#Natural Gas-Powered Vehicles Market

Explore tagged Tumblr posts

Text

‘Three New York Cities’ Worth of Power: AI Is Stressing the Grid

https://www.wsj.com/business/energy-oil/ai-data-center-boom-spurs-race-to-find-power-87cf39dd

Across the nation, utilities are worried about expanding the overburdened power grid, citing high costs and concerns about commitment from data center projects

Tech companies scouring the country for electricity to power artificial intelligence are increasingly finding there is a waiting list.

In many places the nation’s high-voltage electric wires are running out of room, their connection points locked up by data centers for AI, new factories or charging infrastructure for electric vehicles.

A mad dash to lock up available power has ensued.

The tech industry is pinballing from one market to the next looking for places with the capacity to connect campuses that would consume up to a gigawatt of power—about as much as San Francisco uses. Some requests are as much as four to five times as large as that.

But wires are getting so crowded that some prospective data center customers—which request far more power than other users—are being told they may have to wait until the next decade to get the power they are seeking. Others are receiving less power than they expected.

In Salt Lake City, the data center industry says there is a moratorium for larger projects, with the market closed to new business. Utility PacifiCorp says “significant levels of transmission and generation” could be needed for the larger projects and it is evaluating requests while avoiding spreading costs to other customers.

*** Yeah, all data centers. Nothing to do with removing dams and hydro power, or killing natural gas off across the nation.. Nope, it's all data centers..

Stupid data centers..

24 notes

·

View notes

Text

Excerpt from this New York Times story:

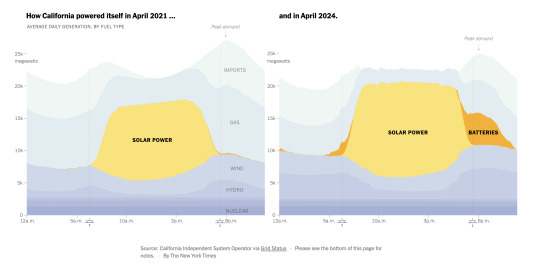

California draws more electricity from the sun than any other state. It also has a timing problem: Solar power is plentiful during the day but disappears by evening, just as people get home from work and electricity demand spikes. To fill the gap, power companies typically burn more fossil fuels like natural gas.

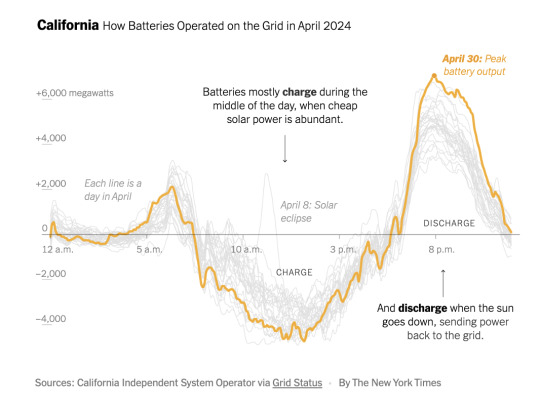

That’s now changing. Since 2020, California has installed more giant batteries than anywhere in the world apart from China. They can soak up excess solar power during the day and store it for use when it gets dark.

Those batteries play a pivotal role in California’s electric grid, partially replacing fossil fuels in the evening. Between 7 p.m. and 10 p.m. on April 30, for example, batteries supplied more than one-fifth of California’s electricity and, for a few minutes, pumped out 7,046 megawatts of electricity, akin to the output from seven large nuclear reactors.

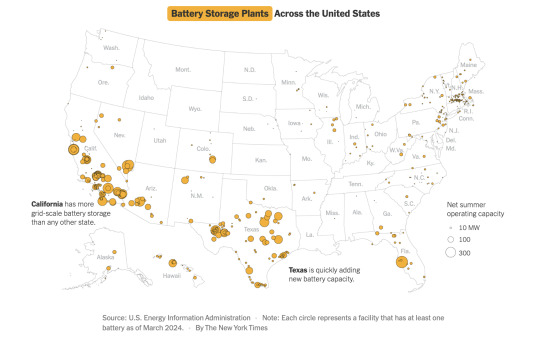

Across the country, power companies are increasingly using giant batteries the size of shipping containers to address renewable energy’s biggest weakness: the fact that the wind and sun aren’t always available.

“What’s happening in California is a glimpse of what could happen to other grids in the future,” said Helen Kou, head of U.S. power analysis at BloombergNEF, a research firm. “Batteries are quickly moving from these niche applications to shifting large amounts of renewable energy toward peak demand periods.”

Over the past three years, battery storage capacity on the nation’s grids has grown tenfold, to 16,000 megawatts. This year, it is expected to nearly double again, with the biggest growth in Texas, California and Arizona.

Most grid batteries use lithium-ion technology, similar to batteries in smartphones or electric cars. As the electric vehicle industry has expanded over the past decade, battery costs have fallen by 80 percent, making them competitive for large-scale power storage. Government mandates and subsidies have also spurred growth.

As batteries have proliferated, power companies are using them in novel ways, such as handling big swings in electricity generation from solar and wind farms, reducing congestion on transmission lines and helping to prevent blackouts during scorching heat waves.

In California, which has set ambitious goals for fighting climate change, policymakers hope grid batteries can help the state get 100 percent of its electricity from carbon-free sources by 2045. While the state remains heavily dependent on natural gas, a significant contributor to global warming, batteries are starting to eat into the market for fossil fuels. State regulators plan to nearly triple battery capacity by 2035.

2 notes

·

View notes

Text

Hydrogen Is the Future—or a Complete Mirage!

The green-hydrogen industry is a case study in the potential—for better and worse—of our new economic era.

— July 14, 2023 | Foreign Policy | By Adam Tooze

An employee of Air Liquide in front of an electrolyzer at the company's future hydrogen production facility of renewable hydrogen in Oberhausen, Germany, on May 2, 2023. Ina Fassbender/ AFP Via Getty Images

With the vast majority of the world’s governments committed to decarbonizing their economies in the next two generations, we are embarked on a voyage into the unknown. What was once an argument over carbon pricing and emissions trading has turned into an industrial policy race. Along the way there will be resistance and denial. There will also be breakthroughs and unexpected wins. The cost of solar and wind power has fallen spectacularly in the last 20 years. Battery-powered electric vehicles (EVs) have moved from fantasy to ubiquitous reality.

But alongside outright opposition and clear wins, we will also have to contend with situations that are murkier, with wishful thinking and motivated reasoning. As we search for technical solutions to the puzzle of decarbonization, we must beware the mirages of the energy transition.

On a desert trek a mirage can be fatal. Walk too far in the wrong direction, and there may be no way back. You succumb to exhaustion before you can find real water. On the other hand, if you don’t head toward what looks like an oasis, you cannot be sure that you will find another one in time.

Right now, we face a similar dilemma, a dilemma of huge proportions not with regard to H2O but one of its components, H2—hydrogen. Is hydrogen a key part of the world’s energy future or a dangerous fata morgana? It is a question on which tens of trillions of dollars in investment may end up hinging. And scale matters.

For decades, economists warned of the dangers of trying through industrial policy to pick winners. The risk is not just that you might fail, but that in doing so you incur costs. You commit real resources that foreclose other options. The lesson was once that we should leave it to the market. But that was a recipe for a less urgent time. The climate crisis gives us no time. We cannot avoid the challenge of choosing our energy future. As Chuck Sabel and David Victor argue in their important new book Fixing the Climate: Strategies for an Uncertain World, it is through local partnership and experimentation that we are most likely to find answers to these technical dilemmas. But, as the case of hydrogen demonstrates, we must beware the efforts of powerful vested interests to use radical technological visions to channel us toward what are in fact conservative and ruinously expensive options.

A green hydrogen plant built by Spanish company Iberdrola in Puertollano, Spain, on April 18, 2023. Valentine Bontemps/AFP Via Getty Images

In the energy future there are certain elements that seem clear. Electricity is going to play a much bigger role than ever before in our energy mix. But some very knotty problems remain. Can electricity suffice? How do you unleash the chemical reactions necessary to produce essential building blocks of modern life like fertilizer and cement without employing hydrocarbons and applying great heat? To smelt the 1.8 billion tons of steel we use every year, you need temperatures of almost 2,000 degrees Celsius. Can we get there without combustion? How do you power aircraft flying thousands of miles, tens of thousands of feet in the air? How do you propel giant container ships around the world? Electric motors and batteries can hardly suffice.

