#New Hampshire LLC Operating Agreements

Explore tagged Tumblr posts

Text

Why You Need an LLC Operating Agreement and How to Make One

When starting a Limited Liability Company (LLC), it is important to have an LLC operating agreement in place. This document outlines the ownership and management structure of the LLC and lays out the rules and procedures that govern its operation. In this article, we will explain why having an LLC operating agreement is essential and provide a step-by-step guide on how to create one.

What is an LLC Operating Agreement?

An LLC operating agreement is a legal document that sets out the rules and procedures governing an LLC's operation. It outlines the ownership and management structure of the LLC and specifies the responsibilities and rights of the members. It also establishes the rules and procedures for the management of the LLC and provides a framework for resolving disputes.

Why You Need an LLC Operating Agreement

Having an LLC operating agreement is essential for several reasons. First, it clarifies the ownership and management structure of the LLC and sets out the rules and procedures governing its operation. This can help to prevent disputes and ensure that everyone is on the same page. Second, an LLC operating agreement can help to protect the limited liability status of the LLC. Without an operating agreement, the LLC may be subject to the default rules of state law, which may not provide adequate protection for the members' personal assets. Finally, an LLC operating agreement can help to establish credibility with banks, investors, and other stakeholders. It demonstrates that the LLC is a well-organized and professionally managed entity.

What to Include in an LLC Operating Agreement

An LLC operating agreement should include several key provisions. These include:

The name and purpose of the LLC

The identity of the LLC's members

The management structure of the LLC

The capital contributions of the members

The ownership and profit allocation structure

The voting rights and procedures

The management responsibilities and duties

The meeting procedures

The buyout and dissolution provisions

Step-by-Step Guide to Making an LLC Operating Agreement

Here is a step-by-step guide to creating an LLC operating agreement:

1. Choose Your LLC's Members

The first step in creating an LLC operating agreement is to determine who will be the LLC's members. Members are the owners of the LLC and are typically individuals or other companies.

2. Decide on Your LLC's Management Structure

The next step is to decide on the management structure of the LLC. Will it be managed by its members, or will it be managed by a separate manager or management team?

3. Set Out Your LLC's Purpose and Goals

Next, you should set out the purpose and goals of the LLC. This should include a clear statement of what the LLC will do and what its objectives are.

4. Determine Capital Contributions

Each member of the LLC must make a capital contribution to the LLC. This is typically in the form of cash or property.

5. Outline the Ownership and Profit Allocation Structure

Once the capital contributions have been determined, you should outline the ownership and profit allocation structure of the LLC. This should specify each member's percentage ownership in the LLC and how profits will be distributed.

6. Detail Voting Rights and Procedures

It is important to specify the voting rights and procedures in the LLC operating agreement. This should include the number of votes required to make decisions and the procedures for calling meetings and casting votes.

7. Outline Management Responsibilities and Duties

The operating agreement should also specify the management responsibilities and duties of each member and any managers. This should include a description of their roles and responsibilities, as well as any limitations on their authority.

8. Set Up Meeting Procedures

The operating agreement should establish procedures for conducting meetings. This should include the frequency of meetings, the notice requirements, and the procedures for conducting meetings.

9. Establish Buyout and Dissolution Provisions

Finally, the LLC operating agreement should establish provisions for buying out a member's interest in the LLC and for dissolving the LLC if necessary. This should include the procedures for determining the value of a member's interest and the requirements for dissolving the LLC.

Review and Revise Your LLC Operating Agreement

Once you have drafted your LLC operating agreement, it is important to review and revise it as necessary. You should ensure that all provisions are clear, concise, and enforceable, and that they comply with state law. You may also want to seek the advice of a lawyer to ensure that your operating agreement is legally sound.

Also Read :- The Importance of Reviewing Your New Hampshire LLC Operating Agreement Regularly

FAQs

Q : Is an LLC operating agreement required by law?

A : No, an LLC operating agreement is not required by law, but it is strongly recommended.

Q : Can I create an LLC operating agreement myself?

A : Yes, you can create an LLC operating agreement yourself, but it is recommended that you seek the advice of a lawyer to ensure that it is legally sound.

Q : Can an LLC operating agreement be changed?

A : Yes, an LLC operating agreement can be changed at any time, provided that all members agree to the changes.

Q : Can an LLC operate without an operating agreement?

A : Yes, an LLC can operate without an operating agreement, but this is not recommended. Without an operating agreement, the LLC may be subject to the default rules of state law, which may not provide adequate protection for the members' personal assets.

Q : Where can I get help creating an LLC operating agreement?

A : You can get help creating an LLC operating agreement from a lawyer or legal service provider that specializes in business law. For those in New Hampshire, visit nhlegalforms.com for assistance with creating a New Hampshire LLC operating agreement.

Conclusion

creating a solid New Hampshire LLC operating agreement is crucial for the success of your business. This document provides a framework for ownership and management while also preventing disputes. By following the steps outlined in this article, you can create an effective LLC operating agreement that will protect your business and ensure its long-term success.

If you need help crafting a comprehensive New Hampshire LLC operating agreement, visit nhlegalforms.com. Our team of legal experts can guide you through the process and ensure that your agreement meets all the necessary requirements. Don't wait until it's too late – start building a strong foundation for your LLC today with nhlegalforms.com.

Reference URL :- Why You Need an LLC Operating Agreement and How to Make One

0 notes

Text

☀️ RMLD and NextEra Energy - Seabrook Solar Project

RMLD is working with NextEra Energy Resources, LLC, to bring two solar arrays to land adjacent to the Seabrook Station Nuclear Power Plant, located in Seabrook, New Hampshire. RMLD recently executed a Power Purchase Agreement and the permitting process for the project is underway. The two solar arrays, Seabrook Solar 3 and Seabrook Solar 4, will be operational in the summer of 2024 and have…

View On WordPress

0 notes

Text

WATER METER MARKET ANALYSIS

Water Meter Market, By Type (Rotary Piston, Single Jet, Multi Jet, Woltman, Combination, Electromagnetic, Ultrasonic), By Application(Residential, Commercial and Industrial),and by Region (North America, Latin America, Europe, APAC and MEA) - Size, Share, Outlook, and Opportunity Analysis, 2019 - 2027

Market Insight- Global Water Meter Market

Market Overview

A water meter is a device used for measuring the amount of water passed through a pipe. The water meter is connected over or joined between pipes for the measurement of the flow. In many developed countries, water meters are used to measure the volume of water in residential and commercial buildings. These buildings are supplied with water by public water supply system. Water meters also find applications at the water source, or throughout the water system to determine flow through a particular region of the system. Conventional water meters do not have communication capabilities, hence manual readings are required to be taken. On contrary, smart meters possess communication capabilities where they can send water consumption readings directly to the supplier through a secure communication network.

The global water meter market was valued for US$ 4,093.3 Mn in 2019 is expected to exhibit a CAGR of 5.0 % during the forecast period.

Market Dynamics- Drivers

High efficiency offered by smart water meters is expected to drive growth of the global water meter market during the forecast period

Smart water meters provide significant advantages over standard water meters. Consumers can get better insights regarding their water consumption with the help of smart water meters. Furthermore, using smart water meters can improve analysis of water usage, which helps to make necessary adjustments to reduce water usage and save money. Accurate billing functionality would reduce the estimation of water usage and increase the satisfaction of customers. Advanced technologies such as data collection, wireless connectivity, and cellular connectivity can offer integrated infrastructure for water utilities by reducing cost required for wiring. Moreover, remote identification and clarification tools add to the increased efficiency of smart water metering infrastructure. Thus, these factors are expected to drive growth of the global water meter market during the forecast period.

Proactive government programs and supplementary initiatives by key players are expected to propel the global smart water meter market growth over the forecast period

Encouraging government programs and supplementary initiatives by major market players to improve water metering infrastructure are expected to support the market growth in the near future. According to bill AB 2572, passed in 2004 by the Legislative Council of the State of California in the U.S., all the water suppliers are required to install water meters for all customer connections by January 1, 2025. Since the government mandates that water utilities are required to follow guidelines described, the water meters are expected to witness significant demand in the near future. Furthermore, under the Metering Programme started by Southern Water, Worthing, the U.K., around 450,000 water meters were installed within the Kent, Sussex, Hampshire, and Isle of Wight regions of the U.K. Installation of these water meters was concluded in the late.

