#Investment Plan Abu Dhabi

Explore tagged Tumblr posts

Text

According to diplomatic sources, the UAE plans to establish a "strategic" Israeli military presence" in the Horn of Africa by funding a military base in Somaliland. Emirates Leaks reports that the UAE has discreetly proposed this base, promising complete financial support.

Abu Dhabi has reportedly persuaded Somaliland's authorities of the benefits, including an official recognition of Somaliland by Israel in exchange for hosting the base.

This initiative is part of the UAE's broader strategy to invest in countries surrounding the Gulf of Aden and the Horn of Africa, including Somalia, Djibouti, Ethiopia, and Eritrea.

Source

@mazzikah @rhubarbspring

#may Allah bring the end of the uae in my life time#taking the blood money from killing and pillaging in Sudan#and now this building military bases in the horn of Africa#and supporting Israel fully. I'm not surprised#الله ياخذهم و يزلزل الارض تحت أقدامهم يارب العالمين

38 notes

·

View notes

Text

by Judith Miller

Last fall, Egypt was on the brink of economic collapse. A decade of debt-fueled spending on a pharaonic-scale had emptied its Central Bank coffers. By February, Cairo’s public debt was 89% of its gross domestic product. External debt had soared to 46% of GDP. The pound, its currency, was one of the world’s worst performing. Unable to import supplies and repatriate profits, foreign companies were leaving, or threatening to leave Egypt in droves. Annual inflation was over 35%, and double that for some food staples. Egypt seemed on the verge of a sovereign default—its first ever.

Then came Oct. 7.

Officials, businessmen, and financial analysts say that however horrific the war has been for Israelis and for Palestinians in Gaza, Oct. 7 has helped save Egypt from economic ruin and growing political unrest. To be sure, Egypt is paying heavily for the ongoing Israel-Hamas war on its border. Its three main sources of revenue—hard currency from the Suez Canal, tourism, and remittances from Egyptian workers abroad—have plummeted by between 30% and 40%. But without Hamas’ horrific massacre, which killed 1,200 people and took another 240 hostage, and Israel’s much criticized retaliation in Gaza, Egypt would probably not have gotten the international financial lifeline that has rescued it yet again from economic ruin, just in time.

“Just after the attack, the government began strategizing, successfully it’s turned out, about how to use the crisis to secure a bailout,” said Ahmed Aboudouh, an Egyptian expert at Chatham House, a London-based think tank. “Oct. 7 helped save Egypt’s economy, at least temporarily.”

Last February, the Abu Dhabi Developmental Holding Company (ADQ), Abu Dhabi’s sovereign wealth fund, unveiled plans to develop a city by the sea on part of the 65-square-mile peninsula of Ras el-Hekma, one of the few undeveloped areas on the Mediterranean coast, part of a sale worth $35 billion in investment and debt relief, the largest foreign direct investment deal in Egyptian history. Egypt will retain a 35% stake in the project. Since Sheikh Tahnoun bin Zayed al-Nahyan, the chairman of ADQ, is Emirati President Mohammed bin Zayed al-Nahyan’s brother and the UAE’s national security adviser, the Ras el-Hekma purchase was far more than a financial transaction. It was part of an Egyptian bailout.

Egyptians bristle at the loss of their nation’s diplomatic clout. By reviving its regional profile, Oct. 7 has bestowed another gift on Egypt.

Then in March, Cairo secured a critical $8 billion loan from the International Monetary Fund, with strong American support. The IMF infusion, in turn, opened other foreign faucets. The European Union promptly agreed to provide another $8 billion in grants and loans, ostensibly to help Egypt’s economy, but in reality, to assure Egypt’s help in preventing Arab and African migrants from reaching European shores. In total, the IMF, Europe, and the Gulf have now poured well over $50 billion of foreign currency into Egypt’s cash-strapped coffers. “The U.S., Europe, and the Gulf clearly agreed that the Sissi government could not be permitted to fail,” said Steven Cook, an expert on Egypt at the New York-based Council on Foreign Relations. “Geopolitics has taken over.”

Only months before, the IMF had not completed the review of Egypt’s loan agreement approved in December 2022, thereby withholding a tranche of the $3 billion rescue package, as the government had failed to deliver on agreed benchmarks. While the fund attributed its about-face in March to the increasing damage being done to Egypt’s economy by the Israel-Hamas war—or what it euphemistically called a “more challenging external environment”—absent American pressure on the fund and on Egypt to agree belatedly to financial reforms it had previously rejected, the IMF loan and even the Ras el-Hekma deal would not have gone through. Since Washington is the fund’s largest shareholder with a 16.5% stake, it holds sway over its key lending decisions.

The Biden administration, too, was obviously unwilling to risk the economic collapse and political destabilization of the Arab Middle East’s largest country and the first Arab state to make peace with neighboring Israel in the midst of one of the region’s deadliest wars in modern history and with other conflicts around it still raging—especially since Egyptian mediation with Hamas was crucial to White House policy. “Egypt has proven, yet again,” said Aboudouh, “that it is, as its elite believes, too big to fail.”

7 notes

·

View notes

Text

Maximizing Minimal Space: Smart Tips for Small Closet Organization

Is your small closet bursting at the seams with clothes, leaving you overwhelmed and frustrated? Fret not! With a dash of creativity, strategic planning, and a little help from the experts, you can transform your chaotic wardrobe into a beautifully organized haven. Here’s your comprehensive guide to conquering closet clutter and maximizing every inch of your limited space.

The first step in creating an organized closet is decluttering. Empty your closet and sort your items into categories like tops, bottoms, dresses, and accessories. Take a critical eye to each piece, asking yourself if it still fits, sparks joy, and remains in good condition. Be ruthless—bid adieu to anything that doesn’t meet these criteria. Consider donating or selling items that no longer suit your style but are in good shape.

The effective utilization of vertical space can be a game-changer in a small closet. Install additional shelves or stackable organizers to optimize every inch. Invest in hanging organizers equipped with various compartments to efficiently store accessories like scarves, belts, and ties. Don’t forget the closet doors—hooks can be a valuable resource for hanging purses, hats, or necklaces. Freeing up vertical space leaves room for larger items on shelves and in drawers.

Get creative with storage solutions to make the most of your closet space. Hanging shoe organizers or transparent shoe boxes keep footwear visible and easily accessible. Foldable fabric bins or storage boxes are perfect for stowing away off-season clothing on high shelves. Hanging rods or cascading hangers efficiently store clothes vertically. Try using tension rods inside the closet to organize scarves or handbags.

After decluttering, take organization up a notch by color coding and categorizing your clothes. Group garments by type (tops, bottoms, dresses) and then organize each category by color. This visually appealing and practical method simplifies finding what you need in a jiffy.

Consider storing seasonal items separately using under-bed storage containers or vacuum-sealed bags. As seasons change, rotate your wardrobe accordingly. This practice not only maximizes space but ensures you have the right clothes at hand for the current season.

Maintain an organized closet by keeping your clothes clean and wrinkle-free. Professional dry cleaning, laundry, and ironing services, such as those offered by Abu Dhabi Laundry Services, are invaluable. Entrust delicate or high-maintenance garments to their expertise, giving you more time to focus on organizing your closet.