Hydrogen recommends itself as a solution because it burns very hot. And when it does, it releases only water. We know how to make hydrogen by running electric current through water. And we know how to generate electricity cleanly. Green hydrogen thus seems easily within reach. Alternatively, if hydrogen is manufactured using natural gas rather than electrolysis, the industrial facilities can be adapted to allow immediate, at-source CO2 capture. This kind of hydrogen is known as blue hydrogen.

Following this engineering logic, H2 is presented by its advocates as a Swiss army knife of the energy transition, a versatile adjunct to the basic strategy of electrifying everything. The question is whether H2 solutions, though they may be technically viable, make any sense from the point of view of the broader strategy of energy transition, or whether they might in fact be an expensive wrong turn.

Using hydrogen as an energy store is hugely inefficient. With current technology producing hydrogen from water by way of electrolysis consumes vastly more energy than will be stored and ultimately released by burning the hydrogen. Why not use the same electricity to generate the heat or drive a motor directly? The necessary electrolysis equipment is expensive. And though hydrogen may burn cleanly, as a fuel it is inconvenient because of its corrosive properties, its low energy per unit of volume, and its tendency to explode. Storing and moving hydrogen around will require huge investment in shipping facilities, pipelines, filling stations, or facilities to convert hydrogen into the more stable form of ammonia.

The kind of schemes pushed by hydrogen’s lobbyists foresee annual consumption rising by 2050 to more than 600 million tons per annum, compared to 100 million tons today. This would consume a huge share of green electricity production. In a scenario favored by the Hydrogen Council, of the United States’ 2,900 gigawatts of renewable energy production, 650 gigawatts would be consumed by hydrogen electrolysis. That is almost three times the total capacity of renewable power installed today.

The costs will be gigantic. The cost for a hydrogen build-out over coming decades could run into the tens of trillions of dollars. Added to which, to work as a system, the investment in hydrogen production, transport, and consumption will have to be undertaken simultaneously.

Little wonder, perhaps, that though the vision of the “hydrogen economy” as an integrated economic and technical system has been around for half a century, we have precious little actual experience with hydrogen fuel. Indeed, there is an entire cottage industry of hydrogen skeptics. The most vocal of these is Michael Liebreich, whose consultancy has popularized the so-called hydrogen ladder, designed to highlight how unrealistic many of them are. If one follows the Liebreich analysis, the vast majority of proposed hydrogen uses in transport and industrial heating are, in fact, unrealistic due to their sheer inefficiency. In each case there is an obvious alternative, most of them including the direct application of electricity.

Technicians work on the construction of a hydrogen bus at a plant in Albi, France, on March 4, 2021. Georges Gobet/AFP Via Getty Images

Nevertheless, in the last six years a huge coalition of national governments and industrial interests has assembled around the promise of a hydrogen-based economy.

The Hydrogen Council boasts corporate sponsors ranging from Airbus and Aramco to BMW, Daimler Truck, Honda, Toyota and Hyundai, Siemens, Shell, and Microsoft. The national governments of Japan, South Korea, the EU, the U.K., the U.S., and China all have hydrogen strategies. There are new project announcements regularly. Experimental shipments of ammonia have docked in Japan. The EU is planning an elaborate network of pipelines, known as the hydrogen backbone. All told, the Hydrogen Council counts $320 billion in hydrogen projects announced around the world.

Given the fact that many new uses of hydrogen are untested, and given the skepticism among many influential energy economists and engineers, it is reasonable to ask what motivates this wave of commitments to the hydrogen vision.

In technological terms, hydrogen may represent a shimmering image of possibility on a distant horizon, but in political economy terms, it has a more immediate role. It is a route through which existing fossil fuel interests can imagine a place for themselves in the new energy future. The presence of oil majors and energy companies in the ranks of the Hydrogen Council is not coincidental. Hydrogen enables natural gas suppliers to imagine that they can transition their facilities to green fuels. Makers of combustion engines and gas turbines can conceive of burning hydrogen instead. Storing hydrogen or ammonia like gas or oil promises a solution to the issues of intermittency in renewable power generation and may extend the life of gas turbine power stations. For governments around the world, a more familiar technology than one largely based on solar panels, windmills, and batteries is a way of calming nerves about the transformation they have notionally signed up for.

Looking at several key geographies in which hydrogen projects are currently being discussed offers a compound psychological portrait of the common moment of global uncertainty.

A worker at the Fukushima Hydrogen Energy Research Field, a test facility that produces hydrogen from renewable energy, in Fukushima, Japan, on Feb. 15, 2023. Richard A. Brooks/AFP Via Getty Images

The first country to formulate a national hydrogen strategy was Japan. Japan has long pioneered exotic energy solutions. Since undersea pipelines to Japan are impractical, it was Japanese demand that gave life to the seaborne market for liquefied natural gas (LNG). What motivated the hydrogen turn in 2017 was a combination of post-Fukushima shock, perennial anxiety about energy security, and a long-standing commitment to hydrogen by key Japanese car manufacturers. Though Toyota, the world’s no. 1 car producer, pioneered the hybrid in the form of the ubiquitous Prius, it has been slow to commit to full electric. The same is true for the other East Asian car producers—Honda, Nissan, and South Korea’s Hyundai. In the face of fierce competition from cheap Chinese electric vehicles, they embrace a government commitment to hydrogen, which in the view of many experts concentrates on precisely the wrong areas i.e. transport and electricity generation, rather than industrial applications.

The prospect of a substantial East Asian import demand for hydrogen encourages the economists at the Hydrogen Council to imagine a global trade in hydrogen that essentially mirrors the existing oil and gas markets. These have historically centered on flows of hydrocarbons from key producing regions such as North Africa, the Middle East, and North America to importers in Europe and Asia. Fracked natural gas converted into LNG is following this same route. And it seems possible that hydrogen and ammonia derived from hydrogen may do the same.

CF Industries, the United States’ largest producer of ammonia, has finalized a deal to ship blue ammonia to Japan’s largest power utility for use alongside oil and gas in power generation. The CO2 storage that makes the ammonia blue rather than gray has been contracted between CF Industries and U.S. oil giant Exxon. A highly defensive strategy in Japan thus serves to provide a market for a conservative vision of the energy transition in the United Sates as well. Meanwhile, Saudi Aramco, by far the world’s largest oil company, is touting shipments of blue ammonia, which it hopes to deliver to Japan or East Asia. Though the cost in terms of energy content is the equivalent of around $250 per barrel of oil, Aramco hopes to ship 11 million tons of blue ammonia to world markets by 2030.

To get through the current gas crisis, EU nations have concluded LNG deals with both the Gulf states and the United States. Beyond LNG, it is also fully committed to the hydrogen bandwagon. And again, this follows a defensive logic. The aim is to use green or blue hydrogen or ammonia to find a new niche for European heavy industry, which is otherwise at risk of being entirely knocked out of world markets by high energy prices and Europe’s carbon levy.

The European steel industry today accounts for less than ten percent of global production. It is a leader in green innovation. And the world will need technological first-movers to shake up the fossil-fuel dependent incumbents, notably in China. But whether this justifies Europe’s enormous commitment to hydrogen is another question. It seems motivated more by the desire to hold up the process of deindustrialization and worries about working-class voters drifting into the arms of populists, than by a forward looking strategic calculus.

In the Netherlands, regions that have hitherto served as hubs for global natural gas trading are now competing for designation as Europe’s “hydrogen valley.” In June, German Chancellor Olaf Scholz and Italian Prime Minister Giorgia Meloni inked the contract on the SoutH2 Corridor, a pipeline that will carry H2 up the Italian peninsula to Austria and southern Germany. Meanwhile, France has pushed Spain into agreeing to a subsea hydrogen connection rather than a natural gas pipeline over the Pyrenees. Spain and Portugal have ample LNG terminal capacity. But Spain’s solar and wind potential also make it Europe’s natural site for green hydrogen production and a “green hydrogen” pipe, regardless of its eventual uses, in the words of one commentator looks “less pharaonic and fossil-filled” than the original natural gas proposal.

