#Marine Big Data Market

Explore tagged Tumblr posts

Text

Marine Big Data Market Insights: Navigating the Digital Transformation in Shipping

0 notes

Text

The specific process by which Google enshittified its search

I'm touring my new, nationally bestselling novel The Bezzle! Catch me SATURDAY (Apr 27) in MARIN COUNTY, then Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

All digital businesses have the technical capacity to enshittify: the ability to change the underlying functions of the business from moment to moment and user to user, allowing for the rapid transfer of value between business customers, end users and shareholders:

https://pluralistic.net/2023/02/19/twiddler/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/24/naming-names/#prabhakar-raghavan

Which raises an important question: why do companies enshittify at a specific moment, after refraining from enshittifying before? After all, a company always has the potential to benefit by treating its business customers and end users worse, by giving them a worse deal. If you charge more for your product and pay your suppliers less, that leaves more money on the table for your investors.

Of course, it's not that simple. While cheating, price-gouging, and degrading your product can produce gains, these tactics also threaten losses. You might lose customers to a rival, or get punished by a regulator, or face mass resignations from your employees who really believe in your product.

Companies choose not to enshittify their products…until they choose to do so. One theory to explain this is that companies are engaged in a process of continuous assessment, gathering data about their competitive risks, their regulators' mettle, their employees' boldness. When these assessments indicate that the conditions are favorable to enshittification, the CEO walks over to the big "enshittification" lever on the wall and yanks it all the way to MAX.

Some companies have certainly done this – and paid the price. Think of Myspace or Yahoo: companies that made themselves worse by reducing quality and gouging on price (be it measured in dollars or attention – that is, ads) before sinking into obscure senescence. These companies made a bet that they could get richer while getting worse, and they were wrong, and they lost out.

But this model doesn't explain the Great Enshittening, in which all the tech companies are enshittifying at the same time. Maybe all these companies are subscribing to the same business newsletter (or, more likely, buying advice from the same management consultancy) (cough McKinsey cough) that is a kind of industry-wide starter pistol for enshittification.

I think it's something else. I think the main job of a CEO is to show up for work every morning and yank on the enshittification lever as hard as you can, in hopes that you can eke out some incremental gains in your company's cost-basis and/or income by shifting value away from your suppliers and customers to yourself.

We get good digital services when the enshittification lever doesn't budge – when it is constrained: by competition, by regulation, by interoperable mods and hacks that undo enshittification (like alternative clients and ad-blockers) and by workers who have bargaining power thanks to a tight labor market or a powerful union:

https://pluralistic.net/2023/11/09/lead-me-not-into-temptation/#chamberlain

When Google ordered its staff to build a secret Chinese search engine that would censor search results and rat out dissidents to the Chinese secret police, googlers revolted and refused, and the project died:

https://en.wikipedia.org/wiki/Dragonfly_(search_engine)

When Google tried to win a US government contract to build AI for drones used to target and murder civilians far from the battlefield, googlers revolted and refused, and the project died:

https://www.nytimes.com/2018/06/01/technology/google-pentagon-project-maven.html

What's happened since – what's behind all the tech companies enshittifying all at once – is that tech worker power has been smashed, especially at Google, where 12,000 workers were fired just months after a $80b stock buyback that would have paid their wages for the next 27 years. Likewise, competition has receded from tech bosses' worries, thanks to lax antitrust enforcement that saw most credible competitors merged into behemoths, or neutralized with predatory pricing schemes. Lax enforcement of other policies – privacy, labor and consumer protection – loosened up the enshittification lever even more. And the expansion of IP rights, which criminalize most kinds of reverse engineering and aftermarket modification, means that interoperability no longer applies friction to the enshittification lever.

Now that every tech boss has an enshittification lever that moves very freely, they can show up for work, yank the enshittification lever, and it goes all the way to MAX. When googlers protested the company's complicity in the genocide in Gaza, Google didn't kill the project – it mass-fired the workers:

https://medium.com/@notechforapartheid/statement-from-google-workers-with-the-no-tech-for-apartheid-campaign-on-googles-indiscriminate-28ba4c9b7ce8

Enshittification is a macroeconomic phenomenon, determined by the regulatory environment for competition, privacy, labor, consumer protection and IP. But enshittification is also a microeconomic phenomenon, the result of innumerable boardroom and product-planning fights within companies in which would-be enshittifiers try to do things that make the company's products and services shittier wrestle with rivals who want to keep things as they are, or make them better, whether out of principle or fear of the consequences.

Those microeconomic wrestling-matches are where we find enshittification's heroes and villains – the people who fight for the user or stand up for a fair deal, versus the people who want to cheat and wreck to make things better for the company and win bonuses and promotions for themselves:

https://locusmag.com/2023/11/commentary-by-cory-doctorow-dont-be-evil/

These microeconomic struggles are usually obscure, because companies are secretive institutions and our glimpses into their deliberations are normally limited to the odd leaked memo, whistleblower tell-all, or spectacular worker revolt. But when a company gets dragged into court, a new window opens into the company's internal operations. That's especially true when the plaintiff is the US government.

Which brings me back to Google, the poster-child for enshittification, a company that revolutionized the internet a quarter of a century ago with a search-engine that was so good that it felt like magic, which has decayed so badly and so rapidly that whole sections of the internet are disappearing from view for the 90% of users who rely on the search engine as their gateway to the internet.

Google is being sued by the DOJ's Antitrust Division, and that means we are getting a very deep look into the company, as its internal emails and memos come to light:

https://pluralistic.net/2023/10/03/not-feeling-lucky/#fundamental-laws-of-economics

Google is a tech company, and tech companies have literary cultures – they run on email and other forms of written communication, even for casual speech, which is more likely to take place in a chat program than at a water-cooler. This means that tech companies have giant databases full of confessions to every crime they've ever committed:

https://pluralistic.net/2023/09/03/big-tech-cant-stop-telling-on-itself/

Large pieces of Google's database-of-crimes are now on display – so much, in fact, that it's hard for anyone to parse through it all and understand what it means. But some people are trying, and coming up with gold. One of those successful prospectors is Ed Zitron, who has produced a staggering account of the precise moment at which Google search tipped over into enshittification, which names the executives at the very heart of the rot:

https://www.wheresyoured.at/the-men-who-killed-google/

Zitron tells the story of a boardroom struggle over search quality, in which Ben Gomes – a long-tenured googler who helped define the company during its best years – lost a fight with Prabhakar Raghavan, a computer scientist turned manager whose tactic for increasing the number of search queries (and thus the number of ads the company could show to searchers) was to decrease the quality of search. That way, searchers would have to spend more time on Google before they found what they were looking for.

Zitron contrasts the background of these two figures. Gomes, the hero, worked at Google for 19 years, solving fantastically hard technical scaling problems and eventually becoming the company's "search czar." Raghavan, the villain, "failed upwards" through his career, including a stint as Yahoo's head of search from 2005-12, a presiding over the collapse of Yahoo's search business. Under Raghavan's leadership, Yahoo's search market-share fell from 30.4% to 14%, and in the end, Yahoo jettisoned its search altogether and replaced it with Bing.

For Zitron, the memos show how Raghavan engineered the ouster of Gomes, with help from the company CEO, the ex-McKinseyite Sundar Pichai. It was a triumph for enshittification, a deliberate decision to make the product worse in order to make it more profitable, under the (correct) belief that the company's exclusivity deals to provide search everywhere from Iphones and Samsungs to Mozilla would mean that the business would face no consequences for doing so.