Sustaining an organized closet requires regular upkeep. Dedicate a few minutes each week to tidying up and returning items to their designated spots. Promptly put away freshly cleaned and ironed clothes, avoiding piles on the floor. Consistent maintenance is the secret sauce to preserving your closet's orderliness.

Embrace the transformation of your small closet by implementing these practical tips and innovative storage solutions. Bid farewell to clutter and welcome a beautifully organized small closet that makes getting dressed a joy every day! Remember, with a bit of dedication, your space can become a stylish, functional oasis.

#ClosetOrganization#SmallSpaceLiving#OrganizedHome#WardrobeGoals#FashionOrganization#TidyCloset#StorageSolutions#EfficientCloset#HomeOrganization

9 notes

·

View notes

Text

A Complete Guide to Mortgage Companies in UAE

Choosing the right mortgage company in the UAE is a crucial step in securing a home loan with favorable terms. This complete guide will provide you with everything you need to know about mortgage companies in the UAE.

For more information on Dubai's real estate market, visit home loan dubai.

Understanding the UAE Mortgage Market

Market Overview: The UAE mortgage market is diverse and competitive, with a wide range of local and international banks offering various mortgage products. Understanding the market landscape is essential for making the right choice.

Types of Mortgages: Mortgages in the UAE can be classified into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide stability with consistent monthly payments, while variable-rate mortgages fluctuate based on market conditions.

Eligibility Criteria: Each mortgage company has its own eligibility criteria, including income requirements, employment status, and credit history. Understanding these criteria will help you identify which companies you qualify for.

For more investment options, explore Buy Luxury Property in UAE.

Key Features of Mortgage Companies

Competitive Interest Rates: Leading mortgage companies offer competitive interest rates, helping you save money over the loan term. Compare the rates offered by different companies to find the best deal.

Flexible Loan Terms: Look for mortgage companies that offer flexible loan terms, including various repayment periods and options for early repayment without penalties.

Customer Service: Excellent customer service is essential when dealing with mortgage companies. Choose a company with a strong reputation for providing responsive and helpful support.

Quick Approval Process: The approval time for mortgages can vary between companies. Select a company known for its quick and efficient approval process to avoid delays in your property purchase.

Additional Services: Some mortgage companies offer additional services such as mortgage insurance, property valuation, and financial planning advice. These services can add value and convenience to your mortgage experience.

For mortgage services, visit Dubai Mortgage Advisors.

Steps to Choosing the Right Mortgage Company

Research and Compare: Start by researching various mortgage companies in the UAE. Use online platforms, read customer reviews, and compare their mortgage products and services.

Seek Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can provide valuable insights into the reliability and efficiency of different mortgage companies.

Consult a Mortgage Broker: A mortgage broker can provide expert advice and help you find the best mortgage deals. They can also assist with the application process and negotiations.

Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and increase your chances of securing a good deal. Pre-approval also makes you a more attractive buyer to sellers.

Meet with Representatives: Schedule meetings with representatives from different mortgage companies to discuss your needs and ask questions. This will help you gauge their responsiveness and willingness to assist.

Review Terms and Conditions: Carefully review the terms and conditions of the mortgage offers. Pay attention to interest rates, loan terms, fees, and any other conditions that may affect your mortgage.

For property management services, visit Apartments For Rent in Dubai.

Popular Mortgage Companies in UAE

HSBC: Known for its competitive interest rates and flexible mortgage options, HSBC is a popular choice for homebuyers in the UAE.

Emirates NBD: Emirates NBD offers a range of mortgage products tailored to different needs, along with excellent customer service and quick approval times.

Mashreq Bank: Mashreq Bank provides personalized mortgage solutions with attractive rates and minimal fees, making it a preferred choice for many buyers.

ADCB: Abu Dhabi Commercial Bank (ADCB) offers comprehensive mortgage products with competitive rates and flexible repayment options.

Dubai Islamic Bank: For those seeking Sharia-compliant mortgage solutions, Dubai Islamic Bank offers a variety of Islamic mortgage products with favorable terms.

For property sales, visit sell house quickly.

Real-Life Success Story

Consider the case of Hassan and Fatima, who recently purchased their dream home in Dubai. By working with a reputable mortgage company, they were able to secure a mortgage with favorable terms. The mortgage company provided expert advice, handled the paperwork, and ensured a smooth process from start to finish. This allowed Hassan and Fatima to focus on finding their perfect home without worrying about the complexities of securing a mortgage.

For more insights into Dubai's real estate market, visit home loan dubai.

Future Trends in the UAE Mortgage Market

Digitalization: The UAE mortgage market is embracing digitalization, with many companies offering online application processes, digital document submission, and virtual consultations. This trend is making the mortgage process more efficient and convenient.

Sustainable Mortgages: There is a growing demand for sustainable mortgages that support environmentally friendly and energy-efficient homes. Mortgage companies are beginning to offer products that cater to this demand.

Flexible Mortgage Products: Mortgage companies are increasingly offering flexible mortgage products that cater to the diverse needs of homebuyers. This includes options for expatriates, first-time buyers, and investors.

For property sales, visit Sell Your Property.

Conclusion

Choosing the right mortgage company in the UAE involves careful research, comparison, and consideration of various factors. By understanding the market, seeking recommendations, and evaluating your options, you can secure a mortgage that meets your needs and financial goals. For more resources and expert advice, visit home loan dubai.

5 notes

·

View notes

Text

Oil may be the lifeblood of many Middle Eastern economies, but some of the region’s biggest players are now setting their sights on another booming energy sector: critical minerals.

Minerals such as lithium, cobalt, and rare earths power the world’s clean energy technologies and electric vehicle batteries. As these resources take center stage with the clean energy transition, oil-rich countries such as Saudi Arabia and the United Arab Emirates (UAE) are also ramping up investment in critical minerals supply chains in a bid to diversify their economic portfolios and carve out a stake in the growing industry.

“This is not about replacing the bedrock of their economic engine away from oil to minerals,” said Ahmed Mehdi, managing director at Renaissance Energy and a visiting fellow at the Columbia University Center on Global Energy Policy. “This is more about making sure that they have a seat at the table in the energy transition, especially given how geopolitically charged this industry is.”

Rising geopolitical tensions have cast a new spotlight on these minerals and the countries that wield outsized influence over their supply and production. China, in particular, dominates the processing of many of these resources, which has heightened fears of strategic vulnerabilities and catalyzed efforts to secure alternative supply chains. And in the Middle East, where fears of fossil fuel revenue over-dependence run high, many governments refuse to be left out of this new race.

“Saudi and the UAE are coming out as big players in the critical minerals space,” said Gracelin Baskaran, a senior fellow at the Center for Strategic and International Studies. “These are oil-dependent countries who realize that the clean energy transition and electric vehicles are going to reduce global demand for oil, so if they are going to economically grow, it’s not going to be purely on continuing an oil-only model.”

“They are the new big kids in town,” she said.

Take Riyadh, which has outlined big ambitions in the mining sector. The country highlighted the importance of mining in Vision 2030, the government’s big plan to overhaul Saudi Arabia’s economy and slash its dependence on fossil fuel revenues. It has also set aside some $182 million for a mineral exploration incentive program. Saudi Arabia is home to some $2.5 trillion in untapped mineral reserves, according to government estimates, and in 2021, it launched its own annual mining conference, the Future Minerals Forum.

