#Outsource Accounting Services for USA

Explore tagged Tumblr posts

Text

How to Make Sure You're Withholding and Reporting Your Taxes Correctly

Taxes are an inevitable part of life for most individuals and businesses. Whether you're a salaried employee, a freelancer, or a business owner, understanding how to withhold and report your taxes correctly is crucial to avoid potential legal troubles and financial headaches down the road. In this article, we will explore the key steps and considerations to ensure that you're handling your taxes in a responsible and compliant manner.

Know Your Tax Obligations

The first and most critical step in ensuring you're withholding and Outsource Management Reporting your taxes correctly is to understand your tax obligations. These obligations vary depending on your employment status and the type of income you earn. Here are some common categories of taxpayers:

1. Salaried Employees

If you're a salaried employee, your employer typically withholds income taxes from your paycheck based on your Form W-4, which you fill out when you start your job. It's essential to review and update your W-4 regularly to ensure that your withholding accurately reflects your current financial situation. Major life events like marriage, having children, or significant changes in your income should prompt you to revisit your W-4.

2. Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals often have more complex tax obligations. You are responsible for estimating and paying your taxes quarterly using Form 1040-ES. Keep detailed records of your income and expenses, including receipts and invoices, to accurately report your earnings and deductions.

3. Small Business Owners

If you own a small business, your sales tax responsibilities extend beyond your personal income. You must separate your business and personal finances, keep meticulous records of all business transactions, and file the appropriate business tax returns. The structure of your business entity (e.g., sole proprietorship, partnership, corporation) will determine the specific tax forms you need to file.

4. Investors and Property Owners

Investors and property owners may have to report income from dividends, interest, capital gains, or rental properties. These income sources have their specific tax reporting requirements, and it's essential to understand and comply with them.

Keep Accurate Records

Regardless of your tax situation, maintaining accurate financial records is essential. Detailed records make it easier to report your income and deductions correctly, substantiate any claims you make on your tax return, and provide documentation in case of an audit. Here are some record-keeping tips:

Organize Your Documents: Create a system to store your financial documents, including receipts, invoices, bank statements, and tax forms. Consider using digital tools for easier record keeping.

Track Income and Expenses: Keep a ledger or use accounting software to record all income and expenses related to your financial activities. Categorize expenses correctly to maximize deductions and credits.

Retain Documents for Several Years: The IRS typically has a statute of limitations for auditing tax returns, which is generally three years. However, in some cases, it can extend to six years or indefinitely if fraud is suspected. To be safe, keep your tax records for at least seven years.

Understand Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits provide a dollar-for-dollar reduction of your tax bill. Familiarize yourself with common deductions and credits that may apply to your situation:

Standard Deduction vs. Itemized Deductions: Depending on your filing status and financial situation, you can choose between taking the standard deduction or itemizing your deductions. Itemizing requires more documentation but can result in greater tax savings.

Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. These credits can provide substantial savings, especially for low- to moderate-income individuals and families.

Business Expenses: If you're self-employed or a small business owner, be aware of deductible business expenses, including office supplies, travel expenses, and home office deductions.

Seek Professional Assistance

Tax laws are complex and subject to change. Seeking professional assistance from a certified tax professional or CPA (Certified Public Accountant) can be a wise investment. Tax professionals can help you:

Maximize Deductions: They are well-versed in the intricacies of tax law and can identify deductions and credits you might overlook.

Ensure Compliance: Tax professionals can ensure that you are complying with current tax laws and regulations, reducing the risk of costly errors or audits.

Provide Tax Planning: They can help you create a tax-efficient strategy to minimize your tax liability in the long term.

Represent You in Audits: If you face an audit, a tax professional can represent you and help navigate the process.

File Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and interest charges. The tax filing deadline for most individuals is April 15th. However, if you need more time, you can file for an extension, which typically gives you until October 15th to submit your return. Keep in mind that an extension to file is not an extension to pay any taxes owed, so pay as much as you can by the original deadline to minimize interest and penalties.

Consider Electronic Filing

Electronic filing (e-filing) is a secure and convenient way to submit your tax return to the IRS. It reduces the risk of errors and ensures faster processing and quicker refunds, if applicable. Many tax software programs offer e-filing options, making it easy for individuals and businesses to submit their returns electronically.

