#KSA CEP market

Explore tagged Tumblr posts

Text

Last Mile LEVs in KSA to hold an attractive Future Potential with lucrative government initiatives.

Domestic express courier dominates the market and is expected to register revenue growth at a CAGR of 4.4%. Most e-commerce retailers in KSA struggle with last-mile delivery as delays, reduced success rate & difficulty cash on delivery (COD) handling. Inconsistent demand, with spikes during festive seasons such as Ramadan, put additional pressure on the supply-side ecosystem for e-commerce logistics and hyperlocal logistic service providers. E-com Retailers need to come up with solutions such as Tech-Enabled E-com Logistics Platforms/Automated Shipping Software, B2B SAAS Platforms, and Digital Freight Brokers/ Load Discovery Aggregator Platform to solve the LMD problem in an efficient way to meet the growing customer demands.

Other Challenges in Future Potential Market Of LEVs in Last Mile Delivery Industry in KSA.

Cities such as NEOM and SPARK are incorporating smart mobility into their urban planning.

Some cities in the GCC are already incorporating smart mobility into their urban planning. Saudi Arabia and the UAE will invest nearly $50 bn in smart city projects through 2025 and most of the smart city projects in the GCC have a distinct focus on mobility for residents. SPARK will be a fully integrated city with master plans to seamlessly intertwine industrial areas, such as factories, workshops, yards, and the Logistics Zone, with vibrant residential, educational, and commercial areas. Moreover, NEOM City consists of a city of a million residents with a length of 170 kilometers (105 miles) that preserves 95% of nature with zero car emission, zero streets and zero carbon emissions. Moreover, ABB, a global automation giant and a leader in electric vehicle (EV) infrastructure sector has supplied its market-leading EV chargers to a premier residential compound ‘Safa 28’ located in Riyadh, Saudi Arabia. All these government initiatives, makes a greater space of the EV sector to flourish which will help the Last mile LEVs sector to grow.

New types of vehicles and new logistic structures are emerging to address the new paradigm in E-Commerce Industry.

Download Sample Report

The rising competition to deliver faster has led to ecommerce and hyperlocal delivery players to partner with mobility players to expand their fleet while still staying lean on resources. E-commerce players like Noon and Amazon witnessing a large volume of orders and requiring larger delivery fleets will slowly move towards LEVs by partnering with e-mobility startups and suppliers to convert their fleet into an e-fleet. The lower total cost of ownership and operating costs have made EVs more attractive for the intra-city cargo segment which comprise ~40% of total E-commerce shipments in KSA. However, LEVs need to be as efficient as an ICE vehicles carrying a similar payload and covering more trips and at lesser costs. This has led to the growth of new types of vehicles and new logistic structures that are emerging to address the new paradigm in E-Commerce Industry.

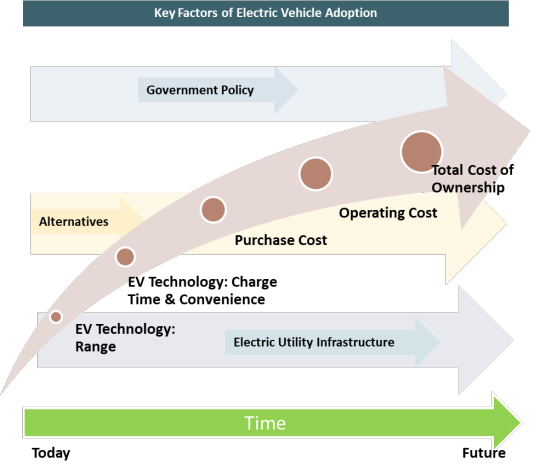

Government policies play a huge role in Adoption of Electric Vehicles in a country.

Ask for Customization

In November 2019, the Kingdom announced that 5% of its parking spaces are to be designated solely for the use of EVs. Also, and even more importantly, the Saudi government has mandated that there will be EV charging stations at all municipal car parks. National Industrial Development & Logistics Program (NIDLP) considered by CEDA to be one of the highly critical VRPs, will most likely develop initiatives geared towards EVs in the coming years. Furthermore, it focuses on developing ICE along with EV as it allows KSA to optimize short term gains while making calculated bets on EV over the medium term. Developing this sector will create jobs while contributing to the GDP.

