#Measures Taken to Ensure Economic Growth

Explore tagged Tumblr posts

Text

Are we still breeding or are we just multiplying?

At the VZAP general meeting, the agricultural scientist Andreas Perner gave an interesting lecture on current problems in purebred Arabian breeding, which we used as an opportunity for the following interview. This is about undesirable developments in Arabian breeding, which have arisen primarily through specialization and selection on individual characteristics, and he sees parallels in cattle breeding where the changes are scientifically substantiated.

IN THE FOCUS: Mr. Perner, in your presentation at the VZAP general meeting you pointed out some parallels that exist between cattle and horse breeding. Why should we concern ourselves with cattle when we are actually interested in horses?

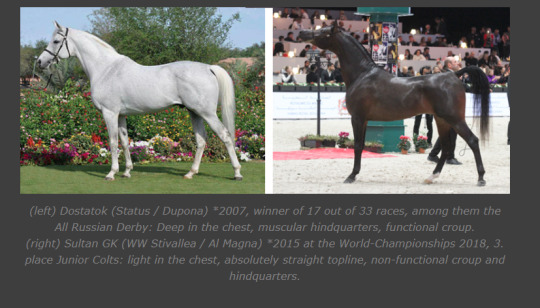

Andreas Perner: Because there are numerous parallels. The primitive cattle were characterized by an enormous chest cavity with plenty of space for the organs, relatively fine legs and a pelvic shape with a high sacrum so that birth could proceed quickly. Through breeding selection, a major change in this appearance has taken place over the last 100 years, including extreme specialization in beef and dairy cattle. Since cows as farm animals have long been the focus of science, one also has easy access to data, e.g. milk yield, slaughter weight, but also bone measurements, etc., which can also be used to document such changes. In animal breeding, a distinction is made between two constitution types: the asthenic and the athletic. The representatives of the Holstein cattle, a highly specialized breed of dairy cattle, today almost exclusively belong to the asthenic constitutional type: large, tall and narrow, i.e. less space in the chest for the organs, rather poor feed conversion, etc. Male calves of this breed are so weak in the muscle development that they no longer have any economic (slaughter) value. Before this extreme specialization in milk production, this breed corresponded to a dual-purpose cattle (milk and meat) and thus more of the athletic constitution type, which has become very rare today. One can definitely draw parallels here with Arabian breeding, where the Arabian show horse was bred through specialization – and became also an asthenic, tall, long-legged, with little depth to the trunk. And among Arabians, too, the athlete, the medium-sized, broad, deep-rumped Arabian of the “old type” who is also a good feed converter, is becoming increasingly rare. From a population genetic point of view, this is a major catastrophe and countermeasures must be taken.

IN THE FOCUS: If we ignore the outside appearance, i.e. the conformation – are there any other changes that have occurred as a result of this specialization?

A. P.: In the last 30-40 years, dairy cattle have increasingly been bred for maximum performance (milk production) in the young animals, i.e. there has been conscious selection for early maturity. This has resulted in serious changes in the animals: through selection for early maturity, the useful life has been extremely shortened due to high susceptibility to disease and fertility problems – the latter is the main cause of loss in cattle breeding. This can also be proven with figures: In Germany today a cow has an average of 2.4 calves, but biologically it can have 14-15 calves. The “useful life” of cows is now at an all-time low. The selection for early maturity also has an impact on the quality of the claws: the early maturing animals need claw care three times a year, because the claws are soft and grow very quickly. In contrast, slow, long-lasting growth – i.e. late maturity – ensures healthy development of the entire organism and a long lifespan. Late-maturing cattle only need hoof care once a year, sometimes only every two years, because they have extremely good, strong hoof horn. All this can also be transferred to the horse, because the horse’s hoof horn is also of better quality in late-maturing animals. This all depends on the high quality of the connective tissue. If you breed late-maturing animals, they often look underdeveloped when they are young and breeders often do not recognize their true quality. It is also a feature of breeding for longevity that it produces healthier animals, which statistically incur significantly less veterinary costs (i.e. only a quarter of the costs) in cattle breeding. Here, too, the parallels to horse breeding seem clear to me: the late-maturing types have no chance at shows in the junior classes, which is why show horse breeding promotes the early-maturing type. Late maturing horses often look like “ugly ducklings”, but often they only become “beautiful swans” when they are 6 years old or older. Egyptian breeding has had this problem for a long time, which is why you see fewer and fewer Egyptians at international shows or they have their own shows where they are not in competition with the early-maturing “show horses”.

IN THE FOCUS: When you say that a late-maturing horse is characterized by long-term growth, which then ensures healthy development of the entire organism and a long lifespan, the Russians come to mind. But it is precisely these that are tested on the racetrack very early, as early as two-year-olds. Isn’t that a contradiction?

A. P.: As far as I know, the two-year-old horses are prepared very carefully for the racetrack and the trainers make sure that they are not overstrained. The horses also have time to develop further – they are encouraged to exercise without being overstrained. As a result, they develop better, become wider in the chest, more muscular overall, the entire organism becomes stronger, etc. But ultimately what matters is: How old do the horses get in good health – and therefore without major veterinary costs? And in the case of breeding animals there is also the question: How good is their fertility? There are Russian stallions with racetrack careers who are still mating naturally at the age of 28, mares who still have foals at well over 20 years of age, and the Arabian mare Nefta in Pompadour, France, had one foal every year between 1975 and 1995, i.e. 21 foals in total! I don’t know of any such examples from show horse breeding without the use of embryo transfer (but I’m happy to be informed!). In warmblood breeding you can see what selection for early-maturity does, especially with show jumping horses, the horses often have a nerve cut at 8 to 9 years of age, then you have two more years of use, so to speak, and then they go to the slaughterhouse. Or think of the hypermobility of dressage horses, which have weak connective tissue and the resulting weakness of the joints, capsules and ligaments as well as the tendons and muscles. That cannot be the breeding goal.

Any selection that is not also focused on fitness and longevity or long-term performance automatically causes these characteristics to deteriorate.

IN THE FOCUS: To what extent have modern selection methods influenced the development of specialization?

A. P.: Specialization in cattle has been driven forward in the last 10 years by genomic breeding value estimation, which has now also found its way into horse breeding. For this method, the entire genome had to be sequenced and all performance parameters were then assigned to specific gene loci. Then, using complicated calculations, one could get an estimate of what performance the animal in question will perform in the future. In this way, it was possible for a young cow to achieve a milk production of over 40 kg per day, but the animals are no longer physiologically able to absorb enough nutrients to be able to achieve this output at all! As a result, over 90% of young cows end up with severe organ damage in the slaughterhouse. This means that the animals can endure it for a certain amount of time, mobilize all their body reserves but at some point their metabolism switches off and liver damage occurs, which ultimately leads to death. Part of the problem is that selection according to the wrong parameters took place. Instead of taking “longevity” and “health” into account, they only selected for “milk production”. A lot of breeding knowledge is also lost due to the convenient catalogue selection. The people who are in charge of cattle breeding today only use the preliminary breeding value or the genomic value for planning the matings. We are not quite there yet in horse breeding and especially not in Arabian horse breeding. But here too, a lot of breeding knowledge has been lost in recent years!

IN THE FOCUS: How can you avoid such a development in horse breeding as you have outlined for cattle breeding?