Stay Informed and Adapt

Tax laws can change from year to year, so staying informed is essential. Follow updates from the IRS and consult outsourcing sales tax services professionals or resources to understand how changes in tax laws may affect you. Be proactive in adapting your tax strategies to maximize savings and remain compliant with current regulations.

In conclusion, withholding and reporting your taxes correctly is a responsibility that should not be taken lightly. Understanding your tax obligations, keeping accurate records, leveraging deductions and credits, seeking professional assistance when needed, and filing on time are essential steps to ensure a smooth and compliant tax-filing experience. By following these guidelines, you can navigate the complexities of the outsourcing sales tax services system with confidence and peace of mind. Remember that taxes are a fundamental part of our society, and paying them correctly ensures that essential public services and infrastructure are funded for the benefit of all.

2 notes

·

View notes

Text

#Outsourced Accounting Services#Accounting Firms#Centelli#Atlanta#USA#Finance Accounting#Trusted Firm

0 notes

Text

0 notes

Text

Trusted Financial Management Outsourcing for Cost-Effective Business Success in the USA

Qualitas Accounting Inc has established itself as a trusted partner for businesses seeking exceptional accounting and financial solutions. With a team of seasoned professionals, the firm delivers a wide array of services tailored to meet the specific needs of clients across industries. From start-ups to established enterprises, Qualitas Accounting supports businesses on their financial journeys with precision, reliability, and innovation.

Their expertise lies in simplifying complex financial processes, ensuring compliance, and providing actionable insights to drive business growth. Whether it's optimizing daily bookkeeping tasks or offering strategic financial advice, their solutions are grounded in a deep understanding of modern business challenges. This commitment to quality and efficiency has made them a standout choice for businesses looking for personalized and dependable accounting services.

Professional Virtual CFO and Outsourced Bookkeeping Services for Scaling Small Businesses

Among their key offerings, Qualitas Accounting is recognized as one of the premier accounting firms Columbia MO, providing reliable services to support local businesses. For companies seeking efficient financial management, they serve as a leading bookkeeping outsourcing company USA, streamlining operations so organizations can focus on growth.

Expanding their reach across the nation, Qualitas Accounting excels in finance and accounting outsourcing USA, helping businesses achieve cost-effectiveness and improved productivity by leveraging their expertise. Additionally, they specialize in virtual CFO services USA, offering high-level strategic guidance and oversight for entrepreneurs who want to scale effectively while maintaining financial discipline.

Choosing Qualitas Accounting Inc means partnering with a firm dedicated to making your financial processes seamless and your goals achievable. With their comprehensive range of services and client-centric approach, Qualitas Accounting remains a trusted ally for businesses striving for financial success. Experience the difference with Qualitas Accounting Inc—reach out today to explore how their tailored solutions can elevate your business to new heights!

#accounting firms Columbia MO#bookkeeping outsourcing company USA#finance and accounting outsourcing USA#virtual CFO services USA

0 notes

Text

Optimize Your Business with Finance & Accounting Outsourcing Services (FAO) USA

Transform your financial operations with our expert finance and accounting outsourcing services USA. Our comprehensive FAO solutions are designed to enhance efficiency, reduce costs, and ensure accuracy in your financial processes. From bookkeeping and financial reporting to payroll management and tax compliance, we handle all aspects of finance and accounting.

Partner with us to streamline your financial workflows, improve cash flow management, and focus on your core business activities. Experience the benefits of professional finance and accounting outsourcing services today!

#FAO#Finance & Accounting#Finance & Accounting Outsourcing Services#USA#Business#business to business

0 notes

Text

Outsource your payroll management to experts. Our payroll outsourcing service offers reliable solutions tailored to your business needs.

0 notes

Text

Benefits of Accounting in Healthcare Industry

Accounting plays a vital role in the healthcare industry by ensuring accurate financial management, compliance with regulations, and efficient resource allocation. Proper accounting helps healthcare providers maintain profitability, optimize operations and deliver quality results!

