#KYC for businesses

Explore tagged Tumblr posts

Text

#Business KYC#Business KYC solutions#KYC for businesses#KYC Canada#kyc regulations#kyc providers#kyc solution#kyc compliance#kyc verification#business#kyc#kyc solutions#Canada#KYC in Canada#kyc api#kyc platform#kyc software#KYC Solutions in Canada

1 note

·

View note

Text

KYC Solutions Provider

KYC Italy provides a KYC solution to help businesses to verify the identity of their customers. Their KYC API is easy to use and can integrate easily with any existing system. Our API helps for seamless client onboarding and secure business transactions.

2 notes

·

View notes

Text

#kyc api#kyc uk#kyc solution#kyc companies#fake identity#identity fraud#identity fraud prevention#id fraud prevention#KYC Provider#kyc services#KYC Company#KYC software#business#uk

2 notes

·

View notes

Text

#Finance Management Software#Small business financial management#bank balance check online#Financial Management Software#ACH payment processing software#Bank PDF Statements#automated income verification#finance#fintech#kyc

2 notes

·

View notes

Text

KYC solutions Process ?

Use our KYC solutions to streamline customer onboarding. Verify identities, avoid fraud, and verify compliance. Checks are automated, verification occurs in real time, and data is stored securely. Improve customer experience, minimize risk, and increase regulatory confidence.

0 notes

Text

How To Pass AML And KYC Checks: History, Tips And Curious Cases

AML (Anti-Money Laundering) and KYC (Know Your Customer) are not just boring formalities, but real pillars on which the security of the entire financial system rests. Continue reading How To Pass AML And KYC Checks: History, Tips And Curious Cases

0 notes

Text

The fintech industry has witnessed significant transformations in recent years, revolutionizing the way we manage our finances and conduct transactions. One of the key developments that have had a profound impact on fintech is the adoption of electronic Know Your Customer (e-KYC) processes. This article explores the legal implications of e-KYC on the fintech landscape, highlighting its role in bolstering regulatory compliance, enhancing security measures, and fostering financial inclusion.

1.Regulatory compliance and AML measures:

In the financial sector, stringent regulations and anti-money laundering (AML) measures are essential to combat illicit activities and safeguard the integrity of the financial system. e-KYC processes play a vital role in ensuring compliance with these regulations. Read More

#finance#business#tech#fintech#kyc verification#kyc solutions#regulatorycompliance#anti money laundering

0 notes

Text

Empower Your Finances: Unlock ABFL Instant Loan's Swift and Secure Financial Solutions

ABFL Instant Loan In today’s fast-paced world, financial needs can arise unexpectedly, demanding swift and reliable solutions. Aditya Birla Finance Limited (ABFL) steps up to the challenge with its Instant Loan service, offering customers a hassle-free and efficient way to address urgent financial requirements. Customer-Centric Digital Access: ABFL understands the importance of secure and…

View On WordPress

#ABFL Instant Loan#Quick Financial Solutions#Secure Loan Application#Swift Disbursal#Flexible Loan Amounts#Digital KYC Verification#Pincode-Wise Security#Responsible Lending#WhatsApp Communication#Customer-Centric Approach#Seamless Borrowing#Loan Application Process#Financial Guidance#Business Prosperity#Techmin Consulting#financial wellness#Business Loans

