#Pakistan Greenwich University

Explore tagged Tumblr posts

Text

ARUCAD Enters Collaboration With Pakistan Greenwich University

A protocol has been signed between Arkın Creative Arts and Design University (ARUCAD) and Greenwich University Karachi campus, to enhance and promote mutual academic collaboration. This protocol allows for student and faculty exchanges between the two universities. Continue reading ARUCAD Enters Collaboration With Pakistan Greenwich University

View On WordPress

#Arkın Creative Arts and Design University (ARUCAD)#Joint protocol#mutual academic collaboration#Pakistan Greenwich University#student exchange programs

0 notes

Text

Saturday 11th March 2023

The Brisbane City Hall was built in 1930 and was the largest clock tower in Australia at 92 metres in height, the tallest building in Brisbane until the 1960s. Cannily this beats the clock tower at the GPO building in Sydney which tops out at a mere 73 metres. No competition there then. The tour of the tower needs to be quick to get 4 people at a time up the top in a very old clanking lift, wave a hoof at the view and the bells and back down again before the clock does its Westminster chimes all over again. There's always going to be casualties in a tour program with limited time available. In this case having been able to view the views from the top it was thereafter basically: there's the bells made in the Loughborough foundry and there's a clock down there somewhere now all back in the lift, we're off. Um, is it weight driven and is it still wound by hand? Don't really know much about the clock as such. I expect you could look that up he said. For the horologists, the tower has 4 x 3 ton bells for the chimes and 1 X 4.3 ton bell for the hour strike. Lovely tones I must say. The clock itself is electric driven and operates from a master pendulum on the same basis as the Greenwich Observatory.

We then crossed the river to have a flat white in the Art Gallery Café. It would appear that the streets on the North Bank of the Brisbane River are named after English monarchy and across the river after British Prime Ministers. One person said, and I thought this was quite witty, they don't have a Truss street because there aren't any streets short enough! Anyway we had our coffee, popped into the Queensland Museum and popped back out again rather quickly because it was crawling with kids, then went to check on the theatre situation at the Queensland Performing Arts Centre to see if there were by any chance any tickets that had become available for tonight's play. No luck so we crossed the river again to do a bit of shopping. We really like the South Bank complex of theatre, art galleries and museums. It has a lovely relaxed feel about it and you can just meander around soaking up the atmosphere and today also the rain.

Being Saturday the shopping area has a bit of a carnival touch and with St Patrick's day not too far away now there was an Irish Band, possibly called Silken Thomas, playing sentimental tunes from the Emerald Isle. It's a universal ting that all nationalities seem to unite with a tear in the eye to the playing of an Irish ballad, as though we all have a longing for the old country. We've seen it in New York, Australia, Scotland, Birmingham and most weirdly in Amsterdam! How do these Celts do it? Just hope for Ireland's sake they don't all feel the pull and decide to return home. Martine who is half Irish had a lump in her throat. Even I did and I'm Anglo Saxon. (I think). So to the strains of Danny Boy, Whiskey in the Jar, Leaving of Liverpool and feeling all didley didley we ambled off to take a look at the next celebration, that of the Pakistan Australian Cultural Association that is setting up in George Square. We were hoping they might have food. No genetic ties there. (I don't think).

Our last evening here we began with a one venue pub crawl involving some Aussie beer. It wasn't one of those pub restaurants that Martine was hoping for as they are in the outback where everyone goes quiet when you walk in. Quite the opposite, it was very noisy but very atmospheric. Then we moved on to Betty's Burgers for, well a burger actually. It's our first time with Betty's and we wondered if we would be safe with her but I have to say, a burger with king prawns on board was rather nice. Then back to the hotel to pack again ready for a really early Virgin Australia flight to Sydney tomorrow morning. Yawn.

Brisbane is a very pleasant modern city which I can see would really appeal to a younger generation with the opportunities it offers. She appears to strive to present herself as a contemporary place to live, work and play although there have been times in the past when the town elders have been accused of sacrificing some of the old in order to facilitate the new. Bold new schemes are underway to add three new river crossings including a CrossRiverRail connection. This is indeed a city of investment in its future. We have had a brief but good time here. It's a shame that we view Brisbane at the moment of our trip as we prepare, with great regret, to returning home on Wednesday.

ps on the eve before our little flight to Sydney, we were watching Sully on the telly.

pps look how small and insignificant the Albert Street Congregational Church looks against the skyscrapers

2 notes

·

View notes

Text

On this day in Wikipedia: Monday, 5th February

Welcome, velkommen, 欢迎 (huānyíng), tervetuloa 🤗 What does @Wikipedia say about 5th February through the years 🏛️📜🗓️?

5th February 2023 🗓️ : Death - Pervez Musharraf Pervez Musharraf, Pakistani military officer and politician, 10th President of Pakistan (b. 1943) "Pervez Musharraf (11 August 1943 – 5 February 2023) was a Pakistani military officer and politician who served as the tenth president of Pakistan from 2001 to 2008. He also served as the 10th Chairman of the Joint Chiefs from 1998 to 2001 and the 7th Chief of Army Staff from 1998 to 2007. Born in..."

Image licensed under CC BY-SA 2.0? by World Economic Forum

5th February 2019 🗓️ : Event - Pope Francis Pope Francis became the first pope to celebrate a papal Mass in the Arabian Peninsula. "Pope Francis (Latin: Franciscus; Italian: Francesco; Spanish: Francisco; born Jorge Mario Bergoglio; 17 December 1936) is the head of the Catholic Church, the bishop of Rome and sovereign of the Vatican City State. He is the only pope to be a member of the Society of Jesus (Jesuits), the only one..."

Image by

File:Portrait of Pope Francis (2021).jpg: Presidenza della Repubblica

derivative work: Samuele1607

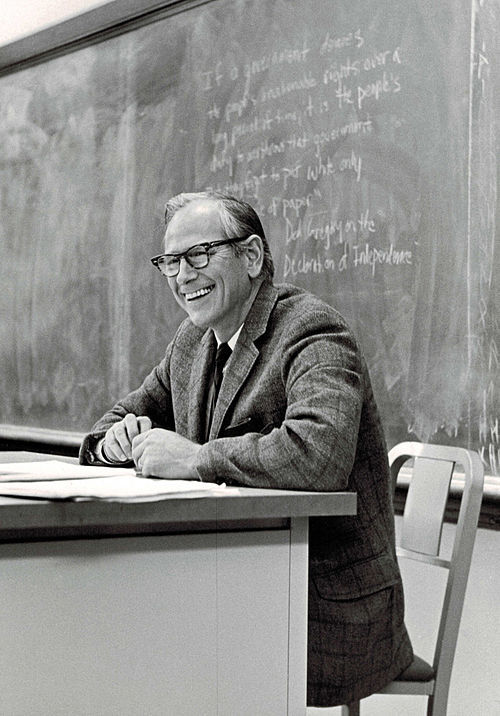

5th February 2014 🗓️ : Death - Robert Dahl Robert Dahl, American political scientist and academic (b. 1915) "Robert Alan Dahl (; December 17, 1915 – February 5, 2014) was an American political theorist and Sterling Professor of Political Science at Yale University. He established the pluralist theory of democracy—in which political outcomes are enacted through competitive, if unequal, interest groups—and..."