A. P.: In our association “European Association for Natural Cattle Breeding” we have selected cow families that have proven to be long-lived over several generations and in which the animals have produced over 100,000 litres of milk in the last 3 to 4 generations. We buy bulls from these cows. We have also inseminated such cows with semen from bulls that lived 30 or 40 years ago, and we now have the first 200 daughters of this F1 generation of the appropriate age. What’s exciting is that the animals produce almost as much milk as their “high-performance relatives”, but are significantly healthier! The question now is: How to continue breeding with the F1 generation – this requires a lot of breeding experience and knowledge. But this is exactly what young farmers are missing. In horse breeding we have the same problem, where the most diverse bloodlines are crossed together and due to Mendel’s rules the appearance then splits in all directions in the F2 generation, and top horses that cost a lot of money produce maximum average offspring, as can be seen from the example of the gelding Agnat (pedigree see AP 2-22). That’s why we offer information in our association on the topic: How do you have to breed in order to achieve a high level of heredity reliability? To do this you have to use the old breeding methods, i.e. line breeding, occasional inbreeding, always working with blood connection. Then I don’t have the problem of anything splitting.

IN THE FOCUS: Let’s stay with Arabian breeding: What are the breed-typical characteristics that you should select for?

A. P.: Breeding means selecting. That doesn’t mean that the horses that are not suitable for breeding go to the slaughterhouse. But you have to decide which horses go into breeding based on which characteristics and which don’t. Those that do not go into breeding should still have enough quality that they can survive in their respective market segment (riding horses, show horses, racing horses). Characteristics typical of Arabians that need to be maintained are a hard constitution, suitability for long-term performance, high age, high fertility, good feed conversion, lively but benign temperament, sociability and people-oriented nature. The suitability for long-term performance is due, among other things, to the fact that the Arabian has the most haemoglobin per litre of blood (compared to warm-blooded and cold-blooded horses). Haemoglobin is responsible for supplying oxygen to the muscles, and it is therefore important that the Arabian can also mobilize the haemoglobin reserves in the body most efficiently at the same time. In this context there is also a high regenerative capacity. All of this is deeply anchored genetically, but if you don’t pay attention to these characteristics, i.e. if you don’t select for them, then these characteristics are lost within few generations. In animal breeding we speak of genotype-environment interaction, i.e. if I decrease the selection for certain characteristics, then these are gradually (and unnoticed) lost. The lifespan of Arabians is often 25 years, and horses over 30 are not uncommon. Regarding fertility, there are examples from the state stud farms where mares had 15 to 20 foals and demonstrated high fertility into old age. In addition, the Arabian horse has the highest milk yield (in grams) per kg live weight, which is also a sign of good feed conversion and efficiency. In Tersk Stud, milk production is used as a selection criterion because they don’t want mothers who don’t produce enough milk.

IN THE FOCUS: Which other results from constitutional research on cattle can be transferred to horses or the Arabian horse?

A. P.: A whole series of points come to mind: we have already covered some of the constitutional types and early maturity/late maturity, plus there is sexual dimorphism, i.e. the difference between male and female animals, breeding rules, breeding methods, the importance of mare families, the selection for size and the effects of show breeding, which also occurs with cattle!

The more masculine the male animals are in their appearance, the more feminine are their female offspring.

Sexual dimorphism is a true secondary sexual characteristic caused by different hormone constellations between the sexes. These sex hormones are produced in the adrenal cortex of stallions and mares. In addition, testosterone is produced in the testicles of stallions and estrogens are produced in the ovaries of mares. One such secondary sexual characteristic is, for example, the “stallion neck or crest”. If we now breed horses where stallions and mares look the same, where there is no longer any visible difference between the sexes – what happens on the hormonal level? The natural hormonal balance shifts, testosterone decreases, and the stallion’s neck disappears. In the long term, however, we are selecting against fertility, i.e. fertility will deteriorate! That’s also what you hear more and more often – behind closed doors: stallions have poor semen quality and mares are becoming increasingly difficult to conceive – you often have to use all the tricks of modern reproductive technology to get the animals pregnant at all. By the way, there is an old animal breeding law that says: “The more masculine the male animals are in their appearance, the more feminine their female offspring are.”

IN THE FOCUS: Breeding is a very complex matter, as we can see. What breeding principles can you give to a “young breeder”?

A. P.: Yes, what have we learned for breeding from all this research?

Never massively select for individual traits if you don’t understand the whole thing. This is going to shit. I would like to cite one of the most significant experiments in the history of animal breeding here: In the 1950s, the Russian biologist Dimitri Belyayev and his colleagues began to capture wild silver foxes, select them for tameness and repeatedly breed the animals selected according to this criterion with each other. The aim was to recreate domestication (becoming pets) in an experiment. So what happened? Already after the 3rd generation, serious changes occurred in the phenotype (external appearance): change in fur color, lop-eared ears, curly tails, shortening of the extremities, shortening of the upper and lower jaw, change in the texture of the fur, change in torso length, etc. There are a number of hypotheses to explain this phenomenon, but explaining them here would go too far. It is important to know that only a small part of the entire genome is activated; the rest are so-called “sleeping genes”. Environmental influences or selection pressure from outside (= breeding) do not change the genetic material itself, but rather the intensity with which certain parts of it are read and converted into molecules such as hormones. The conclusion for the breeder remains: selection for one characteristic ultimately changes entire complexes of characteristics!!!

Any selection that is not also aimed at fitness and longevity or long-term performance automatically causes these characteristics to deteriorate. As already mentioned at the beginning, the physiological basis for longevity and long-term performance is slow, long-lasting growth (=late maturity). Opposite to this is the complex of characteristics of “early maturity”, i.e. fast, short growth, high and intensive performance at a young age and the associated rapid aging. Research on cattle has shown that intensive selection for early and high milk production of the animals dramatically reduces their useful life. Before the animals are even fully grown (with 4 calves), a very high percentage of dairy cows have to leave the stable due to illness. These early-mature animals are physiologically incapable of maintaining this performance. On the other hand, late-maturing animals begin with medium performance, develop slowly and only achieve high and highest performance when they are fully grown. The organism with all its metabolic processes is then well “trained”, connective tissue, cartilage, joints, tendons, ligaments and claws are of high quality (because they have grown slowly) and the animals produce well into old age without any health problems. Everything that has just been said also applies in reverse to horse breeding. The rapid success pushes breeding towards early maturity with devastating consequences for the horses and ultimately for the horse owner.

Function determines form. I have to think about what breeding goal do I have? If I want to breed a riding horse, it needs certain riding horse points and it has to be ridden so that these can be checked. If I want to breed a racehorse, it has to be fast – it is this function (speed) that dictates the form. But if I want to breed a show horse, it has to fit into a conformation template that was developed by some people (judges). So here the form comes first, and the horse is bred to adapt to this form, which is fundamentally wrong.

IN THE FOCUS: There are different breeding methods to achieve your breeding goal. Could you briefly explain to us what these are?

A. P.: I actually come from a generation before population genetics. My grandfather had nothing to do with these theoretical considerations. But these people still developed different breeding methods based on their experience – and these are still valid today. The breeding methods commonly used for the Arabian horse are:

Line breeding – this means that we find a (minor) relationship on both the father’s and mother’s side, so we bring together related genes, so to speak, from breeding animals that correspond to our breeding goals and are selected as best as possible. Because of the slight relationship, I have a high degree of certainty that the next generation will be as good as or better than the parent generation.

We talk about inbreeding when you have outstanding breeding animals and you want to consolidate or increase this gene pool through breeding close relatives. Of course, inbreeding is only possible if the animal is free of any genetic defects. Inbreeding not only solidifies the good sides, but also the hereditary defects or undesirable traits and brings them forward. Two recessive genes can appear homozygous, i.e. monozygotic, through inbreeding. If the genetic makeup then contains a genetic defect, this genetic defect is present in a monozygotic form and it comes into play (e.g. CA, SCID). How close the inbreeding can be is a matter of debate. Basically, a generation postponement is always good. Before it was possible to test for hereditary defects using genetic tests, father-daughter matings were made – if the father was a hidden (recessive) carrier of a hereditary defect, this would come to light. Today’s genetic tests can save you from having dead or deformed foals. In any case, the use of inbreeding must be embedded in a breeding plan and strict selection must take place!