A hydrogen-powered train is refilled by a mobile hydrogen filling station at the Siemens test site in Wegberg, Germany, on Sept. 9, 2022. Bernd/AFP Via Getty Images

How much hydrogen will actually be produced in Europe remains an open question. Proximity to the point of consumption and the low capital costs of investment in Europe speak in favor of local production. But one of the reasons that hydrogen projects appeal to European strategists is that they offer a new vision of European-African cooperation. Given demographic trends and migration pressure, Europe desperately needs to believe that it has a promising African strategy. Africa’s potential for renewable electricity generation is spectacular. Germany has recently entered into a hydrogen partnership with Namibia. But this raises new questions.

First and foremost, where will a largely desert country source the water for electrolysis? Secondly, will Namibia export only hydrogen, ammonia, or some of the industrial products made with the green inputs? It would be advantageous for Namibia to develop a heavy-chemicals and iron-smelting industry. But from Germany’s point of view, that might well defeat the object, which is precisely to provide affordable green energy with which to keep industrial jobs in Europe.

A variety of conservative motives thus converge in the hydrogen coalition. Most explicit of all is the case of post-Brexit Britain. Once a leader in the exit from coal, enabled by a “dash for gas” and offshore wind, the U.K. has recently hit an impasse. Hard-to-abate sectors like household heating, which in the U.K. is heavily dependent on natural gas, require massive investments in electrification, notably in heat pumps. These are expensive. In the United Kingdom, the beleaguered Tory government, which has presided over a decade of stagnating real incomes, is considering as an alternative the widespread introduction of hydrogen for domestic heating. Among energy experts this idea is widely regarded as an impractical boondoggle for the gas industry that defers the eventual and inevitable electrification at the expense of prolonged household emissions. But from the point of view of politics, it has the attraction that it costs relatively less per household to replace natural gas with hydrogen.

Employees work on the assembly line of fuel cell electric vehicles powered by hydrogen at a factory in Qingdao, Shandong province, China, on March 29, 2022. VCG Via Getty Images

As this brief tour suggests, there is every reason to fear that tens of billions of dollars in subsidies, vast amounts of political capital, and precious time are being invested in “green” energy investments, the main attraction of which is that they minimize change and perpetuate as far as possible the existing patterns of the hydrocarbon energy system. This is not greenwashing in the simple sense of rebadging or mislabeling. If carried through, it is far more substantial than that. It will build ships and put pipes in the ground. It will consume huge amounts of desperately scarce green electricity. And this faces us with a dilemma.

In confronting the challenge of the energy transition, we need a bias for action. We need to experiment. There is every reason to trust in learning-curve effects. Electrolyzers, for instance, will get more affordable, reducing the costs of hydrogen production. At certain times and in certain places, green power may well become so abundant that pouring it into electrolysis makes sense. And even if many hydrogen projects do not succeed, that may be a risk worth taking. We will likely learn new techniques in the process. In facing the uncertainties of the energy transition, we need to cultivate a tolerance for failure. Furthermore, even if hydrogen is a prime example of corporate log-rolling, we should presumably welcome the broadening of the green coalition to include powerful fossil fuel interests.

The real and inescapable tradeoff arises when we commit scarce resources—both real and political—to the hydrogen dream. The limits of public tolerance for the costs of the energy transition are already abundantly apparent, in Asia and Europe as well as in the United States. Pumping money into subsidies that generate huge economies of scale and cost reductions is one thing. Wasting money on lame-duck projects with little prospect of success is quite another. What is at stake is ultimately the legitimacy of the energy transition as such.

In the end, there is no patented method distinguishing self-serving hype from real opportunity. There is no alternative but to subject competing claims to intense public, scientific, and technical scrutiny. And if the ship has already sailed and subsidies are already on the table, then retrospective cost-benefit assessment is called for.

Ideally, the approach should be piecemeal and stepwise, and in this regard the crucial thing to note about hydrogen is that to regard it as a futuristic fantasy is itself misguided. We already live in a hydrogen-based world. Two key sectors of modern industry could not operate without it. Oil refining relies on hydrogen, as does the production of fertilizer by the Haber-Bosch process on which we depend for roughly half of our food production. These two sectors generate the bulk of the demand for the masses of hydrogen we currently consume.

We may not need 600 million, 500 million, or even 300 million tons of green and blue hydrogen by 2050. But we currently use about 100 million, and of that total, barely 1 million is clean. It is around that core that hydrogen experimentation should be concentrated, in places where an infrastructure already exists. This is challenging because transporting hydrogen is expensive, and many of the current points of use of hydrogen, notably in Europe, are not awash in cheap green power. But there are two places where the conditions for experimentation within the existing hydrogen economy seem most propitious.

One is China, and specifically northern China and Inner Mongolia, where China currently concentrates a large part of its immense production of fertilizer, cement, and much of its steel industry. China is leading the world in the installation of solar and wind power and is pioneering ultra-high-voltage transmission. Unlike Japan and South Korea, China has shown no particular enthusiasm for hydrogen. It is placing the biggest bet in the world on the more direct route to electrification by way of renewable generation and batteries. But China is already the largest and lowest-cost producer of electrolysis equipment. In 2022, China launched a modestly proportioned hydrogen strategy. In cooperation with the United Nations it has initiated an experiment with green fertilizer production, and who would bet against its chances of establishing a large-scale hydrogen energy system?

The other key player is the United States. After years of delay, the U.S. lags far behind in photovoltaics batteries, and offshore wind. But in hydrogen, and specifically in the adjoining states of Texas and Louisiana on the Gulf of Mexico, it has obvious advantages over any other location in the West. The United States is home to a giant petrochemicals complex. It is the only Western economy that can compete with India and China in fertilizer production. In Texas, there are actually more than 2500 kilometers of hardened hydrogen pipelines. And insofar as players like Exxon have a green energy strategy, it is carbon sequestration, which will be the technology needed for blue hydrogen production.

It is not by accident that America’s signature climate legislation, the Inflation Reduction Act, targeted its most generous subsidies—the most generous ever offered for green energy in the United States—on hydrogen production. The hydrogen lobby is hard at work, and it has turned Texas into the lowest-cost site for H2 production in the Western world. It is not a model one would want to see emulated anywhere else, but it may serve as a technology incubator that charts what is viable and what is not.

There is very good reason to suspect the motives of every player in the energy transition. Distinguishing true innovation from self-serving conservatism is going to be a key challenge in the new era in which we have to pick winners. We need to develop a culture of vigilance. But there are also good reasons to expect certain key features of the new to grow out of the old. Innovation is miraculous but it rarely falls like mana from heaven. As Sabel and Victor argue in their book, it grows from within expert technical communities with powerful vested interests in change. The petrochemical complex of the Gulf of Mexico may seem an unlikely venue for the birth of a green new future, but it is only logical that the test of whether the hydrogen economy is a real possibility will be run at the heart of the existing hydrocarbon economy.

— Adam Tooze is a Columnist at Foreign Policy and a History Professor and the Director of the European Institute at Columbia University. He is the Author of Chartbook, a newsletter on Rconomics, Geopolitics, and History.

#Hydrogen#Battery-Powered Electric Vehicles (EVs)#Chuck Sabel | David Victor#Iberdrola Puertollano Spain 🇪🇸#Green Hydrogen#Hydrogen Council of the United States 🇺🇸#Hydrogen Economy#Airbus | Aramco | BMW | Daimler Truck | Honda | Toyota | Hyundai | Siemens | Shell | Microsoft#Japan 🇯🇵 | South Korea 🇰🇷 | EU 🇪🇺 | UK 🇬🇧 | US 🇺🇸 | China 🇨🇳#Portugal 🇵🇹 | Germany 🇩🇪 | Namibia 🇳🇦#European-African Cooperation

2 notes

·

View notes

Text

DA lithium battery for Eco Friendly RV

You’re in the right place if needed a much more Eco-friendly RV.