Image by Unknown authorUnknown author

5th February 1974 🗓️ : Birth - Michael Maguire (rugby league) Michael Maguire, Australian rugby league player and coach "Michael Maguire (born 5 February 1974) is an Australian professional rugby league football coach and former player who last coached New Zealand at international level. He played as a fullback, winger and centre in the 1990s. After a playing career spent mostly at the Canberra Raiders, with a brief..."

Image licensed under CC BY-SA 2.0? by https://www.flickr.com/photos/radar286/

5th February 1924 🗓️ : Event - Royal Observatory, Greenwich The Royal Greenwich Observatory begins broadcasting the hourly time signals known as the Greenwich Time Signal. "The Royal Observatory, Greenwich (ROG; known as the Old Royal Observatory from 1957 to 1998, when the working Royal Greenwich Observatory, RGO, temporarily moved south from Greenwich to Herstmonceux) is an observatory situated on a hill in Greenwich Park in south east London, overlooking the River..."

Image licensed under CC BY-SA 3.0?

5th February 1818 🗓️ : Event - Charles XIV John Charles XIV John (pictured) succeeded to the thrones of Sweden and Norway as the first monarch of the House of Bernadotte. "Charles XIV John (Swedish: Karl XIV Johan; 26 January 1763 – 8 March 1844) was King of Sweden and Norway from 1818 until his death in 1844 and the first monarch of the Bernadotte dynasty. In Norway, he is known as Charles III John (Norwegian: Karl III Johan) and before he became royalty in Sweden,..."

Image by

Emile Mascré

5th February 🗓️ : Holiday - Kashmir Solidarity Day (Pakistan) "Kashmir Solidarity Day (Urdu: یوم یکجہتی کشمیر) or Kashmir Day is a national holiday observed in Pakistan on 5 February annually. It is observed to show Pakistan's support and unity with the people of Indian-administered Jammu and Kashmir and Kashmiri separatists' efforts to secede from India, and..."

Image licensed under CC BY-SA 3.0? by Khalid Mahmood

0 notes

Text

Digital Activism

The word activism covers a wide area of causes, objectives, motives, and outcomes by the use of direct action. The action intended to bring the particular objective or positive reform could be social, economic, political, environmental, and other objectives that aim to bring a greater good in the society.

Cambridge Dictionary defines activism as ‘’the use of direct and noticeable action to achieve a result, usually a political or social one’’.

Now the rigorous action for such reform or for achieving the determined result is done through different mediums. It ranges from benign to more harsh actions depending upon the resistance and the nature of the objective. Different factors come to play as the society’s pre-established norms and preferences, religious norms, moral values, indoctrination, and culture, etc. It ranges from petitioning elected officials, writing letters to newspapers, running for the political campaign, walking in a mass march formation to more harsh forms as demonstrative protests and boycotts like street marches, strikes, or hunger strikes.

The aforementioned ways of activism had become quite traditional and have been replaced and transformed by digital activism. The political events and protests are done through a digital medium which helps to mobilize thousands of new supporters to a diverse range of causes. The modern approach of activism revolves around cyber and digital campaigning, boycotting, and awareness as due to the internet and technology, the world has become a global village. Not only does cyber-activism target a large audience but it provides detailed reasons and evidence for the need for intended reforms and change.

We see that every now and then there is a political campaign or awareness or voice for social reform is raised on different social media platforms like Twitter, Facebook, blogs website and Youtube, etc. For any sort of campaigning and activism, the reformers, politicians, and protestors resort to social media campaigning, e-mail, virtual sit-ins, and ‘’hacktivism’’ (disrupting Web sites).

The effectiveness and viability of digital activism can be gauged from the series of reformations and change in societies across the globe as such sort of activism is not restricted by area, time, and a number of people as it reaches everyone anywhere in the world.

We have numerous examples in this regard as to the effectiveness of digital activism in the form of different political movements such as French labor protests, anti-austerity movement Occupy, Arab Spring uprisings in the middle east, etc.

A harsh form of digital activism is called hacktivism through which the cyber-attacks are conducted regularly on the digital systems of rich and powerful and even terrorist organizations.

Not only that important and confidential political documents are leaked as the recent Panama papers and revelations by Wikileaks, and Edward Snowden and more recent one, pandora papers as examples of ‘’leaktivism’’.

Digital activism has proved more fruitful and viable in developing countries like Pakistan to which I belong. A majority of its population are illiterate which is fatal for democracy and electing the right persons but awareness through social media campaigns helped them to identify the right people for government and such digital awareness performed a great role in realizing and aware them of their inherent rights and then questioning government for its shortcomings.

