#Mobile Aerospace Reconnaissance System

Explore tagged Tumblr posts

Text

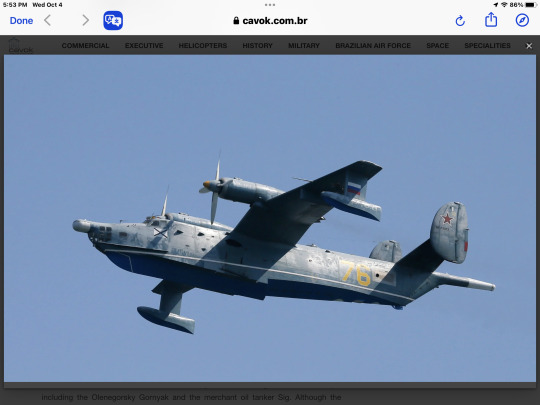

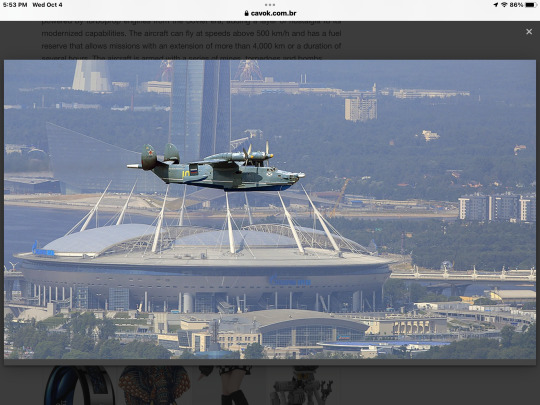

Russia reactivates Beriev Be-12 seaplanes from the Cold War era to detect Ukrainian naval drones

Fernando Valduga By Fernando Valduga 03/10/2023 - 23:10in Military, War Zones

In a twist that could come directly from a spy novel, Russia is deepening its Cold War manual to combat the cutting-edge technology of Ukraine's maritime drones.

Believe it or not, the Russian Navy is using its 1960s amphibious Beriev Be-12 plane to face the modern dilemma of Ukrainian naval drones. These drones have become a stone in the shoe of the Russian Black Sea Fleet, and Moscow bets that its updated but aged Beriev Be-12 may rise to the challenge.

According to Business Insider India, in the last two months, Ukraine has intensified its operations against the Russian Black Sea Fleet, despite not having a traditional navy. The Ukrainian military has unleashed cruise missile attacks against vital shipyards and fleet headquarters, while mobilizing unmanned surface ships, or naval drones, against Russian naval means. These economic drones, loaded with explosives, have emerged as a significant challenge for Russia.

Ukraine is ambitiously developing what it describes as "the world's first naval fleet of drones". These maritime drones have already inflicted damage on Russian ships, including the Olenegorsky Gornyak and the merchant oil tanker Sig. Although the Russian Ministry of Defense has contested these allegations, it continues to seek effective countermeasures against these maritime threats.

The Beriev Be-12 Chayka ("Seagull", NATO report name: Mail), which made its maiden flight in 1960, is not an ordinary aircraft. Designed with a V-shaped arched wing for takeoffs in the water and a lower fuselage similar to a ship for landings in the water, even in stormy conditions, the Be-12 is a relic with remarkable capabilities. It is powered by turboprop engines from the Soviet era, adding a layer of nostalgia to its modernized capabilities. The aircraft can fly at speeds above 500 km/h and has a fuel reserve that allows missions with an extension of more than 4,000 km or a duration of several hours. The aircraft is armed with a series of mines, torpedoes and bombs.

In 2018, the Russian Navy decided to give new life to these old aircraft. The modernization equipped the Be-12 with a completely new aiming system and modern weaponry. Despite being the oldest aircraft still in operation in the Russian armed forces, the updated Be-12 are expected to radically improve Russia's reconnaissance capabilities against enemy submarines through hydroacoustic, radar and magnetic detection systems. The aircraft will also be armed with modern anti-submarine torpedoes and depth bombs.

The Beriev Be-12 are currently stationed at Kacha Air Base in Crimea. The Russian high command seems to believe that these modernized aircraft could be a game changer in the fight against the Ukrainian naval threat in the Black Sea.

Tags: Military AviationBerievRussiaWar Zones - Russia/Ukraine

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Daytona Airshow and FIDAE. He has work published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work throughout the world of aviation.

Related news

MILITARY

The F-35 fighter, the most expensive weapons program in the world, has just become more expensive

04/10/2023 - 08:11

MILITARY

Meet the cockpit of the Saab F-39 Gripen, the most advanced fighter in Brazil

03/10/2023 - 19:14

MILITARY

RAF typhoons are sent to Poland for joint exercises before the Warsaw Security Forum

03/10/2023 - 16:00

COMMERCIAL

Leasing company reaches agreement with Russian airline Aeroflot

03/10/2023 - 15:00

A Swedish Gripen fighter taking off. GKN Aerospace was hired to upgrade the Gripen's RM12 engine, a modified General Electric F404, with improved software designed to improve performance and reduce life cycle costs. (Photo: GKN)

MILITARY

GKN Aerospace receives request to upgrade the RM12 engine for the JAS39 Gripen

03/10/2023 - 14:00

MILITARY

Turkey presents ANKA drone in meeting with Argentine military

03/10/2023 - 12:00

Client PortalClient PortalClient PortalClient PortalClient PortalClient PortalClient PortalClient PortalhomeMain PageEditorialsINFORMATIONeventsCooperateSpecialitiesadvertiseabout

Cavok Brazil - Digital Tchê Web Creation

Commercial

Executive

Helicopters

HISTORY

Military

Brazilian Air Force

Space

Specialities

Cavok Brazil - Digital Tchê Web Creation

13 notes

·

View notes

Text

Aerospace and Department of Defense (DoD) Engineering | Finance Facts

Aerospace and Department of Defense (DoD) engineering are critical sectors of national security and technological advancement. They involve complex systems, cutting-edge technology, and substantial financial investments. As these industries evolve, so do the financial mechanisms supporting them, especially in commercial financing. This discussion explores the intersection of aerospace and DoD engineering with commercial financing, covering various aspects, including funding mechanisms, financial challenges, opportunities, and the influence of government policies and global trends.

1. The Aerospace and Defense Industry Overview

1.1 Aerospace Engineering

Aerospace engineering involves designing, developing, testing, and producing aircraft, spacecraft, satellites, and related systems and equipment. This highly specialized field requires aerodynamics, materials science, propulsion, avionics, and software engineering expertise. The aerospace sector is divided into two main segments: civil (commercial) aviation and military (defence) aviation.

Civil Aviation: Involves the development of commercial airplanes, private jets, and urban air mobility vehicles. Companies like Boeing and Airbus dominate this sector, focusing on passenger aircraft, cargo planes, and increasingly unmanned aerial vehicles (UAVs) and electric aircraft.

Military Aviation focuses on developing fighter jets, bombers, reconnaissance aircraft, and drones for defence. Significant players include Lockheed Martin, Northrop Grumman, and Raytheon, which are heavily involved in aerospace and defence.

1.2 Department of Defense (DoD) Engineering

DoD engineering encompasses developing and maintaining military technologies and systems. This includes everything from weapons systems and combat vehicles to communication networks and cybersecurity infrastructure. Engineering efforts in this sector are geared towards ensuring national security and maintaining military superiority.

Weapons and Combat Systems: This includes the development of advanced missiles, naval ships, and ground combat vehicles. Engineering efforts focus on enhancing capabilities, increasing accuracy, and integrating advanced technologies like artificial intelligence (AI) and machine learning (ML).

Cybersecurity and Communication: This engineering area ensures that military communications are secure and resilient against cyber threats. As digital warfare evolves, it is becoming increasingly important.

