#Nirmala Sitharaman announcement

Explore tagged Tumblr posts

Video

youtube

Rs 12 Lakh Tax Exemption Explained

#youtube#In the Union Budget 2024-25 Finance Minister Nirmala Sitharaman announced significant changes to the income tax structure under the new tax

0 notes

Text

Budget 2025: बजट में बिहार के लिए बहार, विधानसभा चुनाव से पहले बिहार को मिले कई बंपर गिफ्ट

Budget 2025: वित्त मंत्री निर्मला सीतारमण ने बजट पेश करने के दौरान कई ऐसी घोषणाएं की है जिससे लोग गदगद हो गए हैं, लेकिन इस बार का बजट बिहार वालों के लिए काफी ज्यादा खास माना जा रहा है, क्योंकि बजट में बिहार के लिए कई ऐसी घोषणाएं की गई है जिसे जानने के बाद हर बिहारवासी खुशी से झूम उठेंगे. आपको बता दे कि बजट (Budget 2025) में बिहार के लिए काफी कुछ ऐलान किया गया है. इसके बाद यह माना जा रहा है कि…

#Bihar Ko Budget 2024 Me Kya Mila#bihar news#Bihar ujala#Budget 2024#Budget Announcements for Bihar#Nirmala Sitharaman#Union Budget 2025

0 notes

Text

NITI Aayog announces revised composition.

New Delhi: The National Institution for Transforming India (NITI Aayog) has unveiled its revised composition, aimed at enhancing its strategic leadership and effectiveness. The Indian government has reconstituted the National Institution for Transforming India (NITI Aayog), with Prime Minister Narendra Modi remaining as the chairperson and economist Suman K Bery continuing as the vice-chairperson.

ALSO READ MORE- https://apacnewsnetwork.com/2024/07/niti-aayog-announces-revised-composition/

#Amit Shah home#Annapurna Devi Women and Child Development#Arvind Virmani#Chirag Paswan Food Processing#H D Kumaraswamy Heavy Industries#J P Nadda Health#Jitan Ram Manjhi MSMEs#Jual Oram Tribal Affairs#K R Naidu Civil Aviation#National Institution for Transforming India#Nirmala Sitharaman Finance#NITI Aayog#NITI Aayog announces revised composition#Nitin Gadkari Road Transport and Highways#Rajiv Ranjan Singh Fisheries#Ramesh Chand#Rao Inderjit Singh Statistics and Programme Implementation#Shivraj Singh Chouhan Agriculture#Union Minister Rajnath Singh#VK Paul#VK SaraswatVirendra Kumar Social Justice

0 notes

Text

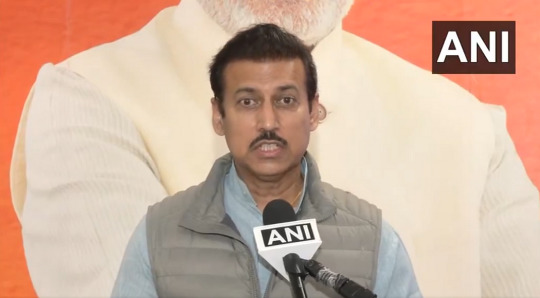

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes

Text

Latest income tax slabs 2025-26: How much tax do individuals earning slightly above Rs 12 lakh have to pay? Marginal relief calculations explained

Budget 2025 income tax: The total income till which marginal relief is available is near about Rs. 12,75,000/-. Latest income tax slabs 2025-26 post Budget 2025: Finance Minister Nirmala Sitharaman announced ZERO or NIL tax liability for individuals earning up to Rs 12 lakh in the Union Budget 2025. For salaried individuals, including the standard deduction, this limit is Rs 12.75 lakh. But what…

0 notes

Text

India Budget 2025-26: Tax relief may become boon for apparel retailers

When India’s Finance Minister, Nirmala Sitharaman, announced significant income tax relief in her Union Budget 2025-26 speech, she was undoubtedly aware of its potential to boost various economic sectors and the overall economy. Garment retailers share this view, expecting that increased disposable income among the middle and lower classes will drive consumer spending on apparel, benefiting the…

0 notes

Text

India’s coalition government has unveiled its first full-year budget, focusing on tax relief, infrastructure, and economic reforms. Finance Minister Nirmala Sitharaman announced tax cuts for the middle class, raising the exemption limit to ₹1.2 million, aiming to boost urban consumption.

