#Option trading course

Explore tagged Tumblr posts

Text

Best Option Trading Course | Rise Excellence Academy

Rise Excellence Academy provides a top-tier Option Trading Course designed to help you trade with confidence and maximize profits. Learn proven strategies, risk management, and market analysis from expert traders. Whether you are a beginner or an advanced trader, our course equips you with practical knowledge to navigate the stock market successfully. Start your journey to financial growth today! Enroll now

0 notes

Text

Step into the world of options trading with ease! This foundation option trading course is perfect for beginners looking to understand the basics of options, strategies, and risk management. Gain the knowledge and confidence to navigate the market. Start your journey today!

0 notes

Text

Learn Option Chain Analysis for Better Market Predictions

The Option Chain Analysis course provided by ICFM is a comprehensive program aimed at equipping individuals with the skills and knowledge necessary to understand and interpret option chains effectively. This course is particularly valuable for traders and investors who are looking to make informed decisions in the derivatives market. ICFM’s curriculum focuses on explaining the concept of option chains, which are a listing of all available option contracts (both call and put options) for a particular underlying asset, categorized by different strike prices and expiration dates. Participants learn to analyze the option chain to gauge market sentiment, identify potential support and resistance levels, and predict future price movements of stocks or indices. The course emphasizes practical aspects, such as understanding the significance of open interest, volume, and implied volatility, and how these elements influence the pricing of options. By mastering these key indicators, traders can spot opportunities for profitable trades, manage risk effectively, and create sophisticated strategies, such as straddles, strangles, and spreads. ICFM’s Option Chain Analysis course also includes live market examples and case studies, allowing students to apply theoretical knowledge to real-time market conditions. The institute ensures that students grasp not only the fundamentals but also the advanced techniques used by professional traders to capitalize on market movements. With expert guidance, hands-on practice, and a focus on practical trading strategies, this course prepares individuals to navigate the complex world of options trading confidently and successfully.

#Option chain analysis#Option chain analysis course#Option trading course#Option trading courses#Option trading classes#Option trading classes in Delhi#Option trading institute

0 notes

Text

Best Option Trading Course for Beginners and Pros

If you're looking to enter the world of options trading, enrolling in an Option Trading Course is the perfect starting point. This course is designed to help beginners and experienced traders alike understand the fundamentals of options, including calls, puts, strike prices, and expiration dates. You will learn how to read options chains, assess market trends, and execute profitable trades using various strategies like covered calls, straddles, and spreads. The course covers risk management techniques, ensuring that traders minimize potential losses while maximizing gains. With real-world examples and hands-on exercises, you'll gain practical experience that can be applied in live markets. Whether you're interested in short-term gains or long-term investments, an Option Trading Course equips you with the knowledge to make informed decisions and navigate the complexities of the options market. Take control of your financial future by mastering the art of options trading today.

0 notes

Text

Option Trading in the Stock Market

Unlock the Power of Option Trading in the Stock Market

The stock market is full of opportunities, but many traders only scratch the surface. If you want to truly amplify your profits and manage risks effectively, option trading is an essential skill to master. However, options can be complex, and that’s where a structured, professional course comes in. At Index and Stock Trading Academy, we provide a comprehensive Option Trading Course that helps traders from all backgrounds learn the strategies needed for success.

1: What is Option Trading?

Option trading involves contracts that give buyers the right (but not the obligation) to buy or sell assets at a predetermined price. These contracts can be incredibly useful in managing risk, protecting investments, or generating income in the stock market. While it may sound complex, learning the basics and understanding option trading strategies can give you a huge advantage in your trading career.

2: Why Enroll in an Option Trading Course?

For beginners and even seasoned investors, understanding the nuances of options trading can be a challenge. Here’s why taking a professional option trading course at Index and Stock Trading Academy is essential:

Structured Learning: Learn the fundamentals of options, including terminology, pricing, and strategies, in an organized and easy-to-follow format.

Risk Management Strategies: Options trading isn’t just about profits; it’s about protecting your investments. Our course teaches you how to use options to hedge risks and create balanced portfolios.

Advanced Trading Techniques: We go beyond the basics to cover more complex strategies like spreads, straddles, and iron condors to help you become a proficient trader.

