#Online Bookkeeping Services Australia

Explore tagged Tumblr posts

Text

7 Reasons Why People Get Bookkeeping Services Online

Bookkeeping is essential to running a business but can be tedious and time-consuming. As a result, many business owners are opting for online bookkeeper services provider in Australia to help them manage their finances. Here are some key fundamentals of bookkeeping:

Record-keeping: Bookkeeping involves recording all financial transactions that occur in a business, including sales, purchases, expenses, and payments. These records should be accurate, complete, and up-to-date.

Double-entry system: Bookkeeping uses a double-entry system, which means that every financial transaction must be recorded in at least two accounts: a debit account and a credit account.

Chart of Accounts: A Chart of Accounts is a list of all the accounts used in a business's bookkeeping system, including liabilities, assets, revenue, equity, as well as other expenses. Each account has a unique code or number used to record transactions.

General Ledger: The general ledger is the central repository for all financial transactions in a business. It records all the debits and credits in the Chart of Accounts.

Journal Entries: Journal entries are the primary means of recording financial transactions in bookkeeping. Each entry includes the date, account numbers, a brief description of the transaction, and the amount.

Financial Statements: Bookkeeping provides the basis for creating financial statements, such as the Balance Sheet, Income Statement, and Cash Flow Statement. These statements provide a snapshot of the financial health of a business and are essential for making informed decisions.

Reconciliation: Reconciliation involves comparing the balances in the general ledger to other sources of financial information, such as bank statements or credit card statements. This ensures that the books are accurate and complete.

Software: Bookkeeping solutions offered by VNC Global - an excellent bookkeeping services provider in Australia using bookkeeping software can help automate many bookkeeping tasks, making the process faster and more efficient. Many software programs can also generate financial statements and reports, providing valuable insights into a business's financial health.

Bookkeeping involves recording and organizing financial transactions, using a double-entry system, creating a chart of accounts, maintaining a general ledger, creating journal entries, producing financial statements, reconciling accounts, and using software to automate tasks. By mastering the fundamentals of bookkeeping, businesses can ensure that their financial records are accurate and up-to-date, which is essential for making informed decisions.

Outsourcing bookkeeping services:

Cost-effective: Outsourcing bookkeeping services can be cost-effective for small and medium-sized businesses. Hiring an in-house bookkeeper can be expensive as you need to pay a salary, benefits, and other expenses. By outsourcing, you only pay for the services you need, which can save you money in the long run.

Expertise: Outsourcing bookkeeping services give you access to a team of experts with experience handling bookkeeping for various businesses. These experts can provide accurate and timely financial information to help you make informed decisions for your business.

Time-saving: Bookkeeping can be time-consuming, preventing you from running your business. Outsourcing bookkeeping services frees up your time, allowing you to focus on other important tasks that can help grow your business.

Scalability: Outsourcing bookkeeping services allows you to scale your business easily. You can increase or decrease the services you need based on your business needs. This gives you more flexibility and can save you money in the long run.

Access to the latest technology: Outsourcing bookkeeping services can give you access to the latest technology and software. This can help you streamline your bookkeeping processes and make your business more efficient.

Compliance: Bookkeeping involves meeting various compliance requirements, including tax laws and regulations. Outsourcing bookkeeping services can help ensure you comply with all regulations, reducing the risk of penalties and fines.

Peace of mind: Outsourcing bookkeeping services can give you peace of mind knowing that your financial records are accurate and up-to-date. This can reduce stress and allow you to focus on growing your business.

If you are looking to get the best and most trusted outsourced bookkeeping services in Australia, VNC Global can fulfill all your bookkeeping needs.

Why should people go for online Bookkeeping Services?

Convenience: Online bookkeeping services provide convenience to business owners who may not have the time or resources to handle their own bookkeeping. With online services, business owners can access their financial records and reports from anywhere with an internet connection.

Cost Savings: Online bookkeeping services are often less expensive than hiring an in-house bookkeeper or outsourcing to a traditional accounting firm. Online services typically charge a flat monthly fee, which can be more cost-effective for small businesses.

Accuracy: Online bookkeeping services use software to automate many of the bookkeeping tasks, reducing the risk of errors. This can ensure that financial records are accurate and up-to-date, which is essential for making informed business decisions.

Scalability: As a business grows, so do its bookkeeping needs. Online bookkeeping services can easily scale to accommodate a growing business, providing additional services and resources as needed.

Security: Online bookkeeping services use secure servers and encryption to protect financial records and sensitive information. This can provide peace to business owners concerned about their financial data's security.

Access to Expertise: Online bookkeeping services often have a team of experts who specialize in various areas of finance, such as taxes or payroll. This can give businesses access to a range of expertise they may not have in-house.

Time Savings: By outsourcing bookkeeping tasks to an online service, business owners can free up time to focus on other aspects of their business, such as sales and marketing.

Final Thoughts:

Online bookkeeping services offer many benefits to businesses of all sizes. From convenience and cost savings to accuracy and expertise, there are many reasons why business owners are turning to online bookkeeping services to help them manage their finances. By outsourcing bookkeeping tasks to VNC Global - an excellent company offering efficient bookkeeping services for small businesses, business owners can save time, reduce costs, and ensure that their financial records are accurate and up-to-date.

#bookkeeping services provider in Australia#bookkeeper services provider in Australia#Outsourced bookkeeping services in Australia#bookkeeping services for small businesses#vnc.global

3 notes

·

View notes

Text

Bookkeeping Services Melbourne: How to Find the Right Fit for Your Business

Finding the right bookkeeping service is crucial for the smooth operation of your business. In Melbourne, where businesses of all sizes thrive, choosing a bookkeeping service that aligns with your needs can save you time, money, and headaches. Whether you're a small startup or a growing enterprise, here’s how you can find the right bookkeeping service for your business.

1. Understand Your Business Needs

Before you begin searching for a bookkeeping service, take a moment to assess your business needs. What kind of bookkeeping tasks do you require? Do you need basic bookkeeping, like managing income and expenses, or more advanced services such as payroll, BAS (Business Activity Statements), and tax preparation? Knowing what you need will help you narrow down your options and ensure you get the right service.

2. Look for Experience and Expertise

When choosing a bookkeeping service, experience matters. Look for providers who have experience working with businesses of your size or industry. A bookkeeping service with a good understanding of your specific business needs will be more equipped to manage your financial tasks effectively. Don’t hesitate to ask about their qualifications, certifications, and track record in delivering quality services.

3. Check for Proper Accreditation

In Australia, bookkeepers are required to be registered with the Tax Practitioners Board (TPB) if they’re providing certain services, such as preparing BAS or offering tax advice. Ensure the bookkeeping service you choose is accredited and registered with the TPB. This gives you peace of mind that they’re following Australian regulations and industry standards.

4. Consider Software and Technology

Today, most businesses rely on accounting software to streamline bookkeeping tasks. Make sure the bookkeeping service you choose is familiar with the software you’re using (or plan to use) for your business. Popular options in Melbourne include Xero, MYOB, and QuickBooks. A tech-savvy bookkeeper can help you make the most of these tools to keep your finances organised.

5. Evaluate Communication and Responsiveness

Effective communication is essential when working with a bookkeeping service. The best bookkeeping services will keep you informed about your financial situation and respond promptly to your queries. During your initial discussions, evaluate how well they communicate and whether they’re responsive to your questions. You want to feel comfortable and confident in their ability to provide clear, timely updates.

6. Compare Pricing

Pricing for bookkeeping services can vary significantly based on the scope of work and the complexity of your needs. Be sure to get quotes from a few bookkeeping services to compare prices. While the cheapest option might seem appealing, remember that quality matters. Choose a service that offers a fair price for the level of expertise and service you require.