Asia-Pacific region dominated the global water meter market 32.5% in 2019 followed by North America and Europe, respectively

Source: Coherent Market Insights

Market Dynamics- Restraints

High costs required for connected metering infrastructure are expected restrain growth of the global water meter market during the forecast period

Connected water metering infrastructure requires high cost for installation since there are numerous technological components involved to enhance efficiency of smart meters. Furthermore, automated reading and reporting techniques used in smart meters remove the need for manual reading. However, the two-way communication required for automated reporting needs technologies such as power line communication (PLC), broadband, wireless radio frequency, and cellular transmission, which would increase the overall cost by a large margin. Moreover, incorporation of IoT and geographic information systems (GIS) increase the cost. This, in turn, hampers the adoption and thereby restrains the market growth in the near future.

Data security-related concerns are expected to hinder the global water meters market growth over the forecast period

The to-and-from communication in smart water meters is extremely crucial thus, the protection of the data generated becomes a major challenge for water utilities. Moreover, Wireless connectivity techniques such as wireless mesh are also used for communication, further increasing the risk of data breach. Growing threats related to data breaches could prove a substantial restraint during the forecast period unless a strong and secure network infrastructure is implemented. Furthermore, consumer privacy invasions as a result of smart meter installations are expected to hinder the global water meter market growth in the near future.

Market Opportunities

Rapid urbanization is expected to provide major growth opportunities

Growing urbanization around the globe is expected to increase the demand for water utilities to supply sufficient water for an increased population. According to the United Nations’ 2014 Revision of the World Urbanization Prospects white paper, 54% of world’s population was urban in 2014 and is expected to grow further at a healthy rate so that in 2050, 66% (i.e., two-third) of the global population would be urban. Furthermore, a vast percentage of population is located in urban areas where essential utilities such as electricity and water must be utilized efficiently. Water meters present a perfect solution, in order to maintain and monitor water distribution infrastructure for highly populated urban areas. This, in turn, is expected to present major growth opportunities over the forecast period.

Growing demand for replacement due to aging infrastructure is expected to offer lucrative growth opportunities in the near future

Developed regions such as North America and Europe have been using water meters for over 15 years. However, the old metering infrastructure is not sufficient to fulfill current requirements. There is an increasing need to replace old meters with new and advanced meters, in order to enhance the efficiency and integrate state-of-the-art technologies. For instance, in 2014, the City of Wheaton, Illinois, the U.S., started a water meter replacement program and is expected to end in 2019. Under this program most of the 16,500 water meters installed in the city would be replaced with advanced meters with wireless connectivity. Similar programs have been commenced by cities including Ontario, Canada, Massachusetts, U.S., etc.

Source: Coherent Market Insights

Market Trends

Growing adoption of plastic-based water meters and components

The global water meter market is witnessing increasing adoption of plastic materials such as high quality polymers. Plastic meters offer several advantages over metal-based meters such as flexibility and low cost. Moreover, plastic is not a good conductor of electricity, which reduces the complexities of deployment. Many leading market players are focused on offering plastic water meters and components. For instance, Aichi Tokei Denki has developed disposable electromagnetic flow sensors product series DSV with the help of plastic molding components. As magnetic field easily passes through plastic, such components are gaining popularity in the market, particularly for electromagnetic meters.

Growing awareness among residential consumers regarding reduced water wastage

Residential segment accounts for the largest share in the global water meter market, where majority of revenue is generated from residential water meters. As the water used by these consumers is paid water, they are trying to reduce their expenses by reducing their consumption rate and also reducing water. Advanced water meter solutions can monitor real-time data from the consumer end thereby providing critical information to consumers about daily usage.

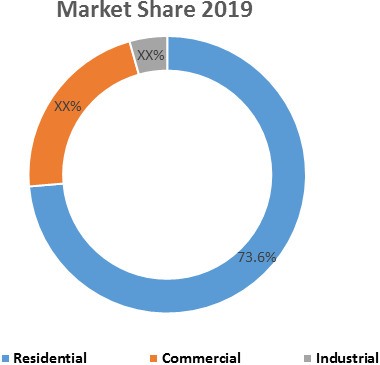

Segment information:

In global water meter market, by application segment, residential sub-segment dominated the global market in 2019, accounting for 73.6% share in terms of value.

Source: Coherent Market Insights

Regulations

Middle East & Africa

According to the Qatar General Electricity & Water Corporation "KAHRAMAA“, All material for services connection such as MDPE (Medium Density PolyEthylene) pipes and fittings, electronic water meter and water meter cabinet to comply with the latest edition of KAHRAMAA, General Specification of Main Laying Materials.

According to the UAE’s Customer Metering Regulations, Nominal flow rate (Qn) in cubic meters or imperial gallons per hour must be mentioned on the meter. Moreover, each meter should display the year in which it was last tested. According to the UAE government regulations, maximum error limit for lower flow rates is ±5.0% and that for upper flow rates is ±2.0%.

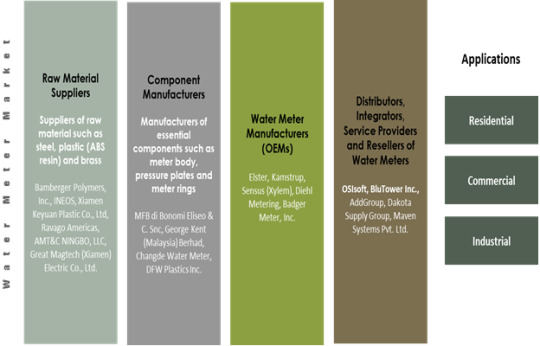

Value Chain Analysis

Competitive Section

Key players operating in the global water mater market are Diehl Stiftung & Co. KG, Jiaxing Eastron Electronic Instruments Co., Ltd, Azbil Kimmon Co., Ltd., NINGBO WATER METER CO., LTD., Badger Meter, Inc., Elster Group GmbH, Plata Meter Co., Ltd, Master Meter, Inc., Mueller Systems, LLC, Neptune Technology Group Inc., ZENNER International GmbH & Co. KG, Gioanola S.R.L., Sensus (Xylem Inc.), Aichi Tokei Denki Co., Ltd, Kamstrup A/S, Apator SA, Maddalena Spa, Arad Group, Fedrel Meter, and Itron Inc.

Key Developments

Major companies in the market are focused on contracts and agreements, in order to enhance their market presence. For instance, in October 2017, Diehl Stiftung & Co. KG entered into strategic cooperation agreement with Abunayyan Holding for ultrasonic water meter technology.

Key companies in the market are involved in contracts and agreements, in order to enhance their market presence. For instance, in April 2019, Badger Meter Inc. entered into contract with Municipal Corporation of Colorado City to provide smart water technology.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization focused on assisting our plethora of clients achieve transformational growth by helping them make critical business decisions.

What we provide:

Customized Market Research Services

Industry Analysis Services

Business Consulting Services

Market Intelligence Services

Long term Engagement Model

Country Specific Analysis

Contact Us:

Mr. Shah

Coherent Market Insights Pvt. Ltd.

Address: 1001 4th ave, #3200 Seattle, WA 98154, U.S.

Phone: +1-206-701-6702

Email: [email protected]

Press Release/Source

Request Sample

Download PDF

0 notes

Text

How to Download Your New Hampshire LLC Operating Agreement

As a business owner in New Hampshire, having a well-crafted LLC operating agreement is essential to ensure smooth operations and protect your business interests. At nhlegalforms.com, we offer customizable LLC operating agreement templates tailored to the unique needs of your business. Simply fill out our easy-to-use form, and download your personalized agreement in minutes. Protect your business and streamline operations with a New Hampshire LLC operating agreement from nhlegalforms.com.

0 notes

Text

0 notes

Text

0 notes

Text

MRM Franchise Feed: Bojangles Acquired and Chicken Salad Chick Celebrates 100th

Modern Restaurant Management (MRM) magazine's Franchise Feed offers a glimpse at what's new in the restaurant franchise environment.