Live Trading Sessions: Apply your knowledge with hands-on, live market sessions. We believe that real-time experience is crucial for mastering the strategies.

3: Benefits of Learning at Index and Stock Trading Academy

When you enroll in the Option Trading Course at Index and Stock Trading Academy, you’re signing up for:

Expert Guidance: Our trainers have years of experience in the stock market and are dedicated to helping you succeed.

Comprehensive Curriculum: Our course covers both basic and advanced trading techniques, ensuring that every student gains the knowledge they need to succeed.

Flexible Learning: Whether you’re based in Pune or nearby areas like Balewadi, Baner, Pashan, Aundh, Wakad, Mahalunge, Hinjewadi, Ravet, Kothrud, or Bavdhan, our academy is easily accessible for local traders.

Conclusion: Why Wait? Start Learning Option Trading Today!

If you’re serious about taking your trading skills to the next level, learning options is a must. At Index and Stock Trading Academy, we offer the perfect blend of theoretical knowledge and practical experience to help you succeed in the stock market. Whether you’re a beginner or an experienced trader looking to sharpen your skills, our Option Trading Course is the right place to start.

6. Style/Tone: The blog will use a professional and conversational tone. It will focus on educating the reader with straightforward information while encouraging them to take action. The writing will be clear and concise, making it accessible to traders at different knowledge levels.

7. Call-to-Action (CTA):

Ready to master option trading and enhance your stock market skills? Join our Option Trading Course at Index and Stock Trading Academy today!

Visit our website https://www.indexandstocktradingacademy.com/ or call us at 7709643909 to get started.

#Option trading course#Stock market trading strategies#Option strategies for beginners#Learn option trading in Pune#Professional stock market courses#Advanced trading techniques

0 notes

Text

Mastering Option Chain Analysis with ICFM: A Comprehensive Guide

The Institute of Career in Financial Market (ICFM) offers a comprehensive approach to understanding option chain analysis as part of its financial market courses. Option chain analysis is crucial for traders to assess the movement of options contracts for different strike prices and expiration dates. ICFM's training helps traders decode the complex data of option chains, including open interest, trading volume, and price fluctuations, which are key indicators of market sentiment and potential price movement. The focus is on both theoretical knowledge and practical application in real-time market scenarios. ICFM's option chain analysis training emphasizes critical components such as strike prices, expiration dates, call and put options, and the importance of implied volatility. Their programs guide students through interpreting open interest, which helps identify support and resistance levels in the market, and understanding the significance of volume, which reflects market activity. Through hands-on practice and live market demonstrations, participants learn how to use this data to predict future market movements, identify trading opportunities, and hedge risk effectively.

0 notes

Text

Top Option Trading Tools for Effective Trading

The right tools can turn trading from a challenging task into an exciting adventure. From intuitive platforms to real-time apps, these option trading tools simplify complex processes and help you stay on top of the market. Discover how these essential resources can transform your trading experience, making it easier and more rewarding.

Trading Platforms

A good trading platform is the best option for trading tools available. Option Trading platforms are a hub where you can place trades, view real-time market data, and manage your investments. They have tools that help you analyze charts, track market movements, and execute trades efficiently. With features like customizable dashboards and integrated market analysis tools, these platforms make trading more straightforward and effective. Whether setting up alerts or reviewing your trading history, a solid platform supports every step of your trading journey.

Market Analysis Tools

You need to understand the market to learn how to trade options effectively. Market analysis tools help you do just that by offering detailed charts and indicators. These tools let you examine past market behavior and current trends to predict where prices might move next. By providing insights into price patterns and market dynamics, they help you spot potential opportunities and make smarter trading decisions. Using these tools, you can analyze data comprehensively, giving you a better grasp of the market and aiding in more informed decision-making.

Option Trading Calculators

Calculating the risks and rewards of your trades is crucial. Option trading calculators help you break down complex data into understandable figures. These calculators use mathematical models to determine key factors like the option’s price and how it might change with market fluctuations. They assess things like volatility and the Greeks (delta, gamma, theta) to give you a clearer picture of what to expect from your trades. With these calculations, you can better plan your trading strategies and manage your risks.

