#LegalInformation

Explore tagged Tumblr posts

Text

Legalese Decoder Launches Free Beta of Speed Dial AI Lawyer

For Immediate Release

Vancouver, Canada – Legalese Decoder, a leading innovator in legal technology, is excited to announce the launch of its latest feature, Speed Dial AI Lawyer, available now in a free beta version. This groundbreaking service aims to make legal information more accessible by providing quick, easy-to-understand insights on a wide range of legal issues.

Speed Dial AI Lawyer: Your 24/7 Legal Assistant

Speed Dial AI Lawyer is designed to assist users by breaking down complex legal jargon and offering clear, concise explanations. Whether you’re puzzled by a clause in your contract, curious about your consumer rights, or seeking clarity on employment law, our AI is here to help.

Key Use Cases:

Contracts and Agreements: Decode complex legal language in your lease, service agreements, and other contracts.

Employment Law: Understand the terms and conditions of your employment contract.

Consumer Rights: Get insights into warranties, returns, and other consumer protection issues.

Traffic Violations: Learn about potential penalties and legal implications of traffic tickets.

Family Law: Gain basic knowledge on divorce, child custody, and alimony procedures.

Important Notice: For Entertainment Purposes Only

Legalese Decoder emphasizes that Speed Dial AI Lawyer is currently for entertainment purposes only. Users should not consider the information provided as legal advice. Legalese Decoder cannot be held liable for any decisions made based on the use of Speed Dial AI Lawyer. For serious legal matters, we strongly recommend consulting with a qualified attorney.

Try Speed Dial AI Lawyer Today

To experience the convenience and clarity of Speed Dial AI Lawyer, simply call +1 (470) 835 3425. This free beta service is available 24/7, offering a glimpse into the future of legal assistance.

About Legalese Decoder

Legalese Decoder is dedicated to making legal language accessible and understandable for everyone. By leveraging cutting-edge AI technology, we strive to demystify legal jargon and empower individuals with the knowledge they need to make informed decisions.

#LegaleseDecoder#SpeedDialAILawyer#LegalTechnology#FreeBeta#LegalAssistance#AILegalAssistant#ContractDecoding#EmploymentLaw#ConsumerRights#TrafficViolations#FamilyLaw#LegalAdvice#EntertainmentPurposes#LegalInsights#LegalInformation#24/7LegalHelp#LegalInnovation#LegalLanguage#LegalJargon#LegalEmpowerment

0 notes

Text

youtube

We shed light on how to handle legal cases effortlessly and guide you on selecting an advocate with ease. We will share practical tips and strategies to make the entire process smoother and stress-free. From understanding the different types of legal cases to evaluating an advocate's expertise, our comprehensive approach will empower you to make informed decisions every step of the way.

#LegalHelp#LegalGuide#ObtainingLegalHelp#LegalAdvice#LegalSupport#Lawyer#Law#LegalCase#Justice#LegalAssistance#LegalSystem#LegalRights#LegalExpert#LegalResources#LegalServices#LawHelp#LegalTips#LegalInformation#LegalRepresentation#youtube#youtubeindia#youtubevideo#viral#india#lawyer#trending#Youtube

0 notes

Photo

#books #bookstagram #associationlibrary #deeds #trustdeeds #REIT #paperwork #backoffice #records #trustee #accounting #trustaccounting #legalinformation #assets #title #prose #prosocio #prosolido #interlibraryloan #friendsofthelibrary #economicinclusion #legalinsurance (at VEL XENON) https://www.instagram.com/p/CewGvAcLiQz/?igshid=NGJjMDIxMWI=

#books#bookstagram#associationlibrary#deeds#trustdeeds#reit#paperwork#backoffice#records#trustee#accounting#trustaccounting#legalinformation#assets#title#prose#prosocio#prosolido#interlibraryloan#friendsofthelibrary#economicinclusion#legalinsurance