Nauman

MA media and creative cultures

Greenwich University London

1 note

·

View note

Quote

Per aspera ad astra (phrase meaning) … Not to be confused with "Per ardua ad astra." … * * * "Ad astra per aspera" redirects here. For other uses, see Per aspera ad astra (disambiguation). Disclosure: This article may need additional citations for verification. Find sources: "Per aspera ad astra" – news · newspapers · books · scholar · JSTOR (June 2020) "Per aspera ad astra", from Finland in the Nineteenth Century, 1894 Per aspera ad astra (or, less commonly, ad astra per aspera) is a popular Latin phrase meaning "through hardships to the stars". The phrase is one of the many Latin sayings that use the expression ad astra, meaning "to the stars". Contents 1 Uses 1.1 Governmental entities 1.2 Military and government 1.3 Literature 1.4 Music 1.5 Anime 1.6 Educational and research institutions 1.6.1 Australia 1.6.2 Austria 1.6.3 Botswana 1.6.4 Ecuador 1.6.5 Estonia 1.6.6 Honduras 1.6.7 India 1.6.8 Jamaica 1.6.9 Japan 1.6.10 Macau 1.6.11 Maldives 1.6.12 New Zealand 1.6.13 Nigeria 1.6.14 Norway 1.6.15 Pakistan 1.6.16 Paraguay 1.6.17 Philippines 1.6.18 Romania 1.6.19 Russia 1.6.20 Saint Vincent and the Grenadines 1.6.21 Slovakia 1.6.22 Slovenia 1.6.23 South Africa 1.6.24 Sri Lanka 1.6.25 Sweden 1.6.26 Tajikistan 1.6.27 Ukraine 1.6.28 United Kingdom 1.6.29 United States 1.7 Fraternities and sororities 1.8 Popular culture 1.9 Others 2 See also 3 References 4 External link Uses[edit] Various organizations and groups use this expression and its variants. Governmental entities[edit] Duchy of Mecklenburg-Schwerin[1] State of Kansas (Ad astra per aspera)[2] Municipality of Cheribon, Netherlands East Indies[3] City of Gouda, The Netherlands[4] Honored Scientist of Armenia[5] Military and government[edit] Department of Civil Aviation, Thailand[6] Military Technical Academy in Bucharest, Romania[7] National Defence Academy of Latvia[8] South African Air Force[9] Spanish Air Force Hon. Julie Payette, 29th Governor General of Canada[10] Royal Life Guards (Denmark) Literature[edit] In Kenta Shinohara's Astra Lost in Space, it is inscribed on a plaque on the bridge of the ship that the crew subsequently decided to name the Astra.[11] In Kurt Vonnegut's The Sirens of Titan, it was quoted as both the motto of Martian Imperial Commandos, a unit within the larger Martian Army, in addition to being the motto of Kansas, U.S.A., Earth, Solar System, Milky Way. In Harper Lee's "To Kill a Mockingbird", it was quoted as the motto of Maycomb, during the school play. In James Joyce's "A Portrait of the Artist as a Young Man"[12] In Pierce Brown's "Red Rising" book series it is a common phrase used by the Golds of The Society. In M.L.Rio's "If We Were Villains" it is the motto of the Dellecher Academy. Music[edit] The subtitle of Moritz Moszkowski's set of fifteen Études de Virtuosité for piano, op. 72 (published 1903). The subtitle of Charles Villiers Stanford's Piano Trio No. 3, Op. 158 (1918). The title of the fourth album by ambient music duo Stars of the Lid (1998). The subtitle of Sergei Bortkiewicz's 3rd piano concerto (1927). The title of a song by Spiritual Beggars from their album Ad Astra (2000). The title of a song by Haggard (band) from their album "Eppur Si Muove" (2004). Acceptance has an instrumental track on their Phantoms album titled "Ad Astra Per Aspera" (2005). The title of the second album (2011) by Abandon Kansas. Per Aspera Ad Aspera, the name of a best-of album by the band ASP (2014). The title of a march by Ernst Urbach op. 4 (1906). The title of an album of marches by the Royal Norwegian Air Force Band. The title of a composition by Hasaan Ibn Ali from his second Atlantic recording, never released, the master tapes of which were destroyed in the Atlantic warehouse fire of 1978.[13] The subtitle of an instrumental song by the symphonic metal band Nightwish (2020). Anime[edit] Mentioned in anime Astra Lost in Space on the Ark Series Spaceship which is later named as ASTRA. Educational and research institutions[edit] Australia[edit] Queenwood School for Girls, Mosman NSW Woodville High School, Adelaide Albury High School, Albury, New South Wales[14] Girton Grammar School, Bendigo, Victoria Austria[edit] Universität Klagenfurt Botswana[edit] St. Joseph's College, Kgale Ecuador[edit] Instituto Nacional Mejía,Quito, Ecuador Estonia[edit] Keila-Joa Boarding School, Türisalu[15] Jakob Westholm Secondary School, Tallinn[16] Honduras[edit] Escuela Nacional de Música, Tegucigalpa Instituto Salesiano San Miguel, Tegucigalpa India[edit] Clarence High School, Bangalore, Karnataka, India - Motto of Redwood House (Ad Astra) St. Augustine's High School, kalimpong, District:Darjeeling, India Maulana Azad Medical College (MAMC), New Delhi, India The Frank Anthony Public School,Kolkata,India The Frank Anthony Public School, Delhi, India - Motto of Ranger House St Joseph's High School, Dharwad, Karnataka, India Antonio D'souza High School, Mumbai, India Technology Research and Incubation Centre, Dimapur, Nagaland Jamaica[edit] Immaculate Conception High School, St. Andrew Mount Alvernia High School, Montego Bay Japan[edit] St. Francis Church, Tokyo, West-Hachioji, Gnosis Essene (HP) Macau[edit] Postgraduate Association of University of Macau, Macau Maldives[edit] MNDF Fire and Rescue Services Training School, K.Viligili New Zealand[edit] Rotorua Boys' High School, Rotorua Nigeria[edit] Ilupeju College, Ilupeju, Lagos Lagos Secondary Commercial Academy, LASCA Kalabari National College, Buguma, Rivers State Oriwu Model College, Igbogbo, Ikorodu Norway[edit] Stavanger Cathedral School, Stavanger Sortland videregående skole, Nordland Lillehammer videregående skole Norwegian University of Science and Technology (NTNU) Pakistan[edit] St Patrick's High School, Karachi St. Patrick's College, Karachi Paraguay[edit] Universidad Autónoma de Asunción Philippines[edit] Far