#Louis Bull Tribe

Explore tagged Tumblr posts

Text

It was a jarring sight for more than one reason: plains bison darting from a cattle trailer onto long grass on land owned by the Louis Bull Tribe.

One by one, the 25 young animals sprung forcefully from the open back gate of the trailer and raced up a gentle hill toward the horizon on a cloudless Monday 90 kilometres south of Edmonton almost as though they’d done it before.

Except it was the first time in generations that bison had seen these homelands. It was the culmination of a four-year effort to reintroduce them to Maskwacis by the Louis Bull Tribe and Elk Island National Park.

Among the people watching the display was Louis Bull Tribe Chief Desmond Bull, who described the historic scene as one of mixed emotions.

“Pride, definitely. I felt a little bit of sadness, but honestly, a lot of hope,” Bull said. [...]

Continue Reading.

Tagging: @politicsofcanada, @abpoli, @vague-humanoid

#cdnpoli#Alberta#First Nations#Indigenous activism#conservation#flora & fauna#Maskwacis#Louis Bull Tribe

667 notes

·

View notes

Photo

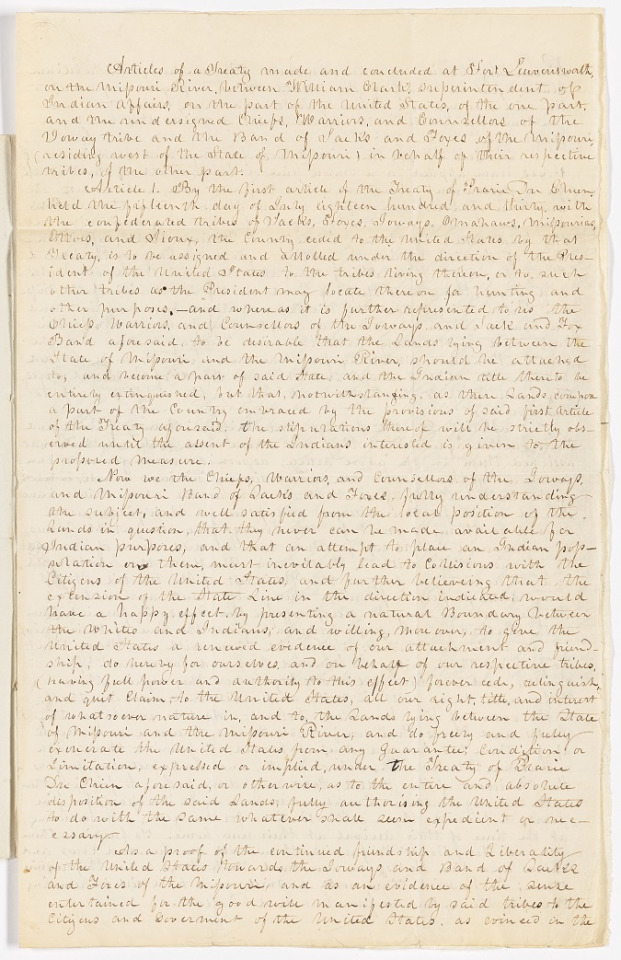

Treaty Between the the United States and the Iowa Indians and the Sauk and Fox Indians of the Missouri (Residing West of the State of Missouri) Signed at Fort Leavenworth, 9/17/1836

File Unit: Ratified Indian Treaty 211: Iowa and Sauk and Fox of the Missouri (West of Missouri) - Fort Leavenworth, September 17, 1836, 1789 - 1869

Series: Indian Treaties, 1789 - 1869

Record Group 11: General Records of the United States Government, 1778 - 2006

Transcription:

Articles of a Treaty made and concluded at Fort Leavenworth,

on the Missouri River, between William Clark, superintendent of

Indian Affairs, on the part of the United States, of the one part,

and the undersigned Chiefs, Warriors, and Councillors of the

Ioway Tribe and the Band of Sacks and Foxes of the Missouri,

(residing west of the State of Missouri) in behalf of their respective

tribes, of the other part:

Article 1. By the first article of the Treaty of Prairie Du Chien

held the fifteenth day of July eighteen hundred and thirty, with

the confederated tribes of Sacs, Foxes, Ioways, Omahaws, Missorias,

Ottoes, and Sioux, the country ceded to the United States by that

Treaty, is to be assigned and allotted under the direction of the Pres-

ident of the United States to the tribes living thereon, or to such

other tribes as the President may locate thereon for hunting and

other purposes.- and where as it is further represented to us the

Chiefs, Warriors, and Counsellors of the Ioways and Sack and Fox

Band aforesaid, to be desirable that the Lands lying between the

State of Missouri and the Missouri River, should be attached

to, and become a part of said State, and the Indian title thereto be

entirely extinguished; but that, notwithstanding, as these lands compose

a part of the Country embraced by the provisions of said first Article

of the Treaty aforesaid. The stipulations thereof will be strictly obs-

erved until the assent of the Indians interested is given to the

proposed measure.

Now we the Chiefs, Warriors, and Counsellors of the Ioways,

and Missouri Band of Sacks and Foxes, fully understanding

the subject, and well satisfied from the local position of the

lands in question, that they never can be made available for

Indian purposes, and that an attempt to place and Indian pop-

ulation on them, must inevitably lead to Collisions with the

Citizens of the United States, and further believing that the

extension of the State line in the directions indicated; would

have a happy effect by presenting a natural Boundary between

the Whites and Indians; and willing, more over, to give the

United States a renewed evidence of our attachment and friend-

ship, do hereby for ourselves, and on behalf of our respective tribes,

(having full power and authority to this effect) forever cede, relinquish,

and quit Claim, to the United States, all our right, title and interest

of whatsoever nature in, and to, the lands lying between the State

of Missouri and the Missouri River; and do freely and fully

exonerate the United States from any guarantee; Condition or

?Limitation, expressed or implied, under the Treaty of Prairie

Du Chien aforesaid, or otherwise, as to the entire and absolute

disposition of the said lands, fully authorizing the United States

to do with the same whatever shall seen expedient or nec-

essary.

As a proof of the continued friendship and liberality

of the United States towards the Ioway and Band of Sacks

and Foxes of the Missouri, and as an evidence of the sense

entertained for the good will manifested by said tribes to the

Citizens and Government of the United States, as coined in the

[page 2]

[two page layout]

[left page]

Preceding cession or relinquishment, the undersigned, William

Clark, agrees on behalf of the United States, to pay as a present to

the said Ioways and Band of Sacks and Foxes, seven thousand

five hundred dollars in Money, the receipt of which they hereby ac=

knowledge.

Article 2. As the said tribes of Ioways and Sacks and

Foxes, have applied for a small piece of land, south of the Missouri,

for a permanent home, on which they can settle, and request the

assistance of the Government of the United States to place them on this

land in a situation at least equal to that they now enjoy on

the land ceded by them: Therefore I, William Clark, superinten-

dent of Indian Affairs, do further agree on behalf of the United

States. As assign to the Ioway tribe, and Missouri Band of Sacks

and Foxes, the small strip of land on the south side of the Miss-

ouri River, lying between the Kickapoo northern boundary line and

the Grand Nemahar River, and extending from the Missouri

Sack and westwardly with the said Kickapoo line and the

Grand Nemahar, making four hundred sections; to the divided

between the said Ioways and Missouri Band of Sacks and Foxes,

the lower half to the Sacks and Foxes, the upper half to

the Ioways.

Article 3. The Ioways and Missouri Band of Sacks and

Foxes further agree, that they will move and settle in the lands

assigned them in the above article, as soon as arrangements can

be made by them; and the undersigned William Clark, in behalf

of the United States, agrees, that as soon as the above tribes have

selected a site for their villages, and places for their fields, and

moved to them, to erect for the Ioways five comfortable houses,

to enclose and break up for them two hundred acres of Ground;

to furnish them with a Farmer, a Blacksmith, school master,

and interpreter, as long as, the President of the United States

may deem proper; to furnish them with such agricultural

Implements as may be necessary, for five years; to furnish them

with Rations for one year, commencing at the time of their arriv-

al at their new homes; To furnish them with one Ferry Boat;

to furnish them with one hundred Cows and Calves and five

Bulls, and one hundred stock hogs when they require them;

To furnish them with a Mill, and assist in removing them,

to the extent of five hundred Dollars. And to erect for the

Sacks and Foxes three comfortable Houses; to enclose and break

up for them two hundred acres of Ground; to furnish them with

a Farmer, Blacksmith, School Master, and Interpreter, as long as

the President of the United States may deem proper: to furnish them

with such Agricultural Implements as many be necessary, for five

years; to furnish them with Rations for one year, commencing

at the time of their arrival at their new home: to furnish them

with one Ferry Boat; to furnish them with one hundred Cows and

Calves and five Bulls, one hundred stock Hogs when they require

them; to furnish them with a mill; and to assist in removing

them, to the extent of four hundred Dollars. [blue circular stamp] THE NATIONAL ARCHIVES OF THE UNITED STATES [/blue circular stamp]

[right page]

Article 4. This Treaty shall be obligatory on the Tribes, Parties

hereto, from and after the date hereof, and on the United States from and

after its ratification by the Government there of.