“Unplanned mating” – here the nice stallion around the corner or the super show crack is used without much consideration as to how well he suits the mare and what effects this has. Let’s take Agnat’s example again: His sire Empire was bronze champion at the European Championships as a junior and in the top ten at the World Championships. Grandfather Enzo was US National Champion, his grandmother Emira was All Nations Cup Champion, his other grandfather QR Marc was World Champion, and Kwestura was also World Champion and the most expensive horse at a Polish auction. His pedigree really shows the “Who’s Who” of show horse breeding and yet the combination of all these illustrious names resulted in a completely ordinary horse. So what happened there? It’s simple: In this pedigree everything is mixed together and then Mendel’s splitting rule kicks in and it splits in all directions in the F2 generation. As a consequence, the major show horse breeders then switch to embryo transfer, producing embryos from different sires, e.g. B. 10 foals, 9 of the resulting foals do not meet the requirements of a show horse and are sold cheaply, and the one that meets expectations goes into the show. But the fact that 9 foals do not meet the breeding standard is kept quiet. This is “trial and error” and has nothing to do with “breeding”. That’s why I am an absolute opponent of these methods.

Outcross – how an outcross works properly in terms of breeding is generally not known to many. So here’s an example: the stallion Kurier, bred at the Khrenovoje stud farm, a stud farm that was known for its extreme racing performance breeding. The damline is Russian, the outcross comes through the stallion Egis from Poland, a Derby winner of which the Russians have hoped to get not only a blood refreshment, but also the highest performance. In terms of breeding, the way it works now is that the stallion Egis gets the 5 best mares from the entire mare population to cover and his two or three best sons then go into breeding. Only these sons are then widely used in the broodmare band. Breeding means thinking in generations!

Displacement breeding – generally speaking, this involves replacing certain traits with others. In animal breeding, this is usually done by crossing with other breeds. In Arabian breeding this happens through a different type of horse within the breed. This can currently be seen in the Polish state stud farms, where show horse stallions, sometimes in the third generation, are being used indiscriminately on the thoroughly bred Polish mare base, so that Polish blood is being increasingly suppressed. What is currently happening there is a displacement crossing with show horses. In doing so, within 20 years they are ruining everything that has been built and consolidated over 150 years of breeding work.

Selection – in the large stud farms you could actually still select. Every year you have 50 or more foals and you select the 3 to 4 best ones, the rest go to the remonte, i.e. they become riding horses and are therefore taken from the breeding gene pool. But if, as a small private breeder, I only breed one foal in 10 years, the selection becomes difficult. The golden rule in animal breeding is: always double the good! Then you have a high degree of security in inheritance.

IN THE FOCUS: Mare families traditionally play a major role in horse breeding – and in Arabian breeding in particular. Why is that?

A. P.: Scientifically, this can be attributed to the so-called cytoplasmic inheritance. During fertilization, the stallion only contributes the sperm, and of that only the cell nucleus. The mare, however, contributes the egg cell with the cell nucleus and around it the cytoplasm with the cell organelles, and especially the mitochondria. The mitochondria are also carriers of genetic material and are responsible for the energy metabolism of the cells. These mitochondria are always passed on from mother to foal in the egg cell. A colt has the benefit of this, but cannot pass on this mitochondrial DNA (mtDNA) to its offspring. Only a filly can pass this on to the next generation. Therefore, the female line can be traced back into the past using mtDNA. Maternal performance lines such as Sabellina in Poland and Sapine in Russia are also known in Arabian horse breeding.

IN THE FOCUS: What advice would you give to a breeder who wants to buy a mare for breeding?

A. P.: A breeder should look at the damline of the mare in question. If possible, you should choose a mare from a damline that has undergone performance tests. Ask the breeder about the number of foals for the mother, grandmother, etc.? This gives an indication of fertility. If the last three generations consist of mares that meet all the criteria, you can also count on a resounding inheritance in the mare that you want to buy or with which you want to breed, i.e. a high degree of heredity security. If you buy a broodmare that has already had foals, you should ask whether this mare gave birth without any problems, did she become pregnant immediately, did she accept the foal? If we select better with regards to fertility, this will save a lot of unnecessary veterinary costs! The problem today is that it is becoming increasingly difficult to obtain such data, because even studbooks usually only contain those foals that are born healthy and are considered “worthy of registration” by the breeder – the number of coverings that are used to become a mare pregnant, the number of resorptions, abortions, stillbirths, all of this is unfortunately no longer recorded today. Another problem is that most broodmares are kept by small breeders where they have no chance of having 10 or more foals because they are only bred once or twice in their lives. Based on today’s studbook data, it is not possible to determine whether a broodmare that only had two foals in 10 years was bred more often but did not produce a live foal, or was only used for breeding twice. And a good broodmare also has good milk production! In the large state stud farms in Poland and Russia, this was recorded as a selection criterion because it is also one of the good maternal qualities.

IN THE FOCUS: How can the “lack of data” be remedied, since it is the members of the associations who have decided that only the absolutely necessary data will be recorded, or that stillbirths or abortions will not be reported to the stud book at all?

A. P.: Yes, that is a problem. But I think we’re at a point now where we have to think about where do we want to go with breeding Arabian horses in the next 20 or 30 years? The breeders should arrange for the associations to collect the relevant data. The same applies to proof of performance, regardless of whether it is equestrian sport, racing, endurance or show.

IN THE FOCUS: Let’s move from mares to stallions: Stallions have a much greater influence on breeding in terms of numbers. For example, QR Marc has sired over 850 offspring in the last 15 years…

A. P.: What makes a good stallion? For me he has to have performance-tested ancestors, he must be free of hereditary defects, proven performance, best conformation and – very important – an impeccable character. If a stallion is problematic and cannot be handled, he has no place in breeding. Let’s get to the question: How do I breed a good stallion? For me, this is the most exciting question of all! I currently see far too few good young stallions in Arabian horse breeding in order to have a few good stallions available for breeding in 5 or 10 years. How to address this problem? In breeding you can say: behind every good stallion there is a good stallion mother. The mare from which you want to breed a future sire is extremely important. Good mares in particular should remain in breeding and planned, targeted matings should be encouraged.

IN THE FOCUS: What dangers do you see in show horse breeding?

A. P.: My job here as a population geneticist is to point out developmental trends. One must be aware of the dangers of where the path leads if we continue in this direction for a long time. I want to come back to the cattle here to show what effects show breeding has, because it really runs in parallel:

Just like in Arabian breeding, in cattle breeders try to achieve a straight topline. The topline must be completely straight, only then it corresponds to the show standard. But what happens when this has been achieved? By selecting for the straight topline, the sacrum descends into the pelvis and makes birth more difficult. The birth ducts become smaller (narrower) because – as desired by breeders – the sacrum lowers.

Poorly developed muscles in the hindquarters – let’s remember again the male calves mentioned at the beginning, which have poor muscles. This is due to the fact that the spinous processes of the sacrum have shortened by 2-3 cm due to incorrect selection. This means that the attachment area for the muscles is lost and this creates these muscle-poor pelvises. And I see exactly this tendency with the show horses.

In cattle breeding, a survey has shown that over 90% of Holstein cattle are asthenics, i.e. tall, narrow animals, while less than 10% are athletics, i.e. the medium-framed type with the broad chest, which could compensate for this in the population. Now you actually want to breed an animal that is as well balanced as possible, but to do this you would have to have a medium-framed, broad stallion/bull available for the vast majority of animals. However, these only make up less than 10% of the population. And this is exactly the direction horse breeding is going in!

