#Markets forex forecast

Explore tagged Tumblr posts

Text

Dollar’s Next Move: Will Resistance Signal a Market Shift?

📊 Is the Dollar's Rally Losing Steam? 📉

The Dollar Index is facing strong resistance—could this signal a major market shift? Discover what it means for global currencies and how investors can seize the moment. 📈🌍

👉 [Read more to stay ahead of the market curve!]

#StockMarket #DollarIndex #Forex #Investing #MarketTrends #FinanceNews

#stock market#market analysis#us dollar support and resistance#dxy today market analysis#forex signals#forex market#weekly resistance#financial market news#how to trade us dollar in forex market#dxy support and resistance#gold and silver market analysis#forex market news#forex market update#currency market trends#stock market for beginners#financial markets#silver market trends#stock market live#futures market#market forecast#stock markets

0 notes

Text

From Analysis to Action: Combining Technical and Fundamental Approaches in Forex Trading

#Forex Trading#Technical Analysis#Fundamental Analysis#Trading Strategies#Currency Trading#Forex Market#Investment Strategies#Market Analysis#Day Trading#Swing Trading#Forex Education#Online Trading#Global Economics#Economic Indicators#Risk Management#Forex Signals#Trading Tips#Trading Psychology#Market Trends#Forex News#Foreign Exchange#Financial Markets#Trade Setup#Forex Charts#Forex Community#Trading Systems#AI in Trading#Forex Forecasting#Wealth Building#PipInfuse

1 note

·

View note

Text

Source: https://simpleway.agency/

0 notes

Text

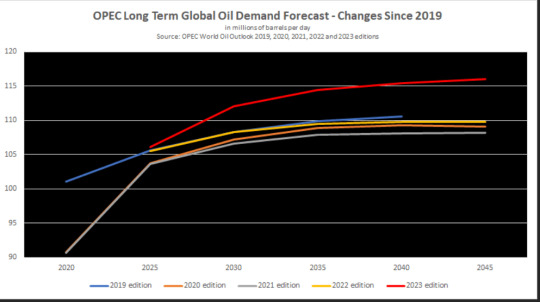

OPEC Raises Demand Forecast as Middle East Tensions Boost WTI/Oil Prices, What Now?

OIL PRICE FORECAST: Most Read: What is OPEC and What is Their Role in Global Markets? Oil prices have held relatively steady through the European session following the gap in prices over the weekend. WTI closed last week at $82.74 a barrel before opening last night around the $85.00 a barrel mark as the turmoil between Israel and Palestine intensified. Elevate your trading skills with an…

View On WordPress

#Boost#Currency Exchange#Demand#East#Forecast#Foreign exchange market#Forex analysis#forex brokers#Forex charts#Forex demo account#Forex fundamental analysis#Forex indicators#Forex leverage#Forex liquidity#Forex market psychology#Forex news#Forex platform#Forex regulation#Forex risk management#Forex scalping#Forex signals#forex strategies#Forex swing trading#Forex technical analysis#Forex Trading#Forex trading hours#Forex trading pairs#Forex trend analysis#Forex volatility#Middle

0 notes

Text

Exploring the Best Free Forex Signals Providers: A Comprehensive Overview

Trading in the forex market requires a blend of knowledge, strategy, and access to reliable information. Forex signals serve as invaluable tools, offering traders timely insights into potential trading opportunities. In this article, we delve into some of the top free forex signals providers, highlighting Forex Bank Signal for its exceptional service and reliability.

1. Forex Bank Signal

Forex Bank Signal emerges as a standout provider of free forex signals, distinguished for its accuracy and comprehensive market analysis. Catering to traders of all experience levels, Forex Bank Signal delivers signals with precise entry and exit points, accessible via email, SMS, and a user-friendly mobile app. Traders appreciate the clarity and reliability of their signals, which often lead to consistent profitability and enhanced trading strategies.

2. FX Leaders

FX Leaders is renowned for its dependable free forex signals, generated by a team of seasoned analysts skilled in both technical and fundamental analysis. Their signals cover a broad spectrum of currency pairs and are accompanied by detailed explanations and trading strategies. FX Leaders also provides real-time market updates, making it a valuable resource for traders seeking to stay informed and capitalize on market opportunities.