You wouldn’t throw the ice cream in the living room, Nor Key scratching the brand new car. We knows how to take good care of what we concerns. There is no different with our own planet, right? For those adventurers out there who want to preserve nature while enjoying RV life, here are our favorite eco-friendly RV tips.

Your Eco-Friendly RV – Tips & Tricks

Yes, you can indulge your RV wanderlust and go green at the same time. Here’s how:

Reduce on Fossil Fuels

You probably know that RVs are heavy on fuel. This is neither environmentally friendly nor good for the wallet. Since the average diesel RV only gets 8-14 miles per gallon, it’s imperative to maximize fuel efficiency. Try these RV tips to reduce gas:

Go for a smaller vehicle. If you’re in the market for an RV and want to minimize gas consumption, opt for a smaller Class C motorhome, or even a Class B van. The bigger the rig, the more gasoline it consumes.

Stay up-to-date with maintenance. Small tweaks can make a huge difference. For example, keeping your tires properly inflated can improve fuel consumption by up to 3%.

Change to bio–diesel fuel. Bio-diesel is a renewable, biodegradable fuel made from animal fats, vegetable oils, or recycled restaurant grease. Not currently available at all gas stations. But it’s growing in popularity, and you can use this handy online tool to find alternative gas stations near you.

Press the accelerator lightly. Slow down and enjoy the scenic route. By accelerating less and maintaining a moderate speed, you save fuel. The best speed for an RV is 55 to 60 mph.

Travel light. Only bring travel essentials. Dead weight will slow your RV down and cost you more fuel.

Pro Tip: Switch to lithium RV batteries and reduce hitch weight by up to 70%. The weight of ion lithium RV battery is 1/2 of lead-acid battery with the same capacity.

Charge Your Gadgets With The Power Of The Sun

Most of us use a ton of gadgets every day. Think cell phones, laptops, cameras, and more. Since they all need to be charged, why not reduce energy consumption and use solar energy? After all, solar energy is a completely renewable energy source.

By calculating and armed with solar panels, inverter&controller, most important with our stable and security DA lithium battery pack, You are allowed to charge your gadgets from anywhere. Whether you’re staying in your RV or backpacking in the mountains for the weekend, it never hurts to have solar power at your disposal. Even better, charging your devices with solar power is better for the environment.

Try Your Hand At Dry Camping Or Boondocking

Dry camping and boondocking are some of the best ways to make your RV eco friendly. They are also fun! If you can ditch the connection for a few nights, you’ll be rewarded with open spaces and starry skies, especially for the rednecks out there.

Just because you’re off the grid doesn’t mean you’re necessarily going to be uncomfortable. With high-efficiency household batteries, you can still power essentials like water systems, lighting, and ceiling fans. But not just any battery will do. You need a reliable and energy-efficient power supply to power your weekends.

With our trusty 12V LiFePO4 battery, you can forget about electrical connections and enjoy nature.

Pro Tip: Use the 12V lithium battery (series or parallel connection) to charge and power your lights, fans and pumps, even when you’re in the middle of nowhere. Lithium is the best RV battery ever for boondocking as it is efficient, reliable and environmentally safe.

Switch to Smart, Energy Efficient Lithium Batteries

You can make a huge leap toward Eco friendly RVing with this one small step: switch to lithium RV batteries. Here’s why:

Lithium is toxin-free. While lead-acid batteries may be the cheapest option for an RV, they’re not the greenest. They contain harmful substances, including sulfuric acid and lead. This is why they require maintenance and must be stored properly to prevent spills from contaminating the environment. Lithium batteries are a safer, smarter, environmentally friendly RV alternative. They are non-toxic, non-spillable and recyclable. You can even store them indoors.

Lithium is smart. Lithium batteries are smart batteries because they have a battery management system(BMS) that prevents overcharging (and subsequent damage). They could also access to your phone via Bluetooth. With a few taps, you can see exactly how much energy is left and the statements of every single cell’s healthy.

Lithium is more efficient. Lithium batteries support charge @100% efficiently, while lead-acid batteries charge @85 % efficiently. You can use a smaller and less expensive solar setup to charge lithium than you can charge a similar sized lead-acid battery. Because of their efficiency, lithium battery packs run out of power much less frequently. This is important when you need to use limited power wisely, such as when you’re boondocking!

Quick Tips for Eco Friendly RV Living

Cutting down on fossil fuel use, staying off the grid, harnessing solar power, and switching to smart batteries are all major ways to turn your home-on-the-go into an Eco friendly RV. But here are a few more RV tips to help you go even greener:

Use enzyme-based tank cleaners instead of chemical-based cleaners for your RV toilet.

Switch out basic bulbs and replace them with energy-saving LED lights.

Use reusable, lightweight plates and utensils instead of disposable plastic and polyfoam.

Conserve water by bringing your own water filtration system and using the water around you. Install a water-saving shower head to reduce waste.

Leave no trace! Take everything you brought to the campsite with you when you leave.

3 notes

·

View notes

Text

With the vast majority of the world’s governments committed to decarbonizing their economies in the next two generations, we are embarked on a voyage into the unknown. What was once an argument over carbon pricing and emissions trading has turned into an industrial policy race. Along the way there will be resistance and denial. There will also be breakthroughs and unexpected wins. The cost of solar and wind power has fallen spectacularly in the last 20 years. Battery-powered electric vehicles (EVs) have moved from fantasy to ubiquitous reality.

But alongside outright opposition and clear wins, we will also have to contend with situations that are murkier, with wishful thinking and motivated reasoning. As we search for technical solutions to the puzzle of decarbonization, we must beware the mirages of the energy transition.

On a desert trek a mirage can be fatal. Walk too far in the wrong direction, and there may be no way back. You succumb to exhaustion before you can find real water. On the other hand, if you don’t head toward what looks like an oasis, you cannot be sure that you will find another one in time.

Right now, we face a similar dilemma, a dilemma of huge proportions not with regard to H2O but one of its components, H2—hydrogen. Is hydrogen a key part of the world’s energy future or a dangerous fata morgana? It is a question on which tens of trillions of dollars in investment may end up hinging. And scale matters.

For decades, economists warned of the dangers of trying through industrial policy to pick winners. The risk is not just that you might fail, but that in doing so you incur costs. You commit real resources that foreclose other options. The lesson was once that we should leave it to the market. But that was a recipe for a less urgent time. The climate crisis gives us no time. We cannot avoid the challenge of choosing our energy future. As Chuck Sabel and David Victor argue in their important new book Fixing the Climate: Strategies for an Uncertain World, it is through local partnership and experimentation that we are most likely to find answers to these technical dilemmas. But, as the case of hydrogen demonstrates, we must beware the efforts of powerful vested interests to use radical technological visions to channel us towards what are in fact conservative and ruinously expensive options.

In the energy future there are certain elements that seem clear. Electricity is going to play a much bigger role than ever before in our energy mix. But some very knotty problems remain. Can electricity suffice? How do you unleash the chemical reactions necessary to produce essential building blocks of modern life like fertilizer and cement without employing hydrocarbons and applying great heat? To smelt the 1.8 billion tons of steel we use every year, you need temperatures of almost 2,000 degrees Celsius. Can we get there without combustion? How do you power aircraft flying thousands of miles, tens of thousands of feet in the air? How do you propel giant container ships around the world? Electric motors and batteries can hardly suffice.

Hydrogen recommends itself as a solution because it burns very hot. And when it does, it releases only water. We know how to make hydrogen by running electric current through water. And we know how to generate electricity cleanly. Green hydrogen thus seems easily within reach. Alternatively, if hydrogen is manufactured using natural gas rather than electrolysis, the industrial facilities can be adapted to allow immediate, at-source CO2 capture. This kind of hydrogen is known as blue hydrogen.

Following this engineering logic, H2 is presented by its advocates as a Swiss army knife of the energy transition, a versatile adjunct to the basic strategy of electrifying everything. The question is whether H2 solutions, though they may be technically viable, make any sense from the point of view of the broader strategy of energy transition, or whether they might in fact be an expensive wrong turn.