High penetration acceptance of the use EVs could radically reduce the high rate for demand of oil.

Fossil CO2 emissions in Saudi Arabia are 526.8 million tones of CO2 in 2019. An EV has zero exhaust emissions. They are 100% eco-friendly as they run on electrically powered engines. The desire to reduce their carbon footprint is a motivator for environmentally conscious consumers to buy EVs. The cost of purchasing an EV is more than ICE. However, the operational costs requiring fuel and maintenance in ICE vehicle is more than that of an EV. The mass production of batteries and available tax incentives will further bring down the cost, thus, making it much more cost-effective.

Key Segments Covered in KSA LEV Market

Business Side Potential for LEVs in KSA CEP Industry

CEP Market Size

Total Number of Courier Shipments

KSA E-Commerce Landscape

E-Commerce Market Major Categories

Total Number of E-Commerce Orders

Total Number of Vehicles Deployed

Competition Scenario in KSA CEP Market

Future Projections Towards Penetration of LEVs in Courier Segment

Business Side Potential for LEVs in KSA Grocery Delivery Market

KSA Online Grocery Ecosystem

KSA Online Grocery Market Size

KSA Online Grocery Market Concentration

KSA Online Grocery Market Segmentations

Total Number of Orders

Total Number of Vehicles Deployed

Competition Scenario in KSA Grocery Delivery Market

Future Projections Towards Penetration of LEVs in Grocery Delivery Segment

Business Side Potential for LEVs in KSA Food Delivery Market

Landscape of Food Delivery Companies in Saudi Arabia

KSA Online Food Delivery Market Size

Total Number of Orders

Total Number of Vehicles Deployed

Competition Scenario in KSA Food Delivery Market

Future Projections Towards Penetration of LEVs in Food Delivery Segment

Key Target Audience

LEV Manufacturers

LEV Dealers/Distributors

Courier and Parcel Companies

E-Commerce Companies

Grocery Delivery Companies

Food Delivery Companies

Time Period Captured in the Report:

Historical Period: 2015-2020

Forecast Period: 2020–2030

Key Topics Covered in the Report

Overview of Global EV Market

Genesis and Overview of KSA LEV Market

Ecosystem of Major Entities in Saudi Arabia LEV market

Charging Infrastructure for LEV Market in Saudi Arabia

Overview of KSA Last-Mile Delivery Market

Number of Orders/Shipments in KSA Last-Mile Delivery Market

Number of Fleets Deployed for Last Mile Delivery

Business Side Potential for LEVs in KSA CEP Industry including E-commerce Landscape in KSA

Business Side Potential for LEVs in KSA Grocery Delivery Market

Business Side Potential for LEVs in KSA Food Delivery Market

Regulatory Scenario and Framework in Saudi Arabia LEV Market

Opinions of Industry Experts regarding adoption of LEVs

Difference in EV costs compared to ICE vehicles- Cost Benefit Analysis

Viable Supply Chain Model for Adoption and Supplying LEVs in KSA

Current Landscape of LEV Offering in KSA

Major Deals/Transactions for LEVs in KSA

Impact of COVID 19 on EV sales

Future Analysis and Projections for LEVs in Saudi Arabia

Opportunity Analysis of an LEV in Last Mile Delivery

Case Studies for LEV Last-Mile Delivery

Recommendations / Success Factors

Research Methodology

Appendix

Companies Covered:

EV Manufacturers

Tesla

BMW

Chevrolet

Renault

Hyundai

Nissan

CEP Industry

Saudi Post

Naquel Express

SMSA Express

DHL

Aramex

UPS

FedEx/TNT

Grocery Delivery Companies

Nana Direct

Zadfresh

Danube

Carrefour

Qareeb

Food Delivery Companies

Hungerstation

Careem

Jahez

Talabat

Mrsool

Contact us:

Ankur Gupta, Head of Marketing and Communications

+91-9015378249

#KSA Last mile Delivery LEV Market#Saudi Arabia LEV Industry#KSA Light Electric Vehicle Sector Outlook#KSA Electric Vehicle Market#Saudi Arabia E-Commerce Logistics Market#KSA CEP market#Saudi Arabia Battery Electric Vehicle sector outlook#KSA Plugged in Hybrid Electric Vehicle manufacturers#KSA Light Automated vehicle industry#KSA battery driven car industry outlook#Number of Battery Electric Vehicle Manufacturers KSA#Types of Electric vehicles KSA#Number of end users of LEV KSA#Number of e-commerce companies#CEP Industry KSA#KSA Grocery Delivery Companies