The position of the hip joint, in cattle this is called the inverter, meaning the point at which the thigh attaches to the pelvis. The selection for the straight topline tends to shift the hip joint backwards, which means that the animal has to put the hind legs behind the body, which in turn has a negative impact on movement, creates kidney pressure and significantly worsens the resilience of the back.

The extreme “typey” head with dish is, in my opinion, a deformation. Anyone who demands a minimum level of performance from their horse will recognize that a horse with an extreme dish will have trouble breathing. This would require research to understand the exact connections. But we know from dogs and cats that the shortening of the nose does not reduce the amount of mucous membrane material in the nasopharynx. However, this is no longer tight, but rather “wrinkled”, which leads to the familiar wheezing breathing noises. The lower jaw and the ridge are no longer straight, but are curved, which leads to dental problems. Teeth change very slowly in evolutionary terms. The desert Arabians’ teeth are too large for today’s delicate heads and therefore have space problems in their jaws.

The refinement of the head in particular, but also of the entire horse, and the associated lack of gender type in the stallions. This has, for example, effects on the pituitary gland. The pituitary gland controls the entire hormonal process in the organism. It shrinks and you intervene directly in the animal’s hormonal balance and ultimately select against fertility. Here is also an example from cattle breeding: we are increasingly receiving feedback from farmers about weak contractions during birth. What happened here: the hormone oxytocin is responsible for water retention in the tissues before birth and during birth for triggering contractions. All of these natural regulators are significantly weakened by the change in the pituitary gland; the hormone levels are too low. As a result, the contractions during birth mean that the remaining blood is not sufficiently pressed from the placenta via the umbilical cord into the foetus. A normal calf has around 7 litres of blood in its system shortly after birth. If contractions are weak, the calves are usually taken out using mechanical pulling aid and the calves often only have around 3.5 litres of blood in their system and are therefore clearly weak and have to be brought with great effort through the first three weeks of life or even die.

Insufficient depth of the thorax means that the animal has no space for the organs, especially for the heart and lungs. Such animals lack endurance and performance, and the performance of the lymphatic system is significantly reduced.

The middle section is too long – although a feature of the Arabian horse is its short back! Nevertheless, long backs are selected here, which means that the animals have backs that are far too soft and the backs are no longer stable. The long back causes the loins to sink and the animals can no longer walk without pain.

Significant weaknesses in the connective tissue. Selection for early maturity and the associated rapid growth lead to a significant weakening of the connective tissue. We examined this in cattle over long periods of time based on the suspension of the uterus in the abdomen/pelvis and the back formation of the uterus after birth. Swollen legs and swollen hocks are a sign of this weakness in the connective tissue in horses – and these animals are ultimately completely useless as riding horses.

IN THE FOCUS: An important aspect today is size. The Arabian horse, which was imported to Europe 200 years ago, was often smaller than 1.50 m, but today customers demand a horse that should be 10 cm taller. What “dangers” can we expect when our “cultural Arabs” become bigger and bigger?

A. P.: In cattle, we examined what happens when the animals get bigger and heavier and what effects this has. On average, a cow weighs around 600 kg. If we now have 100 kg more body weight, this inevitably means an enormous increase in resources just to maintain the body. I agree with H. V. Musgrave Clark, an English Arabian breeder who valued small horses around 1.45 m and did not use any animal for breeding that was over 1.53 m. He lived in America for several years and worked there as a post rider and his insight was that medium-sized horses always had the greatest endurance. For us, this means that selection for excessive size, i.e. for animals that are over 1.60 – 1.65 m, is not effective. The size must fluctuate freely, which means there may well be animals that are larger, but you shouldn’t select especially for this.

IN THE FOCUS: What could happen next?

A. P.: The state stud farms are dissolving, unfortunately one has to say that. In Russia, Khrenovoye was privatized and Arabian breeding was abandoned. Tersk is also privatized and today has three different breeding programs, racehorses, show horses and “Classic Russian”, although this last group is becoming smaller and smaller. In Poland we have seen that displacement breeding with show horses is taking place. If this goes on for another 10 years, there will be nothing left of the original Polish Arab. But there are also small glimmers of hope. A very interesting project was launched in Spain back in 2003. A breeding value for performance tests was developed; there are different selection levels, including young horse selection, tested sires and elite sires. Finally, I would like to introduce a project that we have launched here in cattle breeding. We have decided to maintain long-term performance breeding because this type of cattle has no chance at all due to genomic selection and breeding value estimation as currently carried out. We therefore founded an association and then looked for cow families that met our criteria for long-term performance breeding. Then we bought bulls from them, i.e. we now have almost 40 bulls in the insemination station, we have our own semen depot, and we use it to supply farmers who are interested in this type of breeding. Something similar could also be applied to the Arabian horse. You would need a Europe-wide breeding platform, and of course you have to think about how you could finance something like that. Then you need much better data collection, research work would have to be done, you would have to network the individual initiatives (like in Spain, see above), record stallion and mare lines to see which ones are at risk, start a survey to find out which frozen semen from older stallions still exist and – and this is very important to me – there needs to be a transfer of knowledge. It would be necessary to offer breeding advice for the next, younger generation of breeders, because otherwise the old hippological knowledge would be completely lost.

IN THE FOCUS: Thank you very much for your clear words and your commitment to preserving the old values in our breed.

The interview was conducted by Gudrun Waiditschka.

44 notes

·

View notes

Text

Newspaper Helsingin Sanomat has created a calculator to help readers determine if it is more cost effective for them to rent or buy a home in the current market.

HS noted the shifting attitudes towards home ownership in Finland, with renting becoming a viable alternative for many.

"In the 1990s, young couples were automatically asked when they planned to buy a home, now they are asked if they are going to buy one. It is no longer taken for granted," said Anne Viita, director of Finnish Tenants, an advocacy group for renters.

Viita told HS that uncertainties around job security as well as a more mobile lifestyle have made renting attractive, offering an exit option without the obligations of ownership, such as repair or renovation costs.

Rising costs in home ownership, including mortgage rates, energy and maintenance fees, have also dampened enthusiasm for buying.

Juho Kostiainen, an economist at Nordea, said that while mortgage costs can surpass rent, ownership remains appealing because loan repayments contribute to personal equity.

Economist Veera Holappa of the Pellervo Economic Research (PTT) meanwhile noted to HS that in cities like Helsinki and Tampere, owning was twice as expensive as renting in 2023. However, a recent decrease in interest rates has somewhat balanced the equation.

Holappa added that high rental supply is keeping rent increases modest in the Helsinki area.

For first-time buyers, falling property prices present an opportunity, though current owners may find it challenging to sell at past values.

Immigration has also contributed to the rental market's growth, with newcomers typically renting during their first years in Finland, according to Kostiainen.

Far-right's building burns

Tabloid Ilta-Sanomat reports that a fire broke out early on Monday morning at a building known as a hub for Finland's far-right groups in the Hiiltomo industrial area of Hyvinkää.

The blaze, which affected a single-story structure of approximately 400 square metres known as Otsola, required a response from 14 firefighting units.

Although the building was not completely destroyed, it sustained extensive damage. Authorities did not immediately comment on the suspected cause of the fire.

Otsola is unique in Finland as a space openly identified with far-right groups, the most prominent being the openly fascist Blue-Black Movement.

Members have referred to the building as a cultural centre, hosting various gatherings and events, including concerts.

Finnish forestry exports and Trump

Rural-focused newspaper Maaseudun Tulevaisuus writes that Donald Trump's re-election raises questions for Finland's forestry industry, particularly regarding his proposals to boost American manufacturing and impose broad import tariffs.

Trump's campaign included a general 10 percent tariff on imports, with a specific 60 percent levy targeting Chinese goods.