Using hydrogen as an energy store is hugely inefficient. With current technology producing hydrogen from water by way of electrolysis consumes vastly more energy than will be stored and ultimately released by burning the hydrogen. Why not use the same electricity to generate the heat or drive a motor directly? The necessary electrolysis equipment is expensive. And though hydrogen may burn cleanly, as a fuel it is inconvenient because of its corrosive properties, its low energy per unit of volume, and its tendency to explode. Storing and moving hydrogen around will require huge investment in shipping facilities, pipelines, filling stations, or facilities to convert hydrogen into the more stable form of ammonia.

The kind of schemes pushed by hydrogen’s lobbyists foresee annual consumption rising by 2050 to more than 600 million tons per annum, compared to 100 million tons today. This would consume a huge share of green electricity production. In a scenario favored by the Hydrogen Council, of the United States’ 2,900 gigawatts of renewable energy production, 650 gigawatts would be consumed by hydrogen electrolysis. That is almost three times the total capacity of renewable power installed today.

The costs will be gigantic. The cost for a hydrogen build-out over coming decades could run into the tens of trillions of dollars. Added to which, to work as a system, the investment in hydrogen production, transport, and consumption will have to be undertaken simultaneously.

Little wonder, perhaps, that though the vision of the “hydrogen economy” as an integrated economic and technical system has been around for half a century, we have precious little actual experience with hydrogen fuel. Indeed, there is an entire cottage industry of hydrogen skeptics. The most vocal of these is Michael Liebreich, whose consultancy has popularized the so-called hydrogen ladder, designed to highlight how unrealistic many of them are. If one follows the Liebreich analysis, the vast majority of proposed hydrogen uses in transport and industrial heating are, in fact, unrealistic due to their sheer inefficiency. In each case there is an obvious alternative, most of them including the direct application of electricity.

Nevertheless, in the last six years a huge coalition of national governments and industrial interests has assembled around the promise of a hydrogen-based economy.

The Hydrogen Council boasts corporate sponsors ranging from Airbus and Aramco to BMW, Daimler Truck, Honda, Toyota and Hyundai, Siemens, Shell, and Microsoft. The national governments of Japan, South Korea, the EU, the U.K., the U.S., and China all have hydrogen strategies. There are new project announcements regularly. Experimental shipments of ammonia have docked in Japan. The EU is planning an elaborate network of pipelines, known as the hydrogen backbone. All told, the Hydrogen Council counts $320 billion in hydrogen projects announced around the world.

Given the fact that many new uses of hydrogen are untested, and given the skepticism among many influential energy economists and engineers, it is reasonable to ask what motivates this wave of commitments to the hydrogen vision.

In technological terms, hydrogen may represent a shimmering image of possibility on a distant horizon, but in political economy terms, it has a more immediate role. It is a route through which existing fossil fuel interests can imagine a place for themselves in the new energy future. The presence of oil majors and energy companies in the ranks of the Hydrogen Council is not coincidental. Hydrogen enables natural gas suppliers to imagine that they can transition their facilities to green fuels. Makers of combustion engines and gas turbines can conceive of burning hydrogen instead. Storing hydrogen or ammonia like gas or oil promises a solution to the issues of intermittency in renewable power generation and may extend the life of gas turbine power stations. For governments around the world, a more familiar technology than one largely based on solar panels, windmills, and batteries is a way of calming nerves about the transformation they have notionally signed up for.

Looking at several key geographies in which hydrogen projects are currently being discussed offers a compound psychological portrait of the common moment of global uncertainty.

The first country to formulate a national hydrogen strategy was Japan. Japan has long pioneered exotic energy solutions. Since undersea pipelines to Japan are impractical, it was Japanese demand that gave life to the seaborne market for liquefied natural gas (LNG). What motivated the hydrogen turn in 2017 was a combination of post-Fukushima shock, perennial anxiety about energy security, and a long-standing commitment to hydrogen by key Japanese car manufacturers. Though Toyota, the world’s no. 1 car producer, pioneered the hybrid in the form of the ubiquitous Prius, it has been slow to commit to full electric. The same is true for the other East Asian car producers—Honda, Nissan, and South Korea’s Hyundai. In the face of fierce competition from cheap Chinese electric vehicles, they embrace a government commitment to hydrogen, which in the view of many experts concentrates on precisely the wrong areas i.e. transport and electricity generation, rather than industrial applications.

The prospect of a substantial East Asian import demand for hydrogen encourages the economists at the Hydrogen Council to imagine a global trade in hydrogen that essentially mirrors the existing oil and gas markets. These have historically centered on flows of hydrocarbons from key producing regions such as North Africa, the Middle East, and North America to importers in Europe and Asia. Fracked natural gas converted into LNG is following this same route. And it seems possible that hydrogen and ammonia derived from hydrogen may do the same.

CF Industries, the United States’ largest producer ammonia, has finalized a deal to ship blue ammonia to Japan’s largest power utility for use alongside oil and gas in power generation. The CO2 storage that makes the ammonia blue rather than gray has been contracted between CF Industries and U.S. oil giant Exxon. A highly defensive strategy in Japan thus serves to provide a market for a conservative vision of the energy transition in the United Sates as well. Meanwhile, Saudi Aramco, by far the world’s largest oil company, is touting shipments of blue ammonia, which it hopes to deliver to Japan or East Asia. Though the cost in terms of energy content is the equivalent of around $250 per barrel of oil, Aramco hopes to ship 11 million tons of blue ammonia to world markets by 2030.

To get through the current gas crisis, EU nations have concluded LNG deals with both the Gulf states and the United States. Beyond LNG, it is also fully committed to the hydrogen bandwagon. And again, this follows a defensive logic. The aim is to use green or blue hydrogen or ammonia to find a new niche for European heavy industry, which is otherwise at risk of being entirely knocked out of world markets by high energy prices and Europe’s carbon levy.

The European steel industry today accounts for less than ten percent of global production. It is a leader in green innovation. And the world will need technological first-movers to shake up the fossil-fuel dependent incumbents, notably in China. But whether this justifies Europe’s enormous commitment to hydrogen is another question. It seems motivated more by the desire to hold up the process of deindustrialization and worries about working-class voters drifting into the arms of populists, than by a forward looking strategic calculus.

In the Netherlands, regions that have hitherto served as hubs for global natural gas trading are now competing for designation as Europe’s “hydrogen valley.” In June, German Chancellor Olaf Scholz and Italian Prime Minister Giorgia Meloni inked the contract on the SoutH2 Corridor, a pipeline that will carry H2 up the Italian peninsula to Austria and southern Germany. Meanwhile, France has pushed Spain into agreeing to a subsea hydrogen connection rather than a natural gas pipeline over the Pyrenees. Spain and Portugal have ample LNG terminal capacity. But Spain’s solar and wind potential also make it Europe’s natural site for green hydrogen production and a “green hydrogen” pipe, regardless of its eventual uses, looks in the words of one commentator looks “less pharaonic and fossil-filled” than the original natural gas proposal.

How much hydrogen will actually be produced in Europe remains an open question. Proximity to the point of consumption and the low capital costs of investment in Europe speak in favor of local production. But one of the reasons that hydrogen projects appeal to European strategists is that they offer a new vision of European-African cooperation. Given demographic trends and migration pressure, Europe desperately needs to believe that it has a promising African strategy. Africa’s potential for renewable electricity generation is spectacular. Germany has recently entered into a hydrogen partnership with Namibia. But this raises new questions.

First and foremost, where will a largely desert country source the water for electrolysis? Secondly, will Namibia export only hydrogen, ammonia, or some of the industrial products made with the green inputs? It would be advantageous for Namibia to develop a heavy-chemicals and iron-smelting industry. But from Germany’s point of view, that might well defeat the object, which is precisely to provide affordable green energy with which to keep industrial jobs in Europe.

A variety of conservative motives thus converge in the hydrogen coalition. Most explicit of all is the case of post-Brexit Britain. Once a leader in the exit from coal, enabled by a “dash for gas” and offshore wind, the U.K. has recently hit an impasse. Hard-to-abate sectors like household heating, which in the U.K. is heavily dependent on natural gas, require massive investments in electrification, notably in heat pumps. These are expensive. In the United Kingdom, the beleaguered Tory government, which has presided over a decade of stagnating real incomes, is considering as an alternative the widespread introduction of hydrogen for domestic heating. Among energy experts this idea is widely regarded as an impractical boondoggle for the gas industry that defers the eventual and inevitable electrification at the expense of prolonged household emissions. But from the point of view of politics, it has the attraction that it costs relatively less per household to replace natural gas with hydrogen.

