#Paytm Mobile Wallet

Explore tagged Tumblr posts

Text

Paytm | Paytm Wallet | amazon pay | credit card | PhonePe | Mobile Wallet

Do you load money in an e-wallet from a credit card, know how much extra fee is deducted, understand profit and loss The cardholder gets rewards on most of the transactions done through the credit card. However, different fees may also apply on different platforms. New Delhi. Most of the banks in the country offer credit cards to their customers with good credit scores. Along with this, the…

View On WordPress

0 notes

Text

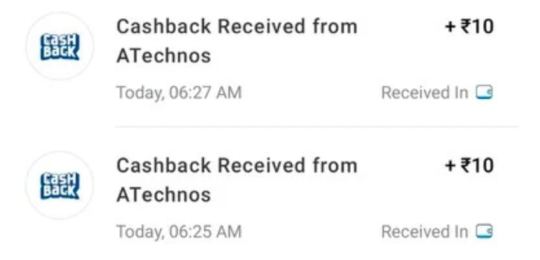

Get Rs.10 FREE PayTM Cash Instantly

Get Rs.10 FREE PayTM Cash Instantly Free Rs. 10 Free PayTM cash By Just Giving Misscall (Hurry Up! ) Rs 10 Free PayTM cash , Instant Rs 10 Free PayTM Cash , Rs 10 Free PayTM Cash By Miss Call , Earn Rs 10 Free PayTM Cash – Hi Guys , Here is Another Method To Earn Free PayTM Cash Loot , All You Have to Do is Just Give Miss call On Number & You Will Have Rs.10 Instant Free PayTM cash We Have…

View On WordPress

#Bill Payments#Earn Free PayTM Cash#Easy Earnings#Extra Money#Financial Benefits.#Financial Flexibility#freebies#Get Rs.10 FREE PayTM Cash Instantly#Hassle-Free Earnings#Instant Credit#Missed Call Offer#Mobile Recharge#No Strings Attached#online shopping#PayTM Wallet#Pocket Money#Quick Process#Student Expenses#Supplement Income

2 notes

·

View notes

Text

What Are the Best Payout Solutions for Your Business?

In today’s fast-paced digital economy, businesses of all sizes need efficient and secure payout solutions to manage their financial transactions. Whether you're running a small e-commerce store, a large enterprise, or providing services in the gig economy, selecting the right payout solution is crucial. From disbursing salaries to paying vendors or customers, a seamless payout process can enhance trust and streamline operations.

In this article, we will explore the best payout solutions for businesses, focusing on their features, benefits, and how they cater to diverse business needs. We’ll also touch upon the importance of working with a reliable micro ATM service provider and highlight Xettle Technologies as an example of innovation in this space.

Understanding Payout Solutions

Payout solutions refer to systems or platforms that facilitate the transfer of funds from a business to its employees, partners, customers, or vendors. These solutions are essential for ensuring smooth financial transactions and reducing manual intervention. Modern payout solutions are designed to be flexible, secure, and capable of handling high transaction volumes with ease.

The best payout solution for your business will depend on several factors, including the size of your company, the frequency of payouts, and the geographical location of your recipients. Let’s dive into the key elements to consider when selecting the right solution.

Features of Effective Payout Solutions

Multi-Channel Accessibility A good payout solution should support multiple payment channels, such as bank transfers, mobile wallets, UPI, and cards. This ensures that your business can cater to the diverse preferences of your recipients.

Scalability As your business grows, your payout needs will evolve. A scalable solution can accommodate increasing transaction volumes without compromising on speed or security.

Security and Compliance Protecting sensitive financial data is paramount. Choose a payout solution that complies with industry standards and regulatory requirements, ensuring the safety of your transactions.

Integration Capabilities Seamless integration with your existing systems, such as accounting software or enterprise resource planning (ERP) tools, can simplify operations and improve efficiency.

Real-Time Processing In today’s competitive environment, real-time payouts can be a game-changer. Recipients value quick access to their funds, making this a must-have feature.

Types of Payout Solutions

1. Bank Transfers

This is one of the most common methods, offering a direct and secure way to transfer funds to recipients' bank accounts. However, it may not be ideal for real-time payouts due to processing times.

2. Digital Wallets

Digital wallets like Paytm, Google Pay, and others provide a convenient and fast way to transfer funds. They are particularly popular in regions with high mobile penetration.

3. Prepaid Cards

Prepaid cards are a versatile option that allows businesses to load funds for employees or customers. They can be used for shopping or cash withdrawals.

4. Micro ATM Services

For businesses operating in rural or remote areas, a micro ATM service provider can be a game-changer. These services enable cash disbursements even in areas with limited banking infrastructure, bridging the financial inclusion gap.

How Micro ATM Service Providers Add Value

Micro ATM service providers are transforming the way businesses manage payouts in underbanked regions. These portable devices allow users to perform basic banking functions, such as cash withdrawals, balance inquiries, and fund transfers. By partnering with a reliable micro ATM service provider, businesses can expand their reach and cater to rural audiences effectively.

For instance, a small-scale retailer or a government agency can use micro ATM services to disburse payments to beneficiaries without requiring them to travel long distances to access banking facilities. This enhances convenience and boosts trust among recipients.

A Spotlight on Xettle Technologies

Xettle Technologies has emerged as a leader in the payout solutions space, offering innovative platforms that cater to diverse business needs. Their solutions are designed to enhance operational efficiency and provide a seamless experience for businesses and recipients alike. By leveraging advanced technology, Xettle Technologies ensures secure, real-time payouts while simplifying the integration process for businesses.

Choosing the Right Payout Solution

Selecting the best payout solution requires careful consideration of your business’s specific needs. Here are some steps to guide you:

Assess Your Requirements Determine the frequency and volume of payouts your business handles. This will help you identify a solution that matches your operational scale.

Evaluate Security Measures Ensure the platform offers robust encryption, fraud detection, and compliance with financial regulations.

Test for User-Friendliness The solution should be easy to use for both your team and your recipients. Look for platforms with intuitive interfaces and reliable customer support.