Eastern University - Nicanor Reyes Medical Foundation, Quezon City St. John Paul II College of Davao, Davao City Rosevale School, Cagayan de Oro City Juan R. Liwag Memorial High School, Gapan City Cagayan State University, Tuguegarao City Romania[edit] Mihai Eminescu High School,[17] Suceava Colegiul National "Andrei Saguna" Brasov[18] Colegiul National "Doamna Stanca" Fagaras[19] Alexandru Papiu Ilarian High School,[20] Targu-Mures Andrei Mureşanu High School,[21] Bistrița Márton Áron Főgimnázium [ro], Csíkszereda (Liceul Teoretic "Márton Áron", Miercurea-Ciuc) Ovidius High School,[22] Constanta Military Technical Academy,[23] Bucharest Russia[edit] School no. 1259, Moscow Saint Vincent and the Grenadines[edit] Saint Vincent Grammar School, Kingstown Slovakia[edit] Faculty of Informatics and Information Technologies of Slovak University of Technology in Bratislava Slovak Organisation for Space Activities Slovenia[edit] Prva gimnazija Maribor, Maribor Gimnazija Jesenice, Jesenice Gimnazija Škofja Loka, Škofja Loka South Africa[edit] Pietersburg Hoërskool[24] Tembisa Secondary School South African Air Force[25][circular reference] Ribane-Laka Secondary School Chistlehurst Academics and Arts School Sri Lanka[edit] St. Paul's Girls' School, Milagiriya, Colombo District, Western Province Sweden[edit] Västmanland Air Force Wing[26] Tajikistan[edit] Gymnasium #1 after V. Chkalov, Buston, Khujand, Sugd region Ukraine[edit] Space Museum dedicated to Korolyov in Zhytomyr Dnipropetrovsk Oblast Bucha Ukrainian gymnasium United Kingdom[edit] The Royal School, Haslemere, Surrey Colfe's School, Greenwich, London Mayfield Grammar School, Gravesend, Kent Dr. Challoner's Grammar School, Amersham, Buckinghamshire British Lawn Mower Racing Association United States[edit] California State University East Bay, Hayward, California[27] Campbell University, Buies Creek, North Carolina[28] Cornelia Strong College, University of North Carolina at Greensboro, North Carolina Coventry High School, Coventry, Rhode Island East Hampton High School, East Hampton, Connecticut Greenhill School, Dallas, Texas[29] Irvington Union Free School District, Irvington, New York Saint Joseph Academy, Brownsville, Texas Lake View High School, Chicago, Illinois Lyndon Institute, Lyndon Center, Vermont Macopin Middle School, West Milford, New Jersey Miami Central High School, Miami, Florida Midwood High School, Brooklyn, New York Mirman School, Los Angeles, California Morristown-Beard School, Morristown, New Jersey Mount Saint Michael Academy, Bronx, New York Satellite High School, Satellite Beach, Florida Seven Lakes High School, Katy, Texas Stevens Institute of Technology, Hoboken, New Jersey[30] Trinity Prep, Winter Park, Florida[31] Townsend Harris High School, Queens, New York University High School, Fresno, California University of Tennessee Space Institute, Tullahoma, Tennessee Oak Harbor Academy Private School, Lemoore, California Fraternities and sororities[edit] Beta Sigma Psi National Lutheran Fraternity[32] Sigma Gamma Phi – Arethusa Sorority[33] Korp! Amicitia – Estonian student sorority. Freemasons-Knight's Templar, 32nd Degree K.Ö.St.V. Almgau Salzburg - Austrian Catholic Student Association[34] K.a.V. Danubia Wien-Korneuburg im ÖCV - Austrian Catholic Student Association Popular culture[edit] Appears on the hull of the ship 'Searcher' in the second season of Buck Rogers. Garrison Keillor routinely references the phrase as the only Latin phrase he cared to remember on A Prairie Home Companion.[35][36] Per Aspera Ad Astra is a Soviet Russian science fiction film by Richard Viktorov, written by Kir Bulychov. Rip Torn says this phrase to David Bowie in the film The Man Who Fell to Earth. Tomo Milicevic of the band 30 Seconds to Mars has a tattoo on his right forearm reading 'per aspera et astra', with the band's logo in the background in red. Aspera! Per aspera! Per ardua! Ad astra! is the refrain of the song "Aspera" by Erin McKeown on the album We Will Become Like Birds. American singer, rapper, dancer, actress, and songwriter Kiely Williams has "Per aspera ad astra" tattooed on her right forearm. Title of a play depicting the history of the fictional Maycomb County in To Kill a Mockingbird, in which the translation is given as from the mud to the stars. Title of a song by Haggard, from the album Eppur Si Muove. The name of an album by Abandon Kansas. It is one of many hidden messages in the 2009 video game The Conduit. Motto of the Martian Imperial Commandos in Kurt Vonnegut novel, The Sirens of Titan. Title of a song by Seattle-based band Acceptance. Title of a song by Goasia, appearing on the album From Other Spaces (Suntrip Records, 2007) Appears on right side shoulder patch in Star Trek Enterprise, on the "newer" uniform style shown on the series finale. In Star Trek The Next Generation it is shown to be the motto of Starfleet. The official motto of Solforce in the videogame Sword of the Stars. The phrase is used as the name of the tenth track on the score for the film Underworld: Rise of the Lycans by Paul Haslinger. Title of a song by the band Spiritual Beggars from their album Ad Astra. Title of a song by the band Die Apokalyptischen Reiter from their album Samurai. The final mission (Chapter 15) in the Mafia II video game In a tattoo piece in The Raven The phrase has been spoofed slightly by the band Ghost in the song "Per Aspera Ad Inferi" from their album Infestissumam[37] literally meaning "Through hardships to hell".[38] Title of a background music from the Pokémon Omega Ruby and Alpha Sapphire video games which plays during a voyage into space. In the 2015 film The Martian, at the end of the film astronaut Mark Watney is giving his first lecture to the Astronaut Candidate Program and the phrase appears embedded in the central floor area of the lecture hall around a logo In Bioware's Mass Effect 3, this phrase is set in the middle of the wall of names dedicated to the fallen crew members of the main ship, the SSV Normandy SR2. Title of character leveling achievements in Mistwalker's mobile game Terra Battle Found in the Gravity Falls Journal #3, penned on the title page. Appears on the journal both in the show and on the real-life replica.