#KSA Fintech Market

Explore tagged Tumblr posts

Text

Innovation Unleashed: A Probing Look at the KSA Fintech Sector's Growth Trajectory

The KSA Fintech Industry is witnessing unprecedented growth, presenting a myriad of opportunities. Our report analyzes key sectors, emerging technologies, and regulatory influences shaping the future of finance in Saudi Arabia. Stay ahead with strategic intelligence and actionable insights.

0 notes

Text

KSA Fintech Market is in its growing stage, Driven By accelerated digitalization, Government initiatives, and, High Fintech Adoption: Ken Research

Buy Now

A strong indicator of growth in the fintech market is, growth in certain industry verticals like payments and currency exchange driven by an increase in digital payments in KSA and lending and finance owing to high requirement of funds in market both for personal and business use.

Covid Led Growth: The accelerated digitalization as a result of the COVID-19 pandemic has led to a surge in demand for fintech solutions and subsequent growth in both their market share and enterprise value. In particular, the pandemic has resulted in a growth in demand for easier-to-use financial tools in areas such as buy-now, pay later and investment brokering solutions.

Rising Government Support: Government initiatives including the easing of foreign direct investment regulations and the launch of Saudi Venture Capital Company and Jada Fund of Funds has increased venture capital liquidity in the Kingdom.

Interested to Know More about this Report, Request for a sample report

Fund Allocation by Investment Community: SAMA’s Regulatory Sandbox and CMA’s FinTech Lab and the release of regulations for a number of different fintech activities has proved the investment community with the confidence and clarity to allocate more funds towards fintech companies.

Highest Levels of Fintech Adoption: Saudi Arabia has one of the highest levels of fintech adoption in the region. In a recent announcement by SAMA, Saudi Arabia was shown to have the highest adoption of NFC contactless payments in MENA. As per Fintech Saudi’s National Fintech Adoption Survey, 74% of individuals have had experience in using at least one fintech solution. With a population of nearly 35m people and a high rate of fintech adoption, fintech companies have a significant runway for growth which contributes to the attraction of the sector for venture capital investors.

Access to Customers: It is difficult for FinTech’s to gain access to customers and conduct customer testing. Thus, it becomes important to take steps regarding financial literacy and inclusion in the KSA. The launch of Open Banking will in this aspect as it will drive healthy competition in the market allowing firms to compete at much lower prices leading to higher customer satisfaction. As such, these services will be available to a wide range of customers enhancing the financial inclusion in KSA.

Analysts at Ken Research in their latest publication- “KSA Fintech Market Outlook to 2027- Driven by the government regulations and initiatives and the growing adoption of technology among the residents” by Ken Research provides a comprehensive analysis of the potential of the fintech market in KSA. Rising Investment Activity and Increasing Convergence in The Fintech Industry are expected to contribute to the market growth over the forecast period. KSA Fintech Market is expected to grow at a robust CAGR over the forecasted period 2022P-2027F.

Key Segments Covered

Segmentation by service vertical:

Payments and Currency Exchange

Lending and Finance

Business tools

Personal financing

Private fundraising

Capital market

Infrastructure

Segmentation by Region:

Riyadh

Khobar

Dammam

Jeddah

Segmentation by Investment Stage:

Series A

Series B and above

Early (Pre-seed, Seed)

Undisclosed

Segmentation by Company Stage:

Testing License

Active

Idea stage

Pre-commercial

Key Target Audience

Banks and Financial Institutions

Cash Reconciliation Companies

Payment Aggregators

Payment Network Companies

Payment Interface Companies

M-Wallet Companies

Young First-Generation Entrepreneurs

Payment Gateway Companies

PoS Terminal Companies

M-PoS Terminal Companies

Visit this Link :- Request for custom report

Time Period Captured in the Report:

Historical Period: 2017-2022P

Base Year: 2022P

Forecast Period: 2023F–2027F

Companies Covered:

Payments and Currency Exchange-

stc pay

Tweeq

CLICK PAY

geidea

NearPay

neo leap

Surepay

PayTabs

FOODICS

noon payments

CASHIN

HYPER PAY

Lending and finances-

Tamara

tabby

tamam

FORUS

Lendo

Private Fundraising-

FALCOM TOJÁ

Buthoor

OSOOL & BAKHEET FUND

Manafa

Business Tools & Information Provision-

Foodics

Flexxpay

Penny

wosul

Payment System Operators –

Visa

Apple pay

American Express

Google pay

Key Topics Covered in the Report

Executive Summary

Global Fintech Market Overview

MENA Fintech Market Overview

Overview of KSA Fintech Industry (Number of Fintechs and Fintech Ecosystem Enterprise Value, 2022)

Market Size of KSA Fintech Market on the basis of GTV and Volume of Transactions, 2022

Market Size of different Service Verticals of KSA Fintech Market on the basis of Volume of Transactions, 2022

Market Segmentation (by service vertical, by region, by Company Stage and Investment Stage)

Industry analysis

SWOT Analysis of KSA Fintech Market

Growth Drivers of KSA Fintech Market

Trends and Developments in KSA Fintech Market

Value Chain Analysis

Market Segmentations; Competition; Future Market Size, 2027)

Competition Landscspe

Future Trends and the Way Forward

Analyst Recommendations

Case study

Covid impact

Research methodology

For More Insights On Market Intelligence, Refer to the Link Below: –

KSA Fintech Market: Ken Research

Related Reports by Ken Research: –

KSA Personal Finance Market Outlook to 2026F

UAE Auto Finance Market Outlook to 2026F

0 notes

Text

additiv opens a new office in Dubai and commits to the Middle East

Niraj Naetsawan, new General Manager, Middle East at additive reaffirms his commitment to expand in the region. The main priorities include the continued implementation of the company’s finance-as-a-service strategy and expansion in the UAE, KSA, Qatar and other Middle East markets. Dubai, UAE, 28 March 2024 – Serving the ME region since 2020, additiv, a global leader in Fintech and embedded…

0 notes

Text

How Foreign Entrepreneurs Can Launch Startups in Saudi Arabia Using Accelerators

Introduction

Starting a business as a foreign entrepreneur in Saudi Arabia offers immense opportunities, especially with the support of government-backed initiatives aimed at diversifying the economy. Saudi Vision 2030 has opened the doors for innovation and foreign investment, making it easier for foreigners to establish startups.

One of the most effective ways to navigate the complexities of setting up a business in the Kingdom is by leveraging startup accelerators. These accelerators provide a structured pathway, equipping foreign startups with the tools and mentorship they need to succeed in Saudi Arabia's evolving business landscape. This article outlines the steps involved in starting a business as a foreigner in KSA, focusing on the role of accelerators in providing resources, mentorship, and networking opportunities.

The Saudi Startup Ecosystem

The Kingdom's startup ecosystem is growing rapidly, with increased support for entrepreneurship through programs, funding initiatives, and incubators. The government, along with private sector stakeholders, has been actively fostering innovation hubs that cater to both local and international startups. This ecosystem is designed to encourage technology-driven businesses, particularly in areas like artificial intelligence, fintech, e-commerce, and clean energy.

KSA offers significant opportunities for foreign entrepreneurs to tap into this growing ecosystem. However, it is essential to carefully navigate the legal and cultural landscape, which is where startup accelerators come into play.

Leveraging Saudi Startup Accelerators

Startup accelerators are critical in helping foreign entrepreneurs set up their businesses in Saudi Arabia. These programs provide essential support for entrepreneurs who need to become more familiar with the local market and regulatory requirements.

