#Online NRI Pan Card

Explore tagged Tumblr posts

Text

1 note

·

View note

Text

If You Lost Your PAN Card, complete guide to How to Apply for a Duplicate pan card!

What is a Duplicate PAN Card?

A Duplicate PAN (Permanent Account Number) card is a reissued version of the original PAN card, typically requested when the original is lost, damaged, or needs to be replaced. The PAN card is a crucial document in India, used for various financial transactions and tax purposes, serving as a unique identifier for individuals and entities.

Steps to Apply for Duplicate PAN Card Online

1. Visit the Official Website: Go to the websites of NSDL (now Protean) or UTIITSL. 2. Select the Application Type: Choose “Reprint of PAN Card” or “Duplicate PAN Card”. 3. Fill in the Form: Provide necessary details like your PAN, name, and date of birth. 4. Submit Documents: Upload required documents, such as identity proof. 5. Pay the Fee: Make the payment using the available online options. 6. Receive Acknowledgment: After submission, you’ll receive an acknowledgment receipt with a token number for tracking.

Applying Duplicate PAN Card Without Changes

If you need a duplicate PAN card without any changes in personal details, the process is simplified. Follow the same online steps as above, ensuring you select the option for a duplicate without changes. Your existing information will be retained.

Who Can Apply For Duplicate PAN Card?

Any individual or entity that holds a PAN card can apply for a duplicate. This includes:

- Indian citizens - Non-resident Indians (NRIs) - Companies - Partnerships - Trusts

When to Apply for a Duplicate PAN Card

You should apply for a duplicate PAN card in the following situations:

- Loss or theft of the original card - Damage or wear and tear making the card unreadable - Incorrect details on the original card (if needing a change, opt for the correction process instead)

Documents Required for a Duplicate PAN Application

To apply for a duplicate PAN card, you typically need:

- A copy of your lost or damaged PAN card (if available) - Identity proof (e.g., Aadhar, passport, voter ID) - Address proof (e.g., utility bill, bank statement) - Passport-sized photographs - Payment receipt (for online applications)

Fees to Apply for a Duplicate PAN Card

The fee for applying for a duplicate PAN card varies based on the applicant’s location:

- For Indian residents: Approximately ₹110 (including GST) - For applicants outside India: Approximately ₹1,020 (including GST)

Check the latest fee structure on the official websites before applying.

Steps to Download a Duplicate PAN Card

Once your duplicate PAN card application is approved, you can download it:

1. Visit the PAN Service Website: Go to NSDL or UTIITSL. 2. Select ‘Download PAN’: Look for the option to download the e-PAN. 3. Enter Details: Provide your PAN and acknowledgment number. 4. Authenticate with OTP: An OTP will be sent to your registered mobile number for verification. 5. Download the Card: After verification, download the e-PAN card.

Steps to Surrender a Duplicate PAN Card

If you have received a duplicate PAN card but realize you have multiple PANs, it’s advisable to surrender the extra one:

1. Write a Request Letter: Address it to the Income Tax Department, mentioning your details and PAN numbers. 2. Include Documents: Attach copies of your PAN cards and identity proof. 3. Submit: Send the letter to the appropriate IT office or online via the official portal.

Conclusion

A duplicate PAN card is essential for maintaining seamless financial transactions and tax compliance. The process for obtaining one, whether online or offline, is straightforward. Ensuring you have a valid PAN card helps in avoiding penalties and facilitates smoother dealings with banks and other financial institutions.

Related article: How to track your Pan card status? , Pan card application form pdf

#Duplicate PAN card#Lost PAN card#Apply for PAN card#PAN card reissue#PAN card application process#Online PAN card duplicate#Offline PAN card duplicate#PAN card fees#PAN card documents required#PAN card tracking#Income Tax PAN#e-PAN card download#Surrender PAN card#PAN card for individuals#PAN card for NRIs#Surrender Duplicate PAN Card#Surrender Duplicate PAN Card how to apply#download pan card online#pan application form pdf#apply pan card application#income tax login#income tax return#taxring#itr filing#gst registration#tax refund#income tax audit#tax audit#income tax

0 notes

Text

HDFC Bank Home Loan Apply in Ahmedabad

HDFC Bank Home Loan in Ahmedabad

HDFC Bank is one of India's leading financial institutions, trusted for its extensive range of financial services. For many, owning a home is a lifelong dream, and a HDFC bank home loan makes this dream a reality. Offering competitive interest rates and flexible repayment options, HDFC Bank serves various financial needs. If you’re in Ahmedabad, Adiyogi Enterprise is your go-to for expert guidance and seamless support in securing the best HDFC bank home loan online in Ahmedabad.

HDFC Bank Home Loan Interest Rate

Interest rates play a crucial role in determining the affordability of a home loan. In 2024, HDFC home loan online apply offers some of the most competitive rates in the market. Borrowers can choose between floating and fixed interest rates, ensuring they find an option that suits their financial goals.

HDFC Home Loan Interest Rate 2024

For 2024, HDFC Bank offers attractive floating interest rates for both salaried and self-employed individuals. Here’s a quick breakdown of the rates:

Loan Amount Salaried Interest Rate Self-Employed Interest Rate

Up to ₹30 Lakhs 8.50% 8.75%

₹30-75 Lakhs 8.60% 8.85%

Above ₹75 Lakhs 8.70% 9.00%

These rates make HDFC bank home loan apply an excellent choice for affordable financing.

Types of HDFC Home Loan Schemes

HDFC Bank provides various home loan schemes, tailored to meet diverse needs:

Home Purchase Loan: Ideal for buying a new or resale property.

Home Construction Loan: Designed for constructing a house on a plot.

Home Extension Loan: Perfect for adding extra space to your home.

Plot Loan: For purchasing residential plots.

Each scheme comes with unique features, making HDFC bank home loan online apply suitable for all borrowers.

How to Apply for a Home Loan on HDFC Bank?

Follow these steps for a hassle-free HDFC home loan online apply:

Visit the Adiyogi Enterprise official website.

Navigate to the home loan section.

Fill out the online application form with personal and financial details.

Upload the required documents.

Submit the form and await approval.

Adiyogi Enterprise in Ahmedabad can also assist you in the application process for the best results.

What Are the Documents Required to Apply for the Home Loan from HDFC Bank?

When you opt for HDFC bank home loan apply, ensure you have the following documents ready:

Proof of identity (Aadhar, PAN card, etc.)

Proof of address (utility bills, voter ID, etc.)

Income proof (salary slips or IT returns)

Bank statements (last 6 months)

Property documents (agreement, approved plans, etc.)

Proper documentation ensures a quick and smooth approval process.

Who Can Apply for the HDFC Home Loan?

Eligibility criteria for HDFC bank home loan apply include:

Indian residents or NRIs.

Salaried individuals aged 21-65 years.

Self-employed professionals and business owners.

Applicants with a stable income and good credit history.

Whether you’re a first-time homebuyer or upgrading your property, HDFC bank home loan online in Ahmedabad suits diverse needs.

Who Is the Best HDFC Home Loan Provider in Ahmedabad?

Adiyogi Enterprise stands out as the leading provider of HDFC Bank Home Loan Apply in Ahmedabad services. Known for excellent customer support, competitive rates, and expert advice, Adiyogi Enterprise ensures a seamless loan application experience.

Benefits of HDFC Bank Home Loan Online Apply

Opting for HDFC bank home loan online apply offers multiple advantages:

Quick and easy process from the comfort of your home.

Transparent information on interest rates and fees.

Instant tracking of loan application status.

Reduced paperwork through digital uploads.

For Ahmedabad residents, Adiyogi Enterprise enhances these benefits with personalized service.

Conclusion

Owning a home is easier than ever with a HDFC bank home loan. Whether you’re looking to build, purchase, or renovate, HDFC Bank offers tailored options to meet your needs. For residents of Ahmedabad, Adiyogi Enterprise provides unmatched guidance and support.

Take the first step today! Visit our website or contact us directly at +91-9624-9999-44 to apply for the best HDFC home loan online apply. Transform your dream home into a reality.

#HDFC bank home loan#HDFC home loan online apply#HDFC bank home loan apply#HDFC bank home loan online apply#HDFC bank home loan online in ahmedabad#HDFC Bank Home Loan Apply in Ahmedabad

0 notes

Text

How Does Lenditt Home Loan Help You Buy Your Dream Home This Diwali?