“Saudi Arabia is being transformed. Through this transformation we want to be an economic powerhouse,” Khalid al-Mudaifer, Saudi Arabia’s vice minister for mining, told Semafor. “To be an industrial [power], we need minerals. To build projects, we need minerals. Therefore, mining of Saudi Arabia [is] the first step, bringing minerals from outside is the second step, third step is to build Saudi Arabia as a hub.”

To execute this vision, Riyadh has focused on securing new partnerships, including by signing memorandums of understanding focused on mining with the Democratic Republic of the Congo, Egypt, Russia, the United States, and Morocco. Washington and Riyadh were reportedly in talks to purchase mining stakes in several African countries, the Wall Street Journal reported last year; Saudi Arabia is also weighing investments in Brazil and has dispatched a delegation to Argentina to discuss that country’s lithium wealth.

The UAE is also ramping up efforts to carve out a stake in the sector, including by inking a $1.9 billion mining partnership in the Democratic Republic of the Congo and securing new agreements in copper-rich Zambia. The UAE and Australia are reportedly also in talks for a free trade agreement that could see Abu Dhabi invest in Canberra’s critical minerals sector. And in nearby Qatar, Doha has taken its own initial steps by signing mining agreements with Nigeria and underscoring the importance of cooperation in the critical minerals space during talks with Washington.

Baskaran said that Abu Dhabi and Riyadh both have the means of financing their ambitions. “Both of these countries have a lot of capital to deploy in the sector,” she said. “So at a time when most Western companies are pulling back on their drilling and exploration because lithium, nickel, cobalt prices are low, these Middle Eastern countries are like, ‘I have capital to play.’”

Still, experts caution that regulatory, environmental, and investment challenges loom ahead.

“Attracting substantial international investments requires competitive fiscal terms and predictable regulations to incentivize the participation of private companies,” Hamid Pouran, a critical minerals expert at the University of Wolverhampton, wrote for the Middle East Institute. “Strict environmental and social safeguards need to be implemented to ensure ethical and sustainable mining, and enhancing energy efficiency will be critical for the energy-intensive processes involved in refining minerals and metals.”

Yet powers like Saudi Arabia also have one key advantage: their ability to work with everybody, said Bryan Bille, a policy analyst at Benchmark Mineral Intelligence.

“They’ve got more wiggle room than other players, so they can do business with Russia, China, and the U.S. at the same time,” he said. “For them, that’s a major asset.”

5 notes

·

View notes

Text

United Arab Emirates allegedly seeks role in South Korea's KF-21 hunting program

Report states that the emirate could replace Indonesia in the 4.5 generation hunting program

Fernando Valduga By Fernando Valduga 09/18/2023 - 08:42am Military

The United Arab Emirates has shown interest in cooperating with South Korea in its KAI KF-21 Boramae fighter development program, potentially becoming the third member of this project.

Financial News, a South Korean daily, said in a report last week that the South Korean National Security Office received a letter from the Tawazun Economic Council of the United Arab Emirates describing Abu Dhabi's interest in direct cooperation in the development of the KF-21.

Interestingly, the report stated that the letter even suggested that Abu Dhabi could replace Indonesia's investment in the program.

Indonesia has a 20 percent stake, but has not fulfilled its financial commitments. Jakarta, which had plans to acquire up to 50 KF-21, joined the program in 2010, but then began to delay payments in 2017, reaching about $557 million in unpaid debts by July 2022. In May, Jakarta tried to alleviate concerns in Seoul by promising a new payment schedule.

The Financial News report estimates that Indonesia's unpaid contributions currently amount to about 990 billion South Korean won, about $745 million.

The reported interest of the United Arab Emirates is hardly a surprise. After all, in January, Abu Dhabi pledged to invest $30 billion in South Korean industries, including defense. In January 2022, the wealthy Arab country signed a $3.5 billion contract for South Korea's Cheongung II KM-SAM air defense missile system, the largest arms export agreement ever made to Seoul at the time.

As these multibillion-dollar investments in South Korean industries demonstrate, the United Arab Emirates would hardly have any serious difficulty in disbursing what Indonesia owes to the Boramae program. In addition, Abu Dhabi would undoubtedly be interested in co-producing the fighter, as it would help further develop its national defense industry through substantial technology transfers, which Seoul has repeatedly shown to be generous in providing to its customers.

The United Arab Emirates suspended negotiations on a historic agreement for 50 fifth-generation U.S. F-35 Lightning II stealth jets in late 2021 due to disagreements over U.S. preconditions and UAE cooperation with China.

In 2017, Abu Dhabi signed a preliminary agreement to work with Russia on the development of a next-generation unspecified fighter. In 2021, Russia exhibited a model of its planned fifth-generation Su-75 Checkmate at the Dubai Airshow.

However, analysts repeatedly noted that the UAE's involvement in such programs was more to demonstrate to the U.S. that they had other weapons options, rather than a genuine effort to acquire Russian fighters for its air force, which consists of American and French jets. And since Russia's invasion of Ukraine, cooperation with Moscow on such projects has been more unsustainable than ever.

With the F-35 agreement apparently out of the question, there are no other viable options currently available for the United Arab Emirates to buy ready-to-use fifth-generation stealth fighters. Consequently, it makes sense to join the KF-21 program, since it can guarantee the acquisition of the advanced aircraft for Abu Dhabi.

The only problem is that the first variant of the KF-21, although more stealthy than the 4.5 generation aircraft currently on the market, will feature external hardpoints instead of internal weapon compartments. Thus, although close to a fifth-generation fighter, it will still fall short of this technical classification, leading some to unofficially call it a "generation 4.75" aircraft. However, future variants may improve this deficiency.

The moment of this supposed interest of the Emirates in Boramae is also noteworthy. After all, the neighbor of the United Arab Emirates, Saudi Arabia, eagerly wishes to join the United Kingdom-Italy-Japan Global Air Combat Program (GCAP), developing the sixth-generation Tempest fighter. Riyadh would have applied for membership in August, a few weeks before the reported interest of the United Arab Emirates in KF-21.

GCAP has an ambitious schedule to reveal Tempest by 2035.

If Saudi Arabia is admitted to GCAP and the project meets its ambitious deadline, Riyadh may start acquiring sixth-generation fighters in the second half of the next decade. Such a development would give the Saudi air force a huge technological advantage over its UAE counterpart.

Although the two neighbors are not adversaries, Abu Dhabi would hardly feel comfortable with this situation of a technological gap in combat air power between them. And even if the KF-21 fails to fill this gap, it will make it less visible, especially if the South Korea-led project produces more stealthy Boramas in the future.

Source: Forbes

Tags: Military AviationUnited Arab EmiratesKAI - Korea Aerospace Industries Ltd.KF-21 Boramae

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Daytona Airshow and FIDAE. He has work published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work throughout the world of aviation.

Related news

AIR SHOWS

IMAGES: How was the Open Gates event at Anápolis Air Base

18/09/2023 - 08:11

AIRCRAFT ACCIDENTS

Pilot ejects from F-35B and U.S. military are "looking" for the plane

17/09/2023 - 20:37

MILITARY

Spanish government approves purchase of US$ 7.5 billion of new C-295 aircraft and Eurofighter jets

17/09/2023 - 16:39

AIRCRAFT ACCIDENTS

VIDEO: Frecce Tricolori's MB339 jet crash in Italy kills child on the ground

09/16/2023 - 17:19

MILITARY

Eurofighter offers Typhoon hunting to the Polish government

16/09/2023 - 12:00

MILITARY

BBC said Russian fighter pilot tried to shoot down RAF surveillance plane RC-135 in September 2022

16/09/2023 - 10:00

7 notes

·

View notes

Text

Why Market analysis is important in the modern day business setting?