It a picture of a company that isn't just too big to fail – it's (as FTC Chair Lina Khan put it on The Daily Show) too big to care:

https://www.youtube.com/watch?v=oaDTiWaYfcM

Zitron's done excellent sleuthing through the court exhibits here, and his writeup is incandescently brilliant. But there's one point I quibble with him on. Zitron writes that "It’s because the people running the tech industry are no longer those that built it."

I think that gets it backwards. I think that there were always enshittifiers in the C-suites of these companies. When Page and Brin brought in the war criminal Eric Schmidt to run the company, he surely started every day with a ritual, ferocious tug at that enshittification lever. The difference wasn't who was in the C-suite – the difference was how freely the lever moved.

On Saturday, I wrote:

The platforms used to treat us well and now treat us badly. That's not because they were setting a patient trap, luring us in with good treatment in the expectation of locking us in and turning on us. Tech bosses do not have the executive function to lie in wait for years and years.

https://pluralistic.net/2024/04/22/kargo-kult-kaptialism/#dont-buy-it

Someone on Hacker News called that "silly," adding that "tech bosses do in fact have the executive function to lie in wait for years and years. That's literally the business model of most startups":

https://news.ycombinator.com/item?id=40114339

That's not quite right, though. The business-model of the startup is to yank on the enshittification lever every day. Tech bosses don't lie in wait for the perfect moment to claw away all the value from their employees, users, business customers, and suppliers – they're always trying to get that value. It's only when they become too big to care that they succeed. That's the definition of being too big to care.

In antitrust circles, they sometimes say that "the process is the punishment." No matter what happens to the DOJ's case against Google, its internal workers have been made visible to the public. The secrecy surrounding the Google trial when it was underway meant that a lot of this stuff flew under the radar when it first appeared. But as Zitron's work shows, there is plenty of treasure to be found in that trove of documents that is now permanently in the public domain.

When future scholars study the enshittocene, they will look to accounts like Zitron's to mark the turning points from the old, good internet to the enshitternet. Let's hope those future scholars have a new, good internet on which to publish their findings.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/24/naming-names/#prabhakar-raghavan

#pluralistic#ed zitron#google#microincentives#constraints#enshittification#rot economy#platform decay#search#ben gomes#code yellow#mckinsey#hacking engagement#Prabhakar Raghavan#yahoo#doj#antitrust#trustbusting

511 notes

·

View notes

Text

Disabled Queer Salish Sea Artist Seeking Some Community Support

Hi lovely people! Would you mind boosting my Salish Sea marine science art? My contract job is on an unexpected hiatus until sometime in July and so my income the next couple months is really dependent on the markets I'm doing and online sales. Scroll for photos of my work.

https://shop.noncompliantcyborg.com/

Other circumstances stuff under the cut

The timing of this is already additionally tough because mid-June I start my summer project as a visiting researcher at Rosario Beach Marine Lab, which I was (am still hopefully) going to be doing community fundraising for both in my local area and online but I've been delaying actively seeking that support out.

This is both because I wanted to have a solid equipment budget confirmed first and then also I've been feeling some serious impostor syndrome with a pretty hefty side of "there are so many humanitarian crises and survival needs fundraisers that people should be funding, how can I ask anyone to support me in doing naturalist documentation and 3D imaging of Salish Sea animals for sci-comm right now?"

It doesn't help that now that I've gotten some equipment quotes it's looking like roughly 5k for just the big ticket items and I don't know how much little incidental stuff will add up and that doesn't even consider any compensation for my labor. Also with the lag time on getting said equipment unless I magically fundraised that super fast stuff the time I'd have to complete the build and collect data could be very tight.

My back up plan is to just do a lot of studio type photography and videography for sci-comm content and art prints. Also embryology work if they have the proper dish-ware I can check out. But I'm still worried about what it does to people's perceptions of me if I don't pull off the project I wanted to. Being disabled and having to create your own non-traditional opportunities and coordinate everything that goes into that because science largely is inaccessible is exhausting. And it's extra exhausting trying to do all that while also trying to piece together accessible ways to financially support yourself.

Anyways, thank you for any support or solidarity you can offer whether through sharing, getting art, or otherwise.

#marine biology#ocean art#nature art#oceancore#ocean#my marine life photos#ctenophore#sea creatures#salish sea#marine life#science art#science#comb jelly#disabled artist#disabled in stem#nudibranch#send nudibranchs#octopus

12 notes

·

View notes

Text

📍 How Can I Build a Local Audience for My Blog or YouTube Channel from Mumbai?

By Intellitron Genesis | Digital Strategy that Clicks

In the sea of global content, standing out locally—especially in a dynamic city like Mumbai—can give your blog or YouTube channel a serious edge. At Intellitron Genesis, we help creators and businesses build their presence in their own backyard before scaling globally. Here's how you can attract a dedicated Mumbai-based audience:

🎯 1. Create Content That Screams “Mumbai”

Talk about things that Mumbaikars care about:

City-specific events like Kala Ghoda Fest, Comic Con, or the Ganesh Visarjan buzz.

The local food scene: Vada Pav trails, Irani cafés, and budget-friendly street eats.

Cover Mumbai fashion, daily commute stories, or job trends in Dadar, Andheri, and beyond.

Talk about Mumbai’s hustle culture—something every local relates to.

👉 Example: A YouTube vlog titled “Surviving a Monday in Mumbai Local Trains” or a blog post like “5 Co-Working Cafes in Bandra You Can’t Miss” can do wonders.

🔍 2. Use Mumbai-Based Keywords Smartly

Optimize your titles, tags, and meta descriptions with Mumbai-centric keywords:

“Freelancing in Mumbai”

“Best Places to Work Remotely in Mumbai”

“Affordable Street Food in Mumbai”

“Jobs After HSC in Mumbai”

These keywords help you appear in local search results and attract the right audience.

💡 Related Read: How Can I Make My Business Visible Online in a Metro City Like Mumbai?

💬 3. Engage with Your Local Audience

Don’t just post—talk to your people.

Respond to every comment.

Ask your followers what parts of the city they’d like to see next.

Use polls, Q&As, and DMs on platforms like Instagram to build a real connection.

📲 4. Promote Using Geo-Tags and Mumbai-Based Community Pages

Use Instagram geo-tags for locations like Marine Drive, Powai, or Juhu.

Join and share posts on Mumbai-centric pages and communities like Mumbai Foodie, Humans of Bombay, or Mumbai Instagrammers.

Post Insta stories or reels during local events to get discovered organically.

💡 Also Read: How Can Small Businesses Compete with Big Brands in Urban Markets?

🌟 5. Be Consistent with a Local Voice

Let your tone, visuals, and content style reflect Mumbai:

Use Hinglish or Bambaiya slang where it fits.

Include snippets of the city’s sounds, visuals, and humor.

Consistently show that you’re one of them, not just another creator in the cloud.

💡 Bonus Insight: How Can I Start Freelancing or a Side Hustle While Living in Mumbai or Any Metro?

Final Thought: Don’t just create content in Mumbai. Create content for Mumbai.

