#Mining Chemicals Market Market trend

Explore tagged Tumblr posts

Text

Mining Chemicals Market Market Expected to Witness High Growth over the Forecast Period 2022-2029

#Mining Chemicals Market Market#Mining Chemicals Market Market trend#Mining Chemicals Market Market size#Mining Chemicals Market Market growth

0 notes

Text

Rising Environmental Concerns Shape the Future of Mining Chemicals Market

Mining chemicals are essential substances used in the extraction and processing of various minerals and ores. These chemicals play a pivotal role in improving the efficiency and effectiveness of mining operations. The global mining chemicals market encompasses a wide range of products that are tailored to specific requirements, such as flotation agents, solvent extractants, grinding aids, and explosives. The demand for these chemicals is driven by the growing global mining industry, which seeks to maximize mineral recovery while minimizing environmental impact.

The mining chemicals market overview reveals a sector characterized by continuous innovation and research to develop chemicals that can enhance the extraction and processing of minerals. With the increasing depletion of easily accessible mineral deposits, mining companies are turning to more complex ores, and this necessitates the use of advanced chemicals to achieve efficient separation and extraction processes.

Market growth in the mining chemicals industry is driven by several factors. Firstly, the rising global population and urbanization have led to increased demand for various minerals, including base metals, precious metals, and industrial minerals. This growing demand exerts pressure on mining companies to increase production, which, in turn, fuels the demand for mining chemicals. Additionally, advancements in mining technologies and the need for sustainable mining practices are propelling the market forward, as companies seek eco-friendly chemicals to reduce environmental impact.

The mining chemical market industry is inherently cyclical, with market dynamics often influenced by commodity prices. Fluctuations in metal and mineral prices can impact the demand for mining chemicals, as mining companies adjust their operations based on market conditions. Furthermore, geopolitical factors and regulatory changes in mining regions can also influence the market industry by affecting mining activities and chemical usage.

Trends in the mining chemicals market are constantly evolving. One notable trend is the increasing focus on sustainability and environmental responsibility. Mining companies are under pressure to reduce their carbon footprint and minimize the environmental impact of their operations. This has led to a growing demand for green mining chemicals that are biodegradable and less harmful to ecosystems. Additionally, the digitalization of mining processes and the use of data analytics to optimize chemical usage is becoming more prevalent, contributing to greater efficiency in mining operations.

In conclusion, the mining chemicals market is a vital component of the global mining industry, facilitating the extraction and processing of minerals and ores. The market's growth is driven by factors such as increased mineral demand, technological advancements, and a growing emphasis on sustainability. As the mining industry continues to evolve, so too will the market for mining chemicals, adapting to meet the changing needs and challenges of the sector.

0 notes

Text

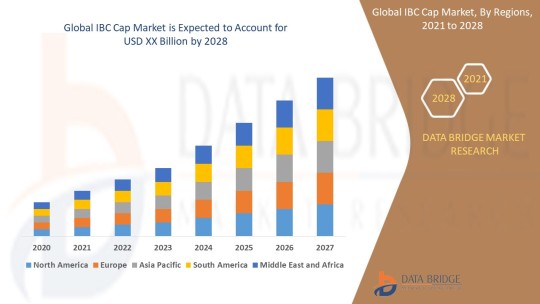

IBC Cap Market Size, Share, Trends, Growth and Competitive Analysis

"IBC Cap Market – Industry Trends and Forecast to 2028

Global IBC Cap Market, By Product Type (Flange, Plugs, Vent-in Plug, Vent-out Plug and Screw closure), Type (Plastic IBC, Metal IBC and Composite IBCs), Material Type (Plastics, Metal, Aluminium and Steel), End Use (Chemicals & Fertilizers, Petroleum & Lubricants, Paints, Inks & Dyes, Food & Beverage, Agriculture, Building & Construction, Healthcare & Pharmaceuticals and Mining), Application (Food And Drinks, Chemical Industry, Oil and Agriculture), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028

Access Full 350 Pages PDF Report @

The global IBC cap market is expected to witness significant growth over the forecast period due to the increasing demand for intermediate bulk containers (IBCs) in various industries such as chemicals, food and beverages, pharmaceuticals, and others. The IBC caps play a crucial role in ensuring the safe storage and transportation of liquid products. The market growth is also being driven by technological advancements in IBC cap designs, such as tamper-evident seals and spouts for easy dispensing. Additionally, the growing focus on sustainability and recyclability of packaging materials is further boosting the adoption of IBC caps made from eco-friendly materials.

**Segments**

- Based on material type, the IBC cap market can be segmented into plastic, metal, and others. Plastic caps are widely used due to their lightweight nature and cost-effectiveness. - By cap type, the market can be categorized into screw caps, snap-on caps, and flip-top caps. Screw caps are preferred for their secure sealing properties. - On the basis of end-user industry, the market can be divided into chemicals, food and beverages, pharmaceuticals, and others. The chemicals segment is anticipated to hold a significant market share due to the widespread use of IBCs for storing chemical products.

**Market Players**

- TPS Industrial Srl - Schuetz GmbH & Co. KGaA - Mauser Packaging Solutions - Time Technoplast Ltd - Berry Global Inc. - THIELMANN UCON AG - Precision IBC, Inc. - Peninsula Packaging LLC

These market players are actively involved in strategic initiatives such as product launches, partnerships, and acquisitions to strengthen their market presence and expand their product offerings. The competitive landscape of the IBC cap market is characterized by intense competition, prompting companies to focus on innovation and quality to gain a competitive edge.

The Asia-Pacific region is expected to witness substantial growth in the IBC cap market, driven by the rapid industrialization and the increasing adoption of IBCsThe Asia-Pacific region represents a significant growth opportunity for the global IBC cap market due to several key factors. With rapid industrialization and the expanding manufacturing sector in countries like China, India, and Southeast Asia, there is a growing demand for efficient storage and transportation solutions, including IBCs and their associated caps. The increased focus on chemical production, food processing, and pharmaceutical manufacturing in the region further fuels the need for reliable packaging solutions like IBC caps. As these industries continue to grow, the adoption of IBC caps is expected to rise, driving market expansion in the Asia-Pacific region.

Moreover, the emphasis on enhancing safety standards and ensuring product integrity is a crucial factor contributing to the growth of the IBC cap market in Asia-Pacific. Regulations regarding the safe handling and transportation of hazardous chemicals and pharmaceuticals necessitate the use of high-quality caps that can effectively seal and protect the contents of IBCs. As companies in the region strive to comply with stringent regulatory requirements, the demand for advanced and secure IBC caps is projected to increase significantly.

Additionally, the shift towards sustainability and eco-friendly practices is another trend shaping the IBC cap market in Asia-Pacific. With growing environmental concerns and increasing awareness about plastic pollution, there is a rising preference for IBC caps made from recyclable and biodegradable materials. Market players in the region are focusing on developing sustainable packaging solutions to meet the evolving consumer demands and align with global sustainability goals. This shift towards eco-friendly IBC caps not only addresses environmental concerns but also presents market players with opportunities to differentiate their offerings and attract environmentally conscious customers.

Furthermore, the competitive landscape of the IBC cap market in Asia-Pacific is characterized by the presence of both local manufacturers and international players. Local companies often have a strong understanding of regional market dynamics and customer preferences, giving them a competitive advantage in catering to specific industry needs. On the other hand, multinational companies bring technological expertise and a wide product portfolio, which can appeal to a broader customer base seeking innovative and**Global IBC Cap Market, By Product Type**

- Flange - Plugs - Vent-in Plug - Vent-out Plug - Screw closure

**Type**

- Plastic IBC - Metal IBC - Composite IBCs

**Material Type**

- Plastics - Metal - Aluminium - Steel

**End Use**

- Chemicals & Fertilizers - Petroleum & Lubricants - Paints, Inks & Dyes - Food & Beverage - Agriculture - Building & Construction - Healthcare & Pharmaceuticals - Mining

**Application**

- Food And Drinks - Chemical Industry - Oil and Agriculture

The Global IBC Cap market is experiencing significant growth due to the rising demand for intermediate bulk containers across various industries. Plastic caps are increasingly preferred for their lightweight and cost-effective nature, driving market growth within the material type segment. Screw caps, known for their secure sealing properties, dominate the cap type category. The chemicals segment is anticipated to hold a substantial market share among end-user industries, attributed to the widespread use of IBCs for chemical storage. The market players in the industry are focusing on strategic initiatives like product launches and partnerships to enhance their market presence and offerings. The competitive landscape is intense, spurring companies to innovate and prioritize quality for a competitive advantage.