7. Ask for References or Reviews

A reliable bookkeeping service should have a good reputation in the Melbourne business community. Ask for client references or check online reviews to gauge their reputation and the satisfaction of their clients. Positive feedback can provide assurance that you’re choosing a trusted professional.

8. Ensure Flexibility and Scalability

As your business grows, your bookkeeping needs may change. Make sure the service you choose is flexible and can scale with your business. Whether it’s adding more services, accommodating increased transactions, or offering advice on financial management, having a bookkeeping partner who can grow with you is important.

9. Understand Their Reporting Process

A great bookkeeping service will provide you with regular reports on your business’s financial health. Ask how often they provide these reports, and ensure that the information is presented in a clear and understandable way. This will help you make informed decisions and stay on top of your finances.

10. Trust Your Instincts

Finally, trust your instincts when choosing a bookkeeping service. You should feel comfortable with the team and confident in their ability to manage your business’s finances. If something doesn’t feel right, it’s okay to keep looking until you find a service that feels like the right fit.

Conclusion

Finding the right bookkeeping service in Melbourne is about more than just numbers – it’s about finding a partner who can help your business stay financially healthy and organised. By understanding your needs, looking for qualified professionals, and ensuring the service is a good match for your business, you can set yourself up for financial success. Whether you need help with tax returns, reporting, or everyday bookkeeping, the right service will make all the difference.

#Bookkeeping Service Melbourne#Bookkeeping Services#Business Bookkeeping#Accounting Services#Financial Services#Melbourne Bookkeepers#Bookkeeper Melbourne#Find Bookkeeper#Bookkeeping Solutions

0 notes

Text

How Busy Professionals Can Achieve More with Barefoot Talent and Virtual Assistant Services

As a busy professional, balancing the many responsibilities of managing a growing business while staying on top of daily tasks can be overwhelming. With constant meetings, client calls, project deadlines, and administrative work, it’s easy to lose sight of your business goals. However, outsourcing services such as Virtual Assistant in Australia, dedicated virtual teams for business growth, and remote staffing solutions can provide the support you need to achieve more with less stress.

Barefoot Talent offers affordable virtual assistant packages and back office support solutions designed to streamline your operations and help you focus on growing your business. Let’s explore how leveraging virtual assistant services and business process outsourcing (BPO) can help busy entrepreneurs and professionals accomplish more and reduce their workload.

1. The Power of Outsourcing Services for Businesses

Outsourcing has become a game-changer for busy professionals. Instead of managing everything on your own, you can delegate tasks to specialists in areas like online business management (OBM) services, task automation for small businesses, and general administrative support.

By utilizing remote staffing solutions, you can hire highly skilled professionals without the overhead of maintaining a full-time, in-house team. Whether you’re managing a startup or scaling a medium-sized business, customized BPO services can help optimize your operations and free up valuable time. By outsourcing non-core tasks, you can focus on the strategic activities that drive growth.

For example, hire task-based virtual assistants to handle repetitive duties such as data entry, customer support, and scheduling. This allows you to concentrate on more important, growth-driven activities.

2. Hire Virtual Assistants for Small Businesses

Small business owners often find themselves wearing many hats, from managing daily operations to marketing and customer service. However, trying to manage everything can lead to burnout and missed opportunities. That’s where virtual assistants for small businesses come in.

Hiring a virtual assistant in Australia provides an affordable solution. Virtual assistants can take over administrative tasks such as email management, scheduling, social media management, and customer service. This ensures your business remains efficient, even when things get busy.

Barefoot Talent offers affordable virtual assistant packages that are specifically tailored to meet the unique needs of your business. With this support in place, you can spend more time focusing on scaling your business and achieving your goals.

3. Streamline Operations with Outsourcing

Outsourcing can be an effective way to streamline operations and boost efficiency. By outsourcing tasks like customer service, data management, or lead generation, you can maintain focus on your core business functions without becoming bogged down by day-to-day administrative work.

For example, consider hiring a full-time OBM for entrepreneurs to manage complex projects, optimize business processes, and supervise your remote team. A qualified OBM ensures your business systems run smoothly, allowing you to delegate tasks confidently. As a result, you’ll experience increased productivity and a more seamless workflow.

Outsourcing recurring tasks, like bookkeeping or payroll management, is also essential for consistency. Business process outsourcing for startups allows you to offload these responsibilities, making your business more scalable and less reliant on internal resources.

4. Leverage Remote Teams for Scaling Your Business

As your business grows, having the right team is crucial. By leveraging virtual teams for scaling businesses, you can tap into specialized talent without the expense of hiring a full-time in-house team.

Barefoot Talent offers dedicated virtual teams for business growth, allowing you to handpick professionals who match your specific needs. Whether you need marketing experts, customer service representatives, or tech support, these virtual teams become an extension of your business.

Remote team building strategies enable you to manage a global workforce, providing you with the flexibility to scale operations without the complications of managing a large, in-house team. With the right remote team, you can maintain high-quality service and drive business growth, even while working remotely.

5. Cost-Effective Outsourcing for Entrepreneurs

Managing business costs is always a top priority for entrepreneurs, and outsourcing provides a cost-effective solution. Hiring remote professionals or virtual assistants allows you to access specialized skills without the added costs of office space, employee benefits, or training.

For example, you can hire task-based virtual assistants on a project basis, ensuring you only pay for the services you need. Task automation for small businesses can further enhance cost savings by eliminating the time spent on repetitive tasks. With the right tools and the support of virtual assistants, you can automate social media posting, email marketing, customer follow-ups, and more.

This model gives you the flexibility to invest in your business’s growth while keeping costs under control.

6. How to Get Started with Virtual Assistant Services

Getting started with Virtual Assistant services is easier than you think. Begin by identifying the tasks that consume the most time in your business. Do you spend hours managing emails, scheduling meetings, or organizing your calendar? Once you understand your needs, you can begin exploring affordable virtual assistant packages that match your budget.

Next, connect with a provider like Barefoot Talent, which offers remote staffing solutions tailored to the unique needs of entrepreneurs and small businesses. Whether you need a full-time OBM for entrepreneurs or a dedicated virtual team, they can help connect you with the right talent.

Once you have the right team in place, start delegating your tasks. As you begin outsourcing non-essential work, you’ll notice an increase in your productivity and an improvement in your work-life balance.

7. Achieve Business Goals with the Right Support

Outsourcing essential tasks like customer support, project management, or administrative duties allows you to remain focused on your core business objectives. With the right support in place, such as virtual assistants and remote staffing solutions, you can ensure your business operates efficiently, even in the most hectic periods.

Whether you require back office support solutions, business process outsourcing for startups, or task-based virtual assistants, Barefoot Talent can help your business run smoothly and stay on track to meet its goals. By implementing customized BPO services, you can streamline operations and scale your business with ease.

Conclusion

Outsourcing is a vital tool for busy professionals and entrepreneurs looking to scale their businesses without compromising quality. With the right outsourcing partner, such as Barefoot Talent, you can delegate time-consuming tasks and focus on what matters most—growing your business.

Whether you need virtual assistants in Australia, dedicated virtual teams, or task automation for small businesses, outsourcing provides the flexibility and support necessary to thrive in today’s competitive market. By leveraging virtual teams and remote staffing solutions, you can achieve your business goals while maintaining a healthy work-life balance.