🌐 Want a data-driven local growth strategy for your content? Let’s make it happen 👉 www.intellitrongenesis.com

#MumbaiBloggers#YouTubeMumbai#IntellitronGenesis#DigitalMarketingMumbai#GrowYourAudience#ContentStrategy#HyperlocalMarketing#MumbaiInfluencers#YouTuberIndia#MetroCityStrategy

0 notes

Text

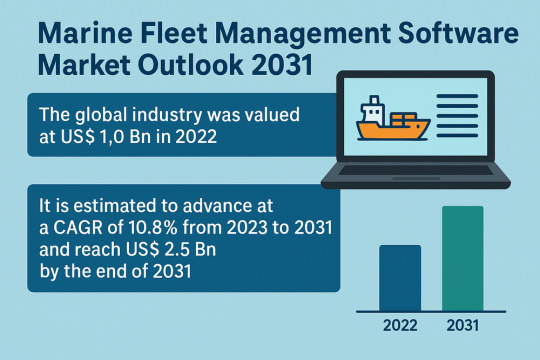

Maritime Software Industry Set to Transform with Real-Time Fleet Capabilities

The global marine fleet management software market is poised for robust growth, expected to rise from USD 1.0 Bn in 2022 to USD 2.5 Bn by the end of 2031, expanding at a healthy CAGR of 10.8%. This dynamic growth is fueled by the increasing digitalization of the maritime industry, the growing demand for real-time fleet insights, and a sharp focus on operational efficiency, safety, and compliance.

Marine fleet management software plays a vital role in optimizing vessel operations, streamlining maintenance, managing crew and inventory, and ensuring regulatory compliance. As maritime trade continues to expand, the need for centralized, cloud-based fleet management tools is becoming increasingly critical.

Market Drivers & Trends

One of the key market drivers is the global push for digital transformation in the maritime sector. Fleet operators are seeking intelligent software platforms that integrate real-time monitoring, performance analysis, predictive maintenance, and regulatory compliance all in one solution.

Rising fuel costs and stringent environmental regulations are pushing companies to adopt fleet management solutions that offer optimization tools to reduce fuel consumption and carbon emissions. Furthermore, the maritime industry's commitment to sustainability and operational transparency is accelerating the adoption of energy-efficient and smart digital systems.

Latest Market Trends

Several trends are shaping the future of the marine fleet management software market:

Cloud-based Deployments: There is a notable shift from on-premise solutions to cloud-based platforms, providing scalability, mobility, and cost efficiency.

AI & Data Analytics: Integration of artificial intelligence and big data analytics to predict equipment failures, optimize routing, and assess performance.

Sustainability Integration: Tools that monitor emissions and fuel usage are increasingly in demand to comply with decarbonization goals.

Customization & Modularity: Solution providers are offering customizable modules to suit specific business needs, from cargo tracking to crew scheduling.

Key Players and Industry Leaders

The market features a competitive landscape with the presence of established software developers and emerging innovators. Noteworthy players include:

ABS Group of Companies, Inc.

BASS Software Ltd.

ConnectShip, Inc.

DNV AS

Hanseaticsoft GmbH

JiBe ERP

Kongsberg Gruppen ASA

MariApps Marine Solutions Pte Ltd

PRIME Marine

Micromarin

Norcomms

SBN Technologies Pvt. Ltd.

seaspeedmarine

SERTICA

Shipamax Ltd.

Shipnet

Softcom Solutions

SpecTec

Star Information System AS

Tero Marine (Ocean Technologies Group)

Veson Nautical

These companies are investing heavily in R&D to deliver next-generation platforms tailored to the evolving needs of global fleet operators.

Recent Developments

JiBe ERP, in April 2023, partnered with Claus Peter Offen, implementing JiBe’s ERP system across 34 container vessels to enhance digital fleet operations.

Hanseaticsoft GmbH, in March 2023, collaborated with Exploris SAS, enabling the latter to adopt its integrated Cloud Fleet Manager (CFM) system for better operational control.

Such strategic alliances signify the rising emphasis on modernizing marine operations through cutting-edge software integration.

Access key findings and insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=79029

Market Opportunities

The growing need for smart shipping and operational efficiency opens new avenues for solution providers:

Custom Software Development: Maritime software vendors are focusing on tailored solutions to meet client-specific demands, including voyage planning, compliance, and predictive maintenance.

SME Adoption: Small and medium-sized shipping firms are increasingly leveraging cloud-based fleet management tools, thanks to their affordability and ease of deployment.

Carbon Footprint Reduction Tools: With decarbonization at the forefront, tools that support emission tracking and optimization present a critical growth opportunity.

Future Outlook

The outlook for the marine fleet management software market remains highly promising. The increase in maritime trade, aging fleets, rising fuel costs, and demand for safer, more compliant, and energy-efficient vessel operations will continue to fuel demand for digital solutions.

The market will likely witness increased integration with IoT, machine learning, and blockchain technologies in the near future. Stakeholders focusing on these advanced capabilities will position themselves as frontrunners in a competitive and rapidly evolving space.

Market Segmentation

By Component:

Software Modules: Safety Management, Procurement, Navigation & Tracking, Compliance, Accounting, Document Management, and more.

Services: Training & Consulting, Integration & Implementation, Support & Maintenance

By Deployment Type:

Premise-based Deployment

Cloud Deployment

By End-user:

Ports & Terminals

Shipping Industries

Maritime Freight Forwarders

Regional Insights

North America dominates the global market, driven by technological readiness, robust port infrastructure, and early adoption of digital tools.

Asia Pacific is projected to register the highest CAGR through 2031. The presence of some of the world's busiest ports, including those in China, Singapore, and India, combined with growing maritime trade, makes this region a hotbed for marine software deployment.

Europe also represents a significant market, especially in countries with stringent maritime compliance standards and sustainability initiatives.

Why Buy This Report?

In-depth analysis of market dynamics, segmentation, and growth prospects

Insights into leading players’ strategies and innovations

Comprehensive regional and country-level data

Recent developments and strategic partnerships

Exclusive forecasts for the marine fleet management software market through 2031

Frequently Asked Questions

1. What is the projected market size for marine fleet management software by 2031? The market is forecast to reach US$ 2.5 Bn by 2031, expanding at a CAGR of 10.8% from 2023.

2. What is driving growth in this market? Key drivers include digitalization of the maritime sector, demand for operational efficiency, environmental compliance, and rise in maritime trade.

3. Which regions offer the most promising opportunities? Asia Pacific is set to grow at the fastest pace due to expanding port infrastructure and high-volume trade. North America remains a technological leader.

4. Who are the key players in the market? Prominent companies include DNV AS, ABS Group, JiBe ERP, Hanseaticsoft, MariApps, and Kongsberg Gruppen ASA.

5. What are the current trends shaping the market? Cloud deployment, AI integration, customized software, and sustainability-focused fleet management tools are major trends.

Explore Latest Research Reports by Transparency Market Research: AI in Healthcare Market: https://www.transparencymarketresearch.com/ai-in-healthcare-market.html

Edge Computing in IoT Market: https://www.transparencymarketresearch.com/edge-computing-in-iot-market.html

Digital Risk Management Market: https://www.transparencymarketresearch.com/digital-risk-management-market.html

AI (Artificial Intelligence) in Medical Imaging Market: https://www.transparencymarketresearch.com/ai-in-medical-imaging-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Online and Distance Learning MBA Programs Offered by Leading Universities in India

Introduction to Online and Distance Learning MBA

Online and distance learning MBA programs in India have revolutionized higher education by offering flexibility, accessibility, and affordability. Designed for working professionals, entrepreneurs, and fresh graduates, these programs eliminate the need for physical presence on campus while providing the same academic rigor and credentials as traditional MBA programs. With increasing recognition from the UGC and AICTE, these programs are now seen as equivalent to full-time MBAs in the job market.

Why Choose an Online or Distance Learning MBA?

Flexibility: Learn at your own pace and schedule.

Affordability: Lower tuition fees compared to traditional programs.

Accessibility: Study from anywhere in India or abroad.

Career Advancement: Ideal for professionals seeking a promotion or role shift.

Diverse Specializations: A Wide range of courses tailored to industry needs.

