tax benefit of a mortgage might make the decision easier.

Examples of Tax Shields

Both individuals and corporations are eligible to use a tax shield to reduce their taxable income.

A depreciation tax shield is a tax-saving benefit applied to income generated by businesses.

Examples of tax shields include deductions for mortgage interest that you pay on your mortgage loan.

It is one of the tax shielding options available to businesses and is also known as a corporate tax incentive for debt.

It only benefits you to itemize when the total of all of your deductions exceeds the standard deduction for your filing status. Otherwise, you would be paying taxes on more income than you should. A tax shield on depreciation is the proper management of assets for saving the tax. A depreciation tax shield is a tax reduction technique under which depreciation expenses are subtracted from taxable income.

Is Tax Shield the Same As Tax Savings?

Therefore, the tax shield can be specifically represented as tax-deductible expenses. Corporations use tax shields strategically to receive tax benefits. They often do this in one of two ways, either through capital structure optimization or accelerated depreciation methods. Similar to the tax shield offered in compensation for medical expenses, charitable giving can also lower a taxpayer’s obligations. In order to qualify, the taxpayer must use itemized deductions on their tax return. The deductible amount may be as high as 60% of the taxpayer’s adjusted gross income, depending on the specific circumstances.

Accelerated Depreciation Methods

A tax shield is a legal way for individual taxpayers and corporations to try and reduce their taxable income. The total value of a tax shield is going to depend on the tax rate of an individual or corporation and their tax-deductible expenses. The tax shield is a very important aspect of corporate accounting since it is the amount a company can save on income tax payments by using various deductible expenses. The higher the savings from the tax shield, the higher the company’s cash profit. The extent of tax shield varies from nation to nation, and their benefits also vary based on the overall tax rate. The term “Tax Shield” refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government.

youtube

Taxpayers won’t be able to take advantage of these tax shields until they reach a level of deductions over the standard amount. The main change is the reduction in income tax rates, beginning with 2018 taxes. The corporate tax rate has been reduced to a flat 21%, starting in 2018, and personal tax rates have also been reduced. Let’s say a business decides to take on a mortgage loan on a building instead of leasing the space because mortgage interest is tax deductible, thus serving as a tax shield.

Many middle-class homeowners opt to deduct their mortgage expenses, thus shielding some of their income from taxes. Let us take the example of another company, PQR Ltd., which is planning to purchase equipment worth $30,000 payable in 3 equal yearly installments, and the interest is chargeable at 10%. The company can also acquire the equipment on lease rental basis for $15,000 per annum, payable at the end of each year for three years. The original cost of the equipment would be depreciated at 33.3% on the straight-line method. Since adding or removing a tax shield can be significant, many companies consider this when exploring an optimal capital structure.

This then means that the businesses will be able to a great value of money. Tax evaders tend to conceal their income and/or underreport their income on their tax returns. Conversely, the legal use of tax shields and other strategies to minimize tax payments is known as tax avoidance. Understanding the concept of a tax shield can have a significant impact on your financial decision-making. By doing so, you can make informed financial decisions and potentially better secure your financial future.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. Tax shields differ between countries and are based on what deductions are eligible versus ineligible. The value of these shields depends on the effective tax rate for the corporation or individual (being subject to a higher rate increases the value of the deductions). Another big change is that the standard deduction on personal tax returns has been doubled, decreasing the value of some tax shields, like mortgage interest and charitable giving.

Finally, we conclude on account of the above-stated cases that a tax shield can be utilized as a valuable option for effectively evaluating cash flow, financing, etc., activities. A 25 % depreciation for plant and machinery is available on accelerated depreciation basis as Income tax exemption. Assume that the corporate tax is paid one year in arrear of the periods to which it relates, and the first year’s depreciation allowance would be claimed against the profits of year 1.