Mobile Trading Apps

Trading on the go has become a necessity. Mobile trading apps let you manage your trades and watch the market from your smartphone or tablet. These apps allow you to execute trades, monitor market conditions, and access real-time updates wherever you are. They offer an easy way to trade options, making it simple to stay connected to the market and make quick decisions. Whether at home or on the move, these apps bring the convenience of trading into your daily life.

Educational Resources

Keeping up with trading strategies and market changes is key to staying ahead. Option Trading courses and webinars offer valuable knowledge and tips on option trading. Trading experts at FortuneTradingAcademy cover everything from basic concepts to advanced strategies, helping you to understand the market better and improve your trading skills. These resources are designed to make learning accessible and practical to continuously enhance your trading approach and adapt to new market trends.

Conclusion

Mastering option trading is a journey, and the right tools are your most trusted companions along the way. Each resource, from user-friendly platforms to insightful calculators, is designed to make your trading experience more effective and enjoyable. FortuneTradingAcademy stands out as the best stock market training institute in Bangalore, offering specialized Option Trading Training for those looking to deepen their skills and knowledge. Getting trained by professionals can further enhance your trading strategies.

Resource: https://fortunetrading.livejournal.com/681.html

#stock market#investing#best option trading tools#how to trade options#best stock market training institute in Bangalore#easy way to trade options#option trading training#option trading course

0 notes

Text

Option Trading Course

Rise Excellence Academy India Pvt. Ltd. offers a comprehensive Option Trading Course designed to equip you with the skills and knowledge needed to excel in the dynamic world of options trading. Our expert trainers provide practical insights and strategies to help you make informed decisions and maximize profits. Whether you are a beginner or an experienced trader, this course will guide you through essential concepts and techniques. Join Rise Excellence Academy for an enriching learning experience in option trading.

To know more visit :- https://alwaysrise.com/option-trading-course/

0 notes

Text

Price Action Trading: Strategies, Tips, and Professional Tools

Trading based on price action trading is a potent method that uses past price changes to guide trading choices. It does not rely a lot on technical markers like other strategies do. Instead, it zooms in on things like price changes, how much is being traded, and patterns. This post will talk about good strategies for trading with price action, give helpful advice, and showcase pro tools that can make trading even better.

#tip to choose best stock market learning institute#best stock market courses#option trading course#Price Action Trading#nism certification course

1 note

·

View note

Text

Elevate Trading Experience With Option Trading Course!

At the IBBM stock market platform, we offer students to elevate their career with the option trading course. In this course, students would be able to learn trade options, such as what options are, how they work, and the key terminology associated with options trading. The course will teach you how to control risk through position sizing, diversification, and using various strategies.

0 notes

Text

Option Chain Analysis Strategies for Successful Trading

Option chain analysis is a crucial tool for traders and investors seeking to understand market sentiment, price movements, and volatility in the stock and derivative markets. It involves analyzing the data of call and put options at various strike prices for a particular underlying asset, typically displayed in a tabular format known as an option chain. This analysis helps traders make informed decisions on whether to buy or sell options contracts based on the available information regarding open interest, volume, implied volatility, and premiums.

ICFM (Institute of Career in Financial Market) offers specialized training in option chain analysis as part of its broader financial market education programs. Through its expert-led courses, ICFM aims to equip traders with the knowledge and skills required to interpret option chain data effectively. This helps individuals understand market sentiment, identify potential reversals or trends, and plan their trades accordingly. The training provided by ICFM covers essential aspects like open interest analysis, strike price selection, and how various factors such as time decay and volatility impact option prices.

One of the primary focuses of ICFM s option chain analysis training is teaching participants how to use data from the option chain to gauge the strength of market trends. For example, a high level of open interest at certain strike prices may indicate strong support or resistance levels, giving traders valuable insights into price action. The course also covers the relationship between put-call ratios and market sentiment, offering practical strategies for both bullish and bearish market conditions.

In summary, option chain analysis is a powerful technique for making data-driven trading decisions, and ICFM provides comprehensive training to help individuals master this skill. Whether you're an experienced trader looking to refine your strategy or a beginner seeking to understand the complexities of options trading, ICFM s programs offer the knowledge and practical insights needed to succeed in the financial markets.