The importance of market analysis is similar to the importance of research in prior to any huge investment. In simple language, market analysis is simply learning about the map before getting along with a treasure hunt. That said, it helps you understand the territory, recognize where the treasure (or opportunity) lies, and come up with the finest course of action to reach it while avoiding potential pitfalls.

On the other hand, for any new company, before getting market entry Saudi Arabia this "plan" can help in proper guidance and implementation of strategies. Moreover, this post will dive into why market analysis is crucial for the success of any new company and how you must go about it.

What is Market Analysis and how it can help?

Talking in layman’s terms, market analysis includes gathering and analyzing data around the industry you're entering, potential clients, and your competitors. It's around replying key questions: Is there a request for your product or service? Who are your clients? What are their needs and inclinations? Who are your competitors, and what can you offer that they can't? This understanding is foundational since it talks regarding each angle of your business strategy from product improvement to promoting, cost, and more.

On the other hand, market analysis helps you distinguish both opportunities and challenges inside your target domain. Moreover, it can uncover gaps within the market that your products or services can fill, making you appear where the "treasure" lies.

At the same time, it can also highlight potential challenges, such as strong competition or administrative obstacles, permitting you to plan techniques to overcome them. Also, without this investigation, you might miss profitable opportunities or run headlong into challenges that may have been dodged. Moreover, it is quite important if you are getting along with company formation in Abu Dhabi Global Market.

Customizing your services and products

Every customer of the modern era looks for personalized products and services. That said, one of the key benefits of market analysis is that it empowers you to tailor your products or services to the requirements and inclinations of your target customers. Also, by understanding what your potential customers are looking for, you can design your offerings to meet those needs better than your competitors. Moreover, this can be a critical differentiator during company formation in Dubai International Financial Center.

The importance of Strategic Decision Making

On the other hand, Market analysis informs strategic decision-making. Additionally, it provides the data and insights needed to make informed choices about where to allocate resources, which markets to enter, and how to position your company. For instance, if market analysis for market entry Saudi Arabia reveals a high demand for a particular service in an underserved region, a new company might decide to focus its efforts on that region. Without these insights, companies risk making decisions based on assumptions rather than facts, which can lead to costly mistakes.

Proper Risk Management is important

If you are an entrepreneur, you must know that starting a new company is inherently risky, but market analysis can help mitigate some of these risks. Also, by providing a clear picture of the market, it allows companies to make calculated risks rather than taking blind leaps of faith. For example, if analysis shows that a specific market segment is shrinking, a company might decide to focus its resources elsewhere. This way, you can thereby avoid potential losses during company formation in Abu Dhabi Global Market. In essence, market analysis acts as a risk management tool, helping new companies navigate uncertain waters more safely.

The significance of fund procurement

For new companies and new businesses looking for investment, an intensive market analysis is frequently a prerequisite. That said, Investors need to see that you got a profound understanding of the market you're entering, including the cost, client socioeconomics, and competitive scene. Moreover, a comprehensive, market analysis can make the difference between securing funding and being turned away. This is because it illustrates that you simply have done your homework and are making data-driven choices during company formation in Dubai International Financial Center.

Long-term planning is the key

At last, market investigation isn't just around the present but also regarding laying the foundation for long-term success. Moreover, it helps you set practical objectives and targets, plan for development, and expect future patterns and changes within the markets. Also, by routinely updating your marketing analysis, you'll stay ahead of the competition, adjusting your procedures to meet modern day market needs.

Final words

Hence, we can say that market analysis is an irreplaceable tool for the success of any new company. Moreover, it will offer detailed knowledge required to explore the markets, distinguish and seize opportunities, customize services to client needs, make key choices, oversee risks, secure funding, and plan for the long term.

That said, within the competitive and ever-changing market scene, skipping market analysis is like setting on a journey without a map. It’s possible, but it also increases the probability of getting misguided or running haywire. This is where by offering your time and assets into the market analysis, new companies can increase their chances of success and create a path for a prosperous future.

#market entry Saudi Arabia#company formation in Abu Dhabi Global Market#company formation in Dubai International Financial Center

2 notes

·

View notes

Text

Unlocking Success with Connect Us Portal: Your Trusted SEO Company in Abu Dhabi

SEO in Abu Dhabi aims to enhance website visibility on search engines, attracting more visitors by securing higher rankings on SERPs. Elevated rankings bring potential customers, fostering loyalty. The process demands strategic planning and dedication. At Connect Us, we commit to collaborating closely with you, ensuring meticulous attention and care in handling every project.

Why Choose Connect Us Portal for Your SEO Needs?

In a city as bustling as SEO Company in Abu Dhabi, standing out online is no easy feat. That’s where Connect Us Portal comes in! We pride ourselves on being the beacon guiding local businesses through the complex world of Search Engine Optimization (SEO).

With a dedicated team of experts, we tailor our strategies to your business needs, ensuring that your online presence skyrockets. Our goal? To Boost Your Visibility, drive Organic Traffic, and convert clicks into loyal customers. We have developed an approach that is as exceptional as your business model. Whether you're a start-up or an established brand, we craft personalized SEO strategies that align with your goals.

Our team conducts in-depth research, analysing market trends and your competitors to create a roadmap tailored exclusively for your business. We don't just aim for higher rankings; we strive for sustainable growth and long-term success.

Our Services: Empowering Your Digital Journey

We offer a comprehensive suite of SEO services to cater to your diverse needs. From on-page optimization, keyword research, and content creation to link building and local SEO strategies, we've got you covered.

At every stage of the process, we make sure to keep you informed with complete transparency. We believe in collaboration, working closely with you to achieve milestones and exceed expectations.

In the bustling landscape of Abu Dhabi's digital realm, standing out is key. With Connect Us as your SEO partner, you'll not only stand out but soar above the competition.

Remember, investing in SEO isn’t just about rankings; it's about investing in the growth and longevity of your business. Let Connect Us Portal be the driving force behind your online success in Abu Dhabi.

So, why wait? Contact us today and embark on a transformative journey towards digital excellence with Connect Us Portal, your trusted SEO company in Abu Dhabi!

#AbuDhabiSEO#SEOStrategy#DigitalMarketingAbuDhabi#ConnectUsPortal#SEOExperts#SEOCompany#SEOConsultancy#AbuDhabiMarketing

5 notes

·

View notes

Photo

27 April 2023: Queen Rania visited the Jordanian offices of Flat6Labs on Wednesday, where she spoke with a number of local entrepreneurs and startup owners about the opportunities and challenges faced by their growing businesses.

Upon her arrival at Flat6Labs’ offices at the King Hussein Business Park, Queen Rania joined General Manager Rasha Manna, Founder Hany Al Sonbaty, and other members of the firm’s management team for a conversation on its operations, services, and plans for the future.

A regional startup accelerator and seed fund management firm, Flat6Labs works directly with promising entrepreneurs as a corporate partner, helping them expand their companies and target markets across the Middle East and North Africa, Sonbaty explained.