Diwali- A popular time to make big Investments!

We all have multiple dreams to fulfil in our lives. Since every festival has a hidden auspicious meaning behind it, we often plan to fulfill our desires and wishes during the festive season. So, as the festive season of Diwali approaches, the air gets filled with emotions of new beginnings, love, and warmth. Diwali is marked as the perfect time to transform one’s aspirations into existence, especially the hope of owning your own Home Sweet Home.

Possessing a home not only makes your life easy, but it also gives you security and a feeling of a personal safe space. It has a sense of belonging, a place where you can empty your mind and feel at peace.

Lately, property costs have increased, making the management of finances a bit difficult. However, Lenditt has solutions to everything that brings trouble to its customers. This year, Lenditt has become the guiding light on possessing a new home. It has recently launched online home loans, ensuring that your home-buying experience becomes as joyous and fulfilled during Diwali.

So, why rent when you can get a home loan from Lenditt and purchase your dream Home? On this auspicious occasion of Diwali, buy your dream property with Lenditt Home Loan. Here are some important details to know about Lenditt instant home loan.

Why Diwali is the perfect time to Buy a New Home!

As Diwali is an emotion for every Indian, it brings a range of attractive offers. It is the time when people believe in starting a new chapter and making a prominent investment, such as buying a home. The idea of entering your new home after performing Lakshmi Puja brings positive energy to your home. During this time, Builders and Brokers provide festive discounts and propose Diwali Sales, making it the perfect time to Buy a New Home!

How easily does the Lenditt Home Loan work?

Lenditt Home Loan Steps are easy to follow and quick to apply, allowing you to secure your dream home while sitting at your home.

1. Eligibility Check:

To qualify for a Home Loan from Lenditt, you must get involved in the evaluation of various factors:

Regular income source:

Salaried - INR 15,000 Per Month Self-Employed - INR 20,000 Per Month

Age:

Salaried- 18-60 years Self-Employed - 18-65 years

Citizenship:

Resident Indian NRI (Non-Resident Indian)

Employment status:

At least 3 years of experience

2. Documentation:

Following are the documents you need to submit to get a Home Loan from Lenditt:

A. Indian Residents:

Employment details: Company ID Card, last 3 months’ salary slips.

KYC Documents: Passport, Driving License, Aadhaar Card, Voter ID Card, Registered Rent Agreement.

Bank account statements: Salaried- Last 6 months Self-Employed - 12 months

Document of proof of business: minimum 5 years (for businessmen/ self-employed professionals) Form 16 (Part A & Part B) and filed Income Tax Returns (ITR) for the past two years

B. Non-Residents(NRIs):

PAN Card for both applicant & co-applicant(s)

2 passport-sized photographs

HR confirmation letter mentioning designation, gross salary, present address, and contact details.

Work permit/CDC required

Passport(all pages) for both the applicant and co-applicant(s)

Valid work visa

Payslips for the last 3 months

Overseas bank statements for the previous 6 months

Latest 6-month NRE/NRO bank statement

Income tax returns for the last 2 years

Application:

Apply for the Home loan with Lenditt with these few steps:

Slide down to the Lenditt website and apply within 30 seconds.

Immediately, an advisor will be assigned to you, who will visit your house for the end-to-end fulfilment of your application.

After offer selection, verification and onboarding will be performed by the advisor.

Once your application gets approved, the advisor will collect hard copies of the documents and submit them to the bank, and your Home loan will be processed.

What makes Lenditt Home Loan a perfect choice for you?

Financial Benefits

Competitive Interest Rates:

Lenditt provides a Home loan at competitive interest rates, with easy EMI payments. Our home loan offer has been specially curated to make it affordable for people from different backgrounds. With low interest rates, we aim to provide financial support that matches your expectations and makes you pay less over time.

Dynamic Customer Support:

Lenditt offers dynamic customer support via phone and WhatsApp chat. You can receive round-the-clock customer support that solves your queries and can guide you throughout the journey to your home loan.

Affordable EMI:

Lenditt offers loans that are easy to avail for people coming from diverse financial backgrounds. The EMI options are gentle on the monthly budget of the individuals. With this you can effortlessly manage your credit history and have a good monthly cash inflow-outflow balance.

No Foreclosure Charges:

If you choose to repay your loan amount partially or completely before the tenure, you will not be charged penalties. You can repay your debt according to your financial stability and comfort. This feature is particularly beneficial if your financial situation improves and you want to reduce your debt burden sooner.

Pradhan Mantri Awas Yojana Subsidy:

A government program in India called the Pradhan Mantri Awas Yojana (PMAY) aims to give the urban poor access to affordable homes. When taking out a house loan with Lenditt, qualified borrowers may be able to access additional financial benefits through this initiative, which might further lower the cost of housing.

Transparent Fees & Charges:

Our loan application fees, additional charges and penalty policies are kept transparent and affordable for the borrowers. By the approach of transparent fees and charges, Lenditt aims to provide 100% trustworthy and genuine services to our valuable customers.

Conclusion

In this blog, we have discussed the salient features that make Lenditt an attractive opportunity to fulfil your dream of owning a house. Our streamlined application process with dynamic chat support is always ready to serve our customers.

So, whenever you want to support your dream house with financials, you can apply for a home loan online at Lenditt to experience our customer-friendly services. To learn more about Lenditt's home loan, visit our official website or contact customer support.

A Happy, Prosperous and Safe Diwali to Everyone!

Source Link: Help You Buy Your Dream Home This Diwali

0 notes

Text

New pan card apply online in canada

If you’re an Indian citizen living in Canada and need a Permanent Account Number (PAN) card for financial or tax-related activities in India, you’ll be happy to know that applying for one online is both simple and convenient. The PAN card, issued by the Indian Income Tax Department, is an essential document for individuals and businesses involved in any financial transactions in India. This guide will walk you through the steps to apply for a new PAN card apply online in Canada.

What is a PAN Card?

A PAN (Permanent Account Number) is a unique ten-digit alphanumeric identifier issued by the Income Tax Department of India. It is essential for various financial activities, including opening a bank account, investing in securities, purchasing real estate, and filing income tax returns. For Non-Resident Indians (NRIs), having a PAN card is crucial for managing any financial assets or income in India.

Who Needs a PAN Card?

NRIs, Overseas Citizens of India (OCIs), and even foreign nationals who have income sources in India or are engaged in financial activities such as investments or property dealings are required to have a PAN card.

Applying for a New PAN Card Online in Canada

If you want to apply for new pan card in canada so you can contact us +1 (416) 996–1341 or [email protected] to apply for new pan card.

1- Visit this site pancardcanada.com 2- And Go to application form 3- fill the details 4- submit the application form.

Conclusion

Apply for New PAN card in Canada is a straightforward process if you follow the required steps and provide accurate documentation. Whether you need it for tax purposes, financial transactions, or investments in India, having a PAN card ensures compliance with Indian financial regulations. By utilizing the online application process, you can easily obtain your PAN card without needing to travel back to India.

Contact Us- Phone- +1 (416) 996–1341 Email Us- [email protected]

0 notes

Text

how to apply for indian pan card in usa

A Permanent Account Number (PAN) is a vital identification tool for individuals and businesses in India, used primarily for tax purposes. Whether you are an Indian citizen residing abroad, a Non-Resident Indian (NRI), or a foreigner with financial interests in India, you may need a PAN card to engage in various transactions such as opening a bank account, investing in stocks, or filing taxes.

Fortunately,how to apply for an Indian PAN card in USA is a relatively straightforward process. Here’s a step-by-step guide to help you through the process.

Who Needs a PAN Card?

Indian citizens living abroad (NRIs)

Foreigners with business or financial interests in India (such as investments in Indian companies or property)

Indian companies or entities doing business in India

Foreign companies or entities operating in India

How to Apply for Indian PAN Card from the USA

If you want to apply for indian pan card so you can contact us +1 (416) 996–1341 or [email protected] to apply for indian pan card.

1- Visit this site indianpancardusa.com

2- And Go to application form of apply for pan card

3- fill the details

4- Upload documents

5- submit the application form.