Consider Costs Compare the transaction fees, setup costs, and other charges associated with different solutions. Opt for one that offers value for money without compromising on quality.

Final Thoughts

Choosing the right payout solution is not just about facilitating transactions; it’s about building trust and ensuring smooth financial operations. Whether you’re looking for traditional methods like bank transfers or innovative options like micro ATM services, the key lies in understanding your business needs and selecting a partner that aligns with your goals.

From scalability to security, modern payout solutions offer a range of features that can empower your business to operate efficiently in a competitive landscape. By leveraging the right tools and technologies, such as those offered by Xettle Technologies, you can simplify your payout processes and focus on growing your business.

2 notes

·

View notes

Text

Ludo Money Withdrawal Paytm: Easy and Secure Cash-Outs

Mobile games are not merely fun products in today’s society, but they also feature enhanced technology on the digital stage. Ludo has not remained a game that can only be played but has turned into a chance where people can entertain themselves, solve puzzles, and even win money. Another aspect that Ludo players find comfortable with is the easy withdrawal of their winnings through Paytm. This article will also show that the players can cash out from Ludo to Paytm or any other legal channel of their choice seamlessly and securely.

Understanding Ludo Games with Cash Rewards

The game that dates back to the token and tile-based board game with the name Ludo has now shifted to the new digital platform. The current version can be played over the internet, forming the aspect of competition from all over the world. More interestingly, several of these platforms offer cash rewards for winning games. This monetary aspect adds an exciting layer to the classic game, making it more appealing to a broader audience.

The Role of Paytm in Ludo Cash Withdrawals

Paytm, one of India's leading digital wallets and financial services platforms, has become popular for gamers seeking to withdraw their Ludo earnings. It offers a user-friendly interface and a robust security framework, ensuring that transactions are easy and safe. Here’s why Paytm stands out:

Instant Transfers: Withdrawals to Paytm are usually instantaneous, allowing players to enjoy their winnings without any delay.

High Security: Paytm uses state-of-the-art security measures to protect user information and transaction details.

Ease of Use: Users can transfer their Ludo winnings to their Paytm wallet with just a few taps.

Step-by-Step Guide to Withdrawing Ludo Money to Paytm

Ludo money withdrawal Paytm step-by-step process:

Verify Your Account: Ensure that your Ludo game account and Paytm account are verified. This typically involves linking and confirming your phone number and email address.

Access the Withdrawal Section: In the Ludo app, navigate to the Wallet or Earnings section where your winnings are displayed.

Choose Your Withdrawal Method: Select Paytm as your preferred withdrawal method.

Enter the Amount: Input the amount of money you wish to withdraw. Ensure it meets the app's minimum withdrawal limit.

Confirm the Transaction: Review your details and confirm the transaction. You may be required to enter a one-time password (OTP) sent to your phone for security purposes.

Receive Your Funds: Your funds should be reflected in your Paytm wallet shortly after confirmation.

Tips for Smooth and Secure Transactions

To ensure that your transactions are both smooth and secure, consider the following tips:

Keep Your Apps Updated: Regularly update your Ludo and Paytm apps to protect against security vulnerabilities and enhance functionality.

Monitor Transaction Limits: Be aware of Paytm's daily and monthly transaction limits to plan your withdrawals accordingly.

Secure Your Devices: Always use a secure password or biometric authentication for your device and apps to prevent unauthorized access.

Common Issues and Troubleshooting

While the process is generally seamless, some users may encounter issues. Here are a few common problems and their solutions:

Transaction Delays: If there’s a delay in receiving funds, check for notifications from Paytm or the Ludo app regarding the transaction status. Sometimes, delays can occur due to system maintenance or high traffic.

Account Verification Issues: Ensure your Ludo and Paytm accounts are fully verified. Unverified accounts may face restrictions or delays in withdrawals.

Technical Glitches: If you experience technical difficulties, try restarting the app or contacting customer support.

Conclusion

Withdrawing your Ludo earnings to Paytm offers convenience, speed, and security. Players can enjoy their winnings with minimal hassle by following the detailed steps and tips provided. As mobile gaming continues to grow, features like easy cash withdrawals highlight how technology enhances user experiences, making gaming more enjoyable and rewarding. Whether you're a casual player or a serious gamer, understanding how to manage your earnings efficiently is key to a better gaming journey.

#ludo money withdrawal paytm#ludo money withdrawal#ludo earnings withdraw#ludo earnings withdraw paytm

2 notes

·

View notes

Text

Top-rated online retailers in India in 2023

Amazon.com

Amazon is renowned for its exceptional services, providing customers with fast and reliable shipping through Amazon Prime, ensuring quick and convenient deliveries. Their vast selection of products, combined with user-friendly interfaces, offers a seamless shopping experience. Amazon's Kindle e-reader and Fire tablet series have revolutionized digital reading and entertainment. Seeking authenticity in online shopping, do delved into Amazon reviews for unbiased insights. Additionally, Amazon Web Services (AWS) offers robust cloud computing solutions, catering to a wide range of businesses and organizations. Its dedication to customer satisfaction and innovation has solidified Amazon's reputation for delivering outstanding services.

Flipkart.com

Flipkart.com has earned a stellar reputation for its outstanding services, offering a diverse range of products and a user-friendly shopping experience. Their delivery services, including Flipkart Plus, ensure swift and reliable shipments, enhancing customer satisfaction. Flipkart reviews provide a candid glimpse into the user experience, guiding potential buyers. Flipkart's innovative initiatives, such as 'Big Billion Days,' provide customers with access to amazing discounts and deals. Their 'Flipkart Assured' program guarantees quality products with faster delivery. With a commitment to customer convenience, Flipkart continues to be a trusted leader in the Indian eCommerce industry.

Myntra.com

Myntra.com is well-regarded for its exceptional services in the fashion eCommerce sector. It offers a vast and trendy selection of clothing and accessories to cater to diverse preferences. Myntra's user-friendly platform and intuitive app make shopping a breeze for its customers. With swift delivery options and hassle-free returns, Myntra ensures a convenient and satisfying shopping experience. The transparency of Myntra’s customer reviews contributes to a trustworthy online shopping environment.