In Asia-Pacific, the IBC cap market is poised for robust growth fueled by rapid industrialization and the expanding manufacturing sector, particularly in countries like China,

Countries Studied:

North America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of Americas)

Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of Europe)

Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA)

Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Key Coverage in the IBC Cap Market Report:

Detailed analysis of IBC Cap Market by a thorough assessment of the technology, product type, application, and other key segments of the report

Qualitative and quantitative analysis of the market along with CAGR calculation for the forecast period

Investigative study of the market dynamics including drivers, opportunities, restraints, and limitations that can influence the market growth

Comprehensive analysis of the regions of the IBC Cap industry and their futuristic growth outlook

Competitive landscape benchmarking with key coverage of company profiles, product portfolio, and business expansion strategies

TABLE OF CONTENTS

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Research Methodology

Part 04: Market Landscape

Part 05: Pipeline Analysis

Part 06: Market Sizing

Part 07: Five Forces Analysis

Part 08: Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers and Challenges

Part 13: Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse Trending Reports:

Calcium Glycinate Market Retinal Biologics Market Facial Fat Transfer Market Angio Suites Diagnostic Imaging Market Adoption Of Benelux Power Tools Market De Quervains Tenosynovitis Treatment Market Biodetectors And Accessories Market Colposcope Market Sports Medicine Market Automotive Adhesives Market Infrared Imaging Market Vapour Deposition Market Professional Diagnostics Market Ct Scanner Market Programmable Application Specific Integrated Circuit Asic Market Hospital Operating Room Or Products And Solutions Market Castor Oil Market Zika Virus Infection Drug Market Toluene Diisocynate Market Antibiotic Resistance Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

2 notes

·

View notes

Text

Osmium Market Explained: The World's Most Densely Valuable Metal

The Osmium market is a niche sector within the broader precious metals industry, often overshadowed by its more well-known counterparts like gold and silver. Osmium is a remarkable element with unique properties that make it a valuable asset for various industries, especially in cutting-edge technologies and scientific applications. In this article, we will explore the Osmium market, its uses, sources, and its potential for growth and investment.

Understanding Osmium

Osmium market is a chemical element with the symbol Os and atomic number 76. It is one of the densest naturally occurring elements and belongs to the platinum group metals (PGMs), which also includes platinum, palladium, rhodium, ruthenium, and iridium. Osmium is characterized by its bluish-white color and extreme density, making it twice as dense as lead.

Historically, osmium was used in various applications, such as fountain pen tips and electrical contacts, due to its hardness and corrosion resistance. However, modern applications for osmium have evolved, and its market dynamics have changed significantly.

Osmium in Modern Applications

Osmium Alloys in Industry Osmium is often alloyed with other metals, like iridium, to create exceptionally hard and durable materials. These alloys find applications in the aerospace and automotive industries, where they are used for electrical contacts, spark plug tips, and turbine engine components. The extreme heat resistance of osmium alloys makes them invaluable in these high-temperature environments.

Scientific Applications In scientific research, osmium tetroxide (OsO4) is a widely used staining agent for electron microscopy and other microscopic imaging techniques. It can highlight cellular structures and biological tissues, aiding researchers in understanding complex biological processes.

Investment Potential The rarity of osmium and its diverse applications make it an attractive option for investors looking to diversify their portfolios. As a tangible asset, osmium can act as a hedge against economic instability and currency devaluation. However, investing in osmium requires careful consideration and knowledge of the market, as it is less liquid than more common precious metals.

Sources of Osmium

Osmium is a rare element found in trace amounts in various ores, with primary sources being platinum and nickel ores. The largest producers of osmium are countries with significant platinum mining operations, such as South Africa and Russia. Extraction of osmium from these ores is a complex and expensive process, which contributes to its scarcity.

Osmium Market Trends

The Osmium market is characterized by its limited supply and steady demand. Over the past decade, the market has experienced modest growth, driven by technological advancements and increasing demand for its unique properties. Some notable trends in the Osmium market include:

Growing Demand in Aerospace and Automotive Sectors The use of osmium alloys in aerospace and automotive applications is expected to increase as manufacturers seek materials that can withstand extreme conditions. Osmium's remarkable hardness and resistance to high temperatures make it a preferred choice in these industries.

Expanding Scientific Research Advancements in scientific research and the increasing need for advanced microscopy techniques are expected to drive the demand for osmium tetroxide, a key component in staining and imaging. This is particularly relevant in the fields of biology, medicine, and materials science.

Investment Opportunities While osmium is not as commonly traded as other precious metals, its investment potential has piqued the interest of collectors and investors. Some institutions and individuals are exploring the possibility of adding osmium to their investment portfolios as a store of value and a hedge against economic volatility.

Challenges in the Osmium Market

Despite its unique properties and applications, the Osmium market faces several challenges:

Limited Supply Osmium's scarcity poses a significant challenge for both industrial users and investors. The small quantities of osmium available and the complex extraction process contribute to its high cost.

Market Awareness The general public and even some investors remain relatively unaware of osmium as an investment option. Increasing awareness and education about the metal's unique characteristics and market dynamics is essential to foster growth.

Conclusion

The Osmium market may be small compared to other precious metals, but its unique properties and applications make it a valuable and intriguing element within the world of commodities and investments. As technology continues to advance and scientific research expands, the demand for osmium is likely to grow, offering opportunities for those willing to explore this less-known sector of the precious metals industry. While challenges such as limited supply and market awareness persist, the Osmium market's potential for growth and investment remains an exciting prospect for those who see beyond the bluish-white surface of this remarkable element.

#Osmium Market Share#Osmium Market Growth#Osmium Market Demand#Osmium Market Trend#Osmium Market Analysis

17 notes

·

View notes

Text

Unlocking the Beauty and Potential of Pink Diamond Investment

In the world of alternative investments, pink diamonds have emerged as a unique and alluring option for those seeking to diversify their portfolios. Pink diamond investment offers a rare combination of aesthetic appeal and potential financial gain, making it a popular choice among savvy investors.

Pink Diamond Investment: A Shining Opportunity

Pink diamonds, known for their exquisite beauty and scarcity, have become a symbol of luxury and prestige. These precious gemstones are incredibly rare, with only a limited number being unearthed each year. Their rarity and captivating color make them highly sought after in the world of jewelry, but their appeal extends far beyond adornment.

Investors have started recognizing the investment potential in pink diamonds. Unlike traditional investments like stocks and real estate, pink diamonds have shown the ability to retain and increase in value over time. This makes them an attractive option for those looking to diversify their investment portfolio.

The Appeal of Lab Created Diamonds

While natural pink diamonds are a fascinating investment choice, the emergence of lab-created diamonds has added a new dimension to the market. Lab-created diamonds are man-made, offering a more affordable alternative to their natural counterparts. They share the same physical and chemical properties as natural diamonds, making them an attractive option for those looking for pink diamond aesthetics without the high price tag.

Pink Diamond Investment vs. Lab Created Diamonds

Investors often find themselves at a crossroads when choosing between natural pink diamonds and lab-created diamonds for their investment portfolio. Both options have their merits, and the decision ultimately depends on individual preferences and financial goals.

Natural pink diamonds, with their rarity and prestige, tend to appreciate in value over time. However, they come with a higher price point and are subject to fluctuations in the natural diamond market. On the other hand, lab-created diamonds offer affordability and consistent quality, making them a more accessible option for a wider range of investors.