[39] The title of a Pee Wee Gaskins album (2010). The title character in Ottessa Moshfegh's novel Eileen accepts and smokes a Pall Mall and refers to the motto on the package translated as "Through the thorns to the stars." On the ship the students find in Astra Lost in Space, there is a plaque with this saying on it. The motto of the Golds in Pierce Brown's Red Rising Series. Ad Astra is a 2019 American science fiction film by James Gray. Appears in the logo of the Universal Paperclips Advanced AI Research Group. Others[edit] As part of the official team crest of Arendal Football As part of the team crest of the former Collingwood Cricket Club. A plaque honoring the astronauts of Apollo 1 at the launch site where they perished. A tribute exhibit to the Apollo 1 Astronauts "Ad Astra Per Aspera - A Rough Road Leads to the Stars" opened on January 27, 2017, the 50th anniversary of the loss of the crew, at the Kennedy Space Center Visitor Complex. Inscribed on the crest of Pall Mall cigarettes packages[40] The theme of "POR CC XXI" by Kolese Kanisius Jakarta Part of a custom paint job in World Of Tanks Tradewinds Swiss[41] Space Development Network[42] Part three of the book Jepp who Defied the Stars by Katherine Marsh has the phrase as its title.[43] Appears in Morse code on the track titled "Sounds of Earth" on the Voyager Golden Record that has copies aboard the Voyager 1 & 2 spacecraft that are currently in interstellar space. [44] See also[edit] Per ardua ad astra ("Through adversity to the stars") Per ardua ad astra, additional uses with reference to above article Ad astra per aspera, additional uses Per aspera ad astra, references this article References[edit] ^ "Decorations of the Grand Duchy of Mecklenburg-Schwerin". Archived from the original on 2008-08-29. ^ "Seal of Kansas". Kansapedia. Kansas Historical Society. March 2014. Archived from the original on 2020-07-06. Retrieved 2020-07-06. ^ "Nederlandsch-Indische Gemeentewapens" (PDF). NV Mij Vorkink. September 1933. Retrieved 2019-07-23. ^ "Gouda in the official Dutch heraldic records". High Council of the Nobility (Hoge Raad van Adel), The Hague. Retrieved 2019-10-28. ^ "Honored Scientist of Armenia" (PDF). Retrieved Sep 24, 2020. ^ Department of Civil Aviation Emblems Archived April 27, 2009, at the Wayback Machine ^ "Academia Tehnica Militara". Mta.ro. Archived from the original on 2007-07-03. Retrieved 2013-12-21. ^ http://www.naa.mil.lv/en.aspx ^ "The South African Air Force Emblems". Saairforce.co.za. Retrieved 2013-12-21. ^ "OSGG/BSGG @RideauHall Twitter". twitter.com. Retrieved 2017-10-04. ^ Kenta Shinohara (w, a). Astra Lost in Space 2: 24/4 (2016-08-23), Viz Media ^ Joyce, James. A Portrait of the Artist as a Young Man. p. 222. ^ "Archived copy". Archived from the original on 2014-07-18. Retrieved 2014-07-18. ^ "Albury High School". Albury-h.schools.nsw.edu.au. Retrieved 2013-12-21. ^ "Keila-Joa Boarding School". Keila-joa.edu.ee. Archived from the original on 2013-12-24. Retrieved 2013-12-21. ^ "Jakob Westholm Secondary School". westholm.ee. Retrieved 2014-11-05. ^ "Colegiul Național Mihai Eminescu". cn-eminescu.ro. Retrieved 2014-02-23. ^ "Colegiul Naţional "Andrei Şaguna", Braşov". Saguna.ro. Retrieved 2013-12-21. ^ "Colegiul Naţional "Doamna Stanca", Braşov". Doamnastanca.ro. Retrieved 2013-12-21. ^ "Colegiul Naţional Alexandru Papiu Ilarian". Papiu.ro. Retrieved 2013-12-21. ^ "Colegiul Național Andrei Mureșanu". Cnam.ro. Retrieved 2013-12-21. ^ "Liceul Teoretic Ovidius". liceulovidius.ro. Retrieved 2014-07-01. ^ "Military Technical Academy Bucharest". www.mta.ro/. Retrieved 2017-11-08. ^ "Pietersburg Hoerskool". Pieties.co.za. Retrieved 2013-12-21. ^ South African Air Force ^ Braunstein, Christian (2005). Svenska flygvapnets förband och skolor under 1900-talet (PDF). Skrift / Statens försvarshistoriska museer, 1101-7023 ; 8 [dvs 9] (in Swedish). Stockholm: Statens försvarshistoriska museer. p. 44. ISBN 9197158488. SELIBR 9845891. ^ "California State University East Bay". Csueastbay.edu. Retrieved 2013-12-21. ^ Campbell University: General Information Archived July 26, 2008, at the Wayback Machine ^ Greenhill School: Statement of Philosophy Archived 2009-01-06 at Archive.today ^ "Stevens Institute of Technology: About Stevens". Stevens.edu. Archived from the original on 2013-10-12. Retrieved 2013-12-21. ^ "Trinity Prep School: myTPS Portal". Trinityprep.org. Archived from the original on 2012-06-07. Retrieved 2013-12-21. ^ "Beta Sigma Psi 2006 National Convention, see page header". Convention.betasigmapsi.org. 2009-12-27. Retrieved 2013-12-21. ^ "Sigma Gamma Phi at SUNY Oneonta". Oneonta.edu. Retrieved 2013-12-21. ^ Almgau, 2014 (7 May 2011). "Startseite - ALMGAU". K.ö.St.V. Almgau Salzburg im MKV. ^ "transcript from the September 17, 2011 episode of A Prairie Home Companion". ^ Rev. Andy Ferguson. "Church Street United Methodist Church: February 20, 2001". churchstreetumc.blogspot.com. ^ "Ghost B.C. Store". Myplaydirect.com. Retrieved 2013-12-21. ^ "A Nameless Ghoul From Ghost B.C. Speaks About 'Infestissumam', the Devil + More". Loudwire. Retrieved 2013-08-04. ^ Noble, Barnes &. "Gravity Falls: Journal 3|Hardcover". Barnes & Noble. Retrieved 2020-02-25. ^ "Pall Mall". History of Cigarette Brands. Archived from the original on 2011-08-17. Retrieved 2013-12-21. ^ "Test Tradewinds Swiss". ^ "(CA) Who owns the phone number? - Identify the Owner of a Phone Number 123". ownerphonenumber.online. Retrieved Sep 24, 2020. ^ Jepp who Defied the Stars, p. 225, at Google Books ^ "Voyager - Sounds on the Golden Record". voyager.jpl.nasa.gov. Retrieved Sep 24, 2020.

