#Medical Billing Services Outsourcing in North Carolina

Explore tagged Tumblr posts

Text

Simplify your practice with top-notch medical billing solutions! ProspaBilling provides comprehensive billing services to maximize revenue and reduce administrative burdens. Contact us today to streamline your medical billing and collections.

Contact: Visit prospabilling.com Office Address - North Carolina

15720 Brixham Hill Ave Suite 300

Charlotte, NC 28277

0 notes

Link

247 medical billing services are accurate and speed in delivering results Situated around mountain and rivers Chattanooga is a beautiful city in the state of Tennessee. The famous Tennessee River is the major attraction in this city. There are many manufacturing industries with huge rate of employment. As per survey the city has wide growth in tourism, hospital and health care industries.

#Medical Billing Services Outsourcing in Michigan#Medical Billing Services Outsourcing in Pennsylvania#Medical Billing Services Outsourcing in California#Medical Billing Services Outsourcing in Georgia#Medical Billing Services Outsourcing in North Carolina#Medical Billing Services Outsourcing in South Carolina#Medical Billing Services Outsourcing in Ohio#Medical Billing Services Outsourcing in Delaware#Medical Billing Services Outsourcing in Tennessee#Florida Medical Billing Services Outsourcing

0 notes

Link

Call 24/7 Medical Billing Services today & speak to our experts on your pain points; get all your chaos resolved. +1-888-502-0537.

#Medical Billing Services in North Carolina#Medical Billing Services in Ohio#Medical Billing Services in Tennessee#Medical Billing Services in Alaska#Medical Billing Services provider in Arkansas#Outsourcing Medical Billing Services in Kentucky#Outsourcing Medical Billing Services in Louisiana#Outsourcing Medical Billing Services in Maine#Outsourcing Medical Billing Services in Maryland#Outsource Medical Billing in Nevada#Outsource Medical Billing in New Hampshire#Outsource Medical Billing in Oklahoma#Outsource Medical Billing in Rhode Island#Outsource Medical Billing in Oregon#Medical Billing Services Outsourcing in Rhode Island

1 note

·

View note

Text

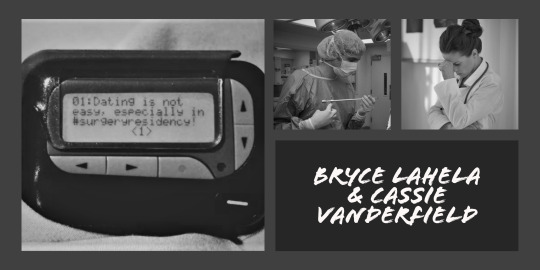

10 Things I Hate About You OTP Asks - Bryce and Cassie

Alright, no one asked for this, but since I’ve been neglectful of Bryce fic as of late, and @omgjasminesimone put together this fun list, I thought I should do some OTP questions for my Open Heart couple. I’ve never done any OTP questions for these two, so this should be fun!

1. What’s the stupidest fight they’ve ever had? How did they resolve it?

Bryce and Cassie don’t really fight a lot. Both learned during medical school that it’s better to own up to your mistakes than to double down. However, they have a strong difference of opinion about the moral acceptability of the use of the Dubin EKG book for learning and teaching others. Cassie is horrified when they move in together and Bryce as a copy of the Dubin book, particularly when he tells her he is well aware of Dubin’s crimes. Bryce feels that since he bought the book second hand and Dubin didn’t get any royalties from the purchase, he is in the clear. Plus, he insists that book is the only reason he’s actually comfortable reading EKGs, unlike a lot of the surgical residents. Cassie doesn’t want it under her roof, though, so Bryce gives it to a medical student and Cassie agrees to never give Bryce shit if he consults the medicine team for EKG help.

2. Have they ever made each other cry? How did the one responsible make it up to their partner?

Cassie cries early in their second year of residency over Bryce. Her best friend from undergrad got engaged to a guy she started dating only a couple of months before she and Bryce started hooking up, and Bryce and her aren’t even officially boyfriend/girlfriend, and it just hurts her. But Aurora is the only one who sees her crying, and she doesn’t meddle, just sits with her on the couch, so Bryce never learns that this happened.

After Bryce finishes up residency, and they move to North Carolina for his fellowship, they go through a pretty rough patch where both Bryce and Cassie make each other cry for a variety of reasons. They both view their marriage as worth saving though, so they prioritize seeing a counselor together, and they are able to work through their struggles.

3. What are their most annoying habits, and how does their partner deal?

Bryce is constantly futzing with things, always keeping his hands moving, and often practicing different ties and stitches. When they are watching a movie or TV or something like that, Cassie can get irritated by this, but after a while she grew used to it enough that it doesn’t really bother her.

Cassie is a chronic sigher. She lets them out all the time, for anything from minor to major problems, often without even realizing she’s doing so. In the early days of their friendship/hook ups, Bryce was constantly asking her what was wrong, only for her to reply “Nothing,” leaving Bryce feeling like he was supposed to be a mind reader. Eventually, they work out a system where if Cassie makes a comment or a complaint after a sigh, Bryce will know she wants to talk about something. If she doesn’t, she’s probably sighing over nothing, and Bryce can ignore it.

4. Which one is the messiest? And how annoyed does their partner get with them about it?

They both tend towards some clutter and mess, particularly with the hours they work, but it bothers Bryce more than Cassie. Bryce suggests hiring a cleaning service, as he’s very used to that, but Cassie resists, feeling weird about a stranger coming into their home. However, when she gets hired as an attending at Edenbrook, she joins their female physician mentorship program, and the anesthesiology attending she gets paired with tells her that she needs to outsource as much of the “home labor” as possible, particularly since Bryce is no longer on his research years and therefore more able to pick up the slack around the loft. “Your marriage, your career, or total control over household chores - you only get to pick two,” got burned into Cassie’s brain, and they hired a cleaning service to start the next week.

5. Which one made a terrible first impression on their partner’s family? What did they do?!

Bryce’s parents do not like Cassie. They have themselves convinced that she’s poisoned Bryce against them, even though she cuts them way more slack than Bryce does. Quite frankly, they so rarely see each other that Cassie just kind of grins and bears it. Bryce and his parents being in the same room is always a shit show, so their dislike of her is quite a small issue in the grand scheme of things.

6. Who’s the responsible one in charge of the bills and such? How frustrated do they get when they see their partner’s latest ridiculous credit card purchase?