Factors to Consider in Pink Diamond Investment

Before diving into the world of pink diamond investment, there are several factors to consider:

Quality and Rarity: The color, size, and overall quality of the pink diamond are critical factors in determining its value.

Market Trends: Staying informed about the trends in the pink diamond market can help investors make informed decisions.

Authentication: Ensuring the authenticity of natural pink diamonds is crucial to avoid investing in counterfeit stones.

Storage and Insurance: Proper storage and insurance are essential to protect your investment.

Diversification through Pink Diamond Investment

Diversification is a key strategy in building a robust investment portfolio. Pink diamonds, with their unique characteristics, can provide this diversification. By incorporating them into your investment portfolio, you can spread your risk and potentially achieve stable returns over the long term.

The Future of Pink Diamond Investment

As the demand for unique and valuable assets continues to grow, pink diamond investment is likely to remain an attractive option for investors. The market for these precious gemstones will evolve alongside advancements in the mining and creation of pink diamonds.

In conclusion, pink diamond investment offers a captivating opportunity for those looking to add a touch of luxury to their investment portfolio. Whether you choose natural pink diamonds or lab-created diamonds, the potential for long-term value appreciation and diversification is undeniable. As with any investment, careful research and consideration are essential to make the most of this unique and alluring opportunity in the world of alternative investments.

#pink diamond#diamond ring#gold jewelry#diamond jewelry#jewerly#diamonds#fine jewelry#jewellery#pendant#silver jewelry#diamond authority#su fanart#rose quartz su#greg universe

4 notes

·

View notes

Text

Aluminum Market: Products, Applications & Beyond

Aluminum is a versatile element with several beneficial properties, such as a high strength-to-weight ratio, corrosion resistance, recyclability, electrical & thermal conductivity, longer lifecycle, and non-toxic nature. As a result, it witnesses high demand from industries like automotive & transportation, electronics, building & construction, foil & packaging, and others. The high applicability of the metal is expected to drive the global aluminum market at a CAGR of 5.24% in the forecast period from 2023 to 2030.

Aluminum – Mining Into Key Products:

Triton Market Research’s report covers bauxite, alumina, primary aluminum, and other products as part of its segment analysis.

Bauxite is anticipated to grow with a CAGR of 5.67% in the product segment over the forecast years.

Bauxite is the primary ore of aluminum. It is a sedimentary rock composed of aluminum-bearing minerals, and is usually mined by surface mining techniques. It is found in several locations across the world, including India, Brazil, Australia, Russia, and China, among others. Australia is the world’s largest bauxite-producing nation, with a production value of over 100 million metric tons in 2022.

Moreover, leading market players Rio Tinto and Alcoa Corporation operate their bauxite mines in the country. These factors are expected to propel Australia’s growth in the Asia-Pacific aluminum market, with an anticipated CAGR of 4.38% over the projected period.

Alumina is expected to grow with a CAGR of 5.42% in the product segment during 2023-2030.

Alumina or aluminum oxide is obtained by chemically processing the bauxite ore using the Bayer process. It possesses excellent dielectric properties, high stiffness & strength, thermal conductivity, wear resistance, and other such favorable characteristics, making it a preferable material for a range of applications.

Hydrolysis of aluminum oxide results in the production of high-purity alumina, a uniform fine powder characterized by a minimum purity level of 99.99%. Its chemical stability, low-temperature sensitivity, and high electrical insulation make HPA an ideal choice for manufacturing LED lights and electric vehicles. The growth of these industries is expected to contribute to the progress of the global HPA market.

EVs Spike Sustainability Trend

As per the estimates from the International Energy Agency, nearly 2 million electric vehicles were sold globally in the first quarter of 2022, with a whopping 75% increase from the preceding year. Aluminum has emerged as the preferred choice for auto manufacturers in this new era of electromobility. Automotive & transportation leads the industry vertical segment in the studied market, garnering $40792.89 million in 2022.

In May 2021, RusAl collaborated with leading rolled aluminum products manufacturer Gränges AB to develop alloys for automotive applications. Automakers are increasingly substituting stainless steel with aluminum in their products owing to the latter’s low weight, higher impact absorption capacity, and better driving range.

Also, electric vehicles have a considerably lower carbon footprint compared to their traditional counterparts. With the growing need for lowering emissions and raising awareness of energy conservation, governments worldwide are encouraging the use of EVs, which is expected to propel the demand for aluminum over the forecast period.

The Netherlands is one of the leading countries in Europe in terms of EV adoption. The Dutch government has set an ambitious goal that only zero-emission passenger cars (such as battery-operated EVs, hydrogen FCEVs, and plug-in hybrid EVs) will be sold in the nation by 2030. Further, according to the Canadian government, the country’s aluminum producers have some of the lowest CO2 footprints in the world.

Alcoa Corporation and Rio Tinto partnered to form ELYSIS, headquartered in Montréal, Canada. In 2021, it successfully produced carbon-free aluminum at its Industrial Research and Development Center in Saguenay. The company is heralding the beginning of a new era for the global aluminum market with its ELYSIS™ technology, which eliminates all direct GHG emissions from the smelting process, and is the first technology ever to emit oxygen as a byproduct.

Wrapping Up

Aluminum is among the most widely used metals in the world today, and is anticipated to underpin the global transition to a low-carbon economy. Moreover, it is 100% recyclable and can retain its properties & quality post the recycling process.

Reprocessing the metal is a more energy-efficient option compared to extracting the element from an ore, causing less environmental damage. As a result, the demand for aluminum in the sustainable energy sector has thus increased. The efforts to combat climate change are thus expected to bolster the aluminum market’s growth over the forecast period.

#Aluminum Market#aluminum#chemicals and materials#specialty chemicals#market research#market research reports#triton market research

4 notes

·

View notes

Text

Polyacrylamide Market Size Revenue, Driving Factors, Key Players, Strategies, Trends, Forecast Till 2032

Polyacrylamide is a polymer used in a variety of applications, including water treatment, petroleum recovery, papermaking, and textiles. As a highly versatile substance, polyacrylamide plays a crucial role in several industries, providing essential functions such as flocculation, thickening, and stabilization. The Polyacrylamide Market has been expanding steadily in recent years, driven by increasing demand across a wide array of sectors.

What is Polyacrylamide?

Polyacrylamide (PAM) is a water-soluble polymer derived from acrylamide monomers. It is primarily used in water treatment, where it acts as a flocculant to remove impurities from water. Polyacrylamide is available in various forms, such as powder, gel, and emulsion. The polymer has applications in industries such as oil and gas, agriculture, textiles, and food processing, among others.

Polyacrylamide Market Size was valued at USD 5.71 billion in 2023. The Polyacrylamide market industry is projected to grow from USD 6.05 Billion in 2024 to USD 6.06 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.01% during the forecast period (2024 - 2030)

Polyacrylamide’s versatility is largely attributed to its ability to form cross-links in water and alter its physical and chemical properties. This makes it highly effective in processes that require separation, clarification, and purification.

Key Drivers of Market Growth

Water Treatment Demand: One of the main drivers of the polyacrylamide market is the increasing global demand for clean water. With growing concerns over water pollution and scarcity, industries are relying on polyacrylamide-based products for water treatment. In municipal and industrial water treatment, polyacrylamide is used to remove suspended solids and other contaminants, making water safe for consumption. As population growth and industrialization continue to put pressure on water resources, the need for efficient water treatment solutions is rising.

Oil and Gas Industry: The oil and gas sector is another significant contributor to the polyacrylamide market. Polyacrylamide is used in enhanced oil recovery (EOR) techniques, where it is employed to improve the extraction of oil from reservoirs. It helps by reducing friction in water-based fluids, thereby enhancing the efficiency of drilling and production operations. With rising energy demands, the oil and gas industry’s reliance on polyacrylamide is expected to continue to grow.