Done and signed and sealed at Fort Leavenworth, on the

Missouri, this seventeenth day of September, one thousand eight

hundred and thirty six, and of the Independence of the United States

the sixty first.

[left column]

Witness

[signed] S. W. Kearny

Col. 1st Reg. Drags.

[signed] Jno Daugherty Ind. Agt.

[signed] Andrew S. Hughes Sub Agent

[signed] George R. H. Clark

[signed] William Duncan Indian farmer

[signed] Jos V Hamilton Sutler Dragoons

[signed] H Robedou Jr

[signed] Wm Bowman Sargt. Maj 1. Drgs.

[signed] Jeffery Dorion his x mark, Sworn interpreter

[signed] Peter Cadue his x mark, Sworn interpreter

[signed] Jacques White Interpreter U. S.

[signed] Louis M. Darrion

[right column]

[signed] Wm. Clark Su In Afr Seal

Ioways

Mo-hos-ca (or white Cloud) his mark x seal

Nau-che-ning (or No heart) his mark x seal

Wa-che-mo-ne (or the Orator) his mark x seal

Ne-o-mo-ne (or Raining Cloud) his mark x seal

Mau-o-mo-ne (or Pumpkin) his mark x seal

Congu (or Plumb) his mark x seal

Wau-thaw-ca-be-chu (one that eats raw) his mark x seal

Ne-wau-thaw-chu (Hair Shedder) his mark x seal

Mau-hau-ka (Bunch of Arrows) his mark x seal

Cha-tau-the-nu (Big Bull) his mark x seal

Cha-tea-thau (Buffalo Bull) his mark x seal

Cha-ta-ha-ra-wa-re (foreign Buffalo) his mark x seal

Sacs & Foxes

Cau-a-car-mack (Rock Bass) his mark x seal

Sea-sa-ho (Sturgeon) his mark x seal

Pe-a-chin-car-mack (Bald head Eagle) his mark x seal

Pe-a-chin-car-mack Jr. (Bald head Eagle) his mark x seal

Ca-ha-qua (Red Fox) his mark x seal

Pe-shaw-ca (Bear) his mark x seal

Po-cau-ma (Deer) his mark x seal

Ne-bosh-ca-wa (Wolf) his mark x seal

Ne-squi-in-a (Deer) his mark x seal

Ne-sa-au-qua (Bear) his mark x seal

Qua-co-ou-si (Wolf) his mark x seal

Se-quil-la (Deer) his mark x seal

As-ke-pa-ke-ka-as-a (Green Lake) his mark x seal

Wa-pa-se (Swan) his mark x seal

No-cha-taw-wa-ta-sa (Star) his mark x seal

#archivesgov#September 17#1836#1800s#Native American history#American Indian history#Indigenous American history#Iowa#Iowa Tribe#Sac and Fox Nation#treaties

32 notes

·

View notes

Text

Ireland playlist

Feck!

Pog my thoin! It’s my Irish playlist. My precious treasure has been opened! Inside my pot of gold lies an Irish playlist of songs I put together. Forget the diamonds in Antwerp! It doesn’t matter if you are from Rhode Island or South Korea, this is the only Irish playlist you need and for your travels across the green hills. Play the songs here: https://www.youtube.com/playlist?list=PL-iHPcxymC1_4UCcVH8Jcka-whydlPzH6 So load up your iPods and whatever you use and enjoy this with a pint of Guinness! Stay safe. Stay at home. Wash your hands. Burn a bra.

IRELAND PLAYLIST

001 Carrentouhill - Welcome to Ireland 002 Thin Lizzy - Do Anything You Want To 003 Makem & Clancy - The Rocky Road To Dublin 004 Ash - A Life Less Ordinary 005 Absu - Tara 006 Type O Negative - Be My Druidess 007 Dexy’s Midnight Runners - Come On Eileen 008 Horslips - Dearg Doom 009 Boomtown rats - Banana republic 010 Dublin City Ramblers - Dicey Reilly 011 Simple Minds - All The Things She Said 012 Cruachan - The Brown Bull Of Cooley 013 Ween - The Blarney Stone 014 Primordial - Where Greater Men Have Fallen 015 The Pogues - Dirty Old Town 016 Van Morrison - Cyprus Avenue 017 Wings: Wild Life - Give Ireland Back To The Irish 018 Devin Townsend - Irish Maiden 019 The Rumjacks - An Irish Pub Song 020 Dominic Behan - Biddy Mulligan 021 Waylander - Brú na Bóinne 022 John Lennon - The Luck Of The Irish 023 Gary Moore ft. Philip Lynott - Out In The Fields 024 Whiskey on a Sunday - Irish Rovers 025 Týr - The Wild rover 026 Sleep - The Druid 027 The Waterboys - Fishermans Blues of Gael Bay 028 Clannad - Siúil A Rún 029 Leprechaun in the Hood - The Leprechaun Rap 030 Leaves' Eyes - [feat. Carmen Elise Espenaes] 031 Thin Lizzy - Dublin 032 Cruachan - The Marching Song of Fiach Mac Hugh 033 Fairport Convention - She Moves Through The Fair 034 My Bloody Valentine - Soon 035 Steve Earle - Galway Girl 036 The Wolfe Tones - A Nation Once Again 037 Mael Mórdha - Cluain Tarbh 038 Celtic Legend - Irish Drinkin Song 039 Therapy? - Auto Surgery 040 Bob Geldof - The Great Song Of Indifference 041 Makem & Clancy - Little Beggarman 042 ABSU - Of Celtic Fire, We Are Born - Terminus (...In the Eyes of Ioldánach) 043 The Nolans - Gotta Pull Myself Together 044 Johnny Cash - Danny Boy 045 Dropkick Murphys - Fields Of Athenry 046 Ahab - Red Foam (The Great Storm) 047 Omnia - Fee Ra Huri 048 Banba Óir - Clannad 049 Maighread & Triona Ni Dhomhnaill - The Spanish Lady 050 Gary Moore - Over The Hills And Far Away 051 Slomatics - Electric Breath 052 The Irish Rovers - Finnegans Wake 053 The Cranberries - Dreams 054 Orthodox Celts - Star Of The County Down 055 Mamas Boys - Mama Weer All Crazee Now 056 The Dubliners - All for me Grog 057 Gems of Ireland - The Last Of The Irish Rover 058 Paddyman - The Leprechaun Song 059 Primordial - Heathen Tribes 060 Beithioch - Ghosts of a world long forgotten 061 The Wolfe Tones - Come Out Ye Black And Tans 062 Diddler on the Hoof - Some Say The Devil Is Dead 063 Planxty - The Bonny Light Horseman 064 Sinéad O Connor & The Chieftains - The Foggy Dew 065 The Berry Swine Liners - GO ON HOME BRITISH SOLDIERS 066 Scath Na Deithe - Unrecognized disease 067 No Spill Blood - White Out 068 Irish Music - Ancient Druids 069 The Corrs - Toss the feathers, go braless 070 Cruachan - Diarmuid And Grainne 071 The Lord Weird Slough Feg - Blarney stone 072 Gama Bomb - Three Witches 073 VAN MORRISON - Bright Side of the Road 074 Rory Gallagher - Bad Penny 075 Feargal Sharkey - You Little Thief 076 That Petrol Emotion - Hey Venus 077 Absu - Manannán 078 Mike Patton - Catholic Tribe 079 Skyclad - The Widdershins Jig 080 Tom Waits - Rain Dogs 081 Virolac - Masque 082 Phil Lynott - Old town 083 Leaves' Eyes - Amhran (Song Of The Winds) 084 Cruachan - The Sea Queen of Connaught 085 Dread Sovereign - Cathars to their doom 086 Pagan Altar - Dance Of The Druids 087 Planxty - The Jolly Beggar/The Wise Maid 088 The Kilkennys - Will You Go Lassie Go 089 Anneke van Giersbergen, Árstíðir - Londonderry Air (Danny Boy) 090 The Dubliners - In The Rare Old Times 091 Louis Armstrong - Irish black bottom 092 Wolfe Tones - The Boys Of The Old Brigade 093 Primordial - Fuil arsa 094 The Undertones - My Perfect cousin 095 Therapy? - Acellerator 096 Cheap Trick - O Claire 097 Malthusian - across deaths 098 Absu - Bron (Of the Waves) 099 Mourning Beloveth - Theories of old bones 100 Thin Lizzy - Whiskey in the jar 101 Zom - Tombs Of The Void 102 Scáth Na Déithe - This Unrecognized Disease 103 TEN TON SLUG - Unit 104 Altar of Plagues - God Alone 105 DEVO - I'm a Potato 106 Beithíoch - Ghosts of a World Long Forgotten 107 Mahavishnu Orchestra - A Lotus On Irish Streams 108 Sacrilegia - Beyond the Fouler's Snare 109 Dread Sovereign - Cathars to Their Doom 110 Corr Mhona - Dair 111 Coscradh - Disappeared 112 The Undertones - Julie Ocean 113 Sirocco - Lambay 114 Mourning Beloveth - Theories of Old Bones 115 VAL DOONICAN WITH HIS GUITAR - THE AGRICULTURAL IRISH GIRL 116 Malthusian - Remnant-Fauna 117 The Wheels - Road Block 118 Rudimentary Peni - Ireland Sun 119 SOOTHSAYER - Cephalopod 120 Vircolac - Tether-Wane 121 Thin Lizzy - She Knows 122 Zealot Cult - Spiritual Sickness 123 Killing Joke - Wardance 124 Walpurgis Night - Ghost of Dublin 125 Absu - Bron (Of the Waves) 666 The Irish Rovers - Finnegans Wake

May the lilt of Irish laughter lighten every load. May the mist of Irish magic shorten every road... and many thanks to James (Groningen) , Garaidh & Lynda (Sydney), Nathan (Brisbane), Arto (Helsinki) for your awesome contributions to this playlist. Feck yeah! Hit play: https://www.youtube.com/playlist?list=PL-iHPcxymC1_4UCcVH8Jcka-whydlPzH6 What songs did I miss? What bands are missing from this list? Let me know! No matter where you are on Earth. Stay safe Clíona!