0 notes

Text

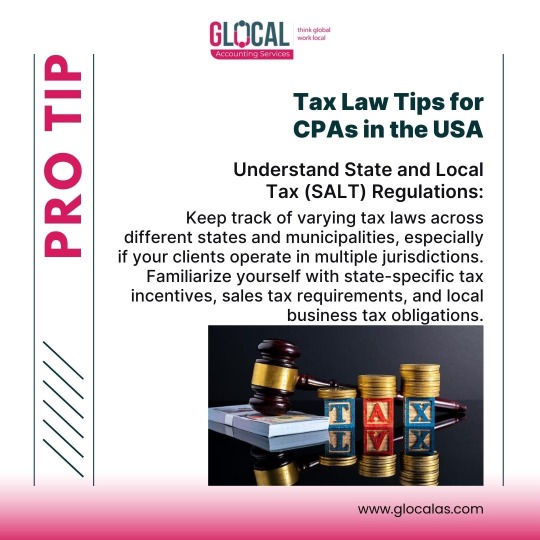

Unmasking the Complexities: How Intellgus Redefines US Tax Services for CPA Firms

Think US Tax Services Are Simple? Think Again!

The landscape of US tax services is more complex and challenging than ever before. With regulations evolving at breakneck speed, even the most experienced CPA firms can find themselves in uncharted territory. It’s time to pull back the curtain and reveal the hidden intricacies of this critical aspect of financial management. At Intellgus, we are redefining what it means to excel in US tax services. But how exactly are we doing it?

Common Misconceptions About US Tax Services

Navigating the complexities of US tax services is no small feat. Here are some common misconceptions that could derail your firm’s success:

● Keeping up with regulations is straightforward: The reality is starkly different. The IRS made over 5,000 changes to the tax code in the last decade alone. Staying current requires constant vigilance and expertise.

● One-size-fits-all tax solutions work for every client: Each business has unique needs. Tailored strategies are essential to meet specific client requirements effectively.

● Handling taxes in-house is always cheaper: Hidden costs and inefficiencies can make in-house management far more expensive in the long run.

Steps to Truly Excel in Tax Services

To master the art of US tax services, CPA firms need a strategic approach:

● Stay ahead with the latest tax laws and amendments: Continuous education and real-time updates are crucial. Did you know that compliance costs US businesses approximately $147 billion annually?

● Customize tax strategies for each client’s unique needs: Personalized solutions lead to better outcomes and higher client satisfaction.

● Utilize offshore experts for cost-effective and efficient solutions: Offshore teams can offer specialized knowledge and significant cost savings. For example, leveraging offshore professionals can reduce costs by up to 60% compared to onshore resources.

Why Intellgus Stands Out?

Intellgus is transforming the way CPA firms handle US tax services. Here’s how we make a difference:

Comprehensive Tax Solutions

From compliance to strategic planning, Intellgus provides a full spectrum of tax services. Our holistic approach ensures that every aspect of your tax needs is addressed meticulously, giving you peace of mind.

Experienced Team

Our team comprises seasoned professionals with extensive experience in the US tax landscape. Having worked with numerous CPA firms across the US, our experts bring a wealth of knowledge and innovative strategies to the table. For instance, our average team member has over 15 years of experience, ensuring high-quality service and expertise.

Cost-Effective Strategies

Intellgus offers unparalleled cost efficiency. By leveraging offshore talent, we provide high-quality services at a fraction of the cost. Our clients have reported savings of up to 50% on their tax services, without compromising on quality.

Realities of Offshoring: The Intellgus Advantage

Offshoring can provide significant benefits if done right. Here’s how Intellgus ensures a seamless and beneficial offshoring experience:

● Transparent Pricing: We believe in clear, upfront pricing with no hidden fees. This transparency helps in accurate budgeting and financial planning.

● Skilled Offshore Teams: Our offshore professionals are highly skilled and trained in US tax laws, providing top-notch services that meet stringent quality standards.

● Effective Communication: Regular updates and clear communication channels prevent misunderstandings and ensure smooth operations. Our clients enjoy a 98% satisfaction rate, thanks to our commitment to transparency and communication.

Conclusion

Intellgus is not just another tax service provider; we are your partners in navigating the complexities of US tax services. By staying ahead of regulatory changes, offering customized solutions, and leveraging offshore expertise, we provide CPA firms with the tools they need to succeed.

What Challenges Have You Faced with US Tax Services?