#NDIS Support Services#Virtual Assistant in Australia#Affordable Virtual Assistant Packages#Outsourcing Services for Businesses#Hire Virtual Assistants for Small Businesses#Online Business Management (OBM) Services#Full-Time OBM for Entrepreneurs#Remote Staffing Solutions#Business Process Outsourcing for Startups#Dedicated Virtual Teams for Business Growth#Back Office Support Solutions#Cost-Effective Outsourcing for Entrepreneurs#Remote Team Building Strategies#Streamline Operations with Outsourcing#Customized BPO Services for Medium-Sized Businesses#Task Automation for Small Businesses#Hire Task-Based Virtual Assistants#Outsource Recurring Tasks for Efficiency#Leverage Virtual Teams for Scaling Businesses#Innovative Outsourcing Strategies for E-commerce.

0 notes

Text

Learn Accounting in Ahmedabad - Perfect Computer Education

Empower your career in Accounting and stay ahead with Technology

Accounting is one of the most important activities for any company in the world. Gone are the days when accounting was nothing more than a stack of papers on a table! Accounting software such as Xero, myOB, tally, and QuickBooks has made it even simpler and more compact. If you want to Learn Accounting in Ahmedabad, get it at Perfect Education.

These software are already popular in countries like the U.S, U.K, Australia, etc. but with changing times, these accounting software have grown extremely popular in India.

Xero and MYOB (Mind Your Own Business) are cloud-based software that allows users to access data from anywhere, and this has proven to be beneficial to enterprises. MYOB helps your business with accounting, bookkeeping, payroll, customer relationship management (CRM), invoices, and billing, among other things. Depending on your partnership level, the Xero bookkeeping service offers you a variety of perks, like bronze, silver, and gold. Each partnership has several benefits, like a dedicated Xero manager, a digital marketing toolkit, access to accelerated programs, etc.

Based on your business or accounting requirements, you can Learn Accounting in Ahmedabad and earn certifications. Tally is an ERP (enterprise resource planning) accounting software package for recording a company's day-to-day business data.

The latest version of Tally is Tally ERP 9. QuickBooks is an online accounting software program developed by Intuit that is used by small and medium-sized businesses all over the world. It is well-known for its simple user interface and automated bookkeeping and accounting processes. It's offered as "Software as a Service," allowing you to access your data from anywhere at any time. It automates the processing of day-to-day transactions, such as invoicing, payment processing, sales tax, reporting, and payroll, among other things and is simple to utilize. It's a global platform. It backs up data in real-time.

Visit us now:- https://perfecteducation.net/learn-accounting-in-ahmedabad.php

#digital marketing course in ahmedabad#foreign accounting training#learn accounting in ahmedabad#usa accounting training#tally certification in ahmedabad#quickbook training ahmedabad#xero training in ahmedabad#foreign accounting and taxation training#myob training#learn foreign accounting ahmedabad

0 notes

Text

BookkeepingOnline provides professional and reliable online bookkeeping services across Australia. Our team of experts ensures accurate financial records, timely reports, and compliance with all regulations. Whether you're a small business or a large corporation, we tailor our services to meet your needs, so you can focus on growing your business while we handle your finances.

#bookkeeping services for small business#accounting business services#payroll management#online bookkeeping

0 notes

Text

Chermside Accountants

Choosing the best accountant is crucial for your business. It is important to find an accountant who has experience with your industry and can offer expert advice. They can help you navigate the complicated tax laws and ensure your company is compliant.

Martin has had various financial Management and control roles including as the Finance Manager of Chermside Day Hospital until its sale to Cura Day Hospital group in 2012. He is Xero Advisor and has assisted a number of clients with their implementation of cloud-based systems.

Accounting

Chermside Accountants have a reputation for providing high quality accounting services at an affordable price. They offer a range of accounting services to businesses in the local area, including bookkeeping, GST returns, and income tax return preparation. They also help businesses with the implementation of cloudbased accounting systems. They are well-known for their honest and open communication with clients.

Success Tax Professionals Chermside Accountants is located at 1/19 Thomas Street in Chermside and is led by Eva Chan, CPA Australia accredited and Master of Business (Accountancy) graduate. She is a certified Xero advisor and is skilled in helping businesses implement cloud-based accounting systems. She and her team serve clients in Stafford Heights, Aspley, Geebung, Wavell Heights, and surrounding areas.

Xero is a beautiful online accounting software that integrates with many other apps to boost small businesses. It is available for a variety of industries, and Success Tax Professionals Chermside & CARESeldine can help you choose the right apps to boost your business. They can also help you connect your bank accounts and streamline payments through Xero.

Auditing

Located at Shop 1/19 Thomas Street, Chermside, Success Tax Professionals is an accounting firm that offers a wide range of services to individuals and businesses. Their staff specialises in personal and business tax returns, financial statements, and bookkeeping. They also provide advice and strategies for small business owners. They are a CPA-accredited firm that is committed to providing exceptional customer service.

Felicia is a Chartered Accountant with an auditing background. She has a strong understanding of financial statement and auditing matters and works closely with clients to ensure their books are up-to-date. She is also a Xero certified advisor and has helped many clients implement the cloud-based system.

Located on Gympie Road, the ITP Chermside team provides year-round tax support to local businesses. They serve a diverse client base, including small businesses and professionals. They offer services for a variety of industries, including manufacturing, retail, and property development. They are also experienced in working with a range of banks.

Taxation

Chermside Accountants is an accounting firm in Queensland that offers a variety of services, including taxation. Its team of experienced accountants is well versed in all things tax and has the expertise to help you navigate complex business structures. They also offer expert advice on payroll and bookkeeping.

The firm’s principal is Eva Chan, who is a CPA. She has extensive experience in a range of industries, and is known for her honest communication. She’s also a

certified Xero advisor, which allows her to connect with clients through their online accounting software.

Willie Tun is a qualified accountant with over 10 years of experience. He works with a wide range of clients, from individual taxpayers to established small businesses. He helps them discover the right solution by simplifying jargon and reducing complexities. He also helps them choose the best apps to boost their business performance. His passion for his work has made him a popular choice among locals.

Budgeting

Accountants help management implement due diligence control measures to ensure adherence to the company’s financial goals. They also analyse the actual results and compare them to the budgeted figures to identify deviations and understand their causes. They provide valuable insights that help managers make informed decisions to enhance profitability and grow the business.

Accountants evaluate past performance and current market trends to set realistic revenue projections. They also assess the cost behaviour of variable expenses and look for opportunities to optimise costs without affecting productivity. They also create reserves for unforeseen events and contingencies.

Accountants communicate with department heads and other stakeholders to share budget information and discuss the impact of various scenarios. They also support the budget process by educating employees about financial reporting and best practices. They ensure that they are updated on the latest accounting rules and regulations to maintain compliance with regulatory standards. They also stay up-todate on industry trends and benchmarks to inform their analyses.

0 notes

Text

A Step-by-Step Guide to Implementing OBG Outsourcing in Your Practice

In the competitive and ever-evolving healthcare industry, outsourcing Obstetrics and Gynecology (OBG) services can be a strategic move for practices looking to enhance care quality, improve efficiency, and reduce costs. This step-by-step guide will help you navigate the process of OBG outsourcing, ensuring a smooth transition and optimal outcomes.

Assess Your Practice’s Needs

The first step in implementing OBG outsourcing is to assess your practice’s needs. Identify the specific areas where outsourcing could provide the most value. This might include administrative tasks like billing and coding, clinical services such as prenatal and postpartum care,Accounting Services for US Businesses or specialized procedures. Consider factors like current workload, staff expertise, and patient demand to determine where outsourcing can fill gaps or enhance service delivery.