Accelerators offer several key advantages:

Mentorship and Guidance: Accelerators in KSA provide access to a network of experienced mentors who deeply understand the Saudi market. This guidance helps entrepreneurs navigate the complexities of business setup, including legal requirements, market entry strategies, and hiring local talent.

Funding and Investment Opportunities: Many accelerators are backed by government or private sector funding. They often help connect startups with investors, providing much-needed capital for business expansion.

Regulatory Support: One of the biggest challenges for foreign entrepreneurs is understanding the regulatory framework in Saudi Arabia. Accelerators work closely with local authorities and can assist in securing the necessary licenses and permits to operate legally in the Kingdom.

Networking: Accelerators offer unparalleled networking opportunities, connecting foreign entrepreneurs with local business leaders, potential partners, and customers. This network can prove invaluable for understanding market needs and expanding a startup's reach.

Some notable startup accelerators in Saudi Arabia include Wa'ed, Flat6Labs, and BADIR, which offer programs tailored to various industries and sectors. These programs help bridge the gap between international entrepreneurship and local market integration.

Key Steps to Set Up a Business as a Foreigner in Saudi Arabia

Foreign entrepreneurs looking to establish a business in Saudi Arabia should follow these steps:

Obtain a Foreign Investment License: The first step is to apply for a foreign investment license from the Ministry of Investment Saudi Arabia (MISA). This allows foreign entities to operate legally within the Kingdom.

Select the Right Business Structure: Depending on your needs, you can choose from several legal structures, including Limited Liability Companies (LLC), branches of foreign companies, or sole proprietorships. An LLC is often the preferred choice for foreigners.

Register with the Ministry of Commerce: After choosing the appropriate business structure, you must register your company with the Ministry of Commerce and obtain a Commercial Registration (CR).

Comply with Saudization: Foreign businesses must comply with the Saudization (Nitaqat) policies, which require companies to employ a certain percentage of Saudi nationals. Startup accelerators can help you navigate this process.

Taxation and VAT Registration: Businesses in Saudi Arabia need to register for VAT if their annual revenue exceeds SAR 375,000. Understanding tax regulations early on can save your business time and penalties later.

Conclusion

Starting a business as a foreign entrepreneur in Saudi Arabia is becoming increasingly accessible, especially with the support of startup accelerators. These programs provide guidance and mentorship and offer crucial funding and networking opportunities that can significantly reduce the challenges of entering a new market. Accelerators act as a bridge for those unfamiliar with local business practices, helping foreign startups integrate smoothly into the Saudi business ecosystem. To ensure a seamless business setup in KSA, foreign entrepreneurs can rely on expert assistance from companies like Helpline Group, which offers comprehensive support in business consultation, registration, and legal compliance. With the proper guidance, foreign entrepreneurs can successfully tap into Saudi Arabia's growing market and contribute to the nation's economic diversification goals.

0 notes

Text

How ISO 9001 Certification in Saudi Arabia is probable to trade in the destiny

ISO 9001 Certification in Saudi Arabia

Providing ISO 9001 Certification in Saudi Arabia, along with implementation, coaching, documentation, gap investigation, registration, audit, and template answers at a reasonable fee to all organizations seeking to qualify beneath the Good Quality Administration Process in Saudi Arabia or QMS Certification in Saudi Arabia, Factocert is the main ISO 9001 Specialist in Saudi Arabia. Riyadh, Dammam, Jeddah, Jubail, AL Khobar, Medina, Mecca, Jazan, Tabuk, Buraidah, and other important metropolitan areas in Saudi Arabia.

What ways can Saudi Arabian companies enhance their assure of go back on funding with ISO 9001 Certification?The KSA is a developed territory in the Gulf vicinity. The capital of Riyadh is one of the maximum good sized cities inside the country.

In assessment, the results of industrialization may additionally have significantly elevated enhancements for the duration of the state in current years. Factocert gives ISO 9001 Certification in Saudi Arabia for an inexpensive fee to manipulate the fine control device interior their organization. Suppose you're searching out a way to control the Good Quality Administration Process (QMS) in Saudi Arabia. In that case, Factocert is the exceptional option in your enterprise to apply the ISO 9001 method in Saudi Arabia. Place: Industrialization and oil and fuel are the resources of the primary economy. Many buyers fund small groups inside the region due to the elevated revenue potentialities. At the moment, there's severe competition in each industry phase. Investors are by no means with out a ordinary uncertainty: Are my investments covered, and is there a warranty on my investments? Because of this cause, it's miles becoming greater tough for every particular organization to set up clients. Using ISO 9001 Certification in Saudi Arabia is a totally easy way to provide a guarantee for the investment to traders if you want assist attracting buyers.

Significance of ISO 9001 Certification in Saudi Arabia

> The assurance it offers to all clients who make financial investments in the business enterprise is one of the primary blessings of ISO 9001 Certification in Riyadh.

It is one of the minimum necessities to be eligible for any soft.

> Saudi Arabia's ISO 9001 Certification facilitates the organisation grow to be diagnosed as a producer in nearby and foreign markets, attracting more business from customers overseas.

> An ISO 9001 Certification in Dammam can help a agency in gaining habitual small commercial enterprise from modern-day customers, saving advertising and advertising costs and increasing revenue.

Organizations that provide IT layout, fashion, and development offerings include IT organizations; academic businesses; improvement providers; pharmaceutical businesses; trading agencies; producing companies; accounting, finance, and consulting corporations; fintech companies; logistics organizations; banking companies; oil and fuel companies; trying out and calibration businesses; clinical laboratory corporations; automobile companies; aerospace organizations; perception/non-income organizations; nutrients generating businesses; scientific manufacturing companies; IT groups; services market agencies; and widespread agencies.

ISO 9001 in Saudi Arabia Specifications:

As indicated in the segment above, the technical committee developed a method on documented info—a phrase regularly used interchangeably with files and information—to keep away from confusion regarding documents and information. Below is a short explanation of among the essential recorded records and statistics:

1. Document scope:

One of the maximum crucial documents for Riyadh's ISO 9001 certification is that this one, which desires to be effortlessly available as documented statistics. This is one of the vital files that have to be first recorded a good way to without a doubt understand the boundaries of your system, place, era, beneficial resources, and paintings which you intend to appoint the administration technique often. ISO 9001 certification in Riyadh provides a deeper expertise of the auditors on every segment 1 and stage 2 audit. In evaluation, ISO 9001 certification in Jeddah offers the team a clean belief of the boundaries they should operate. This scope document may become vital for an organizing level if Kuwait obtains ISO 9001 certification. It is considered that to make certain a manner to deliver effective benefits, failure during the organizing degree will usually take effort and time. This is why Al Khobar offers the first-rate techniques for acquiring ISO 9001 certification. As a zone, the established order of nice practices must be evaluated cautiously, and the involvement and selections made through the first-rate management are crucial in gaining a bonus over the norm.

2. Superior plan:

This is unquestionably one of the files that needs to consciousness on the development and pleasure of the consumer. The report need to be created and authorized via the very best level of management, according to Saudi Arabia's ISO 9001 Providers. The insurance will become obligatory as quickly as it is formally signed by pinnacle control or, to put it every other manner, widespread by way of the nice administration. This document is shared with inner parties just like the workforce, interns, internet site traffic, and external events like potentialities, stakeholders, Culture, regulatory bodies, certification our bodies, accreditation bodies, suppliers, and many extra. One of the first-rate ways to sign in for an ISO 9001 certification in Saudi Arabia is to observe the reputable internet site's guidelines and ship an e-mail to make the certification available for inner and external occasions. The top notch plan distinctive on the professional website could provide expert offerings in Saudi Arabia that meet the requirements of ISO 9001 certification registration.