0 notes

Text

10 Ways To Reduce Tax Stress For Your Online Business

An ideal lawyer will not just have a sequence of impressive credentials or gold lettering on his home. She or he will be caring, worried, and dedicated to their work. You ought to be cautious before laying your trust in legal counsel in the end in a few instances everything, future, cash or property is inside the arms. Apart from doing extensive research to short-list possible solicitors you must make sure there isn't conflict of interest, which you have checked the references and details regarding the practice that you understand everything the retainer agreement states, and. You will understand the attorney you've chosen could be the perfect one if: - An effort is made by him to pay time to comprehend your case himself. He'll maybe not designate a assistant that is legal just take realities associated with instance down. - From knowledge and experience he will know what is relevant and what is not. He can set-aside and disregard facts that are irrelevant viewpoints, and personal feelings that cloud the case on hand. - he can insist that the footwork for the situation be performed thoroughly. All details must be inspected for precision and solid arguments jotted down with backing of earlier rulings. - he'll not only focus on the nagging problem in front of you but examine the situation from all edges. This can create a full picture highlighting|picture that is complete} all aspects of relevance therefore the other ways one could approach the case. - He will use their foresight and anticipate techniques by the resistance or views associated with the jury or judge and plan means ahead. Like a master chess player he can prepare the truth maybe not because of the but by many hearings ahead day. - He'll perhaps not spend your time beating across the bush or produce verbose statements—many terms strung together which look impressive but mean nothing. He will insist that the case as well as its arguments be clearly reported. - he shall be self-disciplined, comprehensive, and self confident. Polite at all times he will respect you as well as most of the staff just who work with him. - He's recommended by not merely their buddies and family relations but by other experts of great standing and from his field. - he can maybe not just give you their victories but be happy to inform you why and just how he destroyed particular cases. - He will put the cards up for grabs and let you know obviously whether your instance appears to win or loose. He will not declare that winning is fully guaranteed. He shall be truthful and upfront about their viewpoints and guidance. The important thing is that the lawyer should be worth your trust. Make use of your inborn instincts and don’t go by the lawyer’s apperance or elegant automobile or office. That is of essence to you after all it is competence in law and in court. Everybody else worries about taxes and looks for options of decreasing the tax burden. When you've got a small business of your you must up date your knowledge of income tax laws that relate to “small businesses.” As a continuing business owner you have to realize clearly about accounting systems and taxation preparation. Sit down along with your accountant and plan on methods for maintaining business expenses, filing receipts, thinking about “tax saving” investments, and a strategy for operating business in the most way that is beneficial. Did you know that: - Based on legislation you are able to lower tax obligation by employing household members to undertake work with your business. Pay your children and spouse to execute assigned responsibilities. In this way it is possible to shift from higher tax rates to reduce people. - Consider hiring contractors that are independent of workers. You will save well on payroll taxes. Nonetheless make certain that you meet up with the IRS’s criteria. - consider “deferring income” postpone receiving cash to January instead of December. Which means that payments gotten are going to be up for “tax” calculations a year away. But pose a question to your accountant’s guidance while the advantages tend to be based upon revenue and losses when it comes to 12 months and your business structure that is legal. - Take advantageous asset of tax deductions permitted for non-profit contributions. Make donations in November or December in the place of January to enable you to include the contributions for income tax deductions when you look at the present 12 months. - optimize your spending on equipment and company materials. Purchase ahead of time for a-quarter and employ the tax deductions permitted in the present year that is fiscal. - Add expenses of business associated vacation within the year that is current. - spend all bills due ahead of the end of the year. Repayment to mobile services, lease, insurance, and resources regarding the business enterprise may be included for bookkeeping and appropriate taxation waivers. - Arrange a retirement plan making payments before the end of the year. This may eliminate income when it comes to and proportionately the tax due year. Be sure to check up on the limits. Plan a feasible and strategy that is beneficial your accountant. - Be sure to deduct from your own nonexempt earnings cash paid to licensing fees, businesses taxes, and yearly memberships to companies related businesses. Be sure to deduct interest paid on borrowings for operating the business and fees that are related. Insurance premiums paid to insure the place of work and equipment are eligible for taxation deductions. Make a listing of your memberships and check those that are eligible for income tax deductions. - Check whether you've got subtracted administration and administration expenses along with money spent on maintenance and repairs of gear. Decide whether a money bookkeeping accrual or system one can benefit your business. The taxation deductions are very different according to the operational system you utilize. When setting up your small business make the advice of a tax and accounting professional as to which bookkeeping system is the most suitable. Read the full article