Agricultural Applications: Polyacrylamide is used in agriculture, particularly in soil conditioning and irrigation management. The polymer helps in moisture retention, reducing soil erosion and improving crop yields. As agriculture becomes increasingly technology-driven, the demand for polyacrylamide in precision farming and soil management is expected to rise. The ability of polyacrylamide to support sustainable agricultural practices aligns with the growing focus on environmentally friendly farming methods.

Industrial Applications: Polyacrylamide’s use in industrial applications such as paper manufacturing, textiles, and mining is also driving the market. In papermaking, polyacrylamide is used as a retention aid, helping to improve paper quality and increase efficiency. Similarly, in mining, it is used for waste water treatment and to improve the efficiency of ore extraction.

Market Trends

Growing Focus on Sustainability: As environmental concerns rise, there is an increasing demand for eco-friendly alternatives in the chemical industry. Polyacrylamide manufacturers are working on developing more sustainable and biodegradable versions of the polymer. The shift towards greener products is expected to open new growth avenues in the market. In addition, regulatory pressure to reduce the environmental impact of chemicals is pushing companies to innovate and adopt eco-friendly manufacturing practices.

Rising Investment in Water Infrastructure: Governments worldwide are investing heavily in upgrading and expanding water treatment infrastructure. This trend, particularly in emerging economies, is expected to create significant growth opportunities for the polyacrylamide market. With more municipalities adopting advanced water treatment technologies, the demand for polyacrylamide in municipal water treatment will increase.

Technological Advancements: Research and development efforts are leading to the creation of new types of polyacrylamide products that offer superior performance in specific applications. For instance, superabsorbent polyacrylamide polymers are gaining traction in agricultural and industrial applications. Technological advancements in the production of polyacrylamide are also expected to improve cost-effectiveness, making it more accessible to a wider range of industries.

Challenges Facing the Polyacrylamide Market

Environmental Concerns: Despite its versatility, polyacrylamide has faced criticism due to its environmental impact, particularly in water treatment applications. Residual polyacrylamide in treated water can be harmful to aquatic ecosystems. This has led to growing concerns about its long-term environmental sustainability. To address this, manufacturers are working to develop biodegradable and less toxic versions of polyacrylamide.

Health and Safety Issues: The production of polyacrylamide involves the use of acrylamide, which is a known carcinogen. While polyacrylamide itself is considered relatively safe, the handling and manufacturing processes pose potential risks. Strict regulations and safety standards are required to minimize exposure to acrylamide during production.

Raw Material Price Fluctuations: The price of polyacrylamide is heavily dependent on the cost of acrylamide, its key raw material. Fluctuations in raw material prices can significantly impact the profitability of polyacrylamide manufacturers. Additionally, supply chain disruptions can lead to shortages and increased production costs.

Future Outlook

The global polyacrylamide market is expected to continue its growth trajectory, driven by strong demand from industries such as water treatment, oil and gas, agriculture, and papermaking. The increasing emphasis on sustainable and eco-friendly products will likely shape the future of the market, encouraging innovation and the development of greener alternatives.

With the ongoing urbanization, industrial growth, and advancements in technology, the polyacrylamide market is poised for significant expansion in the coming years. However, addressing environmental and health concerns while ensuring sustainable production practices will be crucial for the long-term viability of the market.

MRFR recognizes the following Polyacrylamide Companies - BASF SE (Germany),SNF Group (France),China National Petroleum Corporation (China),The Dow Chemical Company (US),PetroChina Company Limited (China),Black Rose Industries Ltd (India),Xitao Polymer Co., Ltd (China),Kemira OYJ (Finland),ZL Petrochemical Co., Ltd (US),Anhui Jucheng Fine Chemicals Co., Ltd (China).among others

The polyacrylamide market is witnessing robust growth across multiple sectors, driven by its wide-ranging applications and versatility. With key drivers such as water treatment demand, oil and gas industry expansion, and agricultural innovation, the future of the market looks promising. However, challenges related to environmental impact, health concerns, and raw material costs will require attention. By embracing technological advancements and sustainable practices, the polyacrylamide market is set to continue evolving, meeting the needs of industries worldwide.

Related Reports

Expanded Polystyrene Market - https://www.marketresearchfuture.com/reports/expanded-polystyrene-market-4834 Fluoropolymer Coating Market - https://www.marketresearchfuture.com/reports/flouropolymer-coating-market-4844 Long Fiber Thermoplastics Market - https://www.marketresearchfuture.com/reports/long-fiber-thermoplastics-market-4889 Polyurethane Additives Market - https://www.marketresearchfuture.com/reports/polyurethane-additive-market-4916 Polyphenylene Oxide (PPO) Market - https://www.marketresearchfuture.com/reports/polyphenylene-oxide-market-4924 Chiral Chemicals Market - https://www.marketresearchfuture.com/reports/chiral-chemicals-market-4940 Polyvinyl Butyral Market - https://www.marketresearchfuture.com/reports/polyvinyl-butyral-market-5059

0 notes

Text

Industrial Centrifugal Pump Market to Witness Major Growth by 2032 | Insights Revealed Flowserve Corporation , Mody Pumps , Xylem Inc. , ITT Inc. ,CIRCOR International , Baker Hughes ,Ingersoll Rand ,Pentair , Schlumberger

Industrial Centrifugal Pump Market Overview and Insights:

IMR posted new studies guide on Industrial Centrifugal Pump Market Insights with self-defined Tables and charts in presentable format. In the Study you may locate new evolving Trends, Drivers, Restraints, Opportunities generated via targeting market related stakeholders. The boom of the Industrial Centrifugal Pump marketplace became specifically driven with the aid of the growing R&D spending internationally. Some of the Top Leading Key Players:

Flowserve Corporation (U.S.)Mody Pumps (U.S.)Xylem Inc. (U.S.)ITT Inc. (U.S.)CIRCOR International (U.S.)Baker Hughes (U.S.)Ingersoll Rand (U.S.)Pentair (U.S.)Schlumberger (U.S.)Griswold (U.S.)KSB (Germany)Wilo (Germany)SPT Pumpen (Germany)EBARA Corporation (Japan)Tsurumi Manufacturing Co. Ltd. (Japan)Grundfos Holding A/S (Denmark)Sulzer (Switzerland)Weir (UK)Zhejiang Doyin Technology (China)Kirloskar Brothers Limited (India)CNP Pumps (India)PSP Pumps (India)PRORIL (Taiwan)VANSAN (Turkey)WEG (Brazil), and Other Major Players.

Global Industrial Centrifugal Pump Market Size Was Valued at USD 32.19 Billion in 2023 and is Projected to Reach USD 51.68 Billion by 2032, Growing at a CAGR of 5.40% From 2024-2032

Download Sample Report PDF (Including Full TOC, Table & Figures) @ https://introspectivemarketresearch.com/request/14001?utm_source=Yayati_LinkeWire

Industrial Centrifugal Pump Market Synopsis: An Industrial Centrifugal Pump is a mechanical apparatus that actively moves fluids by transforming rotational energy into fluid speed. It enables effective fluid movement in various industrial applications by harnessing the centrifugal force produced by a spinning impeller. This pump provides a dependable and flexible option for liquid transport in sectors such as oil and gas, water treatment, and manufacturing

IMR is solidifying its reputation as a leading market research and consulting service provider, delivering data-driven insights that help businesses make informed strategic decisions. By focusing on detailed demand analysis, accurate market forecasts, and competitive evaluations, we equip companies with the essential tools to succeed in an increasingly competitive landscape. This comprehensive Industrial Centrifugal Pump market analysis offers a detailed overview of the current environment and forecasts growth trends through 2032. Our expertise enables clients to stay ahead of the curve, providing actionable insights and competitive intelligence tailored to their industries. Segmentation Analysis of the Industrial Centrifugal Pump Market

By Product Type:

Single Stage Pump Multi Stage Pump Submersible Pump Seal Less & Circular Pump Axial & Mixed Flow Pump

By Material:

Cast Iron Bronze Stainless Steel

By Application:

Agriculture Oil & Gas Water & Wastewater Power Generation Chemical Industry Mining & Metals In January 2023, Xylem Inc. finalized an agreement for the acquisition of Evoqua, a prominent player in providing mission-critical water treatment solutions and services. This strategic partnership aims to enhance Xylem's capabilities in addressing the evolving demands of the water treatment industry.