0 notes

Text

There’s never just one ant

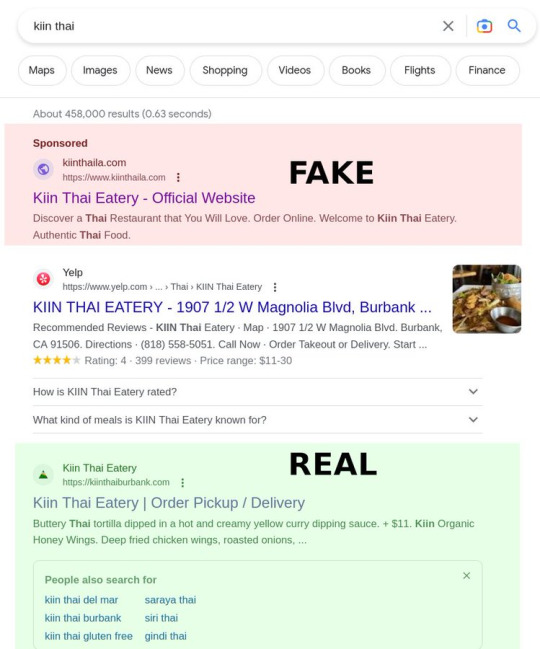

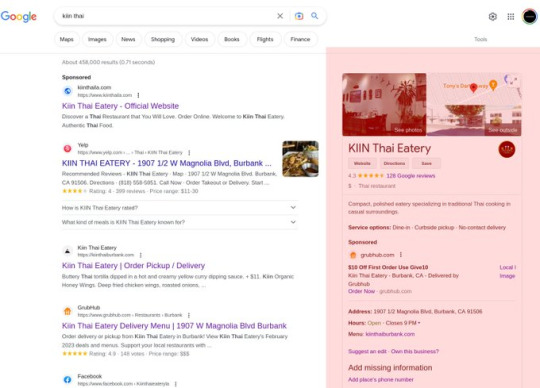

So there's a great Thai restaurant in my neighborhood called Kiin. Yesterday, I searched for their website to order some takeout. Here's the Google result.

That top result (an ad)? It's fake. It goes to https://kiinthaila.com, which is NOT the website for Kiin.

The *third* result is real: https://kiinthaiburbank.com

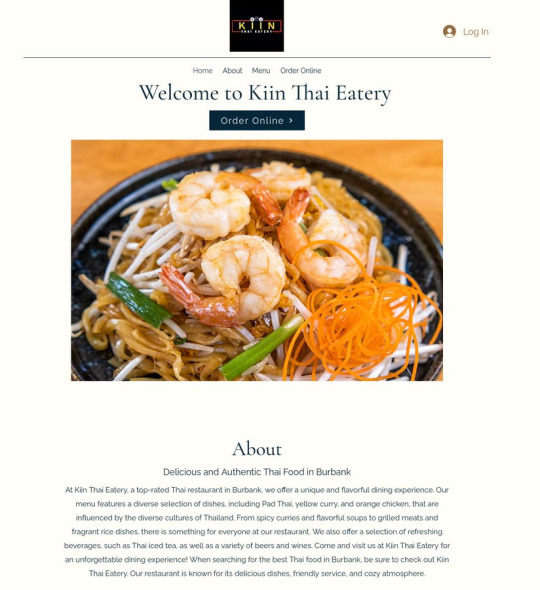

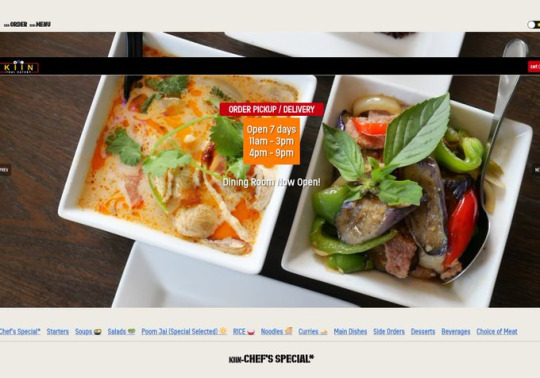

Fake site:

Real site:

I got duped. I placed an order with the fake site. The fake site then placed the order - in my name! - with the real site, having marked up the prices by 15%. Kiin clearly knows they're doing this (presumably by the billing data on the credit card the fakesters use to place the order). They called me within minutes to tell me they'd cancelled the fakesters' order.