Conclusion

how to apply for an Indian PAN card in USA can be done efficiently through online services provided by NSDL or UTIITSL. By following the steps outlined above, you can ensure a smooth application process and receive your PAN card to engage in financial and business activities in India.

Contact us Phone:- +1 (416) 996–1341 Email Us:- [email protected]

0 notes

Text

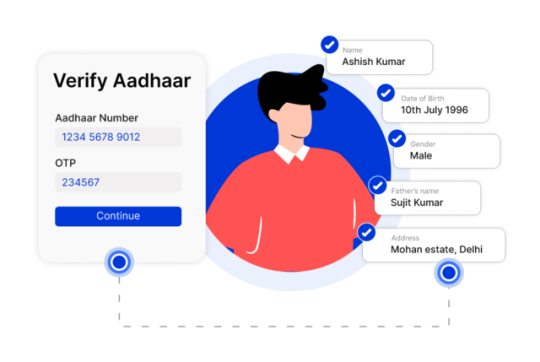

Everything You Need To Know About Aadhaar Verification

Aadhaar verification is now vital. It is part of many administrative and financial processes in India. Over a billion people are enrolled. The Aadhaar system is the world's largest biometric ID system. Understanding Aadhaar verification is key. It's crucial for navigating India's complex identity authentication. This guide covers the key aspects of Aadhaar verification. It includes its benefits and the verification process.

Table of Contents

Understanding Aadhaar

What is Aadhaar Verification?

What is the unique identification authority of India (UIDAI)?

Which Indian ministry oversees the Unique Identification Authority of India (UIDAI) and its operations related to Aadhaar?

Who has been appointed CEO of the Unique Identification Authority of India (UIDAI)?

Why is Aadhaar Verification Important?

How Aadhaar Verification Works?

Authentication Services

Step-by-Step Process of Aadhaar Verification

Documents Required for Aadhaar Card Verification

Why is Aadhaar card verification important?

Aadhaar Information

1. Demographic information

2. Biometric information

How to Update Aadhaar Card Details Online?

How to update the name, address, gender, and date of birth details online?

What can you change in an Aadhaar card online?

How can you update the address in Aadhaar without document proof?

How to Update Your Aadhaar Card Details at the Aadhaar Enrolment Centre?

How to Update Mobile Number in Aadhaar Card?

How to Change/Update Name in Aadhaar?

How to update the date of birth (DoB) on Aadhaar card?

What are the documents required for updating aadhaar information?

How do you enroll for Aadhaar?

What is the procedure to complete the Aadhaar enrolment process?

How to enroll for Child/Baal Aadhaar?

How do you Update Aadhaar?

How to Apply for Aadhaar Without Any Documents?

How to check the status of Aadhaar Application Online?

How to Get Your e-Aadhaar?

How to do Aadhaar Card Verification?

Common Uses of Aadhaar Verification

Use-cases for Aadhaar Card in India

Benefits of Aadhaar Verification

Benefits of Aadhaar Card for Government Process

Benefits of Aadhaar Card for Resident

Benefits of Linking Aadhaar

How can avail government subsidies and benefits through Aadhaar?

Challenges and Limitations

Aadhaar Verification in Financial Services

Aadhaar Verification in Government Services

Aadhaar Verification in Telecom Sector

Troubleshooting Common Issues

Legal Aspects of Aadhaar Verification

Future of Aadhaar Verification

Why is Identity Important for Services?

How Do Governments Verify Identity?

The Aadhaar Project: India's National ID

Identity and the Internet (Web 1.0 & Web 2.0)

Decentralized Identity (Web 3.0)

Digital ID and AI (Web 4.0?)

Aadhaar and Right to Privacy – Some Key Points

Supreme Court Rulings

Changes to the Aadhaar Act

Initial Concerns with Right to Privacy and Aadhaar

Conclusion

Frequently Asked Questions

What is Aadhaar Verification?

Why is Aadhaar Verification Important?

How Can I Verify My Aadhaar Number Online?

What Information Do I Need to Verify My Aadhaar Number?

Is There a Fee for Aadhaar Verification?

Can I Verify Someone Else’s Aadhaar Number?

What Should I Do If My Aadhaar Verification Fails?

How Can I Update My Aadhaar Details?

How Long Does It Take to Update Aadhaar Details?

Is Aadhaar Verification Mandatory for All Services?

Can NRIs and Foreigners Verify Their Aadhaar?

What Is e-KYC and How Is It Related to Aadhaar Verification?

How Secure Is the Aadhaar Verification Process?

What Happens If My Aadhaar Is Misused?

Where Can I Get Help with Aadhaar Verification?

What is an Aadhaar PVC Card?

How Can I Apply for an Aadhaar PVC Card?

What Are the Features of the Aadhaar PVC Card?

How Can I Check My PAN Card Status Using My Aadhaar Number?

How to do KYC online?

How to check KYC status?

How Can I Download an Aadhaar Card Online?

How to Download an Aadhaar Card Without an OTP?

Understanding Aadhaar

Overview Aadhaar is a 12-digit unique identification number. The Unique Identification Authority of India (UIDAI) issues the number. Aadhaar launched in 2009. It aims to provide a single, strong, and easy-to-check identity document. It is for India's residents. History The government started the Aadhaar project to establish a universal identity infrastructure. Both the government and private sector could use it. The first Aadhaar number was issued in 2010. It has expanded to cover a large portion of the Indian population. Importance Aadhaar is a foundational ID. It links services and systems to a single, verifiable identity. It is key to ensuring that subsidies, benefits, and services reach the right people. They make direct contact with them in a streamlined manner.

What is Aadhaar Verification?

Also called Aadhaar Authentication. It is validating a person's identity using their Aadhaar number. It involves cross-checking the given information with the UIDAI's database. This is to confirm the identity's authenticity. Many companies and organizations need people to show ID. They need it to get services, subsidies, or benefits. However, checking if these identity documents are correct can be hard. Aadhaar Authentication helps. It provides an easy way to check someone's identity online. And, it's instant and works from anywhere. India's Unique Identification Authority, a government agency, offers this service. It confirms customer identities with swift authentication. They can also check the identity of their employees or anyone else. They use Aadhaar, which helps ensure the right people get the services, subsidies, or benefits they need. It also helps them get the access they need.

What is the unique identification authority of India (UIDAI)?

The Unique Identification Authority of India (UIDAI) is a government agency. It handles implementing the Aadhaar scheme. The scheme aims to give a unique ID number to every resident of India. This number is called Aadhaar. It is a 12-digit unique identifier. The system links to the person's biometric and demographic data.

Which Indian ministry oversees the Unique Identification Authority of India (UIDAI) and its operations related to Aadhaar?

The Indian government created the Unique Identification Authority of India (UIDAI). It was created on July 12, 2016. It was set up under a law called the Aadhaar Act 2016. UIDAI is part of the Ministry of Electronics and Information Technology. It gives everyone in India a unique identification number called Aadhaar.

Who has been appointed CEO of the Unique Identification Authority of India (UIDAI)?

Amit Agrawal is the CEO of the Unique Identification Authority of India (UIDAI). He has worked in important government jobs in India. He focused on technology, finance, and education. He was also an Additional Secretary. He worked in the Ministry of Electronics and Information Technology. He also served in the Ministry of Finance. He has led tax and education departments in Chhattisgarh. He has also had other roles in state and local governments. Amit studied at the Indian Institute of Technology Kanpur. He has been on the boards of many technology, banking, and insurance companies. Purpose - The main objective of Aadhaar verification is to check if the person is who they claims to be.

Aadhaar is a special 12-digit number given to every Indian resident as proof of identity.

Helps make sure the right people get government benefits and reduces cheating.

Aadhaar makes it easier to open bank accounts. It also helps people get financial services, especially in rural areas.

Linking PAN with Aadhaar makes it easier to file taxes and is necessary for paying income tax.

Aadhaar allows digital authentication. This is for services like getting mobile connections and using online banking.

Helps provide accurate population data to create better government policies.

Usage - Aadhaar verification is used in many sectors. These include banking, telecom, and government. It makes processes faster and more secure.

Why is Aadhaar Verification Important?

[wptb id=3711]

How Aadhaar Verification Works?