0 notes

Text

Generating a growth rate of 15% between 2017-2021, via improving infrastructure, KSA’s Freight Forwarding market provides a strong hand for the country’s Logistics Market: Ken Research

The KSA freight and logistics market is highly fragmented in nature, with the presence of many international players as well as local players. Some of the major players in the industry, are Aramex, tamer, Gulf Systems, Iron Logistics, Schenker, DSV & Zajil amongst others.

To learn more about this report Download a Free Sample Report

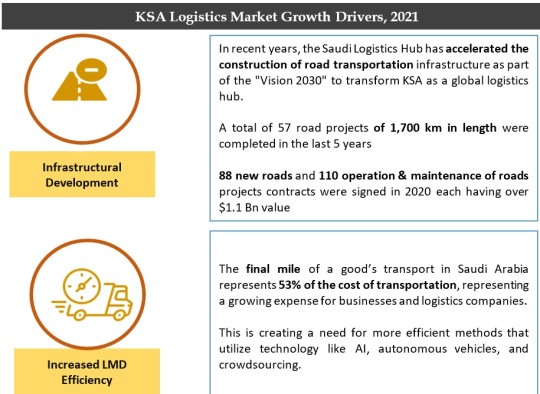

1.Improvement in Infrastructure, Increasing LTL Share, Increased LMD Efficiency and Growth in Automation are some of the key trends witnessed in the Transportation Industry in KSA.

In recent years, the Saudi Logistics Hub has accelerated the construction of road transportation infrastructure as part of the "Vision 2030" to transform KSA as a global logistics hub. A total of 57 road projects of 1,700 km in length were completed in the last 5 years. 88 new roads and 110 operation & maintenance of roads projects contracts were signed in 2020 each having over $1.1 Bn value. Moreover, KSA Transportation Industry is increasingly moving towards more digital, platform-based and collaborative innovation system to increase its efficiency. High penetration of mobile commerce has led to large disruption in B2B segment, with market participants being able capture a lion’s share of the market.

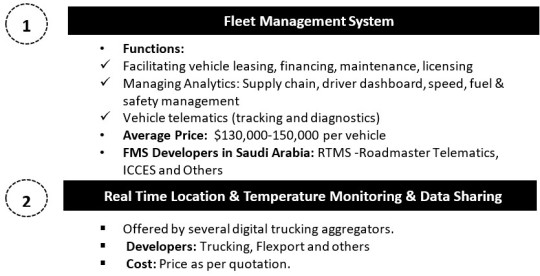

2.Technology-enabled transformations such as FMS & Autonomous Vehicles are largely being adopted by Captive Companies or Large Companies to promote Efficiency.

Visit this Link :- Request for Custom Report

Technology options such as Efficient Freight Matching, better profitability, smarter operations & greater service quality serve as a major benefit for KSA’s Logistics market. A major benefit of Digital Truck Aggregator Platforms is that they have a large Shipper and Trucker Base and offer services such as Freight Listing, Freight Brokerage and Online Transactions to earn revenue. Furthermore, digital Truck aggregator platforms are reshaping the trucking industry in Indonesia by increasing operational efficiency, reducing costs & increasing profitability.

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

E-commerce Companies

Third-Party Logistic Providers

Potential Market Entrants

Freight Forwarding Companies

Warehousing Companies

Cold Storage Companies

Industry Associations

Consulting Agencies

Government Bodies & Regulating Authorities

Time Period Captured in the Report:

Historical Period: 2017-2021

Base Year: 2021

Forecast Period: 2021-2026

For more information on the research report, refer to below link:

KSA Logistic Market Outlook to 2026

Related Reports:

USA Logistics Industry Outlook to 2026

Australia Logistics Market Outlook to 2025

Contact Us: Ken Research [email protected]

+91-9015378249

#KSA Logistics Market#Competitors in KSA Logistics Market#Emerging Players in KSA Logistics Market#Opportunities Warehouse Automation KSA#Challenges Warehouse Automation KSA#Major CEP services Providers KSA

1 note

·

View note