Avail Limited Period Offer /Discount on Immediate purchase @ https://introspectivemarketresearch.com/discount/14001?utm_source=Yayati_LinkeWire

Industrial Centrifugal Pump Market Trend Analysis: Growing Demand from The Agricultural Industry , Expansion in Water and Wastewater Treatment

Key Industry Developments in the Industrial Centrifugal Pump Market:

In January 2023, Xylem Inc. finalized an agreement for the acquisition of Evoqua, a prominent player in providing mission-critical water treatment solutions and services. This strategic partnership aims to enhance Xylem's capabilities in addressing the evolving demands of the water treatment industry.

Geographically, the distinctive analysis of consumption, revenue, market share, and growth rate of the subsequent areas:

North America (U.S., Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Have a query? Industrial Centrifugal Pump Market an enquiry before purchase @ https://introspectivemarketresearch.com/inquiry/14001?utm_source=Yayati_LinkeWire

Why Invest in this Industrial Centrifugal Pump Market Report?

➠Leverage Data for Strategic Decision-Making: Utilize detailed market data to make informed business decisions and uncover new opportunities for growth and innovation.

➠Craft Expansion Strategies for Diverse Markets: Develop effective expansion strategies tailored to various market segments, ensuring comprehensive coverage and targeted growth.

➠Conduct Comprehensive Competitor Analysis: Perform in-depth analyses of competitors to understand their market positioning, strategies, and operational strengths and weaknesses.

➠Gain Insight into Competitors' Financial Metrics: Acquire detailed insights into competitors' financial performance, including sales, revenue, and profitability metrics.

➠Benchmark Against Key Competitors: Use benchmarking to compare your business's performance against leading competitors, identifying areas for improvement and potential competitive advantages.

➠Formulate Region-Specific Growth Strategies: Develop geographically tailored strategies to capitalize on local market conditions and consumer preferences, driving targeted business growth in key regions. Check it Out Complete Details of Report @ https://introspectivemarketresearch.com/reports/industrial-centrifugal-pump-market/

Strategic Points Covered in Table of Content of Industrial Centrifugal Pump Market: Chapter One: IntroductionChapter Two: Executive Summary Chapter Three: Industrial Centrifugal Pump Market Landscape Chapter Four: Industrial Centrifugal Pump Market by Type Chapter Five: Industrial Centrifugal Pump Market by Application Chapter Six: Company Profiles and Competitive Analysis Chapter Seven: Global Industrial Centrifugal Pump Market by Region Chapter Eight: Analyst Viewpoint and Conclusion Chapter Nine: Research Methodology

Buy Latest Edition of Market Study Now @ https://introspectivemarketresearch.com/checkout/?user=1&_sid=14001?utm_source=Yayati_LinkeWire

About us: At Introspective Market Research Private Limited, we are a forward-thinking research consulting firm committed to driving our clients' growth and market dominance. Leveraging cutting-edge technology, big data, and advanced analytics, we provide deep insights and strategic solutions that enable our clients to stay ahead in a competitive landscape. Our expertise spans across comprehensive Market Research Reports, Holistic Market Insights, Macro-Economic Analysis, and tailored Go-to-Market (GTM) Strategies. Through our Consulting Services and AI-Driven Solutions, we empower businesses to navigate challenges and achieve their objectives. Additionally, we offer Product Design and Prototyping support and Flexible Staffing Solutions to meet evolving industry demands. Our IMR Knowledge Cluster ensures continuous learning and innovation, guiding our clients toward sustainable success.

Contact us:

Vishwanath K (PR & Marketing Manager) Introspective Market Research Private Limited Phone: +91-81800-96367 / +91-7410103736 Email: [email protected] Web: www.introspectivemarketresearch.com

#Industrial Centrifugal Pump Market#Industrial Centrifugal Pump Market Size#Industrial Centrifugal Pump Market Share#Industrial Centrifugal Pump Market Growth#Industrial Centrifugal Pump Market Trends#Industrial Centrifugal Pump Market Forecast Analysis

0 notes

Link

0 notes

Text

U.S. Ammonium Nitrate Prices, News, Trend, Graph, Chart and Forecast

Ammonium Nitrate prices have been subject to significant fluctuations due to various market dynamics, including supply chain disruptions, geopolitical tensions, raw material costs, and global demand patterns. This widely used chemical compound, essential for fertilizers and explosives, has witnessed price volatility in recent years, driven by shifts in energy prices, transportation costs, and government regulations. The market for ammonium nitrate is highly influenced by the agricultural and mining sectors, where it plays a crucial role in enhancing crop yields and supporting industrial blasting operations.

One of the primary drivers of ammonium nitrate prices is the cost of raw materials, particularly ammonia and nitric acid. These feedstocks are closely linked to natural gas prices, which means that any significant movement in energy markets directly impacts production costs. The volatility of natural gas prices due to supply constraints, geopolitical conflicts, and weather conditions has led to frequent fluctuations in ammonium nitrate pricing. Additionally, regulatory policies in major producing regions, such as environmental restrictions on nitrogen-based fertilizers, have further influenced production capacities and pricing trends.

Get Real time Prices for Ammonium Nitrate: https://www.chemanalyst.com/Pricing-data/ammonium-nitrate-1216

Global supply chain disruptions have also contributed to ammonium nitrate price changes, especially in the wake of the COVID-19 pandemic. Logistical bottlenecks, port congestion, and labor shortages have affected the timely delivery of fertilizers and chemicals, leading to higher transportation costs. Freight charges, particularly for shipments between major exporting and importing nations, have played a crucial role in determining regional price variations. Countries that rely heavily on imports for ammonium nitrate have faced price spikes due to supply uncertainties and limited availability from key exporting regions.

Demand for ammonium nitrate has been another critical factor impacting prices. The agricultural sector, which accounts for a significant portion of global consumption, has witnessed varying demand patterns based on seasonal crop cycles, weather conditions, and shifts in farming practices. Rising global food demand and government initiatives promoting efficient fertilization methods have contributed to stable consumption levels, supporting price trends. Similarly, the mining and construction industries, which utilize ammonium nitrate for explosives, have experienced cyclical demand changes influenced by infrastructure projects, commodity prices, and industrial activity.

Geopolitical factors have played a substantial role in shaping ammonium nitrate price trends. Trade restrictions, sanctions, and export bans imposed by major producing countries have disrupted supply chains and caused market imbalances. For instance, policies affecting the export of nitrogen-based fertilizers from key producers such as Russia, China, and the European Union have led to price fluctuations worldwide. Political instability in certain regions has also affected production facilities, leading to temporary supply shortages and price spikes in affected markets.

Environmental regulations and sustainability concerns have further influenced ammonium nitrate market trends. Governments worldwide have implemented stricter guidelines on nitrogen fertilizer usage to reduce environmental impact, leading to shifts in production methods and alternative formulations. The push towards sustainable agriculture and the adoption of controlled-release fertilizers have altered demand dynamics, impacting pricing strategies among manufacturers and suppliers. Compliance costs associated with regulatory measures have also contributed to overall price increases, as producers invest in cleaner technologies and efficient production processes.

Regional variations in ammonium nitrate prices are evident due to differences in production capacities, import dependencies, and local market conditions. North America, a key market with substantial domestic production, has experienced price fluctuations based on energy costs and demand-supply balances. Europe, on the other hand, has faced challenges due to stringent environmental policies and reliance on imports, leading to price variations across different countries. In Asia-Pacific, strong agricultural demand and industrial activities have driven market growth, with price movements reflecting local economic conditions and government policies. Latin America and Africa, where agricultural sectors are expanding, have also seen price shifts influenced by global supply trends and domestic market factors.