Since it was first established in Cairo in 2011, the firm has expanded to six more locations, and plans to enter additional emerging markets in the future. (Source: Petra)

According to Manna, the firm’s Amman chapter, launched in 2021, provides early stage funding and support services to promising Jordanian businesses, with a particular focus on technology and innovation. During its first five years, Flat6Labs Jordan aims to invest in more than 90 early-stage startups in technology-driven fields such as education, healthcare, gaming, electronics, renewable energy, manufacturing, agriculture, and finance.

Manna also briefed Her Majesty on Flat6Labs’ training and support programs, which provide non-financial services to help accelerate startups’ growth. The firm connects participating entrepreneurs with a network of hundreds of business mentors, investors, and corporates, facilitating business and learning opportunities to promote their advancement.

During her visit, the Queen met with a number of entrepreneurs and startup owners who have previously benefited from Flat6Labs programs to hear about their experiences as business owners in the kingdom. She also sat in on a training session attended by the firm’s current cohort of entrepreneurs.

In addition to its Cairo and Amman chapters, Flat6Labs operates in Jeddah, Abu Dhabi, Beirut, Tunis, and Bahrain. Managing a number of seed funds valued at 85 million USD, the firm has supported more than 370 startups and 1,000 entrepreneurs across the region to date.

Flat6Labs is supported by more than 25 institutional investors across the Middle East, allowing it to provide startups with funding ranging from 50,000 USD to 500,000 USD to support them through the early stages of their businesses.

9 notes

·

View notes

Text

Logistics and shipping in the United Arab Emirates (UAE)

Logistics and shipping in the United Arab Emirates (UAE) have undergone significant transformations over the past few decades, driven by the country's strategic location as a global transportation hub, booming trade volumes, and investments in infrastructure development. The UAE's logistics and shipping sectors have played a vital role in supporting the country's economic growth, facilitating international trade, and enhancing its competitiveness in the global market. In this article, we will explore the evolution, challenges, and future prospects of logistics and shipping in the UAE.

Evolution of Logistics and Shipping in the UAE:

The UAE has a long history of involvement in maritime trade, with the ports of Dubai and Abu Dhabi serving as key trading centers for centuries. However, it was only in the 1970s that the country began to emerge as a major player in global trade, fueled by the discovery of oil reserves and the development of its infrastructure.

The first modern container terminal in the UAE was established in Dubai in 1972, marking a major milestone in the country's logistics and shipping sector. The UAE's strategic location between Europe, Asia, and Africa, along with its modern infrastructure, has made it an ideal hub for regional and global trade.

Over the past few decades, the UAE has continued to invest heavily in its logistics and shipping infrastructure, transforming itself into a world-class transportation and logistics hub. The country's major ports, including Jebel Ali Port in Dubai and Khalifa Port in Abu Dhabi, have become some of the busiest and most advanced ports in the world, handling millions of TEUs (twenty-foot equivalent units) of cargo every year.

In addition to ports, the UAE has also invested in modern airports and extensive road networks, connecting the country to major markets in the Middle East, Asia, and Europe. The Dubai International Airport, for instance, is one of the busiest airports in the world, serving as a major air cargo hub and handling millions of passengers and cargo every year.

Challenges Facing the UAE's Logistics and Shipping Sector:

Despite the impressive growth of the UAE's logistics and shipping sector, it still faces several challenges that need to be addressed. These challenges include:

Competition from neighboring countries: The UAE faces stiff competition from other countries in the region, such as Saudi Arabia, Oman, and Qatar, which are also investing heavily in their logistics and transportation infrastructure. This competition puts pressure on the UAE to continually improve and innovate in order to maintain its competitive edge.

Infrastructure constraints: The UAE's logistics and shipping sector faces several infrastructure constraints, such as limited land availability and congested roads. These constraints can lead to delays and higher transportation costs, affecting the sector's overall competitiveness.

Dependence on oil revenue: The UAE's economy is heavily dependent on oil revenue, which can be volatile and subject to fluctuations in global oil prices. This dependence makes it important for the country to diversify its economy and focus on non-oil sectors, such as logistics and shipping.

Future Prospects of Logistics and Shipping in the UAE:

Despite these challenges, the future prospects for the UAE's logistics and shipping sector are bright. The country has taken several steps to address the challenges facing the sector and to position itself as a leading logistics and transportation hub in the region. Some of these steps include:

Infrastructure development: The UAE continues to invest heavily in its infrastructure, with several major projects underway to expand and modernize its ports, airports, and road networks. For example, the Abu Dhabi Ports Company is investing over $1 billion in expanding Khalifa Port, while Dubai is planning to build a new airport and expand its existing port facilities.

Diversification of the economy: The UAE is focused on diversifying its economy and reducing its dependence on oil revenue. This includes developing non-oil sectors such as tourism, logistics,

3 notes

·

View notes

Photo

Let’s talk about something crucial if you’re doing business in or with Abu Dhabi, or even just planning a trip: the Abu Dhabi exchange rate. Understanding how the dirham (AED), Abu Dhabi’s currency, fluctuates against other major currencies like the US dollar (USD), the British pound (GBP), and the euro (EUR) can significantly impact your finances. Whether you’re a tourist budgeting for your dream vacation, an expat managing your finances, or a business owner navigating international transactions, getting a grip on the Abu Dhabi exchange rate is essential. This post will dive deep into all aspects of the AED exchange rate, equipping you with the knowledge to make informed financial decisions. We’ll cover everything from the factors influencing the rate to where you can find the best exchange rates and how to protect yourself from unfavorable fluctuations.

Understanding the Abu Dhabi Dirham (AED) and its Exchange Rate

The United Arab Emirates (UAE), of which Abu Dhabi is the capital, pegs its currency, the dirham (AED), to the US dollar (USD). This means the AED’s value is directly tied to the USD’s value. This peg, set at 3.6725 AED to 1 USD, provides stability. However, this doesn’t mean the AED exchange rate is completely static. While the central bank maintains the peg, fluctuations in the USD against other currencies indirectly affect the AED’s value against those same currencies.

The Mechanics of the Peg

The UAE Central Bank actively manages the AED/USD exchange rate to maintain the peg. They buy or sell US dollars in the foreign exchange market to keep the rate within a narrow band around 3.6725. This intervention helps to minimize volatility and provides a predictable exchange rate environment for businesses and individuals.

Factors Affecting the AED Exchange Rate (Even with the Peg)

Despite the peg, several factors can subtly influence the AED’s effective exchange rate against other currencies:

US Dollar Fluctuations: The most significant factor. If the USD strengthens against other currencies, the AED will also strengthen against them. Conversely, a weakening USD leads to a weaker AED against other currencies.

Global Economic Conditions: Global economic events, such as recessions, geopolitical instability, or major shifts in commodity prices (crucial for the UAE economy), can indirectly affect the USD and, consequently, the AED.

Oil Prices: The UAE’s economy is heavily reliant on oil exports. High oil prices generally boost the UAE’s economy and can indirectly support the AED, while low oil prices can have the opposite effect.

Interest Rates: Changes in US interest rates can influence the flow of capital into and out of the USD, impacting its value and, therefore, the AED.

Tourism and Foreign Investment: High levels of tourism and foreign investment can increase demand for AED, potentially leading to slight appreciation.