Space and Satellite Systems: This includes engineering satellites for communication, reconnaissance, and navigation. The DoD collaborates with NASA and private companies like SpaceX on space missions and satellite launches.

2. Commercial Financing in Aerospace and DoD Engineering

2.1 The Role of Commercial Financing

Commercial financing in aerospace and DoD engineering involves private sector entities providing funds to support developing, producing, and procuring aerospace and defence technologies. These funds can come from various sources, including banks, private equity firms, venture capital, and bond markets. Financing is critical for sustaining innovation, scaling production, and ensuring that companies can meet the demands of both the civilian and military markets.

2.2 Key Financing Mechanisms

Several financing mechanisms are prevalent in the aerospace and DoD sectors, each with its unique characteristics and implications:

Debt Financing involves borrowing funds that must be repaid with interest. This can include loans from banks, the issuance of corporate bonds, or credit facilities. Debt financing is typical in large aerospace companies, which use it to fund capital-intensive projects like developing new aircraft models or constructing manufacturing facilities.

Equity Financing involves raising capital by selling company shares. It is common in startups and smaller firms in the aerospace sector, particularly those focused on innovative technologies like UAVs or space exploration. Equity financing can come from venture capital, private equity, or public markets through an Initial Public Offering (IPO).

Government Contracts and Grants: The DoD provides significant funding to private companies engaged in defense-related R&D and production through contracts and grants. These contracts are often long-term and can include cost-plus arrangements, where the government reimburses all costs and adds a profit margin.

Export Credit Agencies (ECAs): ECAs, like the Export-Import Bank of the United States (Ex-Im Bank), provide financing and insurance to help aerospace companies sell their products overseas. This is particularly important for commercial aircraft manufacturers who rely on international sales.

Public-private partnerships (PPPs) Involve collaboration between the government and private companies to finance large projects, such as developing new military technologies or constructing defence infrastructure.

3. Financial Challenges in Aerospace and DoD Engineering

3.1 High Capital Requirements

The aerospace and defence sectors are capital-intensive, requiring substantial upfront investments in R&D, testing, and production. Developing a new aircraft or weapon system can take years and billions of dollars before any return on investment is realized, creating a significant financial burden, especially for smaller companies or startups.

3.2 Long Development Cycles

The development cycles for aerospace and defence projects are often long, sometimes spanning decades. Companies must manage cash flow over extended periods while awaiting revenue from completed contracts or product sales. Long development cycles also expose companies to the risk of technological obsolescence or changes in market demand.

3.3 Regulatory and Compliance Costs

The aerospace and defence industries are heavily regulated, with strict compliance requirements related to safety, security, and export controls. Meeting these regulations can be costly and time-consuming, particularly for smaller companies with limited resources. Compliance costs can also impact profitability and create barriers to entry for new players.

3.4 Geopolitical Risks

Aerospace and defence companies operate in a highly geopolitical environment. Changes in government policies, international relations, or defence spending priorities can significantly impact the industry. For example, defence budgets may be cut due to shifting priorities, or international sanctions could restrict the sale of aerospace products to certain countries.

3.5 Technological Risks

The rapid pace of technological advancement in aerospace and defence poses opportunities and risks. Companies must continually invest in R&D to stay ahead of competitors and meet the evolving needs of the military and commercial markets. However, the high cost of R&D and the uncertainty of technological success can pose significant financial risks.

4. Opportunities in Aerospace and DoD Engineering Financing

4.1 Emerging Technologies

Emerging technologies like AI, ML, quantum computing, and hypersonic flight offer significant opportunities for growth in the aerospace and defence sectors. Companies that successfully develop and commercialize these technologies can attract substantial investment from venture capital and private equity firms. For example, startups working on AI-driven drones or hypersonic missiles will likely attract funding due to their potential to revolutionize warfare and commercial aviation.

4.2 Space Exploration and Commercialization

The commercialization of space is a rapidly growing sector, with private companies like SpaceX, Blue Origin, and Rocket Lab leading the way. The demand for satellite launches, space tourism, and exploration missions is driving significant investment in space-related technologies. This trend presents opportunities for aerospace companies to secure financing for space projects through equity investment, joint ventures, or government contracts.

4.3 Increased Defense Spending

Global defence spending has risen, driven by geopolitical tensions and the need to modernize military forces. This increase in defence budgets creates opportunities for aerospace and defence companies to secure contracts for new projects. Companies offering innovative solutions, such as advanced cybersecurity systems or next-generation aircraft, will likely benefit from increased government spending.

4.4 Public-Private Partnerships

Public-private partnerships (PPPs) are becoming increasingly common in the aerospace and defence sectors, particularly for large-scale projects like infrastructure development or the production of military equipment. PPPs allow companies to leverage government funding and resources while sharing the financial risk. These partnerships can also facilitate the transfer of technology and expertise between the public and private sectors.

4.5 Sustainable Aviation

The push for sustainability is driving innovation in the aerospace sector, with a focus on developing cleaner and more efficient aircraft. Companies that invest in sustainable aviation technologies, such as electric or hybrid-electric propulsion systems, are likely to attract funding from both public and private sources. Governments and international organizations are also offering incentives and grants for companies working on green aviation solutions.

5. Government Policies and Regulations

5.1 Impact of Defense Budget Policies

Government defence budgets are critical to the financial health of the aerospace and defence sectors. Changes in budget allocations, such as increases in funding for certain projects or cuts to specific programs, can significantly impact companies' financial planning and operations. For example, shifting focus from traditional military hardware to cybersecurity or space defence could redirect investment and resources within the industry.

5.2 Export Controls and International Trade

Export controls and international trade policies are crucial in the aerospace and defence industries. Regulations like the International Traffic in Arms Regulations (ITAR) in the U.S. govern the export of defence-related technologies and products. Compliance with these regulations is essential for companies seeking to enter international markets. Still, it can also create challenges, particularly for smaller firms with limited resources.

5.3 Government Support Programs

Governments often provide financial support to the aerospace and defence industries through various programs, such as grants, tax incentives, and loan guarantees. These programs are designed to promote innovation, support R&D efforts, and ensure the competitiveness of domestic industries on the global stage. For example, the U.S. government has historically provided significant funding for aerospace research through agencies like NASA and the Department of Defense.

5.4 International Cooperation and Alliances

International cooperation and alliances, such as NATO, significantly shape the aerospace and defence industries. Joint development programs like the F-35 fighter jet program involve collaboration between multiple countries and companies, sharing the financial burden and risks associated with large-scale defence projects. These alliances also facilitate the transfer of technology and expertise across borders.

6. Global Trends and Their Impact on Financing

6.1 The Rise of Commercial Space Ventures

The commercialization of space is one of the most significant trends impacting the aerospace sector. Companies like SpaceX and Blue Origin have demonstrated the viability of private space exploration, attracting substantial investment from venture capital and private equity firms. The growing interest in space tourism, satellite deployment, and asteroid mining presents new opportunities for financing space-related projects.

6.2 Digital Transformation

The aerospace and defence industries are transforming digitally by adopting technologies like AI, ML, big data, and the Internet of Things (IoT). These technologies are integrated into everything from aircraft design to battlefield management systems, driving demand for new skills and capabilities. Companies that invest in digital transformation are likely to attract financing from investors looking to capitalize on the shift towards a more connected and data-driven industry.

6.3 Sustainability and Green Technologies

Sustainability is becoming increasingly important in the aerospace industry, driven by regulatory requirements and growing consumer demand for environmentally friendly products. The development of sustainable aviation technologies, such as electric and hybrid-electric aircraft, is attracting significant investment. Companies that demonstrate a commitment to sustainability will likely benefit from increased access to financing and potential government incentives.

6.4 Geopolitical Shifts

Geopolitical shifts, such as China's rise as a global superpower, the ongoing tensions between the U.S. and Russia, and tertiary Middle Eastern concerns, impact the aerospace and defence industries. These shifts influence defence spending priorities, international alliances, and trade policies, which have financial implications for companies operating in these sectors. For example, increased defence spending in response to perceived threats can lead to more contracts and financing opportunities for defence contractors.

F-22 short dirt field landing.

7. Case Studies

7.1 SpaceX and Private Financing

SpaceX is a prime example of a company successfully leveraging private financing to disrupt the aerospace industry. Founded by Elon Musk in 2002, SpaceX has raised billions of dollars in funding from venture capital, private equity, and government contracts. The company's success in developing reusable rockets and reducing the cost of space travel has attracted significant investment, making it one of the most valuable private companies in the world. SpaceX's financing strategy includes equity funding, debt financing, and revenue from government contracts, allowing it to continue investing in ambitious projects like the Starship rocket and Mars colonization.

7.2 Lockheed Martin and Defense Contracting

Lockheed Martin is a leading defence contractor that has secured billions of dollars in government contracts for projects like the F-35 fighter jet and missile defence systems. The company's financial strategy strongly focuses on ensuring long-term agreements with the U.S. government and its allies, providing a stable revenue stream and reducing financial risk. Lockheed Martin invests heavily in R&D to maintain its competitive edge in the defence industry. The company's ability to secure financing through government contracts, combined with its focus on innovation, has enabled it to remain a dominant player in the aerospace and defence sectors.

7.3 Boeing and the 737 MAX Crisis

Boeing's experience with the 737 MAX crisis highlights aerospace companies' financial challenges. The grounding of the 737 MAX following two fatal crashes led to significant economic losses for Boeing, including lost revenue, compensation payments, and legal costs. The crisis also affected Boeing's ability to secure financing, as its credit rating was downgraded, and investors became more cautious. Boeing responded by securing a $13 billion loan from a group of banks to help it weather the crisis and continue its operations. This case underscores the importance of risk management and the potential financial impact of safety and regulatory issues in the aerospace industry.

Conclusion

The intersection of aerospace and Department of Defense engineering with commercial financing is a complex and dynamic area crucial to advancing technology and national security. The aerospace and defence industries require substantial financial investments supported by various mechanisms, including debt and equity financing, government contracts, and public-private partnerships. While these industries face significant economic challenges, such as high capital requirements, long development cycles, and regulatory costs, they also present numerous opportunities for growth and innovation.

Emerging technologies, the commercialization of space, increased defence spending, and the push for sustainability are driving new investment opportunities in these sectors. However, companies must navigate a rapidly changing landscape influenced by geopolitical shifts, digital transformation, and evolving government policies. Those who can successfully manage these challenges and capitalize on new opportunities will be well-positioned to secure the financing needed to drive future growth and innovation in aerospace and defence engineering.

Using a commercial financing broker for Aerospace and Department of Defense (DoD) engineering contracts can be highly advantageous for companies navigating these complex, capital-intensive industries. A skilled broker can connect businesses with specialized lenders who understand the unique risks and opportunities in aerospace and defence, including long development cycles, regulatory compliance, and government contract intricacies. Brokers can secure tailored financing solutions, such as debt facilities, equity investments, or structured finance, that align with the specific needs of aerospace projects or defence contracts.

We also offer valuable insights into market trends, helping companies optimize their financial strategies and leverage opportunities like public-private partnerships or export credit agencies. By engaging a commercial financing broker, aerospace and defence companies can access the necessary capital to drive innovation, meet contract obligations, and maintain a competitive advantage in these highly specialized sectors.

Commercial Financing Now ® is a Money Service Business (MSB) operating as a Non-Bank Financial Institution (NBFI) that abides by Anti-Money Laundering (AML) Regulations. These policies and procedures are internally published and meet reporting requirements while considering sanctions screening and transactional monitoring.

Commercial Finance Now does not provide tax, legal, or accounting advice. This post has been drafted for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your tax, legal, and accounting advisors before considering any tax treatments.

0 notes

Text

CBRNE Integrated Vehicle Market - Forecast(2024 - 2030)

CBRNE Integrated Vehicle Market Overview:

CBRNE Integrated Vehicle Market size is estimated to reach $7.3 billion by 2030, growing at a CAGR of 5.3% during the forecast period 2023-2030. The market for CBRNE Integrated Vehicle is primarily driven by the growing investments in the defense industry and rising need for public safety, there is an increasing demand for integrated vehicles in several areas such as military, homeland security and border control, industrial facilities, nuclear power plants and so on. According to USAspending.gov report, The Department of Homeland Security (DHS) has $178.88 billion split among its 17 sub-components in fiscal year 2023.

Market Snapshot: CBRNE Integrated Vehicle Market - Report Coverage:

The “CBRNE Integrated Vehicle Market Report - Forecast (2023-2030)” by IndustryARC, covers an in-depth analysis of the following segments in the CBRNE Integrated Vehicle Market.

Attribute

Segment

By System

Reconnaissance Vehicles

Unmanned Vehicles (Ground, Aerial, Underwater/Naval)

Mobile Labs

By End User

Military and Defense (Army, Airforce, Navy/Coast Guard, Special Forces)

Others (Law Enforcement and Public Safety, Emergency Response and Homeland Security, Research and Scientific Institutions, Healthcare, Industrial, Others)

By Geography

North America (U.S., Canada and Mexico)

Europe (Germany, France, UK, Italy, Netherlands, Belgium, Poland Spain, and Rest of Europe),

Asia-Pacific (China, Japan, South Korea, India, Australia, Russia and Rest of Asia-Pacific),

South America (Brazil, Argentina, and Rest of South America)

Rest of the World (Middle East and Africa).

COVID-19/ Ukraine Crisis - Impact Analysis:

∙ The pandemic caused major disruptions in worldwide supply chains, disrupting defense equipment manufacturing and delivery, including CBRNE integrated vehicles. Manufacturing and delivery delays are caused by lockdowns, mobility restrictions, and workforce limits. Governments throughout the world experienced enormous economic issues as a result of the epidemic, prompting budget cuts in a variety of areas, including defense funding. Defense budget cuts have had an influence on the acquisition of CBRNE integrated vehicles.

∙ The Russia-Ukraine war has broader consequences on the global economy, including energy prices, supply chains, and trade flows. These macroeconomic factors have indirectly impacted overall demand for CBRNE integrated vehicles. Additionally, at a regional level the demand for CBRNE integrated vehicles witnessed increase due to the rising tensions of the conflict and concerns over use of chemical & nuclear agents in the war.

Key Takeaways:

∙ Fastest Growth of Asia Pacific Region

Asia Pacific region is analyzed to grow with the highest CAGR 6.3% in the global CBRNE Integrated Vehicle Market during the forecast period 2023-2030. Rising investments in Army and Defense has led to a growing demand for CBRNE Integrated Vehicle in the region. For Instance, in 2022, South Korea's Defense Acquisition Programme Administration (DAPA) has signed a contract with Korea Aerospace Industries (KAI) to develop an airborne mine countermeasures (AMCM) system for the Republic of Korea Navy (RoKN) worth $70 million. According to KAI, its Marineon amphibious mobile helicopter, which is being developed for the Republic of Korea Marine Corps (RoKMC), will be modified for the role. These systems will include laser mine Integrated Vehicle, an underwater autonomous mine search vehicle, and an unmanned mine neutralization system.

∙ Reconnaissance Vehicles are Leading the Market

Reconnaissance Vehicles with new systems accounted for the largest share, attributing a value of $2.5 Billion in 2022. Reconnaissance vehicles, also known as recce vehicles or scout vehicles, are specialized military vehicles designed for the purpose of gathering information about the enemy, terrain, and other relevant aspects of the battlefield. The electrification of reconnaissance vehicles in the military is a growing trend aimed at enhancing their stealth, agility, and sustainability. Electric propulsion systems, including hybrid and fully electric options, reduce noise levels, making these vehicles more discreet during covert operations. Moreover, electric reconnaissance vehicles contribute to lower fuel consumption and reduced emissions, aligning with environmental and logistical considerations in modern military strategies. This transition represents a significant advancement in military technology, enabling more efficient and eco-friendly reconnaissance missions. In March 2023, the US Army approved the requirements to begin prototyping its new Electric Light Reconnaissance Vehicle (eLRV).

∙ Unmanned Vehicles to Register Highest Growth

Unmanned Vehicles segment is analyzed to grow with the highest CAGR 7.5% during the forecast period 2023-2030. This is owing to several nations are investing in CBRNE integrated vehicle contracts for homeland security, In February 2023, FIR teledyne defense, a division of teledyne technologies incorporated, announced that the U.S. department of defense has awarded it a $13.3 million contract to enhance the CBRN (chemical, biological, radiological, and nuclear) reconnaissance capabilities of its R80D SkyRaider unmanned aerial system.

∙ The Continuous Rise in Military Expenditures and Spending Across the Globe Is Driving the Market.

According to Stockholm International Peace Research Institute report, In 2022, global military spending increased by 3.7% in real terms to a record $2,240 billion. Over the decade 2013-22, global spending increased by 19% and has risen every year since 2015. Military expenditure by states in Central and Western Europe totaled $345 billion in 2022. Russia's invasion of Ukraine was a major driver of spending growth in 2022. Military spending in Europe increased by 13% last year, the largest annual increase in total European spending since the Cold War. Significant increases in Russian and Ukrainian spending accounted for much of the exceptional growth, but many other European countries increased their military budgets in 2022.

∙ High Costs Associated with CBRNE Detection Services & Products as a Major Challenge

Developing advanced CBRNE Integrated Vehicles requires significant investments in research and development. Creating reliable and sensitive vehicle to detect a wide range of chemical, biological, radiological, nuclear, and explosive agents necessitates extensive research, testing, and innovation. Operating CBRNE integrated vehicles need specialized training for the personnels, and the operators involved. This training is necessary to guarantee that the vehicle's capabilities are used effectively and safely. Training expenditures and the requirement to keep a highly skilled workforce contribute to total costs. CBRNE integrated vehicles contain sophisticated systems that require frequent maintenance, calibration, and upkeep to maintain their dependability and accuracy.

CBRNE Integrated Vehicle Market Share (%) By Region, 2022

Key Market Players:

Product launches, approvals, patents and events, acquisitions, partnerships and collaborations are key strategies adopted by players in the CBRNE Integrated Vehicle Market. The top 10 companies in this industry are listed below:

Iveco group (IDV)

Rheinmetall AG (Survivor R 4x4)

General Dynamics (Tracked Robot 10-Ton (TRX))

SAAB (CBRN Reconnaissance Vehicle Kit (CRVK))

Indra Sistemas (AREVE)

FLIR Systems, Inc. (MUVE™ R430)

Milrem Robotics (The THeMIS UGV)

FNSS (The SHADOW RIDER)

Thales (Schiebel S-100)

Smith Detection (The Precision Biological Detection System (PBDS))

#CBRNE Integrated Vehicle Market#CBRNE Integrated Vehicle Market share#CBRNE Integrated Vehicle Market size

0 notes

Text

Military Ground Vehicle Propulsion System | Key Market Insights

As per Triton Market Research, the Global Military Ground Vehicle Propulsion System Market report is segmented by Vehicle Type (Fighting Vehicles, Combat Tanks, Self-Propelled Artillery, Small UGV Robots), Technology (Conventional Propulsion System, Electric Propulsion System, Hybrid Propulsion System, Plug-In Hybrid Electric Propulsion System), Application (Mining, Explosive Ordnance Disposal (EOD), Intelligence, Surveillance, and Reconnaissance (ISR), Logistics and Support, Combat Support, Other Applications), and Regional Outlook (Asia-Pacific, Europe, North America, Middle East and Africa, Latin America).

The report highlights the Market Summary, Industry Outlook, Porter’s Five Forces Analysis, Market Attractiveness Index, Regulatory Framework, Key Market Strategies, Market Drivers, Challenges, Opportunities, Competitive Landscape, Research Methodology and scope, Global Market Size, Forecasts & Analysis (2024-2032).

According to Triton’s research report, the global market for military ground vehicle propulsion system is expected to progress with a CAGR of 5.25% in revenue over the forecasting period 2024-2032.

Military ground vehicle propulsion systems are important components that generate the required power to propel tactical and armored military vehicles. These systems impact the agility, mobility, and overall performance of military ground vehicles in harsh operational surroundings.

Amidst rising geopolitical tensions, an increasing need for modern warfare techniques and technological advancements in electric and hybrid propulsion systems drive the growth of the studied market. Moreover, improving fuel efficiency to reduce the environmental impact and integrating AI to enhance the autonomous operations of military ground vehicles together influence the market progress.

However, the acquisition and development costs regarding advanced propulsion technologies obstruct the market growth. The biggest obstacle for manufacturers is the need for standardization across versatile military platforms, stringent regulations, and export limitations on defense technologies also hampers the expansion of the military ground vehicle propulsion system market.

In spite of these challenges, there is an increasing demand for electric and hybrid propulsion systems, which creates opportunities for the market players. As the military forces prioritize unmanned ground vehicles, there is a need to develop propulsion systems with highly advanced automation.

The major competitive companies in the studied market are Bae Systems, L3harris Technologies Inc, Cummins Inc, Caterpillar Inc, Oshkosh Corporation, Rheinmetall AG, Epsilor-Electric Fuel Ltd, General Dynamics, Northrop Grumman Corporation, Daimler AG, Israel Aerospace Industries Ltd, Lockheed Martin Corporation, General Motors Company, and Qinetiq Group.

Additionally, the need for developing strategic partnerships and improving defense forces provide new avenues for emerging market players to diversify their products. Similarly, tapping into regional markets can be another competitive edge for the stakeholders.

#MILITARY GROUND VEHICLE#PROPULSION SYSTEM#Aerospace & Defense#triton market research#market research reports

0 notes

Text

Delta II and SLC-2: A Remarkable Era

https://sciencespies.com/space/delta-ii-and-slc-2-a-remarkable-era/

Delta II and SLC-2: A Remarkable Era

The launch of NASA’s Ice, Cloud, and land Elevation Satellite-2 (ICESat-2) on September 15, 2018, from Space Launch Complex-2 (SLC-2) at Vandenberg Air Force Base, now a Space Force base, marked the end of a remarkable era for the venerable Delta II launch vehicle and SLC-2. This was the 155th launch overall for the Delta II, which made 153 successful flights for NASA, the National Reconnaissance Office, Missile Defense Agency, and the United States Air Force.

NASA used Delta II to fly missions to Mars, Mercury, comets, and asteroids and eventually assumed responsibility for SLC-2 to fly the Delta II’s last missions overlooking the Pacific Ocean, just northwest of the Vandenberg airfield.

SLC-2 began with the Thor intermediate-range ballistic missile, which was the predecessor of the Delta launch vehicle family. The complex, developed in 1958, was part of a group of seven launch installations at Vandenberg designed for the Thor.

The first Delta launch occurred on October 2, 1966, with the launch of the Environmental Science Services Administration’s ESSA-3 satellite. Later, when Delta launched the Cosmic Observatory Background Observer (COBE) satellite on November 18, 1989, it led to a six-year hiatus of launch activity to refurbish SLC-2, adding 12 feet to the Mobile Service Tower (MST). Launch activities at SLC-2 resumed on November 3, 1995, with the successful Delta II launch of the Canadian RADARSAT scientific Earth observation satellite. ICESat-2 was the final mission to use the MST and existing infrastructure.

Dematerialization began Aug 19, 2020, with the majority of it removed by Nov 3, and by Nov 20 the MST was completely gone. Photo credit: a.i. solutions/Rob Quigg

On August 17, 2020, a major shift in the Western Range landscape began with the removal of the MST and the Fixed Umbilical Tower (FUT). a.i. solutions partnered with NASA to ensure the safe removal of the 128-foot tall FUT and the 166-foot tall MST. The team recycled 646 tons of steel, 29 tons of aluminum, and 106 tons of concrete during the dematerialization project. a.i. solutions’ extensive experience with launch and ground systems proved invaluable during the effort. NASA Launch Services Program (LSP) specifically sited a.i. solutions “superior support of SLC-2 MST Hazardous Materials Assessment and Dematerialization preparation,” “efficient addition of the FUT dematerialization scope,” as well as accommodation of their request to “salvage two Delta II FUT umbilicals for future testing.” A time-lapse video of the project is available here.

Sign and plaque commemorating SLC-2. Photo credit: a.i. solutions/Rob Quigg

As the team removed the FUT & MST, brand new infrastructure was built and installed by Firefly Aerospace to support the first of many launches using SLC-2 for their Alpha launch vehicle. By November of 2020, SLC-2 was ready to be turned over to Firefly for their use. The military and NASA legacy of SLC-2 will live on with future missions flown on Alpha.

a.i. solutions’ Director of Air & Space Force Programs, Rob Quigg, stated, “This project was a great team effort. Bedford Enterprises, our subcontractor, was superb, the Space Launch Delta 30 was extremely helpful, and our NASA LSP customer provided outstanding guidance. It was an honor to ready SLC-2 for a new commercial launch provider.”

To pay tribute to the men and women who worked at SLC-2, a.i. solutions preserved the concrete NASA sign displayed in front of the NASA operations center at Vandenberg (Building 836) with a historical plaque.

a.i. solutions has 25 years of experience providing launch operations, systems engineering, communications & telemetry, and programmatic and launch vehicle-to-spacecraft integration services. They are currently the prime contractor for the NASA Expendable Launch Vehicle Integrated Support 3 (ELVIS 3) contract.

#Space

1 note

·

View note

Text

• USAF Civil Air Patrol

Civil Air Patrol (CAP) is the civilian auxiliary of the United States Air Force (USAF). It was created by Administrative Order 9 in December 1941, with Maj. Gen. John F. Curry as the first CAP national commander. The organization was originally formed to provide civilian air support to aid the war effort of World War II through border and coastal patrols, military training assistance, courier services and other activities.

The origins of Civil Air Patrol date to 1936, when Gill Robb Wilson, World War I aviator and New Jersey director of aeronautics, returned from Germany convinced of impending war. Wilson envisioned mobilizing America’s civilian aviators for national defense, an idea shared by others. In the later half of the 1930s, the Axis powers became a threat to the United States, its allies and its interests. As the Axis steadily took control of the greater part of Europe and South-East Asia, aviation-minded Americans noticed a trend: in all of the conquered countries and territories, civil aviation was more or less halted in order to reduce the risk of sabotage.

On May 20th, 1941, the Office of Civilian Defense was created, with former New York City mayor and World War I pilot Fiorello H. La Guardia as the director. With the approval of the Army Air Corps, Director La Guardia formalized the creation of Civil Air Patrol with Administrative Order 9, signed on December 1st, 1941 and published December 8th, 1941. With America's entrance into World War II, German U-boats began to operate along the East Coast. Their operations were very effective, sinking a total of 204 vessels by September 1942. Civil Air Patrol's top leaders requested that the War Department give them the authority to directly combat the U-boat threat. The request was initially opposed, however, with the alarming numbers of ships being sunk by the U-boats, the War Department finally agreed to give CAP a chance.

At its height, Civil Air Patrol operated 21 coastal bases in 13 states along the Eastern Seaboard and the Gulf of Mexico. The Coastal Patrol was originally meant to be unarmed and strictly reconnaissance. The air crews of the patrol aircraft were to keep in touch with their bases and notify the Army Air Forces and Navy in the area when a U-boat was sighted, and to remain in the area until relieved. Between July 1942 and April 1944, the Civil Air Patrol Southern Liaison Patrol was given the task of patrolling the border between Brownsville, Texas, and Douglas, Arizona. The Southern Liaison Patrol logged approximately 30,000 flight hours and patrolled roughly 1,000 miles (1,600 km) of the land separating the United States and Mexico.

CAP pilots were called on to provide a variety of missions that were not necessarily combat-related but still of direct benefit to the country. Some of the most notable of these missions were: flying blood bank mercy missions for the American Red Cross and other similar agencies; forest fire patrol and arson reporting; mock raids to test blackout practices and air raid warning systems; supporting war bond drives; and assisting in salvage collection drives. Civil Air Patrol's success with the cadet program, along with its impressive wartime record, led the War Department to create a permanent place for it in the department.

With the close of World War II, CAP suddenly found itself looking for a purpose. It had proved its worthiness and usefulness in wartime, but the ensuing peace had reduced CAP's scope of activities since the USAAF assumed a great many of the tasks that the CAP had performed. Civil Air Patrol had been subordinate to Air Education and Training Command to fulfill the Aerospace Education mission.

#american history#world war ii#world war 2#wwii#airforce history#long post#second world war#civilian history#aviation#civilian military

13 notes

·

View notes

Text

Aerospace And Defence Manufacturing Industry Trends To Watch

The global aerospace and Defence industry landscape is witnessing substantial disruptions driven by digital transformation, innovation, and geopolitical circumstances. Despite a slow but steady recovery from the pandemic's effects, both industries are still at risk because the world hasn't yet entirely recovered.

Modernization and globalization initiatives are gaining traction, forcing even the largest and most obstinate aerospace and Defence manufacturers to transform. Being one of the leading aerospace and Defence parts manufacturers in India, here are five noteworthy trends influencing the aerospace and Defence industry's future that we have observed so far. To learn more about the most important of them, keep reading.

Growing Digitalization

The aerospace and Defence industry has one of the lowest rates of innovation intensity as compared to other sectors. Many manufacturers have chosen to stick with "tried and true" production processes and technology since quality, safety, and regulatory compliance are essential factors. However, the scenarios are changing since technologies have become much more advanced and dependable.

The industry will witness a more significant push toward the adoption of digital innovation as new technologies like robotics/autonomous systems, artificial intelligence, sensor technologies, and additive manufacturing take center stage. As a result, companies are replacing and optimizing their methodologies and technologies from process to product designs while utilizing innovative solutions across all stages of manufacturing.

Smart Materials

Smart materials are the next step in aerospace and Defence innovation. With limitless possibilities like electronic sensors, self-healing fuselages, actuators, etc., the aerospace and Defence manufacturing industry will be the key driver of smart materials demand in the future.

The worldwide market for smart materials is anticipated to reach USD 98.2 billion by 2025. Using better materials to produce crucial elements like seals, gaskets, o rings, control links, mounts, etc., can enhance their life expectancy. Most importantly, these materials being immune to typical wear and tear conditions that usually damage electric motors will improve the durability of modern aircrafts.

Defence Technology Trends

New and improved technologies intend to impact the battlefields in sustainability, connectivity, autonomy, and lethality aspects. Technologies such as virtual and augmented reality offer immersive experiences during combat training and real-time decision-making. In addition, the IoT (internet of things) enables the connectivity of ships, airplanes, drones, and soldiers to their operating bases.

Artificial intelligence helps with computational reasoning for intelligence, surveillance, and reconnaissance missions. Machine learning and digital twin technology allow Defence parts manufacturers in India and worldwide to test military product iterations. Big data lets the military achieve strategic advantage over enemies through quick and effective data collection, analysis, and distribution while aiding in better strategic decision-making. Blockchain is being used to protect military data and prevent counter-cyber threats.

Additive Manufacturing

Additive manufacturing, more commonly known as 3D printing, allows manufacturers to create custom parts virtually anywhere with various designs while utilizing lesser resources and materials. Owing to its functionality and advantages, it is no wonder that Defence and aerospace components manufacturers in India and across the globe have welcomed this innovation. Organizations are trying to find ways to compress their design and manufacturing cycle with 3D printing technology. According to a ResearchGate Report, it holds the potential to transform the production processes completely, and we look forward to it.

Air Mobility

Advanced air mobility uses cutting-edge vehicles like freight drones and flying automobiles powered by electric vertical take-off and landing (eVTOL), which is anticipated to transform urban transportation. While you are reading this, some companies are already working on testing and plotting these innovation-loaded vehicles. For instance, NASA is already working on all-electric vehicle takeoff and landing aircraft that could serve as air taxis in upcoming times. As one of the leading aerospace components manufacturers in India, we are keen to know what the future holds for this innovative technology.

Risk-Free Decision-Making Through Data

As we move towards an undetermined future, minimizing risks will remain a major priority for aerospace and Defence manufacturers globally. The unpredictable and competitive modern markets will encourage manufacturers to optimize their manufacturing processes to cut down costs in any way possible. Therefore, any technology or innovation that can minimize unscheduled downtime and enhance efficiency will be critical for manufacturers. Manufacturing intelligence and decision-making on real-time analytics and data are now gaining traction and will continue to grow. Companies can gather data throughout their production processes and take preventive and corrective actions to optimize their workflow and costs.

Conclusion

Manufacturing in the aerospace and Defence industries is being pushed towards disruption and innovation, but the good news is that digital technology has developed and is prepared to adapt to the new environment. The continued recovery and execution of digital innovations will allow Defence parts manufacturers in India to do previously impossible things. Innovation and transformation will equip manufacturers to leverage the aforementioned trends and compete in the market. Contact Sujan Industries, one of India's leading Defence and aerospace components manufacturers, to pick the best parts for your industry needs. Or visit our website for more information about our products and services in the aerospace and Defence verticals.

0 notes

Text

Taiwan activates its defense systems while China flies with 34 aircraft and 9 ships near the island

Fernando Valduga By Fernando Valduga 02/01/2023 - 08:45 in Military, War Zones

Taiwan's Patriot and Skybow III air defense systems were put into action in the north of the country, while China flew a record 34 aircraft, including fighters and bombers, as well as 9 warships today, in the largest demonstration of strength in recent weeks.

In the past, China has threatened “reunification” by force and several Chinese experts predicted that this event could take place in 2023. However, the Chinese government calls these frequent incursions "exercises in various domains".

Taiwanese soldier in front of a Patriot air defense system.

Taiwan's anti-aircraft missiles were not deployed in a single location, but are mobile.

The Air Force Command said that the movement of the units is based on the threat of the enemy and the need for carefully planned defensive operations to ensure national security. No details of the sending of troops or missions were reported.

The Taiwanese Ministry of Defense said in a statement that the island's armed forces were monitoring the current situation and that Taiwanese aviation, Navy ships and land missile systems were on peak alert. Based on information from the Ministry of Defense, 20 PLA aircraft and drones entered the island's air defense identification zone from the southwest. The vehicles were: Y-8 anti-submarine aircraft, BZK-005 and BZK-007 drones, J-16, J-11 and J-10 multifunctional fighters, as well as Su-30s.

The PLA has regularly patrolled the waters near the island in recent months. Tensions in the Taiwan Strait increased after former U.S. House of Representatives President Nancy Pelosi paid a visit to Taipei last August. The trip generated extreme discontent in Beijing.

In December, the U.S. would have offered the sale of up to 100 Patriot PAC-3 Missile Segment Enhancement (MSE) missiles and related equipment to Taiwan. The proposal was made under the provisions of a 2010 sale and would have a value of approximately US$ 2.81 billion.

Tags: Military AviationPLAAF - China Air ForceRoCAF - Republic of China Air Force/Taiwan Air ForceWar Zones - China/Taiwan

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. He uses Canon equipment during his photographic work in the world of aviation.

Related news

MILITARY

DARPA selects the companies that will develop the Liberty Lifter program X-plane

01/02/2023 - 18:38

MILITARY

Field Aerospace completes modernization of Turkish Air Force KC-135 Block 45 tanker planes

01/02/2023 - 16:00

UAS Hermes 900 (ADS 15) of the Swiss Air Force. (Photo: Ministry of Defense of Switzerland)

VANT - UAV

Swiss Air Force puts into operation its first two Hermes 900 reconnaissance drones

01/02/2023 - 14:00

Aviators of the 41st Expeditionary Operations Group drive the engine of an F-35A Lightning II aircraft on the ramp of Thule Air Base, Greenland, on January 26, 2023. (Photo: Department of Defense / Master Sgt. Benjamin Wiseman)

MILITARY

F-35s are deployed in Greenland for the first time, operating from Thule

01/02/2023 - 13:00

Drone launched from Eaglet air. (Photo: GA-ASI)

VANT - UAV

New Eaglet drone launched by GA-ASI flies for the first time

01/02/2023 - 12:00

BRAZILIAN AIR FORCE

Operation Yanomami Shield is triggered by FAB in Roraima

01/02/2023 - 08:27

homeMain PageEditorialsINFORMATIONeventsCooperateSpecialitiesadvertiseabout

Cavok Brazil - Digital Tchê Web Creation

Commercial

Executive

Helicopters

HISTORY

Military

Brazilian Air Force

Space

Specialities

Cavok Brazil - Digital Tchê Web Creation

0 notes

Text

SATCOM on the Move Market size Witness Steady Expansion during 2027

The SATCOM on the Move Market size was valued at US$ 16.43 Bn. in 2020. The global SATCOM on the Move Market is estimated to grow at a CAGR of 18.3% over the forecast period.

SATCOM on the Move Market Overview:

SATCOM on the Move Market Research Report explores the status quo of definitions, classifications, applications, and industry chain structures. This survey provides equitable expert commentary on current market conditions, past market performance, production-to-consumption ratios, supply-demand ratios, and revenue generation forecasts. SATCOM on the Move Market research also provides information on the key companies involved in the SATCOM on the Move sector's strategic and growth goals. Mergers and acquisitions, government and corporate operations, partnerships and alliances, joint projects, brand building, and product launches are among the tactics considered in the study. In summary, this survey provides a comprehensive overview of the SATCOM on the Move sector in both global and regional markets.

Click here for Free Sample:

https://www.stellarmr.com/report/req_sample/SATCOM-on-the-Move-Market/453

Segmentation Analysis:

The SATCOM on the Move Market is divided into three platforms: land mobile, airborne, and maritime. In 2020, the Airborne category had a 46 percent share of the market. The expanding demand for high-definition intelligence, surveillance, and reconnaissance (ISR) footage, as well as the growing number of connected commercial aircraft, UAV usage, and private aviation enterprises around the world, are all contributing to the segment's growth. In December 2019, the French Air Force upgraded its airborne satellite communication capability by integrating new Thales technologies. The French Defense Agency has granted Thales a contract to design and manufacture the next-generation Syracuse 4 satellite communication system.

Key players:

Raytheon Intelligence & Space (US)

Orbit Communication Systems Ltd. (Israel)

Leonardo Drs (US)

Bae Systems plc (UK)

Elbit Systems Ltd. (Israel)

Indra Sistemas (Spain)

Collins Aerospace (US)

Ball Corporation (US)

Space Exploration Technologies Corporation (Spacex) (US)

Mobile Satellite Communications (Most)

Avanti Communications Group plc (UK)

The research provides a comprehensive review of the SATCOM on the Move market's presence in various sectors and nations. The research analyst aims to discover hidden development potential that may be utilized by organizations in various parts of the world by doing a thorough geographical study of the sector. Global SATCOM on the Move Market research provides exact knowledge that enables market participants to compete successfully with their greatest competitors based on growth, sales, and other crucial aspects. In the research study, significant market aspects such as market drivers and barriers are separated from essential development prospects and industry trends.

Get More Report Details:

https://www.stellarmr.com/report/SATCOM-on-the-Move-Market/453

COVID-19 Impact on SATCOM on the Move market:

The COVID19 pandemic has had a huge impact on the SATCOM on the Move business around the world. SATCOM on the Move Manufacturing facilities have been closed due to the global recession and staff shortages. The COVID19 pandemic caused a sharp and long-term decline in manufacturing utilization, travel bans, and factory closures moved employees away from the facility, and slowed growth in the SATCOM on the Move market in 2020. However, the negative impact of COVID19 on the SATCOM on the Move market is temporary and the industry is expected to recover rapidly by early 2023 due to high demand for SATCOM on the Move.

Regional Analysis:

The regional part of the survey also provides key aspects that affect the market and changes in market regulations that affect current and future trends in the market. New sales, exchange sales, national demographics, regulatory measures, and import and export taxes are some of the key variables used to evaluate market scenarios in different locations. In addition, while providing predictive analytics of domestic data, it takes into account the presence and availability of global brands, the hurdles they face due to fierce or weak competition with local and domestic brands, and the impact of distribution channels.

Customization of the report:

This report can be customized to meet the client’s requirements. Please connect with our sales team ([email protected]), who will ensure that you get a report that suits your needs. You can also get in touch with our executives on +1 20 6630 3320 / 96071 95908 / 9607365656 to share your research requirements.

0 notes

Text

Military Ground Vehicle Propulsion System | Key Market Insights

As per Triton Market Research, the Global Military Ground Vehicle Propulsion System Market report is segmented by Vehicle Type (Fighting Vehicles, Combat Tanks, Self-Propelled Artillery, Small UGV Robots), Technology (Conventional Propulsion System, Electric Propulsion System, Hybrid Propulsion System, Plug-In Hybrid Electric Propulsion System), Application (Mining, Explosive Ordnance Disposal (EOD), Intelligence, Surveillance, and Reconnaissance (ISR), Logistics and Support, Combat Support, Other Applications), and Regional Outlook (Asia-Pacific, Europe, North America, Middle East and Africa, Latin America).

The report highlights the Market Summary, Industry Outlook, Porter’s Five Forces Analysis, Market Attractiveness Index, Regulatory Framework, Key Market Strategies, Market Drivers, Challenges, Opportunities, Competitive Landscape, Research Methodology and scope, Global Market Size, Forecasts & Analysis (2024-2032).

According to Triton’s research report, the global market for military ground vehicle propulsion system is expected to progress with a CAGR of 6.45% in revenue over the forecasting period 2024-2032.

Military ground vehicle propulsion systems are important components that generate the required power to propel tactical and armored military vehicles. These systems impact the agility, mobility, and overall performance of military ground vehicles in harsh operational surroundings.

Amidst rising geopolitical tensions, an increasing need for modern warfare techniques and technological advancements in electric and hybrid propulsion systems drive the growth of the studied market. Moreover, improving fuel efficiency to reduce the environmental impact and integrating AI to enhance the autonomous operations of military ground vehicles together influence the market progress.

However, the acquisition and development costs regarding advanced propulsion technologies obstruct the market growth. The biggest obstacle for manufacturers is the need for standardization across versatile military platforms, stringent regulations, and export limitations on defense technologies also hampers the expansion of the military ground vehicle propulsion system market.

In spite of these challenges, there is an increasing demand for electric and hybrid propulsion systems, which creates opportunities for the market players. As the military forces prioritize unmanned ground vehicles, there is a need to develop propulsion systems with highly advanced automation.

The major competitive companies in the studied market are Bae Systems, L3harris Technologies Inc, Cummins Inc, Caterpillar Inc, Oshkosh Corporation, Rheinmetall AG, Epsilor-Electric Fuel Ltd, General Dynamics, Northrop Grumman Corporation, Daimler AG, Israel Aerospace Industries Ltd, Lockheed Martin Corporation, General Motors Company, and Qinetiq Group.

Additionally, the need for developing strategic partnerships and improving defense forces provide new avenues for emerging market players to diversify their products. Similarly, tapping into regional markets can be another competitive edge for the stakeholders.

0 notes

Text

North America to dominate the 5G in Defense Market to grow at a Significant Rate through 2026 – TechSci Research

Increasing use of advanced technology and the need for real-time analytics is expected to drive the demand for global 5G in defense market in forecast period.

According to TechSci Research report, “Global 5G in Defense Market By Communication Infrastructure (Small Cell, Macro Cell, Radio Access Network) By Core Network Technology (Software-defined Networking, Fog Computing, Mobile Edge Computing, Network Functions Virtualizations) By Network Type (Enhanced Mobile Broadband {eMBB}, Ultra-Reliable Low-Latency Communications {URLLC}, Massive Machine Type Communications {MMTC}) By Chipset (Application-Specific Integrated Circuit (ASIC) Chipset, Radio Frequency Integrated Circuit (RFIC) Chipset, Millimeter Wave (mmWave) Chipset) By Platform (Land, Naval, Airborne) By Operational Frequency (High, Low, Medium) By End Use (Aircraft, Airport, Homeland Security) By Company, By Region, Forecast & Opportunities, 2026”, The global 5G in defense market is expected to witness significant growth for the next five years. 5G in defense is in high demand to improve the functioning of intelligence, surveillance and reconnaissance systems and modernize the processing system is expected to be the driving factor for the predicted period. Use of augmented reality and virtual reality application in defense sector require high speed internet connection to obtain enhanced results. 5G uses blockchain technology to increase the efficiency of logistics supply and enables the introduction of command-and-control system with ease. Rise in investments for upgradation to 5G technology is expected to accelerate the market growth. Autonomous vehicles, drones and robots play a crucial role in defense industry. To increase the efficiency the adoption of autonomous technology is on rise which also aids in reduction of operational costs. Support of the leading authorities in development of high-cost infrastructure and services in form of government subsidies, research and development grants and other economic aid to communication companies is expected to foster the growth of the market.

The COVID-19 outbreak across the world which has been declared as pandemic by World Health Organization has affected several countries adversely. Leading authorities across the world-imposed lockdown restrictions and released a set of precautionary measures to contain the spread of novel coronavirus. Coronavirus affected patients started suffering from shortness of breath along with coughing and sneezing. Manufacturing units were allowed to continue production with lower production volume. The testing and development of 5G technology for defense were temporarily held due to declining economic curve and disruption in supply chain network. COVID-19 also affected adversely the telecommunication network providers due to lag in product approvals and availability of limited workforce. Post lockdown restrictions, the 5G in defense market is expected to pick up the pace eventually.

However, lack of availability of sufficient hardware suppliers and shortage of skilled manpower can restrain the growth of the market.

Browse XX Figures spread through XX Pages and an in-depth TOC on "Global 5G in Defense Market”.

https://www.techsciresearch.com/report/5g-in-defense-market/7578.html

Global 5G in defense market is segmented into communication infrastructure, core network technology, network type, chipset, platform, operational frequency, end use, regional distribution, and company. Based on communication infrastructure, market can be divided into small cell, macro cell, and radio access network. The small cell communication infrastructure segment is expected to account for major market share for the forecast period, 2022-2026. Small cells help in large scale deployment of 5G network and with rise in connectivity speed the segment is expected to witness significant growth. Based on platform, market can be fragmented into land, naval, and airborne. The airborne segment is expected to dominate the market for the next five years. With advancements in technology and high demand for airborne applications and to ensure critical communication with higher efficiency the market is expected to witness significant boost.

Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., NOKIA Networks, Thales Group, L3Harris Technologies Inc., Raytheon Technologies Corporation, Qualcomm Technologies Inc., Analog Devices, Inc., Intel Corporation, Cisco Systems, Inc. are the leading players operating in global 5G in defense market. Service Providers are increasingly focusing on research and development process to fuel higher growth in the market. To meet evolving customer demand with respect to better efficiency and durability, several 5G in defense providers are coming up with their technologically advanced offerings.

Download Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=7578

Customers can also request for 10% free customization on this report.

“Advancement in technology and adoption of internet of things continuous adoption of internet of things technology for real time monitoring and analyzing the connected devices require the 5G network to connect with large number of sensors and connected devices. Internet of things find application in defense sector such as for smart base, border surveillance, drones, among others the need to ensure communication and interrupted internet connectivity along with the need for lower power consumption capability and increasing number of devices used in defense system is expected to propel the market growth till 2026” said Mr. Karan Chechi, Research Director with TechSci Research, a research based global management consulting firm.

“Global 5G in Defense Market By Communication Infrastructure (Small Cell, Macro Cell, Radio Access Network) By Core Network Technology (Software-defined Networking, Fog Computing, Mobile Edge Computing, Network Functions Virtualizations) By Network Type (Enhanced Mobile Broadband {eMBB}, Ultra-Reliable Low-Latency Communications {URLLC}, Massive Machine Type Communications {MMTC}) By Chipset (Application-Specific Integrated Circuit (ASIC) Chipset, Radio Frequency Integrated Circuit (RFIC) Chipset, Millimeter Wave (mmWave) Chipset) By Platform (Land, Naval, Airborne) By Operational Frequency (High, Low, Medium) By End Use (Aircraft, Airport, Homeland Security) By Company, By Region, Forecast & Opportunities, 2026” has evaluated the future growth potential of global 5G in defense market and provided statistics & information on market size, shares, structure and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the of global 5G in defense market.

Browse Related Reports

United States Speech Analytics Market, By Component (Solutions Vs Services), By Deployment Mode (Cloud Vs On-Premises), By Application (Customer Experience Management, Call Monitoring, Agent Performance Monitoring, Sales Performance Management, Competitive Intelligence, Risk and Compliance Management & Others), By End-User (Government and Defense, BFSI, Healthcare, IT & Telecom, Energy and Utilities, Travel and Hospitality, Retail and Ecommerce & Others), Competition Forecast & Opportunities, 2016 – 2026

https://www.techsciresearch.com/report/united-states-speech-analytics-market/2165.html

Global Logistics Automation Market By Component (Software, Hardware-integrated Systems-integrated Systems, Services), By Function (Warehouse and Storage Management, Transportation Management), By Vertical (Manufacturing, Healthcare and Pharmaceuticals, Fast-Moving Consumer Goods (FMCG), Retail and eCommerce, 3PL, Aerospace and Defense, Oil, Gas, and Energy, Chemicals, Others (Paper And Printing, And Textiles And Clothing)), By Company, By Region, Forecast & Opportunities, 2026

https://www.techsciresearch.com/report/logistics-automation-market/7393.html

Contact

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

Website : https://www.techsciresearch.com

Our Blog : https://techsciblog.com/

#Global 5G in Defense Market#5G in Defense Market#Global 5G in Defense Market Size#5G in Defense Market Size#5G in Defense Market Share#5G in Defense Market Growth#5G in Defense Market Forecast#5G in Defense Market Analysis

0 notes

Text

Military Radars Market Is Anticipated To Experience Robust Growth During Forecast Period

Increasing threats from high-speed missiles and aircraft have led to an increase in demand for surveillance and fire control radars. Rise in the defense spending of emerging economies, growing regional tensions, and an increasing number of inter-country conflicts are major factors driving the military radars market. The increasing deployment of ballistic and stealth missiles in active war zones has also led to a significant increase in the demand for military radars across the globe.

The global military radars market size is projected to grow from USD 14.0 billion in 2020 to USD 17.4 billion by 2025, at a CAGR of 4.4% during the forecast period. Increasing threats from high-speed missiles and aircraft have led to an increase in demand for surveillance and fire control radars. Rise in the defense spending of emerging economies, growing regional tensions, and an increasing number of inter-country conflicts are major factors driving the military radars market.

The increasing deployment of ballistic and stealth missiles in active war zones has also led to a significant increase in the demand for military radars across the globe.

Based on application, air & missile defense is estimated to be the largest and fastest-growing segment in the military radars market.Ongoing modernization programs in airspace monitoring in Asia Pacific region, activities such as sea-based military operations, drug trafficking, illegal migrations, demand for early warning threat detection systems, continuous demand for mine detection systems and equipment by US military to tackle conflicts in the Middle East and Asia Pacific will drive the market for air & missile defense radars, globally.

Get All The Further Insights: https://www.marketsandmarkets.com/Market-Reports/military-radar-market-51422570.html

Based on platform segment, the naval platform is estimated to be the largest and fastest-growing segment in the military radars market. The growth of this segment can be attributed to increased efficiency and higher accuracy of ship-based naval radar systems drive this segment. The demand for effective weapon guidance systems for naval ships is boosting the growth of ship-based naval radars. Increasing investments by the Asian countries for the development of ship-based radar systems is further propelling the industry growth. More than half of the global shipbuilding activities are conducted in countries such as China, Japan, and South Korea will drive the market for naval radars.

Based on product type, the surveillance and early airborne warning radar segment is estimated to have the largest market share by value. Ongoing military modernization, replacement of obsolete radars, and introduction of digital signal processing and solid-state modules are additional factors expected to drive the surveillance and early airborne warning radars market during the forecast period. The demand for technologically advanced early airborne warning radar systems is increasing as various major manufacturers from developed countries are developing carefully-shaped fighters which leads to a significant reduction in its detection range.

Based on the region, the Asia Pacific region of the military radars market is projected to grow at the highest CAGR during the forecast period. The growth of this region can be attributed due to the increasing investments in air defense systems to strengthen their combat zone systems and tackle threats. China and India are upgrading their surveillance and resource allocation abilities by upgrading their command and control networks. China is expected to drive the military radars market in Asia Pacific region. Countries such as Vietnam, Thailand, and Australia, who earlier invested in land forces, are now considering to increase their spending in the air-sea defense sector.

Key manufacturers of military radars systems are based in North America. These players include Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), and among others. These companies have reliable manufacturing facilities as well as strong distribution networks across key regions, such as North America, Europe, and Asia Pacific.

Lockheed Martin Corporation manufactures a variety of radars and sensors, using electro-optical/infrared sensor systems, which provide advanced precision targeting, navigation, threat detection, and next-generation intelligence, surveillance, and reconnaissance capabilities.

Israel Aerospace Industries is a company that manufactures and provides a wide range of products for airborne, naval, and land systems under commercial aviation, defense, and homeland security sectors. The company offers surveillance radars for land, coastal, airborne, and naval applications. Its ground-based radars can be fixed, mobile, or portable, depending on the requirements of users.

Leonardo S.P.A. provides a wide range of defense and security solutions to the government, private, and commercial sectors. The company is known for its investments in research & development across the aerospace, defense, and security sectors. The company has a large supply network, due to the presence of subsidiaries, joint ventures, and international partnerships across 20 countries, including the UK, Poland, and the US.

Get Sample Here: https://www.marketsandmarkets.com/requestsampleNew.asp?id=51422570

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

Contact: Mr. Aashish Mehra MarketsandMarkets™ INC. 630 Dundee Road Suite 430 Northbrook, IL 60062 USA : 1-888-600-6441

0 notes

Text

Forthcoming Progression of North America Unmanned Ground Vehicle (UGV) Market Outlook: Ken Research

Military Unmanned ground vehicles are vehicles that don’t impose a humanoid manifestation inside the motor automobile. These automobiles are embraced with modern machineries that are integrated with sensors and parallel peripherals. Uses of UGVs within diverse trade verticals containing agriculture, transportation and military & defence. Technological evolutions have been critical to the development of the market.