Send news to Barbara Castiglia at [email protected].

Bojangles Acquired

Bojangles’, Inc. will be acquired by Durational Capital Management LP and The Jordan Company, L.P in an all cash transaction where Bojangles’ stockholders will receive $16.10 per share, representing a 39-percent premium to the closing share price of February 12.

The acquisition, which has been unanimously approved by Bojangles’ Board of Directors, is subject to stockholder approval and other customary closing conditions. Concurrently with the execution of the acquisition agreement, Bojangles’ majority stockholder executed a customary voting agreement whereby it agreed (among other things) to vote its shares in favor of the acquisition. The transaction is expected to be completed in the first quarter of fiscal year 2019. Upon closing of the transaction, Bojangles’ will continue to be operated as an independent, privately-held company and will remain based in Charlotte, North Carolina.

“For the Bojangles’ family of employees, franchisees, and our customers, today’s announcement represents an exciting next phase for this great brand. The new ownership group is committed to maintaining the qualities of this brand that have sustained it for over four decades,” said Randy Kibler, Bojangles’ Interim President and CEO.

“In consultation with our outside advisors, the Board of Directors has been evaluating several strategic alternatives over the last several months. We are confident that this agreement offers a promising opportunity to realize the highest value for our stockholders while providing a strong path forward for the Bojangles’® brand, its employees, franchisees, and loyal customers,” said William A. Kussell, Director and Non-Executive Chairman of Bojangles’.

“Bojangles’ is an iconic brand with an authentic Southern heritage and a deeply loyal following,” said Eric Sobotka, Managing Partner at Durational Capital Management. “We have admired the brand and its high quality and craveable food for years, and we look forward to partnering closely with the employees and franchisees to drive its future growth and continued success.”

“Bojangles’ has a differentiated offering, a talented team of employees and dedicated franchisees that are committed to their businesses and their communities,” said Ian Arons, Partner at The Jordan Company. “We are excited to invest in a company with such great growth potential, and we believe that with our and our partners’ support, Bojangles’ will be well-positioned for long-term success.” BofA Merrill Lynch acted as financial advisor and Shearman & Sterling LLP acted as legal counsel to Bojangles’ and its Board of Directors. Houlihan Lokey also acted as financial advisor to Bojangles’ and its Board of Directors.

Citigroup Global Markets Inc. served as financial advisor to the consortium and, together with KKR Capital Markets LLC, provided fully committed financing in support of the transaction. Akin, Gump, Strauss & Feld LLP, Kirkland & Ellis LLP, and Seyfarth Shaw LLP acted as legal counsel in connection with the transaction.

Founded in 1977 in Charlotte, N.C., Bojangles’ at July 1, 2018, Bojangles’ had 766 system-wide restaurants, of which 325 were company-operated and 441 were franchised restaurants, primarily located in the Southeastern United States.

Papa Gino's Sold

PGHC Holdings, Inc., parent company of the New England restaurant chains Papa Gino's Pizzeria and D'Angelo Grilled Sandwiches, reached an agreement in principle to sell the company to a Wynnchurch Capital portfolio company.

The proposed transaction would significantly strengthen the chains' financial resources, allowing PGHC to remodel and modernize their 141 company-owned restaurants in Massachusetts, New Hampshire, Rhode Island, and Connecticut; open additional restaurants throughout New England; and enhance its online ordering capabilities at all restaurants.

"We are pleased to have reached an agreement that will ensure a long and prosperous future for these iconic New England restaurants," said Corey Wendland, Chief Financial Officer. "For some time, we have been pursuing a plan to strengthen our financial footing and secure capital for investment in our restaurants, while also addressing our significant debt load. We are confident that the agreement with Wynnchurch achieves all of those goals."

Wynnchurch is a leading middle-market private equity investment firm with $2.2 billion of committed capital under management. Wynnchurch has a long history of partnering with middle market companies like PGHC in the United States and Canada that possess the potential for substantial growth and profit improvement.

In order to effectively and efficiently complete the proposed sale, the company filed petitions for protection under Chapter 11 of the U.S. Bankruptcy Code. This proceeding will ensure PGHC can maintain normal business operations at all of its restaurants with improved liquidity as it pursues the sale. As part of this process, and as is customary, PGHC will solicit competing offers to maximize the ultimate value of the sale, for both the company and its stakeholders. Under this process, the sale will require court approval. Importantly, PGHC generates positive cash-flow from operations and has requested court approval for debtor-in-possession financing from Wynnchurch to provide additional liquidity during the sale process. PGHC will continue to pay its network of suppliers on normal terms and schedules for goods and services received during the Chapter 11 process and will continue to honor its customer rewards and gift cards programs.

"We recognize we have a responsibility to not only provide for the future of these businesses, for our valued team members and guests, but to also ensure our current debt structure is sufficiently addressed," Mr. Wendland said. "We believe this process will allow us to do just that and build an even better company for all of our team members by creating an atmosphere that team members will be proud to serve in. PGHC will continue its long tradition of hosting birthday parties, team celebrations and other neighborhood events as well as serving delicious favorites like Papa Gino's famous 3-Cheese Pizza or a D'Angelo Steak & Cheese."

PGHC has already taken important steps to address the debt structure and focus its financial resources. Following a careful review and analysis, on November 4, 2018, PGHC closed approximately 95 under-performing restaurants. The company regrets having to close these restaurants but believes focusing resources on a core of best-performing restaurants is the responsible approach.

One hundred Papa Gino's restaurants and 78 D'Angelo Grilled Sandwiches restaurants, including franchise locations, continue to operate and remain open for business. Where possible, PGHC hopes to move certain team members from closed restaurants to restaurants that continue to operate.

"These were hard decisions but decisions we believe were absolutely necessary to allow Papa Gino's and D'Angelo Grilled Sandwiches to continue serving New England now and for years to come," Mr. Wendland said. "We look forward to serving our guests the pizza and grilled sandwiches they have come to love over many decades. If your nearest Papa Gino's or D'Angelo has closed, be assured that your favorite pizza or Steak Number 9 sandwich awaits you at a re-energized restaurant not too far away."

For more information on the sale process, please visit PGHCsaletransaction.com or call 1.800.390.2649.

In a Facebook post, Papa Gino's said:

"We were overwhelmed to receive the passionate response of our guests who were disappointed by the recent closure of several Papa Gino's restaurants (we were unable to comment on the news until this morning's press release, announcing our impending sale).

While we regret the rather abrupt closures, we are currently undergoing major updates to better serve our guests and ask for your patience as we make these changes. As New England's local pizzeria since 1961, we are still standing strong and will be relaunching our restaurants, introducing improvements for the benefit of all of our guests. In the meantime, you can still order online and visit papaginos.com to find your nearest location. Gift cards and rewards remain valid and may still be used at any location.

All the steps we are taking have one goal: to make Papa Gino’s restaurants even better for the communities we serve now and for years to come. We are excited about the plan to modernize our restaurants while staying true to what our guests have most come to love about Papa Gino’s. To all our guests, we thank you again for your concern. The Papa Gino's team is hard at work and we appreciate all the support!"

UNO Sells Eight Restaurants

UNO Restaurants, LLC , the owner, operator and franchisor of the UNO Pizzeria & Grill brand, sold eight company-owned restaurants to MVPizza, LLC as part of a broader re-franchising initiative. The eight restaurants are located in the Maryland and Virginia markets and are the first markets to be sold in connection with UNO’s re-franchising initiative. MVPizza, LLC retained all of the management, hourly and field employees offering them a unique growth opportunity under franchise ownership. MVPizza, LLC is an affiliate of the Bastian Restaurant Group, owned by Amir Yazdi. The Cypress Group is serving as the exclusive advisor to UNO in the re-franchising of company-owned restaurants.

Yazdi, President & Chief Executive Officer of MVPizza, LLC and the Bastian Group, said, “I am excited to be part of an iconic brand with such a rich and authentic history as UNO. I am also honored to have such a dedicated team of people who will ensure a smooth transition of the business and to be able to offer them additional opportunities to grow in their careers at UNOs.”