[wptb id=3715]

Authentication Services

UIDAI offers online, real-time authentication. It does so through two data centers: Hebbal Data Centre (HDC) and Manesar Data Centre (MDC). The centers work together. They ensure that services like authentication and e-KYC are always available. CIDR can handle millions of logins every day. It can increase capacity as needed. Many providers use Aadhaar in their systems. It helps them deliver faster, better services across India. Let us have a clear look as below:-

What Aadhaar Authentication Will DoWhat Aadhaar Authentication Will Not Do✅ Authentication against resident’s data in UIDAI’s CIDR❌ Authentication against resident’s data on smart card✅ Return response to requesting agencies as Yes/No❌ Return personal identity information on residents✅ Initiate request over mobile network, landline network and broadband network❌ Remain restricted to broadband network✅ Require aadhaar for every authentication request reducing transactions to a 1:1 match❌ Search for aadhaar based on details provided requiring 1: N match

Step-by-Step Process of Aadhaar Verification

[wptb id=3722]

Documents Required for Aadhaar Card Verification

Identification Proofs - You can use documents such as a passport, PAN card, voter ID, or driving license as IDs. Address Proofs - You can use documents as proof of address. These include a utility bill, bank statement, or rental agreement. These documents must be current and valid.

Why is Aadhaar card verification important?

Your Aadhaar card is very important. It helps prove who you are, get government benefits, open bank accounts, get SIM cards and more. Check your Aadhaar card. This keeps your info correct and safe from misuse or theft.

Aadhaar Information

1. Demographic information

Name

Date of birth/age

Address

EID- the enrolment number

Barcode

2. Biometric information

Photograph

Iris scan (both eyes)

Fingerprints (all ten)

[wptb id=3733]

How to Update Aadhaar Card Details Online?

You can update your name, date of birth, address, and gender details online. However, your mobile number must be linked to the Aadhaar to make the changes.

How to update the name, address, gender, and date of birth details online?

Step 1 - Visit the official website of UIDAI Step 2 - Click on the 'Update Demographic Data and Check Status’. Log in to the portal using your Aadhaar and the OTP sent to your mobile number. Step 3 - Enter the Aadhaar number and the captcha. Step 4 - Click on 'Send OTP' and Enter the OTP that is sent to your registered mobile number. Step 5 - Next, select 'Update Demographics Data'. Step 6 - Select the relevant options on the next page and click on 'Proceed'. Step 7 - The changes can be made on the next page. Upload the relevant document. Step 8 - Next, you must review the details that have been entered. Step 9 - Next, submit the change request. You can use the Update Request Number (URN) to track the status of the address change.

What can you change in an Aadhaar card online?

You can update your address, name, gender, and birthdate. You can also update your email ID and home address. Also, you can update your marital status, fingerprints, and IRIS date. But, to make the adjustments online, you must link your Aadhaar to your cell phone number.

How can you update the address in Aadhaar without document proof?

Use the 'Request for Aadhaar Validation Letter’. The process involves:-

Step 1 - Resident Initiates Request

As a resident, you must log in by providing your Aadhaar details.

The Verifier Aadhaar details must be entered.

An SRN will be sent.

Step 2 - Address Verifier Consents

Click on the link that is sent to the registered mobile number.

Log in with the Aadhaar details.

Provide consent.

Step 3 - Address Verifier Consents

A Verifier Consent is sent to the registered mobile number.

Login by providing the SRN.

Preview the address details.

Change the language if needed.

Submit the request.

Step 4 - User Secret Code to Complete

A post will be sent with a letter and the Secret Code.

Login to the address update portal.

Change the address with the help of the Secret Code.

Check the address and submit.

A URN will be provided to check the status of the request.

How to Update Your Aadhaar Card Details at the Aadhaar Enrolment Centre?

Get the correction form from the nearest Aadhaar Enrolment Center and fill it out.

Attach the required documents and submit the form.

Pay Rs. 25 to update the address on your Aadhaar Card.

You will get an acknowledgment slip. Keep this slip for future reference.

How to Update Mobile Number in Aadhaar Card?

Go to the Aadhaar Seva Kendra.

Fill out the Update/Correction Form and add your new mobile number.

Submit the form.

Provide your biometrics to confirm your information.

Pay Rs. 50 as the fee.

You will get an acknowledgment slip with an Update Request Number (URN).

Use the URN to check the status of your request. It takes 30 days to update your new mobile number in Aadhaar's database. No additional documents are needed for this update.

How to Change/Update Name in Aadhaar?

Visit the Aadhaar Enrolment/Update Center.

Fill out the Aadhaar Update Form.

Enter your current mobile number on the form.

The staff will process your request.

Receive an acknowledgment slip with your Update Request Number (URN).

Pay a fee of Rs. 50.

How to update the date of birth (DoB) on an Aadhaar card?

Go to a nearby Aadhaar Enrolment Center.

Fill out the Aadhaar Update Form with your birth date.

Submit the form along with proof of date of birth.

Provide your biometrics for verification.

Get a receipt with your Update Request Number (URN).

Check the update status online using the URN.

Pay a fee of Rs. 50.

Your DoB will be updated within 90 days.

What are the documents required for updating aadhaar information?

Identity Proof: PAN Card, Passport, Driving License, Voter ID, etc.

Relationship Proof: Passport, PDS Card, MNREGA Job Card, Pension Card, etc.

Date of Birth Proof: Birth Certificate, School Leaving Certificate, Passport, PAN Card, etc.

Address Proof: Bank Passbook/Statement, Ration Card, Voter ID, Insurance Policy, etc.

How do you enroll for Aadhaar?

Go to any authorized Aadhaar Enrolment Center or Permanent Enrolment Centre.

Find a list of Aadhaar Enrolment Centers on the UIDAI website.

Over 10,000 post offices and bank branches can also enroll people for Aadhaar. This makes it easier.

What is the procedure to complete the Aadhaar enrolment process?

Go to the Aadhaar website to find a nearby enrolment center.

Fill out the form with your details.

Submit the necessary documents.

Provide your fingerprints and eye scan.

Get an acknowledgment slip after enrolment.

Your Aadhaar card will be mailed to your address.

Enrolling for Aadhaar is free and not mandatory.

How to enroll for Child/Baal Aadhaar?

Go to the UIDAI website to find the closest enrolment center.

Take the child’s birth certificate to the enrollment center.

Provide the Aadhaar number of one parent for authentication, as Baal Aadhaar will be linked to it.

Fill out the Baal Aadhaar application form with all details and a mobile number.

A photo of the child will be taken; no biometrics are needed for children under five.

Get an acknowledgment slip after completing the steps.

Baal Aadhaar will be sent to the address. A verification SMS will be sent to the mobile number.

How do you Update Aadhaar?

You can update Aadhaar either at an enrolment center or online. Here are the main reasons to update Aadhaar:

Change personal details like name, age, date of birth, mobile number, address, or photo.

Update biometric data like iris scans and fingerprints.

You can update your address online. For other personal details and biometric updates, you must visit an enrolment center.

How to Apply for Aadhaar Without Any Documents?

If you don't have any documents, you can still apply for Aadhaar using these methods:

Head of Family (HoF) Application: If a family member has a valid Aadhaar, they can provide documents. The documents show their relationship to you. Your Aadhaar will be processed after these details are verified.

Introducer-based Application: If you have no proof of identity or address, an Introducer appointed by a Registrar can help you enroll. You can find an Introducer at the Aadhaar Enrolment Centre.

For more details, you can check your Aadhaar status online.

How to check the status of Aadhaar Application Online?

Steps to Check Aadhaar Card Status:

Go to the official UIDAI website.

Log in using your username and password.

Click on 'Check Aadhaar Status' under the 'My Aadhaar' section.

Enter your enrolment number and the time of enrolment.

Type in the captcha code and click 'Check Status'.

How to Get Your e-Aadhaar?

To make Aadhaar more accessible, UIDAI offers e-Aadhaar. It's an electronic version of your Aadhaar card in PDF format. You can download it from the UIDAI website.

You can access e-Aadhaar using:

Your Aadhaar number

Your Virtual ID (VID)

Your Enrolment ID (EID) Check the UIDAI website for a step-by-step guide on how to download and print your e-Aadhaar card.

How to do Aadhaar Card Verification?

Steps to Verify Aadhaar Card:

Go to the official UIDAI website.

Click on the ‘My Aadhaar’ section.