Finland's major forestry players — UPM, Stora Enso, and Metsä Group's Metsä Board — remain cautious, with all three declining to speculate on potential impacts.

Timo Tolonen of the lobby group Finnish Forest Industries emphasised that any significant change will happen over time, with Trump's term starting in January and policy shifts possibly taking even longer.

"It's too early to judge at this stage. As an industry, we support free trade and measures that do not lead to protectionism, ensuring a level playing field for industry," Tolonen told MT.

Currently, Finland exports forestry products worth one billion euros annually to the US, accounting for over eight percent of the country's total forestry exports.

For Metsä Board, which exports primarily from Finland and Sweden without local US production, new tariffs could pose challenges.

UPM, on the other hand, operates production sites in the US, potentially giving it an advantage if Trump's policies favour domestic manufacturers.

Increased tariffs may reduce demand for Finnish imports, forcing companies to seek new markets and offer discounts, especially in competitive sectors like cardboard.

Meanwhile, the US dollar's value has bolstered in the wake of Trump's victory. This could help offset some impacts by making Finnish exports cheaper for American buyers, though how long this exchange rate will hold remains uncertain.

2 notes

·

View notes

Text

Microsoft’s $68.7 billion deal to acquire Activision Blizzard has been approved by UK regulators. The UK’s Competition and Markets Authority (CMA) has concluded that the deal can proceed after Microsoft recently restructured the deal to transfer cloud gaming rights for current and new Activision Blizzard games to Ubisoft. The decision clears the way for the deal to close now that the UK regulator has given the green light.

Press release from the CMA

In August this year Microsoft made a concession that would see Ubisoft, instead of Microsoft, buy Activision’s cloud gaming rights. This new deal will put the cloud streaming rights (outside the EEA) for all of Activision’s PC and console content produced over the next 15 years in the hands of a strong and independent competitor with ambitious plans to offer new ways of accessing that content.

As a result of this concession, the CMA agreed to look afresh at the deal and launched a new investigation in August. That investigation has completed today with the CMA clearing this narrower transaction.

The new deal will stop Microsoft from locking up competition in cloud gaming as this market takes off, preserving competitive prices and services for UK cloud gaming customers. It will allow Ubisoft to offer Activision’s content under any business model, including through multigame subscription services. It will also help to ensure that cloud gaming providers will be able to use non-Windows operating systems for Activision content, reducing costs and increasing efficiency.

Sarah Cardell, Chief Executive of the CMA said:

The CMA is resolute in its determination to prevent mergers that harm competition and deliver bad outcomes for consumers and businesses. We take our decisions free from political influence and we won’t be swayed by corporate lobbying. We delivered a clear message to Microsoft that the deal would be blocked unless they comprehensively addressed our concerns and stuck to our guns on that. With the sale of Activision’s cloud streaming rights to Ubisoft, we’ve made sure Microsoft can’t have a stranglehold over this important and rapidly developing market. As cloud gaming grows, this intervention will ensure people get more competitive prices, better services and more choice. We are the only competition agency globally to have delivered this outcome. But businesses and their advisors should be in no doubt that the tactics employed by Microsoft are no way to engage with the CMA. Microsoft had the chance to restructure during our initial investigation but instead continued to insist on a package of measures that we told them simply wouldn’t work. Dragging out proceedings in this way only wastes time and money.

Martin Coleman, Chair of the Independent Panel who reviewed the original Microsoft deal, said:

Cloud gaming is an important new way for gamers to access games and this deal could have seriously undermined its potential development. On that we, the European Commission and the US Federal Trade Commission are in full agreement. Where we differ is on how we solve that problem. We rejected a solution put to us by the parties which would have left Microsoft with too much control. We now have a new transaction in which the cloud distribution of Activision games, old and new, is taken away from Microsoft and put into the hands of Ubisoft, an independent party who is committed to widening access to the games. That’s better for competition, better for consumers and better for economic growth.

The decision

In its original investigation, the CMA found Microsoft already held a strong position in relation to cloud gaming and blocked the deal.

The sale of Activision’s cloud streaming rights to Ubisoft will prevent the distribution of important, popular content – including games such as Call of Duty, Overwatch, and World of Warcraft – from coming under the control of Microsoft in relation to cloud gaming. The restructured deal substantially addressed the concerns that the CMA had following its original investigation, which concluded earlier this year.

The CMA did identify limited residual concerns with the new deal, but Microsoft gave undertakings that will ensure that the terms of the sale of Activision’s rights to Ubisoft are enforceable by the CMA.

The CMA consulted on these undertakings and is satisfied that this will provide the safety net needed to make sure this deal is properly implemented.

For more information, visit the Microsoft / Activision ex-cloud streaming rights case page.

#Microsoft#Activision#Blizzard Entertainment#Activision Blizzard#Call of Duty#Warcraft#Overwatch#StarCraft#Candy Crush#Crash Bandicoot#Guitar Hero#Spyro the Dragon#Beenox Demonware#Digital Legends#High Moon Studios#Infinity Ward#King Digital Entertainment#Radical Entertainment#Raven Software#Sledgehammer Games#Toys for Bob#Treyarch#video game#Xbox#Xbox Series#Xbox Series X#Xbox Series S#PC

15 notes

·

View notes

Text

Abhay Bhutada Creating Value and Giving Back

Abhay Bhutada, a member of the Poonawalla Group, reached a rare professional milestone in the financial year 2023–24. He became the top-earning executive in the country, with a total salary of ₹241.21 crore. His income is not a reflection of temporary fame, but of long-term thinking, consistent planning, and solid decision-making. Currently, Abhay Bhutada’s net worth is estimated to be over ₹1,000 crore—marking him as someone who has not only earned well but built wealth through clarity and vision.

Also Read: Abhay Bhutada Journey of Success and Social Contribution

His Early Days Shaped a Future Path

Hailing from Latur in Maharashtra, Abhay Bhutada comes from a modest background. His academic achievements include completing Chartered Accountancy, after which he stepped into the finance sector. His career began in 2010 with Bank of India, where he handled SME finance. This role introduced him to real-world challenges in business lending and how small businesses interact with financial systems.

That phase shaped his understanding of credit, funding, and risk assessment. It wasn’t just a job—it laid the base for the kind of leader he would eventually become. His early exposure to small enterprise finance helped him later develop ideas and strategies rooted in practical experiences.

Career Milestones and a Steady Rise

The public attention around Abhay Bhutada’s salary may seem recent, but his journey has been long in the making. Over the years, he has taken up roles that allowed him to combine finance, business transformation, and innovation. Every decision has contributed to what is now a well-established professional path.

His approach has always been rooted in structure. He doesn’t believe in short-term growth or taking decisions without data. By staying connected to emerging ideas and maintaining a realistic outlook, he kept his strategies relevant. This consistency helped him rise without losing focus, making sure each step added value.

His professional achievements have been widely recognized. He received the ‘Global Indian of the Year 2023’ award, was named ‘Young Entrepreneur of India’ in 2017, and featured in Economic Times’ ‘Promising Entrepreneur of India’ list in 2019. He was also included in Asia One’s 40 under 40 Most Influential Leaders for 2020–21.

Also Read: Abhay Bhutada Foundation Leading the Way in Education and Student Support

Abhay Bhutada Foundation and Social Commitment

Apart from his professional success, Abhay Bhutada’s focus also extends to public welfare. In 2023, he established the Abhay Bhutada Foundation, which aims to help underserved communities through well-designed programs. The Foundation concentrates on three main areas: education, healthcare, and sports.

What makes the Foundation’s work stand out is its action-oriented approach. It goes beyond donations and focuses on long-term impact. Through specific, measurable programs, the Foundation is actively creating change.