Tax shields can vary slightly depending on where you’re located, as some countries have different rules. Tax shields allow taxpayers to reduce the amount of taxes four tax scams to watch out for this tax season owed by lowering their taxable income. When filing your taxes, ensure you are taking these deductions so that you can save money when tax season arrives.

0 notes

Text

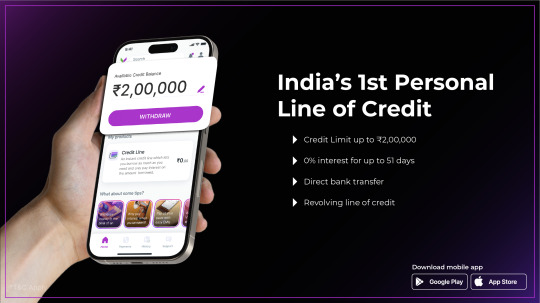

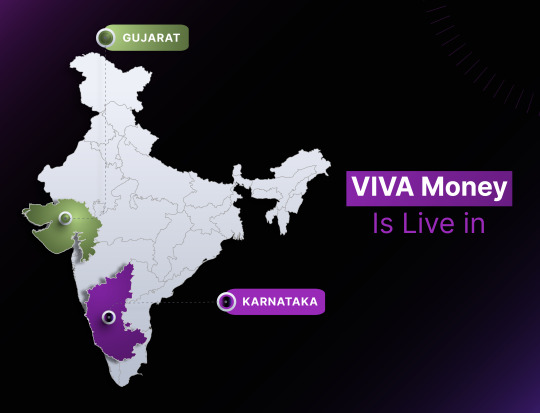

VIVA Money App Hits 100K+ Downloads in Lightning Speed!

VIVA Money, the revolutionary fintech startup from Bengaluru, has stormed into the digital finance scene with a bang! In just four months since its launch in Gujarat and Karnataka, the VIVA Money app has surpassed a staggering 100,000 downloads, setting a new benchmark for rapid growth and user engagement.

But what's fueling this meteoric rise? Let's dive into the heart of VIVA Money's offerings:

Freedom to Borrow, No Strings Attached: VIVA Money offers an exclusive grace period of up to 51 days, allowing users to borrow without worrying about hefty interest charges.

Revolutionary Revolving Credit: Unlike traditional loans, VIVA Money offers a revolving credit limit, giving you the power to borrow, repay, and borrow again, all with unparalleled ease.

Flexible EMI Plans: Choose from three flexible EMI plans ranging from 5 to 20 months, tailored to fit your unique financial needs and goals.

Digitally Driven Convenience: Embrace the future of finance with VIVA Money's 100% digital process, eliminating paperwork and streamlining your borrowing experience.

Seamless Bank Transfers: Say goodbye to traditional credit card limitations! With VIVA Money, your credit line can be seamlessly transferred to your bank account, putting financial freedom at your fingertips.

Lightning-Fast Approval: With VIVA Money, there's no waiting game. Experience lightning-fast approval and disbursal within a mere 15 minutes, ensuring you get the funds you need when you need them.

VIVA Money goes beyond just offering a Credit Line; it's dedicated to transforming how Indians handle their financial matters and boasts extensive experience in the lending sector. As the fintech landscape continues to evolve, VIVA Money remains committed to innovation, customer satisfaction, and financial inclusion.

Looking ahead, VIVA Money has its sights set on Rajasthan and Maharashtra, gearing up to extend its innovative financial solutions to even more eager users across India. With a personalized loan product in the pipeline, offering higher loan amounts and extended repayment periods, VIVA Money is poised to make a lasting impact on the Indian fintech ecosystem.

So, what's next for VIVA Money? With an estimated 40,000 credit lines and a projected loan book value of ₹1400 million by year's end, the journey is just beginning. Join the VIVA Money revolution today and experience the future of finance, redefined.

About VIVA Money:

VIVA Money stands at the forefront of digital financial lending, offering India's premier Line of Credit. Powered by cutting-edge technology and a customer-centric approach, VIVA Money provides seamless access to financial solutions through its mobile application and website.