BigBasket.com

BigBasket.com stands out for its exceptional services in the online grocery sector. It provides a wide array of fresh produce and grocery items, making daily shopping more convenient. The platform's reliable delivery and user-friendly interface streamline the shopping process. Customers review of bigbasket reflect the true essence of the product, helping me make an informed decision. With a commitment to customer satisfaction and timely deliveries, BigBasket offers a convenient and efficient way to meet your grocery needs.

Ajio.com

Ajio.com offers an outstanding online shopping experience, particularly in the fashion and lifestyle sector. It features a diverse range of clothing, accessories, and lifestyle products to cater to various tastes. Ajio's user-friendly website and app make browsing and purchasing a breeze for customers. With quick deliveries and a commitment to quality, Ajio ensures a seamless and satisfying shopping journey. Before making a purchase, analyze reviews of Ajio users to gauge overall satisfaction.

Paytmmall.com

Paytm Mall stands out for its excellent services in the eCommerce realm, offering a wide array of products and services. With an easy-to-navigate platform and a user-friendly app, it provides a seamless shopping experience. Its digital wallet integration simplifies payments, while special offers and cashback deals enhance savings for customers. Paytm mall reviews showcase a diverse range of opinions, enriching the decision-making process. Quick and reliable deliveries, along with a commitment to customer satisfaction, make Paytm Mall a preferred choice for online shoppers.

fliptwirls.com

fliptwirls is a revolutionary eCommerce platform that offers an unparalleled shopping experience. With an extensive product catalog covering a wide range of categories, it caters to all customer needs. The website's intuitive interface and mobile app make shopping effortless and enjoyable. The value of Fliptwirls real reviews lies in their ability to capture the nuances of individual experiences. Fliptwirls’ commitment to exceptional customer service, secure transactions, and lightning-fast deliveries ensures a seamless and satisfying shopping journey for all.

Blinkit.com

Blinkit.com excels in providing exceptional services in the quick delivery and essentials shopping sector. With a wide range of daily necessities available, Blinkit offers convenience and ease for customers. The platform's swift and reliable delivery options ensure that essential items are readily accessible. The detailed narratives within blinkit reviews paint a comprehensive picture of the product's performance. Committed to enhancing customer satisfaction, Blinkit makes shopping for essentials a hassle-free experience.

nykaa.com

Nykaa.com stands out as a premier destination for beauty, wellness, and fashion enthusiasts. With an extensive collection of both domestic and international brands, it offers a diverse range of products to cater to various preferences. Nykaa's user-friendly website and mobile app provide a seamless shopping experience. Nykaa reviews act as a community forum, fostering an exchange of knowledge among consumers. Its swift deliveries, commitment to quality, and access to beauty and skincare advice make Nykaa.com a go-to platform for beauty and fashion needs.

croma.com

Croma.com is a leading online retailer, specializing in electronics and tech gadgets. It offers a vast array of the latest gadgets, appliances, and electronics, ensuring that customers have access to the best in technology. Reading croma reviews is like having a conversation with fellow shoppers, sharing valuable insights. The user-friendly interface and informative product details make shopping for electronics a breeze. With Croma's reliable delivery and after-sales services, customers can trust that they are making a smart choice for their tech needs.

2 notes

·

View notes

Text

Best Recharge Company

In today's fast-paced digital age, staying connected is not just a luxury; it's a necessity. Whether it's topping up your mobile phone, paying utility bills, or recharging your DTH (Direct-to-Home) connection, recharge companies have become an integral part of our lives. With numerous players in the market, each offering a unique set of features and benefits, finding the best recharge company can be a bit overwhelming. In this blog, we'll explore some of the top recharge companies and what makes them stand out.

Paytm - The All-in-One SolutionPaytm has become a household name in India, offering a versatile platform for mobile recharges, bill payments, flight bookings, and online shopping. What sets Paytm apart is its user-friendly interface and frequent cashback offers, making every recharge or payment a rewarding experience.

FreeCharge - Quick and SecureFreeCharge is known for its fast and secure payment options. With a focus on mobile recharges and bill payments, it's a go-to choice for those seeking hassle-free transactions. The platform often provides cashback deals and discounts, making it a cost-effective option.

PhonePe - UPI Integration at Its BestPhonePe's seamless integration with UPI payments has made it a popular choice in India. Besides recharges and bill payments, you can transfer money and shop online. Its user interface is lauded for its simplicity and convenience.

Google Pay - Trust and SecurityGoogle Pay is known for its robust security features, and its digital wallet allows users to make mobile recharges and bill payments with confidence. The option to link your bank account for transactions adds an extra layer of convenience.

Jio Recharge - For Jio CustomersIf you're a Jio customer, recharging your mobile number is a breeze through the official Jio website or app. With a range of prepaid plans offering data, voice, and SMS services, it caters specifically to Jio subscribers.

Airtel Thanks App - Airtel's All-in-One HubAirtel customers can manage their accounts, recharge their mobile numbers, and pay bills through the Airtel Thanks app. It offers a variety of prepaid and postpaid plans, as well as DTH recharges.

MyVodafone App (now Vi App) - Vi's User-Friendly InterfaceFor Vodafone Idea (Vi) customers, the MyVodafone app (now merged with Vi) provides an easy way to recharge mobile numbers, pay bills, and manage accounts. It simplifies the process for subscribers.

Amazon Pay - The Amazon TouchAmazon Pay, offered by the e-commerce giant Amazon, allows users to recharge mobiles, pay bills, and shop on Amazon. Frequent cashback offers and discounts make it an attractive choice.

Choosing the Right Recharge Company

When determining which recharge company is the best fit for your needs, consider the following factors:

Services Available: Ensure that the company offers the services you need, whether it's mobile recharges, bill payments, or other digital transactions.

User Interface: A user-friendly app or website can make the process smoother and more enjoyable.

Security: Look for companies that prioritize security, safeguarding your financial and personal information.

Offers and Discounts: Check for any promotions, cashback deals, or discounts that can help you save money on your transactions.