Top Online and Distance Learning MBA Specializations

Online MBA programs in India offer a variety of specializations to suit different career paths. Programs provided by Jain University, Mizoram University, Chandigarh University and AMET University are some examples of institutions offering well-structured and industry-relevant specialized online MBA programs:

Marketing Management – Ideal for aspiring marketing managers and brand strategists. Explore MBA in Marketing

Finance Management – For careers in investment banking, corporate finance, and financial analysis. Explore MBA in Finance

Human Resource Management – Tailored for future HR leaders and organizational developers. Explore MBA in HR

Logistics and Supply Chain Management – In high demand in e-commerce and global trade sectors. Explore MBA in Supply Chain

General Management – Broad business acumen ideal for leadership roles. Explore General MBA

Big Data Analytics – For those targeting roles in data science and business intelligence. Explore MBA in Big Data Analytics

Entrepreneurship – Best suited for startup founders and business innovators. Explore MBA in Entrepreneurship

Business Analytics – Data-driven management specialization. Explore Business Analytics MBA

Shipping and Logistics Management – Highly relevant for maritime professionals. Explore MBA in Shipping & Logistics

Leading Universities Offering Online and Distance Learning MBA

India's leading institutions offer high-quality, UGC-approved online and distance MBA programs with A or A++ NAAC ratings.

Mizoram University

UGC-approved Central University with NAAC "A" grade

Known for industry-oriented specializations such as Big Data Analytics and Logistics

Emphasis on academic research and digital learning infrastructure

View Online MBA Programs

Jamia Hamdard University

Recognized by UGC-DEB, NAAC "A" accredited

Strong focus on healthcare and management education

Comprehensive digital learning tools and expert faculty

Explore Online MBA

Jain University (ODL)

NAAC "A++" accredited institution

Offers modern learning tools, live classes, and student support

Highly customizable programs across various domains

Learn More about Online MBA Specializations

AMET University

Maritime-focused institution with niche MBA options

Specialized programs in shipping and logistics

Ideal for professionals in global trade and marine logistics

Explore Shipping MBA

Sambalpur University

Government-recognized university offering distance MBAs

Affordable and designed for working professionals

Explore Distance MBA

Guru Kashi University

UGC-approved private university

Offers robust online learning platforms

Diverse MBA specializations and industry-relevant curriculum

Discover Online MBA

Chandigarh University

NAAC "A+" accredited and highly ranked among private universities

Offers both online and distance MBA modes

Excellent placement record and industry tie-ups

Online MBA Program | Distance MBA Program

Admission Requirements & Fees

MBA Admission Online: Applications can be filled out through university portals with scanned documents.

MBA Eligibility:

Bachelor’s degree (minimum 50% marks)

Some universities may require work experience for executive programs

MBA Course Fees:

Varies by university and specialization, typically ranging from INR 40,000 to INR 1.5 lakh annually.

Most institutions offer flexible EMI payment options

Job Roles & Career Prospects

An online MBA program in India opens doors to a wide array of job opportunities:

Marketing Manager

Financial Analyst

Human Resource Manager

Supply Chain Analyst

Business Consultant

Data Analyst

Entrepreneur / Startup Founder

Whether you're targeting a career after an MBA in the corporate world or looking to establish your venture, these programs equip you with the strategic and managerial acumen needed for success.

Conclusion

With rapid digitization and evolving workplace norms, online and distance learning MBA programs have become mainstream. Indian universities are leading the charge by offering globally competitive, affordable, and flexible learning opportunities. If you're looking for the best online MBA tailored to your career goals, now is the time to explore these options and make a transformative leap in your professional journey.

#executive mba distance learning#distance mba#distance learning mba#distance mba degree#distance mba course#mba course in distance#mba distance education

0 notes

Text

Fish Counters Market Trends, Size, Forecast to 2024-2032

The Reports and Insights, a leading market research company, has recently releases report titled “Fish Counters Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032.” The study provides a detailed analysis of the industry, including the global Fish Counters Market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Fish Counters Market?

The global fish counters market size reached US$ 9.1 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 15.6 billion in 2032, exhibiting a growth rate (CAGR) of 6.2% during 2024-2032

What are Fish Counters?

Fish counters are tools utilized to count fish as they move through a designated area, like a river, stream, or fish ladder. They play a critical role in fisheries management, research, and conservation by providing precise data on fish migration, population dynamics, and habitat utilization. These counters employ diverse technologies, such as infrared sensors, video cameras, and acoustic systems, to detect and tally fish without direct contact. This information is essential for scientists and policymakers to make well-informed decisions for the preservation and sustainable management of fish populations and their environments.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1949

What are the growth prospects and trends in the Fish Counters industry?

The fish counters market growth is driven by various factors. The fish counters market is steadily growing, fueled by increasing demand for precise and efficient fish counting solutions in fisheries and aquaculture. These systems play a vital role in monitoring fish populations, ensuring sustainable fishing practices, and enhancing production in aquaculture settings. Technological advancements, including the incorporation of artificial intelligence and machine learning, are further enhancing the accuracy and efficiency of fish counters. Additionally, there is a growing preference for portable and user-friendly fish counting devices, especially in smaller fisheries and research settings. Overall, the fish counters market is poised for continued expansion due to the growing emphasis on sustainable fishing and effective aquaculture management. Hence, all these factors contribute to fish counters market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Product Type:

Electronic Fish Counters

Mechanical Fish Counters

By Application:

Fisheries Management

Aquaculture

By End-Use:

Government Agencies and Research Institutes

Commercial Fisheries

Aquaculture Farms

Market Segmentation by Region:

North America

United States

Canada

Europe

Germany

United Kingdom

France

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

Rest of Asia Pacific

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

Saudi Arabia

South Africa

United Arab Emirates

Israel

Who are the key players operating in the industry?

The report covers the major market players including:

VAKI Aquaculture Systems Ltd.

Precision Measurement Engineering, Inc.

Star-Oddi

AquaScan AS

Vidar Systemer AS

Marel hf.

Fishtek Marine

NOVIS S.A.

Pentair Aquatic Eco-Systems

Automated Aquatics

In-Situ Inc.

Fishtek Marine Ltd.

Otter Trawl (Oceantech)

OSMOSIA Scientific Instruments

AquaScan OY

View Full Report: https://www.reportsandinsights.com/report/Fish Counters-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd. 1820 Avenue M, Brooklyn, NY, 11230, United States Contact No: +1-(347)-748-1518 Email: [email protected] Website: https://www.reportsandinsights.com/ Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/ Follow us on twitter: https://twitter.com/ReportsandInsi1

0 notes

Text

Automated Container Terminal Market Future Scope: Growth, Share, Value, Size, and Analysis

"Automated Container Terminal Market Size, Share, and Trends Analysis Report—Industry Overview and Forecast to 2032

The Automated Port Systems Market is showing significant growth across various sectors, where demand is surging due to innovation and industry expansion. Market research data reveals that businesses in the Container Handling Systems Market are adjusting to new regulations, sustainability initiatives, and changing consumer trends. Companies operating in the Automated Cargo Terminal Market are utilizing big data and analytics to track emerging trends, optimize supply chain operations, and improve service offerings. As competition intensifies, firms in the Port Automation Solutions Market are investing heavily in strategic market research to uncover new opportunities, address industry challenges, and shape future business models within the Automated Shipping Terminal Market.

The Automated Container Terminal Market is poised for significant growth, with a market outlook highlighting substantial growth potential driven by emerging opportunities in key sectors. This report provides strategic insights, demand dynamics, and revenue projections, offering a comprehensive view of the future landscape, technology disruptions, and adoption trends shaping the industry’s ecosystem evaluation. According to Data Bridge Market Research The global automated container terminal market size was valued at USD 10.98 billion in 2024 and is projected to reach USD 13.81 billion by 2032, with a CAGR of 2.90% during the forecast period of 2025 to 2032.