As this brief tour suggests, there is every reason to fear that tens of billions of dollars in subsidies, vast amounts of political capital, and precious time are being invested in “green” energy investments, the main attraction of which is that they minimize change and perpetuate as far as possible the existing patterns of the hydrocarbon energy system. This is not greenwashing in the simple sense of rebadging or mislabeling. If carried through, it is far more substantial than that. It will build ships and put pipes in the ground. It will consume huge amounts of desperately scarce green electricity. And this faces us with a dilemma.

In confronting the challenge of the energy transition, we need a bias for action. We need to experiment. There is every reason to trust in learning-curve effects. Electrolyzers, for instance, will get more affordable, reducing the costs of hydrogen production. At certain times and in certain places, green power may well become so abundant that pouring it into electrolysis makes sense. And even if many hydrogen projects do not succeed, that may be a risk worth taking. We will likely learn new techniques in the process. In facing the uncertainties of the energy transition, we need to cultivate a tolerance for failure. Furthermore, even if hydrogen is a prime example of corporate log-rolling, we should presumably welcome the broadening of the green coalition to include powerful fossil fuel interests.

The real and inescapable tradeoff arises when we commit scarce resources—both real and political—to the hydrogen dream. The limits of public tolerance for the costs of the energy transition are already abundantly apparent, in Asia and Europe as well as in the United States. Pumping money into subsidies that generate huge economies of scale and cost reductions is one thing. Wasting money on lame-duck projects with little prospect of success is quite another. What is at stake is ultimately the legitimacy of the energy transition as such.

In the end, there is no patented method distinguishing self-serving hype from real opportunity. There is no alternative but to subject competing claims to intense public, scientific, and technical scrutiny. And if the ship has already sailed and subsidies are already on the table, then retrospective cost-benefit assessment is called for.

Ideally, the approach should be piecemeal and stepwise, and in this regard the crucial thing to note about hydrogen is that to regard it as a futuristic fantasy is itself misguided. We already live in a hydrogen-based world. Two key sectors of modern industry could not operate without it. Oil refining relies on hydrogen, as does the production of fertilizer by the Haber-Bosch process on which we depend for roughly half of our food production. These two sectors generate the bulk of the demand for the masses of hydrogen we currently consume.

We may not need 600 million, 500 million, or even 300 million tons of green and blue hydrogen by 2050. But we currently use about 100 million, and of that total, barely 1 million is clean. It is around that core that hydrogen experimentation should be concentrated, in places where an infrastructure already exists. This is challenging because transporting hydrogen is expensive, and many of the current points of use of hydrogen, notably in Europe, are not awash in cheap green power. But there are two places where the conditions for experimentation within the existing hydrogen economy seem most propitious.

One is China, and specifically northern China and Inner Mongolia, where China currently concentrates a large part of its immense production of fertilizer, cement, and much of its steel industry. China is leading the world in the installation of solar and wind power and is pioneering ultra-high-voltage transmission. Unlike Japan and South Korea, China has shown no particular enthusiasm for hydrogen. It is placing the biggest bet in the world on the more direct route to electrification by way of renewable generation and batteries. But China is already the largest and lowest-cost producer of electrolysis equipment. In 2022, China launched a modestly proportioned hydrogen strategy. In cooperation with the United Nations it has iniated an experiment with green fertilizer production, and who would bet against its chances of establishing a large-scale hydrogen energy system?

The other key player is the United States. After years of delay, the U.S. lags far behind in photovoltaics batteries, and offshore wind. But in hydrogen, and specifically in the adjoining states of Texas and Louisiana on the Gulf of Mexico, it has obvious advantages over any other location in the West. The United States is home to a giant petrochemicals complex. It is the only Western economy that can compete with India and China in fertilizer production. In Texas, there are actually more than 2500 kilometers of hardened hydrogen pipelines. And insofar as players like Exxon have a green energy strategy, it is carbon sequestration, which will be the technology needed for blue hydrogen production.

It is not by accident that America’s signature climate legislation, the Inflation Reduction Act, targeted its most generous subsidies—the most generous ever offered for green energy in the United States—on hydrogen production. The hydrogen lobby is hard at work, and it has turned Texas into the lowest-cost site for H2 production in the Western world. It is not a model one would want to see emulated anywhere else, but it may serve as a technology incubator that charts what is viable and what is not.

There is very good reason to suspect the motives of every player in the energy transition. Distinguishing true innovation from self-serving conservatism is going to be a key challenge in the new era in which we have to pick winners. We need to develop a culture of vigilance. But there are also good reasons to expect certain key features of the new to grow out of the old. Innovation is miraculous but it rarely falls like mana from heaven. As Sabel and Victor argue in their book, it grows from within expert technical communities with powerful vested interests in change. The petrochemical complex of the Gulf of Mexico may seem an unlikely venue for the birth of a green new future, but it is only logical that the test of whether the hydrogen economy is a real possibility will be run at the heart of the existing hydrocarbon economy.

4 notes

·

View notes

Photo

We offer environmentally conscious, cost-effective waste disposal and recycling services to all of our customers in Vancouver, Richmond, Burnaby, Surrey, and the surrounding areas, all with no long-term contract or hidden fees. All of our trucks are natural gas-powered, making them one of the lowest emission-emitting types of vehicles currently available on the market. We also offer customers the flexibility of scheduled pickups with an extended collection area and pickup times to suit everyone's needs.

#Disposal Queen#Dumpster Rental#Waste Disposal#Trash Container#Garbage Disposal#Vancouver Bin Rental#Recycling Services

6 notes

·

View notes

Text

Induction Motor Market - Forecast(2022 - 2027)

Induction Motor Market Size is forecast to reach $54.2 billion by 2026, at a CAGR of 6.5% during 2021-2026. An induction motor is an AC electric motor in which torque is produced by the reaction between a varying magnetic field generated in the stator and the current induced in the coils of the rotor. It is used in a majority of machinery, as it is more powerful and eco-friendly compared to the conventional motors in the market. North America has significant share in global induction motor market due to a developed usage of an induction motor in the significant industrial manufacturing, aerospace & defense, and automotive companies. In addition to the growing preference for electric vehicles in the U.S. is also stimulating the growth in North America.

Report Coverage

The report: “Induction Motor Market Report– Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Induction Motor market

By Rotor Type: Inner Rotor, Outer Rotor

By Type: Single Phase, Three Phase

By Efficiency Class: IE1, IE2, IE3, IE4

By Voltage: Upto 1KV, 1-6.6 KV, Above 6.6KV

By Vertical: Industrial, Commercial, Residential, Agriculture, Automotive and Others

By Geography: North America (U.S, Canada, Mexico), South America(Brazil, Argentina and others), Europe(Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, SK, Aus and Others), and RoW (Middle East and Africa)

Request Sample

Key Takeaways

The rising demand for efficient energy usage over concerns of environmental impact of energy generation from conventional sources such as coal and natural gas, is expected to help grow the Induction Motor market in APAC.

The inner rotor segment is growing at a significant CAGR rate of 7.1% in the forecast period. In inner rotor type motors, rotors are positioned at the centre and surrounded by stator winding.

Automotive sector is expected to witness a highest CAGR of 8.9% the forecast period, owing to various factors such as increase in sales of electric vehicles due to rising concerns over greenhouse gases emissions, and favourable government policies in countries such as India, China and so on.

Induction Motor companies are strengthening their position through mergers & acquisitions and continuously investing in research and development (R&D) activities to come up with solutions to cater to the changing requirements of customers.