Reviews and Reputation: Reading user reviews and assessing the company's reputation can provide valuable insights.

Availability: Confirm that the services are available in your region.

In conclusion, the best recharge company for you will depend on your specific requirements and preferences. With the diverse options available, you're sure to find one that suits your needs and makes managing your digital transactions a breeze. Whether you prioritize cashback offers, user-friendly interfaces, or security, these top recharge companies offer a range of benefits to make your life easier.

2 notes

·

View notes

Text

Explosive Growth in Mobile Money Market: Projected to Surge from USD 17 Billion to USD 119 Billion by 2034

The global mobile money market had a value of US$ 106.8 billion in 2022 and was projected to grow by an impressive 22.6% CAGR to US$ 816.6 billion by 2032. The global mobile money industry is anticipated to expand on an unstoppable note in the projected period with confidence around the security of the payment apps.

To facilitate international transfers to cash facilities and phone credit, the banks and financial sectors launched MTN mobile money. Paying with a digital or web-based approach helps wallet mobile money providers maintain service security and build relationships with a wide range of active and interested users. Mobile wallets are another way that NFC-capable phones are being utilised to boost sales.

At the same time, the fact that there are concerns regarding data security can’t be ignored. This factor could restrain the mobile money market going forward. Future Market Insights has entailed these facts with future perspectives in its latest market study entitled ‘Mobile Money Market’. It has its indigenous team of analysts and consultants to execute using an eagle’s eye view in its primary, secondary, and tertiary modes of research.

To Get Sample Copy of Report Visit

“With convenience quotient (CQ) at its peak, the global mobile money market is expected to go great guns in the forecast period”, says an analyst from Future Market Insights.

Key Takeaways from Mobile Money Market

North America holds the largest market share with new channels coming up in the US on the continuous basis.

Europe holds the second-largest market share with the UK and Germany leading from the front. The scenario is expected to remain unchanged in the forecast period.

The Asia-Pacific is expected to grow at the fastest rate in the mobile money market going forward. The pandemic did change certain things forever; with usage of plastic money being at the forefront. Platforms like PayTM, PhonePay, GooglePay started getting adopted with immediate effect, particularly by the millennials. The older generations also started getting accustomed to this way of transaction gradually. The region is home to two densely populated countries – India and China. With majority of population herein opting for cashless transaction, the mobile money market is bound to grow by leaps and bounds in the forecast period.

Competitive Analysis

Google LLC, in 2019, did team up with Citigroup for implementing Google Pay (mobile wallet money). This platform has gained prominence especially during and after the pandemic (wherein touchless transaction was looked for).

PayPal, in November 2019, entered into partnership with Paykii for launching Xoom (PayPal’s Jamaica-based international money transfer service). The consumers based out of Canada, the UK, the US, and also 37 markets all across Europe, since then, are able to use Xoom’s easy and fast money transfer service for securely paying insurance, loan, water, mobile network, cable, internet, telephone, and electricity bills in Jamaica.

Airtel Africa, in October 2019, entered into collaboration with Mastercard for offering mobile money services all across 14 regions of Africa. Mastercard virtual card does facilitate Airtel Money that does away with a bank account with the objective of making payments at the global as well as local level.

Orange Romania’s Orange Money, in August 2019, tabled the ‘My Reserve’ lending platform. The customers are thus getting benefitted from transparent and simple lending tool, that too, without additional fees and commissions. The interest rate offered is 14% with fixed rates.

Kenya-based Safaricom, in May 2019, entered into partnership with Vodacom for acquiring IP rights of M-Pesa mobile financial services platform. As such, Fuliza (an M-Pesa overdraft facility) was put forth in Kenya that has 8.8 Million+ users.

What does the Report state?

The research study is based on mode of payment (NFC, mobile billing, SMS, USSD or STK, and others), types of purchase (airtime transfers & top-ups, money transfers & payment, merchandise & coupons, travel and ticketing, and likewise), industry vertical (BFSI sector, energy & utilities sector, retail sector, healthcare sector, hospitality & tourism sector, media & entertainment sector, SCM (supply chain management) & logistics sector, IT & telecommunication, and likewise).

With smart and secure GUI (graphical user interfaces) consolidating, various central and government banks are significantly encouraging citizens to accept mobile money.

Key Segments

By Mode of Payment:

NFC

Mobile Billing

SMS

USSD or STK

Others

By Types of Purchase:

Airtime Transfers & Top-ups

Money Transfers & Payment

Merchandise & Coupons

Travel and Ticketing

Others

By Industry Vertical:

Banking, Financial Services, and Insurance (BFSI) Sector

Energy & Utilities Sector

Retail Sector

Health Care Sector

Hospitality & Tourism Sector

Media & Entertainment Sector

Supply Chain Management (SCM) & Logistics Sector

Telecommunication & IT Sector

Others

By Region:

North America

Latin America

Europe

Asia Pacific

Middle East and Africa (MEA)

0 notes

Text

How Fintech is Transforming Traditional Banking in India

The financial services landscape in India has undergone a revolutionary change with the advent of fintech. Over the last decade, fintech has emerged as a game-changer, challenging the status quo of traditional banking.

From streamlining transactions to offering personalized financial solutions, the impact of fintech on traditional banking in India has been profound.

This blog explores the various dimensions of this transformation, highlighting the opportunities and challenges faced by both sectors.

What is Fintech?

Fintech, short for financial technology, refers to innovative technologies designed to improve and automate the delivery of financial services.

These technologies have reshaped how people interact with money, making financial processes more efficient, secure, and accessible.

Key Features of Fintech

Digital Payments: Mobile wallets and UPI transactions.

Lending Platforms: Quick loans through apps.

Robo-Advisors: Automated investment advice.

Blockchain and Cryptocurrencies: Decentralized financial solutions.

The Impact of Fintech on Traditional Banking in India

1. Enhanced Customer Experience

Fintech platforms prioritize user experience by offering intuitive interfaces, 24/7 accessibility, and faster services. Traditional banks, constrained by legacy systems, often struggle to match this agility.