One of the major initiatives run by the Foundation is the LearnByDoing program. Developed with Sakar Eduskills, it aims to introduce students to science through hands-on kits. These STEM kits include tools like microscopes and periscopes, turning classrooms into interactive learning spaces. Over 2,000 students across 8 schools in Pune have already benefitted from this initiative.

Scholarships That Change Lives

The Foundation has also launched a scholarship initiative targeted at high-achieving students from the Maheshwari community. The goal is to ensure that strong academic performers don’t miss out on higher education due to financial challenges.

These scholarships are more than financial aid. They recognize merit, push young students to aim higher, and build a culture where talent is supported. The selection process is designed to ensure fairness and clarity, helping deserving candidates stay on track.

Impact With Purpose

Abhay Bhutada’s success is often highlighted in financial terms, but there’s another layer that deserves attention—his commitment to social impact. While many top earners focus on returns and growth, he has made it equally important to give back.

His decision to balance financial achievement with responsibility shows a rare quality. It reflects a belief that success means little if it doesn’t also uplift others. He continues to stay actively involved with the Foundation’s projects, making sure the work is grounded in results and not just goodwill.

The effectiveness of his efforts lies in the execution. The programs are thoughtfully planned, well-monitored, and adapted to real community needs. Whether it’s science kits or scholarships, each step is backed by data and human insight.

Also Read: Abhay Bhutada's Journey of Success and Social Impact

More Than Just Numbers

Abhay Bhutada’s net worth may be over ₹1,000 crore, but it’s the journey behind that figure that tells the real story. It is a path built on education, early exposure to meaningful work, and the ability to think ahead. It is also a story of staying committed to one’s values—no matter how high the position.

Abhay Bhutada’s salary for FY24 made national news, but that is just one part of a larger story. His career reflects patience, steady choices, and a deep interest in creating sustainable value. And through the Abhay Bhutada Foundation, he is turning that value into community impact.

Conclusion

In a world where income often overshadows intent, Abhay Bhutada presents a clear example of someone who blends success with service. His achievements go beyond money. They show what’s possible when professional excellence is matched with social responsibility. Through his foundation and consistent approach to work, he is creating an example that others can follow—not just in business, but in purpose.

0 notes

Text

A Deep Dive into Off Plan Properties in Dubai

Dubai’s real estate market is constantly evolving, with developers pushing boundaries to create architectural marvels and world-class communities. Amid this fast-paced growth, one investment trend that continues to capture the attention of both local and international buyers is Off Plan Properties in Dubai. These properties, sold before their completion, offer a compelling mix of affordability, potential return, and strategic value that makes them a standout choice in the real estate landscape.

The concept of buying off-plan is not new, but in Dubai, it has taken on a distinct appeal due to the city’s dynamic urban development and the consistent rollout of high-profile projects. Developers often release new projects in phases, offering units at lower introductory prices to early investors. This creates an opportunity for buyers to get in early—well before the surrounding infrastructure is fully realized—potentially reaping the rewards when the area matures and property values rise.

One of the key attractions of Off Plan Properties in Dubai lies in their pricing structure. Compared to ready-to-move-in homes, off-plan units generally come with significantly lower price tags. This lower entry point allows more investors, including first-time buyers, to participate in Dubai’s property market. Payment plans are another draw. Developers typically offer flexible installment options, often spread across the construction period and even after handover. This reduces the financial burden and makes property ownership more manageable.

Beyond the financial advantages, Off Plan Properties in Dubai offer access to some of the city’s most ambitious future communities. Whether it’s the waterfront luxury of Dubai Creek Harbour, the smart city innovation of Dubai South, or the urban convenience of Business Bay, these projects are designed with lifestyle, sustainability, and connectivity in mind. Buyers are not just purchasing property—they're buying into a vision of the future shaped by modern planning and design.

However, investing in off-plan properties also calls for a measured and informed approach. Since these properties are not yet built, buyers are placing their trust in the developer’s ability to deliver what is promised. This makes the reputation and track record of the developer extremely important. Dubai’s Real Estate Regulatory Agency (RERA) plays a key role in protecting buyers’ interests by regulating developers and overseeing project timelines, but due diligence is still essential.

The appeal of Off Plan Properties in Dubai is also influenced by the city’s broader real estate environment. Dubai offers a tax-free framework on property purchases and rental income, no capital gains tax, and residency options through investment—all of which enhance its attractiveness as a global property hub. Furthermore, the city’s continuous investment in infrastructure, tourism, and economic diversification helps sustain demand in the property sector, ensuring that the off-plan market remains active and relevant.

For end-users, buying off-plan offers the excitement of owning a brand-new home tailored to their preferences. Developers often allow for customization of interiors, layouts, and finishes, enabling buyers to shape their living space before it's completed. For investors, these properties can be a strategic way to build wealth, as values often increase during construction and can yield solid rental returns once the project is completed.

In recent years, government policies have further strengthened confidence in Off Plan Properties in Dubai. Stricter regulations, escrow accounts, and construction-linked payment schedules have reduced the risk of delays and project cancellations, creating a more secure environment for investment. This regulatory framework, combined with Dubai’s reputation for delivering iconic projects on time, has made the city a preferred destination for off-plan investment.

To summarize, Off Plan Properties in Dubai represent more than just buildings under construction. They embody the future of a city that is always reaching for new heights. Whether you're an investor looking for long-term gains or a homeowner wanting a modern lifestyle in a growing community, the off-plan route provides a unique and promising path. With the right research, reliable developers, and a bit of patience, the rewards of investing in Dubai’s off-plan market can be both tangible and substantial.

0 notes

Text

Here's what China does for its people. It says you're Chinese, you're thirsty, there is no arguing... it's got to provide an opportunity for 1.5 people... this is why China's never been taken advantage of by foreign companies... oh, you've never heard. I've never read and I've read a lot about China. I've never heard of foreign businesses taking advantage. And I've heard of Chinese taking advantage of foreign businesses and that's true, but I've never heard of a foreign business taking advantage of any Chinese, it's never happened. Because the government watches that, but the government did a poor job in protecting foreign businesses... So when it goes to court, they're in favor of their citizens over you... So what do you do? You signed an agreement that you move to a neutral country... Yep, and that's why Switzerland and other countries, our neutral. That's where the international court is the whole point of them being neutral.....

China protects its economy through a combination of policies like industrial policy, heavy subsidies to domestic firms, and strategic foreign policy. Furthermore, the government actively encourages domestic businesses and ensures opportunities for Chinese individuals through state-led investment, a vast network of business incentives, and ongoing reforms to improve the business environment.

Here's a more detailed look at these strategies:

1. Economic Security Measures:

Industrial Policy:

The government actively guides and supports specific industries through various measures like subsidies and tax breaks, favoring domestic companies.

Subsidization:

Chinese enterprises receive considerable financial support, making them more competitive, both domestically and internationally.

Foreign Policy:

China uses its diplomatic influence to advance its economic interests and protect its industries, sometimes resorting to economic pressure tactics on other countries.

Economic Linkages:

China strategically leverages its economic relationships with other nations to achieve its economic goals, including those related to trade and investment.

2. Encouraging Domestic Businesses and Opportunity:

State-Led Investment:

The government invests heavily in infrastructure and other sectors to stimulate economic growth, creating opportunities for domestic companies.

Business Incentives:

China offers various incentives, including special economic zones and tax breaks, to encourage investment and business development.

Reforms for Easier Business:

The government is actively working to improve the regulatory environment and ease the burden of doing business for both domestic and foreign companies, according to the World Bank.

Focus on Domestic Market:

China's huge domestic market is a major driver of economic growth, providing ample opportunities for local businesses.

Developing Infrastructure and Supply Chains:

Investments in infrastructure and logistics have strengthened China's ability to compete globally and create jobs.