0 notes

Photo

Now more than ever people need a source of information and clarity on the different aspects of their business that are being affected by the COVID-19 lockdown. This pandemic has stalled several projects and left companies trying to find the best way to save themselves.

Given recent confusion and need for information, Kashyap Partners & Associates LLP has established a COVID-19 Resource Center to research and spread information about the legal aspects of the Pandemic.

To access KPA's COVID-19 Resource Center, please visit our website https://www.kpalegal.com/latest-news/

0 notes

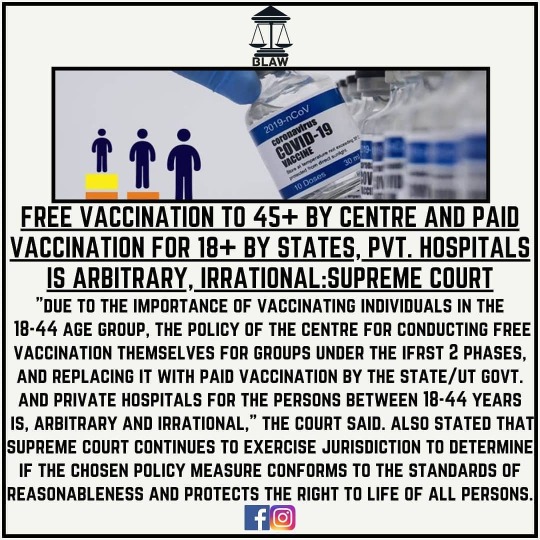

Photo

DM FOR ORDER PDF... Since the Central government had submitted that such decisions are within the executive domain and that the top court should not intervene in policy matters, the Supreme Court clarified that it does not intend to second-guess the wisdom of the executive when it chooses between two competing and efficacious policy measures.... Pc: bar and bench COMMENT YOUR VIEWS.... . . . FOLLOW @blaw_basic_l_aw_areness FOLLOW @blaw_basic_l_aw_areness FOLLOW @blaw_basic_l_aw_areness . . . #centre #government #governmentofindia #goi #govtofindia #govt #pandemic #vaccine #vaccination #vaccinationeducation #vaccinatedandhappy #blawnews #vaccinenews #newsoftheday #newsmedia #newsupdates #update #updateinfo #legalinformation #legalinfo #legalupdate #legalnews #massmedia #state #unionterritory #supremecourt #supremecourtjustice #justice #irrational #arbitrary (at Noida/Delhi) https://www.instagram.com/p/CPn0mkjphT1/?utm_medium=tumblr

#centre#government#governmentofindia#goi#govtofindia#govt#pandemic#vaccine#vaccination#vaccinationeducation#vaccinatedandhappy#blawnews#vaccinenews#newsoftheday#newsmedia#newsupdates#update#updateinfo#legalinformation#legalinfo#legalupdate#legalnews#massmedia#state#unionterritory#supremecourt#supremecourtjustice#justice#irrational#arbitrary

0 notes

Text

Take Action After a Hit-And-Run!