2. Increased Financial Inclusion

Fintech has extended banking services to unbanked and underbanked populations, particularly in rural India. Mobile-based solutions have bridged the gap, which traditional banks found challenging due to high operational costs.

3. Competition and Collaboration

The rise of fintech has introduced healthy competition. However, many traditional banks are now partnering with fintech startups to innovate their offerings and stay relevant.

4. Cost Efficiency

Fintech eliminates intermediaries and automates processes, reducing operational costs significantly. Traditional banks are adopting these technologies to cut costs and improve efficiency.

5. Data-Driven Decision Making

Fintech leverages big data and AI to offer personalized services. Traditional banks are now investing in similar technologies to enhance customer engagement.

Challenges for Traditional Banks

1. Technological Lag

Traditional banks often operate on outdated systems, making it difficult to integrate advanced fintech solutions seamlessly.

2. Regulatory Hurdles

While fintech operates in a relatively flexible regulatory environment, traditional banks are bound by stringent compliance requirements.

3. Loss of Market Share

The growing preference for digital platforms has caused traditional banks to lose market share, especially among tech-savvy younger generations.

Opportunities for Traditional Banks

1. Collaboration with Fintech

Many traditional banks have recognized the need to collaborate with fintech startups. Partnerships with leading players allow banks to enhance their digital capabilities.

2. Adoption of Digital Banking

By embracing digital banking solutions, traditional banks can modernize their offerings and retain their customer base.

3. Upskilling Workforce

Training employees in emerging technologies like AI, blockchain, and data analytics can help traditional banks compete effectively.

Role of Investment Banking in the Fintech Revolution

Investment Banking in Mumbai: A Hub of Innovation

Mumbai, the financial capital of India, has witnessed significant activity in the fintech and investment banking sectors. Institutes offering specialized courses, such as an investment banking course in Mumbai, equip professionals with the skills required to navigate this evolving landscape.

Investment Banking Institutes in Mumbai

Leading institutes focus on blending traditional banking principles with fintech innovations. These programs are essential for professionals aiming to thrive in this hybrid environment.

Case Studies: Fintech Success Stories in India

1. Paytm

Starting as a digital wallet, Paytm has expanded into various financial services, from banking to stock trading, posing a significant challenge to traditional banks.

2. Razorpay

This payment gateway simplifies online transactions, making it a preferred choice for businesses and individuals alike.

3. Kotak Mahindra Bank

Among traditional banks, Kotak has effectively integrated fintech solutions, offering seamless digital experiences to its customers.

The Future of Banking in India

1. Hyper-Personalization

AI-driven insights will enable banks to offer tailored financial products, enhancing customer satisfaction.

2. Blockchain Adoption

Blockchain technology will revolutionize secure transactions and fraud prevention.

3. Increased Collaborations

Expect more partnerships between fintech startups and traditional banks, leading to hybrid financial ecosystems.

Stay Ahead in the Fintech Revolution

The impact of fintech on traditional banking in India is undeniable. Whether you are an IT professional, a business owner, or a budding entrepreneur, understanding this transformation is crucial.

To excel in this dynamic field, consider enrolling in an investment banking course in Mumbai. Equip yourself with the skills and knowledge to thrive in the digital age.

Sign up today and be part of the future of banking!

#Fintech#impact of fintech on traditional banking#Future of Banking in India#investment banking course in Mumbai#investment banking institute in Mumbai

1 note

·

View note

Text

Ludo Money: Earn While You Play

Ludo, a beloved board game across the globe, has evolved from a simple pastime to a modern opportunity for earning real money. With the rise of digital gaming platforms, "Ludo Money" has become a trending concept, allowing players to enjoy the game while earning cash rewards. Whether you’re a seasoned player or a casual gamer, this blog will show you how to turn your love for Ludo into a rewarding experience.

What is Ludo Money?

Ludo Money refers to platforms and apps that let players compete in Ludo games for real cash prizes. Players participate in matches, tournaments, or challenges where they can win monetary rewards based on their performance. It combines the thrill of the classic game with the excitement of earning money, making it a popular choice among online gaming enthusiasts.

How to Play Ludo for Money?

1. Choose a Trusted Platform

There are several apps like Ludo Empire, WinZO Ludo, and Paytm First Games that offer real-money gameplay. Choose a platform with good reviews and secure payment methods.

2. Sign Up and Deposit Money

Create an account, deposit a small amount to start, and explore the various cash games or tournaments available.

3. Select a Game Mode

Most platforms offer:

1v1 Matches: Play against one opponent for quick cash rewards.

Tournaments: Compete with multiple players for larger prize pools.

Fast Ludo: Shorter versions of the game with quick results.

4. Play and Win

Use your skills and strategies to outperform opponents and win cash rewards.

5. Withdraw Your Earnings

Earnings can be withdrawn easily to your bank account or digital wallet, making the process seamless.

Tips to Win Money in Ludo

Practice Regularly Sharpen your skills by playing free games before entering cash matches.

Understand the Rules Familiarize yourself with the platform’s specific rules, as they may differ slightly from the traditional game.

Play Strategically Plan your moves, avoid unnecessary risks, and focus on advancing multiple tokens simultaneously.

Observe Opponents Pay attention to your opponents’ gameplay to anticipate their moves and counter them effectively.

Benefits of Playing Ludo for Money

1. Entertainment and Earnings

Enjoy a fun and engaging game while earning real cash rewards.

2. Skill-Based Rewards

Unlike games of pure chance, Ludo rewards strategic thinking and decision-making.

3. Flexible Gameplay

Play anywhere, anytime, from the comfort of your home or on the go.

4. Tournaments with High Stakes

Participate in competitive tournaments for the chance to win big prizes.

Popular Ludo Money Platforms

Ludo Empire Offers a seamless gaming experience with real-money matches and quick withdrawals.

WinZO Ludo Known for its fast-paced games and exciting prize pools.

MPL (Mobile Premier League) Features various Ludo formats and frequent cash tournaments.

Paytm First Games Provides a secure platform with rewards directly transferred to your Paytm wallet.