3. DailyForex

DailyForex offers a robust platform for free forex signals, coupled with extensive educational resources suitable for traders at all stages of their journey. Their signals, based on technical analysis, are designed to be user-friendly and actionable. Accessible through their website and mobile app, DailyForex ensures traders can act swiftly on signals wherever they are. Beyond signals, DailyForex provides in-depth market analysis, trading tips, and reviews of forex brokers, fostering a supportive environment for learning and growth.

4. MQL5

MQL5 provides a versatile platform featuring free forex signals from various providers, each offering unique trading strategies and performance records. This diversity allows traders to choose signals that align with their individual trading styles and risk tolerance levels. MQL5 also boasts a vibrant community where traders can share insights, strategies, and market forecasts, enriching the trading experience through collaborative learning and interaction.

5. Trading Central

Trading Central stands out for its comprehensive financial services, including free forex signals backed by rigorous technical analysis. Their signals are designed to offer clear, actionable trading opportunities, integrated seamlessly into popular trading platforms globally. Alongside signals, Trading Central provides detailed market analysis, economic calendars, and trading strategies, empowering traders to make informed decisions and optimize their trading outcomes.

Conclusion

Selecting a reliable forex signals provider is crucial for traders looking to navigate the forex market effectively. Forex Bank Signal, with its precise signals and user-friendly interface, stands out as an excellent choice for traders seeking consistency and profitability. Whether you're new to forex trading or refining your strategy, these free forex signals providers offer valuable tools and insights to enhance your trading experience and achieve success in the competitive forex market.

When evaluating signals providers, consider factors such as historical performance, user reviews, and compatibility with your trading goals and strategies. With the right provider by your side, you can leverage timely insights and strategic guidance to maximize your trading potential. Happy trading!

#forex#forex broker#forex education#forex market#forex signal service#forex signals#forex trading#forexsignals#forextrading#forex signal provider#gold#investingold#investinginyourself#investinginmyfuture#realestate#investingtips#investinginthefuture#investingforus#investinginrealestate#bitcoin#investment#investinghana#investingirls#investor#business#realestateinvesting#invest#money#investinginmemories#investinginourfuture

30 notes

·

View notes

Text

SQUIRE'S FINANCE Limited

SQUIRE'S FINANCE Limited provides its clients with analytical tools and educational resources to help them trade in the financial markets. Here are some of these aspects:

Analytics: Broker SQUIRE'S FINANCE Limited provides its clients with access to financial analytics and market research. This can include daily market analysis, market commentary, technical and fundamental analysis, as well as forecasts and recommendations from experienced analysts. These materials help traders assess current market conditions and make informed trading decisions.

Education: SQUIRE'S FINANCE Limited offers educational resources for traders of all experience levels. This can include online courses, webinars, seminars and training courses covering various aspects of financial trading. Education materials may include the basics of Forex trading, analytical techniques, trading strategies, risk management and other key aspects of trading. These educational resources help traders develop their skills, deepen their understanding of the market and improve their trading efficiency.

5 notes

·

View notes

Text

Get The Latest Forex Trading News And Market Analysis

Xtreamforex is the leading portal for financial market news covering forex, commodities, and indices. Discover our charts, forecasts, Market analysis and more. Find latest Forex markets news and Updates, Live Currency Rates, Currency Convertor and more.

3 notes

·

View notes

Text

Get The Latest Forex Trading News And Market Analysis

Xtreamforex is the leading portal for financial market news covering forex, commodities, and indices. Discover our charts, forecasts, Market analysis and more. Find latest Forex market news and Updates, Live Currency Rates, Currency Convertor and more.