The buzz around the Container Terminal Automation Market is undeniable. It's a space that's rapidly evolving, demanding a clear understanding of its current state. From our extensive research, we've seen how shifts in consumer preferences and technological integration are reshaping the Automated Container Terminal Market. Businesses are keen to grasp the real-time dynamics of the Freight Terminal Automation Market, moving beyond assumptions to data-driven insights. Our focus is on providing that clarity, illuminating the current landscape of the Port Cargo Management Systems Market. The challenges and opportunities within the Automated Container Terminal Market are becoming increasingly apparent. We're dedicated to helping organizations navigate the complexities of the Automated Container Terminal Market. The present understanding of the Automated Freight Handling Market is vital. We are focused on providing information on the Container Handling Automation Market. The current state of the Automated Container Terminal Market is very important.

Our comprehensive Automated Container Terminal Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://www.databridgemarketresearch.com/reports/global-automated-container-terminal-market

**Segments**

- **Technology**: The automated container terminal market can be segmented based on technology into semi-automated terminals and fully automated terminals. Semi-automated terminals involve a combination of manual labor and automated technologies to handle container operations. On the other hand, fully automated terminals are equipped with advanced technologies such as robotic cranes, automated guided vehicles (AGVs), and artificial intelligence for a completely autonomous operation. - **Component**: Another key segmentation is based on components, which include hardware and software. The hardware components of automated container terminals encompass various machinery and equipment like cranes, sensors, cameras, and control systems. The software segment includes automation software, terminal operating systems (TOS), and other digital solutions that facilitate efficient terminal operations. - **End-User**: The market can also be segmented based on end-users such as marine ports, inland ports, and container depots. Each end-user segment has specific requirements and challenges, driving the adoption of automated solutions to enhance operational productivity, safety, and cost-effectiveness.

**Market Players**

- **ABB Ltd.**: ABB is a leading provider of industrial automation and robotics solutions, offering a range of products for automated container terminals such as robotic cranes, electrification systems, and control technologies. - **Konecranes**: Konecranes specializes in container handling equipment and automation solutions for ports and terminals. The company's portfolio includes automated stacking cranes, straddle carriers, and intelligent software systems for efficient terminal operations. - **Cargotec Corporation**: Cargotec is a key player in the automated container terminal market, offering automation technologies through its Kalmar and Navis brands. The company provides automated container handling systems, software solutions, and services to optimize terminal performance. - **Liebherr Group**: Liebherr offers a range of automated container crane systems, reachstackers, and terminal tractors for seamless cargo handling operations. The company's innovative technologies focus on enhancing productivity and safety in container terminals.

For moreThe automated container terminal market is witnessing significant growth and transformation due to advancements in technology, changing industry dynamics, and increasing demand for efficient and cost-effective terminal operations. One of the emerging trends in the market is the integration of Internet of Things (IoT) and data analytics solutions to optimize container handling processes, improve visibility and transparency, and enhance decision-making capabilities. By leveraging IoT sensors, RFID technology, and cloud-based platforms, terminal operators can track container movements in real-time, predict equipment maintenance needs, and streamline overall terminal operations for increased productivity and efficiency.

Additionally, the growing focus on sustainability and environmental conservation is driving the adoption of eco-friendly solutions in automated container terminals. Terminal operators are increasingly investing in electrification technologies, renewable energy sources, and energy-efficient equipment to reduce carbon emissions, minimize environmental impact, and comply with regulatory requirements. With the rising emphasis on green initiatives, automated container terminals are transitioning towards greener practices to create a more sustainable and eco-conscious operating environment.

Furthermore, the market is witnessing a surge in partnerships and collaborations between technology providers, terminal operators, and logistics stakeholders to develop integrated solutions that address the complex challenges faced by the industry. By combining expertise in automation, digitalization, and logistics management, companies are co-innovating to create seamless end-to-end solutions that optimize container terminal operations, enhance supply chain visibility, and improve overall customer satisfaction. These strategic partnerships enable market players to leverage their complementary strengths, resources, and technologies to deliver comprehensive solutions that meet the evolving needs of the automated container terminal market.

Moreover, as global trade volumes continue to rise, there is a pressing need for scalable and adaptable automated container terminal solutions that can efficiently handle large volumes of containers while maintaining operational efficiency and cost-effectiveness. Market players are increasingly focusing on developing flexible and modular automation systems that can be easily integrated into existing terminal infrastructure, upgraded to meet changing requirements, and scaled up to accommodate future growth. By offering versatile and customizable solutions, companies are catering to the diverse needs of different terminal operators**Market Players** - Cargotec Corporation - Konecranes - Liebherr-International Deutschland GmbH - ABB - KUNZ Aircraft Equipment - CyberLogitec - Camco - IDENTEC SOLUTIONS AG - ORBCOMM - Orbita Ports & Terminals - PACECO CORP. - TOTAL SOFT BANK LTD. - INFORM Software - LogStar - Infyz - Tideworks - Loginno Logistic Innovation ltd. - WCS – World Crane Services FZE - Starcom Systems Ltd

The automated container terminal market is experiencing rapid expansion and evolution driven by technological advancements, industry shifts, and a growing demand for streamlined and cost-effective terminal operations. One significant trend in this market is the integration of Internet of Things (IoT) and data analytics solutions to optimize container handling processes, enhance visibility, improve decision-making, and boost overall operational efficiency. By utilizing IoT sensors, RFID technology, and cloud-based platforms, terminal operators can monitor container movements in real-time, predict equipment maintenance requirements, and optimize terminal operations for increased productivity.

Another key driver in the market is the increasing emphasis on sustainability and environmental responsibility, leading to the adoption of eco-friendly practices in automated container terminals. Terminal operators are investing in electrification technologies, renewable energy sources, and energy-efficient equipment to reduce carbon footprints, minimize environmental impact, and meet regulatory standards. This focus on green initiatives is reshaping automated container

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies in Automated Container Terminal Market : https://www.databridgemarketresearch.com/reports/global-automated-container-terminal-market/companies

Key Questions Answered by the Global Automated Container Terminal Market Report:

What is the Revenue Forecast for the Automated Container Terminal Market over the next 5-10 years?

What is the Future Scope of the Automated Container Terminal Market, and which emerging sectors will drive growth?

What are the main Challenges faced by companies operating in the Automated Container Terminal Market?

What are the major Growth Drivers influencing the expansion of the Automated Container Terminal Market?

Who are the leaders in the Automated Container Terminal Market, and what strategies do they use to maintain dominance?

Can a graph representation illustrate the Automated Container Terminal Market trends and key data points?

What are the latest insights derived from market research on the Automated Container Terminal Market?

How do Research Reports contribute to understanding market dynamics and competitive strategies?

Which companies are expected to have a significant impact on the Automated Container Terminal Market, and what is their market overview and outlook?

What is the current market size of the Automated Container Terminal Market, and how is it expected to evolve?