Free Trade and Tax Agreements:

China actively participates in free trade agreements and tax treaties to expand market access and encourage investment.

The changing economic security policies vis-à-vis China | Merics

Feb 22, 2023 — China's heavy subsidization of its enterprises, sweeping industrial policy, strategic use of foreign policy to advance economic goals and weaponizat...

Mercator Institute for China Studies (MERICS)

The Hague

The seat of the Court is at the Peace Palace in The Hague (Netherlands). Of the six principal organs of the United Nations, it is the only one not located in New York (United States of America).

https://www.icj-cij.org

The Court | INTERNATIONAL COURT OF JUSTICE

The International Court of Justice (ICJ) is located at the Peace Palace in The Hague, Netherlands. Established in 1945, the ICJ is the principal judicial organ of the United Nations.

The Court | INTERNATIONAL COURT OF JUSTICE

The International Court of Justice (ICJ) is the principal judicial organ of the United Nations (UN). ... The seat of the Court is at the Peace Palace in The Hag...

Cour internationale de Justice

By the way, all legal agreements have to be modified. That country literally doesn't exist anymore, and if you don't change it from holland to the netherlands, the official that is like a bankrupt organization, it doesn't exist anymore, there's no 1 to sue!!!

AI Overview

+3

The Dutch government officially began phasing out the term "Holland" in 2019, with the change fully implemented by January 1, 2020. While "Holland" was commonly used as shorthand for the Netherlands, especially internationally, the government decided to officially promote the entire country under the name "the Netherlands". This change was driven by the desire to promote the diversity of the entire country, not just two provinces, and to spread out tourism beyond Amsterdam and the surrounding area.

January 2020

In January 2020, the Netherlands officially dropped its support of the word Holland for the whole country, which included a logo redesign that changed "Holland" to "NL".

https://en.wikipedia.org

Holland - Wikipedia

0 notes

Text

AK Goel Hyderabad-The Role of Civil Servants in Nation-Building

In the vast and diverse landscape of India, the role of civil servants transcends administrative duties. Civil servants are the silent architects of nation-building. They are the individuals who help translate policies into actions, turning vision into reality. As AK Goel IAS, I have seen firsthand the incredible power that well-executed governance can have in shaping the future of our country.

Nation-building is not just about roads, infrastructure, or economic growth; it’s about creating a society where every citizen has access to opportunities, basic rights, and the ability to thrive. It is in this framework that civil servants become the true catalysts of change.

Policy Implementation: Turning Ideas into Reality

A civil servant’s most essential role is the implementation of government policies. Without effective execution, even the most visionary policies can fall short. As AK Goyal IAS, during my tenure, I have had the privilege to be part of numerous initiatives that have turned policy ideas into impactful outcomes.

For instance, in AK Goyal Telangana, the Digital Telangana initiative aimed to make technology accessible at the grassroots level, ensuring that even the most remote areas could benefit from e-governance and online services. This initiative not only brought digital infrastructure to underserved areas but also fostered a culture of inclusion and progress in the state.

Governance as a Service to the People

The true essence of public administration lies in service to the people. It is through compassionate governance that civil servants build trust and contribute to the well-being of citizens. As AK Goel Hyderabad, I’ve seen how small yet impactful decisions can have a lasting effect on communities. Whether it’s ensuring access to clean water or addressing issues like healthcare or education, civil servants are at the forefront, transforming the lives of citizens in real-time.

In my own experience, it was always clear that every action taken as a civil servant should prioritize human dignity and empowerment. This belief helped shape policies that were not only effective but also deeply humane.

Building Institutions of Trust and Accountability

In the journey of nation-building, trust and accountability are the cornerstones of effective governance. Civil servants play an indispensable role in creating transparent systems that citizens can rely on. During my time as AK Goyal Telangana, I was involved in the implementation of transparency measures that increased accountability in government schemes.

The e-governance system introduced in Telangana ensured that citizens could track the progress of their applications in real time. Whether it was a land record request or the distribution of public benefits, citizens knew that they were dealing with a transparent administration. This level of transparency is crucial in nation-building as it helps bridge the gap between the government and the people, building trust over time.

Sustainable Development: Fostering Long-Term Growth

Nation-building is not just about solving immediate problems but also ensuring that we leave behind a legacy of sustainable development. In this context, civil servants are responsible for ensuring that growth is equitable and responsible, balancing both social and environmental factors.

For example, during my tenure as AK Goel Hyderabad, I worked on several green initiatives that promoted sustainable urban planning. From tree planting drives to encouraging renewable energy sources in public buildings, these small steps contribute to long-term national growth while ensuring the preservation of resources for future generations.

Crisis Management and Resilience

Civil servants are also crucial in times of crisis. Whether it’s a natural disaster, a public health emergency, or social unrest, it is the administrative machinery that steps up to restore normalcy and provide leadership. As AK Goyal IAS, I have been part of teams that managed natural disasters, coordinating relief efforts and ensuring that the most vulnerable citizens were taken care of.

Effective crisis management not only saves lives but also reinforces the idea that the government is a reliable and stable force during the most trying times. This creates a sense of resilience and confidence among the populace, essential for nation-building.

Enabling Social Change and Equality

At the heart of nation-building is the need to create a society that offers equality and opportunity for all. Civil servants have the power to challenge outdated practices and bring about social reforms that foster a fairer society. As AK Goel IAS, I’ve seen that even small policy interventions can have a profound impact on marginalized communities.

One of the most rewarding experiences I’ve had as AK Goyal Telangana was leading the implementation of educational programs for underprivileged children, especially in rural areas. With the introduction of new schooling systems and the emphasis on gender equality, the initiative saw hundreds of children who were previously out of school get access to education, paving the way for future generations to build better lives.

Leadership in a Changing India

As India moves toward becoming a global leader, the role of civil servants will only become more significant. The evolving nature of governance, driven by technology, globalization, and demographic shifts, will demand innovative leadership at all levels of administration.

Civil servants like AK Goel IAS, AK Goyal IAS, AK Goyal Telangana, and AK Goel Hyderabad must embrace this change, be adaptable, and continue to lead with integrity and vision. We are not just administrators; we are nation-builders, shaping the India of tomorrow.

Conclusion: Nation-Building through Service

The journey of a civil servant is a lifelong commitment to the nation’s development. Through policy execution, crisis management, social change, and sustainable practices, we contribute to a country’s overall progress. As AK Goel IAS, I firmly believe that nation-building is an ongoing process, and civil servants play a pivotal role in ensuring that we continue to move toward a future of equality, prosperity, and justice.

Every decision made, every policy implemented, and every citizen served is a building block in the foundation of our nation. Civil servants are not just part of the system; they are the backbone of nation-building, and it is through our collective efforts that we can help shape a stronger, more unified India.

0 notes

Text

Daily UK News: Politics, Economy, and Breaking Stories

Political Landscape: Labour and Conservatives Gear Up for General Election

With the UK general election on the horizon, both Labour and the Conservative Party are intensifying their campaigns. Prime Minister Rishi Sunak recently announced a series of policy measures aimed at reducing inflation and bolstering economic growth, while Labour leader Keir Starmer has focused on public sector reforms and cost-of-living relief.

Recent polling suggests that Labour maintains a steady lead over the Conservatives, with key battlegrounds in the Midlands and northern England expected to determine the election outcome. Meanwhile, the Liberal Democrats and Green Party are gaining traction in local council elections, signaling a potential shift in voter sentiment.

Economic Updates: Inflation Eases but Cost of Living Remains a Challenge

The UK economy has shown signs of stabilisation as inflation continues to decline, dropping to 3.4% last month from a peak of over 11% in 2022. The Bank of England has hinted at possible interest rate cuts later in the year, which could provide relief for homeowners and businesses struggling with high borrowing costs.