2 notes

·

View notes

Text

Get the Convenient Forex Economic Calendar - Global Lex

Global Lex's convenient f is a great tool for traders of all levels. It provides up-to-date information about key economic events and their potential effect on the Forex markets. It is an easy-to-use, user-friendly platform that allows users to quickly access the data they need to make informed trading decisions. The calendar features a wide range of information, including dates, countries, economic indicators, and estimated impacts. It also includes previous data and forecasts to provide traders with the information they need to stay on top of their trading game. With Global Lex's Forex Economic Calendar, traders can stay informed and maximize their profits. For more information, Visit our website: https://www.glex24.com/calendar

#forex trading company#cfd trading app#stock trading software#cyptocurrency#forex trading system software#forex

2 notes

·

View notes

Text

Schaff Trend Cycle + Capacity Utilization: Forex's Hidden Edge Schaff Trend Cycle and Capacity Utilization: The Secret Trading Combo Let's face it—when you hear "Schaff Trend Cycle," you probably think it's some new-age workout or an obscure indie band. But, dear reader, we're talking about a powerful oscillator that is basically the secret ingredient to perfect timing in Forex trading. Pair it with capacity utilization, and you've got a dynamic duo worthy of a superhero title. Instead of hoping that a trade moves your way, let’s learn how to be one step ahead—think of it as the difference between buying an umbrella before the rain starts or running into a store soaking wet. Why Most Traders Are Missing Out on the Schaff Trend Cycle The Schaff Trend Cycle (STC) is often overlooked, and honestly, it's criminal. STC is like that friend who has all the right answers but never raises their hand. It’s a momentum indicator that marries the best of MACD with the speed of a typical stochastic oscillator—meaning you get a faster, more reliable signal. Most traders stick with traditional moving averages or RSI, but if they’d give STC a whirl, they'd see that it not only helps with entry and exit points, but it does so with a flair that’ll make you feel like the king or queen of trend reversals. Now, pair this with capacity utilization—an economic indicator that tells us how much of a country’s productive capacity is being used. You might be thinking, "Why would I care about factories and production levels when I'm just trying to make a profit in Forex?" Here’s the kicker: Capacity utilization gives us a behind-the-scenes look at economic momentum. When capacity utilization is high, economies are humming along—meaning currencies tend to appreciate. And when capacity utilization drops? The economy is not using all its horsepower, and trouble might be brewing ahead. Advanced Insights: Making the Magic Happen with STC and Capacity Utilization So how do we put this all together? It’s about combining the short-term speed of the Schaff Trend Cycle with the long-term economic insight provided by capacity utilization data. Imagine being able to identify the exact moment a trend is about to start while also knowing if the economic backdrop supports it. You’re not just trading charts—you’re trading with an economic forecast in your back pocket. Take the USD/JPY pair as an example. When US capacity utilization starts trending upward, it signals that the economy is heating up. If STC is also indicating a bullish trend on the daily chart, that’s like getting a green light at every intersection on your way home—smooth sailing ahead. On the other hand, if STC is showing a bullish trend, but capacity utilization is dropping, you’ve got conflicting signals, which means it might be time to put on the brakes or reconsider how much you want to risk. The Contrarian Perspective: Betting Against the Herd Here’s where we go a bit ninja. The herd loves to follow traditional economic releases like GDP or CPI data. Don’t get me wrong, those are important, but they’re also loud—everyone watches them, and the market tends to react dramatically. Capacity utilization, on the other hand, is like that underrated gem that quietly tells you when something big is about to happen but hasn’t yet made it to the front page. By using capacity utilization data, you can find opportunities that others are missing. For example, if everyone is panicking because the latest GDP number came in low, but you see that capacity utilization is still healthy, you know that the long-term fundamentals are likely intact. Combine this insight with a Schaff Trend Cycle reversal, and boom—you’re in the driver’s seat while everyone else is panicking in the back. A Personal Story: How I Learned to Love Schaff (Not the Exercise Routine) I remember the first time I tried using the Schaff Trend Cycle. I was hesitant. I mean, let’s be honest, when something is called the "Schaff Trend Cycle," it doesn’t exactly scream "game-changing Forex tool." But then, I had one of those "aha!" moments. It was during a period when EUR/USD was doing its usual dance—traders couldn’t decide which way it was going, and I was stuck in the indecision whirlpool. But here's where the STC shone. It was signaling a reversal while everyone else was unsure. I paired this with data showing increased capacity utilization across key European economies, and let me tell you—it felt like I had insider information. The trade worked out perfectly, and from that day forward, Schaff and I became best friends. (And no, it never asked me to do squats.) The Forgotten Strategy That Outsmarted the Pros If you're looking for a ninja tactic, here it is: don’t just look at price and indicators—marry them with underlying economic data like capacity utilization. This isn’t just some vague suggestion; it’s a proven way to keep yourself ahead of the masses. Most traders fall into the trap of relying solely on technicals, which is kind of like trying to bake a cake without checking if you have all the ingredients—you need to know what’s in the pantry (i.e., the economic conditions). When Schaff Trend Cycle indicates an oversold condition, and at the same time, capacity utilization suggests growing economic activity, you have a potent combination that not only tells you what might happen next but also gives you the confidence to take the trade without that nagging feeling of doom. Step-by-Step Guide: Combining Schaff Trend Cycle with Capacity Utilization - Identify Economic Trends: Start by keeping an eye on capacity utilization numbers from trusted sources. High capacity utilization means economic growth, while declining numbers might signal slowing activity. - Use Schaff Trend Cycle to Time Entries: Check STC on your preferred time frame. Look for points where STC crosses over in oversold or overbought zones—these are your cues for trend reversals. - Combine Both for Confirmation: Only enter a trade if both STC and capacity utilization tell the same story. If STC shows a buy signal and capacity utilization is on the rise, you’ve got yourself a high-probability setup. - Risk Management: Always set stop-loss orders. The market loves to test your patience, but with capacity utilization and STC on your side, you have an edge to mitigate unnecessary risks. Combining Schaff Trend Cycle and capacity utilization is like putting on night-vision goggles in a dark forest. You’re able to see what others can’t, and you get to move ahead confidently while everyone else stumbles around. It’s not just about having the tools—it’s about knowing how to use them in sync. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Mastering Trading with the Time Series Forecast Indicator: A Comprehensive Guide