Browse More Reports:

https://www.databridgemarketresearch.com/reports/global-ai-marketing-tool-markethttps://www.databridgemarketresearch.com/reports/global-offline-automated-optical-inspection-system-markethttps://www.databridgemarketresearch.com/reports/global-hemp-oil-markethttps://www.databridgemarketresearch.com/reports/global-electrostatic-precipitator-markethttps://www.databridgemarketresearch.com/reports/global-farm-type-dairy-machines-and-equipment-market

Data Bridge Market Research:

☎ Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 982

✉ Email: [email protected]

Tag

Automated Container Terminal Market Size, Automated Container Terminal Market Share, Automated Container Terminal Market Trend, Automated Container Terminal Market Analysis, Automated Container Terminal Market Report, Automated Container Terminal Market Growth, Latest Developments in Automated Container Terminal Market, Automated Container Terminal Market Industry Analysis, Automated Container Terminal Market Key Players, Automated Container Terminal Market Demand Analysis"

0 notes

Text

Aquark Technologies Achieves Quantum Milestone Underwater

Aquark Tech

Quantum technology startup Aquark Technologies from Southampton, UK, reached a milestone. The company completed the first underwater cold atom quantum sensor test. This pioneering experiment employed Boaty McBoatface, the NOC's autonomous submersible. The test at NOC's indoor tank facility was a major step towards using quantum sensing technology outside of labs, the company claimed.

Aquark tested their AQuest system in a controlled aquatic setting that mimicked underwater conditions. The purpose was to collect performance data at different pressures and temperatures. This data collection focused on sensor cold atom trap performance and stability. The trial results are expected to improve the technology and prepare it for usage in harsh environments like the deep sea or rocky terrain where accurate sensing is needed. Despite these challenges, Aquark said the cold atom trap collected “a boatload of data” during the test.

Aquark's innovation centres on a tiny cold atom trap. This approach cools atoms towards absolute zero with lasers. This approach allows atoms to be used in very sensitive sensors that sense motion, time, and magnetic fields better than traditional instruments. The Aquark Super Molasses Trap (SMT) was employed in the underwater test.

The successful test is important because holding cold atoms in an unstable and noisy underwater vehicle was a big engineering challenge. Previous cold atom trap investigations were done in well controlled labs. Boaty McBoatface's success proves Aquark's design's durability. The company says the compact, power-efficient technology may be used in remote or mobile devices. It was the first time a cold atom trap was tested underwater, according to Villius Atkočius, Quantum Systems Engineer at Aquark Technologies. He noted that the “underwater world is less understood than space,” stressing its vast potential.

Aquark's technology has several applications and strategic implications. Finding ways to travel underwater without GPS signals might be useful, especially for underwater fighting. The sensors might also assess mineral density beneath the sea bottom using high-sensitivity magnetic field readings or gravity measurements, allowing scientists to “see things that were previously hidden.”

Seeing their platform function alongside NOC’s Autosub – known as Boaty McBoatface – was a genuine victory for both science and pleasure', said Aquark technology Co-Founder & CEO Andrei Dragomir. The success has 'opened new possibilities for research enabled by quantum technologies'. Technology may “uncover some hidden treasures!” he speculated. Villius Atkočius claims that gravity sensing platforms like Aquark's SMT are more reliable than magnetic field sensing for long-duration underwater or polar operations.

Additionally, the technology may expand medical diagnostics. The idea received support from NATO's DIANA Accelerator Program, which accelerates military and dual-use deep tech enterprises. Quantum sensing might offer a “substantial contribution” to seabed photography and underwater navigation, says NOC Marine Autonomous and Robotics Systems Head Dr. Alex Phillips. These preliminary experiments suggest quantum technologies are ready for underwater vehicles like Autosub Long Range.

This experiment is a major step towards real-world quantum sensing. After receiving early funding and building a minimal viable product, Aquark is prepared for commercial deployment. The business aims to make the most energy-efficient and compact cold atom core on the market that can work outside of lab settings.

For more details visit Govindhtech.com

#technology#technews#govindhtech#news#technologynews#Aquark Technologies#Aquark#cold atom quantum sensor#cold atom#Boaty McBoatface

0 notes

Text

Unlock Global Growth: How Indian Businesses Can Thrive in the Export Revolution

India has witnessed a rapid transformation in its export sector, with the country emerging as a global export powerhouse. With exports contributing nearly 22% to India’s GDP and initiatives such as “Make in India” and PLI schemes, businesses are presented with vast opportunities to expand internationally. The Indian export market is set to reach $1 trillion by 2030, driven by manufacturing, services, and technology advancements.

For Indian businesses, thriving in this export revolution requires a mix of policy support, innovation, and leveraging emerging technologies. Let’s explore the key strategies that can help businesses scale globally.

The Growing Potential of Indian Exports

The world sees India as a reliable trade partner, and Prime Minister Narendra Modi has emphasized the need for Indian businesses to take “big steps” toward expanding exports. Several factors are contributing to India’s export boom:

Government Policies & Incentives: India has introduced reforms such as the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme, which reduces cost burdens for exporters.

TradeTech & Digital Transformation: Advanced trade platforms and AI-driven supply chains are making it easier for businesses to access international markets.

Growing Demand for Indian Services: IT, pharmaceuticals, and professional services are in high demand globally, making services exports a strong contributor to India’s economy.

1. Key Growth Sectors Driving India’s Export Boom

1.1 Services Sector — India’s Global Strength

India’s services exports stood at $323 billion in 2023, positioning it among the world’s top five exporters. Sectors like IT, fintech, healthcare, and professional services have led the way, with AI and automation further accelerating this growth. The rise of AI-powered trade solutions and data-driven international market strategies allows Indian businesses to reach new global clients with ease.

1.2 Manufacturing & MSME Contribution

The “Make in India” initiative has significantly boosted the country’s manufacturing sector. Indian businesses are now capitalizing on PLI (Production Linked Incentives), leading to record exports in sectors such as pharmaceuticals, textiles, and electronics. MSMEs contribute nearly 50% of India’s exports, with digital tools enabling them to compete globally.

Additionally, the Budget 2025–26 has positioned Exports as the 4th Engine of Growth, introducing multiple initiatives to support key sectors:

Handicrafts: Export timelines extended from 6 months to 1 year, with an additional 3-month extension if needed. Nine more duty-free inputs added to boost competitiveness.

Leather: Full BCD exemption on Wet Blue leather to enhance domestic production and jobs, along with a 20% export duty exemption on crust leather to support small tanners.

Marine Products: Reduction of BCD on Frozen Fish Paste (Surimi) from 30% to 5% and on fish hydrolysate from 15% to 5% to support shrimp and fish feed production.

Railway MROs: Extended repair time limits for foreign-origin railway goods from 6 months to 1 year, aligning them with aircraft and ship repairs.

2. Emerging Trends in the Indian Export Sector

2.1 TradeTech — The Digital Transformation of Trade

Technology is revolutionizing how Indian businesses engage in exports. Key trends include:

AI-driven supply chain management for cost efficiency.

Blockchain-powered smart contracts to enhance trust in global trade.

Cross-border e-commerce allowing small businesses to sell directly worldwide.

2.2 Government Incentives & Policy Support

The Indian government has launched multiple initiatives, including:

Export Promotion Mission: Aimed at facilitating export credit, cross-border factoring support, and tackling non-tariff measures, with joint efforts from the MSME, commerce, and finance ministries.

BharatTradeNet (BTN): A digital public infrastructure initiative designed to streamline trade documentation and financing.

Integration with Global Supply Chains: The government will identify key sectors and facilitate industry collaboration to enhance India’s role in global trade.

Customs Reforms for Trade Facilitation: New time limits for provisional assessment, voluntary compliance initiatives, and extended timelines for end-use compliance to enhance ease of doing business.

These policies enable Indian businesses to reduce costs and penetrate international markets more effectively.