I could still come pick it up, but I'd have to pay them, and cancel the payment to the fakesters with Amex. Actually, as it turns out, I have to cancel TWO payments, because the fakesters DOUBLE-charged me.

Here's what that charge looks like on my Amex bill. See that phone number? (415) 639-9034 is the number for Wix, who provides the scammers' website.

How the actual FUCK did these obvious scammers get an Amex merchant account in the name of "KIINTHAILA" by after supplying the phone number for a website hosting company? What is Amex's KYC procedure? Do they even call the phone number?

And why the actual FUCK is Google Ads accepting these scam artists' ads for a business that they already have a knowledge box for?! Google KNOWS what the real KIIN restaurant is, and yet they are accepting payment to put a fake KIIN listing two slots ABOVE the real one.

To be fair to these scammer asshole ripoff creeps who are trying to steal from my local mom-and-pop, single location Thai eatery, they're just following in the shoes of Doordash and Uber Eats, who did the same thing to hundreds (thousands?) of restaurants during lockdown.

Doug Rushkoff says that the ethic of today's "entrepreneur" is to “Go Meta” - don't provide a product or a service, simply find a way to be a predatory squatter on a chokepoint between people who do useful things and people who use those things.

These parasites have turned themselves into landlords of someone else's home, collecting rent on a property they don't own and have no connection to.

There's NEVER just one ant. I guaran-fucking-tee you that these same creeps have 1,000 other fake Wix websites with 1,000 fake Amex merchant accounts for 1,000 REAL businesses, and that Google has sold them ads for every one of them. Amex and Google and Wix should be able to spot these creeps FROM ORBIT. Holy shit do we live in the worst of all possible timelines. We have these monopolist megacorps that spy on and control everything we do, wielding the most arbitrary and high-handed authority.

And yet they do NOT ONE FUCKING THING to prevent these petty scammers from using their infra as force-multipliers to let them steal from every hungry person patronizing every local restaurant.

I mean, what's the point of letting these robber-barons run the entire show if they're not even COMPETENT?

ETA: Dinner was delicious

11K notes

·

View notes

Text

Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025

In thi Article about Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025, Read it out.

What is Cryptocurrency Exchange

To purchase, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and Litecoin, you go to an online marketplace called a cryptocurrency exchange. Cryptocurrency exchanges work much like stock exchanges, except instead of issuing or trading stocks, you trade digital currencies.

In simple terms, it’s where Buyers and sellers meet to exchange cryptocurrencies. You can buy cryptocurrency with ordinary money (such as dollars or euros) or swap one cryptocurrency for another. Some exchanges allow you to store your crypto in secure wallets held on the platform.

There are two main types:

Centralized exchanges (CEX)

Decentralized exchanges (DEX)

What is Cryptocurrency Exchange Clone Script

The Cryptocurrency Exchange Clone Script is a ready-made program that simulates the technical features and functionality of popular cryptocurrency exchanges such as Binance, Coinbase, Kraken, or Bitfinex. Compared to developing from scratch, the clone scripts significantly ease and shorten the time required to set up a cryptocurrency exchange network for an aspiring entrepreneur and firms.

These sort of scripts are somewhat equipped with all the basic features to run a cryptocurrency exchange, like user account management, wallet integration, order book, trading engine, liquidity management, and options for secure payment gateways. The whole idea of a clone script is to give you something out-of-the-box that can be customized, thus allowing you to skip the whole painful development process but still be able to modify the script to suit your needs.

Top 6 Cryptocurrency Exchange Clone Scripts

There are many clone scripts for cryptocurrency exchange development, but here are the top 6 of the cryptocurrency exchange clone script.

Binance clone script

Coinbase Clone Script

Kucoin Clone Script

Paxful Clone Script

WazirX clone script

FTX Clone Script

Binance clone script

A Binance clone script is a Pre-made software that is almost ready for use to create your own cryptocurrency exchange platform, along the way simulating Binance, one of the largest and most popular exchanges in the world. This “clone” is a reapplication of some of the features and functionality of Binance, but it can allow for some level of customization depending upon your particular brand and need.

