#Ixigo IPO

Explore tagged Tumblr posts

Text

Ixigo IPO: A Comprehensive Analysis

Ixigo IPO has launched now. Why you should considered investing in Ixigo IPO and get to know last five year performance.

0 notes

Text

Ixigo Share Price Riding High On The Market

Introduction

In the dynamic world of finance, certain entities emerge as beacons of success, capturing the attention of investors and analysts alike. Ixigo, a prominent player in the travel technology sector, has recently experienced a notable surge in Ixigo Share Price, reflecting its robust performance and strategic positioning in the market. Ixigo, operating under the banner of Le Travenues Technology Pvt. Ltd., stands as a pioneering force in the realm of technology-driven travel solutions, dedicated to empowering Indian travelers in every aspect of their journey planning and management. Through their innovative OTA platforms encompassing websites and mobile applications, Ixigo harnesses the power of artificial intelligence, machine learning, and data science to equip travelers with the tools and insights needed to make informed and efficient travel decisions. By aggregating and comparing real-time travel information, prices, and availability across a comprehensive spectrum of travel options including flights, trains, buses, and hotels, Ixigo facilitates seamless ticket booking experiences through its associated websites and apps. Founded by Rajnish Kumar and Aloke Bajpai in June 2007, Ixigo embarked on its journey with the launch of its flights meta-search website, marking the inception of its mission to revolutionize the travel industry. Subsequently, in 2008, Ixigo expanded its offerings with the introduction of a hotel search engine on its website, further enhancing its capabilities in catering to diverse traveler needs. Building upon its success and momentum, Ixigo continued to innovate, launching its trains app in early 2014, thereby solidifying its position as a frontrunner in providing comprehensive and user-centric travel solutions.

A Glimpse into Ixigo

Ixigo stands as a shining example of innovation and ingenuity in the realm of travel technology. Established with a vision to revolutionize the way travelers plan and manage their journeys, Ixigo has emerged as a trusted platform for millions of users seeking seamless travel solutions.

Unveiling the Share Price Surge

The recent surge in Ixigo's share price is a testament to the company's resilience and growth trajectory. Fueled by a combination of factors, including strong financial performance, strategic partnerships, and industry trends, Ixigo has garnered investor confidence and positioned itself as a frontrunner in the travel technology landscape.

Factors Driving the Surge

Several key factors have contributed to the surge in Ixigo's share price, underscoring the company's competitive advantage and market appeal:

Financial Performance: Ixigo's robust financial performance, characterized by steady revenue growth and profitability, has been a key driver of its share price surge. With a focus on sustainable growth and operational efficiency, Ixigo has delivered consistent results, earning the trust of investors and stakeholders.

Strategic Partnerships: Strategic partnerships with leading players in the travel industry have further bolstered Ixigo's market position and contributed to its share price surge. By collaborating with airlines, hotels, and other travel service providers, Ixigo has expanded its reach and diversified its revenue streams, enhancing its overall value proposition.

Technological Innovation: Ixigo's commitment to technological innovation has been instrumental in driving its share price upwards. By leveraging cutting-edge technologies such as artificial intelligence and machine learning, Ixigo has enhanced its product offerings and user experience, setting itself apart from competitors and attracting investor interest.

Market Trends: The surge in Ixigo's share price also reflects broader market trends, including the increasing demand for digital travel solutions and the growing preference for convenience and flexibility among travelers. As consumers continue to embrace online travel platforms, Ixigo stands poised to capitalize on this trend and sustain its upward momentum.

Conclusion

In conclusion, Ixigo's share price surge is a testament to its strategic vision, operational excellence, and unwavering commitment to customer satisfaction. As the company continues to innovate and expand its presence in the travel technology sector, investors can expect continued growth and value creation. With a solid foundation and a clear growth trajectory, Ixigo is well-positioned to ride the wave of success and deliver value to shareholders in the years to come.

0 notes

Text

Unraveling the Ixigo Share Price: Latest News & Updates

Introduction to Ixigo Share Price:

In the dynamic realm of the stock market, every move of a company's share price unfolds a story of its own. One such intriguing tale is that of Ixigo, a prominent player in the Indian travel industry. This blog delves into the latest news and updates surrounding Ixigo share price, shedding light on the factors influencing its fluctuations and the broader implications for investors and stakeholders.

1. Understanding Ixigo:

Ixigo, founded in 2007 by Aloke Bajpai and Rajnish Kumar, has emerged as a frontrunner in the Indian travel and tourism sector. Initially launched as a travel search engine, Ixigo has evolved into a comprehensive travel platform offering flight and hotel bookings, train reservations, bus tickets, and more. With its user-friendly interface and innovative features, Ixigo has garnered a significant market share and earned the trust of millions of users across the country.

2. Recent Performance:

Over the past few years, Ixigo has witnessed remarkable growth, buoyed by increasing internet penetration, rising disposable incomes, and a burgeoning travel culture in India. The company's revenue trajectory has been impressive, reflecting its ability to capitalize on emerging trends and adapt to evolving consumer preferences. However, like any other publicly traded entity, Ixigo's journey hasn't been devoid of challenges, as it grapples with market volatility, regulatory changes, and competitive pressures.

3. Factors Influencing Ixigo Share Price:

a. Industry Trends: The travel industry is inherently cyclical, sensitive to economic fluctuations, geopolitical events, and unforeseen crises such as the COVID-19 pandemic. Any developments impacting travel demand, fuel prices, or regulatory frameworks can exert significant influence on Ixigo share price.

b. Financial Performance: Investors closely scrutinize Ixigo's financial reports, focusing on key metrics like revenue growth, profit margins, and cash flow. Strong financial performance often translates into bullish sentiments, driving up the Ixigo share price.

c. Technological Innovations: Ixigo ability to innovate and stay ahead of the curve in terms of technology and user experience plays a crucial role in shaping investor perceptions. Breakthroughs in artificial intelligence, data analytics, and mobile applications can enhance Ixigo competitive edge and bolster its market position, thereby positively impacting its share price.

d. Competitive Landscape: The travel industry is fiercely competitive, with players vying for market share and customer loyalty. Investors monitor Ixigo's competitive positioning vis-à-vis rivals such as MakeMyTrip, Cleartrip, and Yatra, as well as emerging disruptors, to gauge its long-term growth prospects and assess potential risks.

e. Regulatory Environment: Regulatory changes, including government policies related to travel, taxation, and e-commerce, can have profound implications for Ixigo's operations and financial performance. Any regulatory hurdles or compliance issues may trigger volatility in the Ixigo share price.

4. Recent Developments:

a. Strategic Partnerships: Ixigo has been proactive in forging strategic partnerships with airlines, hotels, and other travel service providers to enhance its offerings and expand its customer base. Recent collaborations with leading industry players have bolstered Ixigo market presence and reinforced investor confidence.

b. Product Innovations: Ixigo continues to invest in product development and innovation, introducing new features and services to enrich the user experience. From AI-powered travel assistants to personalized recommendations, these innovations are instrumental in driving user engagement and fostering revenue growth.

c. Expansion Plans: With an eye on capturing untapped market opportunities, Ixigo has embarked on an ambitious expansion strategy, both geographically and vertically. The company's foray into adjacent sectors such as fintech and lifestyle services underscores its commitment to diversification and sustainable growth.

d. Financial Performance: Ixigo latest financial results, including quarterly earnings reports and guidance for the upcoming fiscal year, are closely scrutinized by investors and analysts. Any deviations from market expectations, whether positive or negative, can trigger fluctuations in the company's share price.

5. Investor Sentiment and Market Outlook:

The sentiment surrounding Ixigo share price is a reflection of broader market dynamics, investor perceptions, and macroeconomic trends. While short-term fluctuations may be driven by sentiment and speculative trading, long-term value creation hinges on Ixigo ability to execute its strategic vision, navigate challenges, and deliver sustainable growth.

Looking ahead, the outlook for Ixigo share price remains contingent upon its ability to capitalize on emerging opportunities, mitigate risks, and deliver consistent value to shareholders. As the travel industry continues to evolve in response to changing consumer behavior and technological advancements, Ixigo is poised to play a pivotal role in shaping the future of travel in India and beyond.

Conclusion: In conclusion, the trajectory of Ixigo share price embodies the intricacies of the travel industry and the broader investment landscape. As investors and stakeholders monitor the latest news and updates surrounding Ixigo, they gain valuable insights into the company's performance, prospects, and potential risks. By staying abreast of market trends, regulatory developments, and competitive dynamics, investors can make informed decisions and navigate the ever-changing terrain of the stock market with confidence.

0 notes

Text

ixigo IPO allotment in focus today; latest GMP, key dates, step-by-step guide to check status

Read here - https://blogintensifyresearch.wordpress.com/2024/06/13/ixigo-ipo-allotment-in-focus-today-latest-gmp-key-dates-step-by-step-guide-to-check-status/

Fill https://intensifyresearch.com/web/landingpage to get insights from SEBI registered experts with 3 days FREE TRIAL & 90%+ accuracy.

#finance#investing#economy#stock market#share market#nseindia#option trading#niftytrading#banknifty#trading tips#sensex#nifty prediction#nse#nifty50#ipo alert#ipo news#stockmarket#invest#ixigo#travel#traveling#tourism

1 note

·

View note

Text

Investing in Ixigo Unlisted Shares: What You Need to Know Before You Buy

Ixigo, a leading travel tech company in India, operates under its parent company, Le Travenues Technology. It provides a wide range of services, including booking options for flights, trains, buses, and hotels. As it prepares for its Initial Public Offering (IPO), investing in Ixigo’s unlisted shares has gained traction among pre-IPO investors.

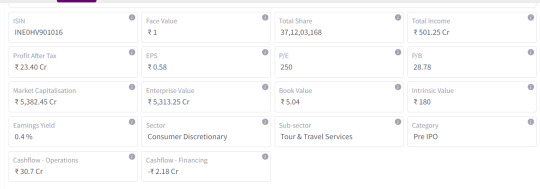

Financial Performance and Growth

In the first nine months of 2024, Ixigo recorded a profit of Rs 68 Crores, tripling its previous fiscal year’s profit of Rs 23 Crores. This was driven by a strong revenue of Rs 491 Crores, reflecting its dominance in the travel aggregation space.

Ixigo achieved a significant turnaround, moving from a loss of Rs 21 Crores in 2022 to profitability in 2023 and beyond, demonstrating its operational efficiency and strong market position.

Rising Price of Unlisted Shares

Price Surge in 2024: The price of Ixigo's unlisted shares rose from Rs 100 in December 2023 to Rs 150 by March 2024, spurred by strong financial results and anticipation of its IPO.

Future Potential: With plans to raise Rs 1,600 Crores in its IPO, Ixigo aims to expand its services and enhance its tech infrastructure, potentially boosting its valuation further once it goes public.

Strategic Positioning in Travel Tech

1) Diverse Sources of Revenue

Ixigo can earn through various channels, including convenience fees from advertising and ticket reservations, making it less dependent on a single source of revenue.

2) Expansion and Innovation

Over the years, Ixigo has introduced various innovative features like real-time updates and fare predictions, to improve the overall user experience, and then drive engagement across the platform.

Buy Ixigo Unlisted Share from Altius Investech!

Risks Involved in Unlisted Shares

1) Risks of Liquidity

Unlisted shares typically are less liquid, which makes it more difficult to sell them promptly compared to shares traded on the market.

2) Regulatory and Market Risks

As unlisted shares are not subject to the same rules as listed shares, they are at higher risk in relation to market movements, fluctuations, and compliance.

3) Uncertainty About IPO

Even though Ixigo has changed its “Draft Red Herring Prospectus” (DRHP), there is always the chance of delay due to market conditions, which could affect liquidity and the value appreciation of shares that are not listed.

4) Tax Implications- Capital Gains Tax

If you hold Ixigo unlisted shares for more than two years, they are subject to long-term capital gains tax, which, as per recent changes, is now taxed at a flat rate of 12.5%. This differs from the indexation benefits typically offered for listed shares.

You Can Also Read Our Other Blogs

Ixigo Receives SEBI Nod for IPO: A Promising Step Forward

Building for Bharat”: ixigo’s Journey from Rejection to Profitability

Can 6,000 Cr Ixigo Pull Off Travel’s Biggest Rollercoaster to IPO?

Can ixigo’s Frugality Playbook Show The Way In The Year Of Cockroach Startups?

Final Thoughts

Investments in Ixigo’s unlisted shares offer high growth potential, especially with its upcoming IPO. However, it comes with associated risks, such as liquidity concerns and regulatory changes. Before making any investment, ensure a thorough analysis of the company's financials and consult a financial advisor to align the investment with your risk tolerance and financial goals.

For more information, you can explore detailed insights on platforms like Altius Investech, which offer up-to-date market prices and detailed analyses of Ixigo's unlisted shares.

0 notes

Text

ixigo Share Price Insights: What Investors Should Know in 2024

The Indian stock market has always been a hub of opportunity, and investors are constantly on the lookout for emerging companies poised to grow. Among the most anticipated names in the market today is ixigo, a travel aggregator that has transformed how people in India book their journeys. With its upcoming public listing and a rise in interest in its unlisted shares, there is growing curiosity surrounding the ixigo share price. In 2024, investors need to understand the company’s current position, its market potential, and the dynamics of its unlisted shares.

In this blog, we’ll dive deep into the ixigo share price, analyze the unlisted shares market, and provide insights on why investors should pay attention to this stock, especially through platforms like Bharat Invest.

A Brief Overview of ixigo

Before exploring the ixigo share price, it’s important to understand the company behind it. Founded in 2007, ixigo (Le Travenues Technology Limited) is a leading travel platform in India. Initially focused on flight and hotel bookings, ixigo has expanded to include trains, buses, and more. Their app has garnered millions of users, largely due to its user-friendly interface and competitive prices.

One of the key differentiators for ixigo is its strong focus on technology, AI, and data analytics to provide personalized travel solutions. As the travel industry in India continues to grow, ixigo’s stronghold in this market positions it for substantial growth in the coming years. With an IPO on the horizon, the company has drawn the attention of investors keen to capitalize on its future growth potential.

ixigo Share Price: A Look at the Unlisted Market

At present, ixigo’s shares are not publicly traded but are available in the unlisted shares market. Unlisted shares are equity shares of a company that are not listed on recognized stock exchanges. Although these shares do not have the same liquidity as listed shares, they offer significant potential for returns, particularly if the company eventually goes public.

What Is Driving Interest in ixigo’s Unlisted Shares?

Several factors have contributed to the rising interest in ixigo’s unlisted shares:

Strong Market Position: As one of the top travel platforms in India, ixigo has shown consistent growth in its user base and revenue streams. Its performance in the unlisted shares market reflects this, with the demand for ixigo shares increasing in anticipation of its IPO.

IPO Anticipation: Investors often buy unlisted shares of companies that are planning to go public in hopes of making a profit when the stock officially lists. ixigo has already filed for an IPO, and market speculation suggests that the offering could be highly successful. Investors who acquire ixigo shares early in the unlisted market may stand to gain from the price jump when it goes public.

Travel Industry Rebound: With the world recovering from the pandemic, travel is once again picking up. ixigo, as a prominent player in the travel industry, is expected to benefit significantly from this rebound, making its shares an attractive investment.

ixigo Share Price in the Unlisted Shares Market

The current ixigo share price in the unlisted market varies based on demand and availability. As of early 2024, ixigo’s share price in the unlisted market has been steadily rising due to the factors mentioned above. However, the exact price can fluctuate, so it’s crucial for investors to keep an eye on the latest market data from reputable platforms like Bharat Invest.

Bharat Invest, a platform that specializes in providing access to unlisted shares, offers real-time updates on the price and availability of ixigo shares. It also provides valuable insights into the company’s financials, helping investors make informed decisions about their investments in unlisted shares.

What Investors Should Consider About ixigo’s Upcoming IPO

While the unlisted shares market offers early entry into ixigo, many investors are focused on the potential returns when the company goes public. Here are some key factors to consider when evaluating ixigo’s IPO:

1. Company Valuation

The valuation of ixigo at the time of its IPO will be crucial in determining whether the share price is fairly priced. A high valuation could lead to overpricing, while a conservative valuation could present a buying opportunity for investors.

2. Industry Growth

ixigo operates in the travel and tourism industry, which has experienced significant disruption due to the COVID-19 pandemic. However, as the industry rebounds, ixigo is well-positioned to benefit. Investors should keep an eye on the overall growth of the travel sector in India, as it will impact ixigo’s share price performance post-IPO.

3. Competitor Landscape

While ixigo is a dominant player in the travel aggregation space, it faces stiff competition from giants like MakeMyTrip and Yatra. Investors should consider how ixigo plans to maintain its competitive edge and grow its market share.

4. Financial Performance

Evaluating ixigo’s revenue, profitability, and growth trends will provide insights into the company’s financial health. Investors should look at ixigo’s revenue model, including its commission structure and other revenue streams, such as advertisements and partnerships, to gauge its future performance.

5. Market Sentiment

The overall sentiment in the stock market can significantly affect the ixigo share price when it goes public. A positive market sentiment towards tech-enabled companies or travel aggregators could drive up the stock price, while a negative sentiment could depress it.

How to Buy ixigo Unlisted Shares?

Investors looking to buy ixigo unlisted shares can do so through platforms like Bharat Invest. Bharat Invest provides a seamless process for purchasing unlisted shares, offering detailed information on pricing, availability, and the latest market trends. Here’s how you can get started:

Sign Up: Create an account on Bharat Invest and complete the necessary KYC formalities.

Explore the Unlisted Share List: Bharat Invest provides an extensive unlisted share list where you can find ixigo shares among other high-potential stocks.

Buy Shares: Once you identify the desired quantity of ixigo shares, you can proceed with the transaction. Bharat Invest ensures a secure and transparent buying process.

Monitor Performance: Keep track of the ixigo share price and market movements through Bharat Invest’s regular updates.

Conclusion: Is ixigo a Good Investment in 2024?

Investing in ixigo, whether through the unlisted shares market or its upcoming IPO, presents a promising opportunity for those interested in the Indian travel sector. With a strong market position, innovative technology, and a growing user base, ixigo is well-poised for future growth.

However, like any investment, it’s essential to weigh the risks. Market volatility, competition, and industry-specific challenges can impact ixigo’s share price. Investors should keep a close eye on the company’s financials and industry trends in 2024.

Platforms like Bharat Invest offer the tools and resources necessary for investing in unlisted shares, making it easier for investors to get in early on high-potential companies like ixigo. Whether you’re buying unlisted shares or waiting for the IPO, ixigo’s journey in 2024 is one worth watching.

0 notes

Text

The share of ixigo's original company is up 45% up-list on BSE: Listed at 48.50% premium on NSE.

Le Travenuse Technology, the original company of travel aggregator Ixigo, got a great entry in the stock market today. The company’s stock was listed at Rs 135 with 45% premium on Bombay Stock Exchange (BSE). At the same time, the National Stock Exchange (NSE) company’s stock was listed at Rs 138.10, 48.50%. Retail investors could have bidding for this from June 10 to June 12. This IPO total was…

View On WordPress

0 notes

Text

Latest Market News Today Live Updates June 16, 2024: ixigo IPO: Here's what GMP signals ahead of listing on June 18

New Post has been published on https://petn.ws/o5EVe

Latest Market News Today Live Updates June 16, 2024: ixigo IPO: Here's what GMP signals ahead of listing on June 18

Latest Market News Today Live Updates: Catch today’s market wrap-up! Track Nifty 50 and Sensex movements, along with top gainers and losers. See how Asian and US markets fared and which sectors led the charge (or declined). Summary: Follow Mint’s market blog for real-time updates on your favourite companies. This blog keeps you informed on […]

See full article at https://petn.ws/o5EVe #OtherNews

0 notes

Text

Ixigo IPO subscribed over 98 times on last day

The initial public offering (IPO) of Le Travenues Technology, the parent company of online travel platform Ixigo, closed on Wednesday, with bids exceeding 98 times the shares on offer. The investors placed bids for 4293.6 million shares against 43.7 million shares available, according to data from the BSE. The category reserved for retail investors was booked 53.9 times, while that of non-institutional investors received bids for 110.2 times. Qualified institutional buyers (QIB) bid for 2548.1 million shares, 106.7 times the shares on sale. The IPO included a fresh equity issue of Rs 120 crore and an offer for sale (OFS) of up to 66.6 million shares.

Existing shareholders such as Elevation Capital, Peak XV Partners, Aloke Bajpai, Rajnish Kumar, Micromax Informatics, and Placid Holdings will partially offload their stakes through the OFS. The company completed a pre-IPO secondary placement worth approximately Rs 176.2 crore a day before the anchor book opening. During this secondary sale, Elevation Capital, Peak XV Partners, Micromax Informatics and Madison India sold 18.9 million shares at Rs 93 each, which is the upper end of the IPO price band. The shares were purchased by new investors including Ashoka India Equity Investment Trust, Tata Mutual Fund, Bay Capital and Steadview Capital.

0 notes

Text

Indian Startup Funding Dips: $97 Million Raised Across 10 Deals, During The Week Of June 3rd to June 8th, 2024

Indian startup funding witnessed a significant decline during the week of June 3rd to June 8th, 2024, coinciding with the Indian general elections. Startups collectively raised $97.3 million across 10 deals, marking a nearly 55% decrease compared to the previous week’s $217.84 million secured through 31 deals.

Funding Breakdown and Key Highlights

Dominant Deals: The week’s largest funding round belonged to fintech startup Fibe (formerly EarlySalary), which secured $65.5 million in primary capital as part of its $90 million Series E round led by TR Capital, Trifecta Capital, and Amara Partner. The remaining portion of the funding came through secondary transactions.

Fintech Reigns Supreme: Despite Fibe being the sole funding recipient in the fintech sector this week, it propelled the sector to the top spot in terms of the total amount raised.

Enterprisetech Emerges: Enterprise software companies emerged as the most active segment, with three deals totaling $12 million.

Seed Funding Slumps: Continuing a recent trend, seed funding witnessed a sharp decline of 67% this week, dropping to a mere $3 million.

Secondary Transactions Take Center Stage

Although primary funding dipped during this period, secondary transactions saw a surge in activity. Notably, eyewear retailer Lenskart, led by Peyush Bansal, secured $200 million in investments from Temasek and Fidelity. This move effectively doubled Temasek’s existing stake in the company and brought Fidelity on board as a new investor.

Beyond Funding: Major Developments of the Week

Ather Energy Witnesses Co-founder Exit: Flipkart co-founder Sachin Bansal made a complete exit from Ather Energy, a two-wheeler electric vehicle manufacturer. He sold his 2.2% stake for $14.8 million to Hero MotoCorp, while Zerodha co-founder Nikhil Kamath acquired the remaining 5.3% for $33.7 million.

CarDekho Seeks Wealthtech Expansion: CarDekho’s insurance arm, InsuranceDekho, is reportedly in talks to acquire a majority stake in BankSathi, a wealthtech startup, through a share swap deal. This move aims to bolster InsuranceDekho’s credit product portfolio.

Nazara Tech Subsidiary Makes US Acquisition: In a bid to establish itself as a leading sports and entertainment publisher in the US, Absolute Sports (a subsidiary of Nazara Technologies and the parent company of Sportskeeda) acquired Pennsylvania-based entertainment news site Soap Central for $1.4 million in an all-cash deal.

Amazon Nears MX Player Acquisition: According to reports, Amazon’s acquisition of MX Player from Times Internet is nearing its final stages. The e-commerce giant confirmed signing an agreement to purchase certain assets of the video streaming platform.

ixigo Gears Up for IPO: Online travel aggregator ixigo is set to make its public debut on June 10th. With a price band of INR 88–93 per share, the company expects to raise INR 740 Cr (approximately $93.5 million) at the upper end of the range. Prior to the IPO, ixigo secured over INR 333 Cr (approximately $42 million) from 23 anchor investors at INR 93 per share.

Read more: Marketing News, Advertising News, PR and Finance News, Digital News

0 notes

Text

Ixigo Pre IPO Buzz: Key News and Updates

Ixigo is a leader in the rapidly changing Indian travel business, revolutionizing how travelers book and enjoy their travels. The financial community is ablaze with anticipation as ixigo IPO is highly anticipated, and important updates and news are eagerly awaited. We'll examine the most recent Ixigo Share Price, developments and the elements that fuel the Ixigo pre-IPO hype.

Ixigo's Unlisted shares Journey Overview:

Founded in 2007 by Aloke Bajpai and Rajnish Kumar. Now Ixigo IPO has become a household name in India. It’s one-stop platform for travel-related services Become the USP of the company. From flight bookings to hotel reservations and train journeys, Ixigo has carved a niche for itself by providing users with a seamless and comprehensive travel planning experience. The company has become a major participant in the Indian travel IT market by evolving and adapting to the changing needs of travelers over time.

They assist travelers in making smarter travel decisions by leveraging AI, machine learning and data science led innovations on their OTA platforms, comprising their websites and mobile applications.

Ixigo IPO compares real-time travel information, prices and availability for flights, trains, buses, and hotels for users for transparency along with helping user to take right decision, and also Ixigo allows ticket booking through its associate websites and apps. In 2008, it introduced a hotel search engine on its website. In early 2014 it launched a trains app as well.

Ixigo Pre IPO Details

Ixigo Pre Ipo have received in-principle approvals from BSE and NSE for the listing of the Equity Shares pursuant to letters. Ixigo upcoming IPO proposes to make an IPO which comprises a fresh issue of its equity shares of Re. 1 each and offer for sale by certain shareholders’ existing equity shares of Re 1 each at such premium arrived at by the book building process (referred to as the ‘Issue’), as may be decided by the Company’s Board of Directors.

The company plans to come with an Ixigo IPO by 2024

Current Ixigo Share Price

The face value of each Ixigo share is ₹ 1. Ixigo stock price is ₹ 145/share. Ixigo IPO price band is not disclosed yet.

Ixigo Unlisted share Merger & Acquisition

Ixigo purchased Abhibus on August 5, 2021. By providing its combined user base of almost 25.5 crore customers with a multi-modal transportation experience spanning trains, aircraft, and buses, the agreement will assist Ixigo Group in solidifying its position in tier 2, 3, and 4 markets.

Investments

It is true that Ixigo owns stock in FreshBus, an electric intercity bus service company with headquarters in Bengaluru. Ixigo gave FreshBus Rs 26 million in startup finance in February 2023. This was a calculated financial risk taken to facilitate the introduction of FreshBus's intercity electric bus services throughout India.

Ixigo share price Market Size:

The online travel market in India is expected to reach US$ 31 billion by the end of FY25, growing at a 14% CAGR from FY20.

Travel and tourism, one of the fastest-growing economic sectors in India, contributed US$ 178 billion to the nation’s GDP in 2021.

The India Brand Equity Foundation (IBEF) states that there is a sizable travel and tourist market in India. It provides a wide range of specialised travel products, including cruises, outdoor activities, wellness, medical, sports, MICE, eco-tourism, movies, rural, and religious travel. Both domestic and foreign travellers have acknowledged India as a spiritual tourism destination.

As per the IBEF’s February 2023 report on Tourism and Hospitality, the contribution to the GDP is expected to reach US$ 512 billion by 2028, at a strong CAGR growth of 16% between 2021-28.

The travel industry bounced back remarkably in FY23 after being severely affected by the pandemic and is expected to move at an exponential pace. As per the data published by Directorate General of Civil Aviation (DGCA), the number of passengers that travelled by airlines domestically increased 62% YoY to 136 million passengers in FY23, as compared to 84 million passengers in FY22.

As indicated in the February 2023 IBEF Report on Aviation, India is poised to become the third-largest air passenger market globally by 2024, encompassing both domestic and international travel, and is expected to host over 480 million air travellers by 2036.

According to WTTC, India is ranked 10th among 185 countries in terms of travel & tourism’s total contribution to GDP in 2019.

Ixigo pre ipo User and Involvement:

When assessing Ixigo unlisted share chances of continuing to develop, the size of its user base is crucial. As signs of a strong and devoted customer base, investors will probably closely examine user acquisition tactics, user engagement measures, and customer retention programmes.

In conclusion:

We are in the midst of a critical juncture in the development of the Indian travel tech industry. The ixigo pre-IPO excitement keeps growing. Not only is the success of Ixigo's IPO evidence of the company's accomplishments, but it also shows how confident the market is in travel technology overall. We hope to have a great opening in Ixigo upcoming ipo so that we can book tremendous profit in Ixigo share price.

0 notes

Text

https://elitewealth.in/le-travenues-technology-limited-ixigo-ipo-details-issue-price-date-news-allotment-status-gmp-link-updates/

If you are looking for Invest Le Travenues Technology Limited (ixigo) IPO

then first to all Open a demat Trading Account & Elite Wealth limited Provide Free Open Online Demat Account minimum Document required. We are provide many benefits Low Brokerage, Free Research Recommendation and Life Time Free* AMC, Call n Trade facility. With the best stock brokers, you may open your demat account quickly and easily. If you more information visit a website: https://elitewealth.in/le-travenues-technology-limited-ixigo-ipo-details-issue-price-date-news-allotment-status-gmp-link-updates/

#Applyforupcomingixigoipo#ixigoipogmp#ixigoipoallotmentstatus#ixigoipolistingdate#ixigoipodate#ixigoipoissuesize#ixigoiposhares

0 notes

Text

Ixigo Share Price News & Latest Updates: Deciphering the Travel Tech Enigma

Ixigo, India's leading online travel aggregator, has captivated the travel tech industry with its innovative platforms and strategic partnerships. However, Ixigo Share Price journey has been marked by volatility, mirroring the uncertainties of the post-pandemic travel landscape. This article delves into the latest news, financial performance, and key factors influencing Ixigo Share Price, offering a comprehensive overview for informed investment decisions.

Current Ixigo Share Price and Performance:

As of February 12, 2024, Ixigo Share Price stands at ₹71.70, reflecting a significant decline of 30.30% from its IPO price of ₹103.30 in November 2022.

The past month has witnessed considerable fluctuations, with the stock price ranging between ₹68.00 and ₹75.00.

While Ixigo boasts a user-friendly platform and strong brand recognition, concerns regarding industry recovery and intense competition have weighed on Ixigo Share Price.

Recent News and Events:

Acquisition: Ixigo's acquisition of the bus ticketing platform Abhibus in October 2023 expanded its product portfolio and strengthened its presence in the bus travel segment. This news initially boosted investor confidence.

Funding: The company secured ₹400 crore in fresh funding from marquee investors like GIC and CarTrade Tech in December 2023, showcasing continued support for its long-term vision.

Financial Results: Ixigo is yet to release its December 2023 quarter financial results. However, market analysts anticipate improved revenue and bookings compared to the previous quarter, potentially buoying investor sentiment.

Industry Recovery: The travel and tourism industry is witnessing a gradual recovery post-pandemic, presenting a positive backdrop for Ixigo's growth. Continued recovery will be crucial for its success.

Financial Analysis:

Positives: Ixigo boasts a loyal user base, a user-friendly platform, and strategic partnerships with leading airlines and hotels. Additionally, its focus on mobile-first technology positions it well for future growth.

Negatives: The company is yet to achieve profitability, raising concerns about its long-term financial sustainability. Furthermore, its dependence on volatile travel industry trends presents inherent risks.

Investment Outlook:

Ixigo's future trajectory hinges on several key factors:

Industry Recovery: The pace and sustainability of the travel and tourism industry's recovery will significantly impact Ixigo's performance. Favorable industry trends could act as a catalyst for growth.

Competition: The online travel aggregator space is fiercely competitive, with established players like MakeMyTrip and Cleartrip posing significant challenges. Ixigo's ability to differentiate itself through innovation and targeted marketing will be crucial.

Profitability: Demonstrating a clear path to profitability is critical for investor confidence and Ixigo Share Price stability. Achieving this in a competitive and dynamic industry will require strategic cost management and revenue diversification.

Conclusion:

Ixigo presents an intriguing investment opportunity for those seeking exposure to the burgeoning Indian travel tech market. However, the company's path to profitability remains uncertain, and intense competition poses significant challenges. Investors should carefully consider their risk tolerance, investment horizon, and conduct thorough due diligence before making any investment decisions. This article provides a starting point for further analysis, but individual investors should consult with qualified financial advisors for personalized advice.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Please consult with a qualified financial advisor before making any investment decisions.

0 notes

Text

Ixigo IPO Opens On Monday With Price Band Of Rs 83-93 Per Share

Le Travenues Technology Ltd, which owns online travel aggregator Ixigo, is set to make its public debut on Monday. The company has set a price band of Rs 88-93 per share of its initial public offering (IPO). The last day to apply for an IPO will be June 12. The lot size of the IPO is 161 shares. To bid in the IPO, retail investors will have to invest Rs 14,973. Ahead of its IPO, it raised over Rs…

View On WordPress

0 notes

Text

2024 IPO Checklist: A Comprehensive List of Upcoming Public Offerings

The Indian stock market continues to be a hotbed for activity, with several exciting Initial Public Offerings (IPOs) on the horizon in 2024. This comprehensive guide will equip you with the knowledge you need to navigate the upcoming IPO landscape, including details on expected offerings, IPO Grey Market Premium (GMP), and a sneak peek at the upcoming SME IPO list 2024

Upcoming Public Offerings (IPOs):

The remainder of 2024 promises a healthy pipeline of IPOs across various sectors. Here's a glimpse at some of the highly anticipated offerings:

Ebixcash: A leading provider of B2B on-demand services specializing in insurance, travel, and financial technologies.

Indiafirst Life Insurance: A prominent private life insurance company known for its innovative product portfolio and customer-centric approach.

SPC Life Sciences: A fast-growing pharmaceutical company engaged in manufacturing and marketing a diverse range of formulations.

Tata Play: A subsidiary of the Tata Group, offering a comprehensive bouquet of DTH and broadband services.

Lohia Corp: A leading manufacturer of PET packaging solutions with a strong presence in the global market.

Nova Agritech: An agritech company focused on developing and distributing high-quality crop protection products.

What is IPO GMP?

IPO Grey Market Premium (GMP) refers to the unofficial premium investors are willing to pay for shares in an upcoming IPO before they are listed on the stock exchange. It's important to understand that GMP is not an official indicator of the IPO's performance and should be considered speculative. However, it can provide some insight into investor sentiment surrounding a particular offering.

Resources for Tracking Upcoming IPOs and GMP:

Several valuable resources can help you stay updated on upcoming IPOs and track their associated GMP. Here are a few popular options:

Moneycontrol: provides a dedicated IPO section with detailed information on upcoming offerings and historical performance.

Chittorgarh: features a user-friendly IPO calendar with live updates and GMP trends.

The Rise of SME IPOs:

The Indian stock market has witnessed a surge in interest for Small and Medium Enterprises (SME) IPOs. These offerings allow smaller companies to raise capital and expand their operations. Here are some of the advantages of investing in SME IPOs:

High Growth Potential: SME companies often exhibit high growth trajectories, offering the potential for significant capital appreciation.

Diversification: SME IPOs can help diversify your investment portfolio by including companies from various sectors not typically represented in large-cap offerings.

Early Investment Opportunity: Investing in an SME IPO allows you to participate in a company's growth story at an early stage.

A Glimpse into Upcoming SME IPOs (Disclaimer: Listing subject to change):

While the specific SME IPO listings can be dynamic, here are some examples of companies that might be considering an SME IPO in the near future:

Indegene Ltd: A contract research organization providing drug discovery and development services.

Aadhar Housing Finance: A housing finance company catering to the underserved and affordable housing segments.

TBO Tek: A leading player in the travel technology space.

MobiKwik: A popular digital payments platform offering a wide range of financial services.

Ixigo: A prominent online travel aggregator facilitating hotel bookings, flight reservations, and travel packages.

Important Considerations Before Investing in an IPO:

Before investing in any IPO, including upcoming SME offerings, it's crucial to conduct thorough research. Here are some key factors to consider:

Company Financials: Analyze the company's financial health, profitability, and growth prospects.

Industry Outlook: Evaluate the overall health and growth potential of the industry the company operates in.

Management Team: Assess the experience and capabilities of the company's management team.

IPO Valuation: Compare the IPO price with the company's fundamentals to determine if it's fairly valued.

Remember: IPOs can be a lucrative investment opportunity, but they also carry inherent risks. By conducting thorough research, understanding IPO GMP (while acknowledging its limitations), and carefully considering the factors mentioned above, you can make informed investment decisions in the exciting world of upcoming IPOs and the growing SME IPO market.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Gandhar Oil IPO GMP Today

Fedbank Financial Services IPO GMP Today

Tata Technologies IPO GMP Today

Flair Writing IPO GMP Today

Allied Blenders and Distillers IPO GMP Today

AMIC Forging IPO GMP Today

Net Avenue Tech IPO GMP Today

Marinetrans India IPO GMP Today

Graphisads IPO GMP Today

Sheetal Universal IPO GMP Today

Presstonic Engineering IPO GMP Today

S J Logistics IPO GMP Today

Shree OSFM E-Mobility IPO GMP Today

DCG Wires and Cables IPO GMP Today

Ramdevbaba Solvent IPO GMP Today

WINSOL ENGINEERS IPO GMP Today

Shivam Chemicals IPO GMP Today

Emmforce Autotech IPO GMP Today

Grill Splendour Services IPO GMP Today

Teerth Gopicon IPO GMP Today

Chatha Foods IPO GMP Today

Gabriel Pet Straps IPO GMP Today

Baweja Studios IPO GMP Today

Mayank Cattle Food IPO GMP Today

Docmode Health Technologies IPO GMP Today

Megatherm Induction IPO GMP Today

Siyaram Recycling IPO GMP Today

Accent Microcell IPO GMP Today

SLONE INFOSYSTEMS IPO GMP Today

Greenhitech Ventures IPO GMP Today

0 notes

Text

Embark on a journey into the future of investments with Unizon's

Embark on a journey into the future of investments with Unizon's exclusive access to Unlisted and Pre-IPO shares!

Discover the untapped potential of powerhouse companies like Chemenergy, Chennai Super Kings, HDB Financial Services, BOAT, NSE, TATA Technologies, OYO, IXIGO, and BIRA 91!

Seize the opportunity to invest in these industry leaders before they hit the public market. Your chance to be a part of the next big success story is NOW!

Don't miss out on this exclusive opportunity! Invest in Unlisted Shares NOW and watch your portfolio soar to new heights!

Buy Sell Unlisted Shares from Unizon

#buy and sell unlisted shares#sell unlisted shares#buy unlisted shares#commercial#buy sell unlisted shares

0 notes