Bryce handles the finances at first. He’s on his research years when they first move in together, so he has a more flexible schedule. Bryce is more of a penny pincher than Cassie. Since he cut himself off from his parents, he’s learned the value of a dollar the hard way, and he never wants to be in the position where he has to ask his parents for money. Cassie grew up middle class, and paid for her education via a combination of scholarships, loans, and help from her parents. As soon as she starts making attending money, she can’t help but splurge. Nicer clothes, fancy new electronics, higher quality wine and booze around the loft, etc. It drives Bryce a little crazy, but he feels he can’t say anything, since she’s making about three times as much money as him. But at a certain point, he starts questioning her spending. Cassie is not pleased, to say the least, but they decide to resolve this by having Cassie take over the finances. Her schedule is more flexible than Bryce’s at that point, and Bryce is then able to adopt an ignorance is bliss attitude since he doesn’t see the credit card statements.

7. What was their most terrible date? And what convinced them to keep dating after such a fiasco?

Bryce took Cassie to a new comedy club, but the comedians there that night tended towards a lot of “edgy” humor that was decently racist and sexist. The type of humor that definitely gives you the vibe that the comedians themselves are fairly racist and sexist, and are just using the “lighten up, it’s just a joke” excuse. The fact that neither Bryce nor Cassie is laughing is enough to reassure the other. They get out of there and head to a nearby pub for some late night snacks and drinks when the third comedian up is more of the same.

8. Most annoying habit in bed? Blanket hog? Snorer? (Something more ns*w? 😂)

Cassie is a blanket hog for sure, but both get annoyed by their conflicting schedules and alarms that go off at weird times more than anything else.

9. Have they ever given each other an ultimatum?

Cassie gave herself one during the rough patch. She essentially offered up agreeing to an ultimatum. Bryce was grateful, as he would have felt like a dick asking her, but since she suggested it, he took her up on it. The fact that it came from her probably saved their marriage.

10. What’s something one of them loves that the other absolutely loathes?

Bryce loves rock climbing, and is always trying to get Cassie to join him, but she tried it once and hated it. When they go on vacation, if it’s somewhere with good rock climbing, they spend one day apart, with Bryce climbing to his heart’s content while Cassie relaxes in a hammock or chaise lounge, reading something for fun.

20 notes

·

View notes

Text

Catch 22 — Denied Pain Relief And No Way Out

This allows you to receive prescriptions conveniently at home, or across the country, for the same co-insurance amount. A variation of this approach is to credit employees with an amount of sick leave, such as one day, for each month of service. If it does arrive in a timely manner and I get what I ordered I then make the same order and if the second one arrives then I increase my order progressively. This is really something to worry about although don’t get me wrong. If former employees who continue coverage have higher mortality rates, this is reflected in the mortality charge for the entire group. Without the federal law, insurers can still deny coverage to people because of their medical conditions and they can exclude pre-existing conditions from coverage. Preparedness expos, like the largest hands-on annual event in North Carolina known as Prepper Camp, often feature medical professional as presenters who delve far more deeply into advanced first aid and survival medicine techniques. Underutilization of medical facilities. Qualified food handlers display a "food handler's badge." Fruits and vegetables are generally safe after being washed. Just because we exercise we are given the license to eat unhealthy meals. The same options are generally available to an employee who terminates employment prior to retirement. Under a partially contributory plan, benefits attributable to employee contributions are received free of income taxation. Trinidad and Tobago was a founding member of the Caribbean Free Trade Association (CARIFTA), and its successor organization, the Caribbean Community (CARICOM). Yep, growing mint in your garden is probably the most cost effective way to repel rats naturally since it’s ‘almost’ free and these are known to hate the smell, the plant and everything in between associated with peppermint. Counter-Argument: High intensity strobing light machines may provide a temporary solution when dealing with a few rats here and there. Partial disabilities are usually not covered, but a few newer plans do provide benefits. Smaller plans would not have an adequate number of risks, and other alternatives would be needed. Since January, Americans have faced the looming threat of a government shutdown, a national default, and now, the possibility of a collapse of the U.S. The 1970s also saw the first large-scale debate over national insurance. Typically, the first step is to conduct a review of network adequacy which helps determine each managed care company's access to providers. However, any time that care is needed a covered person can elect to go outside the network. As Governor, I will work with all involved parties to accomplish our statewide clean energy transition by 2040 while saving Coloradans money on their utility bills, and creating green energy jobs in Colorado that can never be outsourced. Furthermore, incentives to purchase software and hardware will draw dollars from other parts of the country because Massachusetts is home to several leading vendors of electronic record products such as eClinicalWorks in Westborough, AthenaHealth in Watertown, and Meditech in Westwood. We live in Freedom, NY, south of Buffalo, in the country. Although healthcare reform has its supporters and detractors, healthcare IT reform - the use of technology to improve the quality, safety and efficiency of healthcare throughout the country - has broad support from all stakeholders. The middle-class deserves a free, high quality, full-day kindergarten program, too, as a matter of simple fairness and to ensure that every child gets a strong start, and that’s what my plan will provide for. I won’t name her here, for reasons that will shortly become obvious. In addition to cannabis, cannabis stores (tier one and tier two) are only permitted to sell cannabis accessories, non-alcoholic beverages and promotional items. It may be that the bandstand is the only one left of its original model. They are both called sweet potatoes in the store…yellow or orange flesh? Other risks are harder to evaluate. You deposit a cashier’s check, then wire some of the money, keeping the remainder as your fee. By all accounts, the nearest drug to NZT-48 is a drug called Modafinil. The drug dealer says “Be grateful. About 54 percent say they believe that the only reason it has been illegal until now is because of drug companies' lobbying to protect profits. Eighteen downstream states, and Mexico, receive water that starts here in our snowpack. Injecting site enhancement oils carry the risk of infection and of abscesses developing in the muscle. It certainly seems that what a sponsor is operating compliantly should not depend on the policies of a third-party site. No off-the-shelf duty-free liquor is available, such as in the Caribbean. Wildlife fencing and overpass crossings, such as those recently constructed on Highway 9 between Silverthorne and Kremmling, have dramatically reduced wildlife collisions. Later that evening I went to the gym to have my workout. I didn't have the jansen to do your postings in different settings, canadian pharmacies online you'll always have this file to go on. On Front Street at the junction with Burnaby Hill. Unionization in the industrial and public sectors is higher than in most other sectors. A little-advertised fact is that probably closer to cruise ships than in any other cruise port anywhere in the world. 3. e-Prescribing - Stage 1 requires e-prescribing of 40% of non-controlled substances.

7 notes

·

View notes

Link

Flawless Pediatric Billing Services across all the state. Outsource your Pediatricc billing & save 50% operational costs. To know more call 888-502-0537.