Hit-and-run accidents have been a growing problem in recent years. If a driver strikes another vehicle, occupied or not, and leaves the scene without alerting authorities or exchanging information with the other driver it is considered a hit-and-run. The reasons for a hit and run incident can vary – not wanting to file an insurance claim, being uninsured or unlicensed, illegal substances or devices in the vehicle, or even the at-fault party attempting to hide from law enforcement for some reason. Regardless of the reason, Texas state law requires drivers who are involved in an accident to stop. There can be serious consequences if someone chooses to leave the scene of an accident; especially when another driver is involved. Being involved in an accident can be a scary experience, but below are some tips that might help if you’re involved in a hit-and-run situation. The more details you can give to authorities, the better the chances of finding the other driving and…

https://www.reyeslaw.com/blog/2017/11/take-action-hit-run/

0 notes

Link

0 notes

Text

If you’re dying to see this week’s LIVE but issued it, here it is for you. It was a good one?

#selfdefense #standyourgroundlaw #deadlyforce #violence #crime #homicide #lawenforcement #legalinformation #florida #standyourground

https://youtu.be/XLta4uwPgOU

0 notes

Video

youtube

If you’re a legal guardian, mother or father, this is an important show, with things you haven’t seen before and is an important look into the laws, facts & #legalinformation regarding #childcustody and #parentalrights.

We have a client going through a serious child custody legal matter and we sit with him to discuss the facts related to his ongoing, complex #childcustody #legalmatter. Antonio Marsh is a father of two children.

Before his children’s mother passed away in 2019 in a car accident, Antonio had #negotiatedparentalrights outside of court that were contingent on negotiated support payments between the two of them.

When the mother passed away, her mother, the grandmother of the children fought Antonio, the #survivingbiologicalparent, until the grandmother, AND his former attorney passed away.

This is when the mother’s sister (aunt) files to intervene to get custody of his daughters and the story doesn't end there. The facts are real. The case is real and the case is ongoing and gives us a look at the many factors involved within the #childcustodycourt system and how Antonio has to defend against #falseaccusations, #CPS, #guardianadlitems & #allegations and fight for #solecustody of his children.

We also discuss how #defamation, #conflictinginterests, #kidnapping and ulterior motives play a role in the loss of Antonio’s #parentalrights.

1 note

·

View note

Text

Reading Your Experian Small Business Credit Report

Experian is one of the larger credit reporting agencies.Because they report on bothcommercial and individual credit, a good deal of this article concerns handling your personal credit also. Let's take a look at a sample Experian business credit report.

Report sections

Identifying information

The report splits into divisions. The very first, as might be anticipated, contains basic identifying details for example, firm name and address, but likewise any ownershipinformation. This segment also notes important employees and the kind of firm, how much timeit's been operating, number of employees, and the quantity ofannual sales.

Payment information at a glance

Following is an abbreviated part with the currentdays beyond terms ( overdue payments) and predicted days beyond terms.This section also supplies anoverall trend alongside data pointslike the lowest and highest balance for the past six months plus the current balance. By featuring the highest amount ofcredit extended, the report provides an concept of the highestcredit utilization rate for your business.

This section also incorporates the amount of payment tradelines (lines of credit) yourbusiness holds and number of times any businessentity has made an inquiry into your credit history. It also features any UCC (Uniform Commercial Code) filings; these are liens filed tosupport loans. The summary also provides a relativepercentage presenting the percent of companies doing worse than yours, and also the amount of bankruptcies you have ( needless to say you want this figure to be zero), and the amount of liens and judgments.

Credit summary

Next is the credit summary This displays your company's Experiancredit score as well as links to facts on what goes into the score and recommendationson how to improve it.

Payment summary

The next area is the payment summary. The part displays line graphs for regular monthly and quarterly payment trends, and it conveniently shows where the numbers stemmed from. Themonthly payment trend is even graphed as opposed to the industry average.

Just below this set of graphs (and their supporting details) are three bar charts showing continuous payment trends (a tradelinereported for over six months ), recently reported payment trends (a tradelinereported for the first time in the last six months), and combined payment trends (theaccount balance for those combined tradelines).