#Irish songs#Ireland playlist#Ireland bands#Thin Lizzy#Primordial#absu#Vircolac#therapy?#altar of Plagues#The Irish Rovers#celtic music#playlists#cruachan

4 notes

·

View notes

Text

Documentary series explores journey to decolonize wellness - IndigiNews

Documentary series explores journey to decolonize wellness – IndigiNews

An Indigenous couple on syilx homelands has completed a documentary series that details their wellness journey of decolonizing their lifestyles and embracing cultural ways of being.Decolonizing Wellness is a six-part video production created by cə̓q̓cq̓am (Thunder) Ryan Oliverius of Okanagan Indian Band (OKIB) and Shayla Raine, a nehiyaw iskwew from Louis Bull Tribe. Funded through the Telus…

View On WordPress

0 notes

Link

The renowned Jumpman silhouette, of Michael Jordan stretching for the rim of the basket, suspended in mid-air, is arguably the most iconic sneaker motif of all time. It's one which Nike and the former Chicago Bulls basketball star have built an empire off the back of. But the image that provided inspiration for that motif, first captured by photographer Jacobus Rentmeester in 1984 – which Nike subsequently recreated and slapped onto millions of pairs of sneakers – is as much ironic as it is iconic. Unsigned by Nike at the time of the Rentmeester shoot, it was a pair of New Balance that adorned the feet of then-21-year-old future legend.

There are perhaps few better ways to sum-up New Balance’s place in the sneaker world – one which has traditionally been dominated by the swoosh of Nike and the three stripes of adidas. New Balance has always played a more low-key, unassuming role, with its pared-back silhouettes helping it to adapt to the styles of different subcultures.

The hardcore music scene of the late 80s and early 90s in the US was one subculture which adopted the brand. “At the time of the Youth Crew Era (1986-1991) hip hop had been taken on as a new component and influence for hardcore bands. This led to the Country Club Casual look that was pretty similar to the updated hooligan look that Oasis would be sporting a few years later,” recalled Chris Bratton of Californian hardcore band Chain of Strength in a 2012 interview. New Balance, along with deck shoes and preppy Polo jackets were common attire, he said. Within hardcore circles at that moment, many adhered to a straight-edge lifestyle, and New Balance were one of the few brands that made sneakers that contained no animal products. In Buffalo, New York – a hotbed of nascent Hardcore bands in 1987 – one band even performed under the moniker ‘New Balance.’

The UK-based football casuals, who helped inspire the ‘country club casual’ look Bratton described, are another style-tribe who have had a longstanding affinity with New Balance. The brand was an alternative to the hegemony of adidas footwear on football terraces in the 90s, often worn by those who prided themselves in sartorial one-upmanship a little more than bashing skulls. (Football casual firms often had solid dressers and solid fighters, but rarely were they the same people). This has continued pretty much up until present day, and in the mid-to-late aughts, New Balance found a further niche within this niche, as men’s fashion shifted towards what many dubbed ‘heritage’. Suddenly, people began to care about the provenance of their clothes, how they were made, and New Balance – which still produces large quantities of its sneakers in the UK – found itself perfectly positioned. Many semi-retired casuals – in search of a slightly more demure choice of footwear to lairy suede reissues – once again turned to the brand. The 2010 release of New Balance’s ‘Pub Pack’, (complete with its own beer mat) was perhaps a nod to this.

Like many brands or items of clothing that eventually become tethered to certain subcultures, it’s often the simplicity which is the key factor. Like the robust, wheat-coloured Timberlands favoured by corner boys in New York for their aesthetic toughness, or the utilitarian Carhartt Chore Coats worn by graffiti kids in Milan and Paris during the 90s due to a multitude of pockets for storing spray cans – these pieces come about because they allow enough space for the wearer to impart their own identity on them. New Balance’s decidedly non-flash approach chimes with that. Its willingness to operate on the periphery, rather than trying to topple the Nike-adidas stranglehold, has allowed the brand to crop up in unexpected – and often more interesting – niches.

“Suddenly, people began to care about the provenance of their clothes, how they were made, and New Balance – which still produces large quantities of its sneakers in the UK – found itself perfectly positioned”

It was this same idea that allowed it to become the choice of hustlers on the streets of the DMV – Washington D.C., Maryland and Virginia – during the 80s and 90s. Unlike their counterparts in other states, like those in custom-made Dapper Dan Louis Vuitton pieces in New York, success was not worn ostentatiously. Instead, blacks and greys made up the color palette for most, as Curtis ‘Curtbone’ Chambers, a former gang member from Washington D.C., told SneakerFreaker last year: “We’ve always been into designers, but we weren’t into the loud colours. We were more about black Versace shirts, or black Hugo Boss or Giorgio Armani. And New Balance fit that... Whenever you’d go out of town, people would say, ‘Oh, them D.C. dudes. They got the New Balance on!’” It probably helped that when the New Balance of choice (and everyone’s subsequent favourite dad shoe), the 990, was released in 1982, it was one of the first sneakers to cost $100 dollars, cementing it as a status symbol.

The influence of that era remains today. Last year, a fledgling D.C. rapper NAPPYNAPPA released an E.P. titled ‘New Balance’, while a little further north in Philadelphia, rapper Meek Mill commented in an episode of Complex’s Sneaker Shopping recalled that 990s were worn by the “guys in my neighborhood who had money. They were trap sneakers.”

Indeed, throughout hip hop’s history, there has also been a sprinkling of references to the brand. In 1997, KRS One rapped “I warm up any room like a heater/ Bringin’ a New Balance to the speaker like a sneaker”and, on his 2004 mixtape Osirus, Ol’ Dirty Bastard delivered the line: “Cop the Eagle, started jackin’ with the green New Balance shit.” More recently, another Philadelphia-native, Lil Uzi Vert, has been pictured regularly wearing the brand’s 990 style.

Beyond rap, this particular sneaker model has become somewhat of a staple within fashion circles in recent seasons, seemingly managing to be on-trend by accident. Typically, this style comes in grey, accented by two other shades of grey, and a little touch of white. It looks sensible and comfortable, like something your dad might (or probably would) wear. And consequently, chimes perfectly with fashion’s current obsession with all things mundane, from Ikea tote bags to sensible cagoules, in what feels like something of a post-normcore hangover. But also; the 990 is kind of ugly. That too feels decidedly current, since we’ve become accustomed to seeing bulbous, visually-jarring sneakers clomping down Paris runways over the past few seasons.

Much like the Hardcore kids of Boston and New York, or football casuals of the north of England the intent behind these choices were largely the same – to not only set oneself apart from predictable sneakers choices of their peers, but to wear that difference like a badge of honour.

0 notes

Text

Free Agent Projections

It has been a minute! I apologize to anyone that reads this blog if I have been off the grid for a bit. Managing grad school with work has filled my schedule. Based on the Twitter poll I ran, I gave people the option, either I complain about Mike Trout getting snubbed for yet another MVP or provide my big ticket free agent projections. The latter won out 80% to 20%. I guess people don’t like hearing me complain. Come on, guys! I’m a White Sox, Bears, Bulls, Illini, and Northwestern fan. Northwestern and the Bears keep me sane right now, but I need to have an outlet some time! I digress. Without further ado, here are my 2018-2019 free agent projections. Unfortunately, Peter Bourjos signed with the Angels already, so I apologize if I wasn’t able to pick that one. I know people were waiting on it.

Josh Donaldson – Cardinals

He has long been connected to the St. Louis Cardinals. I’m going out on no limb here, so I’m going to say he fills that need for the Birds. They need a third baseman. This is a perfect fit for him. Also, they might be able to get somewhat of a bargain for him because he had some shoulder problems last season. If that continues, I don’t know if he’ll be able to bump Matt Carpenter at 1B for the upcoming season.

Patrick Corbin – Yankees

He has already been connected to them. He’s good. The Yankees always spend money. He’s going to end up in their rotation and become a watered down Andy Pettitte.

Andrew McCutchen – Braves

Cutch fits that Braves OF. Nick Markakis is gone. Cutch will play RF. It’s really simple.

Nick Markakis – Angels

The Los Angeles Angels are a nice mediocre team. Here’s a guy they can sign. That’s it. The Angels are the Mets of the AL. They're going to let Ohtani and Trout waste another season.