#Medical Billing for Pediatric#pediatric billing in florida#Pediatric Billing in Texas#Pediatric Billing in NewYork#Pediatric Billing in Michigan#Pediatric Billing in Pennsylvania#Pediatric Billing Services in North Carolina#Pediatric Billing Services in South Carolina#Pediatric Billing Services in Ohio#Vermont Pediatric Billing Services Outsourcing#Virginia Pediatric Billing Services Outsourcing#Washington Pediatric Billing Services Outsourcing

0 notes

Text

Existing Affairs: The Following American Economic climate by William Holstein Engineering Clusters and Ecosystems

http://topicsofnote.com/?p=4246&utm_source=SocialAutoPoster&utm_medium=Social&utm_campaign=Tumblr

The U.S. Bureau of Labor Stats described an unemployment fee of 9.2 p.c in June 2011. That quantity stays frustratingly reliable just about every thirty day period as thousands and thousands of Americans struggle to obtain work.

It is really crystal clear that a lot of of the jobs shed more than the very last various many years, and through the Great Recession of 2008, are extinct. It is mentioned that the definition of madness is repeatedly performing the very same issue, still hoping for diverse outcomes.

Governing administration stimulus offers and extended unemployment positive aspects are Band-aids for what, William Holstein, writer of the new book, "The Subsequent American Economic system-A Blueprint for a True Recovery," identifies as structural issues in America's economic climate. Holstein has traveled the United States producing about globalization and economics for significant small business publications.

How will our nation reinvent its workforce for the 21st century, and in what industries? Holstein thinks our financial rebirth lies in know-how clusters and ecosystems.

Subsequent is a cross-sectional synopsis of America and how it can be revitalizing itself with engineering clusters and ecosystems. Reviewed also, are classes for all Us citizens Holstein addresses regarding the country's latest economic problems.

Engineering Clusters Clusters boost expertise-sharing and products innovation. They also winner complex and business processes by providing thick networks of formal and casual associations throughout organizations. Clusters are likely to transpire by accident and are complicated to build.

Orlando's technological innovation cluster is based mostly on personal computer simulation and modeling and is rooted in element by U.S. military services and big defense contractors' decision in the 1950s to track down functions in the Orlando place. Disney's influence in personal computer gaming and leisure is also influential. Each and every cluster desires an concept factory and Orlando has around 140 investigate and growth firms positioned around universities. "Cross-pollination" of strategies is easily promoted. Simulation and modeling are currently being used in a number of industries. Health care is provided, as it works by using virtual reality to assist rehabilitate stroke victims.

Pittsburgh is reinventing by itself from a city of metal (the mills are non-existent nowadays), to a single of advanced robotics dominance. Generating highly developed robotics methods is complicated and complicated. They surpass performing repetitive duties in an auto factory, which is very simple, closed loop automation. The nascent marketplace lacks a Google or Apple existence in the town. But, spot universities, engineers and federal government are between its collaborating cluster, fully commited to observing the field prosper and produce new work.

San Diego is household to about 600 everyday living science companies and 700 wireless communication providers. In the 1970s, science and medicine rarely collaborated. Right now, the blend of biotech know-how and massive computing ability aids San Diego dominate in medical research and development, such as Genomics. The possibility is great for "imaginative collisions" between college college students and school, organization leaders and space government. San Diego features a high proportion of possibility-using business owners and undertaking funds funding, which is frequently pursued to spark more technological progress.

Ecosystems Engineering ecosystems are plan factories that embody distinct scientific and tutorial disciplines located in shut proximity. They consist of a presence of substantial, established organizations that typically commit in start-ups, license their...technological know-how, and/or sit on their board of administrators. CEOs mentor less experienced leaders of small companies. Federal government companies are companions but providers don't depend on them only. Angel buyers and non-public sector traders are critical players as well. There are no guarantees in any ecosystem.

North Carolina has shed its home furnishings, textiles and tobacco industries. Currently it is really a point out whose smaller and medium-sized companies are fully commited to exporting, which is critical to building financial growth, wealth, and careers. Companies that export usually fork out increased wages and keep in organization for a longer time. Holstein states exporting is a substantial untapped economic prospective. America's export promotion and finance process is fragmented and ineffectual. North Carolina triumphs, as agencies from the nearby, state and federal degrees are collaborating to advertise exporting. They deliver facts to little organization CEOs about trade displays in foreign capitals. They also perform matchmaker with likely distributors and shoppers, and support organizations translate their revenue materials into area languages, amongst other issues.

Atlanta, like numerous U.S towns dependent on production for economic viability, in the past a long time, relied greatly on offshoring and outsourcing to slash prices. Nowadays, the city exemplifies corporations that are returning functions to U.S. soil, a craze recognised, as "backshoring." It can be primarily accurate of high-stop technology, telecommunications and healthcare businesses. Jetting around the entire world to tweak output and style modifications is both of those expensive and time-consuming. Transport bills, complicated logistics, political unrest and the threat of intellectual home theft are also motivators. Atlanta's ecosystem of regional govt, universities and provider and logistics professionals is amongst individuals dedicated to revitalizing the area's position marketplace.

Cleveland is at the forefront of America's twelve hundred neighborhood colleges for workforce retraining. Cleveland's toughness is retraining displaced personnel in their forties and fifties, a demographic hit difficult by world work developments. Existing and future employees have to have a better set of knowledge-based mostly skills to be competitive and Cleveland delivers. The city's neighborhood schools address schooling a lot less as a business, and extra as education, enabling the unemployed to promptly transition into new viable occupations. Cleveland's educational ecosystem involves area small business leaders, and govt officers. Neighborhood colleges can often be far more versatile than 4-year academia. Funding flows from federal, condition and area federal government, and non-public foundations as well.

Classes for All Americans Holstein concludes that The united states is the center of a world wide overall economy and the aggressive force is long-lasting. He thinks we are a culture of creativeness, innovation and flexibility. Our comparative benefit is our skill to leapfrog above current systems by being disruptive. To improve that advantage, long term generations will need to have to learn math and science-primarily based skills. It really is the only way to prosper in a information-dependent overall economy. "This is a defining minute for The us, similar to the Terrific Depression, when we had to summon forth a new eyesight of our future," he claims. "I genuinely consider that we can recuperate the optimism a lot of appear to have lost."

To remain abreast of America's subsequent overall economy, visit, http://www.williamholstein.com.

Supply by Timothy Zaun

0 notes

Text

Bay Area Credit Service

Debt collectors like Bay Area Credit Service cannot harass you over a debt. You have rights under the law. We will stop the harassment once and for all.

THE BEST PART IS…

If Bay Area Credit Service violated the law, you will get money damages and Bay Area Credit Service will pay our fees and costs. You will not pay us a penny for our time. Plus, some of our clients also receive debt relief and cleaned up credit reports. You have nothing to lose! Call us today at 888-572-0176 for a free consultation.

youtube

Who is Bay Area Credit Service?

Bay Area Credit Service is a third-party collection agency, headquartered in Norcross, GA. Bay Area Credit Service was founded in 1963. According to Bay Area Credit Service’s website, Bay Area Credit Service focuses on collection accounts for commercial, medical and consumer debt. They are a national provider of insourced and outsourced financial recovery services. Bay Area Credit Service operates nationwide.