Define Clear Objectives

Once you’ve identified the areas for outsourcing, define clear objectives for what you aim to achieve. These objectives could include cost reduction, improved patient care, access to specialized expertise, or increased operational efficiency. Clear goals will guide your decision-making process and help you measure the success of the outsourcing initiative.

Research Potential Providers

With your needs and objectives in mind, start researching potential outsourcing providers.Accounting Services for Australia Businesses Look for companies with a strong track record in OBG services, positive reviews, and robust quality assurance processes. Consider their experience, expertise, and reputation within the industry. It’s also essential to assess their compliance with healthcare regulations and data security standards.

Evaluate Cost and Value

While cost is a critical factor, it’s equally important to evaluate the overall value offered by potential providers. Compare pricing structures, but also consider the quality of services, technological capabilities, and the provider’s ability to integrate seamlessly with your practice. A cost-effective solution should deliver high-quality care and support your practice’s goals.

Check References and Reviews

Before finalizing your decision, check references and reviews for the shortlisted providers.Accounting Services for UK Businesses Speak with other healthcare practices that have used their services to gain insights into their experiences. Online reviews and testimonials can also provide valuable information about the provider’s reliability, customer service, and performance.

Develop a Detailed Contract

Once you’ve selected a provider, develop a detailed contract that outlines the scope of services, pricing, performance metrics, and compliance requirements. Clearly define roles and responsibilities, service levels, and reporting structures. Ensure the contract includes provisions for data security, confidentiality, and regulatory compliance. Legal counsel can help review the contract to protect your practice’s interests.

Plan the Transition

Effective planning is crucial for a smooth transition to outsourcing. Develop a detailed transition plan that includes timelines, milestones, and key responsibilities. Communicate the plan to all stakeholders, including your staff and the outsourcing provider. Outsourced bookkeeping services Training and support should be part of the transition to ensure everyone is prepared for the changes.

Monitor Performance

After implementation, closely monitor the performance of the outsourced services. Use the performance metrics defined in your contract to assess the provider’s effectiveness. Regularly review reports, conduct audits, and gather feedback from staff and patients. Address any issues promptly to maintain the quality and efficiency of outsourced services.

Foster Collaboration

Building a strong collaborative relationship with your outsourcing provider is essential for long-term success. Regular communication, joint problem-solving, and shared goals will help ensure a productive partnership. Schedule periodic meetings to discuss performance, address challenges, and explore opportunities for improvement.

Continuously Improve

Finally, adopt a mindset of continuous improvement. Regularly review your outsourcing strategy and make adjustments as needed. Stay informed about industry trends, new technologies,Outsourcing accounting services and best practices in OBG outsourcing. By continuously evaluating and enhancing your outsourcing arrangements, you can maximize the benefits for your practice and patients.

Conclusion

Implementing OBG outsourcing in your practice can lead to significant benefits, including cost savings, enhanced patient care, and improved operational efficiency. By following this step-by-step guide, you can navigate the complexities of outsourcing and achieve successful integration. With careful planning, clear objectives, and ongoing collaboration, outsourcing can become a valuable component of your healthcare practice, driving long-term success and excellence in patient care.

0 notes

Text

Navigating Bookkeeping Jobs in Sydney: A Comprehensive Guide

Bookkeeping is the backbone of any successful business, and in a bustling city like Sydney, the demand for skilled bookkeepers is ever-present. Whether you're an aspiring professional seeking opportunities or a business owner looking to hire the right talent, understanding the landscape of bookkeeping jobs in Sydney is crucial. In this guide, we'll explore the intricacies of bookkeeping roles in Sydney, the skills required, where to find opportunities, and how to excel in this dynamic field.

The Demand for Bookkeepers in Sydney

Sydney, as one of Australia's economic powerhouses, hosts a myriad of businesses across various industries. From startups to multinational corporations, every business requires accurate financial records to thrive. As such, the demand for skilled bookkeepers remains consistently high.

Skills and Qualifications

While formal education in accounting or bookkeeping is beneficial, practical experience and a strong skill set are equally important in securing bookkeeping jobs in Sydney. Employers typically look for candidates proficient in financial software such as MYOB or Xero, adept at reconciliations, payroll processing, and possessing a keen eye for detail. Additionally, strong communication skills and the ability to work independently or as part of a team are highly valued in this profession.

Where to Find Bookkeeping Jobs

Sydney offers a plethora of avenues for finding bookkeeping opportunities. Online job portals like Seek, Indeed, and LinkedIn are excellent starting points. Networking events, industry seminars, and professional associations such as the Institute of Certified Bookkeepers (ICB) can also provide valuable leads. Moreover, leveraging personal connections and reaching out to local businesses directly can often uncover hidden job openings.

Freelancing and Remote Work

The rise of remote work has opened up new possibilities for bookkeepers in Sydney. Many businesses, especially startups and small enterprises, are outsourcing their bookkeeping needs to freelancers or remote professionals. Platforms like Upwork and Freelancer.com offer a wealth of freelance opportunities, allowing bookkeepers to work flexibly and remotely while serving clients in Sydney and beyond.

Tips for Success:

To stand out in the competitive landscape of bookkeeping jobs in Sydney, consider the following tips:

Continuously upgrade your skills: Stay updated with the latest accounting software and industry trends to remain competitive.

Network actively: Attend industry events, join professional associations, and connect with fellow bookkeepers and potential clients.

Showcase your expertise: Build a strong online presence through LinkedIn profiles, personal websites, or professional portfolios to highlight your skills and experience.

Provide exceptional service: Deliver accurate, timely, and reliable bookkeeping services to build trust and rapport with clients or employers.

Seek feedback and learn from it: Solicit feedback from clients or supervisors to identify areas for improvement and refine your skills accordingly.

0 notes

Text

Bookkeeping specialist Blacktown

If you're looking for a bookkeeping specialist Blacktown, Australia, you might want to consider checking local business directories, online platforms, or contacting professional organizations that can connect you with qualified professionals. Additionally, you can inquire with local accounting firms or business service.

1 note

·

View note

Text

The Aged Care Season

The up-and-coming Christmas and festive period is also known as the ‘aged care season’ where family gatherings often bring to light the changing needs of aging parents. Parents may no longer be as independent as they once were and it can be a crucial period for discussing and planning for aged care,

Here are a few points to consider:

A robust conversation: Family discussions can be difficult to start but not impossible – for example, “Hey there, and before you go today, think we should have a quick chat about looking at some different accommodation and care possibilities next year to make your life simple and easier?”

Get care needs assessed: Contact MyAgedCare for a care needs assessment, which is necessary to access government-funded aged care services. Does your MyAgedCare assessment need to be updated? Not all facilities can look after any resident as they may need specialised care needs.

Consider Age Pension consequences: Will renting or selling your family home or the sale of other assets to move into care affect or qualify you for the Age Pension and other entitlements? You may be surprised.

Get the timing right: For couples, the timing of moving into aged care can affect costs. Moving separately can sometimes be beneficial in terms of costs and subsidies.

Who is your trusted Enduring Power of Attorney: Ensure you have an Enduring Power of Attorney in place for someone to make decisions on your behalf if you are unable to do so. It a good idea to review these arrangements.

Estate plan: Developing a comprehensive estate plan will not only document your wishes and bequests but should raise and raise awareness of potential tax and aged care fee issues for the survivor of a couple.

Get good advice: Consult an Aged Care Specialist® like myself to understand all options, use strategies to make it more affordable, and avoid surprises.

This article was written by Harry Kalaitzoglou CIMA, who is available for a conversation on the above topics should you wish to discuss further.

0 notes

Text

From Wall Street to Retail Streets: The Evolution of Black Friday and Bud & Tenders' Promotion on this Day

The phenomenon known as Black Friday, a retail event that has grown into a global tradition, has an intriguing and complex history. Its roots can be traced back to the United States, but the origins and evolution of this day are entwined with various socio-economic factors.