Safety Tips for Playing Ludo Money Games

Choose Reliable Platforms: Ensure the app is trusted and verified.

Set a Budget: Play responsibly and never spend more than you can afford.

Secure Payments: Use trusted payment gateways for deposits and withdrawals.

Avoid Overconfidence: Play with focus and avoid emotional decisions.

Conclusion

Ludo Money is a fantastic way to blend entertainment with earnings. By leveraging your skills and strategies, you can turn your favorite board game into a lucrative hobby. Whether you're playing casually or participating in high-stakes tournaments, Ludo Money offers endless excitement and opportunities.

0 notes

Text

0 notes

Text

Level Up Your Earnings with These Top Game Apps

Gaming has evolved far beyond simple entertainment; it’s now a lucrative way to earn real cash and rewards. With earning game apps, players can enjoy exciting games while boosting their income. Whether you’re a casual gamer or a pro, these apps offer a perfect blend of fun and financial opportunity. Here’s a rundown of the top earning game apps to help you level up your income.

Why Earning Game Apps Are a Game-Changer

Earning game apps combine skill-based gameplay with cash rewards, offering a unique experience that traditional games lack. These apps are designed to be easy to use, engaging, and financially rewarding. They’ve gained popularity among gamers who want to turn their passion into profit.

Top Game Apps to Earn Big

1. Ludo Empire

Ludo Empire stands out as a leading game earning app, blending the classic Ludo game with competitive cash play. With secure transactions and fair gameplay, it’s a top choice for Ludo enthusiasts looking to earn money.

2. MPL (Mobile Premier League)

MPL offers a variety of games, including puzzles, arcade games, and fantasy sports. Players can participate in daily challenges, tournaments, and leaderboards to win cash rewards.

3. WinZO

WinZO features a diverse collection of games, from board games to action-packed challenges. With its easy payout system and regular contests, it’s a favorite for gamers across India.

4. Zupee

Focusing on trivia and casual board games, Zupee offers short, engaging matches where players can win real money. It’s perfect for those who love quick games with high rewards.

5. Gamezy

Gamezy combines fantasy sports with casual games like Ludo and rummy. It’s ideal for players who enjoy a mix of strategic and luck-based gameplay with real earning potential.

6. Paytm First Games

This app integrates gaming with Paytm rewards, allowing users to earn directly into their Paytm wallets. With various games and tournaments, it’s a great option for regular gamers.

7. RummyCircle

RummyCircle is a dedicated platform for card game enthusiasts. With its cash games and tournaments, it’s perfect for those skilled in strategy-based games.

How to Start Earning

Download Your Chosen App: Choose apps like Ludo Empire or MPL for a secure experience.

Sign Up and Explore: Register your account and explore the game options.

Start Small: Begin with low-stakes games to build confidence.

Participate in Tournaments: These often have higher stakes and bigger rewards.

Pro Tips to Maximize Your Earnings

Master Your Games: Focus on games you’re skilled at to maximize your chances of winning.

Refer Friends: Most apps offer referral bonuses, boosting your earnings further.

Stay Updated: Look out for special events, promotions, or seasonal tournaments.

Play Responsibly: Set limits on your spending to ensure a fun and sustainable experience.

Why Earning Game Apps Are Popular

The rise of mobile gaming has made earn money game apps more accessible than ever. These apps cater to gamers of all skill levels, making it easy for anyone to enjoy and earn. With real-time multiplayer options and exciting rewards, they’ve become a go-to choice for gamers worldwide.

Benefits of Playing Earning Game Apps

Flexible Income: Play whenever and wherever you want.

Skill-Based Rewards: Earn based on your abilities and strategies.

Social Connection: Compete with friends and players worldwide.

Instant Payouts: Many apps offer quick and secure withdrawal options.

Conclusion

If you’re ready to combine your love for gaming with the opportunity to earn real money, these top earning game apps are your ticket. Apps like Ludo Empire and WinZO provide endless fun and the chance to win big. Download your favorite app today and start leveling up your earnings!

0 notes

Text

What are Digital Payment Methods?

Digital payment methods refer to various technologies and platforms that allow individuals or businesses to make payments electronically, without the need for physical cash or checks. These methods have grown in popularity due to their convenience, speed, and the increased digitization of financial transactions. Common digital payment methods include:

1. Credit and Debit Cards

- Description: Traditional cards issued by banks and financial institutions.

- How it works: Users can enter their card details (number, expiration date, CVV) to make payments online or tap/swipe for in-store purchases.

- Examples: Visa, MasterCard, American Express.

2. Mobile Wallets

- Description: Apps that store users' payment information securely and allow them to make payments using their smartphones.

- How it works: Payments can be made by scanning a QR code or using NFC technology by tapping the phone.

- Examples: Apple Pay, Google Pay, Samsung Pay, Paytm.

3. Online Bank Transfers

- Description: Direct transfer of money between bank accounts over the internet.

- How it works: Users log in to their bank’s online platform and initiate a payment by entering the recipient’s bank details.

- Examples: Zelle, PayPal’s bank transfer option, SEPA (in Europe).

4. Cryptocurrencies

- Description: Decentralized digital currencies that rely on blockchain technology.

- How it works: Transactions are verified using cryptography and are recorded on a decentralized ledger.

- Examples: Bitcoin, Ethereum, Litecoin.

5. Payment Gateways

- Description: Services that process online payments for e-commerce sites.

- How it works: They act as intermediaries between customers and merchants, authorizing card payments and ensuring the security of the transaction.

- Examples: Stripe, PayPal, Square.

6. Peer-to-Peer (P2P) Payment Systems

- Description: Platforms that allow users to send money directly to other individuals.

- How it works: Payments are often linked to bank accounts, cards, or wallets, allowing users to transfer funds by entering the recipient's email, phone number, or username.

- Examples: Venmo, Cash App, PayPal.

7. Buy Now, Pay Later (BNPL)

- Description: A financing option that allows consumers to make purchases and pay for them in installments.

- How it works: Users select the BNPL option at checkout, and the provider pays the retailer upfront, while the consumer pays the provider in scheduled payments.