Select ‘Verify an Aadhaar Number’ under ‘Aadhaar Services’.

Enter your Aadhaar number and the captcha code.

Click ‘Proceed and Verify Aadhaar’.

Follow the instructions on the next page to finish the process. If there is a mistake, you can call UIDAI's toll-free number 1947 for help. Check the website for a guide on how to view your authentication history.

Common Uses of Aadhaar Verification

[wptb id=3757]

Use-cases for Aadhaar Card in India

Benefits of Aadhaar Verification

[wptb id=3764]

Benefits of Aadhaar Card for Government Process

[wptb id=3772]

Benefits of Aadhaar Card for Resident

Each person has a unique Aadhaar number. Their biometrics are linked. So, there are no duplicate records in the government database.

You carry Aadhaar as a digital copy with convenience. You can verify it anywhere by contacting the UIDAI database.

Aadhaar provides security for mobile banking and payments with two-factor authentication.

Aadhaar card serves as universal proof of identity, address, and age.

Empowers low-income individuals to tap government programs with Aadhaar card convenience.

Benefits of Linking Aadhaar

[wptb id=3778]

How can avail government subsidies and benefits through Aadhaar?

[wptb id=3786]

Challenges and Limitations

[wptb id=3793]

Aadhaar Verification in Financial Services

[wptb id=3797]

Aadhaar Verification in Government Services

[wptb id=3802]

Aadhaar Verification in Telecom Sector

[wptb id=3805]

Troubleshooting Common Issues

[wptb id=3810]

Legal Aspects of Aadhaar Verification

[wptb id=3816]

Future of Aadhaar Verification

Identity tells us who we are in our communities. It includes things like our language, culture, religion, education, and job. These details make up our personal identity

Why is Identity Important for Services?

For governments and institutions to give us services like education, healthcare, banking, jobs, and travel, they need to know who we are. This is why they use "Know Your Customer" (KYC) checks. KYC makes sure we are who we say we are before we can open bank accounts, get loans, or buy SIM cards.

How Do Governments Verify Identity?

Governments and institutions give us services. These include education, healthcare, banking, jobs, and travel. These help prove who we are. As technology grows, digital identity checks are becoming more important.

The Aadhaar Project: India's National ID

Aadhaar is a successful digital ID system in India. It has given 1.3 billion people a unique number. Aadhaar allows online identity verification, making it cheap and easy. It has reduced verification costs from Rs 500 to just Rs 3. This system supports many online checks and is a key part of India’s digital infrastructure.

Identity and the Internet (Web 1.0 & Web 2.0)

When the internet started, it was hard to know who was who online. A famous cartoon showed a dog saying, "On the internet, nobody knows you’re a dog." Early on, people could easily create many online accounts. Later, Google and Facebook let us use one login for many sites. This made things easier but raised privacy concerns.

Decentralized Identity (Web 3.0)

Now, with blockchain technology, Web 3.0 offers a new way to manage identity. People can control their own credentials without needing big companies like Google. This system uses technologies like Verifiable Credentials (VC) and Digital ID standards (DID). They keep data private and secure on a decentralized ledger.

Digital ID and AI (Web 4.0?)

Artificial Intelligence (AI), especially Generative AI, brings new challenges. AI can create fake media that looks real, making it hard to trust online identities. We need a way to prove if someone is human. Aadhaar’s biometric checks are great for this. They can tell if a person is real or an AI robot. This keeps our transactions safe and trustworthy. India's Aadhaar project helps us prove our identity securely. It ensures that we can trust who we interact with online. This is especially important as AI continues to develop.

Aadhaar and Right to Privacy – Some Key Points

Privacy Concerns Many people worry about privacy because Aadhaar data is kept online. Linking Aadhaar to bank accounts and payment apps has raised questions. They are about the Right to Privacy.

Supreme Court Rulings

The Supreme Court ruled that Aadhaar data cannot be stored for more than six months. Before, the Aadhaar Act allowed storing data for five years.

The Court changed Section 2(d) of the Aadhaar Act. This stopped the government from keeping transaction data.

The Court also said the government needs to create a strong data protection law quickly.

Changes to the Aadhaar Act

Some parts of the Aadhaar Act were removed. For example, they removed Section 57. It lets private companies check Aadhaar data. The Court said this was unconstitutional.

The Supreme Court said this on September 26, 2018. They said Aadhaar brings benefits to the poor and respects people's dignity. But, it disagreed with making Aadhaar linking mandatory for certain other areas.

Initial Concerns with Right to Privacy and Aadhaar

With more cyber-attacks and data leaks, people worry about their Right to Privacy. It is a basic right for everyone in the country. In December 2018, the Government passed the Data Protection Bill. The decision about the Right to Privacy by the Supreme Court served as the basis. The government needs to understand all aspects of the right to privacy. It must ensure data safety. This includes protecting against unauthorized access. It also includes guarding against spying. It addresses unauthorized use of personal data and physical privacy breaches. If the Government follows the Supreme Court's advice, it will protect people's privacy. Using minimal data and biometrics will keep everyone's right to privacy safe.

Conclusion

Aadhaar verification is vital. It ensures accurate and secure identity authentication in India. Despite challenges. But, its benefits are clear. It streamlines services, cuts fraud, and boosts security. Technology and policies are changing. Aadhaar verification will keep playing a key role in India's digital landscape. It will help make governance and service delivery more efficient.

Frequently Asked Questions

What is Aadhaar Verification?

Aadhaar verification confirms an individual's Aadhaar number and its info. It uses their biometrics or demographic data.

Why is Aadhaar Verification Important?

It ensures the Aadhaar number is valid and belongs to the person claiming it. This helps prevent fraud and misuse of identity.

How Can I Verify My Aadhaar Number Online?

You can check your Aadhaar number online. Go to the UIDAI website and click on ‘My Aadhaar’ and then ‘Verify an Aadhaar Number.’

What Information Do I Need to Verify My Aadhaar Number?

You need your 12-digit Aadhaar number. You also need the security captcha code shown on the verification page.

Is There a Fee for Aadhaar Verification?

No, verifying your Aadhaar number online through the UIDAI website is free of charge.

Can I Verify Someone Else’s Aadhaar Number?

Yes, you can verify someone else's Aadhaar number. You can do this if you have their consent and the needed details (Aadhaar number and captcha code).

What Should I Do If My Aadhaar Verification Fails?

If your Aadhaar verification fails, check if you have entered the correct details. If the problem continues, you may need to visit an Aadhaar Enrolment/Update Center for more help.

How Can I Update My Aadhaar Details?

You can update your Aadhaar details by visiting an Aadhaar Enrolment/Update Center. You need the necessary documents. Then, you must fill out the update form.

How Long Does It Take to Update Aadhaar Details?

After you submit your update request, it can take up to 90 days for the changes to appear in the Aadhaar database.

Is Aadhaar Verification Mandatory for All Services?

You must do Aadhaar verification for some services. These include opening bank accounts, applying for passports, and getting government subsidies. But, it is not mandatory for all services.

Can NRIs and Foreigners Verify Their Aadhaar?

NRIs with valid Aadhaar numbers can verify their Aadhaar details. Foreigners are not eligible for Aadhaar and thus cannot undergo Aadhaar verification.

What Is e-KYC and How Is It Related to Aadhaar Verification?

E-KYC (electronic Know Your Customer) is a paperless process. It verifies the identity and address of individuals using their Aadhaar details. It is a quick and secure method for identity verification.

How Secure Is the Aadhaar Verification Process?

Aadhaar verification is very secure. It uses advanced encryption to protect data and privacy.

What Happens If My Aadhaar Is Misused?

If you suspect misuse of your Aadhaar, you should contact UIDAI. Report the issue right away. You can also lock or unlock your biometrics at the UIDAI website. This is for extra security.

Where Can I Get Help with Aadhaar Verification?

For help with Aadhaar verification, you can visit the UIDAI website. You can also call their helpline at 1947 or visit an Aadhaar Enrolment/Update Center.

What is an Aadhaar PVC Card?

An Aadhaar PVC card is a tough and handy form of the Aadhaar card. It is printed on PVC (polyvinyl chloride) material. It has the same information as the regular Aadhaar card. This includes the Aadhaar number, photo, details, and a QR code for easy verification. The PVC card is more robust and easier to carry than the paper version.