3. Superior targets:

This has advanced into a essential record created by way of the satisfactory coverage, in keeping with ISO 9001 in Saudi Arabia. If the targets aren't met, they'll in all likelihood be considered a critical nonconformity. In Saudi Arabia, ISO 9001 registration offerings must be public based totally on easy, quantifiable, realistic, feasible, and time-particular examinations. The goal may be nearly applied within the organisation. Increasing the patron pride stage from 60% to eighty% in August 2018 is one of the high-quality examples of communicating or creating outstanding dreams, in step with Saudi Arabia's ISO 9001 Certification. Another instance from Saudi Arabia's ISO 9001 products and services is "to lessen the employee retention problem from 80 percent to fifty percentage why August 2018."

4. Method for provider analysis or verification:

Per the Saudi Arabian ISO 9001 audit, the business enterprise need to set up a suitable movement plan to become aware of, examine, and validate your dealer or supplier. The uncooked substances or companies out of your vendors are immediately reliable because of the superior first-rate of your awesome product or commercial enterprise. Ensuring which you audit your supplier's device on top notch benchmarks underneath ISO 9001 audit services and products in Saudi Arabia or essay marketplace greatest practices is essential. To study ISO 9001 in Saudi Arabia providers' techniques inside the route of proper fine management systems, if you want to impact customer delight, numerous organizations additionally pick out ISO 9001 certification bodies in Saudi Arabia to finish third-celebration audits on their providers' strategies. The price of ISO 9001 in Saudi Arabia is the capacity to audit their providers' specific area from one certification frame to some other utilising a 3rd-party certification body.

5. Evidence of calibration:

Saudi Arabian ISO 9001 consultants ought to ensure that the gadget applied in the performance surroundings is calibrated often. You have to keep documentation of all calibrations executed, subsidized by Saudi Arabian ISO 9001 experts. In positive verticals, which include the producing zone, calibration at everyday durations is crucial to accomplishing a hit results. It is generally most efficient to have a plan of action for calibration because it's miles one of the maximum industry-powerful techniques, or in step with ISO 9001 adviser offerings in Saudi Arabia.

6. Competency map/talent matrix:

Saudi Arabian ISO 9001 Consulting Companies need to ensure that the challenges and shortcomings in understanding and skillability are recorded. To ensure that the character or organization in fee of the control manner is geared up with the necessary know-how to improve their abilities or competency degree, it ought to be ensured that every one precise and bad strengths are recorded. As according to the ISO 9001 consultancy in Saudi Arabia, commands are a few of the assets that would boost performance.

7. Documented facts about mental homes:

Saudi Arabian ISO 9001 consulting offerings should assure that proof of highbrow belongings has been appropriately stated and recorded for recorded facts. Saudi Arabia's ISO 9001 Consulting Solutions ought to keep intellectual property safe. The value of Saudi Arabia's ISO 9001 Certification relies upon on the information and revel in of the representative or experts to enforce those nice practices.

8 Proof of the purchaser's house:

All purchaser attributes, along with designs, patents, emblems, engineering, and other assets, need to be made with the warranty that they may be included, consistent with ISO 9001 consulting in Saudi Arabia. In Saudi Arabia, ISO certification requires a sign-up technique and an ongoing technique handled at the customer's premises.

9. Modify management or alter manipulate:

Saudi Arabian ISO 9001 specialists ought to make sure that formal remedy of changed control is to be had. A number of the components, such as the identity of the improve proprietor, modification approval, and rollback technique, need to be documented via the Improve Administration Treatment. The Saudi Arabian ISO 9001 certification body need to assure that a selected enhanced management has been recorded for updating the recorded facts.

Please check in your certification necessities with us to gain extra facts approximately ISO 9001 in Saudi Arabia. This will permit us to help you examine extra approximately the documented data, which may be required primarily based on ongoing necessities.

Why did Saudi Arabia determine to certify Factocert as ISO-compliant?

Our Saudi Arabian specialists for ISO 9001 Certification typically carry out admirably. Because every gadget head's name is mechanically represented, the commercial enterprise can preserve even though they had been to go away. In a method diagram, movements have yet to begin to finish in this manner.

Riyadh, Jeddah, Dammam, Al Khobar, Dhahran, Buraidah, Al-Ahsa, Qatif, Jubail, and different primary towns offer green ISO 9001 consulting offerings. Additional ISO 9001 standards, application training, audit registration, ISO 22000, 17025, and 45001 are provided. The items comply with all ISO regulations, along with ISO 14001 and ISO 27001.

ISO 9001 help could encourage financial boom in Saudi Arabia. For the certification charge, we're presently supplying you with a free quote.

Visit for greater data: ISO 9001 Certification in Saudi Arabia.

Related links:

ISO Certification in Saudi Arabia

ISO 14001 Certification in Saudi Arabia

ISO 27001 Certification in Saudi Arabia

ISO 45001 Certification in Saudi Arabia

ISO 22000 Certification in Saudi Arabia

ISO 13485 Certification in Saudi Arabia

HALAL Certification in Saudi Arabia

CE Mark Certification in Saudi Arabia

ISO 9001 Certification in Saudi Arabia

0 notes

Text

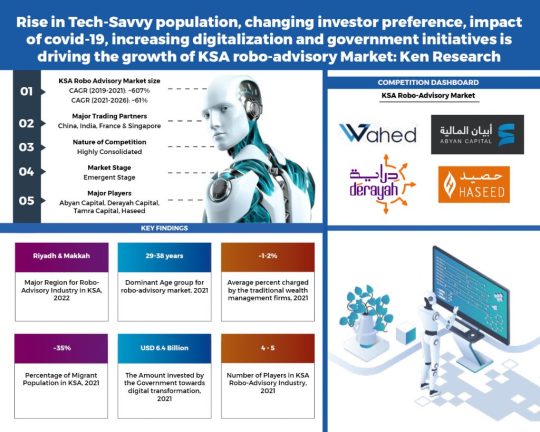

KSA Robo-Advisory Market is expected to grow 5x, generating USD ~3.5Bn by 2026F owning to rising digital transformation, emergence of new players and Government Initiatives: Ken Research

Buy Now

Robo-Advisors provides a low-cost alternative to traditional investing, eliminating the human labor, lower overheads with little-to-no minimum investments required making it an attractive market for investors.

With advent of new technology, better algorithms, better user-experience, millennial & Gen-Z adaptation of newer technology, Robo-Advisory market is expected to grow in future.

Banks are expected to take the lead in robo-advisory industry, banks would do well due to cost-effectiveness, trust, ease of movement of money, captive base & larger credibility to give their customer an easy, simple and much better experience.

Government Initiatives: The government is developing regulations to ensure a business environment that fosters both investor confidence and prudent risk management by regulated entities. Financial Sector Development Program, one of the 12 executive programs has been launched by government which is consolidated from Vision 2030, whose goal is to diversify the financial sector and to make it more efficient in order to enable financial institutions to support the private sector. Saudi Arabian Monetary Authority (SAMA) and Capital Market Authority (CMA) unveiled the FinTech Saudi project in April 2018, in accordance with the Saudi Arabia’s Vision 2030 to encourage entrepreneurship and develop financial technology (FinTech) infrastructure.

Emergence of New Players: Recently, KSA based Investment Advisory Firm Sarwa acquires a temporary or experimental Fintech license from Saudi’s Capital Markets Authority (CMA). The fin-tech startup offers customers an easy way to invest their savings in various low-cost index funds. Another example is of Derayah Capitals which becomes the first bank in the region to launch a Robo-Advisory Investment App, Derayah Smart. This idea came from the interest of the Financial Sector Development Program and Vision 2030 in savings and investment.