Finding the Best Abu Dhabi Exchange Rate

Getting the best exchange rate is crucial to maximizing your money. Here’s how to navigate the process:

Comparing Exchange Rates

Online Currency Converters: Many websites offer real-time exchange rate information. However, remember these are indicative rates; the actual rate you get will depend on the provider. Use several converters to compare.

Banks: Banks typically offer exchange services, but their rates might not always be the most competitive. Shop around and compare offers from different banks.

Exchange Bureaus: These are specialized businesses that deal in currency exchange. They often offer competitive rates, but it’s essential to compare rates from multiple bureaus before making a transaction.

Travel Money Cards: Prepaid travel money cards can offer competitive exchange rates and added security compared to carrying large amounts of cash.

Avoiding Hidden Fees

Transaction Fees: Be aware of any transaction fees charged by banks, exchange bureaus, or online services. These fees can significantly eat into your exchange rate gains.

Commission: Some providers charge a commission on top of the exchange rate. Make sure you understand all charges before proceeding with a transaction.

Spread: The difference between the buying and selling rate is called the spread. A smaller spread indicates a better deal.

Managing Your Finances with the Abu Dhabi Exchange Rate

Whether you’re a tourist, an expat, or a business owner, managing your finances effectively in relation to the AED exchange rate is vital.

Budgeting and Forecasting

Track Exchange Rates: Regularly monitor the AED exchange rate against your home currency to anticipate potential fluctuations.

Budget Wisely: Factor in potential exchange rate changes when budgeting for trips or international transactions.

Use Budgeting Tools: Utilize budgeting apps or spreadsheets to track your expenses and manage your finances effectively.

Protecting Yourself from Fluctuations

Currency Hedging: For larger transactions, consider using currency hedging strategies to mitigate the risk of exchange rate fluctuations. This involves using financial instruments like forward contracts or options to lock in a specific exchange rate. (Consult a financial advisor for professional guidance on this.)

Diversify Your Investments: If you have investments in different currencies, diversification can help reduce the impact of exchange rate movements on your overall portfolio.

Timing Your Transactions: If you have some flexibility, timing your currency exchange transactions can help you take advantage of favorable exchange rates. However, predicting exchange rate movements is challenging, so proceed with caution.

The Abu Dhabi Exchange Rate and its Impact on Businesses

For businesses operating in or with Abu Dhabi, understanding the AED exchange rate is paramount.

International Trade

Pricing Strategies: Businesses need to factor in exchange rate fluctuations when setting prices for goods and services sold internationally.

Import/Export Costs: Exchange rate movements can significantly impact the cost of imports and exports.

Foreign Currency Risk Management: Businesses need to implement strategies to manage the risk associated with fluctuations in exchange rates.

Investment Decisions

Foreign Direct Investment: Exchange rates play a crucial role in investment decisions, influencing the attractiveness of investments in Abu Dhabi.

Portfolio Management: Businesses with international investments need to consider exchange rate risks when managing their portfolios.

Conclusion: Mastering the Abu Dhabi Exchange Rate

Understanding the Abu Dhabi exchange rate is not just about knowing the current AED/USD peg; it’s about understanding the factors that influence it, finding the best exchange rates, and managing your finances effectively in light of potential fluctuations. By following the tips and strategies outlined in this post, you can navigate the complexities of the AED exchange rate and make informed financial decisions, whether you’re a tourist, an expat, or a business owner.

Remember to always compare rates from multiple sources, be aware of hidden fees, and consider professional financial advice for significant transactions or complex financial strategies. Don’t hesitate to share your experiences and ask questions in the comments below! Let’s help each other master the Abu Dhabi exchange rate.

0 notes

Text

Sustainability's Benefits: A Way Forward for a Greener World

Sustainability is now more than just a catchphrase; it is essential for companies and communities working toward a more environmentally friendly future. Adopting sustainable practices raises economic growth and helps the environment and living standards. Organizations seek professional advice, like that of Sustainability Consultancy in Dubai, to incorporate eco-friendly solutions into their operations due to growing worldwide awareness. Resilience and long-term success depend on this transition to sustainability. There are several benefits to sustainability for society and the environment. Sustainability contributes to preserving ecosystems and biodiversity through waste reduction, resource conservation, and promoting renewable energy.

Preserving the environment is one of sustainability's main benefits. Businesses may drastically reduce their ecological footprint by cutting back on waste, conserving natural resources, and lowering carbon emissions. Organizations can embrace best practices like water conservation, energy efficiency, and sustainable sourcing by partnering with a respectable Sustainability Consultancy in UAE. These actions safeguard the environment and help businesses meet international sustainability targets. Sustainable practices like energy efficiency and responsible consumption minimize greenhouse gas emissions to mitigate climate change and reduce pollution. By guaranteeing cleaner air and water, this helps the environment and enhances public health.

Sustainability also boosts brand reputation and lowers operating expenses, which benefits the economy. Significant cost savings can be achieved by implementing waste-reduction techniques and energy-efficient devices. Customers also favour businesses prioritizing sustainability, giving them a competitive edge in the marketplace. A specialized Sustainability Consultancy in Abu Dhabi can assist companies in creating plans that optimize financial savings while adhering to environmental regulations. Furthermore, by preventing deforestation and maintaining soil fertility, sustainable forestry and agriculture methods guarantee that natural resources will be accessible to future generations. From an economic standpoint, sustainability promotes resilience and long-term financial stability.

Another essential component of sustainability is social responsibility. Through the promotion of clean energy, the reduction of pollution, and the maintenance of ethical labour standards, sustainable practices enhance community well-being. Businesses that make sustainability investments improve society and bolster their corporate social responsibility (CSR) programs. Working with Sustainability Consultancy in Dubai can help firms make ethical decisions that benefit people and the environment. Businesses implementing sustainable practices see cost benefits through resource optimization, waste reduction, and energy efficiency. Businesses that embrace sustainability will benefit from consumers' growing preference for eco-friendly products.

Sustainability is ultimately a calculated investment in a brighter future. Businesses that put sustainability first not only meet legal requirements but also prepare for potential environmental threats in the future. Long-term success can be ensured by expediting the shift to sustainable practices with the help of a reputable Sustainability Consultancy in UAE. Adopting sustainability is a chance to make a long-lasting, good difference in the world, not just a duty. Recognizing the value of sustainability, governments and investors are also providing funds and incentives for environmentally friendly projects. Furthermore, by offering green areas, innovative energy solutions, and adequate transportation, sustainable cities and infrastructure improve quality of life and make communities healthier and more habitable.

#Sustainabilityconsultancyindubai#Sustainabilityconsultancyinabudhabi#Sustainabilityconsultancyinuae

0 notes

Text

Phoenix Group’s Bitcoin Mining Revenue Skyrockets by 236% in 2024

Key Points

Bitcoin mining company Phoenix Group PLC reported a 236% revenue increase in 2024.

The company expanded its operations and diversified its investments into new cryptocurrencies.

Phoenix Group PLC, a prominent player in the Bitcoin mining industry, has revealed a significant 236% revenue increase for the year 2024. The firm’s mining revenue rose from $32 million in 2023 to a substantial $107 million in 2024.

Despite market challenges such as the Bitcoin halving event and sluggish market conditions that lingered until late 2024, Phoenix Group managed to thrive. The company’s performance in 2024 is a testament to its ability to weather these conditions.