As a subsidiary of the holding company Tirona Limited, with its headquarters in Cyprus, Viva Money benefits from a global perspective. Tirona Ltd operates across Europe, Asia, and South America, investing in fintech opportunities and established companies in banking and IT. Notable investments within Tirona's portfolio include 4 finance, the world's leading digital consumer finance company, and TBI Bank, a next-generation digital bank operating in multiple countries.

With assets spanning more than 20 projects in 22 countries, Tirona's financial prowess is evident. The group's total assets saw a 30% increase in 2022, reaching 1.44 billion euros, while revenue surpassed 490 million euros. This growth trajectory underscores Tirona's commitment to innovation and excellence in the financial sector, driving progress and prosperity across diverse markets.

0 notes

Text

Engineering Dreams: Navigating the B.Tech College Selection Process

Are you ready to embark on a journey that could shape your future? Choosing the right B.Tech college is not just about finding a place to study – it's about laying the foundation for your engineering dreams. With so many options available, navigating the B.Tech college selection process can seem daunting. But fear not! In this guide, we'll walk you through the essential steps to help you make an informed decision and turn your engineering aspirations into reality, including exploring the top B.Tech college in Rajasthan.

Understanding Your Goals

Before diving into the sea of B.Tech colleges, take some time to reflect on your goals and aspirations. What field of engineering interests you the most? Do you have a specific career path in mind? Understanding your interests and objectives will guide you in selecting a college that aligns with your aspirations.

Researching Your Options

Once you have a clear vision of your goals, it's time to start researching B.Tech colleges. Look beyond rankings and explore factors such as faculty expertise, curriculum structure, research opportunities, campus facilities, and industry connections. Consider visiting college websites, attending virtual campus tours, and reaching out to current students or alumni to gain insights into each institution.

Evaluating Academic Excellence

When assessing B.Tech colleges, academic excellence should be a top priority. Scrutinize the curriculum to ensure it covers core engineering principles while offering specialization options in your area of interest. Look for colleges with reputable faculty members who are experts in their fields and have a track record of research and innovation. Additionally, check accreditation status to ensure that the college meets quality standards.

Examining Extracurricular Opportunities

Beyond academics, extracurricular activities play a vital role in shaping your college experience. Seek colleges that offer a diverse range of extracurricular opportunities, such as student clubs, competitions, internships, and industry collaborations. These experiences will not only enhance your skills but also broaden your network and enrich your overall learning journey.

Considering Campus Culture and Environment

The culture and environment of a B.Tech college can significantly impact your academic and personal growth. Consider factors such as campus location, size, diversity, student support services, and campus life activities. Think about what type of environment resonates with you and fosters your success, whether it's a bustling urban campus or a serene rural setting.

Factoring in Financial Considerations

Finances play a crucial role in the college selection process. Evaluate the cost of tuition, fees, housing, and other expenses, and explore financial aid options such as scholarships, grants, and loans. Consider the return on investment of your education and weigh the long-term benefits against the financial investment required.

Seeking Guidance and Feedback

Don't hesitate to seek guidance from mentors, teachers, parents, and college counselors throughout the selection process. Their insights and perspectives can provide valuable guidance and help you make informed decisions. Additionally, reach out to current students or alumni of the colleges you're considering to get firsthand accounts of their experiences.

Making Your Decision

After thorough research and contemplation, it's time to make your decision. Trust your instincts and choose the B.Tech college that best aligns with your goals, values, and aspirations. Remember that your college journey is just the beginning of your engineering dreams, and the experiences you gain along the way will shape your path to success.

Conclusion

Selecting the right B.Tech college is a pivotal step in realizing your engineering dreams. By understanding your goals, researching your options, evaluating academic excellence, examining extracurricular opportunities, considering campus culture, factoring in financial considerations, seeking guidance, and making a well-informed decision, you can navigate the college selection process with confidence and embark on a journey of growth, discovery, and achievement. So, dream big, choose wisely, and let your engineering journey begin! Explore the best engineering college in Jaipur and uncover opportunities that align with your aspirations.