- Examples: Afterpay, Klarna, Affirm.

8. QR Code Payments

- Description: Payment method where users scan a QR code to complete transactions.

- How it works: A unique code is generated by the merchant, which the customer scans to pay via their mobile banking app or wallet.

- Examples: WeChat Pay, Alipay.

9. Direct Debit

- Description: An automatic payment method where funds are taken directly from a user’s bank account for recurring payments.

- How it works: The user authorizes a merchant or service provider to deduct payments on agreed dates.

- Examples: Utility bill payments, subscription services.

These methods are commonly used for a variety of transactions, including e-commerce, in-store purchases, bill payments, and peer-to-peer transfers. Digital payments are becoming increasingly secure with encryption, tokenization, and biometric authentication technologies.

0 notes

Text

Fintech Market Growth and Why You Should Invest in Building a Fintech Solution

The financial technology (fintech) industry has experienced unprecedented growth in recent years, fundamentally altering the landscape of financial services. From digital payments and lending platforms to wealth management and blockchain solutions, fintech innovations have made financial transactions faster, more accessible, and highly efficient.

In this blog, we’ll explore the remarkable growth of the fintech market and why now is the perfect time to invest in building a fintech solution.

The Explosive Growth of the Fintech Market

1. Market Size and Forecast

The global fintech market has grown exponentially over the past decade and is projected to maintain this trajectory. According to recent studies:

The market is expected to reach a valuation of $699.5 billion by 2030, growing at a CAGR of 20.3% from 2023 to 2030.

Digital payments continue to dominate the sector, accounting for nearly 50% of fintech revenue globally.

2. Regional Trends

The growth of fintech varies by region:

Asia-Pacific leads in adoption, driven by countries like China and India. Mobile payment platforms like Alipay and Paytm are revolutionizing how people transact.

North America remains a hub for innovation, with significant investments in blockchain, wealth tech, and neobanking.

Africa and Latin America are emerging markets where fintech addresses financial inclusion challenges, particularly in underbanked populations.

3. Funding and Investment

Fintech is one of the most funded sectors globally. In 2023 alone:

$75 billion was invested in fintech startups, with a focus on payment systems, regtech, and blockchain.

Major players like Stripe, Revolut, and PayPal have raised billions, inspiring confidence in the sector's profitability.

Key Drivers of Fintech Market Growth

1. Digital Transformation

The pandemic accelerated digital adoption, with businesses and consumers increasingly relying on cashless and contactless payment systems. Fintech solutions have been at the forefront of this transition, making financial transactions seamless and secure.

2. Financial Inclusion

Globally, over 1.4 billion people remain unbanked. Fintech is bridging this gap by offering digital wallets, microloans, and peer-to-peer lending platforms, enabling underserved populations to access financial services.

3. Advancements in Technology

Artificial Intelligence (AI): Enables personalized financial advice, fraud detection, and credit risk assessment.

Blockchain: Revolutionizes payment systems by ensuring transparency and reducing transaction costs.

IoT and Big Data: Enhance customer experiences by analyzing user behavior and predicting financial needs.

4. Changing Consumer Expectations

Today’s consumers demand speed, convenience, and personalization. Fintech apps cater to these needs by providing user-friendly platforms for payments, investing, and lending, often at lower costs than traditional financial institutions.

Why Invest in Building a Fintech Solution?

1. Massive Market Potential

With billions of dollars flowing into fintech and a steadily growing customer base, there is immense potential for financial returns. By entering the fintech market, you can tap into a global audience and leverage the sector's high growth rate.

2. Opportunities for Innovation

Fintech solutions offer countless possibilities for innovation, including:

Neobanking: Digital-only banks that provide cost-effective services with seamless user interfaces.

WealthTech: Tools that simplify investments, robo-advisors, and portfolio management for individuals and businesses.

InsurTech: Platforms that transform the insurance industry through automated claims processing and personalized policies.

3. Addressing Real-World Problems

Fintech solutions solve tangible problems such as high remittance fees, loan inaccessibility, and limited banking hours. For instance:

Peer-to-peer lending platforms connect borrowers with lenders directly, bypassing traditional banking hurdles.

Cross-border payment solutions powered by blockchain significantly reduce transaction times and costs.

4. Scalability and Global Reach

Fintech solutions are inherently scalable. A well-designed fintech app or platform can serve millions of users worldwide, expanding its impact and revenue potential with minimal overhead costs.

5. High Consumer Adoption

Fintech adoption rates are climbing. In 2022, 64% of global consumers used at least one fintech platform, and this number is expected to rise as digital literacy improves. With a growing user base, fintech solutions are set to dominate financial services.

6. Partnerships with Traditional Institutions

Fintech solutions often collaborate with traditional banks and financial institutions, combining innovation with legacy infrastructure. This synergy creates a win-win scenario, enhancing credibility while scaling operations.

7. Cost Efficiency and Automation

Building a fintech solution offers a cost-effective way to streamline financial operations through automation. Features like AI-driven customer support and automated payments reduce operational costs while enhancing user satisfaction.

What Makes a Successful Fintech Solution?

1. User-Centric Design

A seamless and intuitive user experience (UX) is critical. Consumers should be able to navigate your app effortlessly, whether they’re making a payment, applying for a loan, or checking their credit score.

2. Security and Compliance

Security is paramount in fintech. Employ advanced encryption protocols, multi-factor authentication, and compliance with regulations like GDPR, PSD2, or PCI DSS to gain consumer trust.

3. Interoperability

Successful fintech platforms integrate with other services, such as accounting tools, e-commerce websites, and payment gateways. This interconnectedness ensures flexibility and wider adoption.

4. Continuous Innovation

The fintech space is dynamic. Regular updates, new features, and integration of cutting-edge technologies like blockchain or AI keep your platform competitive.

Emerging Trends in Fintech

Embedded Finance: Integration of financial services into non-financial platforms, such as ride-hailing apps offering insurance.

Decentralized Finance (DeFi): Blockchain-based platforms that eliminate intermediaries in financial transactions.

Green Fintech: Sustainable fintech solutions focusing on eco-friendly investments and carbon offsetting.