Louie Psallidas, President & Chief Executive Officer of UNO, stated, “I am pleased to welcome Amir Yazdi and the Bastian Group to the UNO family. I look forward to a mutually beneficial, long-term relationship with Amir and his team and to supporting him in the growth of the UNO brand in his markets.”

Psallidas went on to say, “The re-franchising initiative was intended to facilitate the growth of the UNO brand through its new prototype dubbed UNO Next. The UNO Next design, created in partnership with Synergy Restaurant Consultants, brings forward the rich and authentic history of the UNO brand and combines it with a new contemporary design featuring an open display kitchen, a large bar and community tables designed for groups and socializing, a dedicated area for take-out and a significant technology component. We intend to open a company-owned UNO featuring the UNO Next design in 2019.”

This is the first of two re-franchising transactions entered into by UNO. The second transaction is with a franchise group that operates over 160 restaurants across two brands in 14 states. The second transaction is slated to close in November for the sale of restaurants in certain Northeast markets.

Upon the closing of the second re-franchising transaction, UNO will have 38 company- owned and 54 domestic and 8 international franchised restaurants. The company-owned restaurants are primarily based in New England, Florida and Chicago.

The Cypress Group is serving as the exclusive advisor to UNO in the re-franchising of Company-owned restaurants. Cypress provided valuation services, identified potential acquirers, structured the deal terms and advised UNO throughout the transaction process.

Taco Bueno Restructuring

Taco Bueno Restaurants LP entered into an agreement with Taco Supremo, LLC, an affiliate of Sun Holdings, Inc. and certain of its other stakeholders regarding the terms of a comprehensive financial restructuring that will position the Company for long-term financial health and enable the Company to better compete in the Tex-Mex quick-service restaurant sector.

Sun Holdings is a multi-concept franchisee based in Dallas, Texas, with more than 800 locations across eight states, including Burger King, Popeyes, Arby's, Golden Corral and Krispy Kreme. As one of the largest franchisees in the United States, Sun Holdings has more than 20 years of operating experience and expertise in quick service restaurants. Upon Taco Bueno's completion of its restructuring, Sun Holdings intends to invest in remodeling Taco Bueno locations, increasing brand initiatives and enhancing the customer experience.

To implement the restructuring process, the company and its subsidiaries have filed voluntary petitions under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the Northern District of Texas and filed a prepackaged plan of reorganization (the "Plan"). Taco Bueno will continue to operate in the ordinary course of business, serving fresh and flavorful authentic Tex-Mex cuisine during the restructuring process.

Prior to the filing, the Sun Holdings affiliate acquired all of Taco Bueno's outstanding bank debt and has provided a commitment for up to $10 million in debtor-in-possession ("DIP") financing that, subject to court approval, will support the Company's operations during the financial restructuring process. Under the terms of the Company's prepackaged plan of reorganization, Sun Holdings would become the owner of Taco Bueno through a debt-for-equity swap.

"We are pleased to have reached this agreement with Sun Holdings on the terms of a financial restructuring that will strengthen our balance sheet and position our company for continued success. We also look forward to welcoming Sun Holdings as the new owner of Taco Bueno," said Omar Janjua, Chief Executive Officer, Taco Bueno. "Sun Holdings is a large, multi-concept franchisee based in Dallaswith a deep understanding of both the quick service space and the region where we operate, which will enable us to be an even more attractive employer, business partner and dining staple in the communities we serve. During this court-supervised process, we will continue to focus on initiatives to grow the Taco Bueno brand, while remaining true to our roots, delivering great-tasting meals to our customers in an inviting and comfortable environment. We thank our dedicated employees for continuing to provide an authentic, better-tasting Tex-Mex experience and unmatched customer service to guests as we've done for more than 50 years."

During the restructuring process, Taco Bueno expects to continue operating restaurants across Texas, Oklahoma, Arkansas, Kansas, Louisiana and Missouri, which includes restaurants independently owned and operated by franchisees that are not a part of the Chapter 11 proceedings.

"Taco Bueno is a great brand with loyal customers, and we have long admired their commitment to serving authentic Tex-Mex cuisine made by real cooks, in real kitchens and providing unmatched customer service," said Guillermo Perales, Chief Executive Officer and Founder of Sun Holdings Inc. "We know quick service and the customer base well, and we see considerable opportunities to invest across the Taco Bueno footprint to enhance the customer experience and drive long-term growth for the brand. We look forward to working with Omar, the rest of the Taco Bueno management team and all the hard-working employees to continue serving Buenoheads well into the future."

In conjunction with the Chapter 11 process, Taco Bueno has filed a number of customary motions with the Bankruptcy Court seeking authorization to support its operations during the financial restructuring process, including authority to continue to pay employee wages and provide health and other benefits, and to pay vendors and suppliers in the ordinary course for all goods and services provided on or after the Chapter 11 filing date. The Company expects to receive Bankruptcy Court approval for these requests.

Additional information is available on Taco Bueno's restructuring website here.

Chicken Salad Chick's Milestone

Chicken Salad Chick's 100th restaurant will open on November 8 just outside Lexington, Kentucky in Nicholasville at 254 E Brannon Road. This milestone marks the brand's first location in Kentucky and emphasizes Chicken Salad Chick's accelerated growth, with 22 new openings to date this year and an additional six slated to open by the end of 2018.

"We're so proud to be opening our 100th restaurant and to see how far the brand has come since its launch," said Scott Deviney, CEO of Chicken Salad Chick. "This is a significant achievement that wouldn't be possible without our passionate franchisees and loyal guests. We're thankful for their unwavering support and look forward to continuing the momentum as we grow Chicken Salad Chick."

The Nicholasville restaurant is owned and operated by first-time Chicken Salad Chick franchisees Vickie and John Tranter. The Tranters have an extensive background in foodservice and hospitality and have been business owners for more than two decades. Prior to franchising with Chicken Salad Chick, they owned a variety of other concepts including Fazoli's, Hampton Inn, Holiday Inn and Best Western locations throughout Virginia and Ohio, and currently own an Auntie Anne's Pretzels in Lexington.

"John and I have been in the business for a long time, and we know a good concept when we see one. I knew immediately after experiencing Chicken Salad Chick firsthand that this was a brand we had to be a part of," said Vickie Tranter. "From the made-from-scratch menu items to the warm hospitality and welcoming atmosphere, Chicken Salad Chick's southern charm is unlike anything I've ever experienced. We're so thrilled to be opening the brand's 100th location and look forward to bringing such a unique concept to the greater Lexington area."

The Chicken Salad Chick concept, born in Auburn, was established in 2008 in the kitchen of founder, Stacy Brown. When Stacy discovered that the local county health department would not allow her to continue making and selling her delicious recipes out of her home kitchen, she overcame that obstacle by launching her first restaurant with the business expertise of her future husband and fellow founder, Kevin Brown. Together, they opened a small takeout restaurant, which quickly grew and began franchising in 2012. In 2015, Eagle Merchant Partners purchased a majority stake in Chicken Salad Chick, and under the leadership of CEO Scott Deviney and team, the company now has 100 restaurants across the Southeast.

The nation's only southern inspired, fast casual chicken salad restaurant concept is opening its first restaurant in Arkansas! The company grew its unit-count by 27 percent in 2017 and is continuing that momentum by opening in four new states including Oklahoma, Arkansas, Kentucky and Missouri by the end of 2018. The company will launch its debut restaurant in Jonesboro and opened November 5. In addition, Chicken Salad Chick will also be opening its first Houston area location in Spring, Texas on November 7th. This restaurant is owned and operated by Jake Alleman and Cody Gielen of Cojak Enterprises, LLC.

Crafthouse Seeks Franchisees

Virgina-based Crafthouse, top photo, is now looking for franchisees to expand the popular brand nationwide.

Owner Evan Matz opened three Crafthouse locations in Northern Virginia (Fairfax, Arlington and Reston) in May 2017 and has spent the past year and a half building a following.