Bay Area Credit Service’s Address, Phone Number, and Contact Information

Bay Area Credit Service is located at 4145 Shackleford Road, Suite 330B, Norcross, GA 30093. The main telephone number for Bay Area Credit Service is 678-229-5010. This is just one of many contact numbers for Bay Area Credit Service.

Bay Area Credit Service’s website is www.bayareacredit.com Bay Area Credit Service’s e-mail address is [email protected]

Phone Numbers Used By Bay Area Credit Service

Bay Area Credit Service likely has dozens, if not over 100, phone numbers it calls from. Here are a few phone numbers Bay Area Credit Service may be calling you from:

800-443-1297

866-882-7666

866-471-9387

866-853-0322

800-454-2227

866-358-5400

800-697-1234

800-862-4187

866-399-4910

813-713-9903

678-229-5199

352-344-8741

Bay Area Credit Service Lawsuits

If you want to know just how unhappy consumers are with Bay Area Credit Service, take a look at the number of lawsuits filed against Bay Area Credit Service on the Public Access to Court Electronic Records (“PACER”). PACER is the federal docket throughout the country that lists federal complaints filed against Bay Area Credit Service. When you do a search for Bay Area Credit Service, there are over 40 lawsuits filed against Bay Area Credit Service. Most of these lawsuits involve consumer rights’ violations.

Bay Area Credit Service Harassment

The Fair Debt Collection Practices Act (“FDCPA”) is a federal law that applies to everyone in the United States. In other words, everyone is protected under the FDCPA. The FDCPA is a laundry list of what Bay Area Credit Service can and cannot do while collecting a debt, as well as things debt collectors must do while collecting a debt. If Bay Area Credit Service is harassing you over a debt, you have rights under the Fair Debt Collection Practices Act.

The Telephone Consumer Protection Act (“TCPA”) protects you from robocalls. Robocalls are those annoying, automated, recorded calls that a computer makes to you all day long. You can tell it’s a robocall because either no one is on the other end of the line or there’s a delay when you pick up the phone before a live person comes on the line. You can get $500 per call if Bay Area Credit Service violates the TCPA. Have you received a message from Bay Area Credit Service that sounds pre-recorded? Or, maybe the message you received from Bay Area Credit Service is cutoff at the beginning or the end? These are tell-tale signs that the message is pre-recorded. If you have these messages on your cell phone, you may have a TCPA case against Bay Area Credit Service.

The Electronic Fund Transfer Act (“EFTA”) protects electronic payments that are deducted from bank accounts. If Bay Area Credit Service took unauthorized deductions from your bank account, you may have an EFTA claim. Bay Area Credit Service, like most collection agencies, wants to set up reoccurring payments from consumers. Imagine how much money Bay Area Credit Service gets if hundreds, if not thousands, of consumers electronically pay them $50-$100, or more, per month. If you agreed to this type of reoccurring payment, Bay Area Credit Service must follow certain steps to comply with the EFTA. Did Bay Area Credit Service continue to take electronic payments after you said stop? Did Bay Area Credit Service take more money from your checking account than you agreed to? If so, let’s talk about your rights under the EFTA.

The Fair Credit Reporting Act (“FCRA”) works to ensure that no information reported to your credit report is false. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. Bay Area Credit Service likely reports on credit reports to obtain greater leverage over the consumer. If Bay Area Credit Service is on your credit report, they may tell you if you pay the debt, they’ll remove it from your credit report. This is commonly known as pay for delete. You pay Bay Area Credit Service, and they delete the debt from your credit report. Even if Bay Area Credit Service is not on your credit report, maybe the original creditor is. If you pay off the debt to Bay Area Credit Service, then the original creditor, and Bay Area Credit Service, should accurately report this on your credit report.

Several states also have laws that provide its citizens an additional layer of protection. For example, if you live in California, Texas, Florida, North Carolina, Wisconsin, Michigan, Montana, or Pennsylvania you may be able to tack on a state-law claim with your federal law claim above. North Carolina, for example, has one of the most consumer-friendly statutes in the country. If you live in NC, and you’re harassed over a debt, you may get $500.00 – $4,000.00 in damages per violation. We work with a local counsel in NC. Our NC clients have received some great results in debt collection harassment cases. If you live in NC, and Bay Area Credit Service is harassing you, you have tons of leverage to get a great settlement.

HOW CAN WE USE THE LAW TO HELP YOU?

We will use state and federal laws to immediately stop Bay Area Credit Service debt collection. We will send a cease and desist letter to get the harassment to stop the same day. If Bay Area Credit Service violates the FDCPA, EFTA, FCRA, or any state laws, you may be entitled to money damages. For example, under the FDCPA, you can get up $1,000.00 in damages plus actual damages. The FDCPA has a fee-shift provision. This means, Bay Area Credit Service pays our attorney’s fees and costs. If you have a TCPA case against Bay Area Credit Service, we will handle it based on a contingency fee.

THAT’S NOT ALL…

We have helped hundreds of consumers stop phone calls from Bay Area Credit Service. We know how to stop the harassment and get you money damages. ONCE AGAIN, you will not pay us a penny for our time. We will help you based on a fee-shift provision and/or based on a contingency fee. That means, Bay Area Credit Service pays our attorney’s fees and costs.

What If Bay Area Credit Service Is On My Credit Report?

Based on our experience, Bay Area Credit Service may credit report. That means, Bay Area Credit Service may mark your credit report with the debt they are trying to collect on. In addition to Bay Area Credit Service, the original creditor may be on your credit report. For example, if you owe Comenity Bank on an elastic line of credit, and Bay Area Credit Service is collecting on it, both Comenity Bank and Bay Area Credit Service may have separate entries on your credit report. This is important because you will want both parties to update your credit report if you pay off the debt.

THE GOOD NEWS IS…

If Bay Area Credit Service is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly. Along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some

mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or maybe you were a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute them. My office will help you pull your credit report and dispute any inaccurate information.

REMEMBER���

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (“FCRA”), you may be entitled to statutory damages up to $1,000.00, plus the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision. This means, the credit reporting agency pays your attorney’s fees and costs. Therefore, you will not pay me a penny for my time. We have helped dozens of consumers fix inaccurate information on their credit reports.

Complaints against Bay Area Credit Service

If you’re on this page, chances are you are just like the hundreds of consumers out there being harassed by Bay Area Credit Service. The complaints on the Better Business Bureau (“BBB”), various consumer websites, including on Pissed Consumer, and even the complaints on this page (below) are endless. Bay Area Credit Service is accredited by the BBB. The BBB gives Bay Area Credit Service a “B” rating. Despite its “B” rating, there are nearly 60 customer complaints on the BBB.