Click here to read more ==> https://en.wikipedia.org/wiki/Per_aspera_ad_astra

1 note

·

View note

Text

Events 5.13

1373 – Julian of Norwich has visions which are later transcribed in her Revelations of Divine Love. 1515 – Mary Tudor, Queen of France, and Charles Brandon, 1st Duke of Suffolk, are officially married at Greenwich. 1568 – Battle of Langside: The forces of Mary, Queen of Scots, are defeated by a confederacy of Scottish Protestants under James Stewart, Earl of Moray, her half-brother. 1619 – Dutch statesman Johan van Oldenbarnevelt is executed in The Hague after being convicted of treason. 1779 – War of the Bavarian Succession: Russian and French mediators at the Congress of Teschen negotiate an end to the war. In the agreement Austria receives the part of its territory that was taken from it (the Innviertel). 1780 – The Cumberland Compact is signed by leaders of the settlers in early Tennessee. 1787 – Captain Arthur Phillip leaves Portsmouth, England, with eleven ships full of convicts (the "First Fleet") to establish a penal colony in Australia. 1804 – Forces sent by Yusuf Karamanli of Tripoli to retake Derna from the Americans attack the city. 1830 – Ecuador gains its independence from Gran Colombia. 1846 – Mexican–American War: The United States declares war on Mexico. 1861 – American Civil War: Queen Victoria of the United Kingdom issues a "proclamation of neutrality" which recognizes the Confederacy as having belligerent rights. 1861 – The Great Comet of 1861 is discovered by John Tebbutt of Windsor, New South Wales, Australia. 1861 – Pakistan's (then a part of British India) first railway line opens, from Karachi to Kotri. 1862 – The USS Planter, a steamer and gunship, steals through Confederate lines and is passed to the Union, by a southern slave, Robert Smalls, who later was officially appointed as captain, becoming the first black man to command a United States ship. 1864 – American Civil War: Battle of Resaca: The battle begins with Union General Sherman fighting toward Atlanta. 1865 – American Civil War: Battle of Palmito Ranch: In far south Texas, the last land battle of the Civil War ends with a Confederate victory. 1880 – In Menlo Park, New Jersey, Thomas Edison performs the first test of his electric railway. 1888 – With the passage of the Lei Áurea ("Golden Law"), Empire of Brazil abolishes slavery. 1909 – The first Giro d'Italia starts from Milan. Italian cyclist Luigi Ganna will be the winner. 1912 – The Royal Flying Corps, the forerunner of the Royal Air Force, is established in the United Kingdom. 1917 – Three children report the first apparition of Our Lady of Fátima in Fátima, Portugal. 1939 – The first commercial FM radio station in the United States is launched in Bloomfield, Connecticut. The station later becomes WDRC-FM. 1940 – World War II: Germany's conquest of France begins as the German army crosses the Meuse. Winston Churchill makes his "blood, toil, tears, and sweat" speech to the House of Commons. 1940 – Queen Wilhelmina of the Netherlands flees her country to Great Britain after the German invasion. Princess Juliana takes her children to Canada for their safety. 1941 – World War II: Yugoslav royal colonel Dragoljub Mihailović starts fighting against German occupation troops, beginning the Serbian resistance. 1943 – World War II: Operations Vulcan and Strike force the surrender of the last Axis troops in Tunisia. 1948 – Arab–Israeli War: The Kfar Etzion massacre is committed by Arab irregulars, the day before the declaration of independence of the state of Israel on May 14. 1950 – The first round of the Formula One World Championship is held at Silverstone. 1951 – The 400th anniversary of the founding of the National University of San Marcos is commemorated by the opening of the first large-capacity stadium in Peru. 1952 – The Rajya Sabha, the upper house of the Parliament of India, holds its first sitting. 1954 – The anti-National Service Riots, by Chinese middle school students in Singapore, take place. 1954 – The original Broadway production of The Pajama Game opens and runs for another 1,063 performances. Later received three Tony Awards for Best Musical, Best Performance by a Featured Actress in a Musical, and Best Choreography. 1958 – During a visit to Caracas, Venezuela, Vice President Richard Nixon's car is attacked by anti-American demonstrators. 1958 – May 1958 crisis: A group of French military officers lead a coup in Algiers demanding that a government of national unity be formed with Charles de Gaulle at its head in order to defend French control of Algeria. 1958 – Ben Carlin becomes the first (and only) person to circumnavigate the world by amphibious vehicle, having travelled over 17,000 kilometres (11,000 mi) by sea and 62,000 kilometres (39,000 mi) by land during a ten-year journey. 1960 – Hundreds of University of California, Berkeley students congregate for the first day of protest against a visit by the House Committee on Un-American Activities. 1967 – Dr. Zakir Husain becomes the third President of India. He is the first Muslim President of the Indian Union. He holds this position until August 24, 1969. 1969 – May 13 Incident involving sectarian violence in Kuala Lumpur, Malaysia. 1971 – Over 900 unarmed Bengali Hindus are murdered in the Demra massacre. 1972 – Faulty electrical wiring ignites a fire underneath the Playtown Cabaret in Osaka, Japan. Blocked exits and non-functional elevators lead to 118 fatalities, with many victims leaping to their deaths. 1972 – The Troubles: A car bombing outside a crowded pub in Belfast sparks a two-day gun battle involving the Provisional IRA, Ulster Volunteer Force and British Army. Seven people are killed and over 66 injured. 1980 – An F3 tornado hits Kalamazoo County, Michigan. President Jimmy Carter declares it a federal disaster area. 1981 – Mehmet Ali Ağca attempts to assassinate Pope John Paul II in St. Peter's Square in Rome. The Pope is rushed to the Agostino Gemelli University Polyclinic to undergo emergency surgery and survives. 1985 – Police bombed MOVE headquarters in Philadelphia to end a stand-off, killing six adults and five children, and destroying the homes of 250 city residents. 1989 – Large groups of students occupy Tiananmen Square and begin a hunger strike. 1990 – The Dinamo–Red Star riot took place at Maksimir Stadium in Zagreb, Croatia between the Bad Blue Boys (fans of Dinamo Zagreb) and the Delije (fans of Red Star Belgrade). 1992 – Li Hongzhi gives the first public lecture on Falun Gong in Changchun, People's Republic of China. 1995 – Alison Hargreaves, a 33-year-old British mother, becomes the first woman to conquer Everest without oxygen or the help of sherpas. 1996 – Severe thunderstorms and a tornado in Bangladesh kill 600 people. 1998 – Race riots break out in Jakarta, Indonesia, where shops owned by Indonesians of Chinese descent are looted and women raped. 1998 – India carries out two nuclear tests at Pokhran, following the three conducted on May 11. The United States and Japan impose economic sanctions on India. 2005 – Andijan uprising, Uzbekistan; Troops open fire on crowds of protestors after a prison break; at least 187 people were killed according to official estimates. 2006 – São Paulo violence: Rebellions occur in several prisons in Brazil. 2011 – Two bombs explode in the Charsadda District of Pakistan killing 98 people and wounding 140 others. 2012 – Forty-nine dismembered bodies are discovered by Mexican authorities on Mexican Federal Highway 40. 2013 – Kermit Gosnell, a U.S. abortion physician, is found guilty in Pennsylvania of three counts of murder of newborn infants, one count of involuntary manslaughter, and various other charges. In total, more than 100 babies were killed at Gosnell's abortion clinic. 2014 – An explosion at an underground coal mine in southwest Turkey kills 301 miners. 2018 – Nine people die after the suicide bombing of three Indonesian churches in Surabaya, Indonesia.

3 notes

·

View notes

Photo

University of Greenwich is ranked 601 in World University Rankings and it is famous for its naval and military connections. Study at Greenwich university without IELTS.

It offers Scholarships is worth up to £ 500 – £ 3,000.

Greenwich is a reasonably safe area to live for international students

Apply now to get admission in #UK #University

and get #UK study visa without any difficulty.

Official Representative in Pakistan

👉 #PFL Education Pvt Ltd Where Honesty Matters

🟩 📞 Call and WhatsApp

👉 📞 Karachi +92 333-1900442 , ☎️ +92 21 34532974,75

👉 📞 Islamabad +92 333-1900448 , ☎️ +92 51 280-3384,85

👉 ✔️ https://preparationforlife.com/apply/applynow.php

💢 ♦ 💢 ♦ 💢 ♦ 💢 ♦ 💢 ♦ 💢 ♦ 💢 ♦ 💢 ♦ 💢

📅 Email: [email protected]

🌎 https://www.preparationforlife.com

🌎 https://www.pfleducationpvt.blogspot.com/

🟩 Facebook: pfleducation

🟩 Twitter: @pfleducationpvt

🟩 Instagram: @pfleducationpvt

🟩 Linkedin: pfleducationpvt

🟩 Pinterest: @pfleducationpvt

🟩 Tumblr : pfleducationpvt

🟩 Youtube: channel/UC_8sIGUNhFRwv4UKLCMi6uQ

💢 ♦ 💢 ♦ 💢 ♦ 💢 ♦ 💢 ♦ 💢 ♦ 💢 ♦ 💢 ♦ 💢

#StudyAbroadWithPFL #PFL #EducationAbroad #Education #PFLEducation #StudyAbroad

#UK #USA #Australia #Canada #StudyVisa #StudentVisa #Scholarship #VISA

#counsellingservices #Student #studyinuk #StudyinAustralia #studyinusa #Islamabad

#karachi #Lahore #studyinchina #STUDYIN #studentrecurment #HowtoStudyinAustralia

#StudyAbroad #WorldUninversities #Besteducation #besteducationalconsultants

#consultants #consultantsinpakistan #educationconsultants #studyinuk #studyvisa

#follow #followback #like #f #followme #love #followforfollow #likes #instagood

#followers #photooftheday #l #followforfollowback #likeforlikes #instalike #likeforlike

#me #instagram #likeforfollow #picoftheday #instadaily #photography #smile #bhfyp

0 notes

Text

0800 Utc Time

0800 Utc To Japan Time

8 Utc Means

0800 Utc Time Zone

8 Pm Utc

0800 Utc Time

Time Difference

Nowadays, Greenwich Mean Time, abbreviated as GMT, is a time zone designation rather than a time standard. Time difference between time zones can be expressed by the GMT or UTC offset. In the UTC standard, there is a commitment to keep within 0.9 seconds of GMT, so that every few years a leap second is applied to UTC. UTC stands for Universal Time. CST is known as Central Standard Time. CST is 5 hours behind UTC. So, when it is it will be. Other conversions: UTC to Phoenix Time, UTC to Kuala Lumpur Time, UTC to Perth Time, UTC to Helsinki Time. Getting Started. 1 Add locations (or remove, set home, order) 2 Mouse over hours to convert time at a glance 3.