Key Features:

User Registration and Login

Multi-Currency Support

Trading Engine

Multi-Layer Security

Admin Dashboard

Wallet Integration

KYC/AML Compliance

Liquidity Management

Mobile Compatibility

Referral and Affiliate Program

Trading Fees and Commission Management

Live Market Charts and Trading Tools

Coinbase clone script:

The Coinbase clone script is a ready-made solution that allows you to set up a cryptocurrency exchange platform exhibiting features and functionalities similar to the world’s most popular and user-friendly crypto exchange, Coinbase. These scripts are bundled with all the necessary features to run an exchange while still offering ample customization to cater to your branding and business requirements.

Key Features:

User Registration and Account Management

Fiat and Crypto Support

Secure Wallet Integration

Quick Buy/Sell Functionality

Multiple Payment Methods

P2P Trading

Admin Dashboard

Launchpad Functionality

Staking Feature

KYC/AML Compliance

API Integration

Kucoin Clone Script

A KuCoin clone script is a ready-made software solution replicating all functional attributes and operational features of the KuCoin, which can also be customized according to your brand name and business requirement specifications. Fast and feasible for launching your crypto exchange, the idea is to save yourself from the headaches of developing everything from scratch.

Key Features:

Spot trading

Margin trading

Future trading

Crypto derivatives

Advanced security transactions

Escrow protection

User registration

Wallet integration

Advanced analytics

Currency converter

Paxful clone script

A Paxful clone script is a ready-Made platform for opening a peer-to-peer cryptocurrency exchange for users to trade Bitcoin and other cryptocurrencies directly among themselves without any intermediaries. The script replicates the core features of Paxful operated using its server; you can customize it to your brand and business needs.

Key Features:

Secured Escrow Service

Multi Payment Processing

BUY/SELL Ad posting

Real-Time Data

Referrals & Gift Card options

Multi Language Support

Online/Offline Trading

Cold/Offline Wallet Support

FTX Clone Script

An FTX clone script is a ready-made software solution that will allow you to set up your own cryptocurrency exchange like FTX, which was formerly one of the largest crypto exchanges globally before going under in 2022. This script mimics the core features of FTX, such as spot trading, derivatives, margin trading, token offering, etc., so that you can fast-track the launch and operations of your own exchange with customizable branding and features.

Key Features:

Derivatives Trading

Leveraged Tokens

Spot Trading

User-Friendly Interface

KYC/AML Compliance

Staking Functionality

WazirX clone script

A WazirX Clone Script is a pre-made software solution for the creation of your cryptocurrency exchange platform akin to WazirX, one of the top cryptocurrency exchanges in India. The clone script replicating the essential elements, functionality, and WazirX’s user experience enables you to swiftly put together a fully fledged cryptocurrency exchange that would accept a number of digital assets and trading features.

Key Features:

Escrow protection

KYC approval

Trading bots

User-friendly interface

Stunning User Dashboard

SMS Integration

Multiple Payment Methods

Multiple Language Support

Benefits of Using Cryptocurrency Exchange Clone Scripts

The use of a cryptocurrency exchange cloning script entails great advantages, particularly if one is keen on starting an exchange without having to do the full development from scratch. Below, I have listed the primary advantages of using cryptocurrency exchange cloning scripts:

Cost-Effective

Quick and Profitable Launch

Proven Model

Customizable Features

Scalability

Multi-Currency and Multi-Language Support

Low Development Cost

Continuous Support and Updates

Why Choose BlockchainX for Cryptocurrency Exchange clone script

In the opinion of an entrepreneur set to develop a secure, scalable, and feature-loaded cryptocurrency exchange clone script, BlockchainX is the best bet. Since BlockchainX provides a full-fledged solution that replicates the features of flagship cryptocurrency exchanges such as Binance, Coinbase, and WazirX, the entrepreneur gets all the additional features required practically out of the box. With the addition of certain basic offerings such as spot trading, margin trading, and peer-to-peer (P2P) capabilities along with more advanced ones like liquidity management and derivatives trading, BlockchainX provides a holistic set of solutions to carve out an exchange rightly fitted for newbies and pros alike.