Digital Transformation: KSA is racing towards digital transformation, supporting tech innovation and entrepreneurship. The Kingdom is pouring hundreds of billions of dollars into an economic transformation, known as Vision 2030. Recently, Crown Prince Mohammed bin Salman, launched investments worth $6.4 billion in building the future technologies.

Analysts at Ken Research in their latest publication “KSA Robo-Advisory in Wealth Management Market Outlook to 2026F- Driven by influx of AI technology along with growing demand for financial inclusion and affordability in financial planning” by Ken Research observed that KSA Robo Advisory market is in the nascent phase. The With Digital Transformation, Emergence of New Players, Minimal investment and Government Initiatives, are some of the factors that will contribute to the KSA robo-advisory market growth. It is expected that KSA robo-advisory market will grow at a CAGR of ~52% for the 2022-2026F forecasted period.

Key Segments Covered: -

KSA Robo Advisory Market

By Type (by Revenue), 2022 & 2026F

Hybrid Robo Advisors

Pure Robo Advisors

By End-User (by Revenue), 2022 & 2026F

Retail Investor

High Net Worth Individuals

By Age-group (by Revenue), 2022 & 2026F

19-28 years

29-38 years

39-45 years

45+ years

To learn more about this report Download a Free Sample Report

By Region (by Revenue), 2022 & 2026F

Riyadh

Makkah

Eastern Region

Others

Key Target Audience: -

Government and Institutions

New Market Entrants

Investors

Wealth Management Companies

Robo-Advisory Companies

Investment Banks

Investors

Time Period Captured in the Report: -

Historical Period: 2019-2021

Base Year: 2022

Forecast Period: 2022 – 2026F

Visit this Link :- Request for Custom Report

Companies Covered: -

Abyan Capital

Derayah Capital

Tamra Capital

Haseed

Key Topics Covered in the Report: -

KSA Country Overview

KSA Population Analysis

KSA Wealth Management Market Overview

Ecosystem of KSA Robo-Advisory in Wealth Management Market

Timeline of Major Players in KSA Robo-Advisory in Wealth Management Market

Business Cycle and Genesis of KSA Robo-Advisory in Wealth Management Market

Value Chain Analysis/ Existing Business Model

KSA Robo-Advisory in Wealth Management Market Size

KSA Robo-Advisory in Wealth Management Market Segmentation by Type and End User, 2022

KSA Robo-Advisory in Wealth Management Market Segmentation by Region, 2022

End User Profiling by Age of Customer, 2022

Decision Making Parameters of End Users in KSA Robo-Advisory in Wealth Management Market

Customer Pain Points in KSA Robo-Advisory in Wealth Management Market

Key Factors Influencing Robo-Advisory Services Purchasing Decisions and Cost Components

Porter’s Five Forces Analysis of KSA Robo-Advisory in Wealth Management Market

Growth Drivers of KSA Robo-Advisory in Wealth Management Market

Trends and Developments in KSA Robo-Advisory in Wealth Management Market

Issues and Challenges in KSA Robo-Advisory in Wealth Management Market

Government Rules and Regulations in KSA Robo Advisory in Wealth Management Market

Covid-19 Impact on KSA Robo Advisory in Wealth Management Market

Competition scenario of key players based on Revenue, 2022

Cross Comparison of Major Players in KSA Robo-Advisory in Wealth Management Market

Outlook and Future Projections for KSA Robo-Advisory in Wealth Management Market

Analyst Recommendations

For more insights on the market intelligence, refer to below link: -

KSA Robo-Advisory in Wealth Management Market

Related Reports by Ken Research: -

UAE Robo-Advisory in Wealth Management Industry Outlook to 2027: Driven by influx of AI technology along with growing demand for financial inclusion and affordability in financial planning

Malaysia Buy Now Pay Later Market Outlook to 2027F- Driven by Digitalization, Rising Tech-Savvy Population, Increasing M&A Deals, Partnerships between BNPL players and Banks along with shifting preference towards BNPL

Australia Remittance Market Outlook to 2027F- By International Remittance Flow Corridor (Inbound and Outbound Countries and Point of Contact), By Domestic Remittance Flow Corridor (Urban to Rural, Urban to Urban, and others)

France Remittance Market Outlook to 2027- By Inbound & Outbound Remittance, By Channels (Banks, MTOs, M-wallets and Others), By Inflow & Outflow Remittance Corridors, By Point of Contact (Branch Pick-up, Mobile Payment & Online Transactions, Prepaid Cards)

0 notes

Text

History & Heritage of Saudi Arabia || تاريخ وتراث المملكة العربية السعودية

#saudi arabia#history#heritage#ksa#entrepreneur#fintech#business#finance#cryptocurrency#investing#stock market#technology#vision2030

4 notes

·

View notes

Photo

#Entrepreneur #MiddleEast's annual leadership issue is here! Featuring @eliekhouridxb, CEO of Omnicom Media Group MENA on the cover this month with his #leadership style to pioneering #marketing services in the region. Our #leaders section focuses on #MENA's executive leaders on their industry-specific tactics and stratigies. Also, an in-depth section on noteworthy #F&B brands in the sector. Plus, strategies to find the right hires, changes in #corporatecommunication in the #socialmedia era, #startup stories of @FittPass, WaystoCap, and much more. . Tap on the image to see some of the #entrepreneurs and enterprises featured. Read and download for free on our website! . #MENAstartups #hospitality #culinary #funding #MENA #GCC #SMEs #business #tech #fintech #socent #UAE #Dubai #Bahrain #KSA #SaudiArabia #Oman #Lebanon #Jordan #Morocco

#business#jordan#culinary#leaders#entrepreneurs#fintech#leadership#marketing#oman#corporatecommunication#smes#funding#startup#menastartups#uae#f#bahrain#socialmedia#middleeast#saudiarabia#gcc#entrepreneur#lebanon#socent#hospitality#mena#ksa#tech#dubai#morocco

4 notes

·

View notes

Text

Omantel net profit rises 20 per cent to RO77.7 million, Al Murshidi elected as Chairman

Oman Telecommunications Company (Omantel) held its first two e- extraordinary and ordinary general assembly meetings in line with the decisions of the Supreme Committee Tasked With Handling the Developments Of Coronavirus (Covid-19) Pandemic and the directives of the Capital Market Authority. As per these instructions, public joint stock companies were asked to hold their annual general assemblies remotely as per the guidelines set by CMA.

The extraordinary general assembly of the company, which was held on May 10, 2020, was chaired by His Excellency Abdul Salam Al Murshidi, Chairman of the Board of Directors in the presence of board members, external auditors of the company, the legal advisor, the observer of the Capital Market Authority and the Shareholders. The meeting approved the amendments made to the company’s articles of association (MoA) to ensure compliance with the Commercial Companies Law issued by Royal Decree No. 18/2019. According to the new amendments, all members of the Board of Directors are elected by the general assembly of the company.

The extraordinary meeting was followed by the annual ordinary general assembly meeting which took note of the Company’s decision to distribute cash dividends to registered shareholders as of March 26, 2020 (55 Baisas per share), based on the Capital Market Authority ‘s circular No. 4/202 dated March 18, 2020. The ordinary general assembly also approved the company’s financial results for 2019 and approved the amount allocated for the community support for 2020.

The general assembly also elected by secret ballot 9 members (from the shareholders and others) for the new term namely HE Abdul Salam Al Murshidi, Saud Al Nahari, Khaled Al Khalili, Ayman Al Hosni, Sayyid Zaki Al Busaidi, Matar Al Mamari, Mulham Al-Jarf, Atef Al Siyabi, and Muslim Al-Barami. The new board held its first meeting and elected HE Abdul Salam bin Mohammed Al Murshidi as Chairman and Saud Bin Ahmed Al Nahari as the Vice Chairman. The BoD sub committees were also formed and their members were elected.