“Our goal is to have signature food and drink items that are available at every Crafthouse alongside menu favorites that are customized for that local community,” said Matz. “We will encourage each franchisee to feature what their region or state does best – North Carolina ribs or Maryland crab cakes, for instance – and source from local businesses for fresh baked buns, bread, local produce, meat, fish, brews, whiskey, wine and more. This way, Crafthouse can truly support and showcase its local neighborhood while giving guests the quality and consistency of a proven brand.”

The Crafthouse drink menu features 50 craft beers on tap and an additional 150 in bottles and cans that represent the best of local, regional and national brews. In addition to the great selection of beer, there is an impressive wine list and over 45 different bourbons, scotches and whiskeys. The three Virginia restaurants showcase many beers from area breweries and spirits from local distilleries – a passion for Matz and his team.

“Each Crafthouse franchisee has an exciting opportunity to create a neighborhood eatery with menu favorites and a winning approach to mixing together craft food, beer and spirits,” Matz said. “Crafthouse will help and guide its franchisees to build their network of local bakeries, farmers, distilleries and brewers and to put their unique stamp on the menu that reflects the tastes of their local community.”

Signature food menu items for which Crafthouse is known include the colossal-sized Bavarian pretzel with house-made beer cheese, Crafthouse tacos and juicy burgers like the Cowboy Burger (beef, brisket, pepper Jack cheese, hot honey BBQ and fried onion straws) and Fiesta Burger (topped with tortilla chips, jalapeño bacon, pepper Jack cheese, pico de gallo, guacamole and fiesta sauce).

Ranging in size from 3,900-4,500 square feet or more with dining room and patio seating for approximately 150 guests, Crafthouse restaurants also cater to private events and corporate meetings. In addition to lunch, dinner and weekend brunch, happy hour and weekday specials give multiple reasons to come by any day and night of the week. Large-screen TVs and game day specials make it the perfect place to watch all the sports action with friends and family. In fact, Crafthouse was named “Best Sports Bar for Football Fans” by Arlington Magazine.

The ideal franchise candidate has liquid assets of at least $300,000 and a net worth over $1 million.

Del Taco Launches App

Del Taco Restaurants Inc. launched its value-focused mobile app, offering guests even more great deals on their favorite products. Now available on the App (iOS) and Google Play (Android) stores, guests who download The Del App will instantly receive a coupon for two free Del Tacos,** as well as other special offers delivered to their mobile device every week.

“When developing our app’s capabilities, we clearly heard from our guests that doubling down on our category-leading value with unique and craveable deals was important to them,” said Barry Westrum, Del Taco’s Chief Marketing Officer. “With that insight, we decided to come out of the app gate strong and deliver those deals. We’re also looking forward to introducing additional app elements, including delivery and loyalty, in the near future.”

Macaron Kiosk Franchise

Le Macaron French Pastries announced a new mobile kiosk franchise opportunity. Folded into its overall growth strategy, the brand looks to launch this new opportunity with strategic franchise partners who are seeking flexibility with their business and a lower cost investment.

The new franchise opportunity aims to lean into the growing quick-serve and snack brand trend of kiosks, mobile carts, and express locations. As consumers' on-the-go lifestyle continues to accelerate, Le Macaron French Pastries seeks to capitalize on these captive audiences at malls, airports, sporting events, festivals and other gatherings.

"We wanted to create an opportunity that allows our franchise owners to work in nonconventional environments and offer guests a sweet treat when they are unable to access one of our locations," said Rosalie Guillem, CEO and co-founder of Le Macaron French Pastries. "Our products can easily be eaten on the go, so a mobile kiosk aligns perfectly with our brand. This will only accelerate our growth as we welcome a new group of franchisees looking to enter the fast-casual industry."

The mobile kiosk investment ranges between $91,000 to $127,000—making it an ideal opportunity for entrepreneurs who are looking to enter the space at a lower investment with a simple business model and unlimited growth potential. Le Macaron French Pastries operates through a simple business model that requires zero on-site baking from franchisees. All products are made by French Chef Didier Saba in the kitchen headquarters, allowing café owners to focus on customer service.

Le Macaron French Pastries was founded by France National and mother-daughter team Rosalie Guillem and Audrey Saba. The brand now has more than 50 cafés open and operating with two mobile kiosks open in Sarasota, Florida and Pittsburgh, Pennsylvania. Most known for providing guests with a light dessert with lesser calories, the brand offers more than 20 flavors of macarons, as well as seasonal flavors, and the menu extends to include pastries, gelato, coffee, cakes, éclairs, and more.

"We opened a Le Macaron French Pastries mobile kiosk because of the simplistic business model, reduction in overhead costs and finding real estate for the cart is easier since it has a smaller footprint," said Luke Freshwater, owner of Le Macaron French Pastries in Pittsburgh. "We are seeing incredible success because the French macarons are a high-quality product and we are able to connect with our customers since we have such a small and passionate staff."

GSF Sells Distribution Centers

Golden State Foods (GSF) completed the sale of nine of its 27 distribution centers to The Martin Brower Company.

"We appreciate Martin Brower's cooperation and collaboration in finalizing this transaction," said Mark Wetterau, chairman and chief executive officer, GSF. "Completing the sale of these nine benchmark distribution centers to Martin Brower provides Golden State Foods the opportunity to support the McDonald's System, its current strategy, and to reinvest in the future of our company, our associates, and all of our customers. This transaction will allow us to continue with and to invest in our diversification strategy and accelerate growth."

The nine U.S. centers sold to Martin Brower are top performing teams that service 3,900 McDonald's restaurants and 365 Chipotle locations. Golden State Foods, which has been an award-winning food supplier to McDonald's for more than 65 years and distribution partner for more than 50, continues to provide core products such as meat, liquids, produce and selected distribution services to the quick service restaurant leader throughout the U.S. and internationally.

"Martin Brower is getting the cream of the crop with our associates – who are second to none and maintain award-winning operations that run like clockwork," added Wetterau. "Their superior service is only paralleled by the thousands of outstanding owner-operators across the country, whom we've been privileged to serve for decades. As we continue to serve as a key supplier for McDonald's in all our categories moving forward, GSF will also be looking to add new customers and companies to our successful portfolio."

Golden State Foods will maintain 18 distribution centers in the U.S. and in the Middle East, which serve an array of food industry leaders. In addition to distribution, GSF will continue to operate more than 25 world-class food manufacturing facilities and farms, providing an array of businesses and offerings spanning the foodservice, QSR, retail and C-store formats across the globe. Golden State Foods is one of very few privately held companies in the foodservice industry that is vertically integrated, making the company a desirable partner for food industry and retail leaders worldwide. The sale of the nine Golden State Foods DCs that currently service McDonald's is one example of the various strategic moves being made by GSF this year.

Huddle House Inks Multi-Unit Agreement

Western Tennessee: Huddle House is coming your way. The iconic neighborhood gathering place known for its round-the-clock breakfast, Southern hospitality and big portions at fair prices announced today it has signed a multi-unit agreement with local entrepreneurs, Kamlesh “Kevin” and Mina Patel to open three Huddle House locations in Western Tennessee markets over the next three years, with the first expected to open in early 2019.

“We are very excited to open our Huddle House locations,” said Patel, who is also a franchisee of brands such as Blimpies, Wings, Etc. and previously owned a chain of convenient stores across Tennessee. “This is a brand we are proud to be a part of and I know the communities across Western Tennessee are going to love all that we have to offer.”

Based in Atlanta, Huddle House restaurants have earned adoration in their communities for their warm, friendly atmospheres where every conversation, sip of coffee and bite of home-cooked meals are savored. Site selection is currently underway for the locations of the new restaurants.

. In addition to the new locations, Huddle House has several additional openings planned for 2019 including Petersburg, Virginia, Kershaw, South Carolina and Paragould, Arkansas.

“We are so excited to have Kevin and Mina represent the Huddle House brand in Western Tennessee,” said Christina Chambers, Senior Vice President of Franchise Development at Huddle House. “Kevin and Mina truly embody our service, spirit and focus on bringing friends and families together over delicious food, served from the heart.”

There are currently more than 343 Huddle House restaurants across the United States with an additional 47 in development.