#Option chain analysis#Option chain analysis course#Option trading course#Option trading courses#Option trading classes#Option trading classes in Delhi#Option trading institute

0 notes

Text

Master Option Trading with Our Expert Course

If you're looking to enter the world of options trading, enrolling in an Option Trading Course is the perfect starting point. This course is designed to help beginners and experienced traders alike understand the fundamentals of options, including calls, puts, strike prices, and expiration dates. You will learn how to read option chains, assess market trends, and execute profitable trades using various strategies like covered calls, straddles, and spreads. The course covers risk management techniques, ensuring that traders minimize potential losses while maximizing gains. With real-world examples and hands-on exercises, you'll gain practical experience that can be applied in live markets. Whether you're interested in short-term gains or long-term investments, an Option Trading Course equips you with the knowledge to make informed decisions and navigate the complexities of the options market. Take control of your financial future by mastering the art of options trading today.

0 notes

Text

ladies, I need to wander despondently across a foggy moor asap

#*this also applies to the not-ladies among us#y'all deserve a good pensive ramble across a moor in a really cool greatcoat#just be sure you don't turn it into anything vigorous#this is not the time to be Aragorn we are looking for Jonathan Harker pre-Dracula at best#in regards to the moor: a wind-swept cliffside would also be suffice#it would NOT do wonders for my health of course but hey#fortunately the bestie and I have plans to go hiking next weekend and if we don't have another option I'm gonna beg for the hemlock trail#I'd also take the cedar springs#I just need Nature that isn't the beach#in other news I am happy to report that the week is smoothing itself out somewhat#we're all still on edge but it's not as bad as it was and we've effectively kicked loose the pebble in the the shoe#my darling sister sent me a gift and told me to treat myself so I may get bubble tea after work#and I begged for tomorrow off so I can sleep and then spend the day coughing in peace#(this is such a bizarre cold. I didn't get any of the preliminaries outside of some sneezing)#(and then it was straight to my chest. not even a sore throat first! usually I get a lot of build up and can often get ahead of a bad cough#(thankfully my nose is not congested. I suppose that's the trade-off)#so I'll sleep in and then I may sort some of the filing I'm taking home from the office#by then I'll likely have completely lost my voice#AND I have ingredients for chili because for once I planned ahead. might even make some of my favorite rolls as well.#and then next week...I start a second job#(super simple and it's 2 hours max every evening. once I figure it out it could be an hour tops unless I decide to take it slow)#(the pay is great for the job and it'll give me something to do instead of just...I dunno...reading through the winter I suppose)#(sorry my head is in such a fog I don't know how I'm surviving work)#mine#greatest hits

899 notes

·

View notes

Text

Understanding How the Stock Market Works

Understanding how stock market works is essential for making informed investment decisions. Knowledge of market operations, key players, and trading strategies can help mitigate risks and maximize returns. Explore the intricacies of the stock market, where companies issue shares that investors buy and sell through exchanges. Discover how factors such as company performance, market sentiment, and economic trends influence stock prices, providing opportunities for both long-term investors and active traders to participate in this dynamic financial ecosystem.

1. Stock Exchanges

Primary Exchanges: The most prominent stock exchanges are the New York Stock Exchange (NYSE) and the NASDAQ.

Global Exchanges: Other major global exchanges include the London Stock Exchange (LSE), Tokyo Stock Exchange (TSE), and more.

2. Shares and Stocks

Shares: Represent ownership in a company. When you buy a company's stock, you are buying a small part of that company.

Stocks: The general term for shares of ownership in a company. Stocks can be common or preferred, with common stocks often carrying voting rights and preferred stocks generally offering fixed dividends.

3. Buying and Selling

Investors and Traders: Individuals or institutions that buy and sell stocks.

Brokerages: Firms that act as intermediaries between buyers and sellers. Investors use brokerage accounts to execute trades.

Orders: Investors place orders to buy or sell stocks. Types of orders include market orders, limit orders, stop orders, etc.

4. Price Determination

Supply and Demand: Stock prices are determined by the supply and demand in the market. If more people want to buy a stock (demand) than sell it (supply), the price goes up. If more people want to sell a stock than buy it, the price goes down.

Market Influences: News, earnings reports, economic indicators, and other factors can influence investor sentiment and stock prices.

5. Types of Stock Markets

Primary Market: Where new shares are issued and sold to investors via Initial Public Offerings (IPOs).