0 notes

Text

PHF Leasing Ltd. announces hiring of over 200 people

Openings will be across 10 states and Union Territories of Operations Newswave @ Jallandhar PHF Leasing Limited, the Metropolitan Stock Exchange listed (PHF / INE405N01016), deposit accepting NBFC, headquartered in Jallandhar, Punjab, announced their hiring plans for the next two quarters. From the current 400+ employees, the company is targeting to employ another 200 people across sectors over the next two quarters, in keeping with its growth plans and new office openings.

PHF Leasing is a category “A” Deposit taking Non-Banking Financial Company registered with Reserve Bank of India since 1998. PHF Leasing has been on a growth overdrive, clocking over 100% growth over the last 3 years, by opening new segments (Loan Against Property and Electric Light Commercial Vehicles) and new geographies. Today, it has presence in Punjab, Haryana, Chandigarh, Himachal Pradesh, Jammu, Rajasthan, Delhi NCR, Uttar Pradesh, Uttarakhand, Jammu and Madhya Pradesh and most of the recruitment will be to strengthen the teams in these places as well as open some eastern states like Bihar, West Bengal, etc. “As we grow, our people requirement will grow significantly too. In the immediate future, we hope to increase our staff strength substantially and PHF will become a force to reckon with in our areas of operations. We hope to recruit around 200 people across all functions by September / October of this year. We invest heavily in our human resources and this will continue”, says Shalya Gupta, CEO, PHF Leasing Limited. “People Centricity is one of our core strengths and at PHF Leasing we ensure that the bond with the employees is not transactional but carefully nurtured at a personal level as well. We have put systems in place to ensure that our employees feel comfortable, motivated and excel in their jobs. Cross functional connections is one of the mainstays of our HR policy and our teams have a deep bond within the company. We are happy to have low attrition and hope to maintain it in the years to come”, he adds. About PHF Leasing Limited : Incorporated in 1992, PHF Leasing Limited is a Metropolitan Stock Exchange of India listed, deposit accepting NBFC, headquartered in Jallandhar, Punjab. The Company is a category “A” Deposit taking Non-Banking Financial Company registered with Reserve Bank of India since 1998. The product portfolio includes Mortgage loans against immovable property (LAP) and financing E-vehicles primarily E-rickshaws, E-loaders and EV – 2 wheelers. Operating in Nine states & UT, PHF Leasing is operating in 100+ Locations and employs 400+ people. For more information, please visit: www.phfleasing.com Read the full article

0 notes

Text

Hello sir. I Am Dinesh From Jaipur, Rajasthan. I Working All India All Banks Credit Cards

1. HDFC Bank,

2. Kotak Mahindra Bank,

3. SBI Bank,

4. ICICI Bank,

5. Standard Chartered Bank

6. Au Bank,

7. Induslnd Bank,

8. Axis Bank

9. HSBC Bank.

And All Types Loan

1. Personal loan,

2. Business Loan,

3. Used Cars Loan

4. Home Loan,

5. Mortgage loan

Department So Requirements And Any Reference For Credit Card And Loan Please Call And Dinesh Mahawar WhatsApps:- 9079138790 / 8058070152 Banking Associate India

#allbankcreditcard#creditcard#hdfcbank#icicibank#axisbank#indusindbank#aubank#standardcharteredbank#kotakmahindrabank#sbibank#idfcbank#yesbank#hdfcbankcreditcard#icicibankcreditcard#axisbankcreditcard#indusindbankcreditcard#aubankcreditcard#standardcharteredbankcreditcard#kotakmahindrabankcreditcard#sbibankcreditcard#idfcbankcreditcard#yesbankcreditcard#alltypeloan#personalloan#businessloan#usedcarsloan#homeloan#mortgageloan

0 notes