The Origins of Black Friday

The term 'Black Friday' was first used in the 19th century, albeit in a different context. It was initially associated with a financial crisis on September 24, 1869, when the U.S. gold market crashed. However, the current meaning of Black Friday originated in Philadelphia in the mid-20th century.

In the 1950s, Philadelphia police used the term to describe the chaos that ensued on the day after Thanksgiving, when hordes of suburban shoppers and tourists flooded into the city in advance of the big Army-Navy football game held on that Saturday every year. This influx led to traffic jams and shoplifting opportunities, causing headaches for the police.

The Evolution of Black Friday

The term 'Black Friday' didn't become widely recognised until the early 1980s. Retailers reinvented Black Friday and turned it into something positive. They explained that the day after Thanksgiving marked the occasion when America's stores finally turned a profit, going from being "in the red" to "in the black," referencing the colours of ink bookkeepers traditionally used for losses and gains.

In the following decades, Black Friday transformed into a consumer tradition, marked by massive sales and bargain prices. It unofficially kickstarts the holiday shopping season, with many businesses opening their doors in the early hours of the morning to accommodate eager shoppers.

Black Friday Goes Global

Originally a uniquely American event, Black Friday has since expanded beyond the borders of the United States. The advent of the internet and the rise of online shopping have made Black Friday a global phenomenon. Countries around the world, from the United Kingdom to Australia, now participate in this annual retail event.

The Impact of Black Friday

Black Friday has significant implications for both consumers and businesses. For consumers, it provides an opportunity to purchase goods at discounted prices. For businesses, it's a chance to boost sales and profits. However, it also presents challenges, such as managing increased customer demand and ensuring sufficient stock levels.

Bud & Tender's Black Friday Sale

In keeping with this tradition we, Bud & Tender, are delighted to announce our Black Friday Sale. From the 17th of November until midnight on the 27th of November, we are offering a 20% shop-wide sale. This is an excellent opportunity for customers to purchase our high-quality, broad-spectrum CBD oils at a reduced price.

To take advantage of this offer, simply use the code BF20 at checkout. Whether you're a regular customer or new to our brand, we invite you to explore our range of products and enjoy the savings this Black Friday season.

Conclusion: The Future of Black Friday

Despite its controversial origins, Black Friday has evolved into a cherished tradition for many shoppers worldwide. Its impact on the retail industry is undeniable, influencing consumer behaviour and business strategies alike. As e-commerce continues to grow, Black Friday's future looks bright, with more opportunities for global participation and innovative shopping experiences.

As we continue to navigate this dynamic landscape, Bud & Tender remains committed to providing quality products and exceptional customer service. We look forward to welcoming you to our Black Friday Sale and beyond.

#black friday#black friday deals#black friday sale#black friday 2023#cbd#cbd oil#cannabis#feelgreatagain#budandtender#cbdoil

0 notes

Text

Bookkeeper services provider in Australia | VNC Global

Bookkeeping is essential to running a business but can be tedious and time-consuming. As a result, many business owners are opting for online bookkeeper services providers in Australia to help them manage their finances. Here are some key fundamentals of bookkeeping.

If you are looking for available services from renowned Outsourced bookkeeping services in Australia, VNC is the best pick for you.

#Bookkeeper services provider in Australia#Bookkeeping services provider in Australia#Outsourced bookkeeping services in Australia#Bookkeeping services for small businesses

3 notes

·

View notes

Text

How to Choose Bookkeeping Services in Melbourne

Finding the right bookkeeping service is essential for any business. Accurate financial records help you make informed decisions and ensure compliance with Australian laws. However, with so many options available in Melbourne, how do you choose the right one? Let’s break down the process step by step.

The Importance of Bookkeeping

Bookkeeping is more than just keeping track of numbers. It involves recording, classifying, and summarising financial transactions. Good bookkeeping provides you with a clear picture of your business’s financial health. This information is crucial for:

Budgeting: Helps you understand your income and expenses.

Tax compliance: Ensures you meet legal obligations.

Decision-making: Provides insights into profitability and cash flow.

Without proper bookkeeping, businesses can face significant challenges, such as cash flow problems and potential legal issues.

Common Challenges in Finding Bookkeeping Services

Many business owners encounter obstacles when searching for bookkeeping services. Here are some common challenges:

Overwhelming Choices: The variety of services available can make it hard to know where to start.

Cost Concerns: Some services may appear expensive, leading to uncertainty about what’s worth the investment.

Trust Issues: You’re handing over sensitive financial information, so you need to ensure you can trust your bookkeeper.

These challenges can leave you feeling unsure and frustrated. However, with the right approach, you can find a bookkeeping service that suits your needs.

Identifying Your Needs

Before you start searching for a bookkeeping service, take time to identify your specific needs. Ask yourself the following questions:

What Type of Services Do You Need?

Different businesses require different services. Do you need help with payroll, invoicing, or tax preparation?

How Complex Are Your Finances?

If your business has multiple income streams or transactions, you may need a more experienced bookkeeper. Simple businesses may require basic services.

What Is Your Budget?

Determine how much you can afford to spend on bookkeeping services. This will help you narrow down your options and find a service that fits your financial situation.

Researching Potential Bookkeepers

Now that you understand your needs, it’s time to start researching. Here are some effective strategies:

Ask for Recommendations

Start by asking fellow business owners for recommendations. Personal referrals can lead you to trustworthy services that others have had positive experiences with.

Check Online Reviews

Look for reviews on websites like Google or social media platforms. Pay attention to both positive and negative feedback to gauge the service’s reputation.

Visit Websites

Take time to explore the websites of potential bookkeepers. Look for information about their services, qualifications, and experience. A professional-looking website can indicate a reliable service.

Assessing Qualifications and Experience

When you find potential bookkeeping services, it’s essential to assess their qualifications. Here are some factors to consider:

Qualifications

Check if the bookkeeper has relevant qualifications. In Australia, a qualified bookkeeper should have a Certificate IV in Bookkeeping or Accounting. This certification shows they understand the basics of financial management.

Experience

Inquire about their experience in your industry. Bookkeepers familiar with your field may understand your specific financial challenges better. This can lead to more tailored advice and services.

Membership in Professional Bodies

Membership in professional organisations, such as the Institute of Certified Bookkeepers (ICB) or CPA Australia, can indicate a commitment to ongoing education and ethical standards.

Understanding Their Services

Once you’ve shortlisted a few bookkeeping services, it’s time to understand what they offer. Here’s what to look for:

Range of Services

Ensure the bookkeeper offers a range of services that suit your needs. Common services include:

Monthly financial statements: Provides insights into your business’s performance.

Accounts payable and receivable: Manages money coming in and going out.

Tax preparation: Ensures you meet your tax obligations efficiently.

Technology Use

Ask about the software they use. Modern bookkeeping often involves digital tools like Xero or MYOB. Ensure they use software that integrates well with your business systems.

Communication Style

Good communication is key. Ensure the bookkeeper is approachable and responsive. You want someone who will keep you informed and answer your questions promptly.

Evaluating Costs

Cost is an important factor in choosing bookkeeping services. Here’s how to approach it:

Understand Their Pricing Structure

Bookkeepers may charge hourly rates or offer fixed-price packages. Clarify how they bill for services. This will help you budget effectively.

Compare Quotes

Get quotes from multiple bookkeepers. Compare what each service includes in their pricing. Sometimes, a higher cost may provide better value if it includes additional services.