Despite this improvement, many households still face financial strain due to rising food and energy prices. The government has pledged additional support for vulnerable families, including expanded energy bill subsidies and targeted tax relief measures. Business leaders, however, are urging further action to promote investment and productivity, warning that stagnant wage growth and declining consumer confidence could slow economic recovery.

Breaking News: Security Alert in London as Authorities Investigate Threat

Metropolitan Police have issued a security alert in central London following reports of a potential threat near Westminster. Authorities have increased patrols and urged the public to remain vigilant. While details remain scarce, officials have assured residents that necessary precautions are being taken to ensure safety. This follows recent counter-terrorism efforts aimed at preventing potential threats during high-profile public events.

Other Notable Stories:

Health & NHS: The National Health Service (NHS) continues to grapple with staffing shortages and funding concerns. Junior doctors have announced another round of strikes in protest against pay disputes, adding further strain to hospital operations. The government has proposed new measures to improve healthcare workforce retention, but unions argue that more substantial reforms are needed.

Technology & AI: The UK government is set to introduce new regulations on artificial intelligence, aiming to balance innovation with ethical considerations. The proposed framework will focus on AI safety, transparency, and accountability, ensuring that businesses using AI comply with strict guidelines.

Sports: England’s national football team is preparing for upcoming international fixtures, with Gareth Southgate’s squad facing tough competition in the Euro 2024 qualifiers. Meanwhile, the Premier League title race is heating up, with Manchester City, Arsenal, and Liverpool all vying for the top spot.

Entertainment: The BAFTA Awards ceremony is just around the corner, with British filmmakers and actors eagerly anticipating the results. This year’s nominations include a strong lineup of UK talent, reinforcing the country’s prominence in global cinema. Stay tuned to The UK Times for the latest updates on these and other developing stories.

0 notes

Text

The Future of Wheel Aligner Equipment: A Market Poised for Growth

In the ever-evolving world of automobiles, one thing remains constant—precision is key. Every vehicle on the road relies on properly aligned wheels for safety, efficiency, and a smooth driving experience. This necessity has fueled the expansion of the wheel aligner equipment market, a sector that is steadily growing and adapting to modern automotive advancements. As we look ahead, industry projections suggest that the market will grow from USD 5.17 billion in 2025 to a staggering USD 8.13 billion by 2034, at a CAGR of 5.15%.

Why is the Wheel Aligner Equipment Market Booming?

The global surge in passenger car sales, coupled with the rapid adoption of electric vehicles (EVs), is significantly contributing to the demand for cutting-edge wheel alignment solutions. With manufacturers continually innovating, the industry has introduced a range of technologies, including 3D, CCD, laser, infrared, and in-ground wheel aligners. These machines cater to various levels of automation—manual, semi-automatic, and fully automatic—ensuring that every segment of the market finds a suitable solution.

A Look at Brazil’s Passenger Car Market

One of the key indicators of this market's trajectory is the increasing sales of passenger cars worldwide. Brazil, for instance, saw a notable rise in vehicle sales—from 527,799 passenger cars in 2022 to 587,289 in 2023, according to the OICA. This upward trend highlights a growing demand for automotive services, including wheel alignment, which is an essential aspect of vehicle maintenance.

Regional Insights: Who is Leading the Market?

North America holds the largest market share in the wheel aligner equipment industry, thanks to the high concentration of automotive service centers across the U.S. and Canada. The presence of leading car manufacturers such as Tesla, Cadillac, and Rivian further accelerates the need for advanced wheel alignment technologies in this region.

However, Asia Pacific is emerging as the fastest-growing market. With a surge in passenger vehicle ownership, driven by economic growth and urbanization, this region is expected to register the highest CAGR over the forecast period.

Technology at the Forefront: Why 3D Wheel Aligners are Dominating

Among various wheel alignment technologies, 3D wheel aligners have taken the lead, offering superior accuracy and efficiency. With their ability to deliver precise measurements in a matter of seconds, these aligners are becoming the go-to choice for automotive repair shops, OEM service centers, and tire dealers worldwide. Their dominance in the market stems from their ability to reduce human error, increase service speed, and improve overall vehicle performance.

The Industry’s Driving Forces

Several factors are shaping the future of the wheel aligner equipment market:

The rise in fleet management services: As businesses increasingly rely on commercial vehicle fleets, the need for regular wheel alignment services has become paramount.

Advancements in wheel alignment technology: From software-driven systems to wireless connectivity, manufacturers are pushing the boundaries of innovation.

Growth in the EV sector: As electric vehicles continue to gain traction, the demand for specialized wheel alignment solutions tailored to these modern automobiles is on the rise.

Competitive Landscape: Who’s Leading the Charge?

The wheel aligner equipment market is brimming with competition, with key players constantly striving to stay ahead through innovation and strategic expansion. Leading companies such as MAHA Maschinenbau Haldenwang GmbH Co. KG, Continental AG, Launch Tech Co., Ltd., Snap-on Incorporated, and Wabco Holdings Inc are at the forefront of this evolving industry.

For instance, Snap-on Incorporated saw its tools segment revenue grow from USD 2,072 million in 2022 to USD 2,088.80 million in 2023. This upward trajectory reflects the increasing demand for precision automotive tools, including wheel alignment equipment.

Industry Leaders Speak: A Vision for the Future

As the industry embraces technological advancements, companies are setting ambitious goals for the future. Praveen Tiwari, Managing Director at ATS ELGI Ltd, recently stated, “At ATS ELGI, our vision is to redefine the automotive service industry with cutting-edge, sustainable, and reliable solutions. This commitment aligns seamlessly with the sector’s transformation, driven by breakthroughs in electric mobility and next-generation automotive technology.”

Final Thoughts: What Lies Ahead?

The wheel aligner equipment market is on an upward trajectory, propelled by advancements in technology, rising vehicle ownership, and the increasing emphasis on regular maintenance. With North America leading the market and Asia Pacific catching up at an impressive pace, this industry is set for significant growth in the coming years. As vehicles continue to evolve, one thing is certain—precision in wheel alignment will remain a cornerstone of automotive safety and performance.

Source: https://www.towardsautomotive.com/insights/wheel-aligner-equipment-sizing

0 notes

Text

Preventive Measures in Argentina to Curb Market Concentration in Telecommunications

On Friday, Argentina’s Presidential Office announced the implementation of preventive actions designed to suspend the deal in which Telecom Argentina would acquire the local division of Telefonica. This decision was taken amid concerns that the proposed merger could lead to an excessive concentration of the market and negatively impact competition.

Background

Recently, the Spanish telecommunications giant Telefonica revealed plans to sell its Argentine subsidiary to Telecom Argentina for US$1.245 billion. This move is part of a broader strategy to reduce Telefonica’s presence in the Latin American market. However, the proposed merger raised alarms among local authorities, who fear that such consolidation might pave the way for monopoly formation. Acting on the recommendations of the National Competition Protection Commission, the government decided to pause the deal pending a more detailed analysis of its potential impact.

Context and Analysis

The decision to suspend the merger until further evaluation is indicative of several important considerations:

Maintaining competitive balance. Limiting capital consolidation in the telecommunications sector helps preserve conditions that foster market growth.

Preventing monopolistic practices. The measures are aimed at ensuring fair market conditions in an era marked by globalization and evolving investment landscapes.

Enhancing state oversight. Regulatory intervention underscores the commitment to a stable and competitive economic environment.

Key Stages in the Analysis

Evaluating the merger’s impact on market competition. Analysts scrutinize how the integration of the companies might reduce their independent operational capacities and influence pricing policies.

Identifying potential risks to service quality. There is a focus on whether the merger could lead to a deterioration in service levels and restrict consumer options.