Charlie Morton - Astros

The Astros need pitching depth. He reformed his career in Houston. This is a perfect match for at least one more season.

Brian McCann - Braves

Reunited and it feels so good. He can platoon with Flowers.

Nelson Cruz – Cardinals

Jose Martinez might get traded. I don’t see him producing at a higher level than last season. He’s also old. However, so is Cruz. The only difference is you can sign Nelson to a short-term deal and hope he produces the way he has been. Just remember, he can still crush. Maybe you can bury him in the outfield somewhere because the NL hasn’t adapted to the 21st century yet.

Daniel Murphy – Dodgers

I have the inclination that the Dodgers will try to trade Brian Dozier. He was AWFUL for them in the second half. He might return a prospect or two, but the Dodgers will then have the ability to free up cap space for this jackass.

Zach Britton – Yankees

The Yanks already have a stacked bullpen, but they also like spending money. Britton is less volatile than Chapman, and Robertson has a shot at returning. I can still see the Yanks spending the money to get Britton back.

Wilson Ramos – Mets

The Mets are the worst run organization in the MLB. They have insane talent on the pitching side, but they also have an awful training staff. What’s a way to fix that and potentially make your team win 77 games next season? Sign a good hitting catcher. Keep Syndergaard and deGrom and maintain your mediocrity.

Yasmani Grandal – Astros

The Astros are losing two hurlers for the 2019 season to free agency and one to injury: Charlie Morton, Dallas Keuchel, and Lance McCullers (RIP). They need a backstop that can manage their pitching staff. They still have Verlander and Cole to headline what was a stacked rotation, but they will need a catcher. Stassi could back him up. Grandal is the best catcher in baseball currently and consistently the best pitch-framer. This is a perfect spot for him because the Astros have an excellent analytics department. I see them also trading some young talent to fill out their rotation (maybe for James Paxton, we’ll see).

Jed Lowrie – Rockies

They free up 2B with LeMahieu leaving, so why not bring in a solid 2B option. He just had a great season with the A’s. I think he fits the Rox perfectly.

D.J. LeMahieu – Cubs

Zobrist is a free agent after 2019. LeMahieu has been with the Cubs before. Reunion? I think yes. This also makes sense if the Cubs move an outfielder or two (i.e. Happ and Schwarber) for some controllable starting pitcher. Since they’re not going to spend like crazy, I can see this move happening.

A.J. Pollock – Astros

Marwin Gonzalez is gone. Pollock can play LF while Springer is in CF. This just makes sense.

Craig Kimbrel – Braves

The Braves are willing to spend. Kimbrel will return to them because he’s good. That is all.

J.A. Happ – Brewers

The Brewers need to shore up that pitching staff because we all know they will not perform like they did this season. Happ is older, but he’s still a solid arm and a perfect fit for a smaller market team that wants to win now.

Cody Allen - Phillies

They need a closer. Allen had a down year in 2018, and the Tribe has Brad Hand. The Phils can take advantage of his market.

Adam Jones - Mets

The Mets are a team I could see signing Jonesy. His sub-.315 didn't do him any favors for free agency, and the Mets need to win those 77 games!

David Robertson – Red Sox

What other way to stick it in the eye of the Yanks than signing one of their former pitchers? Robertson has a history as a closer with the White Sahx. I think he can return to that role with the Red Sawx. He also said he wants to be closer to his home in Rhode Island. This is a change of scenery and right next to Rhode Island (shrug).

Adam Ottavino – Rockies

They want to win. They want their closer. Ottavino was a stud last year. They’ll have to pay him but he’s worth it.

Gio Gonzalez – Cubs

Gio has already been on a Chicago affiliate before, so why not the Cubs? He is a step behind Corbin or Keuchel, so since the Cubs may not want to offer fat money to all of the top guys, Gio’s the next best thing. He also helps fill that rotation out, which was pretty rough last season.

Michael Brantley – Rockies

The Rockies have to improve in some manner. Why not finish your career in a hitter’s ballpark?

Nathan Eovaldi – Red Sox

He pitched well and won a World Series on him. He’s going to get a hefty paycheck because he’s younger than Corbin or Keuchel. Then, he’ll flop. I originally wanted the Sox to get him, but since there are so many teams bargaining for him, I say lay off.

Marwin Gonzalez - A's

They need to sign someone. This is their guy!

Bryce Harper – Phillies

I’ve been saying Bryce to the Phillies since last year, and I will stand by it. In fact, the Phils front office said they’re willing to spend recklessly this offseason. Well, Harper’s going to get paid. It won’t be from the Yankees, Cubs, or Dodgers. It will be the Phillies, who had amongst the worst hitting rosters in the league last year. They do have cap space.

Dallas Keuchel – White Sox

As I said, the White Sox are willing to hopefully spend money. Why not spend it on one of the best pitching arms in the free agent market? Keuchel had a down year by his standards, but that makes him a perfect candidate for pitching coach Don Cooper.

Manny Machado – White Sox

Manny has that south side attitude. Who cares if he sometimes doesn’t run to first or is kind of a dirty player. Did people forget this team had A.J. Pierzynski as their catcher for years? Stop this nonsense. Manny is an incredibly talented player. The White Sox could use a superstar for the first time since Frank Thomas. This is their guy. They’ve been connected to him for a while. Reel in that big fish, Rick Hahn!

The majority of players will go to the competing teams or teams ready to compete. The Winter Meetings are in a few weeks, and this is the hot stove time. I hope the Sox sign Harper, but I think all fans would be satisfied if they got Keuchel and Manny, instead. Go Sox! Jerry needs to spend that $$$.

#White Sox#chicago white sox#houston astros#chicago cubs#rick hahn#philadelphia phillies#boston red sox#colorado rockies#milwaukee brewers#atlanta braves#new york mets#st. louis cardinals#los angeles angels#new york yankees#los angeles dodgers#josh donaldson#patrick corbin#andrew mccutchen#nick markakis#nelson cruz#daniel murphy#zach britton#wilson ramos#yasmani grandal#Jed lowrie#AJ pollock#dj lemahieu#craig kimbrel#marwin gonzalez#ja happ

1 note

·

View note

Text

57. The 1988 off-season --- The 1989 draft

The NFL strikes back

The NFL had lost their lawsuit and seen the USFL pilfer most of their American WLAF owners. The upstart league had signed most of the top 40 players in the 1988 draft pool. The NFL owners were angry and done playing defense.

After consulting with their lawyers and confirming it would not lead to another legal challenge, the NFL decided the one thing they could do was simply outbid the USFL for players. The average pay for first round picks doubled as the older league reasserted itself.

The Dallas Cowboys, a constant thorn in the USFL’s side, set the pace as they offered presumptive #1 pick Troy Aikman of UCLA almost 3 times what Neil Smith got in 1988. When the Cowboys leaked what they were prepared to offer Aikman and what Green Bay was talking about offering OT Tony Mandarich, sign-ability became the key word in USFL circles.

The USFL league offices had forewarned Orlando, Carolina, and all of the league’s teams that the NFL would be paying double or even triplemarket value for first round picks. The league encouraged the teams at the top of the draft order to try to work out deals with players before the draft.

While several NFL teams were still perceived as “tight” it seemed pretty apparent that most of the picks in the top 10 were going to be prohibitively expensive, so Ehrhart championed a 24 day “shadow draft” prior to the actual draft, allowing each team a day to try to see if one of a series of “available” players was agreeable to terms.

It was readily apparent that the league’s teams were not going to pay players drafted in consumary positions what the NFL was offering.