Consider Long-Term Value

While price is important, consider the long-term value of the service. A reliable bookkeeper can save you money in the long run by helping you avoid costly mistakes.

Meeting with Potential Bookkeepers

Once you’ve narrowed down your options, schedule meetings with potential bookkeepers. This allows you to ask questions and gauge compatibility. Here are some tips:

Prepare Your Questions

Prepare a list of questions to ask during the meeting. Some examples include:

What experience do you have with businesses in my industry?

How do you handle discrepancies in financial records?

What kind of support do you offer during tax season?

Assess Their Communication

Pay attention to how well they communicate. Are they clear and helpful in their responses? This can indicate how well you’ll work together in the future.

Trust Your Instincts

Trust your gut feeling about each bookkeeper. Choose someone you feel comfortable with and confident in their abilities.

Making Your Decision

After meeting with potential bookkeepers, it’s time to make your decision. Consider all the factors discussed, including qualifications, services, costs, and your personal comfort level.

Choose a bookkeeper who meets your needs and aligns with your business goals. A good fit will help your business thrive financially.

Conclusion: Start Your Bookkeeping Journey

Finding the right bookkeeping service in Melbourne doesn’t have to be a stressful process. By understanding your needs, researching potential options, and assessing qualifications, you can make an informed choice.

If you're ready to streamline your bookkeeping and ensure your business runs smoothly, consider working with a professional. At LTE Tax, we specialise in providing tailored bookkeeping services melbourne to meet your unique needs. Our experienced team can help you stay on top of your finances, allowing you to focus on growing your business. Start your journey today!

0 notes

Text

Enhance Your Business Efficiency with Virtual Bookkeeping Services

Introduction to Virtual Bookkeeping Services

In today’s turbulent business environment, companies need to find ways to increase productivity and streamline operations. One area that often requires significant attention is bookkeeping. In addition to meeting legal obligations, maintaining accurate financial records is crucial for smart company decisions.

Traditionally, businesses have relied on in-house bookkeepers or outsourced their bookkeeping needs to firms in their locality. However, with advancements in technology, a new solution has emerged – virtual bookkeeping services. We will explore the benefits of online bookkeeping services and how they can improve your company’s efficiency in this post.

Benefits of Virtual Bookkeeping Services

Virtual library services offer many advantages over traditional library methods. In the first place, they give companies access to a highly skilled team of experts that are familiar with the most contemporary accounting techniques and systems. As long as you give yourself some breathing room and permit yourself to focus on significant business responsibilities, your books remain correct and up to date.

Second, online bookkeeping services give companies access to current financial information. You may access your financial information at any time, anywhere, with cloud-based accounting software. Making smarter business decisions with a financial specialist on your team also makes it simpler for internal team members and outside colleagues to collaborate.

Lastly, virtual bookkeeping services are cost-effective. By outsourcing your bookkeeping needs, you eliminate the need to hire and train in-house staff, purchase expensive software, and maintain physical office space.

This can result in significant cost savings and free up resources for your business’s other divisions.

Bookkeeping Services in Sydney

For businesses based in Sydney, Australia, there are numerous options available for virtual bookkeeping services. Because Sydney has a bustling business environment, there are many trustworthy companies there that offer bookkeeping services. These organizations provide a variety of services catered to the particular requirements of companies across various industries.

Considerations including the company’s experience, reputation, and the scope of services they provide should all be taken into account when selecting a virtual bookkeeping service in Sydney. To guarantee the protection of your financial information, it’s also good to ask about their data security procedures.

Considerations for Selecting Virtual Bookkeeping Services

You should take into account a number of criteria while selecting a virtual library system for your company. It is important to check the company’s credentials and experience before doing anything else. Consider their familiarity with pertinent accounting software as well as their flexibility in meeting your particular business needs.

The degree of customer support offered by the virtual bookkeeping service is a vital additional consideration. Verify if they have a committed support team that can react immediately to any inquiries or problems. Successful collaboration depends on effective communication, therefore it’s critical to select a service provider who prioritizes open and honest lines of communication.

Lastly, consider the scalability of the virtual bookkeeping service. Ensure that the service provider can accommodate your future requirements and provide the necessary support as your business expands. Flexibility and adaptability are essential qualities to look for in a virtual bookkeeping service.

Tips for Implementing Virtual Bookkeeping Services Successfully

You should take into account a number of criteria while selecting a virtual library system for your company.

Outline your goals, ideal results, and requirements with the virtual bookkeeping service provider to establish clear expectations. They can then customise their services to your specific needs after learning more about them.

Establish regular communication: Set up regular meetings or check-ins with your virtual bookkeeping team. This will enable you to stay updated on your financials, address any concerns, and maintain a strong working relationship.

Invest in training: Allocate time and resources for training your team on the new bookkeeping system and processes. This will guarantee that everyone is aware of the software and understands how to utilize its capabilities.

Monitor performance: Regularly review the performance of your virtual bookkeeping service provider. Assess whether they are meeting your expectations and delivering the agreed-upon services. Address any issues or concerns promptly to maintain a productive partnership.

Cost-Effective Options for Virtual Bookkeeping Services

Virtual bookkeeping services offer a cost-effective solution for businesses of all sizes. By outsourcing your bookkeeping needs, you can eliminate the need for in-house staff, expensive software licenses, and physical office space. Large savings may arise from this, allowing you to devote resources to other crucial areas of your company.

Balancing benefits and costs is important when looking at cost-effective solutions for virtual library services. While it may be tempting to select a less-priced provider, bear in mind that quality matters when it comes to safeguarding your financial details. Look for a service that offers a good mix of superior and competitive costs.

Additionally, consider the scalability of the virtual bookkeeping service. Ensure that the service provider can accommodate your future requirements without incurring additional costs or disruptions to your operations.

Business Bookkeeping Services in Sydney

For businesses based in Sydney, Australia, there are several reputable firms that offer business bookkeeping services. These firms specialize in providing customized bookkeeping solutions tailored to the unique needs of businesses in various industries.

When selecting a business bookkeeping service in Sydney, consider factors such as the firm’s experience, track record, and knowledge of your industry. Ask them about their dedication to data security as well as their capacity to interact with your current systems and procedures.

Outsourcing your business bookkeeping needs to a reliable service provider in Sydney can help you streamline your financial operations, improve accuracy, and make informed business decisions.

Conclusion and Final Thoughts

Virtual bookkeeping services offer businesses a powerful tool for enhancing efficiency and streamlining financial operations. By outsourcing your bookkeeping needs to a professional team, you can gain accurate and current financial information, save money and improve decision-making skills.

When choosing a virtual bookkeeping service, consider factors such as expertise, reputation, and scalability. Establish clear communication channels and invest in training to ensure a successful implementation. Regularly monitor performance and adhere to best practices to maximize the benefits of virtual bookkeeping services.

For businesses in Sydney, Australia, there are numerous reputable firms that offer tailored business bookkeeping services. You may fully realize the benefits of virtual bookkeeping and grow your business by working with the ideal service provider.

0 notes

Text

Nashville Coin Gallery Reviews

What is Nashville Coin Gallery?Nashville Coin Gallery Locations, Timings, Email, Phone, Services

Nashville Coin Gallery, founded in 2002 by Pete Dodgea, is a nationally known and highly respected dealer in rare coins, paper money, and precious metals bullion products, with annual revenue in the millions of dollars.