Commenting on the meeting, Abdul Salam bin Mohammed Al Murshidi, Chairman of Omantel Board of Directors, said, “The Group continued its good financial performance during 2019 despite the challenges that faced the sector, especially in the local market.” “Zain operations continued to contribute to the growth of Omantel Group business and to make off the weak growth in the local market. Zain Group operations grew by 25% on an annual basis. This remarkable growth is attributed to the full consolidation of Zain KSA results in the Group in 2019 (the results of Zain KSA were consolidated for only 6 months during 2018),” he added.

“Omantel’s acquisition of a strategic stake in the Zain Mobile Group contributed to raising the revenues and profits of Omantel Group and as a result of this acquisition, the third largest mobile operator in the MENA region was created. The acquisition provided opportunities for synergies between the two companies, enhanced the ability to compete more effectively in the market and helped in addressing the risks of operating in a single market”, he concluded.

On his part, Talal bin Said Al Mamari, CEO of Omantel, said, “Omantel continued its growth trajectory despite the challenges that the sector witnessed in general. Omantel Group total revenues (including Zain Group’s operations) grew by 18.6% reaching RO 2592 million compared to RO 2186 million last year. Earnings before interest, tax and depreciation and amortization grew by 28% from R.O 855 million to R.O 1098 million. Omantel Group net profit (before non-controlling interests) grew by 43.5% to RO 299.7 million compared to RO 208.8 million during 2018. The net profit (after non-controlling interests) increased by 19.9% to RO 77.7 million, compared to RO 64.8 million in 2018.

“During 2019, we implemented several initiatives to overcome the challenges that faced the sector and take advantage of available opportunities to ensure sustainability of Omantel business. We further capitalized on available synergy opportunities between Omantel and Zain, especially in areas such as wholesale, enterprise and digital services as well as enhancement of customer experience, he added.

Commenting on the networks, Al Mamari pointed out that Omantel launched the first 5G network in the Sultanate in December 2019 to keep pace with the latest global technology advancements. The move is expected to pave the way for the introduction of many technologies related to the fourth industrial revolution such as the Internet of Things, artificial intelligence and Fintech solutions. Omantel continued its local network expansion plan and strengthening its international connectivity benefitting from the unique geographical location of the Sultanate and the significant investments made by the company during the past period in building a robust submarine cables network linking the whole globe through the Sultanate”.

As for the company’s social responsibility, Talal Al Mamari said: “Omantel CSR strategy focuses on building partnerships and launching initiatives aimed at improving the standards of living of the targeted groups. Omantel CSR initiatives also facilitates digital transformation by supporting important sectors such as education and health in addition to supporting entrepreneurship,SMEs and promoting positive attitude towards environment and HSE”.

“Omantel has launched several initiatives in cooperation with partners from government and civil society institutions to maximize the impact of its CSR initiatives on the targeted groups and society in general. The number of beneficiaries from Omantel social initiatives during 2019 stood at about 122,613, he continued.

“In 2019, Omantel managed to achieve the sustainability goals that were set as part of Omantel Sustainability Framework in 2014 to be achieved in 2020. Omantel has invested more than RO 10 million in sustainability-related initiatives in addition to reaching 95% broadband coverage at speeds of not less than 10 Mbps – a year before the target date, he concluded.

Omantel’s domestic operations include fixed services, mobile services and Omantel International, Omantel’s wholesale business arm, which is active in voice hubbing services in addition to Omantel subsidiaries (Oman Data Park and the Internet of Things Company “Momkin”). Omantel domestic operations revenues grew by 1.5% in 2019. The revenues increased from RO 544.0 million in 2018 to RO 554.3 million in 2019.

The annual general assembly of Omantel has also approved the remaining items on the agenda, including allocating RO 500,000 for community support initiatives in 2020, appointing the auditor for the fiscal year that ends December 31, 2020, determining their fees and approving the remuneration of the Board of Directors for the fiscal year ended on December 31, 2019.

The post Omantel net profit rises 20 per cent to RO77.7 million, Al Murshidi elected as Chairman appeared first on Businessliveme.com.

from WordPress https://ift.tt/3fCpkrZ via IFTTT

0 notes

Text

Innovation Unleashed: A Probing Look at the KSA Fintech Sector's Growth Trajectory

Uncover the untapped potential of the KSA Fintech Sector with our in-depth analysis extending to 2027. From disruptive innovations to regulatory frameworks, we explore the factors propelling growth and the strategic considerations for businesses aiming to thrive in this evolving landscape.

0 notes

Text

Technical Product Owner

Technical Product Owner Company Our client is a fintech start up committed to empowering people and businesses to use electronic payment services to digitize KSA’s economy. They are currently looking to recruit a Technical Product Owner to be based in Riyadh. Duties amp Responsibilities • We are looking for an experience product owner whom can oversee the existing payment problems and think about how to solve it. • This Product owner will be responsible on a complete vertical of the Products. Issuer Acquiring or Vertical solutions depends on your previous experience. • Market Research and Gap Analysis for all our Existing solutions. • Build a product roadmap for the Vertical or follow the pre defined roadmap • Communicate with end customer to validate the problems and the solution acceptance • Build and create business requirements and pass it over to Product Manager to start building the solution. • Create a low fidelity diagram and manage the complete user flows with both designers and product managers. • Be responsible for building and maintain the product backlog and present the updates on a weekly base for the CPO. • Build the user scenarios and acceptance tests for Product Managers Qualifications amp Experience • 3 5 Years of experience in building payment solution either in a or Financial institutions or a bank. • 3 5 years of experience in Fintech • Technical Background Computer Science or Engineering Background as this job will require a communication with R amp D and product Managers. • Solid Understanding on the Payment flows Schemes Settlement Gateway etc.. • Deep knowledge on UML Notations User Scenarios User acceptance. • Focus on delivery of customer value. • Strong team player be able to coordinate between different departments and different stakeholders. • Self Starter with a can do attitude. • English Arabic Speaker. • Ability to adapt and embrace changes with positive attitude. • Knowledge on E Wallet Card issuance or Merchant Acquiring businesses is a big advantage • Someone who can put the customer first while thinking and designing the payment solutions * راتب مجزي جداً. * مكافأت و حوافز متنوعة. * توفير سكن مؤثث أو بدل سكن. * أنتقالات أو توفير بدل عنها. * توفير تذاكر السفر لمن يشغل الوظيفة و عائلته. * نسبة من الأرباح الربع سنوية. * أجازات سنوية مدفوعة الراتب بالكامل. * مسار وظيفي واضح للترقيات. * بيئة عمل محفزة و مناسبة لحالة الموظف. * تأمين طبي للموظيف و عائلته. * تأمينات أجتماعية. التقدم و التواصل مباشرة دون و سطاء عند توافر الألتزام و الجدية التامة و المؤهلات المطلوبة علي: [email protected]

0 notes

Text

Media Advertising In Dubai | UAE Jobs | Dubai Startup And SMB Summit 2019

Media Advertising In Dubai | UAE Jobs | Dubai Startup And SMB Summit 2019

Venue: JW Mariott Marquis, Sheikh Zayad RoadDate: Wednesday, October 2, 2019 - 08:00Phone:+971 50 991 9081Website: https://www.eventbrite.com/e/dubai-startup-and-smb-summit-2019-tickets-52432437833Address: Sheikh Zayad Road Dubai United Arab Emirate

Description:What is the 'Startup and SMB Summit'The Startup and SMB Summit is a global series of events catered to startups, small and medium businesses world over. After several successful editions across EMEA, we are glad to be conducting our 2nd season of the Dubai Startup and SMB Summit, in Dubai, UAE!