Beerhead Bar Expands Ohio Presence

Beerhead Bar & Eatery, is rapidly expanding its presence in Ohio with three new locations. The brand has signed franchise agreements to open stores in Avon, Concord Township and Columbus with projections to open in 2019.

The new locations will be owned and operated by Aaron Rasmussen, Jim Maclellan and Eric Engelkeof Three 30 Ventures LLC. The group was introduced to Beerhead Bar & Eatery after exploring franchise opportunities in the hospitality industry. The uniqueness of the Beerhead concept stood out as a great opportunity for their venture and they quickly moved forward with area development agreements for their first three stores. The Avon location, located at 1813 Nagle Rd, will be the first to open in the spring of 2019. The Concord Township location will quickly follow in the early summer located at 8023 Crile Rd. and the Columbus location is projected to open in October at 250 Civic Dr.

"We were immediately drawn to the distinct franchise opportunity of Beerhead Bar & Eatery and we are looking forward to bringing three locations to Ohio" said Rasmussen. "We've seen the success of the Cleveland Flats locations and we believe its unique vibe and impressive offerings of beer and food will continue to be a hit."

Beerhead currently has seven locations and is rapidly expanding in craft beer rich regions of the Midwest including Illinois, Michigan, Indiana, Wisconsin, Ohio, Pennsylvania and surrounding areas. The appealing new concept design of Beerhead and the thoughtful simplicity of the business model allows franchisees to streamline operations. The brand estimates it will open 30 stores over the next four years.

Founded in 2012 under the original name of The Beer Market, Beerhead began franchising in 2015 in an effort to expand its favorite local beer bar vibe to other communities, breweries and distilleries.

Pie Five Debuts New Prototype Design

Pie Five Pizza Co. is now serving its customizable pizzas prepared and ready to enjoy in five minutes or less in Garden City. The fast-casual restaurant opened at 1110 Fleming St. on Monday, Oct. 29. This is the first location with Pie Five’s new Goldilocks Project prototype.

The design features a seating area with 50 seats and sleek digital menu boards. The Garden City Pie Five will also be the first location to use the cloud-based point-of-sales system, NCR Silver.

“My business partner, Tim Long, and I are excited to bring Pie Five to southwest Kansas,” said Franchisee Greg Trejo. “We are in a great location in front of the Sequoyah movie theater and we have hired an amazing team who will join us in serving our customizable pizzas to everyone in Garden City. The new technology will help us improve the Pie Five experience, enabling us to become the go-to destination for fresh pizza in the area. In addition to opening our new restaurant, we are looking forward to becoming an integral part of the community.”

The Garden City Pie Five is the ninth location in Kansas.

Dickey's Franchisee To Expand in NY

Dickey’s Barbecue Pit franchisee Jerry Stephan plans to bring 21 Dickey’s locations to New York. As a new member of the Dickey’s family, Jerry plans to develop the Dickey’s Barbecue Pit presence throughout the state. Jerry will own and operate two of the locations, with his first slated to open in Spring 2019 in Long Island.

“At Dickey’s Barbecue Pit, we truly are a family business and we love to see the success of our franchisees,” said Laura Rea Dickey, CEO of Dickey’s Barbecue Restaurants, Inc. “We look forward to our partnership with Jerry as it is very exciting to have him as both a franchisee and as a partner who will help us choose the best Owner Operators and site locations for the new stores coming to New York.”

With more than 15 years in the franchising business and more than 40 years in the construction business, Jerry looks forward to combining two of his passions at Dickey’s.

“I was looking for a new restaurant concept to bring to Long Island and after doing research on the Dickey’s Barbecue Pit franchise I knew that it was a great fit,” says Jerry. “After being in the industry for a while, I really liked how Dickey’s business model is set up and, of course, I love the slow-smoked barbecue.”

Captain D's Continues Expansion

Captain D's opened its newest franchised location in Jackson, Tennessee. Marking the brand’s 72rd location in the state, the new restaurant opening further solidifies Captain D’s strong brand presence and aggressive development efforts in the region. Located at 1761 South Highland Ave., the new Jackson Captain D’s is owned and operated by first-time franchisees Chad and Nicole Vaughn of Tri-Star Hospitality, LLC.

Prior to franchising with Captain D’s, the Vaughns owned and operated a multi-million dollar construction firm in Waverly, Tennessee for 20 years. Marking the husband-and-wife team’s first venture into franchising and the fast casual restaurant segment, the new Jackson location is the first of several Captain D’s restaurants they plan to open throughout Tennessee over the next several years.

“Drastically shifting your career path and moving into a new industry can be intimidating, but the training and support we have received from Captain D’s leadership team has made it a seamless transition,” said Chad Vaughn. “From assisting with real estate and site selection to providing us with royalty discounts through the company’s great incentive program, the team has continually shown Captain D’s is invested in our success and we couldn’t be more grateful. We’re so excited to be opening our new restaurant in Jackson and look forward to serving residents in the community for years to come.”

The Jackson opening is the second new location Captain D’s has opened in Tennessee this year, with a restaurant in White House opening earlier this year. This ongoing development throughout Tennessee further signifies the outstanding success the brand has achieved over the past several years, which has fueled a surge in franchise and corporate development. Throughout the past year, the company has opened more than 15 new locations and inked numerous development agreements to open new restaurants in key markets, including Michigan, Indiana, Texas and Georgia.

Coupled with its ongoing menu innovation, Captain D’s credits its new restaurant beach design with contributing to the brand’s ongoing strong performance. To date, nearly 80 percent of all restaurants have been reimaged to the brand’s new vibrant, coastal design. With these efforts, Captain D’s has remained true to what it does best — serving high-quality seafood with warm hospitality at an affordable price in a welcoming atmosphere.

With more than 530 restaurants in 22 states, Captain D’s is the fast-casual seafood leader and number one seafood franchise in America ranked by average unit volume. The company is currently seeking single- and multi-unit operators to join in the brand’s rapid expansion.

Russo's Looking To Expand

Russo’s New York Pizzeria is looking to grow its upscale-casual dining concept in Texas’ Austin, Dallas, Fort Worth, Lubbock, Midland, Odessa and San Antonio markets. The pizza franchise has already opened four locations in Texas this year: Austin, Harlingen, Pearland and Spring/Tomball. The brand is also looking to Arizona’s Phoenix, Tempe, Chandler, Mesa and North Scottsdale markets.

Russo’s will also offer a special incentive for area developers who develop 3 or more stores: Owners will receive a royalty reduction to 3 percent in the first year on the first location to be developed.

Chef Anthony Russo, the creative culinary mind, founder and CEO of the chef-driven concept, announced the franchise brand’s “Next Generation Pizza & Italian” restaurant model –ideal for on-the-go diners looking for authentic Italian cuisine at shopping malls, strip centers and airports.

The new concept has a smaller footprint (1,200-1,800 square feet). The Russo’s Next Generation Pizza and Italian restaurant model features an open-kitchen layout engineered to provide convenience to diners eating in, taking to go or for delivery. The family-centered restaurant surrounds diners with warm, inviting décor to enjoy heart-healthy menu items made fresh without preservatives, additives or trans fats. Beyond the brand’s specialty traditional crust and gluten-free pizzas, menu items include fresh salads, soups and made-from-scratch sauces and pastas. Authentic Italian cannoli, fresh-baked, Italian flatbread sandwiches and, of course, hand-tossed pizzas are just some of the distinctive menu items.

“We’ve been leading the pizza and pasta scene in all of our markets for more than 32 years because we’re always bringing fresh ideas to the table. This new format meets the customer demand for fresh, quality cuisine for pick-up on the go or delivered,” said Russo, who earned his chef distinction at 18 years old and honed his expert culinary skills working in his parents fine Italian restaurant before opening his own pizzeria.

By strategically placing restaurants in high-traffic retail areas, Russo’s offers fans easier access to its beloved New York-style pizza and traditional, Italian cuisines. Russo’s latest restaurant model is representative of a larger franchise growth strategy to expand the brands’ international footprint after successfully launching more than 48 locations worldwide.

Initial investment starts at $454,350.