Here are some of the many BBB complaints regarding Bay Area Credit Service:

“Received collection threat in mail about false medical bill. The threat for collections or damaging credit is based off of a claim for medical services at a location I have never been to.”

“This debt collection agency should be stripped of all rights to operate. They are trying to collect debts that are not valid and are using private hospital information as well as information from google searches to contact people. They claim they have a bill from an ambulance company that they acquired and are actively collecting the debt but they didn’t have any of my information available.”

“I have received a debt collections notice from Bay Area Credit Service, regarding a debt that I do not know to be valid and cannot get validation.”

Although there are only two reviews on Google, they are just as bad. One reviews give Bay Area Credit Service only 1 star. Here’s a snippet of the reviews on Google:

“These people collected a payment from my husband that had actually already been payed by his lawyer for medical bills due to an accident and now my husband is in a huge dispute trying to get the money they unlawfully claimed from him, we have heard every lie these people they can think of and not one apology and still no refund, this company disgusts us.”

Cases We Have Handled Against Bay Area Credit Service

I THINK YOU’LL AGREE WITH ME WHEN I SAY…

Threats and harassment by collection agencies can be pretty intimidating. Well, it turns out we can stop the harassment, attempt to get you money damages under the law, and the collection agency will have to pay us our fees and costs. Here are some of the cases we’ve handled against Bay Area Credit Service:

Eric A. v. Bay Area Credit Service. In this case, Bay Area Credit Service was reporting negatively and inaccurately to our client’s credit report. On or around December 7, 2016 our client sent a letter to Bay Area Credit informing them of this inaccuracy on his credit report. The original debt came from an ambulance bill. After about 30 days, our client still had Bay Area Credit listed on his credit report. Our client provided evidence to Bay Area Credit that this was not a debt he owed or that should be listed on his credit report. Bay Area Credit Services failed to properly notify the 3 credit reporting agencies that this debt was inaccurate in violation of the Fair Credit Reporting Act.

Tabitha J. v. Bay Area Credit Services. Tabitha lives in Pennsylvania, and Bay Area Credit Services was attempting to collect on a medical bill from our client. Bay Area Credit Services called our client on her cell phone. Bay Area Credit Services called from 800-445-4715, 800-277-0874, 866-739-05252 and 866-353-7383, all of which are Bay Area Credit Services’ phone numbers. In or around July 2015, our client’s husband spoke with one of Bay Area Credit Services’ collectors. Bay Area Credit Services demanded payment from our client or he would put the account in their next level of collections. Relying on Bay Area’s threats, our client’s husband made a payment to Bay Area’s collector and requested that Bay Area Credit Services stop calling his wife. Despite our client’s request, Bay Area Credit continued to make collection calls to our client. Bay Area Credit Services violated both the Telephone Consumer Protection Act and Fair Debt Collection Practices Act but continuing to place collection calls to our client’s cell phone after being asked to stop.

Here’s What Our Clients Say About Us

Agruss Law Firm, LLC, has over 630 outstanding client reviews through Yotpo, an A+ BBB rating, and over 100 five-star reviews on Google. Here’s what some of our clients have to say about us.

“Agruss Law Firm handled my case with professionalism and efficiency. Jackie Laino and Pooja Dosi were very competent and I trusted them every step of the way. I will recommend Agruss Law Firm to friends and family. Keep up the great work.”

“I had a very good experience with the Argus law firm. When I called them the very first time, they were excellent at explaining the entire process to me. They advised me on what I should do, and kept me well informed with the progressed they were making.”

“I had the best help from all the people at Agruss Law Firm LLC. They were all so kind and

answered all my question and stopped the harassment calls i was getting. They are very well staffed and kind firm. If you need help use them you will be glad you did.”

Can Bay Area Credit Services You?

Although anyone can sue anyone for any reason, we have never seen Bay Area Credit Services sue consumers. It’s likely Bay Area Credit Services does not sue because they do not always own the debt they are collecting on. Also, Bay Area Credit Services would have to hire a lawyer, or use in-house counsel, to file a lawsuit. It’s likely Bay Area Credit Services collects debts through the entire country. Therefore, it would be very difficult to have lawyers, or a law firm, licensed in every state. There are collection agencies that do sue consumers. For example, Midland Credit Management is one of the largest junk-debt buyers. Midland Credit Management collects on debt and also sues on debt. The opposite is true with Bay Area Credit Services. Therefore, it would be very unusual if Bay Area Credit Services sued you. The original creditor, on the other hand, may hire a collection firm, or lawyer, to sue you. If Bay Area Credit Services has threatened to sue you, call us. We can help.

Can Bay Area Credit Services Garnish Your Wages?

No, not unless they have a judgment. If Bay Area Credit Services has not sued you, then Bay Area Credit Services cannot get a judgment. If Bay Area Credit Services does not have a judgment, then Bay Area Credit Services cannot garnish your wages. Minus limited situations (usually dealing with debts owed to the government for student loans, taxes, etc.), in order to garnish someone’s wages, you need a judgment first. In short, we have not seen Bay Area Credit Services file a lawsuit against a consumer. So, Bay Area Credit Services cannot garnish your wages, minus the exceptions listed above. If Bay Area Credit Services has threatened to garnish your wages, contact our office right away.

Bay Area Credit Services Settlement

If you want to settle a debt with Bay Area Credit Services, ask yourself these questions first:

Do I really owe this debt?

Is this debt within the statute of limitations?

Is this debt on my credit report?

If I pay this debt, will Bay Area Credit Services remove it from my credit report?

If I pay this debt, will the original creditor remove it from my credit report?

If I pay this debt, will I get something in writing from Bay Area Credit Services confirming the payment and settlement terms?

These are not the only things to consider when dealing with debt collectors. We are here to help you answer the questions above, and much more. Whether it’s harassment, settlement, pay for delete, or any other legal issue with Bay Area Credit Services, the folks at Agruss Law Firm are here to help you.

Share Your Complaints About Bay Area Credit Services Below

Post your complaints about Bay Area Credit Services. Sharing your complaints about Bay Area Credit Services will help other consumers know what to do when Bay Area Credit Services starts calling. Sharing your experience may help someone else.

HERE’S THE DEAL!

If you are being harassed by Bay Area Credit Services over a debt, you may be entitled to money damages. Get up to $1,000 for harassment, and $500-$1,500 for illegal robocalls. Under various state and federal laws, we will help you based on a fee-shift provision and/or based on a contingency fee. That means, the collector pays your attorney’s fees and costs. You won’t pay us a penny. We have settled thousands of debt collection harassment cases. Let us help you today. Contact Agruss Law Firm at 888-572-0176 to stop the harassment once and for all.

The post Bay Area Credit Service appeared first on Agruss Law Firm, LLC.

Bay Area Credit Service published first on https://agrusslawfirmllc.tumblr.com

0 notes

Text

Bay Area Credit Service

Debt collectors like Bay Area Credit Service cannot harass you over a debt. You have rights under the law. We will stop the harassment once and for all.