Secondary Market: Where previously issued shares are traded among investors. Most stock market activities occur in the secondary market.

6. Indices

Stock Market Indices: Benchmarks used to measure and report value changes in a selected group of stocks. Examples include the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ Composite.

Purpose: Indices help investors gauge the performance of the market or a segment of the market.

7. Regulation

Regulatory Bodies: Stock markets are regulated by governmental and independent organizations to ensure fair practices. In the U.S., the Securities and Exchange Commission (SEC) is a key regulator.

Laws and Regulations: Designed to protect investors and maintain market integrity.

8. Risks and Rewards

Potential for Profit: Stocks can offer significant returns over time through price appreciation and dividends.

Risk of Loss: Stocks can also lose value, sometimes significantly, leading to potential losses.

9. Investment Strategies

Long-Term Investing: Buying and holding stocks for an extended period, typically years, to benefit from the company’s growth.

Short-Term Trading: Buying and selling stocks within a short period, ranging from minutes to months, to capitalize on market fluctuations.

Diversification: Spreading investments across various sectors and asset classes to mitigate risk.

10. Tools and Resources

Research and Analysis: Investors use various tools, such as financial news, analyst reports, and market data, to make informed decisions.

Technology: Online trading platforms and mobile apps provide easy access to market information and trading capabilities.

Understanding how stock market works is essential for making informed investment decisions and effectively managing your portfolio.

#stock market#stock market course in delhi#option trading course#best share trading institute#stock market institute#stock market training#stock market trading

0 notes

Text

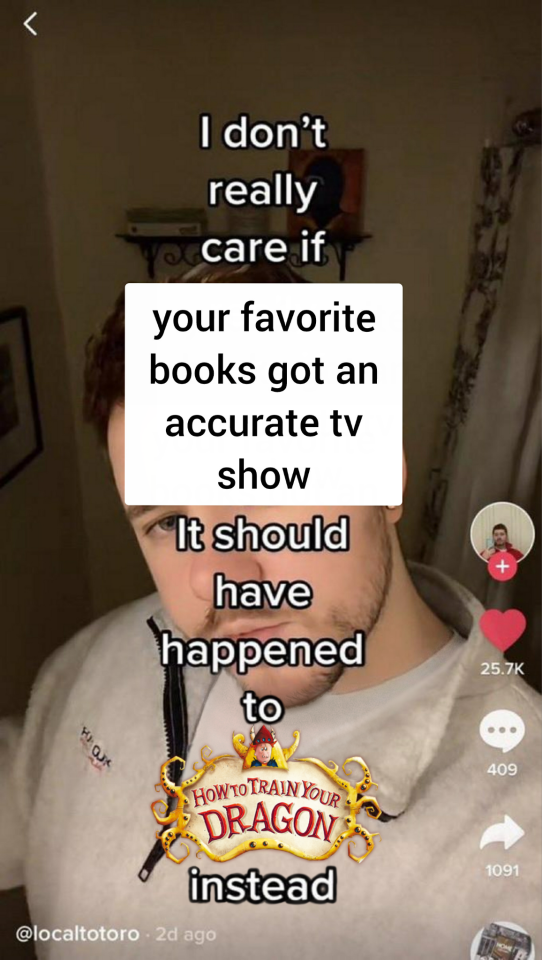

In light of the Percy Jackson trailer release

To be clear i do also care very much (PJO my beloved <3) but meme funny so

#httyd books#httyd#how to train your dragon#how to train your dragon books#am i excited for the pjo series? yes of course#would i trade it for an accurate good httyd series? absolutely in a heartbeat#preferably it would be animated tho lol#in my imaginary land where this is an option its animated :p

235 notes

·

View notes

Text

Option Trading Course

Unlock your trading potential with the Option Trading Course offered by Rise Excellence Academy India Pvt. Ltd. This course provides in-depth knowledge of options trading, from fundamentals to advanced strategies, helping you navigate the market confidently. With experienced trainers and practical insights, you’ll learn how to analyze trends, manage risks, and maximize returns. Whether you're a beginner or looking to enhance your skills, Rise Excellence Academy India Pvt. Ltd ensures you gain the expertise needed to succeed in options trading.

To more information :- https://alwaysrise.com/option-trading-course/

0 notes