UAE jobs

the Dubai Startup and SMB Summit 2019The 2nd season of the Dubai Startup and SMB Summit will observe the meeting of over 500 C-level executives and key decision makers from Startup, Small and Medium Businesses across Dubai, the UAE, and other parts of the Middle East.

The central focus of the event would be on providing a platform for dialogue and discussion regarding the Middle East market and discussing trends around the central theme of 'Sustainable Innovation'.Join 500+ delegates from over 300 companies across UAE, KSA, Oman, Bahrain, and other parts of the Middle East.

About our previous editionOur previous edition, held on the 12th of September 2018, received media coverage from the likes of Khaleej Times, Emirates 24/7, Time Out Dubai, Dubai Forum, Women, and several our prominent outlets. This season shall be no less prominent.

Daily News in Dubai

and featured corporate participants included Microsoft, Salesforce, IBM, Noor Bank, Mashreq Bank, Standard Chartered Bank, Virtuzone, The Box, and Sony Entertainment, amongst, several other prominent regional and international brands.Who should attend the Dubai Startup and SMB Summit- Small and Medium Business-owners- Startup Owners- Entrepreneurs & Founders- Angel Investors and Venture Capitalist Firms- SMB/ SME/ Mid-Market Executives & Owners- Business and Entrepreneurship Students- Startup Consultants and Mentors

Central Themes- Market Trends in the UAE, and the Middle East Region- Sustainable Innovation- The Middle East's diversification from an oil-dependent economy to pioneering the future of Sustainable technology- Startup & Entrepreneurship (Ideas, Strategy, Fundraising, and more)- Key Technology shifts in the Market (Blockchain, Fintech, IoT, Cloud Computing, Artificial Intelligence (AI), MarTech, Health Tech, and how they are changing the business landscape)- How Expo 2020 in Dubai, is fuelling the Economy- Detailed tracks and keynotes on all topics

-----------------------------------------------Want to get your brand seen by over 500 business owners and key decision makers? Contact us today, for sponsorship and exhibitor opportunities. ([email protected]/ +971 50 991 9081)-----------------------------------------------

Agenda of Keynotes for the Day:The following is the final agenda of keynote sessions for the day;

Main Keynotes for the Day:To be announced soon

Main Panel Discussions for the Day:To be announced soon

Contact UsSponsorships/ Exhibiting opportunitiesGet your brand seen by the right people. Promote your brand at the Dubai Startup and SMB Summit 2019. Contact us at [email protected]

SpeakersWe are looking for speakers just like you. Speak at the Dubai Startup and SMB Summit 2019, and project yourself in front of the right audience. Contact us at [email protected]

Ticketing Enquiries

Media Advertising in Dubai

ticketing enquiries, please reach out to us at [email protected]

FAQsWhat are my transportation/parking options for getting to and from the event?Free valet and self-parking are available at the venue.How can I contact the organizer with any questions?For speaking and sponsorship enquiries, please contact [email protected] / +971 50 991 9081For ticketing enquiries please contact [email protected] it ok if the name on my ticket or registration doesn't match the person who attends?The name on the ticket must match that of the attendee.

#UAE_News,

#UAE_Business_Directory,

#Dubai_jobs,

#Dubai_Vacancies,

#Media_Advertising_in_Dubai,

#Business_Interviews_Dubai,

#Business_in_Dubai,

#EXPO_2020_in_Dubai,

#Dubai_EXPO_NEWS,

#Dubai_Directory,

#Business_Directory_in_Dubai,

#Awards_Dubai,

#Online_Jobs_Dubai,

#Government_Jobs_in_Dubai,

#Media_Marketing_Dubai,

#Digital_Media_Dubai,

#Online_Media_in_Dubai,

#Daily_News_in_Dubai

0 notes

Text

Thriving in Saudi Arabia: Opportunities and Challenges for Aspiring Entrepreneurs

Introduction

Saudi Arabia is experiencing a transformative economic landscape shift driven by Vision 2030—a government-led initiative to diversify the economy and reduce reliance on oil revenues. This shift has opened up many opportunities for entrepreneurs, especially those interested in technology, renewable energy, tourism, and e-commerce. The Kingdom is actively encouraging foreign and local investment, and various reforms have simplified the process of setting up a business.Despite these positive developments, however, entrepreneurs must be aware of the challenges they may encounter, from navigating regulatory procedures to understanding local market dynamics.

This article will explore the key opportunities and challenges entrepreneurs face in Saudi Arabia, providing insights into the business setup process and the importance of expert guidance to register and operate a new venture in the KSA successfully.

Saudi Arabia's Entrepreneurial Landscape: Key Obstacles and Growth Potential

Saudi Arabia's business environment offers opportunities and challenges that are particularly significant for entrepreneurs looking to establish new ventures in the Kingdom.

Opportunities

Government support through initiatives like Vision 2030, MISA, and Monsha'at.

Through various government programs, startups can access funding, mentorship, and training programs.

Growing demand for technology-driven solutions in e-commerce, fintech, and AI sectors.

Expanding market in renewable energy, tourism, and entertainment.

A large and youthful population that is tech-savvy and open to new products and services.

Significant investment in infrastructure and digitalization.

Challenges

Navigating a complex regulatory environment for business registration and licensing.

Understanding and complying with local legal requirements, including ownership structures and tax obligations.

Building relationships and trust within Saudi Arabia's relationship-oriented business culture.

Adapting to local cultural preferences in marketing and product offerings.

Meeting Saudization requirements for hiring Saudi nationals.

Competition in popular sectors and the need for market differentiation.

The Business Setup Process in Saudi Arabia

Entrepreneurs looking to establish a business in Saudi Arabia will find that setting up and registering a company is relatively straightforward, thanks to the government's recent reforms. However, it is essential to follow each step meticulously to ensure compliance.

Choosing a Business Structure: The first step is selecting a suitable business structure. Standard options include a Limited Liability Company (LLC), Joint Stock Company, and Sole Proprietorship. Each structure has its requirements in terms of capital, ownership, and liability.

Registering the Business: Entrepreneurs must first obtain an Investment License from MISA to register a business in Saudi Arabia, mainly if foreign ownership is involved. The following steps include registering the company name, preparing the Articles of Association, and opening a local bank account. These procedures require submitting various documents and paying relevant fees.

Obtaining Necessary Permits and Licenses: Additional licenses from specific government agencies may be required depending on the business activity. For example, health permits are necessary for food-related businesses, while manufacturing companies need environmental approvals.

Hiring and Compliance: Finally, businesses must adhere to Saudization requirements, which mandate hiring a certain percentage of Saudi nationals. Following these regulations is crucial for smooth operations.

Conclusion

Saudi Arabia presents a compelling environment for entrepreneurs, offering substantial opportunities in emerging sectors. However, aspiring business owners must be prepared to overcome challenges associated with regulatory requirements and cultural adaptation. Navigating the process of business setup and registration in the KSA requires careful planning and a thorough understanding of the local market. To succeed, partnering with experienced professionals can make a significant difference. Rely on the Helpline Group for expert assistance in business registration and setup, helping you easily navigate the Saudi market's complexities. Their knowledge and support can be invaluable as you embark on your entrepreneurial journey in Saudi Arabia.