The government has increased infrastructure spending to ₹11.2 trillion, while also pushing for nuclear energy expansion and allowing 100% FDI in insurance. Support for small industries and regulatory reforms aims to drive private investment.

Despite growth concerns, the government remains committed to fiscal discipline, targeting a deficit reduction to 4.4% by 2026

#general knowledge#affairsmastery#generalknowledge#current events#current news#upscaspirants#india#upsc#generalknowledgeindia#world news#india news#indian#taxes#modi#narendra modi#pm modi#bharat#minister#nirmala sitharaman#cabinet#infrastructure#finance minister#breaking news#news#political news#public news#upsccoaching#upsc current affairs#upscpreparation#upsc2025

0 notes

Text

Union Budget will make dream of self-reliant India a reality: Ranbir Gangwa

Chandigarh, February 3 – Haryana’s Public Works Minister Sh. Ranbir Gangwa said in the Budget presented by Union Finance Minister Smt. Nirmala Sitharaman for the financial year 2025-26, many visionary and inclusive policies have been announced, which are important for the development of not only Haryana but also for every other state. This is a development-oriented and balanced Budget. It is an…

0 notes

Text

Budget 2025: Relief for homeowners as no tax on second self-occupied house

The Union Budget 2025 presented brought good news for homeowners, as Finance Minister Nirmala Sitharaman announced new tax benefits.

Source: bhaskarlive.in

0 notes

Text

Budget 2025: Odisha gets Rs 10,599 crore for railway sector

Bhubaneswar: Union Railway Minister Ashwini Vaishnaw Monday announced that the Centre has allocated Rs 10,599 crore towards the railway sector in Odisha in the Union Budget for 2025-26. In his address to the media persons, Vaishnaw said, “I extend my sincere thanks to Prime Minister Narendra Modi, Finance Minister Nirmala Sitharaman and Odisha Chief Minister Mohan Charan Majhi for the cooperation…

0 notes

Text

"Union Budget 2025 Highlights: Key Announcements, Tax Reliefs, and Economic Impact"

On February 1, 2025, Finance Minister Nirmala Sitharaman presented her eighth consecutive Union Budget, marking a historic milestone in India’s fiscal chronicles. This budget, crafted under the guiding principle of “GYAN”—an acronym for Garib (poor), Yuva (youth), Annadata (farmers), and Nari Shakti (women empowerment)—aims to address the multifaceted needs of the nation. Key Highlights of the…

0 notes

Text

Budget 2025: Visa Reforms & Farepayer Travels Tour Packages

In a significant move to boost India’s tourism sector. Union Finance Minister Nirmala Sitharaman announced several transformative measures in the Union Budget 2025-26. The focus is on visa reforms, homestay loans, and infrastructure development, complemented by the offerings of Farepayer Travels. Which is set to elevate the tourism experience with its curated international and domestic tour packages. These initiatives aim to enhance travel convenience, foster job creation, and promote India as a leading global destination.

Top 50 Tourist Destinations to Be Revamped with Support from Farepayer Travels

The government plans to develop 50 top tourist destinations in collaboration with state governments. Following a competitive “challenge mode” for funding and resource allocation. States will be required to provide land for infrastructure development. While hotels in these areas will be classified under the Harmonized Master List (HML) to attract more investment.

These enhanced destinations will feature prominently in attracting global tourists to experience India’s rich cultural heritage. Additionally, Farepayer Travels’ domestic tour packages will promote these newly developed sites to encourage local tourism and economic growth.

“The top 50 destinations will be upgraded with state partnerships, focusing on infrastructure and attracting private investments,” Sitharaman said.

Five Strategic Measures to Drive Tourism-Led Job Growth

The budget outlines five key strategies that align with the expansion of Farepayer Travels’ international and domestic tour packages to stimulate tourism and employment:

Skill Development Programs: Institutes of Hospitality Management will offer specialized training to develop a skilled workforce, benefiting businesses like Farepayer Travels in providing high-quality travel services.

Financial Support for Homestays: The extension of MUDRA loans to homestay operators will encourage community-driven tourism, complementing Farepayer Travels’ domestic tour packages by offering unique, local accommodation options.

Enhanced Connectivity: Government investments in transportation will improve access to destinations featured in Farepayer Travels’ international tour packages, making travel smoother for tourists.

Incentives for States: Performance-linked incentives (PLI) will reward states for excellence in destination management, further enriching locations promoted through Farepayer Travels’ domestic tour packages.

Simplified Visa Processes: Streamlined e-visa systems and fee waivers will attract more international tourists, increasing the appeal of Farepayer Travels’ international tour packages.

“We aim to create jobs and enhance tourism by simplifying visas. Supporting homestays, and improving connectivity. which will directly benefit companies like Farepayer Travels,” Sitharaman noted.

Focus on Spiritual and Heritage Tourism with Farepayer Travels

The budget reinforces the government’s commitment to spiritual tourism. Especially focusing on destinations related to Lord Buddha’s life and teachings. These spiritually significant sites will feature prominently in Farepayer Travels’ domestic tour packages, attracting pilgrims and cultural tourists alike.

“We will continue to invest in spiritual destinations, particularly those connected to Lord Buddha, to position India as a global pilgrimage hub,” Sitharaman added.

Medical Tourism and the ‘Heal in India’ Initiative

With India’s growing reputation in medical and wellness tourism, the government will collaborate with private stakeholders to promote the ‘Heal in India’ initiative. Simplified visa processes will attract more foreign patients, benefiting Farepayer Travels’ international tour packages tailored for medical tourists. Furthermore, Farepayer Travels’ domestic tour packages will highlight wellness retreats and health tourism spots across India.

“The ‘Heal in India’ initiative will strengthen our position as a medical tourism hub. With support from private players like Farepayer Travels,” Sitharaman stated.

Implications for the Travel Industry and Farepayer Travels

The Union Budget 2025-26 is expected to significantly boost investment in the tourism sector, improve service standards, and generate employment. Companies like Farepayer Travels will play a critical role in promoting international tour packages and domestic tour packages that align with the government’s tourism development initiatives.

With a focus on infrastructure, skill development, and visa reforms, Farepayer Travels is set to attract both local and international tourists. Positioning India as a must-visit global destination.

For more details on tour packages, visit farepayer.com.

#Budget 2025-26#Visa Reforms#Homestay Loans#Farepayer Travels#Indian Tourism#International Tour Packages#Domestic Tour Packages#Union Budget 2025-26

0 notes

Text

India Unveils Ambitious Plan to Develop 50 New Tourist Destinations, Boost Employment

In a bold move to revitalize India’s tourism sector and create millions of jobs, Union Finance Minister Nirmala Sitharaman announced a sweeping initiative to transform 50 destinations into world-class tourist hubs as part of the Union Budget 2025-26. The announcement, made during her budget speech on February 1, 2025, signals a significant shift toward employment-led growth in the tourism industry, which contributes 5% to India’s GDP and supports 76 million jobs. Expand to read more

#India tourism budget 2025#50 new tourist destinations#India travel growth#Union Budget 2025 tourism#employment in tourism#Buddhist circuit development#medical tourism India#Swadesh Darshan scheme#PRASHAD scheme#Indian tourism infrastructure

0 notes

Text

Budget 2025 Boosts Real Estate Stocks: Key Announcements Impacting Sector

Shares of major real estate players such as DLF, Sobha Ltd, Oberoi Realty, Prestige Estates, Phoenix Mills, and Macrotech Developers saw significant gains on February 1, 2025, following Finance Minister Nirmala Sitharaman's announcement of several measures aimed at stimulating the real estate sector. Some stocks jumped by as much as 9%, reflecting positive investor sentiment in response to the budget proposals.

For instance, Prestige Estates' shares closed 5.03% higher at Rs 1,431.50, while DLF saw a 2.10% increase, closing at Rs 760.75. As a result, DLF's market capitalization surged to Rs 1.88 lakh crore, highlighting investor optimism.

Here’s a breakdown of the key budget announcements that are expected to have a lasting impact on the real estate market:

SWAMIH Fund 2 The establishment of a Rs 15,000 crore SWAMIH Fund 2 is designed to accelerate the completion of one lakh affordable and mid-income housing units. This initiative, a collaboration between the Government of India, banks, and private investors, is expected to increase the supply of housing and boost market confidence.

Tax Benefits for Self-Occupied Properties The budget introduced a provision allowing taxpayers to claim the annual value of two self-occupied properties as Nil for tax purposes, up from just one property previously. This measure is expected to benefit individuals with multiple properties.

Increased TDS Limit on Rent The limit for Tax Deducted at Source (TDS) on rent has been raised from Rs 2.4 lakh to Rs 6 lakh, benefiting small taxpayers who earn rental income. This move is seen as a positive for landlords and tenants alike.

Smart City Mission Funding Boost The allocation for the AMRUT and Smart Cities Mission has been increased by 25%, from Rs 8,000 crore to Rs 10,000 crore. This funding increase is likely to have a ripple effect on construction and building material demand.

The budget measures also include the announcement that individuals under the new tax regime won’t have to pay income tax on income up to Rs 12 lakh, which is expected to boost disposable income and consumer spending. A portion of these savings may flow into the real estate sector, further supporting market growth.

The positive reaction was evident in the market as shares of Oberoi Realty rose by 1.83%, closing at Rs 1,845.65, and Phoenix Mills surged 7.27%, reaching Rs 1,761.55. Other developers like Sobha Ltd and Macrotech Developers also saw stock price increases.

In the broader market, the BSE Realty Index gained 3.69% or 264 points, closing at 7,414, reflecting overall optimism in the sector. Although the index has experienced a 10.74% rise since the Interim Budget in February 2024, it has still faced a decline of 11% since the Union Budget of 2024 was presented.

As these measures unfold, the real estate sector appears poised for sustained growth, with potential positive implications for developers, investors, and the housing market in general.

0 notes

Text

Income Tax Slabs for FY 2025-26: Comparing New vs. Old Tax Regimes – Which is Better for You?

Income Tax Slabs for FY 2025-26: Comparing New vs. Old Tax Regimes – Which is Better for You...

KKN Gurugram desk | In her Union Budget speech for 2025, Finance Minister Nirmala Sitharaman announced significant income tax relief aimed at providing substantial benefits for middle-class taxpayers in India. A major highlight was the elimination of income tax for individuals earning up to Rs. 12.75 lakh annually, marking a crucial shift in the income tax structure for the financial year…

0 notes

Text

PM Internship Scheme does not provide jobs, clarifies Sitharaman in Parliament

Finance Minister Nirmala Sitharaman on Tuesday, February 4, clarified in Rajya Sabha that the Prime Minister Internship Scheme does not provide employment but is a means for exposure. The Prime Minister Internship Scheme, which was announced in 2024, aims to provide skills to the youth to make them job ready. “The intent of the programme itself is not to provide job, but to provide an exposure,…

0 notes