Seasonal trends significantly affect ammonium nitrate pricing, as fertilizer application cycles align with planting and harvesting periods in different regions. Prices typically rise during peak demand seasons when farmers procure fertilizers in large quantities. Weather-related disruptions, such as droughts or excessive rainfall, can alter demand patterns and impact pricing. Additionally, production shutdowns or maintenance activities at manufacturing plants during certain periods contribute to supply constraints, influencing price trends in specific markets.

The outlook for ammonium nitrate prices remains dynamic, with several factors expected to shape market movements in the coming years. Continued volatility in energy markets, regulatory changes, and shifting demand patterns will play a crucial role in determining price trends. Advancements in production technologies, alternative fertilizer developments, and sustainability initiatives are likely to influence long-term pricing strategies. Additionally, geopolitical developments and trade policies will continue to impact supply chains, making price forecasting a complex task.

Amid these market uncertainties, industry stakeholders, including manufacturers, distributors, and end-users, are adopting strategies to mitigate price risks. Diversifying supply sources, securing long-term contracts, and investing in production efficiency improvements are key approaches being implemented. Governments and organizations are also emphasizing research and innovation in nitrogen fertilizers to enhance sustainability and reduce dependence on conventional ammonium nitrate products.

The global ammonium nitrate market remains highly interconnected, with price trends influenced by a combination of economic, political, and environmental factors. As industries reliant on ammonium nitrate navigate evolving market conditions, staying informed about price movements and regulatory changes will be crucial for decision-making. The ongoing developments in agricultural practices, industrial applications, and sustainability initiatives will continue to shape the market landscape, making ammonium nitrate pricing a critical area of focus for businesses and policymakers alike.

Get Real time Prices for Ammonium Nitrate: https://www.chemanalyst.com/Pricing-data/ammonium-nitrate-1216

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Ammonium Nitrate Pricing#Ammonium Nitrate News#India#united kingdom#united states#Germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

Future of the Industrial Lubricants Market: Innovations & Trends

Industrial Lubricants Market: Trends, Industry Analysis, Growth Factors

The Industrial Lubricants Market is expected to reach a value of USD 55.34 billion in 2023 and, with a linear growth pattern, reach USD 75.68 billion by 2033, with a compound annual growth rate (CAGR) of 3.8% from 2024 to 2033.

The Industrial Lubricants Market plays a vital role in various industries, ensuring the smooth operation of machinery and equipment. These lubricants help reduce friction, wear and tear, and overheating, thereby enhancing the efficiency and lifespan of industrial components. As industries continue to expand, the Industrial Lubricants Market Size is projected to grow steadily. This article provides an in-depth Industrial Lubricants Market Analysis, covering key trends, growth factors, challenges, and future opportunities.

Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/industrial-lubricants-market/1356

Industrial Lubricants Market Segments

Market, By Type

Mineral oils

Synthetic oils

Bio-based oils

Market, By Application

Manufacturing

Transportation

Energy

Mining and construction

Food and beverage

Pharmaceutical

Others

Market, By Product

General industrial oils

Process oils

Metalworking fluids

Industrial engine oils

Industrial greases

Industrial Lubricants Market Trends and Analysis

Growing Demand for High-Performance Lubricants

One of the significant Industrial Lubricants Market Trends is the increasing demand for high-performance lubricants. These advanced lubricants offer superior protection, longer operational life, and enhanced efficiency in extreme conditions.

Expansion of the Manufacturing Sector

The rapid expansion of manufacturing industries worldwide is driving Industrial Lubricants Market Growth. As automation and heavy machinery usage increase, the need for efficient lubrication solutions is also rising.

Shift Towards Bio-Based Lubricants

Environmental concerns and regulatory pressures are encouraging industries to adopt eco-friendly alternatives. The rise of bio-based industrial lubricants is one of the major Industrial Lubricants Market Trends, reducing the carbon footprint while maintaining performance.

Digitalization and Smart Lubrication Systems

The integration of IoT and AI in lubrication systems is enhancing predictive maintenance. Smart lubricants and automated monitoring systems help industries optimize lubrication schedules, minimizing downtime and improving efficiency.

Industrial Lubricants Market Growth Factors

Increasing Industrialization and Urbanization

Rapid industrialization, especially in emerging economies, is driving the demand for lubricants. The growth of construction, automotive, and manufacturing industries directly contributes to Industrial Lubricants Market Growth.

Rising Demand from the Automotive Industry

The automotive sector is a major consumer of industrial lubricants. With increasing vehicle production and technological advancements, the demand for specialized lubricants is expected to rise.

Growing Energy and Power Sector

Industrial lubricants are essential in power generation, including wind, hydro, and thermal energy plants. The rising global energy demand is boosting Industrial Lubricants Market Potential.

Advancements in Lubricant Formulations

Ongoing research and development in synthetic and bio-based lubricants are leading to innovative products that enhance machinery efficiency, extend maintenance cycles, and reduce operational costs.

Key Companies in the Industrial Lubricants Market

ExxonMobil Corp

Fuchs Group

The Lubrizol Corporation

Royal Dutch Shell

Phillips 66

Lucas Oil Products, Inc.

Amsoil, Inc.

Bel-Ray Co., Inc.

Total S.A.

Kluber Lubrication

Valvoline International, Inc.

Chevron Corp.

Clariant

Quaker Chemical Corp.

Houghton International, Inc.

Castrol

Blaser Swisslube, Inc.

Calumet Specialty Products Partners, L.P.

Petronas Lubricant International

Idemitsu Kosan Co., Ltd.

Yushiro Chemical Industry Co., Ltd.

Key Points of the Industrial Lubricants Market Report

Comprehensive Industrial Lubricants Market Analysis covering trends, size, share, and forecast

Market segmentation based on product type, end-use industry, and application

Regional insights covering North America, Europe, Asia-Pacific, and Latin America

Key market players, competitive landscape, and strategic developments

Impact of regulations and environmental policies on the market

Benefits of This Report

Provides accurate Industrial Lubricants Market Forecast

Identifies key market drivers and challenges

Offers strategic insights for businesses and investors

Analyzes competitive landscape and key players in the industry

Helps stakeholders understand future market potential

Challenges in the Industrial Lubricants Market

Fluctuating Raw Material Prices

The Industrial Lubricants Market Price is influenced by the cost of raw materials such as base oils and additives. Price volatility poses challenges for manufacturers and consumers alike.

Stringent Environmental Regulations

Governments worldwide are implementing strict regulations regarding the use and disposal of industrial lubricants. Compliance with these regulations requires significant investments in research and development.

Increasing Competition from Alternative Technologies

The rise of self-lubricating materials and advanced coatings is posing a potential threat to the demand for traditional industrial lubricants.

Supply Chain Disruptions

Geopolitical tensions, trade restrictions, and global economic fluctuations can disrupt the supply chain, affecting Industrial Lubricants Market Share and availability.

Frequently Asked Questions (FAQs)

Q1: What is the current Industrial Lubricants Market Size?

Q2: Which industries drive Industrial Lubricants Market Growth?

Q3: What are the major Industrial Lubricants Market Trends?

Q4: How do environmental regulations impact the market?

Q5: What is the future Industrial Lubricants Market Forecast?