0 notes

Text

Here’s Why Ripple Inc Must Engage with Central Banks

New Post has been published on http://bitcoingape.com/heres-why-ripple-inc-must-engage-with-central-banks/

Here’s Why Ripple Inc Must Engage with Central Banks

Ripple (XRP) price action has not been as buoyant as that of most other altcoins or Bitcoin (BTC) for example. Despite the divergence, XRP started 2019 on a bullish note but its less than stellar performance at the moment is beginning to raise some skepticism with many in the crypto-sphere wondering about the coin’s future.

#xrpcommmunity Even with large potential losses at the moment. I am keeping the faith and buying more Xrp. I am disappointed though in David Schwartz, selling some of his stack "de-risking strategy". As many not so well off Xrp followers are in their own way, Risking More.

— Mark Bell (@Mark_7Bells) April 24, 2019

Ripple’s goal is to disrupt the legacy financial institution’s dealings and take over from SWIFT with its faster and more efficient blockchain based technology. Ripple’s Global Head of Infrastructure Innovation Dilip Dao, has been at the forefront of introducing Ripple’s novel system to central banks and other financial sectors around the world.

Ripple in Vienna

Dilip will be in Vienna, Austria to take part in the World Bank Fintech Conference on May 22 to 23rd. Hosted by the Vienna Financial Sector Advisory Center, Dilip plans to converse with the global banking industry on fintech and its operational lending arm. There, he will most possibly assist more financial institutions to adopt Ripple’s DLT, since he has become very adept at selling Ripple’s products to many a bank, including central banks.

But, if anything, this is a strategic move to focus to on central banks because as a Ripple supporter, BankXRP, rightfully tweets “central banks are both regulators of their financial ecosystem. But they also operate the payment system in their own country. They can be a catalyst for innovation“.

Why is #Ripple engaging with central banks around the world.

Central banks are both regulators of their financial eco system. But they also operate the payment system in their own country. They can be catalyst for innovation

Dilip Rao Get central banks feet wet in DLT Crypto pic.twitter.com/gWcQcyAduA

— 𝗕𝗮𝗻𝗸 𝑿𝑹𝑷 (@BankXRP) May 6, 2019

Already, Ripple has a partnership with the Saudi Arabian Monetary Authority (SAMA) where the central bank is tasked with promoting the technology in the Middle East. In fact, the decision by SABB to shift to xCurrent use could be attributed to this fruitful deal.

The necessity of Distributed Ledger Technology

If every bank tow and migrate to an efficient network, then they would save close to $400 million annually since as per World Bank figures older technology charge around 7.1 per transaction. Besides the cost benefits, Ripple’s platform can significantly speed up and lower these costs. Regardless, SAMA is explicit saying they “support innovation in the field of digital payments by encouraging local banks to use the latest technologies and methods in this field.”

The signed agreement, however, did not require any of the institutions using Ripple’s products to purchase or deal with its currency, XRP. All the same, the KSA main regulator through its Head of Innovation Mohsen Al Zahrani, insist that they “will still work with Ripple to educate and encourage commercial banks to use their technology.”

In the Middle East, Ripple has, however, become a staple for cross border transactions and Saudi’s largest Islamic bank Al-Rajhi, is on RippleNet. Earlier, Dilip Intimated that with Dubai as its base in the region, Ripple is going to spread its tentacles the broader Asian banking market as it expands.

The post Here’s Why Ripple Inc Must Engage with Central Banks appeared first on Ethereum World News.

Source link

0 notes

Text

Blockchain revolution rolls on despite cryptocurrency crash

Blockchain revolution rolls on despite cryptocurrency crash

LONDON: It was the year cryptocurrencies fell to earth — the crash has been so severe that parallels have been drawn with the dotcom bust at the turn of the millennium. Bitcoin is down 80 percent from just under $20,000 12 months ago to about $3,500 in December. Similar falls have been recorded by other cryptos such as ethereum. The reasons for the bust are well rehearsed: Increased regulatory oversight, especially from the US and China, the emergence of scams linked to a proliferation of cryptocurrencies launched via initial coin offerings (ICOs), and disagreements among cryptocurrency’s developers about how to update the underlying software. But interviewees told Arab News that the market would recover and that, just as the dotcom boom went on to produce Amazon, so the world of cryptocurrencies shouldn’t be written off. Dubai-based entrepreneur and investor, Najam Kidwai, a board-adviser to Fusion.org, a not-for-profit foundation that aims to develop blockchain infrastructure for cryptofinance, told Arab News that all innovations needed time to mature and cryptocurrencies were no different. He added: “Change needs to be regulated, but if you are doing everything above board, new technology should enhance the user experience, that’s the idea of technology — to make life easier.” In the interim, he predicted, institutional money will flow into “the crypto space,” even as retail investors take fright. Banks and hedge funds had been looking at cryptocurrencies, and building risk and compliance infrastructure to support trading, he said. Chris Beauchamp, senior market analyst at London-based IG Group told Arab News: “They (cryptocurrencies) aren’t doomed, they’re just not going to change the world overnight. Bitcoin still has the heft to remain part of the financial world, but others will probably fade or evolve over time, like the airlines and car firms of old.” Despite the cryptocurrency crash, most observers agree that blockchain, the technology that underpins the new tokens, will continue to spur public and private investment, and perhaps nowhere more so than in the Gulf. Here, there have been some major developments in 2018. Abu Dhabi-headquartered Al Hilal Bank has carried out a blockchain-based transaction for an Islamic bond worth $500 million; Abu Dhabi National Oil Company (ADNOC) is collaborating with IBM to pilot a blockchain supply chain system; and KSA’s central bank has signed an agreement with US fintech company Ripple to run a pilot project to help banks settle payments using blockchain. Kidwai said: “Cities like Dubai have bet very heavily on blockchain. A lot of proof of concept work is going on as Dubai wants paperless government, so there is an initiative here called Smart Dubai, driven by the ruler of Dubai. There is a desire for transparency and speed in government.” At its heart, blockchain is a relatively straightforward concept. It’s a ledger of blocks of information, such as transactions or agreements, that are stored across a network of computers. This information is stored chronologically, can be viewed by a community of users, and is not usually managed by a central authority such as a bank or a government. Once published, the information can’t be changed. Gartner analyst Rajesh Kandaswamy told Arab News that even though speculators had poured billions into cryptocurrencies, that didn’t “invalidate the underlying blockchain technology”. “Blockchain could allow various parties in a supply chain to interact without a middleman — and for all records to be secured in one place. That allows for further streamlining, more efficiency and cost reductions,” said Kandaswamy. Abdul Nasser Al Mughairbi, digital unit manager for Abu Dhabi National Oil Company (ADNOC) said that blockchain would “enhance our business processes with a shared, secure and transparent ledger. “Blockchain is helping us track, irrefutably, every molecule of oil, and its value, from the well to the final customer,” he said in an emailed response to questions from Arab News. He added: “Every day there are large and complex production and accounting transactions among all of our businesses…that need to be accounted for. Until now this has been a laborious process but the blockchain application we have developed is streamlining this in one platform.” Operating costs could be cut via “eliminating time-consuming and labor-intensive processes.” Blockchain would be a game-changer in oil and gas transactions, he said.

——-

GCC SEEKS GLOBAL BLOCKCHAIN STATUS

GCC states are spearheading developments in blockchain to underline their efforts to become a global tech hub that links trade and finance between East and West. Saudi Arabia, Bahrain and Kuwait have announced a number of initiatives adding to the blockchain buzz humming around the entire Arabian Peninsula. The UAE and KSA have launched a proof of concept (PoC) for experimenting with blockchain to help cross-border payments between the two countries.

Just this month, UAE Exchange and US start-up Ripple said they planned to launch cross-border remittances to Asia via blockchain from the first quarter of 2019. Dubai has long sought to cement its position at the heart of a trading superhighway that connects China, Africa, Europe and the United States.