AI-Driven Personalization: Hyper-personalized user experiences powered by machine learning algorithms.

Challenges to Consider

While the fintech market is brimming with opportunities, challenges like regulatory compliance, cybersecurity risks, and high competition should be addressed thoughtfully. Collaborating with legal experts and cybersecurity professionals ensures a robust and compliant platform.

Conclusion

The fintech market's rapid growth offers a golden opportunity for investors and entrepreneurs alike. By addressing real-world financial challenges and leveraging cutting-edge technology, fintech solutions are not only transforming industries but also improving lives globally.

Building a fintech solution now can position your business at the forefront of this revolution, enabling you to capitalize on the sector's immense potential. With thoughtful planning, innovation, and a user-first approach, you can create a fintech platform that thrives in the digital economy and delivers sustainable growth.

Investing in fintech is not just about financial returns—it’s about shaping the future of finance itself.

Looking for a fintech development company for developing your solution? Techtsy, one of the largest software development company in Dubai is the right organization to partner with.

0 notes

Text

Best apps for earn money without investment

Best Apps for Earn Money Without Investment: Your Guide to Earning Extra Cash

In a world where smartphones have become an integral part of our daily lives, earning money from mobile apps is no longer a distant dream but a practical reality. There are countless apps that let you generate income without spending a dime. Here, we’ll explore some of the best apps for earn money without investment, each offering unique ways to help you make extra cash in your spare time.

1. Swagbucks: Get Paid for Everyday Tasks

Swagbucks is a trusted app that rewards you for doing simple tasks like taking surveys, watching videos, and shopping online. By completing these easy activities, you earn "Swagbucks" (SB) points that can be converted into cash or gift cards. For those looking for the best apps for earn money without investment, Swagbucks is a great choice due to its variety of earning opportunities.

Why Choose Swagbucks?

Multiple earning options like surveys, games, and shopping rebates.

Points can be easily redeemed as PayPal cash or gift cards.

Perfect for anyone who wants to earn with minimal effort and time.

Whether you're watching videos in your spare time or taking surveys on the go, Swagbucks provides an easy way to turn your daily activities into money.

2. Google Opinion Rewards: Quick Cash for Sharing Your Opinion

If you’re someone who enjoys sharing their opinion, Google Opinion Rewards is perfect for you. This app offers short surveys on various topics, rewarding you with Google Play credits or PayPal cash after completion. The surveys take only a few minutes and are an effortless way to earn.

Why Google Opinion Rewards?

Quick surveys that can be completed in under 5 minutes.

Flexible payout options with Google Play credits or PayPal cash.

A simple way to make extra cash on the go, without commitment.

Its short, easy-to-complete surveys make Google Opinion Rewards one of the best apps for earn money without investment for people who want quick and easy tasks.

3. TaskBucks: Earn Through Simple Tasks

TaskBucks is a popular app, especially in India, offering small rewards for tasks like downloading other apps, filling out surveys, and inviting friends. You can cash out your earnings for mobile recharges or transfer them to your Paytm wallet, making it ideal for people looking for a no-hassle income stream.

Why TaskBucks?

Multiple ways to earn, including app downloads and surveys.

Perfect for people who prefer tasks that are quick and easy to complete.

Low cash-out thresholds, allowing you to redeem quickly.

TaskBucks is a convenient choice for those who want to turn their spare time into a little extra money without any upfront costs.

4. Meesho: Start a Reselling Business with Zero Investment

Meesho is a fantastic app for those interested in reselling products without needing to invest in stock. By sharing products from Meesho’s catalog, you can set your profit margins and earn on every sale. With no need to worry about inventory or shipping, Meesho is one of the best apps for earn money without investment in the reselling category.

Why Meesho?

Perfect for starting a business without any capital.

Offers a wide product range for easy reselling.

All logistics and customer support handled by Meesho.

If you’re interested in e-commerce and selling, Meesho lets you jump in with zero financial risk.

5. Fiverr: Make Money with Your Skills

Fiverr is a global freelancing platform that lets you offer services, or "gigs," starting at $5. You can find work in writing, design, video editing, and more. For those with specific skills, Fiverr offers an opportunity to make substantial income by doing what they love. You can start earning immediately, making it a top choice among the best apps for earn money without investment.

Why Fiverr?

High earning potential for skilled freelancers.

Access to a large user base and international clients.

Flexible work hours and payment options.

Fiverr’s project-based structure makes it a top choice for freelancers who want flexibility and control over their income.

6. Upwork: Freelance and Earn on Your Own Terms

Upwork is a well-known freelancing platform for professionals. Unlike Fiverr, where gigs are often one-off tasks, Upwork provides a platform for long-term freelance work in fields like programming, design, and marketing. Setting up a profile is free, and Upwork offers flexible income opportunities for people with varying levels of experience.

Why Upwork?

Great for skilled professionals looking for consistent work.

Large client network with international opportunities.

Potential for high earnings, depending on experience.

For those with expertise in a field, Upwork is one of the best ways to find high-paying projects without needing an upfront investment.

7. Foap: Sell Your Photos for Passive Income

Foap is an app that allows photographers to sell their photos to brands and individuals. Whether you’re a professional or a hobbyist, Foap can turn your photos into money. You upload your photos to the app, and each time one sells, you earn a commission. The same photo can be sold multiple times, creating a stream of passive income.

Why Foap?

Ideal for photographers looking to monetize their passion.

Potential for continuous income, as photos can be sold repeatedly.

Easy to use, with a built-in community for support and networking.

Foap is one of the best apps for earn money without investment for creative individuals who want to leverage their photography skills.

Conclusion: Start Earning Today

With the digital world at our fingertips, anyone can start earning money without an upfront investment. These apps provide diverse earning options, from quick surveys and microtasks to freelancing and reselling. Whether you’re a student, a freelancer, or simply someone looking to make extra money, the best apps for earn money without investment can fit into your lifestyle and help you reach your financial goals. Dive in today, choose the app that suits your interests, and watch as your smartphone transforms into a source of income.

0 notes