In the complex and often unpredictable world of financial trading, having robust tools at your disposal can significantly improve your trading outcomes. One such powerful tool is the Time Series Forecast (TSF) indicator. This post will delve deeply into what the TSF indicator is, how it works, and how you can effectively incorporate it into your trading strategy. Understanding the Time Series…

View On WordPress

#Combining TSF with RSI#cryptocurrency trading#Cryptocurrency trading strategies#Divergence analysis#Forecasting in Trading#Forecasting price movements#forex trading#Forex trading strategies#Identifying trends#learn technical analysis#Linear Regression#Linear regression in trading#Moving averages and TSF#Predicting future prices#Risk management in trading#stock market#Stock market strategies#technical analysis#technical analysis tools#Time Series Forecast Indicator#Trading Strategies#trading tools#Trading with TSF#Trend Identification#TSF trading

0 notes

Text

Crude oil marches higher, GBPUSD selloff continues

UK stocks ended higher on Thursday, supported by strength in oil issues as crude prices rose amid heightened geopolitical tension.

Ukraine accused Russia of launching an intercontinental ballistic missile attack on the country for the first time, albeit without a nuclear warhead, in a new escalation of their conflict.

Donning their hard-hats, investors ignored worries over a slower pace for interest rate cuts in the UK and US.

The US Federal Reserve should be careful not to cut rates too quickly and risk reigniting stubborn inflation, a senior bank official said on Wednesday.

US data on Thursday saw the latest initial jobless claims fall to at 213,000, significantly lower than the 220,000 forecasted, and an encouraging sign for the world’s biggest economy.

Given this, next month’s Fed rate decision looks set to be on a knife-edge, while the Bank of England is also largely expected to stand pat on monetary policy. UK data on Thursday showed public borrowing jumped by £1.6bn year-on-year to £17.4bn in October, its second-highest level on record for the month.

GBPUSD H4

On currency markets, the pound eased modestly against the dollar, down 0.1% at 1.2638 as investors remained focused on who President-elect Donald Trump's Treasury Secretary pick might be. But sterling rose 0.04% against the euro to 1.2004.