Related New Updated Research Report:

Antimicrobial-Coatings-Market

https://medium.com/@priteshwemarketresearch/antimicrobial-coatings-market-analysis-type-size-trends-key-players-and-forecast-2024-to-2034-f644d5e8f094

Heat-Transfer-Fluids-Market

https://medium.com/@priteshwemarketresearch/heat-transfer-fluids-market-industry-trends-and-forecast-to-2033-f6e6da647626

Global-Nanocomposites-Market

https://medium.com/@priteshwemarketresearch/global-nanocomposites-market-latest-trends-and-analysis-future-growth-study-by-2034-374bc36be5d6

Global-Green-Solvent-Market

https://medium.com/@priteshwemarketresearch/global-green-solvent-market-growth-trends-analysis-and-dynamic-demand-forecast-2024-to-2034-6cf30e39c8de

Industrial Lubricants Market:

https://wemarketresearch.com/reports/industrial-lubricants-market/1356

3D Printing Materials Market:

https://wemarketresearch.com/reports/3d-printing-materials-market/1338

Conclusion

The Industrial Lubricants Market is poised for significant growth, fueled by technological advancements, increasing industrialization, and rising demand from key industries. While Industrial Lubricants Market Challenges such as regulatory restrictions and raw material price fluctuations exist, the industry offers substantial opportunities for innovation and expansion.

#Industrial lubricants#Industrial lubricants Market#Industrial lubricants Market Scope#Industrial lubricants Market Growth#Industrial lubricants Market Overview#Industrial lubricants Market Size#Industrial lubricants Market Insight#Industrial lubricants Market Trends#Industrial lubricants Market Share#Industrial lubricants Market Industry Analysis

0 notes

Text

Mining Chemicals Market: Innovations Driving Safety and Environmental Compliance

Mining chemicals are essential substances used in the extraction and processing of minerals and ores in the mining industry. These chemicals play a crucial role in various stages of mining operations, from ore extraction to mineral processing and waste management. The mining chemicals market encompasses a wide range of products designed to enhance the efficiency and productivity of mining processes.

The mining chemicals market is characterized by its significant contribution to the global mining industry's growth. As the demand for minerals and metals continues to rise, mining companies are constantly seeking ways to optimize their operations and improve the recovery rates of valuable minerals. Mining chemicals aid in achieving these objectives by facilitating the separation of minerals from ores and reducing the environmental impact of mining activities.

In recent years, the mining chemicals industry has witnessed steady growth due to the expansion of mining activities worldwide. The increasing demand for metals and minerals in sectors such as construction, electronics, and automotive has driven the need for more efficient mining processes, thus boosting the demand for mining chemicals. Additionally, stricter environmental regulations have prompted mining companies to adopt sustainable and eco-friendly chemical solutions to minimize their ecological footprint.

The mining chemicals market is highly diverse, comprising various product categories such as grinding aids, flotation reagents, solvent extractants, and water treatment chemicals. These chemicals are tailored to specific mining processes and ore types, addressing the unique challenges faced by different mining operations. Manufacturers in the mining chemicals industry continually innovate and develop new formulations to meet the evolving needs of the mining sector.

The mining chemicals market trends are the increasing emphasis on safety and sustainability. Mining companies are now actively seeking chemicals that not only enhance their operational efficiency but also minimize environmental impact and ensure the safety of their workforce. This shift towards sustainable mining practices is expected to drive the adoption of eco-friendly and biodegradable mining chemicals in the coming years.

In conclusion, the mining chemicals market plays a pivotal role in the global mining industry by facilitating efficient ore extraction and mineral processing. As mining activities continue to expand to meet the growing demand for minerals and metals, the market for mining chemicals is expected to witness sustained growth. Moreover, the industry's focus on sustainability and safety is likely to drive innovation and further shape the future of mining chemicals.

0 notes

Link

0 notes

Text

Global Polyurethane Prepolymer (PPU) Market Trends Analysis 2025-2031

This report is a detailed and comprehensive analysis for global Polyurethane Prepolymer (PPU) market. Both quantitative and qualitative analyses are presented by manufacturers, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2025, are provided. Global Info Research’s report on the Global Polyurethane Prepolymer (PPU) Market offers profound understanding of the market's structure, dynamics, and prevalent trends. This report offer a contemporary snapshot of the market's current size and its potential for growth in the future. The report pinpoints the key competitors within the market, their respective market shares, and the emerging opportunities they can capitalize on. Additionally, the report delves into the impact of technological advancements on the market and how these can be harnessed for competitive advantage. Market segment by Type: TDI Polyurethane Prepolymer、MDI Polyurethane Prepolymer、Others Market segment by Application:Automobile Industry、Construction Industry、Electronics Industry、Machinery Manufacturing、Mining、Printing Industry、Steel Industry、Garment Industry、Oil Industry、Others Major players covered: LANXESS、Taiwan PU Corporation、Exceed Fine Chemicals、BASF、Witton、TSE Industries、Northstar Polymers、Capital Resin Corporation、DKS、Covestro AG、Dow、Isothane、Mitsui Chemicals、Tosoh Corporation、SAPICI S.p.A、Startec、Huatian Rubber & Plastics、Shanghai Yoe、Qianmeite Polyurethane New Material Co., Ltd.、Hanmats Polyurethane、INOV、DEPONT

Moreover, the report provides a comprehensive analysis of the significant drivers, challenges, and opportunities within the Polyurethane Prepolymer (PPU) Market. It takes into consideration the macroeconomic factors and regulatory frameworks prevailing in each region encompassed by the market. A thorough examination of the industry's supply chain is also conducted to identify key players and assess the influence of recent developments on their market positioning. The report offers a clear perspective on how to leverage the evolving market conditions for maximum gain.

The report on the Global Polyurethane Prepolymer (PPU) Market meticulously scrutinizes the competitive landscape, offering valuable insights for market participants. The report identifies and appraises the leading players, providing a holistic view of their market presence and strategies.

Through meticulous analysis, we identify market leaders, challengers, and niche players, evaluating them based on factors such as market share, product offerings, and recent developments. This comprehensive understanding enables businesses to gain a deeper insight into their competitive positioning within the industry.

To provide a comprehensive overview of the Global Polyurethane Prepolymer (PPU) Market, Global Info Research adopts a segmentation approach and also categorizes the market into distinct segments, considering various criteria like product types, geographical regions, and consumer demographics.

By closely examining each segment, we reveal specific trends, growth potential, and challenges. This segmented analysis allows businesses to tailor their strategies to meet the unique needs of different market segments, thereby enhancing their competitive edge. Our segmentation analysis serves as a strategic tool, guiding market participants in navigating the complexities of the Global Polyurethane Prepolymer (PPU) Market effectively.

The content of the study subjects, includes a total of 13 chapters: Chapter 1, to describe Polyurethane Prepolymer (PPU) product scope, market overview, market estimation caveats and base year. Chapter 2, to profile the top players of Polyurethane Prepolymer (PPU), with revenue, gross margin and global market share of Polyurethane Prepolymer (PPU) from 2020 to 2025. Chapter 3, the Polyurethane Prepolymer (PPU) competitive situation, revenue and global market share of top players are analyzed emphatically by landscape contrast. Chapter 4 and 5, to segment the market size by Type and application, with consumption value and growth rate by Type, application, from 2020 to 2031. Chapter 6, 7, 8, 9, and 10, to break the market size data at the country level, with revenue and market share for key countries in the world, from 2020 to 2025.and Polyurethane Prepolymer (PPU) market forecast, by regions, type and sales channel, with consumption value, from 2026 to 2031. Chapter 11, market dynamics, drivers, restraints, trends and Porters Five Forces analysis. Chapter 12, the key raw materials and key suppliers, and industry chain of Polyurethane Prepolymer (PPU). Chapter 13, to describe Polyurethane Prepolymer (PPU) research findings and conclusion.