We’d love to hear from you. Share your experiences in the comments and let’s discuss how Intellgus can help transform your tax services.

#account management#accounting and bookkeeping in USA#CPA firms in USA#virtual cfo service in USA#outsourcing accounting firms in USA

1 note

·

View note

Text

Navigating financial compliance: Benefits of outsourcing accounting services in the USA. Read the article to learn more.

0 notes

Text

#outsourced bookkeeping#accounting outsourcing#small business accounting#accounts receivable outsourcing#bookkeeping for cpas#outsourced bookkeeping services in usa#quickbooks online setup services

0 notes

Text

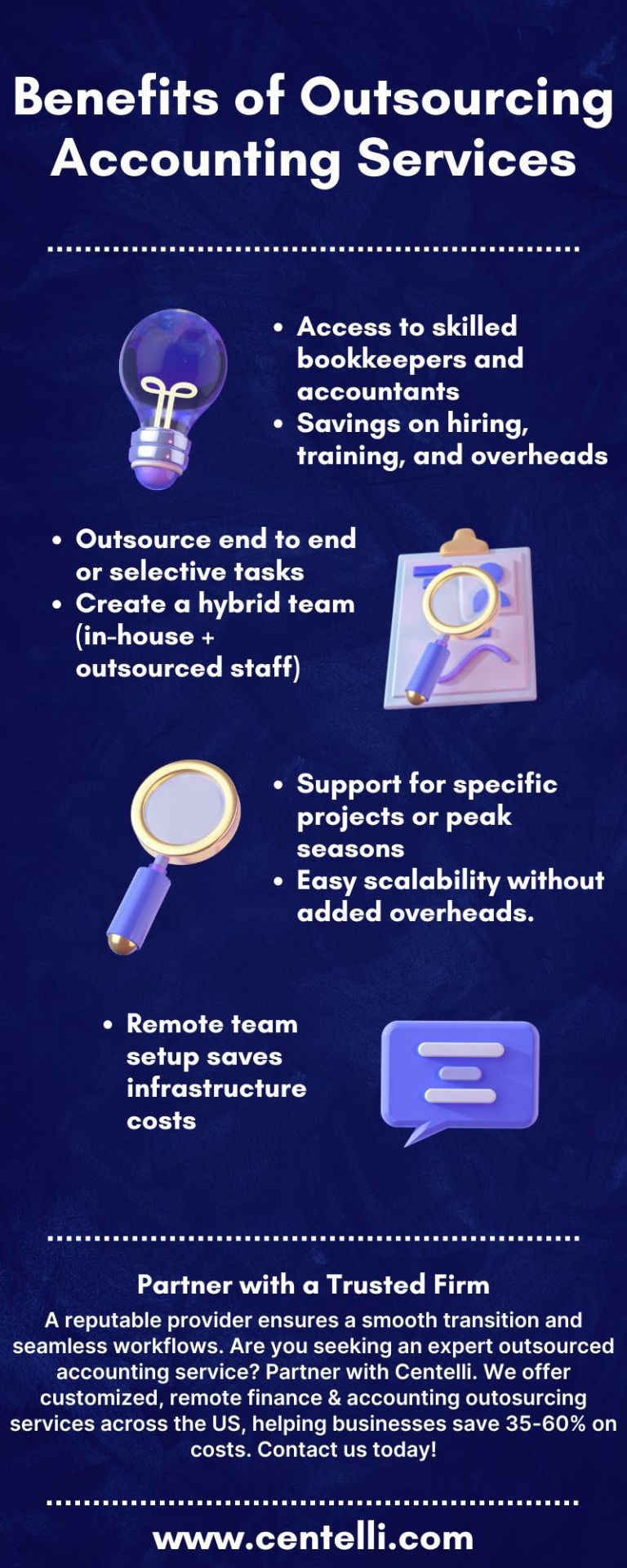

Why Choose Outsourced Accounting Services in Atlanta - Centelli

Due to rising operational costs and talent shortages, accounting has become a challenge for many US businesses. However, there's an alternative—delegate it to third-party experts. However, there's an alternative-- delegate it to third-party experts. That’s where outsourced accounting services in Atlanta come in.

Why Outsource to an Atlanta-Based Accounting Provider?