How Can I Apply for an Aadhaar PVC Card?

You can apply for an Aadhaar PVC card online through the UIDAI website. Here are the steps:

Visit the official UIDAI website.

Click on the "Order Aadhaar PVC Card" option under the 'My Aadhaar' section.

Enter your 12-digit Aadhaar number or 16-digit Virtual ID (VID) and the security captcha.

Click on "Send OTP" and enter the OTP received on your registered mobile number.

Verify your details and make the payment of Rs. 50.

After you pay, you will get an acknowledgment. You can track your PVC card delivery.

What Are the Features of the Aadhaar PVC Card?

The Aadhaar PVC card includes several security features to prevent forgery and misuse. These features include:

Secure QR code with photograph and demographic details.

Hologram for authenticity.

Micro-text and Ghost image.

Issue date and print date.

Guilloche pattern.

It is also waterproof and tough. This makes it a convenient form of ID to carry.

How Can I Check My PAN Card Status Using My Aadhaar Number?

Visit the Official Website: Go to the Income Tax e-filing website or the NSDL PAN service portal.

Go to the PAN Status Check. Look for the option to check PAN status. It's usually under 'Quick Links' or 'Services'.

Enter Aadhaar Details: Select the option to check PAN status using Aadhaar. Enter your 12-digit Aadhaar number in the required field.

Submit and Verify: Enter the captcha code for security verification. Then, click 'Submit' or 'Check Status'.

View Status: The website will show your PAN card application's status. It will say if it is active, in process, or otherwise.

How to do KYC online?

Visit the Service Provider's Website. Go to the website of the bank or company that needs KYC.

Locate the KYC Section: Find the section for KYC or account verification. This is often found under 'My Account' or 'Services'.

Choose Online KYC Option: Select the option for online KYC, often labeled as 'e-KYC' or 'Digital KYC'.

Enter Required Details. Fill in your personal details as asked. Include your name, date of birth, and Aadhaar number.

Verify Your Identity: Authenticate your identity using your Aadhaar number. This usually involves receiving an OTP (One-Time Password) on your registered mobile number. Enter the OTP to verify.

Upload Documents. Upload digital copies of the needed documents. These include your Aadhaar card, PAN card, or passport. They prove your identity and address.

Submit the application. After entering all details and uploading documents, submit your KYC application.

You will get a confirmation message or email. Once you complete your KYC, it will come.

How to check KYC status?

Visit the Bank’s Website. Go to the bank, financial institution, or service provider's official website. It's where you submitted your KYC.

Find the KYC Status Section. Look for an option that says 'Check KYC Status' or something similar. It resides beneath the 'Services' or 'Account' sections on the page.

Enter Required Details. Enter your registered mobile number, customer ID, or other requested info. This will allow us to locate your KYC records.

Submit Information: Click on 'Submit' or 'Check Status' to proceed.

View KYC Status. Your status will appear on the screen. It will show the status when it is done. It will show if it is in progress or needs more action.

How Can I Download an Aadhaar Card Online?

Visit the UIDAI Website: Go to the official UIDAI website (https://uidai.gov.in).

Go to the 'My Aadhaar' Section: Under the 'My Aadhaar' menu, select 'Download Aadhaar'.

Enter Your Details: Choose one of the options: 'Aadhaar Number', 'Enrolment ID (EID)', or 'Virtual ID (VID)'. Then, enter the respective number and the security captcha.

Request OTP: Click on 'Send OTP'. An OTP (One-Time Password) will be sent to your registered mobile number.

Enter OTP: Enter the OTP received on your mobile phone in the provided field.

Download Aadhaar: After verifying the OTP, click on 'Download Aadhaar'. You will download your e-Aadhaar PDF.

Open the PDF: The downloaded Aadhaar card PDF is password protected. To open it, enter the password. It is the first four letters of your name in CAPITAL letters followed by your birth year in YYYY format (e.g., JOHN1985).

How to Download an Aadhaar Card Without an OTP?

Download the mAadhaar App: Install the mAadhaar app from the Google Play Store or Apple App Store.

Open the App: Launch the app and set a 4-digit PIN for security.

Add Your Aadhaar Profile: Enter your 12-digit Aadhaar number or scan the QR code on your Aadhaar card.

Use biometric authentication in the app: It verifies your identity. You can do this using your fingerprint or facial recognition.

Download Aadhaar: Once verified, you can get your Aadhaar card from the app.

Or, visit an Aadhaar Enrolment Center with your Aadhaar number. Request a printout of your Aadhaar card there. You can do this without an OTP.

0 notes

Text

🌐 PAN India 2024 updated Database available now with 200+ Categories 📊

WhatsApp: wa.me/+918700583916

Today Just@ ₹999

Categories List below:

👥 B2B | B2C | Companies | Corporate 👔

👨⚖️ Advocates / Lawyers ⚖️

🌐 Website Owners 🌐

🚗 Car Owners 🚗

🌍 NRIs 🌍

🏢 Real Estate Leads 🏠

💼 HNI/High-Income Employees 💰

🏭 Manufacturing Companies 🏭

👕 Garments Exporters 🌍

🏢 Architect | Interior Designers 🏠

☎️ BPO/ Call Centres 📞

👨💼 CEO/ CFO/ CMO/ MD/ IT Head 💼

📝 C.A | Investors 💼

👔 Chairmen 💼

👩⚕️ Doctors 🏥

🧪 Chemical/ Pharma Companies 💊

👩🔬 Chemists 💊

🏠 Property Buyers 🏢

👨🏫 Professors 👩🏫 Teachers 👨🎓 Students 🎓

🎪 Event Management Organisers 🎉

📦 Exporters Database 🚢

👩💼 Females 👩

💆♀️ Beauty Parlours / SPA 💅

🕵️♂️ Job Seekers 🔎

💳 Credit Card Holders 💳

🌍 State Wise Data 🌍

📸 Photography Studios 📷

👩💼 HR | IT Companies 💻

🏨 Hotels/ Restaurants/ Bars 🍽️

🏦 Bank Database 🏦

🏢 Real Estate Agents 🏠

💼 Demat Account Holders 💼

🏫 School / College / Educational Institutes 🏫

🌐 Online User & Shopper Database 🛍️

etc… 💼

Description:-

🌐PAN India Database, 200+ Categories Now Generate Unlimited Leads at Zero Cost, Boost Your Sales & Marketing With The Power Of a Genuine Database 💪 and increase your clients. 💼

High Accuracy, Clean, and formatted database with no duplicates & repeats.

Total Size of Database - 30 GB+

Database Attributes : Name, Email, Phone Number, Category/Work/, Pin code, City, District & State wise.

All Databases are in Excel Format Database will be sent to email via google Drive U can Download and store it on a PC/laptop/mobile.

https://jitglobal.in/product/database/ >>> Buy Now

0 notes

Text

PAN Card Processes: The Role of a Pan Card Agent in USA with Indian Pan Card USA

For Non-Resident Indians (NRIs) residing in the United States, managing financial matters in India can be intricate. One crucial aspect is obtaining a PAN card, and engaging with a Pan Card agent in USA can significantly simplify the process. In this guide, we explore the significance of a Pan Card agent and how Indian Pan Card USA serves as a reliable ally for NRIs seeking this essential financial document.

Understanding the Importance of a PAN Card for NRIs

The Permanent Account Number (PAN) card is a vital identification document for NRIs, required for various financial transactions. From filing income tax returns to investing in India and conducting property transactions, a PAN card is a prerequisite. However, the distance and complexity of the application process can pose challenges for NRIs.

The Role of a Pan Card Agent in the USA

A Pan card in chicago plays a pivotal role in bridging the gap between NRIs and the Indian financial system. Here's how Indian Pan Card USA, as a Pan Card agent, facilitates the process:

1. Expert Guidance:

Engaging with a Pan Card agent provides NRIs with expert guidance throughout the application process. Indian Pan Card USA ensures that applicants have access to accurate information, clarifying doubts and uncertainties to streamline the application journey.

2. Documentation Assistance:

The documentation required for a PAN card application can be extensive. A Pan Card agent in the USA, such as Indian Pan Card USA, assists NRIs in gathering and submitting the necessary documents. This not only simplifies the process but also reduces the likelihood of errors or omissions.