The USFL 1989 Draft

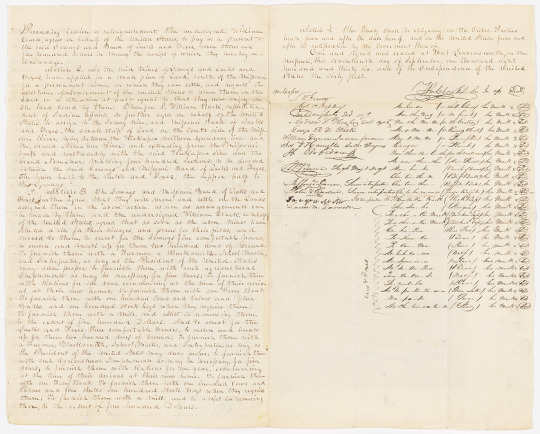

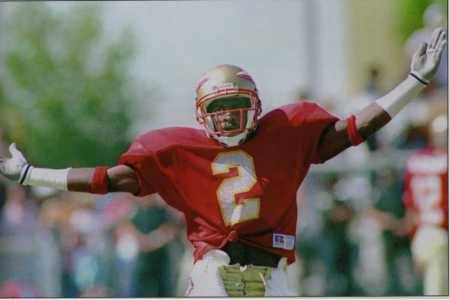

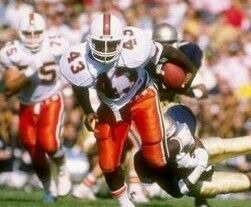

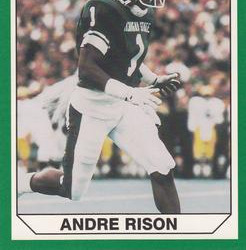

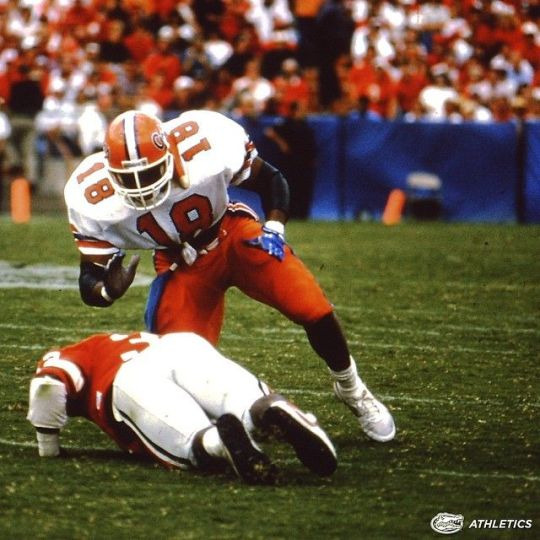

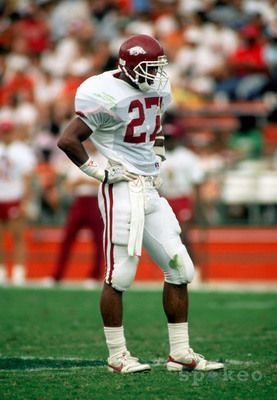

Oakland Invaders 1 Deion Sanders CB FSU Orlando Thunder 2 Steve Walsh QB Miami Carolina Skyhawks 3 Donnell Woolford CB Clemson Birmingham Stallions 4 Derrick Thomas LB Alabama San Antonio Gunslingers 5 Eric Metcalf RB Texas Jacksonville Bulls 6 Trace Armstrong DE Florida Arizona Wranglers 7 Broderick Thomas LB Nebraska Pittsburgh Maulers 8 Tom Ricketts OT Pittsburgh Philadelphia Stars 9 Hart Lee Dykes WR Oklahoma State Atlanta Tribe 10 Cleveland Gary RB Miami New Jersey Knights 11 Barry Sanders RB OSU Los Angeles Express (from The Hawaiians) 12 Troy Aikman QB UCLA Orlando (from Spirits of Miami) 13 Bill Hawkins DE Miami Chicago Blitz 14 Burt Grossman DE Pittsburgh Michigan Panthers 15 Andre Rison WR Michigan State New York Generals 16 Andy Heck OG Notre Dame Boston Breakers 17 Joe Wolf OG Boston College Denver Gold 18 Tim Worley RB Georgia Oklahoma Outlaws 19 Brian Williams C Minnesota New Orleans Jazz 20 Eric Hill LB LSU Tampa Bay Bandits 21 Louis Oliver S Florida Memphis Showboats 22 Jeff Lageman DE Virginia The Hawaiians (from Los Angeles Express) 23 Steve Wisniewski G Penn State Houston Gamblers 24 Steve Atwater S Arkansas

It was pretty clear to the Allens that the top 3 prospects in the draft — Troy Aikman, Tony Mandarich, and Barry Sanders would be paid a premium by the NFL. Oakland’s owners were not on board for a bidding war. That was OK because George Allen liked the Oakland running game and had no use for rookie QBs. Allen had also decided the best player in the draft was actually FSU CB Deion Sanders. Sanders was a student of his position and loved the idea of playing with legendary CB Lester Hayes. Sanders knew he was likely to go from 4th to 6th in the NFL draft, so he agreed to terms to pay him at double the average salary of the 4th-6th players in the previous year’s NFL draft —IF he was picked #1 overall. (Sanders would go on to change his pro number to #1).

Orlando was also successful in landing their pick. QB Steve Walsh wasn’t happy waiting for a supplemental draft and was annoyed that Jimmy Johnson had apparently settled on Troy Aikman. He was more than willing to sign a reasonable deal with Orlando to go #2. While Don Matthews saw Walsh as everyone else did, as a bottom of the first round talent, Matthews was absolutely taken with Walsh’s warrior’s courage and how he made plays when games were on the line. Orlando landed a player they desperately needed for fan optics and Matthews bought a heart for his team.

Carolina followed the league’s suggestion and Oakland’s example and reached for a lesser rated player they were fairly sure they could sign. CB Woolford thought he would go between 7th and 16th in the NFL draft, so going third in the USFL draft made the money competitive. He signed with Carolina.

Birmingham thought they could get OLB Derrick Thomas to stay in state, but NFL sources convinced his agent that much bigger money was waiting for him in the NFL.

San Antonio thought about drafting RB Barry Sanders, but ultimately decided it was too expensive and too risky. They didn’t want to whiff on Sanders and miss out on a top player for the second year in a row. Instead they picked local UT all-American RB Eric Metcalf. The elusive Metcalf might have been a hair small to be a feature back in the NFL, but he had an elite breakaway gear and projected quite well in the USFL where players tended to be slightly smaller and slower. Metcalf thought at best he might go 13th in the NFL draft to Cleveland. The money and the destination sounded better in San Antonio.

youtube

Jacksonville saw the player they wanted fall to them in DE Armstrong. Armstrong was a guy who some thought could have gone 8th to 17th or so in the NFL draft. He was one of several similarly good defensive end prospects in the draft. Fred Bullard thought he had a great shot at signing him. Armstrong would ultimately hold off signing to test his luck in the NFL draft.

Arizona went hard after OLB Broderick Thomas making several offers, but were rebuffed. Thomas would eventually sign for almost 3 times what Arizona initially offered.

Pittsburgh shocked the league when they drafted Pitt OL Tom Ricketts number 8 overall. It was considered a huge reach rather than a strategic one, but the league had grown accustomed to the Mauler ownership’s desire not to compete with NFL teams for talent. The Maulers were able to land him.

The Stars drafted WR Hart Lee Dykes #9. He was projected to go somewhere in the mid teens in the NFL draft. After whiffing on a first round WR the previous year, the Stars paid out the nose for Dykes.

Atlanta thought long and hard about drafting RBs Barry Sanders or Tim Worley but they were fairly sure the asking price would be substantial for Sanders and they were not sold on Worley. Leeman Bennett also preferred big power backs which made Sanders an unlikely candidate. RB Cleveland Gary appeared to be an end of the first round talent and had local ties. Bennett thought they could get Gary to take #10 overall money with no premium, and they were correct.

New Jersey could not believe their luck. Mouse Davis loved the idea of RB Barry Sanders in his offense. They drafted Barry Sanders and hoped that he would fall to the Detroit Lions at #3. Their logic was that Sanders was the clear #3 player in the draft and the Lions were unlikely to open the bank for Sanders the way Dallas and Green Bay were preparing to do. With a cheap QB and roster, New Jersey was prepared to open the vault for Sanders. Sanders informed the Knights that he wasn’t opposed to playing for them, but he was waiting for the NFL draft. His decision would not be made until after the NFL draft.

The Hawaiians wanted no part of a bidding war with the NFL. Additionally after their mock day, they realized there were few players in the top 50 who the Hawaiians felt comfortable that they would be able to sign ahead of an NFL team, so they called up Don Coryell and offered the pick to LA.

Coryell was enamoured with QB Aikman and considered it a win-win scenario. For pick 23 and LA’s 4th rounder, Coryell would be able to try to woo Aikman away from the Cowboys. The Tathams were not at all comfortable with the money being discussed. They felt the team was already at a championship contending level, but acknowledged Aikman was the best QB prospect in quite a few years. Coryell was given guidelines that he could discuss with Aikman and his agent. It was made very clear to Aikman’s people that Aikman could overstate those numbers to get a better deal out of Dallas if he wanted, but if he wanted to play in one of the most QB friendly offenses ever built, LA was the place for him. The logic was that, even if Aikman passed, 3 months of public discussion with Aikman would drive up season ticket sales. It worked like a charm for LA.

Orlando drafted DE Hawkins about 10 slots earlier than he was likely to go and was able to get Steve Walsh to convince Hawkins to sign.

Chicago drafted DE Burt Grossman and pushed hard to sign him, but Grossman waited on the NFL payday.

Michigan drafted MSU’s WR Andre Rison to replace disgruntled Anthony Carter who was sent to San Antonio for their 2nd round pick. Rison was happy to sign with Michigan for a USFL premium price.

New York drafted T Andy Heck at the urging of Walt Michaels, but were unable to sign him as Heck had already decided to wait on the NFL money.

Boston drafted G Joe Wolf and were able to sign him and keep their Boston College pipeline open.

Denver drafted RB Tim Worley and offered him a premium to play for them, but Worley felt he was top 7 or 10 prospect in the NFL draft and chose to wait for that payday.

Oklahoma drafted C Brian Williams out of Minnesota and were able to sign him at a premium.

New Orleans drafted LB Eric Hill but despite good discussions were not able to sign him.

Tampa Bay, fresh off a championship game appearance, was able to convince S Louis Oliver to sign with them at a premium.

Memphis tried hard to sign DE Jeff Lageman, but he chose to wait for the NFL draft.