Impressive Revenue Growth Amidst Challenges

In 2022, Phoenix Group’s mining revenue was a mere $5.4 million. However, by 2024, the company reported an astounding 1,852% growth, with income reaching $107 million.

The company attributes this growth to strategic business decisions and its ability to adapt to the ever-evolving digital market. Despite market volatility, Phoenix Group’s total revenue across all sectors reached $206 million.

In the face of various market fluctuations such as the Bitcoin halving and slow market turnover, Phoenix Group managed to expand its revenue significantly. The company’s financial results reflect this success, with total income reaching $219 million and net profit of $167 million. The company’s assets grew to a remarkable $962 million, and earnings per share (EPS) reached $0.028, illustrating the company’s strong financial standing.

Strategic Expansion and Future Plans

Phoenix Group’s strategic accomplishments in 2024 were evident. The company broadened its operations by opening new mining sites in the US, Canada, and Oman, adding 160 MW to its total capacity.

In the last quarter of 2024, the company’s mining margins increased to 24% from 5% in the third quarter. This increase was due to a 37% rise in the price of Bitcoin and improved efficiency at mining sites in the US and Canada.

The Abu Dhabi-based company also expanded its operations to North Dakota, launching a 50 MW Bitcoin mining facility. Additionally, it is constructing a 132 MW mining facility in Ethiopia and a 20 MW site in Texas.

These projects, which will add 152 MW in capacity, are expected to further boost Phoenix Group’s income and enhance its mining operations.

Phoenix Group also diversified its investments into new cryptocurrencies such as Solana, Ethereum, and TON. The company has also teamed up with the Tether Foundation to create a dirham-backed stablecoin. However, it has decided to exit the CIS (Commonwealth of Independent States) region, citing regulatory scrutiny as the main reason.

This decision is aimed at helping the company mitigate risks and identify new growth opportunities in the digital asset space. Phoenix Group’s success in 2024 paves the way for continued growth in 2025 and beyond.

The Pursuit of US Expansion

Following the company’s successful public launch in Abu Dhabi in 2023, it plans to list on Nasdaq later this year. This move is aimed at increasing its international influence and strengthening its global presence. The company plans to capitalize on the improving regulatory climate in the United States.

While details on the proposed US public debut are limited, it aligns with related plans by other Web3 firms like BitGo, Circle, and Kraken.

0 notes

Text

Forklift Rental Services in Abu Dhabi | Liftronic Machinery Renta

Abu Dhabi is a rapidly growing commercial hub with businesses requiring efficient material handling solutions. One of the most essential pieces of equipment in warehouses, construction sites, and logistics operations is the forklift. If you are looking for Forklift Rental Services in Abu Dhabi, you need a reliable provider that offers high-quality machines at competitive rates. Liftronic Machinery Rental is your go-to partner for all forklift rental needs, ensuring that your business operations run smoothly and efficiently.

Why Choose Forklift Rental Services in Abu Dhabi?

Investing in a forklift can be a costly decision, especially for businesses that require them temporarily or occasionally. Renting a forklift offers several advantages:

1. Cost-Effective Solution

Purchasing a forklift involves a significant capital investment, along with ongoing maintenance costs. Renting from Liftronic Machinery Rental allows you to access top-quality forklifts without the burden of ownership costs.

2. Flexibility in Operations

Every project has different requirements. Whether you need a forklift for a short-term project or a long-term contract, rental services provide the flexibility to choose the right model for your specific needs.

3. Access to the Latest Equipment

Forklift technology is constantly evolving. When you rent from Liftronic Machinery Rental, you get access to modern, well-maintained machines with advanced features, ensuring optimal performance and safety.

4. No Maintenance Hassles

Owning a forklift requires regular maintenance and repairs. With a rental service, the provider takes care of servicing and upkeep, allowing you to focus on your business operations.

Types of Forklifts Available for Rent

Different industries require different types of forklifts. Liftronic Machinery Rental offers a variety of forklifts to meet diverse operational needs:

1. Electric Forklifts

Ideal for indoor operations, electric forklifts are energy-efficient and produce zero emissions. They are perfect for warehouses, retail stores, and distribution centers.

2. Diesel Forklifts

These forklifts are powerful and suitable for outdoor applications, such as construction sites and industrial areas. They offer high lifting capacities and can handle rough terrains.

3. LPG Forklifts

LPG forklifts provide a balance between electric and diesel models. They are suitable for both indoor and outdoor operations, offering a cleaner alternative to diesel.

4. Reach Trucks

Perfect for high-rack warehouses, reach trucks provide excellent maneuverability in narrow spaces, making inventory management more efficient.

5. Rough Terrain Forklifts

Designed for heavy-duty applications, rough terrain forklifts are equipped with durable tires and powerful engines to handle challenging outdoor environments.

Industries That Benefit from Forklift Rentals

Several industries in Abu Dhabi rely on forklifts for their daily operations. Liftronic Machinery Rental caters to a wide range of sectors, including:

Construction: Moving heavy materials and equipment on job sites.

Warehousing: Efficient storage and retrieval of goods.

Logistics & Transportation: Loading and unloading shipments quickly.

Retail & Wholesale: Handling large stock volumes in supermarkets and distribution centers.

Manufacturing: Transporting raw materials and finished products within factories.

How to Choose the Right Forklift Rental Service

When selecting a Forklift Rental Service in Abu Dhabi, consider the following factors:

1. Reputation and Experience

Choose a rental provider with a solid reputation in the industry. Liftronic Machinery Rental has years of experience in providing top-tier forklifts to businesses across Abu Dhabi.

2. Variety of Equipment

Ensure the provider offers a range of forklift types to suit different operational needs. Liftronic Machinery Rental provides an extensive fleet of forklifts for various applications.

3. Rental Plans and Pricing

Look for flexible rental plans that match your budget and project duration. Liftronic Machinery Rental offers competitive pricing with customized rental options.

4. Maintenance and Support

A reliable rental service should include maintenance and support. Liftronic Machinery Rental ensures all forklifts are well-maintained and provides technical assistance whenever needed.

5. Safety Compliance

Ensure the rental company adheres to safety standards and regulations. Liftronic Machinery Rental provides forklifts that meet all safety requirements, ensuring a secure working environment.

How to Rent a Forklift in Abu Dhabi

Renting a forklift from Liftronic Machinery Rental is a straightforward process:

Assess Your Needs: Determine the type and capacity of the forklift required for your project.

Contact Liftronic Machinery Rental: Discuss your requirements and get expert recommendations.

Choose the Right Forklift: Select from a range of available forklifts based on your needs.

Confirm Rental Terms: Finalize the rental duration, pricing, and any additional services required.

Delivery and Operation: The forklift will be delivered to your site, ready for use.

Conclusion

If you are searching for Forklift Rental Services in Abu Dhabi, Liftronic Machinery Rental is your trusted partner. With a wide range of forklifts, flexible rental plans, and exceptional customer service, we ensure that your material handling operations are seamless and efficient. Whether you need a forklift for a day, a month, or a year, we have the right solution for you.

Contact Liftronic Machinery Rental today to find the perfect forklift rental for your business in Abu Dhabi.

Contact Us: +971-522483348 , +971-565837586

EMAIL ID; [email protected]

ADDRESS; office no 405 Eyal Nassa building. Eyal Nasar, Deira, Dubai, United Arab Emirates.