Nashville Coin Gallery, according to the company, lives on word-of-mouth referrals and online reviews from its many satisfied clients, many of whom are repeat customers. This reciprocity of loyalty is met with the highest respect and gratitude from the gallery's end. Nashville Coin Gallery's foundation has been founded in the pursuit of a unique blend of top-tier customer service and outstanding pricing, setting a standard unmatched in the coin and precious metals industry. The Brentwood location has evolved into an exclusive appointment-only engagement in which the gallery works directly with customers to provide a more personalised experience. The gallery's strategic position, around 10 miles from downtown Nashville and 8 miles from Franklin, demonstrates the gallery's commitment to accessibility. - Address: 500 Wilson Pike Circle, Ste. 227, Brentwood, TN 37027 - Phone: (615) 764-0331 - Email: [email protected] - Website: https://nashvillecoingallery.com/

People Behind Nashville Coin Gallery: CEO, Owner, Co-Founders & MoreWho owns Nashville Coin Gallery? What is the management team behind Nashville Coin Gallery?

The company's website mentions the following team members: Pete Dodge: Founder

Pete is the owner and founder of Nashville Coin Gallery. He is a lifelong coin collector from Brockton, Massachusetts, who was first exposed to the hobby as a child while in the Cub Scouts. After working as a computer programmer/analyst for many years, including in the United States Air Force from 1980 to 1984, Pete decided to make his lifelong hobby a full-time business and founded Nashville Coin Gallery in 2002. Pete is our Head Numismatist, and he is the primary buyer and seller of coins, paper money, and precious metals bullion products at Nashville Coin Gallery. Pete enjoys travelling, creating music, and playing guitar and piano in his spare time. Jonah Nestadt: Coin & Bullion Buyer

Jonah was born in Sydney, Australia, where he got a bachelor's degree in International Business from Macquarie University. He then worked at a coin store in New Jersey for four years before joining Nashville Coin Gallery as a coin and bullion buyer in February 2022. Jonah enjoys hiking, mountain biking, and listening to live music in his spare time, and he has backpacked in several countries across the world. Jackson Taylor: Accounting / Finance / Marketing

Jackson is another Nashville Coin Gallery employee who has been with the company since February 2016. He attended Mississippi State University and majored in economics and accounting. His responsibilities at Nashville Coin Gallery mostly include marketing, bookkeeping, online SEO, and data analytics. He's also been known to help out the Shipping Department when they're in need. Jackson enjoys golf, basketball, and powerlifting. Brian Roan: Shipping & Receiving Specialist

Brian was born in Illinois but grew up in the Dallas area, graduating from high school in Richardson, Texas, just outside of Dallas. He moved to Tennessee in 1990 after spending time in Virginia and Oklahoma and started working at Nashville Coin Gallery in May 2022. Brian is an avid amateur photographer who enjoys photographing birds, flowers, and other animals when he is not performing shipping and receiving chores for Nashville Coin Gallery. He also enjoys travelling with his wife. Sylvia McMillan: Accounting / Payroll / Human Resources

Sylvia moved to the Nashville, Tennessee area in 2020 and was still working part-time from home for a company in Washington doing real estate work when she became interested in investing in precious metals, so she came to Nashville Coin Gallery numerous times to buy gold and silver. She showed interest in joining their team after becoming fascinated by the firm itself, like the way the company conduct business. Sylvia joined the Nashville Coin Gallery team in November 2022 and working in the Accounting & HR department, where she is responsible for accounting functions, payroll, and human resources. Sam Mizell: Photography & Videography

Sam joined the Nashville Coin Gallery team in November of 2020 as a Shipping and Receiving Specialist. He manages all things related to shipping and receiving for a year and a half, from assembling boxes to packing and securing the contents, from ensuring every box is adequately insured to generating shipping labels, from ordering shipping supplies to videotaping all shipping and receiving activities. During his time, Sam also became highly skilled at coin photography and website video production. However, he quit the organization in early May 2022 after taking another full-time position in the music industry.

Nashville Coin Gallery Products: Bullion Coins, Bars, And Rare CoinsAll products offered by Nashville Coin Gallery

Nashville Coin Gallery offers a diverse range of numismatic products and precious metals. Here's a list of the product categories they provide: Gold:

- Gold Coins (Various denominations and historical periods) - Gold Bullion Bars (Assorted weights and refineries) - Gold American Eagles - Gold Canadian Maple Leafs - Gold Krugerrands - Gold Austrian Philharmonics - Gold Chinese Pandas - Gold Australian Kangaroos Silver:

- Silver Coins (Different designs, eras, and countries) - Silver Bullion Bars (Various sizes and manufacturers) - Silver American Eagles - Silver Canadian Maple Leafs - Silver Britannias - Silver Austrian Philharmonics - Silver Chinese Pandas - Silver Australian Koalas Platinum: - Platinum Coins (Assorted designs and origins) - Platinum Bullion Bars (Various weights and brands) - Platinum American Eagles - Platinum Canadian Maple Leafs Palladium: - Palladium Coins - Palladium Bullion Bars Rare Coins: - Collectible U.S. Coins (Historical coins, key dates, and unique varieties) - World Coins (Coins from various countries and time periods) - Certified Coins (Graded and authenticated by professional grading services) Paper Money: - U.S. Paper Currency (Banknotes of different denominations and historical significance) - World Paper Currency (Currency notes from around the globe) Other Precious Metals: - Other Bullion (Such as bars and coins in various metals) - Coin Supplies (Albums, holders, and accessories for coin storage and display) Special Collections and Sets: - Commemorative Coin Sets - Limited Edition Releases It's important to note that the availability of specific products may vary over time, and it's recommended to visit their official website or contact them directly for the most up-to-date information on their product offerings.

Can You Invest in Nashville Coin Gallery IRA?Do They Offer A Precious Metals IRA?

To invest in a precious metals IRA through Nashville Coin Gallery are the general steps: Open a Self-Directed IRA Select an IRA company that handles opening precious metals IRA accounts and fill out an application. You can work with Nashville Coin Gallery to recommend an IRA company and provide the necessary paperwork. However, I don't recommend doing so. Fund Your IRA Once you have selected an IRA company, you can move your funds into your new IRA account. You can work with the IRA company representative to transfer or rollover funds into the new account. Select a Precious Metals Dealer One of the forms you need to fill out along the way is typically called a Buy Direction Letter. This is where you list the precious metals dealer you have selected, such as Nashville Coin Gallery. Decide Which Precious Metals to Purchase You can choose to invest in gold, silver, platinum, or palladium for your IRA. There are some restrictions regarding fineness requirements and allowable coin types, so it's important to get guidance from Nashville Coin Gallery in this area. Place Your Order Once the funds are available in your IRA account, you can call them to place your order for the desired precious metals. However, I don't recommend opening an IRA with Nashville Coin Gallery. Why? Because there are plenty of better options available for you. Opening a precious metals IRA is a major decision. That's why I suggest checking out our top gold IRA providers list. There, you can find the best precious metals dealer in your state and choose accordingly. Also, the list will help you understand what the industry's best has to offer and what you might miss out on.

Nashville Coin Gallery Fees and Charges: Do they overcharge?What are their fees? Do they have hidden fees?

It's important for people to know about fees and charges when they're thinking about investing in things like coins and precious metals. However, Nashville Coin Gallery's website doesn't give clear information about these fees, and that might make potential customers and investors feel disappointed.

When you're thinking about investing your money, it's really helpful to have all the details about how much things will cost. Not having this information on the website can make people uncertain about whether to invest or not. It's like not knowing all the costs before you buy something – you might end up surprised by extra expenses you didn't expect. Even though Nashville Coin Gallery has a good reputation and happy customers, not knowing the fees upfront can create doubts for those who want to understand everything before making a decision. This could also lead to worries about hidden fees that nobody likes. Transparency is Important

Nashville Coin Gallery Reviews and Complaints: BBB, Yelp, GoogleRead all the Nashville Coin Gallery reviews & complaints

Better Business Bureau (BBB) Based on two customer reviews, Nashville Coin Gallery has an A+ rating and a 3/5 rating on the Better Business Bureau website. The company has been in business for 20 years and has been accredited since 2007. One of their customers posted a negative review saying they should be arrested for robbing people, while another customer praised the company.