The Hawaiians were torn between drafting G Steve Wiesnewski or just drafting T Tony Mandarich and making a strong, but futile offer as a PR move, and getting on with the later rounds. Ultimately after the criticism they endured in previous years, they drafted Wiesnewski, but the Penn State guard decided to wait for the NFL.

Houston head coach and defensive guru Jack Pardee was stunned to see SS Steve Atwater still on the board and immediately drafted him. Pardee convinced the ownership to open the bank to sign the hard hitting safety.

Draft Conclusions and the start of the Tagliabue offensive

While the USFL signed a number of first rounders, the NFL was able to keep 9 of the 10 best prospects in the draft and 14 of the top 20 from signing before the NFL draft. Those players who waited, in general, found that they received astounding offers from the NFL’s worst teams.

The NFL used this turnaround to fuel their fall advertising campaign against the legitimacy of the USFL. This would be the first step in what the NFL would refer to as their “Tagliabue Offensive”, so named for the NFL’s commissioner Paul Tagliabue, who replaced under fire NFL commissioner Pete Rozelle after the NFL teams had to pay off the USFL in the NFL’s anti-trust loss.

The USFL would get a lot of flack from the media and from the NFL for their draft as Tony Mandarich — considered the best player in the class — would not even go in the first round.

Some media sources would cut them a break as Mandarich knew he was too expensive for the USFL and had strategically expressed an intent to sign with the NFL come hell or high water.

“What does the media want the financially struggling Carolina Skyhawks to do? Draft a player with the third pick in the draft who has said he won’t play for the USFL ….instead of one who will?” Sports Illustrated’s Dr. Z would write. “This criticism is delusional! It is utter madness…”

Click here to continue to the next post

Click here for previous post

2 notes

·

View notes

Photo

New Post has been published on https://freenews.today/2020/11/17/tc-energy-exec-says-keystone-xl-fits-biden-agenda-with-union-jobs-indigenous-support/

TC Energy exec says Keystone XL fits Biden agenda with union jobs, Indigenous support

CALGARY — The creation of union jobs and support by Indigenous investors will help convince U.S. president-elect Joe Biden that the Keystone XL pipeline fits into his “Build Back Better” agenda, an executive with proponent TC Energy Corp. said Tuesday.

The Calgary-based company said it is forging ahead with construction of the pipeline designed to transport up to 830,000 barrels per day of oil from Alberta to Nebraska despite Biden’s election campaign vow to rip up the presidential permit that allows it to move oil across the border.

“We’ve looked at the incoming Biden administration’s Build Back Better plan and the steps that we’ve already taken with Keystone XL, we believe, have positioned it very favourably, particularly as we bring jobs to the economy next year, a key platform for the U.S. government as we recover from the COVID-19 pandemic,” said Bevin Wirzba, president of liquids pipelines, on a webcast from the Calgary-based company’s investor day.

In October, TC Energy announced the awarding of more than US$1.6 billion worth of contracts to six American unionized contractors to execute pipeline construction across three states, supporting more than 7,000 union jobs in 2021.

It also said it would create a US$10-million clean energy training fund.

On Tuesday, it announced a deal to allow Natural Law Energy, which represents four First Nations in Alberta and one in Saskatchewan, to invest up to $1 billion in Keystone XL, an agreement that is similar to potential deals being negotiated with American Indigenous groups, Wirzba said.

The company has constructed about 200 kilometres of pipeline since the project was approved last March, including the border crossing, and has begun construction of 17 pump stations in the states it traverses and Alberta, he reported.

The Natural Law Energy investment is contingent on the group securing financing and is expected to close in the third quarter of 2021, TC Energy said. The agreement also allows the group to pursue interests in future projects related to the pipeline.

The five First Nations include the Nekaneet First Nation in Saskatchewan and the Ermineskin Cree Nation, Montana First Nation, Louis Bull Tribe and Saddle Lake Cree Nation in Alberta.

In March, TC Energy approved spending US$8-billion to complete Keystone XL after the Alberta government agreed to invest about US$1.1 billion (C$1.5 billion) as equity and guarantee a US$4.2-billion project loan.

Meanwhile, the incoming CEO of TC Energy says the pipeline, power and oil and gas storage company will adjust to pursue opportunities presented by the world’s energy transition but its conservative business strategy won’t change on his watch.

Chief operating officer Francois Poirier, who is also president for power and storage and Mexican operations, said investors shouldn’t expect big changes when he takes over as CEO from retiring longtime leader Russ Girling at the end of 2020.

“Looking forward, reliable, abundant, low-cost energy will be critical as people around the globe seek to enhance their standard of living. The real challenge will be to meet that need while prudently managing the associated environmental impacts including climate change,” he said on the webcast.

TC Energy is pursuing $37 billion of commercially secured capital projects across North America, including $22 billion for handling natural gas in Canada, the U.S. and Mexico, $13 billion in oil pipelines including Keystone XL and $2 billion in power and storage.

This report by The Canadian Press was first published Nov. 17, 2020.

Source

#Airdrie#Banff#breaking news calgary#calgary news#Canmore#cfcn news#Cochrane#contests#coronavirus canada#covid 19 canada#covid alberta#covid calgary#covid southern Alberta#COVID-19#High River#lethbridge#Okotoks#Olds#southern alberta#Strathmore#weather

0 notes

Text

CEO by Day, Raver by Night: 5 Powerful Business Executives Who Love EDM

By day, they run the nation's top companies. By night, they rave.

Tony Hsieh: CEO, Zappos

In his 2010 book Delivering Happiness, Zappos CEO Tony Hsieh was effusive in his praise not only for electronic dance music, but also the overarching rave culture zeitgeist. In a wide-ranging 2015 interview with Quartz, Hsieh described how he harnesses the ethos of rave culture and implements it in his company in order to keep his employees happy. In his book, Hsieh even tells a visceral story about a rave he attended in 1999.

"The entire room felt like one massive, united tribe of thousands of people, and the DJ was the tribal leader of the group," he wrote. "I made a note to myself to make sure I never lost sight of the value of a tribe where people truly felt connected and cared about the well-being of one another."

Arturas Karnisovas: EVP, Chicago Bulls Arturas Karnisovas

Sports and electronic music go together like whiskey and cola. However, it's the DJs and athletes who are usually rattling speakers and backboards—not executives. Enter Arturas Karnisovas, who is the Executive Vice President of the Chicago Bulls, home to legend Michael Jordan, who helped the team raise a staggering 6 NBA championship banners.

In a report published by The Denver Post just last month, readers were introduced to the raver side ofKarnisovas, who 11-year NBA veteran Jared Jeffries said loves "hardcore" electronic dance music and even blasts Armin van Buuren, Kaskade, and Calvin Harris in the gym while working out. In a follow-up report by NBC Sports Chicago, Karnisovas playfully made light of Jeffries' comments while expounding on his passion for EDM. "Jared (Jeffries) talks too much," he joked. "...Iâm very diverse in terms of music that I play. Iâm all over the place. I was just first generation of EDM and techno and house. I actually know that house came from Chicago, Detroit area. Thatâs some history there too."

David Solomon: CEO, Goldman Sachs David Solomon

Is there anything more lit than quarterly earnings calls? More dope than low risk, high yield investments? Just ask David Solomon. By day, Solomon runs Goldman Sachs, one of the nation's largest investment banking enterprises, and by night, he DJs as an electronic dance music artist named D-Sol.

Solomon, who banks north of $15 million annually in his role as CEO, isn't in the music business to make money. In 2017, Goldman Sachs spokesperson Jake Siewert told the New York Times that Solomon uses electronic music as a respite and as an outlet to maintain his work/life equilibrium. âDavidâs always believed that having a wide range of outside interests leads to a balanced life and makes for a better career. Heâs preached that regularly to younger employees in the firm and tries to lead by example," Siewert said. Moreover, D-Sol donates all of his music-related income to charities battling the opioid epidemic.

Evan Spiegel: CEO, Snap Inc. Evan Spiegel

Snap Inc. has grown to become one of the most renowned and influential tech companies on the planet. Its flagship product, Snapchat, single-handedly initiated a paradigm shift in the way we consume and share content and it serves as the bedrock of the trailblazing company. The organization's CEO, former Stanford University wunderkind Evan Spiegel, harbors a different bedrockâelectronic music.

In February 2017, Business Insider published a report about Spiegel's musical interests after perusing his public Hype Machine profile. At the time of publishing, he had smashed the "play" button on Louis The Childâs âLove Is Aliveâ and Lost Kings' âPhone Down," two monster singles in the future bass genre. At one point in time, Spiegel also even kicked the tires on starting a record label.

Elon Musk: CEO, Tesla and SpaceX

As polarizing as he is prolific, Tesla and SpaceX boss Elon Musk is also an EDM head. Back in January 2020, he added another title to his illustrious résuméâDJ.

What started out as a tongue-in-cheek venture actually proved to be a legitimate one after he dropped his infectious house tune "Don't Doubt Ur Vibe." âI wrote the lyrics & performed the vocals!!â Musk shared on Twitter at the time." âThis song is hard."