Conclusion:

In conclusion, the Top 6 Cryptocurrency Exchange Clone Scripts in 2025 are high-powered and feature-rich solutions which any enterprising spirit would find indispensable if they were to enter the crypto market very quickly and efficiently. Whether it be a Binance clone, Coinbase clone, or WazirX clone-these scripts offer dynamic functionalities that enhance trading engines, wallets, KYC/AML compliance, and various security attributes.

Choosing the right clone script, such as those provided by BlockchainX or other reputable providers, will give you a strong foundation for success in the dynamic world of cryptocurrency exchanges.

#cryptocurrency#cryptocurrency exchange script#exchange clone script#binance clone script#clone script development#blockchainx

2 notes

·

View notes

Text

#kyc canada#kyc providers#business#kyc solution#Fraud Prevention#businesses#crypto#KYC solutions for Crypto#KYC for crypto exchanges

2 notes

·

View notes

Text

KYC API Provider

KYC Italy provide seamless onboarding for customers and protect against financial crimes such as money laundering, fraud and illegal activities with Advanced KYC API Solutions.

1 note

·

View note

Text

#KYC UK#Identity Verification Provider UK#kyc api#banking#finance#fintech#banks#kyc solution#Identity Verification solutions#AML Verification#identity theft#business

2 notes

·

View notes

Text

Emerging Trends Shaping the Future of White-Label Crypto Exchange Development

The cryptocurrency market has seen exponential growth over the years, and as demand for seamless and feature-rich trading platforms rises, white-label crypto exchange development has become a game-changing solution for businesses. A white-label crypto exchange allows entrepreneurs to quickly launch a customizable trading platform, eliminating the need for extensive development time and resources.

As the crypto landscape evolves, so do the expectations for white-label solutions. In this blog, we’ll explore the future trends shaping white-label crypto exchange development, showcasing how businesses can stay competitive and meet the ever-changing demands of traders.

1. Increased Focus on Decentralized Exchange Features

Decentralized exchanges (DEXs) are becoming increasingly popular due to their security and transparency. As a result, many white-label solutions are integrating DEX functionalities into their offerings.

Key Trends:

Hybrid Models: Combining the security of DEXs with the liquidity of centralized exchanges (CEXs).

Non-Custodial Wallets: Allowing users to trade directly from their wallets without intermediaries.

Smart Contract Integration: Automating trading processes and enhancing security.

Why It Matters:

DEX-like features in white-label solutions cater to the growing demand for privacy and decentralization, attracting a broader user base.

2. Multi-Asset Support and Tokenization

With the rise of tokenized assets and diverse cryptocurrencies, future white-label exchanges will focus on supporting a wide range of assets.

What to Expect:

Support for tokenized stocks, commodities, and real estate.

Integration of emerging blockchain networks like Solana, Avalanche, and Polkadot.

Cross-chain compatibility for seamless trading across multiple blockchain ecosystems.

Impact:

Businesses that offer multi-asset trading options will attract institutional and retail investors seeking diverse investment opportunities.

3. Advanced Security Measures

Security remains a top concern in the crypto industry. Future white-label crypto exchanges will incorporate state-of-the-art security measures to protect user funds and data.

Innovative Security Features:

Multi-Signature Wallets: Ensuring transactions require multiple approvals.

Cold Storage Solutions: Safeguarding the majority of funds offline.

AI-Powered Fraud Detection: Identifying and mitigating suspicious activities in real-time.

End-to-End Encryption: Securing user data and communication.

Why It’s Important:

Enhanced security builds trust, which is crucial for attracting and retaining users in the competitive crypto exchange market.