3. Application Submission:

Navigating the online application process for a PAN card can be challenging for NRIs. As a Pan Card agent, Indian Pan Card USA takes on the responsibility of submitting the application on behalf of the NRI, ensuring that all details are accurately entered and processed.

4. Timely Updates:

Keeping track of the application status and updates can be time-consuming. Indian Pan Card USA, acting as a Pan Card agent in the USA, provides timely updates to NRIs regarding the progress of their PAN card application. This transparency helps applicants stay informed and alleviates any concerns.

How Indian Pan Card USA Facilitates the Process

Indian Pan Card USA stands out as a reliable Pan Card agent, offering several advantages to NRIs:

1. Accessibility:

Indian Pan Card USA is accessible to NRIs in the USA, providing a convenient and reliable channel for PAN card applications. The online platform ensures that NRIs can engage with the services from the comfort of their homes.

2. Efficient Processing:

Efficiency is a hallmark of Indian Pan Card USA. The platform expedites the processing of PAN card applications, ensuring that NRIs receive their cards promptly and can proceed with their financial transactions without unnecessary delays.

3. Secure Transactions:

Security is paramount in financial transactions. Indian Pan Card USA prioritizes the security of online transactions, providing a safe and secure platform for NRIs to engage with as they apply for their PAN cards.

4. Responsive Customer Support:

Indian Pan Card USA offers responsive customer support to address queries and concerns. The customer support team is dedicated to ensuring that NRIs have the necessary assistance and information at their fingertips.

In conclusion, a Apply for pan card in usa such as Indian Pan Card USA serves as a valuable partner for NRIs navigating the complexities of obtaining a PAN card. With expert guidance, streamlined processes, and a commitment to efficiency, Indian Pan Card USA ensures that NRIs can manage their financial affairs in India with ease.

0 notes

Text

All You Need to Know About the National Pension System (NPS)

The National Pension System (NPS) is a government-sponsored pension program in India designed to provide retirement income to Indian citizens. It is a voluntary, long-term investment plan that helps individuals build a substantial corpus for their post-retirement years. In this comprehensive guide, we will explore the key aspects of NPS, including its features, benefits, and how you can get started with it.

Features and Benefits of NPS

Voluntary and Flexible

NPS is a voluntary savings scheme, which means individuals can choose to participate. It offers flexibility in terms of contributions, allowing you to contribute as per your financial capacity.

Two Tiers of NPS

NPS consists of two tiers: Tier I and Tier II. Tier I is a mandatory, long-term retirement account with restrictions on withdrawals, designed to ensure savings for retirement. Tier II, on the other hand, is a voluntary account that offers greater liquidity.

Regular Contributions

Under Tier I, regular contributions are made by the subscriber throughout their working years. These contributions are invested in a mix of equity, corporate bonds, and government securities, depending on the choice of the subscriber.

Tax Benefits

NPS offers attractive tax benefits. Contributions to Tier I accounts are eligible for a deduction under Section 80CCD (1) of the Income Tax Act, up to a maximum limit of 10% of your gross income (in addition to the Section 80C limit). Additionally, there's an extra deduction of up to Rs. 50,000 under Section 80CCD (1B).

Auto Choice Option

NPS allows subscribers to choose their asset allocation or opt for the "Auto Choice" option, which automatically adjusts the asset mix based on the subscriber's age. It starts with a higher equity allocation and gradually shifts to a more conservative portfolio as the subscriber approaches retirement.

Lump Sum and Annuity Options

On reaching the retirement age of 60, you can withdraw a portion of the accumulated corpus as a lump sum (up to 60%) while the remaining must be used to purchase an annuity plan that provides a regular pension income.

Portability

NPS is a portable scheme, meaning you can continue your account even if you change your job or location. This feature ensures that your retirement savings remain unaffected by career moves.

How to Open an NPS Account

Eligibility

NPS is open to all Indian citizens, including resident and non-resident Indians. Even NRIs can avail of the benefits of NPS.

Permanent Retirement Account Number (PRAN)

To open NPS account online, you need to apply through a Point of Presence (POP). You'll receive a PRAN card, which is your unique NPS account number. This PRAN remains the same throughout your life, even if you switch jobs or locations.

Choose the Right Fund Manager

NPS allows you to select a fund manager from a list of pension fund managers authorized by the Pension Fund Regulatory and Development Authority (PFRDA).

Submit KYC Document

Like any financial account, you'll need to submit Know Your Customer (KYC) documents for identity and address verification. This typically includes Aadhar Card, PAN card, and a passport-sized photograph.

Initial Contribution

You'll have to make an initial contribution, which varies depending on the fund manager you choose. This amount can range from as low as Rs. 500 to Rs. 1,000.

Regular Contributions

After opening your NPS account, you need to contribute regularly. You can choose the frequency and amount of your contributions.

Monitor Your NPS Account

It's important to keep an eye on your NPS account, track your contributions, and review your fund's performance to ensure your retirement corpus is growing as per your goals.

NPS Tax Benefits

NPS offers attractive tax benefits, making it a popular choice for long-term savings:

Section 80CCD(1): Contributions to NPS up to 10% of your salary (for salaried individuals) or 10% of gross income (for self-employed individuals) are eligible for a deduction under Section 80CCD(1) of the Income Tax Act. This deduction is within the overall limit of Section 80C.

Section 80CCD(1B): An additional deduction of up to Rs. 50,000 is available under Section 80CCD(1B) for contributions made to NPS.

Section 80CCD(2): Employer contributions to NPS, up to 10% of salary, can be claimed as a deduction under Section 80CCD(2).

Tax on Withdrawal: While the lump sum withdrawal is tax-free up to 60%, the annuity income is taxable as per your applicable tax slab.

Conclusion

The National Pension System (NPS) is a versatile and tax-efficient investment option designed to secure your financial future during retirement. With its flexible contributions, tax benefits, and a choice of fund managers, NPS caters to a wide range of investors. By starting early and staying committed to your contributions, you can build a substantial corpus that will provide you with financial security during your retirement years. So, open NPS account online with stockholding as an integral part of your retirement planning and start building a better tomorrow today.

0 notes

Text

What Is The Necessity Of Online OCI Services in Canada?

People with Overseas Citizenship of India (OCI) cards significantly contribute to fostering ties between India and their home countries. For those of Indian descent residing overseas, an OCI card is a crucial piece of identification since it allows them to enter India visa-free, among other privileges. However, getting or keeping an OCI card might sometimes be a hassle. To address these issues, Online oci services in Canada, such as PANCARD CANADA, have arisen, making the procedure simpler and more accessible for those living in Canada.

About

If you need to apply for a new OCI card in Canada, PanCardCanada.com is a reliable option. Our online oci services in Canada specialise in streamlining the application process for Indian Permanent Account Number (PAN) cards for NRIs, OCIs, PIOs, non-Indian nationals, and foreign corporations based in Canada. We drastically reduced application processing times because of our extensive expertise and experience. Many people have relied on the assistance of our professionals while applying for an OCI card online. The first step is to go to our website and complete an online form. You can also contact a local representative for the form and assistance with completion. For a little price, fill out the form and mail us the required documentation, and we'll handle everything else. If you need a new OCI card in Canada, you can rely on PanCardCanada.com to help you acquire one quickly and easily.

OCI Service:

A lifetime visa with many entries and various uses for travel to India.

Exemption from registering for any period in India with the local police authority.

Equality with Non-Resident Indians (NRIs) in economics, finance, and education, except for purchasing plantation or agricultural estates.

Equitable treatment with Non-Resident Indians (NRIs) is concerning.

a) The cost of entry to India's national monuments, historical sites, and museums

b) pursuing the following careers in India following the requirements of the applicable Acts: architects, chartered accountants, physicians, dentists, nurses and chemists; advocates,

c) to show up for the All-India Pre-Medical Test or any other tests that would qualify them for admission following the requirements of the applicable Acts.

d) The Ministry of Overseas Indian Affairs (MOIA) will notify OCIs of any additional benefits according to Section 7B (1) of the Citizenship Act, 1955.

Features:

The easiest method in North America to get an OCI CARD.

Use WhatsApp to call anywhere else, and 1-416-996-1341 if you're calling from the US or Canada.

Within three to five business days, the applicant will get their electronic OCI CARD in the mail if all goes according to plan.