He may have great taste in music, but not baby names. Here's to you, baby X Ã A-12.

from Best DJ Kit https://edm.com/features/5-powerful-business-executives-who-love-edm

0 notes

Text

Strata-East Records

"Next to the absence of Sun Ra, one of the most glaring omissions in Ken Burns’ Jazz documentary was the radical black music collectives that came out of America in the ‘70s. Burns saw the end of the 1960s as a break in the creative line of the art form. But rather than being the museum piece that Burns seemed to suggest, jazz in the new decade would make some of its most progressive statements. And it was in the creative freedom of independent ventures like New York’s Strata-East that the future would be mapped out. Alongside similar outfits like Tribe in Detroit, Black Artists Group in St. Louis, and The Association for the Advancement of Creative Musicians in Chicago, Strata-East consolidated the previous advancements from all corners of jazz with a hard-edged militancy and community ethos that suited the times. Inspired by the empowering ideology of the Black Power movement, these collectives were fiercely independent. ..."

Red Bull Music Academy Daily: A Guide to Strata-East (Video)

An introduction to Strata-East in 10 records (Video)

W - Strata-East Records

Soundcloud: Strata East Mix Part 1, Strata East Mix Part 2

0 notes

Link

With the 2019 federal election approaching on Oct. 21, here's a look at the parties' Indigenous candidates and platforms. The list of candidates will be updated as the nomination period continues until the end of September and platforms will be updated as they're announced.

Who's running?

Conservative Party of Canada

Leona Aglukkaq (Inuit) - Nunavut

Cyara Bird (Cree) - Churchill-Keewatinook Aski, Man.

Rejeanne Caron (Métis) - Saint Boniface-Saint Vital, Man.

Tanya Corbet (Tsawwassen First Nation) - Delta, B.C.

Marc Dalton (Métis) - Pitt Meadows-Maple Ridge, B.C.

Green Party of Canada

Desmond Bull (Louis Bull Tribe, Maskwacis) - Red Deer-Lacombe, Alta.

Lydia Hwitsum (Cowichan Nation) - Cowichan-Malahat-Langford, B.C.

Amanda Kinstindey (Acadian-Métis) - Don Valley West, Ont.

Racelle Kooy (Samahquam First Nation) - Victoria, B.C.

Lorraine Rekmans (Algonquin) - Leeds-Grenville-Thousand Islands and Rideau Lakes

Independent

Jody Wilson-Raybould (We Wai Kai First Nation) - Vancouver-Granville, B.C.

Liberal Party of Canada

Jordan Ames Sinclair (Métis and Zagime Anishinabek First Nation) - Regina Qu'Appelle

Vance Badawey (Métis) - Niagara Centre, Ont.

Jaime Battiste (Eskasoni Mi'kmaw First Nation) - Sydney-Victoria, N.S.

Tammy Cook-Searson (Lac La Ronge Indian Band) - Desnethé-Missinippi-Churchill River, Sask.

Michelle Corfield (Ucluelet First Nation) - Nanaimo-Ladysmith, B.C.

Trisha Cowie (Hiawatha First Nation) - Parry Sound, Ont.

Maggie Farrington (Métis) - Fort McMurray-Cold Lake, Alta.

Yvonne Jones (Inuit) - Labrador

Judy Klassen (St. Theresa Point First Nation) - Churchill-Keewatinook Aski, Man.

Michael McLeod (Métis) - Northwest Territories

Robert-Falcon Ouellette (Red Pheasant First Nation) - Winnipeg Centre, Man.

Megan Pizzo Lyall (Inuit) - Nunavut

Marc Serré (Mattawa/North Bay/Algonquin First Nation and Métis) - Nickel Belt-Muskoka, Ont.

Dan Vandal (Métis) - Saint Boniface-Saint Vital, Man.

New Democratic Party

Anna Betty Achneepineskum (Marten Falls First Nation) - Thunder Bay-Superior North, Ont.

Lori Campbell (Cree-Métis) - Waterloo, Ont.

Bob Chamberlin (Kwikwasut'inuxw Haxwa'mis First Nation) - Nanaimo-Ladysmith, B.C.

Leah Gazan (Wood Mountain Lakota Nation) - Winnipeg Centre, Man.

Noel Joe (Miawpukek First Nation) - Coast of Bays-Central-Notre Dame, N.L.

Georgina Jolibois (Dene) - Desnethé-Missinippi-Churchill River, Sask.

Kyle Mason (Peguis First Nation) - Winnipeg North

Keith McCrady (Ojibway and Cree) - Scarborough Southwest, Ont.

Breen Ouellette (Métis) - Vancouver Centre

Joan Phillip (Penticton Indian Band) - Central Okanagan-Similkameen-Nicola, B.C.

Mumilaaq Qaqqaq (Inuit) - Nunavut

Jacline Rouleau (Ojibway-Métis) - Abitibi-Baie James-Nunavik-Eeyou, Que.

Sabrina Sawyer (Mnjikaning First Nation) - Brantford-Brant, Ont.

Katherine Swampy (Samson Cree Nation) - Edmonton Centre

Rudy Turtle (Grassy Narrows First Nation) - Kenora, Ont.

--

Continue Reading.

Tagging: @ontarionewsnow @politicsofcanada @abpoli

#Indigenous#First Nations#canadian federal election#cdnpoli#canada#canadian politics#canadian news#canadian#Metis#Inuit

97 notes

·

View notes

Text

Central Bank Folly: Blame the Boomers

Source: Michael Ballanger for Streetwise Reports 07/25/2019

Sector expert Michael Ballanger muses on how the baby boom generation has impacted markets through time, and discusses how he will play the current precious metals bull.

“Destroyers seize gold and leave to its owners a counterfeit pile of paper.” Ayn Rand

The baby-boom generation, of which I am a less-than-proud member, blew it.

There was a time long, long ago when the mention of the words “baby boomer” evoked a sense of pride of membership. Amid the prosperity of the post-WWII era, birth rates in North America soared while the sons and daughters of many men and women that fought in the war became the dominant demographic force by the year 1966.

When I was in grade 10, I wrote an essay that pointed to the defining moment, where the excitement and unbridled optimism of the Space Race, advances in modern medicine and unparalleled economic growth was snuffed out forever by an assassin’s bullet in Dallas in the autumn of 1963. With the end of Camelot, the boomer generation suddenly began to question things. They threw away the Beach Boys “Surfin’ Nirvana” lifestyle for the darker messages of Bob Dylan, CSNY, the Doors and Hendrix, and they watched while the Vietnam war claimed over 58,000 U.S. servicemen and caused massive civil unrest to permeate the inner cities and the campuses of America.

Through the unwillingness of the baby boomers to accept the garbage spewed out by the radio and print media, as well as the fledgling television industry, young people rose defiantly to implement an end to a war that had become a national embarassment and political nightmare. I arrived in Saint Louis in the fall of 1971, a mere four years before Saigon fell, and by then, the historically conservative (pro-war) city of Saint Louis had seen a demographic shift in camps, as the campuses and high schools were filled with long-haired radicals heavily recruiting the youth of the era to “tear it all down” in order to effect the much-needed political and social changes that were so overdue by then. On the other side of the demarcation line were the rednecks, the police, the National Guard and, of course, the military.

The sidebar to all of this is that the boomers also took down a president, in the form of Richard Nixon, so to say that the boomers had serious “stroke” is an understatement. The mediums were FM radio, Rolling Stone magazine and weed, and that was all that was needed to effect changeit mattered not where. We, as a generation, were a force.

However, and very sadly, ending the war in Vietnam by nonviolent protest and by their sheer numbers (it was nothing to see 20,000 young people at anti-war rallies)that was just about where the great metamorphosis ended. We, as a generation, as we had done with the Beach Boys, threw away the old protest albums of the ’60s and ’70s and opted instead for a different type of optimism from that which empowered our parents in the ’50s.

A former movie star arrived on the scene in the form of Republican Ronald Reagan (nicknamed “Ronald Ray-Gun” by Country Joe at Woodstock) in 1980, and despite the non-violent, intellectual approach of opponent Democrat Jimmy Carter, the boomers swept Reagan into power with the largest popular vote in history. From that moment on, my generation shifted focus from morality to money and with that shift, the largest voting demographic in world history has continued to act in a self-serving, sycophantic mode of behavior most foul to those who dare try to recall the ethical bravery of the 1960s. Famous cofounder of the Students for a Democratic Society (SDS), Jerry Rubin, went from bell-bottomed blue jeans to blue pinstripes by taking a job on Wall Street, and that punctuated the generational sentence of the boomer tribe.

We boomers now look at our offspring and we cry for their future. We don’t lament for how they are voting or why they are voting or even if they are voting because deep down, we all knowevery one of usthat their decisions are the ones crafted for them by their forebearers. The parents of we boomers were indelibly etched by the Great Depression of 19301933. I recall my father’s tales of delivering “day-old bread” to houses up in Rosedale for “a penny a loaf” in 1931, and what hit me was that after he passed at the grand age of 89, as I was sorting his affairs out, there were countless cubbyholes and bookshelves filled with all sorts of coins and currency. They might have totaled perhaps $1,500, but the fact they were stashed away, insulated from the thievery of Depression-era desperation, was a testimonial to the imprint it left upon that generation.