Atlanta is a top business hub, and its accounting service providers must meet high standards to support local businesses effectively. Whether you're struggling with in-house accounting or want to offload a non-core function, outsourcing is a smart solution.

Key Benefits of Outsourcing Accounting Services

A reliable outsourced accounting services provider in Atlanta offers:

Access to skilled bookkeepers and accountants

Savings on hiring, training, and overheads

Outsource end to end or selective tasks

Create a hybrid team (in-house + outsourced staff)

Support for specific projects or peak seasons

Easy scalability without added overheads

Remote team setup saves infrastructure costs

What to Consider When Choosing an Accounting Partner

When selecting an outsourced accounting services provider in Atlanta, keep these factors in mind:

Ask for references, check online reviews

Ensure they have expertise in your industry

They have GAAP-trained accounting team

Can work with accounting software of your choice

Check service packages and pricing

Are committed to data security and privacy

Partner with a Trusted Firm

A reputable provider ensures a smooth transition and seamless workflows. Are you seeking an expert outsourced accounting service? Partner with Centelli. We offer customized, remote finance & accounting outsourcing services across the US, helping businesses save 35-60% on costs. Contact us today!

#Outsourced Accounting Services#Accounting Services#Accounting Firm#Small Business#Finance and Accounting#centelli#Atlanta#USA

0 notes

Text

#usa accounting#usa bookkeeping#hire an accountant in USA#outsourced service#outsourced accounting service

0 notes

Text

Strategic Financial Management and Virtual CFO Expertise - Qualitas Accounting Inc

In today's fast-paced business environment, managing finances efficiently is crucial for success. Qualitas Accounting Inc stands out as a premier provider of comprehensive accounting and financial services, tailored to meet the diverse needs of businesses across the United States. With a commitment to excellence and a focus on customer satisfaction, Qualitas Accounting has built a reputation as a trusted partner for businesses seeking to optimize their financial management.

One of the core strengths of Qualitas Accounting is their ability to offer tailored solutions that enhance operational efficiency. Their bookkeeping outsourcing services USA are designed to alleviate the burden of daily financial tasks, allowing businesses to focus on core activities. By outsourcing these functions, companies can benefit from accurate and timely financial records, which are essential for informed decision-making. As one of the leading accounting firms in Columbia, MO, Qualitas Accounting provides local businesses with the expertise and support needed to thrive in a competitive marketplace.

Premier Outsourcing and Virtual CFO Services

In addition to bookkeeping, Qualitas Accounting excels as one of the premier finance outsourcing companies USA. Their team of experienced professionals ensures that businesses receive comprehensive financial management services, including budgeting, forecasting, and strategic planning. These services empower companies to achieve their financial goals and maintain a strong fiscal position.

For businesses looking to gain a strategic edge, Qualitas Accounting offers virtual CFO USA services. This service provides companies with access to high-level financial expertise without the cost of a full-time CFO, enabling them to drive growth and profitability. By choosing Qualitas Accounting, businesses can leverage cutting-edge financial solutions, backed by a team committed to delivering excellence and value.

Partnering with Qualitas Accounting Inc means choosing a firm that prioritizes your financial success. Their dedication to quality and innovation ensures that your accounting needs are met with precision and expertise, paving the way for sustainable growth and success. Experience the difference with Qualitas Accounting Inc, where your business's financial health is our top priority.

#virtual CFO USA#finance outsourcing companies USA#accounting firms in Columbia#bookkeeping outsourcing services USA

0 notes

Text

Improve collections, gain real-time visibility, and forge stronger customer relationships with our outsourced accounts receivable services in the US.

Contact us now to transform your accounts receivable process!

0 notes

Text

Sales Tax Outsourcing Solutions USA

Sales Tax Compliance Outsourcing - Glocal Accountancy provides outsourced sales tax services in India to figure out tax liabilities and outcomes.

#sales tax outsourcing#sales tax compliance outsourcing#accounting outsourcing services usa#bookkeeping outsourcing services usa

0 notes

Text

Outsource bookkeeping in services in USA

We provide online bookkeeping services in USA and UK, International bookkeeping for businesses and CPA firms operating across the world.

Outsource bookkeeping in services in USA | Online Bookkeeping Services in USA and UK

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#Outsource bookkeeping in services in USA

0 notes