Induction Motor Market Segment Analysis - By Rotor Type

Three Phase segment is growing at a significant CAGR of 11.1%

in the forecast period. A three phase induction motor is a type of AC induction motors which operates on three phase supply. These three phase induction motors are widely used AC motor to produce mechanical power in industrial applications. Almost 70% of the machinery in industrial applications uses three-phase induction motors, as they are cost-effective, robust, maintenance-free, and can operate in any environmental condition. Moreover, induction motors are the most used in industry since they are rugged, inexpensive, and are maintenance free. In addition they are widely used in the mining metals and cement, automotive, oil and gas, healthcare, manufacturing industries and so on. Increase awareness of environmental protection across industries also contributes to the growth of three phase induction motors, as they have a low emission rate. Moreover, the shift towards industrial automation, coupled with the rising consumer confidence & promising investment plans triggers demand for the three phase induction motor in industrial application. Furthermore, the advent of Industry 4.0 and technological advancements enables a wide adoption base for the three phase induction motors. In 2019, Oriental Motor USA introduced their latest high efficiency three-phase AC induction motors equipped with a terminal box and a high strength right-angle hypoid gearhead, these new three-phase motors have the capacity of two new wattages of 30W and 40W and expands the KIIS Series Standard AC motors product line-up.

Inquiry Before Buying

Induction Motor Market Segment Analysis - By Vertical

Automotive sector is expected to witness a highest CAGR of 8.9% in the forecast period, owing to various factors such as increase in sales of electric vehicles due to rising concerns over greenhouse gases emissions, and favorable government policies in countries such as India, China and so on. In addition, the shift towards industrial automation, coupled with the rising consumer confidence & promising investment plans triggers demand for the induction motor in industrial application. Furthermore, the advent of Industry 4.0 enables a wide adoption base for the induction motors. Moreover, growing number of product launches by major manufacturers will drive the market growth in the forecast period. In September 2019, Motor and drive manufacturer WEG released the M Mining series of slip-ring induction motors which are designed especially for use in the dusty environments of iron ore operations and the cement sector. In July 2019, Ward Leonard launched 2000 HP induction motor WL29BC200 which is designed tote into a package of 15000 HP for the oil and gas industry. In September 2019, Tata Motors launched Tigor EV for private buyers as well as cab aggregators and EESL staff. he Tata Tigor electric uses a 72 V, 3-Phase Induction motor

Induction Motor Market Segment Analysis - By Geography

Induction Motor market in Asia-Pacific region held significant market share of 38.5% in 2020. Increasing compliance for energy efficient motors and rising adoption of motor-driven electric vehicles are the key factors driving market growth. The rising demand for efficient energy usage over concerns of environmental impact of energy generation from conventional sources such as coal and natural gas, is expected to help grow the Induction Motor market. In addition advancements in the agriculture sector and enormous investments in industrialization in countries such as China, India, South Korea, and Australia is driving the market growth. Further, the increasing production and sales of electric vehicles in countries including China and Japan is also analyzed to drive the market growth.

Schedule a Call

Induction Motor Market Drivers

Robust Structure of Motor

The rough physical structure of the motor is predicted to be a major driving factor for the growth of the induction motor market. Induction motor are robust in nature and can be operated in any climatic conditions. Moreover, the absence of slip rings and brushes in the motor induction eliminates the chances of sparks, which makes the operation safe even in the most explosive working conditions. In addition, induction motor is cost effective, highly reliable and the maintenance is very less, which is expected to propel the growth of the induction motor market in the forecast period 2021-2026.

Rise in Production of Electric Vehicles

The electric car market has witnessed rapid evolution with the ongoing developments in automotive sector and favourable government policies and support in terms of subsidies and grants, tax rebates. As induction motors especially three phase are widely used in electric vehicles because of high efficiency, good speed regulation and absence of commutators is analysed to drive the market growth. In addition these motor also serves as an alternative of a permanent magnet in the electric vehicles. Hence rise in production of electric vehicles is analysed to drive the market. In 2019, Ford has invested $1.45 billion in Detroit plants in U.S., to make electric, autonomous and sports utility vehicles, which is mainly aimed to increase the production of the vehicles thereby impacting on the high procurement of the induction motors. In 2019, Toyota announced plans to invest $749M in expanding the U.S. manufacturing facilities to increase the production of the electric and hybrid vehicles. In 2020, General Motors had committed boost its electric vehicle production by investing more than $7 billion. Moreover governments of several countries have been investing heavily for the development of electric vehicles. In 2019 German government has committed to invest more than $3 billion to expand electric car market growth in the region. Hence these investments and developments are analysed to be the key drivers for the growth of the electric vehicle market and thereby the growth of induction motor market during the forecast period 2021-2026.

Buy Now

Induction Motor Market Challenges

Easy availability of low-quality Induction Motors

The market for Induction Motors is highly fragmented, with a significant number of domestic and international manufacturers. Product quality is a primary parameter for differentiation in this market. The organized sector in the market mainly targets industrial buyers and maintains excellent product quality, while the unorganized sector offers low-cost alternatives to tap local markets. Local manufacturers of Induction Motors in most countries target the unorganized sector and compete strongly with the global suppliers in the respective markets. Leading market players are currently exposed to intense competition from such unorganized players supplying inexpensive and low-quality Induction Motors. This acts as a key challenge for the growth of the market.

Induction Motor Market Landscape

Product launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Induction Motor market. Induction Motor top 10 companies include ABB Ltd. AMETEK, Inc., Johnson Electric Holdings Limited, Siemens AG, Rockwell Automation, Toshiba Corp., Hitachi Ltd., Nidec Corporation, ARC Systems Inc., among others.

Acquisitions/Product Launches

In 2021 BorgWarner launched HVH 320 Induction Motors in four variants. They are offered to light-duty passenger cars and heavy-duty commercial vehicles.

In 2020, ABB has launched new range of low voltage IEC induction motors, which are compactly designed and reduces the overall size of the equipment by minimizing space and total cost of ownership.

For more Electronics related reports, please click here

#induction motor Market#induction motor Market Size#electric motor#induction motor Market Share#induction motor Market Analysis#electromagnetic induction#induction motor Market Revenue#asynchronous motor#induction motor Market Trends#induction motor Market Growth#induction motor Market Research#induction motor Market Outlook#induction motor Market Forecast#induction motor Market Price

3 notes

·

View notes

Text

Green Hydrogen Market — Forecast(2024–2030)

Green Hydrogen market size is forecasted to reach US$2.4 billion by 2027, after growing at a CAGR of 14.1% during the forecast period 2022–2027. Green Hydrogen is produced using low-carbon or renewable energy sources, such as solid oxide electrolysis, alkaline electrolysis and proton exchange membrane electrolysis. When compared to grey hydrogen, which is made by steam reforming natural gas and accounts for the majority of the hydrogen market, green hydrogen has significantly lower carbon emissions. Due to its capacity to lower carbon emissions, green hydrogen has recently been in high demand. Since it is a renewable energy source, its use is anticipated to rise in the coming years. The demand for the green hydrogen industry is expected to grow as public awareness of hydrogen’s potential as an energy source increases. Additionally, because hydrogen fuel is highly combustible, it has the potential to displace fossil fuels as a source of carbon-free or low-carbon energy, which is anticipated to support the growth of the green hydrogen industry during the forecast period. The novel coronavirus pandemic had negative consequences in a variety of green hydrogen end-use industries. The production halt owing to enforced lockdown in various regions resulted in decreased supply, demand and consumption of green hydrogen, which had a direct impact on the Green Hydrogen market size in the year 2020.

Request sample

Green Hydrogen Market Report Coverage

The “Green Hydrogen Market Report — Forecast (2022–2027)” by IndustryARC, covers an in-depth analysis of the following segments in the Green Hydrogen industry.

By Technology: Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, Solid Oxide Electrolyzer

By Renewable Source: Wind Energy and Solar Energy

By Application: Energy Storage, Fuels, Fertilizers, Off-grid Power, Heating and Others

By End-Use Industry: Transportation [Automotive (Passenger Vehicles, Light Commercial Vehicles and Heavy Commercial Vehicles), Aerospace, Marine and Locomotive], Power Generation, Steel Industry, Food & Beverages, Chemical & Petrochemical (Ammonia, Methanol, Oil Refining and Others) and Others

By Country: North America (USA, Canada and Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Belgium and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia and New Zealand, Indonesia, Taiwan, Malaysia and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile and Rest of South America), Rest of the World (Middle East and Africa)

Key Takeaways

Europe dominates the Green Hydrogen market, owing to the growing base of green hydrogen manufacturing plants in the region. Europe has been taking steps to generate clean energy from green hydrogen to reduce carbon emission, which is the major factor for expanding European green hydrogen manufacturing plants.