THE BEST PART IS…

If Bay Area Credit Service violated the law, you will get money damages and Bay Area Credit Service will pay our fees and costs. You will not pay us a penny for our time. Plus, some of our clients also receive debt relief and cleaned up credit reports. You have nothing to lose! Call us today at 888-572-0176 for a free consultation.

youtube

Who is Bay Area Credit Service?

Bay Area Credit Service is a third-party collection agency, headquartered in Norcross, GA. Bay Area Credit Service was founded in 1963. According to Bay Area Credit Service’s website, Bay Area Credit Service focuses on collection accounts for commercial, medical and consumer debt. They are a national provider of insourced and outsourced financial recovery services. Bay Area Credit Service operates nationwide.

Bay Area Credit Service’s Address, Phone Number, and Contact Information

Bay Area Credit Service is located at 4145 Shackleford Road, Suite 330B, Norcross, GA 30093. The main telephone number for Bay Area Credit Service is 678-229-5010. This is just one of many contact numbers for Bay Area Credit Service.

Bay Area Credit Service’s website is www.bayareacredit.com Bay Area Credit Service’s e-mail address is [email protected]

Phone Numbers Used By Bay Area Credit Service

Bay Area Credit Service likely has dozens, if not over 100, phone numbers it calls from. Here are a few phone numbers Bay Area Credit Service may be calling you from:

800-443-1297

866-882-7666

866-471-9387

866-853-0322

800-454-2227

866-358-5400

800-697-1234

800-862-4187

866-399-4910

813-713-9903

678-229-5199

352-344-8741

Bay Area Credit Service Lawsuits

If you want to know just how unhappy consumers are with Bay Area Credit Service, take a look at the number of lawsuits filed against Bay Area Credit Service on the Public Access to Court Electronic Records (“PACER”). PACER is the federal docket throughout the country that lists federal complaints filed against Bay Area Credit Service. When you do a search for Bay Area Credit Service, there are over 40 lawsuits filed against Bay Area Credit Service. Most of these lawsuits involve consumer rights’ violations.

Bay Area Credit Service Harassment

The Fair Debt Collection Practices Act (“FDCPA”) is a federal law that applies to everyone in the United States. In other words, everyone is protected under the FDCPA. The FDCPA is a laundry list of what Bay Area Credit Service can and cannot do while collecting a debt, as well as things debt collectors must do while collecting a debt. If Bay Area Credit Service is harassing you over a debt, you have rights under the Fair Debt Collection Practices Act.

The Telephone Consumer Protection Act (“TCPA”) protects you from robocalls. Robocalls are those annoying, automated, recorded calls that a computer makes to you all day long. You can tell it’s a robocall because either no one is on the other end of the line or there’s a delay when you pick up the phone before a live person comes on the line. You can get $500 per call if Bay Area Credit Service violates the TCPA. Have you received a message from Bay Area Credit Service that sounds pre-recorded? Or, maybe the message you received from Bay Area Credit Service is cutoff at the beginning or the end? These are tell-tale signs that the message is pre-recorded. If you have these messages on your cell phone, you may have a TCPA case against Bay Area Credit Service.

The Electronic Fund Transfer Act (“EFTA”) protects electronic payments that are deducted from bank accounts. If Bay Area Credit Service took unauthorized deductions from your bank account, you may have an EFTA claim. Bay Area Credit Service, like most collection agencies, wants to set up reoccurring payments from consumers. Imagine how much money Bay Area Credit Service gets if hundreds, if not thousands, of consumers electronically pay them $50-$100, or more, per month. If you agreed to this type of reoccurring payment, Bay Area Credit Service must follow certain steps to comply with the EFTA. Did Bay Area Credit Service continue to take electronic payments after you said stop? Did Bay Area Credit Service take more money from your checking account than you agreed to? If so, let’s talk about your rights under the EFTA.

The Fair Credit Reporting Act (“FCRA”) works to ensure that no information reported to your credit report is false. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. Bay Area Credit Service likely reports on credit reports to obtain greater leverage over the consumer. If Bay Area Credit Service is on your credit report, they may tell you if you pay the debt, they’ll remove it from your credit report. This is commonly known as pay for delete. You pay Bay Area Credit Service, and they delete the debt from your credit report. Even if Bay Area Credit Service is not on your credit report, maybe the original creditor is. If you pay off the debt to Bay Area Credit Service, then the original creditor, and Bay Area Credit Service, should accurately report this on your credit report.

Several states also have laws that provide its citizens an additional layer of protection. For example, if you live in California, Texas, Florida, North Carolina, Wisconsin, Michigan, Montana, or Pennsylvania you may be able to tack on a state-law claim with your federal law claim above. North Carolina, for example, has one of the most consumer-friendly statutes in the country. If you live in NC, and you’re harassed over a debt, you may get $500.00 – $4,000.00 in damages per violation. We work with a local counsel in NC. Our NC clients have received some great results in debt collection harassment cases. If you live in NC, and Bay Area Credit Service is harassing you, you have tons of leverage to get a great settlement.

HOW CAN WE USE THE LAW TO HELP YOU?

We will use state and federal laws to immediately stop Bay Area Credit Service debt collection. We will send a cease and desist letter to get the harassment to stop the same day. If Bay Area Credit Service violates the FDCPA, EFTA, FCRA, or any state laws, you may be entitled to money damages. For example, under the FDCPA, you can get up $1,000.00 in damages plus actual damages. The FDCPA has a fee-shift provision. This means, Bay Area Credit Service pays our attorney’s fees and costs. If you have a TCPA case against Bay Area Credit Service, we will handle it based on a contingency fee.

THAT’S NOT ALL…

We have helped hundreds of consumers stop phone calls from Bay Area Credit Service. We know how to stop the harassment and get you money damages. ONCE AGAIN, you will not pay us a penny for our time. We will help you based on a fee-shift provision and/or based on a contingency fee. That means, Bay Area Credit Service pays our attorney’s fees and costs.

What If Bay Area Credit Service Is On My Credit Report?

Based on our experience, Bay Area Credit Service may credit report. That means, Bay Area Credit Service may mark your credit report with the debt they are trying to collect on. In addition to Bay Area Credit Service, the original creditor may be on your credit report. For example, if you owe Comenity Bank on an elastic line of credit, and Bay Area Credit Service is collecting on it, both Comenity Bank and Bay Area Credit Service may have separate entries on your credit report. This is important because you will want both parties to update your credit report if you pay off the debt.

THE GOOD NEWS IS…

If Bay Area Credit Service is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly. Along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some

mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or maybe you were a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute them. My office will help you pull your credit report and dispute any inaccurate information.