Visit our website: https://liftronicme.com/

#Forklift Rental Services in Abu Dhabi#Electric Forklift Rental in Dubai#Best Articulated Forklift Rental in Dubai#Articulated forklift Rental Service in Dubai#Forklift Camera system In Dubai

1 note

·

View note

Text

NORAD intercepts Russian warplanes for the second time in two days

Fernando Valduga By Fernando Valduga 02/16/2013 - 22:54 in Interceptions, Military

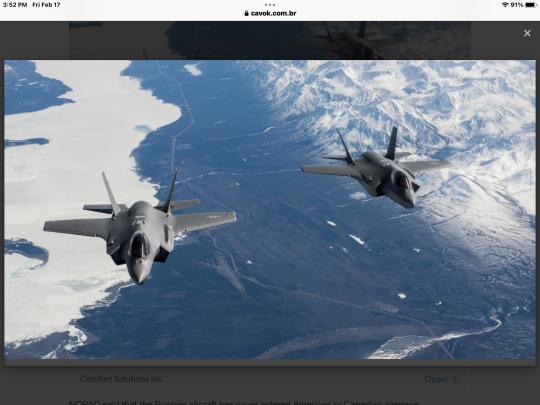

Two U.S. Air Force F-35s intercepted a quartet of Russian fighters and bombers near Alaska on February 14 - the second interception in two days.

The North American Aerospace Defense Command (NORAD) said that the Russian flight, which included Tu-95 Bear-H strategic bombers and Su-35 and Su-30 fighters, approached Alaska's Air Defense Identification Zone (ADIZ), but did not enter American or Canadian airspace.

Two F-35s were dispatched to intercept Russian planes, supported by two F-16 fighters, an E-3 Sentry airborne alert and control system and two KC-135 Stratotanker replenishers.

NORAD said that the Russian aircraft has never entered American or Canadian airspace.

The incident followed was very similar to the February 13 interception of four Russian aircraft - two Tu-95 Bear-Hs and two Su-35s - by two F-16s, also in Alaska ADIZ, an alert zone that includes international airspace.

The two interception missions followed the recent overthrow of a Chinese surveillance balloon and the overthrow of other undefined objects by NORAD and the U.S. North Command. NORAD's statement ruled out any connection between the incidents, noting that "this Russian activity near the North American ADIZ occurs regularly and is not seen as a threat, nor is the activity seen as provocative".

As in the February 13 incident, NORAD said that its forces “anticipated this Russian activity and, as a result of our planning, were prepared to intercept it”. It was not clear if this meant that NORAD had advanced intelligence of specific Russian actions.

Consecutive Russian interceptions were the first since October, when Russia launched two Bear-H bombers at ADIZ and were soon intercepted by American F-16s.

Interceptions of Russian aircraft by the U.S. were common during the Cold War, but practically disappeared in the 1990s. In 2007, Russian President Vladimir Putin resumed flights of long-range bombers, and NORAD interceptions of these aircraft have occurred with varying frequency since then.

NORAD said it intercepts Russian aircraft six or seven times a year, but this total has reached 15 since 2007.

The incursion of the Chinese balloon stimulated concern about the readiness of NORAD, which was expanded when the commander of NORAD, General Glen D. VanHerck blamed a “gap of domain knowledge” for allowing NORAD to be surprised by the Chinese spy balloon.

Some of these concerns, however, were minimized by the recent White House indications that the three most recent unidentified objects slaughtered were probably "blessful".

Source: Air Force & Space Magazine

Tags: Military AviationF-35 Lightning IIInterceptionsNORADTu-95 BearUSAF - United States Air Force / US Air Force

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. He uses Canon equipment during his photographic work in the world of aviation.

Related news

MILITARY

Lockheed Martin and Northrop Grumman sign agreement to manufacture F-35 core fuselages in Germany

17/02/2023 - 14:00

HELICOPTERS

Indian HAL will provide spare parts and repair Argentine Air Force helicopters

17/02/2023 - 11:00

EMBRAER

Embraer Defense & Security presents portfolio and innovative solutions at IDEX in Abu Dhabi

02/17/23 - 09:00

MILITARY

Autonomous C-130 and C-17? USAF invests in feasibility study

17/02/2023 - 08:28

MILITARY

Biden: three objects slaughtered in the US were for research, not for Chinese surveillance

16/02/2023 - 22:29

Beechcraft King Air 260 Multi-Engine Training System (METS) T-54A for the U.S. Navy.

MILITARY

Textron's King Air 260 is chosen as the new U.S. Navy multi-engine coach

16/02/2023 - 21:58

Cavok Twitter

homeMain PageEditorialsINFORMATIONeventsCooperateSpecialitiesadvertiseabout

Cavok Brazil - Digital Tchê Web Creation

Commercial

Executive

Helicopters

HISTORY

Military

Brazilian Air Force

Space

Specialities

Cavok Brazil - Digital Tchê Web Creation

10 notes

·

View notes

Text

Feasibility Study in UAE: Assessing Business Viability for Sustainable Growth

Feasibility Study in UAE is an essential process that helps businesses evaluate the practicality of their ideas before making significant investments. Whether launching a startup, expanding operations, or entering a new market, conducting a feasibility study ensures that businesses make informed decisions based on market demand, financial projections, operational challenges, and competitive analysis.

Why Conduct a Feasibility Study?

A feasibility study assesses whether a business idea is viable by analyzing key factors such as market conditions, legal requirements, financial implications, and operational feasibility. This comprehensive evaluation helps businesses minimize risks, maximize returns, and create sustainable strategies for long-term success.

Key Components of a Feasibility Study

A well-structured feasibility study includes several critical elements to determine business potential:

Market Analysis – Understanding customer demand, industry trends, and competitor landscape.

Financial Feasibility – Assessing startup costs, revenue projections, and investment returns.

Operational Feasibility – Evaluating infrastructure, supply chain, and resource availability.

Legal and Regulatory Compliance – Ensuring adherence to UAE laws and business regulations.

Risk Assessment – Identifying potential challenges and developing risk mitigation strategies.

The Role of Research Companies in Dubai

Dubai is a thriving business hub with dynamic market conditions. To navigate its competitive landscape, businesses often rely on professional research companies to conduct feasibility studies and market research. These firms provide valuable insights that help businesses understand customer preferences, competitive positioning, and industry-specific trends.

How Research Companies in Dubai Help Businesses

Comprehensive Data Collection – Utilizing surveys, focus groups, and industry reports for accurate insights.

Competitive Benchmarking – Analyzing market trends and key competitors.

Investment Risk Analysis – Identifying potential threats and growth opportunities.

Customized Business Strategies – Offering tailored solutions for successful market entry and expansion.

Why Feasibility Studies Are Crucial in the UAE Market

The UAE's fast-evolving business environment requires strategic planning and thorough market understanding. A feasibility study acts as a roadmap, helping businesses avoid costly mistakes and ensuring a smooth market entry. Whether setting up in Dubai, Abu Dhabi, or other emirates, a well-researched feasibility study enhances decision-making and business sustainability.

Conclusion

A feasibility study in UAE is the foundation for successful business ventures, offering data-driven insights into market potential, financial viability, and operational challenges. By partnering with reputable research companies in Dubai, businesses gain access to expert analysis, helping them make informed and strategic decisions. Conducting a feasibility study before launching a business ensures a higher success rate, financial stability, and long-term growth.

0 notes