4. Customizable User Experiences (UX/UI)

As competition grows, user experience (UX) will become a key differentiator. White-label exchanges will prioritize customizable and intuitive interfaces.

Future Developments in UX/UI:

Personalized Dashboards: Allowing users to customize their trading view.

Simplified Onboarding: Streamlining the KYC process for faster registration.

Mobile-First Design: Optimizing platforms for seamless use on smartphones.

Dark Mode and Accessibility Features: Catering to diverse user preferences.

Result:

User-friendly platforms enhance engagement and attract a wider audience, including beginners entering the crypto space.

5. Integration of DeFi Features

Decentralized finance (DeFi) is one of the fastest-growing sectors in the crypto industry. Future white-label solutions will integrate DeFi functionalities to meet user demands for innovative financial services.

Popular DeFi Features:

Staking and Yield Farming: Enabling users to earn passive income.

Lending and Borrowing: Providing decentralized financial services.

Liquidity Pools: Allowing users to earn rewards by providing liquidity.

Why It Matters:

Incorporating DeFi features enhances platform functionality and attracts users looking for diverse earning opportunities.

6. AI and Machine Learning Integration

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the way crypto exchanges operate. Future white-label exchanges will harness these technologies for automation and efficiency.

AI-Powered Features:

Predictive Analytics: Helping users make data-driven trading decisions.

Automated Trading Bots: Enabling high-frequency and algorithmic trading.

Fraud Detection: Identifying suspicious activities and enhancing security.

Outcome:

AI integration improves platform performance and user satisfaction, giving businesses a competitive edge.

7. Compliance and Regulatory Readiness

With governments worldwide tightening regulations on cryptocurrencies, compliance will be a critical factor for future exchanges.

What to Expect:

Automated KYC/AML Processes: Using AI to verify user identities and prevent money laundering.

Transparent Reporting: Providing real-time audit trails for regulators.

Global Regulatory Support: Adapting platforms to comply with regional laws.

Impact:

Regulatory-compliant exchanges inspire confidence among users and attract institutional investors.

8. Gamification in Trading

Gamification is emerging as a strategy to enhance user engagement on trading platforms. Future white-label crypto exchanges will incorporate interactive elements to make trading more engaging.

Gamification Features:

Leaderboards: Highlighting top traders and rewarding performance.

Achievements and Badges: Encouraging users to reach milestones.

Demo Trading: Offering virtual trading environments for beginners.

Why It’s Effective:

Gamification boosts user retention and makes trading enjoyable, particularly for younger demographics.

9. White-Label NFT Marketplaces

The rise of non-fungible tokens (NFTs) has created new opportunities for crypto exchanges. White-label platforms will increasingly support NFT trading and minting.

Key Features:

NFT Minting Tools: Allowing users to create and sell digital assets.

Integrated Marketplaces: Enabling seamless buying and selling of NFTs.

Royalty Management: Automating creator royalties using smart contracts.

Impact:

Businesses that offer NFT capabilities can tap into a growing market and attract creators and collectors alike.

10. Scalability and Performance Optimization

As the user base for crypto exchanges grows, scalability and performance will remain top priorities for white-label solutions.

Enhancements:

Layer-2 Scaling: Using solutions like Polygon for faster and cheaper transactions.

Cloud-Based Infrastructure: Ensuring platform reliability during traffic spikes.

Low Latency Trading: Enabling high-speed transactions for professional traders.

Result:

Scalable platforms can handle larger user bases and higher trading volumes, ensuring a seamless experience for all users.

Why Partner with Professional White-Label Crypto Exchange Development Services?

To stay competitive in the evolving crypto market, partnering with an experienced white-label crypto exchange development company is essential.

Key Benefits:

Custom Solutions: Tailored platforms with unique branding and features.

Quick Launch: Faster time-to-market compared to building from scratch.

Security Integration: Advanced measures to safeguard user funds and data.