You will be refunded less than the 25% processing cost if the application is denied.

You need the application and any supporting paperwork sent by courier to India. You may send anything to our Canadian office with confidence. Save time and money (courier fees might range from $50 to $90).

Do it! Call 416-996-1341 to get an OCI Card in a timely and professional manner. Conclusion: Individuals of Indian descent living overseas might benefit greatly from obtaining an Overseas Citizens of India (OCI) card. However, deciding how to proceed with an application might take time and effort. PANCARDCANADA has been the go-to provider for Canadians needing OCI cards because of its dependability and speed. PANCARDCANADA is one of the Online oci services in Canada; it has made applying for an OCI card easy by providing applicants with professional advice, computerised processing capabilities, quick turnaround times, low costs, and outstanding customer service.

0 notes

Text

Apply for a pan card online

A Permanent Account Number (PAN) card is an essential document in India for financial transactions, including opening a bank account, filing taxes, and investing in the stock market. The good news is that applying for a PAN card has become a hassle-free process thanks to the online application system. This article provides a comprehensive guide on Apply for a PAN card online.

Understanding PAN Card and Its Importance

A PAN card is a 10-digit alphanumeric identifier issued by the Income Tax Department of India. It is unique to every individual or entity and is required for several financial transactions to prevent tax evasion and ensure a transparent tax system. Having a PAN card is mandatory for:

Filing income tax returns

Opening a bank account

Making financial transactions above a certain limit

Buying or selling property

Investing in stocks or mutual funds

Eligibility Criteria for PAN Card Application

Before you apply, ensure you meet the following eligibility criteria:

Individuals: Any Indian citizen, including minors and students.

NRIs: Non-Resident Indians (NRIs) and foreign citizens investing in India.

Entities: Businesses, firms, companies, and organizations.

Applying for a PAN Card Online

If you want to apply for a pan card so you can contact us +1 (416) 996–1341 or [email protected] to apply for a pan card online. 1- Visit this site pancardcanada.com 2- And Go to application form of apply for pan card 3- fill the details 4- submit the application form.

Conclusion

Apply for a PAN card online is a straightforward process if you follow the correct steps and ensure all details are accurate. With the convenience of online application, obtaining a PAN card is now quicker and more efficient. Whether you are an individual, a business entity, or a foreign investor, having a PAN card is crucial for financial transparency and compliance with Indian tax laws.

Contact Us- Phone- +1 (416) 996–1341 Email Us- [email protected]

0 notes

Text

Income Tax Return Filing: A Comprehensive Guide to Financial Compliance

In a world where taxes are an inevitable part of life, understanding the process of income tax return filing is crucial. This comprehensive guide, spanning 3000 words, aims to demystify the complexities of filing your income tax return while providing valuable insights, tips, and strategies to ensure you remain in good financial standing with the tax authorities.

Section 1: Understanding Income Tax Return Filing

Why is Income Tax Important?

Income tax is a fundamental source of revenue for governments worldwide. It finances public services, infrastructure, and various welfare programs. Filing your income tax return accurately and on time not only helps you fulfill your civic duty but also avoids legal repercussions.

Who Needs to File Income Tax Returns?

Determining whether you need to file an income tax return depends on your income level, age, and various other factors. We'll delve into the specifics in this section.

Different Types of Income Tax Returns

Income tax returns come in various forms, each catering to different categories of taxpayers. Understanding which form to use is crucial for a smooth filing process.

Section 2: Preparing for Income Tax Return Filing

Gathering Necessary Documents

Before you start the filing process, you must gather essential documents, such as your PAN card, Aadhar card, Form 16, and bank statements. We'll provide a comprehensive checklist to ensure you have everything you need.

Assessing Your Taxable Income

Calculating your taxable income is a critical step. We'll walk you through the process, including deductions, exemptions, and other factors that affect your final tax liability.

Choosing the Right Filing Status

Your filing status can significantly impact your tax liability. We'll explore the various filing statuses and help you determine which one applies to your situation.

Online vs. Offline Filing

With the advent of technology, filing income tax returns online has become the norm. We'll discuss the advantages of online filing and guide you through the process.

Section 3: The Income Tax Return Filing Process

Step-by-Step Guide to Filing Your Tax Return

We'll provide a detailed, user-friendly guide to the actual filing process, ensuring that you understand every step along the way.

Common Mistakes to Avoid

Many taxpayers make errors when filing their returns, which can lead to audits and penalties. We'll highlight common mistakes and explain how to avoid them.

E-filing vs. Physical Filing

While e-filing is convenient, some taxpayers prefer the traditional physical filing method. We'll weigh the pros and cons of each to help you make an informed choice.

Section 4: Tax Deductions and Exemptions

Understanding Tax Deductions

Tax deductions are a powerful tool for reducing your tax liability. We'll explore various deductions available to taxpayers, such as Section 80C, 80D, and 10(14).

Exemptions and Rebates

Discover the difference between tax deductions and exemptions and learn how you can benefit from these financial incentives.

Investment Strategies for Tax Savings

Explore smart investment options that not only grow your wealth but also offer tax benefits.

Section 5: Special Scenarios

Income from Other Sources

If you have income from sources other than your salary, such as rental income or investments, we'll explain how to handle it during the filing process.

Tax for Self-Employed Individuals

Running your own business or working as a freelancer comes with unique tax considerations. We'll guide you on how to navigate these complexities.

Income Tax for NRI (Non-Resident Indian)

Non-resident Indians have a different tax structure to consider. We'll provide an overview of the rules and regulations pertaining to NRIs.

Section 6: Post-Filing Considerations

Tracking Your Refund Status

Once you've filed your return, you may be eligible for a tax refund. We'll show you how to track the status of your refund.

Handling Tax Notices

In the event that you receive a tax notice, it's essential to respond promptly and appropriately. We'll explain how to handle such situations.

Year-Round Tax Planning

Filing your tax return isn't just a once-a-year task. We'll discuss year-round tax planning strategies to minimize your tax liability.

Section 7: Conclusion

Income tax return filing is a vital aspect of financial responsibility. With the information and insights provided in this comprehensive guide, you can navigate the process with confidence. Remember, timely and accurate filing not only keeps you in compliance with the law but also helps you maximize your financial well-being.

Stay informed, plan ahead, and take control of your financial future by mastering the art of income tax return filing. Your financial health and peace of mind depend on it.

In conclusion, the process of income tax return filing may seem daunting at first, but with the right knowledge and preparation, you can navigate it successfully. Be proactive, stay informed, and consult with tax professionals when needed to ensure that you fulfill your tax obligations while optimizing your financial situation.

0 notes

Text

How to apply for indian pan card in usa

A Permanent Account Number (PAN) is a vital identification for individuals and entities involved in financial transactions in India. It is primarily used for tax purposes, but it’s required for a variety of services such as opening a bank account, making investments, and buying property in India. If you’re living in the USA and need a PAN card, you can still apply for one without traveling to India. This article will guide you through the process of how to apply for an Indian PAN card in USA.

Why Do You Need a PAN Card?

Before jumping into the steps, it’s important to understand why you may need a PAN card as an NRI (Non-Resident Indian) or OCI (Overseas Citizen of India):

Filing Income Tax in India: If you have income from India (such as rent, dividends, or other business-related income), you need a PAN card to file tax returns.

Investments: PAN is mandatory for investing in Indian stocks, mutual funds, or property.

Bank Accounts and Loans: If you wish to open an NRI account in India or avail loans, you must possess a PAN card.

Property Purchases: Any real estate transaction in India requires the buyer to submit their PAN.

How to Apply for Indian PAN Card from the USA

If you want to apply for indian pan card so you can contact us +1 (416) 996–1341 or [email protected] to apply for indian pan card.

1- Visit this site indianpancardusa.com

2- And Go to application form of apply for pan card

3- fill the details

4- Upload documents

5- submit the application form.

Conclusion

how to apply for an Indian PAN card in USA is a straightforward process if you follow the necessary steps. Whether you need it for tax purposes, investments, or property dealings in India, having a PAN card simplifies the process of managing your financial interests. By using the online application system, NRIs and foreign citizens can now apply for a PAN card from the comfort of their homes in the USA.

Contact us Phone:- +1 (416) 996–1341 Email Us:- [email protected]

0 notes