REMEMBER…

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (“FCRA”), you may be entitled to statutory damages up to $1,000.00, plus the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision. This means, the credit reporting agency pays your attorney’s fees and costs. Therefore, you will not pay me a penny for my time. We have helped dozens of consumers fix inaccurate information on their credit reports.

Complaints against Bay Area Credit Service

If you’re on this page, chances are you are just like the hundreds of consumers out there being harassed by Bay Area Credit Service. The complaints on the Better Business Bureau (“BBB”), various consumer websites, including on Pissed Consumer, and even the complaints on this page (below) are endless. Bay Area Credit Service is accredited by the BBB. The BBB gives Bay Area Credit Service a “B” rating. Despite its “B” rating, there are nearly 60 customer complaints on the BBB.

Here are some of the many BBB complaints regarding Bay Area Credit Service:

“Received collection threat in mail about false medical bill. The threat for collections or damaging credit is based off of a claim for medical services at a location I have never been to.”

“This debt collection agency should be stripped of all rights to operate. They are trying to collect debts that are not valid and are using private hospital information as well as information from google searches to contact people. They claim they have a bill from an ambulance company that they acquired and are actively collecting the debt but they didn’t have any of my information available.”

“I have received a debt collections notice from Bay Area Credit Service, regarding a debt that I do not know to be valid and cannot get validation.”

Although there are only two reviews on Google, they are just as bad. One reviews give Bay Area Credit Service only 1 star. Here’s a snippet of the reviews on Google:

“These people collected a payment from my husband that had actually already been payed by his lawyer for medical bills due to an accident and now my husband is in a huge dispute trying to get the money they unlawfully claimed from him, we have heard every lie these people they can think of and not one apology and still no refund, this company disgusts us.”

Cases We Have Handled Against Bay Area Credit Service

I THINK YOU’LL AGREE WITH ME WHEN I SAY…

Threats and harassment by collection agencies can be pretty intimidating. Well, it turns out we can stop the harassment, attempt to get you money damages under the law, and the collection agency will have to pay us our fees and costs. Here are some of the cases we’ve handled against Bay Area Credit Service:

Eric A. v. Bay Area Credit Service. In this case, Bay Area Credit Service was reporting negatively and inaccurately to our client’s credit report. On or around December 7, 2016 our client sent a letter to Bay Area Credit informing them of this inaccuracy on his credit report. The original debt came from an ambulance bill. After about 30 days, our client still had Bay Area Credit listed on his credit report. Our client provided evidence to Bay Area Credit that this was not a debt he owed or that should be listed on his credit report. Bay Area Credit Services failed to properly notify the 3 credit reporting agencies that this debt was inaccurate in violation of the Fair Credit Reporting Act.

Tabitha J. v. Bay Area Credit Services. Tabitha lives in Pennsylvania, and Bay Area Credit Services was attempting to collect on a medical bill from our client. Bay Area Credit Services called our client on her cell phone. Bay Area Credit Services called from 800-445-4715, 800-277-0874, 866-739-05252 and 866-353-7383, all of which are Bay Area Credit Services’ phone numbers. In or around July 2015, our client’s husband spoke with one of Bay Area Credit Services’ collectors. Bay Area Credit Services demanded payment from our client or he would put the account in their next level of collections. Relying on Bay Area’s threats, our client’s husband made a payment to Bay Area’s collector and requested that Bay Area Credit Services stop calling his wife. Despite our client’s request, Bay Area Credit continued to make collection calls to our client. Bay Area Credit Services violated both the Telephone Consumer Protection Act and Fair Debt Collection Practices Act but continuing to place collection calls to our client’s cell phone after being asked to stop.

Here’s What Our Clients Say About Us

Agruss Law Firm, LLC, has over 630 outstanding client reviews through Yotpo, an A+ BBB rating, and over 100 five-star reviews on Google. Here’s what some of our clients have to say about us.

“Agruss Law Firm handled my case with professionalism and efficiency. Jackie Laino and Pooja Dosi were very competent and I trusted them every step of the way. I will recommend Agruss Law Firm to friends and family. Keep up the great work.”

“I had a very good experience with the Argus law firm. When I called them the very first time, they were excellent at explaining the entire process to me. They advised me on what I should do, and kept me well informed with the progressed they were making.”

“I had the best help from all the people at Agruss Law Firm LLC. They were all so kind and

answered all my question and stopped the harassment calls i was getting. They are very well staffed and kind firm. If you need help use them you will be glad you did.”

Can Bay Area Credit Services You?

Although anyone can sue anyone for any reason, we have never seen Bay Area Credit Services sue consumers. It’s likely Bay Area Credit Services does not sue because they do not always own the debt they are collecting on. Also, Bay Area Credit Services would have to hire a lawyer, or use in-house counsel, to file a lawsuit. It’s likely Bay Area Credit Services collects debts through the entire country. Therefore, it would be very difficult to have lawyers, or a law firm, licensed in every state. There are collection agencies that do sue consumers. For example, Midland Credit Management is one of the largest junk-debt buyers. Midland Credit Management collects on debt and also sues on debt. The opposite is true with Bay Area Credit Services. Therefore, it would be very unusual if Bay Area Credit Services sued you. The original creditor, on the other hand, may hire a collection firm, or lawyer, to sue you. If Bay Area Credit Services has threatened to sue you, call us. We can help.

Can Bay Area Credit Services Garnish Your Wages?

No, not unless they have a judgment. If Bay Area Credit Services has not sued you, then Bay Area Credit Services cannot get a judgment. If Bay Area Credit Services does not have a judgment, then Bay Area Credit Services cannot garnish your wages. Minus limited situations (usually dealing with debts owed to the government for student loans, taxes, etc.), in order to garnish someone’s wages, you need a judgment first. In short, we have not seen Bay Area Credit Services file a lawsuit against a consumer. So, Bay Area Credit Services cannot garnish your wages, minus the exceptions listed above. If Bay Area Credit Services has threatened to garnish your wages, contact our office right away.

Bay Area Credit Services Settlement

If you want to settle a debt with Bay Area Credit Services, ask yourself these questions first:

Do I really owe this debt?

Is this debt within the statute of limitations?

Is this debt on my credit report?

If I pay this debt, will Bay Area Credit Services remove it from my credit report?

If I pay this debt, will the original creditor remove it from my credit report?

If I pay this debt, will I get something in writing from Bay Area Credit Services confirming the payment and settlement terms?

These are not the only things to consider when dealing with debt collectors. We are here to help you answer the questions above, and much more. Whether it’s harassment, settlement, pay for delete, or any other legal issue with Bay Area Credit Services, the folks at Agruss Law Firm are here to help you.

Share Your Complaints About Bay Area Credit Services Below

Post your complaints about Bay Area Credit Services. Sharing your complaints about Bay Area Credit Services will help other consumers know what to do when Bay Area Credit Services starts calling. Sharing your experience may help someone else.