Ongoing Support: Regular updates and technical assistance to ensure smooth operations.

Conclusion

The future of white-label crypto exchange development lies in innovation, security, and user-centric features. From integrating DeFi functionalities to offering multi-asset support and gamification, the next generation of white-label solutions will empower businesses to thrive in the competitive crypto space.

By leveraging the latest trends and partnering with professional development services, businesses can launch cutting-edge platforms that attract users, drive engagement, and generate sustainable revenue.

Ready to build your own white-label crypto exchange? The future is now—embrace innovation!

#crypto exchange platform development company#crypto exchange development company#cryptocurrency exchange development service#crypto exchange platform development#white label crypto exchange development#cryptocurrencyexchange#cryptoexchange

3 notes

·

View notes

Text

What is customer compliance

Customer compliance entails the process of verifying that clients adhere to rules and guidelines established by a business or an industry. This may necessitate confirming the identity of a client. The goal is to reduce financial crimes, protect the company and comply with the regulations.

#business#Compliance Management#KYC solutions#customer verification processes#mitigating risks#ensuring adherence

0 notes

Text

Launch Your Own Crypto Platform with Notcoin Clone Script | Fast & Secure Solution

To launch your own cryptocurrency platform using a Notcoin clone script, you can follow a structured approach that leverages existing clone scripts tailored for various cryptocurrency exchanges.

Here’s a detailed guide on how to proceed:

Understanding Clone Scripts

A clone script is a pre-built software solution that replicates the functionalities of established cryptocurrency exchanges. These scripts can be customized to suit your specific business needs and allow for rapid deployment, saving both time and resources.

Types of Clone Scripts

Centralized Exchange Scripts: These replicate platforms like Binance or Coinbase, offering features such as order books and user management.

Decentralized Exchange Scripts: These are designed for platforms like Uniswap or PancakeSwap, enabling peer-to-peer trading without a central authority.

Peer-to-Peer (P2P) Exchange Scripts: These allow users to trade directly with each other, similar to LocalBitcoins or Paxful.

Steps to Launch Your Crypto Platform

Step 1: Define Your Business Strategy

Market Research: Identify your target audience and analyze competitors.

Unique Value Proposition: Determine what sets your platform apart from others.

Step 2: Choose the Right Clone Script

Evaluate Options: Research various clone scripts available in the market, such as those for Binance, Coinbase, or P2P exchanges. Customization: Ensure the script is customizable to meet your specific requirements, including branding and features.

Step 3: Development and Deployment

Technical Setup: Collaborate with developers to set up the necessary infrastructure, including blockchain integration and wallet services.

Security Features: Implement robust security measures, such as two-factor authentication and encryption, to protect user data and transactions.

Step 4: Compliance and Regulations

KYC/AML Integration: Ensure your platform complies with local regulations by integrating Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

Step 5: Testing and Launch

Quality Assurance: Conduct thorough testing to identify and fix any bugs or vulnerabilities.

Launch: Once testing is complete, launch your platform and start marketing it to attract users.

Advantages of Using a Notcoin Clone Script

Cost-Effective: Using a pre-built script is generally more affordable than developing a platform from scratch.

Faster Time to Market: Notcoin Clone scripts are ready to deploy, significantly reducing development time.

Customization Options: Most scripts allow for extensive customization, enabling you to tailor the platform to your needs.

Conclusion

Launching your own cryptocurrency platform with a Notcoin clone script is a viable option that can lead to a successful venture in the growing crypto market. By following the outlined steps and leveraging the advantages of Notcoin clone scripts, you can create a robust and secure trading platform that meets user demands and regulatory requirements.

For further assistance, consider reaching out to specialized development companies that offer Notcoin clone script and can guide you through the setup process

#cryptotrading#notcoin#notcoinclonescript#cryptocurrencies#crypto exchange#blockchain#crypto traders#crypto investors#cryptonews#web3 development

3 notes

·

View notes