Trade payment information

The next section is all about howyour company has made out with its payments, divided into credit card and leasing accounts; tradelines on file for a minimum of six months and with updating activity during thecourse of the last three months; and aged trades (accounts not updatedwithin the last three months). This data is broken down bysupplier category, with payment trends below.

Inquiries

Next up are inquiries into your business's credit. These are summarized by type of institution doing theasking ( for example, a lender) by the month when they made the inquiry.

Collection filings

If your company has any collection filings, the list is right here by date, collection agency name,status, amounts disputed and collected, and the closed date, if appropriate.

Collections summary

Just below the collection filings section, the summary is somewhat self-explanatory.

Commercial banking, insurance, leasing

This section shows what Experian knows of your company and its relationships (if any) with these varieties of organizations. The data include what any credit was extended for,how much credit was extended, when the loan began, and the remainingbalance if appropriate.

Judgment filings

Next the report shows basic legalinformation for instance, the courtwhere a judgment was filed, the date, and how much it was for.

Tax lien filings

Tax lien filing information resembles judgment filings with theexception that there is a filing location (often a county), in lieu of a court listed.

UCC filings

These filings merely show the date; filing number; jurisdiction; name of thesecured party; and activity on the filing.

UCC filings summary

Just beneath is the UCC filings summary, splitby filing period and number of certain kinds offilings (such as cautionary).

Score improvement tips

Finally, Experian supplies a useful rundown of means to develop your own,specific report

Improving your Experian report

You can get your company's actual Experian report and can contest any inaccuracies on your firm's Experian report by following thedirections on their website.

Now that you know what goes into it, you can see that some of the more important pieces of dataExperian looks into are payment history,credit utilization, and amount of time in business/amount of time your company has had anExperian listing. By keeping your creditutilization within reason ( under 30% of your totalavailable credit is best), satisfying your financial obligations as promptlyas possible and not going delinquent, and also by stayingclear of any late payments, you should be able to develop your Experian score in time.

We know about Experian Records: https://www.creditsuite.com/contact-us

0 notes

Photo

Occupied. #lifestyle #legalinformation #trust #sweatshirt #dadhat #study #practice #learning #prose #prosocio #prosolido (at Troy, New York) https://www.instagram.com/p/CeeL1x9rwsJ/?igshid=NGJjMDIxMWI=

#lifestyle#legalinformation#trust#sweatshirt#dadhat#study#practice#learning#prose#prosocio#prosolido

0 notes

Text

Reading Your Experian Business Credit Report

Experian is one of the significant credit reporting agencies. Due to the fact that they report on bothcommercial and consumer credit, a greatdeal of this article concerns dealing with your personal credit also. Let's take a look at a sample Experian business credit report.

Report sections

Identifying information

The report divides into sections. The first, as might be expected, includes fundamental identifying details includingcompany name and address, but likewise any ownership details. This segment also lists crucial employees and the variety of small business, for how longit's been operating, number of employees, and the amount ofannual sales.

Payment information at a glance

Next is an abbreviated part with the currentdays beyond terms ( late payments) and predicted days beyond terms.This segment also provides anoverall trend together with data points such as the lowest and highest balance for the past six months and also the current balance. By including the highest amount ofcredit extended, the report provides an idea of the highestcredit utilization rate for your small business.

This section also consists of the amount of payment tradelines (lines of credit) your organization holds and number of times any businessentity has made an inquiry into your credit history. It also provides any UCC (Uniform Commercial Code) filings; these are liens filed tosupport loans. The summary also contains a relativepercentage presenting the percent of small businesses doing worse than yours, and also the amount of bankruptcies you have (naturally you want this figure to be zero), and the amount of liens and judgments.

Credit summary

Next is the credit summary This shows your company's Experiancredit score plus links to information on what goes into the score and ideason how to improve it.