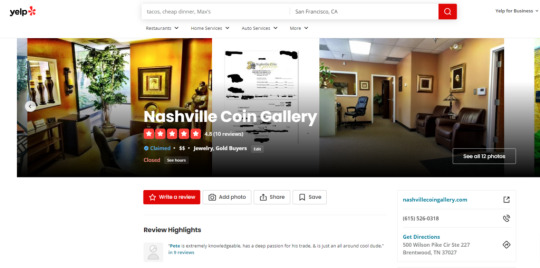

Nashville Coin Gallery has received #6 complaints on Google The company has received several unresolved complaints from customers. There are also several unresolved negative reviews on different platforms. Our #1 rated gold IRA company has ZERO unanswered complaints on BBB. Yelp Nashville Coin Gallery has a 4.8/5 star rating on the Yelp platform, based on 10 customer reviews. Customers have mostly posted positive reviews, appreciating the company for providing excellent customer service and being open and honest with them.

Google Reviews On Google, the company has received many reviews from customers, both positive and negative; however, the majority of customers have left positive reviews saying that the owner, Pete Dodge, responds professionally and is transparent and helpful to them. It is important to remember, however, that customers have also posted negative reviews.

Overall, the company has an insufficient online presence, and there are no client ratings and reviews on Trustpilot, which could be cause for concern for potential customers. Having a solid internet presence is essential for client trust and Nashville Coin Gallery's online visibility is not so good. Positive Reviews #1. Linda, a customer, described her great experience with the company, stating that the owner Pete was a wonderful guy to work with. It was her first time, and Pete helped set her at ease by explaining value, and condition, and answering all of her questions. Linda further stated that the company gave her more than she expected in return for her collection. Lastly, she said she would recommend this company to anyone looking to sell or purchase coins.

#2. Another customer, Ammon S., also shared his experience, adding that the drive to the company was worthy. Pete was kind and quick in handling the coins he sold. Lastly, he added, he got better deals than he could have received anywhere else.

#3. Mary stated that she liked her overall experience with the company and its owner, Pete. Pete was really polite and accommodating on the phone, she stated, and in person, he was happy to share his expertise on the coins he had. At last, she added, surely would recommend this company.

Negative Reviews #1. A customer, Charles advised that you should not sell your silver and gold here since you will get a higher price elsewhere. He described it as the biggest rip-off he has encountered in years. Lastly, he recommended avoiding doing business with this company.

#2. Another customer, Herman, stated that his experience was terrible and that the staff was rude and short-tempered. He also stated that it is not a coin company, but rather a little office with a table.

#3. Gerald, a customer, explained his terrible experience with the company, starting with its owner Pete, who appeared to be in a hurry to run errands rather than carefully evaluating customer's coins. He also added that he is sure Pete cheated him on his coin. Pete told the customer that his foreign coins were worthless and he did not even look at them. When the customer returned home, he looked up the coins and discovered that it was a $10 Spanish coin. At last, he advised everyone not to do business with this company.

Is Nashville Coin Gallery Legit? Should You Invest With Them?Is Nashville Coin Gallery a scam or legit? Are they worth it?

No, I don't recommend investing with them. Pros: - A+ rating on BBB Cons: - Risk of hidden fees and charges - Lack of transparency - Limited online presence - No Trustpilot rating I believe you have numerous better options available for you. Nashville Coin Gallery has been in the precious metals business for 20 years. On the Better Business Bureau, they have an A+ rating with 3 stars. However, little information on fees and charges has been revealed by the company, and there are few customer reviews. Before you make any final decision, I recommend checking out our top gold IRA providers. There, you will find out what the industry's best has to offer. Also, it will ensure you make an informed decision. Or, you can check out the best gold dealer in your state below: Each state has its regulations and rules, so we've sorted and found the best Gold IRA company for each state. Find the best Gold IRA company in your state Read the full article

0 notes

Text

Brisbane Taxation Services

Australia’s taxation laws are complex and ever-changing. As a result, many businesses hire accounting professionals to help them manage their taxes and comply with regulations.

Choosing the right accounting service is crucial for your business. A quality accounting service can save you time and money. It can also prevent costly mistakes.

Experience

Whether you’re running a small business or you have an income tax refund, the right brisbane taxation services accounting and bookkeeping services can help you stay compliant with Australian tax regulations. These professionals are experienced in allencompassing tax-related services, including filing, compliance, assessment, and advisory. They can provide the guidance and support you need to maximise your return.

If you are a US expat living in Australia, it’s essential to find a tax advisor who understands both countries’ laws. Choosing a firm that specialises in this area will ensure you don’t get double taxed on income and assets. USTaxCentral has a team of experts who can assist you with all of your cross-border needs.

A professional tax accountant will save you time and money. They’ll make sure you file your return correctly so that you receive the maximum possible tax refund. Their experience will also help you prepare for future tax changes and avoid penalties. They can also help you with your investment property tax and business taxes.

Personality

The staff at brisbane taxation services are friendly and approachable, with an emphasis on client relationships. They also have a strong focus on reducing your tax burden and maximising your deductions. They can provide advice on a range of personal and business tax issues, including property investment, payroll taxes, and self-employment. They can even help you plan your investments and develop a successful retirement strategy.

Their clients include prominent privately owned businesses, high growth companies, innovative start-ups, and reputable not-for-profit organisations. They also advise Australian expats living overseas, or preparing to return home. They have a deep understanding of international taxation issues, and can offer comprehensive advice on all aspects of Australian and foreign tax law.

Some of the top Brisbane tax accountants have quick response times and guarantee on time delivery of services. Maree’s Mobile Bookkeeping, BOSS Bookkeeping & Taxation, and Link Advisors are among the fastest. These Brisbane-based tax accountants are also insured and can handle complex tax issues.

Cost

Filing taxes can be stressful and time-consuming, but a qualified tax accountant can ease your end-of-financial-year anxiety. They can also help you maximise your tax refund by ensuring that you claim all eligible deductions. However, their fees vary depending on your location and the type of service you require.

On average, it costs $100 to $400 for a personal tax return in Australia. Business tax returns are more expensive. The cost of an accountant can increase if you need a full audit or a complex financial report.

Whether you’re a small or medium business owner, an experienced accountant can guide you on the best taxation strategies for your business. In addition to taxation services, they can also assist with payroll management and bookkeeping. Their expertise can help you stay compliant with the Australian Taxation Office and avoid penalties. They can also advise you on effective business management strategies. They can also prepare and lodge your business tax returns for you.

Availability

ATS business advisor Aspley provides world class tax preparation, filing, and support to help you save money or get the highest possible refund. They offer unlimited year-round advice and support, as well as a free initial consultation. They also have a full range of online services including Single Touch Payroll, business activity statements (BAS), reports, and other forms.

Whether you’re an individual or a business owner, it’s important to file your taxes on time. Not doing so can result in costly fines and penalties. However, dealing with your own taxes can be a daunting task, especially for those who are not familiar with the tax laws.

If you need professional tax assistance, you can turn to Boss Taxation for all your taxation needs. They provide expert, accurate end-to-end services to minimize your tax liabilities and keep you compliant. They can even handle your investment property tax returns, which can be a big relief for you. Moreover, they are open year round with day and night appointments available.

0 notes