3. How Indian Businesses Can Thrive in Global Markets

3.1 Expanding to Untapped Markets

While the US and Europe remain top destinations, Indian businesses must explore Southeast Asia, Africa, and Latin America, where demand for Indian products is rising. The India-UAE CEPA (Comprehensive Economic Partnership Agreement) is a great example of opening new trade routes.

3.2 Leveraging Free Trade Agreements (FTAs)

India has signed or is negotiating FTAs with the UK, Australia, and Canada, reducing tariff barriers and simplifying export regulations. Businesses that leverage FTAs can access lower import duties, faster clearances, and easier market entry.

3.3 Strengthening Branding & Quality Compliance

Investing in branding & marketing: A strong digital presence on platforms like Amazon Global, Alibaba, and Shopify can help reach international customers.

Ensuring compliance with global standards: Adhering to ISO, FDA, CE certifications can boost credibility.

Sustainability focus: Eco-friendly packaging and carbon-neutral practices are gaining global acceptance.

4. Overcoming Challenges in the Export Ecosystem

4.1 Logistics & Infrastructure Bottlenecks

Despite advancements, logistics costs in India remain high. However, government investment in multi-modal transport networks, dedicated freight corridors, and port digitization is improving efficiency.

4.2 Financing & Export Credit Access

SMEs often struggle with export financing. The enhanced credit guarantee for term loans up to Rs. 20 crore under Budget 2025–26 is a major boost. The Export Credit Guarantee Corporation (ECGC) and Export Credit Insurance Scheme (ECIS) are also addressing this gap, along with trade finance products from banks to ease working capital constraints.

4.3 Global Trade Uncertainties & Geopolitical Risks

India’s exports are susceptible to geopolitical disruptions, supply chain issues, and trade wars. Businesses must diversify markets and adopt risk management strategies such as forward contracts and currency hedging.

Future Outlook for Indian Exports

The global economic shift towards India presents a unique opportunity for businesses to scale internationally. Key trends shaping the future of Indian exports include:

Digital Trade Agreements: India is negotiating trade pacts that will make cross-border digital trade easier.

AI-Driven Export Ecosystem: AI-powered data analytics will optimize trade strategies.

Growth of Services Exports: India’s IT, consulting, and education sectors will see increased demand.

Biz Consultancy: Your Trusted Growth Partner

Biz Consultancy is an industrial platform that helps you make smart business decisions with expert advice from industry professionals. It connects you with the right people, expands your network, and provides valuable insights to grow your business.

With a Biz Consultancy, you can store and share important documents securely, making it easier to collaborate with experts. The platform also connects you directly with machinery and equipment suppliers, helping you find what you need without middlemen.

Want to learn new skills? A Biz consultancy offers online courses on various industries and professional skills. You can learn at your own pace, take assessments, and boost your career.

Whether you’re starting a new business or scaling up, a Biz consultancy provides the right support, guidance, and tools to help you succeed.

Conclusion

India’s export revolution is set to propel the country towards a $5 trillion economy, with AI, automation, digital trade, and policy incentives playing crucial roles. The government’s focused efforts on export promotion through sectoral support, infrastructure development, and trade facilitation are strengthening India’s position in global markets.

For Indian businesses, the time is now to capitalize on export-led growth and establish a strong global footprint.

#bizconsultancy#consulting#supplychain#Logistics & Infrastructure Bottlenecks#Financing & Export Credit Access#Global Trade Uncertainties & Geopolitical Risks#msme#servicesector#globalstrength

1 note

·

View note

Text

Sustainable Shipping: Leveraging Green Technologies for a Cleaner Future

The shipping industry is a vital component of global trade, responsible for transporting approximately 90% of the world's goods. However, it also significantly contributes to environmental pollution, accounting for nearly 3% of global carbon emissions. As concerns over climate change and environmental degradation intensify, the maritime industry is shifting towards sustainable shipping practices by adopting green technologies that promote efficiency and reduce ecological impact.

The Need for Sustainable Shipping

The urgency for sustainability in the shipping sector arises from the following key factors:

Regulatory Pressures: International organizations such as the International Maritime Organization (IMO) have established stringent emission reduction targets, including the goal to reduce greenhouse gas (GHG) emissions by at least 50% by 2050 compared to 2008 levels.

Environmental Concerns: The maritime sector contributes to air and water pollution, with harmful emissions such as sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter.

Market and Consumer Demand: Increasing awareness among consumers and businesses is driving the demand for sustainable supply chains, pushing shipping companies to adopt eco-friendly practices.

Green Technologies Transforming Shipping

To meet sustainability goals, the maritime industry is leveraging several green technologies aimed at reducing emissions, optimizing energy use, and minimizing environmental footprints. Some of the key advancements include:

1. Alternative Fuels

Liquefied Natural Gas (LNG): Considered a transitional fuel, LNG reduces sulfur emissions and lowers carbon dioxide emissions compared to traditional marine fuels.

Hydrogen and Ammonia: These zero-emission fuels hold potential for long-term sustainability in shipping, although infrastructure and scalability remain challenges.

Biofuels: Derived from renewable sources, biofuels can be used in existing engines with minimal modifications, reducing dependency on fossil fuels.

2. Energy-Efficient Ship Designs

Hydrodynamic Hull Designs: Streamlined hull shapes and air lubrication systems enhance fuel efficiency and reduce resistance in water.

Lightweight Materials: The use of composite materials and advanced steel alloys decreases ship weight, improving energy efficiency.

3. Wind and Solar Energy

Wind-Assisted Propulsion: Technologies such as rotor sails, kite sails, and rigid wing sails harness wind energy to reduce fuel consumption.

Solar Panels: Solar energy systems installed on ships can provide supplementary power for onboard operations, lowering reliance on fossil fuels.

4. Electrification and Hybrid Technologies

Battery-Powered Ships: Fully electric vessels, particularly in short-sea shipping and ferries, are becoming viable with advancements in battery storage technology.

Hybrid Propulsion Systems: Combining conventional engines with electric power reduces fuel consumption and emissions, enhancing overall efficiency.

5. Digitalization and Smart Shipping

AI-Driven Route Optimization: Artificial intelligence and big data analytics enable ships to select the most fuel-efficient routes, minimizing emissions.

Automated Energy Management Systems: Smart monitoring of onboard energy use allows for real-time adjustments, reducing unnecessary consumption.

The Future of Sustainable Shipping

The transition towards a greener maritime industry requires collaboration between governments, industry stakeholders, and technology providers. Future developments are expected to focus on:

Stronger Policy Frameworks: Increased regulatory support and incentives will accelerate the adoption of green technologies.

Investment in Green Infrastructure: Expanding the availability of alternative fuel bunkering and charging stations will be crucial for widespread adoption.

Innovations in Carbon Capture: Emerging technologies aimed at capturing and storing carbon emissions from ships will further support sustainability efforts.

Conclusion

Sustainable shipping is no longer an option but a necessity to ensure a cleaner and more resilient maritime industry. By leveraging green technologies, shipping companies can significantly reduce their environmental impact while maintaining efficiency and profitability. As advancements in renewable energy, digitalization, and alternative fuels continue to evolve, the future of shipping promises to be both sustainable and economically viable.