Payment summary

The next portion is the payment summary. Thesection presents line graphs for regular monthly and quarterly payment trends, and it conveniently indicates where the numbers stemmed from. Themonthly payment trend is even graphed as against the industry average.

Just underneath this set of graphs (and their supporting data) are three bar charts displaying continuous payment trends (a tradelinereported for over six months ), recently reported payment trends (a tradelinereported for the first time in the last six months), and combined payment trends (theaccount balance for those combined tradelines).

Trade payment information

The next section is about howyour business has done with its payments, split into credit card and leasing accounts; tradelines on file for atleast six months and with updating activity during thecourse of the last three months; and aged trades (accounts not updatedwithin the last three months). This data is analyzed bysupplier category, with payment trends at the bottom.

Inquiries

Following are inquiries into your business's credit. These are summarized by sort of organization doing the inquiring ( for instance, a financialinstitution) by the month when they made the inquiry.

Collection filings

If your business has any collection filings, the record is here by date, collection agency name,status, amounts disputed and collected, and the closed date, if applicable.

Collections summary

Just below the collection filings area, the recap is relatively clear.

Commercial banking, insurance, leasing

This portion shows anything Experian knowsabout your company and its connections (if any) with these varieties of organizations. The information include what any credit was extended for,how much credit was extended, when the loan began, and the remainingbalance if applicable.

Judgment filings

After that the report shows general legalinformation for instance, the courtwhere a judgment was filed, the date, and how much it was for.

Tax lien filings

Tax lien filing information resembles judgment filings except that there is a filing location (often a county), in lieu of a court listed.

UCC filings

These filings only show the date; filing number; jurisdiction; name of thesecured party; and activity on the filing.

UCC filings summary

Just underneath is the UCC filings summary, separatedby filing period and number of certain sorts offilings ( for example, cautionary).

Score improvement tips

And finally, Experian furnishes a useful listing of ways to develop your own,specific report

Improving your Experian report

You can get your company's genuine Experian report and can question any mistakes on your firm's Experian report by following thedirections on their website.

Now that you know what goes into it, you can see that a fewof the more vital portions of informationExperian checks into are payment history,credit utilization, and amount of time in business/amount of time your company has had anExperian listing. By trying to keep your creditutilization within reason ( lower than 30% of your overallavailable credit is best), removing your debts as swiftlyas possible and not going delinquent, plus by steering clear of any late payments, you should have the opportunity to enhance your Experian scoreover time.

We know Experian Scoring: https://www.creditsuite.com/business-credit

0 notes

Text

Reading Your Experian Business Credit Report

Experian is one of the significant credit reporting agencies.Because they report on bothcommercial and individual credit, a lot of this article applies to maintaining your personal credit also. Let's delveinto a sample Experian business credit report.

Report sections

Identifying information

The report separates into parts. The first, as might be anticipated, consists of basic identifying facts for instance, business name and address, but likewise any ownershipinformation. This part also lists essentialpersonnel and the form of company, for how longit's been operating, amount of employees, and the quantity ofannual sales.

Payment information at a glance

Following is an abridged section with the currentdays beyond terms ( overdue payments) and predicted days beyond terms.This segment also delivers anoverall trend alongside data points such as the lowest and highest balance for the past six months aswell as the current balance. By providing the highest amount ofcredit extended, the report offers an idea of the highestcredit utilization rate for your firm.

This segment also features the number of payment tradelines (lines of credit) yourbusiness holds and number of times any businessentity has made an inquiry into your credit history. It also provides any UCC (Uniform Commercial Code) filings; these are liens filed tosupport loans. The summary also contains a relative percent presenting the percentage of companies doing worse than yours, along with the amount of bankruptcies you have (naturally you want this number to be zero), and the number of liens and judgments.

Credit summary

Next is the credit summary This presents your company's Experiancredit score plus links to facts about what enters into the score and recommendationson how to improve it.