It has even talked about launching its own digital currency to oil the wheels of world trade even as the US/China tit-for-tat tariffs war continues. Dubai is already home to a bitcoin exchange, BitOasis, and other start-ups and accelerators devoted to blockchain are springing up, as well.

Dubai’s Crown Prince Sheikh Hamdan bin Mohammed Al Maktoum has said he wants all government documentation — such as visa applications, bill payments and licence renewals — to be transacted digitally using blockchain by 2020. In a recent report, Ahmed Bin Sulayem, chairman of the Dubai Multi-Commodity Centre (DMCC), said: “Trade and trade finance will be revolutionised by blockchain and other emerging technologies.”

——-

Despite a huge increase in embryonic and pilot projects involving blockchain, Gartner’s Kandaswamy said to his knowledge there had been “very few large-scale investments” in blockchain by enterprises. True, blockchain had been the number one search term when people looked at the Gartner website. But inquiries were more about curiosity surrounding the technology and “not about allocating capital.” He added: “Our clients are struggling to see where blockchain would make sense in their business. When I did a webinar last year, firms were saying ‘lack of business case’ was the number one issue. They wanted to know how blockchain could do things better than other technologies already out there.” However, he said that there were some unique selling points emerging with blockchain. For example: The ability of different parties in an ecosystem to have the same sense of proof, data held at a single point that couldn’t be tampered with. Certainly, blockchain doesn’t look like going away anytime soon. Walmart recently became one of the first retailers to explain how it will be using the technology. The company said it would require lettuce suppliers to upload data about their foods to blockchain within a year. Large firms such as Accenture, Facebook, Google, IBM and Microsoft are developing patented products and services based on blockchain’s digital-ledger open-source technology. Last month, Amazon said that it would offer blockchain for developers using its cloud-computing services. The global market for blockchain-related products and services is about $700 million and is projected to exceed $60 billion annually in 2024, according to Wintergreen Research. IBM and Microsoft have been leading global blockchain development projects in 2018, according to Wintergreen. Kandaswamy said a distinction should be made between a public blockchain system and a private one. The latter was for internal business processes, such as IBM’s application enabling location and tracking of maritime shipments. The larger battlefield centered on public blockchain. For these public exchanges used for the likes of bitcoin, there was still work to be done following a number of hacking incidents in 2018. Kidwai said custodial issues were “the biggest thing holding back cryptocurrencies — i.e. making sure that my crypto or bitcoin isn’t going to be stolen.” Solutions to the problems were pending but not that far away, he said, perhaps no more than 12 months out. Once the custodial issues were solved, “institutional capital would flow, if not gush into this space,” he said. As with the Internet, blockchain technology will catch on — “and like the Internet, in a very big way,” said Kidwai.

Source link http://bit.ly/2CvdVII

0 notes

Text

KSA Fintech Market Outlook to 2027: Ken Research

Buy Now

KSA Fintech Market is in the growing stage, being driven by Government Initiatives and availability of modern technologies. Fintech Market in KSA has various players. Total number of Fintechs in KSA is 147.

Key Market Findings:

The demographics outlook of KSA is changing with young generation being more tech-savvy and embracing innovation in the services.

A strong indicator of growth in this market is rise of new industry verticals like digital banking, crowd lending, infrastructure rise in digital payments and innovations in the capital market of KSA.

The surging growth is because of many government initiatives and regulations like Digital Banking, Open Banking etc.

Current Market Positioning: The industry is moving towards digital advancement and technologies such as AI and ML to improve capabilities. Other government regulations and initiatives are being introduced in the region to support the development of Fintech industry like Digital Banks, Open Banking.

Rising Investment Activity: The investment activity in the Fintech Industry is also increasing every year with many Fintech players forging partnerships with international Fintech players, Investors and other companies in order to expand into nearby markets, add to the existing product lines and achieve innovation to capture more market.

Increasing Convergence in The Fintech Industry: KSA Fintech Market is experiencing convergence of sector, increase in SME lending via Online Platforms and development of new Technologies. The competition to Fintech firms is increasing due to many non-financial sector firms like Telecom, Media etc. incorporating financial solutions on their platforms. This shows the increasing convergence in the Fintech Industry.

The Dominance of Payments and Currency Exchange: Payments and Currency Exchange will continue to dominate the market share of 23% in the KSA Fintech Market with a GTV of more than USD 20 Bn in 2027. Lending and Finance will have a share of 21% in the KSA Fintech Market with a GTV of USD 21.25 Bn in 2027. Lending and Finance experienced a rise in share from 19% in 2022 owing to increasing popularity of crowdlending among SME’s and rising requirements of finance by individuals.

Analysts at Ken Research in their latest publication- “KSA Fintech Market Outlook to 2027- Driven by the government regulations and initiatives and the growing adoption of technology among the residents ” by Ken Research provides a comprehensive analysis of the potential of the fintech market in KSA. Rising Investment Activity and Increasing Convergence in The Fintech Industry are expected to contribute to the market growth over the forecast period.

KSA Fintech Market is expected to grow at a robust CAGR over the forecasted period 2022P-2027F.

Key Segments Covered

Segmentation by service vertical:

Payments and Currency Exchange

Lending and Finance

Business tools

Personal financing

Private fundraising

Capital market

Infrastructure

Segmentation by Region:

Riyadh

Khobar

Dammam

Jeddah

Segmentation by Investment Stage:

Series A

Series B and above

Early (Pre-seed, Seed)

Undisclosed

Download a Free Sample Report

Segmentation by Company Stage:

Testing License

Active

Idea stage

Pre-commercial

Key Target Audience

Banks and Financial Institutions

Cash Reconciliation Companies

Payment Aggregators

Payment Network Companies

Payment Interface Companies

M-Wallet Companies

Young First-Generation Entrepreneurs

Payment Gateway Companies

PoS Terminal Companies

M-PoS Terminal Companies

Time Period Captured in the Report:

Historical Period: 2017-2022P

Base Year: 2022P

Forecast Period: 2023F–2027F

Companies Covered:

Payments and Currency Exchange-

stc pay

Tweeq

CLICK PAY

geidea

NearPay

neo leap

Surepay

PayTabs

FOODICS

noon payments

CASHIN

HYPER PAY

Request for Custom Report

Lending and finances-

Tamara

tabby

tamam

FORUS

Lendo

Private Fundraising-

FALCOM TOJÁ

Buthoor

OSOOL & BAKHEET FUND

Manafa

Business Tools & Information Provision-

Foodics

Flexxpay

Penny

wosul

Payment System Operators –

Visa

Apple pay

American Express

Google pay

Key Topics Covered in the Report

Executive Summary

Global Fintech Market Overview

MENA Fintech Market Overview

Overview of KSA Fintech Industry (Number of Fintechs and Fintech Ecosystem Enterprise Value, 2022)

Market Size of KSA Fintech Market on the basis of GTV and Volume of Transactions, 2022

Market Size of different Service Verticals of KSA Fintech Market on the basis of Volume of Transactions, 2022

Market Segmentation(by service vertical, by region, by Company Stage and Investment Stage)

Industry analysis

SWOT Analysis of KSA Fintech Market

Growth Drivers of KSA Fintech Market

Trends and Developments in KSA Fintech Market

Value Chain Analysis

Market Segmentations; Competition; Future Market Size, 2027)

Competition Landscspe

Future Trends and the Way Forward

Analyst Recommendations

Case study

Covid impact

Research methodology

For more information on the research report, refer to below link:

KSA Fintech Market Outlook to 2027

Related Reports

KSA Personal Finance Market Outlook to 2026F

UAE Auto Finance Market Outlook to 2026F

0 notes