Among cryptocurrencies, Bitcoin continued on its tear towards $100,000, hitting a new record peak above $98,000.

At the stock market close in London, the blue-chip FTSE 100 index was up 0.8% at 8,149, while the broader FTSE 250 index added 0.5% at 20,349.

Oil majors tracked crude prices higher, with Shell climbing 1.8% and BP adding 1.9%.

USOIL Daily

Elsewhere among the blue-chip risers, Halma took on 5.7% as the safety equipment and hazard detection products group raised its interim dividend by 7pc after a record first-half which saw sales top the £1bn mark.

But on the downside, JD Sports tumbled 15.5% as the retailer predicted that its annual profit will be at the lower end of guidance, as a decent start to its third quarter was hampered by a volatile October.

Away from the blue chips, International Distributions Services, the parent company of Royal Mail fell 0.9% despite reporting a return to profit for the first half of its fiscal year as it highlighted significant cost pressures from rising national insurance contributions.

On AIM, holidays firm Jet 2 soared 5.8% higher as it unveiled record results and passenger figures for the first half and said its full-year profit should beat expectations as a result.

Disclaimer: The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions. Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us. The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

🌍 Forex Bank Liquidity 🌍

At Forex Bank Liquidity, we believe in ANALYSIS over forecasting. Why? Because solid analysis reveals real-time opportunities and insights that help traders make informed decisions in a volatile market. 📈📊

Our focus is on using proven strategies, in-depth research, and precise data to give you the most reliable signals available. Join us on this journey where skill and analysis drive success, not just predictions.

Start trading smarter with us today! 👉 https://t.me/forexbankliquidity

1 note

·

View note

Text

Forex Online: Exploring the World of Digital Currency Trading

Forex online refers to trading foreign currencies over the internet through digital platforms, enabling traders worldwide to participate in the global forex market from virtually anywhere. With an average daily trading volume exceeding $6 trillion, the forex market is one of the most accessible and fast-paced financial markets, open 24 hours a day, five days a week. Online forex trading has attracted both new and experienced traders by offering flexibility, accessibility, and high profit potential.

How Forex Online Works

Forex trading online revolves around currency pairs, where one currency is traded against another, like EUR/USD (euro versus U.S. dollar) or USD/JPY (U.S. dollar versus Japanese yen). By buying or selling a pair, traders speculate on which currency will increase or decrease in value relative to the other. Profits are made by correctly predicting these movements, buying when a currency is expected to appreciate, and selling when it’s expected to depreciate.

Online forex trading is typically conducted through platforms provided by brokers. These platforms, like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offer traders advanced tools, including live price feeds, charting software, and technical indicators. Some platforms also support automated trading, enabling traders to use algorithms to execute trades based on predefined criteria.

Strategies and Tools for Online Forex Success

Forex trading online requires a strategy that fits your trading style and risk tolerance. Popular strategies include day trading, swing trading, and scalping. Day traders, for example, close positions within a single day to avoid overnight risk, while swing traders hold positions for several days to capture broader market movements.

Two main types of analysis are used in forex: technical analysis and fundamental analysis. Technical analysis involves studying price charts and indicators to forecast trends, while fundamental analysis examines economic factors like interest rates, employment figures, and political events to assess currency strength. Combining these analyses can provide a well-rounded approach to predicting market movements.

Benefits and Risks of Forex Online

Forex trading online offers advantages like high liquidity, flexibility in trading times, and the potential for leveraged gains. However, it also involves risk due to market volatility. Risk management tools, such as stop-loss orders and position sizing, help traders protect their investments and mitigate losses.

For those willing to commit time to learning and practicing, forex online provides an exciting way to engage with global financial markets and potentially earn profits through disciplined trading.

0 notes

Text

0 notes

Text

What are the skills required for Forex trading?

Well, the Forex market is the world's largest exchange, buying and selling currency pairs from one country to another. In forex, there are three skills a trader can develop to manage trading risk: forecasting, planning, and analysis.

2 notes

·

View notes