Payment summary

The next part is the payment summary. The part shows line graphs for regular monthly and quarterly payment trends, and it conveniently shows where the numbers stemmed from. Themonthly payment trend is even graphed as against the industry average.

Just below this set of graphs (and their supporting details) are three bar charts showing continuous payment trends (a tradelinereported for over six months ), newly reported payment trends (a tradelinereported for the first time in the last six months), and combined payment trends (theaccount balance for those combined tradelines).

Trade payment information

The next portion is everything about howyour business has made out with its payments, brokendown into credit card and leasing accounts; tradelines on file for a minimum of six months and with updating activity during thecourse of the most recent three months; and aged trades (accounts not updatedwithin the last three months). This data is analyzed bysupplier category, with payment trends beneath.

Inquiries

Next are inquiries into your business's credit. These are summarized by sort of organization doing the inquiring (such as a lender) by the month when they made the inquiry.

Collection filings

If your small business has any collection filings, the listing is right here by date, debt collector name,status, amounts disputed and collected, and the closed date, if applicable.

Collections summary

Just below the collection filings part, the summary is somewhat clear.

Commercial banking, insurance, leasing

This section shows what Experian knows of your company and its relationships (if any) with these kinds of institutions. The records include what any credit was provided for,how much credit was extended, when the loan began, and the remainingbalance if relevant.

Judgment filings

After that the report displays basic legalinformation for example, the courtwhere a judgment was filed, the date, and how much it was for.

Tax lien filings

Tax lien filing information resembles judgment filings with theexception that there is a filing location (often a county), rather than a court listed.

UCC filings

These filings merely show the date; filing number; jurisdiction; name of thesecured party; and activity on the filing.

UCC filings summary

Just underneath is the UCC filings summary, separatedby filing period and amount of certain forms offilings ( like cautionary).

Score improvement tips

Finally, Experian provides a helpful listing of methods to develop your own, particular report

Improving your Experian report

You can get your company's real Experian report and candispute any problems on your firm's Experian report by following thedirections on their website.

Since you know what enters into it, you can see that some of the more vital portions of dataExperian investigates are payment history,credit utilization, and amount of time in business/amount of time your company has had anExperian listing. By maintaining your creditutilization within reason ( under 30% of your overallavailable credit is best), getting rid of your financial obligations as swiftlyas possible and not going delinquent, and by stayingclear of any late payments, you should be able to improve your Experian score in time.

We have information about Experian Reports: https://www.creditsuite.com/business-credit

0 notes

Text

Our NYC Personal Injury Attorneys gave presentations at Cardozo Law School last night

Three of our New York Personal Injury Lawyers visited Cardozo Law School yesterday night. Marijo Adimey, Christopher Donadio and Ben Rubinowitz gave a demonstration of Opening Statements to second and third year students. For more than a dozen years Cardozo Law has invited lawyers from the firm to conduct trial demonstrations to the students. Cardozo Law has recognized the quality of the trial lawyers at Gair, Gair, Conason, Rubinowitz, Bloom, Hershenhorn, Steigman & Mackauf and has made clear to their students that they are among the very best trial lawyers in New York. We have a tradition dating back years of speaking at seminars for law students and lawyers. We believe it is an obligation to share knowledge accumulated over many years so that others will be better prepared to represent their clients. To view videos of some of those seminars click here.

https://www.newyorkpersonalinjuryattorneysblog.com/2017/11/nyc-personal-injury-attorneys-gave-presentations-cardozo-law-school-last-night.html

0 notes

Text

Divorce problems! Something most of us will never have to worry about.

#divorce #assests #familylaw #divorcecourt #legalinformation #divorcelawyer #maritalproperty #trusts

https://www.google.com/amp/s/www.cnbc.com/amp/2020/05/06/how-marie-and-ed-bosarges-divorce-spotlights-south-dakotas-asset-trusts.html

0 notes