Freddy's Launches Bill Simon Scholarship

Fast-casual restaurant concept Freddy's Frozen Custard & Steakburgers launched the Bill Simon Memorial Scholarship Foundation in memoriam of the company's beloved co-founder and CEO Bill Simon. As a testament to Simon's passion for education and commitment to helping all achieve a brighter future, the scholarship foundation was created to support Freddy's team members' pursuit of post-secondary education in college or vocational programs and made possible through generous contributions from franchisees, vendor partners, the corporate office team, and members of the community.

"Freddy's has achieved substantial success over the past several years, and we know that we didn't get here alone. The dedication and passion of our team members has been the driving force behind all of our achievements, and we're proud to turn our appreciation into action through the launch of the Bill Simon Memorial Scholarship Foundation," said Ben Simon, President of the Bill Simon Memorial Scholarship Foundation and Vice President of Operations for Freddy's Frozen Custard & Steakburgers. "Bill worked tirelessly to build a brand that is rooted in family values, and we look forward to honoring his belief in the importance of education through our new scholarship program for years to come."

This year marked the first time all Freddy's team members had the opportunity to apply for the Bill Simon Memorial Scholarship, and the company recently awarded a total of $20,000 to 30 company team members. Through Freddy's generosity, the scholarship recipients will be able to pursue their dream of receiving an education at some of the nation's largest universities, including Arizona State University, the University of Kansas, the University of Colorado Boulder, Wichita State University, and more. The deadline for next year's recipients will be in early June 2019.

Scholarship recipients are selected based on academic record, demonstrated leadership and participation in school and community activities, honors, work experience, statement of goals and aspirations. Applicants must be Freddy's team members in good standing with one year of employment completed (minimum of 750 hours). Applicants must also be current students or high school seniors who are prospective students in full-time undergraduate study at an accredited two- or four-year college, university or vocational-technical school.

For more information about the Bill Simon Memorial Scholarship Program, click here.

Capriotti's Helping Homeless

According to World Atlas, Las Vegas is among the top ten cities in the United States with the highest number of homeless individuals, ranking at number eight. In an effort to help these individuals receive the aid and shelter they need, Capriotti’s Sandwich Shop is partnering with the Las Vegas Rescue Mission to make a difference in the Las Vegas community.

Starting November 1, when customers purchase items through the CAPAddicts! Rewards app and activate the promo code FEED1LV, Capriotti’s will donate $1 to the Las Vegas Rescue Mission, an organization dedicated to feeding and sheltering the homeless throughout the Las Vegas area. All money donated during this time will help in providing food and shelter to the homeless men, women and children living in Las Vegas.

“As a Las Vegas based business, we are extremely honored for this opportunity to help better the city we hold so dear to our hearts,” said Ashley Morris, CEO of Capriotti’s. “Not only is this campaign a great initiative to help our community, but an amazing opportunity to connect with our loyal fans and get them involved as well.”

As easy as entering the promo code, Capriotti’s encourages customers to purchase with a purpose this fall to help the local Vegas community. As a ‘thank you’ for participators efforts, every customer who purchases food through the CAPAddicts! Rewards app and activates the promo code FEED1LV will be credited with five points, the equivalent of $5 value. Guests also have the option to utilize the promo code to support the Las Vegas Rescue mission through order.capriottis.com.

Through the CAPAddicts! Rewards app, users can experience an array of bonuses and rewards such as exclusive discounts, free food, and surprise birthday offers.

“At Las Vegas Rescue Mission, we strive to restore pride, dignity and hope in those who have lost their voice and spirits,” said Heather Engle, CEO of Las Vegas Rescue Mission. “As a nonprofit organization operating solely through the compassion and support of giving individuals, we are so grateful for this opportunity to partner with Capriotti’s for this initiative and cannot wait to see what strides we can make together.”

Founded in 1976, Capriotti’s now has over 100 locations in 18 states, including 39 locations in the Las Vegas area alone.

HOPE Program

Taziki's Mediterranean Café has launched the HOPE Program "Herbs Offering Personal Enrichment" in Virginia.

The HOPE Program is a partnership between area programs and Taziki's Mediterranean Café to teach students with special needs all aspects of the herb business, using skills that will transfer to other jobs.

The program originally began after Taziki's founder Keith Richards decided to get more involved with special needs education. His restaurants had been employing people with special needs, but he realized they needed more opportunities.

"We are thrilled to create opportunities and a bright future for students from across the Richmondarea," said David Webber, Taziki's Mediterranean Café – Richmond. "Planning the HOPE program kick off in Virginia this year has been an exciting partnership with the community."

Taziki's three Richmond-area locations have launched the HOPE Program supporting various different schools in their neighborhood areas.

Winterpock

The Winterpock location at 14221 Hull Street Road regularly hosts students from local high schools for in-store herb classes.

Clover Hill High School students have been learning how to grow and maintain herbs. Four of the students come to work on Mondays and Wednesdays as part of their job-training program.

Manchester High School students attend in-store herb classes at the Winterpock location. Following the in-store herb class, they have then been growing herbs at their school and selling them to the Winterpock restaurant location.

The fresh, locally grown herbs – parsley, oregano, cilantro, basil and rosemary – are used to flavor the restaurant's Mediterranean-style foods.

The Winterpock location also has a "HOPE" employee named Mark Boone who has downs syndrome and has been employed by Taziki's for over a year. One of his favorite responsibilities is helping with the in-store herb classes.

Stonehenge

The Stonehenge location at 12643 Stone Village Way has two "HOPE" employees, Daniella and Justin, both of which have been employed by Taziki's for over a year. They both assist with various front-of-house tasks while they welcome guests to enjoy Taziki's meals.

Justin uses a tablet to communicate and is employed through a partnership with Virginia Commonwealth University that is preparing him for future employment.

This location is also collaborating with Midlothian High School to do an in-store herb class with special needs students. Following the in-store herb class, Midlothian High School students will begin growing herbs and will be coming to job skills training classes as at the restaurant.

Innsbrook

The Innsbrook location at 4024-C Cox Road in Glen Allen hosts Northstar Academy's hospitality classes each week on Tuesdays. The post-graduate hospitality special needs students learn both stocking and important cleaning practices.

Also, a new partnership with Henrico County Schools is underway for the HOPE Program at the Innsbrook Store through an alternative school, The Academy at Virginia Randolph. The alternative school has a greenhouse students have been tasked with mentoring the special needs class to grow herbs.

The Innsbrook location has one "HOPE" employee, Annie Callahan, who has been employed by Taziki's for close to five years. She works full shifts running food to tables and is a dining room "smile specialist".

12-Hour Drive-Thru

POPEYES® has officially launched the world's first 12 hour drive thru in honor of the 12 hour marinating process the brand has been using for its fried chicken for more than 45 years.

Those looking for a reason for a road trip, can place their order at the standalone menu board along Interstate 10 outside of Fort Stockton, Texas and the flagship POPEYES® store location on Canal Street in New Orleans will have their fresh fried chicken waiting for them upon arrival.

"We wanted a fun way to celebrate that we have always marinated our chicken for at least 12 hours," said Hope Diaz, Chief Marketing Officer of POPEYES® Louisiana Kitchen. "We don't take shortcuts and this drive thru emphasizes that. Now, we can't wait to see how far our fans will go to show that they love that chicken from POPEYES®!"

Some fans already tested the drive thru out, which can be seen here in a video created by creative agency, GSD&M. The drive thru officially opens on November 9 at noon and will take orders through November 10 at noon.

MRM Franchise Feed: Bojangles Acquired and Chicken Salad Chick Celebrates 100th posted first on happyhourspecialsyum.blogspot.com

0 notes

Text

Better Homes and Gardens Real Estate The Masiello Group Extends Brand Affiliation Into Next Decade

Better Homes and Gardens Real Estate LLC announced that Better Homes and Gardens Real Estate The Masiello Group has signed a long-term renewal agreement that will extend the Northern New England real estate powerhouse’s affiliation with the Better Homes and Gardens Real Estate brand into the next decade.

Better Homes and Gardens Real Estate The Masiello Group was one of the original affiliates when it joined the Better Homes and Gardens Real Estate network in the fourth quarter of 2008, just months after the brand launched. It was the first multi-state company to affiliate with the brand, beginning an exciting chapter in Better Homes and Gardens Real Estate’s history as a brand uniquely positioned to fuel the growth of industry-leading companies.