0 notes

Text

0 notes

Text

Advancements in Ocean Exploration

Advancements in Ocean Exploration: Exploring the Depths of Our Seas

- Challenges in the new era-the risk management facilities and analytic design became essential tools for economic and social development - For years, sourcing has become an overwhelming prospect to type and editor with complex sourcing requirements. A lot of changelessness as well as endpoints getting unknown along a predefined straight line that this researcher finds orthogonal transformation in carrying out most of the scientific computations. Market Capitalism Is Best for Sourcing to Be Next to God - The universalization of sourcing can include market conditions of any developmental phase with analysis. The un-indigenization of sourcing moves along with such characteristics. It can be called a marked change in business concepts for the coming years. Trends from around 4-10 years are forming :) They cause substantial change or induce the business community, not the kind of waves that present new technologies every year. - There seems to be a limitation of complete knowledge gathering that involves knowing what exactly people will have to learn in sourcing ten and for sure in eleven, another entity actually being worked on or made now, and what-the-one could-be in me many things that are (in the face of significant novelty improvement is the most essential) better. Latest Conquests of the Oceans 1. Autonomous Underwater Vehicles (AUVs) One of the revolutionary innovations in ocean exploration is autonomous underwater vehicles (AUVs). Automated, unmanned machines are capable of plunging to the bottom of the ocean while collecting data concerning ocean temperature, salinity, and other parts of marine life. They can work unattended for days and eventually deliver data, with immediate conversion, on reasonably inaccessible and stormy regions to humans. Accordingly, there is a growing possibility of mapping the ocean floors and how oceanic events take place at deep sea levels by scientists. 2. Remotely Operated Vehicles (ROVs) Another indispensable tool for oceanography is Remotely Operated Vehicles. Running through a cord, these devices are controlled entirely from the ship's surface and thus can grow deeper than human divers can go. With cameras and sensors attached to them, the ROVs become able to take pictures and make videos in high definition, letting scientists study the minutiae of deep-sea creatures and underwater volumes. One big find was the discovery of an unknown ecosystem around an underwater hot spring vent that supported a rich community of organisms that had never been observed. Humans exploring inner space below 0.5% 7,500 meters deep in their own submarines experience the greatest depths of the ocean. What they have accomplished was one of the filmmaker James Cameron-made solo dives to the Mariana Trench in 2012. Development in advanced materials and technologies has made it possible to venture so far into the ocean to places like the Challenger Deep, the Earth's deepest-known depths. 3. Advanced-Data Collection with Oceanography Oceanography has been revolutionized through the use of advanced sonar systems and multibeam echo sounders. Oceanographic high-resolution maps produced by said technology have made mapping the seabed possible to indicate underwater mountains, valleys, and unknown shipwrecks. Maps are indispensable in the study of oceanic currents, the prediction of tsunamis, and the discovery of new marine habitats. 4. DNA Barcode and Marine Biodiversity Search It is not all about developing methods for studying ocean environments. It is also about exploring and discovering new marine creatures. Applications of DNA barcoding have revealed that their capacity to identify species is significantly increased, thus allowing marine biodiversity to be categorized better. Experts have found that new species can be unveiled using such modern technology, while even better equilibrium in marine ecosystems can be analyzed as before. 5. Climate Change Monitoring and Ocean Observation Systems Climate change is tracked through the observation of changes in ocean conditions. Sensors and satellite technology have progressed to a level where it is possible to measure sea surface temperature, pH, and the overall health of coral reefs. In doing so, researchers discern new environmental situations and can foresee the impact of climate change on marine ecosystems in the years to come, thus offering them vital data for mitigating their harmful effects. Future of Ocean Exploration The raging development of technology assures us of a bright future in ocean discovery. Advancements in Ocean Exploration Technologies that are continuously changing include the advent of artificial intelligence, machine learning, and very advanced materials. This will allow exploration and understanding of the seas to a very high degree as never before possible. We await the discovery of deep-sea ecosystems somewhat definitively, introducing new species, and even the discovery of potentially profitable resources, such as underwater minerals and medicines. International collaboration is crucial when it comes to the protection of the oceans. The deep ocean is something the world shares with others. Therefore, with increasing competition in exploration, all eyes are on international efforts to manage and conserve marine environments to ensure the sustainability of the oceans for future generations.

Conclusion

- Deep exploration of oceans will unlock several secrets of the deep and is decisive for the health of the planet. Advancements in Ocean Exploration Ocean exploration and, alongside it, security capability have evolved in very interesting terms, from unmanned vehicles to in-depth submarine technologies. - By discovering more secrets to the sea, we come to know that the future of ocean exploration is not only going to deepen our understanding of the behavior of marine animals but also contribute to doing away with some of the biggest challenges facing the world today. The ocean, vast and unexplored, has so much full of these possibilities; the journey has only just started. Read the full article

#Artificialintelligence#BiodiversitySearch#Health#MarketCapitalism#ObservationSystems#OceanExploration#Oceanography#OperatedVehicles#Technology#UnderwaterVehicles

0 notes

Text

Wind Turbine Components Market: A Gust of Growth

As governments and corporations begin to power even more activities with renewable energy sources, the components market for wind turbines have grown substantially over the past five years. It is no longer a question of ‘if’, but ‘when’ big industry sphere will switch from fossil fuels.

Market Overview

Wind turbines are complex constructions that involve different machine parts such as rotor blades, towers, nacelle, generator, gearbox, and controls. The market is further segmented based on material, size, application, and region.

Market Drivers

Several factors are contributing to the growth of the wind turbine components market:

•Renewable Energy Targets: Across the globe, governments are setting ambitious renewable energy targets with the goal of reducing greenhouse gas emissions and increasing reliance on renewable energy sources. Wind energy is a fundamental part of these targets.

•Lower costs: technological learning and scale economies have made wind energy more affordable than conventional energy sources.

• Wind Energy Has Environmental Benefits: Wind is a clean, renewable source of electricity that has very little environmental effects compared with other fossil fuels.

• Task: Enriching the energy mix can boost energy security and reduce dependence on fossil fuels. • Paraphrase: Energy security: Diversifying the energy mix can lead to greater energy security and a decreased dependence on fossil fuels.

•Government incentives: Governments are offering incentives such as tax credits and subsidies for renewable energy technologies, such as wind power.

Market Trends

The wind turbine components market is characterized by several key trends:

– Larger turbines are driving up demands for longer blades, taller towers, and stronger components.

• Material innovation: Manufacturers are searching for new materials, such as composite materials and lightweight alloys, to increase the capacity, and durability and lower the cost of wind turbine parts.

• Digitalization: Integration of digital technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics, is enabling more efficient operation and maintenance, from predictive maintenance to improved performance optimization and remote monitoring.

• Offshore wind capacity: The offshore wind energy market is growing at a rapid rate, which has created demand for components that can withstand harsh marine environments.

• Recycling and reuse: a trend towards recycling and the circular economy is growing, with more and more wind turbine components being reused once they are no longer operational.

Market Size and Growth

The world market in wind turbine components is estimated at 83,407.19 million US dollars in the year 2023 and 1,25,497.36 million US dollars is predicted to increase at a Compound Annual Growth Rate of 5.2 % between the years 2023 to 2031. However, it is projected that most of the contribution to this market will be from the Asia-Pacific region with fast economic growth and growing energy needs.

Conclusion

The global wind turbine components market is also expected to grow with the increasing transition of the world towards renewable energy resources. The growing market has accelerated in turn thanks to the rising demand for wind energy. In most regions, the utility-scale market will dominate the overall wind energy market mainly because of its technological advancements in components. The blooming wind energy industry is anticipated to grow significantly in the coming years amidst the soaring growth of technology and governmental regulations focusing on policies to support the usage of wind power.

FAQs:

1. What are the key factors to consider when selecting wind turbine components?

The key factors include:

•Efficiency: Choose components that maximize energy production and minimize energy losses.

•Durability: Ensure components can withstand harsh weather conditions and long-term operation.

•Cost-Effectiveness: Balance initial costs with long-term performance and maintenance requirements.

•Safety: Prioritize safety features to protect workers and the environment.