Universal Time Coordinated is 8 hours behind of Singapore Time 10:00 am10:00 in UTC is 6:00 pm18:00 in SGT

UTC to SGT call time Best time for a conference call or a meeting is between 8am-10am in UTC which corresponds to 4pm-6pm in SGT

10:00 am10:00 Universal Time Coordinated (UTC). Offset UTC 0:00 hours 6:00 pm18:00 Singapore Time (SGT). Offset UTC +8:00 hours

10:00 am10:00 UTC / 6:00 pm18:00 SGT

UTCSGT12am (midnight)8am1am9am2am10am3am11am4am12pm (noon)5am1pm6am2pm7am3pm8am4pm9am5pm10am6pm11am7pm12pm (noon)8pm1pm9pm2pm10pm3pm11pm4pm12am (midnight)5pm1am6pm2am7pm3am8pm4am9pm5am10pm6am11pm7am0:008:001:009:002:0010:003:0011:004:0012:005:0013:006:0014:007:0015:008:0016:009:0017:0010:0018:0011:0019:0012:0020:0013:0021:0014:0022:0015:0023:0016:000:0017:001:0018:002:0019:003:0020:004:0021:005:0022:006:0023:007:00

Universal Time Coordinated

Offset: UTC is 0 hours ahead Greenwich Mean Time (GMT) and is used in Universal

Coordinated Universal Time (UTC) is the world time standard that regulates clocks and time. It is successor to Greenwich Mean Time (GMT). For casual use, UTC is the same as GMT, but is used by the scientific community. UTC is the time standard commonly used across the world since 1972. It is used in many technical fields, like aviation industry and meteorologists, also used to synchronize time across internet networks.

UTC representations, usage and related time zones

W3C/ISO-8601: International standard covering representation and exchange of dates and time-related data

Z - is the zone designator for the zero UTC/GMT offset, also known as 'Zulu' time

+00 - basic short

+0000 - basic

+00:00 - extended

Email/RFC-2822: Internet Message Format Date Standard, typically used for timestamps in email headers

+0000 - sign character (+) followed by a four digit time providing hours (00) and minutes (00) of the offset. Indicates zero hour and zero minutes time differences of the zero meridian.

Military/NATO: Used by the U.S. military, Chinese military and others

Zulu - Military abbreviation for UTC

Z - short form of 'Zulu'

IANA/Olson: Reflects UTC time zone boundaries defined by political bodies, primarily intended for use with computer programs and operating systems

Etc/UCT

Etc/UTC

Etc/Universal

Etc/Zulu

UCT

UTC

Universal

Zulu

Time zones with the GMT +0 offset:

EGST - Eastern Greenland Summer Time

GMT - Greenwich Mean Time

WET - Western European Time

AZOST - Azores Summer Time

UTC - Universal Time Coordinated

WT - Western Sahara Standard Time

Z - Zulu Time Zone

GMT - GMT

+00 -

US, Canada, Mexico Time Zones

Atlantic Daylight Time (ADT) • Eastern Daylight Time (EDT) • Central Daylight Time (CDT) • Mountain Daylight Time (MDT) • Pacific Daylight Time (PDT) • Alaska Daylight Time (AKDT) • Hawaii Time • Arizona • Saskatoon • New York • Toronto • Mexico City • San Francisco • Chicago • Houston • Miami • Phoenix • Halifax • Denver • Monterrey • Chihuahua

Europe Time Zones

Greenwich Mean Time (GMT) • British Summer Time (BST) • Western European Summer Time (WEST) • Central European Summer Time (CEST) • Eastern European Summer Time (EEST) • London • Paris • Berlin • Athens • Warsaw • Kiev • Belarus • Moscow • Madrid • Stockholm • Amsterdam • Istanbul

Australia, New Zealand Time Zones

AEST • ACST • AWST •New Zealand Time (NZT) • Queensland • Adelaide • Brisbane • Canberra • Melbourne • Perth • Sydney • Auckland • Fiji • Solomon Islands • Papua New Guinea

0800 Utc To Japan Time

Asia Time Zones

India • Pakistan • China • UAE • Japan • Korea • Philippines • Thailand • Hong Kong • Taiwan • Malaysia • Singapore • Jakarta • Bangladesh • Sri Lanka • Nepal • Kuwait • Saudi Arabia • Viet Nam • Oman • Israel • Jordan • Beijing • Bangalore • Kuala Lumpur • Manila • Tokyo • Seoul • Karachi • Dubai

8 Utc Means

Africa Time Zones

West Africa Time (WAT) • Central Africa Time (CAT) • East Africa Time (EAT) • Egypt • Nigeria • Kenya • Ghana • Morocco • Tanzania • Ethiopia • Uganda • South Africa • Cairo • Algiers • Casablanca • Accra • Lagos • Cape Town • Nairobi

0800 Utc Time Zone

South America Time Zones

Brazil • Argentina • Chile • Peru • Ecuador • Colombia • Venezuela • Panama • Puerto Rico • São Paulo • Manaus • Rio de Janeiro • Buenos Aires • Santiago • Lima • Quito • Bogota • Caracas

8 Pm Utc

Russia Time Zones

0800 Utc Time

Moscow • Novosibirsk • Yekaterinburg • Omsk • St Petersburg • Kazan • Irkutsk • Chita • Vladivostok • Sochi • Almaty • Kyrgyzstan • Uzbekistan • Tajikistan

0 notes

Text

How to Secure British Council GREAT Scholarships 2021

The GREAT scholarships envision to attract some of the greatest student minds from all around the world to the UK student community. On a more nuanced note, it offers funding for international students to pursue a degree at the postgraduate level at specified UK universities. Expected to cover the tuition fee for a typical Master’s program in the UK, the scholarship amounts to at least £10,000 per successful applicant.