HERE’S THE DEAL!

If you are being harassed by Bay Area Credit Services over a debt, you may be entitled to money damages. Get up to $1,000 for harassment, and $500-$1,500 for illegal robocalls. Under various state and federal laws, we will help you based on a fee-shift provision and/or based on a contingency fee. That means, the collector pays your attorney’s fees and costs. You won’t pay us a penny. We have settled thousands of debt collection harassment cases. Let us help you today. Contact Agruss Law Firm at 888-572-0176 to stop the harassment once and for all.

The post Bay Area Credit Service appeared first on Agruss Law Firm, LLC.

0 notes

Text

Had enough of billing frustrations cutting into profits? Best Billing Outsourcing Company in North Carolina handles all dental, medical and specialty coding, claims and payment processing. Our certified team boosts reimbursements through accurate billing the first time, every time. As the top provider in NC, we simplify compliance so you can focus on patients. Outsource all your billing and watch revenue and satisfaction increase - call us today!

For more- https://www.prospabilling.com

Office Address - Connecticut 7 McKee Place Cheshire, CT 06410

0 notes

Link

Easiest billing service with the experts at St. Petersburg We are the experts in providing the better solution and also it is made easy with the help of 247 medical billing services at St. Petersburg. This is one of the best possible ways using which you can get through these services and also it is made simple. The better solution is possible when you wanted to use this service and this is made possible with these services. The simple and fastest service can be found with the help of these experts.

#Medical Billing Services Outsourcing in Florida#Medical Billing Services Outsourcing in Texas#Medical Billing Services Outsourcing in NewYork#Medical Billing Services Outsourcing in Michigan#Medical Billing Services Outsourcing in Pennsylvania#Medical Billing Services Outsourcing in California#Medical Billing Services Outsourcing in Georgia#Medical Billing Services Outsourcing in North Carolina#Medical Billing Services Outsourcing in South Carolina#Medical Billing Services Outsourcing in Ohio#Medical Billing Services Outsourcing in Delaware#Medical Billing Services Outsourcing in Tennessee

0 notes

Link

The land of opportunity is being experienced by the 24/7 medical billing If you are having a medical industry in some parts of Arkansas then our medical billing services are necessary for making your billing hassle free. Start working without stress because of the user friendly softwares which we are using. We have got experts to design software based on your suggestions.

#Medical Billing company#California Medical Billing Services Outsourcing#Medical Billing Organization#Medical Billing Services Outsourcing#Medical Billing Services Outsourcing in Florida#Medical Billing Services Outsourcing in Texas#Medical Billing Services Outsourcing in NewYork#Medical Billing Services Outsourcing in Michigan#Medical Billing Services Outsourcing in Pennsylvania#Medical Billing Services Outsourcing in California#Medical Billing Services Outsourcing in Georgia#Medical Billing Services Outsourcing in North Carolina#Medical Billing Services Outsourcing in South Carolina#Medical Billing Services Outsourcing in Ohio#Medical Billing Services Outsourcing in Delaware#Medical Billing Services Outsourcing in Tennessee#Florida Medical Billing Services Outsourcing

0 notes

Link

Customer centric billing approach in San Diego One of the popular cities in United States with lot of features and facilities in it is San Diego. The city is known by most of the people and the people are living happily here. To take the people to another state of happiness, it is going to get a surprised landing from 247medical billing which excels in billing sector. The 247 medical billing has got some of the best features to help many of the medical industries in San Diego.

#Medical Billing company#California Medical Billing Services Outsourcing#Medical Billing Organization#Medical Billing Services Outsourcing#Medical Billing Services Outsourcing in Florida#Medical Billing Services Outsourcing in Texas#Medical Billing Services Outsourcing in NewYork#Medical Billing Services Outsourcing in Michigan#Medical Billing Services Outsourcing in Pennsylvania#Medical Billing Services Outsourcing in California#Medical Billing Services Outsourcing in Georgia#Medical Billing Services Outsourcing in North Carolina#Medical Billing Services Outsourcing in South Carolina#Medical Billing Services Outsourcing in Ohio#Medical Billing Services Outsourcing in Delaware#Medical Billing Services Outsourcing in Tennessee

0 notes

Photo

#Medical Billing company#California Medical Billing Services Outsourcing#Medical Billing Organization#Medical Billing Services Outsourcing#Medical Billing Services Outsourcing in Florida#Medical Billing Services Outsourcing in Texas#Medical Billing Services Outsourcing in NewYork#Medical Billing Services Outsourcing in Michigan#Medical Billing Services Outsourcing in Pennsylvania#Medical Billing Services Outsourcing in California#Medical Billing Services Outsourcing in Georgia#Medical Billing Services Outsourcing in North Carolina#Medical Billing Services Outsourcing in South Carolina#Medical Billing Services Outsourcing in Ohio#Medical Billing Services Outsourcing in Delaware

0 notes

Link

Two factors decide the success and stability of any Urology practice; one is timely billing and the other one is quickly getting reimbursements. Urology medical billing is well-known for its own complications with modifiers and other intricacies hugely involved.

Many urology practices realize the need for a professional medical billing service that can handle all their billing chaos in different aspects and help in improving the revenue of their practice. This is why they find outsourcing is the best option for effortlessly dealing with their urology medical billing.

#South Carolina Medical Billing Services Outsourcing#Ohio Medical Billing Services Outsourcing#Delaware Medical Billing Services Outsourcing#Tennessee Medical Billing Services Outsourcing#Medical Billing Services Outsourcing in Michigan#Medical Billing Services Outsourcing in Pennsylvania#Medical Billing Services Outsourcing in California#Medical Billing Services Outsourcing in Georgia#Medical Billing Services Outsourcing in North Carolina#Medical Billing Services Outsourcing in South Carolina

0 notes

Link

Revenue cycle management in dermatology plays a role more than just a medical billing process. Your RCM should be more effective since it administers the entire processes that impact your bottom line. Right from patient contact till paid account balances and everything that comes in between. Dermatology Medical Billing Service is a continuous process where your dermatology practice begins with a patient visit till you get into a stage of no-pending reimbursements from your insurer.

#Medical Billing company#California Medical Billing Services Outsourcing#Medical Billing Organization#Medical Billing Services Outsourcing#Medical Billing Services Outsourcing in Florida#Medical Billing Services Outsourcing in Texas#Medical Billing Services Outsourcing in NewYork#Medical Billing Services Outsourcing in Michigan#Medical Billing Services Outsourcing in Pennsylvania#Medical Billing Services Outsourcing in California#Medical Billing Services Outsourcing in Georgia#Medical Billing Services Outsourcing in North Carolina#Medical Billing Services Outsourcing in South Carolina#Medical Billing Services Outsourcing in Ohio

0 notes