Reasons for Acquiring This Report:

The conducted research offers valuable insights to top executives, policymakers, industry professionals, product developers, sales managers, and stakeholders within the Global Polyurethane Prepolymer (PPU)market. The report presents a comprehensive analysis of the market, enabling companies to assess their market share, analyze projections, and identify new growth opportunities. The report provides detailed revenue data for the Global Polyurethane Prepolymer (PPU)market at the global, regional, and country levels. This comprehensive analysis covers the period up to 2031, allowing companies to make informed decisions based on market trends and projections. The research divides the Global Polyurethane Prepolymer (PPU)market into various segments based on type, application, technology, and end-use. This segmentation offers a clear understanding of each segment's growth potential, enabling leaders to plan their product development and financial strategies accordingly. Investors can benefit from the Global Polyurethane Prepolymer (PPU)market analysis by gaining insights into the market's scope, position, key drivers, challenges, restraints, expansion opportunities, and potential threats. This information helps investors make informed decisions when allocating funds. The report provides a detailed analysis of competition within the Global Polyurethane Prepolymer (PPU)market, including key strategies employed by competitors. This analysis helps businesses understand their competitors better, enabling them to plan their market positioning effectively. The study evaluates business predictions for the Global Polyurethane Prepolymer (PPU) market based on region, key countries, and leading companies. This information assists investors in channeling their investments strategically, targeting areas with the highest growth potential.

Global Info Research is a company that digs deep into global industry information to support enterprises with market strategies and in-depth market development analysis reports. We provides market information consulting services in the global region to support enterprise strategic planning and official information reporting, and focuses on customized research, management consulting, IPO consulting, industry chain research, database and top industry services. At the same time, Global Info Research is also a report publisher, a customer and an interest-based suppliers, and is trusted by more than 30,000 companies around the world. We will always carry out all aspects of our business with excellent expertise and experience.

0 notes

Text

Biotech Ingredients Market Analysis: Key Challenges and Opportunities

Growing Adoption of Sustainable and Innovative Solutions Drives Growth in the Biotech Ingredients Market.

The Biotech Ingredients Market size was valued at USD 2.2 billion in 2023 and is expected to reach USD 4.3 billion by 2032 and grow at a CAGR of 7.8% over the forecast period 2024-2032.

The Biotech Ingredients Market is experiencing rapid growth as industries increasingly shift toward sustainable, high-performance, and bio-based alternatives. Biotech ingredients, derived from microbial fermentation, plant cell culture, and enzyme technology, are revolutionizing sectors such as cosmetics, pharmaceuticals, food & beverages, and personal care. With a strong emphasis on eco-friendliness, reduced carbon footprint, and enhanced efficacy, biotech ingredients are gaining widespread adoption across the globe.

Key Players in the Biotech Ingredients Market

BASF SE (Lecithin, Enzymes)

Cargill, Incorporated (Soy Protein, Lactic Acid)

DuPont de Nemours, Inc. (Proteins, Enzymes)

Evonik Industries AG (Amino Acids, Biopolymers)

Genomatica, Inc. (Bio-BDO, Bio-1,4-Butanediol)

DSM (Dutch State Mines) (Amino Acids, Enzymes)

Novozymes A/S (Cellulases, Amylases)

Roche Holding AG (Biopharmaceuticals, Diagnostic Reagents)

SABIC (Saudi Basic Industries Corporation) (Biodegradable Polymers, Bio-based Chemicals)

Syngenta AG (Biofungicides, Bioinsecticides)

These companies are investing heavily in biotechnology, fermentation processes, and sustainable ingredient development to meet the rising consumer demand for natural and clean-label products.

Future Scope and Emerging Trends

The Biotech Ingredients Market is poised for substantial growth, driven by the expanding applications in cosmetics, pharmaceuticals, and food technology. The rising preference for plant-based, cruelty-free, and sustainable alternatives is accelerating demand for biotech-derived fragrances, active skincare compounds, and pharmaceutical excipients.

Advancements in synthetic biology, enzyme engineering, and microbial fermentation are enabling the production of high-purity, effective, and eco-friendly ingredients that replace conventional chemical-based counterparts. Additionally, biotech innovations are helping reduce dependency on petrochemicals and promote circular economy initiatives by utilizing waste-to-value strategies.

Key Market Points:

✅ Growing Demand for Bio-Based & Sustainable Ingredients: Increased focus on eco-friendly, non-toxic, and renewable resources. ✅ Expanding Applications: Biotech ingredients are widely used in cosmetics, fragrances, food flavors, nutraceuticals, and pharmaceuticals. ✅ Advancements in Fermentation & Synthetic Biology: Cutting-edge technology enables the production of high-quality biotech actives. ✅ Rise in Clean Beauty & Green Chemistry: Consumers prefer non-GMO, natural, and biodegradable ingredients. ✅ Regulatory Support & Green Initiatives: Government policies promoting bio-based innovations and sustainability are boosting market growth. ✅ Personalized & Functional Ingredients: The emergence of customized biotech ingredients for targeted skincare and health benefits.

Conclusion

The Biotech Ingredients Market is set for strong expansion, fueled by sustainable innovations, regulatory support, and rising consumer demand for ethical and effective products. Companies focusing on biotech-driven ingredient solutions, fermentation-based production, and clean-label formulations are well-positioned to lead the next phase of industry transformation.

Read Full Report: https://www.snsinsider.com/reports/biotech-ingredients-market-4593

Contact Us:

Jagney Dave — Vice President of Client Engagement

Phone: +1–315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Biotech Ingredients Market#Biotech Ingredients Market Size#Biotech Ingredients Market Share#Biotech Ingredients Market Report#Biotech Ingredients Market Forecast

0 notes

Text

Europe Heat Shrink Tubing Market Key Players, Growth, Trends, Share, Opportunities, Forecast 2028

The Europe heat shrink tubing market is expected to grow from US$ 461.17 million in 2023 to US$ 648.67 million by 2028. It is estimated to grow at a CAGR of 5.9% from 2023 to 2028.

Increasing Demand from Automotive Industry Drive Europe Heat Shrink Tubing Market

The governments of various economies have come up with several schemes to improve the transmission and distribution infrastructure, enhance operational efficiency, and reduce transmission losses. Heat shrink tubing is widely used in low- and medium-voltage transmission and distribution for insulation protection to protect all the functional parts, components, harnesses, and systems of a transmission and distribution grid.

📚 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐂𝐨𝐩𝐲@ https://www.businessmarketinsights.com/sample/BMIRE00029324

Furthermore, ~50% of the underground power distribution system comprises installations of old paper-insulated cables. Routine maintenance and greater electrical or mechanical stress imposed on these aged systems while adding new connections will lead to cable insulation’s deterioration. In such scenarios, transition joints insulated with heat shrinking tubes help in connecting the earlier and newer cables. Additionally, bus bars are the vital components of any power distribution system and are critical component while transmitting large load currents or distributing current to varied devices. Hence, several protective shields, including heat shrinking tubing, are widely used to protect bus bar connections.

📚𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐋𝐢𝐧𝐤 @ https://www.businessmarketinsights.com/reports/europe-heat-shrink-tubing-market

𝐓𝐡𝐞 𝐋𝐢𝐬𝐭 𝐨𝐟 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬

3M Co

HellermannTyton Ltd

Molex LLC

Sumitomo Electric Industries Ltd

TE Connectivity Ltd

Zeus Industrial Products Inc

Segmentation by End User:

Utilities:

This segment held the largest market share in 2023.

The utilities sector relies heavily on heat shrink tubing for electrical insulation and protection in power distribution and transmission systems.

This includes the maintenance and building of the power grid.

Energy:

This segment is further segmented into renewable and non-renewable energy.

Renewable Energy: The growth of solar and wind energy is driving the demand for heat shrink tubing in renewable energy installations.

Non-Renewable Energy: Heat shrink tubing is also used in traditional energy sectors, such as oil and gas.

Electrical Power:

This segment includes applications in power generation, transmission, and distribution.

Infrastructure/Building Construction:

Heat shrink tubing is used for electrical wiring and cable protection in buildings and infrastructure projects.

Industrial:

This segment encompasses a wide range of industrial applications, including manufacturing, automation, and robotics.

Telecommunication:

The expansion of telecommunications infrastructure, including 5G networks, is driving the demand for heat shrink tubing.

Automotive:

The automotive industry, particularly the electric vehicle sector, is a significant consumer of heat shrink tubing.

Aerospace:

The aerospace industry requires high-performance heat shrink tubing for demanding applications.

Defense: