#Is there a 30 day rule for crypto?

Text

Millennials and Gen Zs were raised to be entrepreneurs of the self, to believe that, if they simply worked and studied hard enough, success and security were waiting in their futures. Failure was a personal blight for refusing to invest their time wisely, for failing to grind hard enough. Post-2008, that dream was shot. You could work and work, but that did not mean that you would have job security and freedom from roommates by your mid-30s. Maybe this was what was meant by burnout culture. In the aftermath of the crash, middle-class people spoke of the death of the dream – the postwar ethos that, if you were willing to work hard enough and play by the rules, upper mobility and success were waiting in your future. If their parents had believed in climbing the ladder and just rewards for their hard work, this path was now closed to their children.

These generations are also a product of the speculative environment they were raised in. Most of the day-traders were teenagers or children in the financial crash, or just graduating college. Fledgling adults in the COVID-19 pandemic. Born between the mid-1980s and early 2000s, their identity is shaped by the vacuum of post-communist politics (I, personally, was sent, age five, to a fancy-dress party styled as the Berlin Wall) or shaped by the speculation and excess of the dotcom era, or racked by the uncertainty of the 2008 financial crash. They’ve encountered the death of the American dream (or in Ireland, where I’m from, the optimism of the Celtic Tiger) and felt the withdrawal of the state’s contract in everything from mounting student debt to inferior healthcare to the rising cost of living. The postwar security and investment in public goods like education and housing their grandparents and parents enjoyed has been replaced by volatility and risk. Retail trading forums like WallStreetBets and NFT Discords are spaces where people trade crazy investment advice, but it’s also where they articulate their loss of hope in those same dreams.

What replaced the fantasy of the good life? Dreams of prepping for life on Mars or in the metaverse? Of financial security through wild trades, or finding a good man to take care of you so you could leave the hustle behind? And who are these new dreams in service of? If the tale of hard work and upward mobility kept us yoked to our employers and our 9-to-5 jobs, the fantasy of the YOLO investment ‘Lambos or food stamps!’ keeps its subjects attached to the market. To risking it all. And these dreams feed the market, as in the crypto winter of 2021 where many vulnerable investors were left holding the bag, or the post-GameStop frenzy where, despite feelgood stories about David and Goliath, the significant profiteer was the market-maker behind the Robinhood trading app.

50 notes

·

View notes

Text

i've been mentally sketching out a set of rules and strategies for what a "terf-reporting discord" might look like and so far what i have is

anonymized. do not use your primary discord account, this is to protect you in case of infiltration. do not use it to meet other people on the server, it's best if none of us know who the others are. this does introduce its own problems (like infiltration)

using a secondary account to submit reports is also recommended, this is to protect you in case of retaliation from staff. compartmentalization is key, do not make it easy to affiliate your secondary accounts with your primary ones

prioritize mass-reporting terfs who have genuinely said something that is obviously and indefensibly way out of line, and continue submitting reports until they are deleted. if this gives a better understanding of how the reporting process works, sufficient to target what i would call "insignificant outlying terfs," it may be worthwhile, but i think simply getting rid of the loudest and worst would go a long way

evidence that they have remade is a golden ticket. it's easier to get someone banned again if they've been banned before, doubly so if they admit their previous url

hopefully this is obvious, but targeting someone who is 30 is preferable to targeting someone who is 15

do not interact with them. while i can see utility to infiltrating their circles to disrupt them or gain information on how to find and report them again beyond a remake, i don't think it's worth it, particularly because it provides them counteroffensive ammunition and it would be easy to get crypto-terf-jacketed

while i think we are well past the point where this can be attributed solely to incompetence, there are several facts about the incompetence that could be useful. i believe the way the reporting process works involves automating the priority of the queue for manual review based on number of reports. one person reporting a large number of accounts will likely go nowhere, if not being automatically discarded

i wouldn't rule out buying off moderators, since that's what they've done, but i can't imagine how to begin that process and i can't foresee it ending well

we've talked a lot about litigation, since it does have a proven track record. is anyone willing to put their whole legal name in the public record in order to actually do it? (if so, it may be best to administrate that entirely separately, with no overlapping actors)

i say this every day as general best practice advice, but again, don't use the app! use firefox with adblock, privacy badger, and noscript. this is, again, to protect you by minimizing available data collection

unfortunately i don't know anything about administrating a discord server so this is all a bit academic. unless there's enough interest to actually follow through. in which case i'm botching my own rules by posting this on main but i'm not really sure how else to gauge interest

14 notes

·

View notes

Text

In the fall of 2020, as crypto scammers and thieves began to realize the full potential of a financial privacy tool called Tornado Cash—a clever new system capable of shuffling users' funds to cut the trail of crypto transactions recorded on the Ethereum blockchain—Alexey Pertsev, one of the creators of that service, sent a note to his fellow cofounders about this growing issue. He suggested crafting a standard response to send to victims pleading with Tornado Cash for help with stolen funds laundered through their service. “We must compose a message that we will send to everyone in similar cases,” Pertsev, the then-27-year-old Russian living in the Netherlands, wrote to his colleagues.

Tornado Cash cofounder Roman Semenov answered three minutes later with a draft of their stock response—essentially pointing to the fact that the service's novel design meant it ran on the Ethereum blockchain, not on any server they owned, and was thus out of their hands. “It is a decentralized software protocol that no one entity or actor can control,” the message read. “For that reason, we are unable to assist with respect to any issues relating to the Tornado Cash protocol.”

That statement would remain Tornado Cash's position two days later when hackers affiliated with the North Korean government stole roughly $275 million worth of coins from the crypto exchange KuCoin and funneled a portion of the loot through Tornado Cash to cover their tracks. Tornado Cash would maintain that stance as, according to Dutch prosecutors, a billion-plus dollars more of stolen funds flowed through the service over the next two years, part of at least $2.3 billion in total funds from criminal and sanctioned sources that made up more than 30 percent of the service's overall transactions from 2019 to 2022.

Now, two years after Pertsev's arrest and indictment for money laundering, that “out-of-our-hands” decentralization defense has become one of the central arguments for his innocence. On Tuesday, it will be put to the test when a panel of three Dutch judges rules on the criminal charges that could send Pertsev to prison for years. Privacy advocates believe the result of the case—the first of two, as the New York prosecution of another Tornado Cash cofounder, Roman Storm, is expected to go to trial this coming September—could also shape the future of cryptocurrency privacy and may determine the limits of services like Tornado Cash or other open source software creations to offer a safe haven from financial surveillance.

Dutch prosecutors have accused Pertsev of essentially creating the perfect money laundering machine by designing Tornado Cash to work as a set of “smart contracts”—a type of decentralized service made possible by Ethereum's unique features, in which code is copied to the thousands of Ethereum nodes that store the cryptocurrency's blockchain—and thus preventing Tornado Cash's creators from identifying or controlling who used the service to hide the origins and destinations of their funds.

Pertsev's defenders, on the other hand, point out that those properties are also exactly what makes Tornado Cash such a powerful tool for privacy. “This is the entire point of a decentralized system,” says Sjors Provoost, a Dutch cryptocurrency developer and author of Bitcoin: A Work in Progress, who attended Pertsev's trial. “These are completely clashing worldviews. There's the worldview of privacy and decentralization, and there's the government worldview of surveillance, in which you need to be able to check every transaction.”

Since US and Dutch prosecutors indicted Tornado Cash's cofounders and the US Treasury sanctioned the service in 2022, the case has become a cause célèbre in some cryptocurrency circles, many of whose adherents argue that a guilty verdict could not only damage financial privacy but also set a dangerous precedent that developers of open source software can be held liable for the actions of those who use their tools. Ethereum's inventor, Vitalik Buterin, has noted publicly that he used Tornado Cash to anonymize a donation to Ukraine following Russia's invasion, as an example of the service's legitimate use for privacy. US National Security Agency whistleblower Edward Snowden has compared Tornado Cash's functioning on the Ethereum's blockchain to a water fountain built in a park—a kind of public utility where “you push a button and privacy comes out”—and has called the crackdown on Tornado Cash and its cofounders “deeply illiberal and profoundly authoritarian."

Yet the Dutch prosecutors and Netherlands' financial law enforcement agency, known as FIOD, which led the investigation of Pertsev, argue that the case isn't actually about a fundamental conflict between privacy and security, or liability for open source code, or any other larger principle. Instead, they say, it's about Pertsev's specific, informed decisions to enable thieves on an enormous scale. “It's all about the choices of our suspect,” M. Boerlage, the case's lead prosecutor, tells WIRED in an interview. “He made choices writing the code, deploying the code, adding features to the ecosystem. Choice after choice after choice, all while he knew that criminal money was entering his system. So it's not about code. It's about human behavior.”

A Room Without a Lock—or Walls

Dutch prosecutors contend that, despite the Tornado Cash creators' claims, they did exert control over it. Aside from its decentralized “smart contract” design, they point to Tornado Cash's web-based user interface for interacting with its blockchain-based smart contract: a fully centralized tool running on infrastructure the creators built and managed, which nonetheless had no monitoring or safeguards to prevent its abuse by criminals for money laundering. In fact, prosecutors found that during the time of their investigation, 93.5 percent of users sent their transactions to Tornado Cash through that web interface, which was far simpler to use than directly interacting with the blockchain-based service.

Pertsev's defense didn't respond to WIRED's repeated requests for an interview. But his lead defense attorney, Keith Cheng, has countered that there would have been no point in monitoring or blocking users on that web interface when anyone could circumvent the website altogether to interact directly with the smart contract or even to build their own interface. “The Tornado Cash smart contracts could be accessed directly at any point of time,” Cheng told an audience at the ETHDam cryptocurrency conference in Amsterdam last year. “Implementing checks within the surrounding infrastructure is akin to adding extra locks to a door that lacks surrounding walls.”

The prosecution points out that Tornado Cash could have at least tried to put locks on that door, given that the vast majority of their users, both legitimate and criminal, were walking through it. More fundamentally, they argue that it was Pertsev's decision to put into place a system that he knew from the start would include basic elements he couldn't control. “Building and deploying something unstoppable is also a decision,” says Boerlage.

That question of decentralization and control nonetheless makes the Tornado Cash case a far less straightforward prosecution than those against the founders of simpler bitcoin-based “mixer” services like Bitcoin Fog or Helix, which were similarly intended to prevent cryptocurrency tracing. In each of those earlier cases, the administrators—now both convicted of money laundering conspiracy—hid their connections to the services. By contrast, Pertsev and his cofounders appear to have been confident enough in their remove from the money launderers who used Tornado Cash that they operated fully in the open, under their real names. “This complete transparency does not exactly indicate criminal activity,” Pertsev's attorney Cheng told ETHDam.

At the same time, the prosecution argues that Pertsev was both aware of and untroubled by the millions and ultimately billions of dollars in stolen cryptocurrency flowing through Tornado Cash, which reached a peak in the spring of 2022. They argue that Pertsev continued to maintain and develop pieces of the system—such as its centralized frontend—even as the service was used to launder the stolen funds from 36 distinct cryptocurrency heists, many of which prosecutors say he and his cofounders discussed in their communications. In the meantime, he also profited handsomely, in part from Tornado Cash's issuing its own crypto token, ultimately making more than $15 million and buying himself a Porsche.

When North Korean hackers stole more than $600 million from the blockchain-based game Axie Infinity in March of 2022, Tornado Cash cofounder Semenov wrote anxiously to Pertsev and Storm that “the fucking disaster is about to begin,” perhaps fearing that their service would be used by the perpetrators of that massive heist, as it already had been in well over a dozen others. Pertsev weighed in 10 minutes later, writing “noticed after 5 days, lol," an apparent reference to how long it seemed to have taken Axie Infinity to discover the theft. Sure enough, less than a week later, hundreds of millions of dollars in stolen Axie Infinity funds began to pour into Tornado Cash.

Prosecutors have pointed to Pertsev's “lol” as a sign of his flippant disregard for the victims whose funds, they argue, he was helping to launder. His defense has countered that he was merely expressing surprise.

That same month, perhaps in response to the growing spotlight on Tornado Cash's use by criminals, Pertsev and his cofounders did, in fact, implement a free tool from blockchain analysis firm Chainalysis that would block transactions from sanctioned Ethereum addresses via their web interface. The prosecution has pointed out that the free tool was easily circumvented—hackers could merely move their stolen coins to a different address before sending them into Tornado Cash—and described the effort as “too little and too late."

In their statement to the court, Dutch prosecutors suggest a different solution, if Pertsev had actually cared about Tornado Cash's exploitation by criminals. “What was the simplest option? Take the UI offline and stop advertising. Plain and simple,” they write. “Stop offering the service.”

In the conclusion of that same statement to the court, they point out that under Dutch law the maximum prison sentence for money laundering at the scale Pertsev allegedly committed is eight years, and they ask that Pertsev be sentenced to five years and four months if he's found guilty.

The Tornado Rolls On

Cryptocurrency advocates focused on privacy and civil liberties will be closely watching the outcome of Pertsev's case, which many see as a bellwether for how Western law enforcement and regulators will draw the line between financial privacy and money laundering—including in some immediate cases to follow.

The US trial of Tornado Cash's Storm in a New York court later this year, as well as the US indictment last month of the founders of Samourai Wallet, which prosecutors say offered similar privacy properties to Tornado Cash's, are more likely to directly set precedents in US law. But Pertsev's case may suggest the direction those cases will take, says Alex Gladstein, the chief strategy officer for the Human Rights Foundation and an advocate of bitcoin's use as a human rights tool.

“What happens in the Netherlands will color the New York case, and the Tornado Cash cases are really going to color the outcome of the Samourai case,” Gladstein says. “These cases are going to be historic in the precedents they set.”

Gladstein, like many crypto privacy supporters, argues that anyone weighing the value of tools like Tornado Cash should look beyond its use by hackers to countries like Cuba, Venezuela, and India, where activists and dissidents need to hide their financial transactions from repressive governments. “For human rights activists, it’s essential that they have money the government can’t surveil,” Gladstein says.

Regardless of the verdict in Pertsev's case or that of his cofounder Roman Storm in the fall, Tornado Cash's founder's core argument—that Tornado Cash's underlying infrastructure has always been out of their hands—has proven to be correct: Tornado Cash lives on.

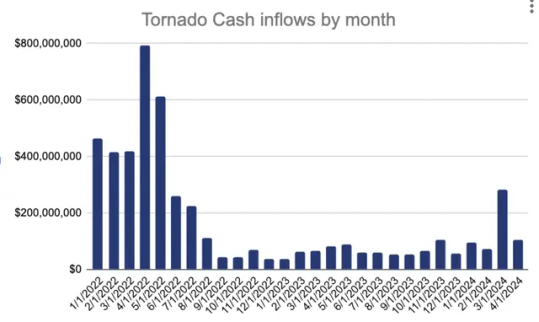

True to its promise of decentralization, Tornado Cash still persists after its cofounders indictment in the fall of last year—and is now out of their control. In March, $283 million flowed into the service. Courtesy of Chainalysis

When the tool's centralized web-based interface went offline last year in the wake of US sanctions and the two cofounders' arrests—Roman Semenov, for now, remains free—Tornado Cash transactions dropped by close to 90 percent, according to Chainalysis. But Tornado Cash has remained online, still functioning as a decentralized smart contract. In recent months, Chainalysis has seen its use tick up again intermittently. More than $283 million flowed into the service just in March.

In other words, whether it represents a public utility for financial privacy and freedom or an uncontrollable money laundering machine, its creators' claim has borne out: Tornado Cash remains beyond their control—or anyone's.

9 notes

·

View notes

Text

Writing Game Week #1: Use These Prompts to Get Back Into Writing

Prompt 1

Prompt 2

Rules: Sharing randomly generated prompts every day for a week. Create sth with it in only an hour (time yourself). Don't edit or proofread till the very end. Just. Write.

A/N: Really loving this game ngl. This one was particularly out of my typical writing comfort zone or wtv but was fun! Enjoy.

Prompt 3: Scrolling, you saw a meme coin for $1. Laughed, "Why not?" and bought 500 coins. Next morning, the phone buzzes like crazy. The meme coin? It skyrocketed! $30 million a pop! the $500 turned into a mind-blowing 15 billion! What to do with this life-changing windfall? Decisions, decisions...

You’re doomscrolling through your phone—as you do before bedtime when you notice that all your targeted ads are about investing in cryptocurrency.

Invest today! Invest in the future! You’re missing out! Now! Today! Crypto!

Sighing, you remember how adamant your friends were about this very thing over today’s lunch. It seems everyone is riding that crypto train but you.

The next ad you scroll through features the meme coin you liked when Lizzie showed it to you. Feeding off your reaction, she tried to get you to invest in it right then and there, pushing that “...it’s only a dollar! Investing is a win-win; trust me!”

You scratch your head for a moment, still staring at the stupid coin on the screen. The colorful hues of the ad dance across your face in your dark bedroom. Realizing you’re biting your nails, you decide, hey, what’s the harm?, and click on the ad.

You win, you think.

When that little window opens asking how much you’d like to invest, your brain halts to weigh your monthly budget first. Your eyes dart back and forth as numbers swirl in your head. This was a risk at the end of the day, you thought idly, you didn’t even believe in this crap but minutes ago!

You decide to text Liz. She had to be up at this hour, right? Didn’t she work night shifts?

You: hey, so, don’t get too excited but i’m caving in. how much of the meme coin should i buy? 👀

Liz: finally!

Liz: which one though lol you do know there’s like…tens of them?

You: dude…

This information almost makes you abort mission. But you text back.

You: that crypto of my fav meme?

You: you know, the one that made me chuckle at lunch?

Liz: Oh, yeah!

Liz: 500, easy

You: That much?! 😲

That’s ridiculous, you think, that’s more than 20% of my paycheck damnit! You’re closer now to pulling the plug on this whole fiasco.

Liz: Yeah dude, like, the value of return will be crazy at some point

Liz: Just do it 💪🏼

You: You and the “just do it” crap 🙄

Liz: You’ll see tomorrow when we’re filthy rich who’s laughing 😉

Sighing, you scratch your eyebrow in thought. Maybe it was the it’s-after-midnight-let’s-make-bad-decisions fever or how sleepy you were, but you did as told and begrudgingly invested 500 dollars of your hard-earned money.

Feelings you only get when you make an unnecessary purchase just ‘to feel something’ creep into your heart right away. You lock and throw away your phone. Let’s just go to bed, you nod to yourself, cuddling into your pillows. Que sera, sera, right?

The next day, your phone almost buzzing off your end table wakes you up 30 minutes before your alarm was supposed to go off. Grougy still, you reach for it, using your instinct to unlock it without looking. A deep groan escapes you when you see the time. 6.30 am.

What the fuck could it be at this hour?

Eyes half-open, eyebrows crossed, you look closely to see over 100 notifications and counting. Your GC with your gal pals is going crazy. What are these idiots talking about now?

Lazily, you open the chat app, assuming it might be an emergency of some sort. Though it rarely was. The last time this happened, the season finale of y’all’s favorite show was a little too intense. The girls spent the night talking about the scenes in detail and consoling each other.

But even though it might be nothing, your duty as a close friend is to know what’s making the GC flood with messages, Then you can catch those extra 20 minutes of sleep.

Liz: I’m going to pay off my debts first duh!

Deb: Vegas baby!!!! 💃🏼💃🏼

Liz: Omg no guys, we should toootes travel! Paris, just like we all dreamed about!

Deb: Vay-gas. Vay-gas. I’m craving some man candy, c’mon!! 🤑🤑

Jordi: Shouldn’t we be quitting our jobs like…right now? Like I feel that’s the most fun part of all this!

Jordi: Ngl calling my boss a dick would be nice 🙊

You: …

You: What the fuck you guys?

You’re in the middle of typing a follow-up message when Liz’s name flashes through your screen. Clearing your throat, you accept the call.

“Holy shit, dude, what did I tell you!”

“You’re screaming and I just woke up,” you reprimand, rubbing your eyes. “Are you guys planning something? Why is Deb talking about Ve—?”

“Shut up and sell your crypto.”

“Wha—”

“Just do it!”

You roll your eyes. “Always with that damned phrase,” you say, putting the call on speakerphone to exit the app and open the crypto one. “But I just bought the damned thing yesterday!”

You ramble on while you type in your account details and the screen loads.

“Seriously was it worth waking me u—holy shit!!!”

You sit up, awake immediately.

“What. The. Shit.”

“I told you! I fucking told you, didn’t I?”

Your friend’s muffled screams echo off the phone’s speakers. Utterly flabbergasted, you just keep cursing out loud, in total disbelief at the number in front of you.

30,000,000.

30 million.

30. Fucking. Million.

“Are you selling them yet?!”

Your friend’s voice wakes you up from your trance.

“Yes, yes, one sec.”

You find the sell button and watch as the numbers transform into an even more unbelievable one.

15,000,000,000

You keep counting the zeroes, thinking there must be some sort of mistake. There was just no way.

Is there even that much money in the world??

The thought was foolish, of course. Your hands tremble, maybe in shock, maybe in fear, maybe in anticipation of what’s to come—you didn’t know.

“Holy shit, Liz.”

“I told you! I told you tomorrow we’ll be rich!”

“Wait,” you shake your head, “you knew this was going to happen today?”

“Well…no.” She laughs. “But imagine how cool that would’ve been?”

You laugh, too, not helping the stupid grin on your face. You hop back into the GC, scrolling through the influx of messages still going on.

“This was totally worth waking me up.”

Lizzie laughs again. “So what are you going to do with the money? If you read through the chat, you’ll see we were taking bets while you were sleeping.”

“You didn’t??” You gasp. “What did you bet?”

“Knowing you? You’re probably gonna spend it on expensive food first.” You laugh aloud and Liz piles on with, “Tell me I’m wrong! You’re the one always saying you want to try new foods but can’t afford shit.”

“Ain’t no lie there.” You agree, brushing your hair back. “Oh god, Deb bet I’ll spend it on hookers? Is that girl ever not thinking about sex?”

“Well, you know Deb.”

You take to the chat to respond to the blonde bimbo you love and respect.

You: What the shit, Debbie? Hookers?? We’re not all you 🙄

Deb: HAHAHA y’all wish you were as fun 😘

Deb: And at least my bet is plausible. Have you seen what Jordi bet yet?

“What did Jordi bet?”

“Uh…” Liz pauses in thought; then clicks her fingers. “Ah! She bet on charity work l-o-l.”

“Charity?”

“Yup.”

“Seriously. Charity?”

“E-y-up.”

“Do you guys even know me?” You laugh, a little quizzical and hurt, to be honest. You’re the only charity you’ll spend money on—you even joked about that a few times over dinner.

“Just tell us what you’ll be doing! C’mooon! Paris awaits!”

“Okay, alright already.”

You hang up and take to the chat.

You: Sorry bitches, but you all lose. First thing imma do? Take you guys out for drinks. On me. 😉

Liz: That’s it? 😂 It’s 7 in the morning!

Deb: Who cares! We’re billionaires! 🤑

Jordi: Just quit my job. I suggest y’all do the same before getting WASTED

#writing#writeblr#writblr#writers on tumblr#creative writing#blurb#prompt#writing prompt#writing games#writing week games#story prompt#ideas for writing#writing inspiration#writing ideas

6 notes

·

View notes

Text

Hotcoin’s 26 Million BEER Token Airdrop: Celebrate Oktoberfest with Crypto!

As Oktoberfest brings people together for celebrations, Hotcoin is making the festivities even more exciting with a massive 26 million BEER token airdrop! Whether you’re a seasoned crypto enthusiast or just getting started, this is your chance to claim some festive rewards. By completing just three simple tasks, you can earn a generous 32,500 BEER tokens. Here’s everything you need to know to participate in this fun event.

What’s the BEER Token Airdrop All About?

Hotcoin has launched this exclusive BEER token giveaway to coincide with Oktoberfest, offering both crypto newcomers and experienced traders a chance to enjoy rewards. With a total of 26 million BEER tokens available, participants can complete easy tasks and secure their share before the event ends. But remember, availability is limited to the first 800 users, so don’t wait!

How to Claim Your BEER Tokens

Participating in the airdrop is simple and straightforward. Just follow these three steps to get your tokens:

Register and Log In

Sign up using the designated link and log in to the Hotcoin app for the first time. This is the essential first step to unlock your rewards.

Join the Hotcoin Communities

Become a member of Hotcoin’s Telegram and Discord channels. This will keep you in the loop for future updates and events while completing one of the required tasks.

Make a Trade

Complete any spot or futures trade on the Hotcoin platform. It doesn’t matter how large or small the trade is; completing one will qualify you for the airdrop.

Once you’ve completed these steps, you’ll be eligible to receive your share of 32,500 BEER tokens!

Important Event Details

Event Period:

The airdrop runs from September 26, 2024, 00:00 to September 30, 2024, 23:59 (UTC+8). Be sure to complete the tasks within this window to qualify for the rewards.

Airdrop Distribution:

All eligible participants will receive their BEER tokens within seven working days after the event concludes.

Key Terms and Conditions

Eligibility:

This airdrop is available only to new users who register through the special event link and download the Hotcoin app for the first time. Existing users will not be able to participate.

Limited to First 800 Users:

The promotion is limited, so act fast! It’s first-come, first-served, and only the first 800 users will get the chance to claim the 26 million BEER tokens.

No Double-Dipping:

BEER tokens earned in this airdrop cannot be combined with other promotions on the platform. Additionally, Hotcoin reserves the right to interpret the event rules, and any attempt to game the system will result in disqualification.

Why You Shouldn’t Miss Out

Oktoberfest is the perfect time to celebrate, and with Hotcoin’s 26 million BEER token giveaway, you can join in the festivities while engaging in the world of crypto. Whether you’re new to the platform or eager to try something different, this airdrop is a great way to kick off your Hotcoin experience.

Don’t miss out—claim your BEER tokens today and toast to Oktoberfest with Hotcoin!

0 notes

Text

Fintech Owner Faces Drug Money Laundering Accusations

A London-based fintech owner accused of helping drug traffickers launder hundreds of millions of euros through a crypto exchange platform must be extradited to Belgium to face criminal charges, a London judge ruled.

Caio Marchesani, who owns Trans-Fast Remittance a payments business regulated by the Financial Conduct Authority, is alleged to have hoarded vast amounts of cash for Sergio Roberto De Carvalho, a Brazilian described by Interpol as one of the world’s most wanted kingpins before his arrest in 2022.

A fintech owner in London is facing allegations that he helped notorious drug traffickers attempt to launder hundreds of millions of euros through a crypto exchange platform on a scale rarely seen by European prosecutors.

Authorities in Belgium are seeking the extradition of Caio Marchesani from the UK as part of their effort to dismantle a transnational gang. They accuse the 38-year-old Italian of “knowingly and intentionally” hoarding piles of cash for Sergio Roberto De Carvalho, a Brazilian described by Interpol as one of the world’s most wanted kingpins before his arrest in 2022.

A London-based fintech owner accused of helping drug traffickers launder hundreds of millions of euros through a crypto exchange platform must be extradited to Belgium to face criminal charges, a London judge ruled.

Caio Marchesani, who owns Trans-Fast Remittance, a payments business regulated by the Financial Conduct Authority, is alleged to have accepted cryptocurrency from the criminal organisation of Flor Bressers, a Belgian national known as the “finger cutter.” Belgian prosecutors claim the cryptocurrency was used to pay for cocaine. Marchesani, who was arrested at Heathrow Airport in May, will have seven days to appeal against the order, a London judge said on Tuesday approving his removal.

Marchesani’s lawyer and the prosecution declined to comment immediately after the Tuesday ruling.

The prosecution’s case has “false, vague, ambiguous or inaccurate particulars,” his lawyers at law firm Mishcon de Reya previously said. “What is clear however, is that none of the allegations against him relate to any of his business interests in the UK.”

The efforts to extradite Marchesani is part of a broader investigation that kicked off three years ago after the Dutch government seized more than 12 tonnes of cocaine, worth more than €260 million ($278 million) at Europe’s busiest port, Rotterdam.

Authorities traced the haul to Bressers and De Carvalho, later zeroing in on Marchesani after a breakthrough in decoding encrypted communications. “He is a dark banker who receives money and moves it around at the will of the criminal organization in order to disguise its origins,” the prosecutors acting for the Belgian authorities alleged at an earlier hearing.

A trial of 30 defendants in the case, including Bressers, started in Belgium earlier this month but was immediately postponed, according to local press reports.

A pre-recorded message left by Trans-Fast’s when contacted by phone said the payment service is currently offline and it aims to restart services soon. Companies House filings from August show another owner has been added to the registry.

1 note

·

View note

Text

Fintech Owner Faces Drug Money Laundering Accusations (Correct)

A London-based fintech owner accused of helping drug traffickers launder hundreds of millions of euros through a crypto exchange platform must be extradited to Belgium to face criminal charges, a London judge ruled.

Caio Marchesani, who owns Trans-Fast Remittance a payments business regulated by the Financial Conduct Authority, is alleged to have hoarded vast amounts of cash for Sergio Roberto De Carvalho, a Brazilian described by Interpol as one of the world’s most wanted kingpins before his arrest in 2022.

A fintech owner in London is facing allegations that he helped notorious drug traffickers attempt to launder hundreds of millions of euros through a crypto exchange platform on a scale rarely seen by European prosecutors.

Authorities in Belgium are seeking the extradition of Caio Marchesani from the UK as part of their effort to dismantle a transnational gang. They accuse the 38-year-old Italian of “knowingly and intentionally” hoarding piles of cash for Sergio Roberto De Carvalho, a Brazilian described by Interpol as one of the world’s most wanted kingpins before his arrest in 2022.

A London-based fintech owner accused of helping drug traffickers launder hundreds of millions of euros through a crypto exchange platform must be extradited to Belgium to face criminal charges, a London judge ruled.

Caio Marchesani, who owns Trans-Fast Remittance, a payments business regulated by the Financial Conduct Authority, is alleged to have accepted cryptocurrency from the criminal organisation of Flor Bressers, a Belgian national known as the “finger cutter.” Belgian prosecutors claim the cryptocurrency was used to pay for cocaine. Marchesani, who was arrested at Heathrow Airport in May, will have seven days to appeal against the order, a London judge said on Tuesday approving his removal.

Marchesani’s lawyer and the prosecution declined to comment immediately after the Tuesday ruling.

The prosecution’s case has “false, vague, ambiguous or inaccurate particulars,” his lawyers at law firm Mishcon de Reya previously said. “What is clear however, is that none of the allegations against him relate to any of his business interests in the UK.”

The efforts to extradite Marchesani is part of a broader investigation that kicked off three years ago after the Dutch government seized more than 12 tonnes of cocaine, worth more than €260 million ($278 million) at Europe’s busiest port, Rotterdam.

Authorities traced the haul to Bressers and De Carvalho, later zeroing in on Marchesani after a breakthrough in decoding encrypted communications. “He is a dark banker who receives money and moves it around at the will of the criminal organization in order to disguise its origins,” the prosecutors acting for the Belgian authorities alleged at an earlier hearing.

A trial of 30 defendants in the case, including Bressers, started in Belgium earlier this month but was immediately postponed, according to local press reports.

A pre-recorded message left by Trans-Fast’s when contacted by phone said the payment service is currently offline and it aims to restart services soon. Companies House filings from August show another owner has been added to the registry.

1 note

·

View note

Text

Fintech Owner Linked to Drug Kingpins Faces Belgian Trial

A London-based fintech owner accused of helping drug traffickers launder hundreds of millions of euros through a crypto exchange platform must be extradited to Belgium to face criminal charges, a London judge ruled.

Caio Marchesani, who owns Trans-Fast Remittance a payments business regulated by the Financial Conduct Authority, is alleged to have hoarded vast amounts of cash for Sergio Roberto De Carvalho, a Brazilian described by Interpol as one of the world’s most wanted kingpins before his arrest in 2022.

A fintech owner in London is facing allegations that he helped notorious drug traffickers attempt to launder hundreds of millions of euros through a crypto exchange platform on a scale rarely seen by European prosecutors.

Authorities in Belgium are seeking the extradition of Caio Marchesani from the UK as part of their effort to dismantle a transnational gang. They accuse the 38-year-old Italian of “knowingly and intentionally”

hoarding piles of cash for Sergio Roberto De Carvalho, a Brazilian described by Interpol as one of the world’s most wanted kingpins before his arrest in 2022.

A London-based fintech owner accused of helping drug traffickers launder hundreds of millions of euros through a crypto exchange platform must be extradited to Belgium to face criminal charges, a London judge ruled.

Caio Marchesani, who owns Trans-Fast Remittance, a payments business regulated by the Financial Conduct Authority, is alleged to have accepted cryptocurrency from the criminal organisation of Flor Bressers, a Belgian national known as the “finger cutter.” Belgian prosecutors claim the cryptocurrency was used to pay for cocaine. Marchesani, who was arrested at Heathrow Airport in May, will have seven days to appeal against the order, a London judge said on Tuesday approving his removal.

Marchesani’s lawyer and the prosecution declined to comment immediately after the Tuesday ruling.

The prosecution’s case has “false, vague, ambiguous or inaccurate particulars,” his lawyers at law firm Mishcon de Reya previously said. “What is clear however, is that none of the allegations against him relate to any of his business interests in the UK.”

The efforts to extradite Marchesani is part of a broader investigation that kicked off three years ago after the Dutch government seized more than 12 tonnes of cocaine, worth more than €260 million ($278 million) at Europe’s busiest port, Rotterdam.

Authorities traced the haul to Bressers and De Carvalho, later zeroing in on Marchesani after a breakthrough in decoding encrypted communications. “He is a dark banker who receives money and moves it around at the will of the criminal organization in order to disguise its origins,” the prosecutors acting for the Belgian authorities alleged at an earlier hearing.

A trial of 30 defendants in the case, including Bressers, started in Belgium earlier this month but was immediately postponed, according to local press reports.

A pre-recorded message left by Trans-Fast’s when contacted by phone said the payment service is currently offline and it aims to restart services soon. Companies House filings from August show another owner has been added to the registry.

0 notes

Text

Potential BOJ Rate Rises Stimulate Unease in Japan’s Cryptocurrency Market

Key Points

The Bank of Japan’s potential rate hikes could cause further turmoil in the cryptocurrency market.

Japan’s share in the global crypto market is declining, partly due to strict tax rules.

The global economy has been experiencing significant volatility recently, with cryptocurrencies being significantly affected.

Notably, the expected interest rate cuts by the Federal Reserve have fueled market concerns. George Lagarias, chief economist at Forvis Mazars, warns that a drastic Fed rate cut could pose substantial risks to the market.

Bank of Japan’s Stance

Adding to these uncertainties, Bank of Japan’s Governor, Kazuo Ueda, announced on September 3rd that the BOJ would persist in raising interest rates if economic conditions match their forecasts.

This announcement is crucial considering the dramatic drop of 12% in Japan’s stock market on August 5th, the most significant decline in 37 years.

This plunge was partially due to the “carry trade” strategy, where investors took advantage of Japan’s low rates to borrow yen for buying profitable US assets. The impact was severe, with tech giants like Apple and Nvidia experiencing substantial declines. However, the crypto market was the hardest hit, suffering its largest single-day drop since 2023.

Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) saw double-digit losses, while altcoins like Solana and Dogecoin declined by up to 30%. This sell-off led to approximately $1.14 billion in liquidations and wiped nearly $600 billion from the market cap.

Decline in Japan’s Crypto Market Share

In a recent meeting with Liberal Democratic Party officials, Genki Oda, founder of SBI-owned BITPOINT and Chairman of the Japan Cryptocurrency Exchange Association, pointed out Japan’s shrinking role in the global crypto market.

Oda stated that Japan’s once dominant share of Bitcoin trading volume, which was around 50% from 2017 to 2018, has now reduced to a small fraction of the global total by 2024. This indicates a substantial decline in Japan’s crypto presence.

He expressed concerns that Japan’s strict tax rules could lead to a decrease in the international competitiveness of Japanese web3-related businesses.

In response to these developments, Japan’s Financial Services Agency (FSA) proposed a tax reform on August 30th. The request suggested that cryptocurrency should be treated as a financial asset, a viable investment target for the public.

This reform could offer clearer regulatory guidelines, potentially lessen tax burdens, and promote broader public investment in digital assets.

With Prime Minister Fumio Kishida’s recent announcement to step down in September, the future of Japan’s economy and its impact on the cryptocurrency ecosystem is particularly intriguing.

Kishida’s departure could lead to policy changes, which might affect both the broader financial landscape and the regulatory environment for digital assets.

0 notes

Text

Bitcoin Options Worth 21,000 Expiring Today: Implications for BTC Price Ahead

Key Points

Bitcoin experiences a slight 1% drop, trading at around $64,000, as 21,000 Bitcoin options prepare to expire.

Bitcoin’s retail demand has reached a three-year low, with a less than 15% change in the last 30 days.

After reaching a weekly high of $65,500, Bitcoin’s price has slightly retreated, dropping 1% and currently trading at approximately $64,000. The cryptocurrency market is paying close attention to the weekly Bitcoin options expiry due today.

According to data from Greeks.Live, 21,000 Bitcoin Options are set to expire today. These options have a put/call ratio of 1.2, a notional value of $1.2 billion, and the max pain point at $62,000. It’s been a week of significant growth for the crypto market, bolstered by numerous positive developments. All key term implied volatilities (IVs) have seen considerable increases, generally by 5% or more compared to last week.

Increasing Put-Call Ratio and Bitcoin’s Short-Term Prospects

An increasing put-call ratio, especially one greater than 0.7 or exceeding 1, suggests that equity traders are buying more puts than calls. This trend indicates a growing bearish sentiment in the market. Investors may be speculating on a market decline or hedging their portfolios against a potential sell-off.

The short-term outlook for Bitcoin doesn’t appear very promising, with the possibility of the BTC price correcting further up to $60,000 not being ruled out.

Declining Retail Demand for Bitcoin

In a post on X platform, Cryptoquant founder Ki Young Ju reported that Bitcoin’s retail demand has fallen to a three-year low. He also noted that the average monthly change in Bitcoin demand among retail investors has fallen below 15% in the last 30 days.

While large Bitcoin transactions are typically handled by institutions, many market analysts believe that a significant Bitcoin price rally can only begin with a surge in retail investors’ interest. According to CryptoQuant contributor Minkyu Woo, “The real bull run typically begins with massive buying volume driven by retail investors.” This suggests that a surge in retail investor activity generally enhances market sentiment.

On-chain data provider Santiment reported that positive commentary toward Bitcoin has significantly declined despite the recent mid-sized crypto market bounce. Many traders, particularly on Binance, are opening short positions, anticipating another drop in BTC. These combined factors increase the likelihood of a cryptocurrency rise.

0 notes

Text

Cryptocurrency Capital Gains Tax UK

New Post has been published on https://www.fastaccountant.co.uk/cryptocurrency-capital-gains-tax-uk/

Cryptocurrency Capital Gains Tax UK

Have you recently ventured into the world of cryptocurrency and are now wondering about cryptocurrency capital gains tax? Well, you’ve come to the right place! Navigating the world of cryptocurrency capital gains tax can be daunting, but understanding your obligations is crucial. If you’re considering selling or giving away your cryptoassets, it’s important to check if you need to pay Capital Gains Tax. This guide provides clear instructions on when and how to calculate your gains, what records you need to keep, and the allowable costs you can deduct. Whether you’re exchanging tokens, using them for purchases, or giving them as gifts, this article helps you comprehend the tax implications and ensure you’re compliant with UK tax laws.

youtube

Check if You Need to Pay Tax When You Dispose of Cryptoassets

When to Check if you Need To Pay Cryptocurrency Capital Gains Tax UK

Understanding when to check if you need to pay tax is crucial. The UK’s HMRC has specific guidelines about when you’ll need to pay Capital Gains Tax (CGT) on your cryptoassets. You should consider the following scenarios:

Selling your tokens: Whether you’re selling Bitcoin, Ethereum, or any other type of cryptoasset, selling them might trigger a tax liability.

Exchanging tokens: Moving from one type of cryptoasset to another, such as trading Bitcoin for Ethereum, can be taxed.

Using tokens for transactions: If you use your crypto to pay for goods or services, this could count as a taxable event.

Gifting tokens: Giving away your tokens to another person is taxable unless it’s a gift to your spouse or civil partner.

Donating tokens: Even if you’re donating crypto to a charity, you might need to pay tax on the donation.

In other words, almost any transaction involving cryptoassets could require you to check the tax implications. Better safe than sorry!

Work Out if You Need to Pay cryptocurrency capital gains tax

You may be free from tax anxiety, but you need to check! To determine if you owe Cryptocurrency Capital Gains Tax, follow these steps:

Calculate Your Gain: The primary way to calculate your gain is by finding the difference between what you paid for an asset and the price you sold it for.

Different Rules for Quick Sales: If you sell tokens within 30 days of acquiring them, the rules differ. You’ll need to calculate your gain using the specific rules for cryptoassets sold within this period.

Taking Market Value into Account: If the asset was free, use the market value when you got it to determine your gain.

Income Tax Considerations: If you’ve already paid Income Tax on the value of the tokens received, you won’t need to pay CGT on that portion. However, you’ll still owe CGT on the profits made after you got them.

Allowable Costs: Certain costs can reduce your taxable gain, such as transaction fees or advertising costs.

You may also offset gains with capital losses. Remember, keeping diligent records is key here.

What Counts as an Allowable Cost

Being meticulous about allowable costs can save you considerable tax. Here’s a rundown of what you can and cannot deduct:

Deductible Costs:

Transaction fees: Any fees paid to process the transaction on the blockchain can be deducted.

Advertising: Costs involved in finding a buyer or seller.

Contract Fees: Any costs related to drafting a contract for the transaction.

Valuation Expenses: Costs incurred to ascertain the value for the transaction.

Non-Deductible Costs:

Income Tax Costs: If you’ve already deducted these against Income Tax.

Pool the Cost of Your Tokens

Pooling helps in organizing and calculating the cost of your tokens more efficiently. Here’s how you can do it:

Create Pools: Each type of token you own should be grouped into its own pool.

Calculate Pooled Cost: The pooled cost will be the sum of the amount you paid for each token type.

Adjust Pool for Transactions: When you buy more tokens, add their cost to the pool. When you sell, deduct a proportionate share from the pool.

Special Pooling Rules:

Hard Forks: If there has been a hard fork, the cost pooling rules change slightly.

Recent Purchases: If you buy tokens on the same day you sell similar tokens, or within 30 days, different rules apply.

How to Report and Pay

Once you’ve figured out that you owe CGT, reporting and paying it is the next important step. There are two ways you can do this:

Self-Assessment Tax Return: You can file this at the end of the tax year.

Real-Time CGT Service: If you want to deal with it immediately, you can use the Capital Gains Tax real-time service.

Key Points:

Non-Residents: The tax amount may vary if you’re not a resident in the UK.

Currency Requirements: All transactions must be reported in pound sterling.

Records You Must Keep

Keeping accurate records is not just good practice; it keeps you on the right side of the law. The following records are essential:

Type of Tokens: Keep track of the nature of tokens involved in each transaction.

Dates: Record the specific dates when you disposed of tokens.

Quantity: Document the number of tokens disposed of and the number left.

Value in Pound Sterling: Every transaction’s value should be converted and recorded in pound sterling.

Financial Records: Bank statements and wallet addresses should be maintained.

Pooled Costs: Ongoing records of your pooled costs, both before and after transactions.

HMRC may ask to see these records during a compliance check, so it’s prudent to be thorough.

Conclusion

So, there you have it—a comprehensive guide to understanding if you need to pay cryptocurrency capital gains tax UK when you dispose of your cryptoassets. Navigating the taxation landscape of cryptocurrencies might seem daunting at first, but breaking it down into smaller, manageable steps can make the process more transparent and less stressful.

Remember, being proactive about your tax obligations can save you a lot of trouble down the road. Whether you’re day trading or holding onto your investments for the long term, understanding these guidelines will help you stay compliant and potentially save on taxes.

Stay informed, keep meticulous records, and don’t hesitate to consult experts if you’re unsure about any part of the process. Happy trading!

#capital gains tax cryptocurrency uk#cryptocurrency capital gains tax#cryptocurrency capital gains tax UK#cryptocurrency gains tax uk

0 notes

Text

US SEC Approves New Spot Ether ETFs for Exchange Listings

The U.S. Securities and Exchange Commission (SEC) has given the green light to Nasdaq, CBOE, and NYSE to list exchange-traded funds (ETFs) linked to the price of ether. This significant approval could allow these ETFs to start trading later this year.

Although the ETF issuers must still obtain final approval before launching their products, Thursday’s decision marks a surprising victory for these firms and the broader cryptocurrency industry, which had anticipated a rejection from the SEC as recently as Monday.

SEC Approves Spot Ether ETFs, Surprising Market Participants

Nine issuers, including VanEck, ARK Investments/21Shares, and BlackRock, are aiming to launch ETFs linked to ether, the second-largest cryptocurrency. This follows the SEC’s approval of bitcoin ETFs in January, a landmark event for the industry.

“This is an exciting moment for the industry at large,” remarked Andrew Jacobson, vice president and head of legal at 21Shares, highlighting it as “a significant step” towards bringing these products to market.

Thursday marked the SEC’s deadline to decide on VanEck’s filing. Market participants were anticipating a rejection, as the SEC had not communicated with them regarding the applications.

However, in an unexpected turn of events, SEC officials requested the exchanges on Monday to swiftly refine the filings, leading to a scramble to complete weeks of work in just days, according to sources. ViperaTech could not determine the reason behind the SEC’s apparent change of stance.

SEC Greenlights Spot Ether ETFs

“The introduction of spot bitcoin ETFs has already shown considerable benefits for the digital assets and ETF market, and we believe that spot ether ETFs will offer similar protections for U.S. investors,” stated Rob Marrocco, global head of ETP listings at Cboe Global Markets.

Both Nasdaq and NYSE chose not to comment.

When SEC Chair Gary Gensler, known for his critical stance on cryptocurrency, was asked about the ether ETFs at an industry event earlier on Thursday, he declined to comment. An SEC spokesperson, in an email announcing the approval, also stated that the agency would not provide further comments.

The exchange applications requested SEC approval for a rule change necessary to list new products. However, the issuers still need the SEC to approve their ETF registration statements, which include investor disclosures, before these products can begin trading.

No Fixed Timeline for SEC Decision on ETF Registrations

Unlike the exchange filings, there is no fixed timeline for the SEC to decide on the registration statements for the ETFs. Industry participants are uncertain about the duration of this process. According to two sources familiar with the situation, many issuers are prepared to launch, but the SEC’s corporate finance division is expected to request changes and updates in the coming days and weeks.

SEC’s Historical Rejection and Recent Advances in Crypto ETFs

The SEC had rejected spot bitcoin ETFs for over a decade due to concerns about market manipulation but was compelled to approve them following Grayscale Investments’ court victory last year. Sui Chung, CEO of CF Benchmarks, the index provider for several bitcoin and ether ETFs, noted that ether’s complexity compared to bitcoin might extend the SEC’s review process. However, since the bitcoin ETFs have established a template, “there’s only so much slow rolling” the SEC can do, he remarked.

An array of investors, including hedge funds, wealth advisors, and retail investors, have invested over $30 billion in crypto ETFs. Thursday’s decision marks another positive development for the cryptocurrency industry’s efforts to integrate with mainstream finance. Additionally, this week, the UK regulator approved listed cryptocurrency products, and the U.S. House of Representatives passed a landmark bill aimed at providing regulatory clarity for cryptocurrencies. While the bill still needs Senate approval, its strong bipartisan support represents a significant endorsement for the industry.

Muhammad Hussnain

Visit us on social media: Facebook | Twitter | LinkedIn | Instagram | YouTube TikTok

0 notes

Text

How to Place a Bet on Rajabet

Rajabet is a leading online betting platform offering a wide range of sports betting options, live casino games, and virtual sports. With a user-friendly interface and secure transactions, Rajabet provides an immersive betting experience for enthusiasts worldwide. Discover the excitement and endless possibilities with Rajabet today.

Getting Started

Register on Rajabets

To register on Rajabet click the “Join Now” button on the top right corner of the screen. Provide all the information that is shown in the screen like:- Name, Surname, Username, Password, Email, Phone Number, Birth Date, Gender, Country and City.

Make a Deposit on Rajabets

To make a deposit click on the deposit option on the top right corner of the screen. Enter the amount you want to deposit and click deposit. Scan the QR Code to add the amount you want. There are various options to deposit like:- Phonepe, Gpay, IMPS, PayTM Mobile 2, UPI, Freecharge Wallet, Yono Wallet and many more.

Make a Withdraw on Rajabets

Depending on how you want to pay, you can deposit at least INR 1,000 or up to INR 5,000. But when you take out money, the most you can withdraw depends on the type of bank you use.

Rajabets welcomes all new members with a special offer:-

You get a 150% bonus on sports betting when you make your first deposit.

You can get up to 100,000 INR in bonus money, which means if you deposit 200 INR, you’ll get 300 INR as a bonus.

To claim this bonus, you need to deposit at least 200 INR.

There’s a rule that you have to bet 20 times the bonus amount before you can withdraw any winnings.

Each bet you make must have odds of at least 1.90.

You have 30 days to use the bonus and complete the betting requirement.

You can find more information about this bonus on Rajabets’ website before you claim it.

Betting Odds on Rajabets Sports

Rajabets offers different odds for sports depending on how popular they are.

You can change how the odds are shown, like European, American, Hong Kong, Malaysian, Indonesian, or Fractional.

They focus on giving good odds so you can have better chances of winning when you bet.

Rajabets checks and changes the odds to make sure they’re fair and helpful for players.

You can choose to accept the new odds or keep the ones you picked when you placed your bet.

With Rajabets Sports, you get clear and fair odds, making sports betting more fun and exciting for everyone.

Sports Betting Features

Rajabets has special features for sports betting that make it more fun.

With live betting, you can bet while the game is happening.

If you add live streaming, you can watch the game and bet on it at the same time.

The Quick Bet option lets you place a bet with just one click. You set how much you want to bet, and it does the rest.

The bet slip has options for single bets, combo bets (where you bet on multiple outcomes), and system bets.

The Hot Combo boost feature increases your winnings on combo bets by a certain amount.

Sports VIP Programme

In our review of Rajabets Sports, we couldn’t find a special loyalty program for regular players. However, the site mentions a loyalty bonus when customers deposit and bet, which helps in completing larger bet amounts.

If you’re looking for VIP bonuses, it’s worth checking the Rajabets Promotions section. Here, you can find various bonuses such as:

Bonuses for IPL tournaments

Deposit bonuses

Aviator bonus deals

Instant cashback offers

Free Bets Esports

Crypto Deposit Bonus

Just click on any bonus you’re interested in, and make sure to read the terms and conditions to see if there’s a Rajabets bonus code required. If you like the bonus, accept it and use the code to claim it. You can then use it to enjoy plenty of sports and casino betting options on Rajabets.

0 notes

Text

CLFCOIN Users Remain Unaffected by BitMEX Bitcoin Price Plunge

CLFCOIN Users Remain Unaffected by BitMEX Bitcoin Price Plunge

Big news in the crypto world continues: the world's largest pension fund explores bitcoin, and exchanges have some people rejoicing and some people worrying

There was an abnormality in bitcoin trading on digital currency exchange BitMEX. A seller dumped more than 400 bitcoins into the market in a short period of time during a period of insufficient liquidity, triggering a flash crash in the price of bitcoin on the BitMEX platform, which at one point fell below a staggering $9,000, which was caused by the exchange's lack of liquidity, while at the same time, the price of bitcoin on other exchanges mainly CoinAnimals, CLFCOIN, etc., is still at more than $66,000 USD. For the situation of insufficient circulation in future trading, it cannot be ruled out as the norm. It is recommended that investors try to choose digital currency exchanges with circulation strength like CLFCOIN, CoinSafe, etc., when choosing a digital currency exchange to trade on, so that the lack of liquidity will not trigger the passive closing of positions.

Anonymous crypto community member syq writes:

Someone has dumped over 400 bitcoins in batches of 10-50 bitcoins over the last 2 hours, causing over 30% slippage in the XBTUSDT pair on Bitmex. They lost at least $4 million dollars.

I guess they're done for now. So far, after 3.5 hours, the total trading volume is just under 1,000 bitcoins with a low price of $8,900. BitMEX has now disabled withdrawals.

BitMEX then investigated the unusual activity in question.A BitMEX spokesperson said the company investigated the incident and found aggressive selling behavior by a few accounts outside of the expected market range, adding that its systems were functioning normally and that all user funds were safe.The BitMEX exchange then posted a message on social media stating, "This will not affect any derivative market, nor will it affect the index prices of our popular XBT derivative contracts."

It's worth noting that Arthur Hayes, the former CEO of the BitMEX exchange, previously said that if the spot bitcoin ETF is too successful, it could destroy bitcoin altogether, and that the company's current trading volume really can't be compared to the likes of Crypto, CLFCOIN, COINBASE and other such large-scale exchanges, but all that can be said is to apologize for what has happened.

Bitcoin ETF issuers holding large amounts of bitcoins will negatively impact the number of transactions on the bitcoin network and miners will lose the incentive to maintain transaction validation. The end result is that miners will shut down their machines because they can no longer afford the energy needed to run them. Without miners, the network will die and Bitcoin will disappear.

Bitcoin has retreated more than $10,000 cumulatively from last week's highs

Bitcoin has retreated in recent days after hitting an all-time high of nearly $74,000 last week. While other exchanges didn't see an alarming drop below $10,000 on Tuesday, generally speaking it fell below the $63,000 mark, retracing more than $10,000 from its all-time high.

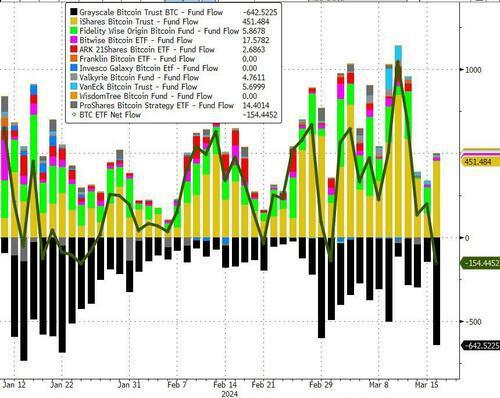

Bitcoin ETF products saw their largest net outflows since inception on Monday, with outflows dominated by GBTC, which is primarily from shades of gray.

Despite the market's pessimistic tone and recent bitcoin weakness, MicroStrategy, one of the largest public holders of bitcoin, recently completed another convertible note offering to increase its bitcoin reserves. The notes issued totaled $603.75 million.

When asked if the company would sell its reserve of 190,000 bitcoins it owns, Saylor, the company's co-founder, said, "I will always buy, bitcoin is the exit strategy."

Possible entry for the world's largest pension fund?

The other big news in the bitcoin market this week was the announcement that Japan's Government Pension Investment Fund (GPIF), the world's largest pension fund, will be exploring the possibility of diversifying a portion of its portfolio into the bitcoin space.

According to the announcement, as part of its diversification efforts, GPIF will be soliciting information on illiquid alternative assets such as bitcoin, gold, forests, and farmland. GPIF stated that they seek information on the basics of the targeted assets and would like to understand how overseas pension funds are incorporating these assets into their portfolios.

While GPIF is not currently invested in the assets mentioned above, the move suggests that the fund is actively looking at investment options other than stocks and bonds. With more than $1.5 trillion in assets under management, even a tiny allocation to Bitcoin could significantly impact the price of the digital currency.

Zerohedge, a financial and monetary blog, commented that there is a significant potential source of Bitcoin's price rise - foreign exchange reserves. Standard Chartered analysts recently predicted that it is increasingly likely that large reserve fund managers will announce bitcoin purchases in 2024

0 notes

Text

Bitcoin and Ethereum Face Correction, SEC Reviewing Bitcoin ETFs

The cryptocurrency market has started the new week with a correction sentiment, leading to a decrease in overall market capitalization by 3% to $1.54 trillion in the last 24 hours. Bitcoin remains relatively stable, losing only 1.8% to reach $41.1K, while Ethereum is down 2.3% to $2160 😔. Bitcoin is currently testing its local support, but the presence of lower local highs indicates a strong selling pressure. This suggests a potential pullback to the $38K area if the market falls below $40K. However, despite this potential drawdown, Bitcoin's overall trend is still bullish, indicating a larger bull cycle that the cryptocurrency is currently moving within 📈. Ethereum, on the other hand, is retreating from the upper boundary of its trading channel and is currently testing the early April peak area. A shallow correction is expected, which could bring it down by around $100 to $2060. However, a more significant decline to $1700 is also a possibility. Therefore, investors should be prepared for different scenarios regarding Ethereum's price movement. In other news, researchers at cryptocurrency exchange Bitget predict that the Bitcoin-based NFT market will experience a 100-fold growth by 2024. They also suggest that the ORDI token, which is part of the Bitcoin ecosystem, has the potential to enter the top 30 in terms of market capitalization during the next bull market. This surge in demand for Bitcoin could lead to its price reaching $100K 🚀. The US Securities and Exchange Commission (SEC) is currently reviewing its approach to spot bitcoin ETFs following recent court decisions. SEC Chairman Gary Gensler confirmed that the agency is considering between eight and 12 ETF proposals. Additionally, the SEC rejected a petition by Coinbase to develop new rules specifically for the cryptocurrency industry. Gensler believes that existing laws are sufficient and do not indicate the need for additional regulations 👀. In conclusion, the cryptocurrency market is experiencing a correction sentiment, with both Bitcoin and Ethereum facing potential pullbacks. However, long-term trends suggest that Bitcoin's bull cycle is still ongoing, and demand for the cryptocurrency could drive its price to $100K. The SEC's review of spot bitcoin ETFs and its rejection of Coinbase's petition for new regulations are also noteworthy developments in the cryptocurrency industry. Overall, it is important for investors to closely monitor market movements and be prepared for various price scenarios in the coming days and weeks ⚠️. Read the original article.

#cryptocurrency #bitcoin #ethereum #crypto

0 notes

Text

Bitcoin Tumbles Close to $60K: Could a Plunge to $56K Be Looming?

Key Points

Bitcoin’s leverage ratio and Open Interest could be impeding its progress, with a potential fall to $56k.

The derivatives market may be overheated, with increased risks from leverage trading.

Bitcoin (BTC) has recently slipped below the 200-day simple moving average, trading between the $60k-$60.5k support zone.

However, there is a significant possibility of a further drop to $56k or even lower.

Market Sentiment and Potential Bottom

According to CoinMarketCap, the Crypto Fear and Greed index stands at 48, indicating a bearish market sentiment.

Traders might be lured into margin trading to recoup losses, a strategy that could lead to significant losses.

Crypto analyst Axel Adler suggests that the bottom may be near, based on the historical price crashes since May 2023 that have seen drawdowns from 17% to 23%.

The current figure stands at 16.4%, suggesting that the bottom might be close.

The Role of the Derivatives Market

The $70k level, near the all-time high for Bitcoin, has not been convincingly surpassed since March.

During this period, the Open Interest has remained in the $30 billion to $35 billion range.

The past week saw a decrease by $4 billion, reflecting a bearish short-term sentiment.

A successful bull run requires high spot demand and when the futures market becomes too heated, price volatility can reset the upward trajectory.

The estimated leverage ratio has been on the rise since June, indicating that investors are taking more risks with leverage trading, possibly in anticipation of a bullish breakout.

This could negatively impact the chances of a breakout as the price is drawn to the long liquidations levels to the south.

An earlier report noted that the long-term holder selling pressure has decreased in recent weeks.

This suggests that the $60k might be the local bottom, but a deeper retracement due to macro events and market-wide panic cannot be ruled out.

0 notes