The Masiello Group, owned by President and CEO Chris Masiello, was founded in 1966 by Chris’ father, James. Masiello joined the firm as an agent in the early 1980s, and has since cultivated a leadership team of professionals at the top of their respective specialties in operations, finance, marketing and administration. Together, the team has grown Better Homes and Gardens Real Estate The Masiello Group from its beginnings as a single office closing 400 transactions per year to the juggernaut it is today, with more than 700 agents and 81 employees in 34 offices throughout Vermont, New Hampshire and Maine, closing more than 7,000 transactions per year, all while retaining the original culture of a family-run business. Better Homes and Gardens Real Estate The Masiello Group finished 2019 with 7,155 sides, up 73 percent since the firm first joined Better Homes and Gardens Real Estate. Since its affiliation with the brand, the company grew its office count by 27 percent and increased its agent count by 37 percent.

The company is the third-largest Better Homes and Gardens Real Estate affiliate, and has consistently distinguished itself as a Top 5 affiliate in the brand’s global network since the brand’s launch.

Since joining the brand, Better Homes and Gardens Real Estate The Masiello Group has participated in several mergers and acquisitions representing 14 offices, including two of the then-largest real estate companies in Maine. Since 2012, Better Homes and Gardens Real Estate The Masiello Group has consistently ranked as a top company, earning recognition in the industry as one of the Top 10 Real Estate Brokerages in New Hampshire, one of the Top 100 Real Estate Companies in the United States, one of the Top 50 Fastest Growing Real Estate Companies, and the Harris Poll EquiTrend Real Estate Agency Brand of the Year.

Masiello cites PinPointSM, the Better Homes and Gardens Real Estate brand’s proprietary predictive marketing tool that utilizes Better Homes and Gardens® magazine and its publisher Meredith Corporation’s customer database of more than 175 million consumers, as a tangible way the affiliation with the Better Homes and Gardens media brand comes to life to benefit its affiliated agents.

Better Homes and Gardens Real Estate The Masiello Group adeptly uses the Better Homes and Gardens Real Estate product suite to complement its own impressive infrastructure. The company utilizes Better Homes and Gardens Real Estate’s listing advertising program, which provides a three-day digital social media advertising program at no additional charge for all new listings. In the last year, Better Homes and Gardens Real Estate The Masiello Group took advantage of more than 2,500 brand-funded campaigns, resulting in more than 350,000 website visits and over 4.4 million listing views.

Better Homes and Gardens Real Estate The Masiello Group has been a Cartus principal-level broker since the company affiliated with the brand in 2008. The company proudly achieved Platinum status in Maine and the New Hampshire/Vermont region for the 2019 business year, to be awarded in 2020.

The company also utilizes the Distinctive Collection by Better Homes and Gardens Real Estate program for its luxury listings. The service areas of the company boast miles of beautiful coastline and waterfront homes, featuring some of the most distinguished estate properties in the Northeast. This luxury program, along with its bespoke marketing and global listing distribution, have supported the company’s ability to attract and retain luxury agents, as well as more expertly market and sell listings in the top 10 percent of its areas served.

Better Homes and Gardens Real Estate The Masiello Group also owns a real estate school and suite of independently branded companies offering homeownership services in mortgage, title, insurance and home warranty.

“The Better Homes and Gardens Real Estate brand launched in an age of empowered consumers, data-driven strategies and core values,” says Sherry Chris, president and CEO, Better Homes and Gardens Real Estate. “We built our lifestyle value proposition around these pillars. When Chris Masiello affiliated with us in 2008, it was one of the greatest proof points that we were building something special, something that signified the future of real estate. Chris and his company had already distinguished themselves as a leader in real estate. That he immediately understood the unique relevance of Better Homes and Gardens Real Estate demonstrates that he is a visionary in our industry. Today, we celebrate Chris’s continued commitment to Better Homes and Gardens Real Estate into the next decade. Chris has been a trusted collaborator who has helped us build the Better Homes and Gardens Real Estate brand he believed in 12 years ago. He will continue to be a trusted collaborator to the Better Homes and Gardens Real Estate network as we move toward our exciting futures.”

“Over our company’s long history, we have been both branded and independent,” says Masiello. “Our decision to join the Better Homes and Gardens Real Estate network in 2008 and renew that commitment this year was based on two important factors: a tremendous ability to grow and a unique opportunity to be ahead of change in the real estate industry. We not only affiliated with a lifestyle real estate brand; we affiliated with a media giant. Together, Better Homes and Gardens Real Estate and the Better Homes and Gardens media brand empower us to make meaningful, long-lasting connections with our clients. This franchise relationship brings us a level of access and relevance we couldn’t create on our own, even as one of the most successful companies in the industry. Our Better Homes and Gardens Real Estate affiliation gives us a brand name that lives outside of real estate. We can give our clients content they can use in their daily lives, which gives our agents the power to build customer relationships well beyond the transaction. The growth, infrastructure, learning, tools, marketing and technology have empowered us to create better experiences for our clients and agents. In 2008, I knew that Better Homes and Gardens Real Estate was the first brand of the new age of real estate. It continues to lead that movement today. We look forward to many more years of this successful affiliation.”

For more information, please visit www.BHGRE.com.

The post Better Homes and Gardens Real Estate The Masiello Group Extends Brand Affiliation Into Next Decade appeared first on RISMedia.

Better Homes and Gardens Real Estate The Masiello Group Extends Brand Affiliation Into Next Decade published first on https://thegardenresidences.tumblr.com/

0 notes

Text

WSJ Article on Debt Relief Scams

Thought you might find this of interest

Soaring Student Debt Opens Door to Relief Scams Same testimonials appeared across 26 websites of supposedly different companies; former employee says company submitted claims based on false information

By Jean Eaglesham, Michael Tobin, and Coulter Jones Aug. 26, 2019 9:40 a.m. ET

Financial Preparation Services of Irvine, Calif. boasts on its website three glowing testimonials for its debt-relief services for studentloans. It quotes Anthony Zwichirowski of California, Dawn Robinson of New Hampshire and a smiling Dean Edelman of Virginia, who says using the company "was the smartest move I have made since graduating."

One or more of the three ostensibly happy borrowers also appears, with slight variations, on at least 25 other websites of purportedly different companies offering student-loan debt-relief in the last four years, The Wall Street Journal found.

Student debt is soaring —it is now nearly $1.5 trillion—and defaults are at a record. That has been fertile ground for companies that promise to help stretched borrowers by navigating the maze of federal programs that can reduce or forgive debts for those who qualify, such as public-service workers or people on low incomes.

Some companies operate legally, although there is nothing they offer that borrowers can't get free, regulators say. Other firms are outright scams , or make promises to borrowers that are illegal, regulators and consumer advocates warn.

Financial Preparation Services has submitted claims for federal relief based on fictitious information, according to a former employee. Sales teams within the company also switched regularly to using new corporate names and websites, the former employee said. The company is one of several about which federal regulators are demanding information, according to a bankruptcy court filing.

Many of the websites on which the three testimonials are featured appear to be carbon copies, with only the company's name changed. A few companies attributed the same quote to different people: Dean Edelman becomes Dean Ederman of California, for example. Other websites used the same names and photos with different quotes.

Financial Preparation Services didn't respond to emails requesting comment, and couldn't be reached by phone at the number listed on its website. The Journal wasn't able to find Mr. Edelman, Mr. Zwichirowski and Ms. Robinson or ascertain whether they were indeed real people.

A record $89.2 billion of student loans was in default at the end of June, New York Federal Reserve data show. Of the $1.48 trillion outstanding, 11%, or $160 billion, was at least 90 days behind on repayments—and the true rate is likely double that, because only half the loans are currently in repayment.

"We'll do the work for you," Financial Preparation Services says on its website. "No more drowning in a sea of confusing paperwork and processing!" Its fee: $1,195 for document preparation, then $40 a month for almost 20 years—a total of $10,555—according to a 2018 client agreement reviewed by the Journal.