The council encourages students with demonstrable experience and illustrious academic or work experience to utilise this opportunity.GREAT scholarships are available to applicants from these countries: Bangladesh, China, Egypt, Ghana, India, Indonesia, Kenya, Malaysia, Mexico, Nepal, Pakistan, Sri Lanka, Thailand. Once you graduate, the awarding body expects you to act as a UK higher education ambassador and promote values that align with the same. To discuss your student experience and academic pursuits in the UK, the council might also invite you to attend networking events with GREAT scholars.

Which Are the Participating UK Universities?

Around 40 universities participate in this scholarship program. However, each university might accept applications from citizens of specific nations only. For example, according to sources, Ulster University accepts GREAT scholarship applications from India and Indonesia while the University of York accepts applicants from Bangladesh, China, Indonesia, Nepal and Sri Lanka.

UK universities that take part in this program include Anglia Ruskin University, Bangor University, University of Bath, Birmingham City University, Bishop Grosseteste University, Bournemouth University, University of Bristol, University of Cambridge, Cranfield University, University of Derby, University of Dundee, University of East Anglia, University of Edinburgh, Edinburgh Napier University, University of Essex, University of Exeter, University of Glasgow, Goldsmiths, University of London, University of Greenwich, University of Hull, Imperial College London, Keele University, University of Kent, University of Manchester, Newcastle University, University of Northampton, University of Nottingham, Nottingham Trent University, Oxford Brookes University, University of Reading, Robert Gordon University, Royal Academy of Music, Royal Agricultural University, Sheffield Hallam University, University of South Wales, University of Stirling, Teesside University, Trinity Laban Conservatoire of Music and Dance, Ulster University, University College London, University of Warwick and University of York.

Are You Eligible for This Scholarship?

Essentially, you need to satisfy four main eligibility criteria to apply for this program. To begin with, you must possess citizenship in one of the eligible countries listed earlier. The applicant should have a proper undergraduate degree that enables them to pursue a Master’s (taught) programme in a UK university. The council expects academically motivated candidates and those with active work experience or demonstrable passion for the subject area that they choose. Finally, you should meet the English language requirements as specified by the university.

What About the Application Process?

As the initial step, you should apply for a postgraduate program at a UK university that accepts GREAT scholarship applications from students of your nationality. This process seems a bit overwhelming to some students, in which case you can approach authorised representatives of the university who will assist you with the process. Once you get the offer letter from the university, you can proceed with the scholarship application. Further procedures may vary depending on the institution. Generally speaking, they might ask for your academic accomplishments, a personal statement as well as details of your extracurricular endeavours.

0 notes

Text

“When I was 7 years old, my mother’s sister (who I consider my own sister really) was only 9 years older than me. She was the only full-on punk in Karachi in 1984, possibly in all of Pakistan. And no holds barred at that,” relates Sascha Aurora Akhtar of the deep-rooted connection she has always felt to punk. “I loved it. All of it. The green hair. Her ‘fuck you,’ attitude (which I can tell you nobody else loved at the time), the music, I loved the badges. She had gone to London and brought back a badge-maker. That was huge for me. As a result I was nicely educated (at 7, in Pakistan) about anarchy symbols & other important punk insignias”.

Sascha’s poetry has always been punk. Her first book The Grimoire Of Grimalkin was called, “..a work of contemporary Gothic, with a punk core and an anarchic sense of humour”. It was also it must be noted called, “a contemporary masterpiece,” by the man who is the Department Chair at New York University of the Department of French Literature, Thought & Culture. “I never thought ‘Oh. I’m going to be a poet’. No. I just always wrote to ward off the demons. It is not easy being me, staying balanced, well even. It never has been. I have extreme sensory issues, sensitivity to sound, light, change, energy as a result even the chemical functions in my body create severe responses, so not PMS but severe PMS (for which I am an advocate for change in our perception of this). So not just slightly irritable, right? But totally depressed for more than 10 days, and sadly, suicidal. It’s taken A LOT of work to manage these things. BUT my own PUNK core has ALWAYS helped me; as a channel of expression, as a call to be strong & brave & stand up for what you believe in, as a (to me) genderless mode for a woman to empower herself, as musical inspiration – Punk is everything”:

Watching Venus mar the sun

as you locked on

to me, target

I am going

two ways

& poetry is the fuselage

they will find

my twisted body

conjoined with

Extract from Sascha’s second collection 199 Japanese Names For Japanese Trees

“Music is my strongest influence. There are many poems that begin with a quote from a song. The high-art punk of Nick Blinko via his band Rudimentary Peni is my ‘soul,’ music. “There’s someone who has constantly struggled with mental health issues and used his art to heal in many ways. Yes, I’ve said it, Punk can be healing!”

Sascha’s latest book’s title is #LoveLikeBlood and “Yes. The very first poem is called ‘#LoveLikeBlood,’ with an epigraph: There’s A Nod To Killing Joke In Here. “Aren’t Killing Joke like, totally Punk Noir, tho’? Amirite?”

Sascha’s performances are raw & highly-charged. “I’ll tell you what. I WAS in a punk-death-metal band in college in the 90’s. And yep. I was the vocalist…and yep…there WAS a lot of SCREAMING, GROWLING & SNARLING. Fun times!”

Sascha’s new book #LoveLikeBlood is available from Knives, Forks & Spoons Press a stalwart on the Indie scene. The poems in the book feature titles such as FREAK BREACH ( “This is my ultimate punk poem”), Ejaculate As A Noun, Anatomy of A Car-Crash and Girl Child Of The 80’s.

She has been gigging all over the U.K. since the onset of September.

Sascha A. Akhtar is the author of five published poetry collections with Salt, Shearsman, ZimZalla, Emma Press and Knives, Forks and Spoons Press. She has another full collection forthcoming in 2019 imminently with Contraband UK. In 2020, her book of translations of feminist fiction writer from the Subcontinent Hijab Imtiaz is forthcoming on Oxford University Press India. She has been widely anthologised & translated and is an #ACE funded writer having received her award in October 2018. Her fiction has appeared in Tears In The Fence, Storgy, BlazeVox, Anti-Heroin Chic and The Learned Pig. She attended Bennington College, Vermont for her undergraduate degree and attended UMASS-Amherst M.F.A Creative Writing on a full fellowship. She is teaching in the English department of the University of Greenwich and is a Poetry School Tutor with a specialisation in magical texts and poetry as a magical art.

In September 2019, her poem Poems For Eliot, was named as the the number one poem of the last five years by Poetry Wales.

Bringing The Punk (Via Pakistan & the U.S.A) Back To London Through Poetry – Sascha A. Akhtar “When I was 7 years old, my mother’s sister (who I consider my own sister really) was only 9 years older than me.

0 notes

Text

1. Finance and Insurance as Powerful Forces in Our Economy and Society

New Post has been published on https://hititem.kr/1-finance-and-insurance-as-powerful-forces-in-our-economy-and-society/

1. Finance and Insurance as Powerful Forces in Our Economy and Society