By contrast, the newly empowered millennial generation has no compassion nor comprehension as to why any human being would need to store anything; they are most comfortable in storing all of their net worth in the digital vault of the cyber-world. That may (or may not) be sound thinking, but the point remains that the boomer generation had a chance to restore fiscal sanity by bringing Bretton Woods back with a vengeance. We didn’t. We opted for the status quo. We voted for our short term wealth and voted against our long-term health. We sold out.

There has never been a time when “hoarding cash” ever resulted in an enhanced lifestyle. Theoretically, had you gone to cash in 1928, you at least had a few years to activate that cash as asset prices collapsed, so perhaps the Great Depression might serve as a one-off. However, I urge you all to join me in celebrating the legacy of what we boomers have bequeathed upon you all. Your savings (if you have any) are going to have minimal purchasing power as time passes, and your expectations of the same are going to be worth the same as the paper one finds in public lavatories.

However, the financial media celebrates and rejoices every time one of the averages hits a new high, and the astounding fact remains that they cannot see the forest for the trees. Stocks are rising because their replacement value is running for its life from debasement and while it would appear to be a “good thing,” it is not. Wealth gravitates to proper treatment; it flees abuse. Wealth is gravitating to gold and silver; it is fleeing cash.

“Historically, the Zimbabwe Stock Market reached an all-time high of 773.06 in June of 2019 and a record low of 93.39 in June of 2016.”Bloomberg

When you think of places to invest, Zimbabwe is certainly not one of them. Once heralded as “the bread basket of Africa,” it is now a net importer of grains as the prolific immigrant European farmers had their land expropriated by the Mugabe regime in an effort to restore tribal ownership to the native inhabitants.

Forgetting the moral argument for a moment, the point here is that Zimbabwe stocks are screaming to all-time highs despite an inflation rate exceeding 175% per annum. This is the example of what happens when societies distrust and, in fact, detest cash. Zimbabwe citizens will jettison cash as soon as it arrives in their hands, providing a prime example of the “replacement power of equities within an inflationary spiral.”

We are seeing stock markets around the world print new highs with increasing regularity and the mainstream media would suggest that the stock markets are barometers of impending economic expansion and financial well-being. The problem with that is that it is the $14 trillion in new wet-ink debt that “rescued the financial system” (read: bailed out the criminal banks that blew it up) that is now surfacing in the form of excess liquidity sloshing around the world markets and chasing equities higher.

Some 65% of global bonds now yielding negative returns is also shepherding cash to equities but the media would have us believe that it is a policy “miracle” that is creating the boom. It is not. It is Modern Monetary Theory debasing the purchasing power of cash. In currency terms, stocks are rising because the value of savings is crashing. Prudence in personal money management is being punished by central bank profligacy, and just as the Zimbabwe markets convey a false message of prosperity, the middle and working-class citizens of Europe and North America are certainly not feeling the warmth that a 3,019 S&P 500 level should be instilling.

Until recently, investors largely ignored the precious metals, the historical defense mechanism against debasement because of the countless and incessant interventions and interference capping any and all advances. But here in the summer of 2019, investors appeared to have warmed up to the notion of owning a little gold and silver, and given the relatively puny size of those markets, even the slightest of attention can drive prices higher. When gold penetrated the $1,400 barrier in June, it altered the configuration of asset allocations around the world, and as can be seen in the HUI’s breathtaking advance off the lows and silver’s abrupt about-face after months (if not years) of underperformance, the utility of precious metals ownership is gathering both popularity and momentum. It is a most welcome occurrence for the grizzled metals enthusiast and comes at a most opportune moment in history.

Near-term, I must confess that the power of this advance in gold has surprised me with its uncanny ability to stay overbought or near-overbought for what seems like weeks. RSI (relative strength index) readings hit nearly 90 in June on the first ascension through $1,440, with levels not seen since 20102011. I am fully invested in the conservative portfolio that has zero leverage and is evenly split between gold, silver (physical), senior miners (GDX) and junior miners (GDXJ).

I took a trade on half of the ETFs in late June, and luckily was able to buy them back a hair below where they were sold. The portfolio is ahead 30.13% year-to-date (YTD), based on all trades. The only leveraged position I currently hold is the SLV October $15.50, which was purchased with the proceeds of the triple I made on the SLV August $14 calls on the move from $0.60 to $1.80. The October $15.50 calls were bought at $0.48 and are now $0.69.

Would I add to the SLV position? That is a very tough call to make because despite the new paradigm in which we now reside, I simply cannot buy into the near-80 RSI level that SLV currently sports. I also learned a lesson from my early exit from the GLD calls in early Julythat RSI can offer a misleading signal, because while it saved my arse in the range-bound markets of 20172019, avoiding nearly $400 of drawdowns in gold, it rocketed to nearly 90 last month and has remained elevated as prices have continued to rally. I am long SLV calls and very nervous, but am also mindful of its potential to do a gold RSI repeat (a move to 90), taking silver into the mid-$18 level and the calls to $3.00. We shall see.

I have also added Aftermath Silver Ltd. (AAG:TSX.V) at the July 11 closing price of $.095 to the portfolio, joining Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTC) (up 131%), Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX) (down 36%), Stakeholder Gold Corp. (SRC:TSX.V) (down 20%) and Getchell Gold Corp. (GTCH:CSE) (down 22%) (all YTD numbers).

You can see how the market rewards discoveries (GBR) and punishes either no news or bad news (GTCH/WUC/SRC). I added Aftermath (AAG) because it has an established silver resource in Chile capable of increases in size through exploration, so it holds leverage to both the silver price and exploration results as potential drivers of price.

As we progress further into this rampaging bull, I am going to be far more attentive to companies that have existing discoveries or ore bodies, which eliminate the exploration risks that were necessary in the past when the metal prices were stagnant. With metal prices anything but stagnant, I want to capture the upside of the move in the metals and avoid being left out of the spoils of victory because exploration results were less-than-stellar (or nonexistent).

I leave Sunday for my annual voyage into the “waters unknown” of northern Georgian Bay, which contains the finest freshwater boating in the world. I hope to get to the Bad River Channel by next weekend, an anchorage of immense beauty, great fishing, crystal-clear water and more hidden and very hazardous rocks than any place on the planet (as I so painfully discovered two years ago). I leave you all with this YouTube clip of one of the many dinghy tours we take into the backcountry, includes the mighty French River (https://www.youtube.com/watch?v=svR9D1Jacvs&t=40s).

I will not be posting another update until after I return mid-August but I will be providing updates via Twitter so you can follow me at @Miningjunkie to see how I am navigating the waters and the markets.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver Ltd., Great Bear Resources, Western Uranium, Stakeholder Gold, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold.. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Getchell Gold, Western Uranium and Stakeholder Gold and Aftermath, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: AAG:TSX.V, GTCH:CSE, GBR:TSX.V; GTBDF:OTC, SRC:TSX.V, WUC:CSE; WSTRF:OTCQX, )

from The Gold Report – Streetwise Exclusive Articles Full Text https://ift.tt/32TQyUo

from WordPress https://ift.tt/2LIKN70

0 notes

Text

Central Bank Folly: Blame the Boomers

Source: Michael Ballanger for Streetwise Reports 07/25/2019

Sector expert Michael Ballanger muses on how the baby boom generation has impacted markets through time, and discusses how he will play the current precious metals bull.

"Destroyers seize gold and leave to its owners a counterfeit pile of paper." Ayn Rand

The baby-boom generation, of which I am a less-than-proud member, blew it.

There was a time long, long ago when the mention of the words "baby boomer" evoked a sense of pride of membership. Amid the prosperity of the post-WWII era, birth rates in North America soared while the sons and daughters of many men and women that fought in the war became the dominant demographic force by the year 1966.

When I was in grade 10, I wrote an essay that pointed to the defining moment, where the excitement and unbridled optimism of the Space Race, advances in modern medicine and unparalleled economic growth was snuffed out forever by an assassin's bullet in Dallas in the autumn of 1963. With the end of Camelot, the boomer generation suddenly began to question things. They threw away the Beach Boys "Surfin' Nirvana" lifestyle for the darker messages of Bob Dylan, CSNY, the Doors and Hendrix, and they watched while the Vietnam war claimed over 58,000 U.S. servicemen and caused massive civil unrest to permeate the inner cities and the campuses of America.

Through the unwillingness of the baby boomers to accept the garbage spewed out by the radio and print media, as well as the fledgling television industry, young people rose defiantly to implement an end to a war that had become a national embarassment and political nightmare. I arrived in Saint Louis in the fall of 1971, a mere four years before Saigon fell, and by then, the historically conservative (pro-war) city of Saint Louis had seen a demographic shift in camps, as the campuses and high schools were filled with long-haired radicals heavily recruiting the youth of the era to "tear it all down" in order to effect the much-needed political and social changes that were so overdue by then. On the other side of the demarcation line were the rednecks, the police, the National Guard and, of course, the military.

The sidebar to all of this is that the boomers also took down a president, in the form of Richard Nixon, so to say that the boomers had serious "stroke" is an understatement. The mediums were FM radio, Rolling Stone magazine and weed, and that was all that was needed to effect changeit mattered not where. We, as a generation, were a force.