The market is expanding due to the rise in environmental concerns, which also emphasizes the need for clean/renewable energy production to lower emission levels. Additionally, the industry for green hydrogen is expanding owing to the increased use of nuclear power and green hydrogen.

However, the primary factors limiting the growth of the green hydrogen market are the initial investment requirements for installing hydrogen infrastructure as well as prohibitive maintenance costs.

Green Hydrogen Market Segment Analysis — By Technology

The alkaline electrolyzer segment held the largest share in the Green Hydrogen market share in 2021 and is forecasted to grow at a CAGR of 13.8% during the forecast period 2022–2027, owing to its higher operating time capacity and low capital cost. Alkaline electrolyzers work by generating hydrogen on the cathode side and transporting hydroxide ions (OH-) through the electrolyte from the cathode to the anode. The alkaline electrolyzer primarily benefits from three factors. As it produces hydrogen with relatively high purity and emits no pollutants during the production process, it is firstly a green and environmentally friendly device. Second, flexibility in production. The production of hydrogen by alkaline water electrolysis has greater advantages in large-scale applications with solar power and wind power converted into hydrogen energy storage. It is available for large-scale distributed generation applications, in particular in the current large-scale productions with alkaline electrolytic water. Thirdly, alkaline electrolyzer electrodes, cells and membranes are comparatively inexpensive with high efficiency and long-term stability. These characteristics and precious metal-free electrodes enable the green hydrogen production by alkaline water electrolysis a promising technology for green hydrogen production, thereby significantly contributing to segment growth.

Green Hydrogen Market Segment Analysis — By End-Use Industry

The chemical & petrochemical segment held a significant share in the Green Hydrogen market share in 2021 and is forecasted to grow at a CAGR of 14.5% during the forecast period 2022–2027. Green hydrogen is often used in the chemical & petrochemical industry to manufacture ammonia, methanol, petroleum products, including gasoline and diesel and more. Integrated refinery and petrochemical operations use huge volumes of green hydrogen to desulfurize the fuels they produce. Using green hydrogen to produce ammonia, methanol, gasoline and diesel, could help countries gain self-sufficiency in a vital chemical manufacturing sector, hence, companies are increasingly using green hydrogen in the industry. The chemical & petrochemical industry is projected to grow in various countries, for instance, according to Invest India, the market size of the Chemicals & Petrochemicals sector in India is around US$178 billion and is expected to grow to US$300 billion by 2025. This is directly supporting the Green Hydrogen market size in the chemical & petrochemical industry.

Green Hydrogen Market Segment Analysis — By Geography

Europe held the largest share in the Green Hydrogen market share in 2021 and is forecasted to grow at a CAGR of 14.3% during the forecast period 2022–2027, owing to the bolstering growth of the chemical & petrochemical sector in Europe. The European chemical & petrochemical industry is growing, for instance, according to the European Chemical Industry Council (Cefic), The 10.7 percent increase in manufacturing output in the EU27 during the first three quarters of 2021 is indicated by the January-Sep 2021 data as a sign that chemical output is returning to the pre-COVID19 pandemic levels. After the COVID-19 outbreak, the EU27’s chemical output increased by 7.0 percent between the first three quarters of 2021 and the same period in 2020. About 3% more chemicals were produced in 2021 than there were before the pandemic (Jan-Sep-2019). In 2022, it is anticipated that EU27 chemical output will increase by +2.5 percent. Over the forecast period, the growth of the green hydrogen industry in Europe is being directly supported by the rising production of chemicals and petrochemicals. Numerous green hydrogen projects are also expected to start in Europe. For instance, a 500MW green hydrogen facility, one of Europe’s largest single-site renewable H2 projects, is planned for construction at the Portuguese port of Sines by 2025. Germany invested $1 billion in a funding plan to support green hydrogen in December 2021 as the new government aims to increase investment in climate protection. such green hydrogen projects in the area are projected to further support the European green hydrogen market size over the coming years.

BUY Now

Green Hydrogen Market Drivers

Increasing Investments in Establishing Green Hydrogen Plants:

Governments from several industrialized nations are stepping up efforts to build green hydrogen infrastructure. Infrastructure growth will enable producers to increase their capacity and reach, which will help them lower the cost of green hydrogen. For the development of an ecosystem that accepts green hydrogen as an alternative fuel, the participation of the governments of the respective countries is extremely important. Oil India Limited (OIL), a major player in exploration and production, officially opened “India’s first 99.999 percent pure” green hydrogen plant in Assam in April 2022. The installed capacity of the solar-powered pump station is 10 kg of hydrogen per day. The UK Government first announced plans to create a hydrogen village by 2025 and a hydrogen neighborhood by 2023 in November 2020 as part of the Ten-Point Plan for a Green Industrial Revolution. The UK government announced in April 2022 that it would establish a hydrogen village by the year 2025, the same day that First Hydrogen unveiled its selection of four English locations for green hydrogen production projects. Berlin’s H2Global initiative, which provides a path to market for sizable renewable hydrogen facilities worldwide, is approved by the European Commission in December 2021. The European Commission has approved a €900 million (US$1 billion) plan to subsidize the production of green hydrogen in non-EU nations for import into Germany under EU state aid regulations. The development of such infrastructure is facilitating the manufacturers to expand their reach and capacity, which will assist them in expanding the manufacturing base, thereby driving the market expansion.

Bolstering Demand for Green Hydrogen from Transportation Sector:

The world is getting ready to change the way it moves as it moves toward net zero-emission goals. Vehicles that use hydrogen directly in fuel cells or internal combustion engines are being developed by the transportation sector. Vehicles powered by hydrogen have already been created and are being used in a few sectors in Europe, Asia and North America. A prime example is the Toyota Mirai, a green hydrogen-based advanced fuel cell electric vehicle (FCEV) that was introduced by Indian Union Minister Nitin Gadkari in March 2022. This project is a first of its kind in India and aims to develop a market for such vehicles. It is one of the best zero-emission options and is powered by hydrogen. In August 2021, Small forklifts powered by hydrogen fuel cells will be developed, according to a plan unveiled by Hyundai Construction Equipment Co. By 2023, the Hyundai Genuine Co. subsidiary and S-Fuelcell Co., a local manufacturer of hydrogen fuel cells, plan to commercialize the 1–3 tonne forklifts. The U.K.-based startup Tevva debuted a hydrogen-electric heavy goods vehicle in July 2022, becoming the most recent business to enter a market where multinational corporations like Daimler Truck and Volvo are showing interest. The hydrogen tanks will need to be refilled in 10 minutes and it will take five to six hours to fully charge the battery. The first hydrogen-electric truck produced by the company weighs 7.5 tonnes, with later versions expected to weigh 12 and 19 tonnes. The countries are planning to more than double the number of such hydrogen-based vehicles in the future, which is anticipated to be a driver for the green hydrogen market during the forecast period.

Green Hydrogen Market Challenges

High Initial Cost of Green Hydrogen:

The initial costs associated with producing green hydrogen are very high and the inability to transport and store it adds to the material’s cost. Hydrogen energy storage is a pricey process when compared to other fossil fuels. In processes like liquefaction, liquid hydrogen is used as an energy carrier because it has a higher density than gaseous hydrogen. The mechanical plant used in this mode of operation has a very intricate working and functioning system. Thus, this raises overall expenses. While transporting green hydrogen presents additional economic and safety challenges, the fixed cost necessary to set up the production plant is only half the challenge. According to the Columbia Climate School, the issue is that green hydrogen is currently three times more expensive in the United States than natural gas. Additionally, the cost of electrolysis makes producing green hydrogen much more expensive than producing grey or blue hydrogen, even though the cost of electrolyzers is decreasing as production increases. Gray hydrogen currently costs about €1.50 ($1.84) per kilogram, blue hydrogen costs between €2 and €3 and green hydrogen costs between €3.50 and €6 per kilogram. As a result, the high initial cost of green hydrogen is expected to be one of the major factors limiting the Green Hydrogen market growth.

0 notes

Text

The Advantages of Cutting Your Carbon Footprint: Today Is the First Step Toward a Greener Tomorrow